Industries > Defence > Electronic Warfare (EW) Market Report 2019-2029

Electronic Warfare (EW) Market Report 2019-2029

Forecasts by Category (Electronc Support (ES), Electronic Attack (EA), Electronic Protection (EP)), by Platform (Air, Ground, Naval, Unmanned), Including Products (Jammers, Integrated Suits, Radar Warning Receivers, Directed Energy, Direction Finders, DIRCM, Airborne Decoys, Antennas), Covering Portable Systems (Radio Frequency Jammers, RCIED Jammers, Vehicle Self Protection System, Direction Finding System, COMINT & ELINT System, EW System)

• Do you need definitive global electronic warfare market data?

• Succinct electronic warfare market analysis?

• Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive report can transform your own research and save you time.

The recent developments in electronic warfare systems in defence platforms and systems, has led Visiongain to publish this timey report. The $ 23 billion electronic warfare is expected to flourish in the next few years because of EA research and development by Russia and China and impact on the U.S. Market, increased demand for improved EA relating to Counter-Insurgency. Additionally, integration of Artificial Intelligence (AI) within ES platforms will drive growth in different submarkets. If you want to be part of this growing industry, then read on to discover how you can maximise your investment potential.

Report highlights

• 443 pages, 225 tables, and 239 figures

• Analysis of key players in electronic warfare market

• BAE Systems

• Boeing

• Cobham plc

• Cohort plc

• Northrop Grumman

• Elbit Systems Ltd

• Leonardo S.P.A

• Harris Corporation

• L3 Technologies

• Lockheed Martin

• Raytheon

• Textron Inc.

• Airbus

• Global electronic warfare market outlook and analysis from 2019-2029

• Electronic warfare forecasts and analysis from 2019-2029

• Category segment includes electronic support, electronic attack and electronic protection.

• Platform segment includes ground, naval, air and unmanned

• Product segment includes jammers, integrated suites, radar warning receivers, directed energy, direction finders, DIRCM, airborne decoys, antennas and others

• Portable system segment includes radio frequency jammer, RCIED jammer, vehicle self-protection, direction finding system, COMINT and ELINT system, Strategic/ Fixed Electronic Warfare System

• Regional electronic warfare market forecasts from 2019-2029

• North America forecast 2019-2029

• Asia Pacific forecast 2019-2029

• Europe forecast 2019-2029

• Middle East forecast 2019-2029

• Latin America forecast 2019-2029

• Africa forecast 2019-2029

• Key questions answered

• What does the future hold for the electronic warfare industry?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to success and why?

• What business models should you adopt?

• What industry trends should you be aware of?

• Target audience

• Leading EW system companies

• Suppliers

• Contractors

• Technologists

• R&D staff

• Consultants

• Analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

• Industry organizations

• Banks

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Electronic Warfare Market Overview

1.2 Global Electronic Warfare Market Segmentation

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Secondary Research

1.7.2 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Electronic Warfare Market

2.1 Global Electronic Warfare Market Structure

2.2 Electronic Warfare Market Definition

2.3 Electronic Attack (EA) Submarket Definition

2.3.1 Radar Jamming and Deception

2.3.2 Anti-Radiation Missiles (ARM)

2.3.3 Directed Energy Weapons (DEWs)

2.3.4 Electromagnetic Pulses (EMP)

2.3.5 Directed Infrared Countermeasures (DIRCMs)

2.3.6 Active Decoys

2.3.7 Towed Decoy Systems

2.3.8 Radar Reflective Decoy Chaff

2.3.9 Infrared (IR) Flare Dispensers

2.4 Electronic Protection (EP) Submarket Definition

2.4.1 Electromagnetic Hardening

2.4.2 Emission Control (EMCON)

2.4.3 Spectrum Management

2.4.4 Wartime Reserve Modes (WARM)

2.5 Electronic Support (ES) Submarket Definition

2.5.1 Electronic Intelligence (ELINT)

2.5.2 Radar Warning Receivers (RWRs)

2.5.3 Laser Warning Receivers (LWRs)

2.5.4 Electronics Security

2.5.5 Electronic Warfare Education and Training

2.5.6 Electronic Warfare Testers

3. Global Electronic Warfare Market 2019-2029

3.1 Global Electronic Warfare Market Forecast 2019-2029

3.2 Global Electronic Warfare Drivers & Restraints 2019

3.3. Global Electronic Warfare Market Drivers 2019

3.3.1 EA Research and Development by Russia and China and impact on the U.S. Market

3.3.2 Increased Demand for Improved EA Relating to Counter-Insurgency

3.3.3 New Long Range Strike-Bomber (LRSB) Announced by U.S. Air Force

3.3.4 Military Strategists are Seeing the Utility of UAV’s in EA

3.3.5 Introduction and proliferation of Gallium Nitride

3.3.6 The Next Generation Jammer (NGJ)

3.3.7 Growing Demand for EW Capabilities within Civilian Markets

3.3.8 Surface Electronic Warfare Improvement Program (SEWIP)

3.3.9 The Integration of Artificial Intelligence (AI) within ES Platforms

3.3.10 Russia’s focus on Military Modernization and EW Assets

3.4 Global Electronic Warfare Market Restraints 2019

3.4.1 Cyber Warfare Capabilities are Becoming as Effective as EA Capabilities

3.4.2 Defence Budgets in a Number of Countries Have Been Constrained by Austerity

3.4.3 Western Forces’ Withdrawal from Afghanistan, Iraq and the Middle East Generally

3.4.4 High Technological Barriers for Entry

4. Global Electronic Warfare Category Submarket Forecast 2019-2029

4.1 Global Electronic Warfare Electronic Support Submarket Forecast 2019-2029

4.1.1 Global Electronic Warfare Electronic Support Market Submarket

4.1.2 Global Electronic Warfare SIGINT Submarket

4.1.3 Global Electronic Warfare Electronic Support Submarket Analysis

4.2 Global Electronic Warfare Electronic Attack Submarket Forecast 2019-2029

4.2.1 Global Electronic Warfare Electronic Attack Market by Submarket

4.2.2 Global Electronic Warfare Electronic Attack Jamming Market by Submarket

4.2.3 Global Electronic Warfare Electronic Attack Submarket Analysis

4.3 Global Electronic Warfare Electronic Protection Submarket Forecast 2019-2029

4.3.1 Global Electronic Warfare Electronic Protection Market by Submarket

4.3.2 Global Electronic Warfare Electronic Protection Analysis

5. Global Electronic Warfare Platform Submarket Forecast 2019-2029

5.1 Global Electronic Warfare Ground Platform Submarket Forecast 2019-2029

5.1.1 Global Electronic Warfare Ground Platform Market Analysis

5.2 Global Electronic Warfare Air Platform Market Forecast 2019-2029

5.2.1 Global Electronic Warfare Air Platform Market Analysis

5.3 Global Electronic Warfare Naval Platform Market Forecast 2019-2029

5.3.1 Global Electronic Warfare Naval Platform Market Analysis

5.4 Global Electronic Warfare Unmanned Platform Market Forecast 2019-2029

5.4.1 Global Electronic Warfare Unmanned Platform Market Analysis

6. Global Electronic Warfare Product Submarket Forecast 2019-2029

6.1 Global Electronic Warfare Product Submarket Analysis

7. Global Electronic Warfare Portable System Submarket Forecast 2019-2029

7.1 Global Electronic Warfare Portable System Submarket Analysis

8. Leading Regional Electronic Warfare Market Forecast 2019-2029

8.1 North America Electronic Warfare Market Forecast 2019-2029

8.1.1 North America Electronic Warfare Category Submarket Forecast 2019-2029

8.1.2 North America Electronic Warfare Platform Submarket Forecast 2019-2029

8.1.3 North America Electronic Warfare Country Submarket Forecast 2019-2029

8.1.3.1 U.S. Electronic Warfare Market Forecast 2019-2029

8.1.3.2 Canada Electronic Warfare Market Forecast 2019-2029

8.1.4 North America Electronic Warfare Market Analysis

8.1.5 North America Electronic Warfare Market Drivers & Restraints

8.2 Europe Electronic Warfare Market Forecast 2019-2029

8.2.1 Europe Electronic Warfare Category Submarket Forecast 2019-2029

8.2.2 Europe Electronic Warfare Platform Submarket Forecast 2019-2029

8.2.3 Europe Electronic Warfare Country Submarket Forecast 2019-2029

8.2.3.1 U.K. Electronic Warfare Market Forecast 2019-2029

8.2.3.2 Germany Electronic Warfare Market Forecast 2019-2029

8.2.3.3 France Electronic Warfare Market Forecast 2019-2029

8.2.3.4 Russia Electronic Warfare Market Forecast 2019-2029

8.2.3.5 Italy Electronic Warfare Market Forecast 2019-2029

8.2.3.6 Turkey Electronic Warfare Market Forecast 2019-2029

8.2.3.7 Rest of Europe Electronic Warfare Market Forecast 2019-2029

8.2.4 Europe Electronic Warfare Market Analysis

8.2.5 Europe Electronic Warfare Market Drivers & Restraints

8.3 Asia Pacific Electronic Warfare Market Forecast 2019-2029

8.3.1 Asia Pacific Electronic Warfare Category Submarket Forecast 2019-2029

8.3.2 Asia Pacific Electronic Warfare Platform Submarket Forecast 2019-2029

8.3.3 Asia Pacific Electronic Warfare Country Submarket Forecast 2019-2029

8.3.3.1 China Electronic Warfare Market Forecast 2019-2029

8.3.3.2 Japan Electronic Warfare Market Forecast 2019-2029

8.3.3.3 India Electronic Warfare Market Forecast 2019-2029

8.3.3.4 South Korea Electronic Warfare Market Forecast 2019-2029

8.3.3.5 Australia Electronic Warfare Market Forecast 2019-2029

8.3.3.6 Rest of Asia Pacific Electronic Warfare Market Forecast 2019-2029

8.3.4 Asia Pacific Electronic Warfare Market Analysis

8.3.5 Asia Pacific Electronic Warfare Market Drivers & Restraints

8.4 Latin America Electronic Warfare Market Forecast 2019-2029

8.4.1 Latin America Electronic Warfare Category Submarket Forecast 2019-2029

8.4.2 Latin America Electronic Warfare Category Submarket Forecast 2019-2029

8.4.3 Latin America Electronic Warfare Country Submarket Forecast 2019-2029

8.4.3.1 Brazil Electronic Warfare Market Forecast 2019-2029

8.4.3.2 Mexico Electronic Warfare Market Forecast 2019-2029

8.4.3.3 Rest of Latin America Electronic Warfare Market Forecast 2019-2029

8.4.4 Latin America Electronic Warfare Market Analysis

8.4.5 Latin America Electronic Warfare Market Drivers & Restraints

8.5 Middle East Electronic Warfare Market Forecast 2019-2029

8.5.1 Middle East Electronic Warfare Category Submarket Forecast 2019-2029

8.5.2 Middle East Electronic Warfare Platform Submarket Forecast 2019-2029

8.5.3 Middle East Electronic Warfare Country Submarket Forecast 2019-2029

8.5.3.1 Israel Electronic Warfare Market Forecast 2019-2029

8.5.3.2 UAE Electronic Warfare Market Forecast 2019-2029

8.5.3.3 Saudi Arabia Electronic Warfare Market Forecast 2019-2029

8.5.3.4 Rest of Middle East Electronic Warfare Market Forecast 2019-2029

8.6.4 Middle East Electronic Warfare Market Analysis

8.6.5 Middle East Electronic Warfare Market Drivers & Restraints

8.6 Africa Electronic Warfare Market Forecast 2019-2029

8.6.1 Africa Electronic Warfare Category Submarket Forecast 2019-2029

8.6.2 Africa Electronic Warfare Platform Submarket Forecast 2019-2029

8.6.3 Africa Electronic Warfare Market Analysis

8.6.4 Africa Electronic Warfare Market Drivers & Restraints

9. SWOT Analysis of the Electronic Warfare Market 2019

9.1 Strengths of the EW Market

9.1.1 EW Systems Will Remain Integral to War-fighting in the Future

9.1.2 The EW Market is Driven by Security Dilemma Politics

9.1.3 EW Systems Become Outdated Quickly

9.1.4 Ongoing Insurgent Threats Increase Defence Procurement Incentive

9.1.5 EW Systems can be effortlessly installed within Many Combat Vehicles

9.1.6 Continuation of the Surface Electronic Warfare Improvement Programme (SEWIP)

9.2 Weaknesses of the EW Market

9.2.1 Active Overseas Operations in Iraq and Afghanistan have Ended

9.2.2 EW Systems Become Outdated Quickly

9.2.3 Increased Modularity will diminish the Costs of New EW Systems

9.3 Opportunities within the EW Market

9.3.1 EW Systems will be Necessary to Countering New and Emerging Threats

9.3.2 Directed Energy Weapons (DEWs)

9.3.3 New Applications of EW (UAVs)

9.3.4 Civilian Market for EW

9.3.5 Many Nations are Currently Undergoing Modernisation Programmes

9.3.6 The Integration of Artificial Intelligence (AI) into Electronic Warfare

9.4 Threats within the EW Market

9.4.1 European Defence Budgets continue to be Stretched in an Age of Austerity

9.4.2 Economic Blackswans and Downturn

9.4.3 Cyber Warfare Capabilities Perform the Same Function as EW Capabilities

10. Leading Electronic Warfare Companies

10.1 Leading Electronic Warfare Companies 2019

10.2 BAE Systems plc

10.2.1 BAE Systems plc Electronic Warfare Selected Recent Contracts / Projects / Programmes 2010-2019

10.2.2 BAE Systems plc Total Company Sales 2013-2017

10.2.3 BAE Systems, plc. Sales by Segment of Business 2013-2017

10.2.4 BAE Systems, plc. Net Income / Loss 2013-2017

10.2.5 BAE Systems, plc. Sales by Regional Segment of Business 2013-2017

10.2.6 BAE Systems plc Electronic Warfare Products / Services

10.2.7 BAE Systems plc Primary Market Competitors 2019

10.2.8 BAE Systems plc Mergers & Acquisitions (M&A) and Joint Venture Activity

10.2.9 BAE Systems plc Analysis

10.3 The Boeing Company

10.3.1 The Boeing Co. Electronic Warfare Selected Recent Contracts / Projects / Programmes 2010-2019

10.3.2 The Boeing Co. Total Company Sales 2013-2017

10.3.3 The Boeing Co. Net Income 2013-2017

10.3.4 The Boeing Company, plc. Sales by Regional Segment of Business 2013-2017

10.3.5 The Boeing Co. Sales by Segment of Business 2013-2017

10.3.6 The Boeing Co. Electronic Warfare Products / Services

10.3.7 The Boeing Co. Primary Market Competitors 2019

10.3.8 The Boeing Co. Mergers & Acquisitions (M&A) Activity

10.3.9 The Boeing Co. Analysis

10.4 Cobham plc

10.4.1 Cobham plc Electronic Warfare Selected Recent Contracts / Projects / Programmes 2010-2019

10.4.2 Cobham plc Total Company Sales 2013-2017

10.4.3 Cobham plc Sales by Segment of Business 2012-2016

10.4.4 Cobham plc Net Income / Loss 2013-2017

10.4.5.Cobham Plc Sales by Regional Segment of Business 2012-2016

10.4.6 Cobham plc Electronic Warfare Products / Services

10.4.7 Cobham plc Primary Market Competitors 2019

10.3.8 Cobham PLC Mergers & Acquisitions (M&A) and Joint Ventures

10.4.8 Cobham plc Analysis

10.5 Cohort plc

10.5.1 Cohort plc Electronic Warfare Selected Recent Contracts / Projects / Programmes 2010-2019

10.5.2 Cohort plc Total Company Sales 2013-2017

10.5.3 Cohort plc Sales by Segment of Business 2013-2016

10.5.4 Cohort plc Net Income / Loss 2013-2017

10.5.5 Cohort plc Sales by Regional Segment of Business 2013-2016

10.5.6 Cohort plc Electronic Warfare Products / Services

10.5.7 Cohort plc Primary Market Competitors 2019

10.5.8 Cohort plc Mergers & Acquisitions (M&A) and Partnership Activity

10.5.9 Cohort plc Analysis

10.6 Northrop Grumman Corporation

10.6.1 Northrop Grumman Electronic Warfare Selected Recent Contracts / Projects / Programmes 2010-2019

10.6.2 Northrop Grumman Total Company Sales 2013-2017

10.6.3 Northrop Grumman Sales by Segment of Business 2014-2017

10.6.4 Northrop Grumman Company Net Income / Loss 2013-2017

10.6.5 Northrop Grumman Sales by Regional Segment of Business 2013-2017

10.6.6 Northrop Grumman Electronic Warfare Products / Services

10.6.7 Northrop Grumman Primary Market Competitors 2019

10.6.8 Northrop Grumman Mergers & Acquisitions (M&A) and Partnership Activity

10.6.9 Northrop Grumman Analysis

10.7 Elbit Systems Ltd

10.7.1 Elbit Systems Ltd Selected Recent Contracts / Projects / Programmes 2012-2018

10.7.2 Elbit Systems Ltd Total Company Sales 2013-2017

10.7.3 Elbit Systems Ltd Net Income 2013-2017

10.7.4 Elbit Systems Ltd Sales by Segment of Business 2012-2016

10.7.5 Elbit Systems Ltd Sales by Regional Segment of Business 2012-2016

10.7.6 Elbit Systems Ltd Electronic Warfare Products / Services

10.7.7 Elbit Systems Ltd Primary Market Competitors 2018

10.7.8 Elbit Systems Ltd Mergers & Acquisitions (M&A) Activity

10.7.9 Elbit Systems Ltd Analysis

10.8 Leonardo S.p.A.

10.8.1 Leonardo S.p.A. Selected Recent Contracts / Projects / Programmes 2010-2019

10.8.2 Leonardo S.p.A. Total Company Sales 2013-2017

10.8.3 Leonardo S.p.A. Net Income 2013-2017

10.8.4 Leonardo S.p.A. Sales by Segment of Business 2013-2017

10.8.5 Leonardo SPA Sales by Regional Segment of Business 2013-2017

10.8.6 Leonardo S.p.A. Electronic Warfare Products / Services

10.8.7 Leonardo S.p.A. Primary Market Competitors 2018

10.8.8 Leonardo S.p.A. Mergers & Acquisitions (M&A) Activity

10.8.9 Leonardo S.p.A. Analysis

10.9 Harris Corporation

10.9.1 Harris Corporation Electronic Warfare Selected Recent Contracts / Projects / Programmes 2010-2018

10.9.1.1 Harris Corporation Electronic Warfare Selected Recent Contracts / Projects / Programmes 2010-2015

10.9.2 Harris Corporation Total Company Sales 2014-2018

10.9.3 Harris Corporation Net Income 2014-2018

10.9.4 Harris Corporation Sales by Segment of Business 2014-2018

10.9.5 Harris Corporation Sales by Regional Segment of Business 2014-2018 (US$m, Total Company Sales AGR %)

10.9.6 Harris Corporation Electronic Warfare Products / Services

10.9.7 Harris Corporation Primary Market Competitors 2019

10.9.8 Harris Corporation Mergers & Acquisitions (M&A) and Partnership Activity

10.9.9 Harris Corporation Analysis

10.10 L3 Technologies, Inc.

10.10.1 L3 Technologies, Inc. Selected Recent Contracts / Projects /Programmes 2010-2018

10.10.2 L3 Technologies, Inc. Total Company Sales 2014-2018

10.10.3 L3 Technologies, Inc. Net Income 2014-2018

10.10.5 L3 Technologies, Inc. Electronic Warfare Products / Services

10.10.6 L3 Technologies, Inc. Primary Market Competitors 2019

10.10.7 L3 Technologies, Inc. Mergers & Acquisitions (M&A) Activity

10.10.8 L3 Technologies, Inc. Analysis

10.11 Lockheed Martin Corporation

10.11.1 Lockheed Martin Electronic Warfare Selected Recent Contracts / Projects / Programmes 2010-2019

10.11.2 Lockheed Martin Total Company Sales 2013-2017

10.11.3 Lockheed Martin Net Income 2013-2017

10.11.4 Lockheed Martin Sales by Segment of Business 2013-2017

10.11.5 Lockheed Martin Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

10.11.6 Lockheed Martin Electronic Warfare Products / Services

10.11.7 Lockheed Martin Primary Market Competitors 2018

10.11.8 Lockheed Martin Mergers & Acquisitions (M&A) Activity

10.11.9 Lockheed Martin Analysis

10.12 Raytheon Company

10.12.1 Raytheon Company Electronic Warfare Selected Recent Contracts / Projects / Programmes 2012-2019

10.12.2 Raytheon Total Company Sales 2013-2017

10.12.3 Raytheon Net Income 2013-2017

10.12.4 Raytheon Sales by Segment of Business 2013-2017

10.12.5 Raytheon Regional Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

10.12.6 Raytheon Electronic Warfare Products / Services

10.12.7 Raytheon Primary Market Competitors 2019

10.12.8 Raytheon Mergers & Acquisitions (M&A) Activity

10.12.9 Raytheon Analysis

10.13 Textron Inc.

10.13.1 Textron Inc. Selected Recent Contracts / Projects / Programmes 2012-2017

10.13.2 Textron Inc. Total Company Sales 2014-2018

10.13.3 Textron Inc. Net Income 2014-2018

10.13.4 Textron Inc. Sales by Segment of Business 2014-2018

10.13.5 Textron Inc. Sales by Regional Segment of Business 2014-2018 (US$m, Total Company Sales AGR %)

10.13.6 Textron Inc. Electronic Warfare Products / Services

10.13.7 Textron Inc. Primary Market Competitors 2019

10.13.8 Textron Inc. Mergers & Acquisitions (M&A) Activity

10.13.9 Textron Inc. Analysis

10.14 Airbus Group SE

10.14.1 Airbus Group SE Electronic Warfare Selected Recent Contracts / Projects / Programmes 2014-2018

10.14.2 Airbus Group SE Total Company Sales 2014-2018

10.14.3 Airbus Group SE Sales by Segment of Business 2014-2018

10.14.4 Airbus Group SE Company Net Income / Loss 2014-2018

10.14.5 Airbus Group SE Sales by Regional Segment of Business 2014-2018

10.14.6 Airbus Group SE Electronic Warfare Products / Services

10.14.7 Airbus Group SE Primary Market Competitors 2019

10.14.8 Airbus Group SE Divestiture Activity

10.14.9 Airbus Group SE Analysis

10.15 General Dynamics Corporation

10.15.1 General Dynamics Corporation Electronic Warfare Selected Recent Contracts / Projects / Programmes 2016-2019

10.15.2 General Dynamics Corporation Total Company Sales 2013-2017

10.15.3 General Dynamics Corporation Sales by Segment of Business 2013-2017

10.15.4 General Dynamics Corporation Company Net Income / Loss 2013-2017

10.15.5 General Dynamics Corporation Sales by Regional Segment of Business 2013-2017

10.15.6 General Dynamics Corporation Electronic Warfare Products / Services

10.15.7 General Dynamics Corporation Primary Market Competitors 2019

10.15.8 General Dynamics Corporation Mergers & Acquisitions (M&A) Activity

10.15.9 General Dynamics Corporation Analysis

10.16 Rockwell Collins, Inc.

10.16.1 Rockwell Collins, Inc. Electronic Warfare Selected Recent Contracts / Projects / Programmes 2013-2018

10.16.2 Rockwell Collins, Inc. Total Company Sales 2013-2017

10.16.3 Rockwell Collins, Inc. Sales by Segment of Business 2013-2017

10.16.4 Rockwell Collins, Inc. Company Net Income / Loss 2013-2017

10.16.5 Rockwell Collins, Inc. Sales by Regional Segment of Business 2013-2017

10.16.6 Rockwell Collins, Inc. Electronic Warfare Products / Services

10.16.7 Rockwell Collins, Inc. Primary Market Competitors 2019

10.16.8 Rockwell Collins, Inc. Mergers & Acquisitions (M&A) Activity

10.16.9 Rockwell Collins, Inc. Analysis

10.17 Leidos

10.17.1 Leidos Electronic Warfare Selected Recent Contracts / Projects / Programmes 2017-2019

10.17.2 Leidos Total Company Sales 2014-2018

10.17.3 Leidos Net Income / Loss 2014-2018

10.17.4 Leidos Sales by Segment of Business 2016-2018

10.17.5 Leidos Analysis

10.18 Israel Aerospace Industries

10.18.1 Israel Aerospace Industries Electronic Warfare Selected Recent Contracts / Projects / Programmes 2017-2018

10.18.2 Israel Aerospace Industries Total Company Sales 2013-2017

10.18.3 Israel Aerospace Industries Net Income / Loss 2013-2017

10.18.4 Israel Aerospace Industries Sales by Regional Segment of Business 2011-2013

10.18.5 Israel Aerospace Industries Future Outlook

10.19 Thales SA

10.19.1 Thales Electronic Warfare Selected Recent Contracts / Projects / Programmes 2016-2018

10.19.2 Thales Group Total Company Sales 2014-2018

10.19.3 Thales Group Sales by Segment of Business 2014-2018

10.19.4 Thales Group Net Income / Loss 2014-2018

10.19.5 Thales Group Sales by Geographical Regional 2014-2018

10.19.6 Thales Mergers & Acquisitions (M&A) Activity

10.19.7 Thales Group Future Outlook

10.20 QinetiQ

10.20.1 QinetiQ Total Company Sales 2014-2018

10.20.2 QinetiQ Sales by Segment of Business 2014-2018

10.20.3 QinetiQ Net Income / Loss 2017-2018

10.20.4 QinetiQ Sales by Regional Segment of Business 2014-2018

10.20.5 Qinetiq Mergers & Acquisitions (M&A) Activity

10.20.6 Qinetiq Analysis

10.21 Hensoldt

10.21.1 Hensoldt Electronic Warfare Selected Recent Contracts / Projects / Programmes 2018-2019

10.21.2 Hensoldt Electronic Warfare Products / Services

10.21.3 Hensoldt Mergers & Acquisitions (M&A) and Joint Venture Activity

10.21.4 Hensoldt Analysis

10.22 Rohde & Schwarz

10.22.1 Rohdes & Schwarz Warfare Products / Services

10.2.2 Rohde & Schwarz Analysis

11. Conclusions and Recommendations

12. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 3.1 Global Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 3.2 Global Electronic Warfare Market Drivers & Restraints 2019

Table 4.1 Global Electronic Warfare Submarket Forecast 2019-2029 (US$m, AGR%, Cumulative)

Table 4.2 Global Electronic Warfare Submarket CAGR Forecast 2019-24, 2024-29, 2019-29 (CAGR%)

Table 4.3 Global Electronic Warfare Electronic Support Submarket by Regional Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 4.4 Global Electronic Support Market by Submarket Forecast 2019-2029 (US$m, AGR%, Cumulative)

Table 4.5 Global Electronic Support Market SIGINT Market by Submarket Forecast 2019-2029 (US$m, AGR%, Cumulative)

Table 4.6 Global Electronic Warfare Electronic Attack Submarket by Regional Market Forecast 2019-2029 (US$m, AGR%, Cumulative)

Table 4.7 Global Electronic Attack Market by Submarket Forecast 2019-2029 (US$m, AGR%, Cumulative)

Table 4.8 Global Electronic Attack Jamming Market by Submarket Forecast 2019-2029 (US$m, AGR%, Cumulative)

Table 4.9 Global Electronic Warfare Electronic Protection Submarket by Regional Market Forecast 2019-2029 (US$m, AGR%, Cumulative)

Table 4.10 Global Electronic Protection Market by Submarket Forecast 2019-2029 (US$m, AGR%, Cumulative)

Table 5.1 Global Electronic Warfare by Platform Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 5.2 Global Electronic Warfare Submarket CAGR Forecast 2019-24, 2024-29, 2019-29 (CAGR %)

Table 5.3 Global Electronic Warfare Ground Platform Submarket by Regional Market Forecast 2019-2029 (US$m, AGR%, Cumulative)

Table 5.4 Global Electronic Warfare Air Platform Market by Regional Market Forecast 2019-2029 (US$m, AGR%, Cumulative)

Table 5.5 Global Electronic Warfare Naval Platform Market by Regional Market Forecast 2019-2029 (US$m, AGR%, Cumulative)

Table 5.6 Global Electronic Warfare Unmanned Platform Market by Regional Market Forecast 2019-2029 (US$m, AGR%, Cumulative)

Table 6.1 Global Electronic Warfare by Product Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 6.2 Global Electronic Warfare Product Submarket CAGR Forecast 2019-24, 2024-29, 2019-29 (CAGR%)

Table 7.1 Global Electronic Warfare by Portable System Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 7.2 Global Electronic Warfare Portable System Submarket CAGR Forecast 2019-24, 2024-29, 2019-29 (CAGR%)

Table 8.1 Leading Regional Electronic Warfare Market by Category Market Forecast 2019-2029 (US$m, Global AGR%, Cumulative)

Table 8.2 North America Electronic Warfare Market by Category Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 8.3 North America Electronic Warfare Market By Platform Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 8.4 North America Electronic Warfare Market By Country Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 8.5 U.S. Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.6 Canada Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.7 North America Electronic Warfare Market Drivers & Restraints 2018

Table 8.8 Europe Electronic Warfare Market by Category Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 8.9 Europe Electronic Warfare Market By Platform Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 8.10 Europe Electronic Warfare Market By Country Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 8.11 U.K. Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.12 Germany Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.13 France Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.14 Russia Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.15 Italy Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.16 Turkey Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.17 Rest of Europe Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.18 Europe Electronic Warfare Market Drivers & Restraints 2019

Table 8.19 Asia Pacific Electronic Warfare Market by Category Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 8.21 Asia Pacific Electronic Warfare Market By Country Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 8.22 China Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.23 Japan Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.24 India Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.25 South Korea Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.26 Australia Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.27 Australia Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.29 Latin America Electronic Warfare Market by Category Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 8.30 Latin America Electronic Warfare Market By Platform Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 8.31 Latin America Electronic Warfare Market By Country Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 8.32 Brazil Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.33 Mexico Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.34 Rest of Latin America Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.35 North America Electronic Warfare Market Drivers & Restraints 2019

Table 8.36 Middle East Electronic Warfare Market by Category Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 8.37 Middle East Electronic Warfare Market By Platform Market Forecast 2019-2029 (US$m, AGR %, CAGR%, Cumulative)

Table 8.38 Middle East Electronic Warfare Market By Country Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 8.39 Israel Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.40 UAE Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.41 Saudi Arabi Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.42 Rest of Middle East Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%, CAGR%, Cumulative)

Table 8.43 Middle East Electronic Warfare Market Drivers & Restraints 2019

Table 8.44 Africa Electronic Warfare Market by Category Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 8.45 Africa Electronic Warfare Market By Platform Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 8.46 Africa Electronic Warfare Market Drivers & Restraints 2019

Table 9.1 Global Electronic Warfare Market SWOT Analysis 2019

Table 10.1 Leading Electronic Warfare Companies Listed (Company, HQ, Primary Submarket Specialisation)

Table 10.2 BAE Systems plc Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 10.3 Selected Recent BAE Systems plc Electronic Warfare Contracts / Projects / Programmes 2010-2019 (Date, Country, Contractor, Value US$m, Product, Details)

Table 10.4 BAE Systems plc Total Company Sales 2013-2017 (US$m, AGR%)

Table 10.5 BAE Systems, plc. Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 10.6 BAE Systems, plc. Net Income / Loss 2013-2017 (US$m, AGR %)

Table 10.7 BAE Systems, plc. Sales by Regional Segment of Business 2012-2016 (US$m, AGR %)

Table 10.8 BAE Systems plc Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.9 BAE Systems plc Mergers and Acquisitions and Joint Ventures 2008-2019 (Date, Company Involved, Value US$m, Details)

Table 10.10 BAE Systems plc Divestitures 2011-2015 (Date, Company Involved, Value US$m, Details)

Table 10.11 The Boeing Co. Profile 2019 (CEO, Total Company Sales US$m, Sales in the Market US$m, Net Income US$m, US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 10.12 Selected Recent Boeing Co. Electronic Warfare Contracts / Projects / Programmes 2010-2019 (Date, Country, Contractor, Value US$m, Product, Details)

Table 10.13 Boeing Total Company Sales 2013-2017 (US$m, AGR%)

Table 10.14 The Boeing Co. Net Income 2013-2017 (US$m, AGR%)

Table 10.15 The Boeing Company, Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 10.16 The Boeing Co. Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 10.17 The Boeing Co. Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.18 The Boeing Co. Mergers and Acquisitions 2008-2011 (Date, Company Involved, Value US$m, Details)

Table 10.19 The Boeing Co. Divestitures 2014 (Date, Company Involved, Details)

Table 10.20 Cobham plc Profile 2019 (CEO, Total Company Sales US$m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 10.21 Selected Recent Cobham plc Electronic Warfare Contracts / Projects / Programmes 2010-2019 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 10.22 Cobham plc Total Company Sales 2013-2017 (US$m, AGR%)

Table 10.23 Cobham plc Sales by Segment of Business 2012-2016 (US$m, AGR %)

Table 10.24 Cobham plc Net Income / Loss 2013-2017 (US$m, AGR%)

Table 10.25 Cobham plc Sales by Regional Segment of Business 2012-2016 (US$m, AGR %)

Table 10.26 Cobham plc Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.27 Cobham plc Mergers & Acquisitions (M&A) and Joint Venture Activity 2012-2018 (Date, Company Involved, Value US$m, Details)

Table 10.28 Cobham plc Divestitures 2010-2011 (Date, Company Involved, Value US$m, Details)

Table 10.29 Cohort plc Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 10.30 Selected Recent Cohort plc Electronic Warfare Contracts / Projects / Programmes 2010-2019 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 10.31 Cohort plc Total Company Sales 2013-2017 (US$m, AGR%)

Table 10.32 Cohort plc Sales by Segment of Business 2013-2016 (US$m, AGR %)

Table 10.33 Cohort plc Net Income / Loss 2013-2017 (US$m, AGR%)

Table 10.34 Cohort plc Sales by Regional Segment of Business 2013-2016 (US$m, AGR %)

Table 10.35 Cohort plc Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.36 Cohort plc Mergers and Acquisitions and Partnerships 2013-2019 (Date, Company Involved, Value US$m, Details)

Table 10.37 Cohort plc Divestitures 2014 (Date, Company Involved, Value US$m, Details)

Table 10.38 Northrop Grumman Profile 2019 (CEO, Total Company Sales US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 10.39 Selected Recent Northrop Grumman Electronic Warfare Contracts / Projects / Programmes 2010-2019 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 10.40 Northrop Grumman Total Company Sales 2013-2017 (US$m, AGR%)

Table 10.41 Northrop Grumman Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 10.42 Northrop Grumman Net Income / Loss 2013-2017 (US$m)

Table 10.43 Northrop Grumman Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 10.44 Northrop Grumman Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.45 Northrop Grumman Mergers and Acquisitions and Partnerships 2012-2018 (Date, Company Involved, Value US$m, Details)

Table 10.46 Northrop Grumman Divestitures 2000 (Date, Company Involved, Value US$m, Details)

Table 10.47 Elbit Systems Ltd Group Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 10.48 Elbit Systems Selected Recent Elbit Systems Electronic Warfare Contracts / Projects / Programmes 2010-2018 (Date, Country, Contractor, Value US$m, Product, Details)

Table 10.49 Elbit Systems Ltd Total Company Sales 2013-2017 (US$m, AGR%)

Table 10.50 Elbit Systems Ltd Net Income 2013-2017 (US$m, AGR%)

Table 10.51 Elbit Systems Ltd Sales by Segment of Business 2012-2016 (US$m, AGR%)

Table 10.53 Elbit Systems Ltd Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.54 Elbit Systems Ltd Mergers and Acquisitions 2010-2018 (Date, Company Involved, Value US$m, Details)

Table 10.55 Elbit Systems Ltd Divestitures 2012-2014 (Date, Company Involved, Details)

Table 10.56 Leonardo S.p.A. Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 10.57 Leonardo S.p.A. Selected Recent Electronic Warfare Contracts / Projects / Programmes 2010-2019 (Date, Country, Contractor, Value US$m, Product, Details)

Table 10.58 Leonardo S.p.A. Total Company Sales 2013-2017 (US$m, AGR%)

Table 10.59 Leonardo S.p.A. Net Income / Loss 2013-2017 (US$m, AGR%)

Table 10.60 Leonardo S.p.A. Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 10.61 Leonardo SPA, Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 10.62 Leonardo S.p.A. Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.63 Leonardo S.p.A. Mergers and Acquisitions 2008-2017 (Date, Company Involved, Value US$m, Details)

Table 10.64 Leonardo S.p.A. Divestitures 2013-2015 (Date, Company Involved, Value US$m, Details)

Table 10.65 Harris Corporation Profile 2019 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Company Sales from Electronic Warfare Market %, Net Income US$m,, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 10.66 Selected Recent Harris Corporation Electronic Warfare Contracts / Projects / Programmes 2010-2018 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 10.67 Selected Recent Harris Corporation. Electronic Warfare Contracts / Projects / Programmes 2010-2017 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 10.68 Harris Corporation Total Company Sales 2014-2018 (US$m, AGR%)

Table 10.69 Harris Corporation Net Income 2014-2018 (US$m, AGR%)

Table 10.70 Harris Corporation Sales by Segment of Business 2014-2018 (US$m, AGR%)

Table 10.71 Harris Corporation, Sales by Regional Segment of Business 2014-2018 (US$m, AGR %)

Table 10.72 Harris Corporation Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.73 Harris Corporation Mergers and Acquisitions and Partnerships 2010-2018 (Date, Company Involved, Value US$m, Details)

Table 10.75 L3 Technologies, Inc. Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 10.76 L3 Technologies, Inc. Selected Recent Electronic Warfare Contracts / Projects / Programmes 2010-2018 (Date, Country, Contractor, Value US$m, Product, Details)

Table 10.77 L3 Technologies, Inc. Total Company Sales 2014-2018 (US$m, AGR%)

Table 10.78 L3 Technologies, Inc. Net Income 2014-2018 (US$m, AGR%)

Table 10.79 L3 Technologies, Inc., Sales by Regional Segment of Business 2016-2018 (US$m, AGR %)

Table 10.80 L3 Technologies, Inc. Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.81 L3 Technologies, Inc. Mergers and Acquisitions 2012-2018 (Date, Company Involved, Value US$m, Details)

Table 10.82 L3 Technologies, Inc. Divestitures 2014 (Date, Company Involved, Details)

Table 10.83 Lockheed Martin Profile 2019 (CEO, Total Company Sales US$m, Sales in the Market US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 10.84 Selected Recent Lockheed Martin Electronic Warfare Contracts / Projects / Programmes 2010-2019 (Date, Country, Contractor, Value US$m, Product, Details)

Table 10.85 Lockheed Martin Total Company Sales 2013-2017 (US$m, AGR%)

Table 10.86 Lockheed Martin Net Income 2013-2017 (US$m, AGR%)

Table 10.87 Lockheed Martin Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 10.88 Lockheed Martin Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 10.89 Lockheed Martin Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.90 Lockheed Martin Mergers and Acquisitions 2008-2015 (Date, Company Involved, Value US$m, Details)

Table 10.91 Lockheed Martin Divestitures 2010-2011 (Date, Company Involved, Value US$m, Details)

Table 10.92 Raytheon Co. Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 10.93 Selected Recent Raytheon Electronic Warfare Contracts / Projects / Programmes 2012-2019 (Date, Country, Contractor, Value US$m, Product, Details)

Table 10.94 Raytheon Total Company Sales 2013-2017 (US$m, AGR%)

Table 10.95 Raytheon Net Income 2013-2017 (US$m, AGR%)

Table 10.96 Raytheon Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 10.97 Raytheon Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 10.98 Raytheon Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.99 Raytheon Mergers and Acquisitions 2011-2014 (Date, Company Involved, Value US$m, Details)

Table 10.100 Raytheon Divestitures 2014 (Date, Company Involved, Details)

Table 10.101 Textron Inc. Group Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 10.102 Textron Inc. Selected Recent Electronic Warfare Contracts / Projects / Programmes 2010-2017 (Date, Country, Contractor, Value US$m, Product, Details)

Table 10.103 Textron Inc. Total Company Sales 2014-2018 (US$m, AGR%)

Table 10.104 Textron Inc. Net Earnings 2014-2018 (US$m, AGR%)

Table 10.105 Textron Inc. Sales by Segment of Business 2014-2018 ($m)

Table 10.106 Textron Inc., Sales by Regional Segment of Business 2014-2018 (US$m, AGR %)

Table 10.107 Textron Inc. Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.108 Textron Inc. Mergers and Acquisitions 2007-2014 (Date, Company Involved, Value US$m, Details)

Table 10.109 Textron Inc. Divestitures 2008 (Date, Company Involved, Details)

Table 10.110 Airbus Group SE Profile 2019 (CEO, Total Company Sales US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 10.111 Selected Recent Airbus Group SE Electronic Warfare Contracts / Projects / Programmes 2014-2018 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 10.112 Airbus Group SE Total Company Sales 2014-2018 (US$m, AGR%)

Table 10.113 Airbus Group SE Sales by Segment of Business 2014-2018 (US$m, AGR%)

Table 10.114 Airbus Group SE Net Income / Loss 2014-2018 (US$m)

Table 10.115 Airbus Group SE Sales by Regional Segment of Business 2014-2018 (US$m, AGR %)

Table 10.116 Airbus Group SE Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.117 Airbus Group SE Divestitures 2017 (Date, Company Involved, Value US$m, Details)

Table 10.118 General Dynamics Corporation Profile 2019 (CEO, Total Company Sales US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 10.119 Selected Recent General Dynamics Corporation Electronic Warfare Contracts / Projects / Programmes 2016-2019 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 10.120 General Dynamics Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Table 10.121 General Dynamics Corporation Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 10.122 General Dynamics Corporation Net Income / Loss 2013-2017 (US$m)

Table 10.123 General Dynamics Corporation Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 10.124 General Dynamics Corporation Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.125 General Dynamics Corporation Mergers and Acquisitions 2018 (Date, Company Involved, Value US$m, Details)

Table 10.126 Rockwell Collins, Inc. Profile 2019 (CEO, Total Company Sales US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 10.127 Selected Recent Rockwell Collins, Inc. Electronic Warfare Contracts / Projects / Programmes 2013-2018 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 10.128 Rockwell Collins, Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Table 10.129 Rockwell Collins, Inc. Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 10.130 Rockwell Collins, Inc. Net Income / Loss 2013-2017 (US$m)

Table 10.131 Rockwell Collins, Inc.Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 10.132 Rockwell Collins, Inc. Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.133 Rockwell Collins, Inc. Mergers and Acquisitions 2012-2014 (Date, Company Involved, Value US$m, Details)

Table 10.134 Leidos Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 10.135 Leidos Selected Recent Electronic Warfare Contracts / Projects / Programmes 2017-2019 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 10.136 Leidos Total Company Sales 2014-2018 (US$m, AGR %)

Table 10.137 Leidos Net Income / Loss 2014-2018 (US$m)

Table 10.138 Leidos Sales by Segment of Business 2016-2018 (US$m, AGR %)

Table 10.139 Israel Aerospace Industries Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 10.140 IAI Selected Recent Electronic Warfare Contracts / Projects / Programmes 2017-2018 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 10.141 Israel Aerospace Industries Total Company Sales 2013-2017 (US$m, AGR %)

Table 10.142 Israel Aerospace Industries Net Income / Loss 2013-2017 (US$m)

Table 10.143 Israel Aerospace Industries Sales by Regional Segment of Business 2011-2013 (US$m, AGR %)

Table 10.144 Thales SA. Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 10.145 Thales Selected Recent Electronic Warfare Contracts / Projects / Programmes 2016-2018 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 10.146 Thales Group Total Company Sales 2014-2018 (US$m, AGR %)

Table 10.147 Thales Group Sales by Segment of Business 2014-2018 (US$m, AGR %)

Table 10.148 Thales Group Net Income / Loss 2014-2018 (US$m)

Table 10.149 Thales Group Sales by Geographical Regional 2014-2018 (US$m, AGR %)

Table 10.150 Rockwell Collins, Inc. Mergers and Acquisitions 2018 (Date, Company Involved, Value US$m, Details)

Table 10.151 QinetiQ Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 10.152 QinetiQ Total Company Sales 2014-2018 (US$m, AGR %)

Table 10.153 QinetiQ Sales by Segment of Business 2014-2018 (US$m, AGR %)

Table 10.154 QinetiQ Net Income / Loss 2017-2018 (US$m)

Table 10.155 QinetiQ Sales by Regional Segment of Business 2014-2018 (US$m, AGR %)

Table 10.156 QinetiQ Mergers and Acquisitions 2017-2018 (Date, Company Involved, Value US$m, Details)

Table 10.157 Hensoldt Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 10.158 Hensoldt Selected Recent Electronic Warfare Contracts / Projects / Programmes 2018-2019 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 10.159 Hensoldt Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 10.160 Hensoldt Mergers and Acquisitions and Joint Ventures 2017-2019 (Date, Company Involved, Value US$m, Details)

Table 10.161 Rohde & Schwarz Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 10.162 Rohde & Schwarz Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

List of Figures

Figure 1.1 Global Electronic Warfare Market Segmentation Overview

Figure 2.1 Global Electronic Warfare Market Segmentation Overview

Figure 3.1 Global Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 4.1 Global Electronic Warfare Submarket AGR Forecast 2019-2029 (AGR%)

Figure 4.2 Global Electronic Warfare Submarket Forecast 2019-2029 (US$m, Global AGR%)

Figure 4.3 Global Electronic Warfare Submarket Share Forecast 2019 (% Share)

Figure 4.4 Global Electronic Warfare Submarket Share Forecast 2024 (% Share)

Figure 4.5 Global Electronic Warfare Submarket Share Forecast 2029 (% Share)

Figure 4.6 Global Electronic Warfare Electronic Support Submarket by Regional Market AGR Forecast 2019-2029 (AGR%)

Figure 4.7 Global Electronic Warfare Electronic Support Market Forecast by Regional Market 2019-2029 (US$m, AGR%)

Figure 4.8 Global Electronic Warfare Electronic Support Submarket Share by Regional Market Forecast 2019 (% Share)

Figure 4.9 Global Electronic Warfare Electronic Support Submarket Share by Regional Market Forecast 2024 (% Share)

Figure 4.10 Global Electronic Support Share by Submarket Market Forecast 2029 (% Share)

Figure 4.11 Global Electronic Warfare Electronic Attack Submarket by Regional Market AGR Forecast 2019-2029 (AGR%)

Figure 4.12 Global Electronic Warfare Electronic Attack Submarket Forecast by Regional Market 2019-2029 (US$m, Global AGR%)

Figure 4.13 Global Electronic Warfare Electronic Attack Submarket Share by Regional Market Forecast 2019 (% Share)

Figure 4.14 Global Electronic Warfare Electronic Attack Submarket Share by Regional Market Forecast 2024 (% Share)

Figure 4.15 Global Electronic Warfare Electronic Attack Submarket Share by Regional Market Forecast 2029 (% Share)

Figure 4.16 Global Electronic Warfare Electronic Protection Submarket by Regional Market AGR Forecast 2019-2029 (AGR%)

Figure 4.17 Global Electronic Warfare Electronic Protection Submarket Forecast by Regional Market 2019-2029 (US$m, Global AGR%)

Figure 4.18 Global Electronic Warfare Electronic Protection Submarket Share by Regional Market Forecast 2019 (% Share)

Figure 4.19 Global Electronic Warfare Electronic Protection Submarket Share by Regional Market Forecast 2024 (% Share)

Figure 4.20 Global Electronic Warfare Electronic Protection Submarket Share by Regional Market Forecast 2029 (% Share)

Figure 4.21 Global Electronic Protection Market by Submarket AGR Forecast 2019-2029 (AGR%)

Figure 4.22 Global Electronic Protection Market by Submarket Forecast 2019-2029 (US$m, Global AGR%)

Figure 4.23 Global Electronic Protection Submarket Share 2019 (% Share)

Figure 4.24 Global Electronic Protection Submarket Share 2024 (% Share)

Figure 4.25 Global Electronic Protection Submarket Share 2029 (% Share)

Figure 5.1 Global Electronic Warfare Market by Platform Market AGR Forecast 2019-2029 (AGR%)

Figure 5.2 Global Electronic Warfare Market by Platform Market Forecast 2019-2029 (US$b, Global AGR %)

Figure 5.3 Global Electronic Warfare Platform Market Share Forecast 2019 (% Share)

Figure 5.4 Global Electronic Warfare Platform Market Share Forecast 2024 (% Share)

Figure 5.5 Global Electronic Warfare Platform Market Share Forecast 2029 (% Share)

Figure 5.6 Global Electronic Warfare Ground Platform Submarket by Regional Market AGR Forecast 2019-2029 (AGR%)

Figure 5.7 Global Electronic Warfare Ground Platform Market Forecast by Regional Market 2019-2029 (US$m, Global AGR%)

Figure 5.8 Global Electronic Warfare Ground Platform Market Share by Regional Market Forecast 2019 (% Share)

Figure 5.9 Global Electronic Warfare Ground Platform Market Share by Regional Market Forecast 2024 (% Share)

Figure 5.10 Global Electronic Warfare Ground Platform Market by Regional Market Share Forecast 2029 (% Share)

Figure 5.11 Global Electronic Warfare Air Platform Market by Regional Market AGR Forecast 2019-2029 (AGR%)

Figure 5.12 Global Electronic Warfare Air Platform Market Forecast by Regional Market 2019-2029 (US$m, Global AGR%)

Figure 5.13 Global Electronic Warfare Air Platform Market Share by Regional Market Forecast 2019 (% Share)

Figure 5.14 Global Electronic Warfare Air Platform Market Share by Regional Market Forecast 2024 (% Share)

Figure 5.15 Global Electronic Warfare Air Platform Market Share by Regional Market Forecast 2029 (% Share)

Figure 5.16 Global Electronic Warfare Naval Platform Market by Regional Market AGR Forecast 2019-2029 (AGR%)

Figure 5.17 Global Electronic Warfare Naval Platform Market Forecast by Regional Market 2019-2029 (US$m, AGR%)

Figure 5.18 Global Electronic Warfare Naval Platform Market Share by Regional Market Forecast 2019 (% Share)

Figure 5.19 Global Electronic Warfare Naval Platform Market Share by Regional Market Forecast 2024 (% Share)

Figure 5.20 Global Electronic Warfare Naval Platform Market Share by Regional Market Forecast 2029 (% Share)

Figure 5.21 Global Electronic Warfare Unmanned Platform Market by Regional Market AGR Forecast 2019-2029 (AGR%)

Figure 5.22 Global Electronic Warfare Unmanned Platform Market Forecast by Regional Market 2019-2029 (US$m, Global AGR%)

Figure 5.23 Global Electronic Warfare Unmanned Platform Market Share by Regional Market Forecast 2019 (% Share)

Figure 5.24 Global Electronic Warfare Unmanned Platform Market Share by Regional Market Forecast 2024 (% Share)

Figure 5.25 Global Electronic Warfare Unmanned Platform Market Share by Regional Market Forecast 2029 (% Share)

Figure 6.1 Global Electronic Warfare Market by Product Market AGR Forecast 2019-2029(AGR%)

Figure 6.2 Global Electronic Warfare Market by Product Market Forecast 2019-2029 (US$b, Global AGR %)

Figure 7.1 Global Electronic Warfare Market by Portable System Market AGR Forecast 2019-2029 (AGR%)

Figure 7.2 Global Electronic Warfare Market by Portable System Market Forecast 2019-2029 (US$m, Global AGR %)

Figure 8.1 Global Electronic Warfare Market by Regional Market Forecast 2019-2029 (US$m, Global AGR%)

Figure 8.2 Global Electronic Warfare Market by Regional Market Forecast AGR 2019-2029 (AGR%)

Figure 8.3 Global Electronic Warfare Market by Regional Market Share Forecast 2019 (% Share)

Figure 8.4 Global Electronic Warfare Market by Regional Market Share Forecast 2024 (% Share)

Figure 8.5 Global Electronic Warfare Market by Regional Market Share Forecast 2029 (% Share)

Figure 8.6 North America Electronic Warfare By Category Market AGR Forecast 2019-2029 (AGR %)

Figure 8.7 North America Electronic Warfare Market by Category Market Forecast 2019-2029 (US$m, North American Total Market Sales AGR%)

Figure 8.8 North America Electronic Warfare By Platform Market AGR Forecast 2019-2029 (AGR %)

Figure 8.9 North America Electronic Warfare Market By Platform Market Forecast 2019-2029 (US$m, North American Total Market Sales AGR%)

Figure 8.10 North America Electronic Warfare By Country Market AGR Forecast 2019-2029 (AGR %)

Figure 8.11 North America Electronic Warfare Market By Country Market Forecast 2019-2029 (US$m, North American Total Market Sales AGR%)

Figure 8.12 U.S. Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.13 Canada Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.14 Europe Electronic Warfare By Category Market AGR Forecast 2019-2029 (AGR %)

Figure 8.15 Europe Electronic Warfare Market by Category Market Forecast 2019-2029 (US$m, Europe Total Market Sales AGR%)

Figure 8.16 Europe Electronic Warfare By Platform Market AGR Forecast 2019-2029 (AGR %)

Figure 8.17 Europe Electronic Warfare Market By Platform Market Forecast 2019-2029 (US$m, European Total Market Sales AGR%)

Figure 8.18 Europe Electronic Warfare By Country Market AGR Forecast 2019-2029 (AGR %)

Figure 8.19 Europe Electronic Warfare Market By Country Market Forecast 2019-2029 (US$m, European Total Market Sales AGR%)

Figure 8.20 U.K. Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.21 Germany Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.22 France Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.23 Russia Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.24 Italy Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.25 Turkey Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.26 Rest Of Europe Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.27 Asia Pacific Electronic Warfare By Category Market AGR Forecast 2019-2029 (AGR %)

Figure 8.28 Asia Pacific Electronic Warfare Market by Category Market Forecast 2019-2029 (US$m, Asia Pacific Total Market Sales AGR%)

Table 8.20 Asia Pacific Electronic Warfare Market By Platform Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Figure 8.29 Asia Pacific Electronic Warfare By Platform Market AGR Forecast 2019-2029 (AGR %)

Figure 8.30 Asia Pacific Electronic Warfare Market By Platform Market Forecast 2019-2029 (US$m, Asia Pacific Total Market Sales AGR%)

Figure 8.31 Asia Pacific Electronic Warfare By Country Market AGR Forecast 2019-2029 (AGR %)

Figure 8.32 Asia Pacific Electronic Warfare Market By Country Market Forecast 2019-2029 (US$m, European Total Market Sales AGR%)

Figure 8.33 China Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.34 Japan Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.35 India Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.36 South Korea Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.37 Australia Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.38 Australia Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Table 8.28 Asia Pacific Electronic Warfare Market Drivers & Restraints 2019

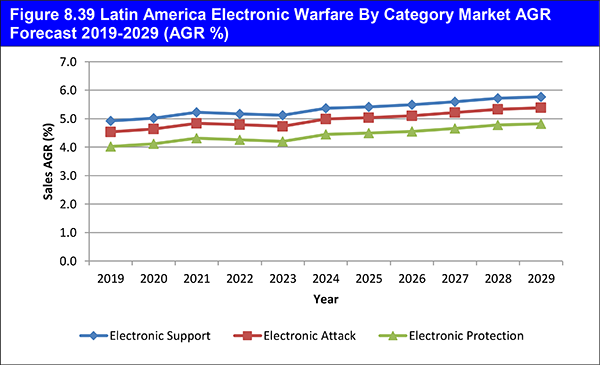

Figure 8.39 Latin America Electronic Warfare By Category Market AGR Forecast 2019-2029 (AGR %)

Figure 8.40 Latin America Electronic Warfare Market by Category Market Forecast 2019-2029 (US$m, Latin American Total Market Sales AGR%)

Figure 8.41 Latin America Electronic Warfare By Platform Market AGR Forecast 2019-2029 (AGR %)

Figure 8.42 Latin America Electronic Warfare Market By Platform Market Forecast 2019-2029 (US$m, Latin America Total Market Sales AGR%)

Figure 8.43 Latin America Electronic Warfare By Country Market AGR Forecast 2019-2029 (AGR %)

Figure 8.44 Latin America Electronic Warfare Market By Country Market Forecast 2019-2029 (US$m, Latin America Total Market Sales AGR%)

Figure 8.45 Brazil Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.46 Mexico Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.47 Rest of Latin America Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.48 Middle East Electronic Warfare By Category Market AGR Forecast 2019-2029 (AGR %)

Figure 8.49 Middle East Electronic Warfare Market by Category Market Forecast 2019-2029 (US$m, The Middle East Total Market Sales AGR%)

Figure 8.50 Middle East Electronic Warfare By Platform Market AGR Forecast 2019-2029 (AGR %)

Figure 8.51 Middle East Electronic Warfare Market By Platform Market Forecast 2019-2029 (US$m, The Middle East Total Market Sales AGR%)

Figure 8.52 Middle East Electronic Warfare By Country Market AGR Forecast 2019-2029 (AGR %)

Figure 8.53 Middle East Electronic Warfare Market By Country Market Forecast 2019-2029 (US$m, Middle East Total Market Sales AGR%)

Figure 8.54 Israel Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.55 UAE Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.56 Saudi Arabia Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.57 Rest of Middle East Electronic Warfare Market Forecast 2019-2029 (US$m, AGR%)

Figure 8.58 Africa Electronic Warfare By Category Market AGR Forecast 2019-2029 (AGR %)

Figure 8.59 Africa Electronic Warfare Market by Category Market Forecast 2019-2029 (US$m, African Total Market Sales AGR%)

Figure 8.60 Africa Electronic Warfare By Platform Market AGR Forecast 2019-2029 (AGR %)

Figure 8.61 Africa Electronic Warfare Market By Platform Market Forecast 2019-2029 (US$m, African Total Market Sales AGR%)

Figure 10.1 BAE Systems plc Total Company Sales 2013-2017 (US$m, AGR%)

Figure 10.2 BAE Systems, plc. Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 10.3 BAE Systems, plc. Sales AGR by Segment of Business 2014-2017 (AGR %)

Figure 10.4 BAE Systems, plc. Net Income / Loss 2013-2017 (US$m, AGR %)

Figure 10.5 BAE Systems, plc. Sales by Regional Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 10.6 BAE Systems, plc. Sales AGR by Regional Segment of Business 2013-2016 (AGR %)

Figure 10.7 BAE Systems plc Primary Market Competitors 2019

Figure 10.8 The Boeing Co. Total Company Sales 2013-2017 (US$m, AGR%)

Figure 10.9 The Boeing Co. Net Income 2013-2017 (US$m, AGR%)

Figure 10.10 The Boeing Company Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 10.11 The Boeing Company Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 10.12 The Boeing Co. Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 10.13 The Boeing Co. Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 10.14 The Boeing Co. Primary Market Competitors 2019

Figure 10.15 Cobham plc Total Company Sales 2013-2017 (US$m, AGR%)

Figure 10.16 Cobham plc Sales by Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 10.17 Cobham plc Sales AGR by Segment of Business 2013-2016 (AGR %)

Figure 10.18 Cobham plc Net Income / Loss 2013-2017 (US$m, AGR %)

Figure 10.19 Cobham plc Sales by Regional Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 10.20 Cobham plc Sales AGR by Regional Segment of Business 2012-2016 (AGR %)

Figure 10.21 Cobham plc Primary Market Competitors 2019

Figure 10.22 Cohort plc Total Company Sales 2013-2017 (US$m, AGR%)

Figure 10.23 Cohort plc Sales by Segment of Business 2013-2016 (US$m, Total Company Sales AGR %)

Figure 10.24 Cohort plc Sales AGR by Segment of Business 2014-2016 (AGR %)

Figure 10.25 Cohort plc Net Income / Loss 2013-2017 (US$m, AGR %)

Figure 10.26 Cohort plc Sales by Regional Segment of Business 2013-2016 (US$m, Total Company Sales AGR %)

Figure 10.27 Cohort plc Sales AGR by Regional Segment of Business 2014-2016 (AGR %)

Figure 10.28 Cohort plc Primary Market Competitors 2019

Figure 10.29 Northrop Grumman Total Company Sales 2013-2017 (US$m, AGR%)

Figure 10.30 Northrop Grumman Sales by Segment of Business 2014-2017 (US$m, Total Company Sales AGR%)

Figure 10.31 Northrop Grumman Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 10.32 Northrop Grumman Net Income / Loss 2013-2017 (US$m)

Figure 10.33 Northrop Grumman Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR )

Figure 10.34 Northrop Grumman Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 10.35 Northrop Grumman Primary Market Competitors 2019

Figure 10.36 Elbit Systems Ltd Total Company Sales 2013-2017 (US$m, AGR%)

Figure 10.37 Elbit Systems Ltd Net Income 2013-2017 (US$m, AGR%)

Figure 10.38 Elbit Systems Ltd Sales by Segment of Business 2012-2016 (US$m, Total Company Sales AGR%)

Figure 10.39 Elbit Systems Ltd Sales AGR by Segment of Business 2013-2016 (AGR%)

Figure 10.40 Elbit Systems Ltd Sales by Regional Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 10.42 Elbit Systems Ltd Primary Market Competitors 2018

Figure 10.43 Leonardo S.p.A. Total Company Sales 2013-2017 (US$m, AGR%)

Figure 10.44 Leonardo S.p.A. Net Income / Loss 2013-2017 (US$m)

Figure 10.45 Leonardo S.p.A. Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 10.46 Leonardo S.p.A. Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 10.47 Leonardo SPA Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 10.48 Leonardo SPA, Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 10.49 Leonardo S.p.A. Primary Market Competitors 2018

Figure 10.50 Harris Corporation Total Company Sales 2014-2018 (US$m, AGR%)

Figure 10.51 Harris Corporation Net Income 2014-2018 (US$m, AGR%)

Figure 10.52 Harris Corporation Sales by Segment of Business 2014-2018 (US$m, Total Company Sales AGR%)

Figure 10.53 Harris Corporation Sales AGR by Segment of Business 2015-2018 (AGR%)

Figure 10.54 Harris Corporation Sales by Regional Segment of Business 2014-2018 (US$m, Total Company Sales AGR %)

Figure 10.55 Harris Corporation Sales AGR by Regional Segment of Business 2015-2018 (AGR %)

Figure 10.56 Harris Corporation Primary Market Competitors 2019

Figure 10.57 L3 Technologies, Inc. Total Company Sales 2014-2018 (US$m, AGR%)

Figure 10.58 L3 Technologies, Inc. Net Income 2014-2018 (US$m, AGR%)

Figure 10.59 L3 Technologies, Inc. Sales by Regional Segment of Business 2016-2018 (US$m, Total Company Sales AGR %)

Figure 10.60 L-3 Technologies Primary Market Competitors 2019

Figure 10.61 Lockheed Martin Total Company Sales 2013-2017 (US$m, AGR%)

Figure 10.62 Lockheed Martin Net Income 2013-2017 (US$m, AGR%)

Figure 10.63 Lockheed Martin Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 10.64 Lockheed Martin Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 10.65 Lockheed Martin Sales AGR by Geographical Location 2014-2017 (AGR%)

Figure 10.66 Lockheed Martin Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR%)

Figure 10.67 Lockheed Martin Primary Market Competitors 2018

Figure 10.68 Raytheon Total Company Sales 2013-2017 (US$m, AGR%)

Figure 10.69 Raytheon Net Income 2013-2017 (US$m, AGR%)

Figure 10.70 Raytheon Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 10.71 Raytheon Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 10.72 Raytheon Sales AGR by Geographical Location 2014-2017 (AGR%)

Figure 10.73 Raytheon Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR%)

Figure 10.74 Raytheon Primary Market Competitors 2019

Figure 10.75 Textron Inc. Total Company Sales 2014-2018 (US$m, AGR%)

Figure 10.76 Textron Inc. Net Earnings 2014-2018 (US$m, AGR%)

Figure 10.78 Textron Inc. Sales AGR by Segment of Business 2015-2018 (AGR%)

Figure 10.79 Textron Inc. Sales by Regional Segment of Business 2014-2018 (US$m, Total Company Sales AGR %)

Figure 10.80 Textron Inc. Sales AGR by Regional Segment of Business 2015-2018 (AGR %)

Figure 10.81 Textron Inc. Primary Market Competitors 2019

Figure 10.82 Airbus Group SE Total Company Sales 2014-2018 (US$m, AGR%)

Figure 10.83 Airbus Group SE Sales by Segment of Business 2014-2018 (US$m, Total Company Sales AGR%)

Figure 10.84 Airbus Group SE Sales AGR by Segment of Business 2015-2018 (AGR%)

Figure 10.85 Airbus Group SE Net Income / Loss 2014-2018 (US$m)

Figure 10.86 Airbus Group SE Sales by Regional Segment of Business 2014-2018 (US$m, Total Company Sales AGR )

Figure 10.87 Airbus Group SE Sales AGR by Regional Segment of Business 2015-2018 (AGR %)

Figure 10.88 Airbus Group SE Primary Market Competitors 2019

Figure 10.89 General Dynamics Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Figure 10.90 General Dynamics Corporation Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 10.91 General Dynamics Corporation Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 10.92 General Dynamics Corporation Net Income / Loss 2013-2017 (US$m)

Figure 10.93 General Dynamics Corporation Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR )

Figure 10.94 General Dynamics Corporation Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 10.95 General Dynamics Corporation Primary Market Competitors 2019

Figure 10.96 Rockwell Collins, Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Figure 10.97 Rockwell Collins, Inc. Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 10.98 Rockwell Collins, Inc. Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 10.99 Rockwell Collins, Inc. Net Income / Loss 2013-2017 (US$m)

Figure 10.100 Rockwell Collins, Inc. Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR )

Figure 10.101 Rockwell Collins, Inc. Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 10.102 Rockwell Collins, Inc.Primary Market Competitors 2019

Figure 10.103 Leidos Total Company Sales 2014-2018 (US$m, AGR %)

Figure 10.104 Leidos Net Income / Loss 2014-2018 (US$m)

Figure 10.105 Leidos Sales by Segment of Business 2016-2018 (US$m, Total Company Sales AGR %)

Figure 10.106 Israel Aerospace Industries Total Company Sales 2013-2017 (US$m, AGR %)

Figure 10.107 Israel Aerospace Industries Net Income / Loss 2013-2017 (US$m)

Figure 10.108 Israel Aerospace Industries Sales by Regional Segment of Business 2011-2013 (US$m, Total Company Sales AGR %)

Figure 10.109 Thales Group Total Company Sales 2014-2018 (US$m, AGR %)

Figure 10.110 Thales Group Sales by Segment of Business 2014-2018 (US$m)

Figure 10.111 Thales Group Sales AGR by Segment of Business 2014-2018 (AGR %)

Figure 10.112 Thales Group.Net Income / Loss 2014-2018 (US$m)

Figure 10.113 Thales Group Sales by Geographical Regional 2014-2018 (US$m)

Figure 10.114 Thales Group Sales AGR by Geographical Regional 2015-2018 (AGR %)

Figure 10.115 QinetiQ Total Company Sales 2014-2018 (US$m, AGR %)

Figure 10.116 QinetiQ Sales by Segment of Business 2014-2018 (US$m)

Figure 10.117 QinetiQ Sales AGR by Segment of Business 2015-2018 (AGR %)

Figure 10.118 QinetiQ Net Income / Loss 2017-2018 (US$m)

Figure 10.119 QinetiQ Sales by Regional Segment of Business 2014-2018 (US$m)

Figure 10.120 QinetiQ Sales AGR by Regional Segment of Business 2015-2018 (AGR %)

Abacus EW

Adaptive Methods, Inc.

Aeroflex Group

Aerosim

AgustaWestland

Airbus

Airbus DS Electronics and Border Security SAS

Amor Group

Ansaldo Energia

AnsaldoBreda

Applied Defence Solutions

Applied Kilovolts Group Holdings, Limited.

Applied Signal Technology, Inc

Aptronics PTE Ltd

Ares and Periscopio

ARI Phantom Technologies

Astrotech

ASV Global

Atlas Group

Aveillant

Aveos Fleet Performance

Aviation Industry Corporation of China (AVIC)

Avibras Divisao Aerea e Naval S.A.

Avio SpA

Axell Wireless

Azimuth

BAE Intelligence and Security

BAE Systems

BAE Systems Safety Products Inc

BAE Systems Tensylon High Performance Materials Inc

Barco Orthagon

Beechcraft

Bharat Electronics Limited

Blackbird Technologies

Boeing

Broadcast Communications

C4i Pty Ltd

CapRock Communications

Carefx Corporation

Carlyle Group

CDL Systems Ltd.

Chandler/May, Inc.

Chess Technologies Limited

China Electronics Technology Avionics Company (CETCA)

Cobham plc

Cohort plc

Commercial Armoured Vehicles LLC

Corp Ten International

CSRA

CTC Aviation Group

Data Tactics Corp (L-3 Data Tactics)

Daylight Solutions

Deposition Sciences Inc

Detica Group plc

Diehl Defence

Doss Aviation, Inc.

DRS Technologies, Inc.

E.I.S. Aircraft Operations

Eclipse Electronic Systems

EID

EIG

Elbit Systems Ltd

Elbit Systems of America

Elisra

Embraer

Engineering Consultancy Group

ETI

EuroAvionics

EuroDass Consortium

Exelis Inc.

Fairchild Imaging Inc

Fata SpA

FBH

Flight Options LLC

Force X

Fraser-Volpe LLC

FWW Fahrzeugwerk GmbH

General Atomic

General Dynamics

Harpia Sistemas

Harris Corporation

Hawker Pacific

Henggeler Computer Consultants Inc, Pikewerks Corporation and Ktech Corporation

Hensoldt GmbH

ImageSat International N.V.

IMI Systems

Incubit Technology Ventures Ltd

Industrial Defender, Inc

Insitu

Israel Aerospace Industries

J+S

JETEYE

Kelvin Hughes

KKR

Kollmorgen Electro-Optical (KEO)

Kratos

KRET

L-1 Identity Solutions Inc

L3 Technologies

Leidos

Leonardo S.P.A

Link Simulation & Training U.K. Limited

Lockheed Martin

Lockheed Martin

M5 Network Security

MacDonald Humfrey (Automation) Ltd

Malaysian Airlines

Marine Systems International (MSI)

Marlborough Communications (Holdings) Limited (MCL)

MAVCO Inc

MBDA

Mechtonix and Opinicus

Micreo Limited

MITEQ, Inc.

Mustang Technology Group, LP

Nantero Inc's Government Services

Narus, Inc.

Non-core Analytics Business

Northrop Grumman

OASYS Technology LLC

Oceanserver Technology

Open Water Power, Inc.

Orbital ATK

OTO Melera SpA and Whitehead Sistemi Subacquei SpA

Pacific Architects and Engineers Inc

PentaTec

Perimeter Internetworking

Poseidon Scientific Instruments Pty Ltd

Procerus Technologies, L.C.

ProFlight, LLC

Qantas Defence Services Pty Limited

QinetiQ

QTC & Sim-Industries

RAF Waddington

Raytheon Company

Raytheon Missile Systems

Rheinmetall

Rockwell Collins

Rohde and Schwarz

RubiKon Group

RVision Inc

SAAB

Safariland, LLC

SafeNet Inc.

Satori SAS

Savi Technology, Inc.

Schlumberger Global Connectivity Services

SEA's Space Business

Selex ES

SESA

SignaCert, Inc.

Sikorsky Aircraft

Soltam and Saymar

Solutions made Simple Inc

Specialty Plastics, Inc.

stratsec.net

Swiss-Photonics AG

Systems made Simple

Tactical Technologies Inc. (TTI)

Telerob GmbH

Teligy Inc

Terma

Textron Inc.

Textron Systems

Thales

The NORDAM Group Inc

Thrane & Thrane

Tor

Trivec-Avant Corporation

UAS Dynamics LLC

United Industrial Corporation (UIC)

Vision Systems LLC

Visual Analytics Inc.