Visiongain has forecasted that the global Offshore Oil & Gas Decommissioning market will see a capital expenditure (CAPEX) of $7,076mn in 2019. Read on to discover the potential business opportunities available.

With such established global offshore oil and gas fields, decommissioning becomes increasingly pertinent. As global offshore oil and gas fields mature, ageing structures must be removed. With the average lifetime of an offshore oil and gas field in the region of 25 to 40 years, this leaves many global structures in need of decommissioning.

The cost involved in the decommissioning varies from project to project and coast to coast. The majority of costs are associated with the jacket, topside and subsea structure removal phases and well P&A.

Decommissioning projects are highly complex, lengthy and expensive; the process involves many different stages and can take more than a decade to complete. With such environmental, economic and social pressures, the offshore decommissioning market is set to drastically increase, creating substantial business opportunities along the way.

Visiongain’s global Offshore Oil & Gas Decommissioning market report can keep you informed and up to date with the developments in the market, across four different regions: The Gulf of Mexico and North America, the North Sea, Asia Pacific and Rest of the World

With reference to this report, it details the key investments trend in the global market, subdivided by regions, capital and operational expenditure and project type. Through extensive secondary research and interviews with industry experts, Visiongain has identified a series of market trends that will impact the Offshore Oil & Gas Decommissioning market over the forecast timeframe.

The report will answer questions such as:

– How is the offshore oil & gas decommissioning market evolving?

– What is driving and restraining the offshore oil & gas decommissioning market?

– How will each offshore oil & gas decommissioning submarket segment grow over the forecast period and how much revenue will these submarkets account for in 2029?

– How will the market shares for each offshore oil & gas Decommissioning submarket develop from 2019 to 2029?

– What will be the main driver for the overall market from 2019 to 2029?

– Will leading offshore oil & gas decommissioning markets broadly follow the macroeconomic dynamics, or will individual national markets outperform others?

– How will the market shares of the national markets change by 2029 and which geographical region will lead the market in 2029?

– Who are the leading players and what are their prospects over the forecast period?

– What are the decommissioning projects for these leading companies?

– How will the industry evolve during the period between 2019 and 2029?

Five Reasons Why You Must Order and Read This Report Today:

1) The report provides forecasts for the Global Offshore Oil & Gas Decommissioning market, by TYPE, for the period 2019-2029

– Well P&A CAPEX 2019-2029

– Jackside & Topside Removal CAPEX 2019-2029

– Others CAPEX 2019-2029

2) The report also forecasts and analyses the global Offshore Oil & Gas Decommissioning market by Regions from 2019-2029

– Gulf of Mexico and North America CAPEX 2019-2029

– North Sea CAPEX 2019-2029

– Asia-Pacific CAPEX 2019-2029

– Rest of the World CAPEX 2019-2029

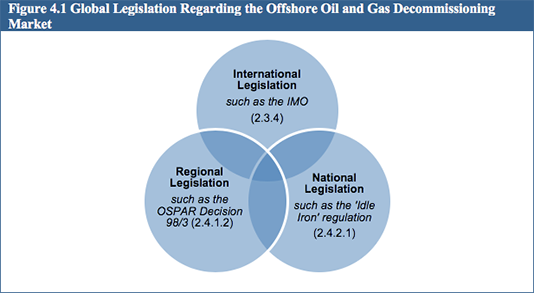

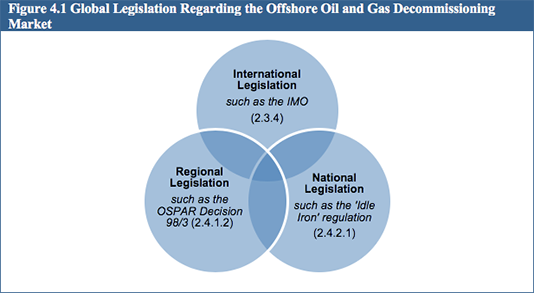

3) The report reveals global regulations and agreements affecting the Offshore Oil and Gas Decommissioning Industry:

4) The report includes Leading Companies analysis in the Offshore Oil & Gas Decommissioning Market Companies

– Companies with Offshore Assets

– Decommissioning Contractors

– Decommissioning Consultancies

5) The report provides detailed profiles of the leading companies operating within the Offshore Oil & Gas Decommissioning market:

– BP Plc

– Canadian Natural Resources

– Chevron Corporation

– ConocoPhillips

– ExxonMobil Corporation

– Total S.A.

– Royal Dutch Shell Plc

– ENI

This independent 135-page report guarantees you will remain better informed than your competitors. With 116 tables and figures examining the Offshore Oil & Gas Decommissioning market space, the report gives you a direct, detailed breakdown of the market. PLUS, Capital expenditure by Type and by Region, as well as in-depth profiles of Companies that will keep your knowledge that one step ahead of your rivals.

This report is essential reading for you or anyone in the Oil and Gas sector. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Offshore Oil & Gas Decommissioning Market Overview

1.2 Global Offshore Oil & Gas Decommissioning Market Segmentation

1.3 Market Definition

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Why You Should Read This Report?

1.7 Who is This Report For?

1.8 Methodology

1.9 Frequently Asked Questions (FAQ)

1.10 Associated Visiongain Reports

1.11 About Visiongain

2. Introduction and Brief History of Offshore Oil & Gas Decommissioning

2.1 What are the stages of Offshore Oil & Gas Decommissioning?

2.1.1 Project Planning and Permitting

2.1.2 Well Plugging and Abandonment (P&A)

2.1.3 Pipeline Cleaning and Decommissioning

2.1.4 Jacket and Topsides Removal

2.1.5 Onshore Disposal

2.1.6 Site Clearance

2.1.7 Continued Monitoring

3. Global Offshore Oil & Gas Decommissioning Market: What are the Global Market Dynamics?

3.1 Drivers and Restraints

3.2 Drivers: What are the Factors Promoting the Growth in the Offshore Oil & Gas Decommissioning Market?

3.2.1 Aging of Oil and Gas Fields and Offshore Infrastructure

3.2.2 Crude Oil Prices

3.3 Visiongain’s Oil Price Assumptions and Forecast

4. Global Regulations Regarding the Offshore Oil and Gas Decommissioning Industry

4.1 1958 Geneva Convention on the Continental Shelf

4.2 1972 London Dumping Convention

4.3 1982 United Nations (UN) Law of the Sea Convention

4.4 International Maritime Organization (IMO) Guidelines

5. Offshore Oil & Gas Decommissioning Markets Forecasts by Type 2019-2029

5.1 Offshore Oil & Gas Decommissioning of Well P&A Market Forecast 2019 2029

5.2 Jackside & Topside Removal Offshore Oil & Gas Decommissioning Market Forecast 2019 2029

5.3 Other Offshore Oil & Gas Decommissioning Market Forecast 2019 2029

6. Offshore Oil & Gas Decommissioning Market Forecast by Region 2019-2029

6.1 Which Geographic Regional Offshore Oil & Gas Decommissioning Markets Share Forecast 2019-2029

6.2 Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market Forecast 2019-2029

6.2.1 North American Regulations

6.2.2 Notice to Lessees and Operators on “Idle Iron”

6.2.3 National Artificial Reef Plan

6.2.4 What is the Structure of the Gulf of Mexico Offshore Oil and Gas Decommissioning Market?

6.2.5 What are the Market Dynamics of the Gulf of Mexico Offshore Oil and Gas Decommissioning Market?

6.2.5.1 The Impact of Ageing Offshore Structures

6.2.5.2 How Strong Regulations have had a Role to Play in the Growth of the Offshore Decommissioning Market in the Gulf of Mexico?

6.2.5.3 Hurricane Damage

6.2.5.4 The Impact of Rigs-to-Reef

6.2.5.5 Has Experience and Skills Led to Market Growth in the Gulf of Mexico?

6.2.5.6 Growth of Unconventional Energy Resources – the Shale Oil and Gas Revolution

6.2.5.7 The Impact of Investments to Prolong the Life of the Fields

6.2.5.8 Permitting Process – Has this Prolonged the Offshore Decommissioning Procedure?

6.2.6 What is the Scenario of Offshore Oil & Gas Decommissioning in Gulf of Mexico and North America Market by Type?

6.2.7 Which is the Largest Market among the Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market 2019-2029?

6.2.7.1 The Gulf of Mexico Offshore Oil & Gas Decommissioning Market Forecast 2019-2029

6.2.7.2 Rest of NAFTA Offshore Oil & Gas Decommissioning Market Forecast 2019-2029

6.3 North Sea Offshore Oil & Gas Decommissioning Market Forecast 2019-2029

6.3.1 Characteristics of the North Sea Offshore Oil and Gas Decommissioning Market

6.3.2 Historical Trends in the North Sea Offshore Oil and Gas Decommissioning Market

6.3.3 European Regulations

6.3.3.1 The Marine Strategy Framework Directive

6.3.3.2 The Oslo/Paris (OSPAR) Agreements

6.3.3.3 EU Water Framework Directive

6.3.3.4 EU Habitats and Birds Directives

6.3.3.5 United Kingdom Regulations

6.3.3.5.1 The Petroleum Act 1998

6.3.3.5.2 Energy Act 2008

6.3.3.6 Norwegian Regulations

6.3.3.6.1 The Petroleum Activities Act 1996

6.3.3.6.2 The Pollution Control Act

6.3.4 What is the Scenario of Offshore Oil & Gas Decommissioning in the North Sea Market by Type?

6.3.5 Which is the Largest Market among the North Sea Offshore Oil & Gas Decommissioning Market 2019-2029?

6.3.5.1 UK North Sea Offshore Oil & Gas Decommissioning Market Forecast 2019-2029

6.3.5.2 Norwegian North Sea Offshore Oil & Gas Decommissioning Market Forecast 2019-2029

6.3.5.3 Rest of North Sea Offshore Oil & Gas Decommissioning Market Forecast 2019-2029

6.4 Asia-Pacific Offshore Oil & Gas Decommissioning Market Forecast 2019-2029

6.4.1 Characteristics of the Asia-Pacific Offshore Oil and Gas Decommissioning Market

6.4.2 What are the Dynamics in Asia-Pacific’s Offshore Oil & Gas Decommissioning Market?

6.4.2.1 Substantial Number of Ageing Structures

6.4.2.2 What are the Decommissioning Conditions in Asia-Pacific?

6.4.2.3 The Limitations of Regulation

6.4.2.4 Lack of Training, Expertise, Equipment and Facilities

6.4.2.5 Deepwater Development and Increasing Production – an Obstruction to Offshore Decommissioning?

6.4.2.6 NOC Control and Budgets

6.4.3 What is the Scenario of Offshore Oil & Gas Decommissioning in the Asia-Pacific Market by Type?

6.4.4 Which is the Largest Market among the Asia-Pacific Offshore Oil & Gas Decommissioning Market?

6.4.4.1 China Offshore Oil & Gas Decommissioning Market Forecast 2019-2029

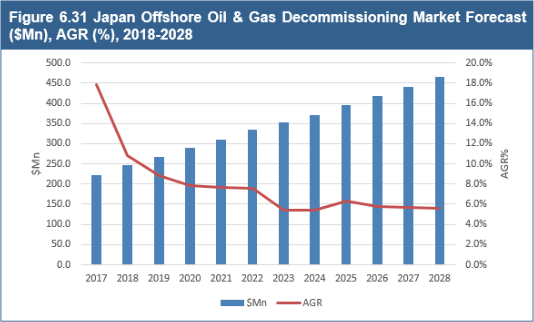

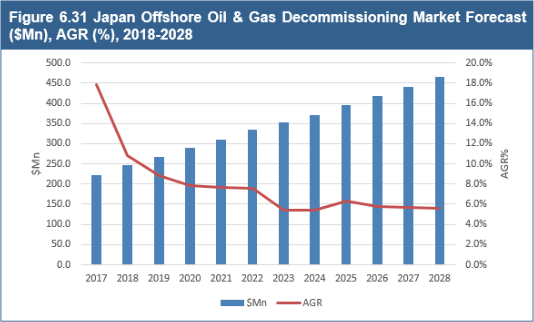

6.4.4.2 Japan Offshore Oil & Gas Decommissioning Market Forecast 2019-2029

6.4.4.3 Australia Offshore Oil & Gas Decommissioning Market Forecast 2019-2029

6.4.4.4 Rest of APAC Offshore Oil & Gas Decommissioning Market Forecast 2019-2029

6.5 RoW Offshore Oil & Gas Decommissioning Market Forecast 2019-2029

6.5.1 What is the Scenario of Offshore Oil & Gas Decommissioning in the RoW market by Type?

6.5.2 Which is the Largest Market among the RoW Offshore Oil & Gas Decommissioning Market?

6.5.2.1 Latin America Offshore Oil & Gas Decommissioning Market Forecast 2019-2029

6.5.2.2 Middle East and Africa Offshore Oil & Gas Decommissioning Market Forecast 2019-2029

7. PEST Analysis of the Global Offshore Oil and Gas Decommissioning Market

8. Leading Companies in the Offshore Oil & Gas Decommissioning Market

8.1 Oil and Gas Companies with Offshore Assets

8.1.1 Apache Corporation

8.1.2 BP

8.1.3 Canadian Natural Resources (CNR)

8.1.4 Chevron Corporation

8.1.5 ConocoPhillips

8.1.6 Eni

8.1.7 ExxonMobil Corporation

8.1.8 Petronas

8.1.9 PTTEP Australasia

8.1.10 Royal Dutch Shell

8.1.11 Statoil

8.1.12 Total S.A.

8.2 Decommissioning Contractors

8.2.1 AF Gruppen (The AF Group)

8.2.2 Aker Solutions

8.2.3 Allseas Group

8.2.4 AMEC

8.2.5 Baker Hughes

8.2.6 Cal Dive International

8.2.7 Cutting Underwater Technologies (CUT)

8.2.8 Halliburton

8.2.9 Heerema Marine Contractors (HMC)

8.2.10 Mactech Inc.

8.2.11 Mammoet Salvage

8.2.12 Oceaneering (Norse Cutting and Abandonment)

8.2.13 Pipeline Services International (PSI)

8.2.14 Proserv

8.2.15 Saipem

8.2.16 SapuraAcergy

8.2.17 Schlumberger

8.2.18 Stork Technical Services

8.2.19 Subsea 7

8.2.20 Technip

8.2.21 TETRA Technologies, Inc.

8.2.22 Weatherford International

8.2.23 Wild Well Control

8.2.24 Wood Group

8.2.25 Bibby Offshore Limited

8.2.26 Maersk Decom

8.2.27 ABLE UK

8.2.28 Petrofac

8.3 Decommissioning Consultancies

8.3.1 BMT Cordah

8.3.2 Bureau Veritas

8.3.3 Eric Faulds Associates, Ltd.

8.3.4 Genesis Oil and Gas Consultants Ltd.

8.3.5 Optimus

8.3.6 PB Consultants

8.3.7 Ramboll

8.3.8 Reverse Engineering Services, Ltd (RESL)

8.3.9 TSB Offshore

8.3.10 WorleyParsons

8.3.11 Linch-Pin Offshore Management Services

9. Conclusions and Recommendations

9.1 Key Findings

9.2 Recommendations

10. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 3.1 Visiongain’s Anticipated Brent Crude Oil Price, 2018, 2019, 2020-2022, 2023-2025, 2026-2029 ($/bbl)

Table 5.1 Global Offshore Oil & Gas Decommissioning Market by Type Forecast ($Mn, AGR (%), CAGR (%), 2019-2029

Table 5.2 Global Well P&A Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 5.3 Global Jackside & Topside Removal Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 5.4 Global Other Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.1 Regional Offshore Oil & Gas Decommissioning Markets Forecasts ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.2 Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.3 Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market by Type Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.4 The Gulf of Mexico Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.5 Rest of NA Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.6 North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.7 North Sea Offshore Oil & Gas Decommissioning Market by Type Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.8 UK North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.9 Norwegian North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.10 Denmark Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.11 Netherlands Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.12 Rest of North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.13 Asia-Pacific Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.14 Asia-Pacific Offshore Oil & Gas Decommissioning Market by Type Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.15 China Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.16 Japan Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.17 Australia Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.18 Indonesia Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.19 Malaysia Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.20 Rest of APAC Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.21 RoW Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.22 RoW Offshore Oil & Gas Decommissioning Market by Type Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.23 Latin America Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 6.24 Middle East and Africa Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), CAGR (%), 2019-2029

Table 7.1 PEST Analysis of the Global Offshore Oil and Gas Decommissioning Market 2019-2029

Table 8.1 BP PLC Profile 2017 (CEO, Total Company Revenue US$m, Decommissioning Liabilities $m, Net Income / Loss (US$m), Net Capital Expenditure (US$m), Strongest Business Region & Business Segment, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.2 Canadian Natural Resources Limited Profile 2017 (CEO, Total Company Revenue US$m, Net Income / Loss (US$m), Net Capital Expenditure (US$m), Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.3 Chevron Corporation Profile 2017 (CEO, Total Company Revenue US$m, Net Income / Loss (US$m), Net Capital Expenditure (US$m), Strongest Business Region & Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.4 ConocoPhillips Company Profile 2017 (CEO, Total Company Revenue US$m, Net Income / Loss (US$m), Net Capital Expenditure (US$m), Strongest Business Region & Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.5 ExxonMobil Corporation Profile 2017 (CEO, Total Company Revenue US$m, Net Income / Loss (US$m), Net Capital Expenditure (US$m), Strongest Business Region & Business Segment, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.6 Total S.A. Profile 2017 (CEO, Total Company Revenue US$m, Net Income / Loss (US$m), Net Capital Expenditure (US$m), Strongest Business Region & Business Segment, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.7 Royal Dutch Shell plc Profile 2017 (CEO, Total Company Revenue US$m, Net Income / Loss (US$m), Net Capital Expenditure (US$m), Strongest Business Region & Business Segment, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.8 ENI 2017 (CEO, Total Company Revenue US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.9 ENI Total Company Revenue 2012-2017 (US$m, AGR %)

Table 8.10 Leading Decommissioning Contractors

Table 8.11 Leading Decommissioning Consultancies

List of Figures

Figure 1.1 Global Offshore Oil & Gas Decommissioning Market Segmentation

Figure 2.1 Stages in Offshore Oil and Gas Decommissioning?

Figure 3.1 Global Offshore Oil & Gas Decommissioning Market Drivers and Restraints 2019-2029

Figure 4.1 Global Legislation Regarding the Offshore Oil and Gas Decommissioning Market

Figure 5.1 Global Offshore Oil & Gas Decommissioning Market Forecast ($Mn, AGR (%), 2019-2029

Figure 5.2 Global Well P&A Offshore Oil & Gas Decommissioning Market by Region Forecast ($Mn, AGR (%), 2019-2029

Figure 5.3 Global Jackside & Topside Removal Offshore Oil & Gas Decommissioning Market by Region Forecast ($Mn), AGR (%), 2019-2029

Figure 5.4 Global Other Offshore Oil & Gas Decommissioning Market by Region Forecast ($Mn), AGR (%), 2019-2029

Figure 6.1 Regional Offshore Oil & Gas Decommissioning Markets Forecasts ($Mn, AGR (%), 2019-2029

Figure 6.2 Regional and Leading National Offshore Oil & Gas Decommissioning Markets Forecasts (AGR (%), 2019-2029

Figure 6.3 Regional Offshore Oil & Gas Decommissioning Markets Share Forecast (% Share), 2019

Figure 6.4 Regional Offshore Oil & Gas Decommissioning Markets Share Forecast (% Share), 2024

Figure 6.5 Regional Offshore Oil & Gas Decommissioning Markets Share Forecast (% Share), 2029

Figure 6.6 Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.7 Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.8 Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.9 Gulf of Mexico and North America Offshore Oil & Gas Decommissioning Market By Country (% Share), 2019

Figure 6.10 The Gulf of Mexico Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.11 The Gulf of Mexico Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.12 Rest of NA Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.13 Rest of NA Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.14 North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.15 North Sea Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.16 North Sea Offshore Installations by Country (%) 2019

Figure 6.17 North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.18 North Sea Offshore Oil & Gas Decommissioning Market by Country (% Share), 2019

Figure 6.19 UK North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.20 UK North Sea Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.21 Norwegian North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.22 Norwegian North Sea Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.23 Denmark Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.24 Denmark Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.25 Netherlands Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.26 Netherlands Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.27 Rest of North Sea Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.28 Rest of North Sea Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.29 Asia-Pacific Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.30 Asia-Pacific Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.31 Asia-Pacific Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.32 Asia-Pacific Offshore Oil & Gas Decommissioning Market by Country (% Share), 2019

Figure 6.33 China Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.34 China Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.35 Japan Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.36 Japan Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.37 Australia Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.38 Australia Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.39 Indonesia Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.40 Indonesia Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.41 Malaysia Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.42 Malaysia Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.43 Rest of APAC Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.44 Rest of APAC Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.45 RoW Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.46 RoW Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.47 RoW Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.48 RoW Offshore Oil & Gas Decommissioning Market by Region (% Share), 2019

Figure 6.49 Latin America Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.50 Latin America Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 6.51 Middle East and Africa Offshore Oil & Gas Decommissioning Market Forecast ($Mn), AGR (%), 2019-2029

Figure 6.52 Middle East and Africa Offshore Oil & Gas Decommissioning Market Share Forecast (% Share), 2019, 2024 and 2029

Figure 8.1 Business Performance of BP PLC, 2015-2017, $Mn

Figure 8.2 Business Performance of BP PLC, By Business Segments, 2017, %share

Figure 8.3 Business Performance of Canadian Natural Resources Limited, 2015-2017, $Mn

Figure 8.4 Business Performance of Chevron Corporation, 2015-2017, $Mn

Figure 8.5 Business Performance of Chevron Corporation, By Business Segments, 2017, %share

Figure 8.6 Company Revenue of ConocoPhillips Company, 2015-2017, $Mn

Figure 8.7 Business Performance of ConocoPhillips Company, By Product, 2017, %Share

Figure 8.8 Business Performance of ConocoPhillips Company, By Geography, 2017, %Share

Figure 8.9 Total Company Revenue of ExxonMobil Corporation, 2015-2017, $Mn

Figure 8.10 Business Performance of ExxonMobil Corporation, By Business Segments, 2017, %share

Figure 8.11 Total Company Revenue of Total S.A., 2015-2017, $Mn

Figure 8.12 Business Performance of Total S.A., By Business Segments, 2017, %share

Figure 8.13 Total Company Revenue of Royal Dutch Shell plc, 2015-2017, $Mn

Figure 8.14 Business Performance of Royal Dutch Shell plc, By Business Segments, 2017, %share

Figure 8.15 ENI Total Company Revenue 2012-2017 (US$m, AGR %)

Able UK

AF Gruppen

Aker Solutions

Allseas

AP Møller

Atotech

Baker Hughes

Bayernoil

Bibby Offshore Limited

BMT Cordah

BP

Brasil Petroleo Ltda

Cal Dive International

Canadian Natural Resources

Chevron Corporation

Chevron Brasil Oleo & Gas Ltda

ConocoPhillips

Cutting Underwater Solutions (CUT)

Daewoo

ENI

Eric Faulds Associates Ltd

ExxonMobil

Genesis Oil and Gas Consultants Ltd

Halliburton

Heerema Marine Contractors (HMC)

JX Nippon Oil and Gas Exploration Corporation

Linch-Pin Offshore Management Solutions

Maamoet Salvage

Mactech Inc.

Maersk Decom

Mauritania Deepwater Ltd.

Oceaneering (Norse Cutting and Abandonment)

Optimus

PB Consultants

Petrofac

Petronas

Petrobras

Perenco

Pipeline Services International

Proserv

Ramboll

Reverse Engineering Services Ltd (RESL)

Royal Dutch Shell

Saipem

Sapura Acergy

Schlumberger

Stork Technical Services

Subsea 7

Technip

Tetra Technologies

Total S.A.

Total Erg

TSB Offshore

Versabar

Weatherford International

Wild Well Control

Wood Group

Worley Parsons

Zhejiang

Organisations Mentioned

Asean Council on Petroleum (ASCOPE)

Bureau of Ocean Energy Management (BOEM)

Bureau of Safety and Environmental Enforcement (BSEE)

Bureau Veritas

Department of Commerce and the National Oceanic and Atmospheric Administration (NOAA)

International Maritime Organisation (IMO)

Kuwait Foreign Petroleum Exploration Company (KUFPEC)

Oil and Gas Authority (OGA)