Industries > Energy > Thermal Enhanced Oil Recovery (EOR) Market Report 2020-2030

Thermal Enhanced Oil Recovery (EOR) Market Report 2020-2030

CAPEX & OPEX ($mn) & Production (bpd) Forecasts for Oil Sands, Heavy Oil, Steam Injection (Cyclic Steam Stimulation (CSS), Steam Flooding), Steam-Assisted Gravity Drainage (SAGD) & Other Technologies Plus Detailed Project Tables & Analysis of Leading Companies

• Sectoral insights?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive report can transform your own research and save your time.

This market is expected to grow at a faster pace, owing to continuous work over oil fields, rapid depletion of fossil fuels, increasing long-term demand for oil are the prime factors propelling the demand of thermal enhanced oil recovery (EOR) market globally. However, factors like requirement for high capital for the exploration of oil wells, fluctuations in oil prices, environmental concerns may hamper the growth of thermal enhanced oil recovery (EOR) market.

Report highlights

• 200+ quantitative tables, charts, and graphs

• Analysis of Key Players in Thermal Enhanced Oil Recovery (EOR) Market

• Suncor

• ConocoPhillips

• Imperial Oil

• Cenovus

• China National Offshore Oil Corporation (CNOOC)

• Royal Dutch Shell plc.

• Equinor ASA

• Chevron Corporation

• PDVSA

• Husky Energy

• Sinopec

• Occidental

• Petroliam Nasional Berhad (Petronas)

• BP plc

• Global Thermal Enhanced Oil Recovery (EOR) Market Outlook and Analysis from 2020-2030

• Global Thermal Enhanced Oil Recovery (EOR) Market by Method projections analysis and potential from 2020-2030

• Global oil sand forecast 2020-2030

• Global heavy oil forecast 2020-2030

• Regional Thermal Enhanced Oil Recovery (EOR) Market Forecast from 2020-2030

• Canada forecast 2020-2030

• US forecast 2020-2030

• Venezuela forecast 2020-2030

• Indonesia forecast 2020-2030

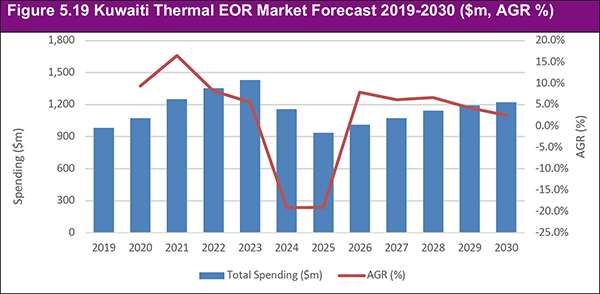

• Kuwait forecast 2020-2030

• Oman forecast 2020-2030

• China forecast 2020-2030

• Russia forecast 2020-2030

• Bahrain forecast 2020-2030

• Saudi Arabia forecast 2020-2030

• Rest of the World forecast 2020-2030

Key questions answered

• How is the Thermal Enhanced Oil Recovery (EOR) Market evolving?

• What is driving and restraining the Thermal Enhanced Oil Recovery (EOR) Market dynamics?

• What are the market shares of the Thermal Enhanced Oil Recovery (EOR) Market submarkets in 2020?

• How will each Thermal Enhanced Oil Recovery (EOR) submarket segment grow over the forecast period and how much revenue will these submarkets account for in 2030?

• How will the market shares for Thermal Enhanced Oil Recovery (EOR) submarket develop from 2020-2030?

• What will be the main driver for the overall market from 2020-2030?

• How will political and regulatory factors influence the regional and national markets and submarkets?

• How will the market shares of the regional and national markets change by 2030 and which geographical region will lead the market in 2030?

• Who are the leading players and what are their prospects over the forecast period?

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1. Report Overview

1.1. Global Thermal Enhanced Oil Recovery (EOR) Market Overview

1.2. Market Structure Overview and Market Definition

1.3. Methodology

1.4. Why You Should Read This Report

1.5. How This Report Delivers

1.6. Key Questions Answered by this Analytical Report Include

1.7. Who is this Report For?

1.8. Frequently Asked Questions (FAQ)

1.9. Associated Visiongain Reports

1.10. About Visiongain

2. Introduction to the Thermal EOR Market

2.1. Stages of Oil Extraction

2.1.1. Primary Recovery

2.1.2. Secondary Recovery

2.1.3. Tertiary Recovery

2.2. Thermal EOR Processes

2.2.1. Steam Injection

2.2.2. Steam-Assisted Gravity Drainage

2.2.3. Small-Scale Commercial EOR Technologies

2.2.4. Other Thermal EOR Technologies

2.3. Unconventional Oil and the Thermal EOR Market

2.3.1. Heavy Oil

2.3.2. Oil Sands

2.4. Thermal EOR Economics

3. The Global Thermal EOR Market 2020-2030

3.1. Global Thermal EOR Market Forecast 2020-2030

3.1.1. Thermal EOR Capital and Operational Expenditure Forecasts 2020-2030

3.1.2. Thermal EOR Production Forecast 2020-2030

3.2. Global Thermal EOR Market Analysis

3.3. Visiongain’s Oil Price Analysis

3.3.1. Visiongain’s Oil Price Analysis

3.4. Drivers and Restraints in the Thermal EOR Market

3.4.1. Thermal EOR Market Drivers

3.4.2. Thermal EOR Market Restraints

4. Thermal EOR Submarkets 2020-2030

4.1. Will the Oil Sands or Other Areas Provide the Strongest Growth?

4.1.1. The Oil Sands Thermal EOR Submarket Forecast 2020-2030

4.1.2. The Thermal Heavy Oil EOR Submarket Forecast 2020-2030

4.2. Which Technology Submarket Will Provide the Strongest Growth?

4.2.1. The Steam Injection Submarket Forecast 2020-2030

4.2.2. The SAGD Submarket Forecast 2020-2030

4.2.3. Other EOR Technologies Submarket Forecast 2020-2030

5. The Leading National Thermal EOR Market Forecasts

5.1. The Canadian Thermal Oil Sand EOR Market Forecast 2020-2030

5.1.1. The Canadian Thermal Oil sand EOR Market Overview

5.1.2. Current Canadian Projects

5.2. The U.S. Thermal EOR Market Forecast 2019-2030

5.2.1. The U.S. Thermal EOR Market Overview

5.2.2. California Continues to Dominate Thermal EOR Projects

5.2.3. Future Outlook – Traditional Thermal EOR to Continue Decreasing

5.3. The Venezuelan Thermal EOR Market Forecast 2020-2030

5.3.1. The Venezuelan Thermal EOR Market Overview

5.3.2. Current Projects

5.3.3. Future Outlook

5.4. The Indonesian Thermal EOR Market Forecast 2020-2030

5.4.1. The Indonesian Thermal EOR Market Overview

5.4.2. Current Projects

5.4.3. Drivers and Restraints in the Indonesian Thermal EOR Market

5.5. The Kuwaiti Thermal EOR Market Forecast 2020-2030

5.5.1. The Kuwaiti Thermal EOR Market Overview

5.5.2. Chevron’s Project in the Wafra Field

5.5.3. Future Outlook

5.6. The Omani Thermal EOR Market Forecast 2020-2030

5.6.1. The Omani Thermal EOR Market Overview

5.6.2. Current Projects

5.6.3. Future Outlook

5.7. The Chinese Thermal EOR Market Forecast 2020-2030

5.7.1. The Chinese Thermal EOR Market Overview

5.7.2. Current Thermal EOR Projects in China

5.7.3. Steady Increases Forecast in the Chinese Thermal EOR Market

5.8. The Russian Thermal EOR Market Forecast 2020-2030

5.8.1. The Russian Thermal EOR Market Overview

5.8.2. Current Projects

5.8.3. Future Outlook

5.9. The Bahraini Thermal EOR Market Forecast 2020-2030

5.9.1. The Bahraini Thermal EOR Market Outlook

5.10. The Saudi Arabian Thermal EOR Market Forecast 2020-2030

5.10.1. The Saudi Arabian Thermal EOR Market Overview

5.10.2. Chevron’s Project in the Wafra Field

5.10.3. Future Outlook

5.11. The Rest of the World Thermal EOR Market Forecast 2020-2030

5.11.1. Challenges and Opportunities in the Egyptian Thermal EOR Market

5.11.2. Brazil’s Overlooked Thermal EOR Market

5.11.3. Dutch Thermal EOR Market

5.11.4. Steady Thermal EOR Production from India

5.11.5. Tiny Thermal EOR Production from Germany

5.11.6. A Long History of Thermal EOR Production in Trinidad

6. PEST Analysis of the Thermal EOR Market 2020-2030

6.1. Pest Analysis

7. The Leading Companies in the Thermal EOR Market

7.1. The Seven Leading Companies in the Thermal Oil Sands EOR Market Shares and Profiles

7.1.1. Suncor

7.1.1.1 Suncor Introduction

7.1.1.2 Suncor Key Strategic Moves and Developments

7.1.1.3 Suncor Total Company Sales 2015-2018

7.1.2. ConocoPhillips

7.1.2.1 ConocoPhillips Introduction

7.1.2.2 ConocoPhillips Key Strategic Moves and Developments

7.1.2.3 ConocoPhillips Total Company Sales 2015-2018

7.1.3. Imperial Oil

7.1.3.1 Imperial Oil Key Strategic Moves and Developments

7.1.3.2 Imperial Oil Total Company Sales 2015-2018

7.1.4. Cenovus

7.1.4.1 Cenovus Introduction

7.1.4.2 Cenovus Key Strategic Moves and Developments

7.1.4.3 Cenovus Total Company Sales 2015-2018

7.1.5. China National Offshore Oil Corporation (CNOOC)

7.1.5.1 China National Offshore Oil Corporation (CNOOC) Introduction

7.1.5.2 China National Offshore Oil Corporation (CNOOC) Total Company Sales 2015-2018

7.1.6. Royal Dutch Shell plc.

7.1.6.1 Royal Dutch Shell plc. Introduction

7.1.6.2 Royal Dutch Shell plc. Key Strategic Moves and Developments

7.1.6.3 Royal Dutch Shell plc. Total Company Sales 2015-2018

7.1.7. Equinor ASA

7.1.7.1 Equinor ASA Introduction

7.1.6.3 Equinor ASA Key Strategic Moves and Developments

7.1.6.4 Equinor ASA Total Company Sales 2015-2018

7.2. The Seven Leading Companies in the Thermal Heavy Oil EOR Market – Market Ranks and Profiles

7.2.1. Chevron Corporation

7.2.1.1 Chevron Introduction

7.2.1.2 Chevron Total Company Sales 2015-2018

7.2.2. PDVSA

7.2.2.1 PDVSA Introduction

7.2.3. Husky Energy

7.2.3.1 Husky Energy Introduction

7.2.3.2 Husky Energy Key Strategic Moves and Developments

7.2.3.3 Husky Energy Total Company Sales 2015-2018

7.2.4. Sinopec

7.2.4.1 Sinopec Introduction

7.2.4.2 Sinopec Total Company Sales 2015-2018

7.2.5. Occidental

7.2.5.1 Occidental Introduction

7.2.5.2 Occidental Total Company Sales 2015-2018

7.2.6. Petroliam Nasional Berhad (Petronas)

7.2.6.1 Petroliam Nasional Berhad (Petronas) Introduction

7.2.6.2 Petroliam Nasional Berhad (Petronas) Total Company Sales 2015-2018

7.2.7. BP plc

7.2.7.1 BP plc. Introduction

7.2.7.2 BP plc. Total Company Sales 2015-2018

7.2.8. Other Leading Companies in the Thermal EOR Market

8. Conclusions and Recommendations

8.1. EOR Market Outlook

8.2. Key Findings in the Thermal EOR Market

8.3. Recommendations for the Thermal EOR Market

9. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

9.1. About Visiongain

Appendix B

9.2. Visiongain report evaluation form

List of Table

Table 1.1 Comparison of Oil Grading by Leading International Agencies (⁰API, Viscosity cP)

Table 3.1 Global Thermal EOR Market Forecast 2019-2030 ($bn, AGR %, CAGR %, Cumulative)

Table 3.2 Leading National Thermal EOR Market Forecast 2019-2030 (Spending $m, AGR %)

Table 3.3 Global Thermal EOR Market Forecast CAPEX and OPEX 2019-2030 ($bn, AGR %, Cumulative)

Table 3.4 Global Thermal EOR Market Production Forecast 2019-2030 (Mbpd, AGR %)

Table 3.5 Global Thermal EOR Market Forecast 2020-2030 ($mn, AGR %, CAGR %, Cumulative)

Table 4.1 Oil Sands and Non-Oil Sands Submarket Forecasts 2019-2030 ($m, Mbpd, AGR%)

Table 4.2 Thermal EOR in Oil Sands Forecast 2019-2030 (CAPEX and OPEX $m, AGR %, CAGR %, Cumulative)

Table 4.3 Thermal Heavy Oil Forecast 2019-2030 (Production Mbpd, CAPEX and OPEX $m, AGR %, CAGR %)

Table 4.4 Thermal EOR Submarket Forecasts 2019-2030 (Mbpd, $m, AGR %, Cumulative)

Table 4.5 Steam Injection Submarket Forecast 2019-2030 (CAPEX and OPEX $m, AGR %, CAGR %, Cumulative)

Table 4.6 Top 5 Steam Injection Projects (Company, Project, bpd, Country, Resource)

Table 4.7 SAGD Submarket Forecast 2019-2030 (Production (mbpd), CAPEX and OPEX $m, AGR %, CAGR %, Cumulative)

Table 4.8 Top 5 SAGD Projects (Company, Project, bpd, Country, Resource)

Table 4.9 Other EOR Technology Submarket Forecast 2019-2030 (CAPEX and OPEX $m, AGR %, CAGR %, Cumulative)

Table 4.10 Top 2 Other EOR Technologies Projects (Company, Project, bpd, Country, Resource)

Table 5.1 Leading National Thermal EOR Market Forecast 2019-2030 (Spending $m, AGR %)

Table 5.2 Canadian Thermal Oil Sand EOR Market Forecast 2019-2030 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.3 Operational Thermal Oil Sands Projects (Company Name, Project Name, Technology, BPD Capacity, Current BPD)

Table 5.4 Canadian Thermal Heavy Oil Market Forecast 2019-2030 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.5 Operational Canadian Thermal Heavy Oil Projects (Company Name, Project Name, Technology, BPD Capacity, Current BPD)

Table 5.6 Planned Thermal Oil Sands Projects (Company Name, Project Name, Technology, bpd Capacity, Start Date)

Table 5.7 U.S Thermal EOR Market Forecast 2019-2030 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.8 U.S. Thermal EOR Production (Company, Project Location, Production [bpd], Technology)

Table 5.9 Venezuelan Thermal EOR Market Forecast 2019-2030 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.10 Venezuelan Thermal EOR Production (Company, Project Location, Production (bpd), Technology)

Table 5.11 Indonesian Thermal EOR Market Forecast 2019-2030 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.12 Kuwaiti Thermal EOR Market Forecast 2019-2030 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.13 Omani Thermal EOR Market Forecast 2019-2030 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.14 Omani Thermal EOR Production (Company, Project Location, Production [bpd], Technology)

Table 5.15 Chinese Thermal EOR Market Forecast 2019-2030 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.16 Russian Thermal EOR Market Forecast 2019-2030 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.17 Bahraini Thermal EOR Market Forecast 2019-2030 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.18 Saudi Arabian Thermal EOR Market Forecast 2019-2030 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 5.19 Rest of the World Thermal EOR Market Forecast 2019-2030 (Mbpd production, CAPEX and OPEX $m, AGR %, CAGR %)

Table 6.1 PEST Analysis of the Thermal EOR Market 2020-2030

Table 7.1 Seven Leading Companies in the Thermal Oil Sands EOR Market (Rank, 2019)

Table 7.2 Overview of Suncor in the Thermal Oil Sands EOR Market (Headquarters, CEO, Address, Website, Total Company Revenue 2018 ($m), Business Segments, No. of Employees, IR Contact, Ticker

Table 7.3 Key Strategic Moves and Developments of Suncor in the Thermal Oil Sands EOR Market (Date, Strategy, Description)

Table 7.4 Suncor in the Thermal Oil Sands EOR Market Total Company Sales 2015-2018 (US$m, AGR %)

Table 7.5 Overview of ConocoPhillips in the Thermal Oil Sands EOR Market (Headquarters, CEO, Address, Website, Total Company Revenue 2018 ($m), Business Segments, No. of Employees, IR Contact, Ticker

Table 7.6 Key Strategic Moves and Developments of ConocoPhillips in the Thermal Oil Sands EOR Market (Date, Strategy, Description)

Table 7.7 ConocoPhillips in the Thermal Oil Sands EOR Market Total Company Sales 2015-2018 (US$m, AGR %)

Table 7.8 Overview of Imperial Oil in the Thermal Oil Sands EOR Market (Headquarters, CEO, Address, Website, Total Company Revenue 2018 ($m), Business Segments, No. of Employees, IR Contact, Ticker

Table 7.9 Key Strategic Moves and Developments of Imperial oil in the Thermal Oil Sands EOR Market (Date, Strategy, Description)

Table 7.10 Imperial Oil in the Thermal Oil Sands EOR Market Total Company Sales 2015-2018 (US$m, AGR %)

Table 7.11 Overview of Cenovus in the Thermal Oil Sands EOR Market (Headquarters, CEO, Address, Website, Total Company Revenue 2018 ($m), Business Segments, No. of Employees, IR Contact, Ticker

Table 7.12 Key Strategic Moves and Developments of Cenovus in the Thermal Oil Sands EOR Market (Date, Strategy, Description)

Table 7.13 Cenovus Oil in the Thermal Oil Sands EOR Market Total Company Sales 2015-2018 (US$m, AGR %)

Table 7.14 Overview of CNOOC in the Thermal Oil Sands EOR Market (Headquarters, CEO, Address, Website, Total Company Revenue 2018 ($m), Business Segments, No. of Employees, IR Contact

Table 7.15 CNOOC Oil in the Thermal Oil Sands EOR Market Total Company Sales 2015-2018 (US$m, AGR %)

Table 7.16 Overview of Royal Dutch Shell plc in the Thermal Oil sands EOR Market (Headquarters, CEO, Address, Website, Total Company Revenue 2018 ($m), Business Segments, No. of Employees, IR Contact

Table 7.17 Key Strategic Moves and Developments of Royal Dutch Shell plc. in the Thermal Oil Sands EOR Market (Date, Strategy, Description)

Table 7.18 Royal Dutch Shell plc in the Thermal Heavy Oil EOR Market Total Company Sales 2015-2018 (US$m, AGR %)

Table 7.19 Overview of Equinor ASA in the Thermal Oil sands EOR Market (Headquarters, CEO, Address, Website, Total Company Revenue 2018 ($m), Business Segments, No. of Employees, IR Contact

Table 7.20 Key Strategic Moves and Developments of Equinor ASA in the Thermal Oil Sands EOR Market (Date, Strategy, Description)

Table 7.21 Equinor ASA in the Thermal Heavy Oil EOR Market Total Company Sales 2015-2018 (US$m, AGR %)

Table 7.22 Seven Leading Companies in the Thermal Oil Sands EOR Market (Rank, 2019)

Table 7.23 Overview of Chevron in the Thermal Heavy Oil EOR Market (Headquarters, CEO, Address, Website, Total Company Revenue 2018 ($m), Business Segments, No. of Employees, IR Contact, Ticker

Table 7.24 Chevron in the Thermal Heavy Oil EOR Market Total Company Sales 2015-2018 (US$m, AGR %)

Table 7.25 Overview of PDVSA in the Thermal Heavy Oil EOR Market (Headquarters, CEO, Website, No. of Employees

Table 7.26 Overview of Husky Energy in the Thermal Heavy Oil EOR Market (Headquarters, CEO, Address, Website, Total Company Revenue 2018 ($m), Business Segments, No. of Employees, IR Contact, Ticker

Table 7.27 Key Strategic Moves and Developments of Husky Energy in the Thermal Oil Sands EOR Market (Date, Strategy, Description)

Table 7.28 Husky Energy in the Thermal Heavy Oil EOR Market Total Company Sales 2015-2018 (US$m, AGR %)

Table 7.29 Overview of Sinopec in the Thermal Heavy Oil EOR Market (Headquarters, CEO, Address, Website, Total Company Revenue 2018 ($m), Business Segments, No. of Employees, IR Contact, Ticker/ Securities Code

Table 7.30 Sinopec in the Thermal Heavy Oil EOR Market Total Company Sales 2015-2018 (US$m, AGR %)

Table 7.31 Overview of Occidental Petroleum in the Thermal Heavy Oil EOR Market (Headquarters, CEO, Address, Website, Total Company Revenue 2018 ($m), Business Segments, No. of Employees, IR Contact, Ticker/ Securities Code

Table 7.32 Occidental Petroleum in the Thermal Heavy Oil EOR Market Total Company Sales 2015-2018 (US$m, AGR %)

Table 7.33 Overview of Petroliam Nasional Berhad (Petronas) in the Thermal Heavy Oil EOR Market (Headquarters, CEO, Address, Website, Total Company Revenue 2018 ($m), Business Segments, No. of Employees, IR Contact, Ticker/ Securities Code

Table 7.34 Petroliam Nasional Berhad (Petronas) in the Thermal Heavy Oil EOR Market Total Company Sales 2015-2018 (US$m, AGR %)

Table 7.35 Overview of BP plc in the Thermal Heavy Oil EOR Market (Headquarters, CEO, Address, Website, Total Company Revenue 2018 ($m), Business Segments, No. of Employees, IR Contact, Ticker/ Securities Code

Table 7.36 BP plc in the Thermal Heavy Oil EOR Market Total Company Sales 2015-2018 (US$m, AGR %)

Table 7.37 Other Leading Companies in the Thermal EOR Market (Company, Sector, Technology)

List of Figures

Figure 1.1 Oil Sands Forecast 2000-2040 (MT)

Figure 1.2 Global Thermal EOR Market Structure Overview

Figure 2.1 USGS Survey of Global Heavy Oil Resources by Region (Billion Barrels)

Figure 2.2 World Map of Bitumen Reserves (Million Barrels of Bitumen)

Figure 3.1 Global Thermal EOR Market Forecast 2019-2030 ($mn, AGR %)

Figure 3.2 Global Thermal EOR Market and Submarket CAGRs (%), 2020-2025, 2025-2030 and 2020-2030

Figure 3.3 Global Thermal EOR Market and Technology Submarket CAGRs (%),2020-2025, 2025-2030 and 2020-2030

Figure 3.4 Total Spending by Leading National Thermal EOR Markets, 2019-2030 ($mn)

Figure 3.5 Global Thermal EOR Market CAPEX Forecast 2019-2030 ($mn, AGR %)

Figure 3.6 Global Thermal EOR Market OPEX Forecast 2019-2030 ($mn, AGR %)

Figure 3.7 Global Thermal EOR Market Production Forecast 2019-2030 (Mbpd, AGR %)

Figure 3.8 WTI and Brent Oil Prices 2000-2018 ($/bbl)

Figure 3.9 Chinese and Indian Annual GDP Growth Rates, 2008-2018 (%)

Figure 4.1 Thermal EOR Submarket Production Share Forecasts, 2020, 2025 & 2030 (%)

Figure 4.2 Thermal EOR Submarket Forecasts 2019-2030 ($m)

Figure 4.3 Thermal EOR Submarket Spending Share Forecasts, 2020, 2025 & 2030 (%)

Figure 4.4 Thermal EOR in Oil Sands Forecast 2019-2030 ($m, AGR %)

Figure 4.5 Thermal EOR Submarket Spending Share Forecasts, 2020, 2025 & 2030 (%)

Figure 4.6 Thermal EOR in Oil Sands Production Forecast 2019-2030 (Mbpd, AGR %)

Figure 4.7 Thermal EOR in Oil Sands CAPEX and OPEX Forecasts, 2019-2030 ($m)

Figure 4.8 Benchmark Oil Prices, 2008 to 2019 ($/bbl)

Figure 4.9 Map of US Petroleum Administration for Defense Districts (PADD)

Figure 4.10 Thermal Heavy Oil Forecast 2019-2030 ($m, AGR %)

Figure 4.11 Thermal Heavy Oil Market Share Forecast 2020, 2025 and 2030 (% Share)

Figure 4.12 Thermal Heavy Oil Production Forecast 2019-2030 (Mbpd, AGR %)

Figure 4.13 Thermal Heavy Oil CAPEX and OPEX Forecasts, 2019-2030 ($m)

Figure 4.14 USGS Survey of Global Heavy Oil Resources by Region (Billion Bbls)

Figure 4.15 Thermal EOR Technology Submarket Production Share Forecasts 2020, 2025 and 2030 (% Share)

Figure 4.16 Thermal EOR Technology Submarket Spending Forecasts 2019-2030 ($m)

Figure 4.17 Thermal EOR Technology Submarket Spending Share Forecasts 2020, 2025 and 2030 (% Share)

Figure 4.18 Steam Injection Submarket Forecast 2019-2030 ($m, AGR %)

Figure 4.19 Steam Injection Submarket Share Forecast 2020, 2025 and 2030 (% Share)

Figure 4.20 Steam Injection Submarket Production Forecast 2019-2030 (Mbpd, AGR %)

Figure 4.21 Steam Injection Submarket CAPEX and OPEX Forecasts, 2019-2030 ($m)

Figure 4.22 SAGD Submarket Forecast 2019-2030 ($m, AGR %)

Figure 4.23 SAGD Submarket Share Forecast 2020, 2025 and 2030 (% Share)

Figure 4.24 SAGD Submarket Production Forecast 2019-2030 (Mbpd, AGR %)

Figure 4.25 SAGD Submarket CAPEX and OPEX Forecasts, 2019-2030 ($m)

Figure 4.26 Other EOR Technology Submarket Forecast 2019-2030 ($m, AGR %)

Figure 4.27 Other EOR Technology Submarket Share Forecast 2020, 2025 and 2030 (% Share)

Figure 4.28 Other EOR Technology Submarket Production Forecast 2019-2030 (Mbpd, AGR %)

Figure 4.29 Other EOR Technology Submarket CAPEX and OPEX Forecasts, 2019-2030 ($m)

Figure 5.1 Leading National Thermal EOR Market Spending Forecast ($m)

Figure 5.2 Leading National Thermal EOR Markets Share Forecast, 2020, 2025 & 2030 (%)

Figure 5.3 Leading National Thermal EOR Markets CAGR Forecast, 2019-2030 (%)

Figure 5.4 Leading National Thermal EOR Markets Cumulative Spending Forecast 2019-2030 ($m)

Figure 5.5 Canadian Thermal Oil Sand EOR Market Forecast 2019-2030 ($m, AGR %)

Figure 5.6 Canadian Thermal EOR Market Share Forecast, 2020, 2025 and 2030 (% Share)

Figure 5.7 Canadian Oil Sands Deposits in Alberta

Figure 5.8 Canadian Thermal Heavy Oil Market Forecast 2019-2030 ($m, AGR %)

Figure 5.9 Canadian Thermal Heavy Oil EOR Market Share Forecast, 2020, 2025 and 2030 (% Share)

Figure 5.10 U.S. Thermal EOR Market Forecast 2019-2030 ($m, AGR %)

Figure 5.11 US Thermal EOR Market Share Forecast, 2020, 2025 and 2030

Figure 5.12 Thermal EOR Production by State in 2019 (bpd)

Figure 5.13 Venezuelan Thermal EOR Market Forecast 2019-2030 ($m, AGR %)

Figure 5.14 Venezuelan Thermal EOR Market Share Forecast, 2020, 2025 and 2030 (% Share)

Figure 5.15 Venezuela Oil Production 1990-2018 (Mbpd) and Reserves 1990-2018 (Billion Bbls)

Figure 5.16 Indonesian Thermal EOR Market Forecast 2019-2030 ($m, AGR %)

Figure 5.17 Indonesian Thermal EOR Market Share Forecast, 2020, 2025 and 2030 (% Share)

Figure 5.18 Indonesian Oil Production and Proven Reserves 1990-2018 (Mbpd, Billion bbl)

Figure 5.19 Kuwaiti Thermal EOR Market Forecast 2019-2030 ($m, AGR %)

Figure 5.20 Kuwaiti Thermal EOR Market Share Forecast, 2020, 2025 and 2030 (% Share)

Figure 5.21 Omani Thermal EOR Market Forecast 2019-2030 ($m, AGR %)

Figure 5.22 Omani Thermal EOR Market Share Forecast, 2020, 2025 and 2030 (% Share)

Figure 5.23 Omani Oil Production and Proven Reserves 1990-2018 (Mbpd, Billion bbl)

Figure 5.24 Chinese Thermal EOR Market Forecast 2019-2030 ($m, AGR %)

Figure 5.25 Chinese Thermal EOR Market Share Forecast, 2020, 2025 and 2030 (% Share)

Figure 5.26 Russian Thermal EOR Market Forecast 2019-2030 ($m, AGR %)

Figure 5.27 Russian Thermal EOR Market Share Forecast, 2020, 2025 and 2030 (% Share)

Figure 5.28 Bahraini Thermal EOR Market Forecast 2019-2030 ($m, AGR %)

Figure 5.29 Bahraini Thermal EOR Market Share Forecast, 2020, 2025 and 2030 (% Share)

Figure 5.30 Saudi Arabian Thermal EOR Market Forecast 2019-2030 ($m, AGR %)

Figure 5.31 Saudi Arabian Thermal EOR Market Share Forecast, 2020, 2025 and 2030 (% Share)

Figure 5.32 Rest of the World Thermal EOR Market Forecast 2019-2030 ($m, AGR%)

Figure 5.33 Rest of the World Thermal EOR Market Share Forecast 2020, 2025 and 2030 (% Share)

Figure 7.1 Suncor Total Company Sales 2015-2018 (US $m, AGR %)

Figure 7.3 ConocoPhillips Total Company Sales 2015-2018 (US $m, AGR %)

Figure 7.5 Imperial Oil Total Company Sales 2015-2018 (US $m, AGR %)

Figure 7.7 Cenovus Total Company Sales 2015-2018 (US $m, AGR %)

Figure 7.8 Business Performance of Cenovus Oil in the Thermal Oil Sands EOR Market by Business Segment 2018 (% Share)

Figure 7.9 China National Offshore Oil Corporation (CNOOC) Total Company Sales 2015-2018 (US $m, AGR %)

Figure 7.10 Business Performance of CNOOC Oil in the Thermal Oil Sands EOR Market by Business Segment 2018 (% Share)

Figure 7.11 Royal Dutch Shell plc Total Company Sales 2015-2018 (US $m, AGR %)

Figure 7.12 Business Performance of Royal Dutch Shell plc. Oil in the Thermal Oil Sands EOR Market by Business Segment 2018 (% Share)

Figure 7.13 Equinor ASA Total Company Sales 2015-2018 (US $m, AGR %)

Figure 7.14 Business Performance of Equinor ASA Oil in the Thermal Oil Sands EOR Market by Business Segment 2018 (% Share)

Figure 7.15 Chevron Total Company Sales 2015-2018 (US $m, AGR %)

Table 7.24 Chevron in the Thermal Heavy Oil EOR Market Total Company Sales 2015-2018 (US$m, AGR %)

Figure 7.16 Business Performance of Chevron in the Thermal Heavy Oil EOR Market by Business Segment 2018 (% Share)

Figure 7.17 Husky Energy Total Company Sales 2015-2018 (US $m, AGR %)

Figure 7.18 Business Performance of Chevron in the Thermal Heavy Oil EOR Market by Business Segment 2018 (% Share)

Figure 7.19 Sinopec Total Company Sales 2015-2018 (US $m, AGR %)

Figure 7.20 Business Performance of Sinopec in the Thermal Heavy Oil EOR Market by Business Segment 2018 (% Share)

Figure 7.21 Occidental Total Company Sales 2015-2018 (US $m, AGR %)

Figure 7.22 Business Performance of Occidental in the Thermal Heavy Oil EOR Market by Business Segment 2018 (% Share)

Figure 7.23 Petroliam Nasional Berhad (Petronas) Total Company Sales 2015-2018 (US $m, AGR %)

Figure 7.24 Business Performance of Petroliam Nasional Berhad (Petronas) in the Thermal Heavy Oil EOR Market by Business Segment 2018 (% Share)

Figure 7.25 BP plc. Total Company Sales 2015-2018 (US $m, AGR %)

Figure 7.26 Business Performance of BP plc. in the Thermal Heavy Oil EOR Market by Business Segment 2018 (% Share)

BP plc

Cenovus

Chevron Corporation

China National Offshore Oil Corporation (CNOOC)

ConocoPhillips

Equinor ASA

Husky Energy

Imperial Oil

Occidental

PDVSA

Petroliam Nasional Berhad (Petronas)

Royal Dutch Shell plc.

Sinopec

Suncor

Download sample pages

Complete the form below to download your free sample pages for Thermal Enhanced Oil Recovery (EOR) Market Report 2020-2030

Related reports

-

Micro Liquefied Natural Gas (LNG) Market Forecast 2020-2030

Investments in small scale LNG liquefaction facilities are gaining momentum which has surged the demand for less than 0.1 MTPA...Full DetailsPublished: 18 November 2019 -

Well Abandonment Services Market Report 2020-2030

Forecasts by Type (Temporarily Abandoned, Shut In), by Application (Onshore, Offshore), by Region (North America, Europe, Asia Pacific, Central &...

Full DetailsPublished: 01 January 1970 -

Global Land Drill Rigs Market Analysis to 2030

Visiongain has calculated that the global Land Drill Rigs market will see a capital expenditure (CAPEX) of $43,454.1mn in 2020....

Full DetailsPublished: 13 February 2020 -

Microbial Enhanced Oil Recovery Market Report 2020-2030

This latest report by business intelligence provider Visiongain assesses that Microbial Enhanced Oil Recovery Market spending will reach US$ 730...

Full DetailsPublished: 01 January 1970 -

Natural Gas-Fired Power Generation Market Report 2020-2030

Factors Driving the Market Growth:

...

- Rising government support

- Growing investments in gas-fired power generationFull DetailsPublished: 01 January 1970 -

Reservoir Analysis Market Report 2020-2030

Forecasts by Reservoir Type (Conventional, Unconventional), by Service (Geo Modeling, Reservoir Simulation, Data Acquisition & Monitoring, Reservoir Sampling), by Application...

Full DetailsPublished: 01 January 1970 -

Onshore Oil & Gas Pipelines Market Report 2019-2029

Visiongain’s extensive and detailed 427-page report reveals that onshore oil and gas pipeline infrastructure will experience CAPEX of $1,291.3bn in...Full DetailsPublished: 08 March 2019 -

EOR Yearbook 2019: The Ultimate Guide to Enhanced Oil Recovery (EOR)

Visiongain’s latest EOR yearbook provides you with unprecedented in-depth analysis of the global EOR market. Visiongain assesses that the global...

Full DetailsPublished: 13 November 2018 -

Global Early Production Facility Market Forecast 2020-2030

This independent 176-page report guarantees you will remain better informed than your competitors. With 219 tables and figures examining the...

Full DetailsPublished: 17 January 2020 -

Carbon Capture & Storage (CCS) Market Report 2019-2029

Carbon Capture & Storage (CCS) market expected to continue growing amid climate change fears....Full DetailsPublished: 13 August 2019

Download sample pages

Complete the form below to download your free sample pages for Thermal Enhanced Oil Recovery (EOR) Market Report 2020-2030

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Energy news

Energy as a Service (EaaS) Market

The global Energy as a Service (EaaS) market is projected to grow at a CAGR of 12.6% by 2034

25 July 2024

Synthetic Fuels Market

The global Synthetic Fuels market is projected to grow at a CAGR of 23% by 2034

18 July 2024

Power-to-X (P2X) Market

The global Power-to-X (P2X) market is projected to grow at a CAGR of 10.6% by 2034

09 July 2024

Airborne Wind Energy Market

The global Airborne Wind Energy market is projected to grow at a CAGR of 9.7% by 2034

05 June 2024