Industries > Energy > Liquefied Natural Gas (LNG) Carrier Market 2018-2028

Liquefied Natural Gas (LNG) Carrier Market 2018-2028

Forecasts (CAPEX & Capacity) and Analysis by Type including GTT No. 96, Mark III, Moss. SPB & Small Scale, by Retrofit/Conversion & New Build AND by Region PLUS Profiles of Leading Companies in the LNG Carrier Market

Visiongain has calculated that the LNG Carrier market will see a capital expenditure (CAPEX) of $11,208 mn in 2018.Read on to discover the potential business opportunities available.

In recent years, a large number of LNG carriers have been constructed. However, as prices fell, and the global market started to experience an oversupply of LNG due to a slowdown in LNG demand growth in the key countries of Japan, China and South Korea, suddenly there was no need for that many carriers to transport the commodity. As a result of the declining utilisation rates, LNG carrier charter rates have also fallen in 2014 and 2015.

These market conditions have led to significant delays and cancellations on the liquefaction side of LNG infrastructure expansion, which has sustained the mismatch between LNG carrying capacity and liquefaction capacity

The LNG carrier market is driven by the arbitrage opportunity that exists between the supply side (North America, Africa, Qatar, Australia and Russia) and demand side (East Asia, Europe and emerging importers) of the LNG market. Very strong dynamics on both sides has created an opportunity for profits to be made.

The LNG industry has witnessed several technological changes in the past few years. Increasing investments in small-scale LNG terminals is one such upcoming trend which has penetrated the market in the recent years. The small-scale LNG terminals are primarily designed to focus on the requirements of small demand and supply centers.

An oversupplied market will force down LNG prices. It is hoped that low prices will drive further demand growth, though, with a large number of LNG carriers expected to come online over the next 5 years (over 200 new vessels), charter rates and utilisation rates could fall if this fails to happen.

Visiongain’s global LNG Carrier market report can keep you informed and up to date with the developments in the market.

With reference to this report, it details the key investments trend in the global market, subdivided by regions, capital expenditure and projects. Through extensive secondary research and interviews with industry experts, visiongain has identified a series of market trends that will impact the LNG Carrier market over the forecast timeframe.

The report will answer questions such as:

– How is the Liquefied Natural Gas (LNG) Carrier market evolving?

– What is driving and restraining the Liquefied Natural Gas (LNG) Carrier market dynamics?

– How will each submarket segment grow over the forecast period and how much sales will these submarkets account for in 2028?

– How will market shares of each the Liquefied Natural Gas (LNG) Carrier submarket develop from 2018-2028?

– Which individual technologies/type will prevail and how will these shifts be responded to?

– Which Liquefied Natural Gas (LNG) Carrier submarket will be the main driver of the overall market from 2018-2028?

– How will political and regulatory factors influence regional the Liquefied Natural Gas (LNG) Carrier market and submarkets?

– Will leading national the Liquefied Natural Gas (LNG) Carrier market broadly follow macroeconomic dynamics, or will individual country sectors outperform the rest of the economy?

– How will market shares of the national markets change by 2028 and which nation will lead the market in 2028?

– Who are the leading players and what are their prospects over the forecast period?

– How will the sector evolve as alliances form during the period between 2018 and 2028?

– How will the sector evolve as alliances form during the period between 2018 and 2028?

Five Reasons Why You Must Order and Read This Report Today:

1) The report provides forecasts for the five main containment systems in the LNG Carrier Market from 2018-2028

– GTT No 96 CAPEX 2018-2028

– T-Mark III and Mark Flex CAPEX 2018-2028

– Moss CAPEX 2018-2028

– SPB CAPEX 2018-2028

– Small Scale CAPEX 2018-2028

2) The report also Forecasts and Analyses the LNG carrier market by Market Type from 2018-2028

– Retrofit/Conversion CAPEX 2018-2028

– New Build Flex CAPEX 2018-2028

3) The report provides CAPEX and Capacity forecasts (2018-2028), plus analysis, for four national LNG carrier constructor markets, providing unique insight into LNG industry development

– South Korea CAPEX 2018-2028

– Japan CAPEX 2018-2028

– China CAPEX 2018-2028

– India CAPEX 2018-2028

– Rest of the World CAPEX 2018-2028

4) The report reveals tables detailing all existing LNG carriers, as well as the order book of upcoming carriers:

Existing Carriers:

– Ship Name

– Year Built

– Shipbuilder

– Operator

– Capacity

– Cargo System

Order Book:

– Shipbuilder

– Year

– Owner

– Containment System

– Capacity

5) The report provides market share and detailed profiles of the leading companies operating within the LNG Carrier market:

– Samsung Heavy Industries (SHI)

– Kawasaki Heavy Industries

– NYK Line.

– Misc Berhad

– STX Offshore and Shipbuilding

– Hudong Zhonghua

– Daewoo Shipbuilding and Marine Engineering (DSME)

– Mitsubishi Heavy Industries, Ltd.

– Maran Gas Maritime Inc. (MGM)

– Hyundai Heavy Industries Co., Ltd.

This independent 271-page report guarantees you will remain better informed than your competitors. With 164 tables and figures examining the LNG Carrier market space, the report gives you a direct, detailed breakdown of the market. PLUS, Capital expenditure AND detail of all existing LNG carriers, as well as the order book of upcoming carriers from 2018-2028. This report will keep your knowledge that one step ahead of your rivals.

This report is essential reading for you or anyone in the Oil and Gas sector. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Liquefied Natural Gas (LNG)Carrier Market Overview

1.2 Market Structure Overview and Market Definition

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.7.3 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Liquefied Natural Gas (LNG) Carrier Market

2.1 Global LNG Carrier Market Structure

2.2 Market Definition

2.3 LNG Carrier Industry Outlook

2.4 LNG - Value Chain Analysis

3. Global Overview of Liquefied Natural Gas (LNG) Carrier Market 2018-2028

3.1 Demand-Side Factors

3.2 Supply-Side Drivers

3.3 Global LNG Market: Where Are We Now; Where Will We Be in 5 Years; Where Will We Be in 10 Years?

3.4 Oil Price Analysis

3.5 Supply-Side Factors

3.6 Demand-Side Factors

3.7 Other Major Variables that Impact the Oil Price

3.8 Oil Price and LNG Price Relationship

3.9 Towards an Oversupplied LNG Market

3.10 LNG Carriers Fleet and Historical Data

3.11 Global Liquefied Natural Gas (LNG) Carrier Drivers and Restraints

4. Liquefied Natural Gas (LNG) Carrier Submarkets Forecasts 2018-2028

4.1 Global Liquefied Natural Gas (LNG) Carrier Submarkets Forecasts, by Type 2018-2028

4.1.1 Global GTT No 96 Liquefied Natural Gas (LNG) Carrier Forecasts 2018-2028

4.1.1.1 Global GTT No. 96 LNG Carrier Orders

4.1.1.2 Global GTT No. 96 Driver & Restraints

4.1.2 Global Mark III Forecasts 2018-2028

4.1.2.1 Global T-Mark III and Mark Flex LNG Carrier Orders

4.1.2.2 Global Mark III and Mark Flex Driver & Restraints

4.1.3 Global Moss Forecasts 2018-2028

4.1.3.1 Global Moss Rosenberg LNG Carrier Orders

4.1.3.2 Global Moss Driver & Restraints

4.1.4 Global SPB Forecasts 2018-2028

4.1.4.1 Global SBP LNG Carrier Orders

4.1.4.2 Global SBP Driver & Restraints

4.1.5 Global Small Scale Forecasts 2018-2028

4.1.5.1 Small-Scale LNG Carriers Represent a Logical Expansion of LNG Supply Chain

4.1.5.2 Expanding Use of Satellite Stations

4.1.5.3 Development of River-Based LNG Carriers

4.1.5.4 Use of Small-Scale LNG for Island Distribution

4.1.5.5 Expansion of LNG Bunkering

4.1.5.6 Small-Scale LNG Containment Technology Advantage

4.1.5.7 Japanese Small-Scale LNG Prospects

4.1.5.8 Ship-to-Ship Transfers of LNG

4.1.5.9 Environmental Benefits and Small-Scale LNG Carriers

4.1.5.10 LNG Transportation Sector

4.2 Global Liquefied Natural Gas (LNG) Carrier Submarkets Forecasts, by Market Type 2018-2028

4.2.1 Global Retrofit/Conversion Liquefied Natural Gas (LNG) Carrier Forecasts 2018-2028

4.2.1.1 Global Retrofit/Conversion Driver & Restraints

4.2.2 Global New Build Forecasts 2018-2028

4.2.2.1 Global New Build LNG Carrier Driver & Restraints

5. Leading Regional Players in Liquefied Natural Gas (LNG) Carrier Market 2018-2028

5.1 China LNG Carrier Market 2018-2028

5.1.1 Chinese Demand for LNG Carriers

5.1.2 Are Expanding Natural Gas Pipeline Supplies to China a Threat to the Chinese LNG Carrier Market?

5.1.3 Increasing Numbers of Chinese Shipyards Capable of Building LNG Carriers

5.1.4 LNG Carrier Construction and the Chinese Yuan

5.1.5 Labour Costs, Foreign Orders and Attractive Financing

5.1.6 Small Scale LNG Carrier Construction in China

5.1.7 Limitations on LNG Carrier Market in China

5.1.8 Chinese LNG Carrier Orders

5.1.9 China Liquefied Natural Gas (LNG) Carrier Drivers and Restraints

5.2 Japan LNG Carrier Market 2018-2028

5.2.1 The Japanese Yen and LNG Carrier Orders

5.2.2 Are Wage Levels Affecting Japanese LNG Carrier Orders?

5.2.3 The Competitive Advantage of Japanese LNG Carriers

5.2.4 Shift Away from Long-Term Contracts Hurting Japanese LNG Carrier Construction Industry

5.2.5 The Potential for More LNG Carrier Construction in Japan

5.2.6 The Challenge of China to Japanese LNG Carrier Builders

5.2.7 The Advantage of Moss Spherical Containment Systems (Only Used by Japanese Shipbuilders)

5.2.8 The Small-Scale LNG Carrier Market in Japan

5.2.9 The Challenge to Japanese LNG Carrier Builders of South Korean Shipbuilders

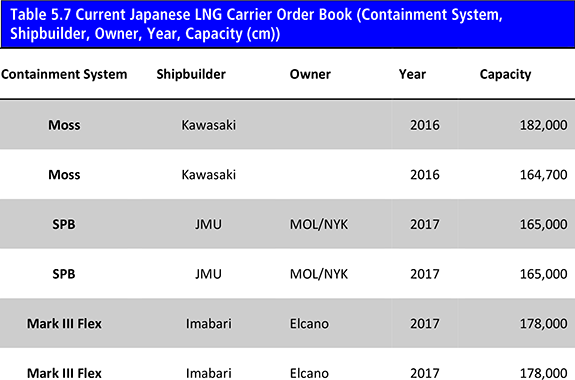

5.2.10 Japanese LNG Carrier Orders

5.2.11 Japan Liquefied Natural Gas (LNG) Carrier Drivers and Restraints

5.3 South Korea LNG Carrier Market 2018-2028

5.3.1 Bulk Orders Potential Provides Competitive Advantage

5.3.2 Highly Trusted Status of South Korean Shipbuilders

5.3.3 Q-Max and Q-Flex Vessel History

5.3.4 The Challenge to South Korea of Chinese Shipbuilders

5.3.5 South Korean LNG Carrier Propulsion Systems Provide Competitive Advantage

5.3.6 South Korean Shipbuilding Expertise Depth

5.3.7 South Korean LNG Carrier Orders

5.3.8 South Korea Liquefied Natural Gas (LNG) Carrier Drivers and Restraints

5.4 India LNG Carrier Market 2018-2028

5.4.1 Pipapav Defence and Offshore Engineering Ltd.

5.4.2 L&T Shipbuilding Ltd.

5.4.3 Cochin Shipyard Ltd.

5.4.4 Other National LNG Building Shipyards with Past Orders

5.4.5 India Liquefied Natural Gas (LNG) Carrier Drivers and Restraints

5.5 Rest of the World LNG Carrier Market 2018-2028

5.5.1 East African LNG Exports and the LNG Carrier Market

5.5.2 The Impact of North American LNG Exports on the LNG Carrier Market

5.5.3 West African Natural Gas Supply, LNG Carrier Mileage and LNG Carrier Demand

5.5.4 Norway, Russia and Ice-Class LNG Carriers

5.5.5 Rest of the World Liquefied Natural Gas (LNG) Carrier Drivers and Restraints

6. PESTEL Analysis of the LNG Carrier Market

7. Expert Opinion

7.1 Primary Correspondents - Mitsubishi Heavy Industries, Ltd.

7.2 Global Liquefied Natural Gas (LNG) Carrier Outlook

7.3 Driver & Restraints

7.4 Dominant Region/Country in the LNG Carrier Market

7.6 Overall Growth Rate

8. Leading Companies in LNG Carrier Market

8.1 Global LNG Carrier Market, Company Market Share (%), 2017

8.2 Samsung Heavy Industries (SHI)

8.2.1 Samsung Heavy Industries (SHI) Business Overview

8.2.2 Samsung Heavy Industries (SHI) Future Outlook

8.3 Kawasaki Heavy Industries

8.3.1 Kawasaki Heavy Industries Business Overview

8.3.2 Kawasaki Heavy Industries Future Outlook

8.4 NYK Line.

8.4.1 NYK Line. Business Overview

8.4.2 NYK Line. Future Outlook

8.5 Misc Berhad

8.5.1 Misc Berhad Business Overview

8.5.2 Misc Berhad Future Outlook

8.6 STX Offshore and Shipbuilding

8.6.1 STX Offshore and Shipbuilding Business Overview

8.6.2 STX Offshore and Shipbuilding Future Outlook

8.7 Hudong Zhonghua

8.7.1 Hudong Zhonghua Business Overview

8.7.2 Hudong Zhonghua Future Outlook

8.8 Daewoo Shipbuilding and Marine Engineering (DSME)

8.8.1 Daewoo Shipbuilding and Marine Engineering (DSME) Business Overview

8.8.2 Daewoo Shipbuilding and Marine Engineering (DSME) Business Strategy

8.9 Mitsubishi Heavy Industries, Ltd.

8.9.1 Mitsubishi Heavy Industries, Ltd. Business Overview

8.9.2 Mitsubishi Heavy Industries, Ltd. Business Strategy

8.10 Maran Gas Maritime Inc. (MGM)

8.10.1 Maran Gas Maritime Inc. (MGM) Business Overview

8.10.2 Maran Gas Maritime Inc. (MGM) Future Outlook

8.11 Hyundai Heavy Industries Co., Ltd.

8.11.1 Hyundai Heavy Industries Co., Ltd. Business Overview

8.11.2 Hyundai Heavy Industries Co., Ltd. Future Outlook

9. Conclusions and Recommendations

9.1 Key Findings

9.2 Recommendations

10. Glossary

Appendix

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

Appendix B

Visiongain Report Evaluation Form

List of Tables

Table 1.1 The LNG Carrier Market by Regional Market Forecast 2018-2028 ($ mn, MCM, AGR %, CAGR)

Table 3.1 Global Liquefied Natural Gas (LNG) Carrier Market by Forecast 2018-2028 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 3.2 LNG Carriers List, Above 60,000cm of Capacity, (Year Built, Ship Name, Shipbuilder, Capacity (cm), Operator, Cargo System)

Table 3.3 Global Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 4.1 Global Liquefied Natural Gas (LNG) Carrier Market Forecast 2018-2028 ($mn, AGR %, Cumulative)

Table 4.2 Global GTT No 96 Liquefied Natural Gas (LNG) Carrier Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 4.3 GTT No. 96 LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 4.4 Global GTT No. 96 Drivers and Restraints

Table 4.5 Global Mark III Liquefied Natural Gas Carrier Forecast 2018-2028($mn, AGR %, CAGR %, Cumulative)

Table 4.6 Mark III LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 4.7 Global Mark III Drivers and Restraints

Table 4.8 Global Moss Liquefied Natural Gas Carrier Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 4.9 Moss LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 4.10 Global Moss Drivers and Restraints

Table 4.11 Global SPB Liquefied Natural Gas Carrier Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 4.12 SPB LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 4.13 Global SBP Drivers and Restraints

Table 4.14 Global Small Scale Liquefied Natural Gas Carrier Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 4.15 Global Liquefied Natural Gas (LNG) Carrier Market Forecast, by Market Type 2018-2028 ($mn, AGR %, Cumulative)

Table 4.16 Global Retrofit/Conversion Liquefied Natural Gas (LNG) Carrier Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 4.17 Global Retrofit/Conversion Drivers and Restraints

Table 4.18 Global New Build Liquefied Natural Gas Carrier Forecast 2018-2028 ($mn, AGR %, CAGR %, Cumulative)

Table 4.19 Global New Build LNG Carrier Drivers and Restraints

Table 5.1 Global LNG Carrier Market, by Country/Region Forecast 2018-2028 ($mn, AGR %, Cumulative)

Table 5.2 Global LNG Carrier Market, by Country/Region Forecast 2018-2028 (MCM, AGR %, Cumulative)

Table 5.3 China Liquefied Natural Gas (LNG)Carrier Market by Forecast 2018-2028 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.4 Chinese LNG Import Terminals (Country, Terminal Name, Start Year, Capacity (MTPA), EPC Cost ($), Owners, Status)

Table 5.5 Current Chinese LNG Carrier Order Book (Containment System, Shipbuilder, Owner, Delivery Year, Capacity (cm))

Table 5.6 China Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 5.7 Japan Liquefied Natural Gas (LNG)Carrier Market by Forecast 2018-2028 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.8 Current Japanese LNG Carrier Order Book (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 5.9 Japan Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 5.10 South Korea Liquefied Natural Gas (LNG)Carrier Market by Forecast 2018-2028 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.11 Current South Korean LNG Carrier Order Book (Containment System, Shipbuilder, Owner, Year, Capacity(cm)

Table 5.12 South Korea Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 5.13 India Liquefied Natural Gas (LNG)Carrier Market by Forecast 2018-2028 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.14 India Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 5.15 India Liquefied Natural Gas (LNG)Carrier Market by Forecast 2018-2028 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.16 Rest of the World Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 6.1 PESTEL Analysis, LNG Carrier Market

Table 8.1 Samsung Heavy Industries (SHI) Profile 2016 (Market Entry, Public/Private, Headquarter, No. of Employees, 2016 Revenue $bn, Change in Revenue from 2015, Geography, Key Markets, Listed on, Products/Services)

Table 8.2 Samsung Heavy Industries LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 8.3 Samsung Heavy Industries (SHI) Total Company Sales 2012-2016 ($ bn, AGR %)

Table 8.5 Kawasaki Heavy Industries LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 8.6 Kawasaki Heavy Industries Total Company Sales 2012-2016 ($ bn, AGR %)

Table 8.7 NYK Line. Profile 2016 (Market Entry, Public/Private, Headquarter, No. of Employees, 2016 Revenue $bn, Change in Revenue from 2015, Geography, Key Markets, Listed on, Products/Services)

Table 8.8 NYK Line. Overview (Total Revenue, Total LNG Carrying Capacity, Percentage in Order Book, Existing Vessels – Orders – Joint Projects, HQ, Contact, Website)

Table 8.9 NYK Line. Total Company Sales 2014-2017 ($ bn, AGR %)

Table 8.10 Misc Berhad Profile 2016 (Market Entry, Public/Private, Headquarter, No. of Employees, 2016 Revenue $bn, Change in Revenue from 2015, Geography, Key Markets, Listed on, Products/Services)

Table 8.11 Misc Berhad LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity)

Table 8.12 Misc Berhad Total Company Sales 2013-2016 ($ bn, AGR %)

Table 8.13 STX Offshore and Shipbuilding Profile 2016 (Market Entry, Public/Private, Headquarter, No. of Employees, 2013 Revenue $bn, Change in Revenue from 2015, Geography, Key Markets, Listed on, Products/Services)

Table 8.14 Hudong Zhonghua Profile 2016 (Market Entry, Public/Private, Headquarter, No. of Employees, 2016 Revenue $bn, Change in Revenue from 2015, Geography, Key Markets, Listed on, Products/Services)

Table 8.15 Hudong Zhonghua LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 8.16 Daewoo Shipbuilding and Marine Engineering (DSME) Profile 2016 (Market Entry, Public/Private, Headquarter, No. of Employees, 2016 Revenue $bn, Change in Revenue from 2015, Geography, Key Markets, Listed on, Products/Services)

Table 8.17 Daewoo Shipbuilding and Marine Engineering (DSME)Total Company Sales 2013-2016 ($ bn, AGR %)

Table 8.18 Mitsubishi Heavy Industries, Ltd. Profile 2016 (Market Entry, Public/Private, Headquarter, No. of Employees, 2016 Revenue $bn, Change in Revenue from 2015, Geography, Key Markets, Listed on, Products/Services)

Table 8.19 Mitsubishi Heavy Industries LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 8.20 Mitsubishi Heavy Industries Ltd. Total Company Sales 2012-2016 ($ bn, AGR %)

Table 8.21 Maran Gas Maritime Inc. (MGM)Profile 2016 (Market Entry, Public/Private, Headquarter, No. of Employees, 2016 Revenue $bn, Change in Revenue from 2015, Geography, Key Markets, Listed on, Products/Services)

Table 8.22 MGM LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity)

Table 8.23 Hyundai Heavy Industries Co., Ltd. Profile 2016 (Market Entry, Public/Private, Headquarter, No. of Employees, 2016 Revenue $bn, Change in Revenue from 2015, Geography, Key Markets, Listed on, Products/Services)

Table 8.24 Hyundai Heavy Industries Co. and Hyundai Samho LNG Carrier Orders (Shipbuilder, Future Owner, Tank Type, LNG Capacity (cm), Delivery Date)

List of Figures

Figure 1.1 The LNG Carrier Market by Country/Region Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 2.1 Global LNG Carrier Market Segmentation Overview

Figure 2.1 LNG Carrier, Value Chain Analysis

Figure 3.1 Global Liquefied Natural Gas (LNG) Carrier Forecast 2018-2028 ($mn, AGR %)

Figure 3.2 Global LNG Carrier, by Capacity (MCM) Forecast 2018-2028 (MCM)

Figure 3.3 Top 10 LNG Exporter Countries (Million Tons), 2016

Figure 3.4 WTI and Brent Oil Prices 2003-2017 ($/bbl)

Figure 4.1 Global Liquefied Natural Gas (LNG) Carrier Submarket Forecast 2018-2028 ($mn)

Figure 4.2 Global Liquefied Natural Gas (LNG) Carrier Market by Type (CAPEX) Share Forecast 2018, 2023, 2028 (% Share)

Figure 4.3 Liquefied Natural Gas (LNG) Carrier Market, By GTT No 96 Forecast 2018-2028 ($mn, AGR%)

Figure 4.4 Liquefied Natural Gas (LNG) Carrier Market, By Mark III Forecast 2018-2028 ($mn, AGR%)

Figure 4.5 Liquefied Natural Gas (LNG) Carrier Market, By Moss Forecast 2018-2028 ($mn, AGR%)

Figure 4.6 Liquefied Natural Gas (LNG) Carrier Market, By SPB Forecast 2018-2028 ($mn, AGR%)

Figure 4.7 Liquefied Natural Gas (LNG) Carrier Market, By Small Scale Forecast 2018-2028 ($mn, AGR%)

Figure 4.8 LNG Bunkering Capacity Forecast (bcm), 2015-2025

Figure 4.9 Global Liquefied Natural Gas (LNG) Carrier Submarket Forecast 2018-2028 ($mn)

Figure 4.10 Global Liquefied Natural Gas (LNG) Carrier Market by Market Type (CAPEX) Share Forecast 2018, 2023, 2028 (% Share)

Figure 4.11 Liquefied Natural Gas (LNG) Carrier Market, By Retrofit/Conversion Forecast 2018-2028 ($mn, AGR%)

Figure 4.12 Liquefied Natural Gas (LNG) Carrier Market, By New Build Forecast 2018-2028 ($mn, AGR%)

Figure 5.1 Regional/Country LNG Carrier Market, by CAPEX

Figure 5.2 Regional/Country LNG Carrier Market, by Capacity (MCM)

Figure 5.3 Leading Country/Regional LNG Carrier Market Share, by CAPEX 2018

Figure 5.4 Leading Country/Regional LNG Carrier Market Share, by CAPEX 2023

Figure 5.5 Leading Country/Regional LNG Carrier Market Share, by CAPEX 2028

Figure 5.6 China LNG Carrier Forecast 2018-2028 ($mn, AGR%)

Figure 5.7 China LNG Carrier Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.8 China LNG Carrier, by Capacity (MCM)Forecast 2018-2028 (MCM)

Figure 5.9 China LNG Carrier, by Type, 2017

Figure 5.10 Japan LNG Carrier Forecast 2018-2028 ($mn, AGR%)

Figure 5.11 Japan LNG Carrier Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.12 Japan LNG Carrier, by Capacity (MCM)Forecast 2018-2028 (MCM)

Figure 5.13 Japan LNG Carrier, by Type, 2017

Figure 5.14 South Korea LNG Carrier Forecast 2018-2028 ($mn, AGR%)

Figure 5.15 South Korea LNG Carrier Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.16 South Korea LNG Carrier, by Capacity (MCM)Forecast 2018-2028 (MCM)

Figure 5.17 South Korea LNG Carrier, by Type, 2017

Figure 5.18 India LNG Carrier Forecast 2018-2028 ($mn, AGR%)

Figure 5.19 India LNG Carrier Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.20 India LNG Carrier, by Type, 2017

Figure 5.21 India LNG Carrier, by Capacity (MCM)Forecast 2018-2028 (MCM)

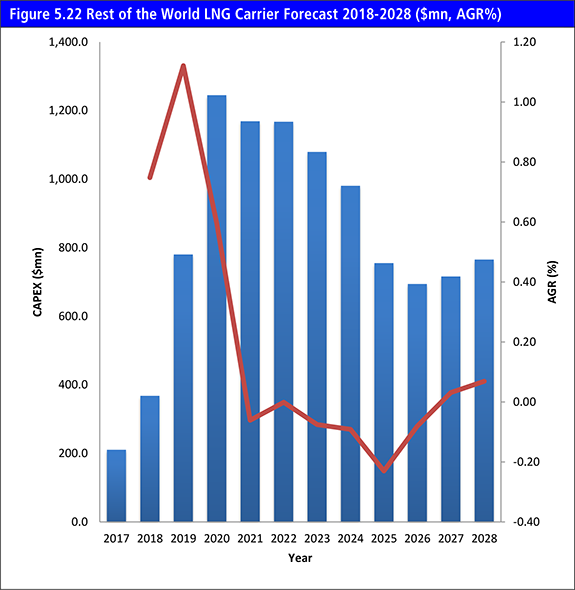

Figure 5.22 Rest of the World LNG Carrier Forecast 2018-2028 ($mn, AGR%)

Figure 5.23 Rest of the World LNG Carrier Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.24 India LNG Carrier, by Capacity (MCM)Forecast 2018-2028 (MCM)

Figure 5.25 Rest of the World LNG Carrier, by Type, 2017

Figure 8.1 Leading Companies Market Share, 2018 LNG Carrier Market

Figure 8.2 Leading Companies Market Share, 2017 LNG Carrier Market

Figure 8.3 Samsung Heavy Industries (SHI), LNG Carrier Types Delivered and Under Construction Status

Figure 8.4 Samsung Heavy Industries (SHI) Revenue, ($bn & AGR %), Y-o-Y Revenue Growth, 2012-2016

Table 8.4 Kawasaki Heavy Industries Profile 2015 (Market Entry, Public/Private, Headquarter, No. of Employees, 2016 Revenue $bn, Change in Revenue from 2015, Geography, Key Markets, Listed on, Products/Services)

Figure 8.5 Kawasaki Heavy Industries, % Revenue Share, by Business Segment, 2017

Figure 8.6 Kawasaki Heavy Industries, % Revenue Share, by Geographical Segment, 2017

Figure 8.7 Kawasaki Heavy Industries Revenue, ($bn & AGR %), Y-o-Y Revenue Growth, 2013-2017

Figure 8.8 NYK Line., % Revenue Share, by Business Segment, 2017

Figure 8.9 NYK Line. Revenue, ($bn & AGR %), Y-o-Y Revenue Growth, 2014-2017

Figure 8.10 Misc Berhad LNG Revenue, ($bn & AGR %), Y-o-Y Revenue Growth, 2013-2016

Figure 8.11 Misc Berhad Revenue Breakup, by Business Segment

Figure 8.12 Daewoo Shipbuilding and Marine Engineering (DSME, % Revenue Share, by Business Segment, 2016

Figure 8.13 Daewoo Shipbuilding and Marine Engineering (DSME), ($mn & AGR %), Y-o-Y Revenue Growth, 2013-2016

Figure 8.14 Mitsubishi Heavy Industries Ltd., % Revenue Share, by Business Segment, 2016

Figure 8.15 Mitsubishi Heavy Industries Ltd., % Revenue Share, by Geography Segment, 2016

Figure 8.16 Mitsubishi Heavy Industries Ltd. Revenue, ($bn & AGR %), Y-o-Y Revenue Growth, 2012-2016

Figure 8.17 Hyundai Heavy Industries Co., % Revenue Share, by Sales Order Breakdown, 2013

Figure 9.1 Global LNG Carrier Market Forecast 2018-2028 ($ mn, AGR %)

A.P. Moller-Maersk Group

Alpha Tankers

Anadarko

Angelicoussis Shipping Group

Anglo Eastern Group

Anthony Veder

Australia LNG

Awilco AS

Bernhard Schulte

BG Group

Bonny Gas Transport (BGT)

BP

BPRL

Brunei Gas Carriers Sdn

Brunei LNG

BW Gas ASA

BW Maritime

Cameron

Chandris (Hellas) Inc.

Cheniere

Chevron

China National Offshore Oil Corporation (CNOOC)

China National Petroleum Corporation (CNPC)

China Ocean Shipping Company (COSCO)

China Petroleum and Chemicals Corp., Ltd

China Shipbuilding Group Corporation

China Shipping Group

China Shipping LNG

China State Shipbuilding Corp (CSSC)

Cochin Shipyard Limited (CSL)

Constructions Navales et Industrielles de la Mediteranee

Cove Energy

Cryovision

CSSC Wärtsilä Engine (Shanghai) Co (CWEC)

Daewoo Shipbuilding and Marine Engineering (DSME)

Dailian Construction Investment Corp

Dailian Port

Dalian New Shipyard

Deen Shipping

DNV GL

Dongguan Fuel Industrial

Dynacom Corporation

Dynagas

Elcano

Emirates LNG LLC

Emprese Nacional Bazán

ENH

Eni

Excelerate

Exmar NV

ExxonMobil

Fincanteri

Flex LNG

FortisBC Energy

Foshan Gas

Fujian Investment Development Co 40

GAIL India

GasLog

GazOcean

Gazprom

Gaztransport & Technigaz (GTT)

GDF SUEZ

General Dynamics UK

Golar LNG

Guangdong Gas

Guangdong Yuedian

Guangzhou Gas Group

Hainan Development Holding Co

Hanjin Shipping Co. Ltd.

Hawaiian Electric Co.

HDW Kiel

Höegh LNG

Hong Kong & China Gas

Hong Kong Electric

Hudon

Hudong Heavy Machinery

Hudong Zhonghua

Humpuss Intermoda Transportasi

Hyproc Shipping Co.

Hyundai Heavy Industries Co., Ltd. (HHI)

Hyundai LNG

Hyundai Merchant Marine

Hyundai Samho Heavy Industries (HSHI)

IINO Kaiun Kaisha Ltd.

Imabari Shipbuilding

Ishikawajima- Harima Heavy Industries (IHI)

IZAR

Japan Marine United (JMU)

Japan Petroleum Exploration Company (Japex)

Jiangnan Shipbuilding Group

Jiangsu Guoxin

Jovo Group

Kawasaki Heavy Industries

Kawasaki Kisen Kaisha Limited

K-Line America Inc.

Knutsen OAS Shipping

Korea Line Corporation

Korea National Gas Company (KOGAS)

L&T Shipbuilding Ltd.

Larsen & Toubro

Linde Ag

Maran Gas Maritime Inc. (MGM)

MBK

Misc Berhad

Mitsubishi Heavy Industries, Ltd.

Mitsui Engineering and Shipbuilding

Mitsui OSK (MOL)

Nantong

National Gas Shipping Co.

Navantia

Ningbo Power Development Co LTD

Nippon Yusen Kabushiki Kaisha

Norgas

NYK Line

OAO Gazprom

Oceanus LNG

OLT Offshore

Oman LNG

Oman Shipping Co.

Overseas Shipholding Group Inc.

Pacific Oil and Gas

Petrochina

Petroliam Nasional Berhad (PETRONAS)

Petronas

Petronet

Pipavav Defence and Offshore Engineering (POED)

Plum Energy

Prometheus Energy

Pronav

PT Pertamina

Qingdao Port

Repsol

Ronsheng Heavy Industries Group

Samsung Heavy Industries (SHI)

Shanghai Waigaoqiao Shipbuilding

Shell

Shenergy Group

Shenghui Gas & Chemical Systems

Shenzhen Energy Group

Sinochem Corporation

Sinopec

Sirius Rederi

SK Shipping

Skangass AS

Sovcomflot

Statoil

Stena Bulk

STX Europe

STX Offshore and Shipbuilding

STX Pan Ocean

STX Shipbuilding

Taizhou Wuzhou Shipbuilding

Teekay Corporation

Teekay LNG Partners LP

Teekay Shipping

Thenamaris

Tokyo Electric Power Company

Toyota Motor Corporation

Tractebel Engineering

Tsakos Energy Navigation Ltd.

Universal Shipbuilding

Veka Group

Wintershall

Yamal Trade

Zhejiang Energy Group Co Ltd

Other Organisations Mentioned in This Report

Chinese Communist Party (CCP)

Chinese Government

Conference Board

Environmental Protection Agency (EPA)

European Union (EU)

Federal Energy Regulatory Commission (FERC)

Government of Canada

Government of Mexico

Indian Government

Indian Navy

International Atomic Energy Agency (IAEA)

International Maritime Organisation (IMO)

International Monetary Fund (IMF)

Japanese Government

National Development and Reform Commission (NDRC)

National Highway Traffic Safety Administration

Organization of the Petroleum Exporting Countries (OPEC)

Russia Bank for Development and Foreign Economic Affairs

State Pricing Bureau

United Nations (UN)

US Congress

US Department of Energy (DoE)

US Geological Survey (USGS)

US Government

World Bank

Download sample pages

Complete the form below to download your free sample pages for Liquefied Natural Gas (LNG) Carrier Market 2018-2028

Related reports

-

The Gas Insulated Substation (GIS) Market Forecast 2018-2028

Visiongain has calculated that the global Gas Insulated Substation (GIS) Market will see a capital expenditure (CAPEX) of $26,069 mn...

Full DetailsPublished: 01 February 2018 -

Liquefied Natural Gas (LNG) Bunkering Market 2019-2029

Visiongain has calculated that the LNG Bunkering market will see a capital expenditure (CAPEX) of $843mn in 2019. Read on...

Full DetailsPublished: 30 April 2019 -

Oil & Gas Subsea Umbilicals, Risers & Flowlines (SURF) Market Forecast 2017-2027

Visiongain has calculated that the global subsea umbilicals, risers and flowlines (SURF) market will see a capital expenditure (CAPEX) of...

Full DetailsPublished: 17 October 2017 -

Deepwater Drilling Market Report 2018-2028

The global deepwater drilling market is calculated to see spending of $30.30 bn in 2018. Excessive supply of oil worldwide...

Full DetailsPublished: 26 March 2018 -

Oil Refineries Market Report 2018-2028

With the recent upswing in oil prices these margins are again rising and Visiongain expects the value of the refinery...Full DetailsPublished: 24 July 2018 -

Land Seismic Equipment & Acquisition Market Forecast 2018-2028

Visiongain has calculated that the global Land Seismic Equipment & Acquisition Market will see a capital expenditure (CAPEX) of $2,168.2mn...

Full DetailsPublished: 26 January 2018 -

Oil & Gas Subsea Umbilicals, Risers & Flowlines (SURF) Market Report 2019-2029

Visiongain has calculated that the global subsea umbilicals, risers and flowlines (SURF) market will see a capital expenditure (CAPEX) of...

Full DetailsPublished: 02 November 2018 -

Floating Liquefied Natural Gas (FLNG) Market Report 2018-2028

This latest report by business intelligence provider visiongain assesses that Floating Liquefied Natural Gas spending will reach $9.6bn in 2018.

...Full DetailsPublished: 28 June 2018 -

Top 20 Small-Scale Liquified Natural Gas (SSLNG) Companies 2019

Small Scale LNG is used to supply small or isolated demand centers not connected to pipeline infrastructure, small scale LNG...

Full DetailsPublished: 24 January 2019 -

Next Generation Energy Storage Technologies (EST) Market Forecast 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global next-generation energy storage technologies market. Visiongain...

Full DetailsPublished: 16 April 2018

Download sample pages

Complete the form below to download your free sample pages for Liquefied Natural Gas (LNG) Carrier Market 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Energy news

Energy as a Service (EaaS) Market

The global Energy as a Service (EaaS) market is projected to grow at a CAGR of 12.6% by 2034

25 July 2024

Synthetic Fuels Market

The global Synthetic Fuels market is projected to grow at a CAGR of 23% by 2034

18 July 2024

Power-to-X (P2X) Market

The global Power-to-X (P2X) market is projected to grow at a CAGR of 10.6% by 2034

09 July 2024

Airborne Wind Energy Market

The global Airborne Wind Energy market is projected to grow at a CAGR of 9.7% by 2034

05 June 2024