Industries > Pharma > Next-Generation Biologics Market 2018-2028

Next-Generation Biologics Market 2018-2028

Revenue Forecasts and R&D Trends for Therapeutic Antibody Technologies, Insulins, Growth Hormones, Recombinant Coagulation Factors and Regenerative Medicine

Next Generation Biologics Market Report 2018-2028: Forecasts by Market and Segments

• Do you need definitive Next Generation Biologics market data?

• Do you want to understand clear demarcation between next generation biologics and traditional biologics?

• Next Generation Biologics and sub-segment market analysis?

• Key drivers and constrains accompanied by this market?

• Clear leaders and lagers?

• Next wave of blockbusters and drivers impacting them?

Read on to discover how this definitive report can transform your own research and save you time.

The introduction of new pipeline drugs in Next generation biologics, has led visiongain to publish this timey report. The Next generation biologics market is expected to flourish in the next few years because of emergence of new phase III as well as marketed candidates which are going change the course of the market. Not only new candidates, but the technology (drug delivery as well as the mechanism of action) are novel which make the report a worth find and insightful.

Report highlights

• 140 quantitative tables, charts, and graphs

• Analysis of key players in Next generation biologics Market

• Abbvie

• Roche/ Genentech

• Amgen

• GSK

• Eli Lilly

• Sanofi Aventis

• Novo Nordisk

• Seattle Genetics

• Global next generation biologics market outlook and analysis from 2018-2028

• Regional Next generation biologics market forecasts from 2018-2028

• US forecast 2018-2028,

• Japan forecast 2018-2028

• India forecast 2018-2028

• Germany forecast 2018-2028

• UK forecast 2018-2028

• France forecast 2018-2028

• Italy forecast 2018-2028

• Spain forecast 2018-2028

• China forecast 2018-2028

• Key questions answered

• What does the future hold for the next generation biologics?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to success and why?

• What business models should you adopt?

• What industry trends should you be aware of?

• Target audience

• Leading Pharmaceutical companies

• Suppliers

• Contractors

• Technologists

• R&D staff

• Consultants

• Analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

• Industry organisations

• Banks

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Overview of the Next-Generation Biologics Market

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Main Questions Answered by This Analytical Study

1.5 Who is This Report For?

1.6 Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Reports

1.9 About Visiongain

2. Introduction to Next-Generation Biologics

2.1 Brief History of Biological Drug Development

2.1.1 Limitations of Present-Generation Biological Drugs

2.2 The Promise of Next-Generation Biologics

2.2.1 Defining Next-Generation Biologics

2.2.1.1 A Definition of Regenerative Medicine

2.2.1.2 Extending Half-Life: Pegylation and Other Novel Strategies

3. World Next-Generation Biologics Market: Outlook and Forecast 2017-2028

3.1 The Next-Generation Biologics Market 2017

3.1.1 Development of the Next-Generation Biologics Market 2009-2016

3.1.2 Rising Demand for Biological Therapies

3.1.3 Next-Generation Drugs as a Share of the Biologics Market 2016

3.1.4 Main Sectors of the Next-Generation Biologics Market: Antibodies and Regenerative Medicine Lead the Way

3.1.5 Leading Companies in the Next-Generation Biologics Market 2017

3.2 The Next-Generation Biologics Market 2017-2028

3.2.1 Growth Drivers for Biological Drug Revenues 2017-2028

3.2.2 The Next-Generation Biologics Market Forecast 2017-2028

3.2.3 Product Launches in All Sectors to Drive Market Growth 2017-2028

3.2.4 Next-Generation Biologics: Market Restraints 2017-2028

3.2.5 Rising Market Shares for Next-Generation Insulins 2017-2028

4. Leading National Submarkets for Next-Generation Biologics 2017-2028

4.1 Leading National Submarkets for Next-Generation Biologics, 2017

4.1.1 National Submarket Forecasts 2017-2028

4.1.2 How Will National Submarket Shares Change to 2028?

4.2 Rising Disease Incidence in Important Markets 2017-2028

4.3 Approval of Next-Generation Biologics in Leading National Submarkets

4.4 The US Will be the Largest Submarket for Next-Generation Biologics 2017-2028

4.4.1 US Submarket Forecast 2017-2028

4.5 Next-Generation Biologics in Japan 2017-2028

4.5.1 National Expertise in Stem Cell Research

4.5.2 Japanese Submarket Forecast 2017-2028

4.6 Next-Generation Biologics in Leading EU Countries 2017-2028

4.6.1 Regenerative Medicine Development in the EU

4.6.2 Market Access for Next-Generation Biologics in the EU

4.6.3 Germany: Submarket Forecast 2017-2027

4.6.4 France: Submarket Forecast 2017-2028

4.6.5 UK: Submarket Forecast 2017-2028

4.6.6 Italy and Spain: Submarket Forecasts 2017-2028

4.7 Next-Generation Biologics in Emerging Markets 2017-2028

4.7.1 Next-Generation Biologics Development in Emerging Countries

4.7.2 Chinese Submarket Forecast 2017-2028

4.7.3 Indian Submarket Forecast 2017-2028

5. Next-Generation Antibodies: Submarket Outlooks 2017-2028

5.1 Strategies for Improving Antibody Therapies

5.1.1 Antibody-Drug Conjugates: Targeted Cytotoxic Therapies

5.1.2 Engineering Antibodies for Improved Potency

5.1.3 Bispecific Antibodies

5.2 Next-Generation Antibody Therapy Submarket

5.3 Next-Generation Antibody Therapy Submarket 2017-2028

5.3.1 Strong Revenue Growth for Next-Generation Antibodies 2017-2028

5.3.2 Blockbuster Potential Will Drive Growth to 2028: Kadcyla, Adcetris and Cosentyx

5.3.3 Next-Generation Antibodies: Submarket Restraints 2017-2028

5.4 Antibody-Drug Conjugates (ADC) Submarket 2017-2028

5.4.1 Antibody-Drug Conjugates Submarket Forecast 2017-2028

5.4.1.1 Kadcyla and Adcetris: Revenue Forecast 2017-2028

5.4.2 What Will Drive Growth for ACDs to 2028

5.4.3 A Long Pipeline of ADCs in Clinical Development

5.4.3.1 CMC544 (Pfizer): NHL Development Halted but Trials in ALL Continue

5.4.3.2 NKTR-102 (Nektar Therapeutics): Phase III for Metastatic Breast Cancer

5.4.3.3 IMGN853 (Immunogen): Phase III for Ovarian Cancer

5.4.3.4 SGN-CD33A (Seattle Genetics): Phase III for Acute myeloid leukemia

5.4.3.5 Rova-T (Abbvie): Phase III for SCLC

5.4.3.6 CDX-011: Potential for Accelerated Approval in Breast Cancer

5.5 Engineered Antibodies Submarket 2017-2028

5.5.1 Engineered Antibodies Submarket Forecast 2017-2028

5.5.1.1 Gazvya Will Lead the Submarket in 2028

5.5.2 Portfolio Management to Drive Growth 2017-2028

5.5.3 Engineered Antibodies Pipeline 2016

5.5.3.1 Benralizumab (MedImmune/Kyowa Hakko Kirin)

5.6 Bispecific Antibodies Submarket 2017-2028

5.6.1 Bispecific Antibodies Submarket Forecast 2017-2028

5.6.2 Bispecific Antibodies: Submarket Drivers and Restraints 2017-2028

5.6.3 One New Approval and Two Phase II Bispecific Antibodies in 2016

5.6.3.1 Blincyto (Amgen): The Second Approved Bispecific Antibody

6. Antibody Fragments and Novel Antibody-like Drugs: Commercial Potential 2017-2028

6.1 Next-Generation Antibody Fragments: Beyond Fab Fragments

6.1.1 Antibody-Like Proteins Mimic Antibody Therapies

6.1.2 There are Advantages to Using Fragments and Novel Scaffolds

6.2 Antibody Fragment and ALP Submarket 2017-2028

6.2.1 Antibody Fragment and ALP Submarket Forecast 2017-2028

6.2.2 Pharma is Investing Strongly in Antibody Fragments and ALPs

6.2.3 Limited Late-Stage R&D Pipeline to Restrain Growth to 2028

6.3 Outlook for Next-Generation Antibody Fragments 2017-2028

6.3.1 Next-Generation Antibody Fragment Submarket Forecast 2017-2028

6.3.2 One Platform Leads the Pipeline in 2016

6.3.2.1 Three Nanobodies in Development for Rheumatoid Arthritis

6.3.2.2 Caplacizumab (Ablynx): Targeting an Orphan Indication

6.4 The Antibody-Like Protein Submarket 2017-2028

6.4.1 Antibody-Like Protein Submarket Forecast 2017-2028

6.4.2 Four ALPs in Clinical Development in 2017

6.4.2.1 Abicipar Pegol (Allergan/Molecular Partners): Development of the Lead Clinical ALP Delayed

6.5 Will Next-Generation Immunotoxins Change the Market to 2028?

6.5.1 Challenges with First Generation Immunotoxins

6.5.2 Fusion Protein Conjugates: Pipeline 2016

6.5.2.1 Moxetumomab Pasudotox

6.5.3 Humanised Immunotoxins

6.5.3.1 Using Granzyme B in Immunotoxins

6.5.3.2 Immunornases: A Future Development Opportunity for Immunotoxins

7. Next-Generation Insulin Submarket: Outlook 2017-2028

7.1 Strategies for Next-Generation Insulin Development

7.1.1 Reformulating Insulin for Convenient Administration

7.1.1.1 Oral Insulin

7.1.1.2 Inhaled Insulin

7.1.1.3 Exubera: A Failed Attempt at Reformulated Insulin

7.2 Next-Generation Insulin Submarket 2017-2028

7.2.1 Tresiba: Approved in the EU and Japan

7.2.1.1 Tresiba: Revenue Forecast 2017-2028

7.3 Next-Generation Insulin Submarket 2016-2027

7.3.1 Next-Generation Insulin Submarket Forecast 2016-2027

7.3.2 Product Launches in the US and EU Will Drive Submarket Growth 2017-2028

7.3.3 Next-Generation Insulin Submarket Restraints 2017-2028

7.3.3.1 Biosimilar Insulins are Available Since 2015

7.4 Oral Insulin Submarket 2017-2028

7.4.1 Oral Insulin Submarket Forecast 2017-2028

7.4.2 Oral Insulin: Submarket Drivers and Restraints 2017-2028

7.4.3 A Limited Clinical-Stage Pipeline for Oral Insulin 2017

7.4.3.1 Oramed Pharmaceuticals: Oral Insulin in Phase II

7.4.3.2 Oshadi Icp: Phase II Currently Recruiting

7.4.3.3 IN-105: Biocon Partners with Bristol-Myers Squibb for Development

7.4.3.4 Diabetology: Multiple Deals Signed for Emerging Markets

7.4.3.5 Novo Nordisk: NN-1953

7.5 Ultra-Rapid Acting Insulin Submarket 2017-2028

7.5.1 Ultra-Rapid Acting Insulin Submarket Forecast 2017-2028

7.5.1.1 Will Inhaled Insulins Drive Revenue Growth to 2028?

7.5.2 Other Submarket Drivers and Restraints 2017-2028

7.5.3 Ultra-Rapid Acting Insulin Pipeline 2016

7.5.3.1 FlAsp (Novo Nordisk)

7.5.3.2 Adocia: Eli Lilly Opts to Discontinue Partnership

7.5.3.3 Halozyme Therapeutics

7.5.3.4 Biodel: Multiple Ultra Rapid Acting Candidates

7.5.3.5 Afrezza: Inhaled Insulin Nearing the Market

7.5.3.6 Adagio: A Second-Generation Inhaled Insulin

7.6 Ultra-Long Acting Insulin Submarket 2017-2028

7.6.1 Ultra-Long Acting Insulin Submarket Forecast 2017-2028

7.6.2 Revenue Growth Driven by Uptake of Tresiba

7.6.3 Ultra-Long Acting Insulin Pipeline 2017

7.6.3.1 Toujeo: Sanofi’s Next-Generation Insulin Analogue

7.6.3.2 LAPS-Insulin

8. Next-Generation Developments for Other Recombinant Proteins 2017-2028

8.1 Defining Next-Generation for Other Recombinant Protein Sectors

8.1.1 Next-Generation Interferon Beta: Plegridy Revenue Forecast 2017-2028

8.1.1.1 Plegridy May Compete With Other Long-Acting Interferon Beta Therapies 2017-2028

8.1.2 Next-Generation G-CSF: Teva Expands its Filgrastim Franchise

8.1.2.1 Other Clinical-Stages Advances in Filgrastim Therapy 2017

8.2 Next-Generation Recombinant Coagulation Factors 2017-2028

8.2.1 Next-Generation Recombinant Coagulation Factors Submarket Forecast 2017-2028

8.2.2 Submarket Drivers and Restraints 2017-2028

8.2.3 Clinical Pipeline for Recombinant Coagulation Factors 2017-2028

8.2.3.1 Fused Factors: Biogen Idec’s Eloctate and Alprolix

8.2.3.2 Baxter’s BAX 855

8.2.3.3 CSL Behring’s rlX-FP: Albumin-Bound Coagulation Factors

8.2.3.4 Bayer’s BAY94-9027

8.2.3.5 Novo Nordisk’s N8-GP for Haemophilia A

8.2.3.6 Novo Nordisk’s N9-GP for Haemophilia B

8.2.4 Gene Therapy as a New Treatment Option for Haemophilia

8.3 Next-Generation Growth Hormones 2017-2028

8.3.1 Next-Generation Growth Hormone Submarket Forecast 2017-2028

8.3.2 Brand Loyalty Will Restrain Uptake of Next-Generation Hormone 2017-2028

8.3.3 Long-Acting Growth Hormones

8.3.3.1 Biopartners/LG Life Sciences: The First Long-Acting Growth Hormone

8.3.3.2 Prolor Biotech/OPKO Health

8.3.3.3 Novo Nordisk: Looking to Extend its Market-Leading Position

8.3.3.4 Versartis: XTEN Technology for Half-Life Extension

8.3.4 Reformulated Growth Hormones: Offering Convenient Dosing for Paediatric Patients

8.3.4.1 Critical Pharmaceuticals: Nasal Delivery of Somatropin

9. Regenerative Medicine: Commercial Outlook 2017-2028

9.1 The Regenerative Medicine Submarket in 2017

9.1.1 Defining Regenerative Medicine

9.2 The Regenerative Medicine Submarket: Revenue Projections 2017-2028

9.2.1 Stem Cell and Gene Therapy Launches to Drive Growth 2017-2028

9.3 The Stem Cell Therapies Submarket 2017-2028

9.3.1 Prochymal (Mesoblast) for GvHD

9.3.1.1 The Future for Prochymal: Approval in Crohn’s Disease?

9.3.1.2 A Note on Stem Cell Transplants

9.3.2 Stem Cell Therapies Submarket Forecast 2017-2028

9.3.3 Stem Cell Therapies: Submarket Drivers and Restraints 2017-2028

9.3.3.1 Will iPSCs Prove Effective for Stem Cell Therapy?

9.3.4 Stem Cell Therapies Late-Stage Pipeline 2017

9.3.4.1 Cx601 (TiGenix)

9.3.4.2 Mesoblast: Mesenchymal Stem Cell Therapies

9.3.4.3 Baxter Pharmaceuticals: A Leading Cardiovascular Candidate

9.3.4.4 StemEx (Gamida Cell)

9.4 Outlook for Tissue Engineering 2017-2028

9.4.1 Two Sectors Lead the Market: Wound and Cartilage Repair

9.4.1.1 Apligraf Leads the Wound Repair Submarket

9.4.1.2 Organogenesis Markets Apligraf and Dermagraft from 2014

9.4.2 Tissue Engineering Submarket Forecast 2017-2028

9.4.3 Tissue Engineering: Submarket Drivers and Restraints 2017-2028

9.4.4 Future Developments in Cartilage Repair: Pipeline 2016

9.4.5 Organ Repair and Engineering: The Next Step in Tissue Engineering?

9.4.5.1 Engineered Skin

9.4.5.2 Engineered Veins

9.4.5.3 Organ Transplant: A Long-Term Tissue Engineering Opportunity

9.5 The Gene Therapies Submarket 2017-2028

9.5.1 Glybera Approved and Set for Launch in the EU

9.5.2 Gene Therapies Submarket: Revenue Projections 2017-2028

9.5.3 Glybera’s Approval Driving Submarket Growth Since 2014

9.5.4 There are More Than Five Gene Therapies in Late-Stage Development

9.5.4.1 ProstAtak: Gene Therapy for Prostate Cancer

9.5.4.2 TVEC (Amgen)

9.5.4.3 Generx (Cardium Therapeutics)

9.5.4.4 Spark Therapeutics: Established in 2013 for Ophthalmic Gene Therapy

10. Next-Generation Biologics: Industry Trends 2017-2028

10.1 Next-Generation Biologics: Market Strengths 2017

10.2 Next-Generation Biologics: Market Weakness 2017

10.3 The Next-Generation Biologics Market: STEP Analysis 2017-2028

10.3.1 Social Factors: Rising Disease Incidence and Demands for Convenience

10.3.1.1 Rising Incidence in Cardiovascular Disease, Cancer and Diabetes

10.3.1.2 Next-Generation Biologic Development in Emerging Markets

10.3.2 Technological Developments 2017-2028

10.3.3 Economic Pressures 2017-2028

10.3.3.1 High Drug Costs and Healthcare Spending

10.3.3.2 Limited Commercial Potential in Emerging Markets?

10.3.4 Political Issues: Regulatory Developments 2017-2028

10.4 Next-Generation Biologics: Development Trends 2017-2028

10.4.1 Improving Patient Convenience

10.4.2 Sustained Release Biologics: Pegylation and Beyond

10.4.3 Therapeutic Focus for Next-Generation Biologics

10.4.4 Next-Generation Biologics as Personalised Medicine

10.5 Manufacturing Challenges and Opportunities for Next-Generation Biologics

10.5.1 Contract Manufacturers Invest to Follow Development Trends

10.6 Commercialising Next-Generation Biologics

10.6.1 Product Lifecycle Management for First Generation Biologics

10.6.2 Proving Benefit in Next-Generation Products

10.6.3 Biosimilars as a Challenger 2017-2028

10.7 Partnering for Next-Generation Biologic Development

10.7.1 The Role of Big Pharma in the Next-Generation Biologics Market

10.7.2 Most Development Platforms Stem from Small Biotechs

11. Conclusions from Our Research and Analysis

11.1 The Next-Generation Biologics Market Will Grow Strongly to 2028

11.2 Next-Generation Antibody Development Will Lead the Market

11.3 New Treatment Regimens Will Drive Demand for Next-Generation Biologics

11.4 Leading Regional Markets

11.5 Challenges Remain in Developing and Commercialising Next-Generation Biologics

Associated Reports

Visiongain Report Sales Order Form

About Visiongain

Visiongain Report Evaluation Form

List of Figures

Figure 1.1 Next-Generation Biologic Market Segmentation, 2017

Figure 3.1 Next-Generation Biologics: Market Shares (%) by Sector, 2017

Figure 3.2 Next-Generation Biologics Market: Revenue Forecast ($bn), 2017-2028

Figure 3.3 Next-Generation Biologics: Market Drivers, 2018-2028

Figure 3.4 Next-Generation Biologics: Market Restraints, 2017-2028

Figure 3.5 Next-Generation Biologics: Market Shares (%) by Sector, 2023

Figure 3.6 Next-Generation Biologics: Market Shares (%) by Sector, 2028

Figure 4.1 Next-Generation Biologics: Market Shares (%) by Country, 2017

Figure 4.2 Next-Generation Biologics: Market Shares (%) by Country, 2023

Figure 4.3 Next-Generation Biologics: Market Shares (%) by Country, 2028

Figure 4.4 US Next-Generation Biologics Submarket Forecast ($bn) & AGR (%), 2017-2028

Figure 4.5 Japanese Next-Generation Biologics Submarket Forecast ($bn) & AGR (%), 2017-2028

Figure 4.6 EU5 Nations: Next-Generation Biologics Submarket Shares (%), 2017

Figure 4.7 German Next-Generation Biologics Submarket Forecast ($bn) & AGR (%), 2017-2028

Figure 4.8 French Next-Generation Biologics Submarket Forecast ($bn) & AGR (%), 2017-2028

Figure 4.9 UK Next-Generation Biologics Submarket Forecast ($bn) & AGR (%), 2017-2028

Figure 4.10 Italian Next-Generation Biologics Submarket Forecast ($bn), 2017-2028

Figure 4.11 Spanish Next-Generation Biologics Submarket Forecast ($bn) & AGR (%), 2017-2028

Figure 4.12 Biosimilar Approvals in India, 2001-2015

Figure 4.13 Chinese Next-Generation Biologics Submarket Forecast ($bn) &AGR (%), 2017-2028

Figure 4.14 Indian Next-Generation Biologics Submarket Forecast ($bn) & AGR (%), 2017-2028

Figure 5.1 Next-Generation Antibodies: Submarket Shares (%) by Sector, 2017

Figure 5.2 Next-Generation Antibodies Submarket Forecast ($bn), 2017-2028

Figure 5.3 Antibody-Drug Conjugates: Submarket Shares (%) by Drug, 2017

Figure 5.4 Adcetris: Revenue Forecasts ($bn) & AGR (%), 2017-2028

Figure 5.4 Kadcyla Revenue Forecasts ($bn) & AGR (%), 2017-2028

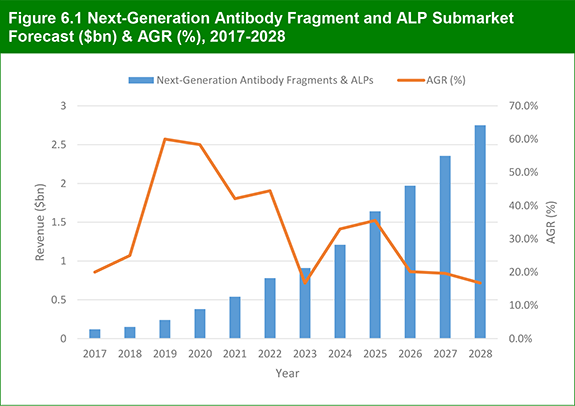

Figure 6.1 Next-Generation Antibody Fragment and ALP Submarket Forecast ($bn) & AGR (%), 2017-2028

Figure 6.2 Next-Generation Antibody Fragment Submarket Forecast ($bn), 2017-2028

Figure 6.3 Next-Generation Antibody-Like Protein Submarket Forecast ($bn), 2017-2028

Figure 7.1 Tresiba: Revenue Forecast ($bn), & AGR (%), 2017-2028

Figure 7.2 Next-Generation Insulin Submarket Revenue Forecast ($bn), 2017-2028

Figure 7.3 Diabetes: Proportion of Population Affected, 2016

Figure 7.4 Oral Insulin Submarket Forecast ($bn), 2017-2028

Figure 7.5 Ultra-Rapid Acting Insulin Submarket Forecast ($bn), 2017-2028

Figure 7.6 Afrezza: Revenue Forecast ($bn), 2017-2028

Figure 7.7 Ultra-Long Acting Insulin Submarket Forecast ($bn) & AGR (%), 2017-2028

Figure 8.1 Plegridy: Revenue Forecast ($bn) & AGR (%), 2017-2028

Figure 8.2 Next-Generation Recombinant Coagulation Factors Submarket Forecast ($bn) & AGR (%), 2017-2028

Figure 8.3 Eloctate: Revenue Forecast ($bn), 2017-2028

Figure 8.4 Alprolix: Revenue Forecast ($bn), 2017-2028

Figure 8.5 Next-Generation Growth Hormones Submarket Forecast ($bn), 2017-2028

Figure 9.1 Regenerative Medicine: Submarket Shares (%) by Sector, 2016

Figure 9.2 Regenerative Medicine Submarket Forecast ($bn) & AGR (%), 2017-2028

Figure 9.3 Stem Cell Therapies Submarket Forecast ($bn) & AGR (%), 2017-2028

Figure 9.4 Tissue Engineering Submarket Forecast ($bn) & AGR (%), 2017-2028

Figure 9.5 Gene Therapies Submarket Forecast ($bn) & AGR (%), 2017-2028

Figure 10.1 Big Pharma Partnering Opportunities for Next-Generation Biologics Development, 2017

List of Tables

Table 2.1 First Approvals for Recombinant Protein Therapies, 1982-1997

Table 2.1 First Approvals for Recombinant Protein Therapies, 1982-1997

Table 3.1 Top Ten Bestselling Prescription Pharmaceuticals: Revenues ($bn), 2016

Table 3.2 Next-Generation Biologics Market: Revenues ($bn) & Market Share (%) by Sector, 2017

Table 3.3 Biological Drugs Market: Drivers and Restraints, 2017-2028

Table 3.4 Next-Generation Biologics Market: Overall Market Forecast and Revenue Forecasts ($bn), AGR (%), & CAGR (%) by Sector, 2017-2028

Table 3.5 Next-Generation Biologics: Market Shares (%) by Sector, 2018, 2023 and 2028

Table 4.1 Next-Generation Biologics Market: Revenues ($bn) by National Submarket, 2017

Table 4.2 Next-Generation Biologics Market: Revenues ($bn), AGR (%), & CAGR (%) by National Submarket, 2017-2028

Table 4.2 Next-Generation Biologics Market: Revenues ($bn), AGR (%), & CAGR (%) by National Submarket, 2017-2028 (continued)

Table 4.3 Next-Generation Biologics: Revenue ($bn) & Market Shares (%) by National Submarket, 2023 and 2028

Table 4.4 National Incidence and Prevalence of Leading Indications Treated with Biologics (millions of patients), 2016

Table 4.5 Main Approval Dates for Next-Generation Biologics in Leading National Submarkets, 2003-2013

Table 4.6 US Next-Generation Biologics Submarket Forecast ($bn), AGR (%), & CAGR (%), 2017-2028

Table 4.7 Biosimilars Approved and Marketed in Japan, 2016

Table 4.8 Japanese Next-Generation Biologics Submarket Forecast ($bn), AGR (%), & CAGR (%), 2017-2028

Table 4.9 Next-Generation Biologics Submarkets in the EU5 Nations: Revenues ($bn) & Market Share (%) 2017

Table 4.10 German Next-Generation Biologics Submarket Forecast ($bn), AGR (%), & CAGR (%), 2017-2028

Table 4.11 France Next-Generation Biologics Submarket Forecast ($bn), AGR (%), & CAGR (%), 2017-2028

Table 4.12 UK Next-Generation Biologics Submarket Forecast ($bn), AGR (%), & CAGR (%), 2017-2028

Table 4.13 Italian Next-Generation Biologics Submarket Forecast ($bn), AGR (%), & CAGR (%), 2017-2028

Table 4.14 Spanish Next-Generation Biologics Submarket Forecast ($bn), AGR (%), & CAGR (%) 2017-2028

Table 4.15 Chinese Next-Generation Biologics Submarket Forecast ($bn), AGR (%), & CAGR (%), 2017-2028

Table 4.16 Indian Next-Generation Biologics Submarket Forecast ($bn), AGR (%), & CAGR (%), 2017-2028

Table 5.1 Monoclonal Antibodies Submarket: Leading Drug Revenues ($bn), 2016

Table 5.2 Next-Generation Antibodies Submarket: Approved Drug Revenues ($bn), 2016

Table 5.3 Selected Clinical and Pre-Clinical ADC Platforms, 2016

Table 5.4 Selected Clinical and Pre-Clinical Engineered Antibody Platforms, 2016

Table 5.5 Next-Generation Antibodies Submarket: Revenues by Sector ($bn) & Market Share (%), 2017

Table 5.6 Next-Generation Antibodies Submarket: Overall Submarket Forecast and Revenue Forecasts ($bn), AGR (%), & CAGR (%), by Sector, 2018-2028

Table 5.7 Next-Generation Antibodies Submarket: Drivers and Restraints, 2017-2028

Table 5.8 Antibody Drug Conjugates Submarket: Revenues ($bn) and Submarket Shares (%) by Drug, 2017

Table 5.9 Antibody-Drug Conjugates Submarket Forecast ($bn), AGR (%), & CAGR (%), 2017-2028

Table 5.10 Kadcyla and Adcetris: Revenue Forecasts ($bn), 2023-2028

Table 5.11 Antibody-Drug Conjugates Submarket: Drivers and Restraints, 2017-2028

Table 5.12 Selected Antibody-Drug Conjugates in Phase III Development, 2016

Table 5.13 Selected Antibody-Drug Conjugates in Phase II Development, 2016

Table 5.14 Selected Antibody-Drug Conjugates in Phase I Development, 2016

Table 5.15 Engineered Antibodies Submarket Forecast ($bn), 2017-2028

Table 5.16 Gazyva/Gazyvaro: Revenue Forecast ($bn), 2017-2022

Table 5.17 Engineered Antibodies Submarket: Drivers and Restraints, 2017-2028

Table 5.18 Selected Engineered Antibodies in Phase II and III Development, 2016

Table 5.19 Bispecific Antibodies Submarket Forecast ($bn), 2017-2022

Table 5.20 Bispecific Antibodies Submarket: Drivers and Restraints, 2017-2028

Table 5.21 Bispecific Antibodies in Phase I and II Development, 2016

Table 6.1 Selected Next-Generation Antibody Fragment Platforms, 2018

Table 6.2 Selected Antibody-Like Protein Platforms, 2017

Table 6.3 Next-Generation Antibody Fragment and ALP Submarket: Overall Submarket Forecast and Revenue Forecasts ($bn), AGR (%) & CAGR (%), by Sector, 2017-2028

Table 6.4 Next-Generation Antibody Fragment and ALP Submarket: Drivers and Restraints, 2017-2028

Table 6.6 Next-Generation Antibody Fragment Submarket Forecast ($bn), AGR (%) & CAGR (%), 2017-2028

Table 6.8 Next-Generation Antibody Fragment Submarket: Clinical Pipeline, 2017

Table 6.9 Next-Generation Antibody-Like Protein Submarket Forecast ($bn), 2018-2028

Table 6.10 Next-Generation Antibody-Like Protein Submarket: Clinical Pipeline, 2016

Table 7.1 Tresiba: Revenue Forecast ($bn), AGR (%) & CAGR (%), 2017-2028

Table 7.2 Next-Generation Insulin Submarket: Overall Submarket Forecast and Revenue Forecasts ($bn) by Sector, 2017-2028

Table 7.3 Next-Generation Insulin Submarket: Drivers and Restraints, 2017-2028

Table 7.4 Diabetes: Prevalence and Proportion of Population Affected, 2016

Table 7.5 Leading Insulin Analogues: US and EU Patent Expiries, 2013-2019

Table 7.6 Oral Insulin Submarket Forecast ($bn), 2023-2028

Table 7.7 Oral Insulin Submarket: Drivers and Restraints, 2017-2028

Table 7.8 Oral Insulin: Selected Pre-Clinical and Clinical-Stage Pipeline, 2017

Table 7.9 Ultra-Rapid Acting Insulin Submarket Forecast ($bn), 2017-2028

Table 7.10 Ultra-Rapid Acting Insulin Submarket: Drivers and Restraints, 2017-2028

Table 7.11 Ultra-Rapid Acting Insulin: Pre-Clinical and Clinical-Stage Pipeline, 2016

Table 7.12 Afrezza: Revenue Forecast ($bn), AGR (%) & CAGR (%), 2017-2028

Table 7.13 Ultra-Long Acting Insulin Forecast ($bn) AGR (%) & CAGR (%), 2018-2028

Table 7.14 Ultra-Long Acting Insulin Submarket: Drivers and Restraints, 2017-2028

Table 7.15 Selected Ultra-Long Acting Insulin: Clinical-Stage Pipeline, 2017

Table 8.1 Plegridy: Revenue Forecast ($bn), AGR (%) & CAGR (%), 2018-2028

Table 8.2 Recombinant Coagulation Factor Half-Lives and Target Populations, 2017

Table 8.3 Next-Generation Recombinant Coagulation Factors Submarket Forecast ($bn), AGR (%) & CAGR (%), 2017-2028

Table 8.4 Next-Generation Recombinant Coagulation Factors Submarket: Drivers and Restraints, 2017-2028

Table 8.5 Eloctate: Revenue Forecast ($bn), AGR (%) & CAGR (%), 2017-2028

Table 8.5 Long-Acting Recombinant Factors VIII and IX in Late-Stage Clinical Development, 2017

Table 8.6 Alprolix: Revenue Forecast ($bn), 2017-2022

Table 8.7 Next-Generation Growth Hormones Submarket Forecast ($bn), 2017-2022

Table 8.8 Next-Generation Growth Hormones Submarket: Drivers and Restraints, 2017-2028

Table 8.9 Selected Next-Generation Growth Hormones in Clinical Development, 2016

Table 9.1 Regenerative Medicine Submarket: Revenues by Sector ($bn) & Submarket Share (%) 2017

Table 9.2 Regenerative Medicine Submarket: Overall Submarket Forecast and Revenue Forecasts ($bn), AGR (%) and CAGR (%) by Sector, 2018-2028

Table 9.3 Regenerative Medicine Submarket: Drivers and Restraints, 2017-2028

Table 9.4 Stem Cell Therapies Submarket Forecast ($bn), AGR (%) & CAGR (%), 2017-2022

Table 9.5 Stem Cell Therapies Submarket: Drivers and Restraints, 2017-2028

Table 9.6 Selected Stem Cell Therapies in Phase II and III Clinical Trials, 2017

Table 9.7 Selected Stem Cell Therapies in Phase I/II Development, 2017

Table 9.8 Tissue Engineering Submarket Forecast ($bn), AGR (%) & CAGR (%), 2017-2028

Table 9.9 Tissue Engineering Submarket: Drivers and Restraints, 2017-2028

Table 9.10 Gene Therapies Submarket Forecast ($bn), AGR (%) & CAGR (%), 2017-2028

Table 9.11 Gene Therapies Submarket: Drivers and Restraints, 2017-2028

Table 9.12 Gene Therapies in Phase II and III Clinical Trials, 2017

Table 10.1 Next-Generation Biologics: STEP Analysis, 2017-2028

Table 10.2 Selected CMO Investments in Next-Generation Biologics, to 2017

Table 12.1 Next-Generation Biologics Market: Submarket Forecasts ($bn) and Market Shares (%), 2017, 2023 and 2028

3SBio

Aastrom Biosciences (now Vericel Corporation)

AbbVie

Abcam

Ablynx

ADC Therapeutics

Adnexus (part of Bristol-Myers Squibb)

Adocia

Advanced Cell Technology (now Ocata Therapeutics)

Advantagene

Affibody

Agensys (now part of Astellas Pharma)

Alcon (part of Novartis)

Alexion Pharmaceuticals

Alfacell (now Tamir Biotechnology)

Alkermes

Allergan

Allozyne

Ambrx

Amgen

AMRI

AnGes

Applied Genetic Technologies (AGTC)

Ark Therapeutics

Astellas Pharma

AstraZeneca

Athersys

Avita Medical

Baxter International

Bayer Healthcare

Belrose Pharma

Benda Pharmaceutical

Biocad

BioCancell Therapeutics

Biocon

Biodel

Biogen Idec

Bioheart

BioMarin Pharmaceutical

Biopartners (part of Bioton)

Biotest Pharmaceuticals

Bioton

BioVex Group (part of Amgen)

BioWa (part of Kyowa Hakko Kirin)

bluebird bio

Boehringer Ingelheim

BrainStorm Cell Therapeutics

Bristol-Myers Squibb

Capricor Therapeutics

Cardio3 BioSciences

Cardium Therapeutics

Catalent Pharma Solutions

Celgene

Celladon

CellCoTec

Celldex Therapeutics

Cellerant Therapeutics

Cellular Dynamics International (CDI)

Cephalon (part of Teva)

CEPiA (part of Sanofi)

Ceregene

Chatham Therapeutics

Chiesi Farmaceutici

Chugai (part of Roche)

Civitas Therapeutics

Clayton Biotechnologies

Cold Genesys

Concortis

Covagen

Crescendo Biologics

Critical Pharmaceuticals

CSL Behring

CytoMedix

Cytori Therapeutics

Dance Biopharm

Delenex Therapeutics

Depuy Mitek (part of J&J)

Diabetology

Diasome Pharmaceuticals

Dr. Reddy’s Laboratories

Dyax

Eddingpharm

EGEN

Eisai

Elan Pharmaceuticals (now part of Perrigo Company)

Eli Lilly

Emisphere

Enzon Pharmaceuticals

EnzymeRx

Epitomics (part of Abcam)

ESBATech (part of Novartis)

Flamel Technologies

Fresenius Biotech (now named Neovii Biotech, part of Neopharm)

Fuji Pharma

Fujifilm Diosynth Biotechnologies

Gamida Cell

Genentech (part of Roche)

Generex Biotechnology

Genmab

Genzyme (part of Sanofi)

Geron

GlaxoSmithKline (GSK)

GlycoExpress

Glycotope

Halozyme Therapeutics

Hanmi Pharmaceutical

Health Canada

Hikma Pharmaceuticals

Histogenics

Humacyte

Human Stem Cells Institute (HSCI)

Igenica

ImmunoGen

Immunomedics

Innovent Biologics

Integra LifeSciences

Introgen Therapeutics

Jain Foundation

JCR Pharmaceuticals

Johnson & Johnson (J&J)

Juventas Therapeutics

Karolinska Institute

Kyowa Hakko Kirin

LG Life Sciences

LifeCell

Lonza

Loyola University

MacroGenics

MannKind

MedImmune (part of AstraZeneca)

Merck & Co.

Merck KGaA

Merck Serono

Merrimack Pharmaceuticals

Merrion Pharmaceuticals

Mersana Therapeutics

Mesoblast

Micromet (part of Amgen)

Millennium Pharmaceuticals

Mitsubishi Tanabe Pharma

Mochida Pharmaceutical

Molecular Partners

MorphoSys

Nektar Therapeutics

Neopharm Group

NeoStem

NeuralStem

Nippon Kayaku

Novartis

Novo Nordisk

Nuron Biotech

NuVasive

Ocata Therapeutics (formerly Advanced Cell Technology)

OncoSec Medical

OPKO Health

Oramed Pharmaceuticals

Organogenesis

Organovo

Orthofix

Osiris Therapeutics

PeriphaGen Holdings

Perrigo Company

Pfizer

Pieris

Piramal Group

Progenics Pharmaceuticals

Prolor Biotech (part of OPKO Health)

Rani Therapeutics

ratiopharm (part of Teva)

Redwood Bioscience

Regeneron Pharmaceuticals

Reliance Life Sciences

ReNeuron

RIKEN [Japan]

Roche

Roche Glycart (part of Roche)

SAFC

Sandoz (part of Novartis)

Sanofi

Seattle Genetics

Shanghai Sunway Biotech

Shenzhen SiBiono GeneTech (part of Benda)

Shreya Life Sciences

SironRX Therapeutics

Skye Orthobiologics

Sorrento Therapeutics

Sotex PharmFirm

Spark Therapeutics

Spectrum Pharmaceuticals

Spirogen (part of AstraZeneca)

Stelis Biopharmaceuticals (part of Strides Arcolab)

Stem CentRx

StemCells

Stempeutics Research

Strativa Pharmaceuticals

Strides Arcolab

Sutro Biopharma

Swedish Orphan Biovitrum (Sobi)

Symphogen

Synthon

Synthon Biopharmaceuticals BV (part of Synthon)

Takeda Pharmaceutical Company

Teva Pharmaceutical Industries

Thermalin Diabetes

TiGenix

TRION Pharma

UCB

UniQure

USV

VBL Therapeutics

Vericel Corporation

Versartis

viDA Therapeutics

Viventia Biotechnologies Inc

VX Pharma

Wyeth (part of Pfizer)

Xencor

Xeris Pharmaceuticals

Zydus Cadila

List of Organizations

Agence Nationale de Sécurité du Médicament et des Produits de Santé (ANSM)

Babraham Institute

Centers for Disease Prevention and Control (CDC) [US]

Children’s Hospital of Philadelphia (CHOP)

China Food and Drug Administration (CFDA)

Duke University

Duke University Hospital

EMA’s Committee for Medicinal Products for Human Use (CHMP)

European Commission

European Medicines Agency (EMA)

Food and Drug Administration (FDA) [US]

Institut für Qualität und Wirtschaftlichkeit im Gesundheitswesen (IQWiG) [Germany]

International Diabetes Federation (IDF)

Ministry of Health, Labor and Welfare (MHLW) [Japan]

Moorfields Eye Hospital [UK]

National Cancer Institute (NCI) [US]

National Health Service (NHS) [UK]

National Institute for Health and Care Excellence (NICE) [UK]

National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) [US]

Royal Institute of Technology [Sweden]

Russian Ministry of Healthcare (Minzdrav)

Scottish Medicines Consortium (SMC)

Stanford University

Swiss Federal Institute of Technology

Tianjin International Joint Academy of Bio-medicine

University of California, San Francisco (UCSF)

University of Chicago

University of Toronto

World Bank Group

World Cancer Research Fund (WCRF)

World Health Organization (WHO)

Yale School of Medicine)

Download sample pages

Complete the form below to download your free sample pages for Next-Generation Biologics Market 2018-2028

Related reports

-

Global Precision Medicine Market Forecast 2018-2028

The global precision medicine market is expected to grow at an estimated CAGR of 12.08% from 2018 to 2028. The...

Full DetailsPublished: 26 March 2018 -

Top 25 Antibiotic Drugs Manufacturers 2018

Visiongain forecasts the antibiotic drugs market to increase to $ 43,841.7m in 2022. The market is estimated to grow at...

Full DetailsPublished: 12 June 2018 -

Pharmaceutical Contract Manufacturing Market 2018-2028

The pharmaceutical contract manufacturing market is expected to grow at a CAGR of 6.0% in the first half of the...

Full DetailsPublished: 27 June 2018 -

Global Inflammatory Bowel Diseases (IBD) Drug Market Forecast 2018-2028

The global inflammatory bowel diseases (IBD) drug market is estimated at $6.7bn in 2017 and $7.6bn in 2023. Biologic therapies...

Full DetailsPublished: 29 May 2018 -

Medical Device Leader Series: Top Pre-Filled Injection Device Manufacturers 2018-2028

The Pre-Filled Device Manufacturing market is estimated to reach $7.5bn in 2022, growing at a CAGR of 10.5% from 2017...Full DetailsPublished: 13 November 2018 -

Generic Drugs Market Forecast 2018-2028

The generic drugs market is estimated at $257.3bn in 2017 and is expected to grow at a CAGR of 7.9%...

Full DetailsPublished: 25 April 2018 -

Pharma Leader Series: 25 Top Biosimilar Drug Manufacturers 2017-2027

Our 233-page report provides 126 tables, charts, and graphs, giving a clear view on companies in the biosimilar market. Who...Full DetailsPublished: 31 August 2017 -

Global Biomarkers Market Forecast 2017-2027

The global biomarkers market is expected to grow at a CAGR of 9.1% in the first half of the forecast...

Full DetailsPublished: 18 October 2017 -

Global Liquid Biopsy Market Forecast 2018-2028

Our 156-page report provides 144 tables, charts, and graphs. Read on to discover the most lucrative areas in the industry...

Full DetailsPublished: 24 April 2018 -

Gene Therapy R&D and Revenue Forecasts 2018-2028

The gene therapy market is projected to grow at a CAGR of 41.1% in the first half of the forecast...

Full DetailsPublished: 31 May 2018

Download sample pages

Complete the form below to download your free sample pages for Next-Generation Biologics Market 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Pharma news

Retinal Gene Therapy Market

The global Retinal Gene Therapy market is projected to grow at a CAGR of 9.6% by 2034

26 July 2024

HIV Drugs and Injectables Market

The global HIV Drugs & Injectables market is projected to grow at a CAGR of 4.6 % by 2034

24 July 2024

Digital Twin Technology in Pharmaceutical Manufacturing Market

The global Digital Twin Technology in Pharmaceutical Manufacturing market is projected to grow at a CAGR of 31.3% by 2034

23 July 2024

Specialty Pharma Market

The global Specialty Pharma market is projected to grow at a CAGR of 7.5% by 2034

22 July 2024