Industries > Pharma > Biologics Market Trends and Forecasts 2018-2028

Biologics Market Trends and Forecasts 2018-2028

Protein Therapeutics, Monoclonal Antibodies, Fusion Proteins, Regenerative Medicines, Insulin, Other Recombinant Hormones, Plasma & Recombinant Coagulating Factors, Interferons, Enzyme Replacement, Stem Cell Therapies, Tissue Engineered Products, Gene Therapies

The global biologics market is estimated to reach $250bn in 2023. The market is expected to grow at a CAGR of 4.8% from 2018 to 2023. In 2017, the monoclonal antibodies submarket held 36.3% share of the global biologics market.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 303-page report you will receive 166 charts– all unavailable elsewhere.

The 303-page report provides clear detailed insight into the global biologics market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• Global Biologics Market outlook from 2018-2028

• Global Biologics Submarkets analysis and forecast from 2018-2028:

• Protein therapeutics, with sub-forecasting for insulin, other recombinant hormones, plasma and recombinant coagulating factors, interferons, enzyme replacement and other agents

• Monoclonal antibodies (mAbs)

• Fusion proteins

• Regenerative medicine, with sub-forecasting for stem cell treatment, tissue engineering and gene therapy

• Vaccines

• Analysis and forecast from 2018-2028 for selected leading biologics in the market:

• Lantus

• NovoLog/NovoRapid

• Humalog

• Avonex

• Rebif

• Humira

• Remicade

• Tysabri

• Herceptin

• Kadcyla

• Perjeta

• Enbrel

• Eylea

• OsteoCel Plus

• Trinity Evolution and Trinity Elite

• Apligraf

• Dermagraft

• IMLYGIC

• This report provides individual revenue forecasts from 2018-2028 for these national markets:

• The US

• Japan

• Germany

• France

• UK

• Italy

• Spain

• China

• India

• Russia

• Brazil

• Our study discusses the selected leading companies that are the major players in the biologics market:

• AbbVie

• Amgen

• AstraZeneca

• Bayer

• Eli Lilly

• GlaxoSmithKline (GSK)

• Johnson & Johnson

• Merck & Co., Inc.

• Novartis

• Pfizer

• Roche

• Sanofi S.A.

• This report discusses factors that drive and restrain this market. As well as opportunities and trends in this market.

• This report discusses the SWOT and STEP Analysis of the biologics market.

Visiongain’s study is intended for anyone requiring commercial analyses for the biologics market. You find data, trends and predictions.

Buy our report today Biologics Market Forecasts : Protein Therapeutics, Monoclonal Antibodies, Fusion Proteins, Regenerative Medicines, Insulin, Other Recombinant Hormones, Plasma & Recombinant Coagulating Factors, Interferons, Enzyme Replacement, Stem Cell Therapies, Tissue Engineered Products, Gene Therapies.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Biologics Overview

1.2 Why you Should Read this Report

1.3 How this Report Delivers

1.4 Main Questions Answered by this Report

1.5 Who is this Report for?

1.6 Research and Analysis Methods

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Market Dynamics

2.1 Drivers

2.1.1 Increasing Biologics Approvals

2.1.2. Rise in the Prevalence of Chronic Diseases

2.2 Restraints

2.2.1 Complex in Nature

2.2.2 High Cost

2.3 Opportunities

2.3.1 Strong Pipeline of biologics drugs

2.3.2 Emerging technology

2.4 Trends

2.4.1 Growing strategic partnerships in China

2.4.2 Outsourcing strategies

3. Introduction to the Biologics Market and Key Concepts

3.1 Biologics: Large and Complex Products

3.2 A Brief History of Biological Drug Development

3.3 Why are Biologics the Most Lucrative Products in the Global Pharmaceutical Market?

3.4 What are Biosimilars?

3.4.1 Brief History of Biosimilars

3.4.2 What are Interchangeable Biological Products and how do They Differ from Biosimilars?

3.4.3 Why Many Nations Oppose Automatic Substitution of Reference Biologics with Biosimilars

3.5 Marginal Cases

3.6 Vaccines Market

4. The Global Biologics Market 2018 - 2028

4.1 The Global Biologics Market 2018 - 2028

4.2 What Factors Will Drive Growth in the Biologics Market?

4.2.1 Ageing Population and the Rise of Chronic Disease

4.2.2 Biologics Constitute 19% of the Global Pharmaceutical Market - Further Launches Will Drive Market

4.3 Biosimilars - Both an Opportunity and a Threat

4.4 What Factors Will Restrain Growth in the Biologics Market?

4.4.1 High Costs in the Face of Declining National Healthcare Budgets

4.4.2 In Some Areas, Clinical Efficacy is not Superior Enough to Justify the Price Gap

4.4.3 Over $100bn worth of Biologic Patents due to Expire by 2020

4.4.4 Administration is Often not as Convenient

4.5 Biologics Market: Submarket Forecasts 2018 - 2028

5. Protein Therapeutics Submarket 2018 - 2028

5.1 Largest and Most Diverse Submarket

5.2 Proteins have been used Medicinally since the 19th Century

5.2.1 Recombinant DNA Technology - The Major Breakthrough in the use of Protein Drugs

5.3 Protein Therapeutics Submarket Forecast 2018 - 2028

5.4 Insulin Submarket 2018 - 2028

5.4.1 The First Protein Therapeutic

5.4.2 Around 430 Million People Expected to be Diagnosed with Diabetes by 2030

5.4.3 Insulin Submarket Forecast 2018 - 2028

5.4.4 Lantus: The Market Leading Drug by Far

5.4.4.1 Lantus Revenue Forecast 2018 - 2028

5.4.5 NovoLog/NovoRapid Revenue Forecast to 2028

5.4.6 Humalog Revenue Forecast to 2028

5.4.7 New Approvals and Pipeline

5.4.7.1 Tresiba (Novo Nordisk)

5.4.7.2 BIOD-123 (Biodel)

5.5 Biosimilar Insulin

5.5.1 Approved Insulin Biosimilars

5.5.2 Abasaglar/Basaglar/Insulin Glargine BS - The First Insulin Biosimilars to be Approved in Developed Markets. Delayed in the US

5.6 Other Recombinant Hormones: Erythropoietins, G-CSF and Human Growth Hormone

5.6.1 Erythropoietin

5.6.1.1 First-Generation Therapies Launched in the 1980s

5.6.1.2 Aranesp: Slowly Growing

5.6.1.3 Epogen: Increases in Selling Price are No Longer Enough to Ward off Decline

5.6.1.4 Procrit/Eprex: In Decline Since 2013

5.6.1.5 NeoRecormon and Mircera (Roche) Provides Competition for Market Leader Amgen

5.6.1.6 Safety Concerns for Erythropoietin-Stimulating Agents is Leading to Decreased Demand

5.6.1.7 The Challenge from Oral Therapies is Coming

5.6.1.8 Treating Anaemia in Patients with CKD - The Leading Use of EPO Therapies

5.6.1.9 Many Biosimilar Epoetins Approved Around the World

5.6.2 G-CSF

5.6.2.1 G-CSF: Discovered 1983. Recombinant Forms Available Since 1991

5.6.2.2 Amgen Leads the Market

5.6.2.3 Neupogen and Neulasta Revenues, and the Onpro Kit

5.6.2.4 Teva Aiming to Challenge Amgen’s Dominance

5.6.2.5 Facing Much Biosimilar Competition Around the World

5.6.3 Human Growth Hormone

5.6.3.1 Human Growth Hormone: First Extracted in 1958

5.6.3.2 Novo Nordisk Dominates Market

5.6.3.3 Novo Nordisk Aiming to Retain Dominance Through FlexPro Device and NN8640 Somatropin Candidate

5.6.3.4 Multiple Biosimilars Available - Omnitrope is Market Leader

5.6.3.5 Biosimilar Growth Hormones in Asia

5.6.4 Other Recombinant Hormones Submarket Forecast to 2028

5.7 Plasma and Recombinant Coagulating Factors

5.7.1 Types of Recombinant Factor

5.7.2 Clotting Factor Deficiency Diseases

5.7.3 Baxter/Baxalta: Entered the Bleeding Disorders Market in 1992, Markets Various Leading Products

5.7.3.1 Baxter: New Product Launches Include Rixubis and Obizur

5.7.4 Novo Nordisk: Committed to Remaining a Leading Company in the Bleeding Disorders Market

5.7.4.1 Novo Nordisk: Has filed for Approval for N9-GP and NovoEight is Doing Well

5.7.5 Bayer: Markets Kogenate, Kogenate FS, and has Received FDA Approval for Kovaltry

5.7.6 Limited Opportunities for Biosimilar Challenge

5.7.7 Plasma and Recombinant Coagulating Factors Submarket Forecast 2018 - 2028

5.8 Interferons

5.8.1 Interferons: Key Antiviral and MS Therapies Since the 1990s

5.8.2 Interferons for Treating Hepatitis: Its Influence is Decreasing

5.8.3 Competition from Oral Protease and Polymerase Inhibitors

5.8.3.1 Oral Therapies are Expensive

5.8.4 Avonex: The Leading Interferon Therapy

5.8.4.1 Avonex Revenue Forecast 2018 - 2028

5.8.5 Rebif: Merck Attempting to Differentiate Rebif from Other Interferon Therapies

5.8.5.1 Rebif Revenue Forecast 2018 - 2028

5.8.6 Betaseron

5.8.7 Plegridy: New Therapy with High Potential

5.8.8 Biosimilar Interferons: None Approved in Developed Markets, but Many Available in Emerging Nations

5.8.9 Interferon Submarket Forecast 2018 - 2028

5.9 Enzyme Replacement and Other Protein Therapies Submarket

5.9.1 Cerezyme: Genzyme’s Leading Enzyme Replacement Therapy

5.9.2 Myozyme and Lumizyme

5.9.3 Fabrazyme and Aldurazyme

5.9.4 Botulinum Toxin Brands Include Botox, Dysport and Xeomin

5.9.5 Other Protein Therapeutics Pipeline

5.9.5.1 Anthera Buys Sollpura from Eli Lilly, Phase 3 Results Expected Q4 2016

5.9.5.2 Multikine (CEL-SCI)

5.9.5.3 Vonapantiase (Proteon Therapeutics)

5.9.6 Enzyme Replacement and Other Protein Therapeutics Submarket Forecast 2018 - 2028

6. Monoclonal Antibodies Submarket 2018 - 2028

6.1 Monoclonal Antibodies Submarket: Scientific and Historical Background

6.1.1 Natural Antibodies: Key to the Immune System

6.1.2 From Serum Therapy to Monoclonal Antibodies

6.1.3 Humanising the mAb

6.1.4 MAbs have found Success in Treating Autoimmune Disorders, Cancers and Others Diseases - Great Potential for the Future

6.1.5 MAbs for All? Technologies Come Off Patent

6.2 Autoimmune mAbs

6.2.1 Past Approvals

6.2.2 Humira - The World’s Best-Selling Prescription Drug

6.2.2.1 AbbVie Plans to Drive Growth Through New Indications

6.2.2.2 Positive Opinion from CHMP for Treatment of Non-Infectious Uveitis

6.2.2.3 Recently Approved for Hidradenitis Suppurativa in the US, Europe, and Japan

6.2.2.4 Biosimilar Adalimumab: Patents Protect Humira in Developed Markets for Now

6.2.2.5 Humira Revenue Forecast 2018 - 2028

6.2.3 Remicade: Second Only to Humira

6.2.3.1 Has Defended Revenues Well but Now Has to Deal with Biosimilar Competition

6.2.3.2 Patent Dance in US

6.2.3.3 Biosimilar Infliximab: Multiple Launches

6.2.3.4 Remicade Revenue Forecast 2018 - 2028

6.2.4 Stelara: Blockbuster Status Well Established

6.2.4.1 Stelara Revenues 2015-2017

6.2.4.2 Orphan Drug Designation for paediatric Crohn’s Disease

6.2.5 Tysabri: Blockbuster Drug’s High Efficacy Offsets its Risks

6.2.5.1 Tysabri Revenue Forecast 2018 - 2028

6.2.6 Xolair: New Indication, and Revenue Breakdown

6.2.7 Actemra/RoActemra: Strong Growth in All Regions

6.2.8 Cimzia: Blockbuster Which has been Used by Over 90,000 Patients

6.2.9 Autoimmune mAbs Pipeline: RA is the Main Target

6.2.9.1 Sarilumab (REGN88/SAR153191) by Regeneron and Sanofi: BLA Accepted for Review and Decision Expected by November 2016

6.2.9.2 Sirukumab (CNTO-136) by J&J and GSK: Multiple Phase 3 Studies Around the World

6.2.9.3 Clazakizumab: Developed by Alder Biopharmaceuticals and BMS but now Licensed to Vitaeris

6.2.9.4 Tregalizumab (BT-061) by Biotest: AbbVie Backs out After Poor Results

6.2.9.5 Mavrilimumab by AstraZeneca: Approaching Phase 3

6.2.9.6 Zinbryta (daclizumab high-yield process) by Biogen and AbbVie: Positive Opinion from CHMP

6.2.9.7 Lebrikizumab by Roche: Undergoing Phase 3 After Positive Phase 2b Results

6.2.9.8 Sifalimumab (MEDI-545) by AstraZeneca: Hasn’t Made the Cut for Phase 3

6.2.9.9 Anifrolumab by AstraZeneca

6.3 Oncology mAbs

6.3.1 Past Approvals

6.3.2 Rising Incidence of Cancer Will Drive Demand

6.3.3 Rituxan: The World’s Leading Anti-Cancer mAb

6.3.4 Biosimilar Rituximab: Two Candidates Await Approval in Europe

6.3.5 Gazyva: Roche’s Successor to Rituxan, Will Help to Retain Revenues in Face of Biosimilar Competition

6.3.5.1 Approval for Follicular Lymphoma and Being Investigated for Other Indications

6.3.6 Avastin: Growing under CER, Through New Indications

6.3.6.1 Controversy over Off-Label Avastin use: Roche is Backed up by Incidents in India, and Opinion of EFPIA

6.3.6.2 Biosimilar Bevacizumab: Late Patent Expiry is a Blessing for Roche, Although Various Biosimilars in Development

6.3.7 Herceptin: Breast Cancer Blockbuster

6.3.7.1 Pricing Challenges in Emerging Markets, and 2016 Revenues

6.3.7.2 Roche Builds Franchise of Anti-HER2 mAbs Around Herceptin

6.3.7.3 Herceptin Revenue Forecast 2018 - 2028

6.3.7.4 Biosimilar Trastuzumab

6.3.8 Kadcyla

6.3.8.1 Mixed Results from Different Clinical Trials

6.3.8.2 Kadcyla Sales Forecast 2018 -2028

6.3.9 Perjeta

6.3.9.1 Positive Results from Different Clinical Trials

6.3.9.2 Perjeta Revenue Forecast 2018 - 2028

6.3.10 Yervoy: Bristol-Myers Squibb’s Leading Anti-Cancer mAb, KeepsHigh Revenues, but with Decline over 2015

6.3.11 Opdivo: Big Potential for Bristol-Myer Squibb’s PD-1 Inhibitor

6.3.11.1 Good News and Bad News for NSCLC from CheckMate Trials

6.3.11.2 Cyramza (Eli Lilly): Approved in Three Additional Indications Since its First Approval in April 2014

6.3.12 Oncology mAbs: New Approvals and Pipeline

6.3.12.1 Empliciti (Elotuzumab) by Bristol-Myers Squibb and AbbVie): Recently Approved

6.3.12.2 Avelumab: Pfizer and Merck KGaA Team Up to Develop Their Own Anti-PD mAb

6.3.12.3 Unituxin (United Therapeutics) Receives FDA Approval March 2015

6.3.12.4 SAR3419 (coltuximab ravtansine) (anti-CD19, Sanofi)

6.4 Monoclonal Antibodies Submarket Forecast 2018 - 2028

7. Fusion Proteins Submarket 2018 - 2028

7.1 Scientific and Historical Background

7.2 Differentiating Fusion Proteins

7.3 Enbrel: The First FP to be Approved, in 1998

7.3.1 Gradually Approved for Additional Indications

7.3.2 Enbrel Granted Extended Patent Protection in the US, Patent has Expired in EU

7.3.3 Multiple Biosimilars Available in Emerging Markets

7.3.4 Enbrel Revenue Forecast 2018 - 2028

7.4 Eylea: Blockbuster FP Treatment for Wet AMD

7.4.1 Eylea Revenue Forecast 2018 - 2028

7.5 Orencia: Grows Blockbuster Revenues for Second Year in a Row

7.6 Nplate: Generates Half a Billion in Revenues for Amgen

7.7 Eloctate: Approved June 2014, Fulfils Unmet Need in the Haemophilia Community

7.8 Nulojix: Bristol-Myers Squibb’s Therapy for Preventing Organ Rejection

7.9 Arcalyst by Regeneron Pharmaceuticals: For Very Rare Conditions

7.10 Fusion Proteins Pipeline

7.10.1 Trebananib (Amgen)

7.10.2 Sotatercept by Acceleron Pharma and Celgene Corporation - Currently Undergoing Eight Clinical Trials

7.10.3 Blisibimod (Anthera Pharmaceuticals) for the Treatment of Various Autoimmune Diseases, in Late Stage Development

7.11 Fusion Protein Submarket Forecast to 2018 - 2028

8. Regenerative Medicines Submarket 2018 - 2028

8.1 Regenerative Medicines Market Breakdown

8.2 Regenerative Medicines Submarket Forecast, 2018 - 2028

8.3 Stem Cell Therapies Submarket, 2018 - 2028

8.3.1 Stem Cells: Scientific Breakdown

8.3.2 Stem Cell Therapies Submarket Breakdown

8.3.3 Haematopoietic Stem Cell Transplantation: Over 95,000 Carried out in 2016

8.3.3.1 From Procedures to Products: Cord Blood Stem Cell Approvals

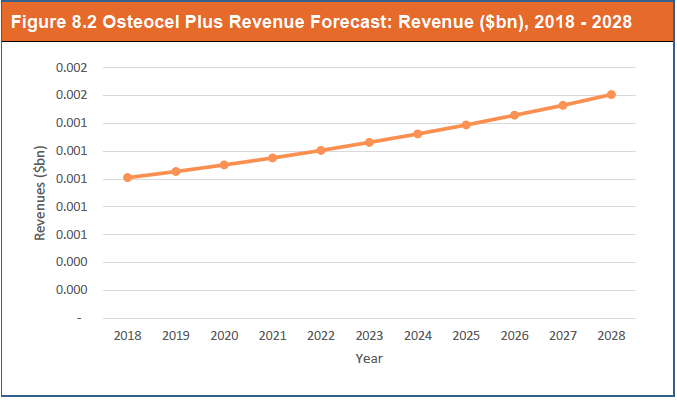

8.3.4 Osteocel Plus: The Leading Stem Cell Orthobiologic

8.3.4.1 Osteocel Plus Revenue Forecast 2018 - 2028

8.3.5 Trinity Evolution and Trinity Elite

8.3.5.1 Trinity Evolution and Trinity Elite Revenue Forecast to 2028

8.3.6 MSC-100-IV (Previously Known as Prochymal): World’s First Approved Stem Cell Drug Outside of South Korea

8.3.6.1 An Important Role to Play in the Future of HSCT, and also Wins Approval in Japan through Partner

8.3.7 CARTISTEM (MEDIPOST): The World’s First Allogeneic Stem Cell Drug

8.3.8 Hearticellgram-AMI (PharmaCell B.V.): One of the First Approved Cardiovascular Stem Cell Treatments in the World

8.3.9 Stem Cell Therapies Pipeline

8.3.9.1 Cx601 by TiGenix: Marketing Authorisation Application has been Submitted to EMA

8.3.9.2 CardiAMP (BioCardia) for Heart Failure: Undergoing Phase 3 Trial and has Received Grant from MSCRF

8.3.9.3 NurOwn (BrainStorm Cell Therapeutics): Neurotrophic Factor -Releasing Stem Cells for ALS in Phase 2 and Due to end Soon

8.3.9.4 Agenmestencel-T (Apceth): Phase 1/2 Due to end Soon

8.3.10 Stem Cell Therapies Submarket Forecast 2018 - 2028

8.4 Tissue Engineering Therapies Submarket 2018 - 2028

8.4.1 Tissue Engineering – In Vitro Manipulation for Therapeutic Purposes

8.4.2 Current Status of the Market

8.4.3 Apligraf: The Leading Product

8.4.3.1 Apligraf Revenue Forecast 2018 - 2028

8.4.4 Dermagraft: Organogenesis Further Strengthens Position Through this 2014 Acquisition

8.4.4.1 Dermagraft Revenue Forecast 2018 - 2028

8.4.5 ReCell

8.4.6 MySkin and CyroSkin

8.4.7 Tissue Engineering Therapies Pipeline

8.4.7.1 NeoCart by Histogenics: Undergoing Phase 3 Trial for Knee Cartilage Repair

8.4.7.2 Extracorporeal Bio-Artificial Liver Therapy by Vital Therapies

8.4.7.3 StrataGraft by Stratatech Corporation Demonstrates Positive Top-Line Results

8.5 Gene Therapies Submarket 2018 - 2028

8.5.1 Gene Therapy: Historical and Scientific Background

8.5.2 Harnessing Infectivity: Viral Vectors in Gene Therapy

8.5.3 Approved Gene Therapy Products

8.5.3.1 Gendicine: The World’s First Commercial Gene Therapy Product

8.5.3.2 Oncorine: First Oncolytic Viral Therapy

8.5.3.3 Neovasculgen: Russia’s First Gene Therapy

8.5.3.4 Neovasculgen: Drop in Revenues in 2015, but HSCI Predicts Notable Increases as Product is Added to VED List

8.5.3.5 Glybera: The First Gene Therapy for Western Markets, Although Has Abandoned Hope of Receiving FDA-Approval

8.5.4 IMLYGIC

8.5.4.1 IMLYGIC: Clinical Trials and Development Efforts

8.5.4.2 IMLYGIC: Revenue Forecast 2018 - 2028

8.5.5 Gene Therapies Pipeline

8.5.5.1 AAV2-hRPE65v2 (Spark Therapeutics): Undergoing Phase 3 Trial

8.5.5.2 AdV-tk/ProstAtak (Advantagene): Phase 3

8.5.5.3 Collategene (beperminogene perplasmid, AMG0001) - (AnGes MG/Vical)

9. Leading National Markets for Biologics 2018 - 2028

9.1 Regional Forecasts for the Global Biologics Market to 2028

9.2 US Biologics Market 2018 - 2028

9.2.1 The Major National Market

9.2.2 Value-Based Pricing in the US

9.2.3 Regulation of Biologics in the US

9.2.4 US Biosimilars Market

9.2.4.1 FDA Finalises Biosimilar Guidelines and Biosimilar Naming

9.2.5 US Biologics Market Forecast 2018 - 2028

9.3 EU5 Biologics Market 2018 - 2028

9.3.1 Current Composition and Future Outlook

9.3.2 European Biosimilar Market

9.3.2.1 History of EMA Guidelines and Updates

9.3.3 EU5 Market Forecast by Nation 2018 - 2028

9.4 Japanese Biologics Market 2018 - 2028

9.4.1 Current Status of the Japanese Biologics Market

9.4.2 Japanese Biosimilar Market

9.4.3 Japanese Biologics Market Forecast 2018 - 2028

9.5 BRIC National Biologic Markets 2018 - 2028

9.5.1 BRIC Markets Overview

9.5.2 BRIC Biologic Market Forecast 2018 - 2028

9.5.2.1 Unique Challenges Faced by the Biologics Industry have led to Current Composition of the BRIC Biologic Market

9.5.2.2 Future Outlook

9.5.2.3 BRIC Nation Market Shares in the Global Biologics Market Will Nearly Double During the Forecast Period

9.5.3 Brazil: Disproportionately High Government Spending on Biologics

9.5.3.1 Brazilian Government Eager to Promote Domestic Biologic and Biosimilar Development

9.5.4 Russia: Another Government Which is Eager to Increase Domestic Biological Drug Development

9.5.5 India: Biologics Market Behind that of Other BRIC Nations, but Biosimilars Submarket Thriving

9.5.5.1 CDSCO Guidelines Released in 2012

9.5.6 China: Expected to be the Largest BRIC Market for Biologics by 2020

9.5.6.1 The Largest National Biosimilar Market in the World

10. Qualitative Analysis of the Biologics Market and Industry

10.1 SWOT Analysis of the Global Biologics Market and Industry

10.1.1 Strengths

10.1.2 Opportunities

10.1.3 Weaknesses

10.1.4 Threats

10.2 STEP Analysis of the Global Biologics Market and Industry

10.2.1 Social Factors

10.2.2 Technological Developments

10.2.3 Economic Pressures

10.2.4 Political Issues

11. Company Profiles

11.1 AbbVie Inc.: Profile

11.1.1 AbbVie Inc.: Company Overview

11.2 Amgen: Profile

11.2.1 Amgen: Company Overview

11.3 AstraZeneca PLC: Profile

11.3.1 AstraZeneca PLC: Company Profile

11.4 Bayer AG: Profile

11.4.1 Bayer AG: Profile

11.5 Eli Lilly: Profile

11.5.1 Eli Lilly: Company Overview

11.6 F. Hoffmann-La Roche Ltd.: Profile

11.6.1 F. Hoffmann-La Roche Ltd.: Company Overview

11.7 GlaxoSmithKline Plc.: Profile

11.7.1 GlaxoSmithKline Plc.: Company Overview

11.8 Johnson & Johnson Services, Inc.: Profile

11.8.1 Johnson & Johnson Services, Inc.: Company Overview

11.9 Merck & Co., Inc.: Profile

11.9.1 Merck & Co., Inc.: Company Overview

11.10 Novartis AG: Profile

11.10.1 Novartis AG: Profile

11.11 Pfizer Inc.: Profile

11.11.1 Pfizer Inc.: Company Overview

11.12 Sanofi S.A.: Profile

11.12.1 Sanofi S.A: Company Overview

12. Conclusions

12.1 Biologics Market to Achieve Steady Growth Throughout the Forecast Period

12.2 Changes in Market Composition: mAbs to Become Leading Submarket

12.3 The Emergence of Biosimilars

12.4 Challenges for the Market

Appendices

Visiongain Report Sales Order Form

Associated Visiongain Reports

About Visiongain

Visiongain report evaluation form

List of Tables

Table 3.1 First Approvals for Recombinant Protein Therapies, 1982-1993

Table 4.1 Global Biologics Market Forecast: Revenues ($bn), AGR (%), CAGR (%), 2018-2023

Table 4.2 Global Biologics Market Forecast: Revenues ($bn), AGR (%), CAGR (%), 2023-2028

Table 4.3 Patent Status of Selected Leading Biologics

Table 4.4 Submarkets within the Biologics Market, Forecast: Revenues ($bn), AGR (%), CAGR (%), Market Share (%), 2018-2023

Table 4.5 Submarkets within the Biologics Market, Forecast: Revenues ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 5.1 First Approvals for Recombinant Protein Therapies,1982-1993

Table 5.2 Protein Therapeutics Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), 2018-2023

Table 5.3 Protein Therapeutics Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), 2023-2028

Table 5.4 Diabetes Prevalence in Leading National Markets, 2017

Table 5.5 Insulin Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), 2018-2023

Table 5.6 Insulin Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), 2023-2028

Table 5.7 Lantus Revenue Forecast: Revenues ($bn), AGR (%), CAGR (%), 2018-2023

Table 5.8 Lantus Revenue Forecast: Revenues ($bn), AGR (%), CAGR (%),2023-2028

Table 5.9 NovoLog/NovoRapid Revenue Forecast: Revenues ($bn), AGR (%), CAGR (%), 2018-2023

Table 5.10 NovoLog/NovoRapid Revenue Forecast: Revenues ($bn), AGR (%), CAGR (%), 2023-2028

Table 5.11 Humalog Revenue Forecast: Revenues ($bn), AGR (%), CAGR (%),2018-2023

Table 5.12 Humalog Revenue Forecast: Revenues ($bn), AGR (%), CAGR (%),2023-2028

Table 5.13 Selected Insulin Biosimilars which have been Approved and Launched

Table 5.14 Selected EPO Biosimilars Approved in India

Table 5.15 European Biosimilar Approvals: G-CSF

Table 5.16 Selected Filgrastim Biosimilars Approved Worldwide, 2016

Table 5.17 Other Recombinant Hormones Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), 2018-2023

Table 5.18 Other Recombinant Hormones Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 5.19 Selected Coagulating Factors Significant in Segment

Table 5.20 Plasma and Recombinant Coagulating Factors Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), 2018-2023

Table 5.21 Plasma and Recombinant Coagulating Factors Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%),2023-2028

Table 5.22 Selected Approved Branded Interferon Therapies

Table 5.23 Avonex Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 5.24 Avonex Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), to 2028

Table 5.25 Rebif Revenue Forecast: Revenue ($m), AGR (%), CAGR (%), 2018-2023

Table 5.26 Rebif Revenue Forecast: Revenue ($m), AGR (%), CAGR (%), 2023-2028

Table 5.27 Selected Interferon Alfa Biosimilars Approved Worldwide, 2016-2017

Table 5.28 Selected Interferon Beta Biosimilars Approved Worldwide, 2016-2017

Table 5.29 Interferon Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), 2018-2023

Table 5.30 Interferon Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), 2023-2028

Table 5.31 Enzyme Replacement and Other Protein Therapeutics Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%), 2018-2023

Table 5.32 Enzyme Replacement and Other Protein Therapeutics Submarket Forecast: Revenues ($bn), AGR (%), CAGR (%),2023-2028

Table 6.1 Regions of an Antibody

Table 6.2 Natural Antibody Mechanisms of Action

Table 6.3 Selected Biosimilar Adalimumab Candidates

Table 6.4 Humira Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 6.5 Humira Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 6.6 Remicade Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 6.7 Remicade Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%),2023-2028

Table 6.8 Stelara Revenue 2015-2017:

Revenues ($bn), AGR (%)

Table 6.9 Tysabri Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 6.10 Tysabri Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 6.11 Xolair Revenue Breakdown (between Roche and Novartis): Revenue ($bn), AGR (%), 2016-2017

Table 6.12 Selected Ongoing Lebrikizumab Clinical Trials

Table 6.13 Selected Ongoing Anifrolumab Clinical Trials

Table 6.14 Herceptin Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%),2018-2023

Table 6.15 Herceptin Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%),2023-2028

Table 6.16 Kadcyla Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%),2018-2023

Table 6.17 Kadcyla Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%),2023-2028

Table 6.18 Perjeta Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 6.19 Perjeta Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 6.20 FDA-Approved Indications for Cyramza

Table 6.21 Monoclonal Antibodies Submarket Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 6.22 Monoclonal Antibodies Submarket Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 7.1 Amgen’s US Patents and Expiry Dates for Enbrel

Table 7.2 Enbrel Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 7.3 Enbrel Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%),2023-2028

Table 7.4 Eylea Revenue Breakdown 2016-2017: Regeneron and Bayer

Table 7.5 Eylea Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 7.6 Eylea Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 7.7 Bristol-Myers Squibb’s pipeline developments for Orencia

Table 7.8 Fusion Proteins Submarket Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 7.9 Fusion Proteins Submarket Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 8.1 Regenerative Medicines Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 8.2 Regenerative Medicines Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 8.3 Potency and Source of Stem Cells

Table 8.4 Osteocel Plus Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 8.5 Osteocel Plus Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 8.6 Trinity Evolution and Trinity Elite Revenue Forecast: Revenue ($m), AGR (%), CAGR (%), 2018-2023

Table 8.7 Trinity Evolution and Trinity Elite Revenue Forecast: Revenue ($m), AGR (%), CAGR (%), 2023-2028

Table 8.8 Stem Cell Therapies Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 8.9 Stem Cell Therapies Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 8.10 Apligraf Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 8.11 Apligraf Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 8.12 Dermagraft Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 8.13 Dermagraft Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 8.14 IMLYGICRevenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2018-2023

Table 8.15 IMLYGICRevenue Forecast: Revenue ($bn), AGR (%), CAGR (%),

2023-2028

Table 9.1 Regional Forecasts for the Global Biologics Market: Revenues ($bn), AGR (%), CAGR (%), Market Share (%), 2018-2023

Table 9.2 Regional Forecasts for the Global Biologics Market: Revenues ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 9.3 US Biologics Market: Revenues ($bn), AGR (%), CAGR (%), Global Market Share (%), 2018-2023

Table 9.4 US Biologics Market: Revenues ($bn), AGR (%), CAGR (%), Global Market Share (%), 2023-2028

Table 9.5 European Biosimilar Approvals, 2006-2017

Table 9.6 EU5 Biologics Market: Revenues ($bn), AGR (%), CAGR (%), EU5 Market Share (%), 2018-2023

Table 9.7 EU5 Biologics Market: Revenues ($bn), AGR (%), CAGR (%), EU5 Market Share (%), 2023-2028

Table 9.8 Japanese Biologics Market: Revenues ($bn), AGR (%), CAGR (%), Global Market Share (%), 2018-2023

Table 9.9 Japanese Biologics Market: Revenues ($bn), AGR (%), CAGR (%), Global Market Share (%), 2023-2028

Table 9.10 BRIC Biologics Market: Revenues ($bn), AGR (%), CAGR (%), BRIC Market Share (%), 2018-2023

Table 9.11 BRIC Biologics Market: Revenues ($bn), AGR (%), CAGR (%), BRIC Market Share (%), 2023-2028

Table 11.1 AbbVie, Inc.: Profile

Table 11.2 AbbVie, Inc.: Key Developments

Table 11.3 Amgen: Profile

Table

Table 11.4 Amgen: Key Developments

Table 11.5 AstraZeneca PLC: Profile

Table 11.6 AstraZeneca PLC: Key Developments

Table 11.7 Bayer AG: Profile

Table 11.8 Eli Lilly: Profile

Table 11.9 Eli Lilly: Key Developments

Table 11.10 Roche: Profile

Table 11.11 Roche: Key Developments

Table 11.12 GSK: Profile

Table 11.13 Johnson & Johnson: Profile

Table 11.14 Johnson & Johnson: Profile

Table 11.15 Merck & Co., Inc.: Profile

Table 11.16 Merck & Co., Inc.: Key Developments

Table 11.17 Novartis: Profile

Table 11.18 Novartis: Key Developments

Table 11.19 Pfizer: Profile

Table 11.20 Pfizer: Key Developments

Table 11.21 Sanofi: Profile

Table 11.22 Sanofi: Key Developments

List of Figures

Figure 1.1 Forecasted Submarkets of the Biologics Market

Figure 4.1 Global Biologics Market Forecast: Revenues ($bn), 2018 - 2028

Figure 4.2 Submarkets within the Biologics Market Forecast: Revenues ($bn),2017-2028

Figure 5.1 Protein Therapeutics Submarket Forecast: Revenues ($bn), 2018 - 2028

Figure 5.2 Diabetes Prevalence in Leading National Markets, 2017

Figure 5.3 Insulin Submarket Forecast: Revenues ($bn), 2018 - 2028

Figure 5.4 Lantus Revenue Forecast: Revenues ($bn), 2018 - 2028

Figure 5.5 NovoLog/NovoRapid Revenue Forecast: Revenues ($bn), 2018 - 2028

Figure 5.6 Humalog Revenue Forecast: Revenues ($bn), 2018 - 2028

Figure 5.7 Other Recombinant Hormones Submarket Forecast: Revenues ($bn), 2018 - 2028

Figure 5.8 Plasma and Recombinant Coagulating Factors Submarket Forecast: Revenues ($bn), 2018 - 2028

Figure 5.9 Avonex Submarket Forecast: Revenues ($bn), 2018 - 2028

Figure 5.10 Rebif Revenue Forecast: Revenue ($bn), 2018 - 2028

Figure 5.11 Interferon Submarket Forecast: Revenues ($bn), 2018 - 2028

Figure 5.12 Enzyme Replacement and Other Protein Therapeutics Submarket Forecast: Revenues ($bn), 2018 - 2028

Figure 6.1 Humira Revenue Forecast: Revenue ($bn), 2018 - 2028

Figure 6.2 Remicade Revenue Forecast: Revenue ($bn), 2018 - 2028

Figure 6.3 Stelara Revenue 2015-2017, Revenue ($bn)

Figure 6.4 Tysabri Revenue Forecast: Revenue ($m), 2018 - 2028

Figure 6.5 Herceptin Revenue Forecast: Revenue ($bn), 2018 - 2028

Figure 6.6 Kadcyla Revenue Forecast: Revenue ($m), 2018 -2028

Figure 6.7 Perjeta Revenue Forecast: Revenue ($bn), 2018 - 2028

Figure 6.8 Monoclonal Antibodies Submarket Forecast: Revenue ($bn), 2018 - 2028

Figure 7.1 Enbrel Revenue Forecast: Revenue ($bn), 2018 - 2028

Figure 7.2 Eylea Revenue Forecast: Revenue ($bn), 2018 - 2028

Figure 7.3 Fusion Proteins Forecast: Revenue ($bn), 2018 - 2028

Figure 8.1 Regenerative Medicines Market Forecast: Revenue ($bn), 2018 - 2028

Figure 8.2 Osteocel Plus Revenue Forecast: Revenue ($bn), 2018 - 2028

Figure 8.3 Trinity Evolution and Trinity Elite Revenue Forecast: Revenue ($m), 2018 - 2028

Figure 8.4 Stem Cell Therapies Market Forecast: Revenue ($bn), 2018 - 2028

Figure 8.5 Apligraf Revenue Forecast: Revenue ($bn), 2018 - 2028

Figure 8.6 Dermagraft Revenue Forecast: Revenue ($bn), 2018 - 2028

Figure 8.7 IMLYGIC Revenue Forecast: Revenue ($bn), 2018 - 2028

Figure 9.1 Regional Breakdown of Global Biologics Market: Revenues ($bn), Market Share (%), 2017

Figure 9.2 Regional Breakdown of Global Biologics Market: Revenues ($bn), Market Share (%), 2028

Figure 9.3 Regional Forecasts for Global Biologics Market: Revenues ($bn),to 2028

Figure 9.4 US Biologics Market: Revenues ($bn), 2018 - 2028

Figure 9.5 EU5 Market Breakdown: Market Share (%), 2017

Figure 9.6 EU5 Biologics Market: Revenues ($bn), 2018 - 2028

Figure 9.7 Japanese Biologics Market: Revenues ($bn), 2018 - 2028

Figure 9.8 Biologics Market Breakdown: Revenues ($bn), Market Share (%), 2017

Figure 9.9 BRIC Biologics Market: Revenues ($bn), 2018 - 2028

Figure 9.10 Biologics Market Breakdown: Revenues ($bn), Market Share (%), 2028

Figure 10.1 SWOT Analysis of Biologics Market and Industry

Figure 10.2 STEP Analysis of Biologics Market and Industry

Figure 12.1 Global Biologics Market Forecast: Revenues ($bn), Annual Growth Rate (%), 2018 - 2028

3SBio

AbbVie

Ablynx

Acceleron Pharma

Accord Healthcare

Aché

Actavis

Adaptive Biotechnologies Corporation

Advanced BioHealing

Advantagene

Advaxis, Inc.

Afferent Pharmaceuticals

Alder Biopharmaceuticals

Alector

Allergan

Alteogen

Amega Biotech

Amgen

AM‐Pharma B.V.

Anacor Pharmaceuticals, Inc.

AnGes

Anthera Pharmaceuticals

Apceth

Apeiron Biologics

Apotex

Argenx

ARMO BioSciences, Inc.

Aryogen

Aspen Global Incorporated

Astellas Pharma

AstraZeneca

AurKa Pharma, Inc.

Aventis

Avita Medical

Bamboo Therapeutics, Inc.

Banner Alzheimer's Institute

Basilea Pharmaceutica Ltd.

Baxalta

Bayer

Beijing Four Rings

Beijing SL Pharmaceutical

Benda Pharmaceuticals

Biocad

BioCardia

Biocon

Biodel

Biogen

Bionovis

Biopartners

BioPharma

Biosidus

Biotest

Bioton

BioXpress Therapeutics

Boehringer Ingelheim

BrainStorm Cell Therapeutics

Bristol-Myers Squibb (BMS)

Cambridge Antibody Technology

cCAM Biotherapeutics

CCL Pharmaceuticals

Celgene Corporation

Celltrion

CEL-SCI

Centocor Ortho Biotech

Children’s Oncology Group

CHMP

Chugai

CinnaGen

ClinImmune Labs

CSL Behring

CT Arzneimittel

CureVac AG

Cystic Fibrosis Foundation Therapeutics Inc

CytomX Therapeutics

Daiichi Sankyo Company, Limited

Dako

Dendreon

Dezima Pharma B.V.

DNAtrix

Dong-A Pharmaceutical

Dr. Reddy's Laboratories

Dynavax Technologies Corporation

Eisai Co., Ltd.

Eli Lilly and Company

Emcure Pharmaceuticals

EMS

Epirus

Europharm

Evotec

FDA

FibroGen

FierceBiotech

Finox Biotech

Flatiron Health

Foundation Medicine, Inc.

Fuji Pharma

Galencia

Gan & Lee

GE Healthcare

Genentech

Gennova

GenSci

Genzyme

Gilead Sciences

GlaxoSmithKline (GSK)

Hangzhou Jiuyuan Gene Engineering Co.

Hanwha Chemical

Harpoon Therapeutics

Harrisvaccines Inc.

Heptares Therapeutics

Hexal

Hindustan Antibiotic

Histogenics

Hospira, Inc.

Human Genome Sciences

Humana Inc.

Hypermarcas

IBM Watson Health

ICU Medical Inc.

Ignyta, Inc.

Immatics Biotechnologies GmbH

Immune Design

Immunex Corporation

Immunocore Limited

Incyte Corporation

Innovare R&D

Intas Pharmaceuticals

IOmet Pharma

Ipsen

Isis Pharmaceuticals, Inc.

Janssen

JingYuan Bio

Johnson & Johnson

Kite Pharma

Kyowa Hakko Kirin

Laboratorios Delta

LG Life Sciences

LifeSouth Community Blood Centers

Lonza

Luye Pharma Group, Ltd.

M2Gen

MacroGenics, Inc.

Massachusetts General Hospital

Medice

MEDICE Arzneimittel Pütter

MedImmune

MEDIPOST

Medivation, Inc.

Medtronic

Merck & Co., Inc.

Merck KGaA

Merz Pharma

Mirati Therapeutics, Inc.

Mitsubishi Tanabe

Mochida Pharmaceutical

Moderna Therapeutics

Mylan

NanoString Technologies, Inc.

NGM Biopharmaceuticals, Inc.

Nippion Kayaku

Northwestern University

Novartis

Novo Nordisk

NuVasive

Oanda

Organogenes

OrLife Bio

Orthofix

Orygen

Peregrine Pharmaceuticals, Inc.

Pfizer

Pharmacyclics

Pharmicell

Pharmstandard

Plexxikon Inc.

Porbiomed

Portola Pharmaceuticals Inc.

Premier Inc.

Principia

Probiomed

Protein Sciences

Proteon Therapeutics

Qilu Pharmaceutical

Ranbaxy

Ratiopharm

Redvax GmbH

Regeneron Pharmaceuticals, Inc.

Regenerys

Reliance Life Sciences

Rentschler Biotechnologie.

Rigontec

Roche

Samsung Bioepis

Sandoz

Sangamo Therapeutics, Inc.

Sanofi

Schering-Plough

SciGen

Shandong Kexing Pharma

Shanghai CP Guojian Pharmaceutical

Shanghai Fosun

Shanghai Sunway Biotech

Shantha Biotechnics

Shenzhen SiBiono GeneTech

Shire

Sicor Biotech

Sigilon Therapeutics

Simcere Pharmaceutical Group

Smith and Nephew

Spark Therapeutics

Stada

Stemcentrx

Stragen Pharma

Stratatech Corporation

Swiss Re

Takeda Pharmaceutical Company Limited

TESARO, Inc.

TetraLogic Pharmaceuticals Corporation

Teva

Tianjin Hualida Biotechnology

TiGenix

Tonghua Dongbao

Trophos

Turnstone Biologics

UCB

União Química

UniQure

Valeant Pharmaceuticals

Vertex Pharmaceuticals

Viralytics Limited

Vital Therapies Inc.

Voyager Therapeutics

Wockhardt

Wyeth-Ayerst Laboratories

Xencor, Inc.

Xiamen Amoytop Biotech

XO1 Limited

Zenotech

ZS Pharma

Zuventus

Zydus Biovation

Zydus Cadila

Organizations Mentioned in the Report

Agência Nacional de Vigilância Sanitária (ANVISA)

Australia's Walter and Eliza Hall Institute

Boston Children's Hospital

Center for Disease Prevention and Control (CDC)

Central Drugs Standard Control Organisation

China Food and Drug Administration

Duke University School of Medicine

EMA (European Medicines Agency)

European Commission (EC)

European Federation of Pharmaceutical Industries and Associations

Harvard University

Human Stem Cells Institute

International Myeloma Foundation

Johns Hopkins

Musculoskeletal Transplant Foundation (MTF)

National Cancer Institute

New York Blood Center

NHS

NICE

Rice University

Saudi Food and Drug Authority

SSN Cardinal Glennon Children’s Medical Center

Stanford University

The European Generic medicines Association (EGA)

The European Group for Blood and Marrow Transplantation (EBMT)

The U.S. President’s Emergency Plan for AIDS Relief (PEPFAR)

The University of Manchester

The University of Texas

The University of Texas MD Anderson Cancer Center

Toronto University

Toronto University

UCSF (University of California, San Francisco)

United Therapeutics

University of California, Berkeley

University of Colorado Cord Blood Bank

University of Tokyo

US Center for Disease Prevention and Control (CDC)

US Food and Drug Administration

Walter and Eliza Hall Institute

World Bank

World Health Organization (WHO)

Yonsei University

Download sample pages

Complete the form below to download your free sample pages for Biologics Market Trends and Forecasts 2018-2028

Related reports

-

Global Bariatric Surgery Devices Market Forecast 2018-2028

The Global Bariatric Surgery Devices Market is estimated at $879.7m in 2017 and is expected to grow at a CAGR...

Full DetailsPublished: 08 February 2018 -

Top 20 Vaccines Manufacturers 2019

The global vaccines market has witnessed strong growth in past few years. The top 5 manufacturers in the global vaccines...

Full DetailsPublished: 12 February 2019 -

Drug Delivery Technologies Market Forecast 2019-2029

The Drug Delivery Technologies market is estimated to grow at a CAGR of 8.3% in the first half of the...

Full DetailsPublished: 27 February 2019 -

Global Vaccine Contract Manufacturing Market Report 2018-2028

The global vaccine contract manufacturing market was worth $883.0m in 2017 and is expected to grow at a CAGR of...

Full DetailsPublished: 06 March 2018 -

Global Bioreactors Market 2019-2029

The global bioreactors market is expected to grow at a CAGR of 7.5% in the second half of the forecast...

Full DetailsPublished: 18 December 2018 -

Generic Drugs Market Forecast 2018-2028

The generic drugs market is estimated at $257.3bn in 2017 and is expected to grow at a CAGR of 7.9%...

Full DetailsPublished: 25 April 2018 -

Pharma Leader Series: 25 Top Biosimilar Drug Manufacturers 2017-2027

Our 233-page report provides 126 tables, charts, and graphs, giving a clear view on companies in the biosimilar market. Who...Full DetailsPublished: 31 August 2017 -

Global Translational Regenerative Medicine Market Prospects 2018-2028

The Global Translational Regenerative Medicine market is estimated to grow at a CAGR of 22.1% in the first half of...

Full DetailsPublished: 27 March 2018 -

Global Influenza Vaccines Market Outlook 2018-2028

The latest report from business intelligence provider visiongain offers comprehensive analysis of the global influenza vaccines market. Visiongain assesses that...

Full DetailsPublished: 19 June 2018 -

Global Diabetes Drugs Market 2017-2027

The global diabetes drugs market was valued at $49.26bn in 2016 and is projected to grow at a CAGR of...Full DetailsPublished: 27 July 2017

Download sample pages

Complete the form below to download your free sample pages for Biologics Market Trends and Forecasts 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Pharma news

Retinal Gene Therapy Market

The global Retinal Gene Therapy market is projected to grow at a CAGR of 9.6% by 2034

26 July 2024

HIV Drugs and Injectables Market

The global HIV Drugs & Injectables market is projected to grow at a CAGR of 4.6 % by 2034

24 July 2024

Digital Twin Technology in Pharmaceutical Manufacturing Market

The global Digital Twin Technology in Pharmaceutical Manufacturing market is projected to grow at a CAGR of 31.3% by 2034

23 July 2024

Specialty Pharma Market

The global Specialty Pharma market is projected to grow at a CAGR of 7.5% by 2034

22 July 2024