Industries > Energy > Chemical Enhanced Oil Recovery (EOR) Market 2019-2029

Chemical Enhanced Oil Recovery (EOR) Market 2019-2029

Spending ($m) and Production (MMbbls/yr) Forecasts by Chemical (ASP, Polymer, Surfactant, Biopolymer, ASP/Polymer and Polymer/ Surfactant) Plus Forecasts for Major Countries and Leading Companies in the Sector

This latest report by business intelligence provider visiongain assesses that Chemical EOR spending will reach $2.89bn in 2019. This report addresses the development of the global Chemical EOR market, analysing the prospects for 6 technologies, 15 regional & national markets and including forecasts for Spending and production from 2019-2029. It is therefore critical that you have your timescales correct and your forecasting plans ready. This report will ensure that you do. Visiongain’s report will ensure that you keep informed and ahead of your competitors. Gain that competitive advantage.

The Chemical EOR Market Forecast 2019-2029 responds to your need for definitive market data:

Read on to discover how you can exploit the future business opportunities emerging in this sector. Visiongain’s new study tells you and tells you NOW.

In this updated report, you find 200+ in-depth tables, charts and graphs all unavailable elsewhere.

The 253-page report provides clear, detailed insight into the global Chemical EOR market. Discover the key drivers and challenges affecting the market.

By ordering and reading our report today, you stay better informed and ready to act.

Report Scope

The report delivers considerable added value by revealing:

• 200+ tables, charts and graphs are analysing and revealing the growth prospects and outlook for the Chemical EOR.

• Chemical EOR market forecasts and analysis from 2019-2029

• Chemical EOR market provides spending and production from 2019-2029 for 6 Chemical EOR technologies:

• ASP

• Polymer

• Surfactant

• Biopolymer

• ASP/Polymer

• Polymer/Surfactant

• Regional Chemical EOR market forecasts from 2019-2029-2028 with drivers and restraints for the regions including:

• China

• Canada

• Russia

• Oman

• Rest of Middle East

• Indonesia

• Venezuela

• Colombia

• Rest of Latin America

• United States

• India

• Mexico

• North Sea

• Malaysia

• Rest of the World

• Company profiles for the leading Chemical EOR companies

• BlackPearl Resources

• Cenovus Energy

• PetroChina (CNPC)

• China National Offshore Oil Corporation (CNOOC)

• Canadian Natural Resources (CNRL)

• Murphy Oil Corporation

• Petroleum Development Oman (PDO)

• Sinopec Corp

• Zargon Oil and Gas

• Conclusions and recommendations which will aid decision-making

How will you benefit from this report?

• Keep your knowledge base up to speed. Don’t get left behind

• Reinforce your strategic decision-making with definitive and reliable market data

• Learn how to exploit new technological trends

• Realise your company’s full potential within the market

• Understand the competitive landscape and identify potential new business opportunities & partnerships

Who should read this report?

• Anyone with involvement in the Chemicals and Oil company

• Energy price reporting companies

• Energy company managers

• Energy consultants

• Oil and gas company executives and analysts

• Heads of strategic development

• Business development managers

• Marketing managers

• Market analysts,

• Technologists

• Suppliers

• Investors

• Banks

• Government agencies

Visiongain’s study is intended for anyone requiring commercial analyses for the Chemical EOR market and leading companies. You find data, trends and predictions.

Buy our report today the Chemical Enhanced Oil Recovery (EOR) Market 2019-2029: Spending ($m) and Production (MMbbls/yr) Forecasts by Chemical (ASP, Polymer, Surfactant, Biopolymer, ASP/Polymer and Polymer/ Surfactant) Plus Forecasts for Major Countries and Leading Companies in the Sector Avoid missing out by staying informed – get our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1.1 Global Chemical EOR Market Overview

1.2 Global Chemical EOR Market Segmentation

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report For?

1.7 Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Chemical Enhanced Oil Recovery (EOR) Market

2.1 How is the Enhanced Oil Recovery (EOR) Market Structured?

2.1.1 Primary Recovery

2.1.2 Secondary Recovery

2.1.3 Tertiary Recovery

2.2 Chemical EOR Processes

2.2.1 Polymer Flooding

2.2.2 Surfactant Flooding

2.2.3 Alkaline Flooding

2.2.4 Micellar Flooding

2.3 Major Chemicals Used in EOR Projects

2.4 Major Themes Impacting the Chemical EOR Market

3. Impact of oil prices on the Chemical EOR Market

3.1 Visiongain’s Oil Price Forecast and Analysis

3.1.1 Supply-Side Factors

3.1.1.1 Tight Oil

3.1.1.2 OPEC

3.1.2 Demand-Side Factors

3.1.2.1 Chinese and Indian Growth

3.1.3 Other Major Variables that Impact the Oil Price

3.1.3.1 North Africa

3.1.3.2 Russia

3.1.3.3 U.S. Shale

3.1.3.4 Iran

3.1.3.5 International Incidents

3.1.4 Visiongain’s Oil Price Assumptions and Forecast

3.2 How the Oil Price Will Impact the Chemical EOR Market

4. Global Chemical EOR Market Forecast 2019-2029

4.1 What are the Drivers and Restraints of the Global Chemical EOR Market?

4.1.1 Major Chemical EOR Drivers

4.1.2 Major Chemical EOR Restraints

4.2 Chemical EOR Market SWOT Analysis

5. Chemical EOR Technology Forecast 2019-2029

5.1 Global Chemical EOR Technology Production Forecast 2019-2029

5.2 Global Chemical EOR Technology Market Analysis

5.2.1 The Characteristics Governing Chemical EOR Projects

5.2.2 The Current Status of EOR Projects Globally

5.3 Global Alkali Surfactant Polymer Flooding (ASP) Production Forecast 2019-2029

5.4 Global Alkali Surfactant Polymer Flooding (ASP) Market Analysis

5.5 Global Polymer Flooding Production Forecast 2019-2029

5.6 Global Polymer Flooding Market Analysis

5.7 Global Surfactant EOR Production Forecast 2019-2029

5.8 Global Surfactant EOR Market Analysis

5.9 Global Biopolymer Flooding Production Forecast 2019-2029

5.10 Global Biopolymer Flooding Market Analysis

5.11 Global Polymer/ASP Production Flooding Forecast 2019-2029

5.12 Global Polymer/ASP Flooding Market Analysis

5.13 Global Polymer/Surfactant Flooding Production Forecast 2019-2029

5.14 Global Polymer/Surfactant Flooding Market Analysis

5.15 Global Chemical EOR Application Market Analysis 2019-2029

6. Leading National Chemical EOR Markets 2019-2029

6.1 The Leading National Chemical EOR Markets 2019-2029

6.2 The Chinese Chemical EOR Production and Market Forecast 2019-2029

6.2.1 The Chinese Chemical EOR Production Forecast 2019-2029

6.2.2 The Chinese Chemical EOR Spending Market Forecast 2019-2029

6.2.3 The Chinese Chemical EOR Market Analysis

6.2.3.1 A Focus on Chinese Oil Operators and Opportunities for Chemical EOR

6.2.4 The Drivers and Restraints Impacting the Chinese Market

6.2.4.1 China: A World Leader in Chemical EOR

6.2.4.2 Despite Opportunity, Could the Chinese Chemical EOR Market be Limited by Competition?

6.2.5 The Outlook for China: Will Its Dominance Continue?

6.3 The Canadian Chemical EOR Production and Market Forecast 2019-2029

6.3.1 The Canadian Chemical EOR Production Forecast 2019-2029

6.3.2 The Canadian Chemical EOR Spending Market Forecast 2019-2029

6.3.3 The Canadian Chemical EOR Market Analysis

6.3.3.1 Cenovus’ Experience with Chemical EOR at Pelican Lake

6.3.3.2 CNRL’s Experience with Chemical EOR at Pelican Lake

6.3.3.3 Other Projects in Canada

6.3.3.4 A Focus on ASP Projects

6.3.4 What is Driving and Restraining the Canadian Chemical EOR Market?

6.3.4.1 Is Experience Enough to Drive the Canadian Chemical EOR Market Forward?

6.3.4.2 To What Extent Do Oil Prices, Costs and Technicalities Restrict the Canadian Chemical EOR Market?

6.3.5 Future Prospects for Chemical EOR in Canada

6.4 The Russian Chemical EOR Production and Market Forecast 2019-2029

6.4.1 The Russian Chemical EOR Production Forecast 2019-2029

6.4.2 The Russian Chemical EOR Spending Market Forecast 2019-2029

6.4.3 The Russian Chemical EOR Market Analysis

6.4.3.1 The Use of Chemical EOR by Lukoil

6.4.4 Drivers and Restraints in the Russian Chemical EOR Market

6.4.4.1 Western Siberia and Falling Production

6.4.4.2 What Are the Restraints in Russia?

6.4.4.3 Potential of Russian Regions to Implement CO2-Enhanced Oil Recovery (2019)

6.5 The Omani Chemical EOR Production and Market Forecast 2019-2029

6.5.1 The Omani Chemical EOR Production Forecast 2019-2029

6.5.2 The Omani Chemical EOR Spending Market Forecast 2019-2029

6.5.3 The Omani Chemical EOR Market Analysis

6.5.3.1 Marmul Chemical EOR: A Case Study

6.5.3.2 Does Oman Have Any Further Chemical EOR Experience?

6.5.4 The Drivers and Restraints Impacting the Omani Chemical EOR Market

6.5.4.1 PDO EOR Strategies

6.5.4.2 Oman’s Pilot Experience and Goals

6.5.4.3 The Implications of Investment in Alternative EOR Techniques

6.5.5 What is the Overall Outlook for Oman?

6.6 The Rest of the Middle East Chemical EOR Production and Market Forecast 2019-2029

6.6.1 The Rest of the Middle East Chemical EOR Production Forecast 2019-2029

6.6.2 The Rest of the Middle East Chemical EOR Spending Market Forecast 2019-2029

6.6.3 The Rest of the Middle East Chemical EOR Market Analysis

6.6.3.1 Opportunities in Kuwait

6.6.3.2 Potential for the UAE

6.6.3.3 The Chemical EOR Market in Saudi Arabia

6.7 The Indonesian Chemical EOR Production and Market Forecast 2019-2029

6.7.1 The Indonesian Chemical EOR Production Forecast 2019-2029

6.7.2 The Indonesian Chemical EOR Spending Market Forecast 2019-2029

6.7.3 The Indonesian Chemical EOR Market Analysis

6.7.4 Drivers and Restraints for the Indonesian Chemical EOR Market

6.7.4.1 The Importance of Chemical EOR in Indonesia

6.7.4.2 Chemical EOR Potential in Indonesia

6.8 The Venezuelan Chemical EOR Production and Market Forecast 2019-2029

6.8.1 The Venezuelan Chemical EOR Production Forecast 2019-2029

6.8.2 The Venezuelan Chemical EOR Spending Market Forecast 2019-2029

6.8.3 The Venezuelan Chemical EOR Market Analysis

6.8.3.1 Are There Any Chemical EOR Projects in Venezuela Currently?

6.8.4 The Drivers and Restraints in the Venezuelan Chemical EOR Market

6.8.4.1 Extra-Heavy Oil and Falling Production Set to Provide Lift for the Chemical EOR Market in Venezuela

6.8.4.2 The Future for PDVSA

6.8.5 What is the Outlook for Venezuela?

6.9 The Colombian Chemical EOR Production and Market Forecast 2019-2029

6.9.1 The Colombian Chemical EOR Production Forecast 2019-2029

6.9.2 The Colombian Chemical EOR Spending Market Forecast 2019-2029

6.9.3 The Colombian Chemical EOR Market Analysis

6.9.3.1 Are There Current Chemical EOR Projects in Colombia?

6.9.4 The Drivers and Restraints Impacting the Colombian Market

6.9.4.1 What is Driving the Colombian Market?

6.9.4.2 Will a Lack of Experience Detract from Chemical EOR Growth?

6.10 The Rest of Latin American Chemical EOR Production and Market Forecast 2019-2029

6.10.1 The Rest of Latin America Chemical EOR Production Forecast 2019-2029

6.10.2 The Rest of Latin America EOR Spending Market Forecast 2019-2029

6.10.3 The Rest of Latin America Chemical EOR Market Analysis

6.10.3.1 Argentina

6.10.3.1.1 What Are the Main Drivers and Restraints Impacting the Argentine Chemical EOR Market?

6.10.3.1.2 The Outlook for Chemical EOR in Argentina

6.10.3.2 Brazil

6.10.3.3 Ecuador

6.11 The United States Chemical EOR Production and Market Forecast 2019-2029

6.11.1 The United States Chemical EOR Production Forecast 2019-2029

6.11.2 The United States EOR Spending Market Forecast 2019-2029

6.11.3 The United States Chemical EOR Market Analysis

6.11.3.1 What Is the Current Status of Chemical EOR In the US?

6.11.4 The Drivers and Restraints Impacting the US Chemical EOR Market

6.11.4.1 Will the Chemical EOR Market in the US Rebound?

6.11.4.2 Will Increased Energy Security and Competition from Other EOR Techniques Push Chemical EOR Out?

6.11.5 The Outlook for the US: Experience from Pilot Projects

6.12 The Indian Chemical EOR Production and Market Forecast 2019-2029

6.12.1 The Indian Chemical EOR Production Forecast 2019-2029

6.12.2 The Indian EOR Spending Market Forecast 2019-2029

6.12.3 The Indian Chemical EOR Market Analysis

6.12.4 What are the Major Drivers and Restraints in the Indian Chemical EOR Market?

6.12.4.1 As Energy Consumption Increases and Oil Fields Mature, Will Chemical EOR be a Panacea for India?

6.12.4.2 How Will Market Restraints Impact the Indian Chemical EOR Market?

6.12.4.3 Challenges in EOR Implementation

6.12.5 Indian Chemical EOR Market Outlook: Future Projects and Opportunities

6.13 The Mexican Chemical EOR Production and Market Forecast 2019-2029

6.13.1 The Mexican Chemical EOR Production Forecast 2019-2029

6.13.2 The Mexican EOR Spending Market Forecast 2019-2029

6.13.3 The Mexican Chemical EOR Market Analysis

6.13.4 The Drivers and Restraints in the Mexican Chemical EOR Market

6.13.4.1 PEMEX’s EOR Strategy and the Mexican Reform

6.13.5 What is the Outlook for Mexico?

6.14 The North Sea Chemical EOR Production and Market Forecast 2019-2029

6.14.1 The North Sea Chemical EOR Production Forecast 2019-2029

6.14.2 The North Sea EOR Spending Market Forecast 2019-2029

6.14.3 The North Sea Chemical EOR Market

6.14.3.1 What Projects Exist in the UK?

6.14.3.2 What Projects Exist in Norway?

6.14.4 The Drivers and Restraints for the North Sea Chemical EOR Market

6.14.4.1 Will Chemical EOR Be a Solution for Production Depletion?

6.14.4.2 The Realities of Chemical EOR Offshore

6.14.5 Is Chemical EOR Likely to be the Chosen Technology Going Forward?

6.15 The Malaysian Chemical EOR Production and Market Forecast 2019-2029

6.15.1 The Malaysian Chemical EOR Production Forecast 2019-2029

6.15.2 The Malaysian EOR Spending Market Forecast 2019-2029

6.15.3 The Malaysian Chemical EOR Market

6.15.3.1 Petronas and ExxonMobil’s Angsi Development

6.15.3.2 The Development of the St Joseph Field

6.15.4 Drivers and Restraints for the Malaysian Chemical EOR Market

6.15.4.1 Production Sharing Contracts as a Support Mechanism for Chemical EOR

6.15.4.2 Will Costs and Delays Weigh Down on Market Sentiment?

6.15.5 The Outlook for Chemical EOR in Malaysia

6.16 The Thai Chemical EOR Market 2019-2029

6.16.1 PTT Public Company Limited

6.16.1.1 Promotional Privileges for PTT Public Company Limited

7. Emerging Technologies and Future Trends

7.1 Biopolymers

7.2 Hybrid Chemical Formulas

7.3 Nanoplate Surfactants

7.4 Microbial EOR

7.5 The Outlook for Emerging Technologies

8. PEST Analysis of the Chemical EOR Market 2019-2029

9. Expert Opinion

9.1 Kemira

9.1.1 Introduction

9.1.2 Effects of The Oil Price Collapse

9.1.3 Future Role of Emerging Chemical EOR Projects

9.1.4 Offshore Chemical EOR Developments

9.1.5 What Are Other Important Drivers and Restraints in The Market?

10. Major Companies in the Chemical EOR Market 2019-2029

10.1 Major Oil Companies in the Chemical EOR Market

10.1.1 BlackPearl Resources Inc.

10.1.1.1 BlackPearl Resources Analysis

10.1.1.2 BlackPearl Resources Chemical EOR Projects

10.1.1.3 The Outlook for BlackPearl Resources

10.1.2 Cenovus Energy Inc.

10.1.2.1 Cenovus Analysis

10.1.2.2 Cenovus Chemical EOR Projects

10.1.2.3 The Outlook for Cenovus

10.1.3 PetroChina (CNPC)

10.1.3.1 CNPC Analysis

10.1.3.2 CNPC Chemical EOR Projects

10.1.3.3 The Outlook for CNPC

10.1.4 China National Offshore Oil Corporation (CNOOC) Ltd.

10.1.4.1 CNOOC Analysis

10.1.4.2 CNOOC Chemical EOR Projects

10.1.4.3 The Outlook for CNOOC

10.1.5 Canadian Natural Resources (CNRL)

10.1.5.1 CNRL Analysis

10.1.5.2 CNRL Chemical EOR Projects

10.1.5.3 The Outlook for CNRL

10.1.6 Murphy Oil Corporation

10.1.6.1 Murphy Oil Analysis

10.1.6.2 Murphy Oil Chemical EOR Projects

10.1.6.3 The Outlook for Murphy Oil

10.1.7 Petroleum Development Oman (PDO)

10.1.7.1 PDO Analysis

10.1.7.2 PDO Chemical EOR Projects

10.1.7.3 The Outlook for PDO

10.1.8 Sinopec Corp (China Petroleum & Chemical Corporation)

10.1.8.1 Sinopec Analysis

10.1.8.2 Sinopec Chemical EOR Projects

10.1.8.3 The Outlook for Sinopec

10.1.9 Zargon Oil and Gas

10.1.9.1 Zargon Oil and Gas Energy Analysis

10.1.9.2 Zargon Oil and Gas Chemical EOR Projects

10.1.9.3 The Outlook for Zargon Oil and Gas

10.1.10 BP p.l.c.

10.1.10.1 BP p.l.c. Analysis

10.1.10.2 BP p.l.c. Chemical EOR Projects

10.2 Chemical Companies – Providers and Developers

10.2.1 BASF

10.2.2 Huntsman

10.2.3 Kemira

10.2.4 Sasol

10.2.5 Shandong Polymer

10.2.6 SNF Group

10.2.7 Solvay

10.2.8 Surtek

10.2.9 Tiorco

11. Conclusions & Recommendations

11.1 Chemical EOR Market Outlook

11.2 Key Findings in the Chemical EOR Market

11.3 Recommendations for the Chemical EOR Market

12. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

Appendix B

List of Tables

Table 3.1 Visiongain’s Anticipated Brent Crude Oil Price, 2019, 2020-2022, 2023-2025, 2026-2029 ($/bbl)

Table 4.1 Global Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 4.2 Global Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %, CAGR%, Cumulative)

Table 4.3 Drivers and Restraints in the Global Chemical EOR Market

Table 5.1 Chemical EOR Production Forecasts by Technology 2019-2029 (bbl/day, AGR %, Cumulative)

Table 5.2 Global ASP EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

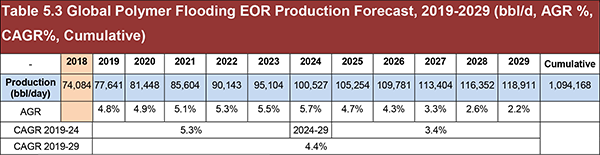

Table 5.3 Global Polymer Flooding EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 5.4 Global Surfactant EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 5.5 Global Biopolymer EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 5.6 Global Polymer/ASP EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 5.7 Global Polymer/Surfactant EOR Production Forecast, 2019-2029 (bbl/d, AGR%)

Table 5.8 Table 5.8 Chemical EOR Production Forecasts by Application 2019-2029 (bbl/day, AGR %, Cumulative)

Table 6.1 Leading National Chemical EOR Production Forecasts 2019-2029 ($ m)

Table 6.2 Leading National Chemical EOR Production Forecasts 2019-2029 (bbl/day)

Table 6.3 The Chinese Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 6.4 The Chinese Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %, CAGR%, Cumulative)

Table 6.5 Oil, Population and Economic Growth Statistics for China (‘000 bbl/d, bn, AGR %)

Table 6.6 Drivers and Restraints in the Chinese Chemical EOR Market

Table 6.7 The Canadian Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 6.8 List of Chemical EOR Projects in Canada

Table 6.9 Characteristics of the Pelican Lake Field, Canada (Field Name, Location, Geology, Oil Characteristics, Other Characteristics

Table 6.10 Major ASP Projects in Canada

Table 6.11 Drivers and Restraints in the Canadian Chemical EOR Market

Table 6.12 The Russian Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 6.13 The Russian Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %, CAGR%, Cumulative)

Table 6.14 List of Chemical EOR Projects in Russia

Table 6.15 The Omani Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 6.16 The Omani Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %, CAGR%, Cumulative)

Table 6.17 Major Characteristics of the Marmul Field (Field, Operator, Location, Lithology, Oil Type, Discovery Date)

Table 6.18 Drivers and Restraints in the Oman Chemical EOR Market

Table 6.19 Omani Oil Consumption 1990-2019 (Year, bbl/d, % Change)

Table 6.20 The Rest of the Middle East Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 6.21 The Rest of the Middle East Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %, CAGR%, Cumulative)

Table 6.22 The Indonesian Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 6.23 The Indonesian Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %, CAGR%, Cumulative)

Table 6.24 Indonesian Chemical EOR Projects

Table 6.25 Drivers and Restraints in the Indonesian Chemical EOR Market

Table 6.26 The Venezuelan Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 6.27 The Venezuelan Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %, CAGR%, Cumulative)

Table 6.28 Characteristics of the Petrocedeño Chemical EOR Pilot Project

Table 6.29 Drivers and Restraints in the Venezuelan Chemical EOR Market

Table 6.30 The Colombian Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 6.31 List of Chemical EOR Projects in Colombia

Table 6.32 Drivers and Restraints in the Colombian Chemical EOR Market

Table 6.33 The Rest of Latin America Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Table 6.34 The Rest of Latin America Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %, CAGR%, Cumulative)

Table 6.35 Argentina Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Table 6.36 Argentina Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %, CAGR%, Cumulative)

Table 6.37 Chemical EOR Pilot Projects in Argentina (Field, Type, Details, Project Dates)

Table 6.38 Drivers and Restraints in the Argentine Chemical EOR Market

Table 6.39 The US Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 6.40 The US Chemical EOR Spending Market Forecast, 2019-2029($m, AGR %, CAGR%, Cumulative)

Table 6.41 List of Chemical EOR Projects in the US

Table 6.42 Drivers and Restraints in the US Chemical EOR Market

Table 6.43 Part-Funded Chemical EOR Projects in the US

Table 6.44 The Indian Chemical EOR Market Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 6.45 The Indian Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %, CAGR%, Cumulative)

Table 6.46 Drivers and Restraints in the Indian Chemical EOR Market

Table 6.47 The Mexican Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 6.48 The Mexican Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %, CAGR%, Cumulative)

Table 6.49 Drivers and Restraints in the Mexican Chemical EOR Market

Table 6.50 PEMEX’s Upcoming Pilot Chemical EOR Projects

Table 6.51 The North Sea Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 6.52 The North Sea Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %, CAGR%, Cumulative)

Table 6.53 List of Chemical EOR Projects in UK

Table 6.54 Drivers and Restraints in the North Sea Chemical EOR Market

Table 6.55 The Malaysian Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Table 6.56 The Malaysian Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %, CAGR%, Cumulative)

Table 6.57 Drivers and Restraints in the Malaysian Chemical EOR Market

Table 6.58 Thailand Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Table 6.59 Thailand Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %, CAGR%, Cumulative)

Table 8.1 PEST Analysis of the Chemical EOR Market 2019-2029

Table 10.1 Leading Companies in Global Chemical EOR, 2018 Production Forecast, 2018 Production Share (bbl/d, %)

Table 10.2 BlackPearl Resources Overview: Total Daily Production, 2018 Chemical EOR Production Forecast, Oil and Gas Sales 2018, 2018 Chemical EOR Global Production Share, 2018 Chemical EOR Global Production Rank, Headquarters, Ticker, Employees, Website (bbl/d, $m, %)

Table 10.3 Cenovus Overview: Total Daily Production 2018, Revenue 2018, 2018 Global Production Share, 2018 Chemical EOR Production Forecast, 2018 Global Production Rank, Headquarters, Ticker, Employees, Website

Table 10.4 PetroChina (CNPC) Overview: Crude Oil Output (Expect) 2018, Revenue 2017, 2018 Chemical EOR Production (bbl/d), 2018 Global Chemical EOR Production Share (%), 2018 Global Chemical EOR Production Rank, Headquarters, Employees, Ticker, Website (bbl/d, $m, %)

Table 10.5 CNOOC Overview: Total Daily Crude and Liquids Production Target 2018, Oil and Gas Production 2018, Total Oil and Gas Sales 2018, 2018 Chemical EOR Production Forecast, 2018 Global Chemical EOR Production Share, 2018 Chemical EOR Production Rank, Headquarters, Employees, Website (bbl/d, $m, %)

Table 10.6 CNRL Overview: Total Daily Production 2018, Total Sales, 2018 Chemical EOR Production Forecast, 2018 Global Chemical EOR Production Share, 2018 Chemical EOR Production Rank, Headquarters, Employees, Ticker, Website (bbl/d, $m, %)

Table 10.7 Murphy Oil Overview: Total Daily Production 2018, Total Revenue 2018, 2018 Chemical EOR Production, 2018 Global Chemical EOR Production Share, 2018 Chemical EOR Production Rank, Headquarters, Employees, Ticker, Website (bbl/d, $m, %)

Table 10.8 PDO Overview: Total Daily Production, 2018 Chemical EOR Production, 2018 Global Chemical EOR Production Share, 2018 Global Chemical EOR Production Rank, Headquarters, Employees, Website (bbl/d, $m, %)

Table 10.9 Sinopec Overview: Total Oil Production 2018, Operating Income 2018, 2018 Chemical EOR Production Forecast, 2018 Global Chemical EOR Production Share, 2018 Global Chemical EOR Production Rank, Headquarters, Employees, Ticker, Website (bbl/d, $m, %)

Table 10.10 Sinopec Chemical EOR Projects (Field, Type, Project Start Date)

Table 10.11 Zargon Oil and Gas Overview: Total Daily Production 2018, Revenue 2018, 2018 Chemical EOR Production, 2018 Global Chemical EOR Production Share, 2018 Market Rank, Headquarters, Employees, Ticker, Website)

Table 10.12 BP: Crude Oil Production 2018, Revenue 2018, Crude Oil Revenue 2018, Crude Oil Reserves 2018, Headquarters, Employees, Website (bbl/d, $m, %)

List of Figures

Figure 1.1 Global Oil Consumption 1990-2018 (‘000 bbl/d)

Figure 1.2 Global Oil Reserves, At end 1997, At end 2007, At end 2016, At end 2017 (Billion barrels)

Figure 1.3 Global Chemical EOR Market Segmentation Overview

Figure 1.4 Global Chemical EOR National Market Breakdown

Figure 2.1 Enhanced Oil Recovery by Segment

Figure 2.2 Main Properties for Chemical EOR

Figure 2.3 Major Chemicals Used in Enhanced Oil Recovery

Figure 2.4 Major Trends Affecting the Chemical EOR Market

Figure 3.1 WTI and Brent Oil Prices 2012-2019 ($/bbl)

Figure 3.2 Chinese and Indian Annual GDP Growth 2000-2018 (%)

Figure 3.3 Visiongain’s Anticipated Brent Crude Oil Price, 2018, 2019, 2020-2022, 2023-2025, 2026-2029 ($/bbl)

Figure 3.4 WTI Crude Spot Price and the Number of EOR Projects Implemented Each Year 1990-2016

Figure 3.5 Degree of Oil Price Impact on Leading National Markets 2019-2029

Figure 4.1 Global Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR%)

Figure 4.2 Global Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR%)

Figure 4.3 Locations of Known Active Chemical EOR Projects and Pilots 2018

Figure 4.4 Total Spending per National Market, 2029 ($m)

Figure 4.5 National Chemical EOR Market Share by Spend, 2019, 2024, 2029 (%)

Figure 4.6 Factors Influencing the Economic Viability of a Chemical EOR Project

Figure 5.1 Chemical EOR Production Forecasts by Technology 2019-2029 (bbl/d)

Figure 5.2 Chemical EOR Technology Market Shares 2019-2029 (%)

Figure 5.3 Chemical EOR Total Production Forecasts by Technology 2019-2029 (bbl/d)

Figure 5.4 Chemical EOR Total Production Split by Polymer and Non-Polymer Technology 2019-2029 (bbl/d)

Figure 5.5 Global ASP EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Figure 5.6 The Global ASP Flooding Production Share Forecast 2019, 2024 and 2029 (%)

Figure 5.7 Global Polymer EOR Production Forecast, 2019-2029 (bbl/d, AGR%)

Figure 5.8 The Global Polymer Flooding Production Share Forecast 2019, 2024 and 2029 (%)

Figure 5.9 Global Surfactant EOR Production Forecast, 2019-2029 (bbl/d, AGR%)

Figure 5.10 The Global Surfactant EOR Production Share Forecast 2019, 2024 and 2029 (%)

Figure 5.11 Global Biopolymer EOR Production Forecast, 2019-2029 (bbl/d, AGR%)

Figure 5.12 The Biopolymer Flooding Production Share Forecast 2019, 2024 and 2029 (%)

Figure 5.13 Global Polymer/ASP EOR Production Forecast, 2019-2029 (bbl/d, AGR%)

Figure 5.14 The Global Polymer/ASP Production Share Forecast 2019, 2024 and 2029 (%)

Figure 5.15 Global Polymer/Surfactant EOR Production Forecast, 2019-2029 (bbl/d, AGR%)

Figure 5.16 Global Polymer/Surfactant EOR Production Forecast, 2019-2029 (bbl/d, AGR%)

Figure 5.17 The Global Polymer/Surfactant Flooding Production Share Forecast 2019, 2024 and 2029 (%)

Figure 6.1 Leading National Chemical EOR Production Forecasts 2019-2029 (bbl/d)

Figure 6.2 Leading National Chemical EOR Production Forecasts 2019-2029 Excluding China (bbl/d)

Figure 6.3 Leading National Chemical EOR Spending Market Forecasts 2019-2029 ($m)

Figure 6.4 Leading National Chemical EOR Production and Market Share Forecast 2019 (%)

Figure 6.5 Leading National Chemical EOR Production and Market Share Forecast 2024 (%)

Figure 6.6 Leading National Chemical EOR Production and Market Share Forecast 2029 (%)

Figure 6.7 Barriers to Entry vs. Regional Market Size vs. CAGR 2019-2029 ($m, CAGR%)

Figure 6.8 The Chinese Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Figure 6.9 The Chinese Chemical EOR Production Share Forecast 2019, 2024 and 2029 (%)

Figure 6.10 The Chinese Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %)

Figure 6.11 The Chinese Chemical EOR Spending Market Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.12 Major Chemical EOR Projects in China

Figure 6.13 Chemical EOR Developments within the Daqing Field, China 1970-2007

Figure 6.14 Chinese Chemical EOR Project Breakdown

Figure 6.15 The Canadian Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Figure 6.16 The Canadian Chemical EOR Production Share Forecast 2019, 2024 and 2029 (%)

Figure 6.17 The Canadian Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %)

Figure 6.18 The Canadian Chemical EOR Spending Market Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.19 Total Oil Production (bbl/d) in Canada by Year 1980-2018 (‘000 bbl/d)

Figure 6.20 Top 10 Oil Producers Globally 2018 (‘000 bbl/d)

Figure 6.21 Timeline of Developments in the Pelican Lake Field, Canada 1970-2005

Figure 6.22 Chemical EOR Projects in Alberta, Canada 1982-2012 (Blue: Alkaline; Green: AP; Orange: ASP; Purple: Polymer; Red: Other)

Figure 6.23 The Russian Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Figure 6.24 The Russian Chemical EOR Production Share Forecast 2019, 2024 and 2029 (%)

Figure 6.25 The Russian Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %)

Figure 6.26 The Russian Chemical EOR Spending Market Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.27 Incremental Production From EOR Technologies In 2019, %

Figure 6.28 Incremental Production From EOR Technologies As A Share Of Total Production In The Region In 2019, %

Figure 6.27 The Omani Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Figure 6.28 The Omani Chemical EOR Production Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.29 The Omani Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %)

Figure 6.30 The Omani Chemical EOR Spending Market Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.31 Estimated Oil Recovery Before and After Polymer Flooding (%)

Figure 6.32 The Rest of the Middle East Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Figure 6.33 The Rest of the Middle East Chemical EOR Production Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.34 The Rest of the Middle East Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %)

Figure 6.35 The Indonesian Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Figure 6.36 The Indonesian Chemical EOR Production Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.37 The Indonesian Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %)

Figure 6.38 The Indonesian Chemical EOR Spending Market Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.39 Indonesian Oil Production 2007-2018 (Thousand bpd)

Figure 6.40 Oil and Condensate Reserves In Indonesia, 2019 (%)

Figure 6.41 The Venezuelan Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Figure 6.42 The Venezuelan Chemical EOR Production Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.43 The Venezuelan Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %)

Figure 6.44 The Venezuelan Chemical EOR Spending Market Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.45 Total Oil Production in Venezuela 1990-2019 (‘000 bbl/d)

Figure 6.46 The Colombian Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Figure 6.47 The Colombian Chemical EOR Production Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.48 The Colombian Chemical EOR Spending Market Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.49 The Rest of Latin America Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Figure 6.50 Rest of Latin America Chemical EOR Production Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.51 The Rest of Latin America Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %)

Figure 6.52 Rest of Latin America Chemical EOR Market Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.53 Argentina Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Figure 6.54 Argentina Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %)

Figure 6.55 The US Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Figure 6.56 The US Chemical EOR Production Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.57 The US Chemical EOR Spending Market Forecast, 2019-2029

Figure 6.58 The US Chemical EOR Spending Market Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.59 Locations of US Chemical Pilot Projects by Type: ASP, Alkaline, AP, AS and SP

Figure 6.60 Department of Energy Funding Allocation, Ultra-Deepwater Vs. Unconventional Resources Vs. Small Producer

Figure 6.61 The Indian Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Figure 6.62 The Indian Chemical EOR Production Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.63 The Indian Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %)

Figure 6.64 The Indian Chemical EOR Spending Market Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.65 Total Oil Production in India 1990-2018 (‘000 bbl/d)

Figure 6.66 Oil Production and Consumption in India 1990-2017 (‘000 bbl/d)

Figure 6.67 The Mexican Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Figure 6.68 The Mexican Chemical EOR Production Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.69 The Mexican Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %)

Figure 6.70 The Mexican Chemical EOR Spending Market Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.71 Oil Production in Mexico 1990-2019 (Thousand bbl/d)

Figure 6.72 The North Sea Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %)

Figure 6.73 The North Sea Chemical EOR Production Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.74 The North Sea Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %)

Figure 6.75 The North Sea Chemical EOR Spending Market Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.76 The Malaysian Chemical EOR Production Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.77 The Malaysian Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %)

Figure 6.78 The Malaysian Chemical EOR Spending Market Share Forecast, 2019, 2024 and 2029 (%)

Figure 6.79 Thailand Chemical EOR Production Forecast, 2019-2029 (bbl/d, AGR %, CAGR%, Cumulative)

Figure 6.80 Thailand Chemical EOR Spending Market Forecast, 2019-2029 ($m, AGR %)

Figure 6.81 Thailand Oil Production, 2007-2019 (Thousand bbl/d)

Figure 6.82 PTT Public Company Limited Annual Revenue, Business Segment (%)

Figure 7.1 SWOT Analysis for Biopolymers

Figure 7.2 SWOT Analysis for Hybrid Approaches to Chemical EOR

Figure 7.3 SWOT Analysis for Nanotechnology Development

Figure 10.1 Leading Companies and Research Bodies in the Global Chemical EOR Market (Operators, Chemical Providers and Developers and R&D Institutes)

Figure 10.2 Distribution of BlackPearl Resources’ Capital Expenditure in 2018

Figure 10.3 Cenovus’ EOR Production Split (%) Thermal, Gas and Chemical

Figure 10.4 CNOOC 2014 Crude and Liquid Production by Region

Figure 10.5 CNRL Sales Values 2012, 2013 and 2014 (US $m)

Figure 10.6 Murphy Oil Crude Oil and Liquids Production per Global Region (bbl/d)

Figure 10.7 Sinopec’s 2014 Crude Oil Production by Region (million bbl/d)

Figure 10.8 Zargon Oil and Gas Budget by Production Type: Non-ASP Vs. ASP (%) in 2018

Figure 10.9 BP p.l.c. Annual Revenue, 2016 – 2018 (USD Million)

Figure 10.10 BP p.l.c. Annual Revenue, By Product, 2018 (%)

Figure 10.11 Leading Chemical Companies by Revenue, 2018 (USD Billion)

Accelerated Oil Technologies LLC

Anterra Energy Inc

BASF

Beijing Hengju Chemical Group Corp

Belayim Petroleum Company

Berexco

BlackPearl Resources

BP

BP Migas

Cairn Energy India

Cenovus

Chevron

China Petroleum & Chemical Corporation

CNOOC

CNPC

CNRL

Connacher Oil and Gas Limited

Dow

Ecopetrol S.A

ExxonMobil

GlassPoint

Harvest Energy

Harvest Operations

Huntsman

Husky Energy

Husky Oil Operations

Hyak Energy

Hyundai

IFP Energies Nouvelles

Kemira

KOC

Lukoil

Medco Enerji Internasional

Murphy Oil

Nalco

Nexen Inc.

Occidental Petroleum

Oil Chem Technologies

Oil India Ltd.

ONGC

Pan American Energy

Partex Corporation

Pengrowth Energy Corporation

Penn West

Pertamina

Petroamazonas

Petrobras

Petrochina

Petróleos de Venezuela, S.A. (PDVSA)

Petróleos Mexicanos (PEMEX)

Petroleum Development Oman (PDO)

Petronas

Petrofac

PT Chevron Pacific Indonesia

PT Erraenersi Konstruksindo

PT Multi Structure

PwC

Repsol

Rex Energy

Rock Energy

RusPAV

Sasol

Saudi Aramco

Shandong Polymer Bio-Chemicals Co. Ltd

Shell (Royal Dutch Shell)

Shell Canada

Shell Chemicals

SIBUR

Siemens Energy

Sinopec (China Petroleum and Chemical Corporation)

SNF Group

Solvay

Statoil

Stepan

Surtek

Talisman

TD Securities

Terrex Energy

Texaco

Tiorco

Titan Oil Recovery Inc.

Total

Wintershall

YPF

Zargon Oil and Gas

Government Agencies and Other Organisations Mentioned in This Report

Alberta Energy Regulator

CASCO

CCC Leduc

Centre of Excellence in EOR (Malaysia)

Chemical EOR Alliance

Chinese EOR Laboratory

EOR Centre of Excellence (Oman)

EXPEC Advanced Research Center

FORCE (Forum for improved oil and gas recovery and improved exploration in Norway)

Government of Alberta

Government of Oman

Instituto Colombiano del Petróleo (ICP)

National Energy Technology Laboratory (NETL)

National Enhanced Oil Recovery Institute

Norwegian Government

Oil & Gas UK

OPEC

Petroleum Technology Research Centre

Research Partnership to Secure Energy for America (RPSEA)

RNZ Integrated

Saskatchewan Ministry of the Economy

Texas A&M University

UAE Oil Ministry

University of Kansas

University of Oklahoma

University of Wyoming

University of Wyoming Enhanced Oil Recovery Institute

US Department of Energy (DoE)

US EIA

World Bank

Download sample pages

Complete the form below to download your free sample pages for Chemical Enhanced Oil Recovery (EOR) Market 2019-2029

Related reports

-

Intelligent Pumps Market Report 2018-2028

The increased focus on efficient energy usage has led Visiongain to publish this timely report. The intelligent pumps market is...Full DetailsPublished: 18 September 2018 -

Marine Seismic Equipment & Acquisition Market Forecast 2019-2029

Visiongain assesses that marine seismic equipment and acquisition market will reach $5.39bn in 2019. ...Full DetailsPublished: 21 June 2019 -

Carbon Capture & Storage (CCS) Market Report 2018-2028

The Paris Climate Summit had 187 countries in attendance and certain measures were put in place to combat climate change...

Full DetailsPublished: 16 March 2018 -

Pipeline Leak Detection Market of the Oil and Gas Industry 2019-2029

Pipeline Leak Detection market of the oil and gas industry market worth $2.8 billion in 2019. ...Full DetailsPublished: 06 August 2019 -

Clean Coal Technologies (CCT) Market 2019-2029

Visiongain has calculated that the clean coal market will see a total expenditure of $3.68bn in 2019, from capital expenditure...Full DetailsPublished: 18 July 2019 -

Land Seismic Equipment & Acquisition Market Forecast 2020-2030

Land Seismic Equipment & Acquisition Market reached an accumulative capital expenditure (CAPEX) of $2,405.3mn in 2019....Full DetailsPublished: 05 December 2019 -

Carbon Capture & Storage (CCS) Market Report 2019-2029

Carbon Capture & Storage (CCS) market expected to continue growing amid climate change fears....Full DetailsPublished: 13 August 2019 -

Thermal Enhanced Oil Recovery (EOR) Market Report 2020-2030

This market is expected to grow at a faster pace, owing to continuous work over oil fields, rapid depletion of...

Full DetailsPublished: 27 November 2019 -

Carbon Dioxide (CO2) Enhanced Oil Recovery (EOR) Market 2019-2029

The latest report from business intelligence provider visiongain offers in depth analysis of the global carbon dioxide (CO2) enhanced oil...Full DetailsPublished: 13 December 2018 -

EOR Yearbook 2018: The Ultimate Guide To Enhanced Oil Recovery (EOR)

Visiongain’s latest EOR yearbook provides you with this unprecedented in-Depth analysis of the global EOR market. Visiongain assesses that the...

Full DetailsPublished: 24 January 2018

Download sample pages

Complete the form below to download your free sample pages for Chemical Enhanced Oil Recovery (EOR) Market 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Latest Energy news

Visiongain Publishes Carbon Capture Utilisation and Storage (CCUS) Market Report 2024-2034

The global carbon capture utilisation and storage (CCUS) market was valued at US$3.75 billion in 2023 and is projected to grow at a CAGR of 20.6% during the forecast period 2024-2034.

19 April 2024

Visiongain Publishes Liquid Biofuels Market Report 2024-2034

The global Liquid Biofuels market was valued at US$90.7 billion in 2023 and is projected to grow at a CAGR of 6.7% during the forecast period 2024-2034.

03 April 2024

Visiongain Publishes Hydrogen Generation Market Report 2024-2034

The global Hydrogen Generation market was valued at US$162.3 billion in 2023 and is projected to grow at a CAGR of 3.7% during the forecast period 2024-2034.

28 March 2024

Visiongain Publishes Biofuel Industry Market Report 2024-2034

The global Biofuel Industry market was valued at US$123.2 billion in 2023 and is projected to grow at a CAGR of 7.6% during the forecast period 2024-2034.

27 March 2024