Small Scale LNG is used to supply small or isolated demand centers not connected to pipeline infrastructure, small scale LNG infrastructure is now increasingly deployed to cater to the growing demand for LNG as a transport fuel.

Natural gas can be transported from gas production centers to consumption centers in the form of liquefied natural gas (LNG) through ships and pipelines. Natural gas can be transported in ships and trucks to locations that are not connected to pipelines. Transportation of LNG takes place between exporting terminal (liquefaction plant) to importing terminal (regasification plant).

Small scale liquefaction and regasification infrastructure are ideally placed to assist with the development of stranded assets, the supply of remote residential and commercial demand centers but also the provision of LNG as a fuel.

LNG adoption is rapidly increasing due to the fact that natural gas is a competitive and environment-friendly option when compared to other fossil fuel sources. Small-scale LNG import terminals are primarily designed to serve the fuel requirements of a particular industry such as power generation and/or functions as a hub for ship and truck fueling. The risks associated with the development of large LNG facilities are significantly high when compared to small-scale terminals.

Small-scale LNG import terminals are the most economical option for such nations which have just started adopting LNG as a fuel in their respective industries. Several small nations are importing or planning to import LNG in small quantities specifically to cater to the feeling requirements of the power generation industry.

Several nations such as the Dominican Republic have just started importing LNG in small quantities to fulfil some of their industrial requirements. Such countries do not prefer importing large shipments of LNG as the demand for natural gas is still in the nascent stages in these nations.

The global market for small scale LNG is driven by high levels of spending in established and emerging markets. An important share of future capital expenditure will be driven by the greater deployment of LNG as a fuel, and growing investment in small scale LNG carriers.

The report will answer questions such as:

• Who are the leading companies in the SSLNG industry?

– What is their strategy?

– What is their existing processing capacity and where is it based?

– What are their core strengths and weaknesses?

– Do they have expansion plans, and if so where are they likely to go?

• What is driving and restraining the involvement of each leading company within the market?

• What is the total size of the SSLNG market in 2019? How much will it grow and why?

• What political, economic, environmental and technological factors affect the SSLNG market?

How will you benefit from this report?

• This report you will keep your knowledge base up to speed. Don’t get left behind

• This report will allow you to reinforce strategic decision-making based upon definitive and reliable market data

• You will learn how to exploit new technological trends

• You will be able to realise your company’s full potential within the market

• You will better understand the competitive landscape and identify potential new business opportunities and partnerships

Three reasons why you must order and read this report today:

1) The study reveals where and how leading companies are investing in the SSLNG market. We show you the prospects for companies operating in:

– North America

– Middle East

– Asia

– Europe

– South America

2) The report provides a detailed individual profile for each of the 20 leading companies in the Small-Scale LNG market in 2017, providing data for Revenue and details of existing and upcoming SSLNG projects:

– Air Products & Chemicals Inc

– Black & Veatch

– BP Plc

– Chart Industries Inc

– ConocoPhillips

– Eni SpA

– ENN Energy Holdings Ltd.

– Evergas A/S

– Equinor

– Gasum Oy

– Gazprom

– General Electric (GE Oil & Gas)

– Honeywell International Inc.

– Linde Group

– PT Pertamina

– Petronas

– Royal Dutch Shell

– Siemens AG

– Total SA

– Wartsila

3) It also provides a PEST analysis of the key factors affecting the overall SSLNG market:

– Political

– Economic

– Social

– Technical

Competitive advantage

This independent, 143-page report guarantees you will remain better informed than your competitors. With 106 tables and figures examining the companies within the SSLNG market space, the report gives you an immediate, one-stop breakdown of the leading Small-Scale LNG companies plus analysis and future outlooks, keeping your knowledge one step ahead of your rivals.

Who should read this report?

• Anyone within the LNG value chain

• CEOs

• COOs

• CIOs

• Business development managers

• Marketing managers

• Technologists

• Suppliers

• Investors

• Banks

• Government agencies

• Contractors

Don’t miss out

This report is essential reading for you or anyone in the oil or other industries with an interest in LNG. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. Order our Top 20 Small-Scale Liquified Natural Gas (SSLNG) Companies 2019: Company Revenues and Analysis of the Top 20 Leading Companies in the Small-Scale Liquefied Natural Gas Market Space. Plus, Global Forecast for SSLNG by Use (Road Transportation, Power Generation, Marine Transportation), by Spending ($m).

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Small-Scale LNG (SSLNG) Market Overview

1.2 Global Small-Scale LNG (SSLNG) Market Structure

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.7.3 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Small-Scale Liquefied Natural Gas (SSLNG) Market

2.1 Small-Scale Liquefied Natural Gas (SSLNG) Market Definition

2.2 SSLNG Industry Outlook

2.3 SSLNG Value Chain Analysis

2.3.1 SSLNG Value Chain Classification

2.3.2 Parties Involved in SSLNG Value Chain

2.4 Benefits of Small-Scale LNG

2.5 Applications of SSLNG

3. Global Small-Scale Liquefied Natural Gas (SSLNG) Market

3.1 Sizing the SSLNG Market

3.2 Global SSLNG Market Forecast 2019-2029

3.3 Global SSLNG Market by Applications

3.3.1 Road Transportation SSLNG Market Forecast 2019-2029

3.3.2 Marine Transportation SSLNG Market Forecast 2019-2029

3.3.3 Power Generation SSLNG Market Forecast 2019-2029

3.4 Global SSLNG Market Attractiveness

3.5 Global SSLNG Market Drivers & Restraints

3.5.1 Global SSLNG Market Drivers

3.5.1.1 Rising LNG Demand & Supply

3.5.1.2 Technology Advancement

3.5.1.3 SSLNG Supporting Policies

3.5.2 SSLNG Market Restraints

4. Individual Analysis for the Leading 20 Companies in the Global SSLNG Market

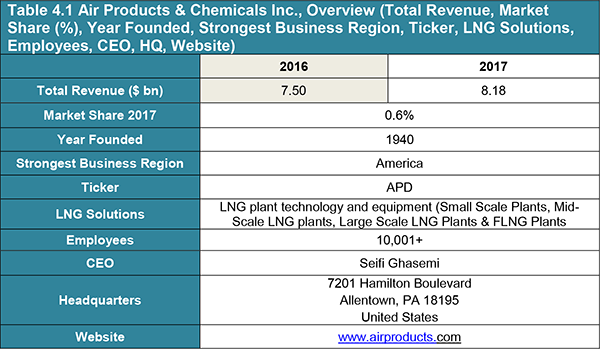

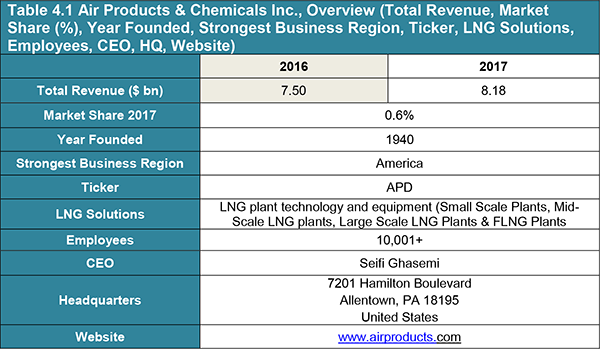

4.1 Air Products & Chemicals Inc., Overview

4.1.1 Air Products & Chemicals Total Revenue

4.1.2 Air Products & Chemicals Inc, Revenue by Business Segments

4.1.3 Air Products & Chemicals, LNG Solutions

4.2 Black & Veatch Overview

4.2.1 Black & Veatch Total Revenue

4.2.2 Black & Veatch, LNG Solutions

4.3 BP p.l.c. Overview

4.3.1 BP p.l.c. Total Revenue

4.3.2 BP p.l.c. Revenue by Business Segments

4.3.3 BP p.l.c. Region Wise Revenue

4.3.4 BP p.l.c. Upstream Revenue

4.4 Chart industries Inc., Overview

4.4.1 Chart industries Inc., Total Revenue

4.4.2 Chart industries Inc., Revenue by Business Segments

4.4.3 Chart industries Inc., Region- Wise Revenue

4.4.4 Chart industries Inc., Energy & Chemical and Distribution & Storage Revenue

4.4.5 Chart industries Inc, LNG Solutions

4.5 ConocoPhillips Overview

4.5.1 ConocoPhillips Total Revenue

4.5.2 ConocoPhillips Revenue by Products

4.5.3 ConocoPhillips Region Wise Revenue

4.6 Eni SpA Overview

4.6.1 Eni SpA Total Revenue

4.6.2 Eni SpA LNG Sales

4.6.3 Eni SpA LNG Sales Segmentation

4.7 ENN Energy Holdings Limited, Overview

4.7.1 ENN Energy Holdings Limited Total Revenue

4.7.2 ENN Energy Holdings Limited Revenue by Business Segments

4.8 Evergas A/S Overview

4.8.1 Evergas A/S Total Revenue

4.8.2 Evergas LNG Solutions

4.9 Equinor (Formerly Statoil ASA), Overview

4.9.1 Equinor Total Revenue

4.9.2 Equinor Revenue by Business Segments

4.9.3 Equinor Natural Gas Liquid Revenue

4.9.4 Equinor Region Wise Natural Gas Liquid Revenue

4.10 Gasum Oy Overview

4.10.1 Gasum Oy Total Revenue

4.10.2 Gasum Oy Business Revenue Segmentation

4.10.3 Gasum Oy Business Revenue Segmentation

4.10.4 Gasum Oy LNG Revenue

4.10.5 Gasum Oy LNG Solutions

4.11 Gazprom Overview

4.11.1 Gazprom Total Revenue

4.11.2 Gazprom LNG Sales

4.11.3 Gazprom LNG Region Wise Sales

4.11.4 Gazprom SSLNG Sales

4.12 General Electric (GE Oil & Gas) Overview

4.12.1 General Electric Total Revenue

4.12.2 General Electric Revenue by Business Segments

4.12.3 General Electric Oil & Gas Revenue

4.13 Honeywell International Inc., Overview

4.13.1 Honeywell International Inc., Total Revenue

4.13.2 Honeywell International Inc., Revenue by Business Segments

4.13.3 Honeywell International Inc., Performance Materials and Technologies Revenue

4.14 Linde Group Overview

4.14.1 Linde Group Total Revenue

4.14.2 Linde Group Revenue by Business Segment

4.14.3 Linde Group Gases Division Revenue

4.14.4 Linde Group Gases Divisions Revenue Segmentation

4.14.5 Linde Group Gases Divisions Region-Wise Segmentation

4.14.6 Linde Group Engineering Divisions Revenue

4.14.7 Linde Group Engineering Division Revenue Segmentation

4.15 PT Pertamina Overview

4.15.1 PT Pertamina Total Revenue

4.15.2 PT Pertamina LNG Sales

4.15.3 PT Pertamina LNG Solutions

4.16 Petronas Overview

4.16.1 Petronas Total Revenue

4.16.2 Petronas Revenue by Products

4.16.3 Petronas Region Wise Revenue

4.16.4 Petronas LNG Revenue

4.17 Royal Dutch Shell plc, Overview

4.17.1 Royal Dutch Shell plc, Total Revenue

4.17.2 Royal Dutch Shell plc, Revenue by Business Segments

4.17.3 Royal Dutch Shell plc, Region Wise Revenue

4.17.4 Royal Dutch Shell plc, Integrated Gas Revenue

4.17.5 Royal Dutch Shell plc, LNG Solutions

4.18 Siemens AG, Overview

4.18.1 Siemens AG Total Revenue

4.18.2 Siemens AG Revenue by Business Segments

4.18.3 Siemens AG Region Wise Revenue

4.18.4 Siemens AG Power & Gas Revenue

4.18.5 Siemens AG, LNG Solutions

4.19 Total S.A. Overview

4.19.1 Total S.A., Total Revenue

4.19.2 Total S.A. Revenue by Business Segments

4.19.3 Total S.A. Region Wise Revenue

4.19.4 Total S.A. LNG Solutions

4.20 Wartsila Corporation Overview

4.20.1 Wartsila Corporation Total Revenue

4.20.2 Wartsila Corporation Revenue by Business Segments

4.20.3 Wartsila Corporation Region Wise Revenue

4.20.4 Wartsila Corporation, Energy Solutions Revenue

4.20.5 Wartsila Corporation, LNG Solutions

4.21 Other Companies Involved in SSLNG

5. PEST Analysis of the Small-scale LNG Market

6. Conclusions

6.1 Trends Stimulating SSLNG Market Growth

6.2 Who is Leading the SSLNG Market?

6.3 How SSLNG Market is Hindered?

7. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 2.1 Key SSLNG Liquification Technologies

Table 2.2 SSLNG Storage Tanks

Table 3.1 Global SSLNG Market Forecast 2019-2029 ($ Billion, AGR %, CAGR %)

Table 3.2 SSLNG Drivers and Restraints

Table 3.3 SSLNG Supporting Policies (Country, Policies and Initiatives)

Table 3.3 Industry Wise Key Market Drivers for SSLNG

Table 4.1 Air Products & Chemicals Inc., Overview (Total Revenue, Market Share (%), Year Founded, Strongest Business Region, Ticker, LNG Solutions, Employees, CEO, HQ, Website)

Table 4.2 Air Products & Chemicals Inc, LNG Solutions

Table 4.3 Black & Veatch Overview (Total Revenue, Year Founded, Ticker, LNG Solutions, Employees, CEO, HQ, Website)

Table 4.4 Black & Veatch, LNG Solutions

Table 4.5 BP p.l.c., Overview (Total Revenue, Upstream Revenue, Net Income, Net Capital Expenditure, Market Share (%), Year Founded, Strongest Business Region, Ticker, LNG Solutions, Employees, CEO, HQ, IR Contact, Website)

Table 4.6 Chart industries Inc., Overview 2017 (Total Revenue ($bn), Energy & Chemicals Revenue ($bn), Distribution & Storage Revenue ($bn), LNG Solutions, Employees, CEO, HQ, Website)

Table 4.7 Chart industries Inc, LNG Solutions

Table 4.8 ConocoPhillips Overview (Total Revenue, Net Income, Net Capital Expenditure, Market Share (%), Year Founded, Strongest Business Region, Ticker, LNG Solutions, Employees, CEO, HQ, Website)

Table 4.9 Eni SpA Overview (Total Revenue, LNG Sales, Net Income, Net Capital Expenditure, Market Share (%), Year Founded, Strongest Business Region, Ticker, LNG Solutions, Employees, CEO, HQ, Website)

Table 4.10 ENN Energy Holdings Limited Overview 2017 (Total Revenue ($bn), LNG Solutions, CEO, HQ, Website)

Table 4.11 Evergas A/S Overview (Total Revenue, LNG Solutions, CEO, HQ, Website)

Table 4.12 Evergas, LNG Solutions

Table 4.13 Equinor Overview (Total Revenue, Natural Gas Liquid Revenue, Net Income, Net Capital Expenditure, Market Share (%), Year Founded, Strongest Business Region, Ticker, LNG Solutions, Employees, CEO, HQ, Website).

Table 4.14 Gasum Oy, Overview (Total Revenue, LNG Revenue, LNG Solutions, Employees, CEO, HQ, Website)

Table 4.15 Gasum Oy, LNG Solutions

Table 4.16 Gazprom, Overview (Total Revenue, LNG Sales, SSLNG Sales, Net Income, Net Capital Expenditure, Market Share (%), Year Founded, Strongest Business Region, Ticker, LNG Solutions, Employees, CEO, HQ, IR Contact, Website)

Table 4.17 General Electric (GE Oil & Gas), Overview (Total Revenue, Oil & Gas Revenue, Net Income, Net Capital Expenditure, Market Share (%), Year Founded, Strongest Business Region, Ticker, LNG Solutions, Employees, CEO, HQ, IR Contact, Website)

Table 4.18 Honeywell International Inc., Overview (Total Revenue, Performance Materials and Technologies Sales, LNG Solutions, Employees, CEO, HQ, Website)

Table 4.19 Linde Group Overview 2017 (Total Revenue ($bn), Gas Division Revenue ($bn), Engineering Division Revenue ($bn), LNG Solutions, Employees, CEO, HQ, Website)

Table 4.20 PT Pertamina Overview (Total Revenue, LNG Sales, Net Income, Net Capital Expenditure, Market Share (%), Year Founded, Ticker, LNG Solutions, Employees, CEO, HQ, Website)

Table 4.21 PT Pertamina, LNG Solutions

Table 4.22 Petronas Overview (Total Revenue, LNG Revenue, Net Income, Market Share (%), Year Founded, Strongest Business Region, Ticker, LNG Solutions, Employees, CEO, HQ, IR Contact, Website)

Table 4.23 Royal Dutch Shell plc, Overview (Revenue, Integrated Gas Revenue, Net Income, Net Capital Expenditure, Market Share (%), Year Founded, Strongest Business Region, Ticker, LNG Solutions, Employees, CEO, HQ, Website)

Table 4.24 Royal Dutch Shell plc, LNG Solutions

Table 4.25 Siemens AG Overview (Total Revenue, Power & Gas Revenue, Net Income, Net Capital Expenditure, Market Share (%), Year Founded, Strongest Business Region, Ticker, LNG Solutions, Employees, CEO, HQ, Website)

Table 4.27 Total S.A., Overview (Total Revenue, Net Income, Net Capital Expenditure, Market Share (%), Year Founded, Strongest Business Region, Ticker, LNG Solutions, Employees, CEO, HQ, Website)

Table 4.28 Wartsila Corporation, Overview (Total Revenue, Energy Revenue, Net Income, Net Capital Expenditure, Year Founded, Strongest Business Region, Ticker, LNG Solutions, Employees, CEO, HQ, Website)

Table 4.29 Wartsila Corporation, LNG Solutions

Table 5.1 PEST Analysis, Small Scale LNG Market

List of Figures

Figure 2.1 Small-Scale Liquefaction and Regasification Capacity (2017)

Figure 3.1 Global SSLNG Market Forecast 2019-2029 (USD Billions, AGR %, CAGR %, gross additions)

Figure 3.2 Regional Drivers for Small-Scale LNG

Figure 3.3 LNG Exports by Country in MTPA (2017)

Figure 4.1 Air Products & Chemicals, 2014-2017 ($ Mn)

Figure 4.2 Air Products & Chemicals Inc., Revenue by Business Segments, 2017

Figure 4.3 Black & Veatch, Total Revenue, 2014-2017 ($ Mn)

Figure 4.4 BP p.l.c., Total Revenue, 2014-2017 ($ Mn)

Figure 4.5 BP p.l.c., Revenue by Business Segments, 2016-2017

Figure 4.6 BP p.l.c., Region Wise Revenue 2016-2017

Figure 4.7 BP p.l.c. Upstream Revenue, 2014-2017 ($ Mn)

Figure 4.8 Chart industries Inc., Total Revenue, 2014-2017 ($ Mn)

Figure 4.9 Chart industries Inc., Revenue by Business Segments, 2016-2017

Figure 4.10 Chart industries Inc., Region- Wise Revenue, 2016-2017

Figure 4.11 Chart industries Inc., Total Revenue, 2014-2017 ($ Mn)

Figure 4.12 ConocoPhillips, Total Revenue, 2014-2017 ($ Mn)

Figure 4.13 ConocoPhillips Revenue by Products, 2016-2017

Figure 4.14 ConocoPhillips Region Wise Revenue, 2017

Figure 4.15 Eni SpA, Total Revenue, 2014-2017 ($ Mn)

Figure 4.16 Eni SpA LNG Sales, 2014-2017 (BCM)

Figure 4.17 Eni SpA LNG Sales Segmentation, 2016-2017

Figure 4.18 ENN Energy Holdings Limited, Total Revenue, 2014-2017 ($ Mn)

Figure 4.19 ENN Energy Holdings Limited Revenue by Business Segments, 2016-2017

Figure 4.20 Evergas A/S, Total Revenue, 2014-2017 ($ Mn)

Figure 4.21 Equinor Total Revenue, 2014-2017 ($ Mn)

Figure 4.22 Equinor Revenue by Business Segments, 2016-2017

Figure 4.23 Equinor Natural Gas Liquid Revenue, 2014-2017 ($ Mn)

Figure 4.24 Equinor Region Wise Natural Gas Liquid Revenue, 2016-2017

Figure 4.25 Gasum Oy Total Revenue, 2014-2017 ($ Mn)

Figure 4.26 Gasum Oy Business Revenue Segmentation, 2016-2017

Figure 4.27 Gasum Oy Region Wise Revenue, 2016-2017

Figure 4.28 Gasum Oy LNG Revenue, 2014-2017 ($ Mn)

Figure 4.29 Gazprom Total Revenue, 2014-2017 ($ Mn)

Figure 4.30 Gazprom LNG Sales, 2014-2017 (mmBTU)

Figure 4.31 Gazprom LNG Region Wise Sales, 2016-2017

Figure 4.32 Gazprom SSLNG Sales, 2015-2017 (mmBTU)

Figure 4.33 General Electric (GE Oil & Gas) Total Revenue, 2014-2017 ($ Mn)

Figure 4.34 General Electric Revenue by Business Segments, 2016-2017

Figure 4.35 General Electric Oil & Gas Revenue, 2014-2017 ($ Mn)

Figure 4.36 Honeywell International Inc., Total Revenue, 2014-2017 ($ Mn)

Figure 4.37 Honeywell International Inc., Revenue by Business Segments, 2016-2017

Figure 4.38 Honeywell International Inc., Performance Materials and Technologies Revenue 2014-2017 ($ Mn)

Figure 4.39 Linde Group, Total Revenue, 2014-2017 ($ Mn)

Figure 4.40 Linde Group Revenue by Business Segment, 2016-2017

Figure 4.41 Linde Group Gases Division Revenue, 2014-2017 ($ Mn)

Figure 4.42 Linde Group Gases Divisions Revenue Segmentation, 2016-2017

Figure 4.43 Linde Group Gases Divisions Revenue Segmentation, 2016-2017

Figure 4.44 Linde Group Engineering Divisions Revenue, 2014-2017 ($ Mn)

Figure 4.45 Linde Group Engineering Division Revenue Segmentation, 2016-2017

Figure 4.46 PT Pertamina Total Revenue, 2014-2017 ($ Mn)

Figure 4.47 PT Pertamina LNG Sales, 2014-2017 (MMBTU Million)

Figure 4.48 Petronas, Total Revenue, 2014-2017 ($ Mn)

Figure 4.49 Petronas, Revenue by Products, 2016-2017

Figure 4.50 Petronas Region Wise Revenue, 2016-2017

Figure 4.51 Petronas LNG Revenue, 2014-2017 ($ Mn)

Figure 4.52 Royal Dutch Shell plc, Total Revenue, 2014-2017 ($ Mn)

Figure 4.53 Royal Dutch Shell plc, Revenue by Business Segments, 2016-2017

Figure 4.54 Royal Dutch Shell plc, Region Wise Revenue, 2016-2017

Figure 4.55 Royal Dutch Shell plc, Integrated Gas Revenue, 2014-2017 ($ Mn)

Figure 4.56 Siemens AG Total Revenue, 2014-2017 ($ Mn)

Figure 4.57 Siemens AG Revenue by Business Segments, 2016-2017

Figure 4.58 Siemens AG Region Wise Revenue, 2016-2017

Figure 4.59 Siemens AG, Power & Gas Revenue, 2014-2017 ($ Mn)

Figure 4.60 Total S.A. Total Revenue, 2014-2017 ($ Mn)

Figure 4.61 Total S.A. Revenue by Business Segments, 2016-2017

Figure 4.62 Total S.A. Region Wise Revenue, 2016-2017

Figure 4.63 Wartsila Corporation Total Revenue, 2014-2017 ($ Mn)

Figure 4.64 Wartsila Corporation Revenue by Business Segments, 2016-2017

Figure 4.65 Wartsila Corporation Region Wise Revenue, 2016-2017

Figure 4.66 Wartsila Corporation Total Revenue, 2014-2017 ($ Mn)

Figure 6.1 Trends Stimulating SSLNG Market Growth