Industries > Energy > LNG Yearbook 2018: The Ultimate Guide to Liquefied Natural Gas Infrastructure 2018-2028

LNG Yearbook 2018: The Ultimate Guide to Liquefied Natural Gas Infrastructure 2018-2028

Capex Forecasts for Large-Scale Onshore Liquefaction Plants (Export) & Regasification (Import) Terminals, FLNG, FPSO, FSRU Vessels, Small-Scale LNG Bunkering, Fuelling, Satellite Stations & LNG Carriers GTT No. 96, T-Mark III & Mark III Flex, Moss Rosenberg & SPB Technologies

The definitive LNG Yearbook 2018 is the ultimate reference source for the liquefied natural gas industry. The yearbook indicates that the global LNG infrastructure market including large and small-scale LNG, FLNG and Carriers will experience a total Capex of $55.6bn in 2018.

The report will answer the following questions:

• What will dictate investment in LNG infrastructure over the coming 10 years?

• How is the current oil price environment affecting the market and how will CAPEX evolve?

• What is the future of the LNG trade?

• What is the direction that demand for LNG most likely to take?

• Where will the capital be deployed to liquefy natural gas?

• What influences the development of LNG export infrastructure in the US? What is the likely trajectory of investment and why?

• How will the Japanese and Chinese demand for LNG evolve and what impact will this have on the demand for LNG infrastructure?

• How viable are Canadian and East African LNG terminal prospects? When is capital most likely to be deployed on the projects?

• What will the capital expenditure on liquefaction terminals be over the coming 10 years?

• What liquefaction and regasification terminals are in operation, under construction and planned?

• What liquefaction terminals are the most likely to proceed from the planning stage into the construction stage?

• Who are the leading companies in the industry, and, in particular, who are the leading suppliers of LNG?

• What are the growth potentials for existing players and the prospects for new market entrants?

• What political, economic, environmental and technological factors affect expenditure upon onshore LNG terminal infrastructure?

• How and when are floating LNG solutions a viable or preferable alternative to a large-scale onshore facility?

• What are the prospects for the two submarkets- LNG FPSOs and FSRUs?

• Who are the main companies in the FLNG market and what are their market shares?

• Where are the major FLNG projects currently taking place around the world?

• How will each LNG carrier submarket segment grow over the forecast period and how much revenue will these submarkets account for in 2028?

• How will the market shares for each LNG carrier submarket develop from 2018-2028?

• Which containment technologies will prevail and how will these shifts be responded to?

• What is driving and restraining the Small-Scale LNG market dynamics?

• What are the market shares of the submarkets of the overall Small-Scale LNG Market in 2018?

Five reasons why you must order and read this report today:

1. The LNG Yearbook is a compilation of four sector reports providing a complete LNG industry outlook

• Liquefied Natural Gas (LNG) Infrastructure

– Liquefaction

– Regasification

• Floating Liquefied Natural Gas (FLNG)

– LNG FPSO (liquefaction)

– FSRU (regasification)

• Small Scale Liquefied Natural Gas (LNG)

– Small Scale Liquefaction

– Small Scale Regasification

– LNG Satellite Stations

– LNG Bunkering Facilities for Vessels

– LNG Fuelling Stations for Road Vehicles

• Liquefied Natural Gas (LNG) Carriers

– GTT No 96

– T-Mark III and Mark Flex

– Moss

– SPB Containment System

2. The LNG Yearbook contains LNG infrastructure spending and capacity forecasts between 2018 and 2028 across 8 regional markets:

– Australasia

– North America

– Asia

– South America

– South East Asia

– Europe

– Middle East

– Africa

3. The LNG Yearbook features full transcripts of Visiongain’s interviews with key opinion leaders in all fields of the LNG infrastructure market

– Aecom

– Black & Veatch

– Herose

– Kosan Crisplant

– Next Decade LNG

– SNC Lavalin

– Stena Bulk

– Texas LNG

– Tokyo Gas

– WorelyParsons

– Plus 3 other experts: A Senior LNG Advisor at an Oil Major, A Leading Oil & Gas Operator and A leading LNG operator

4. The LNG Yearbook provides detailed tables of all LNG carriers, onshore, offshore & small-scale liquefaction, regasification, bunkering and fuelling projects

– Project name

– Capacity

– Technology

– Main Sponsor

– Status

– Expected delivery date

5. The LNG Yearbook provides analysis of the existing LNG infrastructure fleet including carriers, import and export terminals, bunkering, fuelling and satellite stations

– Project name

– Capacity

– Technology

– Main Sponsor

– Location

Who should read this report?

– Anyone within the global LNG industry

– Oil Engineers/Technicians

– CEOs

– COOs

– Business development managers

– Project and site managers

– Suppliers

– Investors

– Contractors

– Government agencies

The report includes 500+ tables, charts, and graphs that analyse the market into leading national and regional markets. The report also contains profiles and analysis of the leading companies in the market.

How will you benefit from this report?

• Read forecasts of top national and regional markets

• Discover global LNG infrastructure market forecast and the breakdown into the four submarkets: large-scale onshore infrastructure, LNG carriers, floating LNG and small-scale infrastructure

• 700+ pages of insightful quantitative analysis including 500+ tables, charts, and graphs

• See profiles of 30 major companies involved in the market, and their market shares in their relevant submarket as well as expert interviews with leading experts from across the four LNG submarkets

Don’t miss out

LNG Yearbook 2018: The Ultimate Guide to Liquefied Natural Gas (LNG) Infrastructure Market Analysis : Capex Forecasts for Large-Scale Onshore Liquefaction Plants (Export) & Regasification (Import) Terminals, FLNG, FPSO, FSRU Vessels, Small-Scale LNG Bunkering, Fuelling, Satellite Stations & LNG Carriers GTT No. 96, T-Mark III & Mark III Flex, Moss Rosenberg & SPB Technologies report will be of value to anyone who wants to better understand the industry and its dynamics. It will be useful for businesses already involved in a segment of the LNG market, or for those wishing to enter this growing market in the future.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 LNG Yearbook 2016: The Definitive Reference Guide

1.2 Market Definition

1.2.1 Large-Scale Onshore Liquefied Natural Gas Infrastructure Definition

1.2.2 LNG Carriers Market Definition

1.2.3 Floating Liquefied Natural Gas (FLNG) Definition

1.2.4 Small-Scale LNG Infrastructure Definition

1.3 Methodology

1.3.1 Large-Scale Onshore LNG Infrastructure Market Forecast Methodology

1.3.2 Floating LNG Market Forecast Methodology

1.3.3 LNG Carriers Market Forecast Methodology

1.3.4 Small-Scale LNG Market Forecast Methodology

1.4 Why You Should Read This Report

1.5 Benefits of This Report

1.6 Structure of This Report

1.7 Key Questions Answered by This Analytical Report

1.8 Who Is This Report For?

1.9 Frequently Asked Questions (FAQ)

1.10 Associated Visiongain Reports

1.11 About Visiongain

2. Introduction to the LNG Infrastructure Market

2.1 The Role and Function of LNG Infrastructure

2.1.1 The LNG Supply Chain

2.1.2 What is LNG Regasification?

2.1.3 Brief History of LNG Infrastructure

2.2 The Role of LNG Carriers

2.2.1 Global LNG Carrier Market Segmentation

2.2.2 History of LNG Carriers

2.2.3 LNG Carrier Technologies

2.2.4 The LNG Carrier Market Structure

2.3 The Role of FLNG

2.3.1 FLNG Market Structure Overview

2.3.2 FLNG Vessels

2.3.2.1 Regasification Vessels

2.3.2.2 Liquefaction Vessels

2.3.3 FLNG Technology

2.3.3.1 Brief History of FLNG

2.3.3.2 Offshore Regasification

2.3.3.3 Offshore Liquefaction

2.3.3.4 Conversions and New Builds

2.4 The Role of Small-Scale LNG

2.4.1 Global Small-Scale LNG Market Overview

2.4.2 Global Small-Scale LNG Market Segmentation

2.4.3 Small Scale LNG Submarket Categories

2.5 Introduction to LNG Market Dynamics

3. The Global LNG Market

3.1 The Global LNG Submarket Forecasts

3.2 The Global LNG Market Analysis

3.2.1 What is Shaping the Expansion of the Global LNG Trade?

3.2.1.1 Demand Side Factors

3.2.1.2 Supply-Side Drivers

3.2.1.3 Global LNG Market: Where Are We Now; Where Will We Be in 5 Years; Where Will We Be in 10 Years?

3.2.2 The Economics of the LNG Trade versus Movement of Natural Gas via Pipelines

3.2.3 Declining Arbitrage Opportunity

3.2.4 Rising Desire to Increase Energy Security

3.2.5 Unconventional Gas Reserves

3.2.6 Oil Price Collapse Analysis

3.2.7 Supply- Side Factors: Tight Oil

3.2.8 Supply-Side Factors: OPEC

3.2.9 Demand-Side Factors: Western Stagnation

3.2.10 Oil Price and LNG Price Relationship

3.2.11 Can a Global LNG Spot Market Emerge?

4. The Global Large-Scale Onshore LNG Market

4.1 Global Liquefaction Liquefied Natural Gas (LNG) Infrastructure Forecasts 2018-2028

4.2 Global regasification Forecasts

4.3 Global liquefied Natural Gas (LNG) infrastructure, by Liquefied Natural Gas (LNG) Infrastructure Type drivers and restraints

4.4 Large-Scale Liquefaction terminals in operation, Under Construction and Planned

4.5 Large-Scale Regasification Terminals in Operation, Under Construction and Planned

4.6 Leading Regional Players in LNG Liquefaction Market (Large-Scale Onshore) 2018-2028

4.6.1 Australian Large-Scale Onshore LNG Liquefaction market 2018-2028

4.6.1.1 Overall Drivers & Restraints on Australian LNG Liquefaction Investment

4.6.2 U.S. Large-Scale Onshore LNG Liquefaction Market 2018-2028

4.6.2.1 Overall Drivers & Restraints on U.S. LNG Liquefaction Investment

4.6.3 Russian Large-Scale Onshore LNG Liquefaction Market 2018-2028

4.6.3.1 Overall Drivers & Restraints on Russian LNG Liquefaction Investment

4.6.4 Canadian Large-Scale Onshore LNG Liquefaction Market 2018-2028

4.6.4.1 Overall Drivers & Restraints on Canadian LNG Liquefaction Investment

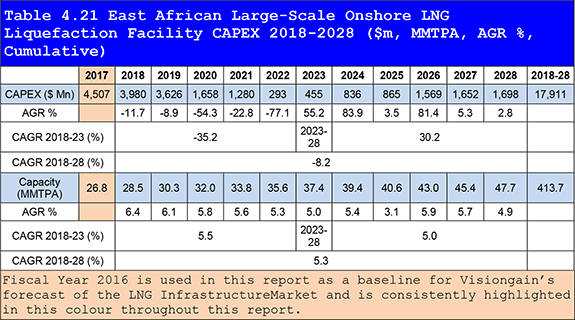

4.6.5 East African Large-Scale Onshore LNG Liquefaction Market 2018-2028

4.6.5.1 Overall Drivers & Restraints on East African LNG Liquefaction investment

4.6.6 rest Of the World Large-Scale Onshore LNG Liquefaction Market 2018-2028

4.6.7 other Onshore LNG Liquefaction Market Outlooks

4.6.7.1 Trinidad & Tobago Onshore LNG Prospects

4.6.7.2 Algeria

4.6.7.3 Angola

4.6.7.4 Nigeria

5. Leading Regional Players in LNG Regasification Market (Large-Scale Onshore) 2018-2028

5.1 China Large-Scale Onshore LNG Regasification Market 218-2028

5.1.1 Overall Drivers & Restraints on China LNG regasification Investment

5.2 Japan Large-Scale Onshore LNG Regasification Market 218-2028 5.2.1 Overall Drivers & Restraints on Japan LNG regasification Investment

5.3 India Large-Scale Onshore LNG Regasification Market 218-2028

5.3.1 Overall Drivers & Restraints on India LNG regasification Investment

5.4 Europe Large-Scale Onshore LNG Regasification Market 218-2028 5.4.1 Overall Drivers & Restraints on Europe LNG Regasification Investment

5.5 South Korea Large-Scale Onshore LNG Regasification Market 218-2028

5.5.1 Overall Drivers & Restraints on South Korea LNG Regasification Investment

5.6 Rest of the World Large-Scale Onshore LNG Regasification Market 218-2028

5.6.1 Overall Drivers & Restraints on Rest of the World LNG Regasification Investment

5.7 South & Central America

5.8 Middle East & Africa

5.9 Global Overview of Liquefied Natural Gas (LNG) Carrier Market

5.9.1 LNG Carriers Fleet and Historical Data

5.10 Global Liquefied Natural Gas (LNG) Carrier Drivers and Restraints

5.11 Global Liquefied Natural Gas (LNG) Carrier Submarkets Forecasts, by Type 2018-2028

5.11.1 Global GTT No 96 Liquefied Natural Gas (LNG) Carrier Forecasts 2018-2028

5.11.1.1 Global GTT No. 96 LNG Carrier Orders

5.11.1.2 Global GTT No. 96 Drivers & Restraints

5.11.2 Global Mark 3 Forecasts 2018-228

5.11.2.1 Global T-Mark 3 Flex LNG Carrier Orders

5.11.2.2 Global Mark 3 and Mark Flex Drivers & Restraints

5.11.3 Global Moss Forecasts 2018-2028

5.11.3.1 Global Moss Rosenberg LNG Carriers Orders

5.11.3.2 Global Moss Drivers & Restraints

5.11.4 Global SPB Forecasts 2018-2028

5.11.4.1 Global SPB LNG Carrier Orders

5.11.4.2 Global SBP Drivers & Restraints

5.11.5 Global Small-Scale Forecasts 2018-2028

5.11.5.1 Small-Scale LNG Carriers Represent a Logical Expansion of LNG Supply

5.11.5.2 Expanding Use of Satellite Stations

5.12 Global Liquefied Natural Gas (LNG) carrier Submarkets Forecasts, by Market Type 2018-2028

5.12.1 Global Retrofit/ Conversion Liquefied Natural Gas (LNG) Carrier Forecasts 2018-2028

5.12.1.1 Global Retrofit/ Conversion Drivers & Restraints

5.12.2 Global New Build Forecasts 2018-2028

5.12.2.1 Global New Build LNG Carrier Market Drivers & Restraints

5.13 Leading Regional Players in Liquefied Natural Gas (LNG) Carrier Market 2018-2028

5.13.1 China LNG Carrier Market 2018-2028

5.13.1.1 Chinese Demand for LNG Carriers

5.13.1.2 Are Expanding Natural Gas Pipeline Supplies to China a Threat to the Chinese LNG Carrier Market

5.13.1.3 increasing Numbers of Chinese Shipyards Capable of Building LNG Carriers

5.13.1.4 LNG Carrier Construction and the Chinese Yuan

5.13.1.5 Labour Costs, Foreign Orders and Attractive Financing

5.13.1.6 Small Scale LNG Carrier Construction in China

5.13.1.7 Limitations on LNG Carrier Market in China

5.13.1.8 Chinese LNG Carrier Orders

5.13.1.9 China Liquefied Natural Gas (LNG) Carrier Drivers and Restraints

5.13.2 Japan LNG Carrier Market 2018-2028

5.13.2.1 The Japanese Yen and LNG Carrier Orders

5.13.2.2 Are Wage Levels Affecting Japanese LNG Carrier orders?

5.13.2.3 The Competitive Advantage of Japanese LNG Carriers

5.13.2.4 Shift Away from Long-Term Contracts Hurting Japanese LNG Carrier Construction Industry

5.13.2.5 The Potential for More LNG Carrier Construction in Japan

5.13.2.6 The Challenge of China to Japanese LNG Carrier Builders

5.13.2.7 The Advantage of Moss Spherical Containment Systems (Only Used by Japanese Shipbuilders)

5.13.2.8 The Small-Scale LNG Carrier Market in Japan

5.13.2.9 The Challenge to Japanese LNG Carrier Builders of South Korean Shipbuilders

5.13.2.10 Japanese LNG Carrier Orders

5.13.2.11 Japan Liquefied Natural Gas (LNG) Carrier Drivers and restraints

5.14 South Korea LNG Carrier Market 2018-2028

5.14.1 Bulk Orders Potential Provides Competitive Advantage

5.14.2 Highly Trusted Status of South Korean Shipbuilders

5.14.3 Q-Max and Q-Flex Vessel History

5.14.4 The Challenge to South Korea OF Chinese Shipbuilders

5.14.5 South Korean LNG Carrier Propulsion Systems Provide Competitive advantage

5.14.6 South Korean Shipbuilding Expertise Depth

5.14.7 South Korean LNG Carrier Orders

5.14.8 South Korea Liquefied Natural Gas (LNG) Carrier Drivers and Restraints

5.15 India LNG Carrier Market 2018-2028

5.15.1 Pipapav Defence and Offshore Engineering Ltd.

5.15.2 L&T Shipbuilding Ltd.

5.15.3 Cochin Shipyard Ltd.

5.15.4 Other National LNG Building Shipyards with Past Orders

5.15.5 India Liquefied Natural Gas (LNG) Carrier Drivers and Restraints

5.16 Rest of the World LNG Carrier Market 2018-2028

5.17 East African LNG Exports and the LNG Carrier Market

5.18 The Impact of North American LNG Exports on the LNG Carrier Market

5.19 West African Natural Gas Supply, LNG Carrier Mileage and LNG Carrier Demand

5.20 Norway, Russia and Ice-Class LNG Carriers

5.21 Rest of the World Liquefied Natural Gas (LNG) Carrier Drivers and Restraints

6. The Global FLNG Market

6.1 Global Floating Liquefied Natural Gas (FLNG) Submarkets Forecasts, by Type 2018-2028

6.1.1 Global FPSO Floating Liquefied Natural Gas (LNG) Forecasts 2018-2028

6.1.1.1 Global FPSO Drivers & Restraints

6.1.2 Global Floating Production Storage and Offloading (FPSO) Submarkets Forecasts, by Component 2018-2028

6.1.2.1 Global Topside Floating Production Storage and Offloading 2018-2028

6.1.2.2 Global Hull Floating Production Storage and Offloading (FPSO) Forecasts 2018-2028

6.1.2.3 Global Mooring System Floating Production Storage and Offloading (FPSO) Forecasts 2018-2028

6.1.2.4 Global FPSO Planned Projects (Current, Planned & Upcoming)

6.1.2.5 Global FSRU Floating Liquefied Natural Gas (LNG) Forecasts 2018-2028

6.1.2.6 Global FSRU Drivers & Restraints

6.1.2.7 Global FSRU Planned Projects (Current, Planned & Upcoming)

6.2 Global Floating Liquefied Natural Gas (LNG) Submarkets Forecasts, by Build Type 2018-2028

6.2.1 Global Converted Floating Liquefied Natural Gas (LNG) Forecasts 2018-2028

6.2.1.1 Global Converted Drivers & Restraints

6.2.2 Global New Build Floating Liquefied Natural Gas (LNG) Forecasts 2018-2028

6.2.2.1 Global New Build Drivers & Restraints

6.3 Global Floating Liquefied Natural Gas (FLNG) Submarkets Forecasts, by Operator 2018-2028

6.3.1 Global Type 1 Floating Liquefied Natural Gas (FLNG) Forecasts 2018-2028

6.3.2 Global Type 2 Floating Liquefied Natural Gas (FLNG) Forecasts 2018-2028

6.3.3 Global Type 3 Floating Liquefied Natural Gas (FLNG) Forecasts 2018-2028

6.3.4 Global Type 4 Floating Liquefied Natural Gas (FLNG) Forecasts 2018-2028

6.4 Leading Regional Players in Floating Liquefied Natural Gas (FLNG) Market 2018-2028

6.4.1 Top 3 Leading Countries in the Global FLNG Market-Investment Opportunity

7. Global Overview of Small-Scale Liquefied Natural Gas (LNG) Market

7.1 Global Small-Scale LNG Market Attractiveness Analysis

7.2 Global Small-Scale LNG Market Analysis

7.2.1 Small-Scale LNG Carriers as Part of the LNG Supply Chain

7.2.2 Small-Scale LNG Containment Technology Advantage

7.2.3 Japanese Small-Scale LNG Prospects

7.2.4 Ship-to-Ship Transfers LNG

7.2.5 Environmental benefits and Small-Scale LNG Carriers

7.2.6 Development of River-Based LNG Carriers

7.2.7 use of Small-Scale LNG for Island Distribution

7.2.8 Oil Prices and the Small-Scale LNG Market

7.3 Global Small Scale Liquefied Natural Gas (LNG) Market Drivers and Restraints

7.4 Global Small-Scale Liquefied Natural Gas (LNG) Submarkets Forecasts, by Type 2018-2028

7.4.1 Global Small-Scale regasification Forecasts 2018-2028

7.4.1.1 Global Small-Scale regasification Drivers and Restraints

7.4.2 Global Small-Scale Liquefaction Forecasts 2018-2028

7.4.2.1 Global Small-Scale Liquefaction Drivers and restraints

7.4.3 Global LNG Satellite Stations Forecasts 2018-2028

7.4.3.1 Global LNG Satellite Stations Drivers and Restraints

7.4.4 Global LNG Bunkering Facilities for Vessels Forecasts 2018-2028

7.4.4.1 Global LNG Bunkering facilities for Vessels Drivers and Restraints

7.4.5 Global Flueing Forecasts 2018-2028

7.4.5.1 Global Fueling Drivers and Restraints

7.5 Leading Regional Market Forecasts 2018-2028

7.5.1 China Small-Scale Liquefied Natural Gas (LNG) Market

7.5.1.1 China Small-Scale Liquefied Natural Gas (LNG) Submarket Forecast 2018-2028

7.5.1.2 China Small-Scale Liquefied Natural Gas (LNG) Market Analysis

7.5.2 Indonesia Small-Scale Liquefied Natural Gas (LNG) Market

7.5.2.1 Indonesia Small-Scale Liquefied Natural Gas (LNG) Submarket Forecast 2018-2028

7.5.2.2 Indonesia Small-Scale Liquefied Natural Gas (LNG) Market Analysis

7.5.3 Japan Small-Scale Liquefied natural Gas (LNG) Market

7.5.3.1 Japan Small-Scale Liquefied Natural Gas (LNG) Submarket Forecast 2018-2028

7.5.3.2 Japan Small-Scale Liquefied Natural Gas (LNG) Market Analysis

7.5.4 U.S. Small-Scale Liquefied natural Gas (LNG) Market

7.5.4.1 U.S. Small-Scale Liquefied Natural Gas (LNG) Submarket Forecast 2018-2028

7.5.4.2 U.S. Small-Scale Liquefied Natural Gas (LNG) Market Analysis

7.5.5 Europe Small-Scale Liquefied Natural Gas (LNG) Market

7.5.5.1 Europe Small-Scale Liquefied Natural Gas (LNG) Submarket Forecast 2018-2028

7.5.5.2 Europe Small-Scale Liquefied Natural Gas (LNG) Market Analysis

7.5.6 Rest of the World Small-Scale Liquefied Natural Gas (LNG) Market

7.5.6.1 Rest of the World Small-Scale Liquefied Natural Gas (LNG) Submarket Forecast 2018-2028

7.5.6.2 rest of the World Small-Scale Liquefied Natural Gas (LNG) Market Analysis

8. PEST Analysis

8.1 PEST Analysis- LNG Infrastructure Market

8.2 PEST Analysis- LNG Carrier Market

8.3 PEST Analysis- FLNG Market

8.4 PEST Analysis- Small-Scale LNG Market

9. Expert Opinion

9.1 Primary Correspondents- LNG Infrastructure

9.1.1 Global LNG Infrastructure Market Outlook

9.1.2 Drivers & Restraints

9.1.3 Dominant region/ Country in the LNG Liquefaction Market

9.1.4 Dominant region/ Country in the LNG Regasification Market

9.1.5 By type (Liquefaction & Regasification Market Scenario

9.1.6 Overall growth Rate, Globally

9.2 Primary Correspondents- LNG Carrier

9.2.1 Drivers & Restraints

9.2.2 Dominant region/ Country in the LNG Carrier Market

9.2.3 Dominant LNG Carrier Type

9.2.4 Overall growth Rate, Globally

9.3 Primary Correspondents- Small-Scale LNG

9.3.1 Small-Scale LNG Market Outlook

9.3.2 Drivers & Restraints

9.3.3 Dominant Region in the Small-Scale LNG Market

9.3.4 By type Market Scenario

9.3.5 Overall Growth Rate, Globally

10. Leading Companies in LNG Infrastructure Market

10.1 BHP Billiton

10.1.1 Company Analysis

10.2 Exxon Mobil

10.2.1 Company Analysis

10.3 BP PLC

10.3.1 Company Analysis

10.4 ConocoPhillips

10.4.1 Company Analysis

10.4.2 Near-Term Expansion

10.4.3 Second Half Expansion

10.4.4 Company Outlook

10.5 Total S.A.

10.5.1 Business Overview

10.5.2 Company Outlook

10.6 Linde AG

10.6.1 Business Overview

10.6.2 Company Outlook

10.7 Royal Dutch Shell

10.7.1 Company Analysis

10.8 Petronas

10.8.1 Company Analysis

10.8.2 Company Outlook

10.9 Chevron Corporation

10.9.1 Company Analysis

10.10 Rosneft

10.10.1 Business Overview

10.10.2 Company Outlook

11. Leading Companies in LNG Carrier Market

11.1 Global LNG Carrier Market, Company Market Share (%), 2017

11.2 Samsung Heavy Industries (SHI)

11.2.1 Business Overview

11.2.2 Future Outlook

11.3 Kawasaki Heavy Industries

11.3.1 Business Overview

11.3.2 Future Outlook

11.4 NYK Line.

11.4.1 Business Overview

11.4.2 future Outlook

11.5 Misc Berhad

11.5.1 Business Overview

11.5.2 Future Outlook

11.6 STX Offshore and Shipbuilding

11.6.1 Business Overview

11.6.2 Future Outlook

11.7 Daewoo Shipbuilding and Marine Engineering (DSME)

11.7.1 Business Overview

11.7.2 Business Strategy

11.8 Mitsubishi Heavy Industries, Ltd.

11.8.1 Business Overview

11.8.2 Business Strategy

11.9 Hyundai Heavy Industries Co., Ltd (Including Hyundai Samho)

11.9.1 Business Overview

11.9.2 Future Outlook

12. The Leading Companies in the FLNG Market

12.1 Excelerate Energy L.P.

12.1.1 Excelerate L.P. Products and Services

12.1.2 Analysis of Excelerate Energy within the FLNG Market

12.1.3 Excelerate M&A Activity

12.1.4 Future Outlook for Excelerate Energy

12.1.5 Excelerate LNG FPSO Projects

12.2 Höegh LNG

12.2.1 Höegh LNG Total Company Revenue 2013-2017

12.2.2 Höegh LNG Products and Services

12.2.3 Analysis of Höegh LNG within the FLNG Market

12.2.4 Höegh LNG M&A Activity

12.2.5 Future Outlook for Höegh LNG

12.2.6 Höegh LNG Projects

12.3 Golar LNG Limited

12.3.1 Golar LNG Limited Total Company Revenue 2013-2017

12.3.2 Golar LNG Products and Services

12.3.3 Analysis of Golar LNG within the FLNG Market

12.3.4 Golar LNG Limited M&A Activity

12.3.5 Future Outlook for Golar LNG

12.3.6 Golar LNG Projects

12.4 Royal Dutch Shell plc

12.4.1 Royal Dutch Shell plc Total Company Revenue 2013-2017

12.4.2 Analysis of Royal Dutch Shell plc within the FLNG Market

12.4.3 Future Outlook for Royal Dutch Shell plc

12.4.4 Royal Dutch Shell plc Projects

12.5 Petronas

12.5.1 PETRONAS Total Company Revenue 2013-2017

12.5.2 Analysis of PETRONAS within the FLNG Market

12.5.3 PETRONAS M&A Activity

12.5.4 Future Outlook for PETRONAS

12.5.5 PETRONAS LNG FPSO Projects

12.6 EXMAR

12.6.1 EXMAR Total Company Revenue 2013-2017

12.6.2 Analysis of EXMAR within the FLNG Market

12.6.3 EXMAR M&A Activity

12.6.4 Future Outlook for EXMAR

12.7 Noble Energy

12.7.1 Noble Energy Total Company Revenue 2013-2017

12.7.2 Analysis of Noble Energy within the FLNG Market

12.7.3 Noble Energy M&A Activity

12.7.4 Future Outlook for Noble Energy

12.8 Woodside

12.8.1 Woodside Total Company Revenue 2013-2017

12.8.2 Analysis of Woodside within the FLNG Market

12.8.3 Future Outlook for Woodside

12.9 DAEWOO Shipbuilding & Marine Engineering Co., Ltd. (DSME)

12.9.1 DSME Total Company Revenue 2013-2017

12.9.2 Analysis of DSME within the FLNG Market

12.9.3 DSME M&A Activity

12.9.4 Future Outlook for DSME

12.9.5 DSME Projects

12.10 Samsung Heavy Industries Co., Ltd.

12.10.1 Analysis of Samsung Heavy Industries Co., Ltd within the FLNG Market

12.10.2 Samsung Heavy Industries Co., Ltd. Total Company Revenue 2013-2017

12.10.3 Samsung Heavy Industries Co., Ltd. M&A Activity

12.10.4 Future Outlook for Samsung Heavy Industries Co., Ltd.

12.10.5 Samsung Heavy Industries Co., Ltd. Projects

12.11 Hyundai heavy Industries Co., Ltd.

12.11.1 Analysis of Hyundai Heavy Industries Co., Ltd within the FLNG Market

12.11.2 Hyundai Heavy Industries Co., Ltd. Total Company Revenue 2012-2016

12.11.3 Hyundai Heavy Industries Co., Ltd M&A Activity

12.11.4 Future Outlook for Hyundai Heavy Industries Co., Ltd.

12.11.5 Hyundai Heavy Industries Co., Ltd. Projects

13. leading Companies in Small-Scale Liquefied natural Gas (LNG) Market

13.1 Gasnor Shell

13.1.1 Company Analysis

13.1.2 Company Outlook

13.2 Skangas

13.2.1 Company Analysis

13.2.2 Company Outlook

13.3 Gazprom

13.3.1 Company Analysis

13.3.2 Company Outlook

13.4 Wartsila

13.4.1 Company Analysis

13.4.2 Company Outlook

13.5 Prometheus Energy Company

13.5.1 Company Analysis

13.5.2 Company Outlook

13.6 PETRONAS

13.6.1 Company Analysis

13.6.2 Company Outlook

13.7 EcoElectrica Inc.

13.7.1 Company Analysis

13.7.2 Company Outlook

13.8 Air Products and Chemicals, Inc.

13.8.1 Company Analysis

13.9 ENN Energy Holdings Limited

13.9.1 Company Analysis

13.9.2 Company Outlook

13.10 Kunlun Energy Company Limited

13.10.1 Company Analysis

13.10.2 Company Outlook

13.11 Global Small-Scale LNG Market, Company Market Share (%), 2017

14. Conclusions & Recommendations

14.1 LNG Infrastructure Market

14.2 LNG Carrier Market

14.2.1 Recommendations for the LNG Carrier Market

14.3 Small-Scale LNG Market

14.4 FLNG Market Conclusion

14.4.1 Key Findings in the FLNG Market

14.4.2 Recommendations

15. Glossary

List of Tables

Table 1.1 Global LNG Infrastructure Market by Regional Market Forecast 2018-2028 ($ mn/MMTPA, AGR %, CAGR)

Table 1.2 The LNG Carrier Market by Regional Market Forecast 2018-2028 ($ mn, MCM, AGR %, CAGR)

Table 1.3 The Small-Scale LNG Market by Regional Market Forecast 2018-2028 ($ mn, MTPA, AGR %, CAGR)

Table 1.4 Global Floating Liquefied Natural Gas (FLNG) Market, by Country/Region Forecast 2018-2028 (CAPEX, Units, AGR %, Cumulative)

Table 3.1 Global LNG Infrastructure CAPEX 2018-2028: Large-Scale Onshore Liquefaction and Regasification (LNG Infrastructure), FLNG, Small-Scale LNG and LNG Carriers ($m, AGR %, Cumulative)

Table 4.1 Global Liquefied Natural Gas (LNG) Infrastructure Forecast 2018-2028($mn, AGR %, CAGR %, Cumulative)

Table 4.2 Global Liquefied Natural Gas (LNG) Import Terminals Details

Table 4.3 Global Liquefied Natural Gas (LNG) Export Terminal

Table 4.4 Global Liquefied Natural Gas (LNG) Infrastructure Market Forecast 2018-2028($mn, AGR %, Cumulative)

Table 4.5 Global Liquefied Natural Gas (LNG) Infrastructure Market Forecast 2018-2028(MMTPA, AGR %, Cumulative)

Table 4.6 Global Liquefaction Liquefied Natural Gas (LNG) Infrastructure Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 4.7 Global Regasification Forecast 2018-2028($mn, AGR %, CAGR %, Cumulative)

Table 4.8 Global Liquefaction Natural Gas (LNG) Infrastructure Drivers and Restraints

Table 4.9: LNG Liquefaction Facilities (Large-Scale) In Operation, Under Construction and Planned (Name, Country, Type, First LNG Export (Year), First Anticipated Production, Status, Current Capacity, Intended Capacity, EPC Cost, Number of Trains)

Table 4.10 Large-Scale Regasification Terminals in Operation, Under Construction and Planned

Table 4.11 Global LNG Liquefaction Market, by Country/Region Forecast 2018-2028 ($mn, AGR %, Cumulative)

Table 4.12 Global LNG Liquefaction Market, by Country/Region Forecast 2018-2028 (MMTPA, AGR %, Cumulative)

Table 4.13 Australian Large-Scale Onshore LNG Liquefaction Facility CAPEX 2018-2028 ($m, MMTPA, AGR %, Cumulative)

Table 4.14 Australian Large-Scale Onshore LNG Liquefaction Drivers and Restraints

Table 4.15 U.S. Large-Scale Onshore LNG Liquefaction Facility CAPEX 2018-2028 ($m, MMTPA, AGR %, Cumulative)

Table 4.16 U.S. Large-Scale Onshore LNG Liquefaction Drivers and Restraints

Table 4.17 Russian Large-Scale Onshore LNG Liquefaction Facility CAPEX 2018-2028 ($m, MMTPA, AGR %, Cumulative)

Table 4.18 Russian Large-Scale Onshore LNG Liquefaction Drivers and Restraints

Table 4.19 Canadian Large-Scale Onshore LNG Liquefaction Facility CAPEX 2018-2028 ($m, MMTPA, AGR %, Cumulative)

Table 4.20 Canadian Large-Scale Onshore LNG Liquefaction Drivers and Restraints

Table 4.21 East African Large-Scale Onshore LNG Liquefaction Facility CAPEX 2018-2028 ($m, MMTPA, AGR %, Cumulative)

Table 4.22 East African Large-Scale Onshore LNG Liquefaction Drivers and Restraints

Table 4.23 Rest of the World Large-Scale Onshore LNG Liquefaction Facility CAPEX 2018-2028 ($m, MMTPA, AGR %, Cumulative)

Table 5.1 Global LNG Regasification Market, by Country/Region Forecast 2018-2028 ($mn, AGR %, Cumulative)

Table 5.2 Global LNG Regasification Market, by Country/Region Forecast 2018-2028 (MMTPA, AGR %, Cumulative)

Table 5.3 China Large-Scale Onshore LNG Regasification Facility CAPEX 2018-2028 ($m, MMTPA, AGR %, Cumulative)

Table 5.4 China Large-Scale Onshore LNG Regasification Drivers and Restraints

Table 5.5 Japan Large-Scale Onshore LNG Regasification Facility CAPEX 2018-2028 ($m, MMTPA, AGR %, Cumulative)

Table 5.6 Japan Large-Scale Onshore LNG Regasification Drivers and Restraints

Table 5.7 India Large-Scale Onshore LNG Regasification Facility CAPEX 2018-2028 ($m, MMTPA, AGR %, Cumulative)

Table 5.8 India Large-Scale Onshore LNG Regasification Drivers and Restraints

Table 5.9 Europe Large-Scale Onshore LNG Regasification Facility CAPEX 2018-2028 ($m, MMTPA, AGR %, Cumulative)

Table 5.10 Europe Large-Scale Onshore LNG Regasification Drivers and Restraints

Table 5.11 South Korea Large-Scale Onshore LNG Regasification Facility CAPEX 2018-2028 ($m, MMTPA, AGR %, Cumulative)

Table 5.12 South Korea Large-Scale Onshore LNG Regasification Drivers and Restraints

Table 5.13 Rest of the World Large-Scale Onshore LNG Regasification Facility CAPEX 2018-2028 ($m, MMTPA, AGR %, Cumulative)

Table 5.14 Rest of the World Large-Scale Onshore LNG Regasification Drivers and Restraints

Table 5.15 Global Liquefied Natural Gas (LNG)Carrier Market by Forecast 2018-2028($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.16 LNG Carriers List, above 60,000cm of Capacity, (Year Built, Ship Name, Shipbuilder, Capacity (cm), Operator, Cargo System)

Table 5.17 Global Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 5.18 Global Liquefied Natural Gas (LNG) Carrier Market Forecast 2018-2028($mn, AGR %, Cumulative)

Table 5.19 Global GTT No 96 Liquefied Natural Gas (LNG) Carrier Forecast 2018-2028($mn, AGR %, CAGR %, Cumulative)

Table 5.20 GTT No. 96 LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 5.21 Global GTT No. 96 Drivers and Restraints

Table 5.22 Global Mark III Liquefied Natural Gas Carrier Forecast 2018-2028($mn, AGR %, CAGR %, Cumulative)

Table 5.23 Mark III LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 5.24 Global Mark III Drivers and Restraints

Table 5.25 Global Moss Liquefied Natural Gas Carrier Forecast 2018-2028($mn, AGR %, CAGR %, Cumulative)

Table 5.26 Moss LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 5.27 Global Moss Drivers and Restraints

Table 5.28 Global SPB Liquefied Natural Gas Carrier Forecast 2018-2028($mn, AGR %, CAGR %, Cumulative)

Table 5.29 SPB LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 5.30 Global SBP Drivers and Restraints

Table 5.31 Global Small Scale Liquefied Natural Gas Carrier Forecast 2018-2028($mn, AGR %, CAGR %, Cumulative)

Table 5.32 Global Liquefied Natural Gas (LNG) Carrier Market Forecast, by Market Type 2018-2028($mn, AGR %, Cumulative)

Table 5.33 Global Retrofit/Conversion Liquefied Natural Gas (LNG) Carrier Forecast 2018-2028($mn, AGR %, CAGR %, Cumulative)

Table 5.34 Global Retrofit/Conversion Drivers and Restraints

Table 5.35 Global New Build Liquefied Natural Gas Carrier Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 5.36 Global New Build LNG Carrier Drivers and Restraints

Table 5.37 Global LNG Carrier Market, by Country/Region Forecast 2018-2028 ($mn, AGR %, Cumulative)

Table 5.38 Global LNG Carrier Market, by Country/Region Forecast 2018-2028 (MCM, AGR %, Cumulative)

Table 5.39 China Liquefied Natural Gas (LNG)Carrier Market by Forecast 2018-2028 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.40 Chinese LNG Import Terminals (Country, Terminal Name, Start Year, Capacity (MTPA), EPC Cost ($), Owners, Status)

Table 5.41 Current Chinese LNG Carrier Order Book (Containment System, Shipbuilder, Owner, Delivery Year, Capacity (cm))

Table 5.42 China Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 5.43 Japan Liquefied Natural Gas (LNG)Carrier Market by Forecast 2018-2028 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.44 Current Japanese LNG Carrier Order Book (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 5.45 Japan Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 5.46 South Korea Liquefied Natural Gas (LNG)Carrier Market by Forecast 2018-2028($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.47 Current South Korean LNG Carrier Order Book (Containment System, Shipbuilder, Owner, Year, Capacity (cm)

Table 5.48 South Korea Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 5.49 India Liquefied Natural Gas (LNG)Carrier Market by Forecast 2018-2028($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.50 India Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 5.51 Rest of the World Liquefied Natural Gas (LNG)Carrier Market by Forecast 2018-2028 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.52 Rest of the World Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 6.1 Global Floating Liquefied Natural Gas (FLNG)Market by Forecast 2018-2028($mn, Number of Vessels (Units), AGR %, CAGR %, Cumulative)

Table 6.2 Global Floating Liquefied Natural Gas (LNG) Market Forecast 2018-2028($mn, AGR %, Cumulative)

Table 6.3 Global Floating Liquefied Natural Gas (LNG) Market Forecast 2018-2028(Units, AGR %, Cumulative)

Table 6.4 Global FPSO Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 ($m, Units, AGR %, Cumulative)

Table 6.5 Global FPSO Drivers and Restraints

Table 6.6 Global Floating Production Storage and Offloading (FPSO), by Component Submarket Forecast 2018-2028($mn, AGR %, Cumulative)

Table 6.7 Global Topside Floating Production Storage and Offloading (FPSO) CAPEX 2018-2028 ($mn, AGR %, Cumulative)

Table 6.8 LNG FPSO Topside Components

Table 6.9 Global Hull Floating Production Storage and Offloading (FPSO)CAPEX 2018-2028 ($m, AGR %, Cumulative)

Table 6.10 LNG FPSO Hull Components

Table 6.11 Global Mooring System Floating Production Storage and Offloading (FPSO) CAPEX 2018-2028 ($mn, AGR %, Cumulative)

Table 6.12 LNG FPSO Mooring System Components

Table 6.13 Planned Global LNG FPSO Projects (Main Sponsor(s), Constructor, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($bn))

Table 6.14 List of Global Operational FPSO Fleet (Unit Name, Location, Owner, Storage (000BBL), Oil Prices, Water Depth, Installation Date)

Table 6.15 Global FSRU Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 ($m, Units, AGR %, Cumulative)

Table 6.16 Global FSRU Drivers and Restraints

Table 6.17 Planned FSRU

Table 6.18 Current Global FSRU Fleet (Owner, Constructor/Converter, MMTPA, Location, Vessel Name, Cost ($m))

Table 6.19 Global Floating Liquefied Natural Gas (LNG), by Build Type Submarket Forecast 2018-2028($mn, AGR %, Cumulative)

Table 6.20 Global Floating Liquefied Natural Gas (LNG), by Build Type Submarket Forecast 2018-2028 (Units, AGR %, Cumulative)

Table 6.21 Global Converted Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 ($m, Units, AGR %, Cumulative)

Table 6.22 Global Converted Drivers and Restraints

Table 6.23 Global New Build Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 ($m, Units, AGR %, Cumulative)

Table 6.24 Global New Build Drivers and Restraints

Table 6.25 Global Floating Liquefied Natural Gas (FLNG), by Operator Submarket Forecast 2018-2028($mn, AGR %, Cumulative)

Table 6.26 Global Floating Liquefied Natural Gas (FLNG), by Operator Submarket Forecast 2018-2028(Units, AGR %, Cumulative)

Table 6.27 Global Type I Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 ($m, Units, AGR %, Cumulative)

Table 6.28 Global Type II Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 ($m, Units, AGR %, Cumulative)

Table 6.29 Global Type III Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 ($m, Units, AGR %, Cumulative)

Table 6.30 Global Type IV Floating Liquefaction Natural Gas (FLNG) CAPEX 2018-2028 ($m, Units, AGR %, Cumulative)

Table 6.31 Global Floating Liquefied Natural Gas (FLNG) Market, by Country/Region Forecast 2018-2028 ($mn, AGR %, Cumulative)

Table 6.32 Global Floating Liquefied Natural Gas (FLNG) Market, by Country/Region Forecast 2018-2028 (Units, AGR %, Cumulative)

Table 7.1 Global Small Scale Liquefied Natural Gas (LNG) Market, by Region Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 7.2 Global Small Scale Liquefied Natural Gas (LNG) Market, by Region Forecast 2018-2028 (MTPA, AGR %, CAGR %, Cumulative)

Table 7.3 Global Small Scale Liquefied Natural Gas (LNG) Market Drivers and Restraints

Table 7.4 Global Small Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028 ($mn, AGR %, Cumulative)

Table 7.5 Global Small-Scale Regasification Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 7.6 Small-Scale Regasification Projects Examples (Name, Country, Start Date, Company, Status)

Table 7.7 Small Scale Regasification Projects Examples (Plant Name, Location, Country, Receiving Capacity, Start Date, Company, Status)

Table 7.8 Global Small-Scale Regasification Drivers and Restraints

Table 7.9 Global Small-Scale Liquefaction Forecast 2018-2028($mn, AGR %, CAGR %, Cumulative)

Table 7.10 Small-Scale Liquefaction Projects Examples (Name, Country, Start Date, Company, Status)

Table 7.11 Small-Scale Liquefaction Projects Examples (Name, Country, Liquefaction Capacity, Start Date, Company, Status)

Table 7.12 Global Small-Scale Liquefaction Drivers and Restraints

Table 7.13 Global LNG Satellite Stations Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 7.14 Global LNG Satellite Stations Drivers and Restraints

Table 7.15 Global LNG Bunkering Facilities for Vessels Forecast 2018-2028($mn, AGR %, CAGR %, Cumulative)

Table 7.16 Operational LNG Bunkering Facilities for Vessels (Name, Location, Country, Company, Date, Notes)

Table 7.17 Operational LNG Bunkering Facilities for Vessels (Name, Location, Country, Company, Date, Notes)

Table 7.18 Global LNG Bunkering Facilities for Vessels Drivers and Restraints

Table 7.19 Global Fueling Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 7.20 LNG Refuelling Stations (Station Name, Year Built, Country, Location, Operator)

Table 7.21 Global Flueing Drivers and Restraints

Table 7.22 Leading National Small-Scale Liquefied Natural Gas (LNG) Market Forecast by Submarket 2018-2028 ($mn, AGR)

Table 7.23 Leading National Small Scale Liquefied Natural Gas (LNG) Market Forecast by Submarket 2018-2028 (MTPA, AGR %)

Table 7.24 China Small-Scale Liquefied Natural Gas (LNG) Market by Forecast 2018-2028 ($mn, MTPA, AGR %, CAGR %, Cumulative)

Table 7.25 China Small-Scale Liquefied Natural Gas (LNG) Market, by Type Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 7.26 Indonesia Small-Scale Liquefied Natural Gas (LNG) Market by Forecast 2018-2028 ($mn, MTPA, AGR %, CAGR %, Cumulative)

Table 7.27 Indonesia Small-Scale Liquefied Natural Gas (LNG) Market, by Type Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 7.28 Japan Small-Scale Liquefied Natural Gas (LNG) Market by Forecast 2018-2028 ($mn, MTPA, AGR %, CAGR %, Cumulative)

Table 7.29 Japan Small-Scale Liquefied Natural Gas (LNG) Market, by Type Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 7.30 U.S. Small-Scale Liquefied Natural Gas (LNG) Market by Forecast 2018-2028 ($mn, MTPA, AGR %, CAGR %, Cumulative)

Table 7.31 U.S. Small-Scale Liquefied Natural Gas (LNG) Market, by Type Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 7.32 Europe Small-Scale Liquefied Natural Gas (LNG) Market by Forecast 2018-2028 ($mn, MTPA, AGR %, CAGR %, Cumulative)

Table 7.33 Europe Small-Scale Liquefied Natural Gas (LNG) Market, by Type Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 7.34 Rest of the World Small-Scale Liquefied Natural Gas (LNG) Market by Forecast 2018-2028 ($mn, MTPA, AGR %, CAGR %, Cumulative)

Table 7.35 Rest of the World Small-Scale Liquefied Natural Gas (LNG) Market, by Type Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 7.36 Global Projects Scenario (Region, Country, Project Name, Terminal Type, Type, Operator, Throughput, Capacity, Status and commissioning date)

Table 8.1 PEST Analysis, LNG Infrastructure Market

Table 8.2 PEST Analysis, LNG Carrier Market

Table 8.3 PEST Analysis, FLNG Market

Table 8.4 PEST Analysis, Small-Scale LNG Market

Table 10.1 BHP Billiton Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 10.2 BHP Billiton, Total Company Revenue 2013-2017 ($bn, AGR %)

Table 10.3 Exxon Mobil Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue $mn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 10.4 ExxonMobil, Total Company Revenue 2013-2017 ($bn, AGR %)

Table 10.5 BP P.L.C. (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 10.6 BP P.L.C., Total Company Revenue 2013-2017 ($bn, AGR %)

Table 10.7 ConocoPhilips Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue US$m, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 10.8 ConocoPhilips Total Company Revenue 2013-2017 ($bn, AGR %)

Table 10.9 Total S.A., Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue $mn, Change in Revenue, Geography, Key Market, Products/Services, No. of Employees)

Table 10.10 Total S.A., Inc. Total Company Revenue 2013-2017 ($bn, AGR %)

Table 10.11 Linde AG Company Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue $mn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 10.12 Linde AG Total Company Revenue 2013-2017 ($bn, AGR %)

Table 10.13 Royal Dutch Shell Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 10.14 Royal Dutch Shell, Total Company Revenue 2013-2017 ($bn, AGR %)

Table 10.15 PETRONAS Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue $mn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 10.16 PETRONAS Total Company Revenue 2013-2017 ($bn, AGR %)

Table 10.17 Chevron Corporation Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 10.18 Chevron Corporation, Total Company Revenue 2013-2017 ($bn, AGR %)

Table 10.19 Rosneft. Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue $mn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 10.20 Rosneft Total Company Revenue 2013-2017 ($bn, AGR %)

Table 11.1 Samsung Heavy Industries (SHI) Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $mn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 11.2 Samsung Heavy Industries LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 11.3 Samsung Heavy Industries (SHI) Total Company Revenue 2013-2017 ($ bn, AGR %)

Table 11.4 Kawasaki Heavy Industries Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 11.5 Kawasaki Heavy Industries LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 11.6 Kawasaki Heavy Industries Total Company Revenue 2012-2016 ($ bn, AGR %)

Table 11.7 NYK Line. Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 11.8 NYK Line. Overview (Total Revenue, Total LNG Carrying Capacity, Percentage in Order Book, Existing Vessels – Orders – Joint Projects, HQ, Contact, Website)

Table 11.9 NYK Line. Total Company Revenue 2014-2017 ($ bn, AGR %)

Table 11.10 Misc Berhad Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 11.11 Misc Berhad LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity)

Table 11.12 Misc Berhad Total Company Revenue 2014-2017 ($ bn, AGR %)

Table 11.13 STX Offshore and Shipbuilding Profile 2016(Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 11.16 Daewoo Shipbuilding and Marine Engineering (DSME) Profile 2016 Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 11.17 Daewoo Shipbuilding and Marine Engineering (DSME)Total Company Revenue 2013-2016 ($ bn, AGR %)

Table 11.18 Mitsubishi Heavy Industries, Ltd. Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 11.19 Mitsubishi Heavy Industries LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 11.20 Mitsubishi Heavy Industries Ltd. Total Company Revenue 2013-2017 ($ bn, AGR %)

Table 11.21 Hyundai Heavy Industries Co., Ltd. Profile 2016(Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 11.22 Hyundai Heavy Industries Co. and Hyundai Samho LNG Carrier Orders (Shipbuilder, Future Owner, Tank Type, LNG Capacity (cm), Delivery Date)

Table 12.1 Excelerate Energy L.P. Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 12.2 Excelerate Energy L.P. Products and Services (Product/Service, Notes)

Table 12.3 Current FSRU Owned by Excelerate (Owner, Constructor, MMTPA, Location, Vessel Name, Estimated Cost ($mn))

Table 12.4 Excelerate’s Planned FSRU Newbuilds and Conversions (Main Sponsor(s), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($m))

Table 12.5 Planned LNG FPSO Projects Involving Excelerate (Main Sponsor(s), Constructor, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 12.6 Höegh LNG Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 12.7 Höegh LNG Total Company Revenue 2013-2017 (US$ mn, AGR %)

Table 12.8 Höegh LNG Products and Services (Product/Service, Notes)

Table 12.9 Current FSRU Owned by Höegh (Owner, Constructor, MMTPA, Location, Vessel Name, Estimated Cost ($mn)

Table 12.10 Höegh’s Planned FSRU Newbuilds and Conversions (Main Sponsor(s), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 12.11 Planned LNG FPSO Projects Involving Höegh (Main Sponsor(s), Constructor, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 12.12 Golar LNG Limited Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 12.13 Golar LNG Limited Total Company Revenue 2013-2017 (US$mn, AGR %)

Table 12.14 Golar LNG Products and Services (Product/Service, Notes)

Table 12.15 Current FSRU Owned by Golar (Owner, Constructor, MMTPA, Location, Vessel Name, Estimated Cost ($mn))

Table 12.16 Golar LNG Planned FSRU Newbuilds and Conversions (Main Sponsor(s), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 12.17 Royal Dutch Shell plc Profile 2017(Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 12.18 Royal Dutch Shell plc Total Company Revenue 2013-2017 (US$mn, AGR %)

Table 12.19 Royal Dutch Shell plc Planned FSRU Newbuilds and Conversions (Main Sponsor(s), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 12.20 PETRONAS Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 12.21 PETRONAS Total Company Revenue 2013-2017 (US$ bn, AGR %)

Table 12.22 PETRONAS Planned LNG FPSO Projects (Main Sponsor(s), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 12.23 EXMAR Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 12.24 EXMAR Total Company Revenue 2013-2017 (US$mn, AGR %)

Table 12.25 Noble Energy Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 12.26 Noble Energy Total Company Revenue 2013-2017 (US$mn, AGR %)

Table 12.27 Woodside Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 12.28 Woodside Total Company Revenue 2013-2017 (US$mn, AGR %)

Table 12.29 DSME Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 12.30 DSME Total Company Revenue 2013-2017 (US$bn, AGR %)

Table 12.31 Current FSRU Owned by DSME (Owner, Constructor, MMTPA, Location, Vessel Name, Estimated Cost ($mn))

Table 12.32 DSME Planned FSRU Newbuilds and Conversions (Main Sponsor(s), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 12.33 Planned LNG FPSO Projects Involving DSME (Main Sponsor(s), Constructor, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 12.34 Samsung Heavy Industries Co., Ltd Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 12.35 Samsung Heavy Industries Co., Ltd. ME Total Company Revenue 2013-2017 (US$ bn, AGR %)

Table 12.36 Current FSRU Owned by SHI (Owner, Constructor, MMTPA, Location, Vessel Name, Estimated Cost ($mn))

Table 12.37 SHI Planned FSRU Newbuilds and Conversions (Main Sponsor(s), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 12.38 Planned LNG FPSO Projects Involving SHI (Main Sponsor(s), Constructor, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 12.39 Scheduled SHI FSRU Deliveries with No Specified Destination (Main Sponsor(s), Constructor/Converter, MMTPA, Earliest Operation, Note, Est. Cost ($mn))

Table 12.40 Hyundai Heavy Industries Co., Ltd.Profile 2016 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 12.41 Hyundai Heavy Industries Co., Ltd. Total Company Revenue 2012-2016 (US$bn, AGR %)

Table 12.42 Current FSRU Owned by HHI (Owner, Constructor, MMTPA, Location, Vessel Name, Estimated Cost ($mn))

Table 12.43 HHI Planned FSRU Newbuilds and Conversions (Main Sponsor(s), Constructor/Converter, MMTPA, Status, Earliest Operation, Location (Field), Est. Cost ($mn))

Table 13.1 Skangas AS LNG Operations

Table 13.2 Gazprom 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 13.3 Gazprom, Total Company Revenue 2013-2017 ($bn, AGR %)

Table 13.7 Wartsila Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 13.8 Wartsila Total Company Revenue 2013-2017 ($bn, AGR %)

Table 13.9 Prometheus Energy Company Profile 2016(Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 13.10 PETRONAS Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 13.11 PETRONAS Total Company Revenue 2013-2017 ($bn, AGR %)

Table 13.12 EcoElectrica Inc. 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 13.13 Air Products and Chemicals, Inc. Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 13.14 Air Products and Chemicals, Inc Total Company Revenue 2013-2017 ($bn, AGR %)

Table 13.15 ENN Energy Holdings Limited Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 13.16 ENN Energy Holdings Limited Total Company Revenue 2013-2017 ($bn, AGR %)

Table 13.17 Kunlun Energy Company Limited 2017 (Market Entry, Public/Private, Headquarter, Total Company Revenue $bn, Change in Revenue, Geography, Key Market, Listed on, Products/Services, No. of Employees)

Table 13.18 Kunlun Energy Company Limited, Total Company Revenue 2013-2017 ($bn, AGR %)

List of Figures

Figure 1.1 World Natural Gas Consumption Forecast, 2010-2040 (Trillion Cubic Feet)

Figure 1.2 The LNG Infrastructure Market by Country/Region Market Share Forecast 2018, 2023, 2028(% Share)

Figure 1.3 The LNG Carrier Market by Country/Region Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 1.4 The Small-Scale LNG Market by Country/Region Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 1.5 Leading Country/Regional Floating Liquefied Natural Gas (FLNG) Market Share, by CAPEX 2018

Figure 1.6 Leading Country/Regional Floating Liquefied Natural Gas (FLNG) Market Share, by CAPEX 2023

Figure 1.7 Leading Country/Regional Floating Liquefied Natural Gas (FLNG) Market Share, by CAPEX 2028

Figure 1.8 Large-Scale Onshore LNG Liquefaction Market Space Definitions

Figure 2.1 LNG, Value Chain Analysis

Figure 2.2 LNG Industry Brief Early History Timeline

Figure 2.3 Global LNG Carrier Market Segmentation Overview

Figure 2.4 History of LNG Carriers

Figure 2.5 Total Number of LNG Carriers Each Year (1965-2015)

Figure 2.6 Global FLNG Market Segmentation Overview

Figure 2.7 Simplified Flow Diagram of the Liquefaction

Figure 2.8 Global Small-Scale LNG Market Segmentation Overview

Figure 2.9 The LNG Supply Chain Including Small-scale Operations

Figure 2.10 Natural Gas Spot Price Forecasts (2000-2050), EIA

Figure 2.11 Top 10 LNG Exporter Countries (Million Tons), 2018

Figure 2.12 Top 10 LNG Importing Countries (MTPA), 2018

Figure 3.1 Global LNG Market (LNG Infrastructure, LNG Carrier, FLNG, Small Scale LNG) Forecast 2018-2028 ($ mn)

Figure 3.2 World Natural Gas Consumption Forecast, 2010-2035 (mtoe)

Figure 3.3 Natural Gas Production by Type and Region (2013-2035) (Billion cubic feet per day and trade (1990-2035)

Figure 3.4 Global LNG Carrier, by Capacity (MCM)Forecast 2018-2028 (MCM)

Figure 4.1 Global Liquefied Natural Gas (LNG) Infrastructure Forecast 2018-2028 ($mn, AGR %)

Figure 4.2 Global Liquefied Natural Gas (LNG) Infrastructure Submarket Forecast 2018-2028 ($mn)

Figure 4.3 Global Liquefied Natural Gas (LNG) Infrastructure Market by Type (CAPEX) Share Forecast 2018, 2023, 2028 (% Share)

Figure 4.4 Liquefied Natural Gas (LNG) Infrastructure Market, By Liquefaction Forecast 2018-2028 ($mn, AGR%)

Figure 4.5 Liquefied Natural Gas (LNG) Infrastructure Market, By Regasification Forecast 2018-2028 ($mn, AGR%)

Figure 4.6 Regional LNG Liquefaction Market, by CAPEX 2018-2028

Figure 4.7 Regional LNG Liquefaction Market, By Capacity (MMTPA) 2018-2028

Figure 4.8 Leading Country/Regional LNG Liquefaction Market Share, by CAPEX 2018

Figure 4.9 Leading Country/Regional LNG Liquefaction Market Share, by CAPEX 2023

Figure 4.10 Leading Country/Regional LNG Liquefaction Market Share, by CAPEX 2028

Figure 4.11 Australian Large-Scale Onshore LNG Liquefaction Facility Forecast 2018-2028 ($mn, AGR%)

Figure 4.12 Australian Large-Scale Onshore LNG Liquefaction Facility Share Forecast 2018, 2023, 2028 (% Share)

Figure 4.13 Australian Large-Scale Onshore LNG Liquefaction Facility, by Capacity Forecast 2018-2028

Figure 4.14 U.S. Large-Scale Onshore LNG Liquefaction Facility Forecast 2018-2028 ($mn, AGR%)

Figure 4.15 U.S. Large-Scale Onshore LNG Liquefaction Facility Share Forecast 2018, 2023, 2028 (% Share)

Figure 4.16 U.S. Large-Scale Onshore LNG Liquefaction Facility, by Capacity Forecast 2018-2028

Figure 4.17 Russian Large-Scale Onshore LNG Liquefaction Facility Forecast 2018-2028 ($mn, AGR%)

Figure 4.18 Russian Large-Scale Onshore LNG Liquefaction Facility Share Forecast 2018, 2023, 2028 (% Share)

Figure 4.19 Russian Large-Scale Onshore LNG Liquefaction Facility, by Capacity Forecast 2018-2028

Figure 4.20 Canadian Large-Scale Onshore LNG Liquefaction Facility Forecast 2018-2028 ($mn, AGR%)

Figure 4.21 Canadian Large-Scale Onshore LNG Liquefaction Facility Share Forecast 2018, 2023, 2028 (% Share)

Figure 4.22 Canadian Large-Scale Onshore LNG Liquefaction Facility, by Capacity Forecast 2018-2028

Figure 4.23 East African Large-Scale Onshore LNG Liquefaction Facility Forecast 2018-2028 ($mn, AGR%)

Figure 4.24 East African Large-Scale Onshore LNG Liquefaction Facility Share Forecast 2018, 2023, 2028 (% Share)

Figure 4.25 East African Large-Scale Onshore LNG Liquefaction Facility, by Capacity Forecast 2018-2028

Figure 4.26 Rest of the World Large-Scale Onshore LNG Liquefaction Facility Forecast 2018-2028 ($mn, AGR%)

Figure 4.27 Rest of the World Large-Scale Onshore LNG Liquefaction Facility Share Forecast 2018, 2023, 2028 (% Share)

Figure 4.28 Rest of the World Large-Scale Onshore LNG Liquefaction Facility, by Capacity Forecast 2018-2028

Figure 5.1 Regional LNG Regasification Market, by CAPEX

Figure 5.2 Regional LNG Regasification Market, By Capacity (MMTPA)

Figure 5.3 Leading Country/Regional LNG Regasification Market Share, by CAPEX 2018

Figure 5.4 Leading Country/Regional LNG Regasification Market Share, by CAPEX 2023

Figure 5.5 Leading Country/Regional LNG Regasification Market Share, by CAPEX 2028

Figure 5.6 China Large-Scale Onshore LNG Regasification Facility Forecast 2018-2028 ($mn, AGR%)

Figure 5.7 China Large-Scale Onshore LNG Regasification Facility Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.8 China Large-Scale Onshore LNG Regasification Facility, by Capacity Forecast 2018-2028

Figure 5.9 Japan Large-Scale Onshore LNG Regasification Facility Forecast 2018-2028 ($mn, AGR%)

Figure 5.10 Japan Large-Scale Onshore LNG Regasification Facility Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.11 Japan Large-Scale Onshore LNG Regasification Facility, by Capacity Forecast 2018-2028

Figure 5.12 India Large-Scale Onshore LNG Regasification Facility Forecast 2018-2028 ($mn, AGR%)

Figure 5.13 India Large-Scale Onshore LNG Regasification Facility Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.14 India Large-Scale Onshore LNG Regasification Facility, by Capacity Forecast 2018-2028

Figure 5.15 Europe Large-Scale Onshore LNG Regasification Facility Forecast 2018-2028 ($mn, AGR%)

Figure 5.16 Europe Large-Scale Onshore LNG Regasification Facility Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.17 Europe Large-Scale Onshore LNG Regasification Facility, by Capacity Forecast 2018-2028

Figure 5.18 South Korea Large-Scale Onshore LNG Regasification Facility Forecast 2018-2028 ($mn, AGR%)

Figure 5.19 South Korea Large-Scale Onshore LNG Regasification Facility Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.20 South Korea Large-Scale Onshore LNG Regasification Facility, by Capacity Forecast 2018-2028

Figure 5.21 Rest of the World Large-Scale Onshore LNG Regasification Facility Forecast 2018-2028 ($mn, AGR%)

Figure 5.22 Rest of the World Large-Scale Onshore LNG Regasification Facility Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.23 Rest of the World Large-Scale Onshore LNG Regasification Facility, by Capacity Forecast 2018-2028

Figure 5.24 Global Liquefied Natural Gas (LNG) Carrier Forecast 2018-2028 ($mn, AGR %)

Figure 5.25 Global LNG Carrier, by Capacity (MCM)Forecast 2018-2028 (MCM)

Figure 5.26 Average Capacity (cm) of LNG Carriers Delivered Each Year

Figure 5.27 Total Combined LNG Carrying Capacity (cm) of Carriers Delivered Each Year (1965-2015)

Figure 5.28 Global Liquefied Natural Gas (LNG) Carrier Submarket Forecast 2018-2028 ($mn)

Figure 5.29 Global Liquefied Natural Gas (LNG) Carrier Market by Type (CAPEX) Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.30 Liquefied Natural Gas (LNG) Carrier Market, By GTT No 96 Forecast 2018-2028 ($mn, AGR%)

Figure 5.31 Liquefied Natural Gas (LNG) Carrier Market, By Mark III Forecast 2018-2028 ($mn, AGR%)

Figure 5.32 Liquefied Natural Gas (LNG) Carrier Market, By Moss Forecast 2018-2028 ($mn, AGR%)

Figure 5.33 Liquefied Natural Gas (LNG) Carrier Market, By SPB Forecast 2018-2028 ($mn, AGR%)

Figure 5.34 Liquefied Natural Gas (LNG) Carrier Market, By Small Scale Forecast 2018-2028 ($mn, AGR%)

Figure 5.35 Global Liquefied Natural Gas (LNG) Carrier Submarket Forecast 2018-2028 ($mn)

Figure 5.36 Global Liquefied Natural Gas (LNG) Carrier Market by Market Type (CAPEX) Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.37 Liquefied Natural Gas (LNG) Carrier Market, By Retrofit/Conversion Forecast 2018-2028 ($mn, AGR%)

Figure 5.38 Liquefied Natural Gas (LNG) Carrier Market, By New Build Forecast 2018-2028 ($mn, AGR%)

Figure 5.39 Regional/Country LNG Carrier Market, by CAPEX 2018-2028

Figure 5.40 Regional/Country LNG Carrier Market, by Capacity (MCM) 2018-2028

Figure 5.41 Leading Country/Regional LNG Carrier Market Share, by CAPEX 2018

Figure 5.42 Leading Country/Regional LNG Carrier Market Share, by CAPEX 2023

Figure 5.43 Leading Country/Regional LNG Carrier Market Share, by CAPEX 2028

Figure 5.44 China LNG Carrier Forecast 2018-2028 ($mn, AGR%)

Figure 5.45 China LNG Carrier Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.46 China LNG Carrier, by Capacity (MCM)Forecast 2018-2028 (MCM)

Figure 5.47 China LNG Carrier, by Type, 2017

Figure 5.48 Japan LNG Carrier Forecast 2018-2028 ($mn, AGR%)

Figure 5.49 Japan LNG Carrier Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.50 Japan LNG Carrier, by Capacity (MCM)Forecast 2018-2028 (MCM)

Figure 5.51 Japan LNG Carrier, by Type, 2017

Figure 5.52 South Korea LNG Carrier Forecast 2018-2028 ($mn, AGR%)

Figure 5.53 South Korea LNG Carrier Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.54 South Korea LNG Carrier, by Capacity (MCM)Forecast 2018-2028 (MCM)

Figure 5.55 South Korea LNG Carrier, by Type, 2017

Figure 5.56 India LNG Carrier Forecast 2018-2028 ($mn, AGR%)

Figure 5.57 India LNG Carrier Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.58 India LNG Carrier, by Type, 2017

Figure 5.59 India LNG Carrier, by Capacity (MCM)Forecast 2018-2028 (MCM)

Figure 5.60 Rest of the World LNG Carrier Forecast 2018-2028 ($mn, AGR%)

Figure 5.61 Rest of the World LNG Carrier Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.62 India LNG Carrier, by Capacity (MCM)Forecast 2018-2028 (MCM)

Figure 5.63 Rest of the World LNG Carrier, by Type, 2017

Figure 6.1 Global Floating Liquefied Natural Gas (FLNG) Forecast 2018-2028 ($mn, AGR %)

Figure 6.2 Global LNG Carrier, by Capacity (MCM)Forecast 2018-2028 (MCM)

Figure 6.3 Global Floating Liquefied Natural Gas (LNG) Submarket Forecast 2018-2028 ($ mn)

Figure 6.4 Global Floating Liquefied Natural Gas (LNG) Market by Type (CAPEX) Share Forecast 2018, 2023, 2028 (% Share)

Figure 6.5 Floating Liquefied Natural Gas (LNG) Market, By FPSO Forecast 2018-2028 ($mn, AGR%)

Figure 6.6 Floating Liquefied Natural Gas (LNG) Market, By FPSO Forecast 2018-2028 (Units, AGR%)

Figure 6.7 Global Floating Production Storage and Offloading (FPSO)by Component Submarket Forecast 2018-2028 ($ mn)

Figure 6.8 Floating Production Storage and Offloading (FPSO) Market, By Topside Forecast 2018-2028 ($mn, AGR%)

Figure 6.9 Floating Production Storage and Offloading (FPSO) Market, By Hull Forecast 2018-2028 ($mn, AGR%)

Figure 6.10 Floating Production Storage and Offloading (FPSO) Market, By Mooring System Forecast 2018-2028 ($mn, AGR%)

Figure 6.11 Floating Liquefied Natural Gas (LNG) Market, By FSRU Forecast 2018-2028 ($mn, AGR%)

Figure 6.12 Floating Liquefied Natural Gas (LNG) Market, By FSRU Forecast 2018-2028 (Units, AGR%)

Figure 6.13 Global Floating Liquefied Natural Gas (LNG,) by Build Type Submarket Forecast 2018-2028 ($ mn)

Figure 6.14 Global Floating Liquefied Natural Gas (LNG) Market, by Build Type (CAPEX) Share Forecast 2018, 2023, 2028 (% Share)

Figure 6.15 Floating Liquefied Natural Gas (LNG) Market, By Converted Forecast 2018-2028 ($mn, AGR%)

Figure 6.16 Floating Liquefied Natural Gas (LNG) Market, By Converted Forecast 2018-2028 (Units, AGR%)

Figure 6.17 Floating Liquefied Natural Gas (LNG) Market, By New Build Forecast 2018-2028 ($mn, AGR%)

Figure 6.18 Floating Liquefied Natural Gas (LNG) Market, By New Build Forecast 2018-2028 (Units, AGR%)

Figure 6.19 Floating Liquefied Natural Gas (FLNG) Market, Operator Owned VS Contractor % Share, 2017

Figure 6.20 Global Floating Liquefied Natural Gas (FLNG)by Operator Submarket Forecast 2018-2028 ($ mn)

Figure 6.21 Global Floating Liquefied Natural Gas (FLNG) Market, by Operator (CAPEX) Share Forecast 2018, 2023, 2028 (% Share)

Figure 6.22 Floating Liquefied Natural Gas (FLNG) Market, By Type I Forecast 2018-2028 ($mn, AGR%)

Figure 6.23 Floating Liquefied Natural Gas (LNG) Market, By Type I Forecast 2018-2028 (Units, AGR%)

Figure 6.24 Floating Liquefied Natural Gas (FLNG) Market, By Type II Forecast 2018-2028 ($mn, AGR%)

Figure 6.25 Floating Liquefied Natural Gas (LNG) Market, By Type II Forecast 2018-2028 (Units, AGR%)

Figure 6.26 Floating Liquefied Natural Gas (FLNG) Market, By Type III Forecast 2018-2028 ($mn, AGR%)

Figure 6.27 Floating Liquefied Natural Gas (LNG) Market, By Type III Forecast 2018-2028 (Units, AGR%)

Figure 6.28 Floating Liquefied Natural Gas (FLNG) Market, By Type IV Forecast 2018-2028 ($mn, AGR%)

Figure 6.29 Floating Liquefied Natural Gas (LNG) Market, By Type IV Forecast 2018-2028 (Units, AGR%)

Figure 6.30 Floating Liquefied Natural Gas (LNG) Market, FSRU Fleet by operator

Figure 6.31 Regional/Country Floating Liquefied Natural Gas (FLNG) Market, by CAPEX 2018-2028

Figure 6.32 Regional/Country Floating Liquefied Natural Gas (FLNG) Market, by Number of Fleet (Units) 2018-2028

Figure 6.33 Leading Country/Regional Floating Liquefied Natural Gas (FLNG) Market Share, by CAPEX 2018

Figure 6.34 Leading Country/Regional Floating Liquefied Natural Gas (FLNG) Market Share, by CAPEX 2023

Figure 6.35 Leading Country/Regional Floating Liquefied Natural Gas (FLNG) Market Share, by CAPEX 2028

Figure 6.36 Brazil, Angola, and India FLNG Market Snapshot 2018-2028

Figure 6.37 Top 3 Nations by Highest Number of FLNG Fleet by 2028

Figure 7.1 Global Small Scale Liquefied Natural Gas (LNG) Forecast 2018-2028 ($mn, AGR %)

Figure 7.2 Small Scale Liquefied Natural Gas (LNG) Market by Regional Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 7.3 Global Small Scale Liquefied Natural Gas (LNG) Market, Market Attractiveness, By Region 2018

Figure 7.4 Global Small Scale Liquefied Natural Gas (LNG) Submarket Forecast 2018-2028 ($mn, AGR%)

Figure 7.5 Global Small Scale Liquefied Natural Gas (LNG) Market by Type Share Forecast 2018, 2023, 2028 (% Share)

Figure 7.6 Small Scale Liquefied Natural Gas (LNG) Market, By Small Scale Regasification Forecast 2018-2028 ($mn, AGR%)

Figure 7.7 Small Scale Liquefied Natural Gas (LNG) Market, By Small Scale Liquefaction Forecast 2018-2028 ($mn, AGR%)

Figure 7.8 Small-Scale Liquefied Natural Gas (LNG) Market, By LNG Satellite Stations Forecast 2018-2028 ($mn, AGR%)

Figure 7.9 Small-Scale Liquefied Natural Gas (LNG) Market, By LNG Bunkering Facilities for Vessels Forecast 2018-2028 ($mn, AGR%)

Figure 7.10 Small-Scale Liquefied Natural Gas (LNG) Market, By Fueling Forecast 2018-2028 ($mn, AGR%)

Figure 7.11 Large Scale VS Small Scale LNG, Global LNG Trade Share % 2017

Figure 7.12 Leading National Small Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028 (MTPA)

Figure 7.13 Leading Regional Players in Small Scale Liquefied Natural Gas (LNG) Market, % Share, 2018

Figure 7.14 Leading Regional Players in Small Scale Liquefied Natural Gas (LNG) Market, % Share, 2023

Figure 7.15 Leading Regional Players in Small Scale Liquefied Natural Gas (LNG) Market, Share, 2028

Figure 7.16 Cumulative 10-Year Forecast Value by Nation 2018-2028

Figure 7.17 Percentage of Cumulative 10-Year Forecast Value by National Market, 2018-2028, (%)

Figure 7.18 Incremental Opportunity (CAPEX) by National Market from 2017 to 2028 ($ mn)

Figure 7.19 China Small-Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028 ($mn, AGR %)

Figure 7.20 China Small-Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028 (MTPA, AGR %)

Figure 7.21 Indonesia Small-Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028 ($mn, AGR %)

Figure 7.22 Indonesia Small-Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028 (MTPA, AGR %)

Figure 7.23 Japan Small-Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028 ($mn, AGR %)

Figure 7.24 Japan Small-Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028 (MTPA, AGR %)

Figure 7.25 U.S. Small-Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028 ($mn, AGR %)

Figure 7.26 U.S. Small-Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028 (MTPA, AGR %)

Figure 7.27 Europe Small-Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028 ($mn, AGR %)

Figure 7.28 Europe Small-Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028 (MTPA, AGR %)

Figure 7.29 Rest of the World Small-Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028 ($mn, AGR %)

Figure 7.30 Rest of the World Small-Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028 (MTPA, AGR %)

Figure 10.1 BHP Billiton, Revenue, ($bn& AGR %), 2013-2017

Figure 10.2 BHP Billiton Revenue % Share, by Geographic Segment, 2017

Figure 10.3 BHP Billiton Revenue % Share, by Business Segment, 2017

Figure 10.4 ExxonMobil, Revenue, ($bn& AGR %), 2013-2017

Figure 10.5 BP P.L.C., Revenue, ($bn& AGR %), 2013-2017

Figure 10.6 BP P.L.C. Revenue % Share, by Geographic Segment, 2017

Figure 10.7 BP P.L.C. Revenue % Share, by Business Segment, 2017

Figure 10.8 ConocoPhilips, Revenue, ($bn& AGR %), 2013-2017

Figure 10.9 ConocoPhilips Revenue % Share, by Product Segment, 2017

Figure 10.10 ConocoPhillips Revenue % Share, by Regional Segment, 2017

Figure 10.11 Total S.A., Inc. Total Company Revenue 2013-2017 ($bn, AGR %)

Figure 10.12 Total S.A. Revenue % Share, by Business Segment, 2017

Figure 10.13 Linde AG, Revenue, ($bn, AGR %), 2013-2017

Figure 10.14 Linde AG Revenue % Share, by Business Segment, 2017

Figure 10.15 Linde AG Revenue % Share, by Regional Segment (Gases Division), 2017

Figure 10.16 Royal Dutch Shell, Revenue, ($bn& AGR %), 2013-2017

Figure 10.17 Royal Dutch Shell Revenue % Share, by Geographic Segment, 2017

Figure 10.18 Royal Dutch Shell Revenue % Share, by Business Segment, 2017

Figure 10.19 PETRONAS Total Company Revenue, ($bn & AGR %), 2013-2017

Figure 10.20 Petronas Revenue % Share, by Product Segment, 2017

Figure 10.21 Petronas Revenue % Share, by Geographical Trade, 2017

Figure 10.22 Petronas Revenue % Share, by Business Segment, 2017

Figure 10.23 Petronas Revenue % Share, by Geographic Segment, 2017

Figure 10.24 Chevron Corporation, Revenue, ($bn& AGR %), 2013-2017

Figure 10.25 Chevron Corporation Revenue % Share, by Business Segment, 2017

Figure 10.26 Rosneft Revenue, ($bn& AGR %), 2013-2017

Figure 10.27 Rosneft % Share, by Business Segment, 2017

Figure 11.1 Leading Companies Market Share, 2018 LNG Carrier Market

Figure 11.2 Leading Companies Market Share, 2017 LNG Carrier Market

Figure 11.3 Samsung Heavy Industries (SHI), LNG Carrier Types Delivered and Under Construction Status