Industries > Pharma > Top 50 Bioreactor Manufacturers 2019

Top 50 Bioreactor Manufacturers 2019

Danaher Corporation, Eppendorf AG, GE Healthcare, Merck KGaA, Thermo Fisher, Sartorius AG, Bioengineering AG and Others

Asia-Pacific bioreactors market is anticipated to be the fast-growing market in the forecast period with a CAGR of 8.0% from 2023-2029. Presence of large number of contract research organizations and increasing number of strategic alliances with international companies are the key factors that will propel the market growth in the Asia-Pacific region.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 246-page report you will receive 126 charts– all unavailable elsewhere.

The 246-page report provides clear detailed insight into top 50 bioreactor manufacturers. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• Our study discusses 50 leading companies that are the major players in the bioreactor industry, including:

• Applikon Biotechnology Inc.

• BBI-Biotech GmbH

• Bioengineering AG

• Cellexus Ltd.

• CESCO Bioengineering Co. Ltd.

• Danaher Corporation

• Eppendorf AG

• Finesse Solutions Inc.

• GE Healthcare

• Infors AG

• Merck KGaA

• PBS Biotech Inc.

• Sartorius AG

• Solaris Biotech Company

• Thermo Fisher Scientific

• Xcellerex, Inc.

• Other companies

Overview of company, financial information, product portfolio, R&D, product launches, mergers & acquisitions, divestitures, research collaborations and license agreements are discussed

• Our study gives qualitative analysis of the bioreactors market. It discusses the Drivers and Restraints that influence this market

Visiongain’s study is intended for anyone requiring commercial analyses for the top 50 bioreactor manufacturers. You find data, trends and predictions.

Buy our report today Bioreactor Manufacturers : Danaher Corporation, Eppendorf AG, GE Healthcare, Merck KGaA, Thermo Fisher, Sartorius AG, Bioengineering AG and Others.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Bioreactors Market Overview

1.2 Why You Should Read This Report

1.3 Who is This Report For?

1.4 Methodology

1.5 Frequently Asked Questions (FAQ)

1.6 Associated Visiongain Reports

1.7 About Visiongain

2. Bioreactors Market Definition

2.1 What is a Bioreactor?

2.2 Types of Bioreactors

2.2.1 Glass Bioreactors

2.2.2 Stainless Steel Bioreactors

2.2.3 Single-Use Bioreactors

2.2.4 Lab Scale Production

2.2.5 Pilot Scale Production

2.2.6 Full Scale Production

2.3 Bioreactors Market Structure

2.4 Classification of Bioreactors

3. Global Bioreactors Market Forecasts, 2018-2029

4. Competitor Positioning in the Bioreactors Market

4.1 Top revenue generating companies in the bioreactors industry

5. Leading 50 Companies in the Bioreactors Market

5.1 Danaher Corporation

5.1.1 Danaher Manufactures Consumables and Equipment

5.1.2 Product Portfolio of Danaher: Bioreactors

5.1.3 Acquisitions Drive Revenue Growth, 2012-2017

5.2 Eppendorf AG

5.2.1 Eppendorf AG’s Complete Focus on Digitalization

5.2.2 Product Portfolio of Eppendorf AG: Bioreactors

5.2.3 New Product Launches Drive Revenue Growth, 2012-2017

5.3 General Electric Company (GE Healthcare)

5.3.1 GE’s Focus on Portfolio Growth and Shareholder Value Creation

5.3.2 Product Portfolio of GE Healthcare: Bioreactors

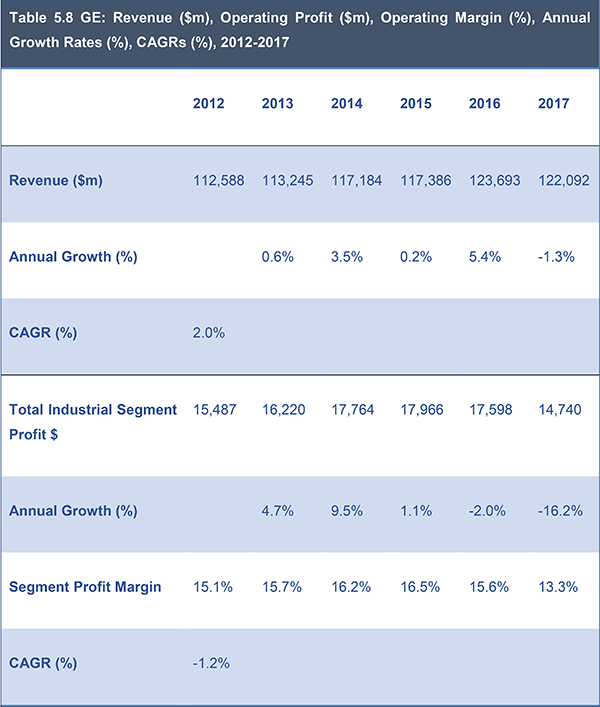

5.3.3 Product Innovation and Acquisitions Drive Revenue Growth, 2012-2017

5.4 Merck KGaA (Merck Millipore)

5.4.1 Product Portfolio of Merck KGaA: Bioreactors

5.4.2 Acquisitions, Divestitures, Research Collaborations and License Agreements Drive Revenue Growth, 2012-2017

5.5 Sartorius AG

5.5.1 Product Portfolio of Sartorius AG: Bioreactors

5.5.2 Business Acquisitions Drive Revenue Growth, 2012-2017

5.6 Bioengineering AG

5.6.1 Focus towards manufacturing bioreactors with innovative features

5.6.2 Product Portfolio of Bioengineering AG: Bioreactors

5.7 Applikon Biotechnology Inc.

5.7.1 Turn-key solutions for vaccines biosafety and development

5.7.2 Product Portfolio of Applikon Biotechnology Inc.: Bioreactors

5.8 Solaris Biotech Company

5.8.1 R&D benchtop fermenters/bioreactors

5.8.2 Product Portfolio of Solaris Biotech Company: Bioreactors

5.9 BBI-Biotech GmbH

5.9.1 Increasing focus on offering wider exposure to their innovative products

5.9.2 Product Portfolio of BBI-Biotech GmbH: Bioreactors

5.10 Infors AG

5.10.1 Infors is developing scale-up solutions suitable for bioprocessing

5.10.2 Product Portfolio of Infors AG: Bioreactors

5.11 PBS Biotech Inc

5.11.1 PBS is working towards shaping the future of single-use bioreactors

5.11.2 Product Portfolio of PBS Biotech: Bioreactors

5.12 Finesse Solutions Inc

5.12.1 Manufactures a wide range of bioreactor controllers

5.12.2 Product Portfolio of Finesse Solutions: Bioreactors

5.13 Cellexus Ltd

5.13.1 CellMaker SUB is suitable across life sciences, brewing, biopharmaceutical and agricultural feed applications

5.13.2 Product Portfolio of Cellexus: Bioreactors

5.14 CESCO Bioengineering Co. Ltd

5.14.1 Developmental stages of CESCO’s entry in the market

5.14.2 Product Portfolio of CESCO Bioengineering: Bioreactors

5.15 Xcellerex, Inc

5.15.1 Acquisition of Xcellerex, Inc. by GE Healthcare

5.15.2 Product Portfolio of Xcellerex: Bioreactors

5.16 Thermo Fisher Scientific, Inc

5.16.1 Thermo Fisher Manufactures Single-use Bioprocessing Bioreactors

5.16.2 Product Portfolio of Thermo Fisher: Bioreactors

5.16.3 Acquisitions Drive Revenue Growth, 2012-2017

5.17 Pierre Guerin

5.17.1 Pierre Guerin Manufactures Autoclavable Fermenters and Bioreactors

5.17.2 Product Portfolio of Pierre Guérin: Bioreactors

5.18 Solida Biotech

5.18.1 Solida Biotech manufactures lab bioreactors and industrial bioreactors

5.18.2 Product Portfolio of Solida Biotech: Bioreactors

5.19 Distek Inc.

5.19.1 Emphasis towards manufacturing bioreactors for mammalian and microbial models

5.19.2 Product Portfolio of Distek Inc.: Bioreactors

5.20 Bellco Glass

5.20.1 Diversified product portfolio

5.20.2 Product Portfolio of Bellco Glass: Bioreactors

5.21 Broadley-James Corporation

5.21.1 Product developments and product launches drive the market growth

5.21.2 Product Portfolio of Broadley-James Corporation: Bioreactors

5.22 Major Science

5.22.1 Product launches

5.22.2 Product Portfolio of Major Science: Bioreactors

5.23 Techniserv Inc.

5.23.1 Varied Services

5.23.2 Product Portfolio of Varied Services: Bioreactors & fermenters

5.24 Bilfinger SE

5.24.1 Pharmaceuticals & biopharma

5.24.2 Product Portfolio of Bilfinger SE: Bioreactors

5.25 Centrion.Co.,Ltd.

5.25.1 Innovative technology drives the market growth

5.25.2 Product Portfolio of Centrion Co.,Ltd.: Bioreactors

5.26 Bioprocess Technology

5.26.1 Equipment for biotechnological processes

5.26.2 Product Portfolio of Bioprocess Technology: Bioreactors

5.27 CerCell

5.27.1 Product Portfolio of CerCell: Bioreactors

5.28 Praj HiPurity Systems Limited

5.28.1 Praj offers after sales services

5.28.2 Product Portfolio of Praj HiPurity: Bioreactors

5.29 3M Company

5.29.1 3M integrated towards offering novel bioprocessing solutions

5.29.2 Product Portfolio of 3M Company: Bioreactor associated filters

5.30 Shanghai BaiLun BioEngineering Co., Ltd.

5.30.1 Product Portfolio of Shanghai Bailun: Bioreactors

5.31 Celltainer Biotech B.V.

5.31.1 Product Portfolio of Celltainer Biotech: Bioreactors and Products

5.32 Fermentec Ltda.

5.32.1 Fermentec Offers products with automation and simulation systems

5.32.2 Product Portfolio of Fermentec: Bioreactors

5.33 Andel Equipment

5.33.1 Andel Equipment provides solutions in biotech industry

5.33.2 Product Portfolio of Andel Equipment: Bioreactors

5.34 Bio-Age Equipment & Services

5.34.1 Bio-Age has a wide product portfolio

5.34.2 Product Portfolio of Bio-Age: Bioreactors

5.35 Electrolab Biotech Limited

5.35.1 Electrolab Biotech Ltd.’s special projects will create lucrative opportunities

5.35.2 Product Portfolio of Electrolab Biotech Limited: Bioreactors

5.36 GEA Group

5.36.1 GEA Group’s products for diverse applications

5.36.2 Growth in Customer Industries Drive Revenue Growth, 2012-2017

5.36.3 Product Portfolio of GEA Group: Bioreactors

5.37 Medorex e.K.

5.37.1 Medorex e.K. precise fermenters

5.37.2 Product Portfolio of Medorex: Bioreactors

5.38 Novaferm AB

5.38.1 Novaferm’s quality services

5.38.2 Product Portfolio of Novaferm: Bioreactors

5.39 Shanghai RITAI medicine equipment project co., Ltd

5.39.1 Ritai’s varied range of products and services

5.39.2 Product Portfolio of Ritai Medicine Equipment: Bioreactors

5.40 Sysbiotech GmbH

5.40.1 SYSBIOTECH offers varied range of fermentation and bioprocessing equipment

5.40.2 Product Portfolio of Sysbiotech: Bioreactors

5.41 Parker-Hannifin

5.41.1 Product Portfolio of Parker-Hannifin: Bioreactors & Products

5.41.2 Key Markets of Parker-Hannifin: Biopharmaceuticals

5.42 BioTron Inc.

5.42.1 Product Portfolio of BioTron Inc.: Bioreactors & Products

5.43 Spectrochem Instruments

5.43.1 Product Portfolio of Spectrochem Instruments: Bioreactors

5.44 ZETA Holding GmbH

5.44.1 ZETA Holding GmbH’s partnership with key players

5.44.2 Product Portfolio of ZETA Holding GmbH: Bioreactors and Fermenters

5.45 BiOZEEN

5.45.1 BiOZEEN’s clientele

5.45.2 Product Portfolio of BiOZEEN: Bioreactors and Fermenters

5.46 CESCO BIOENGINEERING CO., LTD

5.46.1 CESCO BIOENGINEERING CO., LTD’s strong geographical presence

5.46.2 Product Portfolio of CESCO BIOENGINEERING CO., LTD: Bioreactors and Fermenters

5.47 LAMBDA Laboratory Instruments

5.47.1 LAMBDA’s varied product portfolio

5.47.2 Product Portfolio of LAMBDA Laboratory Instruments: Bioreactors and Fermenters

5.48 Heinrich Frings GmbH & Co. KG

5.48.1 Frings offers highly specialized products for various industries

5.48.2 Product Portfolio of Frings: Bioreactors and Fermenters

5.49 Katalyst Bio Engineering

5.49.1 Katalyst Bio Engineering offers quality services

5.49.2 Product Portfolio of Katalyst Bio Engineering: Bioreactors and Fermenters

6. Drivers & Restraints of the Bioreactors Market

6.1 Drivers

6.1.1 Increasing Rate of Adoption of Single-Use Technologies

6.1.2 Rising popularity of single-use bioreactor among biopharmaceutical organizations

6.1.3 Growth in the Biologics Market

6.1.4 Exponential Rise in the Usage of Hybrid Technologies

6.2 Restraints

6.2.1 Regulatory Constraints Pertaining to Single-Use Bioreactors

6.2.2 Issues Concerning Leachables and Extractables related to Single-Use Bags

7. Bioreactors Market Analysis

7.1 Bioreactors in biopharmaceutical applications

7.2 Bioreactors used for cell-based therapies

7.3 Bioreactors systems used for cell expansion

7.4 Bioreactors Market Key Trends

7.5 Materials Used in the Development of Bioreactors

Glossary

Appendices

Associated Visiongain Reports

About Visiongain

Visiongain Report Evaluation Form

List of Tables

TABLE 3.1 REGIONAL BIOREACTORS MARKET FORECASTS: ($M, AGR% CAGR%) 2017-2029

TABLE 5.1. DANAHER DETAILS, 2017

TABLE 5.2 DANAHER: REVENUE ($M), OPERATING PROFIT ($M), OPERATING MARGIN (%), ANNUAL GROWTH RATES (%), CAGRS (%), 2012-2017

TABLE 5.3 DANAHER SWOT ANALYSIS, 2018

TABLE 5.4 EPPENDORF AG DETAILS, 2017

TABLE 5.5 EPPENDORF AG: REVENUE ($M), OPERATING PROFIT ($M), OPERATING MARGIN (%), ANNUAL GROWTH RATES (%), CAGRS (%), 2012-2017

TABLE 5.6 EPPENDORF AG SWOT ANALYSIS, 2018

TABLE 5.7 GE DETAILS, 2017

TABLE 5.8 GE: REVENUE ($M), OPERATING PROFIT ($M), OPERATING MARGIN (%), ANNUAL GROWTH RATES (%), CAGRS (%), 2012-2017

TABLE 5.9 GE HEALTHCARE SWOT ANALYSIS, 2018

TABLE 5.10 MERCK DETAILS, 2017

TABLE 5.11 MERCK: REVENUE ($M), OPERATING PROFIT ($M), OPERATING MARGIN (%), ANNUAL GROWTH RATES (%), CAGRS (%), 2012-2017

TABLE 5.12 MERCK SWOT ANALYSIS, 2018

TABLE 5.13 SARTORIUS DETAILS, 2017

TABLE 5.14 SARTORIUS: REVENUE ($M), OPERATING PROFIT ($M), OPERATING MARGIN (%), ANNUAL GROWTH RATES (%), CAGRS (%), 2012-2017

TABLE 5.15 SARTORIUS SWOT ANALYSIS, 2018

TABLE 5.16 BIOENGINEERING DETAILS, 2017

TABLE 5.17 BIOENGINEERING SWOT ANALYSIS, 2018

TABLE 5.18 APPLIKON DETAILS, 2017

TABLE 5.19 APPLIKON SWOT ANALYSIS, 2018

TABLE 5.20 SOLARIS DETAILS, 2017

TABLE 5.21 SOLARIS SWOT ANALYSIS, 2018

TABLE 5.22 BBI-BIOTECH DETAILS, 2017

TABLE 5.23 BBI-BIOTECH SWOT ANALYSIS, 2018

TABLE 5.24 INFORS AG DETAILS, 2017

TABLE 5.25 INFORS AG SWOT ANALYSIS, 2018

TABLE 5.26 PBS BIOTECH DETAILS, 2017

TABLE 5.27 PBS BIOTECH SWOT ANALYSIS, 2018

TABLE 5.28 FINESSE SOLUTIONS DETAILS, 2017

TABLE 5.29 FINESSE SOLUTIONS SWOT ANALYSIS, 2018

TABLE 5.30 CELLEXUS DETAILS, 2017

TABLE 5.31 CELLEXUS SWOT ANALYSIS, 2018

TABLE 5.32 CESCO BIOENGINEERING DETAILS, 2017

TABLE 5.33 CESCO BIOENGINEERING SWOT ANALYSIS, 2018

TABLE 5.34 XCELLEREX DETAILS, 2017

TABLE 5.35 XCELLEREX SWOT ANALYSIS, 2018

TABLE 5.36 THERMO FISHER DETAILS, 2017

TABLE 5.37 THERMO FISHER: REVENUE ($M), OPERATING PROFIT ($M), OPERATING MARGIN (%), ANNUAL GROWTH RATES (%), CAGRS (%), 2012-2017

TABLE 5.38 THERMO FISHER SWOT ANALYSIS, 2018

TABLE 5.39 PIERRE GUERIN, 2017

TABLE 5.40 PIERRE GUERIN SWOT ANALYSIS, 2018

TABLE 5.41 SOLIDA BIOTECH, 2017

TABLE 5.42 SOLIDA BIOTECH SWOT ANALYSIS, 2018

TABLE 5.43 DISTEK INC. DETAILS, 2017

TABLE 5.44 DISTEK INC SWOT ANALYSIS, 2018

TABLE 5.45 BELLCO GLASS, INC. DETAILS, 2017

TABLE 5.46 BELLCO GLASS SWOT ANALYSIS, 2018

TABLE 5.47 BROADLEY-JAMES CORPORATION DETAILS, 2017

TABLE 5.48 BROADLEY-JAMES CORPORATION SWOT ANALYSIS, 2018

TABLE 5.49 MAJOR SCIENCE DETAILS, 2017

TABLE 5.50 MAJOR SCIENCE SWOT ANALYSIS, 2018

TABLE 5.51 TECHNISERV INC. DETAILS, 2017

TABLE 5.52 VARIED SERVICES: SWOT ANALYSIS, 2018

TABLE 5.53 BILFINGER SE DETAILS, 2017

TABLE 5.54 BILFINGER: REVENUE ($M), OPERATING PROFIT ($M), 2016-2017

TABLE 5.55 BILFINGER SE SWOT ANALYSIS, 2018

TABLE 5.56 CENTRION.CO.,LTD. DETAILS, 2017

TABLE 5.57 CENTRION CO.,LTD. SWOT ANALYSIS, 2018

TABLE 5.58 BIOPROCESS TECHNOLOGY DETAILS, 2017

TABLE 5.59 BIOPROCESS TECHNOLOGY SWOT ANALYSIS, 2018

TABLE 5.60 CERCELL DETAILS, 2017

TABLE 5.61 CERCELL SWOT ANALYSIS, 2018

TABLE 5.62. PRAJ DETAILS, 2017

TABLE 5.63 PRAJ: REVENUE ($M), OPERATING PROFIT ($M), OPERATING MARGIN (%), ANNUAL GROWTH RATES (%), CAGRS (%), 2012-2017

TABLE 5.64 PRAJ SWOT ANALYSIS, 2018

TABLE 5.65. 3M DETAILS, 2017

TABLE 5.66 3M COMPANY: REVENUE ($M), OPERATING PROFIT ($M), OPERATING MARGIN (%), ANNUAL GROWTH RATES (%), CAGRS (%), 2012-2017

TABLE 5.67 3M SWOT ANALYSIS, 2018

TABLE 5.68 SHANGHAI BAILUN BIOENGINEERING CO., LTD DETAILS, 2017

TABLE 5.69 SHANGHAI BAILUN SWOT ANALYSIS, 2018

TABLE 5.70 CELLTAINER BIOTECH DETAILS, 2017

TABLE 5.71 CELLTAINER BIOTECH SWOT ANALYSIS, 2018

TABLE 5.72 FERMENTEC, DETAILS 2017

TABLE 5.73 FERMENTEC LTDA. SWOT ANALYSIS, 2018

TABLE 5.74 ANDEL EQUIPMENT, 2017

TABLE 5.75 ANDEL EQUIPMENT SWOT ANALYSIS, 2018

TABLE 5.76 BIO-AGE, 2017

TABLE 5.77 BIO-AGE SWOT ANALYSIS, 2018

TABLE 5.78 ELECTROLAB BIOTECH LIMITED, 2017

TABLE 5.79 ELECTROLAB BIOTECH LTD SWOT ANALYSIS, 2018

TABLE 5.80 GEA GROUP, 2017

TABLE 5.81 GEA: REVENUE ($M), OPERATING PROFIT ($M), OPERATING MARGIN (%), ANNUAL GROWTH RATES (%), CAGRS (%), 2012-2017

TABLE 5.82 GEA GROUP SWOT ANALYSIS, 2018

TABLE 5.83 MEDOREX, 2017

TABLE 5.84 MEDOREX SWOT ANALYSIS, 2018

TABLE 5.85 NOVAFERM 2017

TABLE 5.86 NOVAFERM SWOT ANALYSIS, 2018

TABLE 5.87 RITAI 2017

TABLE 5.88 RITAI SWOT ANALYSIS, 2018

TABLE 5.89 SYSBIOTECH 2017

TABLE 5.90 SYSBIOTECH SWOT ANALYSIS, 2018

TABLE 5.91 PARKER-HANNIFIN DETAILS, 2017

TABLE 5.92 PARKER-HANNIFIN: REVENUE ($M), OPERATING PROFIT ($M), OPERATING MARGIN (%), ANNUAL GROWTH RATES (%), CAGRS (%), 2013-2018

TABLE 5.93 PARKER-HANNIFIN SWOT ANALYSIS, 2018

TABLE 5.94 BIOTRON DETAILS, 2017

TABLE 5.95 BIOTRON SWOT ANALYSIS, 2018

TABLE 5.96 SPECTROCHEM DETAILS, 2017

TABLE 5.97 SPECTROCHEM SWOT ANALYSIS, 2018

TABLE 5.98 ZETA HOLDING GMBH 2017

TABLE 5.99 ZETA HOLDING GMBH SWOT ANALYSIS, 2018

TABLE 5.100 BIOZEEN 2017

TABLE 5.101 BIOZEEN SWOT ANALYSIS, 2018

TABLE 5.102 CESCO BIOENGINEERING CO., LTD 2017

TABLE 5.103 CESCO BIOENGINEERING CO., LTD SWOT ANALYSIS, 2018

TABLE 5.104 LAMBDA LABORATORY INSTRUMENTS 2017

TABLE 5.105 LAMBDA LABORATORY INSTRUMENTS SWOT ANALYSIS, 2018

TABLE 5.106 FRINGS 2017

TABLE 5.107 FRINGS SWOT ANALYSIS, 2018

TABLE 5.108 KATALYST 2017

TABLE 5.109 KATALYST BIO ENGINEERING SWOT ANALYSIS, 2018

List of Figures

FIGURE 1.1 GLOBAL BIOREACTORS MARKET SEGMENTATION OVERVIEW, 2018

FIGURE 2.1 GLOBAL BIOREACTORS MARKET SEGMENTATION OVERVIEW, 2018

FIGURE 2.2 REGIONAL BIOREACTORS MARKETS FORECASTS: ($M), 2019-2029

FIGURE 4.1 BIOREACTOR MANUFACTURERS GENERATING HIGHEST REVENUE,2017

FIGURE 5.1 DANAHER: REVENUE ($M), 2012-2017

FIGURE 5.2 EPPENDORF AG: REVENUE ($M), 2012-2017

FIGURE 5.3 GE HEALTHCARE: REVENUE ($M), 2012-2017

FIGURE 5.4 MERCK: REVENUE ($M), 2012-2017

FIGURE 5.5 SARTORIUS: REVENUE ($M), 2012-2017

FIGURE 5.6 THERMO FISHER: REVENUE ($M), 2012-2017

FIGURE 5.7 BILFINGER: REVENUE ($M), 2016-2017

FIGURE 5.8 PRAJ: REVENUE ($M), 2013-2018

FIGURE 5.9 3M COMPANY: REVENUE ($M), 2012-2017

FIGURE 5.10 GEA: REVENUE ($M), 2012-2017

FIGURE 5.11 PARKER-HANNIFIN: REVENUE ($M), 2013-2018

FIGURE 6.1 DRIVERS AND RESTRAINTS

Access Tech S.A.

ACHEMA

Advanced Scientifics

Affymetrix

Alfa Aesar

Alfa Laval

Alfa Wassermann

Alvotech

American Society of Microbiology

Andel Equipment

Andgel Industries China

Applikon Biotechnology Inc.

Attra Giand Industrial Taiwan

BBI-Biotech GmbH

Becton, Dickinson and Company (BD)

Beijing Minhai, Walvax

Bell Glass Company

Bellco Glass, Inc.

Bilfinger SE

Bilthoven Biologicals/SII

Bio-Age Equipment & Services

Bioceros

Biofarma

Biological E ltd

Biologics World Taiwan

Bioprocess Technology

Biotechnology Consortium India

Biotron

Biovet

Biozeen

Bravovax

Broadly-James Corporation

Cellexus Ltd.

Celltainer Biotech

Centrion

CEPA

CerCell

CESCO Bioengineering Co. Ltd.

CESCO BIOENGINEERING CO., LTD

Chemocomplex

China National Biotech Group

Chinese Pharmaceutical Equipment Industry Association

CIPLA

Conoor

COPHEX

Danaher Corporation

Distek Inc.

East China University of Science and Technology (ECUST)

Electrolab Biotech

Eppendorf AG

Essen BioScience Inc.

Expres2ion

FEI Company

Fermentec Ltda.

Finesse Solutions Inc.

Fisher Scientific

Fujifilm Holdings

GE Healthcare

GEA Group Aktiengesellschaft

Gennova Pharmaceuticals

Glenmark Pharmaceuticals

Goodwin Biotechnology

GSK Veterinary

Hamilton

Heinrich Frings GmbH & Co. KG

IGE Igenieros sl Spain

ilShinBioBase

Infors AG

InterPhex New York

Intervet India Pvt Ltd

Intravacc

IPL Biotech

ISPE Singapore

Katalyst Bio Engineering

LAMBDA Laboratory Instruments

Life Technologies

Medorex

Merck

Merial Veterinary

MilliporeSigma

Neela Systems Limited

Nordic Engineering Denmark

Novaferm AB

Packo Inox

Pall corporation

Parker-Hannifin

Pasteur Institutes Kasauli

PBS Biotech Inc.

Phadia

Pharmacep France

Pierre Guérin

Praj HiPurity Systems

Ritai Medicine Equipment

Sanofi

Sartorius

Scottish Enterprise

Serum institute India

Shanghai Bailun

Shanghai Special Equipment Management Association

Sibitech GmbH

Sigma-Aldrich

Smart lab

Solaris Biotech Company

Solida Biotech

Spectrochem Instruments (SCI)

Stobbe Pharma GmbH

Sysbiotech GmbH

Techniserv Inc.

Tektronix, Inc.

Thermo Electron

Thermo Fisher

TU Berlin

University Putra Malaysia

Vacsera

Vision Systems Limited

Waterloo University

Xcellerex, Inc.

Zeta GmbH Austria

ZETA Holding GmbH

Zeta India

Download sample pages

Complete the form below to download your free sample pages for Top 50 Bioreactor Manufacturers 2019

Related reports

-

Biologics Market Trends and Forecasts 2018-2028

The global biologics market is estimated to reach $250bn in 2023. The market is expected to grow at a CAGR...

Full DetailsPublished: 14 November 2018 -

Global Bioprocess Optimisation & Digital Biomanufacturing Market Forecast to 2029

The global market for bioprocess optimisation and digital biomanufacturing was valued to be $29.7bn in 2019 and is valued to...

Full DetailsPublished: 28 February 2020 -

Top 25 Biosimilar Drug Manufacturers 2019

Visiongain forecasts that the biosimilar drugs market will grow with a CAGR of 40% from 2018 to 2028.

...Full DetailsPublished: 17 April 2019 -

Drug Delivery Technologies Market Forecast 2019-2029

The Drug Delivery Technologies market is estimated to grow at a CAGR of 8.3% in the first half of the...

Full DetailsPublished: 27 February 2019 -

Biologics Market Trends and Forecasts 2019-2029

The global biologics market is estimated to reach $266bn in 2024. The market is expected to grow at a CAGR...

Full DetailsPublished: 28 August 2019 -

Top 20 Vaccines Manufacturers 2019

The global vaccines market has witnessed strong growth in past few years. The top 5 manufacturers in the global vaccines...

Full DetailsPublished: 12 February 2019 -

Global Biosimilar Monoclonal Antibodies Forecast 2018-2028

The global biosimilar monoclonal antibodies market is expected to reach $5.9bn in 2023 and is estimated to grow at a...

Full DetailsPublished: 27 February 2018 -

Pharma Leader Series: Top 50 Pharmaceutical Contract Manufacturing Organisations (CMOs) Market 2018

Contract manufacturing represents the largest sector of the pharma outsourcing industry. Pharmaceutical companies have sought to take advantage of the...Full DetailsPublished: 28 September 2018 -

Pharmaceutical Contract Manufacturing Market 2018-2028

The pharmaceutical contract manufacturing market is expected to grow at a CAGR of 6.0% in the first half of the...

Full DetailsPublished: 27 June 2018 -

Global Pre-Filled Syringes Market Forecast 2019-2029

The global pre-filled syringes market was valued at $9.8bn in 2018. This market is estimated to grow at a CAGR...

Full DetailsPublished: 31 January 2019

Download sample pages

Complete the form below to download your free sample pages for Top 50 Bioreactor Manufacturers 2019

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Pharma news

Retinal Gene Therapy Market

The global Retinal Gene Therapy market is projected to grow at a CAGR of 9.6% by 2034

26 July 2024

HIV Drugs and Injectables Market

The global HIV Drugs & Injectables market is projected to grow at a CAGR of 4.6 % by 2034

24 July 2024

Digital Twin Technology in Pharmaceutical Manufacturing Market

The global Digital Twin Technology in Pharmaceutical Manufacturing market is projected to grow at a CAGR of 31.3% by 2034

23 July 2024

Specialty Pharma Market

The global Specialty Pharma market is projected to grow at a CAGR of 7.5% by 2034

22 July 2024