Industries > Defence > Directed Energy Weapons (DEW) Market Report 2019-2029

Directed Energy Weapons (DEW) Market Report 2019-2029

Forecasts by Product Type (High Powered Microwave HPM, High Powered Laser HPL). Analysis of Defensive, Offensive, C-UAV & Non-Lethal Applications for Leading Defence & Civilian Companies with DEW Technologies High Energy Laser (HEL), Airborne Laser (ABL), Chemical Oxygen Iodine Laser (COIL), Free Electron Laser (FEL), Solid-State Laser (SSL), Tactical High Energy Laser (THEL), Laser Directed Energy Weapon (LDEW), Laser Weapon System (LaWS) Plus Analysis of Defensive, Offensive, C-UAV & Non-Lethal Applicat ions for Leading Defence Contractors & Civilian Companies

A directed-energy weapon (DEW) is the future weapon system that emits highly focused energy for target destruction. The potential applications of this advanced technology include anti-personnel weapon systems, missile defence system, and the disabling of lightly armoured vehicles. The use of DEW systems is much more cost effective than the massive cost associated with a single missile launch. With fast-track innovations in the military technology, such weapons are tools for future warfare.

The growing demand for non-lethal weapons is a primary driver of the market. Visiongain expects that countries such as Russia, the US, the UK, Israel, China, Japan, South Korea, India, and the UAE will increase their demand for these weapons, during the forecast period owing to the increasing extremist attacks and territorial disputes.

Such weapons have a number of advantages such as enhanced accuracy, reduced violence, limited damage, and multiple target attack. The integration of directed energy in chemical, biological, radiological, and nuclear (CBRN) defence helps in effective limitation of its impact on human lives and the environment by detecting the nuclear radiation through laser and high-power microwave systems. Similarly, the progressive demand for laser weapon systems that have enhanced attack capabilities such as accuracy and undetectable characteristic are key drivers of the market.

This report splits the Directed Energy Weapons (DEW) market into two product type submarket categories: high-powered microwaves and high-energy lasers. Microwaves and lasers both operate on the electromagnetic spectrum, however, laser wavelengths are about 10,000 times smaller than microwaves, which means high-energy microwaves are more suited to emitting pulses of radiation at a wide angle, while high-energy lasers direct more focused beams of lower-powered energy using one of two mechanisms: chemical fuel or electric power.

Report Scope

View detailed company profiles of key players within the market with analysis of their product portfolios and strategies.

• Azimuth Corporation

• BAE Systems plc

• Battelle

• The Boeing Company

• General Atomics

• General Dynamics Corporation

• Kratos Defense & Security Solutions

• Lockheed Martin Corporation

• MBDA

• Northrop Grumman Corporation

• Thales Group

• Raytheon Company

• Rheinmetall AG

Review The Global Directed Energy Weapons Market Forecast From 2019-2029

Featuring 132 Exclusive Tables

115 Exclusive Figures

262 Pages

See Forecasts For Regional Directed Energy Weapons Markets From 2019-2029

• Australia Direct Energy Weapons Market Forecast 2019-2029

• Canada Direct Energy Weapons Market Forecast 2019-2029

• Germany Direct Energy Weapons Market Forecast 2019-2029

• India Direct Energy Weapons Market Forecast 2019-2029

• Israel Direct Energy Weapons Market Forecast 2019-2029

• Japan Direct Energy Weapons Market Forecast 2019-2029

• UK Direct Energy Weapons Market Forecast 2019-2029

• US Direct Energy Weapons Market Forecast 2019-2029

• Rest of the World (RoW) Direct Energy Weapons Market Forecast 2019-2029

Examine Directed Energy Weapons Forecast By Submarkets

• High Powered Microwave (HPM)

• High Powered Laser (HPL)

View prospects for DEW in the leading regions and countries

Discover individual revenue forecasts for 9 leading national Directed Energy Weapons (DEW) market markets and RoW from 2019-2029: Each of the 8 leading national markets as well as the ROW are further segmented by the two submarkets for High Powered Microwave (HPM) and High Powered Laser (HPL)

• Australia

• Canada

• Germany

• India

• Israel

• Japan

• UK

• US

• ROW

Detailed information on Directed Energy Weapons Market analysis can help to develop your business plans and strategy. With a Visiongain report, the reader is able to see a clear overview of the market. Concise analysis supports Visiongain’s conclusions, and our market evaluations will help your company when considering the market analysis.

Who should read this report?

• Aircraft OEMs

• Energy Weapon specialists

• Systems integrators

• Laser operators

• Missile Defence designers

• Missile Defence Integrators

• Electronics companies

• Prime contractors

• Tier 1 & tier 2 contractors

• Component suppliers

• Software specialists

• Product development managers

• Business development managers

• Market analysts

• Researchers

• Academics

• Consultants

• CEO’s

• Senior executives

• Managers

• Banks

• Investors

• Regulators

• Industry associations

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Directed Energy Weapons (DEW) Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.6.3 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2 Introduction to the Directed Energy Weapons (DEW) Market

2.1 Directed Energy Weapons (DEW) Market Structure

2.2 Directed Energy Weapons (DEW) Market Definition

2.3 Directed Energy Weapons (DEW) Characteristics

2.4 Directed Energy Weapons (DEW) Submarkets Definition

2.4.1 Directed Energy Weapons (DEW) High-Powered Microwave (HPM) Submarket Definition

2.4.2 Directed Energy Weapons (DEW) High-Powered Laser (HPL) Submarket Definition

3 Global Directed Energy Weapons (DEW) Market 2019-2029

3.1 Global Directed Energy Weapons (DEW) Market Forecast 2019-2029

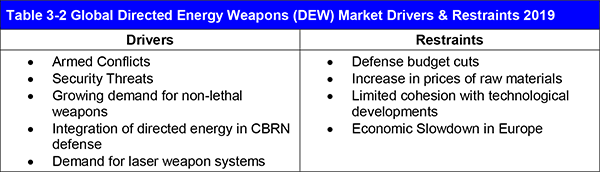

3.2 Global Directed Energy Weapons (DEW) Drivers & Restraints 2019

3.3 Drivers

3.3.1 Armed Conflicts

3.3.2 Security Threats

3.3.3 Growing demand for non-lethal weapons

3.3.4 Integration of directed energy in CBRN defense

3.4 Challenges

3.4.1 Defense Budget Cuts

3.4.2 Increase in Raw Materials’ Prices

3.4.3 Stringent regulatory norms

3.5 Market Trends

3.5.1 Evolution of non-lethal laser weapons

3.5.2 Increasing investments in R&D

3.5.3 Transition to urban warfare

4 Global Directed Energy Weapons (DEW) Submarket Forecast 2019-2029

4.1 Global Directed Energy Weapons (DEW) Microwave Forecast by National Market 2019-2029

4.2 Delayed Growth in the Microwave DEW Submarket

4.3 Global Directed Energy Weapons (DEW) Laser Forecast by National Market 2019-2029

4.4 Strong Growth in the Emerging Laser DEW Submarket

5 Leading National Directed Energy Weapons (DEW) Market Forecast 2019-2029

5.1 Global Directed Energy Weapons (DEW) Market by National Market Share Forecast 2019-2029

5.2 Australia Directed Energy Weapons (DEW) Market Forecast 2019-2029

5.2.1 Australia Directed Energy Weapons (DEW) Market Drivers & Restraints

5.2.2 Security Issues Drive Steady Growth in the Australian Market

5.3 Canada Directed Energy Weapons (DEW) Market Forecast 2019-2029

5.3.1 Canada Directed Energy Weapons (DEW) Market Drivers & Restraints

5.3.2 Lack of Domestic Expertise Slows Canadian Growth

5.4 Germany Directed Energy Weapons (DEW) Market Forecast 2019-2029

5.4.1 Germany Directed Energy Weapons (DEW) Market Contract / Programme 2019

5.4.2 Germany Directed Energy Weapons (DEW) Market Drivers & Restraints

5.4.3 Close Partnerships with Domestic Companies coupled with Increased Domestic Spending Will Drive Growth

5.5 India Directed Energy Weapons (DEW) Market Forecast 2019-2029

5.5.1 India Directed Energy Weapons (DEW) Market Example Contract / Programme 2014-2019

5.5.2 India Directed Energy Weapons (DEW) Market Drivers & Restraints

5.5.3 Domestic Commitment to DEW Development Will Drive Spending

5.6 Israel Directed Energy Weapons (DEW) Market Forecast 2019-2029

5.6.1 Israel Directed Energy Weapons (DEW) Market Example Contract / Programme 2014-2018

5.6.2 Israel Directed Energy Weapons (DEW) Market Drivers & Restraints

5.6.3 Existing Capabilities and New Threats Will Drive Spending

5.7 Japan Directed Energy Weapons (DEW) Market Forecast 2019-2029

5.7.1 Japan Directed Energy Weapons (DEW) Market Drivers & Restraints

5.7.2 Laser DEW for Sea and Land Use Will Drive Spending

5.8 United Kingdom Directed Energy Weapons (DEW) Market Forecast 2019-2029

5.8.1 United Kingdom Directed Energy Weapons (DEW) Market Example Contract / Programme 2016-2019

5.8.2 United Kingdom Directed Energy Weapons (DEW) Market Drivers & Restraints

5.8.3 Political Uncertainty Will Stymie Defence Spending

5.9 United States Directed Energy Weapons (DEW) Market Forecast 2019-2029

5.9.1 United States Directed Energy Weapons (DEW) Market Contracts & Programmes 2015-2018

5.9.2 United States Directed Energy Weapons (DEW) Market Drivers & Restraints

5.9.3 High Profile DEW Programmes Confirm US as Market Leader

5.10 Rest of the World (ROW) Directed Energy Weapons (DEW) Market Forecast 2019-2029

5.11 China Directed Energy Weapons (DEW) Market Analysis 2019-2029

5.11.1 China Directed Energy Weapons (DEW) Market Drivers & Restraints

5.11.2 Mounting Domestic Expertise Will Drive the Chinese Market

5.12 Russia Directed Energy Weapons (DEW) Market Analysis 2019-2029

5.12.1 Russia Directed Energy Weapons (DEW) Market Drivers & Restraints

5.12.2 Economic Issues May Stymie DEW Spending

6 SWOT Analysis of the Directed Energy Weapons (DEW) Market 2019-2029

7 Five Forces Analysis 2019-2029

8 Leading 13 Directed Energy Weapons (DEW) Companies

8.1 Leading 13 Directed Energy Weapons (DEW) Companies 2019

8.2 Azimuth Corporation

8.2.1 Azimuth Corporation Directed Energy Weapons (DEW) Selected Recent Contracts / Projects / Programmes (Singular) 2019

8.2.2 Azimuth Corporation Organisational Structure

8.2.3 Azimuth Corporation Primary Market Competitors 2019

8.2.4 Azimuth Corporation Analysis

8.2.5 Azimuth Corporation Future Outlook

8.3 BAE Systems plc

8.3.1 BAE Systems plc Directed Energy Weapons (DEW) Selected Recent Contracts / Projects / Programmes 2015-2019

8.3.2 BAE Systems plc Total Company Sales 2013-2017

8.3.3 BAE Systems plc Sales by Segment of Business 2013-2017

8.3.4 BAE Systems plc Net Income 2013-2017

8.3.5 BAE Systems plc Regional Emphasis / Focus

8.3.6 BAE Systems plc Organisational Structure / Subsidiaries

8.3.7 BAE Systems plc Directed Energy Weapons (DEW) Products / Services

8.3.8 BAE Systems plc Primary Market Competitors

8.3.9 BAE Systems plc Mergers & Acquisitions (M&A) Activity

8.3.10 BAE Systems plc Analysis

8.3.11 BAE Systems plc Future Outlook

8.4 Battelle

8.4.1 Battelle Directed Energy Weapons (DEW) Selected Recent Contracts / Projects / Programmes (Singular) 2016-2019

8.4.2 Battelle Regional Emphasis / Focus

8.4.3 Battelle Organisational Structure / Subsidiaries

8.4.4 Battelle Directed Energy Weapons (DEW) Products / Services

8.4.5 Battelle Primary Market Competitors 2019

8.4.6 Battelle Analysis

8.4.7 Battelle Future Outlook

8.5 The Boeing Company

8.5.1 The Boeing Company Directed Energy Weapons (DEW) Selected Recent Contracts / Projects / Programmes (Singular) 2015-2019

8.5.2 The Boeing Company Total Company Sales 2013-2017

8.5.3 The Boeing Company Sales by Segment of Business 2015-2017

8.5.4 The Boeing Company Net Income 2013-2017

8.5.5 The Boeing Company Order Backlog 2013-2017

8.5.6 The Boeing Company Regional Emphasis / Focus

8.5.7 The Boeing Company Organisational Structure / Subsidiaries

8.5.8 The Boeing Company Directed Energy Weapons (DEW) Products / Services

8.5.9 The Boeing Company Primary Market Competitors 2019

8.5.10 The Boeing Company Mergers & Acquisitions (M&A) Activity

8.5.11 The Boeing Company Analysis

8.5.12 The Boeing Company Future Outlook

8.6 General Atomics

8.6.1 General Atomics Directed Energy Weapons (DEW) Selected Recent Contracts / Projects / Programmes 2017-2018

8.6.2 General AtomicsOrganisational Structure

8.6.3 General Atomics Directed Energy Weapons (DEW) Products / Services

8.6.4 General Atomics Primary Market Competitors 2019

8.6.5 General Atomics Acquisition Activity

8.6.6 General Atomics Analysis

8.6.7 General Atomics Future Outlook

8.7 General Dynamics Corporation

8.7.1 General Dynamics Directed Energy Weapons (DEW) Selected Recent Contracts / Projects / Programmes 2013-2019

8.7.2 General Dynamics Corporation Total Company Sales 2013-2017

8.7.3 General Dynamics Corporation Sales by Segment of Business 2013-2017

8.7.4 General Dynamics Corporation Net Income / Loss 2013-2017

8.7.5 General Dynamics Corporation Order Backlog 2013-2017

8.7.6 General Dynamics Corporation Regional Emphasis / Focus

8.7.7 General Dynamics Corporation Organisational Structure

8.7.8 General Dynamics Corporation Primary Market Competitors 2019

8.7.9 General Dynamics Corporation Mergers & Acquisitions (M&A) Activity

8.7.10 General Dynamics Corporation Analysis

8.7.11 General Dynamics Corporation Future Outlook

8.8 Kratos Defense & Security Solutions

8.8.1 Kratos Defense & Security Solutions Directed Energy Weapons (DEW) Selected Recent Contracts / Projects / Programmes (Singular) 2013-2019

8.8.2 Kratos Defense & Security Solutions Total Company Sales 2013-2017

8.8.3 Kratos Defense & Security Solutions Sales by Segment of Business 2013-2017

8.8.4 Kratos Defense & Security Solutions Net Income / Loss 2013-2017

8.8.5 Kratos Defense & Security Solutions Regional Emphasis / Focus

8.8.6 Kratos Defense & Security Solutions Organisational Structure

8.8.7 Kratos Defense & Security Solutions Directed Energy Weapons (DEW) Products / Services

8.8.8 Kratos Defense & Security Solutions Primary Market Competitors 2019

8.8.9 Kratos Defense & Security Solutions Merger Activity

8.8.10 Kratos Defense & Security Solutions Analysis

8.8.11 Kratos Defense & Security Solutions Future Outlook

8.9 Lockheed Martin Corporation

8.9.1 Lockheed Martin Corporation Directed Energy Weapons (DEW) Selected Recent Contracts / Projects / Programmes

8.9.2 Lockheed Martin Corporation Total Company Sales 2013-2017

8.9.3 Lockheed Martin Corporation Sales by Segment of Business 2015-2017

8.9.4 Lockheed Martin Corporation Net Income 2013-2017

8.9.5 Lockheed Martin Corporation Order Backlog 2013-2017

8.9.6 Lockheed Martin Corporation Regional Emphasis / Focus

8.9.7 Lockheed Martin Corporation Revenue by Geographic Location

8.9.8 Lockheed Martin Corporation Organisational Structure

8.9.9 Lockheed Martin Corporation Directed Energy Weapons (DEW) Products / Services

8.9.10 Lockheed Martin Corporation Primary Market Competitors 2019

8.9.11 Lockheed Martin Corporation Mergers & Acquisitions (M&A) Activity

8.9.12 Lockheed Martin Corporation Analysis

8.9.13 Lockheed Martin Corporation Future Outlook

8.10 MBDA

8.10.1 MBDA Directed Energy Weapons (DEW) Selected Recent Contracts / Projects / Programmes (Singular) 2016-2019

8.10.2 MBDA Regional Emphasis / Focus

8.10.3 MBDA Organisational Structure / Subsidiaries

8.10.4 MBDA Directed Energy Weapons (DEW) Products / Services

8.10.5 MBDA Primary Market Competitors 2019

8.10.6 MBDA Analysis

8.10.7 MBDA Future Outlook

8.11 Northrop Grumman Corporation

8.11.1 Northrop Grumman Corporation Directed Energy Weapons (DEW) Selected Recent Contracts / Projects / Programmes (Singular)

8.11.2 Northrop Grumman Corporation Total Company Sales 2013-2017

8.11.3 Northrop Grumman Corporation Sales by Segment of Business 2015-2017

8.11.4 Northrop Grumman Corporation Net Income 2013-2017

8.11.5 Northrop Grumman Corporation Order Backlog 2013-2017

8.11.6 Northrop Grumman Corporation Regional Emphasis

8.11.7 Northrop Grumman Corporation Organisational Structure

8.11.8 Northrop Grumman Corporation Directed Energy Weapons (DEW) Products / Services

8.11.9 Northrop Grumman Corporation Primary Market Competitors 2019

8.11.10 Northrop Grumman Corporation Mergers & Acquisitions (M&A) Activity

8.11.11 Northrop Grumman Corporation Analysis

8.11.12 Northrop Grumman Corporation Future Outlook

8.12 Thales Group SA

8.12.1 Thales Group. Directed Energy Weapons (DEW) Selected Recent Contracts / Projects / Programmes (Singular) 2013-2019

8.12.2 Thales Group SA Total Company Sales 2013-2017

8.12.3 Thales Group SA Net Income 2013-2017

8.12.4 Thales Group SA Order Book 2013-2017

8.12.5 Thales Group SA Primary International Operations

8.12.6 Thales Group SA Organisational Structure

8.12.7 Thales Group Directed Energy Weapons (DEW) Products / Services

8.12.8 Thales Group SA Primary Market Competitors 2019

8.12.9 Thales Group SA Analysis

8.12.10 Thales Group Future Outlook

8.13 Raytheon Company

8.13.1 Raytheon Company Total Company Sales 2013-2017

8.13.2 Raytheon Company Sales by Segment of Business 2015-2017

8.13.3 Raytheon Company Net Income 2013-2017

8.13.4 Raytheon Company Order Backlog 2013-2017

8.13.5 Raytheon Company Regional Emphasis

8.13.6 Raytheon Company Organisational Structure

8.13.7 Raytheon Company Directed Energy Weapons (DEW) Products / Services

8.13.8 Raytheon Company Primary Market Competitors 2019

8.13.9 Raytheon Company Mergers & Acquisitions (M&A) Activity

8.13.10 Raytheon Company Analysis

8.13.11 Raytheon Company Future Outlook

8.14 Rheinmetall AG

8.14.1 Rheinmetall AG Directed Energy Weapons (DEW) Selected Recent Contracts / Projects / Programmes

8.14.2 Rheinmetall AG Total Company Sales 2013-2017

8.14.3 Rheinmetall AG Sales by Segment of Business 2013-2017

8.14.4 Rheinmetall AG Net Income / Loss 2013-2017

8.14.5 Rheinmetall AG Order Backlog 2013-2017

8.14.6 Rheinmetall AG Regional Emphasis / Focus

8.14.7 Rheinmetall AG Organisational Structure

8.14.8 Rheinmetall AG Directed Energy Weapons (DEW) Products / Services

8.14.9 Rheinmetall AG Primary Market Competitors 2019

8.14.10 Rheinmetall AG Mergers & Acquisitions (M&A) Activity

8.14.11 Rheinmetall AG Analysis

8.14.12 Rheinmetall AG Future Outlook

8.15 Other Companies Involved in the Directed Energy Weapons (DEW) Market 2019

9 Conclusions and Recommendations

Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

Appendix B

List of Tables

Table 1 1 Example of Directed Energy Weapons (DEW) Market by National Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 1 2 Example of Leading National Directed Energy Weapons (DEW) Market Forecast by Submarket 2019-2029 (US$m, AGR %, Cumulative)

Table 3 1 Global Directed Energy Weapons (DEW) Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 3 2 Global Directed Energy Weapons (DEW) Market Drivers & Restraints 2019

Table 4 1Global Directed Energy Weapons (DEW) Submarket Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 4 2Global Directed Energy Weapons (DEW) Submarket by National Market Forecast 2019-2029 (US$m, Cumulative, Global AGR %)

Source: Visiongain 2019

Table 4 3Global Directed Energy Weapons (DEW) Submarket CAGR Forecast 2019-2024, 2024-2029, 2019-2029 (CAGR %)

Table 4.4 Global Directed Energy Weapons (DEW) Submarket Percentage Change in Market Share 2019-2024, 2024-2029, 2019-2029 (% Change)

Table 4 4Global Directed Energy Weapons (DEW) Microwave Submarket by National Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 4 5 Global Directed Energy Weapons (DEW) Laser Submarket by National Market Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5 1 Leading National Directed Energy Weapons (DEW) Market Forecast 2019-2029 (US$m, AGR %, Cumulative)

Table 5 2 Global Directed Energy Weapons (DEW) Submarket by National Market CAGR Forecast 2019-2024, 2024-2029, 2019-2029 (CAGR %)

Table 5 3 National Directed Energy Weapons (DEW) Market Percentage Change in Market Share 2019-2024, 2024-2029, 2019-2029 (% Change)

Table 5 4 Australia Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5 5 Australia Directed Energy Weapons (DEW) Market Drivers & Restraints 2019

Table 5 6 Canada Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5 7 Canada Directed Energy Weapons (DEW) Market Drivers & Restraints 2019

Table 5 8 Germany Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5 9 Germany Directed Energy Weapons (DEW) Market Example Contract / Programme 2016-2018 (Date, Company, Product, Details)

Table 5 10 Germany Directed Energy Weapons (DEW) Market Drivers & Restraints 2019

Table 5 11 India Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5 12 India Directed Energy Weapons (DEW) Market Example Contract / Programme 2014-2018 (Date, Value US$m, Product, Details)

Table 5 13 India Directed Energy Weapons (DEW) Market Drivers & Restraints 2019

Table 5 14 Israel Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5 15 Israel Directed Energy Weapons (DEW) Market Example Contract / Programme 2014-2018 (Date, Company, Product, Details)

Table 5 16 Israel Directed Energy Weapons (DEW) Market Drivers & Restraints 2019

Table 5 17 Japan Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5 18 Japan Directed Energy Weapons (DEW) Market Drivers & Restraints 2019

Table 5 19 United Kingdom Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5 20 United Kingdom Directed Energy Weapons (DEW) Market Example Contract / Programme 2016 (Date, Company, Value US$m, Product, Details)

Table 5 21 United Kingdom Directed Energy Weapons (DEW) Market Drivers & Restraints 2019

Table 5 22 United States Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5 23 United States Directed Energy Weapons (DEW) Market Major Contracts & Programmes 2015-2018 (Date, Company, Value US$m, Product, Details)

Table 5 24 United States Directed Energy Weapons (DEW) Market Drivers & Restraints 2019

Table 5 25 Rest of the World (ROW) Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, AGR %, CAGR %, Cumulative)

Table 5 26 China Directed Energy Weapons (DEW) Market Drivers & Restraints 2019

Table 5 27 Russia Directed Energy Weapons (DEW) Market Drivers & Restraints 2019

Table 6 1 Global Directed Energy Weapons (DEW) Market SWOT Analysis 2019-2029

Table 7 1 Global Directed Energy Weapons (DEW) Market Five Forces Analysis 2019-2029

Table 8 1 Leading 13 Directed Energy Weapons (DEW) Companies Sales 2017 (Company, FY2015 Total Company Sales US$m, Primary Submarket Specialisation)

Table 8 2 Azimuth Corporation Profile 2019 (CEO, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Website)

Table 8 3 Selected Recent Azimuth Corporation Directed Energy Weapons (DEW) Contracts / Projects / Programmes (Singular) 2015 (Date, Country, Value US$m, Product, Details)

Table 8 4 BAE Systems plc Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8 5 Selected Recent BAE Systems plc Directed Energy Weapons (DEW) Contracts / Projects / Programmes 2013 (Date, Country, Value US$m, Product, Details)

Table 8 6 BAE Systems plc Total Company Sales 2013-2017 (US$m, AGR %)

Table 8 7 BAE Systems plc Sales by Business Segment 2013-2017 (US$m, AGR %)

Table 8 8 BAE Systems plc Net Income 2013-2017 (US$m, AGR %)

Table 8 9 BAE Systems plc Sales by Geographical Location 2013-2017 (US$m, AGR %)

Table 8 10 BAE Systems plc Subsidiaries (Subsidiary, Location)

Table 8 11 BAE Systems plc Directed Energy Weapons (DEW) Products / Services (Segment of Business, Product, Specification / Features

Table 8 12 BAE Systems plc Mergers and Acquisitions 2013-2019 (Date, Company Involved, Value US$m, Details)

Table 8 13 BAE Systems plc Divestitures 2015-2019 (Date, Company Involved, Value US$m, Details

Table 8 14 Battelle Profile 2019 (CEO, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Website)

Table 8 15 Selected Recent Battelle Directed Energy Weapons (DEW) Contracts / Projects / Programmes (Singular) 2019 (Date, Country, Value US$m, Product, Details)

Table 8 16 Battelle Subsidiaries 2019 (Subsidiary, Location)

Table 8 17 Battelle Directed Energy Weapons (DEW) Products / Services (Segment of Business, Product, Specification / Features)

Table 8 18 The Boeing Company Overview 2019(CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8 19 Selected Recent The Boeing Company Directed Energy Weapons (DEW) Contracts / Projects / Programmes (Date, Country, Value US$m, Product, Details)

Table 8 20 The Boeing Company Total Company Sales 2013-2017 (US$m, AGR %)

Table 8 21 The Boeing Company Sales by Business Segment 2015-2017 (US$m, AGR %)

Table 8 22 The Boeing Company Net Income 2013-2017 (US$m, AGR %)

Table 8 23 The Boeing Company Order Backlog 2013-2017 (US$m, AGR %)

Table 8 24 The Boeing Company Sales by Geographical Location 2013-2017 (US$m, AGR %)

Table 8 25 The Boeing Company Subsidiaries 2019 (Subsidiary, Location)

Table 8 26 The Boeing Company Directed Energy Weapons (DEW) Products / Services (Segment of Business, Product, Specification / Features)

Table 8 27 The Boeing Company Mergers and Acquisitions (Date, Company Involved, Value US$m, Details)

Table 8 28 The Boeing Company Divestiture (Date, Company Involved, Details)

Table 8 29 General Atomics Profile 2019 (CEO, Business Segment in the Market, Submarket Involvement, HQ, Founded, IR Contact, Website)

Table 8 30 Selected Recent General Atomics Directed Energy Weapons (DEW) Contracts / Projects / Programmes (Date, Country, Product, Details)

Table 8 31 General Atomics Directed Energy Weapons (DEW) Products / Services (Segment of Business, Product, Specification / Features)

Table 8 32 General Atomics Acquisition (Date, Company Involved, Value US$m, Details)

Table 8 33 General Dynamics Corporation Profile 2019(CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8 34 Selected Recent General Dynamics Directed Energy Weapons (DEW) Contracts / Projects / Programmes (Date, Country, Value (US$m), Product, Details)

Table 8 35 General Dynamics Corporation Total Company Sales 2013-2017 (US$m, AGR %)

Table 8 36 General Dynamics Corporation Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8 37 General Dynamics Corporation Net Income / Loss 2013-2017 (US$m )

Table 8 38 General Dynamics Corporation Order Backlog 2013-2017 (US$m, AGR %)

Table 8 39 General Dynamics Corporation Sales by Geographical Location 2013-2017 (US$m, AGR %)

Table 8 40 General Dynamics Corporation Mergers and Acquisitions 2013-2019 (Date, Company Involved, Details)

Table 8 41 Kratos Defense & Security Solutions Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, No. of Employees, IR Contact, Ticker, Website

Table 8 42 Selected Recent Kratos Defense & Security Solutions Directed Energy Weapons (DEW) Contracts / Projects / Programmes (Date, Country, Value US$m, Product, Details)

Table 8 43 Kratos Defense & Security Solutions Total Company Sales 2013-2017 (US$m, AGR %)

Table 8 44 Kratos Defense & Security Solutions Sales by Segment of Business 2013-2015 (US$m, AGR %)

Table 8 45 Kratos Defense & Security Solutions Net Income / Loss 2013-2017 (US$m)

Table 8 46 Kratos Defense & Security Solutions Directed Energy Weapons (DEW) Products / Services (Segment of Business, Product, Specification / Features)

Table 8 47 Kratos Defense & Security Solutions Mergers 2018 (Date, Details)

Table 8 48 Lockheed Martin Corporation Profile 2019 (CEO, Total Company Sales US$m, Net Income (US$m), Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8 49 Selected Recent Lockheed Martin Corporation Directed Energy Weapons (DEW) Contracts / Projects / Programmes (Country, Product, Details)

Table 8 50 Lockheed Martin Corporation Total Company Sales 2013-2017 (US$m, AGR %)

Table 8 51 Lockheed Martin Corporation Sales by Business Segment 2015-2017 (US$m, AGR %)

Table 8 52 Lockheed Martin Corporation Net Income 2013-2017 (US$m, AGR %)

Table 8 53 Lockheed Martin Corporation Order Backlog 2013-2017 (US$m, AGR %)

Table 8 54 Lockheed Martin Corporation Sales by Geographical Location 2013-2017 (US$m, AGR %)

Table 8 55 Lockheed Martin Corporation Directed Energy Weapons (DEW) Products / Services (Product, Specification / Features

Table 8 56 Lockheed Martin Corporation Mergers and Acquisitions (Date, Company Involved, Value US$m, Details)

Table 8.59 Lockheed Martin Corporation Divestitures 2013-2019 (Date, Company Involved, Value US$m, Details)

Table 8 57 MBDA Profile 2019 (CEO, Total Company Sales US$m, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Website)

Table 8 58 Selected Recent MBDA Directed Energy Weapons (DEW) Contracts / Projects / Programmes (Singular) 2019 (Date, Country, Value US$m, Product, Details)

Table 8 59 MBDA Subsidiaries 2019 (Subsidiary, Location)

Table 8 60 MBDA Directed Energy Weapons (DEW) Products / Services (Product, Specification / Features)

Table 8 61 Northrop Grumman Corporation Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8 62 Selected Recent Northrop Grumman Corporation Directed Energy Weapons (DEW) Contracts / Projects / Programmes (Country, Product, Details)

Table 8 63 Northrop Grumman Corporation Total Company Sales 2013-2017 (US$m, AGR %)

Table 8 64 Northrop Grumman Corporation Sales by Segment of Business 2015-2017 (US$m, AGR %)

Table 8 65 Northrop Grumman Corporation Net Income 2013-2017 (US$m, AGR %)

Table 8 66 Northrop Grumman Corporation Order Backlog 2013-2017 (US$m, AGR %)

Table 8 67 Northrop Grumman Corporation Sales by Geographical Location 2013-2017 (US$m, AGR %)

Table 8 68 Northrop Grumman Corporation Directed Energy Weapons (DEW) Products / Services (Product, Specification / Features)

Table 8 69 Northrop Grumman Corporation Mergers and Acquisitions (Date, Company Involved, Value US$m, Details)

Table 8 70 Thales Group SA Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8 71 Selected Recent Rafael Advanced Defense Systems Ltd. Energy Weapons (DEW) Contracts / Projects / Programmes (Date, Company, Product, Details)

Table 8 72 Thales Group SA Total Company Sales 2013-2017 (US$m, AGR %)

Table 8 73 Thales Group SA Net Income 2013-2017 (US$m, AGR %)

Table 8 74 Thales Group SA Order Book 2013-2017 (US$m, AGR %)

Table 8 75 Thales Group SA Directed Energy Weapons (DEW) Products / Services (Segment of Business, Product, Specification / Features)

Table 8 76 Raytheon Company Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8 77 Raytheon Company Total Company Sales 2013-2017 (US$m, AGR %)

Table 8 78 Raytheon Company Sales by Segment of Business 2015-2017 (US$m, AGR %)

Table 8 79 Raytheon Company Net Income 2013-2017 (US$m, AGR %)

Table 8 80 Raytheon Company Order Backlog 2013-2017 (US$m, AGR %)

Table 8 81 Raytheon Company Sales by Geographical Location 2013-2017 (US$m, AGR %)

Table 8 82 Raytheon Company Directed Energy Weapons (DEW) Products / Services (Product, Specification / Features)

Table 8 83 Raytheon Company Mergers and Acquisitions (Date, Company Involved, Value US$m, Details)

Table 8 84 Raytheon Company Divestitures (Date, Details)

Table 8 85 Rheinmetall AG Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8 86 Selected Recent Rheinmetall AG Directed Energy Weapons (DEW) Contracts / Projects / Programmes (Date, Country, Product, Details)

Table 8 87 Rheinmetall AG Total Company Sales 2013-2017 (US$m, AGR %)

Table 8 88 Rheinmetall AG Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8 89 Rheinmetall AG Net Income / Loss 2013-2017 (US$m, AGR %)

Table 8 90 Rheinmetall AG Order Backlog 2013-2017 (US$m, AGR %)

Table 8 91 Rheinmetall AG Sales by Geographical Location 2016-2017 (US$m, AGR %)

Table 8 92 Rheinmetall AG Directed Energy Weapons (DEW) Products / Services (Segment of Business, Product, Specification / Features)

Table 8 93 Rheinmetall AG Mergers and Acquisitions (Date, Company Involved, Details)

Table 8 94 Other Companies Involved in the DEW Market 2019

List of Figures

Figure 1.1 Example of Directed Energy Weapons (DEW) Market by National Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 1.2 Example of National vs Global Directed Energy Weapons (DEW) Market CAGR Forecast 2019-2024, 2024-2029, 2019-2029 (CAGR %)

Figure 2.1 Global Directed Energy Weapons (DEW) Market Segmentation Overview

Figure 2.2 Directed Energy Weapons (DEW) Characteristics

Figure 3.1 Global Directed Energy Weapons (DEW) Market Forecast 2019-2029 (US$m, AGR %)

Figure 4.1 Global Directed Energy Weapons (DEW) Submarket AGR Forecast 2019-2029 (AGR %)

Figure 4.2 Global Directed Energy Weapons (DEW) Submarket Forecast 2019-2029 (US$m, Global AGR %)

Figure 4.3 Global Directed Energy Weapons (DEW) Submarket Share Forecast 2019 (% Share)

Figure 4.4 Global Directed Energy Weapons (DEW) Submarket Share Forecast 2024 (% Share)

Figure 4.5 Global Directed Energy Weapons (DEW) Submarket Share Forecast 2029 (% Share)

Figure 4.6 Global Directed Energy Weapons (DEW) Submarket CAGR Forecast 2019-2024 (CAGR %)

Figure 4.7 Global Directed Energy Weapons (DEW) Submarket CAGR Forecast 2024-2029 (CAGR %)

Figure 4.8 Global Directed Energy Weapons (DEW) Submarket CAGR Forecast 2019-2029 (CAGR %)

Figure 4.9 Global Directed Energy Weapons (DEW) Submarket Percentage Change in Market Share 2019-2024 (% Change)

Figure 4.10 Global Directed Energy Weapons (DEW) Submarket Percentage Change in Market Share 2024-2029 (% Change)

Figure 4.11 Global Directed Energy Weapons (DEW) Submarket Percentage Change in Market Share 2019-2029 (% Change)

Figure 4.12 Global Directed Energy Weapons (DEW) Microwave Market Forecast by National Market 2019-2029 (US$m, Global AGR %)

Figure 4.13 Global Directed Energy Weapons (DEW) Laser Market Forecast by National Market 2019-2029 (US$m, Global AGR %)

Figure 5.1 Global Directed Energy Weapons (DEW) Market by National Market Forecast 2019-2029 (US$m, Global AGR %)

Figure 5.2 Global Directed Energy Weapons (DEW) Market by National Market AGR Forecast 2019-2029 (AGR %)

Figure 5.3 Leading National Directed Energy Weapons (DEW) Market CAGR Forecast 2019-2024 (CAGR %)

Figure 5.4 Leading National Directed Energy Weapons (DEW) Market CAGR Forecast 2024-2029 (CAGR %)

Figure 5.5 Leading National Directed Energy Weapons (DEW) Market CAGR Forecast 2019-2029 (CAGR %)

Figure 5.6 Global Directed Energy Weapons (DEW) Market by National Market Share Forecast 2019 (% Share)

Figure 5.7 Global Directed Energy Weapons (DEW) Market by National Market Share Forecast 2024 (% Share)

Figure 5.8 Global Directed Energy Weapons (DEW) Market by National Market Share Forecast 2029 (% Share)

Figure 5.9 National Directed Energy Weapons (DEW) Market Percentage Change in Market Share 2019-2024 (% Change

Figure 5.10 National Directed Energy Weapons (DEW) Market Percentage Change in Market Share 2024-2029 (% Change)

Figure 5.11 National Directed Energy Weapons (DEW) Market Percentage Change in Market Share 2019-2029 (% Change)

Figure 5.12 Australia Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, Australia Total Market Sales AGR %)

Figure 5.13 Canada Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, Canada Total Market Sales AGR %)

Figure 5.14 Germany Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, Germany Total Market Sales AGR %)

Figure 5.15 India Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, India Total Market Sales AGR %)

Figure 5.16 Israel Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, Israel Total Market Sales AGR %)

Figure 5.17 Japan Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, Japan Total Market Sales AGR %)

Figure 5.18 United Kingdom Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, United Kingdom Total Market Sales AGR %)

Figure 5.19 United States Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, United States Total Market Sales AGR %)

Figure 5.20 Rest of the World (ROW) Directed Energy Weapons (DEW) Market by Submarkets Forecast 2019-2029 (US$m, Rest of the World (ROW) Total Market Sales AGR %)

Figure 8.1 Azimuth Corporation Organisational Structure 2019

Figure 8.2 Azimuth Corporation Primary Market Competitors 2019

Figure 8.3 BAE Systems plc Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.4 BAE Systems plc Sales by Business Segment 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.5BAE Systems plc Net Income 2013-2017 (US$m, AGR %)

Figure 8.6 BAE Systems plc Primary International Operations 2019

Figure 8.7 BAE Systems plc Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.8 BAE Systems plc Organisational Structure 2019

Figure 8.9 BAE Systems plc Primary Market Competitors 2019

Figure 8.10 Battelle Primary International Operations 2019

Figure 8.11 Battelle Organisational Structure 2019

Figure 8.12 Battelle Primary Market Competitors 2019

Figure 8.13 The Boeing Company Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.14 The Boeing Company Sales by Business Segment 2015-2017 (US$m, Total Company Sales AGR %)

Figure 8.15 The Boeing Company Net Income 2013-2017 (US$m, AGR %)

Figure 8.16 The Boeing Company Order Backlog 2013-2017 (US$m, AGR %)

Figure 8.17 The Boeing Company Primary International Operations 2019

Figure 8.18 The Boeing Company Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.19 The Boeing Company Organisational Structure 2019

Figure 8.20 The Boeing Company Primary Market Competitors 2019

Figure 8.21 General Atomics Organisational Structure 2019

Figure 8.22 General Atomics Primary Market Competitors 2019

Figure 8.23 General Dynamics Corporation Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.24 General Dynamics Corporation Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.25 General Dynamics Corporation Net Income / Loss 2013-2017 (US$m )

Figure 8.26 General Dynamics Corporation Order Backlog 2013-2017 (US$m, AGR %)

Figure 8.27 General Dynamics Corporation Primary International Operations 2019

Figure 8.28 General Dynamics Corporation Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.29 General Dynamics Corporation Organisational Structure 2019

Figure 8.30 General Dynamics Corporation Primary Market Competitors 2019

Figure 8.31 Kratos Defense & Security Solutions Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.32 Kratos Defense & Security Solutions Sales by Segment of Business 2013-2015 (US$m, Total Company Sales AGR %)

Figure 8.33 Kratos Defense & Security Solutions Net Income / Loss 2013-2017 (US$m)

Figure 8.34 Kratos Defense & Security Solutions Primary International Operations 2019

Figure 8.35 Kratos Defense & Security Solutions Organisational Structure 2019

Figure 8.36 Kratos Defense & Security Solutions Primary Market Competitors 2019

Figure 8.37 Lockheed Martin Corporation Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.38 Lockheed Martin Corporation Sales by Business Segment 2015-2017 (US$m, Total Company Sales AGR %)

Figure 8.39 Lockheed Martin Corporation Net Income 2013-2017 (US$m, AGR %)

Figure 8.40 Lockheed Martin Corporation Order Backlog 2013-2017 (US$m, AGR %)

Figure 8.41 Lockheed Martin Corporation Primary International Operations 2019

Figure 8.42 Lockheed Martin Corporation Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.43 Lockheed Martin Corporation Organisational Structure 2019

Figure 8.44 Lockheed Martin Corporation Primary Market Competitors 2019

Figure 8.45 MBDA Primary International Operations 2019

Figure 8.46 MBDA Organisational Structure 2019

Figure 8.47 MBDA Primary Market Competitors 2019

Figure 8.48 Northrop Grumman Corporation Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.49 Northrop Grumman Corporation Sales by Segment of Business 2015-2017 (US$m, Total Company Sales AGR %)

Figure 8.50 Northrop Grumman Corporation Net Income 2013-2017 (US$m, AGR %)

Figure 8.51 Northrop Grumman Corporation Order Backlog 2013-2017 (US$m, AGR %)

Figure 8.52 Northrop Grumman Corporation Primary International Operations 2019

Figure 8.53 Northrop Grumman Corporation Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.54 Northrop Grumman Corporation Organisational Structure 2019

Figure 8.55 Northrop Grumman Corporation Primary Market Competitors 2019

Figure 8.56 Thales Group SA Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.57 Thales Group SA Net Income 2013-2017 (US$m, AGR %)

Figure 8.58 Thales Group SA Order Backlog 2013-2017 (US$m, AGR %)

Figure 8.59 Thales Group SA Primary International Operations 2019

Figure 8.60 Thales Group SA Organisational Structure 2019

Figure 8.61 Thales Group SA Primary Market Competitors 2019

Figure 8.62 Raytheon Company Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.63 Raytheon Company Sales by Segment of Business 2015-2017 (US$m, Total Company Sales AGR %)

Figure 8.64 Raytheon Company Net Income 2013-2017 (US$m, AGR %)

Figure 8.65 Raytheon Company Order Backlog 2013-2017 (US$m, AGR %)

Figure 8.66 Raytheon Company Primary International Operations 2019

Figure 8.67 Raytheon Company Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.68 Raytheon Company Organisational Structure 2019

Figure 8.69 Raytheon Company Primary Market Competitors 2019

Figure 8.70 Rheinmetall AG Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.71 Rheinmetall AG Sales by Segment of Business 2013-2016 (US$m, Total Company Sales AGR %)

Figure 8.72 Rheinmetall AG Net Income / Loss 2013-2017 (US$m)

Figure 8.73 Rheinmetall AG Order Backlog 2013-2017 (US$m, AGR %)

Figure 8.74 Rheinmetall AG Primary International Operations 2019

Figure 8.75 Rheinmetall AG Sales by Geographical Location 2016-2017 (US$m, Total Company Sales AGR %)

Figure 8.76 Rheinmetall AG Organisational Structure 2019

Figure 8.77 Rheinmetall AG Primary Market Competitors 2019

2d3 Sensing

Aérospatiale-Matra Missiles

Airbus

Airway Inc

Alenia Difesa

Alenia Marconi Systems

Almaz-Antey

Applied Physical Sciences

Argon ST, Inc.

Astro Limited

Astrotech

Aviall Services, Inc.

Aviall UK, Inc.

Aviall, Inc.

Azimuth Corporation

Babcock International Group plc

BAe Dynamics

BAE Intelligence and Security

BAE Systems

BAE Systems (Operations) Limited

BAE Systems Controls Inc.

BAE Systems Information and Electronic Systems Integration Inc

BAE Systems Information Solutions Inc

BAE Systems Land & Armaments LP

BAE Systems Oman

BAE Systems Safety Products Inc

BAE Systems Saudi Arabia

BAE Systems Surface Ships Limited

BAE Systems Tensylon High Performance Materials Inc

Battelle

Battelle Japan

Bayern-Chemie

BCC Cove Corporation

BCC Equipment Leasing Corporation

Beriev Aircraft Company

Bharat Electronics Ltd

Boeing Aerospace Operations, Inc.

Boeing Airborne Surveillance Enterprises, Inc.

Boeing Aircraft Holding Company

Boeing Canada Operations Ltd.

Boeing Capital Corporation

Boeing Capital Loan Corporation

Boeing CAS Holding GmbH

Boeing Commercial Space Company

Boeing Company, The

Boeing Defence UK Limited

Boeing Intellectual Property Licensing Company

Boeing International B.V. & Co. Holding KGaA

Boeing International Logistics Spares, Inc.

Boeing Logistics Spares, Inc.

Boeing North American Space Alliance Company

Boeing Operations International, Inc

Boeing Satellite Systems International, Inc.

China Poly Group Corporation

Commercial Armored Vehicles LLC

CONTROP Precision Technologies Ltd

Defence Support Group

Denel Munitions

Deposition Sciences Inc

DEW Engineering and Development ULC

EADS Aerospatiale Matra Missiles

EADS LFK-Lenkflugkörpersysteme GmbH

Eclipse Electronic Systems

EIG

Elbit Systems

ETI

Fairchild Imaging Inc

Ferrostaal Industrieanlagen

Finmeccanica (now Leonardo)

Flight Options LLC

FNSS Savuma Sistemleri AS

Force Protection Inc

Foreground Security

Forensic Technology WAI

GEC-Marconi Radar & Defence

General Atomics

GESPI Aeronautics

HUAYU Automotive Systems (Shanghai) Co. Ltd.

Hughes Research Labs

Industrial Defender, Inc

Insitu

Integral Systems, Inc.

IRIS Acquisition Sub LLC.

IRIS Merger Sub Inc.

Israel Aerospace Industries (IAI)

Israel Military Industries (IMI)

Jeppesen GmbH

Jeppesen Sanderson, Inc.

Kratos Defense & Security Solutions

KS HUAYU AluTech GmbH

Ktech Corp

Kylmar Ltd

L-1 Identity Solutions Inc

LaSalle Capital

Laser Energetics, Inc

Leonardo - Finmecannica

Lindsay Goldberg LLC

Lockheed Martin Corporation

M5 Network Security

Marshall Defence and Aerospace

Matra BAe Dynamics

Matra Defense

MBDA

MBDA Deutschland GmbH

MBDA France

MBDA Inc

MBDA Italy

MBDA UK

Metro Machine Imperial Docks Inc

Miltec Corporation

Narus, Inc.

Northrop Grumman Australia

Northrop Grumman Corporation

Northrop Grumman Integrated Defence Services Pty Limited

OASYS Technology LLC

OMG Plc

Open Kernel Labs

Pacific Architects and Engineers Inc

Perimeter Internetworking Corp

Pine Telecom Ltd.

Poseidon Scientific Instruments Pty Ltd

Protac

Qantas Defence Services Pty Limited

QinetiQ

Rafael Advanced Defense Systems Ltd

Raytheon Blackbird Technologies

Raytheon Company

Rheinmetall AG

Rheinmetall International Engineering

Safariland, LLC

Savi Technology, Inc.

Schroth Safety Products GmbH businesses (Safety Products)

SeeByte

Sikorsky Aircraft

SilverSky

Solutions Made Simple Inc

stratsec.net

Swiss-Photonics AG

Symantec Corporation

Systems Made Simple

Teligy Inc

Thales

The O’Gara Group, Inc.

The Veritas Capital Fund III, LP

UES Inc

Vangent, Inc.

Veritas Capital

Visual Analytics Inc

Vought Aircraft Industries

Websense

Winner Water Services

Wireless Facilities Incorporated

Zeta Associates, Inc

Organisations Mentioned

AAR Corp

Aerojet Rocketdyne

AgustaWestland

Airbus Group (Netherlands)

Airbus Helicopters

Alenia Aermacchi

Alion Science and Technology

Alliant Techsystems

Almaz Antey

ASC Pty Ltd

Aselsan

Austal

Austal USA

Australian Defence Force (ADF)

Australian Defence Science and Technology (DST) Group

Babcock International Group

Bechtel

Beriev Aircraft Company

Bharat Electronics

Booz Allen Hamilton

CACI International

CAE Inc.

CEA

Chemring Group

Chief of Staff of the Israel Defence Force (IDF)

China Aerospace Science and Technology Corp.

China National Precision Machinery,

Chinese National People's Congress

Chinese People’s Liberation Army (PLA)

CNH Industrial

Cobham plc

Computer Sciences Corp.

Conservative Party of Canada

Cubic Corporation

Daesh/Islamic State

Dassault Aviation

Dassault Aviation Groupe

Diehl BGT Defence

Dyncorp

EADS Astrium

Embraer

European Bank for Reconstruction and Development

European Union (EU)

Federal German Cabinet

Fincantieri

Fluor Corporation

GenCorp

General Electric

German Alliance 90/Green Party

German Bundeswehr

German Christian Democratic Union (CDU)

German Christian Social Union of Bavaria (CSU)

German Ministry of Defence

German Social Democrat Party (SPD)

Government of Australia

Government of Canada

Government of Germany

Government of India

Government of Israel

Government of Japan

Government of People's Republic of China

Government of Russia

Government of United Kingdom

Government of United States

Hamas

Hanwha

Harris Corporation

Hezbollah

Hindustan Aeronautics Limited

Honeywell

Huntington Ingalls

India Centre for High Energy Systems and Sciences (CHESS)

Indian Defence Research and Development Organisation (DRDO)

Indian Defence Research and Development Organisation (DRDO) Laser Science and Technology Centre (LASTEC)

Indian Ministry of Defence

Indian Ministry of Defence Integrated Defence Staff (HQ IDS)

Indian Ordnance Factories

International Monetary Fund (IMF)

Irkut Corporation

Israel Aerospace Industries

Israeli Defence Force (IDF)

Israeli Finance Ministry

Israeli Ministry of Defence

ITT Exelis

IVECO

Jacobs Engineering Group

Japanese Defense Ministry

Kawasaki Heavy Industries

Kongsberg Gruppen

Korea Aerospace Industries

Krauss-Maffei Wegmann

KRET

L-3 Technologies

Lasetel

Leidos

Leonardo

Leonardo-Finmeccanica

Liberal Party of Canada

ManTech International

Meggitt

MIT

Mitsubishi Heavy Industries

Moog Inc.

Naval Group

Navantia

NEC

Nexter

North Atlantic Treaty Organization (NATO)

Oshkosh Truck

Patria Industries

Pilatus Aircraft

Pratt & Whitney

Precision Castparts

Radiance Technologies

Rafael Advanced Defense Systems Ltd.

Reiner Stemme Utility Air-Systems GmbH

Rockwell Collins

Rolls-Royce

Royal Netherlands Air Force

Royal Netherlands Army

RTI Systems

RUAG

Russian Defence Ministry

Russian Helicopters

Russian Navy

SAAB

SAFRAN

Samsung Techwin

Selex ES

Serco

Sevmash (USC)

Soviet Strategic Missile Troops Military Academy

Sozvezdie

ST Engineering

Sukhoi

Tactical Missiles Corporation

Technical Research and Design Institute of the Japanese Defense Ministry

Textron

Textron Inc

Thales Systèmes Aéroportés

The Aerospace Corporation

ThyssenKrupp

Triumph Group

UK Conservative and Unionist Party

UK Defence Science and Technology Laboratory (DSTL)

UK Home Office

UK Liberal Democrat Party

UK Ministry of Defence (MOD)

UK Royal Navy

Ukroboronprom

Ultra Electronics

United Aircraft Corporation

United Engine Corporation

United Shipbuilding Corporation

United Technologies

Uralvagonzavod

URS Corporation

US Air Force (USAF)

US Air Force Research Laboratory

US Army

US Congress

US Defense Advanced Research Project Agency (DARPA)

US Democratic Party

US Department of Defense

US Department of Homeland Security

US Missile Defense Agency (MDA)

US Navy

US Office of Naval Research (ONR)

US Republican Party

US Space and Missile Defense Command (SMDC)

US Strategic Defense Initiative (SDI)

Download sample pages

Complete the form below to download your free sample pages for Directed Energy Weapons (DEW) Market Report 2019-2029

Related reports

-

Military Smart Weapons Market Report 2020-2030

Smart Weapons market to total USD 32.8 billion in 2030....Full DetailsPublished: 11 December 2019 -

Unmanned Combat Aerial Vehicle (UCAV) Market Report 2018-2028

The global Unmanned Combat Aerial Vehicle Systems market consists of worldwide government spending on the procurement, development, and upgrades of...

Full DetailsPublished: 29 March 2018 -

Autonomous Weapons Market Report 2020-2030

Autonomous Weapons market to total USD 29 billion in 2030.

...Full DetailsPublished: 17 February 2020 -

Military Embedded Systems Market Forecast 2018-2028

Developments in military embedded systems have had a significant impact on the embedded systems market. This market is estimated by...

Full DetailsPublished: 26 April 2018 -

Small and Tactical UAV Fuel Cell Market Report 2020-2030

This latest report by business intelligence provider Visiongain assesses that Small and Tactical UAV Fuel Cell Market is projected to...

Full DetailsPublished: 01 January 1970 -

Non-Lethal Weapons Market Report 2020-2030

Non-Lethal Weapons Market to total USD 7.1 billion in 2030....Full DetailsPublished: 20 December 2019 -

Electronic Warfare (EW) Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Electronic Warfare market. Visiongain assesses that...

Full DetailsPublished: 18 May 2018 -

Air and Missile Defence System Market Forecast 2019-2029

Are you looking for a definitive report on the $14.1bn AMDS Market? You will receive a highly granular market analysis...

Full DetailsPublished: 31 January 2019 -

Weapons Carriage & Release System Market Report 2020-2030

The missile segment is expected to develop at the largest pace between 2020 and 2030 based on the type of...

Full DetailsPublished: 01 January 1970 -

Remote Weapon Station Market Report 2020-2030

Remote Weapon Station market to total USD 15.7 billion in 2030....Full DetailsPublished: 31 December 2019

Download sample pages

Complete the form below to download your free sample pages for Directed Energy Weapons (DEW) Market Report 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain defence reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible, Visiongain analysts reach out to market-leading vendors and industry experts and review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain defence reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

ADS Group

Aerial Refueling Systems Advisory Group

Aerospace and Defence Industries Association of Nova Scotia

Aerospace Industries Association

Aerospace Industries Association of Canada

AHS International – The Vertical Flight Technical Society

Air Force Association

Aircraft Electronics Association

Airlift/Tanker Association

American Astronautical Society

American Gear Manufacturers Association

American Institute of Aeronautics and Astronautics

American Logistics Association

American Society of Naval Engineers

AMSUS – The Society of the Federal Health Agencies

Armed Forces Communications and Electronics Association

Armed Forces Communications and Electronics Association

Army Aviation Association of America

ASD – Aerospace & Defence Association of Europe

Association for Unmanned Vehicle Systems International

Association of Aviation Manufacturers of the Czech Republic

Association of Naval Aviation

Association of Old Crows

Association of Polish Aviation Industry

Association of the Defense Industry of the Czech Republic

Association of the United States Army

Association of the United States Navy

Australia Defence Association

Australian Industry & Defence Network

Australian Industry Group Defence Council

Austrian Aeronautics Industries Group

Aviation Distributors and Manufacturers Association

Aviation Suppliers Association

Belgian Security and Defence Industry

Bulgarian Defence Industry Association

Business Executives for National Security

Canadian Association of Defence and Security Industries

Conference of Defense Associations

Council of Defense and Space Industry Associations

Danish Defence & Security Industries Association

Defence Industry Manufacturers Association

Defense Industry Initiative on Business Ethics and Conduct

Defense Industry Offset Association

Defense Orientation Conference Association

Deutsche Gesellschaft fur Wehrtechnik

Federal Association of the German Security and Defence Industry

Federation of Aerospace Enterprises in Ireland

French Aerospace Industries Association

French Land Defence Manufacturers Association (GICAT)

German Aerospace Industries Association

Helicopter Association International

Hellenic Aerospace & Defense Industries Group

Homeland Security & Defense Business Council

International Stability Operations Association

Japan Association of Defense Industry

Korea Defense Industry Association

Marine Corps Association & Foundation

National Aeronautic Association

National Association of Ordnance and Explosive Waste Contractors

National Defense Industrial Association

National Defense Transportation Association

National Guard Association of the U.S.

Navy League of the United States

Netherlands Aerospace Group

New Zealand Defence Industry Association

Portuguese Association of Defense Related Industries & New Technologies Companies

Québec Ground Transportation Cluster

Satellite Industry Association

Society of American Military Engineers

South African Aerospace Maritime and Defence Industries Association

Spanish Aerospace and Defence Association Industries

Submarine Industrial Base Council

Swedish Aerospace Industries

Swedish Security and Defence Industry Association

Swiss Aeronautical Industries Group

The Association of Finnish Defence and Aerospace Industries

The Italian Industries Association for Aerospace Systems and Defence

The Netherlands Defence Manufacturers Association

The Society of Japanese Aerospace Companies

UK AeroSpace, Defence & Security Industries

United Kingdom National Defence Association

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Defence news

Robotic Warfare Market

The global Robotic Warfare market is projected to grow at a CAGR of 6.7% by 2034

19 July 2024

Cyber Warfare Market

The global Cyber Warfare market is projected to grow at a CAGR of 17.7% by 2034

16 July 2024

Counter-UAV (C-UAV) Market

The global Counter-UAV (C-UAV) market is projected to grow at a CAGR of 29.6% by 2034

08 July 2024

Special Mission Aircraft Market

The global Special Mission Aircraft market is projected to grow at a CAGR of 4.6% by 2034

27 June 2024