Industries > Defence > Smart Sensors in Military and Defence Market Report 2019-2029

Smart Sensors in Military and Defence Market Report 2019-2029

Forecasts by Sensor Type (Accelerometers, Inertial Sensors, Pressure Sensors, Force Sensors, Motion Sensors, Gyroscopes, Temperature Sensor and Others), by Product (Device-based Sensor, and Clothing-based Sensor), by Application (Wrist Wear, Foot Wear, Eye Wear, Body Wear and Neck Wear)

• Do you need definitive Smart Sensor market data?

• Succinct Smart Sensor market analysis?

• Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive report can transform your own research and save you time.

The latest demand in Smart Sensors has led Visiongain to publish this unique report, which is crucial to your companies improved success. I thought it would be of interest to you. If you want to be part of this growing industry, then read on to discover how you can maximise your investment potential.

Report highlights

• 104 Figures

• 63 Tables

• 494 pages

• Analysis of key players in Manned Electric Aircraft market

• Leidos

• Lockheed Martin

• TT Electronics

• BAE Systems

• Thales

• TE Connectivity

• FLIR Systems Inc

• STMicroelectronics

• General Electric

• Ceinsys Tech Ltd.

• Global Smart Sensor market outlook and analysis from 2019-2029

• 681 Contracts/agreements featuring companies involved in the Smart Sensor Value chain

• Smart Sensor application forecasts and analysis from 2019-2029

• Regional Smart Sensor market forecasts from 2019-2029

• North America forecast 2019-2029,

• Europe forecast 2019-2029

• Asia Pacific forecast 2019-2029

• Middle East and Africa forecast 2019-2029

• South America forecast 2019-2029

Each Region forecast by the following segments for 2019-2029

• Sensor Type

• Accelerometer

• Inertial Sensors

• Pressure Sensors

• Force Sensors

• Motion Sensors

• Gyroscopes

• Temperature Sensors

• Others

• Product Type

• Device based sensor

• Clothing based sensor

• Application

• Wrist wear

• Foot wear

• Eye wear

• Body wear

• Neck wear

• Key questions answered

• What does the future hold for the Smart Sensor industry?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to success and why?

• What business models should you adopt?

• What industry trends should you be aware of?

• Target audience

• Leading Smart Sensor companies

• Suppliers

• Contractors

• Technologists

• R&D staff

• Consultants

• Analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

• Industry organisations

• Banks

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1.1 Research Scope

1.2. Research Methodology

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Secondary Research

1.7.2 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Global and Submarket, Smart Sensors in Military and Defence Market 2019 - 2029

2.1 What are Smart Sensors in Military and Defence?

2.2 Classification of Smart Sensors in Military and Defence Market

3. Executive Summary: Global Smart Sensors in Military and Defence Market, 2019 – 2029

3.1 Market Snapshot: Smart Sensors in Military and Defence Market (2019 and 2029)

3.2 Smart Sensors in Military and Defence Market, 2019 – 2029, Revenue (US$ Mn) and AGR Growth (%)

4. Global & Submarket Smart Sensors in Military and Defence Market Dynamics

4.1 Smart Sensors in Military and Defence Market: Driver

4.1.1 Advantages of Wearable Technologies in Military

4.1.2. Health Monitoring

4.2 Smart Sensors in Military and Defence Market: Restraint

4.2.1. Risk of Cyber Intrusion

4.3 Smart Sensors in Military and Defence Market: Opportunity

4.3.1 Rise of Smart Clothing for Military Use

5. Global Smart Sensors in Military and Defence Market

5.1 Global Smart Sensors in Military and Defence Market, by Sensor Type, 2018 (%)

5.2 Global Smart Sensors in Military and Defence Market, by Product Type, 2018 (%)

5.3 Global Smart Sensors in Military and Defence Market, by Application, 2018 (%)

5.4 Global Smart Sensors in Military and Defence Market, by Geography, 2018 (%)

6. Global Smart Sensors in Military and Defence Market Analysis and Forecasts 2019 - 2029, By Sensor Type

6.1 Global Smart Sensors in Military and Defence Market, by Sensor Type Market Share and Forecast, 2019 Vs 2029 (Value %)

7. Global Smart Sensors in Military and Defence Market Analysis and Forecasts 2019 - 2029, By Product Type

7.1 Global Smart Sensors in Military and Defence Market, by Product Type Market Share and Forecast, 2019 Vs 2029 (Value %)

8. Global Smart Sensors in Military and Defence Market Analysis and Forecasts 2019 - 2029, By Application

8.1 Global Smart Sensors in Military and Defence Market, by Application Market Share and Forecast, 2019 Vs 2029 (Value %)

9. Smart Sensors in Military and Defence: World Market Forecast, 2019 – 2029, by Geographic Region

9.1 Smart Sensors in Military and Defence Market Share by Geographic Region, 2019 and 2029 (%)

9.2 Global Smart Sensors in Military and Defence Market, Revenue, By Region, 2019 – 2029 (US$ Mn)

10. North America Smart Sensors in Military and Defence Market Analysis and Forecast 2019 - 2029

10.1 North America Smart Sensors in Military and Defence Market Outlook

10.2 North America Smart Sensors in Military and Defence Market Analysis, 2019 – 2029, by Sensor Type

10.2.1. Smart Sensors in Military and Defence Market, by Sensor Type – Revenue (US$ Mn)

10.3 North America Smart Sensors in Military and Defence Market. Analysis, 2019 – 2029, by Product Type

10.3.1.Smart Sensors in Military and Defence Market, by Product Type – Revenue (US$ Mn)

10.4 North America Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Application

10.4.1. Smart Sensors in Military and Defence Market, by Application – Revenue (US$ Mn)

10.5 North America Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Country

10.5.1. Smart Sensors in Military and Defence Market, by Country – Revenue (US$ Mn)

11. Europe Smart Sensors in Military and Defence Market Analysis and Forecast 2019 – 2029

11.1 Europe Smart Sensors in Military and Defence Market Outlook

11.2 Europe Smart Sensors in Military and Defence Market Analysis, 2019 – 2029, by Sensor Type

11.2.1. Smart Sensors in Military and Defence Market, by Sensor Type –Revenue (US$ Mn)

11.3 Europe Smart Sensors in Military and Defence Market. Analysis, 2019 – 2029, by Product Type

11.3.1. Smart Sensors in Military and Defence Market, by Product Type – Revenue (US$ Mn)

11.4 Europe Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Application

11.4.1. Smart Sensors in Military and Defence Market, by Application – Market Revenue (US$ Mn)

11.5 Europe Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Country

11.5.1. Smart Sensors in Military and Defence Market, by Country – Revenue (US$ Mn)

12. Asia Pacific Smart Sensors in Military and Defence Market Analysis and Forecast 2019 – 2029

12.1 Asia Pacific Smart Sensors in Military and Defence Market Outlook

12.2 Asia Pacific Smart Sensors in Military and Defence Market Analysis, 2019 – 2029, by Sensor Type

12.2.1. Smart Sensors in Military and Defence Market, by Sensor Type – Revenue (US$ Mn)

12.3 Asia Pacific Smart Sensors in Military and Defence Market. Analysis, 2019 – 2029, by Product Type

12.3.1. Smart Sensors in Military and Defence Market, by Product Type – Revenue (US$ Mn)

12.4 Asia Pacific Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Application

12.4.1. Smart Sensors in Military and Defence Market, by Application – Revenue (US$ Mn)

12.5 Asia Pacific Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Country

12.5.1. Smart Sensors in Military and Defence Market, by Country – Revenue (US$ Mn)

13. Middle East and Africa Smart Sensors in Military and Defence Market Analysis and Forecast 2019 – 2029

13.1 Middle East and Africa Smart Sensors in Military and Defence Market Outlook

13.2 Middle East and Africa Smart Sensors in Military and Defence Market Analysis, 2019 – 2029, by Sensor Type

13.2.1.Smart Sensors in Military and Defence Market, by Sensor Type – Revenue (US$ Mn)

13.3 Middle East and Africa Smart Sensors in Military and Defence Market. Analysis, 2019 – 2029, by Product Type

13.3.1. Smart Sensors in Military and Defence Market, by Product Type – Revenue (US$ Mn)

13.4 Middle East and Africa Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Application

13.4.1. Smart Sensors in Military and Defence Market, by Application – Revenue (US$ Mn)

13.5 Middle East and Africa Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Country

13.5.1. Smart Sensors in Military and Defence Market, by Country – Revenue (US$ Mn)

14. South America Smart Sensors in Military and Defence Market Analysis and Forecast 2019 – 2029

14.1 South America Smart Sensors in Military and Defence Market Outlook

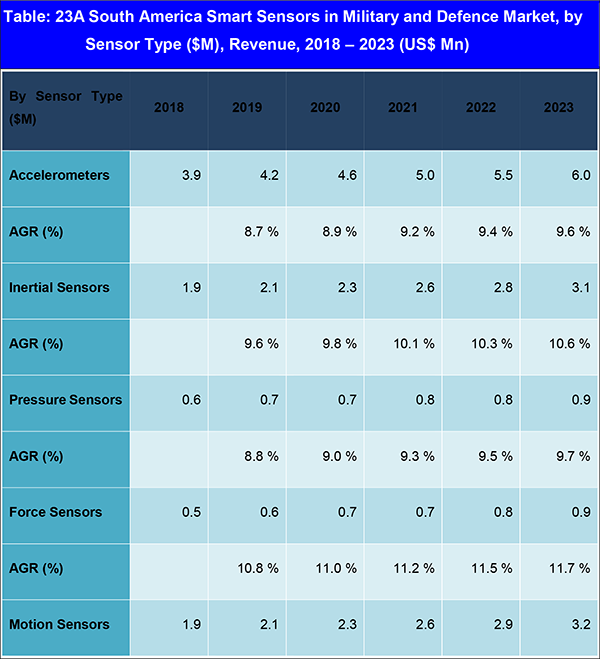

14.2 South America Smart Sensors in Military and Defence Market Analysis, 2019 – 2029, by Sensor Type

14.2.1. Smart Sensors in Military and Defence Market, by Sensor Type – Revenue (US$ Mn)

14.3 South America Smart Sensors in Military and Defence Market. Analysis, 2019 – 2029, by Product Type

14.3.1.Smart Sensors in Military and Defence Market, by Product Type – Revenue (US$ Mn)

14.4 South America Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Application

14.4.1. Smart Sensors in Military and Defence Market, by Application – Revenue (US$ Mn)

14.5 South America Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Country

14.5.1. Smart Sensors in Military and Defence Market, by Country – Revenue (US$ Mn)

15. Leading Companies in the Smart Sensors in Military and Defence Market 2019 – 2029

15.1 Leidos Holdings, Inc.

15.1.1. Leidos Holdings, Inc. Geographical Presence

15.1.2. Leidos Holdings, Inc. Historic Roadmap and Contracts

15.1.3. Leidos Holdings, Inc. Product Portfolio

15.1.4. Leidos Holdings, Inc. Sales Analysis

15.2. Lockheed Martin Corporation

15.2.1. Lockheed Martin Corporation Historic Roadmap and Contracts

15.2.2. Lockheed Martin Corporation Product Portfolio

15.2.3. Lockheed Martin Corporation Sales Analysis

15.3. TT Electronics plc

15.3.1. TT Electronics plc Geographical Presence

15.3.2. TT Electronics plc Historic Roadmap and Contracts

15.3.3. TT Electronics plc Product Portfolio

15.3.4. TT Electronics plc Sales Analysis

15.4. BAE SYSTEMS PLC

15.4.1. BAE Systems Plc Company Details:

15.4.2. BAE SYSTEMS PLC Geographical Presence

15.4.3. BAE SYSTEMS PLC Historic Roadmap and Contracts

15.4.4. BAE SYSTEMS PLC Product Portfolio

15.4.5. BAE SYSTEMS PLC Sales Analysis

15.5. Thales SA

15.5.1. Thales SA Geographical Presence

15.5.2. Thales SA Historic Roadmap and Contracts

15.5.3. Thales SA Product Portfolio

15.5.4. Thales SA Sales Analysis

15.6. TE Connectivity

15.6.1. TE Connectivity Geographical Presence

15.6.2. TE Connectivity Historic Roadmap and Contracts

15.6.3. TE Connectivity Product Portfolio

15.6.4. TE Connectivity Sales Analysis

15.7. FLIR Systems, Inc.

15.7.1. FLIR Systems, Inc. Geographical Presence

15.7.2. FLIR Systems, Inc. Historic Roadmap and Contracts

15.7.3. FLIR Systems, Inc. Product Portfolio

15.7.4. FLIR Systems, Inc. Sales Analysis

15.8. STMicroelectronics

15.8.1. STMicroelectronics Geographical Presence

15.8.2. STMicroelectronics Historic Roadmap and Contracts

15.8.3. STMicroelectronics Product Portfolio

15.8.4. STMicroelectronics Sales Analysis

15.9. GENERAL ELECTRIC

15.9.1. GENERAL ELECTRIC Geographical Presence

15.9.2. GENERAL ELECTRIC Historic Roadmap and Contracts

15.9.3. GENERAL ELECTRIC Product Portfolio

15.9.4. General Electric Sales Analysis

15.10. Ceinsys Tech Ltd.

15.10.1. Ceinsys Tech Ltd. Product Portfolio

15.10.2. Ceinsys Tech Ltd. Sales Analysis

16. Conclusion

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Figures

Figure: 1 Global Smart Sensors in Military and Defence Market, Segmentation Overview

Figure: 2 Smart Sensors in Military and Defence Market, 2019 – 2029, Revenue (US$ Mn) and AGR Growth (%)

Figure: 3 Global Smart Sensors in Military and Defence Market, by Sensor Type ($M), 2018 (%)

Figure: 4 Global Smart Sensors in Military and Defence Market, by Product Type ($M), 2018 (%)

Figure: 5 Global Smart Sensors in Military and Defence Market, by Application, 2018 (%)

Figure: 6 Global Smart Sensors in Military and Defence Market, by Geography, 2018 (%)

Figure: 7 Global Smart Sensors in Military and Defence Market, by Sensor Type ($M) Market Share and Forecast, 2019 Vs 2029 (Value %)

Figure: 8 Global Smart Sensors in Military and Defence Market, Revenue, By Sensor Type ($M), 2019 – 2029 (US$ Mn)

Figure: 9 Global Smart Sensors in Military and Defence Market, by Product Type ($M) Market Share and Forecast, 2019 Vs 2029 (Value %)

Figure: 10 Global Smart Sensors in Military and Defence Market, Revenue, By Product Type ($M), 2019 – 2029 (US$ Mn)

Figure: 11 Global Smart Sensors in Military and Defence Market, by Application Market Share and Forecast, 2019 Vs 2029 (Value %)

Figure: 12 Global Smart Sensors in Military and Defence Market, Revenue, By Application, 2019 – 2029 (US$ Mn)

Figure: 13 Smart Sensors in Military and Defence Market Share by Geography, 2019 and 2029 (%)

Figure: 14 Global Smart Sensors in Military and Defence Market by Region, 2018, (% Share)

Figure: 15 Global Manned Aircraft Submarkets, by Region, Forecast (US$ Mn) 2019 – 2029

Figure: 16 North America Smart Sensors in Military and Defence Market Outlook.

Figure: 17 Market Attractiveness Analysis, By Sensor Type ($M)

Figure: 18 Market Attractiveness Analysis, By Product Type ($M)

Figure: 19 Market Attractiveness Analysis, By Application

Figure: 20 Market Attractiveness Analysis, By Country

Figure: 21 North America Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Sensor Type ($M)

Figure: 22 North America Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Product Type ($M)

Figure: 23 North America Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Application

Figure: 24 North America Smart Sensors in Military and Defence Market. Analysis, 2019 – 2029 by Country (US$ Mn

Figure: 25 Europe Smart Sensors in Military and Defence Market Outlook.

Figure: 26 Market Attractiveness Analysis, By Sensor Type ($M)

Figure: 27 Market Attractiveness Analysis, By Product Type ($M)

Figure: 28 Market Attractiveness Analysis, By Application

Figure: 29 Market Attractiveness Analysis, By Country

Figure: 30 Europe Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Sensor Type ($M)

Figure: 31 Europe Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Product Type ($M)

Figure: 32 Europe Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Application

Figure: 33 Europe Smart Sensors in Military and Defence Market. Analysis, 2019 – 2029 by Country (US$ Mn)

Figure: 34 Asia Pacific Smart Sensors in Military and Defence Market Outlook.

Figure: 35 Market Attractiveness Analysis, By Sensor Type ($M)

Figure: 36 Market Attractiveness Analysis, By Product Type ($M)

Figure: 37 Market Attractiveness Analysis, By Application

Figure: 38 Market Attractiveness Analysis, By Country

Figure: 39 Asia Pacific Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Sensor Type ($M)

Figure: 40 Asia Pacific Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Product Type ($M)

Figure: 41 Asia Pacific Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Application

Figure: 42 Asia Pacific Smart Sensors in Military and Defence Market. Analysis, 2019 – 2029 by Country (US$ Mn)

Figure: 43 Middle East and Africa Smart Sensors in Military and Defence Market Outlook.

Figure: 44 Market Attractiveness Analysis, By Sensor Type ($M)

Figure: 45 Market Attractiveness Analysis, By Product Type ($M)

Figure: 46 Market Attractiveness Analysis, By Application

Figure: 47 Market Attractiveness Analysis, By Country

Figure: 48 Middle East and Africa Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Sensor Type ($M)

Figure: 49 Middle East and Africa Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Product Type ($M)

Figure: 50 Middle East and Africa Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Application

Figure: 51 Middle East and Africa Smart Sensors in Military and Defence Market. Analysis, 2019 – 2029 by Country (US$ Mn)

Figure: 52 South America Smart Sensors in Military and Defence Market Outlook.

Figure: 53 Market Attractiveness Analysis, By Sensor Type ($M)

Figure: 54 Market Attractiveness Analysis, By Product Type ($M)

Figure: 55 Market Attractiveness Analysis, By Application

Figure: 56 Market Attractiveness Analysis, By Country

Figure: 57 South America Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Sensor Type ($M)

Figure: 58 South America Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Product Type ($M)

Figure: 59 South America Smart Sensors in Military and Defence Market Analysis, 2019 – 2029 by Application

Figure: 60 South America Smart Sensors in Military and Defence Market. Analysis, 2019 – 2029 by Country (US$ Mn)

Figure: 61 Leading Companies, Smart Sensors in Military and Defence Market Share, 2018 (% share)

Figure: 62 Leidos Holdings, Inc. Sales Analysis, 2016 - 2018, US$ Mn

Figure: 63 Leidos Holdings, Inc. Sales Analysis, By Business Segment, 2016 - 2018, US$ Mn

Figure: 64 Leidos Holdings, Inc. Sales Analysis, By Business Segments, 2018, (% Share)

Figure: 65 Lockheed Martin Corporation Sales Analysis, 2016 - 2018, US$ Mn

Figure: 66 Lockheed Martin Corporation Sales Analysis, By Business Segment, 2016 - 2018, US$ Mn

Figure: 67 Lockheed Martin Corporation Sales Analysis, By Business Segments, 2018, (% Share)

Figure: 68 Lockheed Martin Corporation Sales Analysis, By Geography, 2016 - 2018, US$ Mn

Figure: 69 Lockheed Martin Corporation Sales Analysis, By Geography, 2018, (% Share)

Figure: 70 TT Electronics plc Sales Analysis, By 2015 - 2017, US$ Bn

Figure: 71 TT Electronics plc Sales Analysis, By Business Segment, 2017, (% Share)

Figure: 72 TT Electronics plc Sales Analysis, By Geography, 2015 - 2017, US$ Bn

Figure: 73 TT Electronics plc Sales Analysis, By Geography, 2017, (% Share)

Figure: 74 BAE SYSTEMS PLC Sales Analysis, 2017 - 2018, US$ Mn

Figure: 75 BAE SYSTEMS PLC Sales Analysis, By Business Segments, 2018, (% Share)

Figure: 76 BAE SYSTEMS PLC Sales Analysis, By Geography, 2018, (% Share)

Figure: 77 Thales SA Sales Analysis, 2016 - 2018, US$ Mn

Figure: 78 Thales SA Sales Analysis, By Business Segment, 2016 - 2018, US$ Mn

Figure: 79 Thales SA Sales Analysis, By Business Segments, 2018, (% Share)

Figure: 80 Thales SA Sales Analysis, By Geography, 2016 - 2018, US$ Mn

Figure: 81 Thales SA Sales Analysis, By Geography, 2018, (% Share)

Figure: 82 TE Connectivity Sales Analysis, 2016 - 2018, US$ Mn

Figure: 83 TE Connectivity Sales Analysis, By Business Segment, 2016 - 2018, US$ Mn

Figure: 84 TE Connectivity Sales Analysis, By Business Segment, 2018, (% Share)

Figure: 85 TE Connectivity Sales Analysis, By Geography, 2016 - 2018, US$ Mn

Figure: 86 TE Connectivity Sales Analysis, By Geography, 2018, (% Share)

Figure: 87 FLIR Systems, Inc. Sales Analysis, 2016 - 2018, US$ Mn

Figure: 88 FLIR Systems, Inc. Sales Analysis, By Business Segments, 2015 - 2017, US$ Mn

Figure: 89 FLIR Systems, Inc. Sales Analysis, By Business Segments, 2017, (% Share)

Figure: 90 FLIR Systems, Inc. Sales Analysis, By Geography, 2015 - 2017, US$ Mn

Figure: 91 FLIR Systems, Inc. Sales Analysis, By Geography, 2017, (% Share)

Figure: 92 STMicroelectronics Sales Analysis, 2015 - 2017, US$ Mn

Figure: 93 STMicroelectronics Sales Analysis, By Business Segments, 2016 - 2017, US$ Mn

Figure: 94 STMicroelectronics Sales Analysis, By Business Segments, 2017, (% Share)

Figure: 95 STMicroelectronics Sales Analysis, By Geography, 2015 - 2017, US$ Mn

Figure: 96 STMicroelectronics Sales Analysis, By Geography, 2017, (% Share)

Figure: 97 General Electric Sales Analysis, 2016 - 2018, US$ Mn

Figure: 98 General Electric Sales Analysis, By Business Segments, 2016 - 2018, US$ Mn

Figure: 99 General Electric Sales Analysis, By Business Segments, 2018, (% Share)

Figure: 100 General Electric Sales Analysis, By Geography, 2016 - 2018, US$ Mn

Figure: 101 General Electric Sales Analysis, By Geography, 2018, (% Share)

Figure: 102 Ceinsys Tech Ltd. Sales Analysis, 2016 – 2018, US$ Mn

Figure: 103 Ceinsys Tech Ltd. Sales Analysis, By Geography, 2016 - 2018, US$ Mn

Figure: 104 Ceinsys Tech Ltd. Sales Analysis, By Geography, 2018, (% Share)

List of Tables

Table: 1 Market Snapshot: Smart Sensors in Military and Defence Market (2019 and 2029)

Table: 2 Smart Sensors in Military and Defence Market, 2019 – 2029, Revenue (US$ Mn) and AGR Growth (%)

Table: 3A Global Smart Sensors in Military and Defence Market, by Sensor Type ($M), Revenue, 2018 – 2023 (US$ Mn)

Table: 3B Global Smart Sensors in Military and Defence Market, by Sensor Type ($M), Revenue, 2019 – 2029 (US$ Mn)

Table: 4A Global Smart Sensors in Military and Defence Market, by Product Type ($M), Revenue, 2018 – 2023 (US$ Mn)

Table: 4B Global Smart Sensors in Military and Defence Market, by Product Type ($M), Revenue, 2019 – 2029 (US$ Mn)

Table: 5A Global Smart Sensors in Military and Defence Market, by Application, Revenue, 2018 – 2023 (US$ Mn)

Table: 5B Global Smart Sensors in Military and Defence Market, by Application, Revenue, 2024 – 2029 (US$ Mn)

Table: 6A Global Smart Sensors in Military and Defence Market, Revenue and AGR, By Region, 2018 – 2023 (US$ Mn)

Table: 6B Global Smart Sensors in Military and Defence Market, Revenue and AGR, By Region, 2024 – 2029 (US$ Mn)

Table: 7A North America Smart Sensors in Military and Defence Market, by Sensor Type ($M), Revenue, 2018 – 2023 (US$ Mn)

Table: 7B North America Smart Sensors in Military and Defence Market, by Sensor Type ($M), Revenue, 2024 – 2029 (US$ Mn)

Table: 8A North America Smart Sensors in Military and Defence Market, by Product Type ($M), Revenue, 2018 – 2023 (US$ Mn)

Table: 8B North America Smart Sensors in Military and Defence Market, by Product Type ($M), Revenue, 2024 – 2029 (US$ Mn)

Table: 9A North America Smart Sensors in Military and Defence Market, by Application, Revenue, 2018 – 2023 (US$ Mn)

Table: 9B North America Smart Sensors in Military and Defence Market, by Application, Revenue, 2024 – 2029 (US$ Mn)

Table: 10A North America Smart Sensors in Military and Defence Market, Revenue, By Country, 2018 – 2023 (US$ Mn)

Table: 10B North America Smart Sensors in Military and Defence Market, Revenue, By Country, 2024 – 2029 (US$ Mn)

Table: 11A Europe Smart Sensors in Military and Defence Market, by Sensor Type ($M), Revenue, 2018 – 2023 (US$ Mn)

Table: 11B Europe Smart Sensors in Military and Defence Market, by Sensor Type ($M), Revenue, 2024 – 2029 (US$ Mn)

Table: 12A Europe Smart Sensors in Military and Defence Market, by Product Type ($M), Revenue, 2018 – 2023 (US$ Mn)

Table: 12B Europe Smart Sensors in Military and Defence Market, by Product Type ($M), Revenue, 2024 – 2029 (US$ Mn

Table: 13A Europe Smart Sensors in Military and Defence Market, by Application, Revenue, 2018 – 2023 (US$ Mn)

Table: 13B Europe Smart Sensors in Military and Defence Market, by Application, Revenue, 2024 – 2029 (US$ Mn)

Table: 14A Europe Smart Sensors in Military and Defence Market, Revenue, By Country, 2018 – 2023 (US$ Mn)

Table: 14B Europe Smart Sensors in Military and Defence Market, Revenue, By Country, 2024 – 2029 (US$ Mn)

Table: 15A Asia Pacific Smart Sensors in Military and Defence Market, by Sensor Type ($M), Revenue, 2018 – 2023 (US$ Mn)

Table: 15B Asia Pacific Smart Sensors in Military and Defence Market, by Sensor Type ($M), Revenue, 2024 – 2029 (US$ Mn)

Table: 16A Asia Pacific Smart Sensors in Military and Defence Market, by Product Type ($M), Revenue, 2018 – 2023 (US$ Mn)

Table: 16B Asia Pacific Smart Sensors in Military and Defence Market, by Product Type ($M), Revenue, 2024 – 2029 (US$ Mn)

Table: 17A Asia Pacific Smart Sensors in Military and Defence Market, by Application, Revenue, 2018 – 2023 (US$ Mn)

Table: 17B Asia Pacific Smart Sensors in Military and Defence Market, by Application, Revenue, 2024 – 2029 (US$ Mn)

Table: 18A Asia Pacific Smart Sensors in Military and Defence Market, Revenue, By Country, 2018 – 2023 (US$ Mn)

Table: 18B Asia Pacific Smart Sensors in Military and Defence Market, Revenue, By Country, 2024 – 2029 (US$ Mn)

Table: 19A Middle East and Africa Smart Sensors in Military and Defence Market, by Sensor Type ($M), Revenue, 2018 – 2023 (US$ Mn)

Table: 19B Middle East and Africa Smart Sensors in Military and Defence Market, by Sensor Type ($M), Revenue, 2024 – 2029 (US$ Mn)

Table: 20A Middle East and Africa Smart Sensors in Military and Defence Market, by Product Type ($M), Revenue, 2018 – 2023 (US$ Mn)

Table: 20B Middle East and Africa Smart Sensors in Military and Defence Market, by Product Type ($M), Revenue, 2024 – 2029 (US$ Mn)

Table: 21A Middle East and Africa Smart Sensors in Military and Defence Market, by Application, Revenue, 2018 – 2023 (US$ Mn)

Table: 21B Middle East and Africa Smart Sensors in Military and Defence Market, by Application, Revenue, 2024 – 2029 (US$ Mn)

Table: 22A Middle East and Africa Smart Sensors in Military and Defence Market, Revenue, By Country, 2018 – 2023 (US$ Mn)

Table: 22B Middle East and Africa Smart Sensors in Military and Defence Market, Revenue, By Country, 2024 – 2029 (US$ Mn)

Table: 23A South America Smart Sensors in Military and Defence Market, by Sensor Type ($M), Revenue, 2018 – 2023 (US$ Mn)

Table: 23B South America Smart Sensors in Military and Defence Market, by Sensor Type ($M), Revenue, 2024 – 2029 (US$ Mn)

Table: 24A South America Smart Sensors in Military and Defence Market, by Product Type ($M), Revenue, 2018 – 2023 (US$ Mn)

Table: 24B South America Smart Sensors in Military and Defence Market, by Product Type ($M), Revenue, 2024 – 2029 (US$ Mn)

Table: 25A South America Smart Sensors in Military and Defence Market, by Application, Revenue, 2018 – 2023 (US$ Mn)

Table: 25B South America Smart Sensors in Military and Defence Market, by Application, Revenue, 2024 – 2029 (US$ Mn)

Table: 26A South America Smart Sensors in Military and Defence Market, Revenue, By Country, 2018 – 2023 (US$ Mn)

Table: 26B South America Smart Sensors in Military and Defence Market, Revenue, By Country, 2024 – 2029 (US$ Mn)

Table: 27 Leidos Holdings, Inc. Company Information

Table: 28 Leidos Holdings, Inc. Geographical Presence

Table: 29 Leidos Holdings, Inc. Historic Roadmap and Contracts

Table: 30 Leidos Holdings, Inc. Product Portfolio

Table: 31 Lockheed Martin Corporation Information

Table: 32 Lockheed Martin Corporation Historic Roadmap and Contracts

Table: 33 Lockheed Martin Corporation Product Portfolio

Table: 34 TT Electronics plc Information

Table: 35 TT Electronics plc Geographical Presence

Table: 36 TT Electronics plc Historic Roadmap and Contracts

Table: 37 TT Electronics plc Product Portfolio

Table: 38 BAE SYSTEMS PLC Information

Table: 39 BAE SYSTEMS PLC Geographical Presence

Table: 40 BAE SYSTEMS PLC Historic Roadmap and Contracts

Table: 41 BAE SYSTEMS PLC Product Portfolio

Table: 42 Thales SA Information

Table: 43 Thales SA Geographical Presence

Table: 44 Thales SA Historic Roadmap and Contracts

Table: 45 Thales SA Product Portfolio

Table: 46 TE Connectivity Information

Table: 47 TE Connectivity Geographical Presence

Table: 48 TE Connectivity Historic Roadmap and Contracts

Table: 49 TE Connectivity Product Portfolio

Table: 50 FLIR Systems, Inc. Information

Table: 51 FLIR Systems, Inc. Geographical Presence

Table: 52 FLIR Systems, Inc. Historic Roadmap and Contracts

Table: 53 FLIR Systems, Inc. Product Portfolio

Table: 54 STMicroelectronics Information

Table: 55 STMicroelectronics Geographical Presence

Table: 56 STMicroelectronics Historic Roadmap and Contracts

Table: 57 STMicroelectronics Product Portfolio

Table: 58 GENERAL ELECTRIC Information

Table: 59 GENERAL ELECTRIC Geographical Presence

Table: 60 GENERAL ELECTRIC Historic Roadmap and Contracts

Table: 61 GENERAL ELECTRIC Product Portfolio

Table: 62 Ceinsys Tech Ltd. Information

Table: 63 Ceinsys Tech Ltd. Smart Sensors Product Portfolio

Aerius Photonics

Alstom

Apple

ARCCORE

Australian Army

Autotalks

AWS

BAE SYSTEMS PLC

Baker Hughes

Bangladesh Power Development Board

Boeing

Brazil's Special Secretariat for the Security of Major Events (SESGE)

Cedip Infrared Systems

Ceinsys Tech Ltd.

Cerberus Capital Management

Datamax-O'Neil

Defence Advanced Research Projects Agency (DARPA)

Defence Electronics and Components Agency (DECA)

Defence Security Cooperation Agency (DSCA)

Department of Defence

Dewa

DigitalOptics Corporation

DJI Innovations

Doughty Hanson

Draupner Graphics

DroneSense, Inc

DVTEL, Inc

ETAS

Exelon

Extech Data Systems

FLIR Systems, Inc.

GE Energy Connections

GE Money Bank

GENERAL ELECTRIC

Green Investment Group Limited

ICx Technologies

Jetoptera

Leidos Holdings Inc

Lockheed Martin Corporation

Mass Holding Group

MicroGroup

Microsoft

MicroVision

Military Sealift Command (MSC)

Milrem LCM

Mobileye

Niger Delta Power

OmniTech Partners

Powerhouse International

Prox Dynamics AS

Qualcomm All-Ways Aware

Raymarine Holdings.

Royal Australian Air Force

Shapoorji Pallonji Group

SnapEDA

STMicroelectronics

Tata Power Renewable Energy Ltd

TE Connectivity

Thales SA

TT Electronics plc

U.S. Navy

US Air Force

US Army

US Army Space and Missile Defence Command

US Coast Guard

US Naval Surface Warfare Center

Weifu High-Technology

Download sample pages

Complete the form below to download your free sample pages for Smart Sensors in Military and Defence Market Report 2019-2029

Related reports

-

Wearable Technology Market 2018-2028

Our 172-page report provides 134 tables, charts, and graphs. Read on to discover the most lucrative areas in the industry...

Full DetailsPublished: 16 January 2018 -

Military Armoured Vehicle Market Report 2018-2028

The arms race developing between east and west, has led Visiongain to publish this timey report. The Armoured Vehicle market...Full DetailsPublished: 27 September 2018 -

Military Airborne Intelligence, Surveillance & Reconnaissance (ISR) Technologies Market 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Airborne ISR market. Visiongain assesses...Full DetailsPublished: 30 August 2018 -

Military Simulation, Modelling and Virtual Training Market Report 2019-2029

Developments in simulation systems related technology have had a significant impact on the defence military simulation and virtual training market.

...Full DetailsPublished: 06 December 2018 -

Global Military Personnel Health Monitoring Bioinformatics Market Forecast 2017-2027

The global military personnel health monitoring bioinformatics market is expected to grow at a CAGR of 12.8% from 2017-2027. Bioinformatics...Full DetailsPublished: 03 October 2017 -

Unmanned Aerial Vehicle (UAV) Payloads & Subsystems Market Report 2018-2028

The latest report from business intelligence provider visiongain offers comprehensive analysis of the global Unmanned Aerial Vehicle (UAV) Payloads &...

Full DetailsPublished: 17 July 2018 -

Directed Energy Weapons (DEW) Market Report 2019-2029

Directed Energy Weapons (DEW) market worth $5.8 billion in 2019.

...Full DetailsPublished: 28 January 2019 -

Military Cyber Security Market 2019-2029

The $8.8bn Military Cyber Security Market is set to grow by 5.7% in the 2019-2029 period.

...Full DetailsPublished: 29 March 2019 -

Military Aviation Sensors & Switches Market Report 2020-2030

The Market is estimated to be worth $1,583.1 million in 2020 and is expected to record favourable growth rates. There...

Full DetailsPublished: 07 May 2020 -

Military Wearable Sensors Market Report 2019-2029

Visiongain assesses the military wearable sensors market at $179m in 2019....Full DetailsPublished: 03 May 2019

Download sample pages

Complete the form below to download your free sample pages for Smart Sensors in Military and Defence Market Report 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain defence reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible, Visiongain analysts reach out to market-leading vendors and industry experts and review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain defence reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

ADS Group

Aerial Refueling Systems Advisory Group

Aerospace and Defence Industries Association of Nova Scotia

Aerospace Industries Association

Aerospace Industries Association of Canada

AHS International – The Vertical Flight Technical Society

Air Force Association

Aircraft Electronics Association

Airlift/Tanker Association

American Astronautical Society

American Gear Manufacturers Association

American Institute of Aeronautics and Astronautics

American Logistics Association

American Society of Naval Engineers

AMSUS – The Society of the Federal Health Agencies

Armed Forces Communications and Electronics Association

Armed Forces Communications and Electronics Association

Army Aviation Association of America

ASD – Aerospace & Defence Association of Europe

Association for Unmanned Vehicle Systems International

Association of Aviation Manufacturers of the Czech Republic

Association of Naval Aviation

Association of Old Crows

Association of Polish Aviation Industry

Association of the Defense Industry of the Czech Republic

Association of the United States Army

Association of the United States Navy

Australia Defence Association

Australian Industry & Defence Network

Australian Industry Group Defence Council

Austrian Aeronautics Industries Group

Aviation Distributors and Manufacturers Association

Aviation Suppliers Association

Belgian Security and Defence Industry

Bulgarian Defence Industry Association

Business Executives for National Security

Canadian Association of Defence and Security Industries

Conference of Defense Associations

Council of Defense and Space Industry Associations

Danish Defence & Security Industries Association

Defence Industry Manufacturers Association

Defense Industry Initiative on Business Ethics and Conduct

Defense Industry Offset Association

Defense Orientation Conference Association

Deutsche Gesellschaft fur Wehrtechnik

Federal Association of the German Security and Defence Industry

Federation of Aerospace Enterprises in Ireland

French Aerospace Industries Association

French Land Defence Manufacturers Association (GICAT)

German Aerospace Industries Association

Helicopter Association International

Hellenic Aerospace & Defense Industries Group

Homeland Security & Defense Business Council

International Stability Operations Association

Japan Association of Defense Industry

Korea Defense Industry Association

Marine Corps Association & Foundation

National Aeronautic Association

National Association of Ordnance and Explosive Waste Contractors

National Defense Industrial Association

National Defense Transportation Association

National Guard Association of the U.S.

Navy League of the United States

Netherlands Aerospace Group

New Zealand Defence Industry Association

Portuguese Association of Defense Related Industries & New Technologies Companies

Québec Ground Transportation Cluster

Satellite Industry Association

Society of American Military Engineers

South African Aerospace Maritime and Defence Industries Association

Spanish Aerospace and Defence Association Industries

Submarine Industrial Base Council

Swedish Aerospace Industries

Swedish Security and Defence Industry Association

Swiss Aeronautical Industries Group

The Association of Finnish Defence and Aerospace Industries

The Italian Industries Association for Aerospace Systems and Defence

The Netherlands Defence Manufacturers Association

The Society of Japanese Aerospace Companies

UK AeroSpace, Defence & Security Industries

United Kingdom National Defence Association

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Defence news

Robotic Warfare Market

The global Robotic Warfare market is projected to grow at a CAGR of 6.7% by 2034

19 July 2024

Cyber Warfare Market

The global Cyber Warfare market is projected to grow at a CAGR of 17.7% by 2034

16 July 2024

Counter-UAV (C-UAV) Market

The global Counter-UAV (C-UAV) market is projected to grow at a CAGR of 29.6% by 2034

08 July 2024

Special Mission Aircraft Market

The global Special Mission Aircraft market is projected to grow at a CAGR of 4.6% by 2034

27 June 2024