Industries > Pharma > Global Vaccine Contract Manufacturing Market Report 2018-2028

Global Vaccine Contract Manufacturing Market Report 2018-2028

Leading Countries, Technologies and Companies

The global vaccine contract manufacturing market was worth $883.0m in 2017 and is expected to grow at a CAGR of 9.1% from 2017-2022. Visiongain predicts a CAGR of 9.2% for the global vaccine contract manufacturing market over the whole forecast period (2017-2028).

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 150-page report you will receive 69 charts– all unavailable elsewhere.

The 150-page report provides clear detailed insight into the global vaccine contract manufacturing market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand new report today you stay better informed and ready to act.

Report Scope

• Revenue and growth forecasts to 2028 for the global vaccine market and market shares in 2017 and 2018 of the submarkets: paediatric vaccines, adult vaccines, influenza vaccines and therapeutic vaccines

• Revenue and growth forecasts to 2028 for the global vaccine contract manufacturing market

• Revenue and growth forecasts to 2028 for the leading national markets:

• United States

• Germany

• France

• United Kingdom

• Italy

• Spain

• Japan

• Brazil

• Russia

• China

• India

• Rest of the World

• Discussion and profiles of the leading players in the vaccine contract manufacturing market:

• Baxter BioPharma Solutions

• Boehringer Ingelheim

• Catalent

• Charles River Laboratories

• IDT Biologika

• Lonza

• Meridian Life Science

• Sigma Aldrich Fine Chemicals

• Merck

• Synco Bio Partners

• Analysis of what stimulates and restrains the global vaccine contract manufacturing market: Trends and SWOT Analysis

Visiongain’s study is intended for anyone requiring commercial analyses for the global vaccine contract manufacturing market. You find data, trends and predictions.

Buy our report today Global Vaccine Contract Manufacturing Market Report 2018-2028: Leading Countries, Technologies and Companies.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 World Vaccine Contract Manufacturing Market Highlights

1.2 Why You Should Read This Report?

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report

1.5 Who is This Report For?

1.6 Methodology

1.7 Associated Visiongain Reports

1.8 Frequently Asked Questions (FAQ)

2. Introduction to Vaccines

2.1 The History of Vaccines

2.2 How Do Vaccines Work?

2.2.1 Artificial Immunity

2.3 Types of Vaccine

2.3.1 Live, Attenuated Vaccines (LAVs)

2.3.2 Recombinant Live Vaccines

2.3.3 Inactivated Vaccines

2.3.4 Toxoid Vaccines

2.3.5 Subunit Vaccines

2.3.6 Conjugate Vaccines

2.3.7 Recombinant Subunit Vaccines

2.3.8 DNA Vaccines

2.3.9 Recombinant Vector Vaccines

2.3.10 Therapeutic Vaccines

2.4 Diseases Preventable with Vaccines

2.5 The Rise of the Vaccines Market

2.6 Technological and Regulatory Improvements

3. Vaccine Manufacturing Technologies, 2017

3.1 Summary of Vaccine Technology Trends

3.2 New Substrates for Vaccine Production

3.2.1 Shift towards Cell-Based Manufacturing Technology

3.2.2 Benefits of Cell-Based Techniques

3.2.3 Mammalian Cell Lines

3.2.3.1 MCDK (Madin Darby Canine Kidney Cells)

3.2.3.2 Vero Cells

3.2.3.3 PerC6 Cells

3.2.4 Avian-Derived Cell Lines

3.2.4.1 EB66 Stem Cell Technology: Vivalis

3.2.5 Plant-Based Vaccines

3.2.5.1 Medicago’s Proficia VLP Vaccine Technology

3.2.6 Insect Egg-Based Production Systems

3.2.6.1 Novavax

3.2.6.2 Protein Sciences Corporation (PSC)

3.3 Next-Generation Expression Systems and Vectors: Increasing Production Yield

3.3.1 AdVac Technology: Crucell

3.3.2 AdCEV Vectors: AfriVax

3.3.3 Pfenex Expression Technology: Pfenex

3.4 Equipment Trends

3.4.1 The Shift Towards Disposable Single-use Equipment

3.4.2 Bioreactors and Vaccine Production

3.4.2.1 Single-Use Bioreactors

3.4.2.2 Main Applications of Disposable Bioreactors

3.4.2.3 Current Single-Use Bioreactor Systems on the Market

3.5 Prefilled Syringes and Vaccines

3.5.1 Growing Market for Pre-Filled Syringes

3.5.2 Pre-Filled Vaccine Products

3.5.3 Drivers and Restraints for Pre-Filled Syringes

3.5.4 Product Stability and Quality Assurance Programme

3.5.4.1 Paediatric H1N1 Vaccine

3.5.4.2 Reported Challenges Flu Vaccines

3.5.4.3 Novartis' Agriflu and Fluad Ban is Lifted

3.5.4.4 Baxter Flu Vaccine and Side Effects

3.5.4.5 Reported Shelf Life with H1N1 Vaccine

3.6 Lyophilisation and Vaccine Manufacturing

3.6.1 Lyophilisation of Vaccines Will Increase

3.7 Cell Media Can Improve Virus Yield

4. The Global Vaccine Manufacturing Market 2018-2028

4.1 Overview of the Global Vaccine Manufacturing Market 2018-2028

4.2 World Vaccine Market Forecast 2018-2028

4.3 The Global Vaccine Market by Submarket, 2016 and 2017

4.4 Growth in Vaccine Market Will Drive Efficiency in Vaccine Manufacturing

4.5 Paediatric Vaccines Market Overview

4.6 Adult Prophylactic Vaccines Market Overview

4.7 Influenza Vaccines Market Overview

4.8 Therapeutic Vaccines Market Overview

5. The Global Vaccine Contract Manufacturing 2018-2028

5.1 Outsourcing in the Pharmaceutical and Biotechnology Industry

5.1.1 Reasons to Outsource

5.1.2 Benefits of Outsourcing

5.1.3 The Challenges in Outsourcing Vaccine Manufacturing

5.1.4 Why Should Companies Outsource Vaccine Manufacturing?

5.1.5 Strategic Outsourcing vs. Tactical Outsourcing

5.1.6 Virtual Companies

5.2 Contract Manufacturing Organisations (CMOs)

5.2.1 Manufacturing Services Offered by CMOs

5.2.2 Vaccine Manufacturing Activities Typically Outsourced

5.3 The Pharmaceutical Contract Manufacturing Market: Overall Revenue Forecast 2016-2028

5.4 Contract Manufacturing Market for Vaccines 2017-2028

5.4.1 Market Size for Contract Manufacturing of Vaccines 2017

5.4.2 Vaccine Contract Manufacturing Market Forecast 2017-2028

6. The Leading National Markets for Vaccine Contract Manufacturing, 2018-2028

6.1 The Leading National Markets for Vaccine Contract Manufacturing

6.2 The Leading National Markets for Vaccine Contract Manufacturing, 2016-2017

6.3 The Leading National Markets for Vaccine Contract Manufacturing, 2017-2028

6.3.1 The US Vaccine Contract Manufacturing Market Forecast, 2017-2028

6.3.2 The EU5 Vaccine Contract Manufacturing Market, 2016 and 2017

6.3.2.1 The EU5 Vaccine Contract Manufacturing Market, 2016-2028

6.3.2.2 The German Vaccine Contract Manufacturing Market, 2016-2028

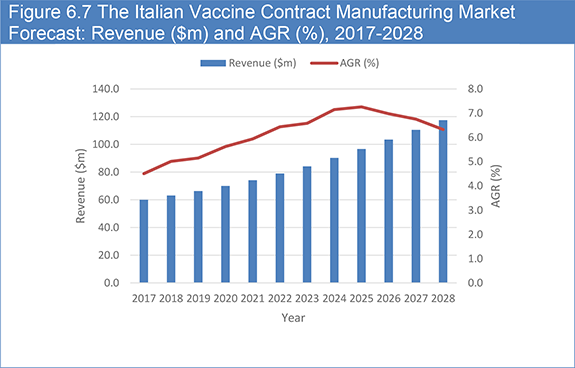

6.3.2.3 The Italian Vaccine Contract Manufacturing Market, 2018-2028

6.3.2.4 The UK Vaccine Contract Manufacturing Market, 2018-2028

6.3.2.5 The French Vaccine Contract Manufacturing Market, 2018-2028

6.3.2.6 The Spanish Vaccine Contract Manufacturing Market, 2018-2028

6.3.3 The Japanese Vaccine Contract Manufacturing Market, 2018-2028

6.3.4 The Chinese Vaccine Contract Manufacturing Market, 2018-2028

6.3.5 The Indian Vaccine Contract Manufacturing Market, 2018-2028

6.3.6 The Russian Vaccine Contract Manufacturing Market, 2018-2028

6.3.7 The Brazilian Vaccine Contract Manufacturing Market, 2018-2028

7. Leading Vaccine Contract Manufacturing Companies, 2018-2028

7.1 Leading Vaccine Contract Manufacturing Organisations

7.2 Baxter BioPharma Solutions

7.3 Boehringer Ingelheim

7.3.1 Recent Financial Performance

7.3.2 Ben Venue Laboratories

7.3.3 Manufacturing Deals 2011-2017

7.4 Catalent

7.4.1 Recent Financial Performance

7.4.2 Catalent: Financial Performance by Segment, 2011-2016

7.4.3 Catalent Injectable Vaccines

7.4.4 Catalent: Zydis Technology

7.4.5 Regional Market Expansion Strategy

7.5 Charles River Laboratories

7.5.1 Recent Financial Performance, 2010-2016

7.5.2 Financial Performance by Segment, 2010-2016

7.5.3 Vaccine Manufacturing Services

7.5.4 Charles River Avian Vaccine Services

7.5.5 Vaccine Manufacturing Expansion

7.5.6 Outlook and Early Stage Restructuring

7.5.7 Partnerships

7.5.7.1 Partnership with AstraZeneca

7.5.7.2 Partnership with Batavia

7.6 IDT Biologika GmbH

7.7 Lonza

7.7.1 Recent Financial Performance

7.7.2 Manufacturing Division Restructuring

7.8 Meridian Life Science

7.8.1 Recent Financial Performance, 2010-2016

7.8.2 Recent Financial Performance by Segment, 2011-2016

7.9 Sigma-Aldrich Fine Chemicals (SAFC) (Merck KGaA)

7.10 SynCo Bio Partners

7.10.1 Recent Developments

7.10.1.1 Expansion of Facilities

7.10.1.2 FDA Approval of Partner Application

8. Vaccine Manufacturing Market: World Market Trends 2018-2028

8.1 Vaccine Contract Manufacturing Industry Trends

8.2 Strengths

8.2.1 Many Companies Cannot Afford In-house Capabilities

8.2.2 Outsourcing Improves Time to Market

8.2.3 Manufacturers Get Access to Specialised Technologies

8.2.4 Shift Towards Emerging Markets as Favourable Outsourcing Destinations

8.3 Weaknesses

8.3.1 Mass Vaccine Manufacturing Kept In-house

8.3.2 A Highly-Fragmented Vaccine Contract Manufacturing Market

8.3.3 An Unpredictable Supply and Demand Business Model

8.4 Opportunities

8.4.1 Many Vaccines in the Product Pipeline

8.4.2 Emerging Market’s Growing Demand for Vaccines

8.4.2.1 Dynamic Change: Emerging Markets are Major Vaccine Developers

8.4.3 Changing World Demographics

8.5 Threats

8.5.1 Post Recession: Biotech Suffer from Severe Cuts in Capital Funding

8.5.2 The Public are Slow to Accept Novel Technologies

8.5.3 Perception of Risk by the Original Vaccine Manufacturers

9. Conclusion

9.1 Overview

9.2 Regulatory and Quality Standards Create High Barriers of Entry

9.3 Emerging Markets Will Show Stronger Growth

Appendices

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 2.1 Timeline of Key Events in Vaccine Development, c.1000 AD – Present

Table 3.1 Vaccine Development Pipeline Using Crucell’s AdVac Technology

Table 3.2 Benefits and Drawbacks of Using Disposable Technology for Vaccine Production

Table 3.3 Companies Providing Disposable Biomanufacturing Platforms/Systems

Table 3.4 Some Leading Pre-Filled Syringe Vaccine Products

Table 3.5 Prominent Lyophilised Vaccines

Table 3.6 Examples of Serum-Free Media for Vaccine Manufacturing

Table 4.1 The Global Vaccine Market Forecast: Revenue ($bn), AGR (%) and CAGR (%) 2017-2028

Table 4.2 The Global Vaccine Market: Revenue ($bn) and Market Share by Submarket (%), 2017-2018

Table 5.1 The Global Vaccine Contract Manufacturing Forecast: Revenue ($m), AGR (%) and CAGR (%), 2017-2028

Table 6.1 The Leading National Vaccine Contract Manufacturing Markets Forecast: Revenue ($m) and Market Share (%), 2017-2018

Table 6.2 The US Vaccine Contract Manufacturing Forecast: Revenue ($m), AGR (%) and CAGR (%), 2017-2028

Table 6.3 The EU5 National Vaccine Contract Manufacturing Markets: Revenue ($m) and Market Share (%) by Country, 2017-2018

Table 6.4 The EU5 Vaccine Contract Manufacturing Market Forecast: Revenue ($m), AGR (%) and CAGR (%), 2017-2028

Table 6.5 The German Vaccine Contract Manufacturing Market Forecast: Revenue ($m), AGR (%) and CAGR (%), 2017-2028

Table 6.6 The Italian Vaccine Contract Manufacturing Market Forecast: Revenue ($m), AGR (%) and CAGR (%), 2017-2028

Table 6.7 The UK Vaccine Contract Manufacturing Market Forecast: Revenue ($m), AGR (%) and CAGR (%), 2017-2028

Table 6.8 The French Vaccine Contract Manufacturing Market Forecast: Revenue ($m), AGR (%) and CAGR (%), 2017-2028

Table 6.9 The Spanish Vaccine Contract Manufacturing Market Forecast: Revenue ($m), AGR (%) and CAGR (%), 2017-2028

Table 6.10 The Japanese Vaccine Contract Manufacturing Market Forecast: Revenue ($m), AGR (%) and CAGR (%), 2017-2028

Table 6.11 The Chinese Vaccine Contract Manufacturing Market Forecast: Revenue ($m), AGR (%) and CAGR (%), 2017-2028

Table 6.12 The Indian Vaccine Contract Manufacturing Market Forecast: Revenue ($m), AGR (%) and CAGR (%), 2017-2028

Table 6.13 The Russian Vaccine Contract Manufacturing Market Forecast: Revenue ($m), AGR (%) and CAGR (%), 2017-2028

Table 6.14 The Brazilian Vaccine Contract Manufacturing Market Forecast: Revenue ($m), AGR (%) and CAGR (%), 2017-2028

Table 7.1 Boehringer Ingelheim: Biopharmaceuticals Revenue ($m) and Annual Growth Rate (%), 2010-2016

Table 7.2 Catalent: Revenue($m) and AGR (%), 2010-2016

Table 7.3 Catalent by Segment: Revenue($m), AGR (%), and Intersegment Revenue Eliminations, 2011-2016

Table 7.4 Charles River Laboratories: Revenue ($bn) and AGR (%), 2010-2015

Table 7.5 Charles River Laboratories: Newly Revised Reportable Segments

Table 7.6 Charles River Laboratories: cGMP Vaccine Manufacturing and Testing Capabilities

Table 7.7 Lonza Custom Manufacturing: Revenue ($m) and AGR (%), 2010-2016

Table 7.8 Meridian Bioscience: Revenue ($m), AGR (%), 2010-2016

Table 7.9 Meridian Bioscience: Revenue ($m) and AGR (%) by Segment, 2011-2016

Table 7.10 SynCo Bio Partners Capabilities

Table 8.1 SWOT Analysis of the Vaccine Contract Manufacturing Market

List of Figures

Figure 3.1 Influenza Vaccine Production Using a Cell-Based Manufacturing Method

Figure 3.2 Medicago’s Product Pipeline

Figure 3.3 Novavax’ Insect Egg-Based Vaccine Production Process

Figure 3.4 Pre-filled Syringes Market: Drivers and Restraints, 2018-2028

Figure 4.1 The Global Vaccine Market Forecast: Revenue ($bn), AGR (%) 2017-2028

Figure 4.2 The Global Vaccine Market: Market Share by Submarket (%), 2017

Figure 5.1 Selected Tasks Outsourced in the Pharmaceutical and Biotech Industry

Figure 5.2 The Global Vaccine Contract Manufacturing Forecast: Revenue ($m), 2017, 2022 and 2028

Figure 5.3 The Global Vaccine Contract Manufacturing Forecast: Revenue ($m) and AGR (%), 2017-2028

Figure 6.1 The Leading National Vaccine Contract Manufacturing Markets: Market Share (%) by Region, 2017

Figure 6.2 The US Vaccine Contract Manufacturing Forecast: Revenue ($m) and AGR (%), 2017-2028

Figure 6.3 The EU5 Vaccine Contract Manufacturing Markets: Market Share (%) by Country, 2017

Figure 6.4 The EU5 Vaccine Contract Manufacturing Market Forecast: Revenue ($m) and AGR (%), 2017-2028

Figure 6.5 The EU5 Vaccine Contract Manufacturing Markets: Market Share (%) by Country, 2018

Figure 6.6 The German Vaccine Contract Manufacturing Market Forecast: Revenue ($m) and AGR (%), 2017-2028

Figure 6.7 The Italian Vaccine Contract Manufacturing Market Forecast: Revenue ($m) and AGR (%), 2017-2028

Figure 6.8 The UK Vaccine Contract Manufacturing Market Forecast: Revenue ($m) and AGR (%), 2017-2028

Figure 6.9 The French Vaccine Contract Manufacturing Market Forecast: Revenue ($m) and AGR (%), 2017-2028

Figure 6.10 The Spanish Vaccine Contract Manufacturing Market Forecast: Revenue ($m) and AGR (%), 2017-2028

Figure 6.11 The Japanese Vaccine Contract Manufacturing Forecast: Revenue ($m), AGR (%) and CAGR (%), 2017-2028

Figure 6.12 The Chinese Vaccine Contract Manufacturing Market Forecast: Revenue ($m) and AGR (%) 2017-2028

Figure 6.13 The Indian Vaccine Contract Manufacturing Market Forecast: Revenue ($m) and AGR (%) 2017-2028

Figure 6.14 The Russian Vaccine Contract Manufacturing Market Forecast: Revenue ($m) and AGR (%), 2017-2028

Figure 6.15 The Brazilian Vaccine Contract Manufacturing Market Forecast: Revenue ($m) and AGR (%), 2017-2028

Figure 7.1 Boehringer Ingelheim: Biopharmaceuticals Revenue ($m) and Annual Growth Rate (%), 2010-2016

Figure 7.2 Catalent: Revenue ($m) and AGR (%), 2010-2016

Figure 7.3 Catalent: Revenue ($m) by Segment, 2011-2016

Figure 7.4 Catalent: Market Shares (%) by Segment, 2016

Figure 7.5 Charles River Laboratories: Revenue ($bn) and AGR (%), 2010-2016

Figure 7.6 Lonza Custom Manufacturing: Revenue ($m) and AGR (%), 2010-2016

Figure 7.7 Meridian Bioscience: Revenue ($m), and AGR (%), 2010-2016

Figure 7.8 Meridian Bioscience: Revenue ($m) by Segment, 2011-2016

Figure 7.9 Meridian Bioscience: Market Share (%) by Segment,2016

Figure 8.1 Drivers and Restraints for the Vaccine Contract Manufacturing Sector

Accugenix

Aeras Global

AfriVax

Amgen

AmProtein

Antigenics Inc.

Artelis

AstraZeneca

ATM Life Sciences

ATMI

AVEO Pharmaceuticals

Bacteriological Institute of the Anhaltian Administrative Areas

Batavia Bioservices

Baxter

Baxter BioPharma Solutions

Bayer

Beijing Tiantan Biological Productions

Ben Venue Laboratories

Berna Biotech

Bharat Biotech International Limited

Binnopharm

BioKangtai

Biovest

Boehringer Ingelheim

Boehringer Ingelheim Biopharmaceuticals (China)

Boehringer Ingelheim BioXcellence

Cadila Pharmaceuticals

Catalent

Cellexus Limited

Charles River Laboratories

Chengdu Institute of Biological Products Co.

China National Biotec Group Co., Ltd. (CNBG)

Crucell

CSL Biotherapies

Daiichi Sankyo Co. Ltd.

Dalian Hissen Bio-Pharm

Dendreon

Elanco Animal Health

Eli Lilly

Farmindustria

FiberCell

Gallant Custom Laboratories

GE Healthcare

GE Healthcare Life Sciences

GE Wave Biotech

Gelita

GlaxoSmithKline (GSK)

GlaxoSmithKline Biologics

Hikma

Hualan Biological Bacterin

Hyclone

IDT Biologika GmbH

Impfstoffwerk Dessau-Tornau GmbH (IDT)

Institut Pasteur

Intercell Corporation

Invitrogen

Irvine Scientific

Klocke Group

Kuhner

LG Life Sciences

Lonza

Medicago

Medimmune

Meissner Filtration

Merck & Co.

Merck KGaA

Merck Millipore

Merck Serono

Meridian Bioscience

Meridian Life Science

MGC Pharma Co.

Micron Technologies

Millipore

Mitsubishi Tanabe Pharma (MTPC)

MorphoSys

MP Biomedicals

Novartis

Novartis Vaccines and Diagnostics

Novavax

Organon Teknika Corporation

Pall Life Sciences

Paragon Bioservices

Patheon

PaxVax Corporation

PBS Biotech

Pfenex

Pfizer

Pharmaceutical Base Development Co., Ltd.

Philip Morris

Philip Morris Investments

Pierre-Guerin Biolafitte

Protein Sciences Corporation

Refine Technology

Sanofi

Sanofi Pasteur

Sanofi Pasteur MSD

Sartorius Stedim

Shanghai Zhangjiang Biotech

ShangPharma Corporation

Sigma Aldrich

Sigma-Aldrich Fine Chemicals (SAFC)

Sunrise Farms, Inc.

SynCo Bio Partners (SynCo)

Thermo Fisher

Vector Solutions

Vivalis

Wave Biotech

Wyeth

Xcellerex

Xencor

ZellWerk

Zhejiang Jiang Yuan Tang Biotechnology Corporation

List of Organisations Mentioned in the Report

Biomedical Advanced Research and Development Authority (BARDA)

Center for Disease Control (CDC)

China Food and Drug Administration (CFDA)

Defense Advanced Research Projects Agency (DARPA)

Department of Health and Human Services (HHS)

Emory University

European Medical Agency

Food and Drug Administration (FDA)

National Institute of Allergy and Infectious Diseases (NIAID)

PATH

U.S. Department of Health and Human Services Office

U.S. Department of Homeland Security

World Health Organisation (WHO)

Download sample pages

Complete the form below to download your free sample pages for Global Vaccine Contract Manufacturing Market Report 2018-2028

Related reports

-

Global Biosimilars and Follow-On Biologics Market 2018-2028

The global biosimilars and follow-on biologics market is estimated to have reached $7.70bn in 2017 and expected to grow at...

Full DetailsPublished: 01 June 2018 -

Global Pre-Filled Syringes Market Forecast 2019-2029

The global pre-filled syringes market was valued at $9.8bn in 2018. This market is estimated to grow at a CAGR...

Full DetailsPublished: 31 January 2019 -

Global Allergic Rhinitis Drugs Market 2018-2028

The global allergic rhinitis drugs market is expected to grow at a CAGR of 3.3% in the first half of...

Full DetailsPublished: 24 August 2018 -

Pharma Leader Series: Top 50 Pharmaceutical Contract Manufacturing Organisations (CMOs) Market 2018

Contract manufacturing represents the largest sector of the pharma outsourcing industry. Pharmaceutical companies have sought to take advantage of the...Full DetailsPublished: 28 September 2018 -

Biologics Market Trends and Forecasts 2018-2028

The global biologics market is estimated to reach $250bn in 2023. The market is expected to grow at a CAGR...

Full DetailsPublished: 14 November 2018 -

Global Biosimilar Monoclonal Antibodies Forecast 2018-2028

The global biosimilar monoclonal antibodies market is expected to reach $5.9bn in 2023 and is estimated to grow at a...

Full DetailsPublished: 27 February 2018 -

Global Influenza Vaccines Market Outlook 2018-2028

The latest report from business intelligence provider visiongain offers comprehensive analysis of the global influenza vaccines market. Visiongain assesses that...

Full DetailsPublished: 19 June 2018 -

Gene Therapy R&D and Revenue Forecasts 2018-2028

The gene therapy market is projected to grow at a CAGR of 41.1% in the first half of the forecast...

Full DetailsPublished: 31 May 2018 -

Pharmaceutical Contract Manufacturing Market 2018-2028

The pharmaceutical contract manufacturing market is expected to grow at a CAGR of 6.0% in the first half of the...

Full DetailsPublished: 27 June 2018 -

Top 25 Antibiotic Drugs Manufacturers 2018

Visiongain forecasts the antibiotic drugs market to increase to $ 43,841.7m in 2022. The market is estimated to grow at...

Full DetailsPublished: 12 June 2018

Download sample pages

Complete the form below to download your free sample pages for Global Vaccine Contract Manufacturing Market Report 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Drug Delivery Technologies Market Report 2024-2034

The global Drug Delivery Technologies market is estimated at US$1,729.6 billion in 2024 and is projected to grow at a CAGR of 5.5% during the forecast period 2024-2034.

23 April 2024

Visiongain Publishes Cell Therapy Technologies Market Report 2024-2034

The cell therapy technologies market is estimated at US$7,041.3 million in 2024 and is projected to grow at a CAGR of 10.7% during the forecast period 2024-2034.

18 April 2024

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024

Visiongain Publishes Anti-obesity Drugs Market Report 2024-2034

The global Anti-obesity Drugs market is estimated at US$11,540.2 million in 2024 and is expected to register a CAGR of 21.2% from 2024 to 2034.

12 April 2024