Industries > Biosimilars Market Size Reports > Global Next-Generation Antibody Therapies Market Forecast 2018-2028

Global Next-Generation Antibody Therapies Market Forecast 2018-2028

Antibody-Drug Conjugates, Engineered Antibodies, Bispecific Antibodies, Antibody Fragments & ALPs, Biosimilar Antibodies

The global next-generation antibody therapies market reached $4bn in 2017 and is estimated to reach $17bn by 2023. In 2017, the antibody-drug conjugates segment held 45% of the global next-generation antibody therapies market.

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector.

In this brand new 217-page report you will receive 141 charts– all unavailable elsewhere.

The 217-page report provides clear detailed insight into the next-generation antibody therapies market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand-new report today you stay better informed and ready to act.

Report Scope

• Global Next-Generation Antibody Therapies Market from 2018-2028

• Forecast of the Global Next-Generation Antibody Therapies market by Submarket:

• Antibody Fragments & ALPs

• Antibody-Drug Conjugates

• Biosimilar Antibodies

• Bispecific Antibodies

• Engineered Antibodies

• Forecast of the Global Antibody Fragments & ALPs submarket by Product:

• Kalbitor

• Other Antibody Fragments

• Forecast of the Global Antibody-Drug Conjugates submarket by Product:

• Adcetris

• Kadcyla

• Mylotarg

• Other ADCs

• Forecast of the Global Biosimilar Antibodies submarket by Product:

• Infliximab

• Adalimumab

• Rituximab

• Bevacizumab

• Trastuzumab

• Other Biosimilar mAbs

• Forecast of the Global Bispecific Antibodies submarket by Product:

• Blincyto

• Hemlibra

• Other Bispecific Antibodies

• Forecast of the Global Engineered Antibodies submarket by Product:

• Gazyva/Gazyvaro

• Poteligeo

• Fasenra

• Other Engineered Antibodies

• This report provides individual revenue forecasts to 2028 for these regional and national markets:

• North America: US, Canada, and Mexico

• Europe: Germany, France, United Kingdom, Italy, Spain, Russia, and rest of Europe

• Asia-Pacific: Japan, China, Australia, South Korea, India, and rest of Asia-Pacific

• LAMEA: Brazil, Saudi Arabia, Republic of South Africa, Turkey, and rest of LAMEA

• Our study discusses the selected leading companies that are the major players in the next-generation antibody therapies market:

• Amgen, Inc.

• GlaxoSmithKline (GSK)

• Kirin Holdings (Kyowa Hakko Kirin Co., Ltd.)

• Merck KGaA

• Novartis AG

• Pfizer, Inc.

• Roche

• Sanofi

• Seattle Genetics, Inc.

• Shire plc

• This report discusses SWOT & STEP analysis of the next-generation antibody therapies market as well as factors that drive and restrain this market. This report also discusses the opportunities that can be tapped in this market.

• This report also discusses selected at that are in the pipeline.

Visiongain’s study is intended for anyone requiring commercial analyses for the next-generation antibody therapies market. You find data, trends and predictions.

Buy our report today Global Next-Generation Antibody Therapies Market Forecast 2018-2028: Antibody-Drug Conjugates, Engineered Antibodies, Bispecific Antibodies, Antibody Fragments & ALPs, Biosimilar Antibodies

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Next-Generation Antibody Therapies Market Overview

1.2 Global Next-Generation Antibody Therapies Market Segmentation

1.3 Why you Should Read this Report?

1.4 How this Report Delivers

1.5 Main Questions Answered by This Analytical Study

1.6 Who is This Report For?

1.7 Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Reports

1.10 About Visiongain

2. Introduction to Next-Generation Antibody Therapies

2.1 Market Definition & Scope of this Report

2.2 Antibodies: An Overview

2.2.1 Monoclonal vs Polyclonal Antibodies

2.2.2 A Brief History of Antibody Drug Development

2.2.3 The Antibody Manufacturing Process

2.2.4 Trends in Antibody Development

2.3 Defining Next-Generation Antibodies

2.4 Classification of Next-Generation Antibody Therapies

2.5 The Need for Next-Generation Technologies

2.6 Development Trends for Next-Generation Antibodies

2.7 Phases of Clinical Trials

3. Global Next-Generation Antibody Therapies Market, 2017-2028

3.1 The Global Next-Generation Antibody Therapies Market Overview and Segmentation, 2017

3.2 Leading Next-Generation Antibody Therapies

3.3 Global Next-Generation Antibody Therapies Market: Sales Forecast 2017-2028

3.4 How Will Segments Market Shares Change to 2028?

3.5 Global Next-Generation Antibody Therapies Market: Drivers and Restraints 2017-2028

3.6 Global Next-Generation Antibody Therapies Market by Product Type, 2017-2028

4. Global Next-Generation Antibody Therapies Market by Product Type: Revenue Forecast, 2018-2028

4.1 Antibody-Drug Conjugates Submarket

4.1.1 Global Antibody-Drug Conjugates Submarket: Revenue Forecast, 2018-2028

4.2 Engineered Antibodies Submarket

4.2.1 Global Engineered Antibodies Submarket: Revenue Forecast, 2018-2028

4.3 Bispecific Antibodies Submarket

4.3.1 Global Bispecific Antibodies Submarket: Revenue Forecast, 2018-2028

4.4 Antibody Fragments and ALPs

4.4.1 Global Antibody Fragments and ALPs Revenue Submarket: Forecast, 2018-2028

4.5 Biosimilar Antibody Submarket

4.5.1 Global Biosimilar Antibody Submarket: Revenue Forecast, 2018-2028

4.6 Segment Share Analysis by Product Type

5. Global Next-Generation Antibody Therapies Market by Regional and National Market: Revenue Forecast, 2018-2028

5.1 Global Next-Generation Antibody Therapies Market by Region: Revenue Forecast, 2018-2028

5.2 North America

5.2.1 North America Next-Generation Antibody Therapies Market by Country: Revenue Forecast, 2018-2028

5.2.2 US Next-Generation Antibody Therapies Market: Revenue Forecast, 2018-2028

5.2.3 Canada Next-Generation Antibody Therapies Market: Revenue Forecast, 2018-2028

5.2.4 Mexico Next-Generation Antibody Therapies Market, Revenue Forecast, 2018-2028

5.3 Europe

5.3.1 Europe Next-Generation Antibody Therapies Market by Country: Revenue Forecast, 2018-2028

5.3.2 Germany Next-Generation Antibody Therapies Market: Revenue Forecast, 2018-2028

5.3.3 France Next-Generation Antibody Therapies Market: Revenue Forecast, 2018-2028

5.3.4 United Kingdom Next-Generation Antibody Therapies Market: Revenue Forecast, 2018-2028

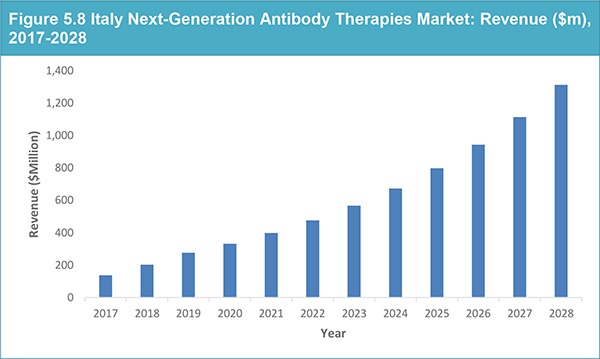

5.3.5 Italy Next-Generation Antibody Therapies Market: Revenue Forecast, 2018-2028

5.3.6 Spain Next-Generation Antibody Therapies Market: Revenue Forecast, 2018-2028

5.3.7 Russia Next-Generation Antibody Therapies Market: Revenue Forecast, 2018-2028

5.4 Asia-Pacific

5.4.1 Asia-Pacific Next-Generation Antibody Therapies Market by Country: Revenue Forecast, 2018-2028

5.4.2 Japan Next-Generation Antibody Therapies Market: Revenue Forecast, 2018-2028

5.4.3 China Next-Generation Antibody Therapies Market: Revenue Forecast, 2018-2028

5.4.4 Australia Next-Generation Antibody Therapies Market: Revenue Forecast, 2018-2028

5.4.5 South Korea Next-Generation Antibody Therapies Market: Revenue Forecast, 2018-2028

5.4.6 India Next-Generation Antibody Therapies Market, Revenue Forecast, 2018-2028

5.5 LAMEA

5.5.1 LAMEA Next-Generation Antibody Therapies Market by Country: Revenue Forecast, 2018-2028

5.5.2 Brazil Next-Generation Antibody Therapies Market: Revenue Forecast, 2018-2028

5.5.3 Saudi Arabia Next-Generation Antibody Therapies Market: Revenue Forecast, 2018-2028

5.5.4 Republic of South Africa Next-Generation Antibody Therapies Market, Revenue Forecast, 2018-2028

6. Antibody-Drug Conjugates: Market Forecast and Pipeline 2017-2028

6.1 Market Overview

6.2 Leading ADCs in 2017

6.3 Antibody-Drug Conjugates: Market Forecast 2017-2028

6.4 Adcetris

6.4.1 Adcetris: Sales 2013-2017

6.4.2 Adcetris Results in AETHERA Trial and Approval for in HL following Stem Cell Transplantation

6.4.3 Expanding Adcetris Indications for Future Revenue Growth

6.4.4 Adcetris Sales Forecast 2018-2028

6.5 Kadcyla

6.5.1 Mixed Results from Different Clinical Trials

6.5.2 NICE Rejects Kadcyla on Cost Grounds, but it Just Manages to Hold on in the Cancer Drugs Fund List

6.5.3 Kadcyla Sales Forecast 2018-2028

6.6 Mylotarg

6.6.1 Mylotarg Sales Forecast 2018-2028

6.7 Antibody-Drug Conjugate Platforms

6.7.1 Radioconjugation

6.7.2 Seattle Genetics’ Platform

6.7.3 ImmunoGen: TAP Technology

6.7.4 Immunomedics

6.7.5 Preclinical Platforms for ADC Development

6.8 ADCs Have Attracted High-Value Deals and Will Continue to do so

6.9 Antibody-Drug Conjugates: Pipeline Analysis 2017-2028

6.9.1 The Longest Pipeline in the Next-Generation Antibodies Market

6.9.2 Cancer Is the Only Target for Current Clinical-Stage ADCs

6.9.3 Seattle Genetics’ Phase 1 and Phase 2 ADCs

6.9.3.1 SGN-LIV1A (anti-LIV-1) for Relapsed Breast Cancer

6.10 Antibody-Drug Conjugates: Phase 3 Pipeline

6.10.1 CMC544 (inotuzumab ozogamicin, Pfizer)

6.10.1.1 Granted Breakthrough Therapy Designation

6.10.2 Roche Attempting to Expand Kadcyla Indications and also Possesses some Unique ADCs in the Pipeline

6.10.2.1 RG7596 (polatuzumab vedotin) for NHL and DLBCL

6.11 Antibody-Drug Conjugates: Phase 2 Pipeline

6.11.1 ABT-414 (anti-EGFR, AbbVie/Seattle Genetics)

6.11.2 BT-062 (indatuximab ravtansine; anti-CD138, Biotest)

6.11.3 Immunomedics’ IMMU-130 (labetuzumab-SN-38; anti-CEA/CD66e) and IMMU-132 (anti-TROP-2)

6.11.4 PSMA ADC (anti-PSMA, Progenics Pharmaceuticals/ Seattle Genetics)

6.12 Antibody-Drug Conjugates: Phase 1 Pipeline

6.13 Antibody-Drug Conjugates: Preclinical Pipeline

6.14 Future Developments in ADC Technology

6.14.1 Site-Specific Linkage for Improved Safety Profiles

7. Engineered Antibodies: Market Forecast 2017-2028

7.1 Market Overview

7.2 Leading Engineered Antibodies in 2017

7.3 Engineered Antibodies: Market Forecast 2017-2028

7.4 Gazyva/Gazyvaro

7.4.1 Gazyva/Gazyvaro Sales Forecast, 2018-2028

7.5 Poteligeo

7.5.1 Poteligeo Sales Forecast, 2018-2028

7.6 Engineered Antibodies Platforms

7.6.1 Roche Glycart: GlucoMAb

7.6.2 Kyowa Hakko Kirin: Potelligent

7.6.3 Glycotope: GlycoExpress

7.6.4 MacroGenics

7.6.5 Xencor: XmAb

7.7 Engineered Antibodies: Phase 3 Pipeline

7.7.1 Ublituximab (anti-CD20, TG Therapeutics)

7.7.2 MEDI-551 (anti-CD19, AstraZeneca)

7.7.3 MOR-208 (XmAb5574) (anti-CD19, MorphoSys/Xencor)

7.8 Engineered Antibodies: Phase 2 Pipeline

7.8.1 Glycotope’s CetuGEX (anti-EGFR), PankoMab-GEX (anti-TA-MUC1) and TrasGEX (anti-HER2)

7.8.2 Margetuximab (anti-HER2, MacroGenics)

7.8.3 Teplizumab (anti-CD3, MacroGenics)

7.8.4 XmAb5871 (anti-CD19, Xencor)

7.9 Engineered Antibodies: Phase 1 Pipeline

8. Bispecific Antibodies: Market Forecast 2017-2028

8.1 Market Overview

8.2 Bispecific Antibodies: Market Forecast 2017-2028

8.3 Blincyto

8.3.1 Blincyto Sales Forecast, 2018-2028

8.4 Bispecific Antibodies Platforms

8.4.1 BiTE Platform

8.4.2 MacroGenics’ DART Platform

8.4.3 TriomAbs (TRION Pharma)

8.4.4 Other Bispecific Antibody Platforms

8.4.4.1 DuoBodies (Genmab)

8.4.4.2 ImmTAC (Immunocore)

8.5 Bispecific Antibodies: Pipeline Analysis 2017-2028

8.6 Bispecific Antibodies: Phase 2 and Phase 3 Pipeline

8.6.1 ABT-981 (anti-IL-1α and IL-1β, AbbVie)

8.6.2 AFM13 (anti-CD30 and CD16A, Affimed Therapeutics)

8.6.3 MM-141 (anti-IGF-1R and ErbB3, Merrimack Pharmaceuticals)

8.6.4 SAR156597 (anti-IL-4 and IL-13, Sanofi)

8.7 Bispecific Antibodies: Phase 1, Phase 1/2 and Preclinical Pipeline

9. Antibody Fragments and Antibody-Like Proteins (ALPs): Market Forecast 2017-2028

9.1 Market Overview

9.2 Antibody Fragments and Antibody-Like Proteins (ALPs): Market Forecast 2017-2028

9.3 Kalbitor

9.3.1 Kalbitor Sales Forecast, 2018-2028

9.4 Antibody Fragments and ALPs Platforms

9.4.1 Single-chain Variable Fragment Platforms

9.4.1.1 ESBATech and Delenex Therapeutics

9.4.1.2 Nanobodies: The Smallest Antibody Fragment

9.4.1.3 Ablynx’s Nanobody Platform

9.4.1.4 Domain Antibodies: GSK and Crescendo Biologics

9.4.2 Non-Antibody Protein Scaffolds: Antibody-Like Proteins

9.4.2.1 DARPins: One-Tenth the Size of Antibodies

9.4.2.2 Anticalins (Pieris)

9.4.2.3 Affibodies (Affibody)

9.4.2.4 Fynomers (Covagen/Johnson & Johnson)

9.4.2.5 Affilins (Scil Proteins)

9.4.2.6 Adnectins (Bristol-Myers Squibb)

9.4.2.7 AdAlta: i-bodies

9.5 Antibody Fragments and ALPs: Pipeline Analysis 2017-2028

9.5.1 Ablynx Leads the Pipeline with Eight Clinical Projects

9.6 Antibody Fragments and ALPs: Phase 3 Pipeline

9.6.1 Caplacizumab (anti-vWF, Ablynx)

9.6.2 Abicipar (anti-VEGF, Allergan/Molecular Partners)

9.7 ESBA1008 (anti-VEGF, Novartis)

9.8 Antibody Fragments and ALPs: Phase 2 Pipeline

9.8.1 ALX-0061 (anti-IL-6R, Ablynx/AbbVie)

9.8.2 Ozoralizumab (anti-TNFα, Ablynx )

9.8.3 DLX105 (anti-TNF-α, Delenex Therapeutics)

9.8.4 ALX-0171 (anti-respiratory syncytial virus)

9.8.5 PRS-080 (Pieris Pharmaceuticals GmbH)

9.9 Antibody Fragments and ALPs: Phase 1 Pipeline

9.9.1 ALX-0761/M1095 (anti-IL-17A and IL-17F, Ablynx/Merck Serono)

9.9.2 ALX-0141 (anti-RANKL, Ablynx/Eddingpharm)

9.10 Other Phase 1 Candidates, and the Preclinical Pipeline

10. Biosimilar Antibodies: Market Forecast 2017-2028

10.1 Market Overview

10.2 Leading Biosimilar Antibodies in 2017

10.3 Biosimilar Antibodies: Market Forecast 2017-2028

10.4 Infliximab Biosimilar Sales Forecast, 2018-2028

10.5 Adalimumab Biosimilar Sales Forecast, 2018-2028

10.6 Rituximab Biosimilar Sales Forecast, 2018-2028

10.7 Trastuzumab Biosimilar Sales Forecast, 2018-2028

10.8 The Biosimilar Antibodies Market: Drivers and Restraints 2017-2028

10.8.1 New Launches of Biosimilar mAbs in Developed and Emerging Markets

10.8.2 Rising Incidence of Cancer Will Drive Demand

10.8.3 Novel mAb Developers Choosing to Develop Biobetters and Next-Generation Therapies in Face of Biosimilar Competition

10.8.4 Will Biosimilars Challenge Next-Generation Antibodies in this Decade?

11. Leading Companies in Next-Generation Antibody Therapies Market

11.1 Seattle Genetics Inc.

11.1.1 Company Overview

11.1.2 Operating Segments

11.1.3 Financial Highlights

11.1.4 Product Pipeline

11.1.5 Recent Strategic Developments

11.2 F. Hoffmann-La Roche Ltd.

11.2.1 Company Overview

11.2.2 Operating Segments

11.2.3 Financial Highlights

11.2.4 Product Pipeline

11.2.5 Recent Strategic Developments

11.3 Pfizer, Inc.

11.3.1 Company Overview

11.3.2 Operating Segments

11.3.3 Financial Highlights

11.3.4 Recent Strategic Developments

11.4 Kirin Holdings (Kyowa Hakko Kirin Co., Ltd.)

11.4.1 Company Overview

11.4.2 Operating Segments

11.4.3 Financial Highlights

11.4.4 Recent Strategic Developments

11.5 Sanofi S.A.

11.5.1 Company Overview

11.5.2 Operating Segments

11.5.3 Financial Highlights

11.5.4 Recent Strategic Developments

11.6 Merck KGaA (Merck Sereno)

11.6.1 Company Overview

11.6.2 Operating Segments

11.6.3 Financial Highlights

11.6.4 Recent Strategic Developments

11.7 Amgen Inc.

11.7.1 Company Overview

11.7.2 Operating Segments

11.7.3 Financial Highlights

11.7.4 Recent Strategic Developments

11.8 Novartis AG

11.8.1 Company Overview

11.8.2 Operating Segments

11.8.3 Financial Highlights

11.8.4 Recent Strategic Developments

11.9 GlaxoSmithKline plc

11.9.1 Company Overview

11.9.2 Operating Segments

11.9.3 Financial Highlights

11.10 Shire plc

11.10.1 Company Overview

11.10.2 Operating Segments

11.10.3 Financial Highlights

12. Qualitative Analysis of the Next-Generation Antibody Therapies Market 2017-2028

12.1 SWOT Analysis of the Next-Generation Antibody Therapies Market

12.1.1 Strengths: The Path Towards Market Acceptance

12.1.2 Weaknesses – Multiple Companies Targeting Similar Indications

12.1.2.1 Challenges Exist with Current Monoclonal Antibody Therapies

12.1.3 Opportunities: Novel Platforms

12.1.3.1 Big Pharmas are Investing Heavily in Next-Generation Pipelines

12.1.4 Threats: Entry of Biosimilars

12.1.4.1 Will Biosimilars Growth Slow Down in the Next-Generation Antibody Market?

12.2 Market Dynamics

12.2.1 Drivers

12.2.1.1 Rise in prevalence of cancer diseases

12.2.1.2 Increase in medical insurance coverage

12.2.1.3 Strong pipeline of drugs

12.2.2 Restraints

12.2.2.1 Risk of allergic reaction and limitations

12.2.2.2 Lengthy & stringent government regulations

12.2.3 Opportunities

12.2.3.1 Increasing R&D in cancer therapy

12.2.3.2 Increase in purchasing power of emerging economies

12.3 PEST Analysis of the Next-Generation Antibody Therapies Market

12.3.1 Political and Regulatory Issues

12.3.1.1 Regulatory Challenges for Biosimilar Antibodies

12.3.2 Economic Pressures

12.3.2.1 Next-Generation Antibodies Are High-Cost

12.3.2.2 Outsourced Manufacturing: CMOs Are Expanding Capabilities

12.3.2.3 Next-Generation Launches for Product Lifecycle Management

12.3.3 Social Factors

12.3.3.1 Cancer Incidence Is Rising Rapidly

12.3.3.2 Next-Generation Antibodies for Personalised Medicine

12.3.4 Technological Developments

12.3.4.1 There Are Many Competing Platforms

12.3.4.2 Manufacturing Challenges Exist for Most Sectors

12.3.4.3 New Analytical Tools for Target Identification and Protein Characterisation

12.4 Key Targets for Next-Generation Antibody Development 2017-2028

12.4.1 Oncology Is the Lead Indication in All Sectors

12.4.1.1 HER2 and HER3 for Breast Cancer

12.4.1.2 CD19 and CD20 for Lymphoma and Leukaemia

13. Conclusions

13.1 High Growth Potential in the Next-Generation Antibody Therapies Market in 20167-2028

13.2 Current Status of the Market and Leading Segments

13.3 Leading Next-Generation Antibody Therapies Profiled in this Report

13.4 Leading Regional Markets

13.5 Development of the Market to 2028

13.6 Technology Platforms Will Continue to Attract Big Pharma Interest

13.7 Most Developers Continue to Target Cancer

13.8 Strategies for Growth in 2017-2028

Appendices

Associated Visiongain Reports

Visiongain Report Sales Order Form

About Visiongain

Visiongain report evaluation form

List of Tables

Table 2.1 Monoclonal Antibody Types and Sources

Table 2.2 The Different Phases of Clinical Trials and What They Assess

Table 3.1 Global Next-Generation Antibody Therapies Market by Product: Revenue ($m) and Market Share (%), 2017

Table 3.2 Global Next-Generation Antibody Therapies Market Forecast: Revenue ($m), AGR (%) and CAGR (%), 2017-2028

Table 3.3 Global Next-Generation Antibody Therapies Market by Product: Revenue ($m) and Market Share (%), 2017 & 2028

Table 4.1 Global Next-Generation Antibody Therapies Market by Product Type: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 4.2 Global Antibody-Drug Conjugates Submarket: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 4.3: Global Engineered Antibodies Submarket: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 4.4 Global Bispecific Antibodies Submarket: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 4.5 Global Antibody Fragments and ALPs Submarket: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 4.6 Global Biosimilar Antibody Submarket: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 4.7 Global Next-Generation Antibody Therapies Market by Product Type: Revenue ($m), Revenue Share (%), 2017, 2023, 2028

Table 5.1 Global Next-Generation Antibody Therapies Market by Region: Revenue ($m), Revenue Share (%), 2017, 2023, 2028

Table 5.2 Global Next-Generation Antibody Therapies by Leading National Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.3 North America Next-Generation Antibody Therapies Market by Country: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.4 US Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.5 Canada Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.6 Mexico Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.7 Europe Next-Generation Antibody Therapies Market by Country: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.8 Germany Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.9 France Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.10 United Kingdom Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.11 Italy Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.12 Spain Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.13 Russia Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.14 Asia-Pacific Next-Generation Antibody Therapies Market by Country: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.15 Japan Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.16 China Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.17 Australia Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.18 South Korea Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.19 India Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.20 LAMEA Next-Generation Antibody Therapies Market by Country: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.21 Brazil Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.22 Saudi Arabia Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 5.23 Republic of South Africa Next-Generation Antibody Therapies Market: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 6.1 Antibody-Drug Conjugates Market by Type: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 6.2 Adcetris: Market Revenue ($m) 2013-2017

Table 6.3 Adcetris Market Revenue ($m), AGR (%) and CAGR (%) 2018-2028

Table 6.4 Kadcyla: Market Revenue ($m), AGR (%) and CAGR (%) 2018-2028

Table 6.5 Mylotarg Market Revenue ($m), AGR (%) and CAGR (%) 2018-2028

Table 6.6 Seattle Genetics ADC Collaborator Pipeline

Table 6.7 Selected Preclinical ADC Development Platforms

Table 6.8 ADC Pipeline by Major Indications, 2017

Table 6.9 ADC Phase 3 Pipeline by Indication, 2018

Table 6.10 Selected Ongoing Clinical Trials for CMC544 (inotuzumab ozogamicin), 2018

Table 6.11 Roche’s Antibody-Drug Conjugates Pipeline, 2018

Table 6.12 Selected Ongoing Clinical Trials for RG7596 (polatuzumab vedotin), 2018

Table 6.13 ADC Phase 2 Pipeline by Indication, 2018

Table 6.14 Selected Ongoing Clinical Trials for ABT-414, 2018

Table 6.15 ADC Phase 1 Pipeline by Indication, 2018

Table 6.16 ADC Preclinical Pipeline, 2018

Table 7.1 Engineered Antibodies Market by Type: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 7.2 Gazyva/Gazyvaro Market: Revenue ($m), AGR (%) and CAGR (%) 2018-2028

Table 7.3 Poteligeo Market: Revenue ($m), AGR (%) and CAGR (%) 2018-2028

Table 7.4 Engineered Antibodies Phase 3 Pipeline by Indication, 2018

Table 7.5 Selected Ongoing Clinical Trials for MEDI-551, 2018

Table 7.6 Engineered Antibodies Phase 2 Pipeline by Indication, 2018

Table 7.7 Selected Ongoing Clinical Trials for Margetuximab, 2018

Table 7.8 Engineered Antibodies Phase 1 Pipeline by Indication, 2018

Table 8.1 Bispecific Antibodies Market by Type: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 8.2 Blincyto: Market Revenue ($m), AGR (%) and CAGR (%) 2018-2028

Table 8.3 Bispecific Antibodies Pipeline by Indication and Phase, 2017

Table 8.4 Bispecific Antibodies Pipeline by Indication and Phase, 2018

Table 8.5 Bispecific Antibodies: Phase 1/2 Pipeline, 2018

Table 8.6 Bispecific Antibodies: Phase 1 Pipeline, 2018

Table 8.7 Bispecific Antibodies: Preclinical Pipeline, 2018

Table 9.1 Antibody Fragments and Antibody-Like Proteins (ALPs) Market by Type: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 9.2: Kalbitor Market: Revenue ($m), AGR (%) and CAGR (%) 2018-2028

Table 9.3 Antibody Fragments and ALPs Pipeline, 2018

Table 10.1 Biosimilar Antibody Market by Type: Revenue ($m), AGR (%) and CAGR (%) 2017-2028

Table 10.2 Infliximab Biosimilar Market: Revenue ($m), AGR (%) and CAGR (%) 2018-2028

Table 10.3 Adalimumab Biosimilar Market: Revenue ($m), AGR (%) and CAGR (%) 2018-2028

Table 10.4 Rituximab Biosimilar Market: Revenue ($m), AGR (%) and CAGR (%) 2018-2028

Table 10.5 Trastuzumab Biosimilar Market: Revenue ($m), AGR (%) and CAGR (%) 2018-2028

Table 10.6 Patent Status of Five Leading mAbs

Table 11.1 Seattle Genetics Inc. Operating Segments

Table 11.2 Seattle Genetics Inc.: Revenue ($m), R&D ($m), 2015-2017

Table 11.3 Seattle Genetics Inc. Product Pipeline

Table 11.4 Seattle Genetics Inc. Recent Developments

Table 11.5 Roche Operating Segments

Table 11.6 Roche: Revenue ($m), R&D ($m), 2015-2017

Table 11.7 Roche Product Pipeline

Table 11.8 Roche Recent Developments

Table 11.9 Pfizer Operating Segments

Table 11.10 Pfizer: Revenue ($m), R&D ($m), 2015-2017

Table 11.11 Pfizer Recent Developments

Table 11.12 Kyowa Hakko Kirin Operating Segments

Table 11.13 Kyowa Hakko Kirin: Revenue ($m), R&D ($m), 2015-2017

Table 11.14 Kyowa Hakko Kirin Recent Developments

Table 11.15 Sanofi Operating Segments

Table 11.16 Sanofi: Revenue ($m), R&D ($m), 2015-2017

Table 11.17 Sanofi Recent Developments

Table 11.18 Merck Operating Segments

Table 11.19 Merck: Revenue ($m), R&D ($m), 2015-2017

Table 11.20 Merck Recent Developments

Table 11.21 Amgen Operating Segments

Table 11.22 Amgen: Revenue ($m), R&D ($m), 2015-2017

Table 11.23 Amgen Recent Developments

Table 11.24 Novartis Operating Segments

Table 11.25 Novartis: Revenue ($m), R&D ($m), 2015-2017

Table 11.26 Novartis Recent Developments

Table 11.27 GSK Operating Segments

Table 11.28 GSK: Revenue ($m), R&D ($m), 2015-2017

Table 11.29: Shire Operating Segments

Table 11.30: Shire: Revenue ($m), R&D ($m), 2015-2017

List of Figures

Figure 1.1 Global Next-Generation Antibody Therapies Market, Market Segmentation

Figure 3.1 Global Next-Generation Antibody Therapies by Product: Market Share (%), 2017

Figure 3.2 Global Next-Generation Antibody Therapies Market Forecast Revenue ($m) & AGR (%), 2017-2028

Figure 3.3 Global Next-Generation Antibody Therapies Market by Product: Revenue ($m), 2028

Figure 3.4 World Next-Generation Antibody Therapies Market: Drivers and Restraints, 2017-2028

Figure 3.5 Global Next-Generation Antibody Therapies Market by Product: Revenue ($m), 2017-2028

Figure 4.1 Global Antibody-Drug Conjugates Submarket: Revenue ($m), 2017-2028

Figure 4.2 Global Engineered Antibodies Submarket: Revenue ($m), 2017-2028

Figure 4.3 Global Bispecific Antibodies Submarket: Revenue ($m), 2017-2028

Figure 4.4 Global Antibody Fragments and ALPs Submarket: Revenue ($m), 2017-2028

Figure 4.5: Global Next-Generation Antibody Therapies Market, Biosimilar Antibody Revenue ($m), 2017-2028

Figure 5.1 Global Next-Generation Antibody Therapies Market by Region: Revenue ($m), 2017-2028

Figure 5.2 US Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 5.3 Canada Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 5.4 Mexico Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 5.5 Germany Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 5.6 France Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 5.7 United Kingdom Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 5.8 Italy Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 5.9 Spain Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 5.10 Russia Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 5.11 Japan Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 5.12 China Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 5.13 Australia Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 5.14 South Korea Next-Generation Antibody Therapies Market, Revenue ($m), 2017-2028

Figure 5.15 India Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 5.16 Brazil Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 5.17 Saudi Arabia Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 5.18 Republic of South Africa Next-Generation Antibody Therapies Market: Revenue ($m), 2017-2028

Figure 6.1 Antibody-Drug Conjugates Market Forecast: Revenue ($m) & AGR (%), 2017-2028

Figure 7.1 Engineered Antibodies Market Forecast: Revenue ($m) & AGR (%), 2017-2028

Figure 8.1 Bispecific Antibodies Market Forecast: Revenue ($m) & AGR (%), 2017-2028

Figure 9.1 Antibody Fragments and Antibody-Like Proteins (ALPs) Market Forecast: Revenue ($m) & AGR (%), 2017-2028

Figure 10.1 Biosimilar Antibody Market Forecast: Revenue ($m) & AGR (%), 2017-2028

Figure 12.1 Next-Generation Antibody Therapies Market: Strengths and Weaknesses, 2017-2028

Figure 12.2 Next-Generation Antibody Therapies Market: Opportunities and Threats, 2017-2028

AbbVie

AbGenomics

Ablynx

AdAlta

ADC Therapeutics

Adnexus

Affimed Therapeutics

Agensys

Alcon

Alexion

Algeta ASA

Allergan

ALMAC Group

Ambrx

Amgen

arGEN-X

Astellas Pharma

AstraZeneca

Bayer

Biogen Idec

BioNet Ventures

Biotest

BioWa

Boehringer Ingelheim

Bristol-Myers Squibb

Cancer Drugs Fund

CARBOGEN AMCIS

Cascadian Therapeutics, Inc.

Catalent Pharma Solutions

Celgene

Celldex Therapeutics

Cephalon

Cilag GmbH International

Clovis Oncology

Coldstream Laboratories

Concortis Biosystems

Corixa

Covagen

Crescendo Biologics

CSL Behring

CVie Therapeutics

CytomX Therapeutics

Daiichi Sankyo

Defiante Farmaceutica

Delenex Therapeutics

Domantis

Dutalys

Dyax

Eddingpharm

Eisai

Eli Lilly

Emergent BioSolutions

Endo Pharmaceuticals

ESBATech

Esperance Pharmaceuticals

ETH Zurich

FDA

Five Prime Therapeutics

Formation Biologics

Fresenius Biotech

F-Star

Fujifilm

Genentech

Genmab

Gilead Sciences

Glenmark

Glycart

Glycotope

Goodwin Biotechnology

GSK

Health Canada

Igenica

Immune Design

Immunocore

ImmunoGen

Immunomedics

IONTAS

Janssen Biotech

Jazz Pharmaceuticals

Kalobios

Karolinska Institute

Kyowa Hakko Kirin

Kyowa Medex

LINDIS Biotech

Lonza

MacroGenics

MedImmune

Merck

Merrimack Pharmaceuticals

Mersana Therapeutics

Merus

Micromet

Millennium Pharmaceuticals

Molecular Partners

MorphoSys

MultiCell Immunotherapeutics (MCIT)

National Institute of Diabetes and Digestive and Kidney Diseases

Neopharm

Neovii Biotech

Nerviano Medical Sciences

NHS

NICE

NMS Group

Nordic Nanovector ASA

Novartis

Novartis Institutes for BioMedical Research (NIBR)

NovImmune

Oxford BioTherapeutics

Oxis Biotech

Pfizer

Pharmacyclics

Pieris

Piramal Enterprises

Piramal Healthcare

PolyTherics

ProBioGen

Progenics

ProStrakan

Redwood BioScience

Roche

Salix

Sanofi

Scil Proteins

Seattle Genetics

Servier

Shinogi

Shire

Sigma-Tau

Simcere Pharmaceutical Group

Sorrento Therapeutics

Spectrum Pharmaceuticals

Spirogen

Stelis Biopharma

Stemcentrx

Strides Arcolab

Sutro Biopharma

Swedish Orphan Biovitrum (Sobi)

Swiss Federal Institute of Technology

Synthon

Synthon Biopharmaceuticals

Takeda

Talon Therapeutics

Teva

TG Therapeutics

The American Society of Hematology

The University of Texas MD Anderson Cancer Center

TRION Pharma

UCB

WHO

Wyeth

Xencor

Zydus Cadila

Zymeworks

Download sample pages

Complete the form below to download your free sample pages for Global Next-Generation Antibody Therapies Market Forecast 2018-2028

Related reports

-

Top 25 Antibiotic Drugs Manufacturers 2018

Visiongain forecasts the antibiotic drugs market to increase to $ 43,841.7m in 2022. The market is estimated to grow at...

Full DetailsPublished: 12 June 2018 -

Biologics Market Trends and Forecasts 2018-2028

The global biologics market is estimated to reach $250bn in 2023. The market is expected to grow at a CAGR...

Full DetailsPublished: 14 November 2018 -

Global Biosimilars and Follow-On Biologics Market 2018-2028

The global biosimilars and follow-on biologics market is estimated to have reached $7.70bn in 2017 and expected to grow at...

Full DetailsPublished: 01 June 2018 -

Biological Drug API Manufacturing Services World Industry and Market Predictions 2018-2028

The biological drug API manufacturing market is estimated to grow at a CAGR of 9.0% in the first half of...

Full DetailsPublished: 06 July 2018 -

Global Medical Device Contract Manufacturing Market Forecast 2018-2028

The global medical device contract manufacturing market was valued at $70bn in 2017. Visiongain forecasts this market to increase to...

Full DetailsPublished: 17 July 2018 -

Pharma Leader Series: Top 50 Pharmaceutical Contract Manufacturing Organisations (CMOs) Market 2018

Contract manufacturing represents the largest sector of the pharma outsourcing industry. Pharmaceutical companies have sought to take advantage of the...Full DetailsPublished: 28 September 2018 -

Biological Drug API Manufacturing Services World Industry and Market Forecast to 2029

The biological drug API manufacturing market is estimated to grow at a CAGR of 9.5% in the first half of...Full DetailsPublished: 07 November 2019 -

Global Melanoma Drugs Market 2018-2028

Our new 149-page report provides 161 tables, charts, and graphs. Discover the most lucrative areas in the industry and the...Full DetailsPublished: 17 April 2018 -

Antibody Drug Conjugates Market Report 2021-2031

Antibody drug conjugate (ADC) technology continues to evolve as a widely successful drug targeting technology for the treatment of cancer....

Full DetailsPublished: 03 November 2020 -

Rheumatoid Arthritis Pricing, Reimbursement & Market Access 2018

This report provides analysis and evaluation of the current and potential economic burden of Rheumatoid Arthritis (RA) in the major...

Full DetailsPublished: 29 March 2018

Download sample pages

Complete the form below to download your free sample pages for Global Next-Generation Antibody Therapies Market Forecast 2018-2028

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: sara.peerun@visiongain.com

If so, please drop an email to Sara Peerun stating your chosen report title to sara.peerun@visiongain.com

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Sara Peerun on sara.peerun@visiongain.com or call her today on +44 (0) 20 7549 9987

- Advanced Truck Technologies Market 2019-2029

- Biometric Vehicle Access Technologies Market 2019-2029

- Automotive Composites 2019-2029

- Automotive Vehicle to Everything (V2X) Technologies Market 2019-2029

- Automotive Driver Monitoring Systems (DMS) Market 2019-2029

- Wireless Electric Vehicle Charging (WEVC) Technologies Market 2019-2029

Association of Russian Automakers

Audio Video Bridging (AVB)

China Association Of Automoblie Manufacturers

European Association of Automotive Suppliers

European Automobile Manufacturers’ Association

European Council for Automotive Research and Development

Former Society of Automotive Engineers

German Association of the Automotive Industry

Institute of the Motor Industry

International Organization of Motor Vehicle Manufacturers

In-Vehicle Infotainment (IVI)

Italian Association of the Automotive Industry

Japan Automobile Manufacturers Association

One-Pair Ether-Net

Society of Indian Automobile Manufacturers (SIAM)

Society of Motor Manufacturers and Traders

The International Council For Clean Transport

US National Highway Traffic Safety Administration