Industries > Pharma > Pharma Leader Series: Top 50 Pharmaceutical Contract Manufacturing Organisations (CMOs) Market 2018

Pharma Leader Series: Top 50 Pharmaceutical Contract Manufacturing Organisations (CMOs) Market 2018

Financial Performances, Services, Capacities, Mergers & Acquisitions, SWOT Analysis

Contract manufacturing represents the largest sector of the pharma outsourcing industry. Pharmaceutical companies have sought to take advantage of the benefits of contract manufacturing – lower costs, increased flexibility and external expertise – to focus resources on core competencies in drug development and marketing.

CMOs are increasingly seen as a strategic partner for pharmaceutical companies, providing a one-stop-shop of services for formulation development and manufacturing throughout the lifecycle of a drug.

The market-leading CMOs have grown through acquisitions and site expansions to offer almost all required services on a global scale. However, there is still a role to be played by specialist CMOs, particularly those that offer biological drug manufacturing services.

This updated study discusses market-leading companies worldwide, as well as the strategies they have employed to develop in recent years. Visiongain’s research and analysis explore opportunities and challenges for the top 50 pharma contract manufacturing organisations.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 257-page report you will receive 189 charts– all unavailable elsewhere.

The 257-page report provides clear detailed insight into the leading pharmaceutical contract manufacturing organizations. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• Global Pharmaceutical Contract Manufacturing Market Size in 2017

• Pharmaceutical Contract Manufacturing Market Size in 2017 segmented by national market:

• US

• EU

• China

• Japan

• India

• Brazil

• Russia

• South Korea

• Others

• Discussion and analysis of factors that drive and restrain the pharmaceutical contract manufacturing market

• Profiles of the 50 leading pharmaceutical contract manufacturing organizations:

• AbbVie Contract Manufacturing

• Aenova Group

• Aesica Pharmaceuticals

• Ajinomoto Althea, Inc.

• Albany Molecular Research, Inc.

• Alcami Corporation

• Alkermes plc

• Almac Group

• Amatsigroup

• Aurobindo Pharma Ltd.

• Avid Bioservices Inc.

• Bayer AG

• Baxter Biopharma Solutions

• Biomay AG

• Boehringer Ingelheim GmbH

• Catalent Pharma Solutions Inc.

• Charles River Laboratories International Inc.

• Cardinal Health

• Corden Pharmaceutical

• Daito Pharmaceutical

• Delpharm

• Divis Laboratories Ltd.

• Dr. Reddy’s Laboratories Ltd.

• DPT Laboratories

• Esteve Química

• Evonik Degussa

• Famar Health Care Services

• Fareva

• Fujifilm Diosynth Biotechnologies UK Ltd.

• GlaxoSmithKline plc

• Huapont Medical

• Lonza Group Ltd.

• Nipro Corporation

• Paragon Bioservices Inc

• Patheon Inc

• Pfizer Inc./Pfizer CentreSource (PCS)

• Piramal Healthcare L

• Recipharm A

• Roche

• Royal DSM NV

• Shandong Xinhua Pharmaceutical

• Siegfried

• Teva API

• Therapure Biopharma Inc.

• UPM Pharmaceuticals Inc.

• Vetter Pharmacuticals

• Xcelience LLC

• Xcellerex LLC

• Zhejiang Hisun Pharmaceutical

• Zhejiang Huahai Pharmaceuticals

• The content of each profile differs, depending on the organization. In general, a profile gives the following information:

• Overview of the company’s contract manufacturing services and operations

• Analysis of recent financial performance – annual revenue for CMO services, including some data on operating profit and margins

• Assessment of developments – activities, acquisitions, production capacity, deals, new service offerings and collaborations

• SWOT analysis – a firm’s strengths and weaknesses, as well as opportunities and threats to manufacturing sales growth

Visiongain’s study is intended for anyone requiring commercial analyses for pharmaceutical contract manufacturing market. You find data, trends and predictions.

Buy our report today Pharma Leader Series: Top 50 Pharmaceutical Contract Manufacturing Organisations (CMOs) Market 2018: Financial Performances, Services, Capacities, Mergers & Acquisitions, SWOT Analysis.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1.1 Leading Contract Manufacturing Organizations (CMOs) Overview

1.2 Benefits of This Report

1.3 How This Report Delivers Information

1.4 Main Questions This Report Answers

1.5 Who is This Report For?

1.6 Methods of Research and Analysis

1.7 Frequently Asked Questions (FAQs)

1.8 Some Associated Reports

1.9 About Visiongain

2. Introduction to Pharmaceutical Contract Manufacturing, 2017

2.1 What Services Do Contract Manufacturers Offer?

2.1.1 Why Do Firms Outsource Manufacturing?

2.1.2 What Is Driving Demand for Contract Manufacturing Services?

2.2 The Pharmaceutical Contract Manufacturing Market, 2017

2.2.1 Where is Supply and Demand Highest for Contract Manufacturing Services?

2.3 Driving and Restrictive Forces for Pharmaceutical Contract Manufacturing

2.3.1 Pharmaceutical Contract Manufacturing: Market Drivers

2.3.2 Pharmaceutical Contract Manufacturing: Market Restraints

3. Leading Contract Manufacturing Organizations

3.1 Alcami Corporation – A Contract Development and Manufacturing Organization

3.1.1 Alcami: Manufacturing Services and Capabilities

3.1.2 Divisional Segmentation – Breakdown of Alcami’s Service

3.1.3 Alcami Focuses on Advancing its Analytical Testing Turnaround Time

3.1.4 Alcami Extended its Laboratory Service Program

3.1.5 Alcami: Madison Dearborn Partners

3.1.6 Alcami Expands its Sales Office

3.1.7 Alcami Partnered with Solasia Pharma for Manufacturing Active Pharmaceutical Ingredient

3.2 AbbVie Contract Manufacturing

3.2.1 AbbVie Offers Full-Service Contract Manufacturing

3.2.2 Expanding and Adding New Services: 2017-2018

3.2.3 Biologics and HPAPIs Opportunities for Growth 2017-2028

3.3 Aenova Group

3.3.1 Acquisition of Haupt Creates European CMO Giant

3.3.2 Aenova’s Ever Expanding Manufacturing Capacity

3.3.3 Aenova’s Competitive Position in the Contract Manufacturing Market: SWOT Analysis 2017

3.3.4 Aenova: New Manufacturing Facilities to Expand Geographic Presence

3.4 Aesica Pharmaceuticals

3.4.1 Aesica Manufactures APIs and Finished Dosage Forms

3.4.2 Acquisitions Drive Revenue Growth, 2012-2017

3.4.3 Partnering with Academia for Innovative Solutions

3.4.4 Growth through Acquisitions and Internal Expansion

3.4.5 Aesica: Opportunities for Expansion

3.5 Ajinomoto Althea, Inc.

3.5.1 Ajinomoto Althea Expands its Manufacturing Capabilities

3.5.2 Ajinomoto: New U.S. Patent for Manufacturing Crystal Monoclonal Antibodies

3.5.3 Ajinomoto Althea Expanding its Manufacturing Capacity

3.6 Albany Molecular Research, Inc.

3.6.1 Acquiring New Businesses to Expand Capabilities and Services

3.6.2 Expanding Business Operations in New Geographies

3.6.3 Collaborations to Enhance Services

3.6.4 AMRI Acquisition of Euticals S.p.a

3.7 Alkermes

3.7.1 Collaboration as a Growth Strategy to Develop and Commercialize Products

3.7.2 Alkermes: Clinical Development Program

3.8 Almac Group

3.8.1 Almac’s Manufacturing Services

3.8.2 Almac Adding Capacity Globally

3.8.3 New Services Added 2012-2016

3.8.4 Almac Group: Contract Manufacturing Market Outlook

3.9 Amatsigroup

3.9.1 Amatsi: Contract Manufacturing Agreement

3.9.2 Mergers and Acquisitions to Enhance Market Presence

3.9.3 Amatsigroup Expands its Operations and Product Portfolio

3.10 Aurobindo Pharma

3.10.1 API Manufacturing Services

3.10.2 Aurobindo Pharma: Steady Revenue Growth 2012-2017

3.10.3 Aurobindo Expanding Outside of Antibacterial

3.10.4 Aurobindo: Opportunities for Expansion

3.11 Avid Bioservices, Inc.

3.11.1 Avid Focuses on Expanding its Manufacturing Capacity

3.11.2 Avid Bioservices Selected by Acumen Pharmaceuticals to Lead Process Development and Clinical Manufacture

3.11.3 Avid Bioservices Expands Process Development Capabilities and Laboratory Infrastructure

3.12 Bayer Healthcare AG

3.12.1 Bayer Focuses on Providing Superior Pharmaceutical Services

3.12.2 Bayer Focuses Quality for all the Products and Services Offered by the Company

3.13 Baxter BioPharma Solutions

3.13.1 BioPharma Solutions Offers a Broad Product Portfolio of Sterile Contract Manufacturing Services and Solutions

3.13.2 BioPharma Focuses on Expanding its Manufacturing Capacities

3.13.3 Baxter BioPharma Solutions and SAFC Collaborate on Complete ADC Offering

3.13.4 Baxter BioPharma Solutions Focuses on Research & Development Investments

3.13.5 Baxter BioPharma is the Global Leader in Sterile Fill and Finish

3.13.6 Baxter BioPharma SWOT Analysis

3.14 Biomay AG

3.14.1 Biomay Offers Fully Integrated GMP Capacities

3.14.2 Biomay Focuses on Increasing its Capital

3.15 Boehringer Ingelheim Contract Manufacturing

3.15.1 Expanding Biopharmaceuticals Manufacturing Services in China

3.15.2 Production Through to Fill and Finished Biopharmaceuticals

3.15.3 A Track Record of Production for 29 Biopharma Products

3.15.4 Increasing Revenue from Contract Manufacturing, 2012-2017

3.15.5 Pulling Out of Small Molecule API Manufacturing

3.15.6 Expanding through New Services

3.15.7 Boehringer Ingelheim Biopharmaceuticals: Opportunities for Growth

3.16 Catalent Pharma Solutions - the World’s Leading CMO

3.16.1 Catalent: Manufacturing Services and Capabilities

3.16.2 Divisional Segmentation –Catalent’s Service

3.16.3 Catalent Pharma’s Revenue Growth, 2012-2017

3.16.4 Catalent Is Expanding its Soft Gel Technologies Division

3.16.5 Quadrupling Biopharmaceutical Manufacturing Capacity

3.16.6 Expansion of Packaging Services in Asia-Pacific and Europe: 2015

3.16.7 Adding New Early-Stage Development Services

3.16.8 Expansion in Japan – Growth Prospects for Catalent

3.16.9 New Business Contracts 2014-2016

3.16.10 Catalent: Opportunities for Growth

3.17 Charles River Laboratories International, Inc.

3.17.1 Charles River Laboratories Focuses on Increasing the Service Areas of its Offerings

3.17.2 Strategic Acquisitions as a Growth Strategy to Expand Product Portfolio

3.17.3 Charles River Laboratories Revenue Growth, 2012-2017

3.18 Cardinal Health, Inc.

3.18.1 Cardinal Health Focuses on Helping Healthcare Organizations for Patient Safety

3.18.2 Cardinal Revenue Growth, 2012-2017

3.19 CordenPharma International

3.19.1 CordenPharma Service Division

3.19.2 CordenPharma Emerging in the API Market

3.19.3 Investments in Highly Potent Capabilities

3.19.4 CordenPharma: SWOT Analysis

3.20 Daito Pharmaceutical Co., Ltd.

3.20.1 Daito Has a Portfolio of More than 43 APIs

3.20.2 Rapid Growth in Revenue and Operational Profit: Daito Financial Performance 2012-2017

3.20.3 Daito Is Well-Placed for Asian Market Growth – SWOT Analysis

3.21 Delpharm

3.21.1 Finished Dosage Form Manufacturing for Developed Markets

3.21.2 Delpharm: Rapid Revenue Growth Via Acquisitions, 2012-2017

3.21.3 Delpharm: Outlook and Prospects for Growth

3.22 Divis Laboratories

3.22.1 Divis Laboratories and the Contract Manufacturing Industry

3.22.2 Divis Laboratories: A Rapidly Growing CMO, 2012-2017

3.22.3 Divis Laboratories: API Manufacturing

3.23 Dr. Reddy’s Laboratories Ltd.

3.23.1 API and FDF Manufacturing Services

3.23.2 Dr. Reddy’s PSAI: Strong Revenue Growth 2012-2017

3.23.3 Advancing in Complex Drug Manufacturing

3.23.4 Expanding in the European Manufacturing Market

3.24 DPT Laboratories, Ltd.

3.24.1 Mylan Acquires Topicals-Focused Specialty and Generic Business of DPT

3.24.2 DPT Enhances Flexibility and Efficiencies

3.24.3 DPT Enhances Capabilities with New High-Speed Filling Center

3.25 Esteve Qu`mica

3.25.1 Esteve Química Manufactures APIs for Developed and Emerging Markets

3.25.2 Expanding in the US, 2016

3.25.3 Esteve Química: SWOT Analysis

3.26 Evonik Degussa

3.26.1 Investing in API and Drug Delivery Services

3.26.2 Moderate Growth in Pharmaceutical Manufacturing Services, 2012-2017

3.26.3 Evonik Is a HPAPI Specialist

3.26.4 Evonik Continues to Grow Across All Segments

3.26.5 How Can Evonik Expand in the Pharmaceutical Contract Manufacturing Market?

3.27 FAMAR Health Care Services

3.27.1 Famar Is an Expert in Lyophilisation

3.27.2 Sustained Growth in Famar’s Revenue: 2011-2016

3.27.3 Expanding Outside Europe

3.27.4 Further Site Acquisitions Are an Opportunity for Growth

3.28 Fareva Group

3.28.1 Fareva Has 35 Years’ Manufacturing Experience

3.28.2 Revenue Growth through Acquisitions: 2012-2017

3.28.3 Fareva SWOT Analysis

3.29 FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

3.29.1 Opening of New Manufacturing facility

3.29.2 Fujifilm Establishes Cell Culture Process Development Laboratories

3.29.3 Fujifilm Completes Acquisition of Kalon Biotherapeutics LLC

3.30 GlaxoSmithKline plc

3.30.1 GSK Enters into an Agreement with Novartis for Full Ownership of Consumer Healthcare Business

3.30.2 GSK Received Complete Response from FDA for Candidate Pandemic H5N1 Adjuvanted Influenza Vaccine

3.31 Pfizer CentreOne

3.31.1 Pfizer CentreSource: Historic Revenue Performance, 2012-2017

3.31.2 Will Hospira Acquisition Lead to Revenue Growth in Future?

3.32 Huapont Pharmaceutical Co., Ltd.

3.32.1 China Pharmaceutical Trade

3.33 Lonza

3.33.1 Lonza Is a Leader in Biologics Manufacturing

3.33.2 Lonza Contract Manufacturing and Development: 2012-2017

3.33.3 Investing in Advanced Biological Drug Sectors

3.33.4 The Promise of Antibody-Drug Conjugates (ADCs)

3.33.5 The Regenerative Medicine Future in Japan

3.33.6 Lonza: SWOT Analysis

3.34 Nipro Corporation: Japan’s Leading CMO

3.34.1 Nipro Pharmaceutical Contract Manufacturing Capabilities

3.34.2 Nipro Revenues 2012-2017

3.34.3 Biosimilars and Anti-Cancer Drugs Are Opportunities for Future Growth: SWOT Analysis

3.35 Paragon Bioservices, Inc.

3.35.1 Paragon Announced Expansion of its New Manufacturing Facility

3.36 Patheon – One of the Top 3 CMOs

3.36.1 Patheon – Global leader in Pharmaceutical Development Services

3.36.2 Contract Manufacturing Services at Patheon

3.36.3 Steady Revenue Growth 2012-2017

3.36.4 DPx Holdings: Developments

3.36.5 Adding New Formulations and Formulation Development Services

3.36.6 Expanding Services Through Acquisition, 2016

3.36.7 Patheon: SWOT Analysis

3.37 Recipharm

3.37.1 Contract Development and Manufacturing Services

3.37.2 Recipharm: Financial Performance 2012-2017

3.37.3 Recipharm Invests in Facility Expansion

3.37.4 Recipharm Growing in the Development and Technology Market Through Acquisitions

3.37.5 Recipharm: SWOT Analysis

3.38 F. Hoffman-La Roche Ltd.

3.38.1 Amplified Revenue Growth in Pharma Manufacturing 2012-2017

3.38.2 Value of Innovation

3.38.3 Approvals and Extensions in Pharmaceuticals Division

3.38.4 Launch of New Products Drive the Growth of the Company

3.39 Royal DSM

3.39.1 Amplified Revenue Growth in Pharma Manufacturing 2012-2017

3.39.2 DSM Pharmaceuticals Products/DPx Holdings: Manufacturing Services

3.39.3 DSM Sinochem Pharmaceuticals: A World Leader in Antibacterial Manufacturing

3.39.4 DPx Holdings: A New Pharma Leader

3.39.5 Investing in Biopharma Manufacturing

3.39.6 Expanding API Manufacturing

3.39.7 Generics and Biologics Offer Room for Growth

3.40 Shandong Xinhua Pharmaceutical

3.40.1 Experience in APIs and Finished Dosage Forms

3.40.2 Shandong Xinhua: Strong Revenue Growth 2012-2017

3.40.3 Growing through Joint Ventures

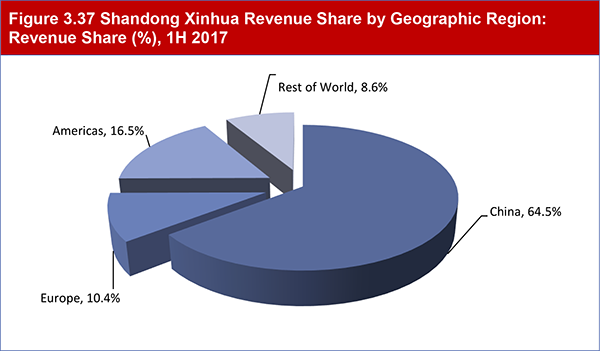

3.40.4 Looking to Expand in the US and EU

3.41 Siegfried

3.41.1 Siegfried’s Acquisitions, 2012-2017

3.41.2 Expanding Siegfried’s Manufacturing Footprint Globally

3.41.3 Expanding High Potency API Capabilities

3.41.4 Siegfried: Financial Performance 2012-2017

3.41.5 Siegfried’s Characteristics within the Contract Manufacturing Market: SWOT Analysis

3.42 TEVA Pharmaceutical, Ltd.

3.42.1 API Manufacturing Services

3.42.2 Teva API: Financial Performance 2012-2017

3.42.3 Building a Footprint in Mexico, India and China

3.42.4 Teva API: SWOT Analysis

3.43 Therapure Biopharma, Inc.

3.43.1 Therapure Collaborated with 3SBio Inc., and CPE Funds

3.44 UPM Pharmaceuticals

3.45 Vetter Pharmaceutical

3.45.1 Vetter is an Injectable Manufacturing Specialist

3.45.2 Services, Collaborations and Differentiating Factors

3.45.3 Expanding Services in the US and Asia

3.45.4 Biologics: Opportunity for Growth for Vetter

3.46 Xcelience, LLC

3.47 Xcellerex, Inc.

3.48 Piramal Pharma Solutions

3.48.1 Mergers and Acquisitions

3.48.2 Piramal Pharma Solutions: Financial Performance 2012-2017

3.48.3 Investment in Technology-based Delivery Platforms

3.48.4 Quality Governance

3.49 Zhejiang Hisun Pharmaceutical

3.49.1 API Manufacturing for Markets Worldwide

3.49.2 Moving into International Drug Marketing

3.49.3 Zhejiang Hisun: Opportunities for Growth

3.50 Zhejiang Huahai Pharmaceuticals

3.50.1 Zhejiang Huahai is a Market Leader Within the Antihypertensive API Market

3.50.2 Zhejiang Huahai: Contract Manufacturing Performance 2012-2017

3.50.3 Expanding in the US Generic Drugs Market

3.50.4 Zhejiang Huahai: SWOT Analysis

4. Conclusions of the Study

4.1 What Has Driven Growth for CMO Market Leaders in Recent Years?

4.2 Strategies for Growth: Prospects for Leading CMOs

4.3 High Demand for Biopharmaceutical Manufacturing Services

4.4 Investing in Novel Technologies

4.5 Outlook for API Manufacturers

Appendices

Some Associated Visiongain Reports

Visiongain Report Sales Order Form

About Visiongain

Visiongain Report Evaluation Form

List of Tables

Table 2.1 Benefits and Drawbacks to Outsourcing Pharmaceutical Manufacturing, 2017

Table 2.2 Contract Manufacturing Market Total Revenue: Total Revenue ($bn), Annual Growth (%), 2015-2017

Table 2.3 Contract Manufacturing Market by Leading Country: Market Size ($bn), Market Share (%), 2017

Table 3.1 Alcami Details, 2017

Table 3.2 Alcami Facility Details, 2017

Table 3.3 AbbVie Contract Manufacturing: Details, 2017

Table 3.4 AbbVie Contract Manufacturing Facility Capabilities, 2017

Table 3.5 AbbVie Contract Manufacturing SWOT Analysis, 2017

Table 3.6 Aenova Group Details, 2017

Table 3.7 Aenova Group Manufacturing Capacity by Dosage Form, 2017

Table 3.8 Aenova Group Manufacturing Facility Details, 2017

Table 3.9 Aenova Group SWOT Analysis, 2017

Table 3.10 Aesica Details, 2017

Table 3.11 Aesica Pharmaceuticals: Revenue ($m), Operating Profit ($m), Operating Margin (%), Annual Growth Rates (%), CAGRs (%), 2012-2017

Table 3.12 Aesica SWOT Analysis, 2018

Table 3.13 Ajinomoto Althea, Inc. Details, 2017

Table 3.14 Albany Molecular Research, Inc. Details, 2017

Table 3.15 Alkermes Details, 2017

Table 3.16 Almac Details, 2017

Table 3.17 Almac Pharmaceutical Manufacturing Facilities Details, 2017

Table 3.18 Almac: SWOT Analysis, 2017

Table 3.19 Amatsigroup Details, 2017

Table 3.20 Aurobindo Pharma Details, 2016

Table 3.21 Aurobindo Contract Manufacturing: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2012-2017

Table 3.22 Aurobindo Contract Manufacturing: SWOT Analysis, 2017

Table 3.23 Avid Bioservices, Inc. Details, 2017

Table 3.24 Bayer Healthcare AG Details, 2017

Table 3.25 Baxter BioPharma Solutions Details, 2017

Table 3.26 Baxter BioPharma Solutions: Facilities and Services Offered, 2016

Table 3.27 Baxter BioPharma Solutions SWOT Analysis, 2017

Table 3.28 Biomay AG Details, 2017

Table 3.29 Boehringer Ingelheim Biopharmaceuticals Details, 2017

Table 3.30 Boehringer Ingelheim Total Pharmaceutical Manufacturing Capacity: Reactor Size and Number of Units by CMO Service, 2017

Table 3.31 Products Developed by Boehringer Ingelheim Biopharmaceuticals, 1983-2014

Table 3.32 Boehringer Ingelheim Pharmaceutical Manufacturing: Revenue ($m), Annual Growth (%), CAGR (%), 2012-2017

Table 3.33 Boehringer Ingelheim: SWOT Analysis, 2017

Table 3.34 Catalent Details, 2017

Table 3.35 Catalent Facility Details, 2017

Table 3.36 Catalent Financial Performance: Revenue ($m), Annual Growth Rates (%), CAGR (%), 2012-2017

Table 3.37 Catalent Financial Performance by Product Type: Revenue ($m), Revenue Share (%), 2017

Table 3.38 Catalent Pharma SWOT Analysis, 2017

Table 3.39 Charles River Laboratories International, Inc. Details, 2017

Table 3.40 Charles River Financial Performance: Revenue ($m), Annual Growth Rates (%), CAGR (%), 2012-2017

Table 3.41 Cardinal Health, Inc. Details, 2017

Table 3.42 Cardinal Health Financial Performance: Revenue ($b), Annual Growth Rates (%), CAGR (%), 2012-2017

Table 3.43 CordenPharma International Details, 2017

Table 3.44 CordenPharma Facilities and Service Details, 2017

Table 3.45 CordenPharma SWOT Analysis, 2017

Table 3.46 Daito Pharmaceutical: Details, 2017

Table 3.47 Daito Pharmaceuticals Financial Performance: Revenue ($m), Revenue (¥m), CAGR (%), 2012-2017

Table 3.48 Daito Pharmaceuticals SWOT Analysis, 2017

Table 3.49 Delpharm Details, 2017

Table 3.50 Delpharm: Facilities and Services, 2017

Table 3.51 Delpharm: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2012-2017

Table 3.52 Delpharm: SWOT Analysis, 2017

Table 3.53 Divis Laboratories Details, 2017

Table 3.54 Divis Laboratories: Facility Details, Production Capacity and Services, 2017

Table 3.55 Divis Laboratories: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2012-2017

Table 3.56 Divis Laboratories Revenue Distribution: Revenue ($m), Share of Total (%), 2017

Table 3.57 Divis Laboratories Revenue by Region: Revenue ($m), Share of Total (%), 2017

Table 3.58 Divis Laboratories Contract Manufacturing: SWOT Analysis, 2017

Table 3.59 Dr. Reddy’s Laboratories Ltd. Details, 2017

Table 3.60 Dr. Reddy’s Laboratories Cumulative Drug Master File (DMF) Applications: Applications Accepted by Region, Regional Share (%), 2017

Table 3.61 Dr. Reddy’s Laboratories Contract Manufacturing: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2012-2017

Table 3.62 Dr. Reddy’s Laboratories: Contract Manufacturing Revenue ($m) by Regional Market and Revenue Share (%), FY 2017

Table 3.63 Dr. Reddy’s Laboratories: SWOT Analysis, 2017

Table 3.64 DPT Laboratories Ltd. Details, 2017

Table 3.65 Esteve Química Details, 2017

Table 3.66 Esteve Química SWOT Analysis, 2017

Table 3.67 Evonik Degussa Details, 2017

Table 3.68 Evonik Health and Nutrition: R&D and Production Sites by Region, 2017

Table 3.69 Evonik Pharmaceutical Manufacturing: Revenue ($m), Annual Growth (%), CAGR (%), 2012-2017

Table 3.70 Evonik Pharmaceutical Manufacturing: SWOT Analysis, 2017

Table 3.71 Famar Details, 2017

Table 3.72 Famar Pharmaceutical Manufacturing Facilities, 2017

Table 3.73 Famar Pharmaceutical Manufacturing: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2011-2016

Table 3.74 Famar: SWOT Analysis, 2017

Table 3.75 Fareva Details, 2016

Table 3.76 Fareva Manufacturing Facilities, 2017

Table 3.77 Fareva Pharmaceutical Manufacturing: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2012-2017

Table 3.78 Fareva: SWOT Analysis, 2017

Table 3.79 FUJIFILM Diosynth Biotechnologies U.S.A., Inc. Details, 2017

Table 3.80 GlaxoSmithKline plc Details, 2017

Table 3.81 Pfizer CentreOne Details, 2017

Table 3.82 Pfizer CentreSource: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2012-2017

Table 3.83 Pfizer CentreOne SWOT Analysis, 2017

Table 3.84 Huapont Pharmaceutical Co., Ltd. Details, 2017

Table 3.85 Lonza Details, 2017

Table 3.86 Selected Lonza Pharmaceutical and Biotech Manufacturing and Development Agreements, 2010-2015

Table 3.87 Lonza Pharma & Biotech Department: Revenue ($m), 2012-2018

Table 3.88 ADCs Approved and in Late Stage Clinical Development, 2014

Table 3.89 Lonza SWOT Analysis, 2017

Table 3.90 Nipro Pharma Details, 2017

Table 3.91 Nipro Pharmaceutical Contract Manufacturing Capabilities: 2012-2017

Table 3.92 Nipro Pharmaceutical Contract Manufacturing: Annual Production Capacity, 2017

Table 3.93 Nipro Pharmaceutical Contract Manufacturing Financial Performance: Revenue ($m), Annual Growth Rates (%), CAGR (%), 2012-2017

Table 3.94 Nipro Pharmaceutical Contract Manufacturing SWOT Analysis, 2017

Table 3.95 Paragon Bioservices, Inc. Details, 2017

Table 3.96 Patheon Details, 2017

Table 3.97 Patheon Manufacturing Facilities, 2017

Table 3.98 Patheon Pharmaceutical Manufacturing: Revenue ($m), Annual Growth Rates (%), CAGRs (%), 2012-2017

Table 3.99 Patheon: SWOT Analysis, 2017

Table 3.100 Recipharm Details, 2017

Table 3.101 Recipharm: Facility Details and Services, 2017

Table 3.102 Recipharm: Revenue ($m), Annual Growth Rates (%), CAGRs (%), 2012-2017

Table 3.103 Recipharm Manufacturing Revenue by Client Size: Revenue ($m), Share of Total Revenues (%), 2017

Table 3.104 Recipharm Manufacturing Revenue Distribution: Customer Revenue ($m), Share of Total Revenues (%), 2017

Table 3.105 Recipharm: SWOT Analysis, 2017

Table 3.106 F. Hoffman-La Roche Details, 2017

Table 3.107 Roche Pharmaceutical Manufacturing: Revenue ($bn), Annual Growth (%), CAGR (%) 2012-2017

Table 3.108 Royal DSM Details, 2017

Table 3.109 Royal DSM Pharmaceutical Manufacturing: Revenue ($m), Annual Growth (%), CAGR (%) 2012-2017

Table 3.110 DSM Pharmaceutical Products (DPP)/DPx Holdings Division: Revenue ($m), Annual Growth (%), CAGR (%), 2011-2016

Table 3.111 DSM Sinochem Pharmaceuticals (DSP): Revenue ($m), Annual Growth (%), CAGR (%), 2012-2017

Table 3.112 DSM Pharmaceutical Manufacturing: SWOT Analysis, 2017

Table 3.113 Shandong Xinhua Pharmaceuticals Details, 2017

Table 3.114 Shandong Xinhua Pharmaceutical Production Capacity by Dosage Form, 2017

Table 3.115 Shandong Xinhua: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2012-2017

Table 3.116 Shandong Xinhua Revenue Share by Geographic Region: Revenue Share (%), 2017

Table 3.117 Shandong Xinhua Manufacturing: SWOT Analysis, 2017

Table 3.118 Siegfried Details, 2017

Table 3.119 Siegfried Pharmaceutical Manufacturing Facilities Details, 2017

Table 3.120 Siegfried Pharmaceutical Manufacturing: Revenue ($m), Annual Growth Rates (%), CAGRs (%), 2012-2017

Table 3.121Siegfried: SWOT Analysis, 2017

Table 3.122 Teva API Details, 2017

Table 3.123 Teva API: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2012-2017

Table 3.124 Teva API SWOT Analysis, 2017

Table 3.125 Therapure Biopharma Details, 2017

Table 3.126 UPM Pharmaceuticals Details, 2017

Table 3.127 Vetter Details, 2017

Table 3.128 Vetter Pharmaceutical Facilities, 2017

Table 3.129 Vetter: SWOT Analysis, 2017

Table 3.130 Xcelience LLC Details, 2017

Table 3.131 Xcellerex, Inc. Details, 2017

Table 3.132 Piramal Pharma Solutions Details, 2017

Table 3.133 Piramal Pharma Solutions: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2012-2017

Table 3.134 Zhejiang Hisun Pharmaceuticals Details, 2017

Table 3.135 Zhejiang Hisun Manufacturing: SWOT Analysis, 2017

Table 3.136 Zhejiang Huahai Pharmaceuticals Details, 2017

Table 3.137 Zhejiang Huahai Contract Manufacturing: Revenue ($m), Annual Growth Rate (%), CAGR (%), 2012-2017

Table 3.138 Zhejiang Huahai Contract Manufacturing: SWOT Analysis, 2017

Table 4.1 Top Five Developed and Emerging Market CMOs: Grouped Revenue ($m), Annual Growth Rate (%), CAGR (%), 2012-2017

List of Figures

Figure 2.1 Selected Services Contracted to CMOs by Developmental Stage, 2017

Figure 2.2 Contract Manufacturing Market Total Revenue: Total Revenue ($bn), 2015-2017

Figure 2.3 Contract Manufacturing Market by Leading Country: Market Share (%), 2017

Figure 2.4 Pharmaceutical Contract Manufacturing: Drivers and Restraints

Figure 3.1 Aesica Pharmaceuticals: Revenue ($m), 2012-2017

Figure 3.2 Aurobindo Contract Manufacturing: Revenue ($m), 2012-2017

Figure 3.3 Boehringer Ingelheim Pharmaceutical Manufacturing: Revenue ($m), 2012-2017

Figure 3.4 Catalent Facilities by Region, 2017

Figure 3.5 Catalent Facilities by Service Offered, 2017

Figure 3.6 Catalent Financial Performance: Revenue ($m), 2012-2017

Figure 3.7 Catalent Financial Performance by Product Type: Revenue Share (%), 2017

Figure 3.7 Charles River Laboratories Financial Performance: Revenue ($m), 2012-2017

Figure 3.8 Cardinal Health Financial Performance: Revenue ($b), 2012-2017

Figure 3.9 Daito Pharmaceuticals Financial Performance: Revenue ($m), 2012-2017

Figure 3.10 Delpharm: Revenue ($m), 2012-2017

Figure 3.11 Divis Laboratories Contract Manufacturing: Revenue ($m), 2012-2017

Figure 3.12 Divis Laboratories Revenue Distribution: Revenue ($m), 2017

Figure 3.13 Divis Laboratories Revenue by Region: Share of Total (%), 2017

Figure 3.14 Dr. Reddy’s Laboratories Cumulative Drug Master File (DMF) Applications: Accepted by Region (%), 2017

Figure 3.15 Dr. Reddy’s Laboratories Contract Manufacturing: Revenue ($m), 2012-2017

Figure 3.16 Dr. Reddy’s Laboratories Contract Manufacturing Revenue: Regional Revenue Share (%), FY 2017

Figure 3.17 Evonik Health and Nutrition: R&D and Production Sites (%) by Region, 2017

Figure 3.18 Evonik Pharmaceutical Manufacturing: Revenue ($m), 2012-2017

Figure 3.19 Famar Pharmaceutical Manufacturing: Revenue ($m), 2011-2016

Figure 3.20 Fareva Pharmaceutical Manufacturing: Revenue ($m), 2012-2017

Figure 3.21 Pfizer CentreOne: Revenue ($m), 2012-2017

Figure 3.22 Lonza Pharma & Biotech: Revenue ($m), 2012-2018

Figure 3.23 Lonza Custom Manufacturing by Regional Market: Revenue Share (%), 2017

Figure 3.24 Nipro Pharmaceutical Contract Manufacturing Capabilities: Orally Administered Drugs, Injectables, External Preparations, 2012-2017

Figure 3.25 Nipro Pharmaceuticals Financial Performance: Revenue ($m), 2012-2017

Figure 3.26 Patheon Pharmaceutical Development Projects (%) by Phase, 2017

Figure 3.27 Patheon Pharmaceutical Manufacturing Projects by Client Size: Proportion of Total Revenue (%), 2017

Figure 3.28 Patheon Pharmaceutical Manufacturing: Revenue ($m), 2012-2017

Figure 3.29 Recipharm: Revenue ($m), 2012-2017

Figure 3.30 Recipharm Manufacturing Revenue by Client: Share of Total Revenues (%), 2017

Figure 3.31 Recipharm Manufacturing Revenue Distribution: Customer Revenue ($m), 2017

Figure 3.32 Roche Pharmaceutical Manufacturing: Revenue ($b), 2012-2017

Figure 3.33 Royal DSM Pharmaceutical Manufacturing: Revenue ($m), 2012-2017

Figure 3.34 DSM Pharmaceutical Products (DPP)/ DPx Holdings Division: Revenue ($m), 2011-2016

Figure 3.35 DSM Sinochem Pharmaceuticals (DSP): Revenue ($m), 2012-2017

Figure 3.36 Shandong Xinhua: Revenue ($m), 2012-2017

Figure 3.37 Shandong Xinhua Revenue Share by Geographic Region: Revenue Share (%), 1H 2017

Figure 3.38 Siegfried Pharmaceutical Manufacturing: Revenue ($m), 2012-2017

Figure 3.39 Teva API: Revenue ($m), 2012-2017

Figure 3.40 Piramal Pharma Solutions: Revenue ($m), 2012-2017

Figure 3.41 Zhejiang Huahai Contract Manufacturing: Revenue ($m), 2012-2017

Figure 4.1 Top Five Developed and Emerging Market CMOs: Grouped Revenue ($m), 2012-2017

Abbott

AbbVie

Accucaps Industries Limited

Acorda

Activa Capital

Acumen Pharmaceuticals, Inc.

AdAlta

Adamas Pharmaceuticals

Aenova Group

Aesica Pharmaceuticals

Agennix

Agere Pharmaceuticals

Ajinomoto Althea, Inc.

Albany Molecular Research, Inc.

Alcami Corporation

Alkermes plc

Alliance Medical Products (AMP)

Almac Group

Althea Technologies Inc.

Amatsigroup

AmatsiQBiologicals

AMYRA Biotech

Apexigen

arGEN-X

Astellas Pharma

AstraZeneca

Athera Biotechnologies

Aurobindo Pharma Ltd.

Avalanche Biotechnologies

Avepharm

Avid Bioservices Inc.

Avogadro

Banner Life Sciences

Baxter Biopharma Solutions

Bayer AG

BC Partners

Biogen

Biomay AG

Bionomics

Biotest

Boehringer Ingelheim BioXcellence

Boehringer Ingelheim GmbH

Breckenridge Pharmaceutical

Bristol-Myers Squibb

Cambridge Major Laboratories, Inc.

Carbogen Amcis

Cardinal Health

Catalent Pharma Solutions Inc.

Catalyst Capital Group, Inc.

Celladon

Celldex Therapeutics

Celsion

CEVEC Pharmaceuticals

Charles River Laboratories International Inc.

Chemisch-Pharmazeutisches Laboratorium Ravensburg

Chemtrix

Chongqing Huapont Pharmaceutical Co., Ltd.

Circadian Technologies

CITICPE

Cleveland BioLabs

Cobra Biomanufacturing

Consort Medical

Corden Pharmaceutical

Corvette

CPE Funds

Daiichi Sankyo

Daito Pharmaceutical

DBI

Delmas Perfusion

Delpharm

Divis Laboratories Ltd.

DPT Laboratories

DPX Holdings

Dr. Reddy’s Laboratories Ltd.

Dragenopharm Apotheker Püschl

DSM Pharmaceutical Products (DPP)

Eagle Pharmaceuticals

Eclipse Therapeutics

Eisai

Ekkio Capital

Eli Lilly

EmulTech

Enzon Pharmaceuticals

Esteve Química

Euro Vital Pharma

Eurofins Amatsigroup

Euticals

Evonik

Exelixis

Famar Health Care Services

Fareva

Flamel Technologies

Frazier Healthcare

Fujifilm Diosynth Biotechnologies UK Ltd.

Gadea Pharmaceutical Group

Gallus BioPharmaceuticals

Genzyme

GlaxoSmithKline (GSK)

Hameln Pharmaceuticals GmbH

Hameln RDS GmbH

Haupt Pharma

Hospira, Inc.

Huapont Medical

Human Genome Sciences

Icagen, Inc.

Immune Pharmaceuticals

Immunomedics

Index Ventures

Indoco Remedies

Intellect Neurosciences

International Chemical Investors Group (ICIG)

IRIX Pharmaceuticals

Janssen

JK Pharmaceutical

JLL Partners

Johnson & Johnson (J&J)

KWS BioTest Limited

Laboratoire Aguettant

Laboratoires Besins

Lanxess Corporation

Lonza Group Ltd.

Lusomedicamenta

Madison Dearborn Partners, LLC (MDP)

Marine Ingredients

Marinopoulos Group

Merck KGaA

Mesoblast

Micron Technologies

Molecular Partners

Mundipharma

Mylan

New York Center for Nanomedicine Research (NYCNMR)

NIH CRM

Nikon

Nipro Corporation

Novozymes

Octane

OncoMed Pharmaceuticals

OPKO Health. Inc.

Opthea

Orpegen Peptide Chemicals GmbH

Osiris Therapeutics

Paragon Bioservices Inc

Patheon Inc

Pfizer

Pfizer CentreOne

Pfizer Inc./Pfizer CentreSource (PCS)

Pharmacia (now Pfizer)

Pharmacyclis

Pharmatek Laboratories, Inc.

Piramal

Piramal Healthcare L

Precision Ocular Ltd

Prime European Therapeuticals S.p.A

Progenics Pharmaceuticals

Propanc Health Group

Q-Biologicals

R5 Pharmaceuticals

Ranbaxy

Recipharm A

Regeneus

Relthy Laboratórios

Relypsa

Renaissance Acquisition Holdings, LLC

Rexim

Roche

Royal DSM

Sandoz

Sanofi

Schering (now Bayer)

Seattle Genetics

Sentry BioPharma Services

Servier

Shandong Tianda Biological Pharmaceutical

Shandong Xinhua Pharmaceutical

Siegfried

Sigma-Aldrich

Sigmar Italia

Sinopharm

Solasia Pharma

Solvay

SurModics

Swedish Orphan Biovitrium AB (Sobi)

Swiss Caps

Syntex (now Roche)

Takeda

Temmler Group

Tessenderlo Group

Teva

The Carlyle Group

Therapure Biopharma Inc.

TL Biopharmaceuticals Ltd

Tohoku Nipro Pharmaceutical Corporation

Tunitas Therapeutics

UCB

UMN Pharma

UPM Pharmaceuticals Inc.

Valerion Therapeutics

Vetter Pharmacuticals

Virbac

Whitehouse Analytical Laboratories, LLC.

WindRose

Xcelience LLC

Xcellerex LLC

Xinhua Pharmaceutical (Gaomi) Company

XOMA

Yiwu Huayi Fine Chemical Co.

Zhejiang Hisun Pharmaceutical

Zhejiang Huahai Pharmaceuticals

Zhejiang Jiang Yuan Tang

Zumutor

ZYMtronix

List of Organizations Mentioned in the Report

Agence Nationale de sécurité du Médicament et des produits de santé (ANSM)

Agência Nacional de Vigilância Sanitária (ANVISA)

Biomedical Advanced Research and Development Authority (BARDA)

Cardinal Health Foundation

Eindhoven University of Technology

FDA

Générique Même Médicament (GEMME)

Health Canada

International Chemical Investors Group (ICIG)

MHRA

Queens University Belfast

Sanquin Blood Supply Foundation

University College London (UCL)

University of Bradford

University of Durham

University of Leeds

Download sample pages

Complete the form below to download your free sample pages for Pharma Leader Series: Top 50 Pharmaceutical Contract Manufacturing Organisations (CMOs) Market 2018

Related reports

-

Generic Drugs Market Forecast 2018-2028

The generic drugs market is estimated at $257.3bn in 2017 and is expected to grow at a CAGR of 7.9%...

Full DetailsPublished: 25 April 2018 -

Vaccine Sales Market Forecast 2018-2028

The Global Vaccines Sales market was valued at $36.9 billion in 2017. This value will grow to $61.1bn in 2022...

Full DetailsPublished: 09 March 2018 -

Global Respiratory Diagnostics Market Report 2017-2027

The global respiratory diagnostics market is expected to grow at a CAGR of 7.1% in the first half of the...Full DetailsPublished: 08 June 2017 -

Top 25 Antibiotic Drugs Manufacturers 2018

Visiongain forecasts the antibiotic drugs market to increase to $ 43,841.7m in 2022. The market is estimated to grow at...

Full DetailsPublished: 12 June 2018 -

Pharma Leader Series: Top 25 Ophthalmic Drug Manufacturers 2018-2028

The global ophthalmic drugs market was valued at $23bn in 2017. The market was dominated by the Retinal Disorder drug...

Full DetailsPublished: 19 July 2018 -

Pharma Leader Series: Top 20 Asthma & COPD Companies 2019-2029

The global asthma & COPD therapies market was valued at $36.21bn in 2018 and is projected to grow to $47bn...

Full DetailsPublished: 19 December 2018 -

Global Bioreactors Market 2019-2029

The global bioreactors market is expected to grow at a CAGR of 7.5% in the second half of the forecast...

Full DetailsPublished: 18 December 2018 -

Global Biosimilars and Follow-On Biologics Market 2018-2028

The global biosimilars and follow-on biologics market is estimated to have reached $7.70bn in 2017 and expected to grow at...

Full DetailsPublished: 01 June 2018 -

Top 20 Vaccines Manufacturers 2019

The global vaccines market has witnessed strong growth in past few years. The top 5 manufacturers in the global vaccines...

Full DetailsPublished: 12 February 2019 -

Medical Device Leader Series: Top Pre-Filled Injection Device Manufacturers 2018-2028

The Pre-Filled Device Manufacturing market is estimated to reach $7.5bn in 2022, growing at a CAGR of 10.5% from 2017...Full DetailsPublished: 13 November 2018

Download sample pages

Complete the form below to download your free sample pages for Pharma Leader Series: Top 50 Pharmaceutical Contract Manufacturing Organisations (CMOs) Market 2018

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Pharma news

Retinal Gene Therapy Market

The global Retinal Gene Therapy market is projected to grow at a CAGR of 9.6% by 2034

26 July 2024

HIV Drugs and Injectables Market

The global HIV Drugs & Injectables market is projected to grow at a CAGR of 4.6 % by 2034

24 July 2024

Digital Twin Technology in Pharmaceutical Manufacturing Market

The global Digital Twin Technology in Pharmaceutical Manufacturing market is projected to grow at a CAGR of 31.3% by 2034

23 July 2024

Specialty Pharma Market

The global Specialty Pharma market is projected to grow at a CAGR of 7.5% by 2034

22 July 2024