Industries > Pharma > Gene Therapy R&D and Revenue Forecasts 2018-2028

Gene Therapy R&D and Revenue Forecasts 2018-2028

Prospects for Drugs Treating Cancer, Cardiovascular Disorders, Rare Diseases, Ophthalmologic Conditions, Other Diseases, Approved Gene therapies, R&D Pipeline Analysis, Gene Therapy Regulations by Region and Leading Players

The gene therapy market is projected to grow at a CAGR of 41.1% in the first half of the forecast period. In 2018, the cancer treatment submarket accounted for 68.7% of the gene therapy drug market. Visiongain estimated that gene therapy for rare diseases will be the driver for market growth in the second half of the forecast period.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand-new 134 page report you will receive 72 charts– all unavailable elsewhere.

The 134-page report provides clear detailed insight into the gene therapy market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• Gene Therapy market forecasts from 2018-2028

• This report assesses the approved gene therapy products in the market and gives revenue to 2028 for Neovasculgen

• Provides qualitative analysis and forecast of the submarket by indication for the period 2018-2028:

• Cancer

• Cardiovascular disorders

• Rare diseases

• Ophthalmological diseases

• Other therapeutic uses

• Profiles leading companies that will be important in the development of the gene therapy market. For each company, developments and outlooks are discussed and companies covered in this chapter include:

• UniQure

• Biogen

• Bluebird Bio

• Spark Therapeutics

• Applied Genetics Technologies Corporation

• Oxford Biomedica

• GenSight Biologics

• Assesses the outlook for the leading gene treatment R&D pipeline for 2018 and discusses technological progress and potential. Profiles appear for gene therapy drug candidates, with revenue forecasts for six leading agents:

• SPK-RPE65 (Spark Therapeutics)

• Collategene (AMG0001, AnGes MG/Vical)

• Invossa (TissueGene-C, TissueGene Inc/Kolon Life Science)

• BC-819 (BioCancell)

• Lenti-D (Bluebird Bio)

• GSK2696273 (GlaxoSmithKline)

• Provides qualitative analysis of trends that will affect the gene therapies market, from the perspective of pharmaceutical companies, during the period 2018 to 2028. SWOT analysis is provided and an overview of regulation of the gene therapy market by leading region given.

• Our study discusses factors that influence the market including these:

• Translation of research into marketable products modifying human DNA – gene transfer for therapeutic use, altering the nuclear genome

• Genomic editing technology and other supporting components

• Collaborations to develop and launch gene-based products – acquisitions and licensing deals

• Supporting technologies for human genetic modification, gene replacement and targeted drug delivery

• Gene therapies for ophthalmologic diseases – next-generation medicines

• Regulations in the United States, the European Union and Japan – overcoming technological and medical challenges to pass clinical trials.

Visiongain’s study is intended for anyone requiring commercial analyses for the gene therapy market. You find data, trends and predictions.

Buy our report today Gene Therapy R&D Market Research: Prospects for Drugs Treating Cancer, Cardiovascular Disorders, Rare Diseases, Ophthalmologic Conditions, Other Diseases, Approved Gene therapies, R&D Pipeline Analysis, Gene Therapy Regulations by Region and Leading Players.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Gene Therapy Market Overview

1.2 Benefits of This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report

1.5 Who is This Report For?

1.6 Methods of the Study

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to Gene Therapy

2.1 What is Gene Therapy?

2.2 Types of Gene Therapy

2.3 Products Excluded from the Report

2.4 Gene Therapy Vectors

3. Gene Therapy World Market: Leading Treatments and Forecasts, 2017-2028

3.1 The World Market for Gene Therapy: Overview of Products

3.2 Gendicine (rAd-p53) – The First Gene Therapy to Market

3.3 Oncorine: Growth is Hindered by Certain Factors

3.4 Neovasculgen: Russia’s First Gene Therapy

3.4.1 Neovasculgen: Historical Performance and Revenue Forecast, 2017-2028

3.5 Glybera: A Drug with Promise

3.5.1 Glybera: Pricing Ends the Dream to Become a Blockbuster Product

3.6 Strimvelis: Second Gene Therapy for an Inherited Disease Ever to be approved for Sale and the First Corrective Gene Therapy for Children to be Approved Anywhere in the World

3.6.1 Even Big Pharma Struggle in the Rare Disease Space

4. Gene Therapy World Market and Disease Submarkets, 2017-2028

4.1 The Global Market for Gene Therapy Drug Treatments in 2017

4.2 Gene Therapy Market Forecast, 2017-2028

4.3 Gene Therapy for Cancer

4.3.1 Clinical Trials for Cancer

4.3.2 The Cancer Gene Therapy Treatment Submarket Forecast 2017-2028

4.4 Gene Therapy for Rare Diseases

4.4.1 The Rare Disease Treatment Submarket Forecast 2017-2028

4.5 Gene Therapy for Cardiovascular Diseases

4.5.1 The Cardiovascular Disease Treatment Submarket Forecast 2017-2028

4.6 Gene Therapy for Ophthalmologic Diseases

4.6.1 Advanced Stage Gene Therapies for Ophthalmologic Diseases

4.6.2 The Ophthalmologic Disease Treatment Submarket Forecast 2017-2028

4.7 Gene Therapy for Other Diseases

4.7.1 The Other Disease Treatment Submarket Forecast 2017-2028

4.7.2 Changing Market Shares: Cancer Disease Gene Therapies Will Dominate and Become Market Leader

5. R&D Pipeline Analysis and Forecasts, 2017-2028

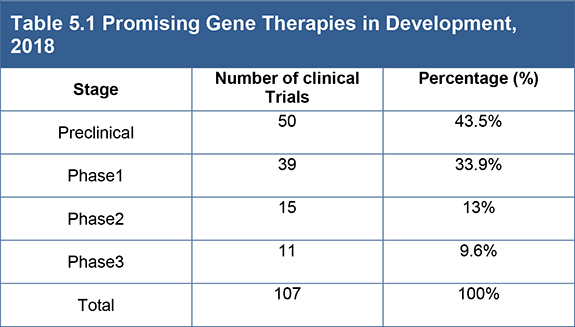

5.1 Pipeline

5.2 Pipeline Analysis

5.3 Collategene (AMG0001) - AnGes MG/Vical

5.4 BC-819 - BioCancell

5.5 BC-821 - BioCancell

5.6 Lenti-D - Bluebird Bio

5.7 LentiGlobin (LentiGlobin BB305) - Bluebird Bio

5.8 SPK-RPE65 - Spark Therapeutics

5.9 SPK-CHM - Spark Therapeutics

5.10 SPK-FIX - Spark Therapeutics/Pfizer

5.11 SPK-TPP1- Spark Therapeutics

5.12 Invossa (TissueGene-C) - TissueGene Inc/Kolon Life Science

5.13 VM202-DPN - ViroMed

5.14 Important Pipeline Technology Developments

5.15 Clustered regularly interspaced short palindromic repeats (CRISPR)

5.16 The Future of the Gene Therapy Pipeline

6. Companies of Interest in the Gene Therapy Market: Robust Pipelines Will Yield Revenue in the Future

6.1 UniQure- the First Commercial Stage Gene Therapy Company in the West

6.2 Biogen - Focusing on Ophthalmologic and Rare Disease Gene Therapies

6.3 Bluebird Bio: Gene Editing Technology

6.4 Spark Therapeutics- Strong Change to Become the First Company with Marketed Gene Therapy in the US

6.5 Applied Genetic Technologies Corporation: Specialisation in Ophthalmologic Diseases

6.6 Oxford Biomedica: Collaboration as a Strategy

6.7 GenSight Biologics - Novel Mitochondrial Technology Platform

6.8 Gene Therapy and Big Pharma: Collaborations

7. Qualitative Analysis of the Gene Therapy Market, 2018-2028

7.1 SWOT Analysis of the Gene Therapy Treatment Market, 2018

7.2 Strengths: A Vast Pipeline for a Wide Range of Indications

7.3 Weaknesses: Low Patient Populations Cannot Sustain Long-Term Growth

7.4 Opportunities and Threats for the Gene Therapy Drug Market, 2018-2028

7.5 Opportunities: Collaborations and Novel Technologies Will Pave the Way

7.6 Threats: Expensive Drugs with Strict Regulations

7.7 National Markets: Regulation of the Gene Therapy Market

7.7.1 Gene Therapy Regulations: Evolving with the Market

7.7.2 US Regulations: Strict Regulation of a Cautious Market

7.7.3 EU Regulations: One Approval So Far

7.7.4 Japanese Regulations: A Rigorous Process

7.7.5 China Has Highest Gene Sequencing Capacity

8. Conclusions

8.1 The World Gene Therapy Treatment Market: Current World Outlook

8.1.1 Leading Gene Therapy Treatment Submarkets and Products, 2017-2028

8.1.2 Driver for Growth to 2028: A Vast Pipeline of Gene Therapy Products

8.1.3 Leading Regional Markets and Companies: Partnerships Will Achieve Success

8.2 The Future of the Gene Therapy Treatment Market

Associated Visiongain Reports

Visiongain report sales order form

About Visiongain

Visiongain Report Evaluation Form

Table of Tables

Table 1.1 Foreign Currency Exchange Rates Utilised: Exchange Rate to $US, 2015, 2016, and 2017

Table 3.1 Approved Gene Therapies, 2017

Table 3.2 Gene Therapies in Pipeline, 2017

Table 3.3 Neovasculgen Historical Revenue Comparisons, Revenue ($m), AGR (%), 2013-2017

Table 3.4 Neovasculgen Forecast, Revenue ($m), AGR (%), CAGR (%), 2017-2028

Table 4.1 Leading Gene Therapy Drugs by Revenue ($m), 2017

Table 4.2 World Market Forecasts for Gene Therapy Drugs by Indication, Market Sizes ($m), Annual Growth Rates (%), CAGR (%), 2017-2028

Table 4.3 Selected Anti-Angiogenic Gene Therapy Using a Non-Viral Vector, 2017

Table 4.4 Selected Anti-Angiogenic Gene Therapy Using a Retroviral Vector, 2017

Table 4.5 Selected Anti-Angiogenic Gene Therapy Using an Adenoviral Vector, 2017

Table 4.6 Selected Anti-Angiogenic Gene Therapy Using an Adeno-Associated Virus Vector, 2017

Table 4.7 Selected Anti-Angiogenic Gene Therapy Using Lentiviral Vector, 2017

Table 4.8 Global Gene Therapy Clinical Trials by Indication, 2017

Table 4.9 Selected Cancer Gene Therapies in Phase 2 and Phase 3 Clinical Trial Development, 2017

Table 4.10 Selected Cancer Gene Therapies in Phase 1 and Phase 1/2 Clinical Trial Development, 2017

Table 4.11 Global Gene Therapy Market: Revenue ($m) and Market Shares (%) by Indication, 2017

Table 4.12 Global Market Forecast for Cancer Gene Therapies: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2017-2028

Table 4.13 Rare Diseases Gene Therapy Pipeline, 2017

Table 4.14 Global Market Forecast for Rare Disease Gene Therapies: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2017-2028

Table 4.15 Cardiovascular Gene Therapy Pipeline, 2017

Table 4.16 Global Market Forecast for Cardiovascular Disease Gene Therapies: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2017-2028

Table 4.17 Preclinical Ophthalmologic Pipeline, 2017

Table 4.18 Clinical Ophthalmologic Pipeline, 2017

Table 4.19 Additional Products in the Clinical Ophthalmologic Pipeline, 2017

Table 4.20 Global Market Forecast for Ophthalmologic Disease Gene Therapies: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2017-2028

Table 4.21 Global Market Forecast for Other Disease Gene Therapies: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2017-2028

Table 4.22 Global Market Forecast for Gene Therapies by Indication: Market Shares (%), 2017-2022

Table 4.23 Global Market Forecast for Gene Therapies by Indication: Market Shares (%), 2023-2028

Table 5.1 Promising Gene Therapies in Development, 2018

Table 5.2 Gene Therapies in Phase 3, 2017

Table 5.3 Collatagene Forecast, Revenue ($m), AGR (%), CAGR (%), 2017-2028

Table 5.4 BC-819 Forecast, Revenue ($m), AGR (%), CAGR (%), 2017-2028

Table5.5 Lenti-D Forecast, Revenue ($m), AGR (%), CAGR (%), 2017-2028

Table 5.6 SPK-RPE65 Forecast, Revenue ($m), AGR (%), CAGR (%), 2017-2028

Table 5.7 Invossa Forecast, Revenue ($m), AGR (%), CAGR (%), 2017-2028

Table 6.1 uniQure Pipeline, 2017

Table 6.2 Spark Therapeutics Collaborations, 2017

Table 6.3 Selected Big Pharma Collaborations in Gene Therapy, 2017

Table 7.1 Strengths and Weaknesses of the Gene Therapy Drug Treatment Market, 2017

Table 7.2 Gene Therapy Pipeline for Neurodegenerative Diseases, 2017

Table 7.3 Gene Therapy Pipeline for Metabolic Diseases, 2017

Table 7.4 Gene Therapy Pipeline for Musculoskeletal Diseases, 2017

Table 7.5 Gene Therapy Pipeline for Viral Diseases, 2017

Table 7.6 Opportunities and Threats of the Gene Therapy Drug Market, 2017

Table 7.7 Clinical Trials for Standard Drug Development Versus Orphan Drug Development, 2017

Table 8.1 Global Gene Therapy Drug Market Forecasts by Indication: Market Size ($m), Market Share (%), CAGR (%), 2017, 2022 and 2028

Table of Figures

Figure 1.1 Global Gene Therapy Market Segmentation Overview, 2017

Figure 2.1 Vectors Used in Gene Therapy Clinical Trials, 2017

Figure 3.1 Neovasculgen Forecast, Revenue ($m), 2017-2028

Figure 4.1 Gene Therapy World Market Forecast, Market Size ($m), AGR (%), 2017-2028

Figure 4.2 Global Gene Therapy Clinical Trials by Indication, 2017

Figure 4.3 Cancer Gene Therapy Pipeline by Phase of Development, 2017

Figure 4.4 Global Gene Therapy Market: Market Shares (%) by Indication, 2018

Figure 4.5 Global Market Forecast for Cancer Gene Therapies: Revenue ($m), 2017-2028

Figure 4.6 Rare Diseases Gene Therapy Pipeline by Phase of Development, 2017

Figure 4.7 Global Market Forecast for Rare Disease Gene Therapies: Revenue ($m), 2017-2028

Figure 4.8 Cardiovascular Gene Therapy Pipeline by Phase of Development, 2017

Figure 4.9 Global Market Forecast for Cardiovascular Disease Gene Therapies: Revenue ($m), 2017-2028

Figure 4.10 Global Market Forecast for Ophthalmologic Disease Gene Therapies: Revenue ($m), 2017-2028

Figure 4.11 Global Market Forecast for Other Disease Gene Therapies: Revenue ($m), 2017-2028

Figure 4.12 Global Market for Gene Therapy Drugs: Market Shares by Indication (%), 2022

Figure 4.13 Global Market for Gene Therapy Drugs: Market Shares by Indication (%), 2028

Figure 5.1 Gene Therapies in Clinical Development by Phase, 2017

Figure 5.2 Collategene Forecast, Revenue ($m), 2017-2028

Figure 5.3 BC-819 Forecast, Revenue ($m), 2017-2028

Figure 5.4 Lenti-D Forecast, Revenue ($m), 2017-2028

Figure 5.5 SPK-RPE65 Forecast, Revenue ($m), 2017-2028

Figure 5.6 Invossa Forecast, Revenue ($m), 2017-2028

Figure 5.7 Gene Therapy Market Strategy Analysis

Figure 5.8 Key Take Ways, Challenges and Application of CRISPR Market

Figure 5.9 Impact of CRISPR Technology on the Gene Therapy Market

Figure 8.1 Gene Therapy Drug Treatment Market Forecast by Indication: Market Sizes ($m), 2017, 2022, and 2028

4DMT (4D Molecular Therapeutics)

Abeona

AGTC (Applied Genetics Technologies Corporation)

AMT (Amsterdam Molecular Therapeutics)

AnGes MG

Asklepios BioPharma

AstraZeneca

Audentes Therapeutics

Avalanche Biotech

Bayer Healthcare

Beijing Northland Biotech Co

Benda Pharmaceutical

Benitec Biopharma

BioCancell

Biogen

Biogen Idec

Bluebird Bio

BMS (Bristol-Myers Squibb)

Broad Institute/Whitehead Institute

Celgene

Cell Therapy Catapult

Cellectis

Chiesi Farmaceutici

Clearside Biomedical

Convergence Pharmaceuticals

Daiichi Sankyo

Dimension Therapeutics

Editas Medicine

Fondazione Telethon

Francis Crick Institute

Genable Technologies Ltd

Genethon

GenSight Biologics

GenVec

Google

GSK (GlaxoSmithKline)

Henry Ford Health System

HSCI (Human Stem Cells Institute)

HSR-TIGET (San Raffaele Telethon Institute for Gene Therapy),

ImaginAb

Immune Design Corp

InoCard

Inovio

Intellia Therapeutics

Invetech

Kite Pharma

Kolon Group

Kolon Life Science

Lysogene

Mitsubishi Tanabe Pharma Corporation

Neuralgene

NightstaRx

Northwestern Memorial Hospital

Novartis

OXB (Oxford Biomedica)

Pfizer

PNP Therapeutics

Precision Genome Engineering Inc aka Pregenen

ProNai

Protek Group

Raffaele Hospital

REGENX Biosciences

Renova Therapeutics

Roche

Roszdravnadzor

Sangamo Biosciences

Sanofi

Sarepta Therapeutics

Shanghai Sunway Biotech

Shenzhen SiBiono GeneTech

Sotex Pharm Firm

Spark Therapeutics

SynerGene Therapeutics

Takara Bio

TAP Biosystems

Thermo Fisher Scientific

TissueGene

ToolGen

UC Berkeley

UC San Francisco

uniQure

US Business Innovation Network

Vertex Pharmaceuticals

Vical Incorporated

ViroMed

VM Biopharma

Voyage Therapeutics

List of Organisation Mentioned

ASCO (American Society of Clinical Oncology)

ASI (Agency for Strategic Initiatives)

CAT (Committee for Advanced Therapies)

CBER (Center for Biologics Evaluation and Research)

CHMP (Committee for Medicinal Products for Human Use)

CHOP (The Children’s Hospital of Philadelphia)

DCGI (Drugs Controller General of India)

DHHS (Department of Health and Human Services)

EMA (European Medicines Agency)

FDA (US Food and Drug Administration)

INSERM (Institut National de la Santé et de la Recherche Médicale)

IRB (Institutional Review Boards)

MFDS (Korean Ministry of Food and Drug Safety)

MHLW (Ministry of Health, Labour, and Welfare)

MHRA (Medicines and Healthcare Products Regulatory Agency)

Ministry of Health Commission

NHS (National Health Service)

NICE (the National Institute for Health and Care Excellence)

NIH (National Institutes of Health)

OHRP (Office for Human Research Protections)

PMDA (Pharmaceuticals and Medical Devices Agency)

RCGM (Review Committee of Genetic Manipulation)

Russian Ministry of Healthcare and Social Development

SFDA (State Food and Drug Administration of China)

SMC (Scottish Medicines Consortium)

The Fund for Promotion of Small Innovative Enterprises in Science and Technology

The IGI (Innovative Genomics Initiative)

The Innovative Genomics Initiative

The Walter and Eliza Hall Institute

The Wellcome Trust Sanger Institute

WFH (World Federation of Hemophilia)

WHO (World Health Organization)

Download sample pages

Complete the form below to download your free sample pages for Gene Therapy R&D and Revenue Forecasts 2018-2028

Related reports

-

Generic Drugs Market Forecast 2018-2028

The generic drugs market is estimated at $257.3bn in 2017 and is expected to grow at a CAGR of 7.9%...

Full DetailsPublished: 25 April 2018 -

Checkpoint Inhibitors for Treating Cancer Market Report 2018-2028

Our 161-page report provides 107 tables, charts, and graphs. Read on to discover the most lucrative areas in the industry...Full DetailsPublished: 23 April 2018 -

Global Stem Cell Technologies and Applications Market 2018-2028

The global stem cell technologies and applications market is estimated to have reached $12,040 million and is expected to grow...

Full DetailsPublished: 02 March 2018 -

Global Ophthalmic Drugs Market Forecast 2017-2027

The global ophthalmic drugs market is expected to grow at a CAGR of 4.0% in the first half of the...Full DetailsPublished: 14 June 2017 -

Global Transplant Market Forecast 2019-2029

The global transplant market will reach $29bn in 2019 and is estimated to grow at a CAGR of 9.9% from...

Full DetailsPublished: 18 December 2018 -

Biological Drug API Manufacturing Services World Industry and Market Predictions 2018-2028

The biological drug API manufacturing market is estimated to grow at a CAGR of 9.0% in the first half of...

Full DetailsPublished: 06 July 2018 -

Global Genomics Market Report 2018-2028

The global genomics market is estimated to reach $23bn by 2022. In 2017, the diagnostic test segment held 27% of...Full DetailsPublished: 31 October 2018 -

Global Acute Myeloid Leukaemia Market Forecast 2018-2028

The global acute myeloid leukaemia market reached $1bn in 2017 and is estimated to reach $2.8bn by 2022. In 2017,...

Full DetailsPublished: 21 September 2018 -

Global Macular Degeneration (AMD) and Other Retinal Diseases Drugs Industry and Market 2018-2028

Our 171-page report provides 140 tables, charts, and graphs. Read on to discover the most lucrative areas in the industry...

Full DetailsPublished: 30 May 2018 -

Vaccine Sales Market Forecast 2018-2028

The Global Vaccines Sales market was valued at $36.9 billion in 2017. This value will grow to $61.1bn in 2022...

Full DetailsPublished: 09 March 2018

Download sample pages

Complete the form below to download your free sample pages for Gene Therapy R&D and Revenue Forecasts 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Pharma news

Retinal Gene Therapy Market

The global Retinal Gene Therapy market is projected to grow at a CAGR of 9.6% by 2034

26 July 2024

HIV Drugs and Injectables Market

The global HIV Drugs & Injectables market is projected to grow at a CAGR of 4.6 % by 2034

24 July 2024

Digital Twin Technology in Pharmaceutical Manufacturing Market

The global Digital Twin Technology in Pharmaceutical Manufacturing market is projected to grow at a CAGR of 31.3% by 2034

23 July 2024

Specialty Pharma Market

The global Specialty Pharma market is projected to grow at a CAGR of 7.5% by 2034

22 July 2024