Industries > Pharma > Top 20 Vaccines Manufacturers 2019

Top 20 Vaccines Manufacturers 2019

Merck & Co., Sanofi, Pfizer, GlaxoSmithKline, Johnson & Johnson, AstraZeneca, Emergent Biosolutions, Other Companies

The global vaccines market has witnessed strong growth in past few years. The top 5 manufacturers in the global vaccines market are, Merck & Co., Inc., Sanofi, Pfizer Inc., GlaxoSmithKline PLC, and Johnson & Johnson. These companies secured about 76% revenue share in the global vaccines market.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new report you will find 157-page report and you will receive 90 tables and 75 figures – all unavailable elsewhere.

The 157-page report provides clear detailed insight into the Top 20 Vaccines Manufacturers 2019. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand new report today you stay better informed and ready to act.

Report Scope

• Assessment of the leading companies in the global vaccines market:

• Astellas Pharma Inc.

• AstraZeneca

• Bavarian Nordic

• CSL Ltd.

• Emergent Biosolutions, Inc.

• F. Hoffmann-La Roche Ltd.

• Gilead Sciences

• GlaxoSmithKline PLC

• Inovio Pharmaceuticals

• Johnson & Johnson

• Merck & Co., Inc.

• Mitsubishi Tanabe Pharma Corporation

• Novavax, Inc.

• Pfizer Inc.

• Sanofi

• SELLAS Life Sciences Group, Inc.

• Serum Institute of India Pvt. Ltd.

• Sun Pharmaceutical Industries Ltd.

• Takeda Pharmaceutical Company Ltd.

• Teva Pharmaceutical

This report discusses financial outlook, product portfolio and strategic developments.

• Revenues forecast from 2017-2028 for the US, Europe and Japan Vaccines Market.

• Market share of key companies in the vaccines market.

• Market share of leading vaccines in the global vaccines market.

• Drivers, Challenges and Opportunities for the global vaccines market.

• A SWOT analysis of the global vaccines market.

Visiongain’s study is intended for anyone requiring commercial analyses for the Top 20 Vaccines Manufacturers 2019. You find data, trends and predictions.

Buy our report today Top vaccine manufacturers Market Analysis : Merck & Co., Sanofi, Pfizer, GlaxoSmithKline, Johnson & Johnson, AstraZeneca, Emergent Biosolutions, Other Companies.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Overview of the Global Vaccines Market

1.2 Why You Should Read This Report

1.3 Benefits of This Report

1.4 Report Structure

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.7 Frequently Asked Questions (FAQs)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the World Human Vaccines Market

2.1 Vaccines Market Definition

2.2 Vaccines Market Segmentation

2.2.1 Vaccine Types:

2.2.1.1 Inactivated Vaccines

2.2.1.2 Live Attenuated Vaccines

2.2.1.3 Conjugate Vaccines

2.2.1.4 Recombinant Vector Vaccines

2.2.2 Vaccine Submarket

2.2.2.1 Paediatric vaccines

2.2.2.2 Adult vaccines

2.2.2.3 Elderly vaccines

2.2.2.4 Travel vaccines

2.2.2.5 Therapeutic Vaccines

2.3 Demand for Vaccines in Regional Markets

2.3.1 U.S. Vaccines Market Overview - 2018

2.3.2 Europe Vaccines Market Overview- 2018

2.3.3 Japan Vaccines Market Overview- 2018

3. World Vaccine Market Outlook, 2017-2028

3.1 Global Vaccines Market 2018 Overview

3.2 The World Vaccine Market: Industry Trends, 2017-2028

3.3 Drivers and Challenges for the Global Vaccines Market

3.3.1 Drivers

3.3.1.1 Growing demand from emerging markets

3.3.1.2 Increasing birth rates in developing countries

3.3.1.3 Rise in ageing population globally

3.3.2 Challenges

3.3.2.1 Funding can be difficult to sustain

3.3.2.2 Oligarchic market presents barrier to entry

3.3.3 Opportunities

3.3.3.1 Advancements in vaccine technology and a strong culture of innovation and R&D pipelines

3.3.3.2 Growing awareness of benefits of vaccinations amongst adults

4. Leading 20 Companies Ranking in the Vaccines Market

4.1 Leading 20 Companies Ranking in the Vaccines Market 2018

4.2 Global Vaccines Market Forecast, 2017-2028

5. Top 20 Vaccines Manufacturers

5.1 Merck & Co., Inc. Overview

5.1.1 Merck Financial Outlook

5.1.2 Merck Product Portfolio

5.1.3 Merck Strategic Developments

5.2 Sanofi Overview

5.2.1 Sanofi Financial Outlook

5.2.2 Sanofi Product Portfolio

5.2.3 Sanofi Strategic Developments

5.3 Pfizer Overview

5.3.1 Pfizer Financial Outlook

5.3.2 Pfizer Product Portfolio

5.3.3 Pfizer Strategic Developments

5.4 GlaxoSmithKline PLC Overview

5.4.1 GlaxoSmithKline PLC Financial Outlook

5.4.2 GlaxoSmithKline PLC Product Portfolio

5.4.3 GlaxoSmithKline PLC Strategic Developments

5.5 Johnson & Johnson Overview

5.5.1 Johnson & Johnson Financial Outlook

5.5.2 Johnson & Johnson Product Portfolio

5.5.3 Johnson & Johnson Strategic Developments

5.6 AstraZeneca Overview

5.6.1 AstraZeneca Financial Outlook

5.6.2 AstraZeneca Product Portfolio

5.6.3 AstraZeneca Strategic Developments

5.7 Emergent Biosolutions Overview

5.7.1 Emergent Biosolutions Financial Outlook

5.7.2 Emergent Biosolutions Product Portfolio

5.7.3 Emergent Biosolutions Strategic Developments

5.8 CSL Ltd. Overview

5.8.1 CSL Ltd. Financial Outlook

5.8.2 CSL Ltd. Product Portfolio

5.8.3 CSL Ltd. Strategic Developments

5.9 Serum Institute of India Pvt. Ltd. Overview

5.9.1 Serum Institute of India Pvt. Ltd. Financial Outlook

5.9.2 Serum Institute of India Pvt. Ltd. Product Portfolio

5.9.3 Serum Institute of India Pvt. Ltd. Strategic Developments

5.10 Astellas Pharma Overview

5.10.1 Astellas Pharma Financial Outlook

5.10.2 Astellas Pharma Product Portfolio

5.10.3 Astellas Pharma Strategic Developments

5.11 SELLAS Life Sciences Group, Inc. Overview

5.11.1 SELLAS Life Sciences Group, Inc. Financial Outlook

5.11.2 SELLAS Life Sciences Group, Inc. Product Portfolio

5.11.3 SELLAS Life Sciences Group, Inc. Strategic Developments

5.12 Novavax, Inc. Overview

5.12.1 Novavax, Inc. Financial Outlook

5.12.2 Novavax, Inc. Product Portfolio

5.13 Inovio Pharmaceuticals Overview

5.13.1 Inovio Pharmaceuticals Financial Outlook

5.13.2 Inovio Pharmaceuticals Product Portfolio

5.13.3 Inovio Pharmaceuticals Strategic Developments

5.14 Mitsubishi Tanabe Pharma Corporation Overview

5.14.1 Mitsubishi Tanabe Pharma Corporation Financial Outlook

5.14.2 Mitsubishi Tanabe Pharma Corporation Product Portfolio

5.14.3 Mitsubishi Tanabe Pharma Corporation Strategic Developments

5.15 Sun Pharmaceutical Industries Ltd. Overview

5.15.1 Sun Pharmaceutical Industries Ltd. Financial Outlook

5.15.2 Sun Pharmaceutical Industries Ltd. Product Portfolio

5.15.3 Sun Pharmaceutical Industries Ltd. Strategic Developments

5.16 Gilead Sciences Overview

5.16.1 Gilead Sciences Financial Outlook

5.16.2 Gilead Sciences Product Portfolio

5.16.3 Gilead Sciences Strategic Developments

5.17 F. Hoffmann-La Roche Ltd. Overview

5.17.1 F. Hoffmann-La Roche Ltd. Financial Outlook

5.17.2 F. Hoffmann-La Roche Ltd. Product Portfolio

5.17.3 F. Hoffmann-La Roche Ltd. Strategic Developments

5.18 Takeda Pharmaceutical Company Limited Overview

5.18.1 Takeda Pharmaceutical Company Limited. Financial Outlook

5.18.2 Takeda Pharmaceutical Company Limited. Product Portfolio

5.18.3 Takeda Pharmaceutical Company Limited. Strategic Developments

5.19 Teva Pharmaceutical Overview

5.19.1 Teva Pharmaceutical Financial Outlook

5.19.2 Teva Pharmaceutical Product Portfolio

5.19.3 Teva Pharmaceutical Strategic Developments

5.20 Bavarian Nordic Overview

5.20.1 Bavarian Nordic Financial Outlook

5.20.2 Bavarian Nordic Product Portfolio

5.20.3 Bavarian Nordic Strategic Developments

6. SWOT Analysis of the Global Vaccines Market, 2018

6.1 Strengths

6.2 Weaknesses

6.3 Opportunities

6.4 Threats

7. Conclusion

7.1 Strong and Diverse Research and Development

7.2 Oligarchic market presents

7.3 Emerging Markets: High Demand for Vaccines

7.4 Top 20 Companies and Revenue

Appendices

Associated Visiongain Reports

Visiongain Report Sales Order Form

About Visiongain

Visiongain Report Evaluation Form

List of Tables

Table 2.1 The US Vaccines Revenue Forecast ($bn) and Annual Growth (%), 2017-2028

Table 2.2 The Europe Vaccines Revenue Forecast ($bn) and Annual Growth (%), 2017-2028

Table 2.3 Japan Vaccines Revenue Forecast ($bn) and Annual Growth (%), 2017-2028

Table 4.1 Companies Profiled in this Report and Country HQ

Table 4.2 Global Vaccines Revenue Forecast ($bn) and Annual Growth (%), 2017-2028

Table 5.1 Merck & Co., Inc.: Key Facts, 2017

Table 5.2 Merck & Co., Inc.: Revenue ($million) and Revenue Shares (%) by Reporting Segment, 2017

Table 5.3 Merck & Co., Inc.: Product Revenue ($million) and Revenue Shares (%) by Reporting Segment, 2017

Table 5.4 Merck & Co., Inc.: Vaccines Clinical Pipeline

Table 5.5 Merck & Co., Inc.: Vaccines Revenue ($million), AGR (%) 2015-2017

Table 5.6 Merck & Co., Inc.: Vaccines Product Revenue ($million) and Revenue Shares (%), 2017

Table 5.7 Merck & Co., Inc.: Strategic Developments, 2015-2018

Table 5.8 Sanofi: Key Facts, 2017

Table 5.9 Sanofi: Revenue ($million) and Revenue Shares (%) by Reporting Segment, 2017

Table 5.10 Sanofi: Vaccines Clinical Pipeline

Table 5.11 Sanofi: Vaccines Revenue ($million), AGR (%) 2015-2017

Table 5.12 Sanofi: Vaccines Product Revenue ($million) and Revenue Shares (%), 2017

Table 5.13 Sanofi: Strategic Developments, 2015-2018

Table 5.14 Pfizer: Key Facts, 2017

Table 5.15 Pfizer: Revenue ($million) and Revenue Shares (%) by Reporting Segment, 2017

Table 5.16 Pfizer: Product Revenue ($million) and Revenue Shares (%) by Reporting Segment, 2017

Table 5.17 Pfizer: Vaccines Clinical Pipeline

Table 5.18 Pfizer: Vaccines Revenue ($million), AGR (%) 2015-2017

Table 5.19 Pfizer: Vaccines Product Revenue ($million) and Revenue Shares (%), 2017

Table 5.20 Pfizer: Strategic Developments, 2015-2018

Table 5.21 GlaxoSmithKline PLC: Key Facts, 2017

Table 5.22 GlaxoSmithKline PLC: Revenue ($million) and Revenue Shares (%) by Reporting Segment, 2017

Table 5.23 GlaxoSmithKline PLC: Product Revenue ($million) and Revenue Shares (%) by Reporting Segment, 2017

Table 5.24 GlaxoSmithKline PLC: Vaccines Clinical Pipeline

Table 5.25 GlaxoSmithKline PLC: Vaccines Revenue ($million), AGR (%) 2015-2017

Table 5.26 GlaxoSmithKline PLC: Vaccines Product Revenue ($million) and Revenue Shares (%), 2017

Table 5.27 GlaxoSmithKline PLC: Strategic Developments, 2015-2018

Table 5.28 Johnson & Johnson: Key Facts, 2018

Table 5.29 Johnson & Johnson: Revenue ($million) and Revenue Shares (%) by Reporting Segment, 2017

Table 5.30 Johnson & Johnson: Product Revenue ($million) and Revenue Shares (%) by Reporting Segment, 2017

Table 5.31 Johnson & Johnson: Vaccines Clinical Pipeline

Table 5.32 Johnson & Johnson: Infectious Diseases and Vaccines Revenue ($million), AGR (%) 2015-2017

Table 5.33 Johnson & Johnson: Vaccines Product Revenue ($million) and Revenue Shares (%), 2017

Table 5.34 Johnson & Johnson: Strategic Developments, 2015-2018

Table 5.35 AstraZeneca: Key Facts, 2018

Table 5.36 AstraZeneca: Revenue ($million) and Revenue Shares (%) by Reporting Segment, 2017

Table 5.37 AstraZeneca: Infectious Diseases and Vaccines Revenue ($million), AGR (%) 2015-2017

Table 5.38 AstraZeneca: Vaccines Product Revenue ($million) and Revenue Shares (%), 2017

Table 5.39 AstraZeneca: Strategic Developments, 2015-2018

Table 5.40 Emergent Biosolutions: Key Facts, 2018

Table 5.41 Emergent Biosolutions: Revenue ($million) and Revenue Shares (%) by Reporting Segment, 2017

Table 5.42 Emergent Biosolutions: Vaccines Clinical Pipeline

Table 5.43 Emergent Biosolutions: Strategic Developments, 2015-2018

Table 5.44 CSL Ltd.: Key Facts, 2018

Table 5.45 CSL Ltd.: Revenue ($million) and Revenue Shares (%) by Reporting Segment, 2018

Table 5.46 CSL Ltd.: Vaccines Clinical Pipeline

Table 5.47 CSL Ltd.: Strategic Developments, 2015-2018

Table 5.48 Serum Institute of India Pvt. Ltd.: Key Facts, 2018

Table 5.49 Serum Institute of India Pvt. Ltd.: Strategic Developments, 2015-2018

Table 5.50 Astellas Pharma: Key Facts, 2018

Table 5.51 Astellas Pharma: Revenue ($million) and Revenue Shares (%) by Product, 2018

Table 5.52 Astellas Pharma: Vaccines Clinical Pipeline

Table 5.53 Astellas Pharma: Strategic Developments, 2015-2018

Table 5.54 SELLAS Life Sciences Group, Inc.: Key Facts, 2018

Table 5.55 SELLAS Life Sciences Group, Inc.: Vaccines Clinical Pipeline

Table 5.56 SELLAS Life Sciences Group, Inc.: Strategic Developments, 2015-2018

Table 5.57 Novavax, Inc.: Key Facts, 2018

Table 5.58 Novavax, Inc.: Vaccines Clinical Pipeline

Table 5.59 Inovio Pharmaceuticals: Key Facts, 2018

Table 5.60 Inovio Pharmaceuticals: Vaccines Clinical Pipeline

Table 5.61 Inovio Pharmaceuticals: Strategic Developments, 2015-2018

Table 5.62 Mitsubishi Tanabe Pharma Corporation: Key Facts, 2018

Table 5.63 Mitsubishi Tanabe Pharma Corporation: Revenue ($million) and Revenue Shares (%) by Product Type, 2017

Table 5.64 Mitsubishi Tanabe Pharma Corporation: Vaccines Clinical Pipeline

Table 5.65 Mitsubishi Tanabe Pharma Corporation: Vaccines Revenue ($million), AGR (%) 2015-2017

Table 5.66 Mitsubishi Tanabe Pharma Corporation: Vaccines Product Revenue ($million) and Revenue Shares (%), 2017

Table 5.67 Mitsubishi Tanabe Pharma Corporation: Strategic Developments, 2015-2018

Table 5.68 Sun Pharmaceutical Industries Ltd.: Key Facts, 2018

Table 5.69 Sun Pharmaceutical Industries Ltd.: Strategic Developments, 2015-2018

Table 5.70 Gilead Sciences: Key Facts, 2018

Table 5.71 Gilead Sciences: Revenue ($million) and Revenue Shares (%) by Segment, 2017

Table 5.72 Gilead Sciences: Strategic Developments, 2015-2018

Table 5.73 F. Hoffmann-La Roche Ltd.: Key Facts, 2018

Table 5.74 F. Hoffmann-La Roche Ltd.: Vaccines Clinical Pipeline

Table 5.75 F. Hoffmann-La Roche Ltd.: Strategic Developments, 2015-2018

Table 5.76 Takeda Pharmaceutical Company Limited: Key Facts, 2018

Table 5.77 Takeda Pharmaceutical Company: Vaccines Clinical Pipeline

Table 5.78 Takeda Pharmaceutical Company: Strategic Developments, 2015-2018

Table 5.79 Teva Pharmaceutical: Key Facts, 2018

Table 5.80 Teva Pharmaceutical: Revenue ($million) and Revenue Shares (%) by Segment, 2017

Table 5.81 Teva Pharmaceutical: Strategic Developments, 2015-2018

Table 5.82 Bavarian Nordic: Key Facts, 2018

Table 5.83 Bavarian Nordic: Vaccines Clinical Pipeline

Table 5.84 Bavarian Nordic: Strategic Developments, 2015-2018

Table 7.1 Top 20 Companies and Revenue, 2017 ($million)

List of Figures

Figure 4.1 Market Share of Key Companies in the Vaccines Market (%), 2017

Figure 4.2 Market Share of Leading Vaccines in the Market (%), 2017

Figure 4.3 Global Vaccines Revenue ($bn), 2017-2028

Figure 5.1 Merck & Co., Inc.: Historical Revenues ($million), 2013-2017

Figure 5.2 Merck & Co., Inc.: Revenue Shares (%) by Reporting Segment, 2017

Figure 5.3 Merck & Co., Inc.: Revenue Shares (%) by Reporting Segment, 2017

Figure 5.4 Merck & Co., Inc.: Revenue Shares (%) by Region, 2017

Figure 5.5 Merck & Co., Inc.: Diagnostics Revenue ($million), 2015-2017

Figure 5.6 Merck & Co., Inc.: Vaccines Product Revenue Shares (%), 2017

Figure 5.7 Sanofi: Historical Revenues ($million), 2013-2017

Figure 5.8 Sanofi: Revenue Shares (%) by Reporting Segment, 2017

Figure 5.9 Sanofi: Revenue Shares (%) by Region, 2017

Figure 5.10 Sanofi: Diagnostics Revenue ($million), 2015-2017

Figure 5.11 Sanofi: Vaccines Product Revenue Shares (%), 2017

Figure 5.12 Pfizer: Historical Revenues ($million), 2013-2017

Figure 5.13 Pfizer: Revenue Shares (%) by Reporting Segment, 2017

Figure 5.14 Merck & Co., Inc.: Revenue Shares (%) by Reporting Segment, 2017

Figure 5.15 Pfizer: Revenue Shares (%) by Region, 2017

Figure 5.16 Pfizer: Diagnostics Revenue ($million), 2015-2017

Figure 5.17 Pfizer: Vaccines Product Revenue Shares (%), 2017

Figure 5.18 GlaxoSmithKline PLC: Historical Revenues ($million), 2013-2017

Figure 5.19 GlaxoSmithKline PLC: Revenue Shares (%) by Reporting Segment, 2017

Figure 5.20 GlaxoSmithKline PLC: Revenue Shares (%) by Product, 2017

Figure 5.21 GlaxoSmithKline PLC: Revenue Shares (%) by Region, 2017

Figure 5.22 GlaxoSmithKline PLC: Diagnostics Revenue Shares (%), 2017

Figure 5.23 GlaxoSmithKline PLC: Vaccines Revenue Shares (%), 2017

Figure 5.24 GlaxoSmithKline PLC: Vaccines Revenue by Region ($million), 2017

Figure 5.25 Johnson & Johnson: Historical Revenues ($million), 2013-2017

Figure 5.26 Johnson & Johnson: Revenue Shares (%) by Reporting Segment, 2017

Figure 5.27 Johnson & Johnson: Revenue Shares (%) by Product, 2017

Figure 5.28 Johnson & Johnson: Revenue Shares (%) by Region, 2017

Figure 5.29 Johnson & Johnson: Diagnostics Revenue ($million), 2015-2017

Figure 5.30 Johnson & Johnson: Vaccines Revenue Shares (%), 2017

Figure 5.31 AstraZeneca: Historical Revenues ($million), 2013-2017

Figure 5.32 AstraZeneca: Revenue Shares (%) by Reporting Segment, 2017

Figure 5.33 AstraZeneca: Revenue Shares (%) by Region, 2017

Figure 5.34 AstraZeneca: Diagnostics Revenue ($million), 2015-2017

Figure 5.35 AstraZeneca: Vaccines Revenue Shares (%), 2017

Figure 5.36 AstraZeneca: Vaccines Revenue by Region ($million), 2017

Figure 5.37 Emergent Biosolutions: Historical Revenues ($million), 2013-2017

Figure 5.38 Emergent Biosolutions: Revenue Shares (%) by Reporting Segment, 2017

Figure 5.39 Emergent Biosolutions: Revenue Shares (%) by Region, 2017

Figure 5.40 CSL Ltd.: Historical Revenues ($million), 2013-2017

Figure 5.41 CSL Ltd.: Revenue Shares (%) by Reporting Segment, 2018

Figure 5.42 CSL Ltd.: Revenue Shares (%) by Region, 2017

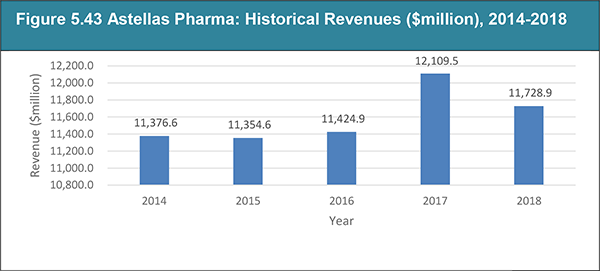

Figure 5.43 Astellas Pharma: Historical Revenues ($million), 2014-2018

Figure 5.44 Astellas Pharma: Revenue Shares (%) by Product, 2018

Figure 5.45 Astellas Pharma: Revenue Shares (%) by Region, 2018

Figure 5.46 Novavax, Inc.: Historical Revenues ($million), 2013-2017

Figure 5.47 Inovio Pharmaceuticals: Historical Revenues ($million), 2013-2017

Figure 5.48 Mitsubishi Tanabe Pharma Corporation: Historical Revenues ($million), 2013-2017

Figure 5.49 Mitsubishi Tanabe Pharma Corporation: Revenue Shares (%) by Product Type, 2017

Figure 5.50 Mitsubishi Tanabe Pharma Corporation: Revenue Shares (%) by Ethical Products, 2017

Figure 5.51 Mitsubishi Tanabe Pharma Corporation: Revenue Shares (%) by Region, 2017

Figure 5.52 Mitsubishi Tanabe Pharma Corporation: Diagnostics Revenue ($million), 2015-2017

Figure 5.53 Mitsubishi Tanabe Pharma Corporation: Vaccines Revenue Shares (%), 2017

Figure 5.54 Sun Pharmaceutical Industries Ltd.: Historical Revenues ($million), 2014-2018

Figure 5.55 Sun Pharmaceutical Industries Ltd.: Revenue Shares (%) by Region, 2018

Figure 5.56 Gilead Sciences: Historical Revenues ($million), 2013-2017

Figure 5.57 Gilead Sciences: Revenue Shares (%) by Segment, 2017

Figure 5.58 Gilead Sciences: Revenue Shares (%) by Product Type, 2017

Figure 5.59 Gilead Sciences: Revenue Shares (%) by Products, 2017

Figure 5.60 Gilead Sciences: Revenue Shares (%) by Region, 2017

Figure 5.61 F. Hoffmann-La Roche Ltd.: Historical Revenues ($million), 2013-2017

Figure 5.62 Mitsubishi Tanabe Pharma Corporation: Revenue Shares (%) by Product Type, 2018

Figure 5.63 F. Hoffmann-La Roche Ltd.: Revenue Shares (%) by Region, 2018

Figure 5.64 Takeda Pharmaceutical Company Limited: Historical Revenues ($million), 2014-2018

Figure 5.65 Takeda Pharmaceutical Company Limited: Revenue Shares (%) by Product Type, 2018

Figure 5.66 Takeda Pharmaceutical Company Limited: Revenue Shares (%) by Region, 2018

Figure 5.67 Teva Pharmaceutical: Historical Revenues ($million), 2013-2017

Figure 5.68 Teva Pharmaceutical: Revenue Shares (%) by Product Type, 2017

Figure 5.69 Teva Pharmaceutical: Revenue Shares (%) by Region, 2017

Figure 5.70 Bavarian Nordic: Historical Revenues ($million), 2013-2017

Figure 5.71 Bavarian Nordic: Revenue Shares (%) by Region, 2017

Figure 6.1 SWOT Analysis of the Global Vaccines Market, 2018

AELIX Therapeutics

Afferent Pharmaceuticals

Astellas Pharma Inc.

AstraZeneca

Bavarian Nordic A/S

Bayer

BIKEN Co. Ltd.

BioJect Medical Technologies Inc.

Biological E. Limited

BioNTech

CSL Ltd.

Daiichi Sankyo Co., Ltd.

Dyadic International, Inc.

Emergent Biosolutions, Inc.

Evaxion Biotech

F. Hoffmann-La Roche Ltd.

Ganymed Pharmaceuticals AG

Genentech, Inc.

GeneOne Life Science Inc.

Gilead Sciences, Inc.

GlaxoSmithKline PLC

GlaxoWellcome

GlobeImmune

GlycoVaxyn AG

Hitachi Ltd.

HitGen Ltd.

Hookipa Pharma

Immunomic Therapeutics, Inc.

Inovio Pharmaceuticals Inc.

IOmet

Janssen Pharmaceutical Companies

Janssen Vaccines & Prevention B.V.

Johnson & Johnson

MedImmune, LLC

Merck & Co., Inc.

Mitsubishi Tanabe Pharma Corporation

Moderna

Nanotherapeutics

Novavax, Inc.

PaxVax

Pfizer Inc.

Plumbline Life Sciences, Inc.

Poonawalla Investment & Industries Pvt. Ltd.

Potenza Therapeutics, Inc.

Protein Sciences

Regeneron Pharmaceuticals, Inc.

Roche

Sanofi

SELLAS Life Sciences Group, Inc.

Seqirus

Serum Institute of India Pvt. Ltd.

Shionogi

SmithKline Beecham

Sun Pharmaceutical Industries Ltd.

Takeda Pharmaceutical Company Ltd.

Teva Pharmaceutical

Valneva SE

Zydus Cadila

List of Organizations Mentioned in the Report

Biomedical Advanced Research and Development Authority (BARDA)

Centers for Disease Control and Protection (CDC)

Defense Advanced Research Projects Agency

Drexel University

Global Alliance for Vaccines and Immunization (GAVI)

International Centre for Genetic Engineering and Biotechnology (ICGEB)

Mayo Clinic

National Cancer Institute

National Institute of Allergy and Infectious Diseases

National Institutes of Health

National Microbiology Laboratory of the Public Health Agency of Canada

Oswaldo Cruz Foundation

Pan American Health Organization (PAHO)

The Jenner Institute

The Ministry of Health, Labour and Welfare and the Health Service Bureau

The National Institute of Virology (NIV), Pune

The Parker Institute for Cancer Immunotherapy

The US Department of Health and Human Services (HHS)

The Wistar Institute

U.S. Army Medical Research Institute of Infectious Diseases

UNICEF

University of Oxford

University of Pennsylvania

University of Tokyo

Walter Reed Army Institute of Research

Download sample pages

Complete the form below to download your free sample pages for Top 20 Vaccines Manufacturers 2019

Related reports

-

Drug Delivery Technologies Market Forecast 2019-2029

The Drug Delivery Technologies market is estimated to grow at a CAGR of 8.3% in the first half of the...

Full DetailsPublished: 27 February 2019 -

Global Vaccine Contract Manufacturing Market Report 2018-2028

The global vaccine contract manufacturing market was worth $883.0m in 2017 and is expected to grow at a CAGR of...

Full DetailsPublished: 06 March 2018 -

Top 50 Bioreactor Manufacturers 2019

Asia-Pacific bioreactors market is anticipated to be the fast-growing market in the forecast period with a CAGR of 8.0% from...

Full DetailsPublished: 25 March 2019 -

Medical Device Leader Series: Top Pre-Filled Injection Device Manufacturers 2018-2028

The Pre-Filled Device Manufacturing market is estimated to reach $7.5bn in 2022, growing at a CAGR of 10.5% from 2017...Full DetailsPublished: 13 November 2018 -

Global Influenza Vaccines Market Outlook 2018-2028

The latest report from business intelligence provider visiongain offers comprehensive analysis of the global influenza vaccines market. Visiongain assesses that...

Full DetailsPublished: 19 June 2018 -

Pharma Leader Series: Top 50 Pharmaceutical Contract Manufacturing Organisations (CMOs) Market 2018

Contract manufacturing represents the largest sector of the pharma outsourcing industry. Pharmaceutical companies have sought to take advantage of the...Full DetailsPublished: 28 September 2018 -

Global Bioreactors Market 2019-2029

The global bioreactors market is expected to grow at a CAGR of 7.5% in the second half of the forecast...

Full DetailsPublished: 18 December 2018 -

Lyophilization in Pharmaceutical Market Forecast 2019-2029

The global lyophilization in pharmaceutical market is estimated to have reached $5.6bn in 2018. The pharmaceutical and biotechnology segment held...Full DetailsPublished: 28 March 2019 -

Vaccine Sales Market Forecast 2018-2028

The Global Vaccines Sales market was valued at $36.9 billion in 2017. This value will grow to $61.1bn in 2022...

Full DetailsPublished: 09 March 2018 -

Biologics Market Trends and Forecasts 2018-2028

The global biologics market is estimated to reach $250bn in 2023. The market is expected to grow at a CAGR...

Full DetailsPublished: 14 November 2018

Download sample pages

Complete the form below to download your free sample pages for Top 20 Vaccines Manufacturers 2019

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Drug Delivery Technologies Market Report 2024-2034

The global Drug Delivery Technologies market is estimated at US$1,729.6 billion in 2024 and is projected to grow at a CAGR of 5.5% during the forecast period 2024-2034.

23 April 2024

Visiongain Publishes Cell Therapy Technologies Market Report 2024-2034

The cell therapy technologies market is estimated at US$7,041.3 million in 2024 and is projected to grow at a CAGR of 10.7% during the forecast period 2024-2034.

18 April 2024

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024

Visiongain Publishes Anti-obesity Drugs Market Report 2024-2034

The global Anti-obesity Drugs market is estimated at US$11,540.2 million in 2024 and is expected to register a CAGR of 21.2% from 2024 to 2034.

12 April 2024