Industries > Pharma > Biological Drug API Manufacturing Services World Industry and Market Predictions 2018-2028

Biological Drug API Manufacturing Services World Industry and Market Predictions 2018-2028

Mammalian Cell Cultures, Microbial Fermentations, Other Expression Systems, Human Growth Hormones, Insulin, Interferons, Monoclonal Antibodies, Vaccines

The biological drug API manufacturing market is estimated to grow at a CAGR of 9.0% in the first half of the forecast period. In 2017, Mammalian cell culture systems submarket represents the largest submarket within the biological drug API manufacturing industry.

How this 209-page report delivers:

• Provides qualitative and quantitative analysis of the leading submarkets the period 2018-2028. Visiongain forecasts revenues and their growth for these submarkets:

• Mammalian cell culture

• Microbial fermentation

• Other expression platforms

• Provides qualitative and quantitative analysis of the leading contract API biological drug applications for the period 2018-2028. Visiongain forecasts contract API drug revenues to 2028 for these individual segments:

• Monoclonal antibody (mAb) therapies

• Vaccines

• Insulin therapies

• Interferon therapies

• Growth hormones

• Find forecasts of the leading national markets from 2018 to 2028:

• The EU, including the five leading markets (UK, Germany, France, Italy and Spain).

• The US

• Japan

• Switzerland

• Emerging markets such as the BRIC (Brazil, Russia, India, and China) countries, South Korea and Singapore.

• Profiles leading global and national companies that offer biotech API manufacturing services to the pharmaceutical industry. For each company, current services offered, recent developments and outlooks are discussed. Leading CMOs profiled in this chapter are:

• Boehringer Ingelheim BioXcellence

• Celltrion

• DSM Biologics

• Lonza

• Samsung BioLogics

• Cytovance Biologics

• Fujifilm Diosynth Biotechnologies

• Operations of leading biopharma companies, such as AbbVie, GSK and Novartis.

• Provides qualitative analysis: SWOT and STEP Analysis of the biological drug API manufacturing market.

• Discover the regulatory outlook for biotech API manufacturing in leading regional and national markets in 2017, as well as predicted developments for the period to 2028.

• Identify important drug development and technology trends that will affect CMOs, their clients and other market participants from 2017. The report also contains SWOT and STEP analysis of the industry and market.

• Find profiles for leading CMOs offering biological drug API manufacturing services to pharmaceutical companies.

• 103 charts unavailable elsewhere

Visiongain’s study is intended for anyone requiring commercial analyses for the biological drug API manufacturing market. You find data, trends and predictions.

Buy our report today Biological Drug API Manufacturing Services World Industry and Market Predictions 2018-2028: Mammalian Cell Cultures, Microbial Fermentations, Other Expression Systems, Human Growth Hormones, Insulin, Interferons, Monoclonal Antibodies, Vaccines.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Contract Biological Drug API Manufacturing: World Market Review 2017

1.2 Benefits of this Report

1.2.1 How This Report Delivers

1.2.2 Main Questions Answered by This Analytical Report

1.3 Who is This Report For?

1.4 Methods of the Study

1.5 Frequently Asked Questions (FAQ)

1.6 Some Associated Reports

1.7 About Visiongain

2. Introduction to Biological drug API Manufacturing Services

2.1 What are Biological drug API Manufacturing Services?

2.1.1 Producing Biological drug API: An Overview of the Manufacturing Process

2.1.2 Defining the Biological drug API Manufacturing Market

2.1.3 Differing Expression Systems to Manufacture APIs

2.2 Challenges in Manufacturing Biological drug API

2.3 Outsourcing: A Common Trend in Biological drug API Manufacturing Services

2.4 Future Trends for the Biological drug API Manufacturing Services Market

3. Biological drug API Manufacturing Services: World Market Outlook and Forecast 2017-2028

3.1 The Contract Biological drug API Manufacturing Services Market Performance, 2017

3.1.1 Contract Biological drug API Manufacturing Services: Forecast 2017-2028

3.2 Drivers and Restraints in the Biological Drug API Manufacturing Services Market

3.2.1 Drivers in the Biological Drug API Manufacturing Market

3.2.1.1 The Ageing Population is a Driver for Growth

3.2.1.2 The Patent Cliff Effect Will Stimulate Biologics and Biosimilar Development

3.2.1.3 Outsourcing as a Driver for Growth

3.2.1.4 Opportunities from the Long Pipeline Will Drive Growth

3.2.1.5 Increased Investment in Orphan Drugs from Companies

3.2.1.6 Emerging Markets Will Grow and Influence the Market

3.2.1.7 Technological Changes: Single-Use Technology Will Become Essential in the Next 10 Years

3.2.2 Restraints on Growth in the Biological drug API Manufacturing Services Market

3.2.2.1 Pricing Pressures Will Limit Market Growth

3.2.2.2 Regulatory Restrictions Will Increase

3.2.2.3 Overcapacity Will Be Adverse to Market Growth for CMOs

3.2.2.4 Complexity of API Production is a Challenge

3.3 Outlook for the Outsourced Biological drug API Services: Increased Demand

4. Biological drug API Manufacturing Services Submarkets: World Market Outlook and Forecasts 2017-2028

4.1 Submarkets for the Biological drug API Manufacturing Services Industry

4.1.1 The Mammalian Cell Culture Submarket

4.1.2 The Mammalian Cell Culture Submarket Forecast 2017-2028

4.1.3 ADCs and Next-Generation Antibodies Will Drive Growth 2017-2028

4.1.4 The Microbial Fermentation Submarket

4.1.5 The Microbial Fermentation Submarket Forecast 2017-2028

4.1.5.1 Increase in Demand for Insulin Will Drive Growth 2017-2028

4.1.6 Other APIs Expression Systems Are Still in Development

4.1.6.1 Plant-Made Pharmaceuticals

4.1.6.2 Yeast Cell Expression Systems

4.1.6.3 Insect Cell Expression Systems

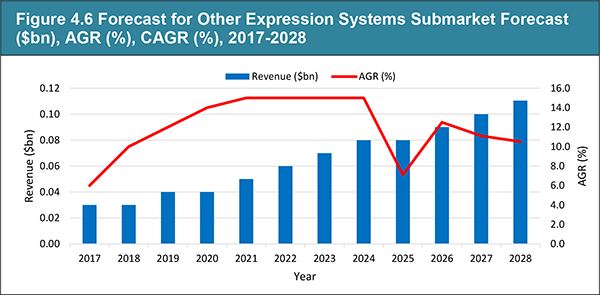

4.1.6.4 Other Expression Systems Submarket Forecast 2017-2028

4.2 Chapter Summary: Positive Growth for the Market

5. Biological drug API Manufacturing: Outlook for Leading Biological Drug Contract API Sectors: 2017-2028

5.1 Antibody Therapies: An Introduction to the Largest Contract API Biological Drug Sector

5.1.1 Contract API Monoclonal Antibody Manufacturing Forecast 2017-2028

5.1.2 Outlook: Outsourced Manufacturing for Monoclonal Antibody APIs Will Increase

5.2 Contract API Vaccine Manufacturing: A Promising Opportunity for CMOs

5.2.1 Contract API Vaccine Market: Outlook and Forecast 2017-2028

5.2.2 Challenges in Manufacturing Vaccines

5.3 Introduction to the Insulin Therapies Market and Outlook for the Contract API Insulin Therapies Market

5.3.1 Contract API Insulin Analogues Forecast 2017-2028

5.3.2 Insulin Analogues: In-House Production Restrains Contract API Insulin Therapies Market Growth

5.3.3 Development Trends in the Contract API Insulin Market 2017 to 2028

5.4 Introduction to the Interferon Therapy Market and Outlook for the Contract API Interferon Therapy Market

5.4.1 Contract API Interferon Market Forecast 2017-2028

5.4.2 Unlikely to be Opportunities in the Contract API Interferon Market

5.5 Introduction to the Growth Hormone Market and Outlook for the Contract API Growth Hormone Manufacturing Market

5.5.1 Contract API Growth Hormone Market Forecast 2017 to 2028

5.5.2 Most Manufacturing is In-House for Growth Hormone Production

5.5.3 Long-Acting Therapies Provide Opportunity for Outsourcing

5.6 Chapter Summary: Outsourcing for Key Biological

Products 2017-2028

6. Leading National Markets for Contract Biological drug API Manufacturing Services 2017-2028

6.1 Regional Breakdown of the World Biological drug API Manufacturing Services Market

6.1.1 US and EU Dominate Growth for Leading National Submarkets 2017-2028

6.1.2 National Revenue Shares by 2028: Emerging Market Growth

6.2 Contract Biological drug API Manufacturing in EU Market 2017-2028

6.2.1 Strong Growth for the EU Revenue Forecasts 2017-2028

6.2.2 Forecasts for Switzerland and Leading EU National Revenues 2017-2028

6.2.2.1 Germany Leads the EU Biotech Market with Strong Growth

6.2.2.2 UK: Strong Research Sector Will Drive Market Growth

6.2.2.3 France: Strong Vaccine Development Industry

6.2.2.4 Switzerland: Headquarters for Leading Companies

6.2.2.5 Spain: Numerous Biotech Companies

6.2.2.6 Italy: Outlook and Forecast 2017-2028

6.2.3 US: A Market Leader in Biological drug API Manufacturing

6.2.4 Japan: A Less Mature Contract Manufacturing Market

6.2.5 BRIC Market: Outlook and Forecasts for Emerging Markets 2017 - 2028

6.2.5.1 Emerging Nations May Develop a Presence in the Biologics Market

6.2.5.2 Increased Demand for Biosimilars and Biological Drugs 2017-2028

6.2.5.3 China is Poised for Growth: Forecast for 2017-2028

6.2.5.4 India Offers a Lower-Cost Advantage for Biological drug API Manufacturing Services: Forecast 2017-2028

6.2.5.5 Brazilian and Russian Governments Promoting Domestic Biotech Development

6.2.5.6 Russian Biological drug API Manufacturing Services Forecast: 2017-2028

6.2.5.7 Brazilian Biological drug API Manufacturing Services Forecast: 2017-2028

6.2.6 South Korea: Market Forecast, 2017-2028

6.2.6.1 Leading CMOs Celltrion and Samsung BioLogics Drive the Market

6.2.7 Singapore: Market Forecast, 2017-2028

6.3 Summary of Chapter: Outlook for Leading National Submarkets 2017-2028

7. Leading CMOs in the Biological drug API Manufacturing Services Market

7.1 Four Companies Led the Market in 2017

7.2 Leading Companies by Capacity

7.2.1 Small-Scale Biopharmaceutical Manufacturing is a Common Trend

7.2.2 Barriers to Market Entry 2017-2028

7.2.2.1 The High Cost of Facilities: Acquisition as a Cheaper Alternative

7.3 FDA Opens Barriers for the Biosimilars Market

7.4 Boehringer Ingelheim BioXcellence

7.4.1 Strategic Outlook: Expanding into the Asian Market

7.5 Celltrion: Biologics Leader in Asia

7.5.1 Celltrion: Likely Target for Mergers and Acquisitions?

7.6 DSM Biologics: Strategically Increasing Capacity

7.7 Lonza Has the Largest Worldwide Cell Culture Capacity

7.7.1 Lonza: Biopharmaceutical Core Competency as a Strategy for Growth

7.8 Other Market Players of Interest in 2017

7.8.1 Samsung BioLogics: Focusing on Biosimilars

7.8.2 Cytovance Biologics: Plans to Expand

7.8.3 Fujifilm Diosynth Biotechnologies

7.8.3.1 Facility and Service Expansion for the Future

7.9 Leading Biopharma Companies Operate CMO Divisions

7.9.1 AbbVie Contract Manufacturing: Strength through Acquisition

7.9.2 GSK Biopharmaceuticals

7.9.3 Sandoz: Expertise in Biologics and Biosimilars

7.9.4 Rentschler Biotechnologie: Recent Expansions

7.10 Teva: A Future Player in the Biologics Market

7.11 Catalent Offers a New Platform through Partnership

7.12 Chapter Summary: Leading Companies 2017-2028

8. Biological drug API Manufacturing Services Market Industry Trends 2017-2028: Qualitative Analysis

8.1 SWOT Analysis: Strengths and Weaknesses of the Biological drug API Manufacturing Services Market 2017

8.1.1 Biopharmaceutical Demand for Outsourcing is increasing

8.1.2 A Fragmented Market with a Costly and Difficult Manufacturing Process

8.2 Opportunities for the Biological drug API Manufacturing Services Market 2017-2028

8.3 Threats for the Biological drug API Manufacturing Services Market 2017-2028

8.4 STEP Analysis of the Biological drug API Manufacturing Services Market

8.4.1 Social Factors: Drug Pricing Pressures to Meet Demand for an Increasing Ageing Population

8.4.2 Technological Factors: Advances Will Drive Growth

8.4.2.1 Single-Use Technology: A Vital Trend for the Future

8.4.3 Economic Factors: The High Cost of Manufacturing Will Lead to Outsourcing

8.4.4 Political Factors: Regulatory Requirements Need to Be Met

8.5 Trends in Biological Drug Development 2017-2028

8.5.1 Biosimilars Will Be an Important Opportunity for CMOs

8.5.2 CMOs are investing in Next-Generation Antibody Development

8.5.3 Orphan Drugs and Personalised Medicine: Trend for Smaller Batches

8.5.4 Outlook for Single-Use Technologies in Biological drug API Manufacturing 2017-2028

8.5.5 Outsourcing Trends for Biological drug API Manufacturing 2017-2028

8.5.5.1 Biopharma Companies Continue to Invest in In-House Facilities

8.5.5.2 Off-shoring Biological drug API Manufacturing to Emerging Markets: Not a Trend for this Decade?

8.5.5.3 Overcapacity is a Risk for the Biotech CMO Industry

8.5.5.4 Future Trends: Strategic Partnering

8.5.5.5 Alternative Expression Methods

8.6 Regulations and Effects on the Biological drug API Manufacturing Services Industry

8.6.1 Effect on the Emerging Biological drug API Manufacturing Services Market 2017-2028

8.6.2 Regulations in Other Countries in the Biological drug API Market

8.7 Chapter Summary: Industry Trends for Contract Biological drug API Manufacturing to 2028

9. Conclusions

9.1 The Contract Biological drug API Manufacturing Services Market

9.2 Outlook for the Biological drug API Manufacturing Services Market

9.2.1 Mammalian Cell Culture is the Leading Expression Platform for Outsourced Biological drug API Manufacturing

9.2.2 The US and EU Markets Lead for the Global Biological drug API Manufacturing Services Market in 2017

9.2.3 Single-Use Technology Will Become Indispensable for Success in the Market

9.3 Growth in the Market 2017-2028

9.3.1 The Future of the Biological drug API Manufacturing Services Marketplace

Appendices

Glossary

Some Associated Reports

Visiongain Report Sales Order Form

About Visiongain

Visiongain Report Evaluation Form

List of Tables

Table 2.1 Contract API Manufacturing: Revenues ($bn) and Market Share (%) by Sector, 2017

Table 3.1 Contract Biological drug API Manufacturing Services Market: Overall Revenue Forecast ($bn), AGR (%), CAGR (%), 2017-2028

Table 4.1 Contract Biological drug API Manufacturing: Overall World Market and Main Submarket Revenue Forecasts ($bn), AGR (%), CAGR (%), 2017-2028

Table 4.2 ADC Pipeline 2017

Table 4.3 Mammalian Cell Culture Submarket: API Revenue Forecast ($bn), AGR (%), CAGR (%), 2017-2028

Table 4.4 Selected CMOs Investing in Biological API Manufacturing Capacity, 2017

Table 4.5 Microbial Fermentation: API Submarket Revenue Forecast ($bn), AGR (%), CAGR (%), 2017-2028

Table 4.6 Other Expression Systems Submarket Two-Year Forecast Revenues ($bn), AGR (%), 2017-2028

Table 5.1 Top Ten Best-Selling Drugs in 2017: Revenue ($bn)

Table 5.2 Contract API Biological Drug Revenue Forecasts ($bn), AGR (%), CAGR (%), by Therapeutic Area, 2017-2028

Table 5.3 Monoclonal Antibody Types and Sources

Table 5.4 Monoclonal Antibody Market: Contract API Revenue Forecast ($bn), CAGR (%), AGR (%), 2017-2028

Table 5.5 The Four Classes of Next- Generation Antibody Therapies

Table 5.6 Vaccines Market: Contract API Revenue Forecast ($bn), GAGR (%), AGR (%) 2017-2028

Table 5.7 Insulin Therapies Market: Contract API Revenue Forecast ($bn), AGR (%), CAGR (%), 2017-2028

Table 5.8 Interferon Therapies Market: Contract API Revenue Forecast ($bn), CAGR (%), AGR (%), 2017-2028

Table 5.9 Growth Hormones Market: Contract API Revenue Forecast ($bn), CAGR (%), AGR (%), 2017-2028

Table 5.10 Selected Long-Acting Growth Hormones in Development, 2017

Table 6.1 Contract Biological drug API Manufacturing Market: Revenues ($bn) and Market Shares (%) by Region, 2017

Table 6.2 Contract Biological drug API Manufacturing Market: Leading Regional and National Revenue Forecasts ($bn), CAGR (%), AGR (%), 2017-2028

Table 6.3 Contract Biological drug API Manufacturing Market: National Revenue Two Year Shares (%), 2017-2028

Table 6.4 EU and Switzerland Contract Biological drug API Manufacturing: Revenue Forecasts ($bn), GAGR (%), AGR (%), 2017-2028

Table 6.5 EU and Switzerland Contract Biological drug API Manufacturing: Revenues ($bn) and Shares (%) by Leading Country, 2017

Table 6.6 Germany Contract Biological drug API Manufacturing Revenue Forecast ($bn), GAGR (%), AGR (%), 2017-2028

Table 6.7 UK Contract Biological drug API Manufacturing Revenue Forecast ($bn), GARG (%), AGR (%), 2017-2028

Table 6.8 France Contract Biological drug API Manufacturing Revenue Forecast ($bn), GARG (%), AGR (%), 2017-2028

Table 6.9 Switzerland Contract Biological drug API Manufacturing Revenue Forecast ($bn), CAGR (%), AGR (%), 2017-2028

Table 6.10 Spain Contract Biological drug API Manufacturing Revenue Forecast ($bn), CAGR (%), AGR (%),2017-2028

Table 6.11 Italian Contract Biological drug API Manufacturing Revenue Forecast ($bn), CAGR (%), AGR (%), 2017-2028

Table 6.12 US Contract Biological drug API Manufacturing Revenue Forecast ($bn), CAGR (%), AGR (%), 2017-2028

Table 6.13 Japanese Contract Biological drug API Manufacturing Revenue Forecast ($bn), CAGR (%), AGR (%), 2017-2028

Table 6.14 Contract Biological drug API Manufacturing Market: BRIC National Revenue Forecasts ($bn), CAGR (%), AGR (%), 2017-2028

Table 6.15 BRIC Markets: API Revenues ($bn) and Market Shares (%), 2017

Table 6.16 Chinese Contract Biological drug API Manufacturing Revenue Forecast ($bn), CAGR (%), AGR (%), 2017-2028

Table 6.17 India Contract Biological drug API Manufacturing Revenue Forecast ($bn), GAGR (%), AGR (%) 2017-2028

Table 6.18 Russia Contract Biological drug API Manufacturing Revenue Forecast ($bn), CAGR (%), AGR (%), 2017-2028

Table 6.19 Brazilian Contract Biological drug API Manufacturing Revenue Forecast ($bn), CAGR (%), AGR (%), 2017-2028

Table 6.20 South Korean Contract Biological drug API Manufacturing Revenue Forecast ($bn), CAGR (%), AGR (%), 2017-2028

Table 6.21 Selected Biotechs and Pharmaceutical Companies with Manufacturing Facilities in Tuas, 2015

Table 6.22 Singaporean Contract Biological drug API Manufacturing Revenue Forecast ($bn), CAGR (%), AGR (%), 2017-2028

Table 7.1 Leading Biological drug API CMOs: Mammalian Cell Culture and Microbial Fermentation Manufacturing Scale, 2017

Table 7.2 Selected Other Biological drug API CMOs: Mammalian Cell Culture and Microbial Fermentation Manufacturing Scale, 2017

Table 7.3 Boehringer Ingelheim BioXcellence: Manufacturing Capacity, 2017

Table 7.4 Boehringer Ingelheim BioXcellence: Revenue ($bn), 2014-2016

Table 7.5 Celltrion: Revenue ($bn), CAGR (%), AGR (%), 2015-2017

Table 7.6 Lonza: Pharmaceutical Contract Manufacturing Revenue ($bn), CAGR (%), AGR (%), 2013-2014

Table 7.7 Sandoz Biosimilar Pipelines: Selected Biosimilars, 2017

Table 8.1 Contract Biological drug API Manufacturing Market: Strengths and Weaknesses, 2017

Table 8.2 Contract Biological drug API Manufacturing Market: Opportunities and Threats, 2017-2028

Table 8.3 Biological drug API Manufacturing Services Market: STEP Analysis, 2017

Table 8.4 Selected EU-Approved Biosimilars: Manufacturers and Companies, 2017

Table 8.5 Approved Next-Generation Antibody Therapies, 2017

Table 9.1 Contract Biological drug API Manufacturing Market: Revenue Forecasts ($bn) by Sector, 2018, 2020, 2022, 2024, 2026 and 2028

Table 9.2 Contract Biological drug API Manufacturing Market: Revenue Forecasts ($bn) by Region, 2018, 2020, 2022, 2024, 2026 and 2028

List of Figures

Figure 1.1 Biological Drug API Manufacturing Services Submarkets 2017

Figure 2.1 Steps for Biological Drug Manufacturing, 2017

Figure 2.2 Contract API Manufacturing: Market Shares by Sector (%), 2017

Figure 2.3 Future Trends in the Biological drug API Manufacturing Market, 2017-2028

Figure 3.1 Contract Biological drug API Manufacturing Services Market: Revenue Forecast ($bn), AGR (%), 2017-2028

Figure 3.2 Contract Biological drug API Manufacturing: Market Drivers, 2017-2028

Figure 3.3 Contract Biological drug API Manufacturing: Market Restraints, 2017-2028

Figure 4.1 Contract Biological drug API Manufacturing: Market Shares (%) by Sector, 2017

Figure 4.2 Mammalian Cell Culture Submarket Forecast, Revenue ($bn), AGR (%), 2017-2028

Figure 4.3 Mammalian Cell Culture Submarket: Drivers and Restraints, 2017-2028

Figure 4.4 Microbial Fermentation Submarket Forecast($bn), AGR (%), 2017-2028

Figure 4.5 Microbial Fermentation Submarket: Drivers and Restraints, 2017

Figure 4.6 Forecast for Other Expression Systems Submarket Forecast ($bn), AGR (%), CAGR (%), 2017-2028

Figure 5.1 Leading Contract API Biological Drug by Sector, 2017

Figure 5.2 Monoclonal Antibody Market: Contract API Revenues Forecast ($bn), AGR (%), 2017-2028

Figure 5.3 Vaccines Market: Contract API Revenues Forecast ($bn), AGR (%) 2017-2028

Figure 5.4 Comparison between biomanufacturing platforms for Vaccine production: VLP

Figure 5.5 Insulin Therapies Market: Contract API Revenues Forecast ($bn), AGR (%), 2017-2028

Figure 5.6 Interferon Therapies Market: Contract API Revenues Forecast ($bn), AGR (%), 2017-2028

Figure 5.7 Growth Hormones Market: Contract API Revenues Forecast ($bn), AGR (%), 2017-2028

Figure 6.1 Contract Biological drug API Manufacturing: Market Shares by Region (%), 2017

Figure 6.2 Contract Biological drug API Manufacturing: Market Shares by Region (%) 2020

Figure 6.3 Contract Biological drug API Manufacturing: Market Shares by Region (%) 2028

Figure 6.4 EU and Switzerland Contract Biological drug API Manufacturing Revenue Forecast ($bn), AGR (%), 2017-2028

Figure 6.5 EU Contract Biological drug API Manufacturing: Leading National Revenue Shares (%), 2017

Figure 6.6 Germany Contract Biological drug API Manufacturing Revenue Forecast ($bn), 2017-2028

Figure 6.7 UK Contract Biological drug API Manufacturing Revenue Forecast ($bn), AGR (%), 2017-2028

Figure 6.8 France Contract Biological drug API Manufacturing Revenue Forecast ($bn), AGR (%), 2017-2028

Figure 6.9 Switzerland Contract Biological drug API Manufacturing Revenue Forecast ($bn), AGR (%), 2017-2028

Figure 6.10 Spanish Contract Biological drug API Manufacturing Revenue Forecast ($bn), AGR (%), 2017-2028

Figure 6.11 Italian Contract Biological drug API Manufacturing Revenue Forecast ($bn), AGR (%), 2017-2028

Figure 6.12 US Contract Biological drug API Manufacturing Revenue Forecast ($bn), AGR (%), 2017-2028

Figure 6.13 Japanese Contract Biological drug API Manufacturing Revenue Forecast ($bn), AGR (%), 2017-2028

Figure 6.14 Contract Biological drug API Manufacturing Market: BRIC National Revenue Forecasts ($bn), AGR (%), 2017 -2028

Figure 6.15 Biologics Market: BRIC Revenue Shares (%), 2017

Figure 6.16 Chinese Contract Biological drug API Manufacturing Revenue Forecast ($bn), CAGR (%), AGR (%), 2017-2028

Figure 6.17 India Contract Biological drug API Manufacturing Revenue Forecast ($bn), AGR (%), 2017-2028

Figure 6.18 Russia Contract Biological drug API Manufacturing Revenue Forecast ($bn), AGR (%), 2017-2028

Figure 6.19 Brazilian Contract Biological drug API Manufacturing Revenue Forecast ($bn), AGR (%), 2017-2028

Figure 6.20 South Korean Contract Biological drug API Manufacturing Revenue Forecast ($bn), AGR (%), 2017-2028

Figure 6.21 Singaporean Contract Biological drug API Manufacturing Revenue Forecast ($bn), AGR (%), 2017-2028

Figure 7.1 Leading Biological drug API CMOs: Mammalian Cell Culture Manufacturing Scale, 2017

Figure 7.2 Leading Biological drug API CMOs: Microbial Fermentation Manufacturing Scale, 2017

Figure 7.3 Boehringer Ingelheim BioXcellence: Revenue ($bn), 2014-2016

Figure 7.4 Celltrion: Revenue ($bn), 2015-2017

Figure 7.5 DSP: Pharmaceutical Biotech Manufacturing Revenue ($bn), 2011-2015

Figure 7.6 Lonza: Pharmaceutical Contract Manufacturing Revenue ($bn), 2013-2017

Figure 9.1 Contract Biological drug API Manufacturing Market: Revenue Forecasts ($bn) by Sector, 2017 - 2028

Figure 9.2 Contract Biological drug API Manufacturing Market: Revenue Forecasts ($bn) by Region, 2018, 2020, 2022, 2024, 2026 and 2028

Abasria

AbbVie

Accord Healthcare

Acquired Cedarburg Pharmaceuticals,

Actavis Generics

Adaptimmune Therapeutics

Agensys

Althera Technologies

Altus Pharmaceuticals

Amgen

Apotex

Aptuit

arGEN-X

Ascendis Pharma A/S

Asterion

Astra Zeneca

Avid Bioservices Inc

Bakhu Pharma.

Banner Life Sciences

Basaglar

Baxalta

Baxter

Bayer

Bever Pharmaceutical

Biocad

Biocon

Biogen

Biogen Idec

BMS

Boehringer Ingelheim

Boehringer Ingelheim BioXcellence

Bolder BioTechnology

Calico Life Science

Caspugel

Catalent Biologics

Celgene

Celldex Therapautics

Celltrion

Cinfa

CMC Biologics

CMIC Holdings Co. Ltd.

CMO Relthy Laboratórios

Cook Pharmica

Critical Pharmaceuticals

CT Arzneimittel

Cytos Biotechnology

Cytovance Biologics

DPx Fine Chemicals

DPx Holdings B.V.

DSM Biologics

DSM Sinochem Pharmaceuticals

Eli Lily

EMD Millipore

Ferring Pharmaceuticals

Filnox Biotech

Fresenius

Fujifilm Diosynth Biotechnologies

Gallus BioPharmaceuticals,

GE Healthcare

Genentech

GeneScience Pharmaceuticals Co., Ltd.

Genexine and Handok

Genmab

Genzyme

Gilead Sciences, Inc.

GSK

Hanmi Pharmaceutical Co.

Hexal

Index Ventures

Infarco

Infinity Pharmaceuticals

Inno Biologics

Innovation Network Corporation of Japan (INCJ),

Johnson and Johnson

Johnson Matthey

JSR Corporation

Kalon Biotherapeutics

KBI Biopharma, Inc.

Kemwell

Kyowa Hakko Kirin

Labrys Biologics Inc,

Laureate Biopharma

LG Life Sciences, Ltd.

Lonza

Matrix Laboratories

Merck

Mitsubishi Gas Chemical Company

Mylan

Neopharm

Nikon

Nippon kayaku

Norbitec

Novartis

Novasep

Novo Nordisk

Nuron Biotech

Nycomed

Opko Health

Patheon

PelChem

Peregrine Pharmaceuticals

Perrigo

Pfizer

Pharmstandard

Phyton Biotech

Piramal Healthcare

Precision Biologics

Progenics

Quintiles

Rebtschler Biotechnologie

Recepta Biopharma

Redwood Bioscience

Rentschler

Rentschler Biotechnologie

Roche

RoYal DSM

SAFC

Samsung BioLogics

Sanofi

SCM Pharma

Seattle Genetics

ShangPharma

SICOR Biotech

Sigma-Aldrich Corporation

Stada

SunShine Biopharma

SynCo BioPartners

Takeda

Teva

Therapure Biopharma

Thermo Fisher

Toyobo Biologics

Transgene SA

Versartis

Vertex

Vida Pharma

VTU

WuXi Biologics,

WuXi PharmaTech

Zhangjiang Biotech

Zhejiang Jiang Yuan Tang Biotechnology

ZJ Base

List of Organisations Mentioned in the Report

FDA

Germany’s Institut für Qualität und Wirtschaftlichkeit im Gesundheitswesen (IQWiG)

Japanese Ministry of Health, Labour and Welfare

NHS

NICE

WHO

Download sample pages

Complete the form below to download your free sample pages for Biological Drug API Manufacturing Services World Industry and Market Predictions 2018-2028

Related reports

-

Gene Therapy R&D and Revenue Forecasts 2018-2028

The gene therapy market is projected to grow at a CAGR of 41.1% in the first half of the forecast...

Full DetailsPublished: 31 May 2018 -

Global Next-Generation Antibody Therapies Market Forecast 2018-2028

The global next-generation antibody therapies market reached $4bn in 2017 and is estimated to reach $17bn by 2023. In 2017,...

Full DetailsPublished: 26 September 2018 -

Pharma Leader Series: 25 Top Biosimilar Drug Manufacturers 2017-2027

Our 233-page report provides 126 tables, charts, and graphs, giving a clear view on companies in the biosimilar market. Who...Full DetailsPublished: 31 August 2017 -

Top 25 Antibiotic Drugs Manufacturers 2018

Visiongain forecasts the antibiotic drugs market to increase to $ 43,841.7m in 2022. The market is estimated to grow at...

Full DetailsPublished: 12 June 2018 -

Biologics Market Trends and Forecasts 2018-2028

The global biologics market is estimated to reach $250bn in 2023. The market is expected to grow at a CAGR...

Full DetailsPublished: 14 November 2018 -

Global Ophthalmic Drugs Market Forecast 2018-2028

The global ophthalmic drugs market is expected to grow at a CAGR of 4.4% in the first half of the...

Full DetailsPublished: 26 June 2018 -

Global Rheumatoid Arthritis Drugs Market Forecast 2019-2029

The global rheumatoid arthritis drugs market will reach $47bn in 2024. In 2018, the Biologics submarket held 87% of the...

Full DetailsPublished: 17 December 2018 -

Pharmaceutical Contract Manufacturing Market 2018-2028

The pharmaceutical contract manufacturing market is expected to grow at a CAGR of 6.0% in the first half of the...

Full DetailsPublished: 27 June 2018 -

Global Melanoma Drugs Market 2018-2028

Our new 149-page report provides 161 tables, charts, and graphs. Discover the most lucrative areas in the industry and the...Full DetailsPublished: 17 April 2018 -

Global OTC Pharmaceutical Market Forecast 2018-2028

In this brand new 201-page report you will receive 84 tables and 79 figures– all unavailable elsewhere. The 201-page report...

Full DetailsPublished: 05 April 2018

Download sample pages

Complete the form below to download your free sample pages for Biological Drug API Manufacturing Services World Industry and Market Predictions 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Cell Therapy Technologies Market Report 2024-2034

The cell therapy technologies market is estimated at US$7,041.3 million in 2024 and is projected to grow at a CAGR of 10.7% during the forecast period 2024-2034.

18 April 2024

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024

Visiongain Publishes Anti-obesity Drugs Market Report 2024-2034

The global Anti-obesity Drugs market is estimated at US$11,540.2 million in 2024 and is expected to register a CAGR of 21.2% from 2024 to 2034.

12 April 2024

Visiongain Publishes Inflammatory Bowel Diseases (IBD) Drugs Market Report 2024-2034

The global Inflammatory Bowel Diseases (IBD) Drugs market was valued at US$27.53 billion in 2023 and is projected to grow at a CAGR of 6.2% during the forecast period 2024-2034.

11 April 2024