Industries > Energy > Liquefied Natural Gas (LNG) Bunkering Market 2019-2029

Liquefied Natural Gas (LNG) Bunkering Market 2019-2029

Forecasts (CAPEX) and Analysis by Mode including Ship-to-Ship, Port-to-Ship, Truck-to-Ship & Portable Tanks, by End-user Vessel Type including Ferries, Cargo Carriers, PSV, Tanker Fleet & Other Service Vehicles AND by Region PLUS Profiles of Leading Companies in the LNG Bunkering Market

Visiongain has calculated that the LNG Bunkering market will see a capital expenditure (CAPEX) of $843mn in 2019. Read on to discover the potential business opportunities available.

The report will answer questions such as:

– How is the Liquefied Natural Gas (LNG) Bunkering market evolving?

– What is driving and restraining the Liquefied Natural Gas (LNG) Bunkering market dynamics?

– How will each submarket segment grow over the forecast period and how much sales will these submarkets account for in 2029?

– How will market shares of each the Liquefied Natural Gas (LNG) Bunkering submarket develop from 2019-2029?

– Which Liquefied Natural Gas (LNG) Bunkering submarket will be the main driver of the overall market from 2019-2029?

– How will political and regulatory factors influence regional the Liquefied Natural Gas (LNG) Bunkering market and submarkets?

– Will the leading national Liquefied Natural Gas (LNG) Bunkering market broadly follow macroeconomic dynamics, or will individual country sectors outperform the rest of the economy?

– How will market shares of the national markets change by 2029 and which nation will lead the market in 2029?

– Who are the leading players and what are their prospects over the forecast period?

– How will the sector evolve as alliances form during the period between 2019 and 2029?

Five Reasons Why You Must Order and Read This Report Today:

1) The report provides forecasts for the five main end user Vessel Type 2019-2029

– Ferries

– Cargo Carriers

– PSV

– Tanker Fleet

– Other Service Vehicles

2) The report also Forecasts and Analyses the LNG Bunkering market by Mode from 2019-2029

– Ship to Ship

– Port to Ship

– Truck to Ship

– Portable Tanks

3) The report provides CAPEX and Capacity forecasts (2019-2029), plus analysis, for five national/regional LNG Bunkering markets, providing unique insight into LNG industry development

– Norway

– Rest of Europe

– North America

– Asia Pacific

– Rest of the World

4) The report reveals tables detailing all confirmed LNG Bunkering projects:

– Year

– Type

– Owner

– Class

– Country

5) The report provides market share and detailed profiles of the leading companies operating within the LNG Bunkering market:

– Korea Gas Corp

– Harvey Gulf International Marine LLC

– Polskie LNG SA

– ENGIE SA

– Fjord Line

– Equinor

– Gasnor AS

– Skangas AS

This independent 187-page report guarantees you will remain better informed than your competitors. With 132 tables and figures examining the LNG Bunkering market space, the report gives you a direct, detailed breakdown of the market. PLUS, Capital expenditure AND detail of all existing LNG Bunkering, as well as project tables for each region showing the upcoming projects. This report will keep your knowledge that one step ahead of your rivals.

This report is essential reading for you or anyone in the Oil and Gas sector. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Liquefied Natural Gas (LNG) Bunkering Market Overview

1.2 Market Structure Overview and Market Definition

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.7.3 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to The Liquefied Natural Gas (LNG) Bunkering Market

2.1 Global LNG Bunkering Market Structure

2.2 Market Definition

2.3 LNG Bunkering Industry Outlook

2.4 LNG Bunkering Value Chain Analysis

3. Global Overview of Liquefied Natural Gas (LNG) Bunkering Market 2019-2029

3.1 The IMO’s Sulphur 2020 Directive

3.2 Development of Small-scale LNG Carriers and Bunkering

3.3 Promising Sectors for LNG Adoption

3.3.1 Container Fleet

3.3.2 Cruise Vessels

3.3.3 Bulk Carriers

3.3.4 Tanker Fleet

3.4 Popularity of Dual-fuel Engines

3.5 Development of an LNG Supply for Maritime Fuelling

3.6 Alternative Emission Control Options for Vessel Owners

3.6.1 Usage of Low-sulphur Fuel oils

3.6.2 Scrubbers

3.7 Bunkering Leaks may Reduce LNG Benefits

3.8 Regulatory Framework Governing LNG Bunkering

3.9 Infrastructure for LNG Bunkering

3.10 Opportunity for LNG Bunkering in Inland Waterways

3.11 LNG Fuelled Fleet and Historical Data

3.12 Global Liquefied Natural Gas (LNG) Bunkering Drivers and Restraints

4. Liquefied Natural Gas (LNG) Bunkering Submarkets Forecasts 2019-2029

4.1 Global Liquefied Natural Gas (LNG) Bunkering Submarkets Forecasts, by Mode 2019-2029

4.1.1 Global Ship-to-Ship Liquefied Natural Gas (LNG) Bunkering Forecasts 2019-2029

4.1.1.1 Global LNG Bunker Vessel Fleet for Ship-to-Ship Bunkering

4.1.1.2 Global Ship-to-Ship Bunkering Driver & Restraints

4.1.2 Global Port-to-Ship Bunkering Forecasts 2019-2029

4.1.2.1 Key LNG Bunkering Ports Worldwide

4.1.2.2 Global Port-to-Ship Bunkering Driver & Restraints

4.1.3 Global Truck-to-Ship Bunkering Forecasts 2019-2029

4.1.3.1 Global Truck-to-Ship Bunkering Drivers & Restraints

4.1.4 Global Portable Tanks Bunkering Forecasts 2019-2029

4.1.4.1 Global Portable Tanks Bunkering Driver & Restraints

4.2 Global Liquefied Natural Gas (LNG) Bunkering Submarkets Forecasts, by End-user Vessel-type 2019-2029

4.2.1 Global Ferries Liquefied Natural Gas (LNG) Bunkering Forecasts 2019-2029

4.2.1.1 Confirmed Orders of LNG Fuelled New-build Ferries

4.2.1.2 Global Ferries Bunkering Driver & Restraints

4.2.2 Global Cargo Carriers Bunkering Forecasts 2019-2029

4.2.2.1 Confirmed Orders of LNG Fuelled New-build Cargo Carriers

4.2.2.2 Global Cargo Carriers Bunkering Driver & Restraints

4.2.3 Global PSV Bunkering Forecasts 2019-2029

4.2.3.1 Confirmed Orders of LNG Fuelled New-build PSVs

4.2.3.2 Global PSV Bunkering Drivers & Restraints

4.2.4 Global Tanker Fleet Bunkering Forecasts 2019-2029

4.2.4.1 Confirmed Orders of LNG Fuelled New-build Tanker Fleet

4.2.4.2 Global Tanker Fleet Bunkering Driver & Restraints

4.2.5 Global Other Service Vehicles Bunkering Forecasts 2019-2029

4.2.5.1 Confirmed Orders of LNG Fuelled New-build Other Service Vehicles

4.2.5.2 Global Other Service Vehicles Bunkering Driver & Restraints

5. Regional Segmentation of the Liquefied Natural Gas (LNG) Bunkering Market 2019-2029

5.1 Norway LNG Bunkering Market 2019-2029

5.1.1 The Business Sector NOx Fund Impacting LNG Uptake

5.1.2 LNG Bunker Infrastructure in Norway

5.1.3 New Norway Tax Discouraging Uptake of LNG Bunkers

5.1.4 Safety Failures and Remedies in Norwegian LNG Bunkering

5.1.5 Norwegian LNG-fuelled Confirmed New-builds on Order

5.1.6 Norway Liquefied Natural Gas (LNG) Bunkering Drivers and Restraints

5.2 Rest of Europe LNG Bunkering Market 2019-2029

5.2.1 Netherlands LNG Bunkering

5.2.1.1 LNG Bunkering at the Port of Rotterdam

5.2.2 Sweden LNG Bunkering

5.2.2.1 LNG Bunkering at the Port of Stockholm

5.2.2.2 LNG Bunkering at the Port of Gothenburg

5.2.3 Italy LNG Bunkering

5.2.4 Greece LNG Bunkering

5.2.5 Rest of Europe LNG-fuelled Confirmed New-builds on Order

5.2.6 Rest of Europe Liquefied Natural Gas (LNG) Bunkering Drivers and Restraints

5.3 North America LNG Bunkering Market 2019-2029

5.3.1 US LNG Bunkering

5.3.1.1 US Ports with Potential for LNG Bunkering

5.3.1.2 LNG Bunkering in the Port of Fourchon

5.3.1.3 LNG Bunkering in Jacksonville

5.3.1.4 LNG Bunkering in Tacoma

5.3.2 Canada LNG Bunkering

5.3.3 North America LNG-fuelled Confirmed New-builds on Order

5.3.4 North America Liquefied Natural Gas (LNG) Bunkering Drivers and Restraints

5.4 APAC LNG Bunkering Market 2019-2029

5.4.1 Singapore LNG Bunkering

5.4.1.1 Singapore’s LNG Bunkering Pilot Programme

5.4.2 Japan LNG Bunkering

5.4.3 South Korea LNG Bunkering

5.4.4 China LNG Bunkering

5.4.5 APAC LNG-fuelled Confirmed New-builds on Order

5.4.6 APAC Liquefied Natural Gas (LNG) Bunkering Drivers and Restraints

5.5 Rest of the World LNG Bunkering Market 2019-2029

5.5.1 Middle East LNG Bunkering

5.5.2 Russia LNG Bunkering

5.5.3 Rest of the World LNG-fuelled Confirmed New-builds on Order

5.5.4 Rest of the World Liquefied Natural Gas (LNG) Bunkering Drivers and Restraints

6. PEST Analysis of the LNG Bunkering Market

7. Leading Companies in LNG Bunkering Market

7.1 Global LNG Bunkering Market, Company Market Share (%), 2018

7.2 Korea Gas Corp

7.2.2 Korea Gas Corp Future Outlook

7.2.3 Korea Gas Corp Key Developments

7.2.4 Korea Gas Corp Investments and JVs

7.3 Harvey Gulf International Marine LLC

7.3.1 Harvey Gulf International Marine LLC Business Overview

7.3.2 Harvey Gulf International Marine LLC Future Outlook

7.3.3 Harvey Gulf International Marine LLC Key Developments

7.4 Fjord Line

7.4.1 Fjord Line Business Overview

7.4.2 Fjord Line Future Outlook

7.4.3 Fjord Line Key Developments

7.5 Polskie LNG SA

7.5.1 Polskie LNG SA Business Overview

7.5.2 Polskie LNG SA Business Strategy

7.5.3 Polskie LNG SA Key Developments

7.6 GASNOR AS

7.6.1 GASNOR AS Business Overview

7.6.2 GASNOR AS Future Outlook

7.6.3 Overall Shell Key Developments

7.7 ENGIE SA

7.7.1 ENGIE SA Business Overview

7.7.2 ENGIE SA Business Strategy

7.7.3 ENGIE SA Key Developments

7.8 Equinor

7.8.1 Equinor Business Overview

7.9 SKANGAS AS

7.9.1 SKANGAS AS Business Overview

7.9.2 SKANGAS AS Business Strategy

7.9.3 SKANGAS AS Key Developments

7.10 Gazprom Neft PJSC

7.10.1 Gazprom Neft PJSC Business Overview

7.10.2 Gazprom Neft PJSC Future Outlook

7.10.3 Gazprom Neft PJSC Key Developments

7.11 Prima LNG

7.11.1 Prima LNG Business Overview

7.11.2 Prima LNG Key Developments

8. Conclusion & Recommendations

8.1 Key Findings

8.2 Recommendations

9. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

Appendix B

Visiongain report evaluation form

List of Tables

Table 3.1 Global Liquefied Natural Gas (LNG) Bunkering Market by Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 3.2 LNG Bunkering Specifics by Vessel-type (Vessel Type (Receiving vessel), Bunker Quantity, Rate, Duration, Hose Diameter, Suited Bunkering Mode)

Table 3.3 Top Container Shipping Players, (Vendor, country, Market Share 2017 %, Number of Ships)

Table 3.4 LNG Handling Infrastructure in Europe, (Facility, Operating, Under Construction, Planned)

Table 3.5 LNG Fueled Fleet in Service List, (Delivery Date, Ship Name, Shipbuilder, Ship Type, Owner, Class)

Table 3.6 Global Liquefied Natural Gas (LNG) Bunkering Drivers and Restraints

Table 4.1 Global Liquefied Natural Gas (LNG) Bunkering Market Forecast 2019-2029 ($mn, AGR %, Cumulative)

Table 4.2 Global Ship-to-Ship Liquefied Natural Gas (LNG) Bunkering Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 4.3 Global LNG Bunker Vessel Fleet for Ship-to-Ship Bunkering (Name/Owner, Delivery, Capacity (m3)

Table 4.4 Global Ship-to-Ship bunkering Drivers and Restraints

Table 4.5 Global Port-to-Ship Liquefied Natural Gas Bunkering Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 4.6 Key LNG Bunkering Ports Worldwide (Name, Description)

Table 4.7 Global Port-to-Ship Bunkering Drivers and Restraints

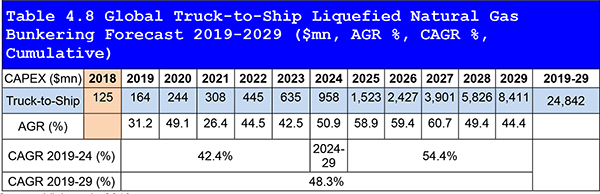

Table 4.8 Global Truck-to-Ship Liquefied Natural Gas Bunkering Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 4.9 Global Truck-to-Ship Bunkering Drivers and Restraints

Table 4.10 Global Portable Tanks Liquefied Natural Gas Bunkering Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 4.11 Global Portable Tanks Bunkering Drivers and Restraints

Table 4.12 Global Liquefied Natural Gas (LNG) Bunkering Market Forecast by End-user Vessel-type 2019-2029 ($mn, AGR %, Cumulative)

Table 4.13 Global Ferries Liquefied Natural Gas (LNG) Bunkering Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 4.14 Confirmed Orders of LNG Fueled New-build Ferries (Year, Type, Owner, Class)

Table 4.15 Global Ferries Bunkering Drivers and Restraints

Table 4.16 Global Cargo Carriers Liquefied Natural Gas Bunkering Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 4.17 Confirmed Orders of LNG Fueled New-build Cargo Carriers (Year, Type, Owner, Class)

Table 4.18 Global Cargo Carriers Bunkering Drivers and Restraints

Table 4.19 Global PSV Liquefied Natural Gas Bunkering Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 4.20 Confirmed Orders of LNG Fueled New-build PSVs (Year, Type, Owner, Class)

Table 4.21 Global PSV Bunkering Drivers and Restraints

Table 4.22 Global Tanker Fleet Liquefied Natural Gas Bunkering Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 4.23 Confirmed Orders of LNG Fueled New-build Tanker Fleet (Year, Type, Owner, Class)

Table 4.24 Global Tanker Fleet Bunkering Drivers and Restraints

Table 4.25 Global Other Service Vehicles Liquefied Natural Gas Bunkering Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 4.26 Confirmed Orders of LNG Fueled New-build Other Service Vehicles (Year, Type, Owner, Class)

Table 4.27 Global Other Service Vehicles Bunkering Drivers and Restraints

Table 5.1 Global LNG Bunkering Market, by Country/Region Forecast 2019-2029 ($mn, AGR %, Cumulative)

Table 5.2 Norway LNG Bunkering Market by Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 5.3 Norwegian LNG-fueled Confirmed New-builds on Order (Year, Type, Owner, Class, Country)

Table 5.4 China Liquefaction Natural Gas (LNG) Bunkering Drivers and Restraints

Table 5.5 Rest of Europe Liquefied Natural Gas (LNG) Bunkering Market by Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 5.6 Rest of Europe LNG-fueled Confirmed New-builds on Order (Year, Type, Owner, Class, Country)

Table 5.7 Rest of Europe Liquefaction Natural Gas (LNG) Bunkering Drivers and Restraints

Table 5.8 North America Liquefied Natural Gas (LNG) Bunkering Market by Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 5.9 Top US Ports and Proximity to Nearest LNG Terminals (US Port Facility, Trade in TEUs (2017), Owner, Closest LNG Terminal, Distance to LNG Terminal)

Table 5.10 North America LNG-fueled Confirmed New-builds on Order (Year, Type, Owner, Class, Country)

Table 5.11 North America Liquefaction Natural Gas (LNG) Bunkering Drivers and Restraints

Table 5.12 APAC Liquefied Natural Gas (LNG) Bunkering Market by Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 5.13 APAC LNG-fueled Confirmed New-builds on Order (Year, Type, Owner, Class, Country)

Table 5.14 APAC Liquefaction Natural Gas (LNG) Bunkering Drivers and Restraints

Table 5.15 Rest of the World Liquefied Natural Gas (LNG) Bunkering Market by Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 5.16 Rest of the World LNG-fueled Confirmed New-builds on Order (Year, Type, Owner, Class, Country)

Table 5.17 Rest of the World Liquefied Natural Gas (LNG) Bunkering Drivers and Restraints

Table 6.1 PEST Analysis, LNG Bunkering Market

Table 7.1 Korea Gas Corp Profile 2017 (Market Entry, Public/Private, Headquarters, No. of Employees, 2017 Revenue $bn, Change in Revenue from 2016, Geography, Key Markets, Listed on, Products/Services)

Table 7.2 Korea Gas Corp Key Developments

Table 7.3 Korea Gas Corp’s Investment in Associates and Joint Ventures 2017 (in million Korean won)

Table 7.4 Korea Gas Corp Total Company Sales 2013-2017 ($ bn, AGR %)

Table 7.5 Harvey Gulf International Marine LLC Profile 2017 (Market Entry, Public/Private, Headquarter, No. of Employees, 2017 Revenue $bn, Change in Revenue from 2016, Geography, Key Markets, Listed on, Products/Services)

Table 7.6 Harvey Gulf International Marine LLC Key Developments

Table 7.7 Fjord Line Profile 2017 (Market Entry, Public/Private, Headquarter, No. of Employees, 2017 Revenue $bn, Change in Revenue from 2016, Geography, Key Markets, Listed on, Products/Services)

Table 7.8 Fjord Line Key Developments

Table 7.9 Fjord Line Total Company Sales 2013-2017 ($ mn, AGR %)

Table 7.10 Polskie LNG SA Profile 2017 (Market Entry, Public/Private, Headquarter, No. of Employees, 2017 Revenue $bn, Change in Revenue from 2016, Geography, Key Markets, Listed on, Products/Services)

Table 7.11 Polskie LNG SA Key Developments

Table 7.12 GASNOR AS 2017 (Market Entry, Public/Private, Headquarters, No. of Employees, 2017 Revenue $bn, Change in Revenue from 2016, Geography, Key Markets, Listed on, Products/Services)

Table 7.13 Overall Shell Key Developments

Table 7.14 GASNOR AS Total Company Sales 2013-2017 ($ mn, AGR %)

Table 7.15 ENGIE SA Profile 2017 (Market Entry, Public/Private, Headquarter, No. of Employees, 2017 Revenue $bn, Change in Revenue from 2016, Geography, Key Markets, Listed on, Products/Services)

Table 7.16 ENGIE SA Key Developments

Table 7.17 ENGIE SA Total Company Sales 2013-2017 ($ bn, AGR %)

Table 7.18 Equinor Profile 2018 (Market Entry, Public/Private, Headquarter, No. of Employees, 2017 Revenue $bn, Change in Revenue from 2016, Geography, Key Markets, Listed on, Products/Services)

Table 7.19 Equinor Total Company Sales 2014-2018 ($ bn, AGR %)

Table 7.20 SKANGAS AS Profile 2017 (Market Entry, Public/Private, Headquarter, No. of Employees, 2017 Revenue $bn, Change in Revenue from 2016, Geography, Key Markets, Listed on, Products/Services)

Table 7.21 SKANGAS AS Key Developments

Table 7.22 SKANGAS AS Total Company Sales 2013-2017 ($ mn, AGR %)

Table 7.23 Gazprom Neft PJSC Profile 2017 (Market Entry, Public/Private, Headquarter, No. of Employees, 2017 Revenue $bn, Change in Revenue from 2016, Geography, Key Markets, Listed on, Products/Services)

Table 7.24 Gazprom Neft PJSC Key Developments

Table 7.25 Gazprom Neft PJSC Total Company Sales 2014-2018($ bn, AGR %)

Table 7.26 Prima LNG Profile 2017 (Market Entry, Public/Private, Headquarter, No. of Employees, 2017 Revenue $bn, Change in Revenue from 2016, Geography, Key Markets, Listed on, Products/Services)

Table 7.27 Prima LNG Key Developments

Table 7.28 Prima LNG Total Company Sales 2013-2017 ($ mn, AGR %)

List of Figures

Figure 2.1 Global LNG Bunkering Market Segmentation Overview

Figure 2.2 LNG Bunkering, Value Chain Analysis

Figure 3.1 Global Liquefied Natural Gas (LNG) Bunkering Forecast 2019-2029 ($mn, AGR %)

Figure 3.2 LNG Fueled Fleet by Type of Engine (% Share)

Figure 3.3 Number of Vessels in Operation or on Order Making Emission Adjustments, market share, (%)

Figure 3.4 Scrubber Adoption by End-user Vessel-type, market share, (%)

Figure 3.5 Total Number of LNG Fueled Fleet by Vessel Type 2017

Figure 4.1 Global Liquefied Natural Gas (LNG) Bunkering Submarket Forecast 2019-2029 ($mn)

Figure 4.2 Global Liquefied Natural Gas (LNG) Bunkering Market by Type (CAPEX) Share Forecast 2019, 2024, 2029 (% Share)

Figure 4.3 Liquefied Natural Gas (LNG) Bunkering Market, By Ship-to-Ship Forecast 2019-2029 ($mn, AGR%)

Figure 4.4 Liquefied Natural Gas (LNG) Bunkering Market, By Port-to-Ship Forecast 2019-2029 ($mn, AGR%)

Figure 4.5 Liquefied Natural Gas (LNG) Bunkering Market, By Truck-to-Ship Forecast 2019-2029 ($mn, AGR%)

Figure 4.6 Liquefied Natural Gas (LNG) Bunkering Market, By Portable Tanks Forecast 2019-2029 ($mn, AGR%)

Figure 4.7 Global Liquefied Natural Gas (LNG) Bunkering Submarket Forecast by End-user Vessel-type 2019-2029($mn)

Figure 4.8 Global Liquefied Natural Gas (LNG) Bunkering Market by End-user Vessel-type (CAPEX) Share Forecast 2019, 2024, 2029 (% Share)

Figure 4.9 Liquefied Natural Gas (LNG) Fueled Fleet by Region, 2006-2018

Figure 4.10 Liquefied Natural Gas (LNG) Bunkering Market, By Ferries Forecast 2019-2029 ($mn, AGR%)

Figure 4.11 Liquefied Natural Gas (LNG) Bunkering Market, By Cargo Carriers Forecast 2019-2029 ($mn, AGR%)

Figure 4.12 Liquefied Natural Gas (LNG) Bunkering Market, By PSV Forecast 2019-2029 ($mn, AGR%)

Figure 4.13 Liquefied Natural Gas (LNG) Bunkering Market, By Tanker Fleet Forecast 2019-2029 ($mn, AGR%)

Figure 4.14 Liquefied Natural Gas (LNG) Bunkering Market, By Tanker Fleet Forecast 2019-2029 ($mn, AGR%)

Figure 5.1 Regional/Country LNG Bunkering Market, by CAPEX

Figure 5.2 Leading Country/Regional LNG Bunkering Market Share, by CAPEX 2019

Figure 5.3 Leading Country/Regional LNG Bunkering Market Share, by CAPEX 2024

Figure 5.4 Leading Country/Regional LNG Bunkering Market Share, by CAPEX 2029

Figure 5.5 Norway LNG Bunkering Forecast 2019-2029 ($mn, AGR%)

Figure 5.6 Norway LNG Bunkering Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.7 Rest of Europe LNG Bunkering Forecast 2019-2029 ($mn, AGR%)

Figure 5.8 Rest of Europe LNG Bunkering Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.9 North America LNG Bunkering Forecast 2019-2029 ($mn, AGR%)

Figure 5.10 North America LNG Bunkering Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.11 APAC LNG Bunkering Forecast 2019-2029 ($mn, AGR%)

Figure 5.12 APAC LNG Bunkering Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.13 Rest of the World LNG Bunkering Forecast 2019-2029 ($mn, AGR%)

Figure 5.14 Rest of the World LNG Bunkering Share Forecast 2019, 2024, 2029 (% Share)

Figure 7.1 Leading Companies in the Market, 2018 LNG Bunkering Market

Figure 7.2 Leading Companies Market Share, 2018 LNG Carrier Market

Figure 7.3 Korea Gas Corp Revenue, ($bn & AGR %), Y-o-Y Revenue Growth, 2013-2017

Figure 7.4 Korea Gas Corp, % Revenue Share, by Business Segment, 2017

Figure 7.5 Korea Gas Corp, % Revenue Share, by Geographical Segment, 2017

Figure 7.6 Fjord Line Revenue, ($mn & AGR %), Y-o-Y Revenue Growth, 2013-2017

Figure 7.7 GASNOR AS Revenue, ($mn & AGR %), Y-o-Y Revenue Growth, 2013-2017

Figure 7.8 ENGIE SA Revenue, ($bn & AGR %), Y-o-Y Revenue Growth, 2013-2017

Figure 7.9 ENGIE SA, % Revenue Share, by Geographical Segment, 2017

Figure 7.10 Equinor Revenue, ($bn & AGR %), Y-o-Y Revenue Growth, 2014-2018

Figure 7.11 Equinor, % Revenue Share, by Business Segment, 2018

Figure 7.12 Equinor, % Revenue Share, by Geographical Segment, 2018

Figure 7.13 SKANGAS ASA Revenue, ($bn & AGR %), Y-o-Y Revenue Growth, 2013-2017

Figure 7.14 Gazprom Neft PJSC Revenue, ($bn & AGR %), Y-o-Y Revenue Growth, 2014-2018

Figure 7.15 Gazprom Neft PJSC, % Revenue Share, by Business Segment, 2017

Figure 7.16 Gazprom Neft PJSC, % Revenue Share, by Geographical Segment, 2017

Figure 7.17 Prima LNG Revenue, ($mn & AGR %), Y-o-Y Revenue Growth, 2013-2017

Figure 8.1 Global LNG Bunkering Market Forecast 2019-2029 ($ mn, AGR %)

ADNOC

AET

Älvtank

Baleària

BC ferries

Blue LNG

Bremenports

Brittany Ferries

Brodosplit

ButanGas

Carnival Corporation

Caronte & Tourist

CHFS

Chubu Electric Power

CIMC

CMA CGM

Confapi Napoli

COSCO Shipping

Crowley Maritime Corp

Danser group

De Biase

DEME

Disney Cruise Lines

Dragages Ports

Drydocks World

Edison

Energas

Engie SA

Equinor

ESL Shipping

Fjord Line

Fred. Olsen

Furetank Rederi

Galdieri

Gasnor AS

Gazprom Neft PJSC

Gazprombank

GNS Shipping

Grandi Navi Veloci

Groupe Desgagnés

Harvey Gulf International marine LLC

Heerema Offshore

Higas

Ilshin Shipping

Inpex Corporation

Italcost

Kawasaki Kisen Kaisha

Keppel Smit Towage

Kogas

Korea Gas Corp

KPC

Kuwait Petroleum

Liegruppen

Liquigas Marine Service

LNG Gorskaya LLC

LNG Masterplan

Maju Maritime

MAN Cryo

Maxcom Bunker

Mitsui O.S.K. Lines

MSC Cruises

Nationaal LNG Platform

Nauticor

Nippon Yusen Kabushiki Kaisha

Nordlaks

Petronas

Polish Baltic Shipping Co

Polskie LNG SA

Ponant

Prima LNG

PSA Marine

Qatar Petroleum

RCCL

Rederi AB Gotland

Rimorchiatori Riuniti Panfido

Rosneft

Royal Doeksen

SCF

Shell

Shturman Koshelev LLC

Siem Car Carriers

Siem Offshore

Skangas AS

Snam

So De Co.

Sofregaz

Sumitomo Corp

Swedegas

Teekay Offshore

Thun Tankers

Torghatten

Total SA

TOTE Ship Holdings

Toyota Tsusho Corporation

Uyeno Transtech

van der Kamp

Wartsila

Xijiang shipping

Organisations Mentioned

Society for Gas as a Marine Fuel

Society of Quebec Ferries

Yokohama-Kawasaki International Port Corp

World Ports Climate Initiative

US Coast Guard

SeOil Agency/Gas Entec

Northern Adriatic Sea Port Authority

German Transport Ministry

Download sample pages

Complete the form below to download your free sample pages for Liquefied Natural Gas (LNG) Bunkering Market 2019-2029

Related reports

-

Small & Mid-Scaled LNGC & LNGBV Market Report 2019-2029

Visiongain’s forecasts indicate that the global the Small-Scale LNG Carrier, Medium-Scale Carrier and LNG Bunkering Vessels see capital expenditures (CAPEX)...

Full DetailsPublished: 13 May 2019 -

The Airborne Geophysical Services Market Forecast 2019-2029

The airborne geophysical services market entails high capital investments along with high risk. The risk involved is comparatively high owing...Full DetailsPublished: 19 March 2019 -

Top 20 Small-Scale Liquified Natural Gas (SSLNG) Companies 2019

Small Scale LNG is used to supply small or isolated demand centers not connected to pipeline infrastructure, small scale LNG...

Full DetailsPublished: 24 January 2019 -

Micro Liquefied Natural Gas (LNG) Market Forecast 2020-2030

Investments in small scale LNG liquefaction facilities are gaining momentum which has surged the demand for less than 0.1 MTPA...Full DetailsPublished: 18 November 2019 -

LNG Yearbook 2018: The Ultimate Guide to Liquefied Natural Gas Infrastructure 2018-2028

The definitive LNG Yearbook 2018 is the ultimate reference source for the liquefied natural gas industry. The yearbook indicates that...

Full DetailsPublished: 14 June 2018 -

The Top 20 LNG Infrastructure Companies 2019

There are a number of exciting LNG liquefaction prospects around the world, both under construction and prospective.

...Full DetailsPublished: 11 March 2019 -

The Microgrid Market Forecast 2019-2029

Visiongain has calculated that the Microgrid Market will see a capital expenditure (CAPEX) of $12.6bn in 2019. Read on to...Full DetailsPublished: 25 February 2019 -

Liquefied Natural Gas (LNG) Carrier Market 2018-2028

Visiongain has calculated that the LNG Carrier market will see a capital expenditure (CAPEX) of $11,208 mn in 2018.Read on...

Full DetailsPublished: 13 February 2018 -

LATAM Small Scale LNG (SSLNG) Market Forecast 2019-2029

Small Scale LNG is used to supply small or isolated demand centers not connected to pipeline infrastructure, small scale LNG...

Full DetailsPublished: 31 July 2019 -

LPG Vaporizer Market Report 2019-2029

Visiongain has calculated that the LPG Vaporizing market will see a capital expenditure (CAPEX) of $1.9 bn in 2019. Read...

Full DetailsPublished: 09 May 2019

Download sample pages

Complete the form below to download your free sample pages for Liquefied Natural Gas (LNG) Bunkering Market 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Energy news

Energy as a Service (EaaS) Market

The global Energy as a Service (EaaS) market is projected to grow at a CAGR of 12.6% by 2034

25 July 2024

Synthetic Fuels Market

The global Synthetic Fuels market is projected to grow at a CAGR of 23% by 2034

18 July 2024

Power-to-X (P2X) Market

The global Power-to-X (P2X) market is projected to grow at a CAGR of 10.6% by 2034

09 July 2024

Airborne Wind Energy Market

The global Airborne Wind Energy market is projected to grow at a CAGR of 9.7% by 2034

05 June 2024