Industries > Energy > Liquefied Natural Gas (LNG) Carrier Market Report 2019-2029

Liquefied Natural Gas (LNG) Carrier Market Report 2019-2029

Forecasts by Type (GTT NO 96, Mark II, Moss, SPB and Small Scale), by Market Type (Retrofit/Converted and New Build), by Propulsion Type (XDF, ME-GI, SSD, TFDE, DFDE, Steam, Others) Plus Contract Tables & Profiles of Leading Companies

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global LNG carrier market. Visiongain assesses that this market will generate revenues of US17.55bn in 2019.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector. Visiongain’s new study tells you and tells you NOW.

In this brand new report you find 200+ in-depth tables, charts and graphs.

The 266 page report provides clear detailed insight into the global LNG carrier. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand new report today you stay better informed and ready to act.

Report Scope

The Report Provides Detailed Profiles Of Key Companies Operating Within The LNG Carrier Market:

Samsung Heavy Industries (SHI)

Kawasaki Heavy Industries (KHI)

NYK Line.

Misc Berhad

STX Offshore and Shipbuilding

Hudong Zhonghua

Daewoo Shipbuilding and Marine Engineering (DSME)

Mitsubishi Heavy Industries, Ltd. (MHI)

Maran Gas Maritime Inc. (MGM)

Hyundai Heavy Industries Co.,(HHI) Ltd.

Global Liquefied Natural Gas (LNG) Carrier Forecasts From 2019-2029

Global Liquefied Natural Gas (LNG) Carrier Submarkets Forecasts, by Type 2019-2029

GTT No 96 Liquefied Natural Gas (LNG) Carrier Forecasts 2019-2029

Mark III Forecasts 2019-2029

Moss Forecasts 2019-2029

SPB Forecasts 2019-2029

Small Scale Forecasts 2019-2029

Global Liquefied Natural Gas (LNG) Carrier Submarkets Forecasts, by Market Type 2019-2029

Retrofit/Conversion Forecast 2019-2029

New Build Forecast 2019-2029

Global Liquefied Natural Gas (LNG) Carrier Submarkets Forecasts, by Propulsion Type 2019-2029

XDF Forecast 2019-2029

ME-GI Forecast 2019-2029

SSD Forecast 2019-2029

TFDE Forecast 2019-2029

DFDE Forecast 2019-2029

Steam Forecast 2019-2029

Others Forecast 2019-2029

Leading Regional Players in Liquefied Natural Gas (LNG) Carrier Market 2019-2029

China Liquefied Natural Gas (LNG) Carrier Forecast 2019-2029

Japan Liquefied Natural Gas (LNG) Carrier Forecast 2019-2029

South Korea Liquefied Natural Gas (LNG) Carrier Forecast 2019-2029

India Liquefied Natural Gas (LNG) Carrier Forecast 2019-2029

Greece Liquefied Natural Gas (LNG) Carrier Forecast 2019-2029

Qatar Liquefied Natural Gas (LNG) Carrier Forecast 2019-2029

Rest of the World Liquefied Natural Gas (LNG) Carrier Forecast 2019-2029

How will you benefit from this report?

• Keep your knowledge base up to speed. Don’t get left behind

• Reinforce your strategic decision-making with definitive and reliable market data

• Learn how to exploit new technological trends

• Realise your company’s full potential within the market

• Understand the competitive landscape and identify potential new business opportunities & partnerships

Who should read this report?

• Anyone within the LNG carrier value chain.

• LNG vessel manufacturers

• Oil & gas companies

• Engineering contractors

• Technologists

• Business development managers

• Marketing managers

• Market analysts

• Consultants

• Investors

• Banks

• Government agencies

• Associations

Visiongain’s study is intended for anyone requiring commercial analyses for the LNG carrier market and leading companies. You find data, trends and predictions.

Buy our report today Liquefied Natural Gas (LNG) Carrier Market Report 2019-2029: Forecasts by Type (GTT NO 96, Mark II, Moss, SPB and Small Scale), by Market Type (Retrofit/Converted and New Build), by Propulsion Type (XDF, ME-GI, SSD, TFDE, DFDE, Steam, Others) Plus Contract Tables & Profiles of Leading Companies.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

Do you have any custom requirements we can help you with? Any need for specific country, geo region, market segment or specific company information? Contact us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

1.1 Liquefied Natural Gas (LNG) Carrier Market Overview

1.2 Market Structure Overview and Market Definition

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.7.3 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Liquefied Natural Gas (LNG) Carrier Market

2.1 Global LNG Carrier Market Structure

2.2 Market Definition

2.3 LNG Carrier Industry Outlook

2.4 LNG- Value Chain Analysis

3. Global Overview of Liquefied Natural Gas (LNG) Carrier Market

3.1 LNG Carriers Fleet and Historical Data

3.2 Global Liquefied Natural Gas (LNG) Carrier Drivers and Restraints

4. Global LNG Carrier Submarkets Forecast 2019-2029

4.1 Global Liquefied Natural Gas (LNG) Carrier Submarkets Forecasts, by Type 2019-2029

4.1.1 Global GTT No 96 Liquefied Natural Gas (LNG) Carrier Forecasts 2019-2029

4.1.2 Global Mark III Forecasts 2019-2029

4.1.3 Global Moss Forecasts 2019-2029

4.1.4 Global SPB Forecasts 2019-2029

4.1.5 Global Small Scale Forecasts 2019-2029

4.2 Global Liquefied Natural Gas (LNG) Carrier Submarkets Forecasts, by Market Type 2019-2029

4.2.1 Global Retrofit/Conversion Liquefied Natural Gas (LNG) Carrier Forecasts 2019-2029

4.2.2 Global New Build Forecasts 2019-2029

4.3 Global Liquefied Natural Gas (LNG) Carrier Submarkets Forecasts, by Propulsion Type 2019-2029

4.3.1 Global Steam Reheat Liquefied Natural Gas (LNG) Carrier Forecasts 2019-2029

4.3.2 Global XDF Forecasts 2019-2029

4.3.3 Global ME-GI Forecasts 2019-2029

4.3.4 Global SSD Forecasts 2019-2029

4.3.5 Global TFDE Forecasts 2019-2029

4.3.6 Global DFDE Forecasts 2019-2029

4.3.7 Global Steam Forecasts 2019-2029

4.3.8 Global Others Forecasts 2019-2029

5. Leading Regional Players in Liquefied Natural Gas (LNG) Carrier Market 2019-2029

5.1. China Liquefied Natural Gas (LNG) Carrier Market

5.2. Japan Liquefied Natural Gas (LNG) Carrier Market

5.3. South Korea Liquefied Natural Gas (LNG) Carrier Market

5.4. India Liquefied Natural Gas (LNG) Carrier Market

5.5. Greece Liquefied Natural Gas (LNG) Carrier Market

5.6. Qatar Liquefied Natural Gas (LNG) Carrier Market

5.7. Rest of the World Liquefied Natural Gas (LNG) Carrier Market

6. PESTEL Analysis of the LNG Carrier Market

7. Expert Opinion

7.1 Primary Correspondents

7.2 Global LNG Infra Market Outlook

7.3 Driver & Restraints

7.4 Dominant Region/Country in the LNG Carrier Market

7.5 Dominant LNG Carrier Type

7.6 Overall Growth Rate, Globally

8. Leading Companies in LNG Carrier Market

8.1 Global LNG Carrier Market, Company Market Share (%), 2018

8.2 Samsung Heavy Industries (SHI)

8.3 Kawasaki Heavy Industries

8.4 NYK Line.

8.5 Misc Berhad

8.6 STX Offshore and Shipbuilding

8.7 Hudong Zhonghua

8.8 Daewoo Shipbuilding and Marine Engineering (DSME)

8.9 Mitsubishi Heavy Industries, Ltd.

8.10 Maran Gas Maritime Inc. (MGM)

8.11 Hyundai Heavy Industries Co., Ltd.

9. Conclusion & Recommendations

10. Glossary

List of Tables

Table 1.1 The LNG Carrier Market by Regional Market Forecast 2019-2029 ($ mn, MCM, AGR %, CAGR)

Table 3.1 Global Liquefied Natural Gas (LNG)Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 3.2 LNG Carriers List, Above 60,000cm of Capacity, (Year Built, Ship Name, Shipbuilder, Capacity (cm), Operator, Cargo System)

Table 3.3 Global Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 4.1 Global Liquefied Natural Gas (LNG) Carrier Submarket Forecast 2019-2029($mn, MCM, AGR %, Cumulative)

Table 4.2 Global GTT No 96 Liquefied Natural Gas (LNG) Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 4.3 GTT No. 96 LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 4.4 Global GTT No. 96 Drivers and Restraints

Table 4.5 Global Mark III Liquefied Natural Gas (LNG) Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 4.6 Mark III LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 4.7 Global Mark III Drivers and Restraints

Table 4.8 Global Moss Liquefied Natural Gas (LNG) Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 4.9 Moss LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 4.10 Global Moss Drivers and Restraints

Table 4.11 Global SPB No 96 Liquefied Natural Gas (LNG) Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 4.12 SPB LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 4.13 Global SBP Drivers and Restraints

Table 4.14 Global Small Scale Liquefied Natural Gas (LNG) Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 4.15 Global Liquefied Natural Gas (LNG) Carrier Submarket Forecast 2019-2029($mn, MCM, AGR %, Cumulative)

Table 4.16 Global Retrofit/ Converted Liquefied Natural Gas (LNG) Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 4.17 Global Retrofit/Conversion Drivers and Restraints

Table 4.18 Global New Build Liquefied Natural Gas (LNG) Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 4.19 Global New Build LNG Carrier Drivers and Restraints

Table 4.20 Global Liquefied Natural Gas (LNG) Carrier Submarket Forecast 2019-2029($mn, MCM, AGR %, Cumulative)

Table 4.21 Global Steam Reheat Liquefied Natural Gas (LNG) Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 4.22 Global XDF Liquefied Natural Gas (LNG) Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 4.23 Global ME-GI Liquefied Natural Gas (LNG) Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 4.24 Global SSD Liquefied Natural Gas (LNG) Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 4.25 Global TFDE Liquefied Natural Gas (LNG) Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 4.26 Global DFDE Liquefied Natural Gas (LNG) Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 4.27 Global Steam Liquefied Natural Gas (LNG) Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 4.28 Global Others Liquefied Natural Gas (LNG) Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.1 Global LNG Carrier Market, by Country/Region Forecast 2019-2029 ($mn, AGR %, Cumulative)

Table 5.2 Global LNG Carrier Market, by Country/Region Forecast 2019-2029 (MCM, AGR %, Cumulative)

Table 5.3 China Liquefied Natural Gas (LNG)Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.4 Chinese LNG Import Terminals (Country, Terminal Name, Start Year, Capacity (MTPA), EPC Cost ($), Owners, Status)

Table 5.5 Current Chinese LNG Carrier Order Book (Containment System, Shipbuilder, Owner, Delivery Year, Capacity (cm))

Table 5.6 China Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 5.7 Japan Liquefied Natural Gas (LNG)Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.8 Current Japanese LNG Carrier Order Book (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 5.9 Japan Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 5.10 South Korea Liquefied Natural Gas (LNG)Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.11 Current South Korean LNG Carrier Order Book (Containment System, Shipbuilder, Owner, Year, Capacity(cm)

Table 5.12 South Korea Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 5.13 India Liquefied Natural Gas (LNG)Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.14 India Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 5.15 Greece Liquefied Natural Gas (LNG)Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.16 Greece Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 5.17 Qatar Liquefied Natural Gas(LNG)Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.18 Qatar Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

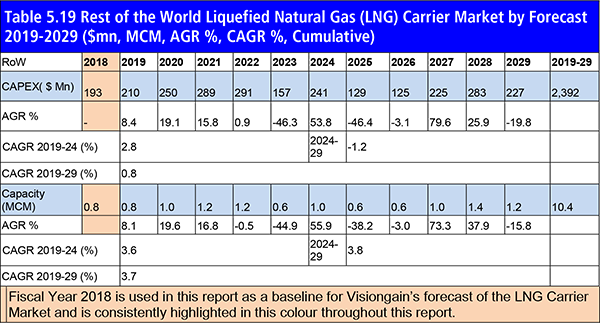

Table 5.19 Rest of the World Liquefied Natural Gas(LNG)Carrier Market by Forecast 2019-2029 ($mn, MCM, AGR %, CAGR %, Cumulative)

Table 5.20 Rest of the World Liquefaction Natural Gas (LNG) Carrier Drivers and Restraints

Table 6.1 PESTEL Analysis, LNG Carrier Market

Table 8.1 Samsung Heavy Industries (SHI) Profile 2016(Market Entry, Public/Private, Headquarter, Total Company Sales $mn, Change in Revenue, Geography, Key Market, Company Sales from Hydrogen Generator Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.2 Samsung Heavy Industries LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 8.3 Samsung Heavy Industries (SHI) Total Company Sales 2013-2017 ($ bn, AGR %)

Table 8.4 Kawasaki Heavy Industries Profile 2015(Market Entry, Public/Private, Headquarter, Total Company Sales $bn, Change in Revenue, Geography, Key Market, Company Sales from Hydrogen Generator Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.5 Kawasaki Heavy Industries LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 8.6 Kawasaki Heavy Industries Total Company Sales 2014-2018 ($ bn, AGR %)

Table 8.7 NYK Line. Profile 2016(Market Entry, Public/Private, Headquarter, Total Company Sales $bn, Change in Revenue, Geography, Key Market, Company Sales from Hydrogen Generator Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.8 NYK Line. Overview (Total Revenue, Total LNG Carrying Capacity, Percentage in Order Book, Existing Vessels – Orders – Joint Projects, HQ, Contact, Website)

Table 8.9 NYK Line.Total Company Sales 2015-2018 ($ bn, AGR %)

Table 8.10 Misc Berhad Profile 2016(Market Entry, Public/Private, Headquarter, Total Company Sales $bn, Change in Revenue, Geography, Key Market, Company Sales from Hydrogen Generator Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.11 Misc Berhad LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity)

Table 8.12 Misc Berhad Total Company Sales 2015-2018 ($ bn, AGR %)

Table 8.13 Misc Berhad, List of LNG Carriers Owned

Table 8.14 STX Offshore and Shipbuilding Profile 2013 (Market Entry, Public/Private, Headquarter, Total Company Sales $bn, Change in Revenue, Geography, Key Market, Company Sales from Hydrogen Generator Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.15 Hudong Zhonghua Profile(Market Entry, Public/Private, Headquarter, Total Company Sales $bn, Change in Revenue, Geography, Key Market, Company Sales from Hydrogen Generator Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.16 Hudong Zhonghua LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 8.17 Daewoo Shipbuilding and Marine Engineering (DSME) Profile 2017 (Market Entry, Public/Private, Headquarter, Total Company Sales $bn, Change in Revenue, Geography, Key Market, Company Sales from Hydrogen Generator Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.18 Daewoo Shipbuilding and Marine Engineering (DSME, Fleet StTA

Table 8.19 Daewoo Shipbuilding and Marine Engineering (DSME)Total Company Sales 2014-2017 ($ bn, AGR %)

Table 8.20 Mitsubishi Heavy Industries, Ltd. Profile 2016(Market Entry, Public/Private, Headquarter, Total Company Sales $bn, Change in Revenue, Geography, Key Market, Company Sales from Hydrogen Generator Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.21 Mitsubishi Heavy Industries LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity (cm))

Table 8.22 Mitsubishi Heavy Industries, Ltd.,Total Company Sales 2013-2017 ($bn, AGR %)

Table 8.23 Maran Gas Maritime Inc. (MGM)Profile 2016(Market Entry, Public/Private, Headquarter, Total Company Sales $mn, Change in Revenue, Geography, Key Market, Company Sales from Hydrogen Generator Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.24 MGM LNG Fleet Statistics, 2019

Table 8.25 MGM LNG Carrier Orders (Containment System, Shipbuilder, Owner, Year, Capacity)

Table 8.26 Hyundai Heavy Industries Co., Ltd.Profile 2016(Market Entry, Public/Private, Headquarter, Total Company Sales $mn, Change in Revenue, Geography, Key Market, Company Sales from Hydrogen Generator Market, Listed on, Products/Services Strongest Business Region, Business Segment in the Market, Submarket Involvement, No. of Employees)

Table 8.27 Hyundai Heavy Industries Co. and Hyundai Samho LNG Carrier Orders (Shipbuilder, Future Owner, Tank Type, LNG Capacity (cm), Delivery Date)

Table 8.28 Hyundai Heavy Industries (HHI) Total Company Sales 2015-2017 ($ bn, AGR %)

Table 8.29 Hyundai Heavy Industries Co., Performance Record- As of December 31, 2018

List of Figures

Figure 1.1 The LNG Carrier Market by Country/Region Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 2.1 Global LNG Carrier Market Segmentation Overview

Figure 2.2 Small Scale LNG, Value Chain Analysis

Figure 3.1 Global Liquefied Natural Gas (LNG) Carrier Forecast 2019-2029 ($mn, AGR %)

Figure 3.2 Global LNG Carrier, by Capacity (MCM)Forecast 2019-2029 (MCM)

Figure 4.1 Global Liquefied Natural Gas (LNG) Carrier Submarket Forecast 2019-2029 ($mn)

Figure 4.2 Global Liquefied Natural Gas (LNG) Carrier Market by Type (CAPEX) Share Forecast 2019, 2024, 2029 (% Share)

Figure 4.3 Global Liquefied Natural Gas (LNG) Carrier Submarket Forecast 2019-2029 (MCM)

Figure 4.4 Liquefied Natural Gas (LNG) Carrier Market, By GTT No 96 Forecast 2019-2029 ($mn, AGR%)

Figure 4.5 Liquefied Natural Gas (LNG) Carrier Market, By GTT No. 96 Forecast 2019-2029 (MCM, AGR%)

Figure 4.6 Liquefied Natural Gas (LNG) Carrier Market, By Mark III Forecast 2019-2029 ($mn, AGR%)

Figure 4.7 Liquefied Natural Gas (LNG) Carrier Market, By Mark III Forecast 2019-2029 (MCM, AGR%)

Figure 4.8 Liquefied Natural Gas (LNG) Carrier Market, By Moss Forecast 2019-2029 ($mn, AGR%)

Figure 4.9 Liquefied Natural Gas (LNG) Carrier Market, By Moss Forecast 2019-2029 (MCM, AGR%)

Figure 4.10 Liquefied Natural Gas (LNG) Carrier Market, By SPB Forecast 2019-2029 ($mn, AGR%)

Figure 4.11 Liquefied Natural Gas (LNG) Carrier Market, By SPB Forecast 2019-2029 (MCM, AGR%)

Figure 4.12 Liquefied Natural Gas (LNG) Carrier Market, By Small Scale Forecast 2019-2029 ($mn, AGR%)

Figure 4.13 Liquefied Natural Gas (LNG) Carrier Market, By Small Scale Forecast 2019-2029 (MCM, AGR%)

Figure 4.14 LNG Bunkering Capacity Forecast (bcm), 2015-2025

Figure 4.15 Liquefied Natural Gas (LNG) Carrier Market, By Retrofit/Conversion Forecast 2019-2029 (MCM, AGR%)

Figure 4.16 Global Liquefied Natural Gas (LNG) Carrier Submarket Forecast 2019-2029 ($mn)

Figure 4.17 Global Liquefied Natural Gas (LNG) Carrier Market by Market Type (CAPEX) Share Forecast 2019, 2024, 2029 (% Share)

Figure 4.18 Liquefied Natural Gas (LNG) Carrier Market, By Retrofit/Conversion Forecast 2019-2029 ($mn, AGR%)

Figure 4.19 Liquefied Natural Gas (LNG) Carrier Market, By Retrofit/Conversion Forecast 2019-2029 (MCM, AGR%)

Figure 4.20 Liquefied Natural Gas (LNG) Carrier Market, By New Build Forecast 2019-2029 ($mn, AGR%)

Figure 4.21 Liquefied Natural Gas (LNG) Carrier Market, By New Build Forecast 2019-2029 (MCM, AGR%)

Figure 4.22 Global Liquefied Natural Gas (LNG) Carrier Submarket Forecast 2019-2029 (MCM)

Figure 4.23 Global Liquefied Natural Gas (LNG) Carrier Submarket Forecast 2019-2029 ($mn)

Figure 4.24 Global Liquefied Natural Gas (LNG) Carrier Market by Market Type (CAPEX) Share Forecast 2019, 2024, 2029 (% Share)

Figure 4.25 Liquefied Natural Gas (LNG) Carrier Market, By Steam Reheat Forecast 2019-2029 ($mn, AGR%)

Figure 4.26 Liquefied Natural Gas (LNG) Carrier Market, By Steam Reheat Forecast 2019-2029 (MCM, AGR%)

Figure 4.27 Liquefied Natural Gas (LNG) Carrier Market, By XDF Forecast 2019-2029 ($mn, AGR%)

Figure 4.28 Liquefied Natural Gas (LNG) Carrier Market, By XDF Forecast 2019-2029 (MCM, AGR%)

Figure 4.29 Liquefied Natural Gas (LNG) Carrier Market, By ME-GI Forecast 2019-2029 ($mn, AGR%)

Figure 4.30 Liquefied Natural Gas (LNG) Carrier Market, By ME-GI Forecast 2019-2029 (MCM, AGR%)

Figure 4.31 Liquefied Natural Gas (LNG) Carrier Market, By SSD Forecast 2019-2029 ($mn, AGR%)

Figure 4.32 Liquefied Natural Gas (LNG) Carrier Market, By SSD Forecast 2019-2029 (MCM, AGR%)

Figure 4.33 Liquefied Natural Gas (LNG) Carrier Market, By TFDE Forecast 2019-2029 ($mn, AGR%)

Figure 4.34 Liquefied Natural Gas (LNG) Carrier Market, By TFDE Forecast 2019-2029 (MCM, AGR%)

Figure 4.35 Liquefied Natural Gas (LNG) Carrier Market, By DFDE Forecast 2019-2029 ($mn, AGR%)

Figure 4.36 Liquefied Natural Gas (LNG) Carrier Market, By DFDE Forecast 2019-2029 (MCM, AGR%)

Figure 4.37 Liquefied Natural Gas (LNG) Carrier Market, By Steam Forecast 2019-2029 ($mn, AGR%)

Figure 4.38 Liquefied Natural Gas (LNG) Carrier Market, By Steam Forecast 2019-2029 (MCM, AGR%)

Figure 4.39 Liquefied Natural Gas (LNG) Carrier Market, By Others Forecast 2019-2029 ($mn, AGR%)

Figure 4.40 Liquefied Natural Gas (LNG) Carrier Market, By Others Forecast 2019-2029 (MCM, AGR%)

Figure 5.1 Regional/Country LNG Carrier Market, by CAPEX

Figure 5.2 Regional/Country LNG Carrier Market, by Capacity (MCM)

Figure 5.3 Leading Country/Regional LNG Carrier Market Share, by CAPEX 2019

Figure 5.4 Leading Country/Regional LNG Carrier Market Share, by CAPEX 2024

Figure 5.5 Leading Country/Regional LNG Carrier Market Share, by CAPEX 2029

Figure 5.6 China LNG Carrier Forecast 2019-2029($mn, AGR%)

Figure 5.7 China LNG Carrier Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.8 China LNG Carrier, by Capacity(MCM)Forecast 2019-2029 (MCM)

Figure 5.9 China LNG Carrier, by Type, 2018

Figure 5.10 Japan LNG Carrier Forecast 2019-2029 ($mn, AGR%)

Figure 5.11 Japan LNG Carrier Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.12 Japan LNG Carrier, by Capacity (MCM)Forecast 2019-2029 (MCM)

Figure 5.13 Japan LNG Carrier, by Type, 2018

Figure 5.14 South Korea LNG Carrier Forecast 2019-2029 ($mn, AGR%)

Figure 5.15 South Korea LNG Carrier Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.16 South Korea LNG Carrier, by Capacity (MCM)Forecast 2019-2029(MCM)

Figure 5.17 South Korea LNG Carrier, by Type, 2017

Figure 5.18 India LNG Carrier Forecast 2019-2029 ($mn, AGR%)

Figure 5.19 India LNG Carrier Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.20 India LNG Carrier, by Type, 2018

Figure 5.21 India LNG Carrier, by Capacity (MCM)Forecast 2019-2029 (MCM)

Figure 5.22 Greece LNG Carrier Forecast 2019-2029 ($mn, AGR%)

Figure 5.23 Greece LNG Carrier Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.24 Greece LNG Carrier, by Type, 2018

Figure 5.25 Greece LNG Carrier, by Capacity (MCM)Forecast 2019-2029 (MCM)

Figure 5.26 Qatar LNG Carrier Forecast 2019-2029 ($mn, AGR%)

Figure 5.27 Qatar LNG Carrier Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.28 Qatar LNG Carrier, by Type, 2018

Figure 5.29 Qatar LNG Carrier, by Capacity (MCM)Forecast 2019-2029 (MCM)

Figure 5.30 Rest of the World LNG Carrier Forecast 2019-2029 ($mn, AGR%)

Figure 5.31 Rest of the World LNG Carrier Share Forecast 2019, 2024, 2029(% Share)

Figure 5.32 Rest of the World LNG Carrier, by Capacity (MCM)Forecast 2019-2029 (MCM)

Figure 5.33 Rest of the World LNG Carrier, by Type, 2018

Figure 8.1 Leading Companies Market Share, 2018 LNG Carrier Market

Figure 8.2 Leading Companies Market Share, 2017 LNG Carrier Market (By Orderbook)

Figure 8.3 Samsung Heavy Industries (SHI), Contracts Share %

Figure 8.4 Samsung Heavy Industries (SHI) Revenue,($bn & AGR %), Y-o-Y Revenue Growth, 2013-2017

Figure 8.5 Kawasaki Heavy Industries, % Revenue Share, by Business Segment, 2018

Figure 8.6 Kawasaki Heavy Industries, % Revenue Share, by Geographical Segment, 2018

Figure 8.7 Kawasaki Heavy Industries Revenue,($bn & AGR %), Y-o-Y Revenue Growth, 2014-2018

Figure 8.8 NYK Line., % Revenue Share, by Business Segment, 2017

Figure 8.9 NYK Line., Number of Patents, 2013-2017

Figure 8.10 NYK Line., Number of Vessels in Operation, 2013-2017

Figure 8.11 NYK Line.Revenue,($bn & AGR %), Y-o-Y Revenue Growth, 2015-2018

Figure 8.12 Misc Berhad LNG Revenue,($bn & AGR %), Y-o-Y Revenue Growth, 2015-2018

Figure 8.13 Misc Berhad Revenue Breakup, by Business Segment,2018

Figure 8.14 Misc Berhad Revenue Breakup, by Contract,2018

Figure 8.15 Daewoo Shipbuilding and Marine Engineering (DSME, % Revenue Share, by Business Segment, 2017

Figure 8.16 Daewoo Shipbuilding and Marine Engineering (DSME),($mn & AGR %), Y-o-Y Revenue Growth, 2014-2017

Figure 8.17 Mitsubishi Heavy Industries, Ltd., Company Revenue,($bn & AGR %), 2013-2017

Figure 8.18 Mitsubishi Heavy Industries, Ltd., % Revenue Share, by Regional Segment, 2017

Figure 8.19 Mitsubishi Heavy Industries, Ltd., % Revenue Share, by Business Segment, 2017

Figure 8.20 Hyundai Heavy Industries Co., % Revenue Share, by Sales, 2017

Figure 8.21 Hyundai Heavy Industries (HHI) Revenue,($bn & AGR %), Y-o-Y Revenue Growth, 2015-2017

Figure 9.1 Global LNG Carrier Market Forecast 2019-2029 ($ mn, AGR %)

Alpha Tankers

Anadarko

Anangel Maritime Services

Angelicoussis Shipping Group

Anglo Eastern Group

Australia LNG

Awilco AS

Bernhard Schulte

BG Group

BGT (Bonny Gas Transport)

Boelwerf

Bonny Gas

BP

BPRL

Brunei Gas Carriers Sdn

Brunei LNG

BW Gas ASA

BW Maritime

Cameron

Canadian FortisBC Energy

Cardiff Gas

Celsius Tankers

Chandris (Hellas) Inc.

Chantiers de France-Dunkerque

Chevron

China LNG Shipping LNG

China Ocean Shipping Group.

China Petroleum and Chemicals Corp., Ltd

China Shipbuilding Group Corporation

China Shipping Group

China Shipping LNG

China State Shipbuilding Corp (CSSC)

Chubu Electric Power

CNIM (Constructions Navales et Industrielles de la Mediteranee)

CNOOC

CNOOC Energy Technology and Services Ltd.

CNPC

Cochin Shipyard Limited (CSL)

Constructions Navales et Industrielles de la Mediteranee

Cove Energy

Cryovision

CSSC (Hong Kong) Shipping Leasing

CSSC Wärtsilä Engine (Shanghai) Co (CWEC)

Daewoo

Daewoo Shipbuilding and Marine Engineering (DSME)

Dailian Construction Investment Corp.

Dailian Port

Deen Shipping

DNV GL

Dongguan Fuel Industrial

Dynacom Corporation

Dynacom Tankers Management

Dynagas (Dynacom)

Elcano

ENH

Eni

Excelerate

Exmar NV

ExxonMobil

Fincantieri

Fiskerstrand Verft

Flex LNG

Foshan Gas

Fujian Investment Development Co.

GAIL

GasLog

Gaz Transport

GazOcean

Gazprom

Gaztransport & Technigaz (GTT)

GD (General Dynamics)

General Dynamics UK

Golar LNG

GTT

Guangdong Gas

Guangdong Yudean

Guangzhou Gas Group

Hainan Development Holding Co.

Hanjin Heavy Industries and Construction Company Ltd. (HHIC)

Hanjin Shipping Co. Ltd.

Hawaiian Electric Co.

HDW (Howaldtswerke-Deutsche Werft)

HDW Kiel

HHI

Höegh LNG

Hong Kong & China Gas

Hong Kong Electric

HSHI

Hudon

Hudong Heavy Machinery

Hudong-Zhonghua Shipbuilding (Group) Co,

Humpuss Intermoda Transportasi

Hyproc Shipping Co.

Hyundai Corporation

Hyundai Heavy Industries (HHI) Co.

Hyundai LNG

Hyundai Merchant Marine

Hyundai Mipo Dockyard Co.

Hyundai Samho Heavy Industries

HZ

I.M. Skaugen

IINO Kaiun Kaisha Ltd.

Imabari Shipbuilding

Ishikawajima-Harima Heavy Industries

IZAR

Japan Marine United (JMU)

Japan Petroleum Exploration Company (Japex)

Japex

JERA Co., Inc.

Jiangsu Guoxin

JMU

Jovo Group

Kawasaki Heavy Industries

Kawasaki Kisen Kaisha, Ltd. ("K" Line)

Kawasaki Sakaide Works

K-Line

K-Line America Inc.

Knutsen OAS Shipping

Korea Line Corporation

Kvaerner Masa

L&T Shipbuilding Ltd

La Ciotat (Chantiers Navales De La Ciotat)

Latsco Shipping

MAN Diesel and Turbo

Maran Gas Maritime Inc.

Maran Tankers

MBK

MHI

MISC

Mitsubishi Corporation

Mitsubishi Heavy Industries (MHI)

Mitsubishi Heavy Industries Group

Mitsubishi Shipbuilding

Mitsui

Mitsui Engineering and Shipbuilding

Mitsui O.S.K. Lines, Ltd.

MO

Moss

Moss Rosenberg Verft

Nakilat

National Gas Shipping Co.

Ningbo Power Development Co LTD

Nippon Yusen Kabushiki Kaisha (NYK Line)

Northrop Grumman

NYK Line

Ocean LNG

Oceanus LNG

OLT Offshore

Oman Shipping Co.

Overseas Shipholding Group Inc.

Pacific Oil and Gas

PetroChina

Petronas

Petronet

Pipavav Defence and Offshore Engineering (POED) Ltd.

Prometheus Energy

Pronav

Qatar Petroleum

Qingdao Port

Repsol

Royal Dutch Shell Plc

Samho Heavy Industries

Samsung

Samsung Heavy Industries (SHI)

Shell

Shenergy Group

Shenzhen Energy Group

Shenzhen Gas

Sinochem Corporation

Sinopacific Shipbuilding Group

Sinopec

Sirius Rederi

SK Shipping

Skangass AS

Sovcomflot

Statoil

Stena Bulk

STX Dalian

STX Finland

STX France

STX Offshore & Shipbuilding

STX Pan Ocean

STX Shipbuilding

Technigaz

Teekay Corporation

Teekay LNG Partners LP

Teekay Shipping

Thenamaris

Tokyo Century Corporation

Tokyo Electric Power Company

Total

Total Gas & Power Chartering Limited (TGPCL)

Toyota Motor Corporation

Tractebel Engineering (GDF SUEZ)

Trans Pacific Shipping 7 Limited

Tsakos Energy Navigation Ltd.

Universal Shipbuilding Corporation

Universal Shipping

Veka Deen LNG

Veka Group

Yamal Trade (ice)

Zhejiang Energy Group Co Ltd

Organisations mentioned

Department of Energy (DoE)

EIA

Environmental Protection Agency (EPA)

Federal Energy Regulatory Commission (FERC).

Government of Canada

Government of Mexico

International Maritime Organisation (IMO)

National Highway Traffic Safety Administration

The Bank for Development and Foreign Economic Affairs in Russia (Vnesheconombank)

United Nations

Download sample pages

Complete the form below to download your free sample pages for Liquefied Natural Gas (LNG) Carrier Market Report 2019-2029

Related reports

-

Floating LNG Power Vessel Market Report 2021-2031

Over the next 20 years, LNG supply is expected to more than treble, resulting in a surge in demand —...Full DetailsPublished: 16 June 2021 -

Liquefied Natural Gas (LNG) Bunkering Market Report 2021-2031

China is the fastest-growing market, with officials promising gas as a cleaner energy source in an effort to quell public...Full DetailsPublished: 22 July 2021 -

The Top 20 LNG Infrastructure Companies 2019

There are a number of exciting LNG liquefaction prospects around the world, both under construction and prospective.

...Full DetailsPublished: 11 March 2019 -

Top 20 Small-Scale Liquified Natural Gas (SSLNG) Companies 2019

Small Scale LNG is used to supply small or isolated demand centers not connected to pipeline infrastructure, small scale LNG...

Full DetailsPublished: 24 January 2019 -

LNG Yearbook 2018: The Ultimate Guide to Liquefied Natural Gas Infrastructure 2018-2028

The definitive LNG Yearbook 2018 is the ultimate reference source for the liquefied natural gas industry. The yearbook indicates that...

Full DetailsPublished: 14 June 2018 -

Small & Mid-Scaled LNGC & LNGBV Market Report 2019-2029

Visiongain’s forecasts indicate that the global the Small-Scale LNG Carrier, Medium-Scale Carrier and LNG Bunkering Vessels see capital expenditures (CAPEX)...

Full DetailsPublished: 13 May 2019 -

Small Scale Liquefied Natural Gas (LNG) Market Report 2021-2031

Special emphasis is given to ongoing research into improved efficiencies of small scale LNG. Important trends are identified and sales...Full DetailsPublished: 25 March 2021 -

Floating Liquefied Natural Gas (FLNG) Market Report 2021-2031

LNG terminals require a vast amount of capital to build: four projects approved in the previous few years, according to...Full DetailsPublished: 28 June 2021 -

Cryogenic Valve Market Report 2021-2031

The pursuit of energy efficiency and the reduction of CO2 and NOx emissions has led to a greater use of...Full DetailsPublished: 02 June 2021 -

Small Scale Liquefied Natural Gas (LNG) Market Forecast 2018-2028

Visiongain has calculated that the global Small Scale Liquefied Natural Gas (LNG) Market will see a capital expenditure (CAPEX) of...

Full DetailsPublished: 05 February 2018

Download sample pages

Complete the form below to download your free sample pages for Liquefied Natural Gas (LNG) Carrier Market Report 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Energy news

Energy as a Service (EaaS) Market

The global Energy as a Service (EaaS) market is projected to grow at a CAGR of 12.6% by 2034

25 July 2024

Synthetic Fuels Market

The global Synthetic Fuels market is projected to grow at a CAGR of 23% by 2034

18 July 2024

Power-to-X (P2X) Market

The global Power-to-X (P2X) market is projected to grow at a CAGR of 10.6% by 2034

09 July 2024

Airborne Wind Energy Market

The global Airborne Wind Energy market is projected to grow at a CAGR of 9.7% by 2034

05 June 2024