Geothermal energy is a clean and renewable energy derived from the heat produced by the slow decay of radioactive particles in the core of the earth. Geothermal reservoirs are located deep underground and can be detected through volcanoes and fumaroles, hot springs and geysers. The most active geothermal resources exist along major tectonic plate boundaries that incorporate maximum volcanic areas. The geothermal energy is mainly used in three main applications including direct use and district heating systems, electricity generation power plants and geothermal heat pumps.

Geothermal energy is considered to be a most sustainable energy source owing to its limited burning of fuels and minimal emission of carbon dioxide and other greenhouse gases. The geothermal power market is mainly driven by the factors including an efficient and sustainable energy source and growing adoption of renewable energy. The limited burning of fuels and minimal emission of carbon dioxide and other greenhouse gases favour the adoption of geothermal energy.

The introduction of favourable government regulations and policies are expected to recover the otherwise untapped huge geothermal potential for low-carbon electricity generation and direct use in cooling and heating. Despite these advantages, the geothermal energy has experienced a low adoption owing to the high initial cost associated with the technology. The increasing demand for reliable and sustainable electricity supply is further expected to boost the demand for geothermal power.

The pressing concerns over global warming and energy security are likely to favour the geothermal power market. As there are significant risks involved with initial exploration and drilling, favourable regulatory environments – including tax incentives and land permits – can do much to facilitate further developments in the sector. Besides from being a clean and renewable energy source, geothermal energy is also suitable for base load electricity generation and thus has the potential to become the backbone of local grid systems.

The report will answer questions such as:

• Who are the leading companies in the geothermal industry?

– What is their strategy?

– What is their existing processing capacity and where is it based?

– What are their core strengths and weaknesses?

– Do they have expansion plans?

• What is driving and restraining the involvement of each leading company within the market?

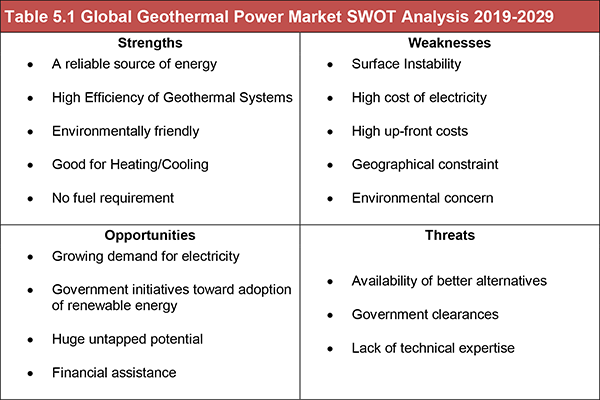

• What are the Strengths, Weaknesses, Opportunities and Threats to the geothermal market as a whole?

• What political, economic, environmental and technological factors affect the geothermal market?

How will you benefit from this report?

• This report you will keep your knowledge base up to speed. Don’t get left behind

• This report will allow you to reinforce strategic decision-making based upon definitive and reliable market data

• You will learn how to exploit new technological trends

• You will be able to realise your company’s full potential within the market

• You will better understand the competitive landscape and identify potential new business opportunities and partnerships

Three reasons why you must order and read this report today:

1) The study reveals where and how leading companies are investing in the geothermal market. We show you the prospects for companies operating in:

– North America

– Middle East

– Asia-Pacific

– Europe

2) The report provides a detailed individual profile for each of the 20 leading companies in the Geothermal market in 2019, providing data for Revenue and capacity along with project details:

– Turboden S.p.A.

– Green Energy Geothermal

– Berkshire Hathaway Inc

– Terra Gen

– Reykjavik Geothermal

– Alterra Power Corporation

– TAS Energy

– Atlas Copco Group

– Exergy

– KenGen

– Halliburton

– Enel Green Power

– ElectraTherm

– Calpine Corporation

– Fuji Electric Co. Ltd.

– Toshiba Corporation

– Mitsubishi Heavy Industries

– General Electric

– Ansaldo Energia

– Ormat Technologies

3) It also provides a PEST analysis of the key factors affecting the overall geothermal market:

– Political

– Economic

– Social

– Technical

Competitive advantage

This independent, 109-page report guarantees you will remain better informed than your competitors. With 96 tables and figures examining the companies within the geothermal market space, the report gives you an immediate, one-stop breakdown of the leading Geothermal Power companies plus analysis and future outlooks, keeping your knowledge one step ahead of your rivals.

Who should read this report?

• Anyone within the geothermal value chain

• CEOs

• COOs

• CIOs

• Business development managers

• Marketing managers

• Technologists

• Suppliers

• Investors

• Banks

• Government agencies

• Contractors

Don’t miss out

This report is essential reading for you or anyone in the oil or other industries with an interest in renewable energy. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. Order our Top 20 Geothermal Power Companies 2019: Profiles of Leading Companies Operating Within the Geothermal Power Market Including Financial and Market Share Analysis (Capacity MW, $million) Plus Tables Outlining Major Projects in Various Regions.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Geothermal Power Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Geothermal Power Market

2.1 Geothermal Power Market Definition

2.2 Geothermal Power Market Structure

2.3 Brief History of Geothermal

2.4 Geothermal Power Plant Technologies

2.4.1 Mainstream Geothermal Power Plant Technologies

2.4.1.1 Dry Steam Power Plants

2.4.1.2 Flash Steam Power Plants

2.4.1.3 Binary Cycle Power Plants

2.4.1.4 Flash-Binary Power Plants

2.4.2 Other Technologies

2.4.2.1 Enhanced Geothermal Systems (EGS)

2.4.2.2 Co-Production

2.4.2.3 Hybrid Generation

2.5 Geothermal Power Plant Development

2.6 Geothermal Power Market Dynamics

2.7 Environmental Factors and the Geothermal Market

2.7.1 Air Pollution

2.7.2 On-Site Chemicals

2.7.3 Land Impacts

2.7.4 Water Impacts

2.7.5 Noise Impacts

2.7.6 Environmental Assessment and Permitting

2.8 Geothermal Market Drivers & Restraints 2018

2.8.1 Drivers in the Geothermal Market

2.8.1.1 Efficient and Sustainable Energy Source

2.8.1.2 Growing Adoption of Renewable Energy

2.8.2 Restraints in the Geothermal Market

2.8.2.1 High Initial Cost

3. Competitor Positioning in the Global Geothermal Power Market

3.1 Increasing Developments in Geothermal Power

3.2 Increasing Demand for Electricity

3.3 The Leading Twenty Companies’ Market Share in the Global Geothermal Power Market 2019

3.4 National Geothermal Power Investment Emphasis

4. The Leading Companies in the Geothermal Power Market

4.1 Ormat Technologies Inc.

4.1.1 Ormat Technologies Inc. Geothermal Power Selected Recent Contracts / Projects / Programmes 2017-2018

4.1.2 Ormat Technologies Inc. Total Company Regional Sales 2017

4.1.3 Ormat Technologies Inc. Total Company Sales 2011-2017

4.1.4 Ormat Technologies Inc. Sales in the Business Segment that includes Geothermal Power Market 2011-2017

4.1.5 Ormat Technologies Inc. SWOT Analysis

4.2 Ansaldo Energia

4.2.1 Ansaldo Energia Total Company Regional Sales 2017

4.2.2 Ansaldo Energia Total Company Sales 2011-2017

4.2.3 Ansaldo Energia SWOT Analysis

4.3 General Electric Company

4.3.1 General Electric Total Company Regional Sales 2017

4.3.2 General Electric Company Total Company Sales 2012-2017

4.3.3 General Electric Company Sales in the Business Segment that includes Geothermal Power Market 2012-2017

4.3.4 General Electric Company SWOT Analysis

4.4 Mitsubishi Heavy Industries Limited

4.4.1 Mitsubishi Heavy Industries Limited Total Company Sales 2011-2017

4.4.3 Mitsubishi Heavy Industries Limited SWOT Analysis

4.5 Toshiba Corporation

4.5.1 Toshiba Corporation Total Company Regional Sales 2017

4.5.2 Toshiba Corporation Total Company Sales 2014-2017

4.5.3 Toshiba Corporation Sales in the Business Segment that includes Geothermal Power 2016-2017

4.5.4 Toshiba Corporation SWOT Analysis

4.6 Fuji Electric Co. Ltd.

4.6.1 Fuji Electric Co. Ltd. Geothermal Power Selected Recent Contracts / Projects / Programmes 2018

4.6.2 Fuji Electric Co. Ltd Total Company Regional Sales 2017

4.6.3 Fuji Electric Co. Ltd. Total Company Sales 2011-2016

4.6.5 Fuji Electric Co. Ltd. SWOT Analysis

4.7 Calpine Corporation

4.7.1 Calpine Corporation Total Company Regional Sales 2017

4.7.2 Calpine Corporation Total Company Sales 2011-2017

4.7.3 Calpine Corporation SWOT Analysis

4.8 ElectraTherm Inc.

4.9 Enel Green Power

4.9.2 Enel Green Power SWOT Analysis

4.10 Halliburton

4.10.1 Halliburton Total Company Regional Sales 201

4.10.2 Halliburton Total Company Sales 2011-2017

4.10.3 Halliburton SWOT Analysis

4.11 KenGen

4.11.1 KenGen Geothermal Power Selected Recent Contracts / Projects / Programmes

4.11.2 KenGen Total Company Sales 2011-2018

4.11.3 KenGen Sales in the Business Segment that includes Geothermal Power Market 2011-2018

4.11.4 KenGen Sales in the Geothermal Power Market 2013-2018

4.12 Exergy

4.12.1 Exergy SWOT Analysis

4.13 Atlas Copco Group

4.13.1 Atlas Copco Group Total Company Regional Sales 2017

4.13.2 Atlas Copco Group Total Company Sales 2011-2017

4.14 Tas Energy

4.15 Alterra Power Corporation

4.15.1 Alterra Power Corporation Geothermal Power Selected Recent Contracts / Projects / Programmes

4.15.2 Alterra Power Corporation Total Company Sales 2013-2017

4.15.3 Alterra Power Corporation SWOT Analysis

4.16 Reykjavik Geothermal

4.16.1 Reykjavik Geothermal SWOT Analysis

4.17 Terra Gen, LLC

4.17.1 Terra Gen, LLC SWOT Analysis

4.18 Turboden S.p.A.

4.18.1 Turboden S.p.A. SWOT Analysis

4.19 Green Energy Geothermal

4.20 Berkshire Hathaway Inc.

4.20.1 Berkshire Hathaway Inc. Total Company Sales 2011-2018

4.20.2 Berkshire Hathaway Inc. Sales in the Business Segment that includes Geothermal Power Market 2013-2018

4.21 Other Companies Involved in Geothermal Power

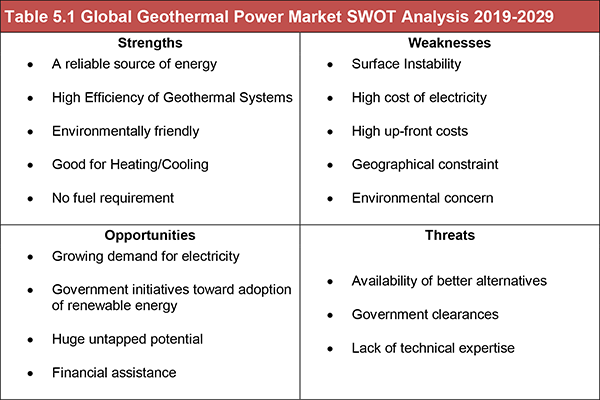

5. SWOT Analysis of the Geothermal Power Market 2019-2029

6. PEST Analysis of the Geothermal Power Market 2019-2029

7. Conclusions and Recommendations

7.1 Recommendations

8. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 2.1 Layers of the Earth, Corresponding Temperature (°C), Depth (km) and Share in Volume of Earth (%)

Table 2.2 Types and Temperatures (°C) of Geothermal Sources

Table 2.3 Types of Geothermal Power Plants, Basic Methodology, Example, Description

Table 2.4 Phases of Geothermal Projects, Portion of Total Cost (%), Years

Table 2.5 Geothermal Power Market Drivers & Restraints

Table 3.1 List of Announced Geothermal Power Developments (Project Name, Country, Capacity (MW), Commissioned/ Operational)

Table 3.2 List of Plants Which Began Operation in 2018 (Date, Plant Name, Capacity (MW), Supplier, Operators & Developer, Country)

Table 3.3 The Leading Twenty Companies in the Geothermal Power Market 2019 (Company, Capex $m, Capacity MW)

Table 4.1 Ormat Technologies Inc. 2017 (CEO, CAPEX US$m, Capacity MW, Total Company Sales US$m, Sales in the Market that includes Geothermal US$m, Share of Total Company Sales from Business Segment that includes Geothermal Power Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.2 Selected Recent Ormat Technologies Inc. Geothermal Power Contracts / Projects / Programmes 2017-2018 (Date, Project, Capacity MW, Value US$m, Location, Status)

Table 4.3 Ormat Technologies Inc. Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.4 Ormat Technologies Inc. Sales in the Business Segment that includes Geothermal Power Market 2010-2017 (US$m, AGR %)

Table 4.5 SWOT Analysis of Ormat Technologies Inc.

Table 4.6 Ansaldo Energia 2018 (CEO, CAPEX US$m, Capacity MW, Total Company Sales US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.7 Ansaldo Energia Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.8 SWOT Analysis of Ansaldo Energia

Table 4.9 General Electric Company 2018 (CEO, CAPEX US$m, Capacity MW, Total Company Sales US$m, Sales in the Market that includes Geothermal US$m, Share of Total Company Sales from Business Segment that includes Geothermal Power Market %, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.10 General Electric Company Total Company Sales 2011-2017 (US$m, AGR %)

Table 4.11 General Electric Company Sales in the Business Segment that includes Geothermal Power Market 2011-2017 (US$m, AGR %)

Table 4.12 SWOT Analysis of General Electric Company

Table 4.13 Mitsubishi Heavy Industries Limited 2018 (CEO, CAPEX US$m, Capacity MW, Total Company Sales US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.14 Mitsubishi Heavy Industries Limited Total Company Sales 2011-2017 (US$m, AGR %)

Table 4.15 SWOT Analysis of Mitsubishi Heavy Industries Limited

Table 4.16 Toshiba Corporation Profile 2018 (CEO, CAPEX US$m, Capacity MW, Total Company Sales US$m, Energy Systems and Solutions Sales ($mn), Net Capital ExpenditureUS$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.17 Toshiba Corporation Total Company Sales 2013-2017 (US$m, AGR %)

Table 4.18 Toshiba Corporation Sales in the Business Segment that includes Geothermal Power Market 2016-2017 (US$m, AGR %)

Table 4.19 SWOT Analysis of Toshiba Corporation

Table 4.20 Fuji Electric Co. Ltd. Profile 2018 (CEO, CAPEX US$m, Capacity MW, Total Company Sales US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.21 Selected Recent Fuji Electric Co. Ltd. Geothermal Power Contracts / Projects / Programmes 2018 (Date, Project, Capacity MW, Value US$m, Location, Status)

Table 4.22 Fuji Electric Co. Ltd. Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.23 SWOT Analysis of Fuji Electric Co. Ltd.

Table 4.24 Calpine Corporation 2018 (CEO, CAPEX US$m, Capacity MW, Total Company Sales US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.25 Calpine Corporation Total Company Sales 2010-2016 (US$m, AGR %)

Table 4.26 SWOT Analysis of Calpine Corporation

Table 4.27 ElectraTherm Inc. 2018 (CEO, CAPEX US$m, Capacity MW, Business Segment in the Market, HQ, Website)

Table 4.28 Enel Green Power 2018 (CEO, CAPEX US$m, Capacity MW, Total Company Sales US$m, Net Income / Loss US$m, Net Capital ExpenditureUS$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.29 SWOT Analysis of Enel Green Power

Table 4.30 Halliburton Profile 2018 (CEO, CAPEX US$m, Capacity MW, Total Company Sales US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.31 Halliburton Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.32 SWOT Analysis of Halliburton

Table 4.33 KenGen Profile 2018 (CEO, CAPEX US$m, Capacity MW, Total Company Sales US$m, Net Income / Loss US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.34 Selected Recent KenGen Geothermal Power Contracts / Projects / Programmes (Project, Capacity MW, Status, Commissioning Year)

Table 4.35 KenGen Total Company Sales 2011-2018 (US$m, AGR %)

Table 4.36 KenGen Sales in the Business Segment that includes Geothermal Power 2011-2018 ($Mn, AGR%)

Table 4.37 KenGen Sales in the Geothermal Power Market 2012-2017 (US$m, AGR %)

Table 4.38 Exergy Profile 2018 (CEO, CAPEX US$m, Capacity MW, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.39 SWOT Analysis of Exergy

Table 4.40 Atlas Copco Group Profile 2018 (CEO, CAPEX US$m, Capacity MW, Total Company Sales US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.41 Atlas Copco Group Total Company Sales 2010-2017 (US$m, AGR %)

Table 4.42 Tas Energy Profile 2018 (CAPEX US$m, Capacity MW, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.43 Alterra Power Corporation Profile 2018 (CEO, CAPEX US$m, Capacity MW, Total Company Sales US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.44 Selected Recent Alterra Power Corporation Geothermal Power Contracts / Projects / Programmes (Project, Capacity MW, Status, Commissioning Year)

Table 4.45 Alterra Power Corporation Total Company Sales 2012-2017 (US$m, AGR %)

Table 4.46 SWOT Analysis of Alterra Power Corporation

Table 4.47 Reykjavik Geothermal Profile 2018 (CEO, CAPEX US$m, Capacity MW, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.48 SWOT Analysis of Reykjavik Geothermal

Table 4.49 Terra Gen, LLC 2018 (CEO, CAPEX US$m, Capacity MW, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Website)

Table 4.50 SWOT Analysis of Terra Gen, LLC

Table 4.51 Turboden S.p.A. 2018 (CEO, CAPEX US$m, Capacity MW, HQ, Founded, No. of Employees, IR Contact, Website)

Table 4.52 SWOT Analysis of Turboden S.p.A.

Table 4.53 Green Energy Geothermal Profile 2018 (CEO, CAPEX US$m, Capacity MW, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.54 Berkshire Hathaway Inc. Profile 2018 (CEO, CAPEX US$m, Capacity MW, Total Company Sales US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.55 Berkshire Hathaway Inc. Total Company Sales 2011-2018 (US$m, AGR %)

Table 4.56 Berkshire Hathaway Inc. Sales in the Business Segment that includes Geothermal Power Market 2013-2018 (US$m, AGR %)

Table 4.57 Other Companies Involved in Geothermal Power

Table 5.1 Global Geothermal Power Market SWOT Analysis 2019-2029

Table 6.1 Global Geothermal Power Market PEST Analysis 2019-2029

List of Figures

Figure 2.1 Global Geothermal Power Market Segmentation Overview

Figure 3.1 The Leading Companies in the Geothermal Power Market 2019 By Capacity (Market Share %)

Figure 3.2 Leading National Geothermal Power Markets Share Forecast 2019 (%)

Figure 4.1 Ormat Technologies Inc. Total Company Regional Sales 2017 (US$m, AGR %)

Figure 4.2 Ormat Technologies Inc. Total Company Sales 2011-2017 (US$m, AGR %)

Figure 4.3 Ormat Technologies Inc. Sales in the Business Segment that includes Geothermal Power Market 2011-2017 (US$m, AGR %)

Figure 4.4 Ansaldo Energia Total Company Regional Sales 2017 (US$m, AGR %)

Figure 4.5 Ansaldo Energia Total Company Sales 2011-2017 (US$m, AGR %)

Figure 4.6 General Electric Total Company Regional Sales 2017 (US$m, AGR %)

Figure 4.7 General Electric Company Total Company Sales 2012-2017 (US$m, AGR %)

Figure 4.8 General Electric Company Sales in the Business Segment that includes Geothermal Power Market 2012-2017 (US$m, AGR %)

Figure 4.9 Mitsubishi Heavy Industries Limited Total Company Sales 2011-2017 (US$m, AGR %)

Figure 4.10 Mitsubishi Heavy Industries Limited Total Company Regional Sales 2017 (US$m, AGR %)

Figure 4.11 Toshiba Corporation Total Company Regional Sales 2017 (US$m, AGR %)

Figure 4.12 Toshiba Corporation Total Company Sales 2014-2017 (US$m, AGR %)

Figure 4.13 Toshiba Corporation Sales in the Business Segment that includes Geothermal Power 2016-2017 (US$m, AGR %)

Figure 4.14 Fuji Electric Co. Ltd Total Company Regional Sales 2017 (US$m, AGR %)

Figure 4.15 Fuji Electric Co. Ltd. Total Company Sales 2011-2017 (US$m, AGR %)

Figure 4.16 Calpine Corporation Total Company Regional Sales 2017 (US$m, AGR %)

Figure 4.17 Calpine Corporation Company Sales 2011-2017 (US$m, AGR %)

Figure 4.18 Halliburton Total Company Regional Sales 2016 (US$m, AGR %)

Figure 4.19 Halliburton Total Company Sales 2011-2017 (US$m, AGR %)

Figure 4.20 KenGen Total Company Sales 2011-2018 (US$m, AGR %)

Figure 4.21 KenGen Sales in the Business Segment that includes Geothermal Power Market 2011-2018 (US$m, AGR %)

Figure 4.22 KenGen Sales in the Geothermal Power Market 2013-2017 (US$m, AGR %)

Figure 4.23 Atlas Copco Group Total Company Regional Sales 2017 (US$m, AGR %)

Figure 4.24 Atlas Copco Group Total Company Sales 2011-2017 (US$m, AGR %)

Figure 4.25 Alterra Power Corporation Total Company Sales 2013-2017 (US$m, AGR %)

Figure 4.26 Berkshire Hathaway Inc. Total Company Sales 2011-2018 (US$m, AGR %)

Figure 4.27 Berkshire Hathaway Inc. Sales in the Business Segment that includes Geothermal Power Market 2013-2018 (US$m, AGR %)

3 Degrees

3S Kale Energy

Advanced Solar LLC

Akca Enerji

Alpine Geothermal Drilling

AltaRock Energy Inc

Alterra Power Corporation

Amaeresco Inc.

American geothermal Systems

Ansaldo Energia

Arctas Capital Group

Atlas Copco Group

Berkshire Hathaway Inc.

Calpine Corporation

Celikler Enerji

Chevron Corp

Daldrup

Eastland Generation

Echogen power systems Inc

EFLA Consulting Engineers

Egesim

ElectraTherm

Elemental Energy

Empire Geothermal Power LLC

Endesa

Enel green Power

ENGIE

Exergy

Fuji electric Co. Ltd.

Geo Hydro Supply

Geo Source One

Goen-MB Holding

Graziella Green Power

Green Energy Geothermal

Halliburton

Kepler Energy Inc

Kyushu electric Power

Landsvirkjun

Maccaferi Industrial Group

Maibarara Geothermal Inc

Mitsubishi Heavy Industries Limited

Mitsubishi Hitachi Power Systems

National power Company of Iceland

Nevada Geothermal Operating Company LLC

Newcore Energy Inc

Open Mountain Energy

Orchid Business Group

Ormat technologies Inc.

PLN

PT Pertamina

Reykjavik Geothermal

RWE Inc

Sarulla Operations Ltd

SECI Energia Holding

Shaanxi Geothermal Energy Development Co.

Siemens

Sohne AG

Sovak Enerji

Tas Energy

Terra Gen, LLC

Toshiba Corporation

Turboden SpA

Turkerler Enerji

U.S Geothermal Inc.

Verdi energy Group

Viridity Energy Inc.

Vulcan Power Company

YPPI New Energy Development Co. Ltd

Zorlu Energy