Industries > Energy > Carbon Capture & Storage (CCS) Market Report 2018-2028

Carbon Capture & Storage (CCS) Market Report 2018-2028

Capacity (MMtpa), CAPEX ($m) & OPEX ($m) Forecasts for CO2 Capture (Pre-Combustion, Post-Combustion, Oxy-Fuel Combustion), CO2 Transportation & Transmission (Pipelines, Ships / Chemical Tankers (Offshore), Chemical Carrier Vehicles (Onshore), CO2 Storage (Depleted Oil & Gas Reservoirs, Un-Minable Coal Seams, Deep Saline Aquifers, Salt Caverns, CO2 EOR, Onshore Reinjection, Subsea Reinjection)

• Do you need definitive CCS market data?

• Succinct CCS market analysis?

• Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive report can transform your own research and save you time.

The Paris Climate Summit had 187 countries in attendance and certain measures were put in place to combat climate change and this has led Visiongain to publish this important report. Notwithstanding the recent decision by the US administration to withdraw from the agreement. the CCS market is nonetheless expected to grow in importance in the next few years because of CO2 EOR and also because pressure from emission targets is expected to feed through in the latter part of the decade driving growth to new heights. If you want to be part of the CCS industry, then read on to discover how you can maximise your investment potential.

Report Highlights

210 Quantitative Tables, Charts, And Graphs

Analysis Of Key Players Providing CCS Technologies

• Air Products & Chemicals Inc.

• Air Liquide

• Babcock& Wilcox

• Fluor Corporation

• General Electric

• HTC Purenergy Inc.

• Linde AG

• Mitsubishi Heavy Industries Ltd.

• Praxair Inc.

Insight Into Utility Companies Involved In The Carbon Capture & Storage Market

• E.ON SE

• Enel S.p.A

• RWE AG

• Saskatchewan Power Cooperation

• Scottish & Southern Company Plc

• Southern Company

Examination Of Energy Companies Involved in the CO2 Storage Market

• Baker Hughes

• Halliburton

• Petrofac

• Schlumberger

Profiles Of Companies Involved In CO2 Transmission By Pipeline

• Kinder Morgan

• National Grid Plc.

Market Share Analysis Of The Top 15 CCS Companies By Capacity

An Exclusive Expert Interview With A Key Industry Expert

• Saskatchewan Power Cooperation (Saskpower)

Global CCS Market Outlook And Analysis From 2018-2028 (CAPEX, OPEX & Capacity)

50 Major CCS Contracts And Projects

• 11 detailed tables of 50 large scale CCS projects

CCS Submarket Forecasts And Analysis From 2018-2028 (CAPEX, OPEX)

• CO2 Capture Submarket Forecast 2018-2028

• CO2 Transportation Submarket Forecast t 2018-2028

• CO2 Storage Submarket Forecast 2018-2028

Regional CCS Market Forecasts From 2018-2028 (CAPEX, OPEX & Capacity)

• The Americas CCS Forecast 2018-2028

• Europe CCS Forecast 2018-2028

• The Africa & Middle East CCS Forecast 2018-2028

• Asia & Oceania CCS Forecast 2018-2028

National CCS Market Forecasts From 2018-2028 (CAPEX, OPEX & Capacity)

• US CCS Forecast 2018-2028

• China CCS Forecast 2018-2028

• Canada CCS Forecast 2018-2028

• Brazil CCS Forecast 2018-2028

• Norway CCS Forecast 2018-2028

• UK CCS Forecast 2018-2028

• Rest of Europe CCS Forecast 2018-2028

• UAE CCS Forecast 2018-2028

• Australia CCS Forecast 2018-2028

• Rest of Africa & Middle East CCS Forecast 2018-2028

• Rest of Asia & Oceania CCS Forecast 2018-2028

Plus Qualitative Analysis Of CCS In The Following Countries

• Algeria

• Saudi Arabia

• Qatar

• Bahrain

• Kuwait

• South Africa

Key Questions Answered

• What does the future hold for the CCS industry?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to success and why?

• What business models should you adopt?

• What industry trends should you be aware of?

Target Audience

• Leading CCS companies

• Oil & gas companies

• Enhanced oil recovery (EOR) specialists

• Suppliers

• Contractors

• Technologists

• R&D staff

• Consultants

• Market analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

• Industry organisations

• Banks

• Industry regulators

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Carbon Capture & Storage Market Overview

1.2 Market Definition

1.3 Carbon Capture & Storage Market Segmentation

1.4 Methodology

1.5 How This Report Delivers

1.6 Key Questions Answered by This Analytical Report Include

1.7 Why You Should Read This Report

1.8 Frequently Asked Questions

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Carbon Capture & Storage Market

2.1 Carbon Capture

2.2 Carbon Transportation

2.3 Carbon Storage

2.3.1 Storage in Depleted Oil and Gas Fields

2.3.2 Storage in Deep Saline Aquifers

2.3.3 Storage in Un-minable Coal Seams

2.4 Carbon Dioxide Enhanced Oil Recovery

2.5 Sources of Carbon Dioxide

2.6 Policy Incentives for the Increased Uptake of Carbon Capture & Storage

2.7 Why Are Carbon Tax Policies & Emission Trading Schemes Necessary?

3 Global Carbon Capture & Storage Market Forecast 2018-2028

3.1 The Global Carbon Capture & Storage Market Forecast 2018-2028

3.2 Drivers & Restraints in the Global Carbon Capture & Storage Market 2018-2028

3.2.1 Ambitious Emissions Reduction Targets Set at the Paris Climate Summit Will Provide New Impetus for CCS Development

3.2.2 Government Funding and Legislation as Principal Drivers to Translate National GHG Emissions Reduction Targets Into Viable Carbon Capture & Storage Projects

3.2.3 A Range of Uses for Carbon Capture & Storage Technologies Could Support Development

3.2.4 Can CO2 Be Seen as a Commodity?

3.2.5 Technological Progression and Market Leaders Give Stimulus to the Carbon Capture & Storage Market

3.2.6 The Impact of Rival Technologies and Alternative Fuels

3.2.7 A Low Carbon Price, Absent Policy and a Global Economic Stagnation are Restricting the Market

3.2.8 Earthquakes, Leaks and Fossil Fuel Dominance: Public Opposition to Carbon Capture & Storage Technology

4. Carbon Capture & Storage Submarket Forecasts 2018-2028

4.1 CO2 Capture Submarket Forecast 2018-2028

4.2 CO2 Transmission Submarket Forecast 2018-2028

4.3 CO2 Storage Submarket Forecast 2018-2028

5. The Americas Carbon Capture and Storage Market Forecasts 2018-2028

5.1 Regional Market Forecasts 2018-2028

5.2 The US CCS Market Forecast 2018-2028

5.2.1 The US CCS Market Analysis

5.2.2 US Carbon Capture & Storage Projects

5.2.3 Numerous Carbon Capture & Storage Project Cancellations in the US

5.2.4 When and How Much? Details on the Carbon Capture & Storage Projects Under Development

5.2.5 Research and Development in the US Carbon Capture & Storage Market

5.2.6 Drivers and Restraints in the US Carbon Capture & Storage Market

5.2.6.1 Strong Investments and Emissions Legislation – Should Carbon Capture & Storage the US?

5.2.6.2 Cost of Carbon Capture & Storage Continues to Restrain Progress

5.2.6.3 Weak Taxes and Increased Concerns Over Uncertainties

5.3 The Canadian CCS Market Forecast 2018-2028

5.3.1 Canada CCS Market Analysis

5.3.2 Canadian Carbon Capture & Storage Projects

5.3.3 Drivers and Restraints in the Canadian Carbon Capture & Storage Market

5.3.3.1 Rising Emissions or Commercial Opportunity as the Main Driver of the Canadian Carbon Capture & Storage Market?

5.3.3.2 The Role of the Canadian Government

5.3.3.3 Can a Weak Carbon Value Impede Carbon Capture & Storage Growth?

5.3.3.4 Cheap Gas and Long Projects: An Imbalance of Economics

5.4 The Brazilian CCS Market Forecast 2018-2028

5.4.1 The Brazilian CCS Market Analysis

5.4.2 Brazilian Carbon Capture & Storage Projects

5.4.3 Background of CO2 EOR in Brazil and the Lula Project

5.4.4 The Drivers and Restraints in the Brazilian Carbon Capture & Storage Market

5.4.4.1 Brazilian Climate Change Legislation and Carbon Capture & Storage Regulatory Frameworks

5.4.4.2 Brazil’s Lack of Coal but Opportunity for Biomass?

5.4.4.3 CO2 EOR as a Driver of CCS in Brazil

5.5 Other American Carbon Capture & Storage Markets

5.5.1 The Mexican Carbon Capture & Storage Market

6. The European Carbon Capture and Storage Market Forecasts 2018-2028

6.1 Regional Market Forecasts 2018-2028

6.2 The UK CCS Market Forecasts 2018-2028

6.2.1 The UK CCS Market Analysis

6.2.2 UK Carbon Capture & Storage Projects

6.2.3 Drivers and Restraints in the UK Carbon Capture & Storage Market

6.2.3.1 Ambitious Emissions Reductions vs. Lack of Public Financial Support

6.2.3.2 Shared Infrastructure and Storage in the UK

6.3 The Norwegian CCS Market Forecast 2018-2028

6.3.1 Norwegian CCS Market Analysis

6.3.2 Norwegian Carbon Capture & Storage Projects

6.3.3 Drivers and Restraints in the Norwegian Carbon Capture & Storage Market

6.3.3.1 Will the Norwegian Carbon Tax be Enough to Support Carbon Capture & Storage in the Long Term?

6.3.3.2 Storage Capacity, Environmental Targets and Research Partnerships – Should Norway Be Leading the Way on Carbon Capture & Storage?

6.3.3.3 High Costs and Increasing Uncertainties

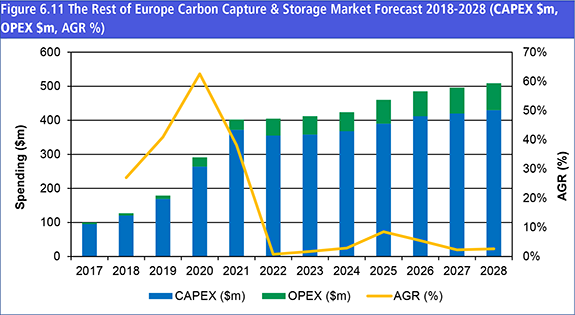

6.4 Rest of Europe CCS Market Forecast 2018-2028

6.4.1 Rest of Europe CCS Market Analysis

6.4.2 Large Numbers of Cancelled Carbon Capture & Storage Projects in the Rest of Europe

6.4.3 Drivers and Restraints in the Rest of Europe Carbon Capture & Storage Market

6.4.3.1 Europe has Ambitious Environmental Targets and Public Funds – So Why Is CCS not Picking Up?

6.4.3.2 Positive Long-Term Outlook as Fundamentals are Strong

7. The Africa & Middle East Carbon Capture and Storage Market Forecasts 2018-2028

7.1 Regional Market Forecasts 2018-2028

7.2 The UAE CCS Market Forecast 2018-2028

7.2.1 The UAE CCS Market Analysis

7.2.2 UAE Carbon Capture & Storage Projects

7.2.3 Drivers and Restraints in the UAE Carbon Capture & Storage Market

7.3 The Rest of Africa & Middle East CCS Market Forecast 2018-2028

7.3.1 The Rest of Africa CCS Market Analysis

7.3.2 The Rest of Africa & Middle East Carbon Capture & Storage Projects

7.3.3 Algerian Carbon Capture & Storage Market Analysis

7.3.4 Saudi Arabia Carbon Capture & Storage Market Analysis

7.3.5 Qatar Carbon Capture & Storage Market Analysis

7.3.6 Bahrain Carbon Capture & Storage Market Analysis

7.3.7 Kuwaiti Carbon Capture & Storage Market Analysis

7.3.8 The South African Carbon Capture & Storage Market Analysis

8. The Asia & Oceania Carbon Capture and Storage Market Forecasts 2018-2028

8.1 Regional Market Forecasts 2018-2028

8.2 The Chinese CCS Market Forecast 2018-2028

8.2.1 The Chinese CCS Market Analysis

8.2.2 China Carbon Capture & Storage Projects

8.2.3 Drivers and Restraints in the Chinese Carbon Capture & Storage Market

8.2.3.1 Does a Future of Coal Require Carbon Capture & Storage?

8.2.3.2 China’s Environmental Legislation

8.2.3.3 China’s Experience in Capture Technology

8.2.3.4 Joint Ventures and International Partnerships May Support Carbon Capture & Storage in China

8.2.3.5 The Cost of Carbon Capture & Storage is Still High

8.3 The Australian CCS Market Forecast 2018-2028

8.3.1 The Australian CCS Market Analysis

8.3.2 Australian Carbon Capture & Storage Projects

8.3.3 Drivers and Restraints in the Australian Carbon Capture & Storage Market

8.3.4 Navigating Between Ambitious GHG Emissions Reduction Targets and Unstable Environmental Legislation

8.4 The Rest of Asia & Oceania CCS Market Forecast 2018-2028

8.4.1 The Rest of Asia CCS Market Analysis

8.4.2 The Rest of Asia and Oceania Carbon Capture & Storage Projects

8.4.3 The South Korean Carbon Capture & Storage Market Analysis

8.4.4 The Indian Carbon Capture & Storage Market Analysis

8.4.5 The Vietnamese Carbon Capture & Storage Market Analysis

8.4.6 The Japanese Carbon Capture & Storage Market Analysis

8.4.7 The Malaysian Carbon Capture & Storage Market Analysis

8.4.8 The New Zealand Carbon Capture & Storage Market Analysis

9. PEST Analysis of the Carbon Capture & Storage Market

9.1 Political

9.2 Economic

9.3 Social

9.4 Technological

10. Expert Opinion

10.1 SaskPower

10.2 The Landscape of the Carbon Capture and Storage Market, Now and in 10 years and the Factors Affecting the Dynamics

10.3 Challenges and Opportunities in the CCS Market in the Next 10 Years

10.4 The Major Drivers in the CCS Market Over the Next 10 Years

10.5 The Restraining Factors in play in the Market Over the Next 10 Years

10.6 Regions with Significant Market Growth or Decline in the Next 10 Years

10.7 Technological Advancements that Could Change the Future of the CCS Market

10.8 The Effect of the Trump Administration on the CCS Market

10.9 The Value of the EOR Market to the CCS Market

10.10 Carbon Capture and Meeting Emissions Targets

10.11 The Key Challengers in Operating the Boundary Dam Power Station

10.12 The Future Developments for SaskPower

11. Leading Companies in the Carbon Capture & Storage Market

11.1 Companies Providing Carbon Capture & Storage Technologies

11.1.1 Air Products & Chemicals Inc. Overview

11.1.1.1 Air Products & Chemicals Inc. Analysis

11.1.1.2 Air Products & Chemicals Inc. Regional Emphasis / Focus

11.1.1.3 Air Products & Chemicals Inc. Future Outlook

11.1.2 Air Liquide Company Overview

11.1.2.1 Air Liquide Analysis

11.1.2.2 Air Liquide Regional Emphasis / Focus

11.1.2.3 Air Liquide Future Outlook

11.1.3 Babcock & Wilcox Company Overview

11.1.1.3 Babcock & Wilcox Analysis

11.1.3.2 Babcock & Wilcox Future Outlook

11.1.4 Fluor Corporation Overview

11.1.4.1 Fluor Corporation Analysis

11.1.4.2 Fluor Corporation Regional Emphasis / Focus

11.1.4.3 Fluor Corporation Future Outlook

11.1.5 General Electric (GE) Company Overview

11.1.5.1 General Electric (GE) Analysis

11.1.5.2 General Electric (GE) Regional Emphasis / Focus

11.1.5.3 General Electric (GE) Future Outlook

11.1.6 HTC Purenergy Inc. Company Overview

11.1.6.1 HTC Purenergy Inc. Analysis

11.1.6.2 HTC Purenergy Inc. Regional Emphasis / Focus

11.1.6.3 HTC Purenergy Inc. Future Outlook

11.1.7 Linde AG Company Overview

11.1.7.1 Linde AG Analysis

11.1.7.2 Linde AG Regional Emphasis / Focus

11.1.7.3 Linde AG Future Outlook

11.1.8 Mitsubishi Heavy Industries Ltd. Overview

11.1.8.1 Mitsubishi Heavy Industries Ltd. Analysis

11.1.8.2 Mitsubishi Heavy Industries Ltd. Future Outlook

11.1.9 Praxair Inc. Company Overview

11.1.9.1 Praxair Inc. Analysis

11.1.9.2 Praxair Inc. Regional Emphasis / Focus

11.1.9.3 Praxair Inc. Future Outlook

11.2 Utility Companies Involved in the Carbon Capture & Storage Market

11.2.1 E.ON SE Overview

11.2.1.1 E.ON SE Analysis

11.2.1.2 E.ON SE Competitors

11.2.2 Enel S.p.A. Company Overview

11.2.2.1 Enel S.p.A. Analysis

11.2.2.2 Enel S.p.A. Competitors

11.2.2.3 Enel S.p.A. Regional Emphasis / Focus

11.2.3 RWE AG Company Overview

11.2.3.1 RWE AG Analysis

11.2.3.2 RWE AG Competitors

11.2.4 Saskatchewan Power Corporation

11.2.4.1 Saskatchewan Power Corporation Analysis

11.2.4.2 Saskatchewan Power Corporation Regional Emphasis / Focus

11.2.4.3 Saskatchewan Power Corporation Competitors

11.2.5 Scottish & Southern Energy Plc. Overview

11.2.5.1 Scottish & Southern Energy Plc. Analysis

11.2.5.2 Scottish & Southern Energy Plc. Competitors

11.2.6 Southern Company Overview

11.2.6.1 Southern Company Analysis

11.2.6.2 Southern Company Future Outlook

11.3 Companies Involved in the CO2 Storage Market

11.3.1 Baker Hughes Company Overview

11.3.1.1 Baker Hughes Analysis

11.3.1.2 Baker Hughes Regional Emphasis / Focus

11.3.2 Halliburton Company Overview

11.3.2.1 Halliburton Analysis

11.3.2.2 Halliburton Regional Emphasis / Focus

11.3.2.3 Halliburton Future Outlook

11.3.3 Petrofac Company Overview

11.3.3.1 Petrofac Analysis

11.3.3.2 Petrofac Regional Focus

11.3.4 Schlumberger Company Overview

11.3.4.1 Schlumberger Analysi

11.3.4.2 Schlumberger Regional Emphasis / Focus

11.4 Companies Involved in CO2 Transmission by Pipeline

11.4.1 Kinder Morgan Company Overview

11.4.1.1 Kinder Morgan Analysis

11.4.1.2 Kinder Morgan Regional Focus

11.4.2 National Grid Plc. Company Overview

11.4.2.1 National Grid Plc. Analysis

11.4.2.2 National Grid Plc. Regional Emphasis / Focus

11.5 Top 15 Companies in the Carbon Capture & Storage Market by Capture Capacity

12. Conclusions

12.1 Key Findings

12.2 Recommendations

13. Glossary

List of Tables

Table 1.1 Sample Global Carbon Capture & Storage Market Forecast 2018-2028 ($m, AGR %)

Table 3.1 Global Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 3.2 Regional Carbon Capture & Storage Market Forecasts 2018-2028 ($m, AGR %, Cumulative)

Table 3.3 Regional Carbon Capture Capacity Forecast 2018-2028 (Cumulative MMtpa of CO2, AGR %)

Table 3.4 Drivers and Restraints to the Global Carbon Capture & Storage Market 2018-2028

Table 3.5 National GHG Emissions Reduction Targets for Leading National Markets

Table 4.1 Carbon Capture & Storage Submarket Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, Cumulative)

Table 4.2 CO2 Capture Submarket Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 4.3 Drivers & Restraints in the CO2 Capture Submarket 2018-2028

Table 4.4 CO2 Transmission Submarket Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 4.5 Drivers & Restraints in the CO2 Transmission Submarket 2018-2028

Table 4.6 CO2 Storage Submarket Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 4.7 Drivers and Restraints of the CO2 Storage Submarket

Table 5.1 The Americas Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 5.2 The Americas National Carbon Capture & Storage Market Spending Forecasts 2018-2028 ($m, AGR %, Cumulative

Table 5.3 The Americas Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2, AGR %)

Table 5.4 The US Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 5.5 The US Carbon Capture Capacity Forecast 2018-2028 (Yearly MMtpa of CO2, AGR %)

Table 5.6 US Carbon Capture & Storage Projects (Name, Location, Companies, Capacity MMtpa, Operation Date, Capture Type, CO2 Storage)

Table 5.7 Drivers and Restraints in the US Carbon Capture & Storage Market 2018-2028

Table 5.8 The Canadian Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative

Table 5.9 The Canadian Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2, AGR %)

Table 5.10 Canadian Carbon Capture & Storage Projects (Name, Location, Companies, Capacity MMtpa, Operation Date, Capture Type, CO2 Storage)

Table 5.11 Driver and Restraints in the Canada Carbon Capture & Storage Market 2018-2028

Table 5.12 The Brazilian Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 5.13 The Brazilian Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2, AGR %)

Table 5.14 Brazilian Carbon Capture & Storage Projects (Name, Location, Companies, Capacity MMtpa, Operation Date, Capture Type, CO2 Storage)

Table 5.15 Drivers and Restraints in the Brazilian Carbon Capture & Storage Market 2018-2028

Table 6.1 The European Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 6.2 European National Carbon Capture & Storage Market Spending Forecasts 2018-2028 ($m, AGR %, Cumulative)

Table 6.3 European Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2, AGR %)

Table 6.4 The UK Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 6.5 The UK Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2, AGR %)

Table 6.6 UK Carbon Capture & Storage Projects (Name, Location, Companies, Capacity MMtpa, Operation Date, Capture Type, CO2 Storage)

Table 6.7 Drivers and Restraints in the UK Carbon Capture and Storage Market 2018-2028

Table 6.8 The Norwegian Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 6.9 The Norwegian Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2, AGR %)

Table 6.10 Norwegian Carbon Capture & Storage Projects (Name, Location, Companies, Capacity MMtpa, Operation Date, Capture Type, CO2 Storage)

Table 6.11 Drivers and Restraints in the Norwegian Carbon Capture & Storage Market 2018-2028

Table 6.12 The Rest of Europe Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 6.13 The Rest of Europe Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2, AGR %)

Table 6.14 Other Dormant Carbon & Storage Projects in the Rest of Europe (Name, Location, Companies, Capacity MMtpa, Operation Date, Capture Type, CO2 Storage)

Table 6.15 Drivers and Restraints in the Rest of Europe Carbon Capture & Storage (CCS) Market 2018-2028

Table 7.1 The Africa & Middle East Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 7.2 The Africa & Middle East National Carbon Capture & Storage Market Spending Forecasts 2018-2028 ($m, AGR %, Cumulative)

Table 7.3 The Africa & Middle East Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2, AGR %)

Table 7.4 The UAE Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 7.5 The UAE Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2, AGR %)

Table 7.6 The UAE Carbon Capture & Storage Projects (Name, Location, Companies, Capacity MMtpa, Operation Date, Capture Type, CO2 Storage)

Table 7.7 Drivers and Restraints in the UAE Carbon Capture and Storage Market 2018-2028

Table 7.8 The Rest of Africa & Middle East Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 7.9 The Rest of Africa & Middle East Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2, AGR %)

Table 7.10 The Rest of Africa & Middle East Carbon Capture & Storage Projects (Name, Location, Companies, Capacity MMtpa, Operation Date, Capture Type, CO2 Storage)

Table 8.1 The Asia & Oceania Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 8.2 Asia & Oceania National Carbon Capture & Storage Market Spending Forecasts 2018-2028 ($m, AGR %, Cumulative)

Table 8.3 The Asia & Oceania Carbon Capture Capacity Forecast 2018-2018 (Yearly Operating MMtpa of CO2, AGR %)

Table 8.4 The Chinese Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 8.5 The Chinese Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2, AGR %)

Table 8.6 Chinese Carbon Capture & Storage Projects (Name, Location, Companies, Capacity MMtpa, Operation Date, Capture Type, CO2 Storage)

Table 8.7 Drivers and Restraints in the Chinese Carbon Capture and Storage Market 2018-2028

Table 8.8 The Australian Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 8.9 The Australian Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2, AGR %)

Table 8.10 Australian Carbon Capture & Storage Projects (Name, Location, Companies, Capacity MMtpa, Operation Date, Capture Type, CO2 Storage)

Table 8.11 Drivers and Restraints in the Australian Carbon Capture & Storage Market 2018-2028

Table 8.12 The Rest of Asia & Oceania Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 8.13 The Rest of Asia & Oceania Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2, AGR %)

Table 8.14 The Rest of Asia & Oceania Carbon Capture & Storage Projects (Name, Location, Companies, Capacity MMtpa, Operation Date, Capture Type, CO2 Storage)

Table 11.1 Air Products & Chemicals Inc. Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.2 Air Products & Chemicals Inc. Carbon Capture Projects (Companies, Country, $m Value, Details)

Table 11.3 Air Products & Chemicals Inc. Company Divisions (% of Revenues)

Table 11.4 Air Liquide Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.5 Air Liquide Carbon Capture & Storage Projects

Table 11.6 Air Liquide Company Divisions (% of Revenues, Products & Services)

Table 11.7 Babcock & Wilcox Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.8 Babcock & Wilcox Carbon Capture & Storage Projects (Companies, Country, Value, Details)

Table 11.9 Babcock & Wilcox Company Division (Products &

Table 11.10 Fluor Corporation Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.11 Fluor Corporation Carbon Capture & Storage Projects (Companies, Country, Details)

Table 11.12 Fluor Corporation Regional Focus by New Orders & Backlog of Work (2016)

Table 11.13 General Electric (GE) Company Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.14 General Electric (GE) Carbon Capture & Storage Projects (Companies, Country, $m Value, Details)

Table 11.15 General Electric (GE) Company Division ($bn Revenues, % of Margins)

Table 11.16 HTC Purenergy Inc. Company Overview 2016 ($bn Revenue, HQ, Ticker, Website)

Table 11.17 HTC Purenergy Inc. Carbon Capture & Storage Projects (Companies, Country, $bn Value, Details)

Table 11.18 Linde AG Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.19 Linde AG Carbon Capture & Storage Projects (Companies, Country, Details, Model/Type)

Table 11.20 Linde AG Company Divisions (% of Total Revenue, Operating Margins, Products & Services)

Table 11.21 Mitsubishi Heavy Industries Ltd. Overview ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.22 Mitsubishi Heavy Industries Ltd. Carbon Capture & Storage Projects (Companies, Country, $m Value, Details)

Table 11.23 Mitsubishi Heavy Industries (MHI) Company Divisions ($bn Sales, % of Total Sales)

Table 11.24 Praxair Inc. Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.25 Praxair Inc. Carbon Capture & Storage Projects

Table 11.26 Praxair Inc. Company Divisions by End Market Sales 2016 (Percentage of Sales)

Table 11.27 E.ON SE Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.28 E.ON SE Carbon Capture & Storage Projects

Table 11.29 Enel S.p.A. Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.30 Enel S.p.A. Carbon Capture & Storage Projects (Companies, Country, Details, Model/Type)

Table 11.31 RWE AG Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.32 RWE AG Carbon Capture & Storage Projects

Table 11.33 Saskatchewan Power Corporation Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.34 Saskatchewan Power Corporation Carbon Capture & Storage Projects (Companies, Country, $m Value, Details)

Table 11.35 Saskatchewan Power Corporation Available Generating Capacity by Fuel Type 2016 (%, MW)

Table 11.36 Scottish & Southern Energy Plc. Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.37 Scottish & Southern Energy Plc. Carbon Capture & Storage Projects (Companies, Country, Details)

Table 11.38 Scottish & Southern Energy Sources of Power Capacity Breakdown 2016 (% of Total, MW)

Table 11.39 Southern Company Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.40 Southern Company Carbon Capture Projects

Table 11.44 Baker Hughes Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.45 Halliburton Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.46 Petrofac Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.47 Petrofac Carbon Capture & Storage Projects

Table 11.48 Schlumberger Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.49 Schlumberger Carbon Capture & Storage Projects (Companies, Country, Details)

Table 11.50 Schlumberger Company Divisions (% of Fourth Quarter 2016 Revenues, Products & Services)

Table 11.51 Kinder Morgan Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.53 National Grid Plc. Overview 2016 ($bn Revenue, Number of Employees, HQ, Ticker, Website)

Table 11.54 National Grid Plc. CO2 Transmission Projects (Companies, Country, Details)

Table 11.55 National Grid Plc. Company Divisions (% of Operating Profits)

Table 11.56 Leading 15 Companies in the Carbon Capture & Storage Market by Carbon Capture Capacity 2018-2028 (Market Ranking, Capture Capacity of New Projects, Market Share %)

Table 12.1 Global Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %, CAGR %, Cumulative)

Table 12.2 Regional Carbon Capture & Storage Market Forecasts 2018-2028 (CAPEX $m, OPEX $m, AGR %, Cumulative)

Table 12.3 Carbon Capture & Storage Submarket Forecasts 2018-2028 ($m, AGR %, Cumulative)

List of Figures

Figure 1.1 Global Carbon & Capture Market Structure Overview

Figure 2.1 Global Carbon Capture & Storage Market Segmentation Overview

Figure 2.2 Global Carbon Capture & Storage Market Structure Overview

Figure 2.3 CO2 Source, Capture, Transport, Injection and Storage Technologies

Figure 2.4 CO2 Emissions by Region in 2016 (Million Tonnes)

Figure 2.5 Global Coal Production and Consumption in 2016 (Million Tons of Oil Equivalent)

Figure 3.1 Global Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 3.2 Regional Carbon Capture & Storage Market Forecasts 2018-2028 ($m)

Figure 3.3 Regional Carbon Capture & Storage Markets Share Forecast 2018 (%)

Figure 3.4 Regional Carbon Capture & Storage Markets Share Forecast 2023 (%)

Figure 3.5 Regional Carbon Capture & Storage Markets Share Forecast 2028 (%)

Figure 3.6 Regional Carbon Capture & Storage Spending Forecasts 2018-2028 ($m)

Figure 3.7 Cumulative Regional Carbon Capture & Storage Spending Forecast 2018-2028 ($m)

Figure 3.8 Regional Carbon Capture & Storage Markets Share Change 2018-2028 (%)

Figure 3.9 CAGR % (x) vs. Barriers to Entry (y) vs. National Market Size (z) 2018-2028 ($m, CAGR %)

Figure 3.10 Regional Carbon Capture Capacity Forecast 2018-2028 (Cumulative MMtpa of CO2)

Figure 4.1 Carbon Capture & Storage Submarket Forecasts 2018-2028 (CAPEX $m, OPEX $m)

Figure 4.2 Carbon Capture & Storage Submarkets Share Forecast 2018 (%)

Figure 4.3 Carbon Capture & Storage Submarkets Share Forecast 2023 (%)

Figure 4.4 Carbon Capture & Storage Submarkets Share Forecast 2028 (%)

Figure 4.5 CO2 Capture Submarket Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 4.6 CO2 Capture Submarket Share Forecast 2018, 2023 and 2028 (%)

Figure 4.7 CO2 Transmission Submarket Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 4.8 CO2 Transmission Submarket Share Forecast 2018, 2023 and 2028 (%)

Figure 4.9 CO2 Storage Submarket Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 4.10 CO2 Storage Submarket Share Forecast 2018, 2023 and 2028 (%)

Figure 5.1 The Americas Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 5.2 The Americas Carbon Capture & Storage Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 5.3 The Americas National Carbon Capture & Storage Market Spending Forecasts 2018-2028 ($m)

Figure 5.4 The Americas Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2)

Figure 5.5 The US Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 5.6 The US Carbon Capture & Storage Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 5.7 The US Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2)

Figure 5.8 The Canadian Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 5.9 The Canadian Carbon Capture & Storage Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 5.10 The Canadian Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2)

Figure 5.11 Canadian Total Oil Production (MMtpa) 1990-2016

Figure 5.12 The Brazilian Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 5.13 The Brazilian Carbon Capture & Storage Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 5.14 The Brazilian Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2)

Figure 6.1 The European Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 6.2 European Carbon Capture & Storage Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 6.3 European National Carbon Capture & Storage Market Spending Forecasts 2018-2028 ($m)

Figure 6.4 European Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2)

Figure 6.5 The UK Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 6.6 The UK Carbon Capture & Storage Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 6.7 The UK Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2)

Figure 6.8 The Norwegian Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 6.9 The Norwegian Carbon Capture & Storage Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 6.10 The Norwegian Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2)

Figure 6.11 The Rest of Europe Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 6.12 The Rest of Europe Carbon Capture & Storage Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 6.13 The Rest of Europe Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2)

Figure 7.1 The Africa & Middle East Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 7.2 Africa & Middle East Carbon Capture & Storage Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 7.3 The Africa & Middle East National Carbon Capture & Storage Market Spending Forecasts 2018-2028 ($m)

Figure 7.4 The Africa & Middle East Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2)

Figure 7.5 The UAE Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 7.6 The UAE Carbon Capture & Storage Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 7.7 The UAE Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2)

Figure 7.8 The Rest of Africa & Middle East Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 7.9 The Rest of Africa & Middle East Carbon Capture & Storage Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 7.10 The Rest of Africa & Middle East Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2)

Figure 8.1 The Asia & Oceania Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 8.2 Asia & Oceania Carbon Capture & Storage Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 8.3 Asia & Oceania National Carbon Capture & Storage Market Spending Forecasts 2018-2028 ($m)

Figure 8.4 The Asia & Oceania Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2)

Figure 8.5 The Chinese Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 8.6 The Chinese Carbon Capture & Storage Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 8.7 The Chinese Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2)

Figure 8.8 Carbon Capture & Storage Projects in China (Year, Cumulative Capacity, CO2 Storage) 2018-2023

Figure 8.9 Chinese Coal Consumption and Production 1990-2016 (Million Short Tonnes)

Figure 8.10 The Australian Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 8.11 The Australian Carbon Capture & Storage Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 8.12 The Australian Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2)

Figure 8.13 Australian Total CO2 Emissions, Coal Consumption, Natural Gas Consumption and Oil Consumption (2005-2016)

Figure 8.14 The Rest of Asia & Oceania Carbon Capture & Storage Market Forecast 2018-2028 (CAPEX $m, OPEX $m, AGR %)

Figure 8.15 The Rest of Asia & Oceania Carbon Capture & Storage Market Share Forecast 2018, 2023 and 2028 (% Share)

Figure 8.16 Rest of Asia & Oceania Carbon Capture Capacity Forecast 2018-2028 (Yearly Operating MMtpa of CO2)

Figure 11.1 Major Companies Owning and Operating CCS Projects

Figure 11.2 Major Companies Involved in Carbon Capture Projects

Figure 11.3 Breakdown of Enel Net Electricity Generation by Resource 2016 (%)

Figure 11.4 Scottish & Southern Energy Capital Expenditure 2016 (% of Total)

Figure 11.5 Key Companies Involved in Carbon Dioxide Transportation & Storage Projects

Figure 11.6 Baker Hughes Company Revenue 2016 by Geographical Area (%)

Figure 11.7 Petrofac Revenue 2016 by country (%)

Figure 11.8 Schlumberger Revenues by Region in 2016 (%)

Figure 11.9 Leading 15 Companies in the Carbon Capture & Storage Market Share by Capturing Capacity of New Projects 2018-2028 (% share)

2Co Energy

8 Rivers Capital

Abu Dhabi National Oil Company (ADNOC)

AGL Energy Limited (AGL)

Agrium

Airgas

Air Liquide

Air Products & Chemicals Inc.

Alabama Power

Alstom

AltaGas Canada

Ameren Energy Resources Company, LLC (AER)

American Electric Power (AEP)

Anadarko Petroleum Corporation

Anglo American

Apache Corporation

Apache Corporation Canada

ArcelorMittal

Archer Daniels Midland (ADM)

Babcock & Wilcox

Babcock & Wilcox Canada

Babcock & Wilcox Power Generation Group

Baker Hughes

BASF SE

BHP Billiton

Blue Source

Bow City Power Ltd

BP

C.Gen NV

C12 Energy

Cansolv Technologies Inc.

CCSD

Cenovus Energy

Centrica Plc.

CF Fertilisers

Chaparral Energy

Chevron

Chevron Canada

Chevron Phillips

Chicago Bridge & Iron

China Datang Corporation

China Huaneng Group

China National Petroleum Company (CNPC)

China Resources Power

Chubu Electric Power

Chugai Technos

CNOOC

CO2 CRC

CO2DeepStore Limited

Coca Cola

ConocoPhillips

Consol Energy

Core Energy

CS Energy

CVR Energy Inc

Dakota Gas

Decatur

DeepStore

Denbury Onshore LLC

Denbury Resources

Dongguan Power Fuel Co. Ltd.

Dongguan Taiyangzhou Power

Doosan Power Systems

Dow Chemicals

Drax Power

Dresser Rand Company

Dresser-Rand Group

E.ON Kraftwerke

E.ON SE

EDF Energy.

Electric Power Development CO., Ltd. (J-Power)

Emirate Steel Industries

Emirates Aluminium (EMAL)

EnBW AG

Endesa

Enel Green Power

Enel S.p.A

Energen Resources Corporation

Enhance Energy

Enhanced Hydrocarbon Recovery (EHR)

Eni

Enmax

Essent (RWE Group)

Exelon Generation

Export-Import Bank of China

ExxonMobil

Fluor Corporation

FuelCell Energy Inc

Gassnova

GDF Suez

GDF Suez E&P Norge AS

General Electric (GE) Energy

General Electric (GE)

GeoGreen

Gorgon Joint Venture

GPC Quimica

GreenGen

GreenGen Tianjin IGCC Co. Ltd

Haliburton

Hess Corporation

Hess Norge

Hilcorp Energy Company

Hitachi Ltd.

HTC CO2 Systems

HTC Purenergy Inc.

Hydrogen Power Abu Dhabi (HPAD)

IESA

IHI Corporation

Inventys Thermal Technologies

Japan CCS (JCCS)

Japan Oil, Gas and Metals National Corporation (JOGMEC)

Japan Vietnam Petroleum Co., Ltd (JVPC)

JCOA

J-POWER

JX Nippon Oil & Gas Exploration Corp.

KBR

Kinder Morgan

Kinder Morgan CO2 Company, L.P.

Koch Fertilizers

Koch Nitrogen Company

Korea Electric Power Corporation (KEPCO)

Kraftwerke GmbH

Kuwait Petroleum Corporation

Leucadia Energy LLC

Linde AG

Lotte Chemical UK

Lurgi GmbH

Luscar

Maersk Tankers

Maicor Wind

Marathon Oil

Masdar

Merit Energy Company

Messer ASCO

Mississippi Power

Mitsubishi Heavy Industries Ltd. (MHI)

Mott MacDonald

National Grid Plc

National Thermal Power Corporation (NTPC)

Neill and Gunter Ltd

NET Power

Norsk Hydro

NRG Energy

Occidental Petroleum

Osaka Gas

Osaki CoolGen Corporation

PCOR

Peabody Energy

Pemex

Petoro AS

Petrobras

Petrofac

Petronas

Petrovietnam

PLT Energia.

Praxair Inc.

Progressive Energy

PricewaterhouseCoopers

Qatar Fuel Additives Company (QAFAC).

Qatar National Bank Group

Qatar Petroleum

Ramgen

Rio Tinto

Royal Dutch Shell

RWE AG

RWE npower

SABIC UK Ltd

Sandridge Energy

Sargas Power

Sargent and Lundy LLC

Saskatchewan Power Corporation (SaskPower)

Saskatoon Light & Power

Saudi Aramco

Schlumberger

Scottish & Southern Energy Plc. (SSE)

ScottishPower

SCS Energy LLC

SECARB (US DOE's Southeast Regional Carbon Sequestration Partnership)

Sembcorp Utilities UK

Shaanxi Yanchang Petroleum Group

Shanxi Coal International Energy Group

Shanxi International Energy Group

Shell

Shell Canada

Shell Cansolv

Shell United Kingdom

Shenhua Group

Siemens

Sinopec

Sinopec Engineering Group

Sitra Petrochemicals

SNC Lavalin

SNC Lavalin-Cansolv

Solid Energy

Sonatrach

Southern Company

Southern Energy

Spectra Energy Inc.

Statoil

Summit Power Group

Summit Texas Clean Energy

Tampa Electric

Taweelah Asia Power Company (TAPCO)

The BOC Group (BOC)

The Chugoku Electric Power CO., Inc.

Tohoku Hokuriku Electric Power

Tokyo Gas

Toshiba

Total E&P Norge AS

Total SA

Trinity Pipelines

Turceni Energy

ULCOS Consortium of companies

Union Engineering

Uniper

Valero Energy Corporation

Vattenfall

Whitecap Resources Inc.

Whiting Petroleum Corporation

Woodside

Xstrata

Xstrata Coal

Organisations Mentioned

Alberta CCS Fund

Australian Coal Association

Australian Department of Mines & Petroleum

Australian Department of Primary Industries

Brazil’s Energy and Carbon Storage Research Centre

BurUAE of Geological and Mining Research (BRGM)

California Energy Commission

CCS Flagship Program

Centre of Excellence in Research and Innovation in Petroleum, Mineral Resources and CARBON Storage (CEPAC)

Clean Energy Fund

Clean Fossil Fuel Energy Development Institute (CFEDI)

Construction Owners Association of Alberta (COAA)

DCC-NDRC.

Doha Carbon and Energy Forum

Electric Power Research Institute

Energy Information Administration (EIA)

Environmental Protection Agency (EPA)

French Petroleum Institute (IFP)

Global CCS Institute

Guangdong Low-Carbon Technology and Industry Research Centre (GDLRC)

Imperial College London

International Energy Agency (IEA)

International Energy Forum

Japanese Ministry of Economy, Trade and Industry (METI)

Low Emissions Technology Demonstration Fund

National Academy of Sciences

National Carbon Capture Centre

Office of Carbon Capture and Storage (UK)

Plains CO2 Reduction (PCOR) Partnership

Pontifical Catholic University of Rio Grade do Sul

Qatar Carbonates and Carbon Storage Research Centre

Qatar Science and Technology Park

Scottish Carbon Capture and Storage (SCCS)

South African Centre for Carbon Capture and Storage (SACCCS)

Stanford University

Texas BurUAE of Economic Geology

UK Carbon Capture and Storage Research Centre (UKCCSRC)

United Nations (UN)

University of Southampton

University of Texas

University of Waikato Centre for Environmental, Resources and Energy Law

US Department of Energy (DOE)

US Department of Energy’s National Energy Technology Laboratories (NETL)

US Environmental Protection Agency (EPA)

US Office of Fossil Energy

World Trade Organisation (WTO)

Download sample pages

Complete the form below to download your free sample pages for Carbon Capture & Storage (CCS) Market Report 2018-2028

Related reports

-

Oil Country Tubular Goods (OCTG) Market Forecast 2019-2029

Oil Country Tubular Goods market to generate $5.9 billion in 2019....Full DetailsPublished: 05 February 2019 -

The Microgrid Market Forecast 2019-2029

Visiongain has calculated that the Microgrid Market will see a capital expenditure (CAPEX) of $12.6bn in 2019. Read on to...Full DetailsPublished: 25 February 2019 -

Chemical Enhanced Oil Recovery (EOR) Market 2019-2029

This latest report by business intelligence provider visiongain assesses that Chemical EOR spending will reach $2.89bn in 2019. ...Full DetailsPublished: 03 June 2019 -

Ultra-Thin Solar Cells Market Report 2019-2029

The USD 3.34 billion Ultra-Thin Solar Cells Market is expected to flourish in the next few years. ...Full DetailsPublished: 22 February 2019 -

Carbon Dioxide (CO2) Enhanced Oil Recovery (EOR) Market 2019-2029

The latest report from business intelligence provider visiongain offers in depth analysis of the global carbon dioxide (CO2) enhanced oil...Full DetailsPublished: 13 December 2018 -

Land Seismic Equipment & Acquisition Market Forecast 2018-2028

Visiongain has calculated that the global Land Seismic Equipment & Acquisition Market will see a capital expenditure (CAPEX) of $2,168.2mn...

Full DetailsPublished: 26 January 2018 -

Top 20 Companies in Carbon Capture and Storage 2019

This report you will keep your knowledge base up to speed. Don’t get left behind....Full DetailsPublished: 04 April 2019 -

Marine Seismic Equipment & Acquisition Market Forecast 2018-2028

This latest report by business intelligence provider Visiongain assesses that marine seismic equipment and acquisition market will reach $5.01bn in...

Full DetailsPublished: 26 June 2018 -

Marine Seismic Equipment & Acquisition Market Forecast 2019-2029

Visiongain assesses that marine seismic equipment and acquisition market will reach $5.39bn in 2019. ...Full DetailsPublished: 21 June 2019 -

Clean Coal Technologies (CCT) Market 2019-2029

Visiongain has calculated that the clean coal market will see a total expenditure of $3.68bn in 2019, from capital expenditure...Full DetailsPublished: 18 July 2019

Download sample pages

Complete the form below to download your free sample pages for Carbon Capture & Storage (CCS) Market Report 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain energy reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and industry experts where possible but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain energy reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

“The Visiongain report was extremely insightful and helped us construct our basic go-to market strategy for our solution.”

H.

“F.B has used Visiongain to prepare two separate market studies on the ceramic proppants market over the last 12 months. These reports have been professionally researched and written and have assisted FBX greatly in developing its business strategy and investment plans.”

F.B

“We just received your very interesting report on the Energy Storage Technologies (EST) Market and this is a very impressive and useful document on that subject.”

I.E.N

“Visiongain does an outstanding job on putting the reports together and provides valuable insight at the right informative level for our needs. The EOR Visiongain report provided confirmation and market outlook data for EOR in MENA with the leading countries being Oman, Kuwait and eventually Saudi Arabia.”

E.S

“Visiongain produced a comprehensive, well-structured GTL Market report striking a good balance between scope and detail, global and local perspective, large and small industry segments. It is an informative forecast, useful for practitioners as a trusted and upto-date reference.”

Y.N Ltd

Association of Dutch Suppliers in the Oil & Gas Industry

Society of Naval Architects & Marine Engineers

Association of Diving Contractors

Association of Diving Contractors International

Associazione Imprese Subacquee Italiane

Australian Petroleum Production & Exploration Association

Brazilian Association of Offshore Support Companies

Brazilian Petroleum Institute

Canadian Energy Pipeline

Diving Medical Advisory Committee

European Diving Technology Committee

French Oil and Gas Industry Council

IMarEST – Institute of Marine Engineering, Science & Technology

International Association of Drilling Contractors

International Association of Geophysical Contractors

International Association of Oil & Gas Producers

International Chamber of Shipping

International Shipping Federation

International Marine Contractors Association

International Tanker Owners Pollution Federation

Leading Oil & Gas Industry Competitiveness

Maritime Energy Association

National Ocean Industries Association

Netherlands Oil and Gas Exploration and Production Association

NOF Energy

Norsk olje og gass Norwegian Oil and Gas Association

Offshore Contractors’ Association

Offshore Mechanical Handling Equipment Committee

Oil & Gas UK

Oil Companies International Marine Forum

Ontario Petroleum Institute

Organisation of the Petroleum Exporting Countries

Regional Association of Oil and Natural Gas Companies in Latin America and the Caribbean

Society for Underwater Technology

Society of Maritime Industries

Society of Petroleum Engineers

Society of Petroleum Enginners – Calgary

Step Change in Safety

Subsea UK

The East of England Energy Group

UK Petroleum Industry Association

All the events postponed due to COVID-19.

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Energy news

Energy as a Service (EaaS) Market

The global Energy as a Service (EaaS) market is projected to grow at a CAGR of 12.6% by 2034

25 July 2024

Synthetic Fuels Market

The global Synthetic Fuels market is projected to grow at a CAGR of 23% by 2034

18 July 2024

Power-to-X (P2X) Market

The global Power-to-X (P2X) market is projected to grow at a CAGR of 10.6% by 2034

09 July 2024

Airborne Wind Energy Market

The global Airborne Wind Energy market is projected to grow at a CAGR of 9.7% by 2034

05 June 2024