Industries > Energy > Pipeline Leak Detection Market of the Oil and Gas Industry 2019-2029

Pipeline Leak Detection Market of the Oil and Gas Industry 2019-2029

By Technology (Negative Pressure Wave, E-RTTM, Fiber Optic, Mass/Volume Balance, Vapor Sensing, Others), Location of Application (Onshore and Offshore) plus Leading Companies, Global, Regional and National Market Analysis

• Do you need definitive pipeline leak detection for oil and gas market data?

• Succinct pipeline leak detection for oil and gas market analysis?

• Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Report highlights

• 116 quantitative tables, charts, and graphs

• Analysis of key players in pipeline leak detection of the oil and gas technologies

• Atmos International

• PSI AG

• FLIR Systems

• ClampOn AS

• Krohne Messtechnik GmbHCGG

• Pentair PLC

• Perma-Pipe, Inc.

• Pure Technologies Ltd

• Schneider Electric SE

• Sensit Technologies LLC

• Siemens AG

• Synodon Inc.

• TTK-Leak Detection System

• Honeywell International Inc.

• Asel-Tech, Inc.

• Omnisens SA

• Omega Engineering

• Global Pipeline Leak Detection Market of the Oil and Gas Industry outlook and analysis from 2019-2029

• What is the outlook per location of application from 2019-2029?

• Onshore Forecast 2019-2029

• Offshore Forecast 2019-2029

• What are the prospects for each technology from 2019-2029?

• Negative Pressure Wave Forecast 2019-2029

• E-RTTM Forecast 2019-2029

• Fibre Optic Forecast 2019-2029

• Mass/Volume Balance Forecast 2019-2029

• Vapour Sensing Forecast 2019-2029

What are the prospects in the leading regions and countries?

In our study you will find individual spending forecasts to 2029 for the leading regional and national markets:

• Regional Pipeline Leak Detection Market of the Oil and Gas Industry forecasts from 2019-2029

• North America Forecast 2019-2029

• Europe Forecast 2019-2029

• Asia-Pacific Forecast 2019-2029

• The Middle-East & Africa Forecast 2019-2029

• Central & South America Forecast 2019-2029

• National Pipeline Leak Detection Market of the Oil and Gas Industry forecasts from 2019-2029

• US Forecast 2019-2029

• Canada Forecast 2019-2029

• Mexico Forecast 2019-2029

• UK Forecast 2019-2029

• Germany Forecast 2019-2029

• Italy Forecast 2019-2029

• Russia Forecast 2019-2029

• Ukraine Forecast 2019-2029

• Rest Of Europe Forecast 2019-2029

• China Forecast 2019-2029

• India Forecast 2019-2029

• Australia Forecast 2019-2029

• Japan Forecast 2019-2029

• Malaysia Forecast 2019-2029

• Indonesia Forecast 2019-2029

• Rest of Asia-Pacific Forecast 2019-2029

• UAE Forecast 2019-2029

• Egypt Forecast 2019-2029

• Saudi Arabia Forecast 2019-2029

• Rest of MEA Forecast 2019-2029

• Brazil Forecast 2019-2029

• Argentina Forecast 2019-2029

• Rest of central & South America Forecast 2019-2029

• Key questions answered

• What does the future hold for the pipeline leak detection for the oil and gas industry?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to succeed, and why?

• What business models should you adopt?

• What industry trends should you be aware of?

• Target audience

• Leading pipeline leak detection companies in the oil and gas industry

• Suppliers

• Contractors

• Technologists

• R&D staff

• Consultants

• Analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

• Industry organisations

• Banks

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1.1 Global Pipeline Leak Detection Market of the Oil and Gas Industry Overview

1.2 Why You Should Read This Report

1.3 Key Questions Answered by This Analytical Report

1.4 Who is this Report For?

1.5 Methodology

1.6 Frequently Asked Questions (FAQs)

1.7 Associated Visiongain Reports

1.8 About Visiongain

2. Introduction to the Pipeline Leak Detection System Market

2.1 What is Pipeline Leak Detection?

2.2 Classification of Pipeline Leak Detection System Market for Oil and Gas Industry

2.3 Pipeline Leak Detection Technology for Oil and Gas Industry

2.3.1 Negative Pressure Wave

2.3.2 E-RTTM

2.3.3 Fiber Optic

2.3.4 Mass/Volume Balance

2.3.5 Vapor Sensing Tubes

2.3.6 Others

3. Market Dynamics

3.1 Introduction

3.2 Drivers and Restraints 2019-2029

3.2.1 Aging Pipelines are Driving the Growth of Pipeline Leak Detection Market

3.2.2 Stringent Government Regulations and Standards on Oil Spill and Gas Emissions

3.2.3 An increasing number of accidents due to leakages in pipelines and storage tanks at oil and gas production facilities

3.2.4 Development and Expansion of Existing Pipelines and Construction of New Pipelines

3.3 Restraints

3.3.1 Complexity and Costs Involved in Leak Detection Systems during Harsh Working Conditions

3.3.2 Challenges of integrating modern leak detection technologies with existing pipelines

3.4 Porter’s Five Forces Analysis of the Pipeline Leak Detection Market of the Oil and Gas Industry

3.4.1 Rivalry among Competitors [High to Medium]

3.4.2 The threat of New Entrants [High]

3.4.3 Power of Suppliers [Medium]

3.4.4 Power of Buyers [Low to Medium]

3.4.5 The threat of Substitutes [Low]

3.5 PEST Analysis of the Pipeline Leak Detection Market of the Oil and Gas Industry

3.5.1 Political Factors

3.5.2 Economic Factors

3.5.3 Social Factors

3.5.4 Technological Factors

3.6 Value Chain Analysis of Pipeline Leak Detection Market of the Oil and Gas Industry 2019-2029

3.6.1 Raw Material Suppliers

3.6.2 Technology Manufacturers

3.6.3 End Users

3.7 Barriers to Entry Analysis

4. Technology Overview & Regulations

4.1 Timeline of Pipeline

4.2 Need for Leak Detection in Oil and Gas Transportation Pipelines

4.3 Regulatory Standards for Pipelines Leak Detection

5. Pipeline Leak Detection Market of the Oil and Gas Industry 2019-2029

5.1 Introduction

5.2 Global Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029

5.3 Global Pipeline Leak Detection Market of the Oil and Gas Industry by Technology 2019-2029

5.4 Global Pipeline Leak Detection Market of the Oil and Gas Industry by Location 2019-2029

5.5 Global Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029

5.5.1 North America Pipeline Leak Detection Market of the Oil and Gas Industry by Country 2019-2029

5.5.2 Europe Pipeline Leak Detection Market of the Oil and Gas Industry by Country 2019-2029

5.5.3 Asia-Pacific Pipeline Leak Detection Market of the Oil and Gas Industry by Country 2019-2029

5.5.4 The Middle East & Africa Pipeline Leak Detection Market of the Oil and Gas Industry by Country 2019-2029

5.5.5 Central & South America Pipeline Leak Detection Market of the Oil and Gas Industry by Country 2019-2029

6. Pipeline Leak Detection Market of the Oil and Gas Industry by Technology in Regions 2019-2029

6.1 North America Pipeline Leak Detection Market of the Oil and Gas Industry by Technology 2019-2029

6.2 Europe Pipeline Leak Detection Market of the Oil and Gas Industry by Technology 2019-2029

6.3 Asia-Pacific Pipeline Leak Detection Market of the Oil and Gas Industry by Technology 2019-2029

6.4 The Middle East & Africa Pipeline Leak Detection Market of the Oil and Gas Industry by Technology 2019-2029

6.5 Central & South America Pipeline Leak Detection Market of the Oil and Gas Industry by Technology 2019-2029

7. Pipeline Leak Detection Market of the Oil and Gas Industry in Regions by Location 2019-2029

7.1 North America Pipeline Leak Detection Market of the Oil and Gas Industry by Location 2019-2029

7.2 Europe Pipeline Leak Detection Market of the Oil and Gas Industry by Location 2019-2029

7.3 Asia-Pacific Pipeline Leak Detection Market of the Oil and Gas Industry by Location 2019-2029

7.4 The Middle East & Africa Pipeline Leak Detection Market of the Oil and Gas Industry by Location 2019-2029

7.5 Central & South America Pipeline Leak Detection Market of the Oil and Gas Industry by Location 2019-2029

8. Pipeline Leak Detection Market of the Oil and Gas Industry by Technology in Regions 2019-2029

8.1 Negative Pressure Wave Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029

8.2 E-RTTM Pipeline Leak Detection Market in the Oil and Gas Industry by Region 2019-2029

8.3 Fiber Optic Pipeline Leak Detection Market in the Oil and Gas Industry by Region 2019-2029

8.4 Mass/Volume Balance Pipeline Leak Detection Market in the Oil and Gas Industry by Region 2019-2029

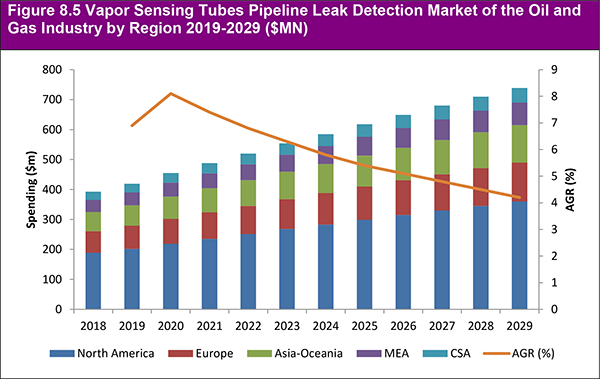

8.5 Vapor Sensing Tubes Pipeline Leak Detection Market in the Oil and Gas Industry by Region 2019-2029

9. Pipeline Leak Detection Market of the Oil and Gas Industry by Location of Application in Regions 2019-2029

9.1. Offshore Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029

9.2. Onshore Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029

10. The Leading Companies in the Pipeline Leak Detection Market of the Oil and Gas Industry

10.1 Atmos International

10.1.1 Atmos International Product Portfolio

10.1.2 Atmos International Sales Analysis

10.2 PSI AG

10.2.1 PSI AG Product Portfolio

10.2.2 PSI AG Sales Analysis

10.3 FLIR Systems, Inc.

10.3.1 FLIR Systems, Inc. Product Portfolio

10.3.2 FLIR Systems, Inc. Sales Analysis

10.4 ClampOn AS

10.4.1 ClampOn AS Product Portfolio

10.4.2 ClampOn AS Sales Analysis

10.5 Krohne Messtechnik GmbH

10.5.1 Krohne Messtechnik GmbH Product Portfolio

10.5.2 Krohne Messtechnik GmbH Sales Analysis

10.6 nVent

10.6.1 nVent Product Portfolio

10.6.2 nVent Sales Analysis

10.7 Perma-Pipe, Inc.

10.7.1 Perma-Pipe, Inc. Product Portfolio

10.7.2 Perma-Pipe, Inc. Sales Analysis

10.8 Xylem Inc. (Pure Technologies Ltd)

10.8.1 Xylem Inc. (Pure Technologies Ltd) Product Portfolio

10.8.2 Xylem Inc. (Pure Technologies Ltd) Sales Analysis

10.9 Schneider Electric SE

10.9.1 Schneider Electric SE Product Portfolio

10.9.2 Schneider Electric SE Sales Analysis

10.10 Sensit Technologies LLC

10.10.1 Sensit Technologies LLC Product Portfolio

10.10.2 Sensit Technologies LLC Sales Analysis

10.11 Siemens AG

10.11.1 Siemens AG Product Portfolio

10.11.2 Siemens AG Sales Analysis

10.12 DNV GL

10.12.1 DNV GL Product Portfolio

10.12.2 DNV GL Sales Analysis

10.13 TTK-Leak Detection System

10.13.1 TTK-Leak Detection System Product Portfolio

10.14 Honeywell International Inc.

10.14.1 Honeywell International Inc. Product Portfolio

10.14.2 Honeywell International Inc. Sales Analysis

10.15 Asel-Tech, Inc.

10.15.1 Asel-Tech, Inc. Product Portfolio

10.15.2 Asel-Tech, Inc. Sales Analysis

10.16 Omnisens SA

10.16.1 Omnisens SA Product Portfolio

10.16.2 Omnisens SA Sales Analysis

10.17 OMEGA Engineering, Inc.

10.17.1 OMEGA Engineering, Inc. Product Portfolio

10.17.2 OMEGA Engineering, Inc. Sales Analysis

10.18 PARSAN

10.18.1 PARSAN Product Portfolio

10.18.2 PARSAN Sales Analysis

10.19 Yokogawa

10.19.1 Yokogawa Product Portfolio

10.19.2 Yokogawa Sales Analysis

10.20 Other Leading Companies in the Pipeline Leak Detection Market of the Oil and Gas Industry

11. Conclusions and Recommendations

11.1 Current Leading Pipeline Leak Detection Techniques

11.2 Leading Pipeline Leak Detection Techniques Manufacturing Companies

11.3 Growth in Regional Markets

11.4 What is the Future of the Pipeline Leak Detection Market?

12. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 5.1 Global Pipeline Leak Detection Market of the Oil and Gas Industry Forecast 2019-2029 ($mn, AGR %, CAGR %, Cumulative)

Table 5.2 Global Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN, AGR (%))

Table 5.3 Global Pipeline Leak Detection Market of the Oil and Gas industry by Technology 2019-2029 ($MN, AGR (%))

Table 5.4 Global Pipeline Leak Detection Market of the Oil and Gas industry by Location 2019-2029 ($MN, AGR (%))

Table 5.5 North America Pipeline Leak Detection Market of the Oil and Gas industry by Country 2019-2029 ($MN, AGR (%))

Table 5.6 Europe Pipeline Leak Detection Market of the Oil and Gas industry by Country 2019-2029 ($MN, AGR (%))

Table 5.7 Asia-Pacific Pipeline Leak Detection Market of the Oil and Gas industry by Country 2019-2029 ($MN, AGR (%))

Table 5.8 MEA Pipeline Leak Detection Market of the Oil and Gas industry by Country 2019-2029 ($MN, AGR (%))

Table 5.9 CSA Pipeline Leak Detection Market of the Oil and Gas industry by Country 2019-2029 ($MN, AGR (%))

Table 6.1 North America Pipeline Leak Detection Market of the Oil and Gas Industry by Technology 2019-2029 ($MN, AGR (%))

Table 6.2 Europe Pipeline Leak Detection Market of the Oil and Gas Industry by Technology 2019-2029 ($MN, AGR (%))

Table 6.3 Asia-Pacific Pipeline Leak Detection Market of the Oil and Gas Industry by Technology 2019-2029 ($MN, AGR (%))

Table 6.4 MEA Pipeline Leak Detection Market of the Oil and Gas Industry by Technology 2019-2029 ($MN, AGR (%))

Table 6.5 CSA Pipeline Leak Detection Market of the Oil and Gas Industry by Technology 2019-2029 ($MN, AGR (%))

Table 7.1 North America Pipeline Leak Detection Market of the Oil and Gas Industry by Location 2019-2029 ($MN, AGR (%))

Table 7.2 Europe Pipeline Leak Detection Market of the Oil and Gas Industry by Location 2019-2029 ($MN, AGR (%))

Table 7.3 Asia-Pacific Pipeline Leak Detection Market of the Oil and Gas Industry by Location 2019-2029 ($MN, AGR (%))

Table 7.4 MEA Pipeline Leak Detection Market of the Oil and Gas Industry by Location 2019-2029 ($MN, AGR (%))

Table 7.5 CSA Pipeline Leak Detection Market of the Oil and Gas Industry by Location 2019-2029 ($MN, AGR (%))

Table 8.1 Negative Pressure Wave Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN, AGR (%))

Table 8.2 E-RTTM Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN, AGR (%))

Table 8.3 Fiber Optic Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN, AGR (%))

Table 8.4 Mass/Volume Balance Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN, AGR (%))

Table 8.5 Vapor Sensing Tubes Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN, AGR (%))

Table 9.1 Offshore Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN, AGR (%))

Table 9.2 Onshore Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN, AGR (%))

Table 10.1 Atmos International Product Portfolio

Table 10.2 PSI AG Product Portfolio

Table 10.3 FLIR Systems, Inc. Product Portfolio

Table 10.4 ClampOn AS Product Portfolio

Table 10.5 Krohne Messtechnik GmbH Product Portfolio

Table 10.6 nVent Product Portfolio

Table 10.7 Perma-Pipe, Inc. Product Portfolio

Table 10.8 Xylem Inc. (Pure Technologies Ltd) Product Portfolio

Table 10.9 Schneider Electric SE Product Portfolio

Table 10.10 Sensit Technologies LLC Product Portfolio

Table 10.11 Siemens AG Product Portfolio

Table 10.12 DNV GL Product Portfolio

Table 10.13 TTK-Leak Detection System Product Portfolio

Table 10.14 Honeywell International Inc. Product Portfolio

Table 10.15 Asel-Tech, Inc. Product Portfolio

Table 10.16 Omnisens SA Product Portfolio

Table 10.17 OMEGA Engineering, Inc. Product Portfolio

Table 10.18 PARSAN Product Portfolio

Table 10.19 Yokogawa Product Portfolio

Table 10.20 Other Active Companies in Pipeline Leak Detection Market

List of Figures

Figure 2.1 Global Pipeline Detection System in the Oil and Gas Industry Market Segmentation Overview 2019

Figure 3.1 Global Pipeline Detection System in the Oil and Gas Industry Market Segmentation Overview 2019

Figure 3.2 All Reported Incident Cause Breakdown in the US

Figure 3.3 Porter’s Five Forces Analysis of the Pipeline Leak Detection Market of the Oil and Gas Industry 2019-2029

Figure 3.4 Value Chain Analysis of the Pipeline Leak Detection Market of the Oil and Gas Industry 2019-2029

Figure 3.5 Barriers to Entry Analysis Vs. National Market Size (2019) Vs. CAGR (2019-2029)

Figure 5.1 Global Pipeline Leak Detection Market of the Oil and Gas Industry Forecast 2019-2029 ($mn, AGR %)

Figure 5.2 Global Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN)

Figure 5.3 Global Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019 and 2029 (%)

Figure 5.4 Global Pipeline Leak Detection Market of the Oil and Gas Industry by Technology 2019-2029 ($MN)

Figure 5.5 Global Pipeline Leak Detection Market of the Oil and Gas Industry by Technology 2019 and 2029 (%)

Figure 5.6 Global Pipeline Leak Detection Market of the Oil and Gas Industry by Location of Application 2019-2029 ($MN)

Figure 5.7 Global Pipeline Leak Detection Market of the Oil and Gas Industry by Location of Application 2019 and 2029 (%)

Figure 5.8 North America Pipeline Leak Detection Market of the Oil and Gas Industry by Country 2019-2029 ($MN)

Figure 5.9 North America Pipeline Leak Detection Market of the Oil and Gas Industry by Country, 2019 and 2029 (%)

Figure 5.10 Europe Pipeline Leak Detection Market of the Oil and Gas Industry by Country 2019-2029 ($MN)

Figure 5.11 Europe Pipeline Leak Detection Market of the Oil and Gas Industry by Country, 2019 and 2029 (%)

Figure 5.12 Asia-Pacific Pipeline Leak Detection Market of the Oil and Gas Industry by Country 2019-2029 ($MN)

Figure 5.13 Asia-Pacific Pipeline Leak Detection Market of the Oil and Gas Industry by Country, 2019 and 2029 (%)

Figure 5.14 MEA Pipeline Leak Detection Market of the Oil and Gas Industry by Country 2019-2029 ($MN)

Figure 5.15 MEA Pipeline Leak Detection Market of the Oil and Gas Industry by Country, 2019 and 2029 (%)

Figure 5.16 CSA Pipeline Leak Detection Market of the Oil and Gas Industry by Country 2019-2029 ($MN)

Figure 5.17 CSA Pipeline Leak Detection Market of the Oil and Gas Industry by Country, 2019 and 2029 (%)

Figure 6.1 Pipeline Leak Detection of the Oil And Gas Industry By Technology in North America ($MN)

Figure 6.2 Pipeline Leak Detection of the Oil And Gas Industry By Technology in Europe ($MN)

Figure 6.3 Pipeline Leak Detection of the Oil And Gas Industry By Technology in Asia-Pacific ($MN)

Figure 6.4 Pipeline Leak Detection of the Oil And Gas Industry By Technology in MEA ($MN)

Figure 6.5 Pipeline Leak Detection of the Oil And Gas Industry By Technology in CSA ($MN)

Figure 7.1 Pipeline Leak Detection of the Oil And Gas Industry By Location in North America ($MN)

Figure 7.2 Pipeline Leak Detection of the Oil And Gas Industry By Location in Europe ($MN)

Figure 7.3 Pipeline Leak Detection of the Oil And Gas Industry By Location in Asia-Pacific ($MN)

Figure 7.4 Pipeline Leak Detection of the Oil And Gas Industry By Location in MEA ($MN)

Figure 7.5 Pipeline Leak Detection of the Oil And Gas Industry By Location in CSA ($MN)

Figure 8.1 Negative Pressure Wave Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN)

Figure 8.2 E-RTTM Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN)

Figure 8.3 Fiber Optic Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN)

Figure 8.4 Mass/Volume Balance Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN)

Figure 8.5 Vapor Sensing Tubes Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN)

Figure 9.1 Offshore Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN)

Figure 9.2 Onshore Pipeline Leak Detection Market of the Oil and Gas Industry by Region 2019-2029 ($MN)

Figure 10.1 PSI AG Revenues 2014-2018 ($Mn)

Figure 10.2 PSI AG Revenues by Business Segments 2018 (%)

Figure 10.3 PSI AG Revenues by Geographic Segments 2018 (%)

Figure 10.4 FLIR Systems, Inc. Revenues 2014-2018 ($Mn)

Figure 10.5 FLIR Systems, Inc. Revenues by Business Segments 2018 (%)

Figure 10.6 FLIR Systems, Inc. Revenues by Geographic Segments 2018 (%)

Figure 10.7 nVent Revenues 2014-2018 ($Mn)

Figure 10.8 nVent Revenues by Business Segments 2018 (%)

Figure 10.9 nVent Revenues by Geographic Segments 2018 (%)

Figure 10.10 Perma-Pipe, Inc. Revenues 2014-2018 ($Mn)

Figure 10.11 Perma-Pipe, Inc. Revenues by Business Segments 2018 (%)

Figure 10.12 Perma-Pipe, Inc. Revenues by Geographic Segments 2018 (%)

Figure 10.13 Xylem Inc. Revenues 2014-2018 ($Mn)

Figure 10.14 Xylem Inc. Revenues by Business Segments 2018 (%)

Figure 10.15 Xylem Inc. Revenues by Geographic Segments 2018 (%)

Figure 10.16 Schneider Electric SE Revenues 2014-2018 ($Bn)

Figure 10.17 Schneider Electric SE Revenues by Business Segments 2018 (%)

Figure 10.18 Schneider Electric SE Revenues by Geographic Segments 2018 (%)

Figure 10.19 Siemens AG Revenues 2014-2018 ($Mn)

Figure 10.20 Siemens AG Revenues by Business Segments 2018 (%)

Figure 10.21 Siemens AG Revenues by Geographic Segments 2018 (%)

Figure 10.22 DNV GL Revenues 2014-2018 ($Mn)

Figure 10.23 DNV GL Revenues by Business Segments 2018 (%)

Figure 10.24 DNV GL Revenues by Geographic Segments 2018 (%)

Figure 10.25 Honeywell International, Inc. Revenues 2014-2018 ($Mn)

Figure 10.26 Honeywell International, Inc. Revenues by Business Segments 2018 (%)

Figure 10.27 Honeywell International, Inc. Revenues by Geographic Segments 2018 (%)

Figure 10.28 Yokogawa Revenues 2014-2018 ($Mn)

Figure 10.29 Yokogawa Revenues by Business Segments 2018 (%)

Figure 10.30 Yokogawa Revenues by Geographic Segments 2018 (%)

Airwave Electronics

American Gas & Chemical Co

Asel-Tech, Inc.

Atmos International

Barnard Construction Company, Inc.

Bonatti

Broadcom Limited (Avago)

ClampOn AS

Concept Controls Inc

Consolidated Contractors Company

Crowcon Detection Instruments Ltd

Desu Systems BV

Detcon

DNV GL

EnTech Engineering Inc

Enviro Trace Ltd.

ESP Safety

Exterran Corporation

FLIR Systems, Inc.

Frontline Safety Ltd

Gas Alarm Systems Ltd

Geospatial Corporation

Halma

Hanby Environmental

Hetek Solutions

Honeywell International Inc.

International Gas Detectors (IGD) Ltd

IRT Consult Ltd.

Kinder Morgan

Krohne Messtechnik GmbH

KWJ Engineering Inc

LG Electronics Inc.

MasTec

North American Oil & Gas Pipelines

nVent

NXP Semiconductors N.V

OMEGA Engineering, Inc.

Omnisens SA

PARSAN

Penspen

Pergam-Suisse AG

Perma-Pipe, Inc.

Petrobras

Pipa Ltd.

Point Safety Ltd

Polycab Wires Pvt. Ltd.

PSI AG

Ribble Enviro Ltd

Robert Bosch GmbH

RR Kabel

Saipem

Samsung Electronics Co Ltd

Schneider Electric SE

Scott Safety

Sensit Technologies LLC

Sharp Corporation

Siemens AG

Sterlite Technologies Ltd.

Stmicroelectronics N.V.

TE Connectivity Ltd.

Texas Instruments Inc.

TTK-Leak Detection System

Tyco gas & Flame detection

United Pipeline Systems Inc

United Piping Inc

Xylem Inc. (Pure Technologies Ltd)

Yokogawa

Download sample pages

Complete the form below to download your free sample pages for Pipeline Leak Detection Market of the Oil and Gas Industry 2019-2029

Related reports

-

Intelligent Pumps Market Report 2018-2028

The increased focus on efficient energy usage has led Visiongain to publish this timely report. The intelligent pumps market is...Full DetailsPublished: 18 September 2018 -

Global Offshore Pipeline Market Report 2019-2029

Companies are actively engaged in different developmental strategies in order to improve and increase their foothold in the global offshore...

Full DetailsPublished: 01 January 1970 -

Carbon Dioxide (CO2) Enhanced Oil Recovery (EOR) Market 2019-2029

The latest report from business intelligence provider visiongain offers in depth analysis of the global carbon dioxide (CO2) enhanced oil...Full DetailsPublished: 13 December 2018 -

EOR Yearbook 2019: The Ultimate Guide to Enhanced Oil Recovery (EOR)

Visiongain’s latest EOR yearbook provides you with unprecedented in-depth analysis of the global EOR market. Visiongain assesses that the global...

Full DetailsPublished: 13 November 2018 -

Thermal Enhanced Oil Recovery (EOR) Market Report 2020-2030

This market is expected to grow at a faster pace, owing to continuous work over oil fields, rapid depletion of...

Full DetailsPublished: 27 November 2019 -

Pipeline & Process Services Market Report 2020-2030

In 2020 the global pipeline & process services market size is expected to value at USD 3,324.8 million and is...

Full DetailsPublished: 10 February 2020 -

Pipeline Pigging Systems Market Report 2020-2030

This latest report by business intelligence provider Visiongain assesses that Pipeline Pigging Systems Market spending will reach $XX.X bn in...

Full DetailsPublished: 01 January 1970 -

Onshore Oil & Gas Pipelines Market Report 2019-2029

Visiongain’s extensive and detailed 427-page report reveals that onshore oil and gas pipeline infrastructure will experience CAPEX of $1,291.3bn in...Full DetailsPublished: 08 March 2019 -

EOR Yearbook 2018: The Ultimate Guide To Enhanced Oil Recovery (EOR)

Visiongain’s latest EOR yearbook provides you with this unprecedented in-Depth analysis of the global EOR market. Visiongain assesses that the...

Full DetailsPublished: 24 January 2018 -

Chemical Enhanced Oil Recovery (EOR) Market 2019-2029

This latest report by business intelligence provider visiongain assesses that Chemical EOR spending will reach $2.89bn in 2019. ...Full DetailsPublished: 03 June 2019

Download sample pages

Complete the form below to download your free sample pages for Pipeline Leak Detection Market of the Oil and Gas Industry 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Energy news

Energy as a Service (EaaS) Market

The global Energy as a Service (EaaS) market is projected to grow at a CAGR of 12.6% by 2034

25 July 2024

Synthetic Fuels Market

The global Synthetic Fuels market is projected to grow at a CAGR of 23% by 2034

18 July 2024

Power-to-X (P2X) Market

The global Power-to-X (P2X) market is projected to grow at a CAGR of 10.6% by 2034

09 July 2024

Airborne Wind Energy Market

The global Airborne Wind Energy market is projected to grow at a CAGR of 9.7% by 2034

05 June 2024