Industries > Energy > Liquefied Natural Gas (LNG) Infrastructure Market 2017-2027

Liquefied Natural Gas (LNG) Infrastructure Market 2017-2027

Global Expenditure CAPEX ($mn) and Capacity (MMTPA) on Large-Scale Onshore LNG Infrastructure, by Liquefied Natural Gas (LNG) Infrastructure type - Liquefaction and Regasification Plus Analysis of Leading Companies

Visiongain has calculated that the LNG infrastructure market will see a total expenditure of $63,606 mn in 2017, including both Liquefaction and Regasification.

Read on to discover the potential business opportunities available.

LNG is used in various sectors such as automobile, industrial, and commercial. It is becoming a popular energy source due to its high replacement potential, considering its environmental benefits over other energy sources. The major advantage of LNG is the low emission of CO2, which makes it an efficient alternative to conventional fossil fuels. These advantages have been driving LNG demand from the industrial as well as automobile sector. Simultaneously, it is boosting the development of large-scale LNG terminals across the globe.

Increasing utilization of natural gas over oil is one of the major drivers for the large-scale terminals market. Various companies are focusing on establishing more liquefaction and regasification terminals in offshore areas to fulfil the increasing demand of LNG. In the current scenario, the overall global outlook is gradually shifting towards utilization of cleaner fuels. Natural gas is expected to occupy a major share of primary energy consumption by the end of the forecast period. With a boom in LNG trade activities expected in the future and steadily growing consumption pattern in emerging nations in Asia Pacific, an upward pressure on large-scale LNG sector development activities is inevitable in the future.

The construction of large-scale onshore liquefaction and regasification terminals is a function of the development of the global LNG industry. Investment in such infrastructure is dictated by unique supply and demand circumstances in different geographies, such as the US unconventional oil and gas boom and economic growth in Asia, particularly China.

There are a number of exciting LNG liquefaction prospects around the world in 2016, both under construction and perspective. The question is whether the demand of East Asia will be strong enough to support the economics of an abundant supply of liquefaction opportunities. The decline of the US as an import market for LNG has troubled financiers but has been balanced by demand in Asia, East Asia and emerging demand in South America.

Visiongain’s LNG infrastructure market report can keep you informed and up to date with the developments in the Liquefication Market in Australia, Canada, US and East Africa and Rest of the World. Visiongain has also included in-Depth market analysis about the Regasification markets in China, Japan, South Korea, India and Europe.

With reference to this report, it details the key investments trend in the global market, subdivided by regions, capital expenditure and capacity. Through extensive secondary research and interviews with industry experts, visiongain has identified a series of market trends that will impact the LNG infrastructure market over the forecast timeframe.

The report will answer questions such as:

– What are the key trends and factors affecting spending on new liquefaction infrastructure?

– What factors dictate this investment?

– How are the economics of terminals shaping up?

– What is the interplay between expenditure on regasification terminals and liquefaction capacity?

– How are demand markets for LNG most likely to evolve, and why?

– Who will be the main exporters and importers of LNG over the next decade?

– How will the future global LNG trade routes change?

– How much extra LNG capacity will enter the global market over the next decade

Five Reasons Why You Must Order and Read This Report Today:

1) The report provides CAPEX and capacity forecasts and analyses for the 5 Leading Regional Players in the LNG Liquefaction Market 2017-2027

– Australia

– Canada

– East Africa

– Russia

– US

– Rest of the World (Includes Iran, Papua New Guinea, Qatar, Trinidad & Tobago, Algeria, Angola & Nigeria)

2) The report provide CAPEX and capacity forecasts and analyses for the 5 Leading Regional Players in the LNG Regasification Market 2017-2027

– China

– Europe

– Japan

– South Korea

– India

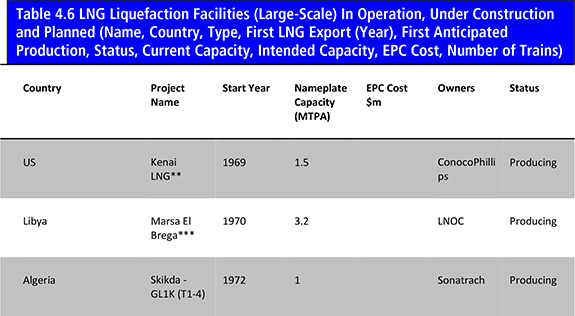

3) The report includes tables of all currently operating, under construction and planned liquefaction and regasification facilities, listing their Location, Operational Year, Status, Capacity, Owner(s) and EPC Cost

4) The analysis is underpinned by our exclusive interviews with leading experts from:

– Linde AG

5) The report provides detailed profiles of the leading companies operating within the LNG Infrastructure market:

– BHP Billiton

– ExxonMobil

– BP

– ConocoPhillips.

– Total S.A

– Linde AG

– Royal Dutch Shell

– PETRONAS

– Chevron Corporation

– Rosneft

This independent 328-page report guarantees you will remain better informed than your competitors. With 156 tables and figures examining the LNG Infrastructure market space, the report gives you a direct, detailed breakdown of the market. PLUS, capital expenditure AND capacity AND tables of all currently operating, under construction and planned liquefaction and regasification facilities, as well as in-Depth analysis, from 2017-2027 will keep your knowledge that one step ahead of your rivals.

This report is essential reading for you or anyone in the LNG sectors. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Liquefied Natural Gas (LNG)Infrastructure Market Overview

1.2 Market Structure Overview and Market Definition

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.7.3 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to The Liquefied Natural Gas (LNG) Infrastructure Market

2.1 Global LNG Infrastructure Market Structure

2.2 Market Definition

2.3 LNG Industry Outlook

2.4 LNG- Value Chain Analysis

2.5 The Role and Function of LNG Infrastructure

2.6 What is Natural Gas Liquefaction?

2.7 What is LNG Regasification?

2.8 Brief History of LNG Infrastructure

3. Global Overview of Liquefied Natural Gas (LNG) Infrastructure Market 2017-2027

3.1 Global Overview

3.2 Global Liquefied Natural Gas (LNG) Import Terminals

3.2 Global Liquefied Natural Gas (LNG) Export Terminals

4. Liquefied Natural Gas (LNG) Infrastructure Submarkets Forecasts 2017-2027

4.1 Global Liquefied Natural Gas (LNG) Infrastructure Submarkets Forecasts, by Type 2017-2027

4.1.1 Global Liquefaction Liquefied Natural Gas (LNG) Infrastructure Forecasts 2017-2027

4.1.2 Global Regasification Forecasts 2017-2027

4.1.3 Global Liquefied Natural Gas (LNG) Infrastructure, by Liquefied Natural Gas (LNG) Infrastructure Type Drivers and Restraints

4.2 Demand Side Factors

4.3 Supply-Side Drivers

4.4 Global LNG Market: Where Are We Now; Where Will We Be in 5 Years; Where Will We Be in 10 Years?

4.5 Oil Price Analysis

4.6 Supply-Side Factors

4.7 Demand-Side Factors

4.8 Other Major Variables that Impact the Oil Price

4.9 Oil Price and LNG Price Relationship

4.10 Towards an Oversupplied LNG Market

4.11 Large-Scale Liquefaction Terminals in Operation, Under Construction and Planned

4.12 Large-Scale Regasification Terminals in Operation, Under Construction and Planned

5. The Leading Regional Players in LNG Liquefaction Market (Large-Scale Onshore) 2017-2027

5.1 Australian Large-Scale Onshore LNG Liquefaction Market 2017-2027

5.1.1 Overall Drivers & Restraints on Australian LNG Liquefaction Investment

5.1.2 Capital Expenditure Analysis

5.1.3 What Are the Prospects for Brownfield Terminal Development?

5.1.4 Future Outlook for Australian LNG Infrastructure

5.2 U.S. Large-Scale Onshore LNG Liquefaction Market 2017-2027

5.2.1 Overall Drivers & Restraints on U.S. LNG Liquefaction Investment

5.2.2 Capital Expenditure Analysis

5.2.2.1 Drivers for Capital Expenditure

5.2.2.2 Restraints on Capital Expenditure

5.2.3 US Large-Scale Onshore LNG Liquefaction Terminal Locations

5.3 Russian Large-Scale Onshore LNG Liquefaction Market 2017-2027

5.3.1 Overall Drivers & Restraints on RUSSIAN LNG Liquefaction Investment

5.3.2 Russia Onshore Liquefaction Facilities and Prospects

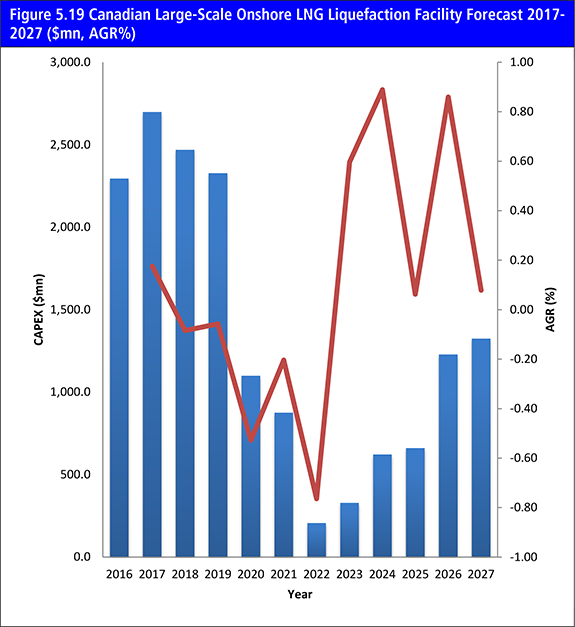

5.4 Canadian Large-Scale Onshore LNG Liquefaction Market 2017-2027

5.4.1 Overall Drivers & Restraints on Canadian LNG Liquefaction Investment

5.4.2 Capital Expenditure Analysis

5.4.3 Canadian Onshore LNG Liquefaction Projects

5.4.4 Greenfield Terminal Costs and Economic

5.4.5 Threats to LNG Liquefaction Terminal Investment

5.5 East African Large-Scale Onshore LNG Liquefaction Market 2017-2027

5.5.1 Overall Drivers & Restraints on East African LNG Liquefaction Investment

5.5.2 Mozambique LNG Liquefaction Outlook

5.5.3 Upstream Assets Relevant to LNG Liquefaction Development

5.5.4 Anadarko’s LNG Plan: The Onshore Option

5.5.5 ENI’s FLNG Option

5.5.6 Mozambique Development Context& Tax Regime

5.5.7 Most Likely Scenario for Mozambique LNG Development

5.5.8 Tanzanian LNG Liquefaction Outlook

5.5.9 Shell’s Acquisition of BG Group in 2015

5.5.10 Tanzania Development Context & Tax Regime

5.6 Rest of the World Large-Scale Onshore LNG Liquefaction Market 2017-2027

5.6.1 Iranian Onshore LNG Liquefaction Prospects

5.6.2 Joint LNG Exports

5.6.3 Potential Export Markets

5.6.4 Domestic Situation

5.6.5 Papua New Guinea Onshore LNG Liquefaction Prospects

5.6.6 Qatari Onshore LNG Liquefaction Prospects

5.6.7 Trinidad & Tobago Onshore LNG Prospects

5.6.8 Algeria

5.6.9 Angola

5.6.10 Nigeria

6. The Leading Regional Players in LNG Regasification Market (Large-Scale Onshore) 2017-2027

6.1 China Large-Scale Onshore LNG Regasification Market 2017-2027

6.1.1 Overall Drivers & Restraints on China LNG Regasification Investment

6.1.2 Domestic Supply – Shale Gas Development

6.1.3 Domestic Supply – Coalbed Methane Development

6.1.4 Domestic Supply – Tight Gas Development

6.1.5 Imports of Pipeline Gas

6.2 Japan Large-Scale Onshore LNG Regasification Market 2017-2027

6.2.1 Overall Drivers & Restraints on Japan LNG Regasification Investment

6.2.2 Capital Expenditure Analysis

6.2.3 Restarting Nuclear Power Generation

6.2.4 The Future of Coal Power Generation

6.2.5 Liquefaction Equity Investment Indicative of Future Imports

6.3 India Large-Scale Onshore LNG Regasification Market 2017-2027

6.3.1 Overall Drivers & Restraints on India LNG Regasification Investment

6.3.2 Indian LNG Infrastructure Outlook

6.3.4 LNG Pricing

6.4 Europe Large-Scale Onshore LNG Regasification Market 2017-2027

6.4.1 Overall Drivers & Restraints on Europe LNG Regasification Investment

6.4.2 How Does the Ukraine Crisis Impact Future European LNG

6.4.3 The Impact of Gas Pipeline Developments on LNG Infrastructure Investment

6.4.4 The Economics of LNG Imports vs Russian Gas

6.4.5 The FSRU Option – A Threat to Onshore Regasification in Europe?

6.4.6 What Will the Effect of UK North Sea Gas Declines be on Regasification Infrastructure?

6.4.7 Shale Gas Development Issues and their Relation to LNG Infrastructure Development

6.4.8 Poland

6.4.9 UK

6.4.10 Energy Security & Geo-Politics as a Driver of Regasification Infrastructure Development

6.4.11 A Shift to Natural Gas Power Generation?

6.4.12 Baltic States LNG Regasification Outlook

6.4.13 Italian LNG Regasification Terminal Outlook

6.5 South Korea Large-Scale Onshore LNG Regasification Market 2017-2027

6.5.1 Overall Drivers & Restraints on South Korea LNG Regasification Investment

6.5.2 Current LNG Demand Situation

6.5.3 What is the Future of Nuclear Power Generation in South Korea?

6.6 Rest of the World Large-Scale Onshore LNG Regasification Market 2017-2027

6.6.1 Overall Drivers & Restraints on Rest of the World LNG Regasification Investment

6.6.2 South & Central America

6.6.3 The Middle East& Africa

7. PESTEL Analysis of the LNG Infrastructure Market

7.1 PESTEL Analysis

8. Expert Opinion

8.1 Primary Correspondents

8.2 Global LNG Infra Market Outlook

8.3 Driver & Restraints

8.4 Dominant Region/Country in the LNG Liquefaction Market

8.5 Dominant Region/Country in the LNG Regasification Market

8.6 By type (Liquefaction & Regas) Market Scenario

8.7 Overall Growth Rate, Globally

9. Leading Companies in LNG Infrastructure Market

9.1 BHP Billiton

9.2 ExxonMobil

9.3 BP P.L.C.

9.4 ConocoPhillips

9.5 Total S.A.

9.6 Linde AG

9.7 Royal Dutch Shell

9.8 PETRONAS

9.9 Chevron Corporation

9.10 Rosneft

10. Conclusion & Recommendations

10.1 Key Findings

10.2 Recommendations

11. Glossary

Appendix

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

Appendix B

Visiongain Report Evaluation Form

List of Tables

Table 1.1 Global LNG Infrastructure Market by Regional Market Forecast 2017-2027 ($ mn/MMTPA, AGR %, CAGR)

Table 3.1 Global Liquefaction Liquefied Natural Gas (LNG) Infrastructure Forecast 2017-2027($mn, AGR %, CAGR %, Cumulative)

Table 3.2 Global Liquefied Natural Gas (LNG) Import Terminals Details (Region, Country, Project, Onshore / Offshore, Status, Startup, Operator, Capacity mt/y)

Table 3.3 Global Liquefied Natural Gas (LNG) Export Terminals (Region, Country, Project, Onshore / Offshore, Status, Startup, Operator, Capacity mt/y, Storage '000cm)

Table 4.1 Global Liquefied Natural Gas (LNG) Infrastructure Market Forecast Liquefaction vs. Regasification 2017-2027($mn, AGR %, Cumulative)

Table 4.2 Global Liquefied Natural Gas (LNG) Infrastructure Market Forecast Liquefaction vs. Regasification 2017-2027(MMTPA, AGR %, Cumulative)

Table 4.3 Global Liquefaction Liquefied Natural Gas (LNG) Infrastructure Forecast 2017-2027($mn, AGR %, CAGR %, Cumulative)

Table 4.4 Global Regasification Forecast 2017-2027($mn, AGR %, CAGR %, Cumulative)

Table 4.5 Global Liquefaction Natural Gas (LNG) Infrastructure Drivers and Restraints

Table 4.6 LNG Liquefaction Facilities (Large-Scale) In Operation, Under Construction and Planned (Name, Country, Type, First LNG Export (Year), First Anticipated Production, Status, Current Capacity, Intended Capacity, EPC Cost, Number of Trains)

Table 4.7 Large-Scale Regasification Terminals in Operation, Under Construction and Planned (Country, Terminal Name, Start Year, Nameplate Receiving Capacity (MTPA), EPC Cost $m, Owners, Status)

Table 5.1 Global LNG Liquefaction Market, by Country/Region Forecast CAPEX 2017-2027 ($mn, AGR %, Cumulative)

Table 5.2 Global LNG Liquefaction Market, by Country/Region Forecast Capacity 2017-2027 (MMTPA, AGR %, Cumulative)

Table 5.3 Australian Large-Scale Onshore LNG Liquefaction Facility CAPEX & Capacity 2017-2027 ($m, MMTPA, AGR %, Cumulative)

Table 5.4 Australian Large-Scale Onshore LNG Liquefaction Drivers and Restraints

Table 5.5 U.S. Large-Scale Onshore LNG Liquefaction Facility CAPEX & Capacity 2017-2027 ($m, MMTPA, AGR %, Cumulative)

Table 5.6 U.S. Large-Scale Onshore LNG Liquefaction Drivers and Restraints

Table 5.7 Russian Large-Scale Onshore LNG Liquefaction Facility CAPEX & Capacity 2017-2027 ($m, MMTPA, AGR %, Cumulative)

Table 5.8 Russian Large-Scale Onshore LNG Liquefaction Drivers and Restraints

Table 5.9 Canadian Large-Scale Onshore LNG Liquefaction Facility CAPEX & Capacity 2017-2027 ($m, MMTPA, AGR %, Cumulative)

Table 5.10 Canadian Large-Scale Onshore LNG Liquefaction Drivers and Restraints

Table 5.11 East African Large-Scale Onshore LNG Liquefaction Facility CAPEX & Capacity 2017-2027 ($m, MMTPA, AGR %, Cumulative)

Table 5.12 East African Large-Scale Onshore LNG Liquefaction Drivers and Restraints

Figure 5.13 Mozambique Gas Blocks Relevant to LNG Exports (Operator, Block, Onshore/Offshore, km2, Project Shareholders, Status)

Table 5.14 Rest of the World Large-Scale Onshore LNG Liquefaction Facility CAPEX & Capacity 2017-2027 ($m, MMTPA, AGR %, Cumulative)

Table 6.1 Global LNG Regasification Market, by Country/Region Forecast CAPEX 2017-2027 ($mn, AGR %, Cumulative)

Table 6.2 Global LNG Regasification Market, by Country/Region Forecast Capacity 2017-2027 (MMTPA, AGR %, Cumulative)

Table 6.3 China Large-Scale Onshore LNG Regasification Facility CAPEX & Capacity 2017-2027 ($m, MMTPA, AGR %, Cumulative)

Table 6.4 China Large-Scale Onshore LNG Regasification Drivers and Restraints

Table 6.5 Japan Large-Scale Onshore LNG Regasification Facility CAPEX & Capacity 2017-2027 ($m, MMTPA, AGR %, Cumulative)

Table 6.6 Japan Large-Scale Onshore LNG Regasification Drivers and Restraints

Table 6.7 India Large-Scale Onshore LNG Regasification Facility CAPEX & Capacity 2017-2027 ($m, MMTPA, AGR %, Cumulative)

Table 6.8 India Large-Scale Onshore LNG Regasification Drivers and Restraints

Table 6.9 Europe Large-Scale Onshore LNG Regasification Facility CAPEX & Capacity 2017-2027 ($m, MMTPA, AGR %, Cumulative)

Table 6.10 Europe Large-Scale Onshore LNG Regasification Drivers and Restraints

Table 6.11 South Korea Large-Scale Onshore LNG Regasification Facility CAPEX & Capacity 2017-2027 ($m, MMTPA, AGR %, Cumulative)

Table 6.12 South Korea Large-Scale Onshore LNG Regasification Drivers and Restraints

Table 6.13 Rest of the World Large-Scale Onshore LNG Regasification Facility CAPEX & Capacity 2017-2027 ($m, MMTPA, AGR %, Cumulative)

Table 6.14 Rest of the World Large-Scale Onshore LNG Regasification Drivers and Restraints

Table 7.1 PESTEL Analysis, LNG Infrastructure Market

Table 9.1 BHP Billiton Profile 2016 (Market Entry, Public/Private, Headquarter, No. of Employees), Revenue 2016 ($bn), Change in Revenue, Geography, Key Market, Listed on & Products/Services

Table 9.2 BHP Billiton, Total Company Sales 2012-2016 ($bn, AGR %)

Table 9.3 ExxonMobil Profile 2016 (Market Entry, Public/Private, Headquarter, No. of Employees, Revenue 2016 ($bn), Change in Revenue, Geography, Key Market, Company Sales from LNG Infrastructure Market, Listed on & Products/Services

Table 9.4 ExxonMobil, Total Company Sales 2012-2016 ($bn, AGR %)

Table 9.5 BP P.L.C. (Market Entry, Public/Private, Headquarter, No. of Employees, Revenue 2016 ($bn), Change in Revenue, Geography, Key Market, Company Sales from LNG Infrastructure Market, Listed on & Products/Services

Table 9.6 BP P.L.C., Total Company Sales 2012-2016 ($bn, AGR %)

Table 9.7 ConocoPhillips Profile 2016 (Market Entry, Public/Private, Headquarter, No. of Employees, Revenue 2016 ($bn), Change in Revenue, Geography, Key Market, Company Sales from LNG Infrastructure Market, Listed on & Products/Services

Table 9.8 ConocoPhillips Total Company Sales 2012-2016 ($bn, AGR %)

Table 9.9 Total S.A., Profile 2016 (Market Entry, Public/Private, Headquarter, No. of Employees, Revenue 2016 ($bn), Change in Revenue, Geography, Key Market, Company Sales from LNG Infrastructure Market, Listed on & Products/Services

Table 9.10 Total S.A., Inc. Total Company Sales 2012-2016 ($bn, AGR %)

Table 9.11 Linde AG Company Profile 2015 (Market Entry, Public/Private, Headquarter, No. of Employees, Revenue 2016 ($bn), Change in Revenue, Geography, Key Market, Company Sales from LNG Infrastructure Market, Listed on & Products/Services

Table 9.12 Linde AG Total Company Sales 2012-2016 ($bn, AGR %)

Table 9.13 Royal Dutch Shell Profile 2016 (Market Entry, Public/Private, Headquarter, No. of Employees, Revenue 2016 ($bn), Change in Revenue, Geography, Key Market, Company Sales from LNG Infrastructure Market, Listed on & Products/Services

Table 9.14 Royal Dutch Shell, Total Company Sales 2012-2016 ($bn, AGR %)

Table 9.15 PETRONAS Profile 2015 (Market Entry, Public/Private, Headquarter, No. of Employees, Revenue 2016 ($bn), Change in Revenue, Geography, Key Market, Company Sales from LNG Infrastructure Market, Listed on & Products/Services

Table 9.16 PETRONAS Total Company Revenue 2011-2015 ($bn, AGR %)

Table 9.17 Chevron Corporation Profile 2015 (Market Entry, Public/Private, Headquarter, No. of Employees, Revenue 2016 ($bn), Change in Revenue, Geography, Key Market, Company Sales from LNG Infrastructure Market, Listed on & Products/Services

Table 9.18 Chevron Corporation, Total Company Sales 2012-2016 ($bn, AGR %)

Table 9.19 Rosneft Profile 2015 (Market Entry, Public/Private, Headquarter, No. of Employees, Revenue 2016 ($bn), Change in Revenue, Geography, Key Market, Company Sales from LNG Infrastructure Market, Listed on & Products/Services

Table 9.20 Rosneft Total Company Sales 2012-2016 ($bn, AGR %)

List of Figures

Figure 1.1 Global Natural Gas Consumption Forecast 2010-2035

Figure 1.2 The LNG Liquefaction Market by Country/Region Market Share Forecast 2017, 2022, 2027 (% Share)

Figure 2.1 Global LNG Infrastructure Market Segmentation Overview

Figure 2.2 LNG, Value Chain Analysis

Figure 2.3 LNG Supply Chain from Field Production to Gas Grid

Figure 2.4 Simplified Flow Diagram of the Liquefaction Process

Figure 2.5 LNG Industry Brief Early History Timeline

Figure 3.1 Global Liquefied Natural Gas (LNG) Infrastructure Forecast 2017-2027 ($mn, AGR %)

Figure 4.1 Global Liquefied Natural Gas (LNG) Infrastructure Submarket Forecast 2017-2027 ($mn)

Figure 4.2 Global Liquefied Natural Gas (LNG) Infrastructure Market by Type (CAPEX) Share Forecast 2017, 2022, 2027 (% Share)

Figure 4.3 Liquefied Natural Gas (LNG) Infrastructure Market, By Liquefaction Forecast 2017-2027 ($mn, AGR%)

Figure 4.4 Liquefied Natural Gas (LNG) Infrastructure Market, By Regasification Forecast 2017-2027 ($mn, AGR%)

Figure 4.5 Top 10 LNG Exporter Countries (Million Tons), 2016

Figure 4.6 WTI, Brent, Dubai, Nigerian Forcados Oil Prices 2000-2016 ($/bbl)

Figure 5.1 Regional LNG Liquefaction Market, by CAPEX 2017-2027

Figure 5.2 Regional LNG Liquefaction Market, By Capacity (MMTPA) 2017-2027

Figure 5.3 Leading Country/Regional LNG Liquefaction Market Share by CAPEX 2017

Figure 5.4 Leading Country/Regional LNG Liquefaction Market Share by CAPEX 2022

Figure 5.5 Leading Country/Regional LNG Liquefaction Market Share 2027

Figure 5.6 Australian Large-Scale Onshore LNG Liquefaction Facility Forecast 2017-2027 ($mn, AGR%)

Figure 5.7 Australian Large-Scale Onshore LNG Liquefaction Facility Share Forecast 2017, 2022, 2027 (% Share)

Figure 5.8 Australian Large-Scale Onshore LNG Liquefaction Facility, by Capacity Forecast 2017-2027

Figure 5.9 Australian Onshore LNG Liquefaction Facility Cost per mmtpa of Capacity (Greenfield Terminals, CAPEX per mmtpa ($mn)

Figure 5.10 U.S. Large-Scale Onshore LNG Liquefaction Facility Forecast 2017-2027 ($mn, AGR%)

Figure 5.11 U.S. Large-Scale Onshore LNG Liquefaction Facility Share Forecast 2017, 2022, 2027 (% Share)

Figure 5.12 U.S. Large-Scale Onshore LNG Liquefaction Facility, by Capacity Forecast 2017-2027

Figure 5.13 USLNG Export Terminals Currently Approved by FERC (Name, Location, Sponsor)

Figure 5.14 USLNG Export Terminals Proposed to FERC (Name, Location, Sponsor)

Figure 5.15 Russian Large-Scale Onshore LNG Liquefaction Facility Forecast 2017-2027 ($mn, AGR%)

Figure 5.16 Russian Large-Scale Onshore LNG Liquefaction Facility Share Forecast 2017, 2022, 2027 (% Share)

Figure 5.17 Russian Large-Scale Onshore LNG Liquefaction Facility, by Capacity Forecast 2017-2027

Figure 5.18 Onshore LNG Liquefaction Facility Cost per mmtpa of Capacity (Greenfield Terminals, CAPEX per mmtpa ($m))

Figure 5.19 Canadian Large-Scale Onshore LNG Liquefaction Facility Forecast 2017-2027 ($mn, AGR%)

Figure 5.20 Canadian Large-Scale Onshore LNG Liquefaction Facility Share Forecast 2017, 2022, 2027 (% Share)

Figure 5.21 Canadian Large-Scale Onshore LNG Liquefaction Facility, by Capacity Forecast 2017-2027 (MMTPA)

Figure 5.22 East African Large-Scale Onshore LNG Liquefaction Facility Forecast 2017-2027 ($mn, AGR%)

Figure 5.23 East African Large-Scale Onshore LNG Liquefaction Facility Share Forecast 2017, 2022, 2027 (% Share)

Figure 5.24 East African Large-Scale Onshore LNG Liquefaction Facility, by Capacity Forecast 2017-2027 (MMTPA)

Figure 5.25 Rest of the World Large-Scale Onshore LNG Liquefaction Facility Forecast 2017-2027 ($mn, AGR%)

Figure 5.26 Rest of the World Large-Scale Onshore LNG Liquefaction Facility Share Forecast 2017, 2022, 2027 (% Share)

Figure 5.27 Rest of the World Large-Scale Onshore LNG Liquefaction Facility, by Capacity Forecast 2017-2027 (MMTPA)

Figure 5.28 North Field, Qatar

Figure 6.1 Regional LNG Regasification Market by CAPEX 2017-2027

Figure 6.2 Regional LNG Regasification Market By Capacity (MMTPA) 2017-2027

Figure 6.3 Leading Country/Regional LNG Regasification Market Share by CAPEX 2017

Figure 6.4 Leading Country/Regional LNG Regasification Market Share by CAPEX 2022

Figure 6.5 Leading Country/Regional LNG Regasification Market Share 2027

Figure 6.6 China Large-Scale Onshore LNG Regasification Facility Forecast 2017-2027 ($mn, AGR%)

Figure 6.7 China Large-Scale Onshore LNG Regasification Facility Share Forecast 2017, 2022, 2027 (% Share)

Figure 6.8 China Large-Scale Onshore LNG Regasification Facility, by Capacity Forecast 2017-2027 (MMTPA)

Figure 6.9 Japan Large-Scale Onshore LNG Regasification Facility Forecast 2017-2027 ($mn, AGR%)

Figure 6.10 Japan Large-Scale Onshore LNG Regasification Facility Share Forecast 2017, 2022, 2027 (% Share)

Figure 6.11 Japan Large-Scale Onshore LNG Regasification Facility, by Capacity Forecast 2017-2027 (MMTPA)

Figure 6.12 Japanese Net Electricity Generation by Fuel Type, 2013 & 2030 Target (% of TWh)

Figure 6.13 India Large-Scale Onshore LNG Regasification Facility Forecast 2017-2027 ($mn, AGR%)

Figure 6.14 India Large-Scale Onshore LNG Regasification Facility Share Forecast 2017, 2022, 2027 (% Share)

Figure 6.15 India Large-Scale Onshore LNG Regasification Facility, by Capacity Forecast 2017-2027 (MMTPA)

Figure 6.16 Europe Large-Scale Onshore LNG Regasification Facility Forecast 2017-2027 ($mn, AGR%)

Figure 6.17 Europe Large-Scale Onshore LNG Regasification Facility Share Forecast 2017, 2022, 2027 (% Share)

Figure 6.18 Europe Large-Scale Onshore LNG Regasification Facility, by Capacity Forecast 2017-2027 (MMTPA)

Figure 6.19 UK Natural Gas Consumption & Production, 2000-2024 (bcm/a)

Figure 6.20 South Korea Large-Scale Onshore LNG Regasification Facility Forecast 2017-2027 ($mn, AGR%)

Figure 6.21 South Korea Large-Scale Onshore LNG Regasification Facility Share Forecast 2017, 2022, 2027 (% Share)

Figure 6.22 South Korea Large-Scale Onshore LNG Regasification Facility, by Capacity Forecast 2017-2027(MMTPA)

Figure 6.23 Rest of the World Large-Scale Onshore LNG Regasification Facility Forecast 2017-2027 ($mn, AGR%)

Figure 6.24 Rest of the World Large-Scale Onshore LNG Regasification Facility Share Forecast 2017, 2022, 2027 (% Share)

Figure 6.25 Rest of the World Large-Scale Onshore LNG Regasification Facility, by Capacity Forecast 2017-2027 (MMTPA)

Figure 9.1 BHP Billiton, Revenue, ($bn& AGR %), 2012-2016

Figure 9.2 BHP Billiton Revenue % Share by Geographic Segment, 2016

Figure 9.3 BHP Billiton Revenue % Share by Business Segment, 2016

Figure 9.4 ExxonMobil, Revenue, ($bn& AGR %), 2012-2016

Figure 9.5 BP P.L.C., Revenue, ($bn& AGR %), 2012-2016

Figure 9.6 BP P.L.C. Revenue % Share by Geographic Segment, 2016

Figure 9.7 BP P.L.C. Revenue % Share by Business Segment, 2016

Figure 9.8 ConocoPhillips, Revenue, ($bn& AGR %), 2012-2016

Figure 9.9 ConocoPhillips Revenue % Share by Product Segment, 2016

Figure 9.10 ConocoPhillips Revenue % Share by Regional Segment, 2016

Figure 9.11 Total S.A., Inc. Revenue, ($bn& AGR %), 2012-2016

Figure 9.12 Total S.A. Revenue % Share by Business Segment, 2016

Figure 9.13 Linde AG, Revenue, ($bn& AGR %), 2012-2016

Figure 9.14 Linde AG Revenue % Share by Business Segment, 2016

Figure 9.15 Linde AG Revenue % Share by Regional Segment (Gases Division), 2016

Figure 9.16 Royal Dutch Shell Revenue ($bn& AGR %), 2012-2016

Figure 9.17 Royal Dutch Shell Revenue % Share by Geographic Segment, 2016

Figure 9.18 Royal Dutch Shell Revenue % Share by Business Segment, 2016

Figure 9.19 PETRONAS Total Company Revenue ($bn & AGR %), 2011-2015

Figure 9.20 PETRONAS Revenue % Share by Product Segment, 2015

Figure 9.21 PETRONAS Revenue % Share by Geographical Trade, 2015

Figure 9.22 PETRONAS Revenue % Share by Business Segment, 2015

Figure 9.23 PETRONAS Revenue % Share by Geographic Segment, 2015

Figure 9.24 Chevron Corporation, Revenue, ($bn& AGR %), 2012-2016

Figure 9.25 Chevron Corporation Revenue % Share by Business Segment, 2016

Figure 9.26 Rosneft Revenue ($bn& AGR %), 2013-2016

Figure 9.27 Rosneft % Share by Business Segment, 2016

Figure 10.1 Global Liquefaction LNG Infrastructure Market Forecast 2017-2027 ($ mn, AGR %)

Figure 10.2 Global Regasification LNG Infrastructure Market Forecast 2017-2027 ($ mn, AGR %)

4Gas

Aceh Regional

Adani Group

ADGAS

Abu Dhabi National Oil Company (ADNOC)

Adria LNG

AES Gener

AIG

Allnet

Anadarko

Annova LNG

Apache

API Nova Energia

Arc Logi

Arrow Energy LNG

Atlantic LNG

Atlantic Sea Island Group LLC

Australian Pacific LNG (APLNG)

Bahia Blanca Gas Port (BBGP)

Bahia de Bizkaia Gas

BC LNG Export Cooperative

Bear Head

BG Group

Bharat Petroleum Corporation

BHP Billiton

Botas

BP

BPCl

Brass LNG

Brindisi LNG

Broadwater Energy

Brunei LNG

Calais LNG

Cameron LNG

Canada Stewart Energy Group

Canaport LNG

Canvey LNG

Cheniere Energy

Chevron

Chinese Petroleum (CPC)

Chita LNG

Chubu Electric

Chubu Electric Power

Chugoko Electric Power

CIC

Cigma LNG

China National Offshore Oil Corporation (CNOOC)

Colbun SA

Comunidad Autonoma de Galicia

ConocoPhillips

Corpus Christi LNG

Cosmo

Cove

Crossnet

Cuadrilla Resources

Daewoo Shipbuilding

Dailian Construction Investment Corp

Dailian Port

DEPA

Dialog LNG

Dominion Energy

Dongguan Fuel Industrial

DOW Chemical

Downeast LNG

Dragon LNG

East Ohio Gas Company

Eco Electrica

EconGas OMV

EDF

Edison

EG LNG

EGAS

Egegaz

EGPC

Egyptian LNG (ELNG)

Elengy

Emirates LNG

Enagas

ENAP

Enarsa

ENDESA

Enel

Energy Transfer Partners

Energy World

ENH

Eni

Esperanza Energy

EVE

Excelerate Energy

ExxonMobil

Fluxys

Fluxys LNG NV (Suez)

Foshan Gas

Freeport LNG

Freeport McMoran LLC

Fujian Investment Development Corporation

Fujian LNG

GAIL

Galp Atlantico (Transgas)

Gangavaram Port Limited

Gas Natural Fenosa

Gas Natural SDG

Gascan

Gasfin

GASSP

Gasunie

Gate Terminal

Gaz de Normandie

Gazprom

GAZ-SYSTEM SA

GDF Suez

GE Capital

GE Energy Financial Services

GNL de Sonora

GNL del Plata

GNL Escobar GasPort

GNL Italia

GNL Mejillones SA

Golden Pass LNG

Grain LNG

Grupo Tojeiro

Gruppo Falcione

GS Energy

Guangdong Dapeng LNG

Guangdong Gas

Guangdong Yudean

Guangzhou Gas Group

Gujarat State Petroleum Corporation

Gulf Coast LNG Partners

Gulf LNG Energy

Hainan Development Holding Corporation

HEP

Heritage Oil

Hess LNG

Highstar

Hiroshima Gas

Hokkaido Gas

Hong Kong & China Gas

Hong Kong Electric

Hunt Oil

Hyundai

Hyundai Heavy Industries

IGas Energy

Imperial Oil

India Oil Company

Indian Oil Corporation

INPEX

Ionio Gas

Iran Liquefied Natural Gas Company

IRIDE Group

Irving Oil

Itochu

Iwatani

Jamaica LNG

Japex

Jiangsu Guoxin

JOGMEC

Jordan Cove Energy

Jovo Group

JX Nippon Oil & Energy

Kanematsu

Kansai Electric Power

KBR

Kinder Morgan

Kitakyushu LNG

Kitimat LNG

Klaipedos Nafta

KM LNG Operating Partnership

KOGAS

Korea LNG

KUFPEC

Kuwait Foreign Petroleum Exploration Company (KUFPEC)

Kyushu Electric

Legislative Assembly of British Columbia

Levant LNG (Pangea LNG)

Linde AG

LNG Japan

LNG Limited

Louisiana LNG

Magnolia LNG

Marathon

Marine Engineering

Mariveles LNG

Marubeni

MedGas LNG

Metrogas

Michael S Smith Cos

Mitsui

MSEB Holding Co

National Grid Transco

National Highway Traffic Safety Administration

National Iranian Oil Company (NIOC)

Nexen Energy

NextDecade

NGC Trinidad

Nigeria LNG (NLNG)

Nihonkai LNG

Ningbo Power Development Co LTD

NIOC (NIGEC)

Nippon Gas

Nippon Oil

Nigerian National Petroleum Corporation (NNPC)

Noble Energy

NOC (Sirte Oil)

Novatek

NTPC

Offshore LNG Toscana

Oil Search

Oita LNG

Okinawa Electric Power Co

OK-LNG OPCO

Oman LNG

Oman Oil

ONGC

Ophir Energy

Oregon LNG

Origin Energy

Osaka Gas

Pacific LNG

Pacific Oil and Gas

Pangea LNG

Partex

Pavilion Energy

PE Wheatstone

Peak Petroleum

Pertamina

Petoro

Petrobras

PetroChina

Petroleum BRUNEI

Petromin PNG

Petronas

Petronet LNG

Philadelphia Gas Works (PGW)

Pieria Energy

Pieridae Energy Canada

Pioneer Natural Resources

Plinacro

PNG Landowners

PNG LNG (Esso Highlands Ltd)

Polskie LNG SP.

Port Dolphin Energy LLC

Port Meridian Energy Ltd

Port Westward LNG

Posco

Project Venezuela LNG

PT Arun NGL (ExxonMobil)

PT Badak NGL

PT Donggi-Senoro LNG

Posta ve Telgraf Teşkilatı (PTT)

PTT LNG Company Ltd

PTTEP

Publigas

Qalhat LNG

Qatar Petroleum

Qatargas

Qingdao Port

Queensland Curtis LNG (QCLNG)

Quicksilver

Quoddy Bay LLC

Rabaska LNG

RasGas

Ratnagiri Gas & Power

Reganosa

REN

Repsol

Rosneft

RREEF Infrastructure

RWE

Sabine Pass LNG

Saggas - Planta de Regasificacion de Sagunto

Saibu Gas

Saipem

Sakai LNG

Sakaide LNG

Sakhalin Energy Investment

Samsung Heavy Industries

Santos Limited

SCT&E LNG

SEGAS

Sempra Energy

Sendai City Gas Bureau

Shannon LNG

Shell

Shell India

Shenergy Group

Shenzhen Energy Group

Shenzhen Gas

Shimizu LNG

Shizuoka Gas

Silk Road Fund 9

Sinochem Corporation

Sinopec

SK Corporation

SK Energy

Skangass AS

Sonagas

Sonangol

Sonatrach

Sorgenia

South Hook LNG

Southern LNG

Southern Union

Statia Terminals Canada

Statoil

Steelhead LNG

Sui Southern Gas

Talisman Energy

Tamil Nadu Industrial Development Corporation (Tidco)

Taranto LNG

Technip

Terasen

Terminal KMS de GNL

Terminale GNL Adriatico SRL

Texas LNG

Thunderbird LNG

Toho Gas

Tohoku Electric Power Co

Tokyo Electric Power (TEPCO)

Tokyo Gas

TonenGeneral

TOTAL

TransCanada

Trieste LNG

Tullow Oil

Ube Industries

Fenosa Gas

Venture Global

Veresen Inc

Vopak

Westpac Terminals

Wheatstone LNG

Woodfibre

Woodside

Woodside Petroleum

Yemen Gas Co

Yemen LNG (YLNG)

ZHA FLNG Purchaser

Zhejiang Energy Group Co Ltd

Other Organisations Mentioned in This Report

Alaska State Government

British Geological Survey (BGS)

China’s Ministry of Land and Resources

Cypriot Government

Dubai Supply Authority (Dusup)

Electricity Generating Authority of Thailand (EGAT)

Environmental Protection Agency (EPA)

Gazprom bank

Government of Brunei

Government of Canada

Government of Mexico

Government of PNG

Government of Russia

Indian financial institutions

International Atomic Energy Agency (IAEA)

International Monetary Fund (IMF)

Japan's Ministry of Economy, Trade and Industry (METI)

Ministry of Water Resources

Omani Government

Russian Development Bank

Russian National Wealth Fund

Sarawak State Government

Singapore Energy Market Authority (EMA)

State Government of Johor

UK Government

UN Security Council

UPS

US Federal Authorities

VEB

World Bank

Download sample pages

Complete the form below to download your free sample pages for Liquefied Natural Gas (LNG) Infrastructure Market 2017-2027

Related reports

-

Top 20 Small-Scale Liquified Natural Gas (SSLNG) Companies 2019

Small Scale LNG is used to supply small or isolated demand centers not connected to pipeline infrastructure, small scale LNG...

Full DetailsPublished: 24 January 2019 -

The Top 20 LNG Infrastructure Companies 2019

There are a number of exciting LNG liquefaction prospects around the world, both under construction and prospective.

...Full DetailsPublished: 11 March 2019 -

Liquefied Natural Gas (LNG) Carrier Market 2018-2028

Visiongain has calculated that the LNG Carrier market will see a capital expenditure (CAPEX) of $11,208 mn in 2018.Read on...

Full DetailsPublished: 13 February 2018 -

Small Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028

Visiongain has calculated that the global Small Scale Liquefied Natural Gas (LNG) Market will see a capital expenditure (CAPEX) of...

Full DetailsPublished: 05 February 2018 -

LNG Yearbook 2018: The Ultimate Guide to Liquefied Natural Gas Infrastructure 2018-2028

The definitive LNG Yearbook 2018 is the ultimate reference source for the liquefied natural gas industry. The yearbook indicates that...

Full DetailsPublished: 14 June 2018 -

Floating Liquefied Natural Gas (FLNG) Market Report 2018-2028

This latest report by business intelligence provider visiongain assesses that Floating Liquefied Natural Gas spending will reach $9.6bn in 2018.

...Full DetailsPublished: 28 June 2018

Download sample pages

Complete the form below to download your free sample pages for Liquefied Natural Gas (LNG) Infrastructure Market 2017-2027

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Latest Energy news

Visiongain Publishes Carbon Capture Utilisation and Storage (CCUS) Market Report 2024-2034

The global carbon capture utilisation and storage (CCUS) market was valued at US$3.75 billion in 2023 and is projected to grow at a CAGR of 20.6% during the forecast period 2024-2034.

19 April 2024

Visiongain Publishes Liquid Biofuels Market Report 2024-2034

The global Liquid Biofuels market was valued at US$90.7 billion in 2023 and is projected to grow at a CAGR of 6.7% during the forecast period 2024-2034.

03 April 2024

Visiongain Publishes Hydrogen Generation Market Report 2024-2034

The global Hydrogen Generation market was valued at US$162.3 billion in 2023 and is projected to grow at a CAGR of 3.7% during the forecast period 2024-2034.

28 March 2024

Visiongain Publishes Biofuel Industry Market Report 2024-2034

The global Biofuel Industry market was valued at US$123.2 billion in 2023 and is projected to grow at a CAGR of 7.6% during the forecast period 2024-2034.

27 March 2024