Industries > Defence > Military Smart Weapons Market Report 2019-2029

Military Smart Weapons Market Report 2019-2029

Top Companies at the Forefront of Radar, GPS/INS, Infrared & Laser Precision Guided Weapons, Munitions, Bombs & Missile Development and Technologies Maverick, Paveway, SARH, ARH, Beam Riding, Passive Seekers

• Do you need Military Smart Weapon market data?

• Succinct Military Smart Weapons market analysis?

• Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive report can transform your own research and save you time.

Also referred to as precision-guided weapons, this report examines expenditure on munitions, missiles and bombs, which utilise a range of technologies to locate and destroy their target(s), principally Radar, GPS/INS, Infrared and Laser technology. Given the tumultuous nature of the international system at present, as both non-state actors gain ascendency and geopolitical rivalry regains relevance, Visiongain expects nations to continue procuring Military Smart Weapons for their arsenals. Furthermore, the demand for greater precision in order to alleviate collateral damage will encourage further research and development (R&D) within the Military Smart Weapons market. Consequentially, Visiongain believes that the global Military Smart Weapons market will sustain modest growth over the next decade.. If you want to be part of this growing industry, then read on to discover how you can maximise your investment potential.

Report highlights

• 141 tables and 162 figures and charts

Analysis of key players in the Global Military Smart Weapons Market

• The Boeing Company

• General Dynamics Corporation

• Lockheed Martin

• Raytheon Company

• Northrop Grumman Corporation

• Kongsberg Gruppen

• MBDA

• BAE Systems

• Textron Inc.

• Denel SOC

• SAAB AB

• L-3 Technologies

Global Military Smart Weapons market outlook and analysis from 2019-2029

• Hundreds of major Military Smart Weapons contracts and projects

• Analysis of major contracts awarded by each country/national market

Military Smart Weapons forecasts and analysis from 2019-2029

• Radar Guided Forecast 2019-2029

• Infrared Forecast 2019-2029

• GPS/INS Forecast 2019-2029

• Laser Forecast 2019-2029

• Other Forecast 2019-2029

Regional Military Smart Weapon market forecasts from 2019-2029

Key questions answered

• What does the future hold for the Military Smart Weapon Market?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to success and why?

• What business models should you adopt?

• What industry trends should you be aware of?

Report Scope

• Global military Smart Weapon market forecasts from 2019-2029

• Country military Smart Weapons forecasts from 2019-2029 covering:

• China

• India

• Kuwait

• Qatar

• Russia

• Saudi Arabia

• South Kore

• UAE

• Uk

• US

• R.O.W.

• Global

• Analysis of the key factors driving growth in the global, regional country level military Smart Weapons markets from 2019-2029

• Detailed tables containing contracts / projects and programmes in the military Smart Weapons market by country

Target audience

• Leading Military Smart Weapons companies

• Suppliers

• Contractors

• Technologists

• R&D staff

• Consultants

• Analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

• Aerospace Industry Organisations

• Systems Integrators

• Sensor Houses

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Military Smart Weapons Market Overview

1.2 Global Military Smart Weapons Market Segmentation

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include

1.6 Who is This Report for?

1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.7.3 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Military Smart Weapons Market

2.1 Global Military Smart Weapons Market Structure

2.2 Military Smart Weapons Market Definition

2.2.1 Radar-Guided Military Smart Weapons Submarket Definition

2.2.2 GPS/INS-Guided Military Smart Weapons Submarket Definition

2.2.3 Infrared-Guided Military Smart Weapons Infrared Submarket Definition

2.2.4 Laser-Guided Military Smart Weapons Submarket Definition

2.2.5 Other-Guided Military Smart Weapons Submarket Definition

2.2.6. A note on Hybrid-Guided Weapons

3. Global Military Smart Weapons Market 2019-2029

3.1 Global Military Smart Weapons Market Forecast 2019-2029

4. Global Military Smart Weapons Submarket Forecast 2019-2029

4.1 Global Military Smart Weapons Radar-Guided Submarket Forecast 2019-2029

4.1.1 Global Military Smart Weapons Radar-Guided Submarket Analysis

4.2 Global Military Smart Weapons GPS/INS-Guided Submarket Forecast 2019-2029

4.2.1 Global Military Smart Weapons GPS/INS-Guided Submarket Analysis

4.3 Global Military Smart Weapons Infrared-Guided Submarket Forecast 2019-2029

4.3.1 Global Military Smart Weapons Infrared-Guided Submarket Analysis

4.4 Global Military Smart Weapons Laser-Guided Submarket Forecast 2019-2029

4.4.1 Global Military Smart Weapons Laser-Guided Submarket Analysis

4.5 Global Military Smart Weapons Other-Guided Submarket Forecast 2019-2029

4.5.1 Global Military Smart Weapons Other-Guided Submarket Analysis

5. Leading National Military Smart Weapons Market Forecast 2019-2029

5.1 Leading National Military Smart Weapons Market Share Forecast 2019-2029

5.2 Chinese Military Smart Weapons Market Forecast 2019-2029

5.2.1 Chinese Military Smart Weapons Contracts & Programmes

5.2.2 Chinese Military Smart Weapons Market Analysis

5.2.3. Chinese Military Smart Weapons Capabilities

5.2.4 Limitations of China’s Precision-Guided Weapons Programme

5.2.5 Beware of Chinese Dragons: A Caveat for Investors

5.2.6 Chinese Military Smart Weapons Market Drivers & Restraints

5.3 Indian Military Smart Weapons Market Forecast 2019-2029

5.3.1 Indian Military Smart Weapons Contracts & Programmes

5.3.2 Indian Military Smart Weapons Market Analysis

5.3.3 Indian Military Smart Weapons Market Drivers & Restraints

5.4 Kuwaiti Military Smart Weapons Market Forecast 2019-2029

5.4.1 Kuwaiti Military Smart Weapons Contracts & Programmes

5.4.2 Kuwaiti Military Smart Weapons Market Analysis

5.4.3 Kuwaiti Military Smart Weapons Market Drivers & Restraints

5.5 Qatari Military Smart Weapons Market Forecast 2019-2029

5.5.1 Qatari Military Smart Weapons Market Contracts & Programmes

5.5.2 Qatari Military Smart Weapons Market Analysis

5.5.3 Qatari Military Smart Weapons Market Drivers & Restraints

5.6 Russian Military Smart Weapons Market Forecast 2019-2029

5.6.1 Russian Military Smart Weapons Contracts & Programmes

5.6.2 Russian Military Smart Weapons Market Analysis

5.6.3 Russian Military Smart Weapons Market Drivers & Restraints

5.7 Saudi Arabian Military Smart Weapons Market Forecast 2019-2029

5.7.1 Saudi Arabian Military Smart Weapons Market Contracts & Programmes

5.7.2 Saudi Arabian Military Smart Weapons Market Analysis

5.7.3 Saudi Arabian Military Smart Weapons Market Drivers & Restraints

5.8 South Korean Military Smart Weapons Market Forecast 2019-2029

5.8.1 South Korean Military Smart Weapons Market Contracts & Programmes

5.8.2 South Korean Military Smart Weapons Market Analysis

5.8.3 South Korean Military Smart Weapons Market Drivers & Restraints

5.9 UAE Military Smart Weapons Market Forecast 2019-2029

5.9.1 UAE Military Smart Weapons Contracts & Programmes

5.9.2 UAE Military Smart Weapons Market Analysis

5.9.3 UAE Military Smart Weapons Market Drivers & Restraints

5.10 United Kingdom Military Smart Weapons Market Forecast 2019-2029

5.10.1 United Kingdom Military Smart Weapons Market Contracts & Programmes

5.10.2 United Kingdom Military Smart Weapons Market Analysis

5.10.5 United Kingdom Military Smart Weapons Market Drivers & Restraints

5.11 United States Military Smart Weapons Market Forecast 2019-2029

5.11.1 United States Military Smart Weapons Market Contracts & Programmes

5.11.2 United States Military Smart Weapons Market Analysis

5.11.3 Death by a Thousand Cuts: The Impact of Sequestration on U.S. Defence Policy

5.11.4 United States Military Smart Weapons Market Drivers & Restraints

5.12 Rest of the World Military Smart Weapons Market Forecast 2019-2029

5.12.1 Rest of the World Military Smart Weapons Market Contracts & Programmes

5.12.2 Rest of the World Military Smart Weapons Market Analysis

5.12.3 Rest of the World Military Smart Weapons Market Drivers & Restraints

6. SWOT Analysis of the Military Smart Weapons Market 2019-2029

6.1 Strengths

6.1.1 Upgrade Kits for “Dumb” Weapons can be a Cost-Effective means of Delivering Precision Strike Capabilities

6.1.2 The Military Smart Weapons Market is Driven by Security Dilemma Politics

6.2 Weaknesses

6.2.1 The Most Advanced Smart Weapons are Costly To Procure, Integrate and Operate

6.3 Opportunities

6.3.1 Investment in Advanced Missile Defence Systems and Interceptor Missiles will be a Major Source of Growth

6.3.2 Increasing Demand for Miniaturised Precision Guided Weapons

6.3.3 Increasing Demand for Greater Precision in Order to Alleviate Collateral Damage

6.4 Threats

6.4.1 Selling Military Smart Weapons to Nations with Poor Human Rights Records Remains Controversial

6.4.2 European Defence Budgets Continue to be Restrained in an Age of Austerity

6.4.3 Economic ‘Blackswans’ and Downturn

7. Leading 12 Military Smart Weapons Companies

7.1 Leading 12 Military Smart Weapons Company Sales Position By Overall Sales 2018

7.2 The Boeing Company

7.2.1 Boeing Military Smart Weapons Selected Recent Contracts / Projects / Programmes 2012-2018

7.2.2 Boeing Total Company Sales 2013-2017

7.2.3 Boeing Net Income 2013-2017

7.2.4 Boeing Sales by Segment of Business 2017

7.2.5 Boeing Regional Emphasis / Focus

7.2.6 Boeing Organisational Structure and Subsidiaries

7.2.7 Boeing Military Smart Weapons Products / Services

7.2.8 Boeing Primary Market Competitors 2019

7.2.9 Boeing Mergers & Acquisitions (M&A) Activity

7.2.10 Boeing Analysis

7.2.11 Boeing Future Outlook

7.3 General Dynamics Corporation

7.3.1 General Dynamics Corporation Military Smart Weapons Selected Recent Contracts & Programmes 2012-2018

7.3.2 General Dynamics Corporation Total Company Sales 2013-2017

7.3.3 General Dynamics Corporation Sales by Segment of Business 2013-2017

7.3.4 General Dynamics Corporation Net Income 2013-2017

7.3.5 General Dynamics Corporation Regional Emphasis

7.3.6 General Dynamics Corporation Organisational Structure / Notable Subsidiaries

7.3.7 General Dynamics Corporation Primary Market Competitors 2019

7.3.8 General Dynamics Corporation Mergers & Acquisitions (M&A) Activity

7.3.9 General Dynamics Corporation Analysis

7.3.9.1 General Dynamics Corporation: Position and Operations in the Military Smart Weapons Market

7.4 Kongsberg Gruppen

7.4.1 Kongsberg Gruppen Military Smart Weapons Selected Recent Contracts / Projects / Programmes 2011-2018

7.4.2 Kongsberg Gruppen Total Company Sales 2013-2017

7.4.3 Kongsberg Gruppen Net Income 2013-2017

7.4.4 Kongsberg Gruppen Sales by Segment of Business 2017

7.4.5 Kongsberg Gruppen Regional Emphasis / Focus

7.4.6 Kongsberg Gruppen Organisational Structure and Subsidiaries

7.4.7 Kongsberg Gruppen Military Smart Weapons Products / Services

7.4.8 Kongsberg Gruppen Primary Market Competitors 2019

7.4.9 Kongsberg Gruppen Analysis

7.5 Lockheed Martin Corporation

7.5.1 Lockheed Martin Military Smart Weapons Selected Recent Contracts / Projects / Programmes 2011-2018

7.5.2 Lockheed Martin Total Company Sales 2013-2017

7.5.3 Lockheed Martin Net Income 2013-2017

7.5.5 Lockheed Martin Sales by Segment of Business 2017

7.5.6 Lockheed Martin Regional Emphasis and Focus

7.5.7 Lockheed Martin Organisational Structure and Subsidiaries

7.5.8 Lockheed Martin Military Smart Weapons Products / Services

7.5.9 Lockheed Martin Primary Market Competitors 2019

7.5.10 Lockheed Martin Mergers & Acquisitions (M&A) Activity

7.5.11 Lockheed Martin Analysis

7.5.12 Lockheed Martin Future Outlook

7.6 MBDA

7.6.1 MBDA Military Smart Weapons Selected Recent Contracts / Projects / Programmes 2010-2018

7.6.2 MBDA Regional Emphasis / Focus

7.6.3 MBDA Subsidiaries

7.6.4 MBDA Military Smart Weapons Products / Services

7.6.5 MBDA Primary Market Competitors 2019

7.6.6 MBDA Analysis

7.6.7 MBDA Future Outlook

7.7 BAE Systems PLC

7.7.1 BAE Systems Military Smart Weapons Selected Recent Contracts & Programmes 2010-2018

7.7.2 BAE Systems Total Company Sales 2013-2017

7.7.3 BAE Systems Sales by Segment of Business 2013-2017

7.7.4 BAE Systems Net Income 2013-2017

7.7.5 BAE Systems Regional Emphasis

7.7.6 BAE Systems Organisational Structure / Notable Subsidiaries

7.7.7 BAE Systems Primary Market Competitors 2019

7.7.8 BAE Systems Mergers & Acquisitions (M&A) Activity

7.7.9 BAE Systems Analysis

7.7.10 BAE Systems: Future Outlook

7.8 Raytheon Company

7.8.1 Raytheon Military Smart Weapons Selected Recent Contracts / Projects / Programmes 2011-2018

7.8.2 Raytheon Total Company Sales 2013-2017

7.8.3 Raytheon Net Income 2013-2017

7.8.4 Raytheon Sales by Segment of Business 2013-2017

7.8.5 Raytheon Regional Emphasis / Focus

7.8.6 Raytheon Organisational Structure and Subsidiaries

7.8.7 Raytheon Military Smart Weapons Products / Services

7.8.8 Raytheon Primary Market Competitors 2019

7.8.9 Raytheon Mergers & Acquisitions (M&A) Activity

7.8.10 Raytheon Analysis

7.8.11 Raytheon Future Outlook

7.9 Textron Inc.

7.9.1 Textron Inc. Selected Recent Contracts / Projects / Programmes 2010-2018

7.9.2 Textron Inc. Total Company Sales 2013-2017

7.9.3 Textron Inc. Net Income 2013-2017

7.9.4 Textron Inc. Sales by Segment of Business 2013-2017

7.9.5 Textron Inc. Regional Emphasis / Focus

7.9.6 Textron Inc. Organisational Structure and Subsidiaries

7.9.7 Textron Inc. Military Smart Weapons Products / Services

7.9.8 Textron Inc. Primary Market Competitors 2019

7.9.9 Textron Inc. Mergers & Acquisitions (M&A) Activity

7.9.10 Textron Inc. Analysis

7.9.11 Textron Inc. Future Outlook

7.10 Northrop Grumman Corporation

7.10.1 Northrop Grumman Corporation Military Smart Weapons Selected Recent Contracts & Programmes 2012-2017

7.10.2 Northrop Grumman Corporation Total Company Sales 2013-2017

7.10.3 Northrop Grumman Corporation Sales by Segment of Business 2013-2017

7.10.4 Northrop Grumman Corporation Net Income 2013-2017

7.10.6 Northrop Grumman Corporation Regional Emphasis

7.10.7 Northrop Grumman Corporation Organisational Structure / Notable Subsidiaries

7.10.9 Northrop Grumman Corporation Primary Market Competitors 2019

7.10.10 Northrop Grumman Corporation Mergers & Acquisitions (M&A) Activity

7.10.12 Northrop Grumman Corporation Analysis

7.11 Denel SOC Ltd

7.11.1 Denel SOC Ltd Military Smart Weapons Selected Recent Contracts / Projects / Programmes 2011-2017

7.11.2 Denel SOC Ltd Total Company Sales 2011-2015

7.11.3 Denel SOC Ltd Sales by Segment Share (%) of Business 2017

7.11.4 Denel SOC Ltd Regional Emphasis / Focus

7.11.5 Denel SOC Ltd Organisational Structure and Subsidiaries

7.11.6 Denel SOC Ltd Military Smart Weapons Products / Services

7.11.7 Denel SOC Ltd Mergers & Acquisitions (M&A) Activity

7.11.8 Denel SOC Ltd Primary Market Competitors 2019

7.11.9 Denel SOC Ltd Analysis

7.11.10 Denel SOC Ltd Future Outlook

7.12 L-3 Technologies Inc.

7.12.1 L-3 Technologies Inc. Military Smart Weapon Selected Recent Contracts & Programmes 2014-2018

7.12.2 L-3 Technologies Inc. Total Company Sales 2013-2017

7.12.3 L-3 Technologies Inc. Sales by Segment of Business 2013-2017

7.12.4 L-3 Technologies Inc. Net Income 2013-2017

7.12.5 L-3 Technologies Inc. Regional Emphasis

7.12.6 L-3 Technologies Inc. Organisational Structure / Notable Subsidiaries

7.12.7 L-3 Technologies Inc. Primary Market Competitors 2019

7.12.8 L-3 Technologies Inc. Mergers & Acquisitions (M&A) Activity

7.12.9 L-3 Technologies Inc. Analysis

7.13 Saab AB

7.13.1 Saab AB Military Smart Weapon Selected Recent Contracts & Programmes 2011-2018

7.13.2 Saab AB Total Company Sales 2013-2017

7.13.3 Saab AB Sales by Segment of Business 2013-2017

7.13.4 Saab AB Net Income 2013-2017

7.13.5 Saab AB Regional Emphasis

7.13.6 Saab AB Organisational Structure/Notable Subsidiaries

7.13.7 Saab AB Primary Market Competitors 2019

7.13.8 Saab AB Mergers & Acquisitions (M&A) Activity

7.13.9 Saab AB Analysis

7.14 Other Companies Involved in the Military Smart Weapons Market 2019

8. Conclusions

9. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 1.1 Example of Military Smart Weapons Market by Regional Market Forecast 2019-2029 (US$m, AGR%, Cumulative)

Table 1.2 Example of Leading National Military Smart Weapons Market Forecast by Submarket 2019-2029 (US$m, AGR%, Cumulative)

Table 3.1 Global Military Smart Weapons Market Forecast 2019-2029 (US$m, AGR %, CAGR%, Cumulative)

Table 4.1 Global Military Smart Weapons Submarket Forecast 2019-2029 (US$m, AGR%, Cumulative)

Table 4.2 Global Military Smart Weapons Submarket Forecast by National Market 2019-2029 (US$m, Cumulative, Global AGR%)

Table 4.3 Global Military Smart Weapons Submarket CAGR Forecast 2019-2024, 2024-2029, 2019-2029 (CAGR%)

Table 4.4 Global Military Smart Weapons Radar-Guided Submarket by National Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 4.5 Global Military Smart Weapons GPS/INS-Guided Submarket by National Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 4.6 Global Military Smart Weapons Infrared-Guided Submarket by National Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 4.7 Global Military Smart Weapons Laser-Guided Submarket by National Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 4.8 Global Military Smart Weapons Other-Guided Submarket by National Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 5.1 Leading National Military Smart Weapons Market by Submarket Forecast 2019-2029 (US$m, Global AGR%, Cumulative)

Table 5.2 Leading Military Smart Weapons Market CAGR Forecast 2019-2024, 2024-2029, 2019-2029 (CAGR%)

Table 5.3 Chinese Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 5.4 Chinese Military Smart Weapons Market Major Contracts & Programmes 2015-2018 (Date, Company, Value US$m, Details)

Table 5.5 Chinese Military Smart Weapons Market Drivers & Restraints 2019

Table 5.6 Indian Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 5.7 Indian Military Smart Weapons Market Major Contracts & Programmes 2011-2018 (Date, Company, Value US$m, Details)

Table 5.8 Indian Military Smart Weapons Market Drivers & Restraints 2019

Table 5.9 Kuwaiti Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 5.10 Kuwaiti Military Smart Weapons Market Major Contracts & Programmes 2013-2018 (Date, Company, Value US$m, Details)

Table 5.11 Kuwaiti Military Smart Weapons Market Drivers & Restraints 2019

Table 5.12 Qatari Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 5.13 Qatari Military Smart Weapons Market Major Contracts & Programmes 2014-2018 (Date, Company, Value US$m, Details)

Table 5.14 Qatari Military Smart Weapons Market Drivers & Restraints 2019

Table 5.15 Russian Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 5.16 Russian Military Smart Weapons Market Major Contracts & Programmes 2011-2018 (Date, Company, Value US$m, Details)

Table 5.17 Russian Military Smart Weapons Market Drivers & Restraints 2019

Table 5.18 Saudi Arabian Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 5.19 Saudi Arabian Military Smart Weapons Market Major Contracts & Programmes 2010-2018 (Date, Company, Value US$m, Details)

Table 5.20 Saudi Arabia Military Smart Weapons Market Drivers & Restraints 2019

Table 5.21 South Korean Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 5.22 South Korean Military Smart Weapons Market Major Contracts & Programmes 2010-2018 (Date, Company, Value US$m, Details)

Table 5.23 South Korean Military Smart Weapons Market Drivers & Restraints 2019

Table 5.24 UAE Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 5.25 UAE Military Smart Weapons Market Major Contracts & Programmes 2014-2018 (Date, Company, Value US$m, Details)

Table 5.26 UAE Military Smart Weapons Market Drivers & Restraints 2019

Table 5.27 United Kingdom Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 5.28 United Kingdom Military Smart Weapons Market Major Contracts & Programmes 2010-2018 (Date, Company, Value US$m, Details)

Table 5.29 United Kingdom Military Smart Weapons Market Drivers & Restraints 2019

Table 5.30 United States Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 5.31 United States Military Smart Weapons Market Major Contracts & Programmes 2012-2018 (Date, Company, Value US$m, Details)

Table 5.32 United States Military Smart Weapons Market Drivers & Restraints 2019

Table 5.33 Rest of the World Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 5.34 Rest of the World Military Smart Weapons Market Major Contracts & Programmes 2011-2018 (Date, Company, Value US$m, Country, Details)

Table 5.35 Rest of the World Military Smart Weapons Market Drivers & Restraints 2019

Table 6.1 Global Military Smart Weapons Market SWOT Analysis 2019-2029

Table 7.1 Leading 12 Military Smart Weapons Companies By Overall Sales 2018 (Business Segment in the Market)

Table 7.2 Boeing Profile 2019 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Military Smart Weapons Market %, Net Income US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, Ticker, Website)

Table 7.3 Selected Recent Boeing Military Smart Weapons Contracts / Projects / Programmes 2012-2018 (Date, Country, Contractor, Value US$m, Details)

Table 7.4 Boeing Total Company Sales 2013-2017 (US$m, AGR%)

Table 7.5 Boeing Net Income 2013-2017 (US$m, AGR%)

Table 7.6 Boeing Subsidiaries 2018 (Subsidiary, Location)

Table 7.7 Boeing Military Smart Weapons Products / Services (Segment of Business, Specification / Features)

Table 7.8 Boeing Mergers and Acquisitions 2008-2018 (Date, Company Involved, Value US$m, Details)

Table 7.9 Boeing Divestitures 2014 (Date, Company Involved, Details)

Table 7.10 General Dynamics Corporation Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.11 Selected Recent General Dynamics Corporation Military Smart Weapons Contracts & Programmes 2012-2018 (Date, Country , Value US$m, Product & Details)

Table 7.12 General Dynamics Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Table 7.13 General Dynamics Corporation Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 7.14 General Dynamics Corporation Net Income 2013-2017 (US$m, AGR%)

Table 7.15 General Dynamics Corporation Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 7.16 General Dynamics Corporation Notable Subsidiaries 2018 (Subsidiary, Location)

Table 7.17 General Dynamics Notable Mergers and Acquisitions 2011-2018 (Date, Company Involved, Details)

Table 7.18 General Dynamics Divestitures 2011-2015 (Date, Company Involved, Details)

Table 7.19 Kongsberg Gruppen Profile 2019 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Military Smart Weapons Market %, Net Income US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.20 Selected Recent Kongsberg Gruppen Military Smart Weapons Contracts / Projects / Programmes 2011-2018 (Date, Country / Region, Contractor, Value US$m, Details)

Table 7.21 Kongsberg Gruppen Total Company Sales 2013-2017 (US$m, AGR%)

Table 7.22 Kongsberg Gruppen Net Income 2013-2017 (US$m, AGR%)

Table 7.23 Kongsberg Gruppen Subsidiaries 2018 (Subsidiary, Location)

Table 7.24 Kongsberg Gruppen Military Smart Weapons Products / Services (Segment of Business, Specification / Features)

Table 7.25 Lockheed Martin Profile 2019 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Total Company Sales from Military Smart Weapons Market %, Net Income US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.27 Lockheed Martin Total Company Sales 2013-2017 (US$m, AGR%)

Table 7.28 Lockheed Martin Net Income 2013-2017 (US$m, AGR%)

Table 7.29 Lockheed Martin Subsidiaries 2018 (Subsidiary, Location)

Table 7.30 Lockheed Martin Military Smart Weapons Products / Services (Segment of Business, Specification / Features)

Table 7.31 Lockheed Martin Mergers and Acquisitions 2012-2017 (Date, Company Involved, Value US$m, Details)

Table 7.32 MBDA Profile 2019 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Company Sales from Military Smart Weapons Market %, Orders US$m, Order Backlog US$m, HQ, Founded, No. of Employees, Website)

Table 7.33 Selected Recent MBDA Military Smart Weapons Contracts / Projects / Programmes 2010-2018 (Date, Country / Region, Value US$m, Details)

Table 7.34 MBDA Subsidiaries 2018 (Subsidiary, Location)

Table 7.35 MBDA Military Smart Weapons Products / Services (Product, Specification / Features)

Table 7.36 BAE Systems Plc Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.37 Selected Recent BAE Systems Military Smart Weapons Contracts & Programmes 2010-2018 (Date, Country, Value US$m, Product & Details)

Table 7.38 BAE Systems Total Company Sales 2013-2017 (US$m, AGR%)

Table 7.39 BAE Systems Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 7.40 BAE Systems Net Income 2013-2017 (US$m, AGR%)

Table 7.41 BAE Systems Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 7.42 BAE Systems Notable Subsidiaries 2018(Subsidiary, Location)

Table 7.43 BAE Systems Notable Mergers and Acquisitions 2013-2017 (Date, Company Involved, Value US$m, Details)

Table 7.44 BAE Systems Notable Divestitures 2011-2017 (Date, Company Involved, Value US$m, Details)

Table 7.45 Raytheon Profile 2019 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Company Sales from Military Smart Weapons Market %, Net Income US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.46 Selected Recent Raytheon Military Smart Weapons Contracts / Projects / Programmes 2011-2018 (Date, Country, Contractor, Value US$m, Details)

Table 7.47 Raytheon Total Company Sales 2013-2017 (US$m, AGR%)

Table 7.48 Raytheon Net Income 2013-2017 (US$m, AGR%)

Table 7.49 Raytheon Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 7.50 Raytheon Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 7.51 Raytheon Subsidiaries 2018 (Subsidiary, Location)

Table 7.52 Raytheon Military Smart Weapons Products / Services (Segment of Business, Specification / Features)

Table 7.53 Raytheon Mergers and Acquisitions 2011-2015 (Date, Company Involved, Value US$m, Details)

Table 7.54 Textron Inc. Group Profile 2019 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Company Sales from Military Smart Weapons Market %, Net Income US$m, Net Capital Expenditure US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.55 Selected Recent Textron Inc. Military Smart Weapons Contracts / Projects / Programmes 2010-2018 (Date, Country, Value US$m, Details)

Table 7.56 Textron Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Table 7.57 Textron Inc. Net Income 2013-2017 (US$m, AGR%)

Table 7.58 Textron Inc. Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 7.59 Textron Inc. Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 7.60 Textron Inc. Subsidiaries 2018 (Subsidiary, Location)

Table 7.61 Textron Inc. Military Smart Weapons Products / Services (Segment of Business, Specification / Features)

Table 7.62 Textron Inc. Mergers and Acquisitions 2007-2014 (Date, Company Involved, Value US$m, Details)

Table 7. 63 Northrop Grumman Corporation Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.64 Selected Recent Northrop Grumman Corporation Military Smart Weapons Contracts & Programmes 2012-2017 (Date, Country, Value US$m, Product & Details)

Table 7.65 Northrop Grumman Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Table 7.66 Northrop Grumman Corporation Sales by Segment of Business 2013-2018 (US$m, AGR%)

Table 7.67 Northrop Grumman Corporation Net Income 2013-2018 (US$m, AGR%)

Table 7.68 Northrop Grumman Corporation Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 7.69 Northrop Grumman Corporation Notable Subsidiaries 2018 (Subsidiary, Location)

Table 7.70 Northrop Grumman Corporation Mergers and Acquisitions 2013-2018 (Date, Company Involved, Value US$m, Details)

Table 7.71 Denel SOC Ltd Profile 2019 (CEO, Total Company Sales US$m%, Net Income US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.72 Selected Recent Denel SOC Ltd Military Smart Weapons Contracts / Projects / Programmes 2011-2017 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 7.73 Denel SOC Ltd Total Company Sales 2014-2017 (US$m, AGR%)

Table 7.74 Denel SOC Ltd Subsidiaries 2018 (Subsidiary, Location)

Table 7.75 Denel SOC Ltd Military Smart Weapons Products / Services (Segment of Business, Product, Specification / Features)

Table 7.76 Denel SOC Ltd Mergers and Acquisitions 2015 (Date, Company Involved, Details)

Table 7.77 L-3 Technologies Inc. Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.78 Selected Recent L-3 Technologies Inc. Military Smart Weapon Contracts & Programmes 2014-2018 (Date, Country, Value US$m, Product & Details)

Table 7.79 L-3 Technologies Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Table 7.80 L-3 Technologies Inc. Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 7.81 L-3 Technologies Inc. Net Income 2013-2017 (US$m, AGR%)

Table 7.82 L-3 Technologies Inc. Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 7.83 L-3 Technologies Inc. Notable Subsidiaries 2018 (Subsidiary, Location)

Table 7.84 L-3 Technologies Inc. Mergers and Acquisitions 2012-2018 (Date, Company Involved, Value US$m, Details)

Table 7.85 L-3 Technologies Inc. Divestitures 2014-2018 (Date, Company Involved, Details)

Table 7.86 Saab AB Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.87 Selected Recent Saab AB Military Smart Weapon Contracts & Programmes 2011-2018 (Date, Country, Value US$m, Product & Details)

Table 7.88 Saab AB Total Company Sales 2013-2017 (US$m, AGR%)

Table 7.89 Saab AB Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 7.90 Saab AB Net Income 2013-2017 (US$m, AGR%)

Table 7.91 Saab AB Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 7.92 Saab AB Notable Subsidiaries 2018 (Subsidiary, Location)

Table 7.93 Saab AB Mergers and Acquisitions 2004-2017 (Date, Company Involved, Details)

Table 7.94 Saab AB Divestitures 2014 (Date, Company Involved, Value US$m, Details)

List of Figures

Figure 1.1 Global Military Smart Weapons Market Segmentation Overview

Figure 1.2 Example of Military Smart Weapons Market by Regional Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 1.3 Example of National vs. Global Military Smart Weapons Market CAGR Forecast 2019-2029, 2019-2024, 2024-2029 (CAGR%)

Figure 1.4 Example of National Military Smart Weapons Market by Submarket Forecast 2019-2029 (US$m, AGR %)

Figure 2.1 Global Military Smart Weapons Market Segmentation Overview

Figure 3.1 Global Military Smart Weapons Market Forecast 2019-2029 (US$m, AGR%)

Figure 4.1 Global Military Smart Weapons Submarket AGR Forecast 2019-2029 (AGR%)

Figure 4.2 Global Military Smart Weapons Submarket Forecast 2019-2029 (US$m, Global AGR%)

Figure 4.3 Global Military Smart Weapons Submarket Share Forecast 2019 (% Share)

Figure 4.4 Global Military Smart Weapons Submarket Share Forecast 2024 (% Share)

Figure 4.5 Global Military Smart Weapons Submarket Share Forecast 2029 (% Share)

Figure 4.6 Global Military Smart Weapons Radar-Guided Submarket by National Market AGR Forecast 2019-2029 (AGR%)

Figure 4.7 Global Military Smart Weapons Radar-Guided Submarket Forecast by National Market 2019-2029 (US$m, Global AGR%)

Figure 4.8 Global Military Smart Weapons Radar-Guided Submarket Share by National Market Forecast 2019 (% Share)

Figure 4.9 Global Military Smart Weapons Radar-Guided Submarket Share by National Market Forecast 2024 (% Share)

Figure 4.10 Global Military Smart Weapons Radar-Guided Submarket Share by National Market Forecast 2029 (% Share)

Figure 4.11 Global Military Smart Weapons GPS/INS-Guided Submarket by National Market AGR Forecast 2019-2029 (AGR%)

Figure 4.12 Global Military Smart Weapons GPS/INS-Guided Submarket Forecast by National Market 2019-2029 (US$m, Global AGR%)

Figure 4.13 Global Military Smart Weapons GPS/INS-Guided Submarket Share by National Market Forecast 2019 (% Share)

Figure 4.14 Global Military Smart Weapons GPS/INS-Guided Submarket Share by National Market Forecast 2024 (% Share)

Figure 4.15 Global Military Smart Weapons GPS/INS-Guided Submarket Share by National Market Forecast 2029 (% Share)

Figure 4.16 Global Military Smart Weapons Infrared-Guided Submarket by National Market AGR Forecast 2019-2029 (AGR%)

Figure 4.17 Global Military Smart Weapons Infrared-Guided Submarket Forecast by National Market 2019-2029 (US$m, Global AGR%)

Figure 4.18 Global Military Smart Weapons Infrared-Guided Submarket Share by National Market Forecast 2019 (% Share)

Figure 4.19 Global Military Smart Weapons Infrared-Guided Submarket Share by National Market Forecast 2024 (% Share)

Figure 4.20 Global Military Smart Weapons Infrared-Guided Submarket Share by National Market Forecast 2029 (% Share)

Figure 4.21 Global Military Smart Weapons Laser-Guided Submarket by National Market AGR Forecast 2019-2029 (AGR%)

Figure 4.22 Global Military Smart Weapons Laser-Guided Submarket Forecast by National Market 2019-2029 (US$m, Global AGR%)

Figure 4.23 Global Military Smart Weapons Laser-Guided Submarket Share by National Market Forecast 2019 (% Share)

Figure 4.24 Global Military Smart Weapons Laser-Guided Submarket Share by National Market Forecast 2024 (% Share)

Figure 4.25 Global Military Smart Weapons Laser-Guided Submarket Share by National Market Forecast 2029 (% Share)

Figure 4.26 Global Military Smart Weapons Other-Guided Submarket by National Market AGR Forecast 2019-2029 (AGR%)

Figure 4.27 Global Military Smart Weapons Other-Guided Submarket Forecast by National Market 2019-2029 (US$m, Global AGR%)

Figure 4.28 Global Military Smart Weapons Other-Guided Submarket Share by National Market Forecast 2019 (% Share)

Figure 4.29 Global Military Smart Weapons Other-Guided Submarket Share by National Market Forecast 2024 (% Share)

Figure 4.30 Global Military Smart Weapons Other-Guided Submarket Share by National Market Forecast 2029 (% Share)

Figure 5.1 Leading National Military Smart Weapons Market by Forecast 2019-2029 (US$m, Global AGR%)

Figure 5.2 Leading National Military Smart Weapons Market by Forecast AGR 2019-2029 (AGR%)

Figure 5.3 Leading National Military Smart Weapons Market Share Forecast 2019 (% Share)

Figure 5.4 Leading National Military Smart Weapons Market Share Forecast 2024 (% Share)

Figure 5.5 Leading National Military Smart Weapons Market Share Forecast 2029 (% Share)

Figure 5.6 Chinese Military Smart Weapons Submarkets AGR Forecast 2019-2029 (AGR%)

Figure 5.7 Chinese Military Smart Weapons by Submarkets Forecast 2019-2029 (US$m, Chinese Total Market Sales AGR%)

Figure 5.8 Indian Military Smart Weapons Submarkets AGR Forecast 2019-2029 (AGR%)

Figure 5.9 Indian Military Smart Weapons by Submarkets Forecast 2019-2029 (US$m, Indian Total Market Sales AGR%)

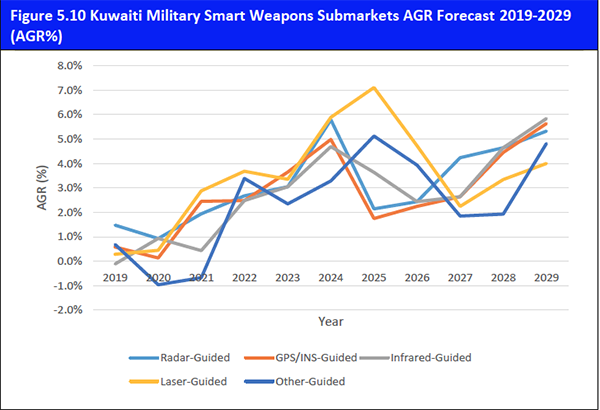

Figure 5.10 Kuwaiti Military Smart Weapons Submarkets AGR Forecast 2019-2029 (AGR%)

Figure 5.11 Kuwaiti Military Smart Weapons by Submarkets Forecast 2019-2029 (US$m, Kuwaiti Total Market Sales AGR%)

Figure 5.12 Qatari Military Smart Weapons Submarkets AGR Forecast 2019-2029 (AGR%)

Figure 5.13 Qatari Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, Qatari Total Market Sales AGR%)

Figure 5.14 Russian Military Smart Weapons Submarkets AGR Forecast 2019-2029 (AGR%)

Figure 5.15 Russian Military Smart Weapons by Submarkets Forecast 2019-2029 (US$m, Russian Total Market Sales AGR%)

Figure 5.16 Saudi Arabian Military Smart Weapons Submarkets AGR Forecast 2019-2029 (AGR%)

Figure 5.17 Saudi Arabian Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, Saudi Arabian Total Market Sales AGR%)

Figure 5.18 South Korean Military Smart Weapons Submarkets AGR Forecast 2019-2029 (AGR%)

Figure 5.19 South Korean Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, South Korean Total Market Sales AGR%)

Figure 5.20 UAE Military Smart Weapons Submarkets AGR Forecast 2019-2029 (AGR%)

Figure 5.21 UAE Military Smart Weapons by Submarkets Forecast 2019-2029 (US$m, UAE Total Market Sales AGR%)

Figure 5.22 United Kingdom Military Smart Weapons Submarkets AGR Forecast 2019-2029 (AGR%)

Figure 5.23 United Kingdom Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, United Kingdom Total Market Sales AGR%)

Figure 5.24 United States Military Smart Weapons Submarkets AGR Forecast 2019-2029 (AGR%)

Figure 5.25 United States Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, United States Total Market Sales AGR%)

Figure 5.26 Rest of the World Military Smart Weapons Submarkets AGR Forecast 2019-2029 (AGR%)

Figure 5.27 Rest of the World Military Smart Weapons Market by Submarkets Forecast 2019-2029 (US$m, Rest of the World Total Market Sales AGR%)

Figure 7.1 Leading 8 Military Smart Weapons Companies FY2017 Sales in the Market (US$m)

Figure 7.2 Boeing Total Company Sales 2013-2017 (US$m, AGR%)

Figure 7.3 Boeing Net Income 2013-2017 (US$m, AGR%)

Figure 7.4 The Boeing Company Sales Share by Business Segment 2017

Figure 7.5 Boeing Primary International Operations 2018

Figure 7.6 The Boeing Company Sales Share by Geographical Location 2017 (% share)

Figure 7.7 Boeing Organisational Structure 2018

Figure 7.8 Boeing Primary Market Competitors 2019

Figure 7.9 General Dynamics Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Figure 7.10 General Dynamics Corporation Sales by Segment of Business 2013-2017 (US$m)

Figure 7.11 General Dynamics Corporation Net Income 2013-2017 (US$m, AGR%)

Figure 7.12 General Dynamics Corporation Primary International Operations 2018

Figure 7.13 General Dynamics Corporation Sales by Geographical Location 2013-2017 (US$m)

Figure 7.14 General Dynamics Corporation Organisational Structure 2018

Figure 7.15 General Dynamics Corporation Primary Market Competitors 2019

Figure 7.16 Kongsberg Gruppen Total Company Sales 2013-2017 (US$m, AGR%)

Figure 7.17 Kongsberg Gruppen Net Income 2013-2017 (US$m, AGR%)

Figure 7.18 Kongsberg Gruppen Sales by Segment of Business 2017 (US$m)

Figure 7.19 Kongsberg Gruppen Primary International Operations 2018

Figure 7.20 Kongsberg Gruppen Sales by Geographical Location 2017 (US$m)

Figure 7.21 Kongsberg Gruppen Organisational Structure 2018

Figure 7.22 Kongsberg Gruppen Primary Market Competitors 2019

Table 7.26 Selected Recent Lockheed Martin Military Smart Weapons Contracts / Projects / Programmes 2011-2018 (Date, Country, Value US$m, Details)

Figure 7.23 Lockheed Martin Total Company Sales 2013-2017 (US$m, AGR%)

Figure 7.24 Lockheed Martin Net Income 2013-2017 (US$m, AGR%)

Figure 7.25 Lockheed Martin Corporation Sales Share by Business Segment 2017

Figure 7.26 Lockheed Martin Primary International Operations 2018

Figure 7.27 Lockheed Martin Corporation Sales Share by Geographical Location 2017

Figure 7.28 Lockheed Martin Organisational Structure 2018

Figure 7.29 Lockheed Martin Primary Market Competitors 2019

Figure 7.30 MBDA Primary International Operations 2018

Figure 7.31 MBDA Primary Market Competitors 2019

Figure 7.32 BAE Systems Total Company Sales 2013-2017 (US$m, AGR%)

Figure 7.33 BAE Systems Sales by Segment of Business 2013-2017 (US$m)

Figure 7.34 BAE Systems Net Income 2013-2017 (US$m, AGR%)

Figure 7.35 BAE Systems Primary International Operations 2018

Figure 7.36 BAE Systems Sales by Geographical Location 2013-2017 (US$m)

Figure 7.37 BAE Systems Organisational Structure 2018

Figure 7.38 BAE Systems Primary Market Competitors 2019

Figure 7.39 Raytheon Total Company Sales 2013-2017 (US$m, AGR%)

Figure 7.40 Raytheon Net Income 2013-2017 (US$m, AGR%)

Figure 7.41 Raytheon Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 7.42 Raytheon Primary International Operations 2018

Figure 7.43 Raytheon Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR%)

Figure 7.44 Raytheon Organisational Structure 2018

Figure 7.45 Raytheon Primary Market Competitors 2019

Figure 7.46 Textron Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Figure 7.47 Textron Inc. Net Income 2013-2017 (US$m, AGR%)

Figure 7.48 Textron Inc. Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 7.49 Textron Inc. Primary International Operations 2018

Figure 7.50 Textron Inc. Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR%)

Figure 7.51 Textron Inc. Organisational Structure 2018

Figure 7.52 Textron Inc. Primary Market Competitors 2019

Figure 7.74 Northrop Grumman Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Figure 7.75 Northrop Grumman Corporation Sales by Segment of Business 2013-2017 (US$m)

Figure 7.76 Northrop Grumman Corporation Net Income 2013-2017 (US$m, AGR%)

Figure 7.77 Northrop Grumman Corporation Primary International Operations 2018

Figure 7.78 Northrop Grumman Corporation Sales by Geographical Location 2013-2018 (US$m)

Figure 7.79 Northrop Grumman Corporation Organisational Structure 2018

Figure 7.80 Northrop Grumman Corporation Primary Market Competitors 2019

Figure 7.81 Denel SOC Ltd Total Company Sales 2011-2015 (US$m, AGR%)

Figure 7.82 Denel SOC Ltd Sales by Segment Share (%) of Business 2017 (%)

Figure 7.83 Denel SOC Ltd Primary International Operations 2018

Figure 7.84 Denel SOC Ltd Organisational Structure 2018

Figure 7.85 Denel SOC Ltd Primary Market Competitors 2019

Figure 7.86 L-3 Technologies Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Figure 7.87 L-3 Technologies Inc. Sales by Segment of Business 2013-2017 (US$m)

Figure 7.88 L-3 Technologies Inc. Net Income 2013-2017 (US$m, AGR%)

Figure 7.89 L-3 Technologies Inc. Primary International Operations 2018

Figure 7.90 L-3 Technologies Inc. Sales by Geographical Location 2013-2017 (US$m)

Figure 7.91 L-3 Technologies Inc. Organisational Structure 2018

Figure 7.92 L-3 Technologies Inc. Primary Market Competitors 2019

Figure 7.93 Saab AB Total Company Sales 2013-2017 (US$m, AGR%)

Figure 7.94 Saab AB Sales by Segment of Business 2013-2017 (US$m)

Figure 7.95 Saab AB Net Income 2013-2017 (US$m, AGR%)

Figure 7.96 Saab AB Primary International Operations 2018

Figure 7.97 Saab AB Sales by Geographical Location 2013-2017 (US$m)

Figure 7.98 Saab AB Organisational Structure 2018

Figure 7.99 Saab AB Primary Market Competitors 2019

Aeroguard Company Ltd

Aerojet Rocketdyne

AeroVironment

AgustaWestland

Airbus Defense & Space

Akendenic Guvenlik Hizmetleri

Al Fatten Ship Industry

Almaz Central Design Bureau

American Eurocopter Corporation

American Science & Engineering Inc

Ares Shipyard

Aselsan

Ashgal

Asia Global Technologies (AGT) International

Austral

Automotive Robotic Industry

Aware

BAE Systems Plc

Bart & Associates

Bharat Dynamics Limited

Bharat Electronics

Blighter Surveillance Systems

BlueBird

Boeing

Bollinger Shipyards

Brahmos Aerospace Private Limited

Bundesdruckerei GmbH

CACI International

Capita PLC

China Aerospace Corporation (CASC)

China Aerospace Science and Industry Corporation (CASIC)

Cisco Systems Inc

CIST

Cobham Plc

Cochin Shipyard

Computer Sciences Corporation (CSC)

CrossMatch Technologies

CTSC, LLC

Daebo Communication & Systems

Damen Shipyards

Dassault

Defense Support Services LLC

DefenSoft

Diehl Stiftung GmbH

Digital Receiver Technology, Inc

eGlobalTech

Embraer SA

Enics Kazan

Etihad Ship Building

Eurosam GIE

Foster & Freeman

G4S Secure Solutions US Inc

Garda Security Screening Inc

GEM Elettronica

Gemalto

General Atomics

Global RadioData Communications (GRC)

Goa Shipyard Limited

Griffon Hoverwork

GSKB Almaz-Antey

Havelsan

Hellfire LLC

Hewlett Packard

Huntington Ingalls Industries

Hydroid

Hytera

IAI

Icx Technologies

InfoPro

InfoZen

IntelliCam LLC

International Business Machines (IBM)

Inuktun US LLC

ITS Corporation

Izhmash JSC

KBP Instrument Design Bureau

Kellog Brown & Root

L3

Leidos Holdings Inc

Lumidign

Lürssen Shipyard

Makeyev Rocket Design Bureau

ManTech

Mectron SA

Mitsubishi Heavy Industries

Nautic Africa

Naykar Makina

Nexter Group

NORINCO

Northrop Grumman Corporation

NPO Mashinostroyeniya

OnTrack Innovations Ltd.

Oshkosh

Outerlink Global Solutions

PIT-RADWAR

Poly Group

QinetiQ Group PLC

Rafael Advanced Defense Systems

Rapiscan Systems

ReconRobotics

Rheinmetall

Rostec Corporation

Russian Helicopters

Saab Group

Safran Group

Salem Technologies

Schiebel

Scientific Systems Co. Inc.

Seaspan

Sierra Nevada Corporation (SNC)

Signalis

SRC Inc

STX Offshore & Shipbuilding Co.

Tactical Missiles Corporation JSC

Tawazun Dynamics

Teledyne Scientific & Imaging, LLC

Telstra

Thales Group

Tula Arms Plant

Vision Box

Download sample pages

Complete the form below to download your free sample pages for Military Smart Weapons Market Report 2019-2029

Related reports

-

Military Unmanned Aerial Vehicle (UAV) Market Report 2018-2028

The global Military Unmanned Aerial Vehicle (UAV) market consists of worldwide government spending on the procurement and development of Military...

Full DetailsPublished: 31 August 2018 -

Leading 20 Electronic Warfare Companies 2018

The top 20 electronic warfare companies report consists of in-depth analysis of top companies involved in the electronic warfare spectrum....Full DetailsPublished: 31 August 2018 -

Unmanned Combat Aerial Vehicle (UCAV) Market Report 2018-2028

The global Unmanned Combat Aerial Vehicle Systems market consists of worldwide government spending on the procurement, development, and upgrades of...

Full DetailsPublished: 29 March 2018 -

Military Airborne Intelligence, Surveillance & Reconnaissance (ISR) Technologies Market 2019-2029

Visiongain expects the Airborne ISR market to generate sales of USD 30.6 billion in 2019 and estimates that this figure...Full DetailsPublished: 30 September 2019 -

Next Generation Cyber Security Market Report 2018-2028

The latest report from business intelligence provider visiongain assesses that the global Next Generation Cyber Security market is expected to...

Full DetailsPublished: 21 August 2018 -

Autonomous Weapons Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Autonomous Weapons market. Visiongain assesses that...Full DetailsPublished: 21 August 2018 -

Military Aircraft Maintenance, Repair & Overhaul (MRO) Market Report 2019-2029

Maintenance, Repair and Overhaul capabilities are a key part of the defence sector and play an especially crucial role for...Full DetailsPublished: 07 November 2018 -

Top 20 Air and Missile Defence System (AMDS) Companies 2019

The market for ADMS market is expected to be valued US$14,221.9 million in 2019 and US$27,205.7 million by 2029, at...

Full DetailsPublished: 30 April 2019 -

Air Traffic Control Training Simulator Market Report 2020-2030

Where is the air traffic control training simulator market heading? If you are involved in this sector you must read...Full DetailsPublished: 25 November 2019 -

Electronic Warfare (EW) Market Report 2019-2029

The recent developments in electronic warfare systems in defence platforms and systems, has led Visiongain to publish this timey report....

Full DetailsPublished: 26 March 2019

Download sample pages

Complete the form below to download your free sample pages for Military Smart Weapons Market Report 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain defence reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible, Visiongain analysts reach out to market-leading vendors and industry experts and review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain defence reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

ADS Group

Aerial Refueling Systems Advisory Group

Aerospace and Defence Industries Association of Nova Scotia

Aerospace Industries Association

Aerospace Industries Association of Canada

AHS International – The Vertical Flight Technical Society

Air Force Association

Aircraft Electronics Association

Airlift/Tanker Association

American Astronautical Society

American Gear Manufacturers Association

American Institute of Aeronautics and Astronautics

American Logistics Association

American Society of Naval Engineers

AMSUS – The Society of the Federal Health Agencies

Armed Forces Communications and Electronics Association

Armed Forces Communications and Electronics Association

Army Aviation Association of America

ASD – Aerospace & Defence Association of Europe

Association for Unmanned Vehicle Systems International

Association of Aviation Manufacturers of the Czech Republic

Association of Naval Aviation

Association of Old Crows

Association of Polish Aviation Industry

Association of the Defense Industry of the Czech Republic

Association of the United States Army

Association of the United States Navy

Australia Defence Association

Australian Industry & Defence Network

Australian Industry Group Defence Council

Austrian Aeronautics Industries Group

Aviation Distributors and Manufacturers Association

Aviation Suppliers Association

Belgian Security and Defence Industry

Bulgarian Defence Industry Association

Business Executives for National Security

Canadian Association of Defence and Security Industries

Conference of Defense Associations

Council of Defense and Space Industry Associations

Danish Defence & Security Industries Association

Defence Industry Manufacturers Association

Defense Industry Initiative on Business Ethics and Conduct

Defense Industry Offset Association

Defense Orientation Conference Association

Deutsche Gesellschaft fur Wehrtechnik

Federal Association of the German Security and Defence Industry

Federation of Aerospace Enterprises in Ireland

French Aerospace Industries Association

French Land Defence Manufacturers Association (GICAT)

German Aerospace Industries Association

Helicopter Association International

Hellenic Aerospace & Defense Industries Group

Homeland Security & Defense Business Council

International Stability Operations Association

Japan Association of Defense Industry

Korea Defense Industry Association

Marine Corps Association & Foundation

National Aeronautic Association

National Association of Ordnance and Explosive Waste Contractors

National Defense Industrial Association

National Defense Transportation Association

National Guard Association of the U.S.

Navy League of the United States

Netherlands Aerospace Group

New Zealand Defence Industry Association

Portuguese Association of Defense Related Industries & New Technologies Companies

Québec Ground Transportation Cluster

Satellite Industry Association

Society of American Military Engineers

South African Aerospace Maritime and Defence Industries Association

Spanish Aerospace and Defence Association Industries

Submarine Industrial Base Council

Swedish Aerospace Industries

Swedish Security and Defence Industry Association

Swiss Aeronautical Industries Group

The Association of Finnish Defence and Aerospace Industries

The Italian Industries Association for Aerospace Systems and Defence

The Netherlands Defence Manufacturers Association

The Society of Japanese Aerospace Companies

UK AeroSpace, Defence & Security Industries

United Kingdom National Defence Association

Latest Defence news

Visiongain Publishes Directed Energy Weapons (DEW) Market Report 2024-2034

The global Directed Energy Weapons (DEW) market was valued at US$6.4 billion in 2023 and is projected to grow at a CAGR of 19.6% during the forecast period 2024-2034.

26 February 2024

Visiongain Publishes Military Embedded Satellite Systems Market Report 2024-2034

The global Military Embedded Satellite Systems market is projected to grow at a CAGR of 8.7% by 2034

21 February 2024

Visiongain Publishes Military Simulation, Modelling and Virtual Training Market Report 2024-2034

The global military simulation, modelling and virtual training market was valued at US$13.2 billion in 2023 and is projected to grow at a CAGR of 8.3% during the forecast period 2024-2034.

15 February 2024

Visiongain Publishes Military Armoured Vehicle Market Report 2024-2034

The global Military Armoured Vehicle market was valued at US$36,123.6 million in 2023 and is projected to grow at a CAGR of 3.6% during the forecast period 2024-2034.

07 February 2024