Industries > Pharma > Pharma Wholesale and Distribution Market Forecasts 2018-2028

Pharma Wholesale and Distribution Market Forecasts 2018-2028

Branded Drugs, Generic Drugs, US, China, Japan, Germany, France, Brazil, Italy, Spain, UK, India, Russia, RoW

The pharma wholesale and distribution market is estimated to grow at a CAGR of 5.6% in the first half of the forecast period. The market is estimated to reach a revenue of $1.3bn in 2023. In 2017, the branded drugs submarket held 79% of the pharma wholesale and distribution market.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 277-page report you will receive 93 tables and 107 figures– all unavailable elsewhere.

The 277-page report provides clear detailed insight into the pharma wholesale and distribution market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• Global Pharma Wholesale and Distribution Market from 2018-2028

• Forecast of the Global Pharma Wholesale and Distribution market by Category:

• Generic Drugs

• Branded Drugs

• Others

• This report provides individual revenue forecasts to 2028 for these national markets:

• US

• Germany

• France

• Italy

• Spain

• UK

• Japan

• China

• Brazil

• India

• Russia

• RoW

Each National Market is further segmented into generic drugs, branded drugs and others

• Our study discusses the selected leading companies that are the major players in the global pharma and wholesale distribution market:

• Alfresa Holdings

• AmerisourceBergen

• Cardinal Health

• McKesson

• Medipal

• PHOENIX Group

• Shanghai Pharma

• SINOPHARM

• Suzuken

• Walgreens Boots Alliance

• This report provides a SWOT and STEP analysis of the pharma wholesale and distribution market.

Visiongain’s study is intended for anyone requiring commercial analyses for the pharma wholesale and distribution market. You find data, trends and predictions.

Buy our report today Pharma Wholesale and Distribution Market Forecasts 2018-2028: Branded Drugs, Generic Drugs, US, China, Japan, Germany, France, Brazil, Italy, Spain, UK, India, Russia, RoW.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1.1 Global Pharma Wholesale and Distribution Industry and Market Overview

1.2 Benefits of This Report

1.3 How This Report Delivers

1.4 Questions Answered by This Analytical Report

1.5 Who is This Report For?

1.6 Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to Pharma Wholesale and Distribution

2.1 The Role of Pharmaceutical Wholesalers: The Middlemen of the Pharmaceutical Industry

2.1.1 Full-Line Wholesalers (FLWs)

2.1.2 Short-Line Wholesalers (SLWs)

2.2 The Chain of Distribution: Wholesalers vs. Logistic Service Providers

2.2.1 Secondary Wholesalers

2.2.2 Direct-to-Pharmacy (DTP) Distribution is Becoming More Prevalent

2.2.3 Major Wholesalers: Distribution of a Large Number of Products to Generate High Profits

2.2.4 Distribution from Large to Small Wholesalers: A Lengthy Distribution Chain

2.2.5 Pharmacy Benefit Managers

2.3 Generative Revenue and Profit

2.3.1 Forward Buying to Avoid Price Increases

2.3.2 Fee-for-Service: A Clear Pricing Structure

2.3.2.1 Inventory Management Agreements

2.3.3 Discounts: Incentives for Prompt Payment or Bulk Purchases

2.3.4 Reimbursement and Wholesalers

2.3.5 Clawback: The Recovery of Reimbursement Costs by Governments

2.3.6 Parallel Trade: Different Attitudes in Europe and the US

3. The World Pharmaceutical Wholesale and Distribution Market: 2017-2028

3.1 The World Pharmaceutical Wholesale and Distribution Market in 2017, Restricted by Government Price Reductions and Generic Substitution

3.2 The Pharmaceutical Wholesale and Distribution Industry: World Market Forecast, 2017-2028

3.3 Branded and Generic Drugs: Revenue vs. Profit, 2017-2028

3.3.1 Branded and Generic Drugs: Revenue Generation, 2017

3.3.2 Branded Drugs: Revenue Forecast, 2017-2028

3.3.3 Generic Drugs: Revenue Forecast, 2017-2028

4. Pharmaceutical Wholesale and Distribution Industry: Leading National Markets, 2017-2028

4.1 The Leading National Markets: the US Dominates in 2017

4.2 The Future of the Leading National Markets: Will the US Continue to Dominate the Market?

4.3 The US Pharma Wholesale and Distribution Market

4.3.1 The Budget Control Act and its Effect on the US Wholesale and Distribution Industry

4.3.2 Legislation to Prevent Counterfeit Drugs Can Differ Between States

4.3.3 An Increase in Fee-For-Service Activity

4.3.4 Pharma Wholesale and Distribution Market in the US: Market Forecast, 2017-2028

4.4 The Leading European (EU5) Pharma Wholesale and Distribution Markets

4.4.1 The Difference Between the US and European Markets

4.4.2 State-Funded Healthcare and Reimbursement

4.4.3 EU5: Market Forecast, 2017-2028

4.4.4 Germany: Pharma Wholesale and Distribution Market, 2017

4.4.4.1 Healthcare Reform

4.4.4.2 Germany: Reform of AMNOG Pharmaceutical Rebate Law

4.4.4.3 Germany Pharma Wholesale and Distribution Market Forecast, 2017-2028

4.4.5 France: Pharma Wholesale and Distribution Market, 2017

4.4.5.1 France: Social Security Finance Bill 2015

4.4.5.2 France: Pharma Wholesale and Distribution Market Forecast, 2017-2028

4.4.6 Italy: Pharma Wholesale and Distribution Market, 2017

4.4.6.1 Italy: Pharma Wholesale and Distribution Market Forecast, 2017-2028

4.4.7 Spain: Pharma Wholesale and Distribution Market, 2017

4.4.7.1 Spain: Pharma Wholesale and Distribution Market Forecast, 2017-2028

4.4.8 UK: Pharma Wholesale and Distribution Market, 2017

4.4.8.1 Price Cuts in the UK

4.4.8.2 UK: Pharma Wholesale and Distribution Market Forecast, 2017-2028

4.5 Japan: Pharma Wholesale and Distribution Market, 2017

4.5.1 Drug Pricing and Performing Fees in Japan

4.5.2 Japan: Pharma Wholesale and Distribution Market Forecast, 2017-2028

4.6 China: Pharma Wholesale and Distribution Market, 2017

4.6.1 China: Leading Pharma Wholesale and Distribution Companies, 2017

4.6.2 China: Pharma Wholesale and Distribution Market Forecast, 2017-2028

4.7 Brazil: Pharma and Wholesale Distribution Market, 2017

4.7.1 Drug Price Controls in Brazil

4.7.2 Brazil: Leading Pharma Wholesale and Distribution Companies, 2017

4.7.3 Brazil: Pharma Wholesale and Distribution Market Forecast, 2017-2028

4.8 India: Pharma Wholesale and Distribution Market, 2017

4.8.1 India: Pharma Wholesale and Distribution Market Forecast, 2017-2028

4.9 Russia: Pharma Wholesale and Distribution Market, 2016

4.9.1 Drug Pricing Controls in Russia

4.9.2 Market Trends in Russia

4.9.3 Russia: Pharma Wholesale and Distribution Market Forecast, 2017-2028

4.10 Conclusion

5. Leading Pharma Wholesalers and Distributors In 2016: Current and Future Performance

5.1 The Leading Pharma Wholesalers and Distribution Companies in 2017

5.2 Revenue vs. Profit

5.3 Leading Pharma Wholesale and Distribution Companies: Grouped Forecasts, 2017-2028

5.4 McKesson: The Oldest and Largest Healthcare Services Company in the US

5.4.1 McKesson: Historical Performance, 2011-2016

5.4.2 Future Strategies: Consummate Acquisitions to Complement Existing Business or Expand Businesses

5.4.3 McKesson: Revenue Forecast, 2017-2028

5.5 Cardinal Health: The World’s Third Largest Pharma Wholesaler

5.5.1 Cardinal Health: Historical Performance, 2011-2016

5.5.2 Will CVS Joint Venture and Acquisitions Stimulate Future Growth?

5.5.3 Cardinal Health: Revenue Forecast, 2017-2028

5.6 AmerisourceBergen: Third Largest Global Pharma Wholesaler and Distributor

5.6.1 AmerisourceBergen: Historical Performance, 2016

5.6.2 Will Contracts with Walgreens and Alliance Boots Drive Future Growth?

5.6.3 AmerisourceBergen: Revenue Forecast, 2017-2028

5.7 Walgreens Boots Alliance: The Largest Drugstore Chain in the US and Global Wholesale and Distribution Network

5.7.1 Walgreens Boots Alliance: Historical Performance, 2011-2016

5.7.2 Acquisitions and Future Strategies of Walgreens Boots Alliance

5.7.3 Walgreens Boots Alliance: Revenue Forecast, 2017-2028

5.8 MEDIPAL HOLDINGS CORPORATION: Japan’s Leading Pharmaceutical Wholesaler

5.8.1 MEDIPAL HOLDINGS CORPORATION: Historical Performance, 2011-2016

5.8.2 Future Strategies of MEDIPAL HOLDINGS CORPORATION: Revised Business Portfolio with Diverse Sources of Earnings

5.8.3 MEDIPAL HOLDINGS CORPORATION: Revenue Forecast, 2017-2028

5.9 Phoenix Group: Biggest European Wholesalers

5.9.1 The PHOENIX Group: Historical Performance, 2011-2016

5.9.2 Future Strategies of the PHOENIX Group: Selective Acquisition

5.9.3 The PHOENIX Group: Revenue Forecast, 2017-2028

5.10 SINOPHARM: The Leading Pharmaceutical Wholesaler and Distributor in China

5.10.1 SINOPHARM: Historical Performance, 2011-2016

5.10.2 Future Strategies of SINOPHARM: Provide Comprehensive Services and Wider Business Coverage

5.10.3 SINOPHARM: Revenue Forecast, 2017-2028

5.11 Alfresa Holdings: Second Largest Pharmaceutical Wholesaler and Distributor in Japan

5.11.1 Alfresa Holdings: Historical Performance, 2011-2016

5.11.2 Future Strategy of Alfresa Holdings: To Focus on Expanding Business Fields and Increasing Footprint

5.11.3 Alfresa Holdings: Revenue Forecast, 2017-2028

5.12 SUZUKEN CO., LTD: The First Nationwide Wholesaler of Japan

5.12.1 SUZUKEN CO. LTD: Historical Performance, 2011-2016

5.12.2 Future Strategies of SUZUKEN CO., LTD: Five Growth Initiatives and Special Focus on Diabetes Field

5.12.3 SUZUKEN CO., LTD: Revenue Forecast, 2017-2028

5.13 Shanghai Pharmaceuticals Holding: China’s Second Largest Wholesaler

5.13.1 Shanghai Pharmaceuticals Holding: Historical Performance, 2011-2016

5.13.2 Future Strategies of Shanghai Pharma: Expansion of Three Leading Regions in China

5.13.3 Shanghai Pharma: Revenue Forecast, 2017-2028

6. Qualitative Analysis of the Pharma Wholesale and Distribution Market

6.1 The Strengths and Weaknesses of the Pharma Wholesale and Distribution Market, 2017

6.1.1 The Insatiable Demand for Drugs: A Recession Proof Industry?

6.1.2 Wholesalers Do More than Deliver Drugs

6.1.2.1 Pre-Wholesaling: More Prevalent in Europe

6.1.2.2 Through Pre-Financing, Full-Line Wholesalers Finance the Entire Medicines Market

6.1.3 Large Companies Dominate the Market

6.1.4 Despite High Revenues, Profit Margins Are Low

6.1.5 Government-Induced Drug Price Pressures Restrict Profits

6.1.6 The Problem of Counterfeit Drugs

6.2 The Opportunities and Threats of the Pharma Wholesale and Distribution Market, 2017-2028

6.2.1 The Demand for Pharmaceuticals is Increasing

6.2.2 The Increasing Use of Specialty Drugs Will Drive Growth

6.2.3 The Increasing Use of Generic Drugs Will Limit Revenue but Drive Profit Generation

6.2.4 The Promotion of Drug Therapy in the US

6.2.5 Globalisation: The Major National Markets are Dominated by Few Companies

6.2.6 Increased Adoption of the DTP Distribution Model

6.2.6.1 DTP in Europe: The First Place the Scheme Has Taken Hold

6.2.6.2 DTP in the UK Since 1991

6.2.6.3 DTP in Poland: The Second European Country To Adopt the DTP Model

6.2.6.4 Further Expansion of the DTP Model

6.2.7 The Threat of Healthcare Budget Cuts

6.2.7.1 Healthcare Budget Cuts in Germany

6.2.7.2 Healthcare Budget Cuts in France

6.2.7.3 Healthcare Budget Cuts in Italy

6.2.7.4 Healthcare Budget Cuts in Spain

6.2.7.5 Healthcare Budget Cuts in the UK

6.2.8 Do Large Pharmacy Chains Pose a Threat?

6.2.8.1 Case Study: Walmart and the $4 Prescription Scheme

6.2.8.2 Vertical Integration of Wholesalers: A Response to the Threat of Pharmacy Chains

6.2.9 Does the Diversion and Re-Importation of Medicines Pose a Threat to the Industry?

6.2.10 The Threat of Industry Consolidation

6.3 Social, Technological, Economic and Political Factors Influencing the Market, 2017-2028 (STEP Analysis)

6.3.1 Political Factor: The Impact of Recent Regulatory Changes in the EU

6.3.2 Political Factor: Combating Counterfeit Medicines

6.3.2.1 The US and E-Pedigree: Becoming Law in California

6.3.2.2 European Pedigree Legislation

6.3.2.3 Anti-Counterfeiting Strategies in Other Markets: The Chinese Government is Attempting to Address the Challenge

6.3.2.4 Serialisation for Wholesalers: Opportunity or a Challenge?

7. Conclusions

7.1 The Future of the Pharma Wholesale and Distribution Market

7.2 The Leading National Pharma Wholesale and Distribution Markets

7.3 The Leading Companies in the Pharma Wholesale and Distribution Industry

7.4 Trends in the Pharma Wholesale and Distribution Industry

7.4.1 Generics Will Threaten Revenue

7.4.2 Manufacturers Will Deliver More Drugs Directly

7.4.3 There Will Be Greater Demand for Specialty Medicines

7.4.4 Consolidation Will Drive Growth

7.4.5 Anti-Counterfeiting Demands Will Add to Wholesalers’ Costs

Appendices

Associated Visiongain Reports

Visiongain Report Sales Order Form

About Visiongain

Visiongain Report Evaluation Form

List of Tables

Table 2.1 Use of DTP Model in the UK, 2007-2012

Table 3.1 Pharmaceutical Wholesale and Distribution: World Market Forecast ($bn), AGR (%), CAGR (%), 2017-2028

Table 3.2 Pharmaceutical Wholesale and Distribution: Branded Drugs, Generic Drugs and Others, Revenue ($bn) Forecasts, AGR (%), CAGR (%) and Market Shares (%), 2017-2028

Table 3.3 Wholesale and Distribution of Branded Drugs: Revenue ($bn) and Market Share (%) Forecast, 2017-2028

Table 3.4 Wholesale and Distribution of Generic Drugs: Revenue ($bn) and Market Share (%) Forecast, 2017-2028

Table 4.1 Pharma Wholesale & Distribution Leading National Markets: Revenues ($bn) and Market Share (%), 2017

Table 4.2 Pharma Wholesale & Distribution Leading National Markets: Revenue ($bn) Forecasts, AGR (%) and CAGR (%), 2017-2028

Table 4.3 US Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.4 Us Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, AGR (%) And CAGR (%), 2017-2028

Table 4.5 Price Controls in Europe, 2016

Table 4.6 EU5 Pharma Wholesale & Distribution Market: Revenue ($bn) Forecasts, AGR (%) and CAGR (%), 2017-2028

Table 4.7 German Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.8 German Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.9 French Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.10 French Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.11 Italian Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.12 Italian Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.13 Spanish Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.14 Spanish Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.15 UK Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.16 UK Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.17 Percentage of The Population Ages 60+ In the Us, Europe, Japan, China and India, 2015 And 2030

Table 4.18 Japanese Pharmaceutical Wholesale and Distribution Market: Drug Price Revision Growth (%), 2007-2017

Table 4.19 Japanese Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.20 Japanese Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.21 Chinese Pharma Wholesale & Distribution: Revenue ($bn) And Market Shares (%) of Leading Companies, 2017

Table 4.22 Chinese Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.23 Chinese Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.24 Brazilian Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.25 Brazilian Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.26 Indian Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.27 Indian Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.28 Russian Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 4.29 Russian Pharma Wholesale & Distribution Market: Revenue ($Bn) Forecast, AGR (%) and CAGR (%), 2017-2028

Table 5.1 Leading Companies in The Pharmaceutical Wholesale and Distribution Market: Revenues ($bn) and Market Shares (%), 2017

Table 5.2 Leading Pharmaceutical Wholesale and Distribution Companies: Revenue Forecasts ($bn), AGR (%) and CAGR (%), 2017-2028

Table 5.3 Leading Pharmaceutical Wholesale and Distribution Companies: Market Shares (%) for 2017, 2022 And 2028

Table 5.4 Mckesson, Distribution Solutions: Services and Customers, 2017

Table 5.5 Mckesson, Technology Solutions: Services and Customers, 2017

Table 5.6 Mckesson: Historical Revenue ($bn), Revenue AGR (%), Revenue CAGR (%), Gross Profit ($bn), Gross Profit AGR (%) and Gross Profit CAGR (%), 2011-2016

Table 5.7 Mckesson: Revenue ($bn), Revenue Share (%) and AGR (%) Breakdown by Business Segment, 2016-2017

Table 5.8 Mckesson: Gross Profit ($bn), Gross Profit Share (%) and AGR (%) Breakdown by Business Segment, 2016-2017

Table 5.9 Acquisitions by Mckesson, 2007-2018

Table 5.10 Mckesson: Revenue ($bn), AGR (%) and CAGR (%) Forecast, 2017-2028

Table 5.11 Cardinal Health: Historical Revenue ($bn), Revenue AGR (%), Revenue CAGR (%), Operating Earnings ($bn), AGR (%) and CAGR (%), 2010-2015

Table 5.12 Cardinal Health: Revenue ($bn), Revenue Share (%) and AGR (%) Breakdown by Business Segment, 2016-2017

Table 5.13 Cardinal Health: Operating Earnings ($bn) and Annual Growth (%) Breakdown by Business Segment, 2016-2017

Table 5.14 Cardinal Health: Revenue ($bn) And Revenue Share (%) Breakdown by Customer, 2017

Table 5.15 Selected Acquisitions by Cardinal Health and Their Line of Business, 2007-2018

Table 5.16 Cardinal Health: Revenue ($bn), AGR (%) and CAGR (%) Forecast, 2017-2028

Table 5.17 Amerisourcebergen: Historical Revenue ($bn), Revenue AGR (%), Revenue CAGR (%), Gross Profit ($bn), Gross Profit AGR (%) and Gross Profit CAGR (%), 2011-2016

Table 5.18 Amerisourcebergen: Revenue ($bn), Revenue Share (%) and AGR (%) Breakdown by Business Segment, 2016-2017

Table 5.19 Amerisourcebergen: Gross Profit ($bn), Gross Profit Share (%) and AGR (%) Breakdown by Business Segment, 2016-2017

Table 5.20 Amerisourcebergen: Revenue ($bn) and Revenue Share (%) Breakdown by Customer, 2017

Table 5.21 Acquisitions by Amerisourcebergen and Their Line of Business, 2007-2018

Table 5.22 Amerisourcebergen: Revenue ($bn), AGR (%) and CAGR (%) Forecast, 2017-2028

Table 5.23 Walgreens Boots Alliance: Revenue ($bn), Revenue AGR (%), Revenue CAGR (%), Gross Profit ($bn), Gross Profit AGR (%) and Gross Profit CAGR (%), 2011-2016

Table 5.24 Walgreens Boots Alliance: Pharmaceutical Wholesale Revenue ($bn), AGR (%), and CAGR (%) Forecast, 2017-2028

Table 5.25 Medipal Holdings: Consolidated Subsidiary Companies, 2017

Table 5.26 Medipal Holdings: Historical Revenue (¥bn, $bn), Revenue AGR (%), Revenue CAGR (%), Gross Profit (¥bn, $bn), Gross Profit AGR (%) and Gross Profit CAGR (%), 2011-2016

Table 5.27 Medipal Holdings: Revenue (¥bn, $bn) and Revenue Share (%) and AGR (%) Breakdown by Business Segment, 2016-2017

Table 5.28 Medipal Holdings: Operating Income ($bn, ¥bn), Operating Income Share (%) and AGR (%) Breakdown by Business Segment, 2016-2017

Table 5.29 Medipal Holdings: Revenue ($bn), AGR (%) and CAGR (%) Forecast, 2017-2028

Table 5.30 Phoenix Group: Subsidiary Companies, 2017

Table 5.31 Phoenix Group: Historical Revenue (€bn, $bn), Revenue AGR (%), Revenue CAGR (%), Gross Profit (€bn, $bn), Gross Profit AGR (%) and Gross Profit CAGR (%), 2011-2016

Table 5.32 Phoenix Group: Revenue (€bn, $bn), Revenue Share (%) Breakdown by Region, 2017

Table 5.33 Phoenix Group: Revenue ($bn), AGR (%) and CAGR (%) Forecast, 2017-2028

Table 5.34 Sinopharm Group: Historical Revenue (RMBbn, $bn), Revenue AGR (%), Revenue CAGR (%), Gross Profit (RMBbn, $bn), Gross Profit AGR (%) and Gross Profit CAGR (%), 2011-2016

Table 5.35 Sinopharm Group: Revenue (RMBbn, $bn) and Revenue Share (%) and AGR (%) Breakdown by Business Segment, 2016-2017

Table 5.36 Sinopharm Group: Operating Profit (RMBbn, $bn), Operating Profit Share (%) and AGR (%) Breakdown by Business Segment, 2015-2016

Table 5.37 Sinopharm Group: Revenue ($bn), AGR (%) and CAGR (%) Forecast, 2017-2028

Table 5.38 Alfresa Holdings: List of Significant Subsidiaries and Affiliates, 2017

Table 5.39 Alfresa Holdings: Historical Revenue (¥bn, $bn), Revenue AGR (%), Revenue CAGR (%), Gross Profit (¥bn, $bn), Gross Profit AGR (%) and Gross Profit CAGR (%), 2011-2016

Table 5.40 Alfresa Holdings: Business Strategies, 2013-2017

Table 5.41 Alfresa Holdings: Revenue (¥bn, $bn), Revenue Share (%) and AGR (%) Breakdown by Business Segment, 2016-2017

Table 5.42 Alfresa Holdings: Gross Profit (¥bn, $bn), Gross Profit Share (%) and AGR (%) Breakdown by Business Segment, 2016-2017

Table 5.43 Alfresa Holdings: Challenges for the 16-18 Mid-Term Management Plan - Break Through to Tomorrow, 2016

Table 5.44 Alfresa Holdings: Revenue ($bn), AGR (%) and CAGR (%) Forecast, 2017-2028

Table 5.45 Suzuken: Historical Revenue (¥bn, $bn), Revenue AGR (%), Revenue CAGR (%), Gross Profit (¥bn, $bn), Gross Profit AGR (%) and Gross Profit CAGR (%), 2011-2016

Table 5.46 Suzuken: Revenue (¥bn, $bn), Revenue Share (%) and AGR (%) Breakdown by Business Segment, 2015-2016

Table 5.47 Suzuken: Operating Income (¥bn, $bn), Operating Income Share (%) and AGR (%) Breakdown by Business Segment, 2015-2016

Table 5.48 Suzuken: Revenue (¥bn, $bn), Revenue Share (%) Breakdown for Pharmaceuticals Distribution Segment by Region, 2014

Table 5.49 Suzuken: Revenue ($bn), AGR (%) and CAGR (%) Forecast, 2017-2028

Table 5.50 Shanghai Pharmaceuticals Holding: Historical Revenue (RMBbn, $bn), Revenue AGR (%), Revenue CAGR (%), Gross Profit (RMBbn, $bn), Gross Profit AGR (%) and Gross Profit CAGR (%), 2011-2016

Table 5.51 Shanghai Pharmaceuticals Holding: Revenue (RMBbn, $bn), Revenue Share (%) and AGR (%) Breakdown by Business Segment, 2015-2016

Table 5.52 Shanghai Pharmaceuticals Holding: Operating Profit (RMBbn, $bn), Operating Profit Share (%) and AGR (%) Breakdown by Business Segment, 2015-2016

Table 5.53 Shanghai Pharmaceuticals Holding: Distribution Revenue (RMBbn, $bn), Distribution Revenue Share (%) Breakdown by Region, 2016

Table 5.54 Shanghai Pharmaceuticals Holding: Revenue ($bn), AGR (%) and CAGR (%) Forecast, 2017-2028

Table 6.1 The Pharmaceutical W&D Market: Strengths and Weaknesses, 2017

Table 6.2 The Pharmaceutical W&D Market: Opportunities and Threats, 2017-2028

Table 6.3 Strengths and Weaknesses of The DTP Distribution Model, 2017

Table 6.4 ITR Ratings and Corresponding Reimbursement Rates, 2017

Table 6.5 Social, Technological, Economic and Political Factors Influencing the Pharmaceutical Wholesale and Distribution Market (Step Analysis), 2017-2028

List of Figures

Figure 2.1 Routes of Drug Distribution, 2017

Figure 3.1 The Global Pharmaceutical Wholesale and Distribution Market: Drivers and Restraints, 2017

Figure 3.2 Pharmaceutical Wholesale and Distribution: World Market Forecast ($Bn), 2017-2028

Figure 3.3 Branded Drugs, Generic Drugs and Others: Market Shares (%), 2017

Figure 3.4 Pharmaceutical Wholesale and Distribution: World Market Forecast ($Bn) By Category, 2017-2028

Figure 3.5 Branded Drugs, Generic Drugs and Others: Market Shares (%), 2023

Figure 3.6 Branded Drugs, Generic Drugs and Others: Market Shares (%), 2028

Figure 3.7 Wholesale and Distribution of Branded Drugs, Generic Drugs and Others: Revenue Forecasts ($bn), 2017-2028

Figure 3.8 Wholesale and Distribution of Branded Drugs: Revenue ($bn) Forecast, 2017-2028

Figure 3.9 Wholesale and Distribution of Generic Drugs: Revenue ($bn) Forecast, 2017-2028

Figure 4.1 Pharma Wholesale & Distribution Leading National Markets: Shares (%), 2017

Figure 4.2 Pharma Wholesale & Distribution Leading National Markets: Shares (%), 2023

Figure 4.3 Pharma Wholesale & Distribution Leading National Markets: Shares (%), 2028

Figure 4.4 Market Share (%) Breakdown of The Us Market: The 3 Leading Companies, 2017

Figure 4.5 US Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, 2017-2028

Figure 4.6 US Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, 2017-2028

Figure 4.7 US Pharma Wholesale & Distribution Market: Drivers and Restraints, 2017

Figure 4.8 EU5 Pharma Wholesale & Distribution Market Shares (%), 2017, 2023 And 2028

Figure 4.9 EU5 Pharma Wholesale & Distribution Market: Revenue ($bn) Forecasts, 2017-2028

Figure 4.10 EU Pharma Wholesale & Distribution Market: Drivers and Restraints, 2017

Figure 4.11 German Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, 2017-2028

Figure 4.12 German Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($Bn) Forecast, 2017-2028

Figure 4.13 German Pharma Wholesale & Distribution Market: Drivers and Restraints, 2017

Figure 4.14 French Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, 2017-2028

Figure 4.15 French Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, 2017-2028

Figure 4.16 French Pharma Wholesale & Distribution Market: Drivers and Restraints, 2017

Figure 4.17 Italian Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, 2017-2028

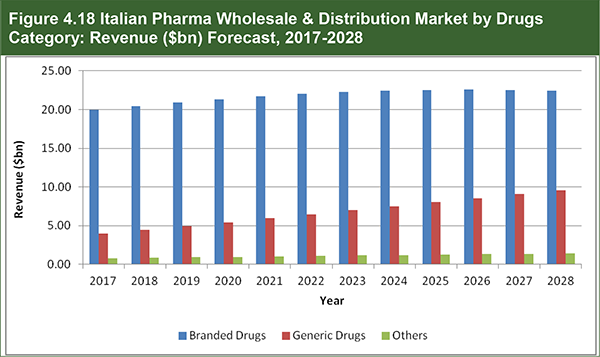

Figure 4.18 Italian Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, 2017-2028

Figure 4.19 Italian Pharma Wholesale & Distribution Market: Drivers and Restraints, 2017

Figure 4.20 Spanish Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, 2017-2028

Figure 4.21 Spanish Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, 2017-2028

Figure 4.22 Spanish Pharma Wholesale & Distribution Market: Drivers and Restraints, 2017

Figure 4.23 UK Pharma Wholesale & Distribution Market: Revenue ($bn), 2017-2028

Figure 4.24 UK Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, 2017-2028

Figure 4.25 UK Pharma Wholesale & Distribution Market: Drivers and Restraints, 2017

Figure 4.26 Percentage of The Population Ages 65+ in the Us, Europe, Japan, China and India, 2015 And 2030

Figure 4.27 Japanese Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, 2017-2028

Figure 4.28 Japanese Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, 2017-2028

Figure 4.29 Japanese Pharma Wholesale & Distribution Market: Drivers and Restraints, 2017

Figure 4.30 Chinese Pharma Wholesale & Distribution: Market Shares (%) of Leading Companies, 2017

Figure 4.31 Chinese Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, 2017-2028

Figure 4.32 Chinese Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, 2017-2028

Figure 4.33 Chinese Pharma Wholesale & Distribution Market: Drivers and Restraints, 2017

Figure 4.34 Brazilian Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, 2017-2028

Figure 4.35 Brazilian Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, 2017-2028

Figure 4.36 Brazilian Pharma Wholesale & Distribution Market: Drivers and Restraints, 2017

Figure 4.37 Pharma Wholesale & Distribution Model in India, 2017

Figure 4.38 Indian Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, 2017-2028

Figure 4.39 Indian Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($bn) Forecast, 2017-2028

Figure 4.40 Indian Pharma Wholesale & Distribution Market: Drivers and Restraints, 2017

Figure 4.41 Russian Pharma Wholesale & Distribution Market: Revenue ($bn) Forecast, 2017-2028

Figure 4.42 Russian Pharma Wholesale & Distribution Market by Drugs Category: Revenue ($Bn) Forecast, 2017-2028

Figure 4.43 Russian Pharma Wholesale & Distribution Market: Drivers and Restraints, 2017

Figure 5.1 Leading Pharmaceutical Wholesale and Distribution Companies: Market Shares (%), 2017

Figure 5.2 Leading Pharmaceutical Wholesale and Distribution Companies: Market Shares (%), 2023

Figure 5.3 Leading Pharmaceutical Wholesale and Distribution Companies: Market Shares (%), 2028

Figure 5.4 Leading Pharmaceutical W&D Companies: Drivers and Restraints, 2017

Figure 5.5 Mckesson: Historical Revenue ($bn), Revenue AGR (%), Gross Profit ($bn) And Gross Profit AGR (%), 2011-2016

Figure 5.6 Mckesson: Revenue Share (%) Breakdown by Business Segment, 2016

Figure 5.7 Mckesson: Revenue Share (%) Breakdown by Business Segment, 2017

Figure 5.8 Mckesson: Revenue ($bn) Forecast, 2017-2028

Figure 5.9 Mckesson: Drivers and Restraints, 2017

Figure 5.10 Cardinal Health: Historical Revenue ($bn), Revenue AGR (%), Operating Earnings ($bn) and Operating Earnings AGR (%), 2011-2016

Figure 5.11 Cardinal Health: Revenue Share (%) Breakdown by Business Segment, 2017

Figure 5.12 Cardinal Health: Revenue Share (%) Breakdown by Customer, 2017

Figure 5.13 Cardinal Health: Revenue ($bn) Forecast, 2017-2028

Figure 5.14 Cardinal Health: Drivers and Restraints, 2017-2028

Figure 5.15 Amerisourcebergen: Historical Revenue ($bn), Revenue AGR (%), Gross Profit ($bn) and Gross Profit AGR (%), 2011-2016

Figure 5.16 Amerisourcebergen: Revenue Share (%) Breakdown by Business Segment, 2017

Figure 5.17 Amerisourcebergen: Revenue ($bn) Breakdown by Customer, 2017

Figure 5.18 Amerisourcebergen: Revenue ($bn) Forecast, 2017-2028

Figure 5.19 Amerisourcebergen: Drivers and Restraints, 2017

Figure 5.20 Walgreens Boots Alliance: Revenue ($bn), Revenue AGR (%), Gross Profit ($bn) and Gross Profit AGR (%), 2011-2016

Figure 5.21 Walgreens Boots Alliance: Revenue ($bn) Forecast, 2017-2028

Figure 5.22 Alliance Boots: Drivers and Restraints, 2017-2028

Figure 5.23 Medipal Holdings: Historical Revenue (¥bn), Revenue AGR (%), Gross Profit (¥bn) and Gross Profit AGR (%), 2011-2016

Figure 5.24 Medipal Holdings: Revenue Share (%) Breakdown by Business Segment, 2016

Figure 5.25 Medipal Holdings: Operating Income Share (%) Breakdown by Business Segment, 2017

Figure 5.26 Medipal Holdings: Revenue ($bn) Forecast, 2017-2028

Figure 5.27 Medipal Holdings: Drivers and Restraints, 2017

Figure 5.28 Phoenix Group: Historical Revenue (€bn), Revenue AGR (%), Gross Profit (€bn) and Gross Profit AGR (%), 2011-2016

Figure 5.29 Phoenix Group: Revenue Share (%) Breakdown by Region, 2014

Figure 5.30 Phoenix Group: Revenue ($bn) Forecast, 2017-2028

Figure 5.31 Phoenix Group Drivers and Restraints, 2017

Figure 5.32 Sinopharm Group: Historical Revenue (RMBbn), Revenue AGR (%), Gross Profit (RMBbn) and Gross Profit AGR (%), 2011-2016

Figure 5.33 Sinopharm Group: Revenue ($bn) Forecast, 2017-2028

Figure 5.34 Sinopharm Group: Drivers and Restraints, 2017

Figure 5.35 Alfresa Holdings: Historical Revenue (¥bn), Revenue AGR (%), Gross Profit (¥bn), Gross Profit AGR (%), 2011-2016

Figure 5.36 Alfresa Holdings: Revenue Share (%) Breakdown by Business Segment, 2016

Figure 5.37 Alfresa Holdings: Gross Profit Share (%) Breakdown by Business Segment, 2017

Figure 5.38 Alfresa Holdings: Revenue ($bn) Forecast, 2017-2028

Figure 5.39 Alfresa Holdings: Drivers and Restraints, 2017

Figure 5.40 Suzuken: Historical Revenue (¥bn), Revenue AGR (%), Gross Profit (¥bn) and Gross Profit AGR (%), 2011-2016

Figure 5.41 Suzuken: Revenue Share (%) Breakdown by Business Segment, 2015

Figure 5.42 Suzuken: Operating Income Share (%) Breakdown by Business Segment, 2016

Figure 5.43 Suzuken: Revenue Share (%) Breakdown by Region in Japan, 2014

Figure 5.44 Suzuken: Revenue ($bn) Forecast, 2017-2028

Figure 5.45 Suzuken: Drivers and Restraints, 2017

Figure 5.46 Shanghai Pharmaceuticals Holding: Historical Revenue (RMBbn), Revenue AGR (%), Gross Profit (RMBbn) and Gross Profit AGR (%), 2011-2016

Figure 5.47 Shanghai Pharmaceuticals Holding: Revenue Share (%) Breakdown by Business Segment, 2016

Figure 5.48 Shanghai Pharmaceuticals Holding: Revenue Share (%) Breakdown by Region, 2016

Figure 5.49 Shanghai Pharmaceuticals Holding: Revenue ($bn) Forecast, 2017-2028

Figure 5.50 Shanghai Pharmaceuticals Holding: Drivers and Restraints, 2017

Figure 6.1 Comparison of The Wholesale and DTP Routes of Distribution, 2017

Figure 7.1 Pharmaceutical Wholesale and Distribution: Global Market Forecasts ($Bn) By Submarket, 2017-2028

Figure 7.2 Leading National Pharmaceutical Wholesale and Distribution Markets: Revenue Projections ($Bn), 2017, 2022 And 2028

Figure 7.3 Leading Pharmaceutical Wholesale and Distribution Companies: Revenue ($Bn) Projections 2017, 2022 And 2028

AAH Pharmaceuticals

AccessClosure

Acofarma (Asociación Cooperativas Farmacéuticas)

ADG Apotheken-Dienstleistungsgesellschaft mbH

Admenta

Alfresa Fine Chemical Corporation

Alfresa Holdings

Alliance Boots

Alliance Healthcare

Alliance Santé

Alliance UniChem

AmeriSource Health

AmerisourceBergen

AmerisourceBergen Canada

AmerisourceBergen Drug Corporation (ABDC)

AmerisourceBergen specialty Group (ABSG)

Apollo Medical Holdings

ASTEC Co., Ltd.

ASTIS Co., Ltd.

Athos Farma

ATOL CO., LTD.

Azwell

Bayer

BENU Apotheek

Bergen Brunswig

Biologics Inc

Boots Group

Bristol-Myers Squibb

Brocacef Groep NV

Brocacef Holding

Bundesverband des Pharmazeutischen Grosshandel

Cardinal Health

Caremark Rx

Celesio AG

CERP Bretagne Nord

CERP Rhin Rhone Mediterranee

CERP Rouen

Chiyaku Co

Chuounyu Co., Ltd.

Cloumed Corporation

Cofares

Comifar

Cordis

CoverMyMeds

CoverMyMeds LLC

CVS Caremark

CVS Corporation

CVS Health Corporation

Cystic Fibrosis Foundation Pharmacy, LLC

Daiichi Sankyo Propharma Co.

Dong Ying (Jiangsu) Pharmaceuticals Co., Ltd.

Drogarias Tamoio

Drug Trading Company Ltd

Dutch ACM

Emart Company

ENSHU YAKUHIN CO., LTD.

Ethicon

EVERLTH AGROTECH Co., Ltd.

EVERLTH Co., Ltd.

Farcopa Distribuzione

Fukujin Co.

Good Service Co

Guangzhou Pharmaceutical Company Ltd.

Guangzhou Pharmaceuticals Corporation

Harvard Drug

Hedef Alliance

Hefame

HEISEI YAKUHIN CO., LTD.

IZUTSU KURAYA SANSEIDO Inc.

IZUTSU PHARMACEUTICAL CO. LTD.

Japanese Pharmaceutical Wholesalers Association

Jingu Yakuhin Co., Ltd.

Johnson & Johnson

Katren

Kenzmedico Co., Ltd.

Kerr Drug

KOBASHOU. CO., LTD.

KURAYA SANSEIDO Inc

Life Medicom Co., Ltd.

Lloyds Pharmacy

MARUZEN YAKUHIN CO., LTD.

McKesson

McQueary Brothers of Springfield

Medical Specialties Distributors

MEDICEO CORPORATION

Medicine Shoppe Canada Inc.

MEDIE Co., Ltd.

MEDIPAL HOLDINGS CORPORATION

Mediq Apotheken Nederland B.V.

Medtronic

Meinan Distribution Center

Metro Medical Supply Inc

Mitsubishi

MM CORPORATION

MP AGRO CO., LTD.

MVC CO., LTD

MWI Veterinary Supply, Inc.

Nadro

Nakano Yakuhin Co., Ltd.

National Health Service (NHS)

National Pharmaceutical Pricing Authority (NPPA)

Nihon Apoch Co.

Novo Nordisk

Novodata Zrt.

Numark

OCP

Oncology Therapeutics

Oncoprod

OptumRx

P.J.D. Network

PALTAC CORPORATION

Paltac Corporation

Paltac Corporation

PALTAC KS CORPORATION

Panpharma

Pfercos Co., Ltd.

Pfizer

PharMEDium

Polska Grupa Farmaceutyczna

Profarma

Prosper

Protek

PSC Co, Ltd.

PSS World Medical Inc.

Ratiopharm

RDC Kanto5

Red Oak Sourcing

Red Oak, LLC

Rexall Health

Rite Aid Corporation

Rosta

RxCrossroads

S. D.Collabo Co.,Ltd.

S.D.Logi CO., Ltd.

Sakurai Tsusho Corporation

Sanacorp

Sandoz

Sanki Corporation

Sanki MediHeart Limited

Sanki Wellbe

Sanki Wellbe Co., Ltd.

Sannova

Sanwa Kagaku Kenkyusho Co., Ltd.

S-Care Mate Co., Ltd.

Sciclone Trade

SEIWA SANGYO CO

Shanghai Fosun Pharmaceutical

Shanghai Pharma Zhenjiang Co., Ltd.

Shanghai Pharmaceutical Holdings

Shinohara Chemicals

Shinsegai Group

Shoyaku Co., Ltd.

SIA International

Sincamesp

SINOPHARM

S-mile, Inc

Sonexus Health

SPH Jiangxi Shangrao Pharmaceutical Co., Ltd.

SPH Keyuan Xinhai Pharmaceutical Hebei Co., Ltd.

SPH Keyuan Xinhai Pharmaceutical Heilongjiang Co., Ltd.

SPLine Corporation

SUZUKEN

Suzuken Co., Ltd.

Suzuken Iwate Co., Ltd.

Suzuken Medical Instruments Co, Ltd

Suzuken Okinawa Yakuhin Co., Ltd.

The PHOENIX Group

Toho Holdings

Tokiwa Yakuhin Co

Torfarm

Tradex International

TS Alfresa Corporation

UniChem

US Oncology Holdings, Inc.

USHIODA KURAYA SANSEIDO Inc.

USHIODA SANGOKUDO YAKUHIN CO., LTD.

Vaccine Safe Co

Vantage Oncology

Victoria Merger Sub, Inc.

Vitaco Holdings

Walgreen

Walgreens Boots Alliance

World Courier Group Inc.

Wyeth Pharmaceuticals

YAMAHIRO KURAYA SANSEIDO Inc.

Yunnan Pharmaceutical Co., Ltd.

Zuellig Pharma

Download sample pages

Complete the form below to download your free sample pages for Pharma Wholesale and Distribution Market Forecasts 2018-2028

Related reports

-

Global Biosimilars and Follow-On Biologics Market 2018-2028

The global biosimilars and follow-on biologics market is estimated to have reached $7.70bn in 2017 and expected to grow at...

Full DetailsPublished: 01 June 2018 -

Global Lab Automation Market Forecast 2018-2028

The global lab automation market is expected to grow at a CAGR of 7.4% in the first half of the...Full DetailsPublished: 26 February 2018 -

Pharmaceutical Contract Manufacturing Market 2018-2028

The pharmaceutical contract manufacturing market is expected to grow at a CAGR of 6.0% in the first half of the...

Full DetailsPublished: 27 June 2018 -

Global Next-Generation Antibody Therapies Market Forecast 2018-2028

The global next-generation antibody therapies market reached $4bn in 2017 and is estimated to reach $17bn by 2023. In 2017,...

Full DetailsPublished: 26 September 2018 -

Pharma Leader Series: Top Generic Drug Producers Market Forecast 2019-2029

The top 10 generic drug producers have 61% share of the total revenue made by these top 50 companies. ...Full DetailsPublished: 29 January 2019 -

Global Rheumatoid Arthritis Drugs Market Forecast 2019-2029

The global rheumatoid arthritis drugs market will reach $47bn in 2024. In 2018, the Biologics submarket held 87% of the...

Full DetailsPublished: 17 December 2018 -

Biological Drug API Manufacturing Services World Industry and Market Predictions 2018-2028

The biological drug API manufacturing market is estimated to grow at a CAGR of 9.0% in the first half of...

Full DetailsPublished: 06 July 2018 -

Generic Drugs Market Forecast 2018-2028

The generic drugs market is estimated at $257.3bn in 2017 and is expected to grow at a CAGR of 7.9%...

Full DetailsPublished: 25 April 2018 -

Global Laboratory Information Systems Market Forecast 2018-2028

The global laboratory information systems market was is valued at $1.8bn in 2017 and is expected to grow at a...

Full DetailsPublished: 19 November 2018 -

Global Pharma Contract Sales Market 2019-2029

The global pharma contract sales market is expected to grow at a CAGR of 8.9% in the first half of...Full DetailsPublished: 28 February 2019

Download sample pages

Complete the form below to download your free sample pages for Pharma Wholesale and Distribution Market Forecasts 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain’s reports are based on comprehensive primary and secondary research. Those studies provide global market forecasts (sales by drug and class, with sub-markets and leading nations covered) and analyses of market drivers and restraints (including SWOT analysis) and current pipeline developments. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

“Thank you for this Gene Therapy R&D Market report and for how easy the process was. Your colleague was very helpful and the report is just right for my purpose. This is the 2nd good report from Visiongain and a good price.”

Dr Luz Chapa Azuella, Mexico

American Association of Colleges of Pharmacy

American College of Clinical Pharmacy

American Pharmacists Association

American Society for Pharmacy Law

American Society of Consultant Pharmacists

American Society of Health-System Pharmacists

Association of Special Pharmaceutical Manufacturers

Australian College of Pharmacy

Biotechnology Industry Organization

Canadian Pharmacists Association

Canadian Society of Hospital Pharmacists

Chinese Pharmaceutical Association

College of Psychiatric and Neurologic Pharmacists

Danish Association of Pharmaconomists

European Association of Employed Community Pharmacists in Europe

European Medicines Agency

Federal Drugs Agency

General Medical Council

Head of Medicines Agency

International Federation of Pharmaceutical Manufacturers & Associations

International Pharmaceutical Federation

International Pharmaceutical Students’ Federation

Medicines and Healthcare Products Regulatory Agency

National Pharmacy Association

Norwegian Pharmacy Association

Ontario Pharmacists Association

Pakistan Pharmacists Association

Pharmaceutical Association of Mauritius

Pharmaceutical Group of the European Union

Pharmaceutical Society of Australia

Pharmaceutical Society of Ireland

Pharmaceutical Society Of New Zealand

Pharmaceutical Society of Northern Ireland

Professional Compounding Centers of America

Royal Pharmaceutical Society

The American Association of Pharmaceutical Scientists

The BioIndustry Association

The Controlled Release Society

The European Federation of Pharmaceutical Industries and Associations

The European Personalised Medicine Association

The Institute of Clinical Research

The International Society for Pharmaceutical Engineering

The Pharmaceutical Association of Israel

The Pharmaceutical Research and Manufacturers of America

The Pharmacy Guild of Australia

The Society of Hospital Pharmacists of Australia

Latest Pharma news

Visiongain Publishes Drug Delivery Technologies Market Report 2024-2034

The global Drug Delivery Technologies market is estimated at US$1,729.6 billion in 2024 and is projected to grow at a CAGR of 5.5% during the forecast period 2024-2034.

23 April 2024

Visiongain Publishes Cell Therapy Technologies Market Report 2024-2034

The cell therapy technologies market is estimated at US$7,041.3 million in 2024 and is projected to grow at a CAGR of 10.7% during the forecast period 2024-2034.

18 April 2024

Visiongain Publishes Automation in Biopharma Industry Market Report 2024-2034

The global Automation in Biopharma Industry market is estimated at US$1,954.3 million in 2024 and is projected to grow at a CAGR of 7% during the forecast period 2024-2034.

17 April 2024

Visiongain Publishes Anti-obesity Drugs Market Report 2024-2034

The global Anti-obesity Drugs market is estimated at US$11,540.2 million in 2024 and is expected to register a CAGR of 21.2% from 2024 to 2034.

12 April 2024