Industries > Floating LNG Power Vessel Market > Floating Liquefied Natural Gas (FLNG) Market Report 2018-2028

Floating Liquefied Natural Gas (FLNG) Market Report 2018-2028

Capex ($m) and Capacity (Number Of Vessels) Forecasts by Type (FPSO Liquefaction (Topside, Hull, Mooring System), FSRU Regasification), by Build Type (New Build, Converted), by Operator (Type I, Type II, Type III, Type IV), Plus Regional Forecasts and Profiles of Top Companies

This latest report by business intelligence provider visiongain assesses that Floating Liquefied Natural Gas spending will reach $9.6bn in 2018. The floating liquefied natural gas (FLNG) market is developing quicklyand the number of countries ordering FSRUs expanding. Though the impact of lower oil prices and an oversupplied LNG market are creating challenges to project economics, the FLNG market will continue to register strong growth over the coming decade. It is therefore critical that you have your timescales correct and your forecasting plans ready. This report will ensure that you do. Visiongain’s report will ensure that you keep informed and ahead of your competitors. Gain that competitive advantage.

The Floating Liquefied Natural Gas Market Forecast 2018-2028 responds to your need for definitive market data.

Read on to discover how you can exploit the future business opportunities emerging in this sector. Visiongain’s new study tells you and tells you NOW.

In this updated report, you find 272 in-depth tables, charts and graphs all unavailable elsewhere.

The 313 page report provides clear detailed insight into the global Floating Liquefied Natural Gas market. Discover the key drivers and challenges affecting the market.

Also in this report are project tables covering over 50 leading current and future vessels and projects by technology, MMTPA, Status, cost ($m), and Location. As well as an interview with an expert from Samsung Heavy Indsutries.

By ordering and reading our brand new report today you stay better informed and ready to act.

Report Scope

The report delivers considerable added value by revealing:

• 272 tables, charts and graphs analysing and revealing the growth prospects and outlook for the Floating Liquefied Natural Gas market.

• Global Floating Liquefied Natural Gas market forecasts and analysis from 2018-2028.

• Floating Liquefied Natural Gas market provides CAPEX and CAPACITY forecasts and analysis from 2018-2028 for five FLNG submarkets:

– LNG FPSO (liquefaction)

– FSRU (regasification)

– New Build

– Converted

– Operator Type (I, II, III, IV)

• Forecasts and analysis of CAPEX in LNG FPSO vessel components between 2018-2028

– Topside

– Hull

– Mooring System

• Regional Floating Liquefied Natural Gas market forecasts from 2018-2028 with drivers and restraints for the countries including:

– Canada

– U.S.

– Brazil

– U.K.

– Norway

– Vietnam

– China

– Australia

– Malaysia

– Indonesia

– India

– Angola

– Nigeria

– Iran

• Company profiles for the leading 11 Floating Liquefied Natural Gas companies

– Excelerate Energy L.P.

– Hoegh LNG

– Golar LNG

– Royal Dutch Shell plc

– Petronas

– Exmar

– Noble Energy Inc.

– Woodside Petroleum Limited

– DAEWOO Shipbuilding & Marine Engineering Co., Ltd. (DSME)

– Samsung Heavy Industries Co., Ltd.

– Hyundai Heavy Industries Co., Ltd.

Conclusions and recommendations which will aid decision-making

How will you benefit from this report?

• Keep your knowledge base up to speed. Don’t get left behind

• Reinforce your strategic decision-making with definitive and reliable market data

• Learn how to exploit new technological trends

• Realise your company’s full potential within the market

• Understand the competitive landscape and identify potential new business opportunities & partnerships

Who should read this report?

• Anyone with involvement in the Floating Liquefied Natural Gas

• Oil & gas operators

• Engineering contractors

• Natural gas traders

• Commodity traders

• Investment managers

• Arbitrage companies and divisions

• Energy price reporting companies

• Energy company managers

• Energy consultants

• Oil and gas company executives and analysts

• Heads of strategic development

• Business development managers

• Marketing managers

• Market analysts,

• Technologists

• Suppliers

• Investors

• Banks

• Government agencies

Visiongain’s study is intended for anyone requiring commercial analyses for the Floating Liquefied Natural Gas market and leading companies. You find data, trends and predictions.

Buy our report today the Floating Liquefied Natural Gas (FLNG) Market Report 2018-2028: Capex ($m) and Capacity (Number Of Vessels) Forecasts By Type (FPSO Liquefaction (Topside, Hull, Mooring System), FSRU Regasification) By Build Type (New Build, Converted) By Operator (Type I, Type II, Type III, Type IV), Plus Regional Forecasts And Profiles of Top Companies. Avoid missing out by staying informed – get our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Floating Liquefied Natural Gas (FLNG) Market Overview

1.2 Market Structure Overview and Market Definition

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.7.3 Market Evaluation & Forecasting

1.8 Frequently Asked Questions (FAQs)

1.9 Associated visiongain Reports

1.10 About visiongain

2. Introduction to the Floating Liquefied Natural Gas (FLNG) Market

2.1 The FLNG Market Structure

2.2 FLNG Market Definition

2.3 LNG Industry Outlook

2.4 LNG Value Chain Analysis.

2.5 FLNG Vessels

2.5.1 Regasification Vessels

2.5.2 Liquefaction Vessels

2.6 FLNG Vessels

2.6.1 Regasification

2.6.2 Liquefaction

2.7 Conversions and New Builds

3. Global Overview of Floating Liquefied Natural Gas (FLNG) Market 2018-2028

3.1 Global FLNG Capex Market Forecast Including Number of Vessels 2018-2028

3.2. Global FLNG Capacity Forecast 2018-2028

4. Global Overview of Floating Liquefied Natural Gas (FLNG) Submarket Forecast

4.1 Global Floating Liquefied Natural Gas (FLNG) Submarkets Forecasts, by Type 2018-2028

4.1.1 Global FPSO Floating Liquefied Natural Gas (FLNG) Forecasts 2018-2028

4.1.1.1 Global FPSO Drivers & Restraints

4.1.2 Global Floating Production Storage and Offloading (FPSO) Submarkets Forecasts, by Component 2018-2028

4.1.2.1 Global Topside Floating Production Storage and Offloading 2018-2028

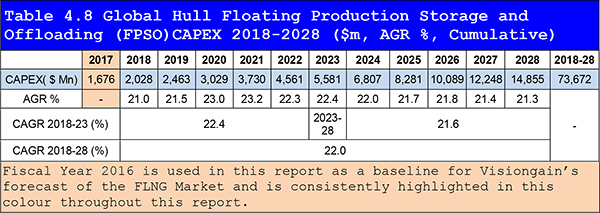

4.1.2.2 Global Hull Floating Production Storage and Offloading (FPSO) Forecasts 2018-2028

4.1.2.3 Global Mooring System Floating Production Storage and Offloading (FPSO) Forecasts 2018-2028

4.1.3 Global FPSO Planned Projects (Current, Planned & Upcoming)

4.1.4 Global FSRU Floating Liquefied Natural Gas (FLNG) Forecasts 2018-2028

4.1.4.1 Global FSRU Drivers & Restraints

4.1.4.2 Global FSRU Planned Projects (Current, Planned & Upcoming)

4.2 Global Floating Liquefied Natural Gas (LNG) Submarkets Forecasts, by Build Type 2018-2028

4.2.1 Global Converted Floating Liquefied Natural Gas (LNG) Forecasts 2018-2028

4.2.1.1 Global Converted Drivers & Restraints

4.2.2 Global New Build Floating Liquefied Natural Gas (LNG) Forecasts 2018-2028

4.2.2.1 Global New Build Drivers & Restraints

4.3 Global Floating Liquefied Natural Gas (FLNG) Submarkets Forecasts, by Operator 2018-2028

4.3.1 Global Type I Floating Liquefied Natural Gas (FLNG) Forecasts 2018-2028

4.3.2 Global Type II Floating Liquefied Natural Gas (FLNG) Forecasts 2018-2028

4.3.3 Global Type III Floating Liquefied Natural Gas (FLNG) Forecasts 2018-2028

4.3.4 Global Type IV Floating Liquefied Natural Gas (FLNG) Forecasts 2018-2028

5. Leading Regional Players in Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.1 Leading Countries/ Regions by CAPEX

5.2 Canada Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.2.1 Canada Floating Liquefied Natural Gas (FLNG) Submarket, By Type Forecast 2018-2028

5.2.2 Canada Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028

5.2.3 Canada Floating Liquefied Natural Gas (FLNG) Market Analysis

5.3 U.S. Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.3.1 U.S. Floating Liquefied Natural Gas (FLNG) Submarket, By Type Forecast 2018-2028

5.3.2 U.S. Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028

5.3.3 U.S. Floating Liquefied Natural Gas (FLNG) Market Analysis

5.4 Brazil Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.4.1 Brazil Floating Liquefied Natural Gas (FLNG) Submarket, By Type Forecast 2018-2028

5.4.2 Brazil Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028

5.4.3 Brazil Floating Liquefied Natural Gas (FLNG) Market Analysis

5.5 UK Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.5.1 Brazil Floating Liquefied Natural Gas (FLNG) Submarket, By Type Forecast 2018-2028

5.5.2 Brazil Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028

5.5.3 Brazil Floating Liquefied Natural Gas (FLNG) Market Analysis

5.6 Norway Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.6.1 Norway Floating Liquefied Natural Gas (FLNG) Submarket, By Type Forecast 2018-2028

5.6.2 Norway Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028

5.6.3 Norway Floating Liquefied Natural Gas (FLNG) Market Analysis

5.7 Vietnam Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.7.1 Vietnam Floating Liquefied Natural Gas (FLNG) Submarket, By Type Forecast 2018-2028

5.7.2 Vietnam Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028

5.7.3 Vietnam Floating Liquefied Natural Gas (FLNG) Market Analysis

5.8 China Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.8.1 China Floating Liquefied Natural Gas (FLNG) Submarket, By Type Forecast 2018-2028

5.8.2 China Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028

5.8.3 China Floating Liquefied Natural Gas (FLNG) Market Analysis

5.9 Australia Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.9.1 Australia Floating Liquefied Natural Gas (FLNG) Submarket, By Type Forecast 2018-2028

5.9.2 Australia Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028

5.9.3 Australia Floating Liquefied Natural Gas (FLNG) Market Analysis

5.10 Malaysia Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.10.1 Malaysia Floating Liquefied Natural Gas (FLNG) Submarket, By Type Forecast 2018-2028

5.10.2 Malaysia Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028

5.10.3 Malaysia Floating Liquefied Natural Gas (FLNG) Market Analysis

5.11 Indonesia Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.11.1 Indonesia Floating Liquefied Natural Gas (FLNG) Submarket, By Type Forecast 2018-2028

5.11.2 Indonesia Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028

5.11.3 Indonesia Floating Liquefied Natural Gas (FLNG) Market Analysis

5.12 India Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.12.1 India Floating Liquefied Natural Gas (FLNG) Submarket, By Type Forecast 2018-2028

5.12.2 India Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028

5.12.3 India Floating Liquefied Natural Gas (FLNG) Market Analysis

5.13 Angola Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.13.1 Angola Floating Liquefied Natural Gas (FLNG) Submarket, By Type Forecast 2018-2028

5.13.2 Angola Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028

5.13.3 Angola Floating Liquefied Natural Gas (FLNG) Market Analysis

5.14 Nigeria Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.14.1 Nigeria Floating Liquefied Natural Gas (FLNG) Submarket, By Type Forecast 2018-2028

5.14.2 Nigeria Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028

5.14.3 Nigeria Floating Liquefied Natural Gas (FLNG) Market Analysis

5.15 Iran Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.15.1 Iran Floating Liquefied Natural Gas (FLNG) Submarket, By Type Forecast 2018-2028

5.15.2 Iran Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028

5.15.3 Iran Floating Liquefied Natural Gas (FLNG) Market Analysis

5.16 Rest of the World Floating Liquefied Natural Gas (FLNG) Market 2018-2028

5.16.1 Rest of the World Floating Liquefied Natural Gas (FLNG) Submarket, By Type Forecast 2018-2028

5.16.2 Rest of the World Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028

5.16.3 Rest of the World Floating Liquefied Natural Gas (FLNG) Market Analysis

6. PEST Analysis of the FLNG Market 2017 - 2027

7. Expert Opinion

7.1 Primary Correspondents

7.2 FLNG Outlook

7.3 Drivers & Restraints

7.4 Dominant Region/ Country

7.5 FLNG Fleet Operator Scenario

7.6 Overall Growth Rate, Globally

8. The Leading Companies in the FLNG Market

8.1 Excelerate Energy L.P.

8.1.1 Excelerate Energy L.P. Products and Services

8.1.2 Analysis of Excelerate Energy within the FLNG Market

8.1.3 Excelerate M&A Activity

8.1.4 Future Outlook for Excelerate Energy

8.1.5 Excelerate LNG FPSO Projects

8.2 Hoegh LNG

8.2.1 Hoegh LNG Total Company Sales 2013-2017

8.2.2 Hoegh LNG Products and Services

8.2.3 Analysis of Hoegh LNG within the FLNG Market

8.2.4 Hoegh LNG M&A Activity

8.2.5 Future Outlook for Hoegh LNG

8.2.6 Hoegh LNG Projects

8.3 Golar LNG

8.3.1 Golar LNG Total Company Sales 2013-2017

8.3.2 Golar LNG Products and Services

8.3.4 Golar LNG Limited M&A Activity

8.3.5 Future Outlook for Golar LNG

8.3.6 Golar LNG Projects

8.4 Royal Dutch Shell plc

8.4.1 Royal Dutch Shell plc Total Company Sales 2013-2017

8.4.2 Analysis of Royal Dutch Shell plc within the FLNG Market

8.4.3 Future Outlook for Royal Dutch Shell plc

8.4.4 Royal Dutch Shell plc Projects

8.5 Petronas

8.5.1 Petronas Total Company Sales 2013-2017

8.5.2 Analysis of Petronas within the FLNG Market

8.5.3 Petronas M&A Activity

8.5.4 Fture Outlook for Petronas

8.5.5 Petronas LNG FPSO Projects

8.6 Exmar

8.6.1 Exmar Total Company Sales 2013-2017

8.6.2 Analysis of Exmar within the FLNG Market

8.6.3 Exmar M&A Activity

8.6.4 Future Outlook for Exmar

8.7 Noble Energy Inc.

8.7.1 Noble Energy Inc. Total Company Sales 2013-2017

8.7.2 Analysis of Noble Energy Within the FLNG Market

8.7.3 Noble Energy M&A Activity

8.7.4 Future Outlook for Noble Energy

8.8 Woodside Petroleum Limited

8.8.1 Woodside Petroleum Limited Total Company Sales 2013-2017

8.8.2 Analysis of Woodside within the FLNG Market

8.8.3 Future Outlook for Woodside

8.9 DAEWOO Shipbuilding & Marine Engineering Co., Ltd. (DSME)

8.9.1 DSME Total Company Sales 2013-2017

8.9.2 Analysis of DSME within the FLNG Market

8.9.3 DSME M&A Activity

8.9.4 Future Outlook for DSME

8.9.5 DSME Projects

8.10 Samsung Heavy Industries Co., Ltd.

8.10.1 Analysis of Samsung Heavy Industries Co., Ltd within the FLNG Market

8.10.2 Samsung Heavy Industries Co., Ltd. Total Company Revenue 2013-2017

8.10.3 Samsung Heavy Industries Co., Ltd. M&A Activity

8.10.4 Future Outlook for Samsung Heavy Industries Co., Ltd.

8.10.5 Samsung Heavy Industries Co., Ltd.Projects

8.11 Hyundai Heavy Industries Co., Ltd.

8.11.1 Analysis of Hyundai Heavy Industries Co., Ltd within the FLNG Market

8.11.2 Hyundai Heavy Industries Co., Ltd. Total Company Sales 2012-2016

8.11.3 Hyundai Heavy Industries Co., Ltd M&A Activity

8.11.4 Future Outlook for Hyundai Heavy Industries Co., Ltd.

8.11.5 Hyundai Heavy Industries Co., Ltd. Projects

9. Conclusions and Recommendations

9.1 Global FLNG Market Outlook

9.2 Recommendations

10. Glossary

Associated visiongain Reports

visiongain Report Sales Order Form

Appendix A

About visiongain

Appendix B

visiongain report evaluation form

List of Tables

Table 3.1 Global Floating Liquefied Natural Gas (FLNG) Market Forecast 2018-2028 ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 4.1 Global Floating Liquefied Natural Gas (LNG) Market Forecast 2018-2028 FPSO and FSRU ($mn, AGR %, Cumulative)

Table 4.2 Global Floating Liquefied Natural Gas (LNG) Market Forecast 2018-2028 FPSO and FSRU (Units, AGR %, Cumulative)

Table 4.3 Global FPSO Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 and number of vessels ($m, Units, AGR %, Cumulative)

Table 4.4 Global FPSO Drivers and Restraints

Table 4.5 Global Floating Production Storage and Offloading (FPSO), by Component Submarket (Topside, Hull, Mooring System) Forecast 2018-2028($mn, AGR %, Cumulative)

Table 4.6 Global Topside Floating Production Storage and Offloading (FPSO) CAPEX 2018-2028 ($mn, AGR %, Cumulative)

Table 4.7 LNG FPSO Topside Components

Table 4.8 Global Hull Floating Production Storage and Offloading (FPSO)CAPEX 2018-2028 ($m, AGR %, Cumulative)

Table 4.9 LNG FPSO Hull Components

Table 4.10 Global Mooring System Floating Production Storage and Offloading (FPSO) CAPEX 2018-2028 ($mn, AGR %, Cumulative)

Table 4.11 LNG FPSO Mooring System Components

Table 4.12 Planned Global LNG FPSO Projects (Main Sponsor(s), Liquefaction Technology, Constructor, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($bn))

Table 4.13 List of Global Operational FPSO Fleet (Unit Name, Location, Owner, Storage (000s bbl), processing capacity (b/d), Gas Handling (mmcf/d), Water Depth (M), Installation date)

Table 4.14 Global FSRU Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 ($m, Units, AGR %, Cumulative)

Table 4.15 Global FSRU Drivers and Restraints

Table 4.16 Planned FSRU Infrastructure (Owner, Name, Assigned, Storage (m3), mmscfd, mtpa, Completion)

Table 4.17 Current Global FSRU Fleet (Owner, Constructor/Converter, MMTPA, Location, Vessel Name, Cost ($m))

Table 4.18 Global Floating Liquefied Natural Gas (LNG), by Build Type Submarket Forecast 2018-2028 ($mn, AGR %, Cumulative)

Table 4.19 Global Floating Liquefied Natural Gas (LNG), by Build Type Submarket Forecast 2018-2028 (Units, AGR %, Cumulative)

Table 4.20 Global Converted Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 and Number of Vessels ($m, Units, AGR %, Cumulative)

Table 4.21 Global Converted Drivers and Restraints

Table 4.22 Global New Build Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 and Number of Vessels ($m, Units, AGR %, Cumulative)

Table 4.23 Global New Build Drivers and Restraints

Table 4.24 Global Floating Liquefied Natural Gas (FLNG), by Operator Submarket Forecast by Type (I, II, III, IV) 2018-2028 ($mn, AGR %, Cumulative)

Table 4.25 Global Floating Liquefied Natural Gas (FLNG), by Operator Submarket Forecast by Type (I, II, III, IV) 2018-2028 (Units, AGR %, Cumulative)

Table 4.26 Global Type I Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 and Number of Vessels ($m, Units, AGR %, Cumulative)

Table 4.27 Global Type II Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 and Number of Vessels ($m, Units, AGR %, Cumulative)

Table 4.28 Global Type III Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 and Number of Vessels ($m, Units, AGR %, Cumulative)

Table 4.29 Global Type IV Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 and Number of Vessels ($m, Units, AGR %, Cumulative)

Table 5.1 Global Floating Liquefied Natural Gas (FLNG) Market, by Country/Region Forecast 2018-2028 ($mn, AGR %, Cumulative)

Table 5.2 Global Floating Liquefied Natural Gas (FLNG) Market, by Country/Region Forecast 2018-2028 (Units, AGR %, Cumulative)

Table 5.3 Canada Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 and Number of Vessels ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 5.4 Canada Floating Liquefied Natural Gas (FLNG) Submarket, by Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.5 Canada Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.6 U.S. Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 5.7 U.S. Floating Liquefied Natural Gas (FLNG) Submarket, by Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.8 U.S. Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.9 Brazil Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 5.10 Brazil Floating Liquefied Natural Gas (FLNG) Submarket, by Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.11 Brazil Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.12 U.K. Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 5.13 U.K. Floating Liquefied Natural Gas (FLNG) Submarket, by Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.14 U.K. Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.15 Norway Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 5.16 Norway Floating Liquefied Natural Gas (FLNG) Submarket, by Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.17 Norway Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.18 Vietnam Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 5.19 Vietnam Floating Liquefied Natural Gas (FLNG) Submarket, by Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.20 Vietnam Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.21 China Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 5.22 China Floating Liquefied Natural Gas (FLNG) Submarket, by Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.23 China Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.24 Australia Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 5.25 Australia Floating Liquefied Natural Gas (FLNG) Submarket, by Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.26 Australia Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.27 Malaysia Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 5.28 Malaysia Floating Liquefied Natural Gas (FLNG) Submarket, by Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.29 Malaysia Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.30 Indonesia Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 5.31 Indonesia Floating Liquefied Natural Gas (FLNG) Submarket, by Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.32 Indonesia Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.33 India Floating Liquefied Natural Gas (FLNG) Market Forecast 2018-2028 ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 5.34 India Floating Liquefied Natural Gas (FLNG) Submarket, by Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.35 India Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.36 Angola Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 5.37 Angola Floating Liquefied Natural Gas (FLNG) Submarket, by Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.38 Angola Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.39 Nigeria Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 5.40 Nigeria Floating Liquefied Natural Gas (FLNG) Submarket, by Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.41 Nigeria Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.42 Iran Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 5.43 Iran Floating Liquefied Natural Gas (FLNG) Submarket, by Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.44 Iran Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.45 Rest of the World Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 5.46 Rest of the World Floating Liquefied Natural Gas (FLNG) Submarket, by Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 5.47 Rest of the World Floating Liquefied Natural Gas (FLNG) Submarket, by Build Type Forecast 2018-2028 ($mn, Number of Vessels (Units) AGR %, Cumulative)

Table 6.1 PEST Analysis, FLNG Market

Table 8.1 Excelerate Energy L.P. Profile 2017(Market Entry, Public/Private, Headquarters, Geography, Key Market, Listed on, Products/Services

Table 8.2 Excelerate Energy L.P. Products and Services (Product/Service, Notes)

Table 8.3 Current FSRU Owned by Excelerate (Owner, Constructor, MMTPA, Location, Vessel Name, Estimated Cost ($mn))

Table 8.4 Excelerate’s Planned FSRU Newbuilds and Conversions (Main Sponsor(s)), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($m)

Table 8.5 Planned LNG FPSO Projects Involving Excelerate (Main Sponsor(s), Constructor, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 8.6 Höegh LNG Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $mn, Change in Revenue, Geography, Key Market, Listed on, Products/Services)

Table 8.7 Höegh LNG Total Company Sales 2013-2017 (US$ mn, AGR %)

Table 8.8 Höegh LNG Products and Services (Product/Service, Notes)

Table 8.9 Current FSRU Owned by Höegh (Owner, Constructor, MMTPA, Location, Vessel Name, Estimated Cost ($mn)

Table 8.10 Höegh’s Planned FSRU Newbuilds and Conversions (Main Sponsor(s), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 8.11 Planned LNG FPSO Projects Involving Höegh (Main Sponsor(s), Constructor, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 8.12 Golar LNG Limited Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $mn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 8.13 Golar LNG Limited Total Company Sales 2013-2017 (US$ mn, AGR %)

Table 8.14 Golar LNG Products and Services (Product/Service, Notes)

Table 8.15 Current FSRU Owned by Golar (Owner, Constructor, MMTPA, Location, Vessel Name, Estimated Cost ($mn))

Table 8.16 Golar LNG Planned FSRU Newbuilds and Conversions (Main Sponsor(s), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 8.17 Royal Dutch Shell plc Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue $mn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 8.18 Royal Dutch Shell plc Total Company Sales 2013-2017 (US$ mn, AGR %)

Table 8.19 Royal Dutch Shell plc Planned FSRU Newbuilds and Conversions (Main Sponsor(s), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 8.20 PETRONAS Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 8.21 PETRONAS Total Company Sales 2013-2017 (US$ bn, AGR %)

Table 8.22 PETRONAS Planned LNG FPSO Projects (Main Sponsor(s), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 8.23 EXMAR Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $mn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 8.24 EXMAR Total Company Sales 2013-2017 (US$ mn, AGR %)

Table 8.25 Noble Energy Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $mn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 8.26 Noble Energy Total Company Sales 2013-2017 (US$ mn, AGR %)

Table 8.27 Woodside Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $mn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 8.28 Woodside Total Company Sales 2013-2017 (US$ mn, AGR %)

Table 8.29 DSME Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 8.30 DSME Total Company Sales 2013-2017 (US$ bn, AGR %)

Table 8.31 Current FSRU Owned by DSME (Owner, Constructor, MMTPA, Location, Vessel Name, Estimated Cost ($mn))

Table 8.32 DSME Planned FSRU Newbuilds and Conversions (Main Sponsor(s), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 8.33 Planned LNG FPSO Projects Involving DSME (Main Sponsor(s), Constructor, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 8.34 Samsung Heavy Industries Co., Ltd Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 8.35 Samsung Heavy Industries Co., Ltd. ME Total Company Revenue 2013-2017 (US$ bn, AGR %)

Table 8.36 Current FSRU Owned by SHI (Owner, Constructor, MMTPA, Location, Vessel Name, Estimated Cost ($ mn))

Table 8.37 SHI Planned FSRU Newbuilds and Conversions (Main Sponsor(s), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 8.38 Planned LNG FPSO Projects Involving SHI (Main Sponsor(s), Constructor, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 8.39 Scheduled SHI FSRU Deliveries with No Specified Destination (Main Sponsor(s), Constructor/Converter, MMTPA, Earliest Operation, Note, Est. Cost ($mn))

Table 8.40 Hyundai Heavy Industries Co., Ltd. Profile 2016 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 8.41 Hyundai Heavy Industries Co., Ltd. Total Company Sales 2012-2016 (US$ bn, AGR %)

Table 8.42 Current FSRU Owned by HHI (Owner, Constructor, MMTPA, Location, Vessel Name, Estimated Cost ($mn))

Table 8.43 HHI Planned FSRU Newbuilds and Conversions (Main Sponsor(s), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

List of Figures

Figure 2.1 Global FLNG Market Segmentation Overview

Figure 2.2 Small Scale LNG, Value Chain Analysis

Figure 2.3 Simplified Flow Diagram of the Liquefaction

Figure 3.1 Global Floating Liquefied Natural Gas (FLNG) Forecast 2018-2028 ($mn, AGR %)

Figure 3.2 Global LNG Carrier, by Capacity (MCM)Forecast 2018-2028 (Units)

Figure 4.1 Global Floating Liquefied Natural Gas (LNG) Submarket Forecast by CAPEX 2018-2028 ($ mn)

Figure 4.2 Global Floating Liquefied Natural Gas (LNG) Market by Type (CAPEX) Share Forecast 2018, 2023, 2028 (% Share)

Figure 4.3 Floating Liquefied Natural Gas (LNG) Market, By FPSO Forecast 2018-2028 ($mn, AGR%)

Figure 4.4 Floating Liquefied Natural Gas (LNG) Market, By FPSO Forecast 2018-2028 (Units, AGR%)

Figure 4.5 Global Floating Production Storage and Offloading (FPSO)by Component Submarket (Topside, Hull, Mooring System) Forecast 2018-2028 ($ mn)

Figure 4.6 Floating Production Storage and Offloading (FPSO) Market, By Topside Forecast 2018-2028 ($mn, AGR%)

Figure 4.7 Floating Production Storage and Offloading (FPSO) Market, By Hull Forecast 2018-2028 ($mn, AGR%)

Figure 4.8 Floating Production Storage and Offloading (FPSO) Market, By Mooring System Forecast 2018-2028 ($mn, AGR%)

Figure 4.9 Floating Liquefied Natural Gas (LNG) Market, By FSRU Forecast 2018-2028 ($mn, AGR%)

Figure 4.10 Floating Liquefied Natural Gas (LNG) Market, By FSRU Forecast 2018-2028 (Units, AGR%)

Figure 4.11 Global Floating Liquefied Natural Gas (LNG,) by Build Type Submarket Forecast 2018-2028 ($ mn)

Figure 4.12 Global Floating Liquefied Natural Gas (LNG) Market, by Build Type (CAPEX) Share Forecast 2018, 2023, 2028 (% Share)

Figure 4.13 Floating Liquefied Natural Gas (LNG) Market, By Converted Forecast 2018-2028 ($mn, AGR%)

Figure 4.14 Floating Liquefied Natural Gas (LNG) Market, By Converted Forecast 2018-2028 (Units, AGR%)

Figure 4.15 Floating Liquefied Natural Gas (LNG) Market, By New Build Forecast 2018-2028 ($mn, AGR%)

Figure 4.16 Floating Liquefied Natural Gas (LNG) Market, By New Build Forecast 2018-2028 (Units, AGR%)

Figure 4.17 Floating Liquefied Natural Gas (FLNG) Market, Operator Owned VS Contractor % Share, 2017

Figure 4.18 Global Floating Liquefied Natural Gas (FLNG) by Operator Submarket by Type (I, II, III, IV) Forecast 2018-2028 ($ mn)

Figure 4.19 Global Floating Liquefied Natural Gas (FLNG) Market, by Operator (CAPEX) Share Forecast 2018, 2023, 2028 (% Share)

Figure 4.20 Floating Liquefied Natural Gas (FLNG) Market, By Type I Forecast 2018-2028 ($mn, AGR%)

Figure 4.21 Floating Liquefied Natural Gas (LNG) Market, By Type I Forecast 2018-2028 (Units, AGR%)

Figure 4.22 Floating Liquefied Natural Gas (FLNG) Market, By Type II Forecast 2018-2028 ($mn, AGR%)

Figure 4.23 Floating Liquefied Natural Gas (LNG) Market, By Type II Forecast 2018-2028 (Units, AGR%)

Figure 4.24 Floating Liquefied Natural Gas (FLNG) Market, By Type III Forecast 2018-2028 ($mn, AGR%)

Figure 4.25 Floating Liquefied Natural Gas (LNG) Market, By Type III Forecast 2018-2028 (Units, AGR%)

Figure 4.26 Floating Liquefied Natural Gas (FLNG) Market, By Type IV Forecast 2018-2028 ($mn, AGR%)

Figure 4.27 Floating Liquefied Natural Gas (LNG) Market, By Type IV Forecast 2018-2028 (Units, AGR%)

Figure 4.28 Floating Liquefied Natural Gas (LNG) Market, FSRU Fleet by operator

Figure 5.1 Regional/Country Floating Liquefied Natural Gas (FLNG) Market, by CAPEX 2018-2028

Figure 5.2 Regional/Country Floating Liquefied Natural Gas (FLNG) Market, by Number of Fleet (Units) 2018-2028

Figure 5.3 Leading Country/Regional Floating Liquefied Natural Gas (FLNG) Market Share, by CAPEX 2018

Figure 5.4 Leading Country/Regional Floating Liquefied Natural Gas (FLNG) Market Share, by CAPEX 2028

Figure 5.5 Leading Country/Regional Floating Liquefied Natural Gas (FLNG) Market Share, by CAPEX 2028

Figure 5.6 Brazil, Angola, and India FLNG Market Snapshot 2017-2028

Figure 5.7 Top 3 Nations by Highest Number of FLNG Fleet by 2028

Figure 5.8 Canada Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, AGR%)

Figure 5.9 Canada Floating Liquefied Natural Gas (FLNG) Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.10 Canada Floating Liquefied Natural Gas (FLNG) Market, by Number of vessels (Units)Forecast 2018-2028

Figure 5.11 Canada Floating Liquefied Natural Gas (FLNG) Submarket, by Type (CAPEX) Forecast 2017-2028

Figure 5.12 North America Floating Liquefied Natural Gas (FLNG) Submarket (CAPEX), by Build Type Forecast 2018-2028

Figure 5.13 Canada Floating Liquefied Natural Gas (FLNG) Market, by Operator type (I, II) 2017

Figure 5.14 U.S. Floating Liquefied Natural Gas (FLNG) Market Forecast 2018-2028 ($mn, AGR%)

Figure 5.15 U.S. Floating Liquefied Natural Gas (FLNG) Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.16 U.S. Floating Liquefied Natural Gas (FLNG)Market, by Number of vessels (Units) Forecast 2018-2028

Figure 5.17 U.S. Floating Liquefied Natural Gas (FLNG) Submarket, by Type (CAPEX) Forecast 2017-2028

Figure 5.18 U.S. Floating Liquefied Natural Gas (FLNG) Submarket (CAPEX), by Build Type Forecast 2018-2028

Figure 5.19 U.S. Floating Liquefied Natural Gas (FLNG)Market, by Operator type (I, II) 2017

Figure 5.20 Brazil Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, AGR%)

Figure 5.21 Brazil Floating Liquefied Natural Gas (FLNG)Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.22 Brazil Floating Liquefied Natural Gas (FLNG) Market, by Number of vessels (Units) Forecast 2018-2028

Figure 5.23 Brazil Floating Liquefied Natural Gas (FLNG) Submarket, by Type (CAPEX) Forecast 2018-2028

Figure 5.24 Brazil Floating Liquefied Natural Gas (FLNG) Submarket (CAPEX), by Build Type (New Build, Converted) Forecast 2018-2028

Figure 5.25 Brazil Floating Liquefied Natural Gas (FLNG)Market, by Operator Type (I, II, III, IV) 2017

Figure 5.26 U.K. Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, AGR%)

Figure 5.27 U.K. Floating Liquefied Natural Gas (FLNG) Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.28 U.K. Floating Liquefied Natural Gas (FLNG) Market, by Number of vessels (Units) Forecast 2018-2028

Figure 5.29 U.K. Floating Liquefied Natural Gas (FLNG) Submarket, by Type (CAPEX) Forecast 2018-2028

Figure 5.30 U.K. Floating Liquefied Natural Gas (FLNG) Submarket (CAPEX), by Build Type (New build, Converted) Forecast 2018-2028

Figure 5.31 U.K. Floating Liquefied Natural Gas (FLNG)Market, by Operator Type (I, II, III, IV) 2017

Figure 5.32 Norway Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, AGR%)

Figure 5.33 Norway Floating Liquefied Natural Gas (FLNG)Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.34 Norway Floating Liquefied Natural Gas (FLNG) Market, by Number of vessels (Units) Forecast 2018-2028

Figure 5.35 Norway Floating Liquefied Natural Gas (FLNG) Submarket, by Type (CAPEX) Forecast 2018-2028

Figure 5.36 Norway Floating Liquefied Natural Gas (FLNG) Submarket (CAPEX), by Build Type Forecast 2018-2028

Figure 5.37 Norway Floating Liquefied Natural Gas (FLNG)Market, by Operator Type (I, II, III, IV) 2017

Figure 5.38 Vietnam Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, AGR%)

Figure 5.39 Vietnam Floating Liquefied Natural Gas (FLNG)Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.40 Vietnam Floating Liquefied Natural Gas (FLNG) Market, by Number of vessels (Units) Forecast 2018-2028

Figure 5.41 Vietnam Floating Liquefied Natural Gas (FLNG) Submarket, by Type (CAPEX) Forecast 2018-2028

Figure 5.42 Vietnam Floating Liquefied Natural Gas (FLNG) Submarket (CAPEX), by Build Type Forecast 2018-2028

Figure 5.43 Vietnam Floating Liquefied Natural Gas (FLNG)Market, by Operator Type (I, II, III, IV) 2017

Figure 5.44 China Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, AGR%)

Figure 5.45 China Floating Liquefied Natural Gas (FLNG)Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.46 China Floating Liquefied Natural Gas (FLNG) Market, by Number of vessels (Units) Forecast 2018-2028

Figure 5.47 China Floating Liquefied Natural Gas (FLNG) Submarket, by Type (CAPEX) Forecast 2018-2028

Figure 5.48 China Floating Liquefied Natural Gas (FLNG) Submarket (CAPEX), by Build Type Forecast 2018-2028

Figure 5.49 China Floating Liquefied Natural Gas (FLNG) Market, by Operator Type (I, II, III, IV) 2017

Figure 5.50 Australia Floating Liquefied Natural Gas (FLNG) Market Forecast 2018-2028 ($mn, AGR%)

Figure 5.51 Australia Floating Liquefied Natural Gas (FLNG) Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.52 Australia Floating Liquefied Natural Gas (FLNG) Market, by Number of vessels (Units) Forecast 2018-2028

Figure 5.53 Australia Floating Liquefied Natural Gas (FLNG) Submarket, by Type (CAPEX) Forecast 2018-2028

Figure 5.54 Australia Floating Liquefied Natural Gas (FLNG) Submarket (CAPEX), by Build Type Forecast 2018-2028

Figure 5.55 Australia Floating Liquefied Natural Gas (FLNG)Market, by Operator Type (I, II, III, IV) 2017

Figure 5.56 Malaysia Floating Liquefied Natural Gas (FLNG) Market Forecast 2018-2028 ($mn, AGR%)

Figure 5.57 Malaysia Floating Liquefied Natural Gas (FLNG) Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.58 Malaysia Floating Liquefied Natural Gas (FLNG) Market, by Number of vessels (Units) Forecast 2018-2028

Figure 5.59 Malaysia Floating Liquefied Natural Gas (FLNG) Submarket, by Type (CAPEX) Forecast 2018-2028

Figure 5.60 Malaysia Floating Liquefied Natural Gas (FLNG) Submarket (CAPEX), by Build Type Forecast 2018-2028

Figure 5.61 Malaysia Floating Liquefied Natural Gas (FLNG) Market, by Operator Type (I, II, III, IV) 2017

Figure 5.62 Indonesia Floating Liquefied Natural Gas (FLNG)Market Forecast 2018-2028 ($mn, AGR%)

Figure 5.63 Indonesia Floating Liquefied Natural Gas (FLNG)Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.64 Indonesia Floating Liquefied Natural Gas (FLNG) Market, by Number of vessels (Units) Forecast 2018-2028

Figure 5.65 Indonesia Floating Liquefied Natural Gas (FLNG) Submarket, by Type (CAPEX) Forecast 2018-2028

Figure 5.66 Indonesia Floating Liquefied Natural Gas (FLNG) Submarket (CAPEX), by Build Type Forecast 2018-2028

Figure 5.67 Indonesia Floating Liquefied Natural Gas (FLNG) Market, by Operator Type (I, II, III, IV) 2017

Figure 5.68 India Floating Liquefied Natural Gas (FLNG) Market Forecast 2018-2028 ($mn, AGR%)

Figure 5.69 India Floating Liquefied Natural Gas (FLNG) Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.70 India Floating Liquefied Natural Gas (FLNG) Market, by Number of vessels (Units) Forecast 2018-2028

Figure 5.71 India Floating Liquefied Natural Gas (FLNG) Submarket, by Type (CAPEX) Forecast 2018-2028

Figure 5.72 India Floating Liquefied Natural Gas (FLNG) Submarket (CAPEX), by Build Type Forecast 2018-2028

Figure 5.73 India Floating Liquefied Natural Gas (FLNG) Market, by Operator Type (I, II, III, IV) 2017

Figure 5.74 Angola Floating Liquefied Natural Gas (FLNG) Market Forecast 2018-2028 ($mn, AGR%)

Figure 5.75 Angola Floating Liquefied Natural Gas (FLNG) Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.76 Angola Floating Liquefied Natural Gas (FLNG) Market, by Number of vessels (Units) Forecast 2018-2028

Figure 5.77 Angola Floating Liquefied Natural Gas (FLNG) Submarket, by Type (CAPEX) Forecast 2018-2028

Figure 5.78 Angola Floating Liquefied Natural Gas (FLNG) Submarket (CAPEX), by Build Type Forecast 2018-2028

Figure 5.79 Angola Floating Liquefied Natural Gas (FLNG) Market, by Operator Type (I, II, III, IV) 2017

Figure 5.80 Nigeria Floating Liquefied Natural Gas (FLNG) Market Forecast 2018-2028 ($mn, AGR%)

Figure 5.81 Nigeria Floating Liquefied Natural Gas (FLNG) Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.82 Nigeria Floating Liquefied Natural Gas (FLNG) Market, by Number of vessels (Units) Forecast 2018-2028

Figure 5.83 Nigeria Floating Liquefied Natural Gas (FLNG) Submarket, by Type (CAPEX) Forecast 2018-2028

Figure 5.84 Nigeria Floating Liquefied Natural Gas (FLNG) Submarket (CAPEX), by Build Type Forecast 2018-2028

Figure 5.85 Nigeria Floating Liquefied Natural Gas (FLNG) Market, by Operator Type (I, II, III, IV) 2017

Figure 5.86 Iran Floating Liquefied Natural Gas (FLNG) Market Forecast 2018-2028 ($mn, AGR%)

Figure 5.87 Iran Floating Liquefied Natural Gas (FLNG)Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.88 Iran Floating Liquefied Natural Gas (FLNG) Market, by Number of vessels (Units)Forecast 2018-2028

Figure 5.89 Iran Floating Liquefied Natural Gas (FLNG) Submarket, by Type (CAPEX) Forecast 2018-2028

Figure 5.90 Iran Floating Liquefied Natural Gas (FLNG) Submarket (CAPEX), by Build Type Forecast 2018-2028

Figure 5.91 Iran Floating Liquefied Natural Gas (FLNG)Market, by Operator Type (I, II, III, IV) 2017

Figure 5.92 Rest of the World Floating Liquefied Natural Gas (FLNG) Market Forecast 2018-2028 ($mn, AGR%)

Figure 5.93 Rest of the World Floating Liquefied Natural Gas (FLNG) Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.94 Rest of the World Floating Liquefied Natural Gas (FLNG) Market, by Number of vessels (Units) Forecast 2018-2028

Figure 5.95 Rest of the World Floating Liquefied Natural Gas (FLNG) Submarket, by Type (CAPEX) Forecast 2018-2028

Figure 5.96 Rest of the World Floating Liquefied Natural Gas (FLNG) Submarket (CAPEX), by Build Type Forecast 2018-2028

Figure 5.97 Rest of the World Floating Liquefied Natural Gas (FLNG) Market, by Operator (I, II, III, IV) 2017

Figure 8.1 Höegh LNG Total Company Sales 2013-2017 (US$ mn, AGR %)

Figure 8.2 Golar LNG Limited Total Company Sales 2013-2017 (US$ mn, AGR %)

Figure 8.3 Royal Dutch Shell plc Total Company Sales 2013-2017 (US$ mn, AGR %)

Figure 8.4 Royal Dutch Shell Revenue %Share, by Business Segment, 2017

Figure 8.5 Royal Dutch Shell Revenue % Share, by Regional Segment, 2017

Figure 8.6 PETRONAS Total Company Sales 2013-2017 (US$ bn, AGR %)

Figure 8.7 PETRONAS Revenue % Share, by Product Segment, 2017

Figure 8.8 PETRONAS Revenue % Share, by Geographical Trade, 2017

Figure 8.9 PETRONAS Revenue % Share, by Business Segment, 2017

Figure 8.10 PETRONAS Revenue % Share, by Geographic Segment, 2017

Figure 8.11 EXMAR Total Company Sales 2013-2017 (US$ mn, AGR %)

Figure 8.12 Noble Energy Total Company Sales 2013-2017 (US$ mn, AGR %)

Figure 8.13 Noble Energy Revenue % Share, by Regional Segment, 2017

Figure 8.14 Woodside Total Company Sales 2013-2017 (US$ mn, AGR %)

Figure 8.15 Woodside Revenue % Share, by Regional Segment, 2017

Figure 8.16 Woodside Revenue % Share, by Business Segment, 2017

Figure 8.17 DSME Total Company Sales 2013-2017 (US$ bn, AGR %)

Figure 8.18 Samsung Heavy Industries Co., Ltd. Total Company Revenue 2013-2017 (US$ bn, AGR %)

Figure 8.19 Hyundai Heavy Industries Co., Ltd. Company Sales 2012-2016 (US$ bn, AGR %)

Figure 8.20 Hyundai Heavy Industries Co., Ltd Revenue % Share, by Business Segment, 2016

Figure 9.1 Global FLNG Market Forecast 2018-2028 ($ mn, AGR %)

AB Klaipedos Nafta

AET

Air Products and Chemicals Inc

Aker Floating Production

Altagas

Anadarko

Avner Oil & Gas Exploration

BC LNG

Berlian Laju

BG Group Plc

BGT Limited

BHP Billiton

Black and Veatch

Blue Sky Langsa

Bolognesi

BP

Browse Joint Venture

Bumi Armada

BW Group

BW Maritime

BW Offshore

CACT

Canada Stewart Energy

CB&I Lummus

Chevron

CNOOC (China National Offshore Oil Corporation)

Colbún SA

ConocoPhillips

Cove Energy

Cove Point LNG

Cuu Long JOC

Daewoo Shipbuilding and Marine Engineering (DSME)

Dana

DCEP Gas Management Ltd.

Delek Drilling

Delphin LNG

Department of Energy

DetNorske

Doris Engineering

Douglas Channel Energy Consortium (DCEC)

Douglas Channel Energy Partnership (DCEP)

Douglas Channel LNG Assets Partnership

Drydocks World

EDF (Électricité de France)

EDF Trading

Egas

Energy World International

ENI Group

ENI Partners

EnQuest

Excelerate Energy

Excelerate Liquefaction Solutions

Exmar

ExxonMobil

Fairwood Group

FLEX LNG

FMC Technologies

Frontline

Gas Sayago

Gastrade

Gazprom

Gazprom Marketing and Trading

GDF Suez

GE Oil & Gas

Golar LNG

Golar LNG Partners

Granherne

Grassy Point Projects

Haisla Nation

Hess

Höegh LNG

Höegh LNG Holdings Ltd.

Hudong Zhonghua

Husky

Hyundai Heavy Industries (HHI)

ICBC

Idemitsu Kosan

IHI Shipbuilding (IHI)

Indonesian government

INPEX Corporation (INPEX)

Isramco Negev 2 Limited Partnership

JGC Corporation

KBR

Keppel Offshore and Marine (Keppel)

Kinsault Energy

Kogas

Leif Höegh & Co

Leviathan Partners

Linde Engineering

Linde Group

Linde Process Plants Inc.

LNG Partners

Lonestar FLNG

LTL Group (Lanka Transformer Ltd Group)

M3nergy

Maersk O&G

Meridian Holdings Co.

MIMI - Mitsubishi and Mitsui's Japan Australia LNG joint venture

MISC

Mitsubishi

Mitsui Japan Australia LNG

Mitsui O.S.K. Lines (MOL)

MODEC Inc.

MOL

Murphy Oil

Noble Energy

Oil and Natural Gas Corp. Ltd (ONGC)

OLT Offshore

Ophir Energy Plc

Orca LNG

Osaka Gas

Pangea LNG

Peninsula Group

Perenco Cameroon

Perisai

Petrobras

Petromin LNG

Petronas

PNG FLNG

Port Meridian Energy Ltd.

Premier Oil

Quadrant

Reliance Industries Limited

Rosneft

Royal Dutch Shell

Rubicon

RWE Group

Saipem

Samsung Heavy Industries (SHI)

Santos

SBM Offshore

Sembawang

Sevan Marine

Shebah Exploration and Production

SNH

Sonangol

Star Energy

Suncor Energy

Swan Energy

Tamar Partnership

Technip

Teekay Corporation

Tokyo Gas

Toyo Engineering

Vietsopetro

Wison Group

Wison Offshore and Marine

Woodside Petroleum

Yantai Port Group Ltd

Government Organisations Mentioned

American Bureau of Shipping (ABS)

Ceylon Electricity Board (CEB)

Israel Electricity Corporation

Jordan Ministry of Energy

Pertamina – State Oil Company of Indonesia

Petrobangla – National Oil Company of Bangladesh

PetroSA

Petrovietnam

PGN (Perusahaan Gas Negara PGN)

PTTEP (Exploration and Production Division of the National Oil Company of Thailand)

Statoil (Equinor)

World Bank

Download sample pages

Complete the form below to download your free sample pages for Floating Liquefied Natural Gas (FLNG) Market Report 2018-2028

Related reports

-

Top 20 Small-Scale Liquified Natural Gas (SSLNG) Companies 2019

Small Scale LNG is used to supply small or isolated demand centers not connected to pipeline infrastructure, small scale LNG...

Full DetailsPublished: 24 January 2019 -

LNG Yearbook 2018: The Ultimate Guide to Liquefied Natural Gas Infrastructure 2018-2028

The definitive LNG Yearbook 2018 is the ultimate reference source for the liquefied natural gas industry. The yearbook indicates that...

Full DetailsPublished: 14 June 2018 -

Small Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028

Visiongain has calculated that the global Small Scale Liquefied Natural Gas (LNG) Market will see a capital expenditure (CAPEX) of...

Full DetailsPublished: 05 February 2018 -

The Top 20 LNG Infrastructure Companies 2019

There are a number of exciting LNG liquefaction prospects around the world, both under construction and prospective.

...Full DetailsPublished: 11 March 2019 -

LPG Vaporizer Market Report 2019-2029

Visiongain has calculated that the LPG Vaporizing market will see a capital expenditure (CAPEX) of $1.9 bn in 2019. Read...

Full DetailsPublished: 09 May 2019 -

Liquefied Natural Gas (LNG) Carrier Market Report 2019-2029

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global LNG carrier market. Visiongain assesses that...Full DetailsPublished: 20 June 2019 -

Land Seismic Equipment & Acquisition Market Forecast 2018-2028

Visiongain has calculated that the global Land Seismic Equipment & Acquisition Market will see a capital expenditure (CAPEX) of $2,168.2mn...

Full DetailsPublished: 26 January 2018 -

Subsea Production & Processing Systems Market Outlook 2018-2028

Visiongain has calculated that the global Subsea Production & Processing Systems Market will see a capital expenditure (CAPEX) of $16.41...

Full DetailsPublished: 12 February 2018 -

Liquefied Natural Gas (LNG) Carrier Market 2018-2028

Visiongain has calculated that the LNG Carrier market will see a capital expenditure (CAPEX) of $11,208 mn in 2018.Read on...

Full DetailsPublished: 13 February 2018 -

Liquefied Natural Gas (LNG) Bunkering Market 2019-2029

Visiongain has calculated that the LNG Bunkering market will see a capital expenditure (CAPEX) of $843mn in 2019. Read on...

Full DetailsPublished: 30 April 2019

Download sample pages

Complete the form below to download your free sample pages for Floating Liquefied Natural Gas (FLNG) Market Report 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Latest Energy news

Visiongain Publishes Carbon Capture Utilisation and Storage (CCUS) Market Report 2024-2034

The global carbon capture utilisation and storage (CCUS) market was valued at US$3.75 billion in 2023 and is projected to grow at a CAGR of 20.6% during the forecast period 2024-2034.

19 April 2024

Visiongain Publishes Liquid Biofuels Market Report 2024-2034

The global Liquid Biofuels market was valued at US$90.7 billion in 2023 and is projected to grow at a CAGR of 6.7% during the forecast period 2024-2034.

03 April 2024

Visiongain Publishes Hydrogen Generation Market Report 2024-2034

The global Hydrogen Generation market was valued at US$162.3 billion in 2023 and is projected to grow at a CAGR of 3.7% during the forecast period 2024-2034.

28 March 2024

Visiongain Publishes Biofuel Industry Market Report 2024-2034

The global Biofuel Industry market was valued at US$123.2 billion in 2023 and is projected to grow at a CAGR of 7.6% during the forecast period 2024-2034.

27 March 2024