The latest report from business intelligence provider visiongain offers in depth analysis of the global carbon dioxide (CO2) enhanced oil recovery (EOR) market. Visiongain evaluates spending, including investments on anthropogenic carbon capture facilities and equipment for CO2 EOR at $18.5bn in 2019.

How this report will benefit you

The 167-page report provides clear detailed insight into the global carbon dioxide (CO2) Enhanced Oil Recovery (EOR). In this brand new report you will find 123 in-depth tables, charts and graphs all unavailable elsewhere.

By ordering and reading our report today you will stay better informed and ready to act.

Report Deliverables

• Global market forecasts and analysis covering the period 2019 to 2029 in terms of CO2 EOR CAPEX ($m) and anthropogenic CO2 providers’ CAPEX ($m)

• Global market forecasts covering the period 2019 to 2029 in terms of CO2 EOR production (MMbbls/yr) and anthropogenic CO2 supply (MMtpa)

• Submarket forecasts and analysis covering the period 2019 to 2029 in terms of total spending for the CO2 EOR cost components:

– CO2 sources,

– Pipelines

– Injection

• National market forecasts and analysis from 2019 to 2029 in terms of CO2 EOR CAPEX ($m) and anthropogenic CO2 providers’ CAPEX ($m) for the US, Canada, China, Brazil, the UAE, the UK, the rest of Europe and the rest of the world

• Multiple project tables located in each country/ region covered in the report

• National market forecasts from 2019 to 2029 in terms of CO2 EOR production (bpd) and anthropogenic CO2 supply (MMtpa) for the US, China, Canada, Brazil, the UAE, the UK, the rest of Europe and the rest of the world

• Details and analysis of all current (known) and upcoming CO2 EOR projects taking place throughout the world detailing: name, company, gas source, start date, current oil production (bpd) and forecasted peak production between 2019 and 2029 (bpd)

• Details and analysis of all known operating or planned CCS projects that have implications for CO2 EOR: location, companies, MMtpa capacity and operation date

• National market forecasts from 2019 to 2029 in terms of CO2 EOR production (mmbbls/yr) and spending ($m)

– US CO2 EOR Forecast 2019-2029

– China CO2 EOR Forecast 2019-2029

– Canada CO2 EOR Forecast 2019-2029

– Brazil CO2 EOR Forecast 2019-2029

– UAE CO2 EOR Forecast 2019-2029

– UK CO2 EOR Forecast 2019-2029

– Rest of Europe CO2 EOR Forecast 2019-2029

– Rest of the world CO2 EOR Forecast 2019-2029

• Submarket forecasts for the period 2019 to 2029

– CO2 Injection (Miscible & Immiscible)

– CO2 Transmission Infrastructure (CO2 Pipeline Networks)

– Naturally Occurring CO2 Sources

– Anthropogenic Carbon Capture & & Storage (CCS) for CO2 EOR

• Analysis of the CO2 EOR industry outlook with analysis of some of the top companies operating within the CO2 EOR market space, including:

– Kinder Morgan

– Denbury Resources

– Hilcorp Energy Company

– Whiting Petroleum Corporation

– Occidental Petroleum Corporation

– Fleur de Lis Energy

– Hess Corporation

– Chaparral Energy Inc.

– Chevron

– Apache Corporation

– Cenovus

– China National Petroleum Corporation

– Husky Energy

– Petrobras

– Sinopec

• PEST analysis of the major political, economic, social and technological aspects impacting the market

• Conclusions and recommendations

How will you benefit from this report?

• Enhance your strategic decision-making

• Assist with your research, presentations and business plans

• Show which emerging market opportunities to focus upon

• Increase your industry knowledge

• Keep you up to date with crucial market developments

• Allow you to develop informed growth strategies

• Build your technical insight

• Illustrate trends to exploit

• Strengthen your analysis of competitors

• Provide risk analysis helping you avoid the pitfalls other companies could make

• Ultimately, help you to maximise profitability for your company

Who should read this report?

• Oil companies and companies specialising in enhanced oil recovery (EOR)

• Anthropogenic CO2 suppliers and potential future anthropogenic CO2 suppliers such as power plants, natural gas processing units and other energy-intensive facilities

• Technology developers

• Heads of strategic development

• Marketing staff

• Market analysts

• Procurement staff & suppliers

• Investors & financial institutions

• Banks

• Governmental departments & agencies

Visiongain’s study is intended for anyone requiring commercial analysis for the carbon dioxide (CO2) Enhanced Oil Recovery (EOR) market and leading companies. You will find data, trends and predictions.

Buy our report today Carbon Dioxide (CO2) Enhanced Oil Recovery (EOR) Market 2019-2029: Production (MMbbls/yr) & CAPEX ($m) Forecasts for CO2 Injection (featuring Miscible & Immiscible) Forecasts for CO2 Transmission Infrastructure (CO2 Pipeline Networks) and Naturally Occurring CO2 Sources; and Capacity (MMtpa) & CAPEX ($m) Forecasts for Anthropogenic Carbon Capture & & Storage (CCS) for CO2 EOR Plus Leading Country/ Region and Company Analysis Avoid missing out by staying informed – get our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Carbon Dioxide (CO2) Enhanced Oil Recovery (EOR) Market Overview

1.2 Market Structure Overview and Market Definition

1.3 Methodology

1.4 Why You Should Read This Report

1.5 How This Report Delivers

1.6 Key Questions Answered by This Analytical Report Include:

1.7 Who is This Report For?

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Carbon Dioxide Enhanced Oil Recovery Market

2.1 A Brief History of the CO2 EOR Industry

2.2 The Importance of Oil Prices

2.3 The Main Costs Involved in CO2 EOR Operations

2.4 Miscible and Immiscible EOR Methods

2.5 Where is CO2 Sourced From?

2.6 Advantages and Disadvantages of Using CO2 for EOR

2.7 Competition from Rival Technologies

2.8 Prospects for Offshore CO2 EOR

2.9 Environmental Issues Related to CO2 EOR Production

3. Global Carbon Dioxide Enhanced Oil Recovery Market 2019-2029

3.1 Global Carbon Dioxide Enhanced Oil Recovery Market Forecast 2019-2029

3.2 Drivers and Restraints in the CO2 EOR Market

3.2.1 Drivers in the CO2 EOR Market

3.2.1.1 Vast Geological Storage Potential in Oil Fields

3.2.1.2 Extensive Industry Experience with CO2 EOR

3.2.1.3 Billions of Barrels of Added Oil Yield

3.2.1.4 Many Fields Approaching Limit of Water Flood Recovery Potential

3.2.1.5 High Costs of Decommissioning Oil and Gas Infrastructure

3.2.1.6 Residual Oil Zones (ROZs)

3.2.1.7 Carbon Trading and Cost Reductions

3.2.2 Restraints in the CO2 EOR Market

3.2.2.1 Limited CO2 Availability

3.2.2.2 High Cost of Carbon Capture

3.2.3 Limited Financial Incentives to Invest

3.2.2.4 Tight Financing

3.2.2.5 Longer Return on Investment Period

3.2.2.6 CO2 Leakage and Environmental Issues

3.2.2.7 Limited or No Government Funding

3.2.2.8 Offshore Decommissioning and Well Abandonment

3.2.2.9 Poorly Conducted Onshore Decommissioning

3.3 CO2 EOR Breakeven Price Analysis

3.4 Oil Prices

3.4.1 Visiongain’s Description and Analysis of the Oil Price Fall

3.4.2 Supply-Side Factors

3.4.2.1 Tight Oil

3.4.2.2 OPEC

3.4.3 Demand-Side Factors

3.4.3.1 Chinese and Indian Growth

3.4.3.2 Western Stagnation

3.4.4 Other Major Variables that Impact the Oil Price

3.4.4.1 North Africa

3.4.4.2 Russia

3.4.4.3 US Shale Industry

3.4.4.4 Iran

3.4.5 Visiongain’s Oil Price Assumptions and Forecast

3.5 Barriers to Entry Analysis

4. Carbon Dioxide Enhanced Oil Recovery Submarket Forecasts 2019-2029

4.1 Read Which CO2 EOR Cost Component Will Provide the Strongest Growth

4.1.1 The CO2 EOR Source Submarket Forecast 2019-2029

4.1.1.1 CO2 EOR Source Submarket Drivers and Restraints

4.1.1.2 Global CO2 Source Projects

4.1.2 The CO2 EOR Pipeline Submarket Forecast 2019-2029

4.1.2.1 CO2 Pipelines Submarket Drivers and Restraints

4.1.3 The CO2 EOR Injection Submarket Forecast 2019-2029

4.1.3.1 Global CO2 Injection Projects

5. The Leading National CO2 EOR Market Forecasts 2019-2029

5.1 The U.S. CO2 EOR Market Forecast 2019-2029

5.1.1 History of CO2 EOR in the U.S.

5.1.2 Where are the CO2 EOR Projects in the U.S. Located?

5.1.3 Where is the CO2 Sourced From?

5.1.3.1 Anthropogenic CO2 Providers in the U.S.

5.1.3.2 Naturally Sourced CO2

5.1.4 Drivers and Restraints in the U.S. CO2 EOR Market 2019-2029

5.1.4.1 The Importance of Government Support and Regulations

5.1.4.2 The Impact of Increasing Shale (Tight) Oil Production on the CO2 EOR Market

5.1.4.3 Offshore EOR Unlikely to come to Fruition

5.1.5 How is the U.S. CO2 EOR Market Likely to Develop over the Next Ten Years?

5.2 The Chinese CO2 EOR Market Forecast 2019-2029

5.2.1 A Brief History of EOR in China

5.2.2 Current Chinese CO2 EOR Projects

5.2.3 Anthropogenic CO2 Providers in China

5.2.4 Drivers and Restraints in the Chinese CO2 EOR Market 2019-2029

5.2.4.1 China’s High Emissions and the Need for More Oil

5.2.4.2 How Suitable is China’s Geology for CO2 EOR?

5.2.4.3 China’s Efforts to Form International Partnerships to Help Promote CO2 EOR

5.2.4.4 The Need for More Government Support for CO2 EOR

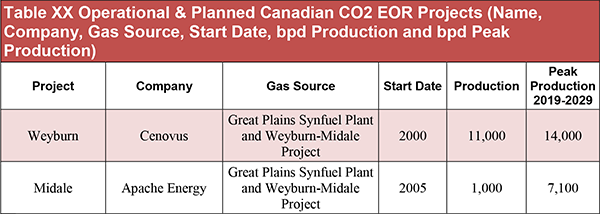

5.3 The Canadian CO2 EOR Market Forecast 2019-2029

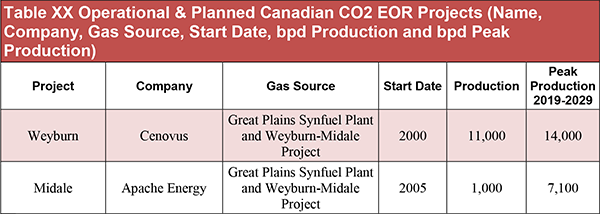

5.3.1 Current and Upcoming Canadian CO2 EOR Projects

5.3.2 Anthropogenic CO2 Providers in Canada

5.3.3 Drivers and Restraints in the Canadian CO2 EOR Market 2019-2029

5.3.3.1 Construction on the Alberta Carbon Trunk Line Project is Underway

5.3.3.2 Despite the Abundance of Maturing Oil Fields, Too Many Pilot Projects Are Abandoned

5.3.3.3 High CO2 Costs Prohibiting Development

5.3.3.4 Shale Oil, Oil Sands and Competition from Other Technologies

5.4 The UAE CO2 EOR Market Forecast 2019-2029

5.4.1 Current and Upcoming UAE CO2 EOR Projects

5.4.2 Anthropogenic CO2 providers in the UAE

5.4.3 Drivers and Restraints in the UAE CO2 EOR Market 2019-2029

5.5 The Brazilian CO2 EOR Market Forecast 2019-2029

5.5.1 Current and Upcoming Brazilian CO2 EOR Projects

5.5.2 Anthropogenic CO2 Providers in Brazil

5.5.3 Drivers and Restraints in the Brazilian CO2 EOR Market 2019-2029

5.5.4 Prospects for the Lula CO2 EOR Project

5.5.5 Future Potential for Brazil’s CO2 EOR Market

5.6 The Russia CO2 EOR Market Forecast 2019-2029

5.7 The Rest of Europe CO2 EOR Market Forecast 2019-2029

5.7.1 Drivers and Restraints in the Rest of Europe CO2 EOR Market

5.7.2 Why is Progress So Slow at Present?

5.7.3 CO2 EOR Prospects in the Netherlands and Denmark

5.7.4 Norway’s Long-Term CO2 EOR Potential

5.7.5 CO2 EOR Opportunities in Other European Countries

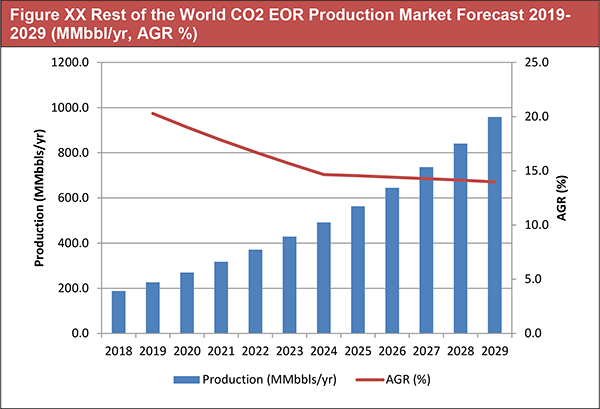

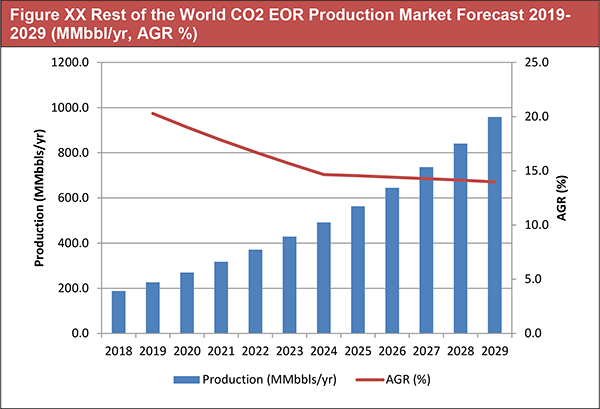

5.8 The Rest of the World CO2 EOR Market Forecast 2019-2029

5.8.1 CO2 EOR Projects and Potential in the Rest of the World

5.8.1.1 The Saudi-Arabian CO2 EOR Market 2019-2029

5.8.1.2 The Kuwaiti CO2 EOR Market 2019-2029

5.8.1.3 The Egyptian CO2 EOR Market 2019-2029

5.8.1.4 The Mexican CO2 EOR Market 2019-2029

5.8.1.5 The Trinidadian CO2 EOR Market 2019-2029

5.8.1.6 The Vietnamese CO2 EOR Market 2019-2029

5.8.1.7 The Malaysian CO2 EOR Market 2019-2029

6. PEST Analysis of the Carbon Dioxide (CO2) Enhanced Oil Recovery Market

6.1 Political

6.2 Economic

6.3 Social

6.4 Technological

7. The Leading Companies in the CO2 Enhanced Oil Recovery Market

7.1 Kinder Morgan

7.2 Denbury Resources

7.3 Hilcorp Energy Company

7.4 Whiting Petroleum Corporation

7.5 Occidental Petroleum Corporation

7.6 Fleur de Lis Energy

7.7 Hess Corporation

7.8 Chaparral Energy Inc.

7.9 Chevron

7.10 Apache Corporation

7.11 Cenovus Energy Inc.

7.12 China National Petroleum Corporation (CNPC)

7.13 Husky Energy

7.14 Petroleo Brasileiro S.A. (Petrobras)

7.15 Sinopec

8. Conclusions and Recommendations

8.1 Key Findings

8.2 Recommendations

9. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 2.1 Global CO2 EOR Market Forecast 2019-2029 (Spending $m, AGR %, Cumulative)

Table 2.2 Global CO2 EOR Market Forecast 2019-2029 (Million Barrel, AGR %, Cumulative)

Table 2.3 Global CO2 EOR Market Forecast 2019-2029 (Spending $mn, AGR %, Cumulative)

Table 2.4 Advantages and Disadvantages of Using CO2 for EOR

Table 2.5 Shale Oil Reserves Top 10 Countries (billion bbls)

Table 3.1 Global CO2 EOR Market Forecast 2019-2029 (MMbbl/yr, Spending $m, AGR %, Cumulative)

Table 3.2 Drivers and Restraints in the CO2 EOR Market

Table 3.3 Visiongain’s Anticipated Brent Crude Oil Price, 2018, 2019, 2020-2022, 2023-2025, 2026-2029 ($/bbl)

Table 4.1 Global CO2 EOR Submarkets Forecast 2019-2029 ($m, AGR %, Cumulative)

Table 4.2 Global CO2 EOR Source Submarkets Forecast 2019-2029 ($m, AGR %, Cumulative)

Table 4.3 CO2 EOR Source Submarket Drivers and Restraints

Table 4.4 Global CO2 Pipelines Submarkets Forecast 2019-2029 ($m, AGR %, Cumulative)

Table 4.5 CO2 Pipelines Submarket Drivers and Restraints

Table 4.6 Global CO2 Injection Submarkets Forecast 2019-2029 ($m, AGR %, Cumulative)

Table 5.1 Leading National CO2 EOR Market Forecast 2019-2029 (Mbbl/yr, AGR %, Cumulative)

Table 5.2 Leading National CO2 EOR Market Forecast 2019-2029 (Spending $mn, AGR %, Cumulative)

Table 5.3 US CO2 EOR Market Forecast 2019-2029 (MMbbls/yr production, Spending $m, AGR %, CAGR %, Cumulative)

Table 5.4 U.S. Regional Submarkets (Name, Location, Number of CO2 EOR Projects, Production)

Table 5.5 Operating & Planned Anthropogenic CO2 Providers Facilities in the U.S. (Location, Companies, MMtpa Capacity, Operation Date and Clients)

Table 5.6 Drivers and Restraints in the US CO2 EOR Market

Table 5.7 15 Largest Companies in CO2 EOR (Production) and Shale (Tight) Oil in 2015 (CAPEX)

Table 5.8 China CO2 EOR Market Forecast 2019-2029 (MMbbl/yr production, Spending $m, AGR %, CAGR %, Cumulative)

Table 5.9 Operating & Planned Anthropogenic CO2 Provider Facilities in China (Location, Companies, MMtpa Capacity and Operation Date)

Table 5.10 Drivers and Restraints in the Chinese CO2 EOR Market

Table 5.11 Canada CO2 EOR Market Forecast 2019-2029 (MMbbl/yr production, Spending $m, AGR %, CAGR %, Cumulative)

Table 5.12 Operational & Planned Canadian CO2 EOR Projects (Name, Company, Gas Source, Start Date, bpd Production and bpd Peak Production)

Table 5.13 Operating & Planned Anthropogenic CO2 Providers Facilities in Canada (Location, Companies, MMtpa Capacity, Operation Date and Clients)

Table 5.14 Drivers and Restraints in the Canadian CO2 EOR Market

Table 5.15 Canadian CO2 EOR Pilots (Project Name, Operator, Operational Dates, bbls Total Oil Production)

Table 5.16 UAE CO2 EOR Market Forecast 2019-2029 (MMbbl/yr production, Spending $m, AGR %, CAGR %, Cumulative)

Table 5.17 Operational & Planned UAE CO2 EOR Projects (Name, Company, Gas Source, Start Date, bpd Production 2016 and bpd Peak Production)

Table 5.18 Operating & Planned Anthropogenic CO2 Provider Facilities in the UAE (Location, Companies, Capacity (MMtpa), Operation date and Clients)

Table 5.19 Drivers and Restraints in the UAE CO2 EOR Market

Table 5.20 Brazil CO2 EOR Market Forecast 2019-2029 (MMbbl/yr production, Spending $m, AGR %, CAGR %, Cumulative)

Table 5.21 Operational & Planned Brazilian CO2 EOR Projects (Name, Company, Gas Source, Start Date, bpd Production 2016 and bpd Peak Production)

Table 5.22 Operating & Planned Anthropogenic CO2 Provider Facilities in Brazil (Location, Companies, Capacity (MMtpa), Operation date and Clients)

Table 5.23 Drivers and Restraints in the Brazilian CO2 EOR Market

Table 5.24 Russia CO2 EOR Market Forecast 2019-2029 (MMbbl/yr production, Spending $m, AGR %, CAGR %, Cumulative)

Table 5.25 Rest of Europe CO2 EOR Market Forecast 2019-2029 (MMbbl/yr production, Spending $m, AGR %, CAGR %, Cumulative)

Table 5.26 Drivers and Restraints in the Rest of Europe CO2 EOR Market

Table 5.27 Rest of the World CO2 EOR Market Forecast 2019-2029 (MMbbl/yr production, Spending $m, AGR %, CAGR %, Cumulative)

Table 7.1 Kinder Morgan 2017 (CEO, Strongest Business Region, Total Revenue $m, Earnings from CO2 $m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.2 Denbury Resources 2017 (CEO, Strongest Business Region, HQ, Founded, Total Revenue $m 2017, Average Daily Production 2017, Proved Oil & Gas Reserves MBOE, Proved CO2 Reserves MMcf, No. of Employees, IR Contact, Ticker, Website)

Table 7.3 Hilcorp Energy Company 2017 (CEO, Total Revenue $m 2017, HQ, Founded, No. of Employees, IR Contact, Website)

Table 7.4 Whiting Petroleum Corporation 2017 (CEO, HQ, Founded, Net Income $m 2017, No. of Employees, IR Contact, Website)

Table 7.5 Occidental Petroleum Corporation 2017 (CEO, Strongest Business Region, HQ, Address, Founded, No. of Employees, Company Sales $m 2017, Business Segments, IR Contact, Ticker, Website)

Table 7.6 Fleur de Lis Energy 2017 (CEO, Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.7 Hess Corporation 2017 (CEO, Strongest Business Region, HQ, Founded, Total Revenue $m 2017, No. of Employees, IR Contact, Ticker, Website)

Table 7.8 Chaparral Energy Inc. 2017 (CEO, Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.9 Chevron 2017 (CEO, Strongest Business Region, HQ, Founded, Total Company Revenue $m 2017, Business Segments, No. of Employees, IR Contact, Ticker, Website)

Table 7.10 Apache Corporation 2017 (CEO, Strongest Business Region, HQ, Oil & Gas Production Revenues $m 2017, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.11 Cenovus Energy Inc. 2017 (CEO, Strongest Business Region, HQ, Founded, Total Revenue $m 2017, No. of Employees, IR Contact, Ticker, Website)

Table 7.12 China National Petroleum Corporation 2017 (CEO, Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.13 Husky Energy 2017 (CEO, Strongest Business Region, HQ, Founded, Company Sales $m 2017, Business Segments, No. of Employees, IR Contact, Ticker, Website)

Table 7.14 Petrobras 2017 (CEO, Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.15 Sinopec 2017 (CEO, Strongest Business Region, HQ, Founded, Company Sales $b, No. of Employees, IR Contact, Ticker, Website)

Table 8.1 Global CO2 EOR Market Forecast 2019-2029 (Spending $m, AGR %, Cumulative)

Table 8.2 Leading National CO2 EOR Market Forecast 2019-2029 (Spending $mn, AGR %, Cumulative)

List of Figures

Figure 1.1 Global CO2 EOR Market Structure Overview

Figure 2.1 Global CO2 EOR Market Forecast 2019-2029 (MMbbl/yr, AGR %)

Figure 2.2 Global CO2 EOR Market Forecast 2019-2029 ($m, AGR%)

Figure 2.3 Leading National CO2 EOR Production and Market Share Forecast 2019 (%)

Figure 2.4 Leading National CO2 EOR Production and Market Share Forecast 2024 (%)

Figure 2.5 Leading National CO2 EOR Production and Market Share Forecast 2029 (%)

Figure 3.1 Global CO2 EOR Market Forecast 2019-2029 (Mbbl/yr, AGR %)

Figure 3.2 Global CO2 EOR Market Forecast 2019-2029 ($m, AGR%)

Figure 3.3 Leading National CO2 EOR Production and Market Share Forecast 2019 (%)

Figure 3.4 Leading National CO2 EOR Production and Market Share Forecast 2024 (%)

Figure 3.5 Leading National CO2 EOR Production and Market Share Forecast 2029 (%)

Figure 3.6 WTI and Brent Oil Prices 2006-2017 ($/bbl)

Figure 3.7 Average Monthly OPEC Crude Oil Price July 2017-July 2018 ($/bbl)

Figure 3.8 China and India Annual GDP Growth 2012-2018 (%)

Figure 3.9 US Refined Product Consumption January 2017 to Sept 2018 Four-Week Average (Mbpd)

Figure 4.1 CO2 EOR Market Share Forecast 2019 (%)

Figure 4.2 CO2 EOR Market Share Forecast 2024 (%)

Figure 4.3 CO2 EOR Market Share Forecast 2029 (%)

Figure 4.4 CO2 EOR Submarkets Forecast 2019-2029 ($m)

Figure 4.5 CO2 EOR Submarkets Cumulative Spending Forecast 2019-2029 ($m)

Figure 4.6 CO2 EOR Sources Markets Forecast 2019-2029 ($m)

Figure 4.7 CO2 EOR Pipelines Markets Forecast 2019-2029 ($m)

Figure 4.8 CO2 EOR Injection Markets Forecast 2019-2029 ($m)

Figure 5.1 Global CO2 EOR Market Forecast 2019-2029 (MMbbl/yr, AGR %)

Figure 5.2 Global CO2 EOR Market Forecast 2019-2029 ($m, AGR%)

Figure 5.3 Leading National CO2 EOR Production and Market Share Forecast 2019 (%)

Figure 5.4 Leading National CO2 EOR Production and Market Share Forecast 2024 (%)

Figure 5.5 Leading National CO2 EOR Production and Market Share Forecast 2029 (%)

Figure 5.6 US CO2 EOR Production Market Forecast 2019-2029 (MMbbl/yr, AGR %)

Figure 5.7 US CO2 EOR Market Share by Production Forecast, 2019, 2024 and 2029 (% Share)

Figure 5.8 US CO2 EOR Spending Market Forecast 2019-2029 ($m, AGR %)

Figure 5.9 US CO2 EOR Market Share by Spending Forecast, 2019, 2024 and 2029 (% Share)

Figure 5.10 Location of U.S. Carbon Dioxide Enhanced Oil Recovery Projects, Carbon Dioxide Sources and Carbon Dioxide Pipelines

Figure 5.11 Naturally Occurring CO2 Production in the U.S. (MMscfd)

Figure 5.12 Naturally Occurring CO2 Proven Reserves in the U.S. (Bscf)

Figure 5.13 China CO2 EOR Production Market Forecast 2019-2029 (MMbbl/yr, AGR %)

Figure 5.14 China CO2 EOR Market Share by Production Forecast, 2019, 2024 and 2029 (% Share)

Figure 5.15 China CO2 EOR Spending Market Forecast 2019-2029 ($m, AGR %)

Figure 5.16 China CO2 EOR Market Share by Spending Forecast, 2019, 2024 and 2029 (% Share)

Figure 5.17 Canada CO2 EOR Production Market Forecast 2019-2029 (MMbbl/yr, AGR %)

Figure 5.18 Canada CO2 EOR Market Share by Production Forecast, 2019, 2024 and 2029 (% Share)

Figure 5.19 Canada CO2 EOR Spending Market Forecast 2019-2029 ($m, AGR %)

Figure 5.20 Canada CO2 EOR Market Share by Spending Forecast, 2019, 2024 and 2029 (% Share)

Figure 5.21 Illustration of the ACTL Project

Figure 5.22 UAE CO2 EOR Production Market Forecast 2019-2029 (MMbbl/yr, AGR %)

Figure 5.23 UAE CO2 EOR Market Share by Production Forecast, 2019, 2024 and 2029 (% Share)

Figure 5.24 UAE CO2 EOR Spending Market Forecast 2019-2029 ($m, AGR %)

Figure 5.25 UAE CO2 EOR Market Share by Spending Forecast, 2019, 2024 and 2029 (% Share)

Figure 5.26 Brazil CO2 EOR Production Market Forecast 2019-2029 (MMbbl/yr, AGR %)

Figure 5.27 Brazil CO2 EOR Market Share by Production Forecast, 2019, 2024 and 2029 (% Share)

Figure 5.28 Brazil CO2 EOR Spending Market Forecast 2019-2029 ($m, AGR %)

Figure 5.29 Brazil CO2 EOR Market Share by Spending Forecast, 2019, 2024 and 2029 (% Share)

Figure 5.30 Russia CO2 EOR Production Market Forecast 2019-2029 (MMbbl/yr, AGR %)

Figure 5.31 Russia CO2 EOR Market Share by Production Forecast, 2019, 2024 and 2029 (% Share)

Figure 5.32 Russia CO2 EOR Spending Market Forecast 2019-2029 ($m, AGR %)

Figure 5.33 Russia CO2 EOR Market Share by Spending Forecast, 2019, 2024 and 2029 (% Share)

Figure 5.34 Rest of Europe CO2 EOR Production Market Forecast 2019-2029 (MMbbl/yr, AGR %)

Figure 5.35 Rest of Europe CO2 EOR Market Share by Production Forecast, 2019, 2024 and 2029 (% Share)

Figure 5.36 Rest of Europe CO2 EOR Spending Market Forecast 2019-2029 ($m, AGR %)

Figure 5.37 Rest of Europe CO2 EOR Market Share by Spending Forecast, 2019, 2024 and 2029 (% Share)

Figure 5.38 Oil Production in the Leading Five European Countries 2007-2017 (Mbpd)

Figure 5.39 Rest of the World CO2 EOR Production Market Forecast 2019-2029 (MMbbl/yr, AGR %)

Figure 5.40 Rest of the World CO2 EOR Market Share by Production Forecast, 2019, 2024 and 2029 (% Share)

Figure 5.41 Rest of the World CO2 EOR Spending Market Forecast 2019-2029 ($m, AGR %)

Figure 5.42 Rest of the World CO2 EOR Market Share by Spending Forecast, 2019, 2024 and 2029 (% Share)

Abu Dhabi National Oil Company (ADNOC)

Agrium

Air Products & Chemicals Inc

Alstom

Anadarko petroleum

Apache Corporation

Bank of America (Merrill Lynch)

Basin Electric Power Cooperative

BP

Breitburn Energy Partners

Cenovus

Chaparral Energy

Chesapeake Energy

Chevron

China Datang Corporation

China Resources Power

CNOOC

CNPC

CNRL

Co2 Deepstore

Coffeyville Resources

ConocoPhillips

Core Energy

Denbury Resources

Devon Energy

Dodsal Group

Dongguan Taiyangzhou Power Corporation

Emirates Aluminium

Emirates Steel Industries

Enhance Energy

EOG Corporation

ExxonMobil

Fleur de Lis Energy

Glencoe Resources

GreenGen Tiajin IGCC Co. Ltd.

Halliburton

Hess Corporation

Hilcorp Energy

Husky Energy

Japan Vietnam Petroleum Co, (JVPC)

JX Nippon Oil & Gas Exploration Corp.

KBR

Kemper County

Kinder Morgan

Koch Nitrogen Company

Marathon Oil

Masdar

Merit Energy

NRG Energy

Occidental Petroleum

OPEC

PCOR

Pengrwoth Energy

Penn West Exploration

Petra Nova

Petrobras

Petroleo Brasiliero S.A. (Petrobras)

Petrovietnam

Pioneer Natural Resources

Royal Dutch Shell (Shell)

Sandridge Energy

SaskPower

Schlumberger

Shaanxi Yanchang Petroleum Group

Shenhua Ningxia

Sinopec

Southern Company

Southwest Partnership

Summit Power

Summit Power Group

Taweelah Asia Power Company (TAPCO)

TransAlta

White Petroleum

Organisations Mentioned

Alberta Department of Energy (ADOE)

Clean Fossil Fuel Development Institute (CFEDI)

Department of Energy (DOE)

Energy Information Administration (EIA)

Environmental Protection Agency (EPA)

Global Carbon Capture and Storage Institute (GCCSI)

Guandong Low-Carbon Technology and Industry research Centre (GDLRC)

IEA

Japan Oil, Gas and Metals National Corporation (JOGMEC)

Japanese Ministry of Economy, Trade and Industry (METI)

National Academy of Sciences

National Enhanced Oil Recovery Initiative (NEORI)

National Grid

Scottish Carbon Capture and Storage (SCCS)

UK Carbon Capture and Storage Research Centre (UKCCSRC)