Industries > Energy > Subsea Production & Processing Systems Market Outlook 2018-2028

Subsea Production & Processing Systems Market Outlook 2018-2028

Forecast by Hardware (Umbilicals, Risers, Flowlines, Controls, Trees, Manifolds and Tie-ins), by Water Depth (Shallow Water, Deepwater and Ultra-Deepwater) AND by Region Plus Leading Companies in the Subsea Production & Processing Systems Market

Visiongain has calculated that the global Subsea Production & Processing Systems Market will see a capital expenditure (CAPEX) of $16.41 bn in 2018. Read on to discover the potential business opportunities available.

The Subsea P&P systems market can be broken down into the seven elements – Umbilicals, Risers, Flowlines, Controls, Trees, Manifold and Tie-Ins. Subsea P&P systems can be used to increase production of a pre-existing site.

One of the main drivers for installation of subsea P&P systems remains global energy demand. Growth is expected for years to come, with the growing developing economies driving this. As a response, offshore production will move further into deepwater and ultra-deepwater, where a large amount of the remaining hydrocarbon reserves remain. Since drilling of the first well below 3,000m was completed in 2003, there have been numerous major discoveries in previously unexplored territories around the world.

A global shift in E&P to deep and ultra-deepwater is being witnessed. Whereas 20 years ago the majority of subsea wells were located in shallow water, a majority proportion is now located in water Depths classified as deepwater. The recent decline in oil prices will prolong expansive developments in deeper waters which have considerably higher costs. However, when the oil price environment stabilizes, companies will become increasingly interested in these projects.

Due to the extreme water Depths and pressures in these environments, reliance on subsea umbilicals, risers and flowlines (SURF) systems in deepwater and ultra-deepwater accelerates. As E&P activity increases in these locations, in a quest to satisfy global energy demand, the pressure on subsea P&P systems intensifies. Without these, subsea production halts. E&P in deepwater and ultra-deepwater poses serious challenges to the economic viability of new discoveries.

The oil price fall is putting a caution into capital markets, with stagnant European economies and slowing growth in China all impacting the potential growth of the global subsea P&P systems market. These market conditions have impacted the wider oil and gas market, as well as more specifically the subsea market, with investments becoming uncertain, and credit conditions tightening. Although market sentiment has improved, fears continue to circulate about the further economic downturn, as such impacting the feasibility of new subsea projects. With the potential for investment in oil and gas to slow, the subsea market will experience delays in reaching maximum growth rates.

Visiongain’s global Subsea Production & Processing Systems Market report can keep you informed and up to date with the developments in the market, across six different regions: Africa, Asia Pacific, Gulf of Mexico, North Sea, South America and Rest of the World.

With reference to this report, it details the key investments trend in the global market, subdivided by regions, capital expenditure by hardware and water Depth. Through extensive secondary research and interviews with industry experts, Visiongain has identified a series of market trends that will impact the Subsea Production & Processing Systems Market over the forecast timeframe.

The report will answer questions such as:

– How is the subsea production & processing systems market evolving?

– What is driving and restraining subsea production & processing systems market dynamics?

– How will each subsea production & processing systems submarket segment grow over the forecast period and how much Sales will these submarkets account for in 2028?

– How will market shares of each subsea production & processing systems submarket develop from 2018-2028?

– Which subsea production & processing systems market space will be the main driver of the overall market from 2018-2028?

– How will political and regulatory factors influence regional subsea production & processing systems markets and submarkets?

– Will leading national subsea production & processing systems market broadly follow macroeconomic dynamics, or will individual country sectors outperform the rest of the economy?

– How will market shares of the national markets change by 2028 and which nation will lead the market in 2028?

– Who are the leading players and what are their prospects over the forecast period?

– How will the sector evolve as alliances form during the period between 2018 and 2028?

Five Reasons Why You Must Order and Read This Report Today:

1) The report provides Forecasts for the Subsea Production & Processing Systems Market by Hardware, for the period 2018-2028

– Umbilicals CAPEX 2018-2028

– Risers CAPEX 2018-2028

– Flowlines CAPEX 2018-2028

– Controls CAPEX 2018-2028

– Trees CAPEX 2018-2028

– Manifolds CAPEX 2018-2028

– Tie-ins CAPEX 2018-2028

2) The report also Forecasts and Analyses the Subsea Production & Processing Systems Market by Water Depth from 2018-2028

– Shallow Water

– Deepwater

– Ultra-Deepwater

3) The report Forecasts and Analyses the Subsea Production & Processing Systems Market by Region from 2018-2028

– Africa CAPEX 2018-2028

– Asia Pacific CAPEX 2018-2028

– Gulf of Mexico CAPEX 2018-2028

– North Sea CAPEX 2018-2028

– South America CAPEX 2018-2028

– Rest of the World CAPEX 2018-2028

4) Details and analysis of Subsea Production & Processing Systems Contracts by Water Depth and Region

– Project Name

– Location

– Client

– Contractor

– Contract Period

– $m Value

– Water Depth

– Details

5) The report provides Detailed Profiles of The Leading Companies Operating within the Subsea Production & Processing Systems Market:

– Aker Solutions

– TechnipFMC plc

– Oceaneering International, Inc.

– Subsea 7 SA

– Saipem SpA

– General Electric

– Halliburton

– Schlumberger Limited

– Dril-Quip, Inc.

This independent 366-page report guarantees you will remain better informed than your competitors. With 253 tables and figures examining the Subsea Production & Processing Systems market space, the report gives you a direct, detailed breakdown of the market. PLUS, Capital expenditure by hardware, water Depth and region, as well as in-Depth analysis of leading companies in the Subsea Production & Processing Systems market from 2018-2028 that will keep your knowledge that one step ahead of your rivals.

This report is essential reading for you or anyone in the Energy sector. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Subsea Production & Processing Systems Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Subsea Production & Processing Systems Market

2.1 Subsea Production & Processing Systems Market Structure

2.2 Subsea Production & Processing Systems Market Definition

2.3 Brief History of Subsea Production & Processing Systems

2.4 Subsea Installation

2.5 Subsea Umbilicals

2.6 Risers and Flowlines

2.6.1 New Riser and Flowline Technologies

2.6.1.1 Electrically Heated Flowlines

2.6.1.2 Steel Catenary Risers

2.7 Subsea Control Systems

2.7.1 Wireless Technology and Buoys

2.7.2 Gas Compressors and Pressure Boosters

2.7.3 Vertical Annular Separation & Pumping System (VASPS)

2.7.4 Subsea Separators & De-Sander Modules

2.7.5 Multiphase Flow Meters

2.7.6 Subsea Water Treatment and Reinjection

2.7.7 Well Containment Systems

2.8 Trees

2.9 Manifolds and Tie-Ins

3. Global Subsea Production & Processing Systems Market 2018-2028

3.1 Oil Prices and the Subsea Production and Processing Systems Market

3.1.1 Visiongain’s Description and Analysis of the Oil Price Fall

3.1.2 Supply-Side Factors

3.1.2.1 Tight Oil

3.1.2.2 Libya

3.1.2.3 OPEC

3.1.3 Demand-Side Factors

3.1.3.1 Chinese and Indian Growth

3.1.3.2 Western Stagnation

3.1.4 Other Major Variables that Impact the Oil Price

3.1.4.1 North Africa

3.1.4.2 Russia

3.1.4.3 US Shale

3.1.4.4 Iraq

3.1.4.5 International Incidents

3.1.4.6 Iran

3.1.5 Visiongain’s Oil Price Assumptions and Forecast

3.2 The Drivers and Restraints in the Global Subsea Production & Processing Systems Market

3.2.1 Global Energy Demand

3.2.2 The Impact of Oil Prices and SURF Technology on Marginal Field Profitability

3.2.3 Technological Diversification and Growth Opportunities

3.2.4 Avoiding Security Challenges

3.2.5 Harsh Environments Lead to Tough Challenges

3.2.6 Concerns about the Supply Chain and Relevant Skills

3.2.7 Is Regulation Enough to Appease Public Unease over Subsea and Deepwater Production?

3.2.8 The Cost of Subsea Developments and Access to Finance

4. Subsea Production & Processing Systems Submarkets Forecast 2018-2028

4.1 The Subsea Production & Processing Systems Hardware Submarket Forecasts 2018-2028

4.1.1 The Umbilicals Submarket Forecast 2018-2028

4.1.2 The Risers Submarket Forecast 2018-2028

4.1.3 The Flowlines Submarket Forecast 2018-2028

4.1.4 The Controls Submarket Forecast 2018-2028

4.1.5 The Trees Submarket Forecast 2018-2028

4.1.6 The Manifolds Submarket Forecast 2018-2028

4.1.7 The Tie-Ins Submarket Forecast 2018-2028

4.2 The Subsea Production & Processing Systems Water Depth Submarket Forecasts 2018-2028

4.2.1 The Shallow Water Subsea Production & Processing Systems Submarket Forecast 2018-2028

4.2.1.1 Shallow Water Subsea Production & Processing Systems Market Drivers and Restraints

4.2.1.2 Shallow Water Subsea Production & Processing Systems Contracts

4.2.2 The Deepwater Subsea Production & Processing Systems Submarket Forecast 2018-2028

4.2.2.1 Deepwater Subsea Production & Processing Systems Market Drivers and Restraints

4.2.2.2 Deepwater Subsea Production & Processing Systems Contracts

4.2.3 The Ultra-Deepwater Subsea Production & Processing Systems Submarket Forecast 2018-2028

4.2.3.1 Ultra-Deepwater Subsea Production & Processing Systems Market Drivers and Restraints

4.2.3.2 Ultra-Deepwater Subsea Production & Processing Systems Contracts

5. The African Subsea Production & Processing Systems Market 2018-2028

5.1 What is the Current Status of the Subsea Production & Processing Systems Market in Africa?

5.2 Drivers and Restraints in the African Subsea Production & Processing Systems Market

5.3 What Potential is there in Africa for Subsea Production & Processing Systems?

5.3.1 Delays and Security Issues Continue to Plague the African Market

5.3.2 Political Instability and Delays to the Petroleum Industry Bill Defer Offshore Growth

5.4 Major African Subsea Production & Processing Systems Projects and Individualised Outlooks

5.4.1 Angola

5.4.2 Cameroon

5.4.3 Congo-Brazzaville

5.4.4 Equatorial Guinea

5.4.5 Gabon

5.4.6 Ghana

5.4.7 Mozambique

5.4.8 Namibia

5.4.9 Nigeria

5.4.10 South Africa

5.4.11 Tanzania

6. The Asia Pacific Subsea Production & Processing Systems Market 2018-2028

6.1 What is the Current Status of the Subsea Production & Processing Systems Market in the Asia Pacific?

6.2 Drivers and Restraints in the Asia Pacific Subsea Production & Processing Systems Market

6.3 What Potential is there in the Asia Pacific for Subsea Production & Processing Systems?

6.4 Major Asia Pacific Subsea Production & Processing Systems Projects and Individualised Outlooks

6.4.1 Australia

6.4.2 Brunei

6.4.3 China

6.4.4 India

6.4.5 Indonesia

6.4.6 Malaysia

6.4.7 Papua New Guinea

6.4.8 Vietnam

7. The Gulf of Mexico Subsea Production & Processing Systems Market 2018-2028

7.1 What is the Current Status of the Subsea Production & Processing Systems Market in the Gulf of Mexico?

7.2 Drivers and Restraints in the Gulf of Mexico Subsea Production & Processing Systems Market

7.3 What Potential is there in the Gulf of Mexico for Subsea Production & Processing Systems?

7.3.1 The Prospects of Growth from Mexican Energy Reforms

7.3.2 Opportunities for Marginal Field Growth

7.3.3 The Role of an Established Supply Chain

7.3.4 Impacts from Environmental Regulations

7.3.5 Is the Offshore Market being Harmed by the Shale Revolution?

7.3.6 Is there a Continued Role for Subsea Production & Processing Systems in the Gulf of Mexico?

7.4 Major Gulf of Mexico Subsea Production & Processing Systems Projects and Individualised Outlooks

8. The North Sea Subsea Production & Processing Systems Market 2018-2028

8.1 What is the Current Status of the Subsea Production & Processing Systems Market in the North Sea?

8.2 Drivers and Restraints in the North Sea Subsea Production & Processing Systems Market

8.3 What Potential is there in the North Sea for Subsea Production & Processing Systems?

8.3.1 Are Increased E&P and Expertise Enough to Counteract Declining Production in Norway?

8.3.2 What Role Does Expertise Play in the Subsea Production & Processing Market?

8.3.3 High Costs and Low Levels of Exploration in the UK

8.3.4 Finding the Right Tax Balance in the Mature UK Market

8.4 Major North Sea Production & Processing Systems Projects and Individualised Outlooks

8.4.1 Denmark

8.4.2 Netherlands

9. The South America Subsea Production & Processing Systems Market 2018-2028

9.1 What is the Current Status of the Subsea Production & Processing Systems Market in South America?

9.2 Drivers and Restraints in the South America Subsea Production & Processing Systems Market

9.3 What Potential is there in South America for Subsea Production & Processing Systems?

9.3.1 Growing Brazilian Energy Demand and Vast Reserves

9.1.2 The Presence of International Companies Helps to Meet Demand

9.1.3 An Over-Reliance on Petrobras?

9.1.4 Local Content Legislation and Project Delays

9.1.5 Are Brazil’s Subsea Sites too tough for Existing Technology?

9.1.6 Will International Competition Stunt Brazilian Development?

9.1.7 What is Happening in the Rest of South America?

9.2 Major South America Production & Processing Systems Projects and Individualised Outlooks

10. The Rest of the World Subsea Production & Processing Systems Market 2018-2028

10.1 Drivers and Restraints in the Rest of the World Subsea Production & Processing Systems Market

10.2 Major Rest of the World Production & Processing Systems Projects and Individualised Outlooks

10.2.1 The Arctic

10.2.2 Canada

10.2.3 Caspian Sea

10.2.4 Ireland

10.2.5 Mediterranean Sea

10.2.6 Persian Gulf

10.2.7 Trinidad and Tobago

11. PEST Analysis of the Subsea Production & Processing Systems Market

11.1 Political

11.2 Economical

11.3 Social

11.4 Technological

12. Expert Opinion

12.1 Airborne Oil & Gas

12.1.1 Operations

12.1.2 Drivers and Restraints in the Subsea Production & Processing Systems Market

12.1.3 Oil Prices and the Subsea Market

12.1.4 Thermoplastic and Steel Pipes

12.1.5 Regional Markets in the SURF Market

12.2 JDR Cable Systems

12.2.1 JDR Operations

12.2.2 Subsea Production & Processing Systems Market Drivers

12.2.3 Subsea Production & Processing Systems Market Restraints

12.2.4 The Effects of Lower Oil Prices on the Subsea Market

12.2.5 Low Oil Prices and New Projects

12.2.6 Business Strategies and Declining Oil Prices

12.2.7 Water Depth and SURF

12.2.8 Deepwater Projects and Oil Prices

12.2.9 Regional Subsea Markets

12.2.10 The Demand for SURF

12.2.11 The Length of Umbilicals

12.2.12 Skills Shortage in the SURF Market

12.3 Subsea UK

12.3.1 Neil Gordon and Subsea UK

12.3.2 The World-Leading UK Subsea Sector

12.3.3 Low Oil Prices and the Subsea Market

12.3.4 North Sea Outlook

12.3.5 Global Outlook

12.3.6 Key Technological Innovations

13. The Leading Companies in the Subsea Production & Processing Systems Market

13.1 Aker Solutions

13.1.1 Aker Solutions Total Company Sales 2011-2016

13.1.2 Aker Solutions Sales in the Subsea Production & Processing Systems Market 2011-2016

13.2 TechnipFMC plc

13.3 Oceaneering International, Inc.

13.3.1 Oceaneering International, Inc. Total Company Sales 2011-2016

13.3.2 Oceaneering International, Inc. Sales in the Subsea Production & Processing Systems Market 2011-2016

13.4 Subsea 7 SA

13.4.1 Subsea 7 SA Total Company Sales 2011-2016

13.4.2 Subsea 7 SA Sales in the Subsea Production & Processing Systems Market 2011-2016

13.5 Saipem SpA

13.5.1 Saipem SpA Total Company Sales 2011-2016

13.6 General Electric

13.6.1 General Electric Total Company Sales 2012-2016

13.6.2 General Electric Sales in the Subsea Production & Processing Systems Market 2012-2016

13.7 Halliburton

13.7.1 Halliburton Total Company Sales 2011-2016

13.7.2 Halliburton Sales in the Subsea Production & Processing Systems Market 2011-2016

13.8 Schlumberger Limited

13.8.1 Schlumberger Limited Total Company Sales 2011-2016

13.9 Dril-Quip, Inc.

13.9.1 Dril-Quip, Inc. Total Company Sales 2011-2016

13.9.2 Dril-Quip, Inc. Sales in the Subsea Production & Processing Systems Market 2011-2016

13.10 Ocean Installer AS

13.11 Prysmian SpA

13.12 Vallourec SA

13.13 John Wood Group Plc

13.14 Aceton Group Ltd.

13.15 Other Companies Involved in the Subsea Production & Processing Systems Market 2017

14. Conclusions and Recommendations

14.1 Key Findings

14.2 Recommendations

15. Glossary

Appendix

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

Appendix B

Visiongain Report Evaluation Form

List of Tables

Table 1.1 Regional Subsea Production and Processing Systems Market Forecast 2018-2028 ($bn, AGR %)

Table 2.1 Subsea Process Classification (Age, Equipment, Characteristics, Water Disposal, Sand Disposal)

Table 2.2 Advantages and Disadvantages of Hydraulic Diaphragm Electric Submersible Pumps

Table 2.3 Advantages and Disadvantages of Electric Submersible Pumps (ESP)

Table 2.4 Advantages and Disadvantages of Progressive Cavity Pumps (PCP)

Table 2.5 Advantages and Disadvantages of Hydraulic Turbine or Helico Axial Pumps (HAP)

Table 2.6 Advantages and Disadvantages of Twin-Screw Pumps (TSP)

Table 3.1 Global Subsea Production and Processing Systems Market Forecast, 2018-2028 ($bn, AGR %, Cumulative)

Table 3.2 Regional Subsea Production and Processing Systems Market Forecast 2018-2028 ($bn, AGR %)

Table 3.3 Visiongain’s Anticipated Brent Crude Oil Average Spot Price, 2017, 2018, 2019-2021, 2022-2024, 2025-2027 ($/bbl)

Table 3.4 Global Subsea Production & Processing Systems Market Drivers & Restraints

Table 4.1 Subsea Production & Processing Systems Hardware Submarket Forecasts, 2018-2028 ($bn, AGR %, Cumulative)

Table 4.2 Subsea Production & Processing Systems Hardware Submarket CAGR (%)2018-2023, 2023-2028 and 2018-2028

Table 4.3 Umbilicals Submarket Forecast, 2018-2028 ($bn, AGR %)

Table 4.4 The Umbilicals Submarket Forecast by Region 2018-2028 ($m, AGR %, Cumulative)

Table 4.5 Risers Submarket Forecast, 2018-2028 ($bn, AGR %)

Table 4.6 Risers Submarket Forecast by Region 2018-2028 ($mn, AGR %, Cumulative)

Table 4.7 Flowlines Submarket Forecast, 2018-2028 ($bn, AGR %)

Table 4.8 Flowlines Submarket Forecast by Region 2018-2028 ($mn, AGR %, Cumulative)

Table 4.9 Controls Submarket Forecast, 2018-2028 ($bn, AGR %)

Table 4.10 Controls Submarket Forecast by Region 2018-2028 ($mn, AGR %, Cumulative)

Table 4.11 Trees Submarket Forecast, 2018-2028 ($mn, AGR %)

Table 4.12 Trees Submarket Forecast by Region 2018-2028 ($mn, AGR %, Cumulative)

Table 4.13 Manifolds Submarket Forecast, 2018-2028 ($bn, AGR %)

Table 4.14 Manifolds Submarket Forecast by Region 2018-2028 ($mn, AGR %, Cumulative)

Table 4.15 Tie-Ins Submarket Forecast, 2018-2028 ($bn, AGR %)

Table 4.16 Tie-Ins Submarket Forecast by Region 2018-2028 ($mn, AGR %, Cumulative)

Table 4.17 Subsea Production & Processing Systems Water Depth Submarket Forecasts, 2018-2028 ($bn, AGR %, Cumulative)

Table 4.18 Subsea Production & Processing Systems Water Depth Submarket CAPEX CAGR Forecasts, 2018-2023, 2023-2028 and 2018-2028 (%)

Table 4.19 Shallow Water Subsea Production & Processing Systems Submarket Forecast, 2018-2028 ($bn, AGR %)

Table 4.20 Shallow Water Subsea Production & Processing Systems Submarket Forecast by Region 2018-2028 ($mn, AGR %, Cumulative)

Table 4.21 Shallow Water Subsea Production & Processing Systems Market Drivers and Restraints

Table 4.22 Shallow Water Subsea Production & Processing Systems Contracts (Project Name, Location, Client, Contractor, Contract Period, $m Value, Water Depth, Details)

Table 4.23 Deepwater Subsea Production & Processing Systems Submarket Forecast, 2018-2028 ($bn, AGR %)

Table 4.24 Deepwater Subsea Production & Processing Systems Submarket Forecast by Region 2018-2028 ($mn, AGR %, Cumulative)

Table 4.25 Deepwater Subsea Production & Processing Systems Market Drivers and Restraints

Table 4.26 Deepwater Subsea Production & Processing Systems Contracts (Project Name, Location, Client, Contractor, Contract Period, $m Value, Water Depth, Details)

Table 4.27 Ultra-Deepwater Subsea Production & Processing Systems Submarket Forecast, 2018-2028 ($bn, AGR %)

Table 4.28 Ultra-Deepwater Subsea Production & Processing Systems Submarket Forecast by Region 2018-2028 ($mn, AGR %, Cumulative)

Table 4.29 Ultra-Deepwater Subsea Production & Processing Systems Market Drivers and Restraints

Table 4.30 Ultra-Deepwater Subsea Production & Processing Systems Contracts (Project Name, Location, Client, Contractor, Contract Period, $m Value, Water Depth, Details)

Table 5.1 The African Subsea Production & Processing Systems Market Forecast, 2018-2028 ($bn, AGR %)

Table 5.2 African Subsea Production & Processing Systems Submarkets Forecast 2018-2028 ($mn, AGR %, Cumulative)

Table 5.3 Drivers and Restraints in the African Subsea Production & Processing Systems Market

Table 5.4 Ultra-Deepwater Subsea Production & Processing Systems Contracts (Project Name, Location, Client, Contractor, Contract Period, $m Value, Water Depth, Details)

Table 5.5 African Subsea Production & Processing Systems Contracts (Project Name, Location, Client, Contractor, Contract Period, $m Value, Water Depth, Details)

Table 6.1 The Asia Pacific Subsea Production & Processing Systems Market Forecast, 2018-2028 ($bn, AGR %)

Table 6.2 Asia Pacific Subsea Production & Processing Systems Submarkets Forecast 2018-2028 ($mn, AGR %, Cumulative)

Table 6.3 Asia Pacific Offshore Oil and Gas Fields with Subsea Production & Processing Systems (Project, Field Type, First Production, Water Depth, Operator, Country)

Table 6.4 Drivers and Restraints in the Asia Pacific Subsea Production & Processing Systems Market

Table 6.5 Asia Pacific Subsea Production & Processing Systems Contracts (Project Name, Location, Client, Contractor, Contract Period, $mn Value, Water Depth, Details)

Table 6.6 Potential Offshore Developments in the Asia Pacific (Project, Operator, Water Depth, Country)

Table 7.1 The Gulf of Mexico Subsea Production & Processing Systems Market Forecast, 2018-2028 ($bn, AGR %)

Table 7.2 Gulf of Mexico Subsea Production & Processing Systems Submarkets Forecast 2018-2028 ($m, AGR %, Cumulative)

Table 7.3 Recent US Deepwater Projects (Field, Operator)

Table 7.4 Drivers and Restraints in the Gulf of Mexico Subsea Production & Processing Systems Market

Table 7.5 Gulf of Mexico Subsea Production & Processing Systems Contracts (Project Name, Location, Client, Contractor, Contract Period, $m Value, Water Depth, Details)

Table 7.6 Potential Offshore Developments in the Gulf of Mexico (Project, Operator, Water Depth, Country)

Table 8.1 The North Sea Subsea Production & Processing Systems Market Forecast, 2018-2028 ($bn, AGR %)

Table 8.2 North Sea Subsea Production & Processing Systems Submarkets Forecast 2018-2028 ($m, AGR %, Cumulative)

Table 8.3 Major North Sea Oil and Gas Fields with Subsea Production & Processing Systems (Project, Field Type, First Production, Water Depth, Operator, Country)

Table 8.4 Drivers and Restraints in the North Sea Subsea Production & Processing Systems Market

Table 8.5 UK Oil and Gas Exploration Taxes (Tax, Details)

Table 8.6 UK Tax Allowance Field Types

Table 8.7 North Sea Subsea Production & Processing Systems Contracts (Project Name, Location, Client, Contractor, Contract Period, $m Value, Water Depth, Details)

Table 8.8 Potential Offshore Developments in the North Sea (Field Name, Location, Operator, Water Depth, Expected Production)

Table 9.1 The South America Subsea Production & Processing Systems Market Forecast, 2018-2028 ($bn, AGR %)

Table 9.2 South America Subsea Production & Processing Systems Submarkets Forecast 2018-2028 ($mn, AGR %, Cumulative)

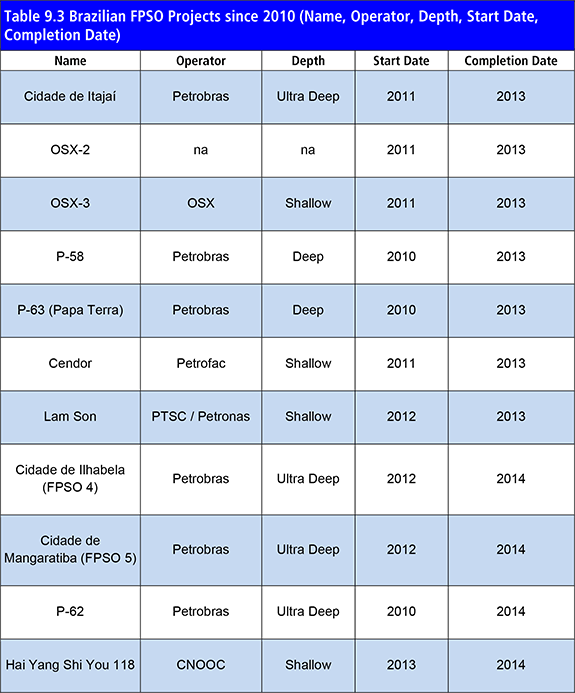

Table 9.3 Brazilian FPSO Projects since 2010 (Name, Operator, Depth, Start Date, Completion Date)

Table 9.4 Drivers and Restraints in the South America Subsea Production & Processing Systems Market

Table 9.5 South America Subsea Production & Processing Systems Contracts (Project Name, Location, Client, Contractor, Contract Period, $m Value, Water Depth, Details)

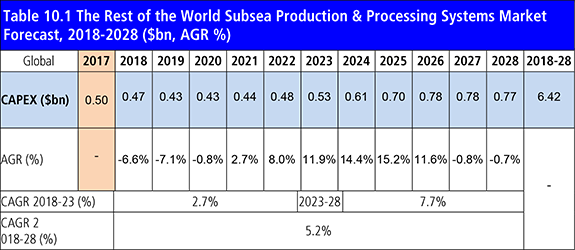

Table 10.1 The Rest of the World Subsea Production & Processing Systems Market Forecast, 2018-2028 ($bn, AGR %)

Table 10.2 Rest of the World Subsea Production & Processing Systems Submarkets Forecast 2018-2028 ($m, AGR %, Cumulative)

Table 10.3 Drivers and Restraints in the Rest of the World Subsea Production & Processing Systems Market

Table 10.4 Rest of the World Subsea Production & Processing Systems Contracts (Project Name, Location, Client, Contractor, Contract Period, $m Value, Water Depth, Details)

Table 10.5 Irish Offshore Fields with Subsea P&P Systems (Project, Majority Partner, Status)

Table 10.6 Irish Offshore Areas with Potential for Subsea P&P Systems (Field, Majority Partner, Water Depth, Estimated Reserves)

Table 13.1 Aker Solutions Profile 2017 (CEO, Total Company Sales US$m, Share of Total Company Sales from Company Division that includes Subsea Production & Processing Systems Market (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.2 Aker Solutions Major Subsea Production & Processing Systems Contracts (Client, Project, Location, Award Date)

Table 13.3 Aker Solutions Total Company Sales 2010-2016 (US$m, AGR %)

Table 13.4 Aker Solutions Sales in the Subsea Production & Processing Systems Market 2010-2016 (US$m, AGR %)

Table 13.5 TechnipFMC plc 2016 (CEO, Total Company Sales US$m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.6 FMC Technologies Major Subsea Production & Processing Systems Contracts (Project, Client, Year Awarded, Depth, Location)

Table 13.7 Technip Subsea Production & Processing Systems Contracts (Client, Project, Location, Award Year)

Table 13.8 Oceaneering International, Inc. Profile 2016 (CEO, Total Company Sales US$m, Sales from Company Division that includes Subsea Production & Processing Systems (US$m), Share of Total Company Sales from Company Division that includes Subsea Production & Processing Systems Market (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.9 Oceaneering Service Divisions

Table 13.10 Oceaneering Subsea Production & Processing Systems Contracts (Client, Project, Location, Award Date)

Table 13.11 Oceaneering International, Inc. Total Company Sales 2010-2016 (US$m, AGR %)

Table 13.12 Oceaneering International, Inc. Sales in the Subsea Production & Processing Systems Market 2010-2016 (US$m, AGR %)

Table 13.13 Subsea 7 SA Profile 2016 (CEO, Total Company Sales US$m, Sales from Company Division that includes Subsea Production & Processing Systems (US$m), Share of Total Company Sales from Company Division that includes Subsea Production & Processing Systems Market (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.14 Subsea 7 Major Subsea Production & Processing Systems Contracts (Client, Project, Location, Award Year)

Table 13.15 Subsea 7 SA Total Company Sales 2010-2016 (US$m, AGR %)

Table 13.16 Subsea 7 SA Sales in the Subsea Production & Processing Systems Market 2010-2016 (US$m, AGR %)

Table 13.17 Saipem SpA Profile 2016 (CEO, Total Company Sales US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.18 Saipem Major Subsea Production & Processing Systems Contracts (Client, Project, Location, Award Year)

Table 13.19 Saipem SpA Total Company Sales 2010-2016 (US$m, AGR %)

Table 13.20 General Electric Profile 2016 (CEO, Total Company Sales US$m, Sales from Company Division that includes Subsea Production & Processing Systems (US$m), Share of Total Company Sales from Company Division that includes Subsea Production & Processing Systems Market (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.21 General Electric Major Subsea Production & Processing Systems Contracts (Client, Project, Location, Award Year)

Table 13.22 General Electric Corporation Total Company Sales 2011-2016 (US$m, AGR %)

Table 13.23 General Electric in the Subsea Production & Processing Systems Market 2011-2016 (US$m, AGR %)

Table 13.24 Halliburton Profile 2016 (CEO, Total Company Sales US$m, Sales from Company Division that includes Subsea Production & Processing Systems (US$m), Share of Total Company Sales from Company Division that includes Subsea Production & Processing Systems Market (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.25 Halliburton Major Subsea Production & Processing Systems Contracts (Client, Project, Location, Award Year)

Table 13.26 Halliburton Total Company Sales 2010-2016 (US$m, AGR %)

Table 13.27 Halliburton in the Subsea Production & Processing Systems Market 2010-2016 (US$m, AGR %)

Table 13.28 Schlumberger Limited Profile 2016 (CEO, Total Company Sales US$m, Sales from Company Division that includes Subsea Production & Processing Systems (US$m), Share of Total Company Sales from Company Division that includes Subsea Production & Processing Systems Market (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.29 Schlumberger Limited Major Subsea Production & Processing Systems Contracts (Client, Project, Location, Award Year)

Table 13.30 Schlumberger Limited Total Company Sales 2010-2016 (US$m, AGR %)

Table 13.31 Dril-Quip, Inc. Profile 2016 (CEO, Total Company Sales US$m, Sales from Company Division that includes Subsea Production & Processing Systems (US$m), Share of Total Company Sales from Company Division that includes Subsea Production & Processing Systems Market (%), Net Income / Loss US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 13.32 Dril-Quip, Inc. Major Subsea Production & Processing Systems Contracts (Client, Project, Location, Award Year)

Table 13.33 Dril-Quip, Inc. Total Company Sales 2010-2016 (US$m, AGR %)

Table 13.34 Dril-Quip, Inc. in the Subsea Production & Processing Systems Market 2010-2016 (US$m, AGR %)

Table 13.35 Other Leading Companies in the Subsea Production & Processing Sy023 (%)

Figure 4.16 The Risers Submarket Market Share Forecast by Region, 2028 (%)

Figure 4.17 The Risers Submarket Forecast by Region 2018-2028 ($mn)

Figure 4.18 Flowlines Submarket Forecast, 2018-2028 ($bn, AGR %)

Figure 4.19 Flowlines Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 4.20 The Flowlines Submarket Market Share Forecast by Region, 2018 (%)

Figure 4.21 The Flowlines Submarket Market Share Forecast by Region, 2023 (%)

Figure 4.22 The Flowlines Submarket Market Share Forecast by Region, 2028 (%)

Figure 4.23 The Flowlines Submarket Forecast by Region 2018-2028 ($mn)

Figure 4.24 Controls Submarket Forecast, 2018-2028 ($bn, AGR %)

Figure 4.25 Controls Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 4.26 The Controls Submarket Market Share Forecast by Region, 2018 (%)

Figure 4.27 The Controls Submarket Market Share Forecast by Region, 2023 (%)

Figure 4.28 The Controls Submarket Market Share Forecast by Region, 2028 (%)

Figure 4.29 The Controls Submarket Forecast by Region 2018-2028 ($mn)

Figure 4.30 Trees Submarket Forecast, 2018-2028 ($bn, AGR %)

Figure 4.31 Trees Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 4.32 The Trees Submarket Market Share Forecast by Region, 2018 (%)

Figure 4.33 The Trees Submarket Market Share Forecast by Region, 2023 (%)

Figure 4.34 The Trees Submarket Market Share Forecast by Region, 2028 (%)

Figure 4.35 The Trees Submarket Forecast by Region 2018-2028 ($mn)

Figure 4.36 Manifolds Submarket Forecast, 2018-2028 ($bn, AGR %)

Figure 4.37 Manifolds Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 4.38 The Manifolds Submarket Market Share Forecast by Region, 2018 (%)

Figure 4.39 The Manifolds Submarket Market Share Forecast by Region, 2023 (%)

Figure 4.40 The Manifolds Submarket Market Share Forecast by Region, 2028 (%)

Figure 4.41 The Manifolds Submarket Forecast by Region 2018-2028 ($mn)

Figure 4.42 Tie-Ins Submarket Forecast, 2018-2028 ($bn, AGR %)

Figure 4.43 Tie-Ins Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 4.44 The Tie-Ins Submarket Market Share Forecast by Region, 2018 (%)

Figure 4.45 The Tie-Ins Submarket Market Share Forecast by Region, 2023 (%)

Figure 4.46 The Tie-Ins Submarket Market Share Forecast by Region, 2028 (%)

Figure 4.47 The Tie-Ins Submarket Forecast by Region 2018-2028 ($mn)

Figure 4.48 Subsea Production & Processing Systems Water Depth Submarket Forecasts, 2018-2028 ($bn)

Figure 4.49 Total CAPEX per Subsea Production & Processing Systems Water Depth, 2018-2028 ($bn)

Figure 4.50 Shallow Water, Deepwater and Ultra-Deepwater Subsea Production & Processing Systems Market Share Forecast, 2018 (%)

Figure 4.51 Shallow Water, Deepwater and Ultra-Deepwater Subsea Production & Processing Systems Market Share Forecast, 2023 (%)

Figure 4.52 Shallow Water, Deepwater and Ultra-Deepwater Subsea Production & Processing Systems Market Share Forecast, 2028 (%)

Figure 4.53 Shallow Water Subsea Production & Processing Systems Submarket Forecast, 2018-2028 ($bn, AGR %)

Figure 4.54 Shallow Water Subsea Production & Processing Systems Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 4.55 The Shallow Water Subsea Production & Processing Systems Market Share Forecast by Region, 2018 (%)

Figure 4.56 The Shallow Water Subsea Production & Processing Systems Market Share Forecast by Region, 2023 (%)

Figure 4.57 The Shallow Water Regional Subsea Production & Processing Systems Market Share Forecast by Region, 2028 (%)

Figure 4.58 The Shallow Water Subsea Production & Processing Systems Submarket Forecast by Region 2018-2028 ($mn)

Figure 4.59 Deepwater Subsea Production & Processing Systems Submarket Forecast, 2018-2028 ($bn, AGR %)

Figure 4.60 Deepwater Subsea Production & Processing Systems Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 4.61 The Deepwater Subsea Production & Processing Systems Market Share Forecast by Region, 2018 (%)

Figure 4.62 The Deepwater Subsea Production & Processing Systems Market Share Forecast by Region, 2023 (%)

Figure 4.63 The Deepwater Regional Subsea Production & Processing Systems Market Share Forecast by Region, 2028 (%)

Figure 4.64 The Deepwater Subsea Production & Processing Systems Submarket Forecast by Region 2018-2028 ($mn)

Figure 4.65 Ultra-Deepwater Subsea Production & Processing Systems Submarket Forecast, 2018-2028 ($bn, AGR %)

Figure 4.66 Ultra-Deepwater Subsea Production & Processing Systems Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 4.67 The Ultra-Deepwater Subsea Production & Processing Systems Market Share Forecast by Region, 2018 (%)

Figure 4.68 The Ultra-Deepwater Subsea Production & Processing Systems Market Share Forecast by Region, 2023 (%)

Figure 4.69 The Ultra-Deepwater Regional Subsea Production & Processing Systems Market Share Forecast by Region, 2028 (%)

Figure 4.70 The Ultra-Deepwater Subsea Production & Processing Systems Submarket Forecast by Region 2018-2028 ($mn)

Figure 5.1 The African Subsea Production & Processing Systems Market Forecast, 2018-2028 ($bn, AGR %)

Figure 5.2 The African Subsea Production & Processing Systems Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 5.3 African Subsea Production & Processing Systems Water Depth Submarket Forecast 2018-2028 ($mn)

Figure 5.4 African Subsea Production & Processing Systems Hardware Submarket Forecast 2018-2028 ($mn)

Figure 5.5 Nigerian and Angolan Oil Production 1996-2016 (Mbpd)

Figure 6.1 The Asia Pacific Subsea Production & Processing Systems Market Forecast, 2018-2028 ($bn, AGR %)

Figure 6.2 The Asia Pacific Subsea Production & Processing Systems Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 6.3 Asia Pacific Subsea Production & Processing Systems Water Depth Submarket Forecast 2018-2028 ($mn)

Figure 6.4 Asia Pacific Subsea Production & Processing Systems Hardware Submarket Forecast 2018-2028 ($mn)

Figure 6.5 Australian Oil and Natural Gas Production 1996-2016 (Mbpd, Bcf)

Figure 6.6 Indonesian Oil Production 1996-2016 (Mbpd)

Figure 7.1 The Gulf of Mexico Subsea Production & Processing Systems Market Forecast, 2018-2028 ($bn, AGR %)

Figure 7.2 The Gulf of Mexico Subsea Production & Processing Systems Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 7.3 Gulf of Mexico Subsea Production & Processing Systems Water Depth Submarket Forecast 2018-2028 ($bn)

Figure 7.4 Gulf of Mexico Subsea Production & Processing Systems Hardware Submarket Forecast 2018-2028 (US$bn)

Figure 7.5 Location of Active Offshore Oil and Gas Platforms in the US Gulf of Mexico

Figure 7.6 US Onshore and Offshore Crude Oil Production 1994-2014 (Mbpd)

Figure 8.1 The North Sea Subsea Production & Processing Systems Market Forecast, 2018-2028 ($bn, AGR %)

Figure 8.2 The North Sea Subsea Production & Processing Systems Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 8.3 North Sea Subsea Production & Processing Systems Water Depth Submarket Forecast 2018-2028 ($mn)

Figure 8.4 North Sea Subsea Production & Processing Systems Hardware Submarket Forecast 2018-2028 ($mn)

Figure 8.5 Norwegian Oil Production, Estimated Net Exports and Proved Reserves 1980-2013 (Mbpd, Bbbls)

Figure 8.6 The Number of Norwegian Exploration Wells Drilled 1970-2014

Figure 8.7 The Number of UK Exploration Wells Drilled 2000-2017

Figure 9.1 The South America Subsea Production & Processing Systems Market Forecast, 2018-2028 ($bn, AGR %)

Figure 9.2 The South America Subsea Production & Processing Systems Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 9.3 South America Subsea Production & Processing Systems Water Depth Submarket Forecast 2018-2028 ($mn)

Figure 9.4 South America Subsea Production & Processing Systems Hardware Submarket Forecast 2018-2028 ($mn)

Figure 10.1 The Rest of the World Subsea Production & Processing Systems Market Forecast, 2018-2028 ($bn, AGR %)

Figure 10.2 The Rest of the World Subsea Production & Processing Systems Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 10.3 Rest of the World Subsea Production & Processing Systems Water Depth Submarket Forecast 2018-2028 ($mn)

Figure 10.4 Rest of the World Subsea Production & Processing Systems Hardware Submarket Forecast 2018-2028 ($mn)

Figure 13.1 Aker Solutions Total Company Sales 2011-2016 (US$m, AGR %)

Figure 13.2 Aker Solutions Sales in the Subsea Production & Processing Systems Market 2011-2016 (US$m, AGR %)

Figure 13.5 Oceaneering International, Inc. Total Company Sales 2011-2016 (US$m, AGR %)

Figure 13.6 Oceaneering International, Inc. Sales in the Subsea Production & Processing Systems Market 2011-2016 (US$m, AGR %)

Figure 13.7 Subsea 7 SA Total Company Sales 2011-2016 (US$m, AGR %)

Figure 13.8 Subsea 7 SA Sales in the Subsea Production & Processing Systems Market 2011-2016 (US$m, AGR %)

Figure 13.9 Saipem SpA Total Company Sales 2011-2016 (US$m, AGR %)

Figure 13.10 General Electric Total Company Sales 2012-2016 (US$m, AGR %)

Figure 13.11 General Electric Sales in the Subsea Production & Processing Systems Market 2012-2016 (US$m, AGR %)

Figure 13.12 Halliburton Total Company Sales 2011-2016 (US$m, AGR %)

Figure 13.13 Halliburton Sales in the Subsea Production & Processing Systems Market 2011-2016 (US$m, AGR %)

Figure 13.14 Schlumberger Limited Company Sales 2011-2016 (US$m, AGR %)

Figure 13.15 Dril-Quip, Inc. Company Sales 2011-2016 (US$m, AGR %)

Figure 13.16 Dril-Quip, Inc. Sales in the Subsea Production & Processing Systems Market 2011-2016 (US$m, AGR %)

2H Offshore

Acergy

Aceton Group Ltd.

AGR Group

Air Products & Chemicals

Airborne Oil & Gas

Aker Solutions

Allseas

Alpha Petroleum

Amerada Hess

Anadarko Petroleum Corporation

Apache Energy

Aquaterra Energy

Ariosh

ATP Oil & Gas Corporation

Australian Worldwide Exploration

Aveon Offshore

Avner Oil Exploration

Azienda Generale Italiana Petroli (AGIP)

Baker Hughes

BG Group

BG International

BG Norge

BHP Billiton

Bluewater Industries

BOS Shelf

BP

BP America

BP Angola

Burullus Gas Company

Cairn Energy

Cairn India Limited

Calder Ltd.

Cameron Group

Cameron International

Canadian Natural Resources

Cardon IV

Centrica

Ceona

Chevron

Chevron Australia

China National Offshore Oil Corporation (CNOOC)

China National Petroleum Corporation (CNPC)

China Offshore Oil Engineering (COOEC)

Claxton

Coastal Energy

Coastal Energy Malaysia

Cobalt Energy

Con Son JOC

ConocoPhillips

COSCO

Cuu Long Joint Operating Company (CLJOC)

Dana Petroleum

DEA

DeepOcean

DeepSea

DeepTrend

Delek Drilling

Delmar Systems Inc.

Det Norske

Det Norske Oljeselskap ASA

DOF

Dong Energy

DorGas Exploration

Dril-Quip, Inc

DSME

Dubai Petroleum Establishment

Duco

Duxvalves

E.ON

EDF

Elf Exploration UK

EMAS AMC

Eni

Eni Ghana E&P

Eni Norge AS

Enquest

EOG Resources

Esso

Esso Exploration Angola Ltd.

Estaleiro Enseada do Paraguaçu (EEP)

Europa

Excelerate

ExxonMobil

Flexibras Vitória

Flexlife

FloaTEC de Mexico

FMC Technologies

Framo Engineering

Galoc Production Company

Gazprom

GDF SUEZ

GE Oil & Gas

General Electric

Ghana National Petroleum Corporation (GNPC)

Gola

Halliburton

Harvest Natural Resources

Helix Well Containment Group (HWCG)

Hess Corporation

Hibernia Management and Development Company (HMDC)

HitecVision AS

Höegh

Husky Energy

Husky Oil

Husky Oil China

INPEX

INPEX Masela

Israeli Electricity Corporation

Isramco Negev 2

Ithaca Energy

ITP Interpipe

JDR

JDR Cable Systems

John Wood Group Plc

JX Nippon

Kangean Energy Indonesia (KEI)

KBR

Korea National Oil Corporation (KNOC)

Kosmos Energy

Koso Kent Introl Ltd.

Lagos Deep Offshore Logistics (LADOL)

LLOG Exploration Offshore

Lukoil

Lundin Petroleum

Maersk Oil

Marathon Oil

Marine Well Containment Company (MWCC)

McDermott

Mobil Producing Nigeria Unlimited

Mogas Industries

Murphy Exploration & Production Company

Murphy Oil

Newfield

Nexans

Nexen Petroleum

Nexus Energy

Nigerian National Petroleum Corporation (NNPC)

Noble Energy

Ocean Installer AS

Oceaneering International, Inc.

Oil & Gas UK

Oil and Natural Gas Corporation (ONGC)

OMV

OneSubsea

Ophir Energy

OSX

Pangea LNG

Parker Energy Products

Pemex

Perenco Cameroon

Petrobras

Petrofac

Petróleo Brasileiro (Petrobras)

Petróleos de Venezuela SA (PDVSA)

Petróleos Mexicanos (Pemex)

Petromin

Petronas

Petronas Carigali

PetroSA

PetroVietnam

Premier Oil

Principia

Providence Resources

Prysmian Group

Prysmian SpA

PTSC

PTTEP

PVEP

Ratio

Reliance Industries

Repsol

Risertec

Roc Oil

Rosneft

Royal Dutch Shell

Royal Niger Emerging Technologies

Sabre Oil and Gas

Saipem SpA

Salamander Energy

Samsung Heavy Industries

Santos

SapuraAcergy

Sarawak Shell Berhad

SBM Offshore

Schlumberger Limited

Shell Brunei

Shell Offshore

SHI

Sinopec

Sirius Petroleum

SNH

Star Gulf FZCO

Statoil

StatoilHydro

Stone Energy Corporation

Stress Subsea Inc

Subsea 7

Subsea Energy Australia (SEA)

Subsea Riser Products

Subsea UK

Sunbird Energy

Suncor Energy

Swiber Offshore Construction

Talisman Energy

Talisman Sinopec Energy

Tamar Partnership

TAQA

Technip Umbilicals

TechnipFMC plc

TNK

TNK Vietnam

TNK-BP

Total

Total E&P Nederland

Total Upstream Nigeria

Transocean

Tullow Ghana

Tullow Oil

Unocal

Vallourec SA

Wellstream

Wintershall

Wood Group

Wood Group Engineering

Wood Group Kenny

Wood Group PSN

Woodside Energy

Xstate Resources

Zarubezhneft

Other Organisations Mentioned in This Report

American Petroleum Institute (API)

Bureau of Ocean Energy Management (BOEM)

Bureau of Safety and Environmental Enforcement (BSEE)

Chinese Government

Communist Party of Vietnam (CPV)

Danish Energy Agency (DEA)

Energy Information Administration (EIA)

European Union (EU)

International Monetary Fund (IMF)

Independent Petroleum Association of America (IPAA)

Indonesian Government

International Atomic Energy Agency (IAEA)

Mozambique Government

National Ocean Industries Association (NOIA)

National Subsea Research Initiative (NSRI)

Nigerian Content Development and Monitoring Board

Nigerian Government

Nigerian Ministry of Petroleum Resources

Norwegian Government

Norwegian Petroleum Directorate

Oil Spill Prevention & Response Advisory Group (OSPRAG)

Organization of the Petroleum Exporting Countries (OPEC)

Papua New Guinean Government

Scottish Development International (SDI)

UK Department of Energy & Climate Change (DECC)

UK Trade & Investment (UKTI)

United States Oil and Gas Association (USOGA)

US Environmental Protection Agency (EPA)

US Government

World Bank

Download sample pages

Complete the form below to download your free sample pages for Subsea Production & Processing Systems Market Outlook 2018-2028

Related reports

-

Deepwater Drilling Market Report 2018-2028

The global deepwater drilling market is calculated to see spending of $30.30 bn in 2018. Excessive supply of oil worldwide...

Full DetailsPublished: 26 March 2018 -

Top 20 Enhanced Oil Recovery (EOR) Companies 2019

The leading 20 players in the EOR market comprise a broad range of companies, including the six supermajors, large state-owned,...Full DetailsPublished: 18 December 2018 -

Offshore Oil & Gas Decommissioning Market Report Forecasts 2020-2030

Global Offshore Oil & Gas Decommissioning market will see a capital expenditure (CAPEX) of $8,279 million in 2020.

...Full DetailsPublished: 16 December 2019 -

Oil Refineries Market Report 2018-2028

With the recent upswing in oil prices these margins are again rising and Visiongain expects the value of the refinery...Full DetailsPublished: 24 July 2018 -

Oil & Gas Subsea Umbilicals, Risers & Flowlines (SURF) Market Forecast 2017-2027

Visiongain has calculated that the global subsea umbilicals, risers and flowlines (SURF) market will see a capital expenditure (CAPEX) of...

Full DetailsPublished: 17 October 2017 -

Oil & Gas Subsea Umbilicals, Risers & Flowlines (SURF) Market Report 2019-2029

Visiongain has calculated that the global subsea umbilicals, risers and flowlines (SURF) market will see a capital expenditure (CAPEX) of...

Full DetailsPublished: 02 November 2018 -

Offshore Oil & Gas Decommissioning Market Report Forecasts 2019-2029

Visiongain has forecasted that the global Offshore Oil & Gas Decommissioning market will see a capital expenditure (CAPEX) of $7,076mn...Full DetailsPublished: 17 January 2019 -

EOR Yearbook 2018: The Ultimate Guide To Enhanced Oil Recovery (EOR)

Visiongain’s latest EOR yearbook provides you with this unprecedented in-Depth analysis of the global EOR market. Visiongain assesses that the...

Full DetailsPublished: 24 January 2018 -

Natural Gas Storage Market Report 2017-2027

The latest research report from business intelligence provider Visiongain offers comprehensive analysis of the global natural gas storage market. Visiongain...

Full DetailsPublished: 22 February 2017 -

Liquefied Natural Gas (LNG) Carrier Market 2018-2028

Visiongain has calculated that the LNG Carrier market will see a capital expenditure (CAPEX) of $11,208 mn in 2018.Read on...

Full DetailsPublished: 13 February 2018

Download sample pages

Complete the form below to download your free sample pages for Subsea Production & Processing Systems Market Outlook 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Latest Energy news

Visiongain Publishes Carbon Capture Utilisation and Storage (CCUS) Market Report 2024-2034

The global carbon capture utilisation and storage (CCUS) market was valued at US$3.75 billion in 2023 and is projected to grow at a CAGR of 20.6% during the forecast period 2024-2034.

19 April 2024

Visiongain Publishes Liquid Biofuels Market Report 2024-2034

The global Liquid Biofuels market was valued at US$90.7 billion in 2023 and is projected to grow at a CAGR of 6.7% during the forecast period 2024-2034.

03 April 2024

Visiongain Publishes Hydrogen Generation Market Report 2024-2034

The global Hydrogen Generation market was valued at US$162.3 billion in 2023 and is projected to grow at a CAGR of 3.7% during the forecast period 2024-2034.

28 March 2024

Visiongain Publishes Biofuel Industry Market Report 2024-2034

The global Biofuel Industry market was valued at US$123.2 billion in 2023 and is projected to grow at a CAGR of 7.6% during the forecast period 2024-2034.

27 March 2024