Industries > Energy > The Microgrid Market Forecast 2019-2029

The Microgrid Market Forecast 2019-2029

Forecasts by Application Including Remote, Utility Distribution, Commercial and Industrial, Community, Institutional/Campus and Military AND National Markets with Extensive Details & Analysis of Contracts, Projects and Programmes PLUS Leading Companies in the Microgrid Market

Visiongain has calculated that the Microgrid Market will see a capital expenditure (CAPEX) of $12.6bn in 2019. Read on to discover the potential business opportunities available.

Microgrid is one of the most advanced concepts in the power generation. The technology acts as a promising source of electricity during emergencies, bad weather conditions and power outages.

The microgrid market is mainly driven by factors including rising demand for efficient energy usage, growing adoption of renewable energy and need for efficient grid infrastructure. The rapid growth in the population has led to increased congestion and stress on the existing grid leading to an unbalanced and inefficient supply of electricity among the consumers; the bulk of them affected by lack of electricity supply.

Most of the rural and remote areas across the world lack an efficient supply of electricity and thus have to rely on imported fossil fuels to meet their energy requirements. The bulk of them lack connectivity to power grids.

Microgrid has an ability to store energy and can be connected and disconnected from the main grid. It helps deliver secure energy for emergency facilities including hospitals, defence and police stations during extreme climatic and weather conditions. The microgrid technology can suffice both fossil fuel and renewable energy resources which can lead to a clean, affordable and efficient electricity supply both on-grid and off-grid

The deployment of microgrid technology will not only reduce the burden on existing utilities but will also help reduce greenhouse gases through the adoption of renewable resources. The technology can be considered as a building block towards the development of smart energy system with its compact design and high reliability during emergency conditions.

Microgrid market is expected to witness a high potential in remote regions and islands. Increasing measures by the government to facilitate efficient and reliable electrification benefits will boost the demand for microgrid globally

Visiongain’s Microgrid market report can keep you informed and up to date with the developments in the market, across five different regions: North America, Europe, Middle East & Africa, Asia Pacific and Latin America.

With reference to this report, it details the key investments trend in the global Microgrid market, subdivided by regions, capital expenditure and capacity. Through extensive secondary research and interviews with industry experts, Visiongain has identified a series of market trends that will impact the Microgrid market over the forecast timeframe.

The report will answer questions such as:

– How is the Microgrid market evolving?

– What is driving and restraining Microgrid market dynamics?

– How will each Microgrid submarket segment grow over the forecast period and how much Sales will these submarkets account for in 2029?

– How will market shares of each Microgrid submarket develop from 2019-2029?

– Which individual technologies will prevail and how will these shifts be responded to?

– Which Microgrid submarket will be the main driver of the overall market from 2019-2029?

– How will political and regulatory factors influence regional Microgrid markets and submarkets?

– Will leading national Microgrid market broadly follow macroeconomic dynamics, or will individual country sectors outperform the rest of the economy?

– How will market shares of the national markets change by 2029 and which nation will lead the market in 2029?

– Who are the leading players and what are their prospects over the forecast period?

– How will the sector evolve as alliances form during the period between 2019 and 2029?

Five Reasons Why You Must Order and Read This Report Today:

1) The report provides Analysis and Forecasts for the Microgrid Markets by

– CAPEX (US$m)

– Capacity (MW)

2) The report provides forecasts for the Microgrid Market by Application, for the period 2019-2029

– Remote Application Forecast 2019-2029

– Utility Distribution Application Forecast 2019-2029

– Commercial and Industrial Application Forecast 2019-2029

– Community Application Forecast 2019-2029

– Institutional/Campus Application Forecast 2019-2029

– Military Application Forecast 2019-2029

3) The report provides forecasts for the Microgrids Market by Region, for the period 2019-2029

North America Microgrid Market

– US Microgrid Forecast 2019-2029

– Canada Microgrid Forecast 2019-2029

Europe Microgrid Market Forecast

– Russia Microgrid Forecast 2019-2029

– France Microgrid Forecast 2019-2029

– Denmark Microgrid Forecast 2019-2029

– Rest of Europe Microgrid Forecast 2019-2029

Asia-Pacific Microgrid Market

– China Microgrid Forecast 2019-2029

– Japan Microgrid Forecast 2019-2029

– South Korea Microgrid Forecast 2019-2029

– India Microgrid Forecast 2019-2029

– Rest of Asia-Pacific Microgrid Forecast 2019-2029

Latin America Microgrid Market

– Brazil Microgrid Forecast 2019-2029

– Rest of Latin America Microgrid Forecast 2019-2029

Middle East and Africa Microgrid Market

– Saudi Arabia Microgrid Forecast 2019-2029

– South Africa Microgrid Forecast 2019-2029

– Rest of the Middle East and Africa Microgrid Forecast 2019-2029

4) The report also includes Extensive details and analysis of contracts, projects and programmes in the Microgrid Market information on:

– Location

– Technology

– Project

– Contractor

5) The report provides market share and detailed profiles of the leading companies operating within the Microgrid market:

– ABB Ltd.

– General Electric

– Hitachi Ltd.

– Siemens AG

– Eaton Corporation

– NRG Energy

– Caterpillar

– Honeywell International Inc.

This independent 171-page report guarantees you will remain better informed than your competitors. With 168 tables and figures examining the Microgrid market space, the report gives you a direct, detailed breakdown of the market. PLUS, Capital expenditure AND Capacity, as well as Analysis of Contracts, Projects and Programmes that will keep your knowledge that one step ahead of your rivals.

This report is essential reading for you or anyone in the Energy sector. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1.1 Global Microgrid Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.6.3 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2 Introduction to the Microgrid Market

2.1 Microgrid Market Structure

2.2 Microgrid Market Definition

2.3 Brief History of Microgrids

2.4 Electrification Rates and Regulations

2.5 Microgrid Submarket Definition

2.5.1 Remote Submarket Definition

2.5.2 Military Submarket Definition

2.5.3 Institutional/Campus Submarket Definition

2.5.4 Utility Distribution Submarket Definition

2.5.5 Commercial and Industrial Submarket Definition

2.5.6 Community Submarket Definition

3 Global Microgrid Market 2019-2029

3.1 Global Microgrid Market Forecast 2019-2029

3.2 Microgrid Market Drivers & Restraints 2019

3.2.1 Drivers in the Microgrid Market

3.2.1.1 Rising Demand for Effective Energy Usage

3.2.1.2 Growing Adoption of Renewable Energy

3.2.1.3 Need for Efficient Grid Infrastructure

3.2.2 Restraints in the Microgrid Market

3.2.2.1 High Cost of Installation

3.2.2.2 Lack of Technical Expertise

4 Global Microgrid by Application Forecast 2019-2029

4.1 Global Microgrid Remote Application Forecast 2019-2029

4.2 Global Microgrid Utility Distribution Application Forecast 2019-2029

4.3 Global Microgrid Commercial and Industrial Application Forecast 2019-2029

4.4 Global Microgrid Community Application Forecast 2019-2029

4.5 Global Microgrid Institutional/Campus Application Forecast 2019-2029

4.6 Global Microgrid Military Application Forecast 2019-2029

5 Leading Regional and National Microgrid Market Forecast 2019-2029

5.1 North America Microgrid Market Forecast 2019-2029

5.1.1 United States Microgrid Market Forecast 2019-2029

5.1.2 Canada Microgrid Market Forecast 2019-2029

5.2 Asia Pacific Microgrid Market Forecast 2019-2029

5.2.1 China Microgrid Market Forecast 2019-2029

5.2.2 Japan Microgrid Market Forecast 2019-2029

5.2.3 South Korea Microgrid Market Forecast 2019-2029

5.2.4 India Microgrid Market Forecast 2019-2029

5.2.5 Rest of Asia Pacific Microgrid Market Forecast 2019-2029

5.3 Europe Microgrid Market Forecast 2019-2029

5.3.1 Russia Microgrid Market Forecast 2019-2029

5.3.2 France Microgrid Market Forecast 2019-2029

5.3.3 Denmark Microgrid Market Forecast 2019-2029

5.3.4 Rest of Europe Microgrid Market Forecast 2019-2029

5.4 Middle East and Africa Microgrid Market Forecast 2019-2029

5.4.1 Saudi Arabia Microgrid Market Forecast 2019-2029

5.4.2 South Africa Microgrid Market Forecast 2019-2029

5.4.3 Rest of the Middle East and Africa Microgrid Market Forecast 2019-2029

5.5 Latin America Microgrid Market Forecast 2019-2029

5.5.1 Brazil Microgrid Market Forecast 2019-2029

5.5.2 Rest of Latin America Microgrid Market Forecast 2019-2029

6. SWOT Analysis of the Microgrid Market 2019-2029

6.1 Strengths

6.2 Weaknesses

6.3 Opportunities

6.4 Threats

7 PEST Analysis of the Global Microgrid Market 2019-2029

8 The Leading Companies in the Microgrid Market

8.1 ABB Ltd.

8.1.1 ABB Ltd. Microgrid Selected Contracts / Projects / Programs 2015-2017

8.1.2 ABB Ltd. Total Company Sales 2012-2017

8.1.3 ABB Ltd. Sales in the Microgrid Market 2015-2017

8.1.4 Collaborations

8.1.5 Recent Developments

8.2 General Electric

8.2.1 GE Microgrid Application Examples

8.2.2 General Electric Microgrid Selected Contracts / Projects / Programmes

8.2.3 General Electric Total Company Sales 2012-2017

8.2.4 General Electric Sales in the Microgrid Market 2015-2017

8.3 Hitachi Ltd.

8.3.1 Hitachi Ltd. Microgrid Selected Contracts /Projects/ Programmes 2016-2017

8.3.2 Hitachi Ltd. Total Company Sales 2012-2017

8.3.3 Hitachi Ltd. Sales in the Microgrid Market 2015-2017

8.3.4 Hitachi Ltd Activities of Grid Solution

8.3.5 Recent Developments

8.4 Siemens AG

8.4.1 Siemens AG Microgrid Selected Contracts / Projects / Programs

8.4.2 Siemens AG Total Company Sales 2012-2017

8.4.3 Siemens AG Microgrid Solutions

8.4.4 Collaborations

8.4.5 Recent Developments

8.5 Eaton Corporation

8.5.1 Eaton Corporation Microgrid Selected Contracts / Projects / Programs

8.5.2 Eaton Corporation Total Company Sales 2012-2017

8.5.3 Eaton Corporation Sales in the Microgrid Market 2015-2017

8.5.4 Recent Developments

8.6 NRG Energy

8.6.1 NRG Energy Microgrid Selected Contracts / Projects / Programs

8.6.2 NRG Energy Total Company Sales 2012-2017

8.6.3 NRG Energy Sales in the Microgrid Market 2015-2017

8.6.4 Partnership

8.7 Caterpillar

8.7.1 Caterpillar Microgrid Selected Contracts / Projects / Programs

8.7.2 Caterpillar Total Company Sales 2012-2017

8.7.3 Caterpillar Sales in the Microgrid Market 2015-2017

8.8 Honeywell International Inc.

8.8.1 Honeywell International Inc. Microgrid Selected Contracts / Projects / Programs

8.8.2 Honeywell International Inc. Total Company Sales 2012-2017

8.8.3 Honeywell International Inc. Sales in the Microgrid Market 2015-2017

8.9 Other Companies Involved in the Microgrid Market 2017

9 Conclusions and Recommendations

9.1 Key Findings

9.2 Recommendations

10 Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 2.1 Global Electricity Access, 2018 (Population Without Electricity (Million), Electrification rate (%), Urban Electrification Rate (%), Rural Electrification Rate (%))

Table 2.2 Policies and Regulations for Microgrid (Region, Country, Renewable Energy / Microgrids Policy, Other Policies, Agencies)

Table 3.1 Global Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 3.2 Global Microgrid Capacity Forecast 2019-2029 (MW, AGR%)

Table 3.3 Microgrid Market Drivers & Restraints

Table 4.1 Global Microgrid By Application Capacity Forecast 2019-2029 (MW, AGR %, Cumulative)

Table 4.2 Global Microgrid By Application CAGR Forecast 2019-2024, 2023-2029, 2019-2029 (CAGR %)

Table 4.3 Global Microgrid Remote Application Capacity Forecast 2019-2029 (MW, AGR %, CAGR %, Cumulative)

Table 4.4 Global Microgrid Utility Distribution Application Capacity Forecast 2019-2029 (MW, AGR %, CAGR %, Cumulative)

Table 4.5 Global Microgrid Commercial and Industrial Application Capacity Forecast 2019-2029 (MW, AGR %, CAGR %, Cumulative)

Table 4.6 Global Microgrid Community Application Capacity Forecast 2019-2029 (MW, AGR %, CAGR %, Cumulative)

Table 4.7 Global Microgrid Institutional/Campus Application Capacity Forecast 2019-2029 (MW, AGR %, CAGR %, Cumulative)

Table 4.8 Global Microgrid Military Application Capacity Forecast 2019-2029 (MW, AGR %, CAGR %, Cumulative)

Table 5.1 Leading Microgrid Market by Region Forecast 2019-2029 (US$mn, Global AGR %, Cumulative)

Table 5.2 Leading Microgrid Market by Region Capacity Forecast 2019-2029 (MW, Global AGR %, Cumulative)

Table 5.3 North America Microgrid Market and Capacity Forecast 2019-2029 (US$mn, MW, AGR %, Cumulative)

Table 5.4 North America Microgrid Market Forecast, By Region 2019-2029 (US$mn, AGR %, Cumulative)

Table 5.5 United States Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.6 Canada Microgrid Projects (Location, technology, Project, Contractor)

Table 5.7 Canada Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.8 Developing Asia - Electricity Access, 2018 (Population Without Electricity (Million), Electrification rate (1), Urban Electrification Rate (%), Rural Electrification Rate (%))

Table 5.9 Asia Pacific Microgrid Market and Capacity Forecast 2019-2029 (US$mn, MW, AGR %, Cumulative)

Table 5.10 Asia Pacific Microgrid Market Forecast, By Region 2019-2029 (US$mn, AGR %, Cumulative)

Table 5.11 Energy Policies for Microgrid, China, 2012-2013

Table 5.12 China Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.13 Japan Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.14 South Korea Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.15 National Policies and Programs for Rural Renewable Microgrids, India 2018

Table 5.16 India Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.17 Rest of Asia Pacific Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.18 Europe Microgrid Market and Capacity Forecast 2019-2029 (US$mn, MW, AGR %, Cumulative)

Table 5.19 Europe Microgrid Market Forecast, By Country 2019-2029 (US$mn, AGR %, Cumulative)

Table 5.20 Russia Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.21 France Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.22 Denmark Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.23 Rest of Europe Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.24 Developing Middle East and Africa - Electricity Access, 2015 (Population Without Electricity (Million), Electrification rate (1), Urban Electrification Rate (%), Rural Electrification Rate (%))

Table 5.25 Middle East and Africa Microgrid Market and Capacity Forecast 2019-2029 (US$mn, MW, AGR %, Cumulative)

Table 5.26 Saudi Arabia Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.27 South Africa Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.28 South Africa Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 5.29 Developing Latin America - Electricity Access, 2016 (Population Without Electricity (Million), Electrification rate (1), Urban Electrification Rate (%), Rural Electrification Rate (%))

Table 5.30 Latin America Microgrid Market and Capacity Forecast 2019-2029 (US$mn, MW, AGR %, Cumulative)

Table 5.31 Brazil Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

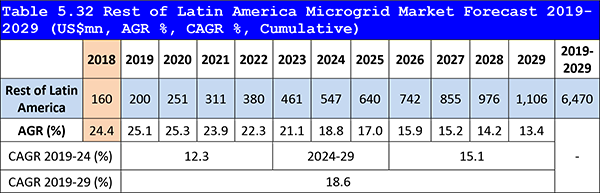

Table 5.32 Rest of Latin America Microgrid Market Forecast 2019-2029 (US$mn, AGR %, CAGR %, Cumulative)

Table 6.1 Global Microgrid Market SWOT Analysis 2019-2029

Table 7.1 Global Microgrid Market PEST Analysis 2019-2029

Table 8.1 ABB Ltd. Profile 2017 (CEO, Total Company Sales US$B, Sales from company division that includes Microgrids US$B, Share of total company sales from company division that includes Microgrids, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.2 Selected ABB Ltd. Microgrid Contracts / Projects / Programmes 2015-2017 (Date, Country, Subcontractor, Details)

Table 8.3 ABB Ltd. Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.4 ABB Ltd. Sales in the Microgrid Market 2015-2017 (US$m, AGR %)

Table 8.5 General Electric Profile 2017 (CEO, Total Company Sales US$B, Sales from company division that includes Microgrid US$B, Share of total company sales from company division that includes Microgrid %, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.6 General Electric Microgrid Application Examples

Table 8.7 Selected General Electric Microgrid Contracts / Projects / Programmes 2014 (Date, Country, Subcontractor, Details)

Table 8.8 General Electric Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.9 General Electric Sales in the Microgrid Market 2015-2017 (US$m, AGR %)

Table 8.10 Hitachi Ltd. Profile 2017 (CEO, Total Company Sales US$B, Sales from company division that includes Microgrid US$B, Share of total company sales from company division that includes Microgrid, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.11 Selected Hitachi Ltd. Microgrid Contracts / Projects / Programmes 2016-2017 (Date, Country, Subcontractor, Details)

Table 8.12 Hitachi Ltd. Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.13 Hitachi Ltd. Sales in the Microgrid Market 2015-2017 (US$m, AGR %)

Table 8.14 Hitachi Ltd Activities of Grid Solution (Items, Demonstration Results, Conventional Technologies)

Table 8.15 Hitachi Solutions (Issue, Solution, Vision)

Table 8.16 Siemens AG Profile 2017 (CEO, Total Company Sales US$B, Sales from company division that includes Microgrid US$B, share of total company sales from company division that includes Microgrid %, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.17 Selected Siemens AG Microgrid Contracts / Projects / Programmes 2015-2017 (Date, Country, Subcontractor, Details)

Table 8.18 Siemens AG Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.19 Siemens AG Microgrid Solutions (Location, Solution)

Table 8.20 Eaton Corporation Profile 2017 (CEO, Total Company Sales US$m, Sales from company division that includes Microgrid US$m, Share of total company sales from company division that includes Microgrid %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.21 Selected Eaton Corporation Microgrid Contracts / Projects / Programmes 2016-2017 (Date, Country, Subcontractor, Details)

Table 8.22 Eaton Corporation Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.23 Eaton Corporation Sales in the Microgrid Market 2015-2017 (US$m, AGR %)

Table 8.24 NRG Energy Profile 2017 (CEO, Total Company Sales US$m, Sales from company division that includes Microgrid US$m, Share of total company sales from company division that includes Microgrid %, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.25 Selected NRG Energy Microgrid Contracts / Projects / Programmes 2015-2017 (Date, Country, Subcontractor, Details)

Table 8.26 NRG Energy Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.27 NRG Energy in the Microgrid Market 2015-2017 (US$m, AGR %)

Table 8.28 Caterpillar Profile 2017 (CEO, Total Company Sales US$m, Sales from company division that includes Microgrid US$m, Share of total company sales from company division that includes Microgrid %, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.29 Selected Caterpillar Microgrid Contracts / Projects / Programmes 2015-2017 (Date, Country, Subcontractor, Details)

Table 8.30 Caterpillar Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.31 Caterpillar in the Microgrid Market 2015-2017 (US$m, AGR %)

Table 8.32 Honeywell International Inc. Profile 2017 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Microgrid Market %, Strongest Business Region, Business Segment in the Market, Submarket Involvement HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.33 Selected Honeywell International Inc. Microgrid Contracts / Projects / Programmes 2014 (Date, Country, Subcontractor, Details)

Table 8.34 Honeywell International Inc. Total Company Sales 2012-2017 (US$m, AGR %)

Table 8.35 Caterpillar in the Microgrid Market 2015-2017 (US$m, AGR %)

Table 8.36 Other Companies Involved in the Microgrid Market 2017 (Company, Location)

List of Figures

Figure 2.1 Global Microgrid Market Segmentation Overview

Figure 3.2 Global Microgrid Capacity Forecast 2019-2029 (MW, AGR %)

Figure 3.1 Global Microgrid Market Forecast 2019-2029

Figure 4.1 Global Microgrid Capacity by Application AGR Forecast 2019-2029 (AGR %)

Figure 4.2 Global Microgrid by Application Capacity Forecast 2019-2029 (MW, Global AGR %)

Figure 4.3 Global Microgrid By Application Share Forecast 2019 (% Share)

Figure 4.4 Global Microgrid By Application Share Forecast 2024 (% Share

Figure 4.5 Global Microgrid By Application Share Forecast 2029 (% Share)

Figure 4.6 Global Microgrid Remote Application Capacity Forecast 2019-2029 (US$mn, Global AGR %)

Figure 4.7 Share of the Remote Application in Total Capacity 2019 (%)

Figure 4.8 Share of the Remote Application in Total Capacity 2024 (%)

Figure 4.9 Share of the Remote Application in Total Capacity 2029 (%)

Figure 4.10 Global Microgrid Utility Distribution Application Capacity Forecast 2019-2029 (MW, Global AGR %)

Figure 4.11 Share of the Utility Distribution Application in Total Capacity 2019 (%)

Figure 4.12 Share of the Utility Distribution Application in Total Capacity 2024 (%)

Figure 4.13 Share of the Utility Distribution Application in Total Capacity 2029 (%)

Figure 4.14 Global Microgrid Commercial and Industrial Application Capacity Forecast 2019-2029 (MW, Global AGR %)

Figure 4.15 Share of the Commercial and Industrial Application in Total Capacity 2019 (%)

Figure 4.16 Share of the Commercial and Industrial Application in Total Capacity 2023 (%)

Figure 4.17 Share of the Commercial and Industrial Application in Total Capacity 2029 (%)

Figure 4.18 Global Microgrid Community Application Capacity Forecast 2019-2029 (MW, Global AGR %)

Figure 4.19 Share of the Community Application in Total Capacity 2019 (%)

Figure 4.20 Share of the Community Application in Total Capacity 2024 (%)

Figure 4.21 Share of the Community Application in Total Capacity 2029 (%)

Figure 4.22 Global Microgrid Institutional/Campus Application Capacity Forecast 2019-2029 (MW, Global AGR %)

Figure 4.23 Share of the Institutional/Campus Application in Total Capacity 2019 (%)

Figure 4.24 Share of the Institutional/Campus Application in Total Capacity 2024 (%)

Figure 4.25 Share of the Institutional/Campus Application in Total Capacity 2029 (%)

Figure 4.26 Global Microgrid Military Application Market 2019-2029 (MW, Global AGR %)

Figure 4.27 Share of the Military Application in Total Capacity 2019 (%)

Figure 4.28 Share of the Military Application in Total Capacity 2023 (%)

Figure 4.29 Share of the Military Application in Total Capacity 2029 (%)

Figure 5.1 Global Microgrid Market by Region Market Forecast 2019-2029 (US$mn, Global AGR %)

Figure 5.2 Global Microgrid Market by Region Market AGR Forecast 2019-2029 (AGR %)

Figure 5.3 Global Microgrid Market by Regional Market Share Forecast 2019 (% Share)

Figure 5.4 Global Microgrid Market by Regional Market Share Forecast 2024 (% Share)

Figure 5.5 Global Microgrid Market by Regional Market Share Forecast 2029 (% Share)

Figure 5.6 Global Microgrid Market by Region Capacity Forecast 2019-2029 (MW, Global AGR %)

Figure 5.7 Global Microgrid Market by Region Capacity AGR Forecast 2018-2029 (AGR %)

Figure 5.8 Global Microgrid Market by Regional Share Capacity Forecast 2019 (% Share)

Figure 5.9 Global Microgrid Market by Regional Share Capacity Forecast 2024 (% Share)

Figure 5.10 Global Microgrid Market by Regional Share Capacity Forecast 2029 (% Share)

Figure 5.11 North America Microgrid Market Forecast 2019-2029 (US$mn, MW)

Figure 5.12 North America Microgrid Market Share By Region Forecast 2019 (% Share)

Figure 5.13 North America Microgrid Market Share By Region Forecast 2024 (% Share)

Figure 5.14 North America Microgrid Market Share By Region Forecast 2029 (% Share)

Figure 5.15 United States Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 5.16 Canada Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 5.17 Asia Pacific Microgrid Market Forecast 2019-2029 (US$mn, MW)

Figure 5.18 Asia Pacific Microgrid Market Share By Region Forecast 2019 (% Share)

Figure 5.19 Asia Pacific Microgrid Market Share By Region Forecast 2023 (% Share)

Figure 5.20 Asia Pacific Microgrid Market Share By Region Forecast 2029 (% Share)

Figure 5.21 China Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 5.22 Japan Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 5.23 South Korea Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 5.24 India Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 5.25 Rest of Asia Pacific Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 5.26 Europe Microgrid Market Forecast 2019-2029 (US$mn, MW)

Figure 5.27 Europe Microgrid Market Share by Region Forecast 2019 (% Share)

Figure 5.28 Europe Microgrid Market Share by Region Forecast 2024 (% Share)

Figure 5.29 Europe Microgrid Market Share by Region Forecast 2029 (% Share)

Figure 5.30 Russia Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 5.31 France Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 5.32 Denmark Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 5.33 Rest of Europe Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 5.34 Middle East and Africa Microgrid Market Forecast 2019-2029 (US$mn, MW)

Figure 5.35 Saudi Arabia Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 5.36 South Africa Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 5.37 Rest of the Middle East and Africa Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 5.38 Latin America Microgrid Market Forecast 2019-2029 (US$mn, MW)

Figure 5.39 Brazil Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 5.40 Rest of Latin America Microgrid Market Forecast 2019-2029 (US$mn, AGR %)

Figure 8.1 ABB Ltd. Total Company Sales 2012-2017 (US$m, AGR %)

Figure 8.2 ABB Ltd. Sales in the Microgrid Market 2016-2017 (US$m, AGR %)

Figure 8.3 General Electric Total Company Sales 2012-2017 (US$m, AGR %)

Figure 8.4 General Electric Sales in the Microgrid Market 2015-2017 (US$m, AGR %)

Figure 8.5 Hitachi Ltd. Total Company Sales 2012-2017 (US$m, AGR %)

Figure 8.6 Hitachi Ltd. Sales in the Microgrid 2015-2017 (US$m, AGR %)

Figure 8.7 Siemens AG Total Company Sales 2012-2017 (US$m, AGR %)

Figure 8.8 Eaton Corporation Total Company Sales 2012-2017 (US$m, AGR %)

Figure 8.9 Eaton Corporation Sales in the Microgrid Market 2015-2017 (US$m, AGR %)

Figure 8.10 NRG Energy Total Company Sales 2012-2017 (US$m, AGR %)

Figure 8.11 NRG Energy Sales in the Microgrid Market 2015-2017 (US$m, AGR %)

Figure 8.12 Caterpillar Company Sales 2012-2017 (US$m, AGR %)

Figure 8.13 Caterpillar Sales in the Microgrid Market 2015-2017 (US$m, AGR %)

Figure 8.14 Honeywell International Inc. Total Company Sales 2012-2017 (US$m, AGR %)

Figure 8.15 Honeywell International Inc. Sales in the Microgrid Market 2015-2017 (US$m, AGR %)

Advanced Microgrid Solutions

Anbaric Microgrid

Canadian Solar Inc

Caterpillar

Centrais Eletricas do Para (CELPA)

Chevron Inc

Corinex Communications

Cummins Inc

Duke Energy Corporation

Dynapower Company LLC

Eaton Corporation

eCAMION

Emerson Electric Corporation

ENERES

ENGIE

Fairbanks Morse

FuelCell Energy Inc.

General Electric

Green Energy Corporation

Hitachi Ltd.

Homer Energy LLC

Honeywell International

Hyosung

IBJ Leasing

KERI

Korea Electric Power Corporation (KEPCO)

Lockheed Martin Corporation

LSIS

METI

Nalcor/ Frontier Power Systems

NEDO

Nimschu Iskudow Inc

NRG Energy

PanaHome

Power Analytics Corporation

PowerShift Atlantic

Princeton Power Systems

Qulliq Energy Corporation

S&C Electric Company

Saudi Electricity Company (SECO)

Siemens AG

Solantro Semiconductor

Tesla Motors Inc.

TUGLIQ Energy Co.

Viridity Energy Inc.

Organisations Mentioned

BC Institute of Technology

Centre for renewable Energy Development (CRED)

China National Renewable Energy Centre

Chinese Academy of Sciences

Department of Energy

Electricity & Cogeneration Regulatory Authority (ECRA) – Saudi Arabia

Energy Market Authority

Fairfield University

Ministry of Trade, Industry and Energy (MOTIE) - South Korea

National Development and Reform Commission (NDRC)

National Energy Agency (NEA)

Natural resources Canada

New York University

Princeton University

Saudi Ministry of Water and Electricity

Sustainable Energy Fund for Africa (SEFA)

University of California, Sand Diego

Download sample pages

Complete the form below to download your free sample pages for The Microgrid Market Forecast 2019-2029

Related reports

-

Grid-Scale Battery Storage Technologies Market Forecast 2019-2029

The latest research report from business intelligence provider Visiongain offers comprehensive analysis of the Grid Scale Battery Storage market. Visiongain...

Full DetailsPublished: 06 June 2019 -

Lithium-Ion Battery Market Report 2020-2030

Visiongain values the lithium-ion battery market at $43.8bn in 2019.

...Full DetailsPublished: 30 March 2020 -

Zero Net Energy Buildings Market 2020-2030

Visiongain’s analysis indicates that total revenue on Zero Net Energy Buildings Market will be $15,057.2 million in 2020 as environmental...

Full DetailsPublished: 31 March 2020 -

Top 20 Geothermal Power Companies 2019

Geothermal energy is a clean and renewable energy derived from the heat produced by the slow decay of radioactive particles...Full DetailsPublished: 28 February 2019 -

Geothermal Power Market Forecast 2019-2029

Visiongain has calculated that the global Geothermal Power Market will see a capital expenditure (CAPEX) of $7,256mn in 2019. Read...

Full DetailsPublished: 23 May 2019 -

Oil Country Tubular Goods (OCTG) Market Forecast 2019-2029

Oil Country Tubular Goods market to generate $5.9 billion in 2019....Full DetailsPublished: 05 February 2019 -

Combined Heat & Power (CHP) Installation Market Forecast 2019-2029

The $800 million combined heat and power installation sector is expected to flourish in the next few years because of...Full DetailsPublished: 10 January 2019 -

LPG Vaporizer Market Report 2019-2029

Visiongain has calculated that the LPG Vaporizing market will see a capital expenditure (CAPEX) of $1.9 bn in 2019. Read...

Full DetailsPublished: 09 May 2019 -

Concentrated Solar Power (CSP) Market Report 2019-2029

Visiongain calculates that the concentrated solar power (CSP) market will reach $37.3bn in 2019....Full DetailsPublished: 15 April 2019 -

Next Generation Energy Storage Technologies (EST) Market Forecast 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global next-generation energy storage technologies market. Visiongain...

Full DetailsPublished: 16 April 2018

Download sample pages

Complete the form below to download your free sample pages for The Microgrid Market Forecast 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Energy news

Energy as a Service (EaaS) Market

The global Energy as a Service (EaaS) market is projected to grow at a CAGR of 12.6% by 2034

25 July 2024

Synthetic Fuels Market

The global Synthetic Fuels market is projected to grow at a CAGR of 23% by 2034

18 July 2024

Power-to-X (P2X) Market

The global Power-to-X (P2X) market is projected to grow at a CAGR of 10.6% by 2034

09 July 2024

Airborne Wind Energy Market

The global Airborne Wind Energy market is projected to grow at a CAGR of 9.7% by 2034

05 June 2024