Industries > Pharma > Global Biosimilars and Follow-On Biologics Market 2018-2028

Global Biosimilars and Follow-On Biologics Market 2018-2028

Monoclonal Antibodies (mAbs), Fusion Proteins, Insulin, Erythropoietins, Granulocyte Colony-Stimulating Factor (G-CSF), Interferons, Growth Hormones, Fertility Hormones

The global biosimilars and follow-on biologics market is estimated to have reached $7.70bn in 2017 and expected to grow at a CAGR of 23.8% in the first half of the forecast period. The market is dominated by Biosimilar Monoclonal Antibodies, this submarket is estimated to hold 24% share of this market by 2022.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 335-page report you will receive 131 tables and 68 figures– all unavailable elsewhere.

The 335-page report provides clear detailed insight into the global biosimilars and follow-on biologics market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• Global Biosimilars and Follow-on Biologics Market forecasts from 2018-2028

• Along with revenue prediction for the overall world market for biosimilars, our investigation shows forecasts to 2028 for 8 individual therapeutic submarkets:

• Monoclonal antibodies (mAbs)

• Fusion proteins

• Insulin

• Erythropoietin (EPO)

• Granulocyte colony-stimulating factor (G-CSF)

• Interferons

• Growth hormones

• Fertility hormones

• This report also shows revenue to 2028 for 12 individual submarkets within the above segments:

• Rituximab, infliximab, trastuzumab, adalimumab and bevacizumab

• Human insulin, insulin analogues, insulin glargine and insulin lispro

• Interferon alfa and interferon beta

• Etanercept

• Our analyses show individual revenue forecasts to 2028 for 12 national markets:

• US

• Japan

• Germany, France, UK, Italy and Spain

• China, India, South Korea, Russia and Brazil

• Our study provides a SWOT analysis of the biosimilars and follow-on biologics market.

• Our study discusses pressures, opportunities and other events affecting the biosimilars industry and market, including these influences:

• Strategies for developing biosimilars – needs, demand, challenges and opportunities

• Guidelines from regulators (FDA, EMA and others)

• Patent challenges and data exclusivity for biopharmaceuticals

• Needs and opportunities in developing biosimilar mAbs, including rising incidence of cancers and increasing demand for lower-cost biologicals

• Developments in technology and operations for biosimilar drug production.

Visiongain’s study is intended for anyone requiring commercial analyses for the biosimilars and follow-on biologics market. You find data, trends and predictions.

Buy our report today Global Biosimilars and Follow-On Biologics Market 2018-2028: Monoclonal Antibodies (mAbs), Fusion Proteins, Insulin, Erythropoietins, Granulocyte Colony-Stimulating Factor (G-CSF), Interferons, Growth Hormones, Fertility Hormones.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Biosimilars Overview

1.2 Biosimilars Market Segmentation

1.3 Why You Should Read this Report

1.4 How this Report Delivers

1.5 Main Questions Answered by this Report

1.6 Who is this Report for?

1.7 Research and Analysis Methods

1.8 Frequently Asked Questions (FAQ)

1.9 Some Associated Reports

1.10 About Visiongain

2. An Introduction to Biosimilars and Biosimilar Drug Development

2.1 What are Biologics?

2.1.1 Biologics can be Very Effective but also Very Expensive

2.1.2 Brief History of Biological Drug Development

2.1.3 Why are Biologics the Most Lucrative Products in the Global Pharmaceutical Market?

2.2 What are Biosimilars?

2.3 Brief History of Biosimilars

2.4 What are Interchangeable Biological Products and how do They Differ from Biosimilars?

2.4.1 FDA Guidelines on Prescription of Interchangeables vs Biosimilars

2.4.2 Where does the EMA Stand with Regard to Interchangeables?

2.4.3 Where do the EU5 and other European Countries Stand with Regard to Automatic Substitution?

2.4.4 Why Would Nations Oppose Automatic Substitution of Reference Biologics with Biosimilars?

2.5 Main Segments of the Overall Biosimilars Market

3. The Global Biosimilars Market 2018-2028

3.1 The Global Biosimilars Market

3.2 Biosimilars as a Share of the Biologics Market, 2017

3.2.1 Seven of the Top Ten Best-Selling Drugs are Biologics

3.2.2 Outlook for the Overall Biologics Market

3.3 Global Biosimilars Market Forecast, 2016-2028

3.4 What will Drive Growth in the Biosimilars Market?

3.4.1 Biosimilars Can Bring about Savings of Billions - $44bn for the US by 2024 and $33bn for Europe by 2020

3.4.2 Over $67bn Worth of Biologic Patents due to Expire by 2020

3.4.3 US Approves First Biosimilar - Zarxio. Will this Open the Floodgates? Interchangeability Can Also Drive Growth

3.4.4 Other Developed and Emerging Markets Will also Provide Opportunities for Growth

3.4.5 Competitive Landscape Emerging for Biosimilars

3.5 What Factors Can Restrain Sales Growth in the Biosimilars Market?

3.5.1 Complexity of Biologics Means that Biosimilar Development Faces Many Challenges

3.5.2 Opposition from Originator Companies and Patent Issues

3.5.3 Fragmentation in the Market as Many Companies Chase the Same Targets

3.5.4 The Threat of Biobetters and Next-Generation Biologics

3.6 Summary of the Drivers and Restraints for the Global Biosimilars Market

3.7 Global Biosimilars Market Forecast by Submarket, 2016-2028

3.7.1 Leading Segments in the Biosimilars Market

3.7.2 How Will the Composition of the Market Change Over the Next Ten Years?

4. Outlook for Biosimilars in Leading Developed Markets, 2016-2028

4.1 The Leading National Biosimilar Submarkets

4.2 National Submarket Forecasts 2016-2028

4.3 How will the Regional Composition of the Global Market Change from 2016-2028?

4.4 US Biosimilars Market Outlook 2016-2028

4.4.1 Status of the US Market in 2014-2018

4.4.2 FDA Finalises Three New Guidelines on 351(k) Applications in April 2015

4.4.2.1 The History of the US’ Biosimilar Guidelines

4.4.3 FDA Finally Releases Guidance on Biosimilar Naming

4.4.4 Individual States Can Pass their Own Biosimilar Substitution Laws

4.4.5 US Biosimilars Market Forecast 2016-2028

4.5 The EU Biosimilar Market: History and Current Status

4.5.1 History of EMA Guidelines and Updates

4.5.2 Biosimilar Uptake in the Europe Varies between Nations

4.5.3 European Biosimilars Market Forecast, 2016-2028

4.5.4 Inflectra and Remsima in Europe - Demonstrates a Path for Other Biosimilar mAbs

4.5.5 German Biosimilar Market Outlook, 2018

4.5.5.1 German Biosimilar Market Forecast, 2016-2028

4.5.6 French Biosimilars Market Outlook, 2018

4.5.6.1 Biosimilar Substitution Passed but Requires Decrees to Come into Effect, Expected Sometime This Year

4.5.6.2 French Biosimilar Market Forecast, 2016-2028

4.5.7 UK Biosimilar Market Outlook, 2018

4.5.7.1 UK Biosimilar Market Forecast, 2016-2028

4.5.8 Italian Biosimilars Market Outlook, 2018

4.5.8.1 Italian Biosimilars Market Forecast, 2016-2028

4.5.9 Spanish Biosimilars Market Outlook, 2018

4.5.9.1 Spanish Biosimilar Market Forecast, 2016-2028

4.5.10 Biosimilar Regulation in Japan and Currently Approved Biosimilars

4.5.10.1 Differences between the European and Japanese Guidelines

4.5.10.2 Currently Approved Biosimilars in Japan

4.5.10.3 Japanese Biosimilar Market Forecast, 2016-2028

5. Outlook for Biosimilars in Emerging Markets, 2016-2028

5.1 China and India Lead Biosimilar Revenues

5.2 Leading Emerging Biosimilar Markets Forecast, 2016-2028

5.3 Chinese Biosimilars Market Outlook, 2018

5.3.1 China Publishes Final Guidelines for Biosimilars

5.3.2 Biosimilars Account for less than Half of Biotech Revenues in China

5.3.3 Chinese Biosimilars Market Forecast, 2016-2028

5.4 Indian Biosimilars Market Outlook, 2018

5.4.1 CDSCO Guidelines Released in 2012

5.4.2 Indian Biosimilars Market Forecast, 2016-2028

5.5 South Korea’s Established Biosimilar Guidelines

5.5.1 Currently Approved Biosimilars in South Korea, 2018

5.5.2 South Korean Biosimilars Market Forecast, 2016-2028

5.6 Russian Biosimilars Market Outlook and Forecast, 2016-2028

5.7 Brazilian Biosimilar Regulation

5.7.1 Government Eager to Promote Biosimilar Development, and Two Major Conglomerates, Bionovis and Orygen, are Racing to Produce Biosimilars

5.7.2 Brazilian Biosimilars Market Forecast, 2016-2028

6. Biosimilar Monoclonal Antibodies: Submarket Forecast and Pipeline, 2016-2028

6.1 MAbs as Part of the Overall Biologics Market in 2018

6.2 Monoclonal Antibodies (mAbs): Largest Biologic Submarket, with Individual Drugs Accumulating Multi-Billion Dollar Revenues

6.3 Biosimilar Monoclonal Antibodies Market and Submarkets Forecast, 2016-2028

6.4 Drivers for the Biosimilar Monoclonal Antibodies Market

6.4.1 New Launches of Biosimilar mAbs in Developed and Emerging Markets

6.4.2 Rising Incidence of Cancer Will Drive Demand

6.4.3 The Need for Lower Cost Therapies

6.4.4 Partnering to Launch Biosimilar mAbs

6.5 Restraints for the Monoclonal Antibodies Market

6.5.1 Novel mAb Developers Choosing to Develop Biobetters and Next-Generation Therapies in Face of Biosimilar Competition

6.5.1.1 Hope for Biosimilars when Competing Against Next-Generation Therapies

6.5.2 Challenges in Antibody Development and Manufacturing

6.5.3 Patent Issues, Market Fragmentation and Perception of Biosimilars

6.6 Leading Targets for Biosimilar Development, 2016-2028

6.7 Biosimilar Rituximab

6.7.1 Rituxan: The First Anti-Cancer mAb

6.7.2 Approved Biosimilars and Rituxan Patent Expiry

6.7.2.1 Reditux (Dr. Reddy’s Laboratories): First Biosimilar Rituximab

6.7.2.2 MabTas (Intas Pharmaceutical): Another Indian Biosimilar

6.7.2.3 AcellBia (Biocad): The Leading Biosimilar Rituximab

6.7.2.4 Kikuzubam (PROBIOMED) – Faced Challenges

6.7.3 Biosimilar Rituximab Pipeline, 2016-2028

6.7.3.1 Terminated Developments

6.7.3.2 GP2013 (Sandoz): One of the Biggest Names in the Biosimilar Industry Throws its Hat into the Ring with Advanced Stage Candidate

6.7.3.3 BI 695500 (Boehringer Ingelheim)

6.7.3.4 MabionCD20 (Mabion): Focusing on Markets with High Demand

6.7.3.5 CT-P10 (Celltrion)

6.7.3.6 PF-05280586 (Pfizer)

6.7.4 Biosimilar Rituximab: Revenue Forecast 2016-2028

6.8 Biosimilar Infliximab

6.8.1 Remicade: Second Only to Humira

6.8.2 Approved Biosimilars and Remicade Patent Expiry: Uncertainty in the US after FDA Rejection

6.8.2.1 Inflectra and Remsima (Hospira and Celltrion)

6.8.2.2 Celltrion Speeds Ahead with US FDA Filing, and Inflectra Approved in Australia and Canada

6.8.2.3 Inflimab and BOW015 (Epirus Biopharmaceuticals and Ranbaxy Laboratories)

6.8.3 Biosimilar Infliximab Pipeline, 2016-2028

6.8.3.1 SB2 (Samsung Bioepis): Has been Filed for EU Approval and Shows Positive Phase 3 Results

6.8.3.2 NI-071 (Nichi-Iko): Advanced Stages

6.8.3.3 ABP 710 (Amgen) and BX2922 (BioXpress Therapeutics)

6.8.4 Biosimilar Infliximab: Revenue Forecast 2016-2028

6.9 Biosimilar Trastuzumab

6.9.1 Herceptin: Another Jewel in Roche’s Cancer mAb Portfolio

6.9.2 Approved Biosimilars and Herceptin Patent Expiry

6.9.2.1 Hertraz and CanMab (Mylan and Biocon): The First to Win Approval

6.9.2.2 Herzuma (Celltrion)

6.9.3 Biosimilar Trastuzumab Pipeline, 2016-2028

6.9.3.1 BCD-022 (Biocad): Leading Biosimilar Rituximab Developer Tries its Hand at Trastuzumab

6.9.3.2 ABP 980 (Amgen and Allergan): CHMP Approval

6.9.3.3 PF-05280014 (Pfizer): FDA halts approval

6.9.3.4 SB3 (Samsung Bioepis) and BX2318 (BioXpress Therapeutics)

6.9.4 Biosimilar Trastuzumab: Revenue Forecast 2016-2028

6.10 Biosimilar Adalimumab

6.10.1 Humira – The World’s Best-Selling Prescription Drug

6.10.2 Approved Biosimilars and Humira Patent Expiry

6.10.2.1 Exemptia (Zydus Cadila): The First Biosimilar Adalimumab

6.10.3 Biosimilar Adalimumab Pipeline, 2016-2028

6.10.3.1 ABP 501 (Amgen and Allergan): Positive Phase 3 Results Released

6.10.3.2 GP2017 (Sandoz): Phase 3

6.10.3.3 BI 695501 (Boehringer Ingelheim)

6.10.3.4 SB5 (Samsung Bioepis)

6.10.4 Biosimilar Adalimumab: Revenue Forecast 2016-2028

6.11 Biosimilar Bevacizumab

6.11.1 Avastin: High Revenues and Late Patent Expiry

6.11.2 Biosimilar Bevacizumab Pipeline, 2016-2028

6.11.2.1 BCD-021 (Biocad)

6.11.2.2 ABP 215 (Amgen and Allergan): Approved

6.11.2.3 BI 695502 (Boehringer Ingelheim): Phase 3

6.11.2.4 PF-06439535 (Pfizer): Phase 3

6.11.3 Biosimilar Bevacizumab: Revenue Forecast, 2016-2028

7. Biosimilar Fusion Proteins: Submarket Forecast and Pipeline, 2016-2028

7.1 Scientific Background

7.2 Differentiating Fusion Proteins

7.3 Fusion Proteins as Part of the Overall Biologics Market

7.4 Biosimilar Fusion Proteins Market Forecast, 2016-2028

7.5 Biosimilar Etanercept, 2016-2028

7.5.1 Enbrel is the Leading Fusion Protein

7.5.2 Enbrel Granted Extended Patent Protection in the US, Patent has Expired in EU

7.5.3 Multiple Biosimilars Available in Emerging Markets

7.5.3.1 Brenzys / SB4 (Merck and Samsung Bioepis): First Product Approval to Result from Biosimilar Collaboration

7.5.3.2 Yi Sai Pu (Shanghai CP Guojian Pharmaceutical) and Qiangke (Shanghai Celgen Biopharmaceutical)

7.5.3.3 Etacept (Cipla) and Intacept (Intas Pharmaceuticals)

7.5.3.4 Davictrel / HD-203 (Hanwha Chemical and Merck KGaA)

7.5.4 Biosimilar Etanercept Pipeline

7.5.5 GP2015 (Sandoz)

7.5.5.1 Sandoz Goes in Early: FDA Accepts Application for GP2015, Despite the Fact that Enbrel Patents are not due to Expire any time Soon

7.5.6 SB4 (Samsung Bioepis): EMA Accepts Application

7.5.6.1 Samsung Bioepis Releases Positive Phase 3 Data for SB4

7.5.7 CHS-0214 (Coherus Biosciences and Baxter)

7.5.8 TuNEX / ENIA11 (Mycenax Biotech / TSH Biopharm Corp): Phase 3 in Taiwan

7.5.9 LBEC0101 (LG Life Sciences): Phase 3

7.5.10 Biosimilar Etanercept: Revenue Forecast 2016-2028

7.6 Eylea and Biosimilar Aflibercept

7.7 Orencia and Biosimilar Abatacept

8. Biosimilar Insulin Submarket Outlook, 2016-2028

8.1 Insulin as Part of the Biological Drug Sector

8.2 30 Million People Expected to be Diagnosed with Diabetes by 2030

8.3 Approved Insulin Biosimilars

8.4 Abasaglar / Basaglar / Insulin Glargine BS - The First Insulin Biosimilars to be Approved in Developed Markets

8.5 EMA Releases Finalised Insulin Biosimilars Guideline

8.6 Basaglar Delayed in the US until End of 2016

8.7 Biosimilar Insulin Market and Submarkets Forecast, 2016-2028

8.8 Biosimilar Human Insulin Submarket, 2016-2028

8.8.1 A Submarket Mostly Restricted to Emerging Markets?

8.8.3 Biosimilar Human Insulin in India

8.8.3.1 Wockhardt and Biocon - Given up on their Desire to Target the US and Europe?

8.8.4 Biosimilar Human Insulin in Russia

8.8.5 Biosimilar Human Insulin Submarket Forecast, 2016-2028

8.9 Biosimilar Insulin Analogues Submarket, 2016-2028

8.9.1 Available Biologic Insulin Analogues – Sanofi’s Lantus Tops Revenues

8.9.2 Insulin Glargine in the Main Biosimilar Target

8.9.2.1 Limited Development for the Other Targets

8.9.3 Insulin Market Leaders are Developing Ultra-Rapid Acting Insulin Analogues

8.9.3.1 Ultra-Long Acting Insulin also in Development

8.9.4 Mylan Partners with Biocon for Insulin Analogues

8.9.5 Other Biosimilar Insulin Analogue Revenue Forecast, 2016-2028

8.10 Biosimilar Insulin Glargine

8.10.1 Biosimilars in India and China

8.10.2 Biosimilar Insulin Glargine Pipeline

8.10.2.1 MK-1293 (Merck / Samsung Bioepis)

8.10.2.2 Mylan’s Insulin Glargine (Mylan and Biocon)

8.10.3 Biosimilar Insulin Glargine: Revenue Forecast, 2016-2028

8.11 Biosimilar Insulin Lispro

8.11.1 Currently Available Biosimilars

8.11.2 Much Smaller Pipeline than for Insulin Glargine

8.11.3 Biosimilar Insulin Lispro: Revenue Forecast, 2016-2028

9. Biosimilar Erythropoietins Submarket Outlook, 2016-2028

9.1 Three Products Lead the Biologic EPO Therapy Market

9.2 Safety Concerns for Erythropoietin-Stimulating Agents

9.3 The Challenge from Oral Therapies is Coming

9.4 Treating Anaemia in Patients with CKD - the Leading Use of EPO Therapies

9.5 Biosimilar Epoetin Approvals in Europe

9.6 Epoetin Alfa Pipeline for the European Market

9.7 Trends in Uptake for Biosimilar Epoetins in Europe

9.8 Epoetin Alfa Pipeline for the US - Companies Preparing for Launch

9.8.1 Pfizer’s Retacrit Delayed after Response Letter from FDA

9.8.2 Binocrit / HX575 has Completed Trials

9.9 Biosimilar Epoetin in Japan

9.10 Biosimilar Epoetin in South Korea

9.11 Biosimilar Epoetin in India and China

9.12 Second-Generation EPO Biosimilars

9.13 No Mircera Biosimilars in Clinical Development

9.14 Biosimilar EPO Market Forecast, 2016-2028

10. Biosimilar G-CSF Submarket Outlook, 2016-2028

10.1 Amgen Leads the Branded Biologic G-CSF Market

10.2 Teva Launches Long-Acting Pegfilgrastim

10.3 Selected Filgrastim Biosimilars Approved Worldwide

10.3.1 The European G-CSF Biosimilars Market

10.3.1.1 Trends in Biosimilar Uptake Across Europe

10.3.2 Tevagrastim (Teva): The First Biosimilar in Europe, Launched as Granix in the US

10.3.3 Nivestim (Hospira – Pfizer)

10.3.4 Zarzio (Sandoz): The Most Prescribed Biosimilar Therapy in Europe

10.3.5 Zarxio Becomes the First Biosimilar to be Approved in the US, Launched in September

10.3.6 Apotex: FDA has Accepted Applications for both its Biosimilar Filgrastim, and its Biosimilar Pegfilgrastim

10.3.7 Multiple Launches in Japan in Recent Years

10.3.8 Biosimilar Filgrastim and Pegfilgrastim in India

10.3.9 Biosimilars in Russia, China and Other Emerging Markets

10.4 Biosimilar G-CSF Market Forecast, 2016-2028

11. Biosimilar Interferons Submarket Outlook, 2016-2028

11.1 Interferons: Key Antiviral and MS Therapies Since the 1990s

11.2 Leading Interferon Brands

11.3 Competition for the Multiple Sclerosis Market - Challenges for Interferon Beta Therapies

11.4 All-Oral Regimens will Challenge Interferon Alfa Therapy

11.4.1 However Oral Therapies will be Expensive

11.5 There are no Approved Biosimilars in Developed Markets

11.6 Biosimilar Interferon Market Forecast, 2016-2028

11.7 Biosimilar Interferon Alfa

11.7.1 Biosimilar Interferon Alfa – a Common Target in Developing Countries, Leading to Fragmented Markets

11.7.2 Biosimilar Peginterferon Alfa

11.7.3 Hepatitis Treatment Rates are Low

11.7.4 Biosimilar Interferon Alfa Submarket Forecast, 2016-2028

11.8 Biosimilar Interferon Beta

11.8.1 Biosimilars are Well-Established in Emerging Markets

11.8.2 Biosimilar Interferon Beta Pipeline

11.8.3 EMA Guidance

11.8.4 Long-Acting Interferon Beta

11.8.5 Biosimilar Interferon Beta Submarket Forecast, 2016-2028

12. Biosimilar Recombinant Hormones Submarket Outlook, 2016-2028

12.1 Human Growth Hormone: First Extracted in 1958

12.2 Biologic Growth Hormone Market in 2014 - Novo Nordisk and Pfizer Dominate

12.2.1 Novo Nordisk Aiming to Retain Dominance Through FlexPro Device and NN8640 Somatropin Candidate

12.3 Biosimilar Growth Hormones

12.3.1 Omnitrope - Well Established in Developed Markets

12.4 Multiple Biosimilars Available Worldwide

12.4.1 Biosimilars Growth Hormones Outside of Asia

12.4.2 Biosimilar Growth Hormones in Asia

12.4.3 Biosimilar Uptake Varies by Region

12.5 Biosimilar Growth Hormones Market Forecast, 2016-2028

12.6 Fertility Hormones

12.6.1 Two Products Lead the Branded Fertility Hormone Market

12.6.2 Long-Acting Follicle Stimulating Hormone (FSH)

12.6.3 Branded Fertility Hormones Market Outlook

12.6.4 Available Biosimilar Fertility Hormones

12.6.5 Biosimilars Approved in Europe

12.6.5.1 Ovaleap (Teva)

12.6.5.2 Befomla (Finox Biotech) Approved in Europe, Undergoing Phase 3 for US

12.6.6 Rising Infertility to Drive Demand to 2028

12.6.7 Biosimilar Fertility Hormones Market Forecast, 2016-2028

13. Biosimilars: Qualitative Analysis and Industry Trends

13.1 SWOT Analysis of the Biosimilars Market

13.2 Biosimilars Market: Strengths

13.2.1 Biosimilars Can Offer Huge Cost Savings

13.2.2 The US has Finally Joined the Global Biosimilars Market

13.2.3 Biosimilars are Already Well-Established in Many National Markets

13.2.4 Outsourcing Offers the Chance for Further Cost Savings

13.3 Biosimilars Market: Weaknesses

13.3.1 Biosimilars are High Cost to Develop and Manufacture

13.3.2 Complexity Means that Development Timelines are Long

13.3.3 Uptake for Biosimilars Varies and is Low in Some Regions

13.4 Biosimilars Market: Opportunities

13.4.1 Blockbuster Biologics Face Patent Expiry

13.4.2 Rising Disease Prevalence

13.4.3 Licensing Agreements for Biosimilars

13.5 Threats

13.5.1 Biobetters and Next-Generation Biologics

13.5.2 Patent Issues and Product Life Cycle Management from Originator Companies

13.5.3 Fragmentation in the Market

13.5.4 Long Market and Data Exclusivity Periods

13.5.5 Biosimilars Require Marketing and Education

13.6 Biosimilars Product Pipeline

14. Conclusions from Visiongain’s Research and Analysis

14.1 Rapid Growth Expected for this High-Potential Market

14.2 Biosimilar Monoclonal Antibodies to be the Fastest Growing Segment

14.3 A Range of Factors Will Stimulate Demand

14.4 Challenges Remain in Developing and Successfully Launching Biosimilars

Associated Reports

Visiongain Report Sales Order Form

About Visiongain

Visiongain report evaluation form

List of Table

Table 2.1 First Approvals for Recombinant Protein Therapies, 1982-1993

Table 3.1 Top Ten Best-Selling Drugs of 2017 (in the Overall Pharmaceutical Market): Revenues ($bn), Market Shares (%)

Table 3.2 Global Biosimilars Market Forecast: Revenue ($bn), AGR (%),CAGR (%), 2016-2022

Table 3.3 Global Biosimilars Market Forecast: Revenue ($bn), AGR (%),CAGR (%), 2023-2028

Table 3.4 Patent Status for Leading Biologics within the Overall Biologics Market, 2018

Table 3.5 Biosimilars Market Forecast by Submarket (Insulin, EPO, G-CSF, Growth Hormones, mAbs): Revenue ($bn), AGR (%), CAGR (%), Market Shares (%), 2016-2022

Table 3.6 Biosimilars Market Forecast by Submarket (Interferons, Fusion Proteins, Fertility Hormones, Other Biosims): Revenue ($bn), AGR (%),CAGR (%), Market Shares (%), 2016-2022

Table 3.7 Biosimilars Market Forecast by Submarket (Insulin, EPO, G-CSF, Growth Hormones, mAbs): Revenue ($bn), AGR (%),CAGR (%), Market Shares(%), 2023-2028

Table 3.8 Biosimilars Market Forecast by Submarket (Interferons, Fusion Proteins, Fertility Hormones, Other Biosims): Revenue ($bn), AGR (%),CAGR (%), Market Shares (%), 2023-2028

Table 4.1 Global Biosimilars Market by Region: Revenues ($bn),

Market Share (%), 2018

Table 4.2 Global Biosimilars Market Forecast Segmented by Nation (China, EU, India, US, South Korea, Japan): Revenue ($bn), AGR (%),CAGR (%),Market Share(%), 2016-2022

Table 4.3 Global Biosimilars Market Forecast Segmented by Nation (Russia, Brazil, Other): Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2016-2022

Table 4.4 Global Biosimilars Market Forecast Segmented by Nation (China, EU, India, US, South Korea, Japan): Revenue ($bn), AGR (%),CAGR (%),Market Share(%) 2023-2028

Table 4.5 Global Biosimilars Market Forecast Segmented by Nation (Russia, Brazil,Other): Revenue ($bn), AGR (%), CAGR (%), Market Share(%), 2023-2028

Table 4.6 U.S. Biosimilar Approvals To-Date, 2018 Table 4.7 US Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2016-2022

Table 4.8 US Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 4.9 European Biosimilar Approvals: Monoclonal Antibodies and Insulin

Table 4.10 European Biosimilar Approvals: G-CSF

Table 4.11 European Biosimilar Approvals: EPO

Table 4.12 European Biosimilar Approvals: Growth Hormones and Fertility

Hormones

Table 4.13 European Biosimilars Market Segmented by Leading Nations: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2016-2022

Table 4.14 European Biosimilars Market Segmented by Leading Nations: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 4.15 German Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2016-2022

Table 4.16 German Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 4.17 French Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2016-2022

Table 4.18 French Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 4.19 UK Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2016-2022

Table 4.20 UK Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 4.21 Italian Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2016-2022

Table 4.22 Italian Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 4.23 Spanish Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2016-2022

Table 4.24 Spanish Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 4.25 Japanese Biosimilar Approvals To-Date, 2018

Table 4.26 Japanese Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2016-2022

Table 4.27 Japanese Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 5.1 Leading Emerging Biosimilar Markets: Revenue ($bn), AGR (%),

CAGR (%), Market Share (%), 2016-2022

Table 5.2 Leading Emerging Biosimilar Markets: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 5.3 Chinese Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2016-2022

Table 5.4 Chinese Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 5.5 Indian Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2016-2022

Table 5.6 Indian Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 5.7 Currently Approved Biosimilars in South Korea, 2016

Table 5.8 South Korean Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2016-2022

Table 5.9 South Korean Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 5.10 Russian Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2016-2022

Table 5.11 Russian Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 5.12 Brazilian Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2016-2022

Table 5.13 Brazilian Biosimilars Market: Revenue ($bn), AGR (%), CAGR (%), Market Share (%), 2023-2028

Table 6.1 The Best-Selling mAbs of 2017: Revenue ($bn), 2017

Table 6.2 Biosimilar Monoclonal Antibodies Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2016-2022

Table 6.3 Biosimilar Monoclonal Antibodies Market Forecast:

Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 6.4 Biosimilar Monoclonal Antibodies Market and Submarkets Forecast: Revenue ($bn), AGR (%), CAGR (%), 2016-2022

Table 6.5 Biosimilar Monoclonal Antibodies Market and Submarkets Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 6.6 Patent Status of Five Leading mAbs, 2018

Table 6.7 Types of Next-Generation Antibody Therapy, 2018

Table 6.8 Past and Present GP2013 (Sandoz) Clinical Trials, 2018

Table 6.9 Ongoing BI 695500 (Boehringer Ingelheim) Clinical Trials, 2018

Table 6.10 Ongoing CT-P10 (Celltrion) Clinical Trials, 2018

Table 6.11 Past and Present PF-05280586 (Pfizer) Clinical Trials, 2018

Table 6.12 Biosimilar Rituximab Revenue Forecast: Revenue ($bn), AGR (%),CAGR (%), 2016-2022

Table 6.13 Biosimilar Rituximab Revenue Forecast: Revenue ($bn), AGR (%),CAGR (%), 2023-2028

Table 6.14 Biosimilar Infliximab Revenue Forecast: Revenue ($bn), AGR (%),CAGR (%), 2016-2022

Table 6.15 Biosimilar Infliximab Revenue Forecast: Revenue ($bn), AGR (%),CAGR (%), 2023-2028

Table 6.16 Ongoing PF-05280014 (Pfizer) Clinical Trials, 2018

Table 6.17 Biosimilar Trastuzumab Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2016-2022

Table 6.18 Biosimilar Trastuzumab Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 6.19 Recent ABP 501 (Amgen and Allergan) Clinical Trials, 2018

Table 6.20 Ongoing BI 695501 (Boehringer Ingelheim) Clinical Trials, 2018

Table 6.21 Biosimilar Adalimumab Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2016-2022

Table 6.22 Biosimilar Adalimumab Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 6.23 Recent BCD-021 (Biocad) Clinical Trials, 2018

Table 6.24 Biosimilar Bevacizumab Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2016-2022

Table 6.25 Biosimilar Bevacizumab Revenue Forecast: Revenue ($bn), AGR (%),CAGR (%), 2023-2028

Table 7.1 Biosimilar Fusion Proteins Market Forecast: Revenue ($bn), AGR (%),CAGR (%), 2016-2022

Table 7.2 Biosimilar Fusion Proteins Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 7.3 Amgen’s US Patents and Expiry Dates for Enbrel

Table 7.4 Ongoing CHS-0214 (Coherus Biosciences and Baxter) Clinical Trials, 2018

Table 7.5 Biosimilar Etanercept Revenue Forecast: Revenue ($bn), AGR (%), CAGR (%), 2016-2022

Table 7.6 Biosimilar Etanercept Market Forecast: Revenue ($bn), AGR (%),CAGR (%), 2023-2028

Table 8.1 Diabetes Prevalence in Leading National Markets,

2012

Table 8.2 Selected Insulin Biosimilars which have been Approved and Launched

Table 8.3 Biosimilar Insulin Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2016-2022

Table 8.4 Biosimilar Insulin Market Forecast: Revenue ($bn), AGR (%),CAGR (%), 2023-2028

Table 8.5 Biosimilar Insulin Submarket Forecast: Revenue ($bn), AGR (%),CAGR (%), 2016-2022

Table 8.6 Biosimilar Insulin Submarket Forecast: Revenue ($bn), AGR (%),CAGR (%), 2023-2028

Table 8.7 Biosimilar Human Insulin Submarket Forecast: Revenue ($bn), AGR (%),CAGR (%), 2016-2022

Table 8.8 Biosimilar Human Insulin Submarket Forecast: Revenue ($bn), AGR (%),CAGR (%), 2023-2028

Table 8.9 Approved Insulin Analogues Marketed Worldwide, 2018

Table 8.10 Other Biosimilar Insulin Analogues Submarket Forecast: Revenue ($bn), AGR (%), CAGR (%), 2016-2022

Table 8.11 Other Biosimilar Insulin Analogues Submarket Forecast:

Revenue ($bn), AGR (%),CAGR (%), 2023-2028

Table 8.12 MK-1293 (Merck / Samsung Bioepis) Recent Clinical Trials, 2018

Table 8.13 Insulin Glargine Biosimilar (Mylan and Biocon) Ongoing Clinical Trials, 2018

Table 8.14 Biosimilar Insulin Glargine Revenue Forecast: Revenue ($bn), AGR (%),CAGR (%), 2016-2022

Table 8.15 Biosimilar Insulin Glargine Revenue Forecast: Revenue ($bn), AGR (%),CAGR (%), 2023-2028

Table 8.16 Biosimilar Insulin Lispro Revenue Forecast: Revenue ($bn), AGR (%),CAGR (%), 2016-2022

Table 8.17 Biosimilar Insulin Lispro Revenue Forecast: Revenue ($bn), AGR (%),CAGR (%), 2023-2028

Table 9.1 Ongoing ASP1517 (Astellas Pharma) Clinical Trials, 2018

Table 9.2 Binocrit / HX575 (Novartis) Clinical Trials, 2018

Table 9.3 Selected EPO Biosimilars Approved in India

Table 9.4 Biosimilar EPO Market Forecast: Revenue ($bn), AGR (%), CAGR (%),2016-2022

Table 9.5 Biosimilar EPO Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 10.1 Selected Filgrastim Biosimilars Approved Worldwide

Table 10.2 Biosimilar G-CSF Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2016-2022

Table 10.3 Biosimilar G-CSF Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 11.1 Types of Interferon Used Therapeutically, 2018

Table 11.2 Approved Branded Interferon Therapies, 2018

Table 11.3 Biosimilar Interferons Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2016-2022

Table 11.4 Biosimilar Interferons Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 11.5 Selected Interferon Alfa Biosimilars Approved Worldwide, 2018

Table 11.6 Chronic Hepatitis B and C: Global Prevalence by Region, 2014

Table 11.7 Biosimilar Interferon Alfa Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2016-2022

Table 11.8 Biosimilar Interferon Alfa Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 11.9 Selected Interferon Beta Biosimilars Approved Worldwide

Table 11.10 Biosimilar Interferon Beta Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2016-2022

Table 11.11 Biosimilar Interferon Beta Market Forecast: Revenue ($bn), AGR (%),CAGR (%), 2023-2028

Table 12.1 Biosimilar Growth Hormone Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2016-2022

Table 12.2 Biosimilar Growth Hormone Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2023-2028

Table 12.3 Recent Bemfola / Afolia (Finox Biotech) Clinical Trials, 2018

Table 12.4 Biosimilar Fertility Hormone Market Forecast: Revenue ($bn), AGR (%), CAGR (%), 2016-2022

Table 12.5 Biosimilar Fertility Hormone Market Forecast: Revenue ($bn),AGR (%), CAGR (%), 2023-2028

Table 13.1 Expected Biologic Patent Expiries, 2016-2029

Table 13.2 Typical Models of Collaboration for Biosimilar Development

Table 13.3 Biosimilars product pipeline

Table 14.1 Biosimilars and Follow-On Biologics Market: Revenue ($bn) and Market Share (%) by Sector, 2018, 2022 and 2028

Table 14.2 Biosimilars and Follow-On Biologics Market: Revenue ($bn) and Market Share (%) by Region, 2018, 2022 and 2028

List of Figure

Figure 1.1 Main Segments and Sub-Segments of the Biosimilars Market, 2018

Figure 3.1 Biosimilars Market as Share of the Overall Biologics Market: Revenue ($bn), Market Share (%), 2017

Figure 3.2 Global Biosimilars Market Forecast: Revenue ($bn), 2016-2028

Figure 3.3 Drivers and Restraints for the Biosimilars Market, 2018

Figure 3.4 Global Biosimilars Market Forecasts by Submarket: Revenue ($bn), 2016-2028

Figure 3.5 Composition of the Biosimilars Market in 2018: Market Shares (%)

Figure 3.6 Composition of the Biosimilars Market in 2022: Market Shares (%)

Figure 3.7 Composition of the Biosimilars Market in 2028: Market Shares (%)

Figure 4.1 Regional Composition of the Biosimilars Market in 2018: Market Shares (%)

Figure 4.2 Global Biosimilars Market Forecast Segmented by Region: Revenue ($bn), 2016-2028

Figure 4.3 The Market Shares (%) for the Major Regional Markets 2016-2028

Figure 4.4 Regional Composition of the Biosimilars Market in 2022: Market Shares (%)

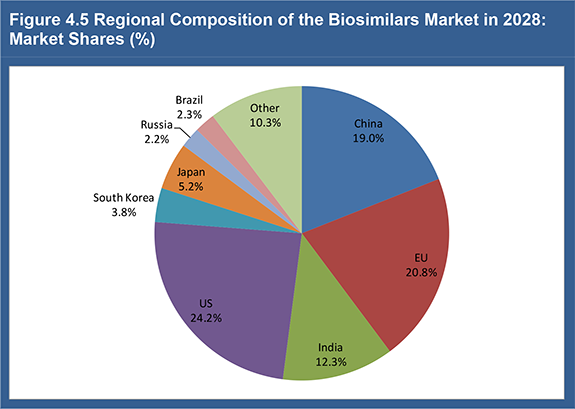

Figure 4.5 Regional Composition of the Biosimilars Market in 2028: Market Shares (%)

Figure 4.6 US Biosimilars Market Forecast: Revenue ($bn), 2016-2028

Figure 4.7 European Biosimilars Market Breakdown: Revenue ($bn), 2018

Figure 4.8 European Biosimilars Market Breakdown: Revenue ($bn), 2022

Figure 4.9 European Biosimilars Market Breakdown: Revenue ($bn), 2028

Figure 4.10 European Biosimilars Market Segmented by Leading Nations: Revenue ($bn), 2016-2028

Figure 4.11 German Biosimilars Market: Revenue ($bn), 2016-2028

Figure 4.12 French Biosimilars Market: Revenue ($bn), 2016-2028

Figure 4.13 UK Biosimilars Market: Revenue ($bn), 2016-2028

Figure 4.14 Italian Biosimilars Market: Revenue ($bn), 2016-2028

Figure 4.15 Spanish Biosimilars Market: Revenue ($bn), 2016-2028

Figure 4.16 Japanese Biosimilars Market: Revenue ($bn), 2016-2028

Figure 5.1 Leading Emerging Nations Biosimilar Market Shares: Revenues ($bn), 2018

Figure 5.2 Leading Emerging Nations Biosimilar Market Shares: Revenues ($bn), 2022

Figure 5.3 Leading Emerging Nations Biosimilar Market Shares: Revenues ($bn), 2028

Figure 5.4 Leading Emerging Nations Biosimilar Market Shares: Revenues ($bn), 2016-2028

Figure 5.5 Chinese Biosimilars Market: Revenue ($bn), 2016-2028

Figure 5.6 Indian Biosimilars Market: Revenue ($bn), 2016-2028

Figure 5.7 South Korean Biosimilars Market: Revenue ($bn),2016-2028

Figure 5.8 Russian Biosimilars Market: Revenue ($bn), 2016-2028

Figure 5.9 Brazilian Biosimilars Market: Revenue ($bn), 2016-2028

Figure 6.1 Monoclonal Antibodies as a Percentage of the Total Biologics Market: Revenue ($bn), Market Share (%), 2016

Figure 6.2 The Best-Selling mAbs of 2017 as a Percentage of the Total Biologics Market: Revenue ($bn), Market Share (%), 2017

Figure 6.3 Biosimilar Monoclonal Antibodies Market Forecast: Revenue ($bn), 2016-2028

Figure 6.4 Biosimilar Monoclonal Antibody Market Forecast, Split by Product: Revenue ($bn), 2016-2028

Figure 6.5 Biosimilar Rituximab Revenue Forecast: Revenue ($bn), 2016-2028

Figure 6.6 Biosimilar Infliximab Revenue Forecast: Revenue ($bn), 2016-2028

Figure 6.7 Biosimilar Trastuzumab Revenue Forecast: Revenue ($bn), 2016-2028

Figure 6.8 Biosimilar Adalimumab Revenue Forecast: Revenue ($bn),2016-2028

Figure 6.9 Biosimilar Bevacizumab Revenue Forecast: Revenue ($bn), 2016-2028

Figure 7.1 Fusion Proteins as a Percentage of the Total Biologics Market: Revenue ($m), Market Share (%), 2016

Figure 7.2 Biosimilar Fusion Proteins Market Forecast: Revenue ($bn), 2016-2028

Figure 7.3 Biosimilar Etanercept Market Forecast: Revenue ($bn), 2016-2028

Figure 8.1 Diabetes Prevalence in Leading National Markets, 2012

Figure 8.2 Biosimilar Insulin Market Forecast: Revenue ($bn), 2016-2028

Figure 8.3 Biosimilar Insulin Submarket Forecasts: Revenue ($bn), 2016-2028

Figure 8.4 Drivers and Restraints for the Biosimilar Insulin Market, 2018

Figure 8.5 Biosimilar Human Insulin Submarket Revenue Forecast: Revenue ($bn), 2016-2028

Figure 8.6 Other Biosimilar Insulin Analogues Submarket Forecast: Revenue ($bn), 2016-2028

Figure 8.7 Biosimilar Insulin Glargine Revenue Forecast: Revenue ($bn),2016-2028

Figure 8.8 Biosimilar Insulin Lispro Revenue Forecast: Revenue ($bn), 2016-2028

Figure 9.1 Biosimilar EPO Market Forecast: Revenue ($bn), 2016-2028

Figure 10.1 Biosimilar G-CSF Market Forecast: Revenue ($bn), 2016-2028

Figure 11.1 Biosimilar Interferons Market Forecast: Revenue ($bn), 2016-2028

Figure 11.2 Chronic Hepatitis B: Global Prevalence (%) by Region, 2014

Figure 11.3 Chronic Hepatitis C: Global Prevalence (%) by Region, 2014

Figure 11.4 Biosimilar Interferon Alfa Market Forecast: Revenue ($bn), 2016-2028

Figure 11.5 Biosimilar Interferon Beta Market Forecast: Revenue ($bn), 2016-2028

Figure 12.1 Biosimilar Growth Hormone Market Forecast: Revenue ($bn), 2016-2028

Figure 12.2 Biosimilar Fertility Hormone Market Forecast: Revenue ($bn), 2016-2028

Figure 13.1 Strengths and Weaknesses of the Biosimilars Market, 2016-2028

Figure 13.2 Opportunities and Threats for the Biosimilars Market, 2016-2028

Figure 13.3 Biosimilar Development Costs by Stage, 2018

Figure 13.4 Typical Biosimilar Development Timeline

Figure 14.1 Biosimilars and Follow-On Biologics Market: Revenue ($bn), by Sector, 2018, 2022 and 2028

Figure 14.2 Biosimilars and Follow-On Biologics Market: Revenue ($bn), by Region, 2018, 2022 and 2028

Allergan

Allozyne

Alteogen

Alvogen

Amarey Novamedical

Amega Biotech

Amgen

Apotex

Astellas Pharma

AstraZeneca

Avesthagen

Baxter

Bayer

Beijing Four Rings

Beijing SL Pharmaceutical

Biocad

Bioceuticals

Biogen

BioGenomics

Biolab

Bionovis

BioPartners

Biosidus

Bioton

BioXpress Therapeutics

Boehringer Ingelheim

Bristol-Myers Squibb

Cambridge Antibody Technology

CCL Pharmaceuticals

CCM Duopharma

Celltrion

Centocor Ortho Biotech

Chong Kun Dang

Chugai

CinnaGen.

Coherus BioSciences

Compass Biotechnologies

Cristália

CT Arzneimittel

Cyplasin

Daiichi Sankyo

Dong-A Pharmaceutical

Dr. Reddy’s Laboratories

Egis Pharmaceuticals

Eisai

Eli Lilly

Elpen Pharmaceutical

Emcure Pharmaceuticals

EMS

Epirus

Eurofarma

Express Scripts

FibroGen

Finox Biotech

Fuji Pharma

Gan & Lee

Genetech

Genexine

Gennova

GenSci

Genzyme

Geropharm

Gilead Sciences

GlaxoSmithKline

Hangzhou Jiuyuan Gene Engineering Co.

Hanmi Pharmaceutical

Hanwha Chemical

Haselmeier

Health Canada

Helius Biotech

Hexal

Hindustan Antibiotic

Hospira

Hualida Biotech

Hypermarcas

IGES Institute

Intas Biopharmaceuticals

inVentiv Health

JCR Pharmaceuticals

Johnson & Johnson

Kabi

Kemwell Biopharma

Kissea

Koçak Farma

Kwizda Pharma

Kyowa Hakko Kirin

Landsteiner Scientific

LG Life Sciences

Libbs

LKM SA

Lonza

Mabion

Marvel Life Sciences

MEDICE Arzneimittel Pütter

Merck (MSD)

Merck KGaA

Merck Serono

Minapharm

Mitsubishi Tanabe

Mochida Pharmaceutical

Momenta Pharmaceuticals

Mycenax Biotech

Mylan

Nichi-Iko

Nippion Kayaku

Novartis

Novo Nordisk

Nuron Biotech

Oncobiologics

Ortho Pharmaceutical

Orygen

PanGen Biotech

Pfenex

Pfizer

Pharmapark

Pharmstandard

PRA International

Pro Generika

PROBIOMED

Qilu Pharmaceutical

Quintiles

Ranbaxy Laboratories

RAND Corporation

Ratiopharm

Regeneron Pharmaceuticals

Reliance GeneMedix

Reliance Life Sciences (RLS)

Rentschler Biotechnologie

Roche

Samsung Bioepis

Samsung BioLogics

Sandoz

Sanofi

SciGen

Shandong Kexing Pharma

Shanghai Celgen Biopharmaceutical

Shanghai CP Guojian

Shanghai Fosun

Shantha Biotechnics

Shinogi

Sicor Biotech

Sothema Laboratories

Spectrum Pharmaceuticals

STADA Arzneimittel

Stragen Pharma

Strides Arcolab

Syngene International

Synthon Biopharmaceuticals

Takeda

Teva

Tianjin Hualida Biotechnology

Tonghua Dongbao

TSH Biopharm Corp

União Química

USV Biologics

Virchow Biotech

Wanbang Biopharmaceuticals

Wockhardt

Xiamen Amoytop Biotech

Zenotech

Zhejian Huahai Pharmaceutical

Zuventus

Zydus Biovation

Zydus Cadila

List of Organisations Mentioned in the Report

Argentine Ministry of Health

Cardiovascular and Renal Drugs Advisory Committee

Cardiovascular Drugs Advisory Committee

Centers of Medicare and Medicaid Services (CMS)

Central Drugs Standard Control Organisation

Centre for Drug Evaluation (CDE)

China Food and Drug Administration

Comisión Federal para la Protección contra Riesgos Sanitarios

Committee for Medicinal Products for Human Use

European Generic Medicines Association (EGA)

European Medicines Agency (EMA)

Intellectual Property Appellate Board (IPAB)

Korea Food and Drug Administration

Mexican Supreme Court

Ministry for Health Labour and Welfare (MHLW)

National Health Service (NHS)

National Institute for Health and Care Excellence (NICE)

Norwegian Ministry of Health

Pan American Health Organization

Pharmaceuticals and Medical Devices Agency (PMDA)

Russian Ministry of Health

Scottish Medicines Consortium (SMC)

Stanford University

State Employees’ Social Security and Social Services Institute (ISSSTE)

The Brazilian Ministry of Health

The Drug Regulatory Authority of Pakistan

The Ministry of Food and Drug Safety (MFDS)

The National Conference of State Legislatures (US)

The United Laboratories (TUL)

Therapeutic Goods Administration

Toronto University

UK Medicines and Healthcare Products Regulatory Agency (MHRA)

University of California, San Francisco

University of Tokyo

US Center for Disease Prevention and Control (CDC)

US Court of Appeals

US Food and Drug Administration (FDA)

US Patent and Trademark Office

World Health Organization (WHO)

Download sample pages

Complete the form below to download your free sample pages for Global Biosimilars and Follow-On Biologics Market 2018-2028

Related reports

-

Global Medical Device Contract Manufacturing Market Forecast 2018-2028

The global medical device contract manufacturing market was valued at $70bn in 2017. Visiongain forecasts this market to increase to...

Full DetailsPublished: 17 July 2018 -

Dermatological Drugs Market Forecast 2018-2028

The revenue of the dermatological drugs market in 2017 is estimated at $26.07bn and is expected to grow at a...

Full DetailsPublished: 14 August 2018 -

Global Biosimilar Monoclonal Antibodies Forecast 2018-2028

The global biosimilar monoclonal antibodies market is expected to reach $5.9bn in 2023 and is estimated to grow at a...

Full DetailsPublished: 27 February 2018 -

Pharma Leader Series: 25 Top Biosimilar Drug Manufacturers 2017-2027

Our 233-page report provides 126 tables, charts, and graphs, giving a clear view on companies in the biosimilar market. Who...Full DetailsPublished: 31 August 2017 -

Generic Drugs Market Forecast 2018-2028

The generic drugs market is estimated at $257.3bn in 2017 and is expected to grow at a CAGR of 7.9%...

Full DetailsPublished: 25 April 2018 -

Global Ophthalmic Devices Market 2018-2028

The global ophthalmic devices market is expected to grow at a CAGR of 5.5% in the first half of the...

Full DetailsPublished: 25 June 2018 -

Next-Generation Biologics Market 2018-2028

The introduction of new pipeline drugs in Next generation biologics, has led visiongain to publish this timey report. The Next...

Full DetailsPublished: 12 March 2018 -

Global Macular Degeneration (AMD) and Other Retinal Diseases Drugs Industry and Market 2018-2028

Our 171-page report provides 140 tables, charts, and graphs. Read on to discover the most lucrative areas in the industry...

Full DetailsPublished: 30 May 2018 -

Global OTC Pharmaceutical Market Forecast 2018-2028

In this brand new 201-page report you will receive 84 tables and 79 figures– all unavailable elsewhere. The 201-page report...

Full DetailsPublished: 05 April 2018 -

Pharmaceutical Contract Manufacturing Market 2018-2028

The pharmaceutical contract manufacturing market is expected to grow at a CAGR of 6.0% in the first half of the...

Full DetailsPublished: 27 June 2018

Download sample pages

Complete the form below to download your free sample pages for Global Biosimilars and Follow-On Biologics Market 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Pharma news

Retinal Gene Therapy Market

The global Retinal Gene Therapy market is projected to grow at a CAGR of 9.6% by 2034

26 July 2024

HIV Drugs and Injectables Market

The global HIV Drugs & Injectables market is projected to grow at a CAGR of 4.6 % by 2034

24 July 2024

Digital Twin Technology in Pharmaceutical Manufacturing Market

The global Digital Twin Technology in Pharmaceutical Manufacturing market is projected to grow at a CAGR of 31.3% by 2034

23 July 2024

Specialty Pharma Market

The global Specialty Pharma market is projected to grow at a CAGR of 7.5% by 2034

22 July 2024