Industries > Pharma > Global Biosimilar Monoclonal Antibodies Forecast 2018-2028

Global Biosimilar Monoclonal Antibodies Forecast 2018-2028

Biosimilar Versions of Infliximab, Rituximab, Trastuzumab, Adalimumab, Bevacizumab and Abciximab

The global biosimilar monoclonal antibodies market is expected to reach $5.9bn in 2023 and is estimated to grow at a CAGR of 19% from 2016 to 2028.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 204-page report you will receive 72 tables and 74 figures– all unavailable elsewhere.

The 204-page report provides clear detailed insight into the global biosimilar monoclonal antibodies market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand new report today you stay better informed and ready to act.

Report Scope

• Global Biosimilar Monoclonal Antibodies Market forecasts from 2018-2028

• Along with revenue prediction for the overall world market for biosimilar monoclonal antibodies, our investigation shows forecasts to 2028 for the market segmented by compound:

• Infliximab

• Rituximab

• Abciximab

• Trastuzumab

• Adalimumab

• Bevacizumab

• This report also shows revenue to 2028 for individual biosimilar mAb products in the market:

• Remsima/Inflectra

• Infimab

• Reditux

• BI695500

• CT-P10

• BI695501

• FKB327

• FKB238

• Mabtas

• AcellBia

• Maball

• Clotinab

• Abcixirel

• BCD-022

• BCD-021

• Herzuma

• CANMAB/Hertraz

• Our analyses show individual revenue forecasts to 2028 for these regional and national markets:

• The US Biosimilar mAb Market

• Japanese Biosimilar mAb Market

• EU5 Biosimilar mAb Markets

• BRIC and South Korea Biosimilar mAb Markets

• Rest of the World Biosimilar mAb Market

• This report profiles 10 leading companies either with biosimilar mAbs already on the market or in the pipeline

• Our study discusses strengths, weaknesses, opportunities and threats affecting the biosimilar monoclonal antibodies market

Visiongain’s study is intended for anyone requiring commercial analyses for the biosimilars monoclonal antibodies market. You find data, trends and predictions.

Buy our report today Global Biosimilar Monoclonal Antibodies Forecast 2018-2028: Biosimilar Versions of Infliximab, Rituximab, Trastuzumab, Adalimumab, Bevacizumab and Abciximab.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Overview of Biosimilar Monoclonal Antibodies: R&D, Industry and Market

1.2 Why You Should Read this Report

1.3 How This Study Delivers

1.4 Main Questions Answered by the Analysis

1.5 Who is This Investigation For?

1.6 Method of Research and Analysis

1.7 Frequently Asked Questions (FAQs)

1.8 Associated visiongain Reports

1.9 About visiongain

2. Introduction to Biosimilar Monoclonal Antibodies

2.1 Natural Antibodies: Key to the Immune System

2.2 From Serum therapy to Monoclonal Antibodies

2.3 Humanising the mAb

2.4 Biologics (Biological Drugs) and Biosimilars

2.5 Why are Biosimilars in High Demand?

2.6 Considerations for the Development of Biosimilars

2.6.1 Biologics and Biosimilars Are Large, Complex Molecules

2.6.2 How Much of a Concern is Immunogenicity?

2.7 Biosimilar Monoclonal Antibodies Currently on the Market

3. The Global Market for Biosimilar Monoclonal Antibodies, 2018-2028

3.1 The Present Global Market for Biosimilar Monoclonal Antibodies

3.2 The Global Market for Biosimilar mAbs: A Revenue Forecast, 2016-2028

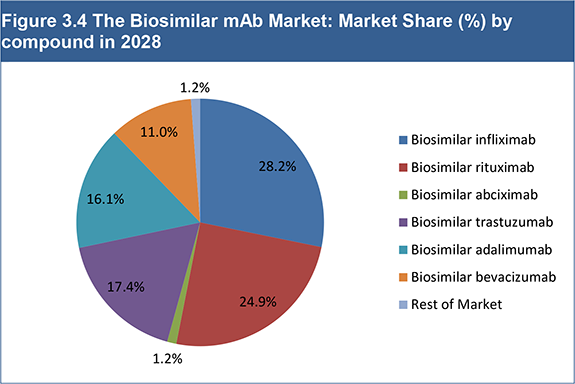

3.3 The Global Market for Biosimilar mAbs by Compound: Predictions for Revenue and Market Share in 2023 and 2028

3.4 The World Market for Biosimilar mAbs by Compound: Revenue Forecasts, 2016-2028

3.4.1 Will Biosimilar Versions of Monoclonal Antibodies Capture a Large Proportion of the Market?

3.4.2 Biosimilar Infliximab

3.4.3 Biosimilar Rituximab

3.4.4 Biosimilar Abciximab

3.4.5 Biosimilar Trastuzumab

3.4.6 Biosimilar Adalimumab

3.4.7 Biosimilar Bevacizumab

3.5 Drivers and Restraints for the Biosimilar mAb market 2018-2028

3.5.1 Driving Factors of the Biosimilar mAb Market 2018-2028

3.6 Restraining Factors of the Biosimilar mAb Market 2018-2028

4. Individual Biosimilar mAb Products: Marketed and Pipeline Drugs, 2018-2028

4.1 Biosimilar mAbs on the Market in 2017

4.1.1 Celltrion’s Remsima/ Hospira’s Inflectra/ Egis’ Flammegis (Infliximab): The First Official Biosimilar Monoclonal Antibody

4.1.2 Infimab (Infliximab): Launched a Quarter Ahead of Schedule

4.1.3 Dr Reddy’s Reditux (Rituximab): No Application for EU or US Approval

4.1.4 Intas Pharmaceuticals’ Mabtas (Rituximab)

4.1.5 AcellBia (Rituximab): Sales in Russia Generating Large Revenue Figures

4.1.6 MABALL: Faces Competition from other Biosimilar Rituximabs in India

4.1.7 Isu Abxis’ Clotinab (abciximab):

4.1.8 AbcixiRel: The First Indian Abciximab Biosimilar

4.1.9 Herzuma (Trastuzumab): Approved in South Korea

4.1.10 CANMAb/Hertraz (Trastuzumab)

4.2 Pipeline Biosimilars

4.2.1 BI695500 (Rituximab)

4.2.2 CT-P10 (Rituximab): Celltrion’s Reputation for Biosimilars will Assist Sales

4.2.3 Boehringer Ingelheim’s BI695501 (Adalimumab)

4.2.4 BCD-022 (Trastuzumab): Approved in Russia

4.2.5 Fujifilm Kyowa Kirin Biologics’ FKB327 (Adalimumab)

4.2.6 Fujifilm Kyowa Kirin Biologics’ FKB238 (Bevacizumab)

4.2.7 BCD-021 (Bevacizumab): Russia Will Contribute the Most Revenue

5. Leading National Markets for Biosimilar Monoclonal Antibodies, 2018-2028

5.1 What Were the Leading National Markets for Biosimilar mAbs in 2017?

5.2 How Will National Market Shares Change Over the Forecast Period?

5.3 India: The Current Leading Nation for Biosimilar mAbs but Growth Will Slow

5.3.1 India Releases New Biosimilar Development Guidelines

5.3.2 Indian Biosimilar Submarket Forecast 2016-2028

5.4 Russia: Lack of Regulatory Framework Works Well in the Short Term

5.4.1 Russian Government Backed ‘Pharma 2020’ Initiative

5.4.2 Russian Biosimilar mAb Revenue Forecast, 2016-2028

5.4 South Korean Market Has Benefitted from Early Biosimilar Guidelines

5.4.1 Significant Investment in Biosimilars in South Korea

5.4.2 South Korean Biosimilar mAb Revenue Forecast, 2016-2028

5.5 China: A Fragmented Biosimilar mAb Market

5.5.1 Chinese FDA Publishes Finalised Biosimilar Guidelines in 2017

5.5.2 China Biosimilar mAb Revenue Forecast, 2016-2028

5.6 Brazil: ANVISA’s Biosimilar Regulations Are Similar the EMA’s

5.6.1 Brazil Biosimilar mAb Revenue Forecast 2016-2028

5.7 The Outlook for Biosimilar mAbs in the EU 2016-2028

5.7.1 Updating Biosimilar Regulation: Guidelines for the Specific Approval of Biosimilar mAbs

5.7.2 Biosimilar mAbs in the EU5: Revenue Forecasts, 2016-2028

5.7.3 Germany: The Current EU Leader

5.7.4 France: Will the Uptake of Biosimilar mAbs be Restricted?

5.7.5 UK: NICE Recommends Use of Remsima for Certain Indications

5.7.6 Italy: Healthcare Spending Cuts Will Drive Growth

5.7.7 Spain: High Biosimilar mAb Discounts Expected

5.8 The Outlook for Biosimilar mAbs in Japan

5.8.1 Regulations for Naming Biosimilars

5.8.2 Biosimilar mAb Market Activity in Japan

5.8.3 Japanese Biosimilar Submarket Forecast 2016-2028

5.9 US Biosimilar mAb Outlook: None Currently on the Market

5.9.1 US FDA Biosimilar Guidelines were Released in 2015

5.9.2 Legal Challenges for Biosimilars in the US

5.9.3 State Regulation of Biosimilar Substitution

5.9.4 The US Biosimilar mAb Market Revenue Forecast, 2016-2028

5.9.5 The Mexico Biosimilar mAb Market Revenue Forecast, 2016-2028

5.9.6 The Canada Biosimilar mAb Market Revenue Forecast, 2016-2028

6. Leading Companies in the Biosimilar Monoclonal Antibodies Market

6.1 Collaboration in Biosimilar mAb Development

6.2 BioXpress

6.3 Celltrion

6.4 Harvest Moon

6.5 Genor Biopharma

6.6 Samsung Bioepsis

6.7 Mabion

6.8 Gene Techno Science

6.9 India’s Biocon

6.10 Coherus Biosciences

6.11 BIOCAD

6.12 Big Pharma and the Biosimilar mAb Market

7. Qualitative Analysis of Biosimilar Monoclonal Antibodies Market

7.1 Strengths and Weaknesses of the Biosimilar Monoclonal Antibodies Market, 2016-2028

7.1.1 Global Demand for Affordable Biopharmaceuticals has Never Been Greater

7.1.2 Adoption of Biosimilar mAbs will be Proportional to the Rate of Discount

7.1.3 Approval Pathways are Now Established in Developed Markets

7.1.4 Complexity of Protein Molecules Leads to Technical Challenges

7.1.5 Doctor and Patient Confidence May Take Time

7.2 Opportunities and Threat Facing the Biosimilar Monoclonal Antibodies Market, 2016-2028

7.2.1 Market Opportunities from Patent Expiries and a Well-Stocked Pipeline

7.2.2 Substitution may Not Occur Automatically

7.2.3 Biobetters Offer a Serious Threat to the Production and Uptake of Biosimilars

7.3 Social and Technological Forces Influencing the Biosimilar Monoclonal Antibodies Market 2016-2028

7.3.1 Social Factors: Driving or Restraining the Market?

7.3.2 Technological Factors Concentrate on Reducing Costs and Increasing Ease of Production

7.3.3 Economic Pressures Raise Demand for Biosimilar mAbs

7.3.4 Political Issues: Stringent Regulations Hurdles to Market Entry

8. Conclusions

8.1 Biosimilar Monoclonal Antibodies: World Market, 2016-2028

8.2 Future of Compounds on the Market and in the Pipeline

8.3 Leading National Markets for Biosimilar Monoclonal Antibodies 2017, 2023, 2028

8.4 Leading Companies in the Biosimilar mAb Market

8.5 Current and Expected Industry Trends 2016-2028

8.5.1 Cost Control of Healthcare Will Work in Favour mAbs

8.5.2 Upcoming Patent Expiries in Developed Markets Offer Large Market Potential

8.5.3 Complex Production Processes are a Restraining Factor

8.5.4 Clinician and Patient Confidence Must be Maximized to Ensure Uptake

8.5.5 Biobetters Pose a Threat

Appendices

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 2.1 Classification of Monoclonal Antibodies

Table 2.2 Murine Monoclonal Antibodies on the Market

Table 2.3 Chimeric Monoclonal Antibodies on the Market

Table 2.4 Humanised Monoclonal Antibodies on the Market

Table 2.5 Fully Human Monoclonal Antibodies on the Market

Table 2.6 Revenue of Originator Monoclonal Antibody Products in 2016

Table 3.1 Global Biosimilar mAbs Market Forecast 2016-2028: Revenue ($m), AGR (%), CAGR (%)

Table 3.2 Global Market for Biosimilar mAbs: Revenues ($m) and Market Shares (%) by Reference Compound, 2017, 2023 and 2028

Table 3.3 EU and US Patent Expiry Dates for the Main mAb Reference Products

Table 3.4 Global Biosimilar mAbs Market Forecast by Reference Compound: Revenue ($m), AGR (%), CAGR (%), 2016-2028

Table 3.5 Biosimilar Infliximab: Compounds Awaiting Approval in the Pipeline

Table 3.6 Global Biosimilar Infliximab Market Forecast 2016-2028: Revenue ($m), AGR (%) and CAGR (%)

Table 3.7 Biosimilar Rituximab: Compounds (Marketed or in the Pipeline), 2018

Table 3.8 Global Biosimilar Rituximab Market Forecast 2016-2028: Revenue ($m), AGR (%) and CAGR (%)

Table 3.9 Biosimilar Abciximab: Compounds (Marketed or in the Pipeline), 2018

Table 3.10 Global Biosimilar Abciximab Market Forecast 2016-2028: Revenue ($m), AGR (%) and CAGR (%)

Table 3.11 Biosimilar Trastuzumab: Compounds Marketed and in the Pipeline, 2018

Table 3.12 Global Biosimilar Trastuzumab Market Forecast 2016-2028: Revenue ($m), AGR (%) and CAGR (%)

Table 3.13 Biosimilar Adalimumab: Compounds (Marketed or in the Pipeline) 2018

Table 3.14 Global Biosimilar Adalimumab Market Forecast 2016-2028: Revenue ($m), AGR (%), and CAGR (%)

Table 3.15 Biosimilar Bevacizumab: Compounds (Marketed or in the Pipeline) 2018

Table 3.16 Global Biosimilar Bevacizumab Market Forecast 2016-2028: Revenue ($m), AGR (%) and CAGR (%)

Table 4.1 Biosimilar mAbs on the Market in 2017: Revenues ($m) and Market Shares (%)

Table 4.2 Remsima/Inflectra/Flammegis (Infliximab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2016-2028

Table 4.3 Infimab (Infliximab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2016-2028

Table 4.4 Reditux (Rituximab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2016-2027

Table 4.5 Mabtas (Rituximab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2016-2028

Table 4.6 Biocad Distribution Partners for AcellBia, 2017

Table 4.7 AcellBia (Rituximab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2016-2028

Table 4.8 MABALL (Rituximab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2016-2028

Table 4.9 Clotinab (Abciximab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2016-2028

Table 4.10 AbcixiRel (Abciximab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2016-2028

Table 4.11 Herzuma (Trastuzumab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2016-2028

Table 4.12 CANMAb/Hertraz (Trastuzumab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2016-2028

Table 4.13 BI695500 (Rituximab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2016-2028

Table 4.14 CT-P10 (Rituximab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2018-2027

Table 4.15 BI695501 (Adalimumab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2017-2028

Table 4.16 BCD-022 (Trastuzumab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2016-2028

Table 4.17 FKB327 (Adalimumab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2017-2028

Table 4.18 FKB238 (Bevacizumab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2020-2028

Table 4.19 BCD-021 (Bevacizumab) Forecast: Revenue ($m), Market Share (%), AGR (%) and CAGR (%), 2018-2028

Table 5.1 Leading National Markets for the Global Biosimilar mAb Industry, 2017

Table 5.2 Leading National Markets for the Global Biosimilar mAb Industry, 2017, 2023, 2028

Table 5.3 The Indian Biosimilar MAb Market: Revenue ($m), Annual Growth (%) and CAGR (%) Forecast, 2016-2028

Table 5.4 The Russian Biosimilar mAb Market: Revenue ($m), Annual Growth (%) and CAGR (%) Forecast, 2016-2028

Table 5.5 The South Korean Biosimilar mAb Market: Revenue ($m), Annual Growth (%) and CAGR (%) Forecast, 2016-2028

Table 5.6 The Chinese Biosimilar mAb Market: Revenue ($m), Annual Growth (%) and CAGR (%) Forecast, 2016-2028

Table 5.7 The Brazilian Biosimilar mAb Market: Revenue ($m), Annual Growth (%) and CAGR (%) Forecast, 2016-2028

Table 5.8 The EU5 Biosimilar mAb Market: Revenue Forecast ($m), 2016-2028

Table 5.9 The German Biosimilar mAb Market: Revenue ($m), Annual Growth (%) and CAGR (%) Forecast, 2016-2028

Table 5.10 The French Biosimilar mAb Market: Revenue ($m), Annual Growth (%) and CAGR (%) Forecast, 2016-2028

Table 5.11 The UK Biosimilar mAb Market: Revenue ($m), Annual Growth (%) and CAGR (%) Forecast, 2016-2028

Table 5.12 The Italian Biosimilar mAb Market: Revenue ($m), Annual Growth (%) and CAGR (%) Forecast, 2016-2028

Table 5.13 The Spanish Biosimilar mAb Market: Revenue ($m), Annual Growth (%) and CAGR (%) Forecast, 2016-2028

Table 5.14 The Japanese Biosimilar mAb Market: Revenue ($m), Annual Growth (%) and CAGR (%) Forecast, 2016-2028

Table 5.15 Finalised FDA Biosimilar Guidelines, 2015

Table 5.16 The US Biosimilar mAb Market: Revenue ($m) and Annual Growth (%) Forecast, 2017-2028

Table 5.17 The Mexico Biosimilar mAb Market: Revenue ($m) and Annual Growth (%) Forecast, 2017-2028

Table 5.17 The Canada Biosimilar mAb Market: Revenue ($m) and Annual Growth (%) Forecast, 2017-2028

Table 6.1 Companies in the Biosimilar mAb Industry by Number of Compounds in Development, 2017

Table 6.2 Selected Collaborations for Biosimilar mAb Development, 2009-2017

Table 6.3 BioXpress: Compounds in the Pipeline, 2018

Table 6.4 Tests Carried Out by BioXpress During Biosimilar mAb Development, with Objectives

Table 6.5 Compounds in Celltrion’s Pipeline: Compound Name, Generic Name, Development Stage and Anticipated Year of Approval, 2017

Table 6.6 Genor Biopharma: Biosimilar mAbs Pipeline, 2017

Table 6.7 Mabion: Compounds in the Pipeline and Their Development Stage, 2017

Table 6.8 Gene Techno Science: Revenue ($m), from 2013-2017

Table 6.9 Biocon: Compounds in the Pipeline and Their Stage of Development, 2017

Table 6.10 Big Pharma's Positions in the Biosimilar mAb Industry, 2017

Table 7.1 Strengths and Weaknesses of the Biosimilar mAb Market, 2016-2028

Table 7.2 Opportunities and Threats Facing the Biosimilar mAb Market, 2016-2028

Table 7.3 Social and Technological Factors Influencing the Biosimilar mAb Market, 2016-2028

List of Figures

Figure 1.1 Main Compound Classes of Biosimilar mAbs, 2018

Figure 2.1 Structure of an Antibody

Figure 3.1 Global Biosimilar mAbs Market Forecast: Revenue ($m), 2016-2028

Figure 3.2 The Biosimilar mAb Market: Market Share (%) by compound in 2017

Figure 3.3 The Biosimilar mAb Market: Market Share (%) by compound in 2023

Figure 3.4 The Biosimilar mAb Market: Market Share (%) by compound in 2028

Figure 3.5 Global Biosimilar Infliximab Market Forecast: Revenue ($m), 2016-2028

Figure 3.6 Global Biosimilar Rituximab Market Forecast: Revenue ($m), 2016-2028

Figure 3.7 Global Biosimilar Abciximab Market Forecast: Revenue ($m), AGR (%), and CAGR (%)

Figure 3.8 Global Biosimilar Trastuzumab Market Forecast: Revenue ($m), 2016-2028

Figure 3.9 Global Biosimilar Adalimumab Market Forecast: Revenue ($m), 2016-2028

Figure 3.10 Global Biosimilar Bevacizumab Market Forecast: Revenue ($m), 2016-2028

Figure 3.11 Drivers and Restraints for the Global Biosimilar mAb market 2016-2028

Figure 4.1 Biosimilar mAb Versions on the Market: Market Share (%) 2017

Figure 4.2 Biosimilar mAb Versions on the Market: Market Share (%) 2023

Figure 4.3 Biosimilar mAb Versions on the Market: Market Share (%) 2028

Figure 4.4 Remsima/Inflectra/Flammegis (Infliximab): Revenue Forecast ($m), 2016-2028

Figure 4.5 Remsima/Inflectra/Flammegis (Infliximab): AGR Forecast (%), 2016-2028

Figure 4.6 Infimab (Infliximab): Revenue Forecast ($m) 2016-2028

Figure 4.7 Infimab (Infliximab): AGR Forecast (%) 2016-2028

Figure 4.8 Reditux (Rituximab): Revenue Forecast ($m) 2016-2028

Figure 4.9 Reditux (Rituximab): AGR Forecast (%) 2016-2028

Figure 4.10 Mabtas (Rituximab): Revenue Forecast ($m) 2016-2028

Figure 4.11 Mabtas (Rituximab): AGR Forecast (%) 2016-2028

Figure 4.12 AcellBia (Rituximab): Revenue Forecast ($m) 2016-2028

Figure 4.13 AcellBia (Rituximab): AGR Forecast(%) 2016-2028

Figure 4.14 MABALL (Rituximab): Revenue Forecast ($m) 2016-2028

Figure 4.15 MABALL (Rituximab): AGR Forecast (%) 2016-2028

Figure 4.16 Clotinab (Abciximab): Revenue Forecast ($m) 2016-2028

Figure 4.17 Clotinab (Abciximab): AGR Forecast (%) 2016-2028

Figure 4.18 AbcixiRel (Abciximab): Revenue Forecast ($m) 2016-2028

Figure 4.19 AbcixiRel (Abciximab): AGR Forecast (%) 2016-2028

Figure 4.20 Herzuma (Trastuzumab): Revenue Forecast ($m) 2016-2028

Figure 4.21 Herzuma (Trastuzumab): AGR Forecast (%) 2016-2028

Figure 4.22 CANMAb/Hertraz (Trastuzumab): Revenue Forecast ($m) 2016-2028

Figure 4.23 CANMAb/Hertraz (Trastuzumab): AGR Forecast (%) 2016-2028

Figure 4.24 BI695500 (Rituximab): Revenue Forecast ($m) 2018-2028

Figure 4.25 BI695500 (Rituximab): AGR Forecast (%) 2019-2028

Figure 4.26 CT-P10 (Rituximab): Revenue Forecast ($m) 2019-2028

Figure 4.27 CT-P10 (Rituximab): AGR Forecast (%) 2019-2028

Figure 4.28 BI695501 (Adalimumab): Revenue Forecast ($m) 2018-2028

Figure 4.29 BI695501 (Adalimumab): AGR Forecast (%) 2019-2028

Figure 4.30 BCD-022 (Trastuzumab): Revenue Forecast ($m) 2016-2028

Figure 4.31 BCD-022 (Trastuzumab): AGR Forecast (%) 2017-2028

Figure 4.32 FKB327 (Adalimumab): Revenue Forecast (%) 2018-2028

Figure 4.33 FKB327 (Adalimumab): AGR Forecast (%) 2019-2028

Figure 4.34 FKB238 (Adalimumab): Revenue Forecast ($m) 2020-2028

Figure 4.35 FKB238 (Adalimumab): AGR Forecast (%) 2022-2028

Figure 4.36 BCD-021 (Bevacizumab): Revenue Forecast ($m) 2017-2028

Figure 4.37 BCD-021 (Bevacizumab): AGR Forecast (%) 2018-2028

Figure 5.1 The Biosimilar MAb Market by Country: Market Shares (%) of Revenue, 2017

Figure 5.2 The Biosimilar MAb Market: National Submarket Shares (%), 2023

Figure 5.3 The Biosimilar MAb Market: National Submarket Shares (%), 2028

Figure 5.4 The Indian Biosimilar mAb Market: Revenue Forecast ($m), 2016-2028

Figure 5.5 The Russian Biosimilar mAb Market: Revenue Forecast ($m), 2016-2028

Figure 5.6 The South Korean Biosimilar mAb Market: Revenue Forecast ($m), 2016-2028

Figure 5.7 The Chinese Biosimilar mAb Market: Revenue Forecast ($m), 2016-2028

Figure 5.8 The Brazilian Biosimilar mAb Market: Revenue Forecast ($m), 2016-2028

Figure 5.9 The EU5 Biosimilar mAb Market: Grouped Revenue Forecast ($m), 2016-2028

Figure 5.10 The EU5 Biosimilar mAb Market: Revenue Forecasts ($m) by Country, 2016-2028

Figure 5.11 The German Biosimilar mAb Market: Revenue Forecast ($m), 2016-2028

Figure 5.12 The French Biosimilar mAb Market: Revenue Forecast ($m), 2016-2028

Figure 5.13 The UK Biosimilar mAb Market: Revenue Forecast ($m), 2016-2028

Figure 5.14 The Italian Biosimilar mAb Market: Revenue Forecast ($m), 2016-2028

Figure 5.15 The Spanish Biosimilar mAb Market: Revenue Forecast ($m), 2016-2028

Figure 5.16 The Japanese Biosimilar mAb Market: Revenue Forecast ($m), 2016-2028

Figure 5.17 Biosimilar mAbs in the US: Revenue Forecast ($m), 2017-2028

Figure 5.18 Biosimilar mAbs in the Mexico: Revenue Forecast ($m), 2016-2028

Figure 5.19 Biosimilar mAbs in the Canada: Revenue Forecast ($m), 2016-2028

Figure 6.1 Prominent Companies in the Biosimilar mAb Industry: Share (%) of the Pipeline (2017)

Figure 8.1 Prominent Compounds in the Biosimilar mAb Market: Comparison of Revenues ($m), 2017, 2023 and 2028

Figure 8.2 Forecasted Biosimilar mAbs: Comparison of Revenues ($m), 2017, 2023 and 2028

Figure 8.3 Leading National Markets: Revenues ($m), 2017, 2023 and 2028

Figure 8.4 Prominent Companies in the Biosimilar mAb Industry: Number of Products in Current Development or in the Pipeline, 2017

Abbott

AbbVie

Aché

Actavis

AET BioTech

Alexion Pharmaceuticals

Allergan

Alvogen

Alvotech

Amgen

Apotex

Aprogen

Array Bridge

AstraZeneca

Aurobindo Pharma Limited

Axis Biotec Brasil

Baliopharm GmbH

Baxalta

Bayer

Binex

BIO

Bio Farma

BIOCAD

Biocerus

Biocon

Biogen Idec

Bio-Manguinhos

Bionovis

BioXpress Therapeutics

Boehringer Ingelheim

Bristol-Myers Squibb

Catalent Pharma Solutions

Cell Therapeutics

Celltrion

Celon Pharma Łomianki

Chugai

CinnaGen

CinnaGen

Coherus BioSciences

Daiichi Sankyo

DM Bio

Dong-A Pharma

Dr Reddy's

Dyadic International, Inc.

Egis Pharmaceuticals

Eisai

Eli Lilly

Emcure

EMS

Epirus Biopharmaceuticals

Farmasa

Fresenius

Fujifilm

Fujifilm Kyowa Kirin Biologics

Gedeon Richter

Gene Techno Science

Genentech

GeneTechno Science

Genexo

Genor Biopharma

GlaxoSmithKline

Glycotope

Hanwha Chemical

Harvest Moon

Hetero Group

Hospira

Hypermarcas

iBio

IBSS Biomed

ImClone LLC

Instas Pharmaceuticals

Instituto Vital Brazil

Intas Biopharmaceuticals

IPCA Labs

Isu Abxis

Janssen

JHL Biotech

Johnson & Johnson

Kyowa Hakko Kirin

Laboratorio Elea

Laboratorios Liomont

LG Life Sciences

Lonza

Mabion

Mabtech Limited

mAbxience

MedImmune

Merck & Co.

Merck (MSD)

Merck Serono

Millhouse LLC

Mitsubishi Tanabe

Mochida Pharmaceutical

Momenta Pharmaceuticals

Mustafa Nevzat Pharmaceuticals

Mylan

Natco Pharma

Nichi-Iko Pharmaceutical Co.

Nippon Kayaku

Novartis

Oncobiologics

Otsuka Pharmaceutical

Parexel

Paul-Ehrlich Institute of Germany

Pfizer

PharmaPraxis

Pharmstandard

PhRMA

PlantForm

Polfarmex

ProBioGen

Probiomed

QuantiaMD

Quintiles

Ranbaxy Laboratories

Regeneron Pharmaceuticals

Reliance GeneMedix

Reliance Life Sciences

Roche

Samsung Bioepis

Samsung Biologics

Sandoz

Sanofi

Schnell

Seattle Genetics

Shanghai CP Guojian

Shionogi

Sorrento Therapeutics

Spectrum Pharmaceuticals

Stada Arzneimittell AG

Synthon

Takeda

Teva Pharmaceutical

TL Biopharmaceutical AG

UCB

União Química

Viropro

Walvax Biotechnology

Wyeth

Zenotech Laboratories

Zhejiang HISUN Pharmaceuticals Co. Ltd. (HISUN)

Zhejiang Huahai Pharmaceutical

Zydus-Cadila

List of Organizations Mentioned in the Report

Agence française de sécurité sanitaire des produits de santé (ANSM)

Agência Nacional de Vigilância Sanitária (ANVISA)

Central Drugs Standard Control Organisation and the Department of Biotechnology

Chinese Centre for Drug Evaluation (CDE)

Cour des Comptes (France)

European Medicines Agency (EMA)

Food and Drug Administration (US FDA)

Fraunhofer Center for Molecular Biology

Health Canada

India Brand Equity Foundation

Israel Institute for Biological Research (IIBR)

Korean Food and Drug Administration (KFDA)

Medicines and Healthcare Products Regulatory Agency (MHRA)

Ministry of Food and Drug Safety (South Korea)

Ministry of Health of the Russian Federation

Ministry of Health, Labour and Welfare (MHLW)

National Institute for Health and Care Excellence (NICE)

National Institute for Health Research Horizon Scanning Centre

Norwegian Medical Agency

Scientific Centre for Expertise of Medicinal Application Products (Russia)

Spanish Ministry of Health

State Food and Drug Administration (SFDA)

The Cancer Centre Bahamas

The European Medicines Agency (EMA)

The German Generics Association Pro Generika

UCAB (The Utrecht Centre of Excellence for Affordable Biotherapeutics for Public Health

Washington Legal Foundation

World Health Organization (WHO)

Download sample pages

Complete the form below to download your free sample pages for Global Biosimilar Monoclonal Antibodies Forecast 2018-2028

Related reports

-

Vaccine Sales Market Forecast 2018-2028

The Global Vaccines Sales market was valued at $36.9 billion in 2017. This value will grow to $61.1bn in 2022...

Full DetailsPublished: 09 March 2018 -

Top 50 Bioreactor Manufacturers 2019

Asia-Pacific bioreactors market is anticipated to be the fast-growing market in the forecast period with a CAGR of 8.0% from...

Full DetailsPublished: 25 March 2019 -

Top 25 Antibiotic Drugs Manufacturers 2018

Visiongain forecasts the antibiotic drugs market to increase to $ 43,841.7m in 2022. The market is estimated to grow at...

Full DetailsPublished: 12 June 2018 -

Global Stem Cell Technologies and Applications Market 2018-2028

The global stem cell technologies and applications market is estimated to have reached $12,040 million and is expected to grow...

Full DetailsPublished: 02 March 2018 -

Global Inflammatory Bowel Diseases (IBD) Drug Market Forecast 2018-2028

The global inflammatory bowel diseases (IBD) drug market is estimated at $6.7bn in 2017 and $7.6bn in 2023. Biologic therapies...

Full DetailsPublished: 29 May 2018 -

Global Vaccine Contract Manufacturing Market Report 2018-2028

The global vaccine contract manufacturing market was worth $883.0m in 2017 and is expected to grow at a CAGR of...

Full DetailsPublished: 06 March 2018 -

Global Cancer Immunotherapy Market Forecast 2019-2029

The world cancer immunotherapy market is expected to grow at a CAGR of 11.4% in the second half of the...Full DetailsPublished: 21 January 2019 -

mRNA Vaccines and Therapeutics Market Forecast 2019-2029

The mRNA Vaccines and Therapeutics Market is estimated at $3.43 billion in 2018. The Standardized Therapeutic Cancer mRNA Vaccines segment...

Full DetailsPublished: 07 May 2019 -

Global Acute Myeloid Leukaemia Market Forecast 2018-2028

The global acute myeloid leukaemia market reached $1bn in 2017 and is estimated to reach $2.8bn by 2022. In 2017,...

Full DetailsPublished: 21 September 2018 -

Cell-Based Assays World Industry and Market 2018-2028

The revenue of the cell-based assays market in 2017 is estimated at $13bn and is expected to grow at a...Full DetailsPublished: 18 September 2018

Download sample pages

Complete the form below to download your free sample pages for Global Biosimilar Monoclonal Antibodies Forecast 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Pharma news

Retinal Gene Therapy Market

The global Retinal Gene Therapy market is projected to grow at a CAGR of 9.6% by 2034

26 July 2024

HIV Drugs and Injectables Market

The global HIV Drugs & Injectables market is projected to grow at a CAGR of 4.6 % by 2034

24 July 2024

Digital Twin Technology in Pharmaceutical Manufacturing Market

The global Digital Twin Technology in Pharmaceutical Manufacturing market is projected to grow at a CAGR of 31.3% by 2034

23 July 2024

Specialty Pharma Market

The global Specialty Pharma market is projected to grow at a CAGR of 7.5% by 2034

22 July 2024