The Global Vaccines Sales market was valued at $36.9 billion in 2017. This value will grow to $61.1bn in 2022 and it is expected to reach $114.2bn in 2028. The CAGR for the Global Vaccines Sales market from 2018-2028 is expected to be 10.9%.

Vaccines – Your 2018 Guide to Developments, Opportunities and Revenues

What does the future hold for vaccine sales? Visiongain’s updated report shows you forecasted sales at overall world market, submarket, product and national level to 2028.

With that study you discover vaccine trends, R&D and revenue prospects for human healthcare. That way you can benefit your research, analysis, decisions and authority. For those technologies, assess sales potentials and opportunities.

Vaccines still hold great technological, medical and commercial potential. See why and what is possible. Read on, then, to explore that industry and see a revenue prediction.

Forecasts from 2018 to 2028 and other analyses showing you vaccine market potentials

Besides revenue forecasting to 2028, our new study gives you historical data, recent results, growth rates and market shares. There you find business outlooks and developments (R&D).

Our report gives you 53 tables and 56 charts. Gain analysis found nowhere else. Discover what the future holds for companies and the vaccines market.

Gains through exploring the vaccines industry – ways to benefit your plans and decisions

Leaders hold the latest knowledge – research and analysis. So explore, in our report, the development, production and sales of vaccines. There, from 2018, you see where needs and money exist for those preventative medicines. Discover what is possible.

Our study’s purpose is to help you avoid struggles to gain business data on vaccines. See how our predictions and discussions could benefit your reputation for commercial insight.

Discover, then, how you and your organisation can gain. The following sections show how our new investigation benefits your plans, decisions and presentations.

Revenues for the world vaccines market and submarkets – what is possible?

What is that industry’s potential? What are the secrets of its progress? Discover in our report overall world revenue forecasting to 2028. Also find individual predictions for four world level submarkets:

• Paediatric vaccines

• Adult vaccines

• Elderly vaccines

• Travel vaccines

• Therapeutic Vaccines

How will sales rise? And which product classes can generate most revenue? In our work you assess prospects for commercial expansion. You see which vaccine types hold greatest potential for sales growth and high revenues.

Benefit your knowledge and authority. You also discover sales potentials of vaccines by brand.

Forecasts and discussions for leading marketed products

How will leading brands perform from 2018 at world level? Our work shows you 10 individual revenue forecasts to 2028 for leading vaccines:

• Prevnar

• Gardasil

• Fluzone

• Pentacel

• ProQuad/M-M-R- II/Varivax.

• Infanrix/Pediarix

• Zostavax

• RotaTeq

• GSK hepatitis Vaccines

• Menactra.

Our study also divides its overall world vaccines forecast into geographical regions.

Healthcare in national markets – what outlooks for sales of those medicines?

Progress worldwide in vaccines and healthcare from 2018 will increase vaccination. With our investigation you hear about the best revenue prospects for those medicines, assessing national prospects.

Our analysis shows you individual revenue forecasts to 2028 for 11 national markets:

• United States (US)

• Japan

• Germany, France, United Kingdom, Italy and Spain (EU5 countries)

• Brazil, Russia, India and China (BRIC group)

There you assess developed and developing countries for revenues and future sales growth. Our work explains. See effects of existing and future prophylactic medicines.

Future vaccines – assess emerging technologies, exploring research and development

Our study also shows you the most promising vaccines in development. There explore product candidates in these six classes:

• Prophylactic vaccines

• Products for children

• Agents for protecting adults

• Treatments for older people

• Travel vaccination

• Therapeutic vaccines.

R&D for vaccines holds great potential to benefit companies, healthcare providers and patients. See what technological, clinical and commercial opportunities exist, helping you stay ahead.

Our study explains progress in human prophylaxis, discussing issues to help your work.

Events affecting developers, producers and sellers of vaccines

Assess forces affecting that industry and market from 2018, including these issues:

• Importance of vaccine production to the pharmaceutical industry

• Immunisation needs and progress in developed and developing countries

• Rising vaccination needs in emerging countries and under-developed regions, including fighting influenza pandemics and the Zika virus

• Developments for combating HIV, cancer, addictions and other emerging uses

• Delivery systems and other innovations improving vaccines’ performance.

With our survey you explore political, economic, social and technological questions, investigating outlooks for business. Examine forces stimulating and restraining that industry and market, seeing what the future holds.

See how high its revenues can go. Discover in our work what is possible for vaccine production and sales, and see which companies hold greatest potential.

In particular our work assesses these organisations:

• GlaxoSmithKline

• Merck & Co.

• Sanofi

• Pfizer

• Johnson & Johnson

• AstraZeneca.

From 2018 to 2028 vaccines will benefit patients, payers and companies, rising in prominence. Our analysis predicts advances there. Stay ahead by getting that study.

Ways Vaccine Sales Market Forecast 2018-2028 benefits your work – gain data you find nowhere else

In particular, our new investigation gives you these analyses to help your research, plans, decisions and proposals:

• Revenues to 2028 for vaccines at world level and for 5 main submarkets – assess prospects for investments, marketing and sales

• Predictions for 10 products to 2028 – discover revenue potentials of leading vaccines, seeing how they can compete and succeed

• Forecasts to 2028 for 11 national markets in the Americas, Europe and Asia – investigate developed and developing countries for potential revenues

• Prospects for established competitors and rising companies – explore products, R&D and outlooks for success.

There you gain competitive intelligence found only in our analysis, finding sales potentials. Benefit your influence by exploring commercial progress, opportunities and potentials.

With our study, by visiongain’s UK-based analysts, you avoid missing out on data to help you stay ahead. See what the future holds for vaccine developers, producers and sellers.

Trying our new report now lets you discover vaccine trends, opportunities and forecasts

Our investigation is for everyone analysing preventive medicines and related biotechnology. There you discover data and forecasts for human vaccines. Avoid missing out and falling behind in knowledge. Instead please get our new report here now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Overview of the World Vaccines Market

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Main Questions Answered by This Analytical Study

1.5 Who is This Report For?

1.6 Methods of Research and Analysis

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the World Human Vaccines Market

2.1 Human Vaccines - Aiming for Global Disease Prevention

2.2 What is the Social and Economic Burden?

2.3 Vaccine Technology

2.3.1 Inactivated Vaccines

2.3.2 Live Attenuated Vaccines

2.3.3 Conjugate Vaccines

2.3.4 Recombinant Vector Vaccines

2.4 Key Influencers of the Human Vaccine Market

2.4.1 Governments and International Organizations

2.4.1.1 The World Health Organisation (WHO)

2.4.1.2 The Governmental Influence

2.4.2 Leading Manufacturers

2.4.2.1 Merck& Co.

2.4.2.2 Sanofi

2.4.2.3 GlaxoSmithKline

2.4.2.4 Pfizer

2.5 Human World Vaccines – Market Segmentation

2.5.1 Paediatric Vaccines

2.5.2 Adult Vaccines

2.5.3 Elderly Vaccines

2.5.4 Travel Vaccines

2.5.5Therapeutic Vaccines

3. World Vaccine Market Outlook, 2017-2028

3.1 World Vaccine Market, 2017

3.1.1 Paediatric Vaccines Maintains Constant Demand

3.1.2 Ageing Population Requires More Care

3.1.3 Emerging Markets Demand Better Immunity

3.2 The World Human Vaccines Forecast, 2017-2028

3.3The World Vaccine Market: Industry Trends, 2017-2028

3.3.1 Undulating Demand

3.3.2 Supply Restraints

3.3.3 Funding Trends

3.3.4 Protecting the Workforce of an Economy

4. World Vaccine Submarkets: Prospects, 2017-2028

4.1 Paediatric Vaccines

4.1.1 Paediatric Vaccine Forecast, 2017-2028

4.1.2 Paediatric Vaccine Trends

4.1.2.1 Innovative Delivery

4.1.2.2 Fear Factor

4.1.2.3 Novel Vectors

4.2 Adult Vaccines

4.2.1 Adult Vaccine Forecast, 2017-2028

4.2.2 Adult Vaccine Trends

4.2.2.1 Fighting the Flu

4.2.2.2 HPV

4.2.2.3 Repeat Doses for Continued Protection

4.3 Elderly Vaccines

4.3.1 Elderly Vaccine Forecast, 2017-2028

4.3.2 Elderly Vaccine Trends

4.3.2.1 With Age Comes Greater Risk

4.3.2.2 Ageing Population across the Globe

4.4 Travel Vaccines

4.4.1 Travel Vaccines Forecast, 2017-2028

4.4.2 Travel Vaccine Trends

4.4.2.1 Zika Virus Outbreak

4.4.2.2 Globalization Carries Diseases

4.5 Therapeutic Vaccines

4.5.1 Therapeutic Vaccine Trends

5. Leading Vaccines: Revenue Forecasts, 2017-2028

5.1 Prevnar (Pfizer) - Pneumococcal Pneumonia

5.2 Gardasil (Merck and Co.) – HPV

5.3 Fluzone (Sanofi) – Influenza

5.4 Pentacel (Sanofi) – DtaP, Polio, HiB

5.5 ProQuad / M-M-R II / Varivax (Merck and Co.) – Varicella/Chickenpox, Measles, Mumps, Rubella.

5.6 Infanrix/Pediarix (GSK) – Diptheria, Tetanus and Acellular Pertussis

5.7 Zostavax (Merk and Co.) – Herpes

5.8 RotaTeq (Merck and Co.) – Rotavirus

5.9 Hepatitis Vaccines (GSK) – Hepatitis A & B

5.10 Menactra (Sanofi) – Meningococcal

6. Leading Developed National Vaccines Markets, 2017-2028

6.1 The United States Vaccine Market, 2017-2028

6.1.1 The US Vaccine Market, 2017

6.1.2 The US Vaccine Market Forecast, 2017-2028

6.2 Japanese Vaccine Market, 2017-2028

6.2.1 The Japanese Vaccine Market, 2017

6.2.2 The Japanese Vaccine Market Forecast, 2017-2028

6.2.3 Addressing the Alleged Vaccine Gap

6.3 EU5Vaccine Market, 2017-2028

6.3.1 The EU5 Vaccine Market, 2017

6.3.2 The EU5 Vaccine Market Forecast, 2017-2028

6.4 United Kingdom Vaccine Market, 2017-2028

6.4.1 The UK Vaccine Market, 2018

6.4.2 The UK Vaccine Market Forecast, 2017-2028

6.5 France: Vaccine Market, 2017-2028

6.5.1 The French Vaccine Market, 2017

6.5.2 The French Vaccine Market Forecast, 2017-2028

6.5.3 French Healthcare System – Immunization Policy

6.6 Germany: Vaccine Market, 2017-2028

6.6.1 The German Vaccine Market, 2017

6.6.2 The German Vaccine Market Forecast, 2017-2028

6.7 Italy: Vaccine Market, 2017-2028

6.7.1 The Italian Vaccine Market, 2017

6.7.2 The Italian Vaccine Market Forecast, 2017-2028

6.7.3 Challenges in Public Healthcare

6.8 Spain: Vaccine Market, 2017-2028

6.8.1 The Spanish Vaccine Market, 2017

6.8.2 The Spanish Vaccine Market Forecast, 2017-2028

6.8.3 District Rules – Economic Challenges

7. Leading Emerging National Markets, 2017-2028

7.1 China: Vaccine Market, 2017-2028

7.1.1 The Chinese Vaccine Market, 2017

7.1.2 The Chinese Vaccine Market Forecast, 2017-2028

7.1.3 Setting-Up Domestic Vaccine Industries

7.2 India: Vaccine Market, 2017-2028

7.2.1 The Indian Vaccine Market, 2017

7.2.2 The Indian Vaccine Market Forecast, 2017-2028

7.2.3 The Extent to which the Vaccine Market Can Flourish?

7.3 Brazil: Vaccine Market, 2017-2028

7.3.1 The Brazilian Vaccine Market, 2017

7.3.2 The Brazilian Vaccine Market Forecast, 2017-2028

7.3.3 Zika Outbreak

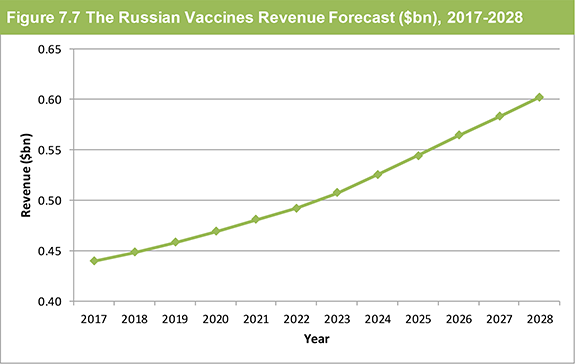

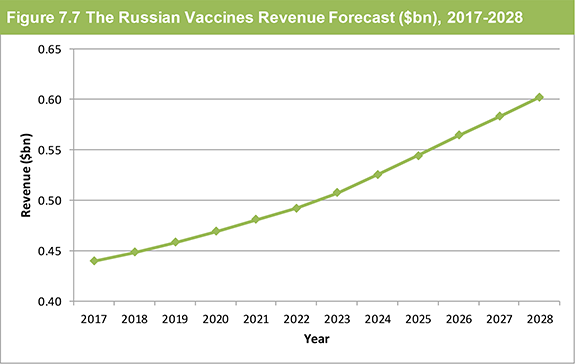

7.4 Russia: Vaccine Market, 2017-2028

7.4.1 The Russian Vaccine Market, 2017

7.4.2 The Russian Vaccine Market Forecast, 2017-2028

7.4.3 Power of the State

8. Leading Manufacturers of Vaccines for Human Use 2018

8.1 GlaxoSmithKline (GSK)

8.1.1 GSK Vaccine Performance

8.1.2 GSK Developments

8.1.2.1 Mergers and Acquisitions

8.1.2.2 GSK Vaccine Pipeline

8.2 Merck& Co.

8.2.1 Merck Vaccine Performance

8.2.2 Merck Developments

8.2.2.1 Merck Market Movements

8.2.2.2 Collaborations

8.2.2.3 Merck Pipeline

8.3 Sanofi

8.3.1 Sanofi Vaccine Performance

8.3.2 Sanofi Developments

8.3.2.1 Acquisitions & Expansions

8.3.2.2 Sanofi Vaccine Pipeline

8.4 Pfizer

8.4.1 Pfizer Vaccine Performance

8.4.2 Pfizer Developments

8.4.2.1 Pfizer Mergers & Acquisitions

8.4.2.2 Pfizer Pipeline

8.5 Johnson & Johnson

8.6 AstraZeneca

8.7 Other Companies Serving the Vaccines Market

9. Research & Development, 2018

9.1 Prophylactic Vaccines R&D Pipeline

9.1.1 Paediatric Vaccines R&D Pipeline

9.1.2 Adult Vaccines R&D Pipeline

9.1.3 Elderly Vaccines R&D Pipeline

9.1.4 Travel Vaccines R&D Pipeline

9.2 Therapeutic Vaccines R&D Pipeline

10. Qualitative Analysis of the World Vaccines Market, 2017-2028

10.1 SWOT Analysis of the World Human Vaccines Market, 2017

10.1.1 Strengths

10.1.1.1 Ageing Population

10.1.1.2 Prevention is Better than Cure

10.1.1.3 Demand from Emerging Markets Continue

10.1.1.4 Promising R&D Pipeline

10.1.1.5 Increasing Awareness

10.1.2 Weaknesses

10.1.2.1 High Manufacturing Costs

10.1.2.2 Time Constraints

10.1.2.3 Barriers to Market Entry

10.1.3 Opportunities

10.1.3.1 Constant Improvements in Vaccine Technology and Delivery Methods

10.1.3.2 Shifting Focus on Adults Vaccines

10.1.4 Threats

10.1.4.1 Oligarchic Presence of Pharmaceutical Giants

10.1.4.2 Productivity Gap

10.2 STEP Analysis of the World Human Vaccines Industry and Market, 2017-2028

10.2.1 Social Factors

10.2.1.1 Maintaining a Healthier Workforce

10.2.1.2 Public Hesitation - Fear of Unwanted Side-Effects

10.2.2 Technological Forces

10.2.2.1 Evolution of Vaccine Technology Pave the Way for Prophylactics and Therapeutics

10.2.3 Economic Factors

10.2.3.1 High Costs of Production

10.2.3.2 Soaring Vaccines Demand from Developing Countries

10.2.4 Political Factors

10.2.4.1 Governments Play Crucial Roles in Vaccination

11. Conclusions

11.1 Segment Market Share Shift

11.2 Elderly People Become the New Target Market

11.3 Endemic Infections Drive Travel Vaccines Growth

11.4 Emerging Markets: High Demand for Vaccines

11.5 Demand in Mature Pharma Markets Continues: in Particular Japan Will Show Sales Growth

11.6 Strong and Diverse Research and Development

11.7 Concluding Remarks

Associated Visiongain Reports

Visiongain Report Sales Order Form

About Visiongain

Visiongain Report Evaluation Form

Table of Tables

Table 1.1 Selected National Vaccines Markets: Revenues ($bn) and Market Shares (%) by Leading Country, 2017, 2022 and 2028 (Sample)

Table 3.1 The Global Vaccines Market: Revenue Forecast ($bn), Annual Growth (%), CAGRs (%), 2017-2028

Table 4.1 World Vaccines Submarkets: Revenue Forecasts ($bn),2017-2028

Table 4.2 World Vaccines Submarkets: Market Shares (%), 2017-2028

Table 4.3 World Paediatric Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 4.4 World Adult Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 4.5 World Elderly Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 4.6 World Travel Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 5.1 Prevnar Revenue ($bn), 2014-2017

Table 5.2 Prevnar Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 5.3 Gardasil Revenue ($bn), 2014-2017

Table 5.4 Gardasil Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 5.5 Fluzone/Vaxigrip: Revenue ($bn), 2014-2016

Table 5.6 Fluzone Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 5.7 Pentacel Revenue ($bn), 2014-2016

Table 5.8 Pentacel Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 5.9 ProQuad / M-M-R II / Varivax Revenue ($bn), 2013-2016

Table 5.10 ProQuad / M-M-R II / Varivax Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 5.11 Infanrix/Pediarix Revenue ($bn), 2014-2016

Table 5.12 Infanrix/Pediarix Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 5.13 Zostavax Revenue ($bn), 2013-2016

Table 5.14 Zostavax Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 5.15 RotaTeq Revenue ($bn), 2013-2016

Table 5.16 RotaTeq Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 5.17 GSK Hepatitis Vaccines Revenue ($bn), 2014-2016

Table 5.18 GSK Hepatitis Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 5.19 Menactra Revenue ($bn), 2014-2016

Table 5.20 Menactra Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 6.1 Leading National Market Revenue Forecasts($bn), 2017, 2022, 2028

Table 6.2 Leading Developed National Markets Revenue Forecasts($bn), 2017, 2022, 2028

Table 6.3 Leading Developed National Market Shares (%), 2017, 2022, 2028

Table 6.4 The US Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 6.5 The Japanese Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 6.6 The EU5 Vaccines World Market Shares (%), 2017, 2022, 2028

Table 6.7 EU5 Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 6.8 The UK Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 6.9 The French Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 6.10 The German Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 6.11 The Italian Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 6.12 The Spanish Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 7.1 Leading Emerging National Market Revenue Forecasts($bn), 2017, 2022, 2028

Table 7.2 Leading Emerging National Market Shares (%), 2017, 2022, 2028

Table 7.3 The Chinese Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 7.4 The Indian Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 7.5 The Brazilian Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 7.6 The Russian Vaccines Revenue Forecast ($bn), Annual Growth (%) and CAGR (%), 2017-2028

Table 8.1 GSK Geographic Revenue ($bn), 2016

Table 9.1 Prophylactic Vaccines in Development, 2017

Table 9.2 Paediatric Vaccines in Development, 2017

Table 9.3 Adult Vaccines in Development, 2017

Table 9.4 Elderly Vaccines in Development, 2017

Table 9.5 Travel Vaccines in Development, 2017

Table 9.6 Therapeutic Vaccines in Development, 2017

Table of Figures

Figure 1.1 World Vaccines Market Segmentation, 2017

Figure 3.1 Vaccines Market Share within Global Pharmaceutical Market (%), 2017

Figure 3.2 World Vaccines Leading National Market Shares (%), 2017

Figure 3.3 World Vaccines Leading National Market Shares (%), 2022

Figure 3.4 World Vaccines Leading National Market Shares (%), 2028

Figure 3.5 World Vaccines Market: Drivers and Restraints, 2017-2028

Figure 4.1 World Prophylactic Vaccines Submarket (%) Segmentation, 2018

Figure 4.2 World Paediatric Vaccines Market Share (%), 2018

Figure 4.3 World Paediatric Vaccines Market Share (%), 2022

Figure 4.4 World Paediatric Vaccines Market Share (%), 2028

Figure 4.5 World Paediatric Vaccines Revenue Forecast ($bn), 2017-2028

Figure 4.6 World Adult Vaccines Market Share (%), 2018

Figure 4.7 World Adult Vaccines Market Share(%), 2022

Figure 4.8 World Adult Vaccines Market Share(%), 2028

Figure 4.9 World Adult Vaccines Revenue Forecast ($bn), 2017-2028

Figure 4.10 World Elderly Vaccines Market Share (%), 2018

Figure 4.11 World Elderly Vaccines Market Share (%), 2022

Figure 4.12 World Elderly Vaccines Market Share (%), 2028

Figure 4.13 World Elderly Vaccines Revenue Forecast ($bn), 2017-2028

Figure 4.14 World Travel Vaccines Market Share (%), 2018

Figure 4.15 World Travel Vaccines Market Share (%), 2022

Figure 4.16 World Travel Vaccines Market Share (%), 2028

Figure 4.17 World Travel Vaccines Revenue Forecast ($bn), 2017-2028

Figure 5.1 Prevnar Revenue Forecast ($bn), 2017-2028

Figure 5.2 Gardasil Revenue Forecast ($bn), 2017-2028

Figure 5.3 Fluzone Revenue Forecast ($bn), 2017-2028

Figure 5.4 Pentacel Revenue Forecast ($bn), 2017-2028

Figure 5.5 ProQuad / M-M-R II / VarivaxRevenue Forecast ($bn), 2017-2028

Figure 5.6 Infanrix/Pediarix Revenue Forecast ($bn), 2017-2028

Figure 5.7 Zostavax Revenue Forecast ($bn), 2017-2028

Figure 5.8 RotaTeq Revenue Forecast ($bn), 2017-2028

Figure 5.9 GSK Hepatitis Vaccines Revenue Forecast ($bn), 2017-2028

Figure 5.10 Menactra Revenue Forecast ($bn), 2017-2028

Figure 6.1 The US Vaccines Revenue Forecast ($bn), 2017-2028

Figure 6.2 The Japanese Vaccines Revenue Forecast ($bn), 2017-2028

Figure 6.3 EU5 Vaccines Market Share (%), 2017

Figure 6.4 EU5 Vaccines Market Share (%), 2022

Figure 6.5 EU5 Vaccines Market Share(%), 2028

Figure 6.6 The UK Vaccines Revenue Forecast ($bn), 2017-2028

Figure 6.7 The French Vaccines Revenue Forecast ($bn), 2017-2028

Figure 6.8 The German Vaccines Revenue Forecast ($bn), 2017-2028

Figure 6.9 The Italian Vaccines Revenue Forecast ($bn), 2017-2028

Figure 6.10 The Spanish Vaccines Revenue Forecast ($bn), 2017-2028

Figure 7.1 BRIC Countries Vaccines Market Share (%), 2017

Figure 7.2 BRIC Countries: Vaccines Market Share (%), 2022

Figure 7.3 BRIC Countries: Vaccines Market Share (%), 2028

Figure 7.4 The Chinese Vaccines Revenue Forecast ($bn), 2017-2028

Figure 7.5 The Indian Vaccines Revenue Forecast ($bn), 2017-2028

Figure 7.6 The Brazilian Vaccines Revenue Forecast ($bn), 2017-2028

Figure 7.7 The Russian Vaccines Revenue Forecast ($bn), 2017-2028

Figure 8.1 GSK Vaccines Revenue ($bn), 2014-2016

Figure 8.2 GSK Vaccines Region Breakdown (%), 2017

Figure 8.3 Merck Vaccines Revenue ($bn), 2014-2016

Figure 8.4 Sanofi Vaccines Revenue ($bn), 2014-2017

Figure 10.1 SWOT Analysis of the World Vaccines Market, 2017

Figure 10.2 STEP Analysis of the World Vaccines Market, 2017

Advisory Committee for Immunization Practices (ACIP)

Aspen

Astellas

AstraZeneca

Bavarian Nordic

Baxter

Bayer

Bharat Biotech

Binnopharm

BiondVax

BravoBio

Brazilian Universal Health Service

Butantan Institute

Cancer Research UK

Centre for Biologics Evaluation and Research (CBER)

Centre for Disease Control and Prevention (CDC)

China National Biotech Group

Crucell

Developing Countries Vaccines Manufacturers Network (DCVMN)

European Medicines Agency (EMA)

Food and Drugs Administration (FDA)

Fresenius

GlaxoSmithKline (GSK)

Global Alliance for Vaccines and Immunization (GAVI)

Health Service Bureau

Henogen

HIV Vaccines Trial Network

Immatics

Indian Department of Biotech

InnoPharma

International Federation of Pharmaceutical Manufacturers & Associations (IFPMA)

International Medica Foundation

InterveXion Therapeutics

Inviragen

Johnson and Johnson

Krka

LigoCyte Pharmaceuticals

MedImmune

Merck & Co.

Ministry of Health, Labour and Welfare

NewLink Genetics

NHS

Novartis

Okairos

Pan American Health Alliance (PAHO)

Pfizer

Roche

Sanofi

Servizio Sanitario Nazionale (SSN)

Shanghai BravoBio

Shionogi

Sistema Único de Saúde (SUS)

Takeda

Themis Bioscience

Unicef

US Department of Health and Human Services (HHS)

US National Cancer Institute

World Health Organisation (WHO)

Zymeworks