Industries > Defence > Military Armoured Vehicle Market Report 2018-2028

Military Armoured Vehicle Market Report 2018-2028

Forecasts by Product (Main Battle Tank (MBT), Medium Armoured Vehicle (MAV), Light Protected Vehicle (LPV), Mine-Resistant Ambush-Protected (MRAP), Other Armoured Vehicle), Forecasts by Type (Wheeled, Tracked), and by Leading National Markets

The arms race developing between east and west, has led Visiongain to publish this timey report. The Armoured Vehicle market is expected to flourish in the next few years because of Russian and Chinese advances and also because platform life cycle expiry is expected to feed through in the latter part of the decade driving growth to new heights. If you want to be part of this growing industry, then read on to discover how you can maximise your investment potential.

Report highlights

• 142 tables and 160 figures

• 346 pages

• Analysis of key players in Armoured Vehicles

• AM General

• BAE Systems plc

• General Dynamics Corporation

• Navistar International Corporation

• Oshkosh Corporation

• Rheinmetall AG

• Textron Inc.

• Thales Group

• Global Armoured Vehicle market outlook and analysis from 2018-2028

• Major Armoured Vehicle contracts and projects

• Australia forecast 2018-2028

• Canada forecast 2018-2028

• China forecast 2018-2028

• France forecast 2018-2028

• Germany forecast 2018-2028

• India forecast 2018-2028

• Israel forecast 2018-2028

• Italy forecast 2018-2028

• Japan forecast 2018-2028

• Russia forecast 2018-2028

• Saudi Arabia forecast 2018-2028

• South Korea forecast 2018-2028

• United Kingdom forecast 2018-2028

• US forecast 2018-2028

• Rest of the World forecast 2018-2028

Continued procurement of armoured vehicles and other similar developments have had a quantifiable effect on the market. This report covers developments within the market, as well as other factors that could affect the military armoured vehicle market and the wider defence sector. By also covering the below submarkets, the report gives readers a concise overview of the market:

• By Product

– Main Battle Tank (MBT)

– Medium Armoured Vehicle (MAV)

– Light Protected Vehicle (LPV)

– Mine-Resistant Ambush-Protected (MRAP)

– Other Armoured Vehicle

• By Type

– Wheeled

– Tracked

• Key questions answered

• What does the future hold for the Armoured Vehicle industry?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to success and why?

• What business models should you adopt?

• What industry trends should you be aware of?

• Target audience

• Leading Armoured Vehicle companies

• Suppliers

• Contractors

• Technologists

• R&D staff

• Consultants

• Analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1.1 Global Armoured Vehicle Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Research

1.6.2 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Armoured Vehicles Market

2.1 Global Armoured Vehicle Market Structure

2.2 Armoured Vehicle Market Definition

2.3 Main Battle Tank (MBT) Submarket Definition

2.4 Medium Armoured Vehicle (MAV) Submarket Definition

2.5 Light Protected Vehicle (LPV) Submarket Definition

2.6 Mine-Resistant Ambush-Protected (MRAP) Vehicle Submarket Definition

2.7 Other Armoured Vehicle (AV) Submarket Definition

2.8 By Type: Wheeled Type Submarket Definition

2.9 By Type: Tracked Type Submarket Definition

3. Global Armoured Vehicle Market 2018-2028

3.1 Global Armoured Vehicle Market Forecast 2018-2028

4. Global Armoured Vehicle by Product Submarket Forecast 2018-2028

4.1 Global Main Battle Tank Submarket Forecast 2018-2028

4.2 Global Medium Armoured Vehicle Submarket Forecast 2018-2028

4.3 Global Light Protected Vehicle Submarket Forecast 2018-2028

4.4 Global Mine-Resistant Ambush-Protected Vehicle Submarket Forecast 2018-2028

4.5 Global Other Armoured Vehicles Submarket Forecast 2018-2028

5. Global Armoured Vehicle by Type Submarket Forecast 2018-2028

5.1 Global Wheeled Armoured Vehicle Submarket Forecast 2018-2028

5.2 Global Tracked Armoured Vehicle Submarket Forecast 2018-2028

6. Leading National Armoured Vehicle Market Forecast 2018-2028

6.1 Leading National Armoured Vehicle Market by Product Submarket Forecast 2018-2028

6.1.1 Leading National Armoured Vehicle Market Share Forecast 2018-2028

6.2 Leading National Armoured Vehicle Market by Type Forecast 2018-2028

6.3 Australian Armoured Vehicle Market Forecast by Product and by Type 2018-2028

6.3.1 Australian Armoured Vehicle Market Contracts & Programmes

6.3.2 Australian Armoured Vehicle Market Analysis

6.3.2.1 Combat Reconnaissance Vehicle (CRV)

6.3.2.2 Bushmaster Protected Mobility Vehicle (PMV)

6.3.2.3 Mine Resistant Armoured Vehicles (MRAP)

6.3.3 Australian Armoured Vehicle Market Drivers & Restraints

6.4 Canadian Armoured Vehicle Market Forecast by Product and by Type 2018-2028

6.4.1 Canadian Armoured Vehicle Market Contracts & Programmes

6.4.2 Canadian Armoured Vehicle Market Analysis

6.4.3 Canadian Armoured Vehicle Market Drivers & Restraints

6.5 Chinese Armoured Vehicle Market Forecast by Product and by Type 2018-2028

6.5.1 Chinese Armoured Vehicle Market Analysis

6.5.1.1 ZTZ99 and Newer A2

6.5.1.2 ZTZ96 MBT Upgrades

6.5.1.3 ZBD97 Tracked Armoured Vehicle

6.5.1.4 ZLC2000 Light Vehicle

6.5.2 China’s Economy as a Driver of the Armoured Vehicle Market

6.5.3 Beware of Chinese Dragons: A Caveat for Investors

6.5.4 Chinese Armoured Vehicle Market Drivers & Restraints

6.6 French Armoured Vehicle Market Forecast by Product and by Type 2018-2028

6.6.1 French Armoured Vehicle Market Contracts & Programmes

6.6.2 French Armoured Vehicle Market Analysis

6.6.3 French Armoured Vehicle Market Drivers & Restraints

6.7 German Armoured Vehicle Market Forecast by Product and by Type 2018-2028

6.7.1 German Armoured Vehicle Market Contracts & Programmes

6.7.2 German Armoured Vehicle Market Analysis

6.7.2.1 Leopard 2A7 Upgrades and Enlarged Active Fleet

6.7.2.2 Puma IFV

6.7.2.3 GFF Programme for New Light Armoured Vehicles

6.7.3 German Armoured Vehicle Market Drivers & Restraints

6.8 Indian Armoured Vehicle Market Forecast by Product and by Type 2018-2028

6.8.1 Indian Armoured Vehicle Market Contracts & Programmes

6.8.2 Indian Armoured Vehicle Market Analysis

6.8.2.1 Arjun Mk2 Tank

6.8.2.2 The T-90

6.8.3 Indian Armoured Vehicle Market Drivers & Restraints

6.9 Israeli Armoured Vehicle Market Forecast by Product and by Type 2018-2028

6.9.1 Israeli Armoured Vehicle Market Contracts & Programmes

6.9.2 Israeli Armoured Vehicle Market Analysis

6.9.2.1 Namer H-APC

6.9.3 Israeli Armoured Vehicle Market Drivers & Restraints

6.10 Italian Armoured Vehicle Market Forecast by Product and by Type 2018-2028

6.10.1 Italian Armoured Vehicle Market Contracts & Programmes

6.10.2 Italian Armoured Vehicle Market Analysis

6.10.3 Italian Armoured Vehicle Market Drivers & Restraints

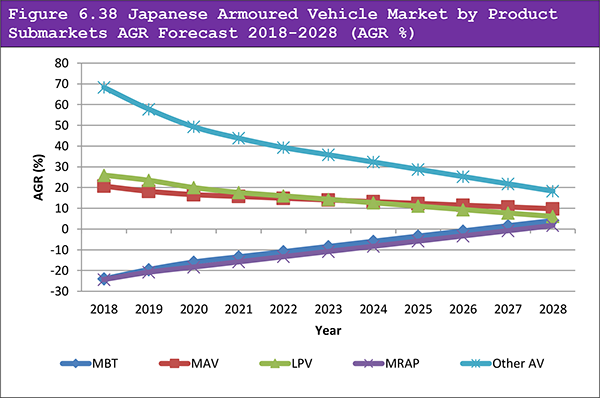

6.11 Japanese Armoured Vehicle Market Forecast by Product and by Type 2018-2028

6.11.1 Japanese Armoured Vehicle Market Contracts & Programmes

6.11.2 Japanese Armoured Vehicle Market Analysis

6.11.2.1 Japan Develops New Main Battle Tank

6.11.2.2 Manoeuvre Combat Vehicle (MCV)

6.11.3 Japanese Armoured Vehicle Market Drivers & Restraints

6.12 Russian Armoured Vehicle Market Forecast by Product and by Type 2018-2028

6.12.1 Russian Armoured Vehicle Market Analysis

6.12.2 Russian Armoured Vehicle Market Drivers & Restraints

6.13 Saudi Arabian Armoured Vehicle Market Forecast by Product and by Type 2018-2028

6.13.1 Saudi Arabian Armoured Vehicle Market Contracts & Programmes

6.13.2 Saudi Arabian Armoured Vehicle Market Analysis

6.13.3 Saudi Arabian Armoured Vehicle Market Drivers & Restraints

6.14 South Korean Armoured Vehicle Market Forecast by Product and by Type 2018-2028

6.14.1 South Korean Armoured Vehicle Market Analysis

6.14.2 South Korean Armoured Vehicle Market Drivers & Restraints

6.15 United Kingdom Armoured Vehicle Market Forecast by Product and by Type 2018-2028

6.15.1 United Kingdom Armoured Vehicle Market Contracts & Programmes

6.15.2 United Kingdom Armoured Vehicle Market Analysis

6.15.3 The 2015 Strategic Defence and Security Review: Implications for the UK Armoured Vehicle Market

6.15.4 The Impact of Britain leaving the European Union

6.15.5 United Kingdom Armoured Vehicle Market Drivers & Restraints

6.16 United States Armoured Vehicle Market Forecast by Product and by Type 2018-2028

6.16.1 United States Armoured Vehicle Selected Market Contracts & Programmes

6.16.2 United States Armoured Vehicle Market Analysis

6.16.2.1 M1A2 Abrams SEPv2 Upgrade

6.16.2.2 Bradley Tracked Vehicle Upgrade

6.16.2.3 From GCV to FFV

6.16.2.4 Stryker and DVH Modification

6.16.3 Potential Increases in US Defence Spending

6.16.4 Mobile Protected Firepower (MPF) Program

6.16.5 Next Generation Combat Vehicle (NGCV) Program

6.16.6 ARV-Armored Reconnaissance Vehicle Program

6.16.7 Recovery Vehicle Improvement Program (M88A2 Hercules improvement)

6.16.8 United States Armoured Vehicle Market Drivers & Restraints

6.17 Rest of the World Armoured Vehicle Market Forecast by Product and by Type 2018-2028

6.17.1 Rest of the World Armoured Vehicle Market Contracts & Programmes

6.17.2 Rest of the World Armoured Vehicle Market Analysis

6.17.3 Czech Republic

6.17.4 Estonia

6.17.5 Finland

6.17.6 The Netherlands

6.17.7 South Africa

6.16.8 Sweden

6.17.9 Qatar

6.17.10 Belgium

6.17.11 Thailand

6.17.12 Rest of the World Armoured Vehicle Market Drivers & Restraints

7. SWOT Analysis of the Armoured Vehicle Market 2018-2028

8. Leading 8 Armoured Vehicle Companies

8.1 AM General

8.1.1 AM General Armoured Vehicles Selected Recent Contracts / Projects / Programmes 2012-2017

8.1.2 AM General Armoured Vehicles Products / Services

8.1.3 AM General Primary Market Competitors 2018

8.1.4 AM General Analysis and Future Outlook

8.2 BAE Systems plc

8.2.1 BAE Systems plc Armoured Vehicle Selected Recent Contracts / Projects / Programmes 2013-2018

8.2.2 BAE Systems plc Total Company Sales 2013-2017

8.2.3 BAE Systems plc Net Income 2013-2017

8.2.4 BAE Systems plc Cost of Research & Development 2013-2017

8.2.5 BAE Systems plc Sales by Segment of Business 2013-2017

8.2.6 BAE Systems plc Regional Emphasis and Focus

8.2.7 BAE Systems plc Organisational Structure and Subsidiaries

8.2.8 BAE Systems plc Armoured Vehicle Products / Services

8.2.9 BAE Systems plc Primary Market Competitors 2018

8.2.10 BAE Systems plc Mergers & Acquisitions (M&A) Activity

8.2.11 BAE Systems plc Analysis

8.2.12 BAE Systems plc Future Outlook

8.3 General Dynamics Corporation

8.3.1 General Dynamics Armoured Vehicle Selected Recent Contracts / Projects / Programmes 2013-2018

8.3.2 General Dynamics Total Company Sales 2013-2017

8.3.3 General Dynamics Net Income / Loss 2013-2017

8.3.4 General Dynamics Cost of Research & Development 2013-2017

8.3.5 General Dynamics Sales by Segment of Business 2013-2017

8.3.6 General Dynamics Regional Emphasis and Focus

8.3.7 General Dynamics Organisational Structure

8.3.8 General Dynamics Armoured Vehicle Products / Services

8.3.9 General Dynamics Primary Market Competitors 2018

8.3.10 General Dynamics Analysis and Future Outlook

8.4 Navistar International Corporation

8.4.1 Navistar Armoured Vehicle Selected Recent Contracts / Projects / Programmes 2012-2016

8.4.2 Navistar Total Company Sales 2013-2017

8.4.3 Navistar Net Income / Loss 2013 -2017

8.4.5 Navistar Sales by Segment of Business 2013-2016

8.4.6 Navistar Regional Emphasis and Focus

8.4.7 Navistar Subsidiaries

8.4.8 Navistar Armoured Vehicle Products / Services

8.4.9 Navistar Primary Market Competitors 2018

8.4.10 Navistar Analysis and Future Outlook

8.5 Oshkosh Corporation

8.5.1 Oshkosh Corporation Armoured Vehicle Selected Recent Contracts / Projects / Programmes 2012-2018

8.5.2 Oshkosh Corporation Total Company Sales 2013-2017

8.5.3 Oshkosh Corporation Net Income 2013-2017

8.5.4 Oshkosh Corporation Sales by Segment of Business 2014-2018

8.5.5 Oshkosh Corporation Regional Emphasis and Focus

8.5.6 Oshkosh Corporation Armoured Vehicle Products / Services

8.5.7 Oshkosh Corporation Primary Market Competitors 2018

8.5.8 Oshkosh Corporation Analysis and Future Outlook

8.6 Rheinmetall AG

8.6.1 Rheinmetall AG Armoured Vehicle Selected Recent Contracts / Projects / Programmes 2013-2018

8.6.2 Rheinmetall AG Total Company Sales 2013-2017

8.6.3 Rheinmetall AG Net Income / Loss 2013-2017

8.6.4 Rheinmetall AG Cost of Research & Development 2013-2017

8.6.5 Rheinmetall AG Sales by Segment of Business 2013-2017

8.6.6 Rheinmetall AG Regional Emphasis and Focus

8.6.7 Rheinmetall AG Organisational Structure and Subsidiaries

8.6.8 Rheinmetall AG Armoured Vehicle Products / Services

8.6.9 Rheinmetall AG Primary Market Competitors 2018

8.6.10 Rheinmetall AG Mergers, Acquisitions and Joint Ventures

8.6.11 Rheinmetall AG Analysis and Future Outlook

8.7 Textron Inc.

8.7.1 Textron Inc. Armoured Vehicle Selected Recent Contracts / Projects / Programmes 2013-2017

8.7.2 Textron Inc. Total Company Sales 2013-2017

8.7.3 Textron Inc. Net Income 2013-2017

7.7.4 Textron Inc. Cost of Research & Development 2013-2017

8.7.5 Textron Inc. Sales by Segment of Business 2013-2017

8.7.6 Textron Inc. Regional Emphasis and Focus

8.7.7 Textron Inc. Organisational Structure and Subsidiaries

8.7.8 Textron Inc. Primary Market Competitors 2018

8.7.9 Textron Inc. Analysis and Future Outlook

8.8 Thales Group

8.8.1 Thales Group Armoured Vehicle Selected Recent Contracts / Projects / Programmes 2013-2018

8.8.2 Thales Group Total Company Sales 2013-2017

8.8.3 Thales Group Net Income 2013-2017

8.8.4 Thales Group Cost of Research & Development 2013-2017

8.8.5 Thales Group Sales by Segment of Business 2013-2017

8.8.6 Thales Group Regional Emphasis and Focus

8.8.7 Thales Group Organisational Structure and Subsidiaries

7.8.8 Thales Group Armoured Vehicle Products / Services

8.8.9 Thales Group Primary Market Competitors 2018

8.8.10 Thales Group Analysis and Future Outlook

8.9 Other Companies Involved in the Armoured Vehicle Technologies Market 2018

9. Conclusions and Recommendations

9.1 Armoured Vehicle Market Key Findings

9.2 Armoured Vehicle Market Recommendations

10. Glossary

Associated Visiongain Reports

List of Tables

Table 1.1 Example of Leading National Armoured Vehicle Market Forecast by Submarket 2018-2028 (US$m, AGR %, Cumulative)

Table 3.1 Global Armoured Vehicle Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 4.1 Global Armoured Vehicle by Product Submarket Forecast 2018-2028 (US$m, AGR %, Cumulative)

Table 4.2 Global Armoured Vehicle by Product Submarket Forecast by National Market 2018-2028 (US$m, Cumulative, Global AGR %)

Table 4.3 Global Armoured Vehicle by Product Submarket CAGR Forecast 2017-2023, 2023-2027, 2018-2028 (CAGR %)

Table 4.4 Global Main Battle Tank Submarket by National Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 4.5 Global Medium Armoured Vehicle Submarket by National Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 4.6 Global Light Protected Vehicle Submarket by National Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 4.7 Global Mine-Resistant Ambush-Protected Vehicle Submarket by National Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 4.8 Global Other Armoured Vehicles Submarket by National Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 5.1 Global Armoured Vehicle by Type Submarket Forecast 2018-2028 (US$m, AGR %, Cumulative)

Table 5.2 Global Armoured Vehicle by Type Submarket Forecast by National Market 2018-2028 (US$m, Cumulative, Global AGR %)

Table 5.3 Global Armoured Vehicle by Type Submarket CAGR Forecast 2017-2023, 2023-2028, 2018-2028 (CAGR %)

Table 5.4 Global Wheeled Armoured Vehicle Submarket by National Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 5.5 Global Tracked Armoured Vehicle Submarket by National Market Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.1 Leading National Armoured Vehicle Market by Product Submarket Forecast 2018-2028 (US$m, Global AGR %, Cumulative)

Table 6.2 Leading National Armoured Vehicle Market CAGR Forecast 2018-2023, 2023-2028, 2018-2028 (CAGR %)

Table 6.3 Leading National Armoured Vehicle Market Percentage Change in Market Share 2018-2023, 2023-2028, 2018-2028 (% Change)

Table 6.4 Leading National Armoured Vehicle Market by Type Submarket Forecast 2018-2028 (US$m, Global AGR %, Cumulative)

Table 6.5 Australian Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.6 Australian Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.7 Australian Armoured Vehicle Market Selected Major Contracts & Programmes 2012-2018 (Date, Company, Value US$m, Customer, Details)

Table 6.8 Australian Armoured Vehicle Market Drivers & Restraints 2018

Table 6.9 Canadian Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.10 Canadian Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.11 Canadian Armoured Vehicle Market Selected Major Contracts & Programmes 2012-2017 (Date, Company, Value US$m, Customer, Details)

Table 6.12 Canadian Armoured Vehicle Market Drivers & Restraints 2018

Table 6.13 Chinese Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.14 Chinese Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.15 Chinese Armoured Vehicle Market Drivers & Restraints 2017

Table 6.16 French Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.17 French Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.18 French Armoured Vehicle Market Selected Major Contracts & Programmes 2014-2018 (Date, Company, Value US$m, Customer, Details)

Table 6.19 French Armoured Vehicle Market Drivers & Restraints 2018

Table 6.20 German Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.21 German Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.22 German Armoured Vehicle Market Selected Major Contracts & Programmes 2013-2017 (Date, Company, Value US$m, Customer, Details)

Table 6.23 German Armoured Vehicle Market Drivers & Restraints 2018

Table 6.24 Indian Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.25 Indian Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.26 Indian Armoured Vehicle Market Selected Major Contracts & Programmes 2013-2018 (Date, Company, Value US$m, Customer, Details)

Table 6.27 Indian Armoured Vehicle Market Drivers & Restraints 2018

Table 6.28 Israeli Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.29 Israeli Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.30 Israeli Armoured Vehicle Market Selected Major Contracts & Programmes 2014-2018 (Date, Company, Value US$m, Customer, Details)

Table 6.31 Israeli Armoured Vehicle Market Drivers & Restraints 2018

Table 6.32 Italian Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.33 Italian Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.34 Italian Armoured Vehicle Market Selected Major Contracts & Programmes 2016 (Date, Company, Value US$m, Customer, Details)

Table 6.35 Italian Armoured Vehicle Market Drivers & Restraints 2018

Table 6.36 Japanese Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.37 Japanese Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.38 Japanese Armoured Vehicle Market Selected Major Contracts & Programmes 2016 (Date, Company, Value US$m, Customer, Details)

Table 6.39 Japanese Armoured Vehicle Market Drivers & Restraints 2018

Table 6.40 Russian Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.41 Russian Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.42 Russian Armoured Vehicle Market Drivers & Restraints 2018

Table 6.43 Saudi Arabian Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.44 Saudi Arabian Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.45 Saudi Arabian Armoured Vehicle Market Selected Major Contracts & Programmes 2013-2018 (Date, Company, Value US$m, Customer, Details)

Table 6.46 Saudi Arabian Armoured Vehicle Market Drivers & Restraints 2018

Table 6.47 South Korean Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.48 South Korean Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.49 South Korean Armoured Vehicle Market Drivers & Restraints 2018

Table 6.50 United Kingdom Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.51 United Kingdom Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.52 United Kingdom Armoured Vehicle Market Selected Major Contracts & Programmes 2012-2018 (Date, Company, Value US$m, Customer, Details)

Table 6.53 United Kingdom Armoured Vehicle Market Drivers & Restraints 2018

Table 6.54 United States Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.55 United States Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.56 United States Armoured Vehicle Market Selected Major Contracts & Programmes 2012-2018 (Date, Company, Value US$m, Customer, Details)

Table 6.57 United States Armoured Vehicle Market Drivers & Restraints 2018

Table 6.58 Rest of the World Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.59 Rest of the World Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR %, Cumulative)

Table 6.60 Rest of the World Armoured Vehicle Market Selected Major Contracts & Programmes 2012-2016 (Date, Company, Value US$m, Customer, Country/Region, Details)

Table 6.61 Rest of the World Armoured Vehicle Market Drivers & Restraints 2018

Table 7.1 Global Armoured Vehicle Market SWOT Analysis 2018-2028

Table 8.1 AM General Profile 2018 (CEO, HQ, Founded, No. of Employees, Website)

Table 8.2 Selected Recent AM General Armoured Vehicles Contracts / Projects / Programmes 2012-2017 (Date, Country / Region, Customer, Value US$m, Product, Details)

Table 8.3 AM General Armoured Vehicles Products / Services (Product, Specification / Features)

Table 8.4 BAE Systems plc Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Cost of Research & Development US$m, Business Segment in the Market, Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.5 Selected Recent BAE Systems plc Armoured Vehicle Contracts / Projects / Programmes 2013-2018 (Date, Country, Customer, Value (US$m), Product, Details)

Table 8.6 BAE Systems plc Total Company Sales 2013-2017 (US$m, AGR %)

Table 8.7 BAE Systems plc Net Income 2013-2017 (US$m, AGR %)

Table 8.8 BAE Systems plc Cost of Research & Development 2013-2017 (US$m, AGR %)

Table 8.9 BAE Systems plc Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8.10 BAE Systems plc Sales by Geographical Location 2013-2017 (US$m, AGR %)

Table 8.11 BAE Systems plc Selected Subsidiaries 2018 (Subsidiary, Location)

Table 8.12 BAE Systems plc Armoured Vehicle Products / Services (Segment of Business, Product, Specification / Features)

Table 8.13 Selected BAE Systems plc Divestitures 2012-2013 (Date, Company Involved, Value US$m, Details)

Table 8.14 General Dynamics Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Cost of Research & Development US$m, Business Segment in the Market, Strongest Business Region, Strongest Business Segment, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.15 Selected Recent General Dynamics Armoured Vehicle Contracts / Projects / Programmes 2013-2018 (Date, Country / Region, Customer, Value US$m, Product, Details)

Table 8.16 General Dynamics Total Company Sales 2013-2017 (US$m, AGR %)

Table 8.17 General Dynamics Net Income / Loss 2013-2017 (US$m)

Table 8.18 General Dynamics Cost of Research & Development 2013-2017 (US$m, AGR %)

Table 8.19 General Dynamics Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8.20 General Dynamics Sales by Geographical Location 2013-2016 (US$m, AGR %)

Table 8.21 General Dynamics Armoured Vehicle Products / Services (Segment of Business, Product, Specification / Features)

Table 8.22 Navistar Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Business Segment in the Market, Strongest Business Region, Strongest Business Segment, HQ, Founded, No. of Employees, Ticker, Website)

Table 8.23 Selected Recent Navistar Armoured Vehicle Contracts / Projects / Programmes 2013-2017 (Date, Country / Region, Customer, Value US$m, Product, Details)

Table 8.24 Navistar Total Company Sales 2013 -2017 (US$m, AGR %)

Table 8.25 Navistar Net Income / Loss 2013 -2017 (US$m)

Table 8.27 Navistar Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8.28 Navistar Sales by Geographical Location 2013 -2017 (US$m, AGR %)

Table 8.29 Navistar Subsidiaries 2018 (Subsidiary, Location)

Table 8.30 Navistar Armoured Vehicle Products / Services (Product, Specification / Features)

Table 8.31 Oshkosh Corporation Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Business Segment in the Market, Strongest Business Region, Strongest Business Segment, HQ, Founded, IR Contact, Ticker, Website)

Table 8.32 Selected Recent Oshkosh Corporation Armoured Vehicle Contracts / Projects / Programmes 2012-2018 (Date, Country / Region, Customer, Value US$m, Product, Details)

Table 8.33 Oshkosh Corporation Total Company Sales 2013 -2017 (US$m, AGR %)

Table 8.34 Oshkosh Corporation Net Income 2013 -2017 (US$m, AGR %)

Table 8.35 Oshkosh Corporation Sales by Segment of Business 2014-2017 (US$m, AGR %)

Table 8.36 Oshkosh Corporation Sales by Geographical Location 2014-2017 (US$m, AGR %)

Table 8.37 Oshkosh Corporation Armoured Vehicle Products / Services (Segment of Business, Product, Specification / Features)

Table 8.38 Rheinmetall AG Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Cost of Research & Development US$m, Business Segment in the Market, Strongest Business Region, Strongest Business Segment, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.39 Selected Recent Rheinmetall AG Armoured Vehicle Contracts / Projects / Programmes 2013-2018 (Date, Country / Region, Customer, Value US$m, Product, Details)

Table 8.40 Rheinmetall AG Total Company Sales 2013-2017 (US$m, AGR %)

Table 8.41 Rheinmetall AG Net Income / Loss 2013-2017 (US$m)

Table 8.42 Rheinmetall AG Cost of Research & Development 2013-2017 (US$m, AGR %)

Table 8.43 Rheinmetall AG Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8.45 Rheinmetall AG Subsidiaries 2018 (Subsidiary, Location)

Table 8.46 Rheinmetall AG Armoured Vehicle Products / Services (Segment of Business, Product, Specification / Features)

Table 8.47 Selected Rheinmetall AG Mergers, Acquisitions and Joint Ventures 2008-2014 (Date, Company Involved, Details)

Table 8.48 Textron Inc. Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Cost of Research & Development US$m, Business Segment in the Market, Strongest Business Region, Strongest Business Segment, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.49 Selected Recent Textron Inc. Armoured Vehicle Contracts / Projects / Programmes 2013-2017 (Date, Country / Region, Customer, Value US$m, Product, Details)

Table 8.50 Textron Inc. Total Company Sales 2013-2017 (US$m, AGR %)

Table 8.51 Textron Inc. Net Income 2013-2017 (US$m, AGR %)

Table 8.52 Textron Inc. Cost of Research & Development 2013-2017 (US$m, AGR %)

Table 8.53 Textron Inc. Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8.54 Textron Inc. Sales by Geographical Location 2013-2017 (US$m, AGR %)

Table 8.55 Textron Inc. Subsidiaries 2018 (Subsidiary, Location)

Table 8.56 Thales Group Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Cost of Research & Development US$m, Business Segment in the Market, Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.57 Selected Recent Thales Group Armoured Vehicle Contracts / Projects / Programmes 2013-2018 (Date, Country, Customer, Value US$m, Product, Details)

Table 8.58 Thales Group Total Company Sales 2013-2017 (US$m, AGR %)

Table 8.59 Thales Group Net Income 2013-2017 (US$m, AGR %)

Table 8.60 Thales Group Cost of Research & Development 2013-2017 (US$m, AGR %)

Table 8.61 Thales Group Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 8.62 Thales Group Sales by Geographical Location 2013-2017 (US$m, AGR %)

Table 8.63 Thales Group Subsidiaries 2018 (Subsidiary, Location)

Table 8.64 Thales Group Armoured Vehicle Products / Services (Segment of Business, Product, Specification / Features)

Table 8.65 Other Companies Involved in the Armoured Vehicle Market 2018 (Company, Location)

List of Figures

Figure 1.1 Example of National Armoured Vehicle Market by Submarket Forecast 2018-2028 (US$m, AGR %)

Figure 2.1 Global Armoured Vehicle Market Product Segmentation Overview

Figure 3.1 Global Armoured Vehicle Market Forecast 2018-2028 (US$m, AGR %)

Figure 4.1 Global Armoured Vehicle by Product Submarket AGR Forecast 2018-2028 (AGR %)

Figure 4.2 Global Armoured Vehicle by Product Submarket Forecast 2018-2028 (US$m, Global AGR %)

Figure 4.3 Global Armoured Vehicle by Product Submarket Share Forecast 2017 (% Share)

Figure 4.4 Global Armoured Vehicle by Product Submarket Share Forecast 2023 (% Share)

Figure 4.5 Global Armoured Vehicle by Product Submarket Share Forecast 2028 (% Share)

Figure 4.6 Global Main Battle Tank Submarket Forecast by National Market 2018-2028 (US$m, Global AGR %)

Figure 4.7 Global Main Battle Tank Submarket Share by National Market Forecast 2017 (% Share)

Figure 4.8 Global Main Battle Tank Submarket Share by National Market Forecast 2023 (% Share)

Figure 4.9 Global Main Battle Tank Submarket Share by National Market Forecast 2028 (% Share)

Figure 4.10 Global Medium Armoured Vehicle Submarket Forecast by National Market 2018-2028 (US$m, Global AGR %)

Figure 4.11 Global Medium Armoured Vehicle Submarket Share by National Market Forecast 2017 (% Share)

Figure 4.12 Global Medium Armoured Vehicle Submarket Share by National Market Forecast 2023 (% Share)

Figure 4.13 Global Medium Armoured Vehicle Submarket Share by National Market Forecast 2028 (% Share)

Figure 4.14 Global Light Protected Vehicle Submarket Forecast by National Market 2018-2028 (US$m)

Figure 4.15 Global Light Protected Vehicles Submarket Share by National Market Forecast 2017 (% Share)

Figure 4.16 Global Light Protected Vehicle Submarket Share by National Market Forecast 2023 (% Share)

Figure 4.17 Global Light Protected Vehicle Submarket Share by National Market Forecast 2028 (% Share)

Figure 4.18 Global Mine-Resistant Ambush-Protected Vehicle Submarket Forecast by National Market 2018-2028 (US$m, Global AGR %)

Figure 4.19 Global Mine-Resistant Ambush-Protected Vehicle Submarket Share by National Market Forecast 2017 (% Share)

Figure 4.20 Global Mine-Resistant Ambush-Protected Vehicle Submarket Share by National Market Forecast 2023 (% Share)

Figure 4.21 Global Mine-Resistant Ambush-Protected Vehicle Submarket Share by National Market Forecast 2028 (% Share)

Figure 4.22 Global Other Armoured Vehicles Submarket Forecast by National Market 2018-2028 (US$m, Global AGR %)

Figure 4.23 Global Other Armoured Vehicles Submarket Share by National Market Forecast 2017 (% Share)

Figure 4.24 Global Other Armoured Vehicles Submarket Share by National Market Forecast 2023 (% Share)

Figure 4.25 Global Other Armoured Vehicles Submarket Share by National Market Forecast 2028 (% Share)

Figure 5.1 Global Armoured Vehicle by Type Submarket AGR Forecast 2018-2028 (AGR %)

Figure 5.2 Global Armoured Vehicle by Type Submarket Forecast 2018-2028 (US$m, Global AGR %)

Figure 5.3 Global Armoured Vehicle by Type Submarket Share Forecast 2017 (% Share)

Figure 5.4 Global Armoured Vehicle by Type Submarket Share Forecast 2023 (% Share)

Figure 5.5 Global Armoured Vehicle by Type Submarket Share Forecast 2028 (% Share)

Figure 5.6 Global Wheeled Armoured Vehicle Submarket Forecast by National Market 2018-2028 (US$m, Global AGR %)

Figure 5.7 Global Wheeled Armoured Vehicle Submarket Share by National Market Forecast 2018 (% Share)

Figure 5.8 Global Wheeled Armoured Vehicle Submarket Share by National Market Forecast 2023 (% Share)

Figure 5.9 Global Wheeled Armoured Vehicle Submarket Share by National Market Forecast 2028 (% Share)

Figure 5.10 Global Tracked Armoured Vehicle Submarket Forecast by National Market 2018-2028 (US$m, Global AGR %)

Figure 5.11 Global Tracked Armoured Vehicle Submarket Share by National Market Forecast 2018 (% Share)

Figure 5.12 Global Tracked Armoured Vehicle Submarket Share by National Market Forecast 2023 (% Share)

Figure 5.13 Global Tracked Armoured Vehicle Submarket Share by National Market Forecast 2028 (% Share)

Figure 6.1 Leading National Armoured Vehicle Market Forecast 2018-2028 (AGR %)

Figure 6.2 Leading National Armoured Vehicle Market Forecast 2018-2028 (US$m, Global AGR %)

Figure 6.3 Leading National Armoured Vehicle Market Share Forecast 2018 (% Share)

Figure 6.4 Leading National Armoured Vehicle Market Share Forecast 2023 (% Share)

Figure 6.5 Leading National Armoured Vehicle Market Share Forecast 2028 (% Share)

Figure 6.6 Australian Armoured Vehicle Market by Product Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.7 Australian Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, Australian Total Market Sales AGR %)

Figure 6.8 Australian Armoured Vehicle Market by Type Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.9 Australian Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, Australian Total Market Sales AGR %)

Figure 6.10 Canadian Armoured Vehicle Market by Product Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.11 Canadian Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, Canadian Total Market Sales AGR %)

Figure 6.12 Canadian Armoured Vehicle Market by Type Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.13 Canadian Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, Canadian Total Market Sales AGR %)

Figure 6.14 Chinese Armoured Vehicle Market by Product Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.15 Chinese Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, Chinese Total Market Sales AGR %)

Figure 6.16 Chinese Armoured Vehicle Market by Type Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.17 Chinese Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, Chinese Total Market Sales AGR %)

Figure 6.18 French Armoured Vehicle Market by Product Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.19 French Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, French Total Market Sales AGR %)

Figure 6.20 French Armoured Vehicle Market by Type Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.21 French Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, French Total Market Sales AGR %)

Figure 6.22 German Armoured Vehicle Market by Product Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.23 German Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, German Total Market Sales AGR %)

Figure 6.24 German Armoured Vehicle Market by Type Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.25 German Armoured Vehicle Market by Submarkets Forecast 2018-2028 (US$m, German Total Market Sales AGR %)

Figure 6.26 Indian Armoured Vehicle Market by Product Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.27 Indian Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, Indian Total Market Sales AGR %)

Figure 6.28 Indian Armoured Vehicle Market by Type Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.29 Indian Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, Indian Total Market Sales AGR %)

Figure 6.30 Israeli Armoured Vehicle Market by Product Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.31 Israeli Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, Israeli Total Market Sales AGR %)

Figure 6.32 Israeli Armoured Vehicle Market by Type Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.33 Israeli Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, Israeli Total Market Sales AGR %)

Figure 6.34 Italian Armoured Vehicle Market by Product Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.35 Italian Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, Italian Total Market Sales AGR %)

Figure 6.36 Italian Armoured Vehicle Market by Type Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.37 Italian Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, Italian Total Market Sales AGR %)

Figure 6.38 Japanese Armoured Vehicle Market by Product Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.39 Japanese Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, Japanese Total Market Sales AGR %)

Figure 6.40 Japanese Armoured Vehicle by Type Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.41 Japanese Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, Japanese Total Market Sales AGR %)

Figure 6.42 Russian Armoured Vehicle Market by Product Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.43 Russian Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, Russian Total Market Sales AGR %)

Figure 6.44 Russian Armoured Vehicle Market by Type Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.45 Russian Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, Russian Total Market Sales AGR %)

Figure 6.46 Saudi Arabian Armoured Vehicle Market by Product Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.47 Saudi Arabian Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, Saudi Arabian Total Market Sales AGR %)

Figure 6.48 Saudi Arabian Armoured Vehicle Market by Type Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.49 Saudi Arabian Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, Saudi Arabian Total Market Sales AGR %)

Figure 6.50 South Korean Armoured Vehicle Market by Product Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.51 South Korean Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, South Korean Total Market Sales AGR %)

Figure 6.52 South Korean Armoured Vehicle Market by Type Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.53 South Korean Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, South Korean Total Market Sales AGR %)

Figure 6.54 United Kingdom Armoured Vehicle Market by Product Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.55 United Kingdom Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, United Kingdom Total Market Sales AGR %)

Figure 6.56 United Kingdom Armoured Vehicle Market by Type Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.57 United Kingdom Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, United Kingdom Total Market Sales AGR %)

Figure 6.58 United States Armoured Vehicle Market by Product Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.59 United States Armoured Vehicle Market by Submarkets Forecast 2018-2028 (US$m, United States Total Market Sales AGR %)

Figure 6.60 United States Armoured Vehicle Market by Type Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.61 United States Armoured Vehicle Market by Submarkets Forecast 2018-2028 (US$m, United States Total Market Sales AGR %)

Figure 6.62 Rest of the World Armoured Vehicle Market by Product Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.63 Rest of the World Armoured Vehicle Market by Product Submarkets Forecast 2018-2028 (US$m, Rest of the World Total Market Sales AGR %)

Figure 5.64 Rest of the World Armoured Vehicle Market by Type Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 6.65 Rest of the World Armoured Vehicle Market by Type Submarkets Forecast 2018-2028 (US$m, Rest of the World Total Market Sales AGR %)

Figure 8.1 AM General Primary Market Competitors 2018

Figure 8.2 BAE Systems plc Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.3 BAE Systems plc Net Income 2013-2017 (US$m, AGR %)

Figure 8.4 BAE Systems plc Cost of Research & Development 2013-2017 (US$m, AGR %)

Figure 8.5 BAE Systems plc Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.6 BAE Systems plc Primary International Operations 2018

Figure 8.7 BAE Systems plc Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.8 BAE Systems plc Organisational Structure 2016

Figure 8.9 BAE Systems plc Primary Market Competitors 2018

Figure 8.10 General Dynamics Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.11 General Dynamics Net Income / Loss 2013-2017 (US$m)

Figure 8.12 General Dynamics Cost of Research & Development 2013-2017 (US$m, AGR %)

Figure 8.13 General Dynamics Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.14 General Dynamics Primary International Operations 2017

Figure 8.15 General Dynamics Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.16 General Dynamics Organisational Structure 2018

Figure 8.17 General Dynamics Primary Market Competitors 2018

Figure 8.18 Navistar Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.19 Navistar Net Income / Loss 2013 -2017 (US$m)

Figure 8.20 Navistar Total Sales AGR % 2013-2017

Figure 8.21 Navistar Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.22 Navistar Primary International Operations 2018

Figure 8.23 Navistar Sales by Geographical Location 2013 -2017 (US$m, Total Company Sales AGR %)

Figure 8.24 Navistar Primary Market Competitors 2018

Figure 8.25 Oshkosh Corporation Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.26 Oshkosh Corporation Net Income 2013-2017 (US$m, AGR %)

Figure 8.27 Oshkosh Corporation Sales by Segment of Business 2014-2017 (US$m)

Figure 8.28 Oshkosh Corporation Primary International Operations 2018

Figure 8.29 Oshkosh Corporation Sales by Geographical Location 2014-2017(US$m)

Figure 8.30 Oshkosh Corporation Primary Market Competitors 2018

Figure 8.31 Rheinmetall AG Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.32 Rheinmetall AG Net Income / Loss 2013-2017 (US$m)

Figure 8.33 Rheinmetall AG Cost of Research & Development 2013-2017 (US$m, AGR %)

Figure 8.34 Rheinmetall AG Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.35 Rheinmetall AG Primary International Operations 2018

Figure 8.37 Rheinmetall AG Organisational Structure 2018

Figure 8.38 Rheinmetall AG Primary Market Competitors 2018

Figure 8.39 Textron Inc. Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.40 Textron Inc. Net Income 2013-2017 (US$m, AGR %)

Figure 8.41 Textron Inc. Cost of Research & Development 2013-2017 (US$m, AGR %)

Figure 8.42 Textron Inc. Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.43 Textron Inc. Primary International Operations 2018

Figure 8.44 Textron Inc. Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.45 Textron Inc. Organisational Structure 2018

Figure 8.46 Textron Inc. Primary Market Competitors 2018

Figure 8.47 Thales Group Total Company Sales 2013-2017 (US$m, AGR %)

Figure 8.48 Thales Group Net Income 2013-2017 (US$m, AGR %)

Figure 8.49 Thales Group Cost of Research & Development 2013-2017 (US$m, AGR %)

Figure 8.50 Thales Group Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.51 Thales Group Primary International Operations 2018

Figure 8.52 Thales Group Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR %)

Figure 8.53 Thales Group Organisational Structure 2018

Figure 8.54 Thales Group Primary Market Competitors 2018

AIM Infrarot-Module GmbH,

Air Command Systems International SAS

Airtanker Holdings Ltd

Allison Transmission

AM General LLC

American Rheinmetall Munitions, Inc.

Amper Programas de Electronica Y Comunicaciones SA

Aselsan

Avco Corporation

Aviation Communications & Surveillance Systems

AxleTech International LLC

BAE Systems (Operations) Limited

BAE Systems AB

BAE Systems Controls Inc.

BAE Systems Flight Training (Australia) Pty Limited

BAE Systems Information and Electronic Systems Integration Inc.

BAE Systems Information Solutions Inc

BAE Systems Land & Armaments LP

BAE Systems Oman

BAE Systems plc

BAE Systems Regional Aircraft (Japan) KK

BAE Systems Saudi Arabia

BAE Systems Surface Ships Limited

BAE Systems Tactical Vehicle Systems LP

BAE Systems Zephyr Corporation

Bell Helicopter Textron Inc.

benntec Systemtechnik GmbH

Bharat

Boeing Company

Brighton Cromwell LLC

Cadillac Gage Textron Inc.

Canadian Commercial Corporation

Caterpillar Inc.

Cessna Aircraft Company

Cessna Finance Export Corporation

Citylink Telecommunications Holding Ltd

Cloudwatt

CMI Defence

Continental AG

Contraves Advanced Devices Sdn. Bhd.,

Critical Solutions International

Cummins

Daewoo Heavy Industries and Machinery Ltd.

Daimler AG

DCNS

Detica Services, Inc

Dew Engineering & Development

Diehl Aerospace GmbH

Diehl BGT Defence

Doosan Infracore

DRS Technologies Inc.

DynCorp International

Elbit Systems

Elettronica SpA

ESG Elektroniksystem- und Logistik GmbH

Finmeccanica/Leonardo

FNSS

FNSS Savuma Sistemleri AS

General Dynamics

General Dynamics Corporation

General Dynamics European Land Systems (GDELS)

General Dynamics Land Systems

General Dynamics UK

GIWS Gesellschaft für Intelligente Wirksysteme GmbH

Greenlee Textron Inc.

Heavy Vehicles Factory Avadi

Honeywell

Hyundai

IBIS TEK

IGOV Technologies Inc.

Industrial Laser Electronics and Engineering (I.L.E.E.),

Israel Military Industries (IMI)

Iveco

Japan Steel Works

Junghans Microtec GmbH

Kautex Inc.

Kharkiv Morozov Machine Design Bureau

Kongsberg

Krauss-Maffei Wegmann (KMW)

Kurganmashzavod JSC

L-3 Communications

Land Services Arabia Ltd.

LDT Laser Display Technology GmbH

Lockheed Martin

Lycoming Engines

Mitsubishi Heavy Industries

Navistar International Corporation

Nexter

Nitrochemie AG

NORINCO

Northrop Grumman Corporation

Orbital ATK

Oshkosh Corporation

Otokar

Panhard

Paramount Group

Patria

Pitch Technologies AB

Plasan

Polaris Defense Inc.

Polska Grupa Zbrojeniowa SA

Poly Group

QinetiQ Ltd

Rafael Advanced Defense Systems Ltd.

Raytheon

Renault Trucks Defence

Renault Trucks Defense

Renk AG

Rheinmetall AG

Rheinmetall Air Defence AG,

Rheinmetall Ballistic Protection GmbH

Rheinmetall Canada Inc

Rheinmetall Chempro GmbH

Rheinmetall Defence Electronics GmbH

Rheinmetall Defence UK Limited

Rheinmetall Denel Munition (Pty) Ltd

Rheinmetall Dienstleistungszentrum Altmark GmbH

Rheinmetall Eastern Markets GmbH,

Rheinmetall Hellas S.A.

Rheinmetall Italia S.p.A.,

Rheinmetall Landsysteme GmbH

Rheinmetall MAN Military Vehicles GmbH

Rheinmetall MAN Military Vehicles Nederland B.V.

Rheinmetall Nordic AS

Rheinmetall Protection Systems Nederland B.V.,

Rheinmetall Simulation Australia Pty Ltd

Rheinmetall Soldier Electronics GmbH

Rheinmetall Technical Publications GmbH,

Rheinmetall Waffe Munition Arges GmbH

Rheinmetall Waffe Munition GmbH

Ricardo Plc

RMMV

Roketsan

Rolls-Royce

RPL (Electronics) Limited

RUAG

RWM Italia S.p.A

RWM Schweiz AG

RWM Zaugg AG

Saab

Sagem

SAIC

Samsung Techwin

Samsung Thales Co. Ltd

Singapore Technologies

Sofradir SAS

Steyr-Daimler-Puch Spezialfahrzeug GmbH

Supacat

Systems Products and Solutions Inc.

TDA Armements SAS

Telespazio SpA

Textron Atlantic LLC

Textron Aviation Finance Corporation

Textron China Inc.

Textron Communications Inc.

Textron Far East Pte. Ltd.

Textron Fastening Systems Inc.

Textron Financial Corporation

Textron Fluid and Power Inc.

Textron Global Services Inc.

Textron Inc

Textron International Inc.

Textron IPMP Inc.

Textron Management Services Inc.

Textron Realty Corporation

Textron Rhode Island Inc.

Textron Systems

Textron Systems Canada Inc.

Thales Air Defence Ltd

Thales Air Systems & Electron Devices GmbH

Thales Air Systems SAS

Thales Alenia Space Italia SpA

Thales Alenia Space SAS

Thales Australia

Thales Australia Ltd

Thales Austria GmbH

Thales Avionics Electrical Systems SAS

Thales Avionics Inc.

Thales Avionics Ltd

Thales Avionics SAS

Thales Canada Inc.

Thales Communications & Security SAS

Thales Components Corporation

Thales Defense & Security, Inc. (ex Communications Inc.)

Thales Electron Devices SAS

Thales Electronic Systems GmbH

Thales Espana Grp, S.A.U.

Thales Group

Thales International Saudi Arabia

Thales Italia SpA

Thales Naval Ltd

Thales Nederland B.V.

Thales Norway A.Ş.

Thales Optronics Ltd

Thales Optronique SA

Thales Rail Signalling Solutions Ltd

Thales Security Solutions & Services Company

Thales Services SAS

Thales Solutions Asia Pte Ltd

Thales Systèmes Aéroportés SAS

Thales Training & Simulation Ltd

Thales Training & Simulation SA

Thales Transport & Security Ltd

Thales Transportation Systems GmbH

Thales UK Ltd

Thales Underwater Systems SAS

Thales Underwater Systems SAS Ltd

Thales-Raytheon Systems Company LLC

Thales-Raytheon Systems Company SAS

TRAK International, Inc.

Trixell SAS

Turbine Engine Components Textron (Newington Operations) Inc.

Ultra Armoring, LLC

Universal Engineering

Uralvagonzavod

Vinghøg AS

Vingtech Corp.

Volkswagen AG

Volvo Group AB

Westminster Insurance Company

Organisations Mentioned

Afghan National Army

Australian Army

Australian Defence Forces

Australian Defence Material Organisation (DMO)

Brazil Marine Corps

Bundeswehr

Chinese Airborne Forces

Czech Republic Army

DRDO

European Union (EU)

Federal Government of Australia

German MoD

Government of Australia

Government of Brazil

Government of Colombia

Government of Iraq

Government of Jamaica

Government of Japan

Government of Peru

Government of Russia

Government of Saudi Arabia

Government of South Korea

Government of Sweden

Government of the Netherlands

Government of the United Kingdom

Human Rights Watch

Indian Army

International Energy Agency (IEA)

Iraqi Ground Forces

Israel Defence Forces (IDF)

Japanese Ground Self-Defence Force

Knesset

Knesset Defence Committee

Ministère de la Défense

Ministero della Difesa

NATO

OPEC

Organization of Petroleum Exporting Countries (OPEC)

People’s Liberation Army (PLA)

Romanian Government

Royal Australian Air Force

Royal Australian Army

Royal Moroccan Armed Forces

South African National Defence Force

South Korea’s Ministry of National Defense

Sweden’s Defence Materiel Organisation

Swedish Army

Transparency International

Turkish Land Forces

U.S. Army

U.S. DoD

U.S. Marine Corps

U.S. Navy

United Nations

Download sample pages

Complete the form below to download your free sample pages for Military Armoured Vehicle Market Report 2018-2028

Related reports

-

Military Land Vehicle Electronics (Vetronics) Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Military Vehicle Electronics (Vetronics) market. Visiongain...

Full DetailsPublished: 31 May 2018 -

Ground Based Ballistic Missile Defence Systems Market Report 2018-2028

Visiongain’s comprehensive new 395 page report reveals that global expenditure on ground based ballistic missile defence systems will achieve revenues...

Full DetailsPublished: 27 June 2018 -

Military Radar Systems Market Report 2018-2028

The global Military Radar Systems market consists of worldwide government spending on the procurement, development, and upgrades of radar systems...

Full DetailsPublished: 16 March 2018 -

Military Aircraft Avionics Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global military aircraft avionics market. Visiongaain assesses...Full DetailsPublished: 31 July 2018 -

Military Land Vehicle Electronics (Vetronics) Market Report 2019-2029

Visiongain’s definitive new report values the Military Land Vehicle Electronics (Vetronics) market at USD 3.56 billion in 2019.

...Full DetailsPublished: 10 June 2019 -

Targeting Pods Market Forecast 2019-2029

The recent developments in targeting pods technologies in airborne defence platforms, has led Visiongain to publish this timey report. The...Full DetailsPublished: 30 April 2019 -

Performance Based Logistics (PBL) Technologies in the Defence Industry 2019-2029

The $1.98 billion performance based logistics market is expected to flourish over the next few years due to rising demand...Full DetailsPublished: 17 May 2019 -

Military Aircraft Avionics Market Report 2019-2029

The $ 24 billion military avionics is expected to flourish in the next few years because of ongoing investment on...Full DetailsPublished: 26 February 2019 -

Electronic Warfare (EW) Market Report 2019-2029

The recent developments in electronic warfare systems in defence platforms and systems, has led Visiongain to publish this timey report....

Full DetailsPublished: 26 March 2019 -

Military Unmanned Aerial Vehicle (UAV) Market Report 2018-2028

The global Military Unmanned Aerial Vehicle (UAV) market consists of worldwide government spending on the procurement and development of Military...

Full DetailsPublished: 31 August 2018

Download sample pages

Complete the form below to download your free sample pages for Military Armoured Vehicle Market Report 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain defence reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible, Visiongain analysts reach out to market-leading vendors and industry experts and review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain defence reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

ADS Group

Aerial Refueling Systems Advisory Group

Aerospace and Defence Industries Association of Nova Scotia

Aerospace Industries Association

Aerospace Industries Association of Canada

AHS International – The Vertical Flight Technical Society

Air Force Association

Aircraft Electronics Association

Airlift/Tanker Association

American Astronautical Society

American Gear Manufacturers Association

American Institute of Aeronautics and Astronautics

American Logistics Association

American Society of Naval Engineers

AMSUS – The Society of the Federal Health Agencies

Armed Forces Communications and Electronics Association

Armed Forces Communications and Electronics Association

Army Aviation Association of America

ASD – Aerospace & Defence Association of Europe

Association for Unmanned Vehicle Systems International

Association of Aviation Manufacturers of the Czech Republic

Association of Naval Aviation

Association of Old Crows

Association of Polish Aviation Industry

Association of the Defense Industry of the Czech Republic

Association of the United States Army

Association of the United States Navy

Australia Defence Association

Australian Industry & Defence Network

Australian Industry Group Defence Council

Austrian Aeronautics Industries Group

Aviation Distributors and Manufacturers Association

Aviation Suppliers Association

Belgian Security and Defence Industry

Bulgarian Defence Industry Association

Business Executives for National Security

Canadian Association of Defence and Security Industries

Conference of Defense Associations

Council of Defense and Space Industry Associations

Danish Defence & Security Industries Association

Defence Industry Manufacturers Association

Defense Industry Initiative on Business Ethics and Conduct

Defense Industry Offset Association

Defense Orientation Conference Association

Deutsche Gesellschaft fur Wehrtechnik

Federal Association of the German Security and Defence Industry

Federation of Aerospace Enterprises in Ireland

French Aerospace Industries Association

French Land Defence Manufacturers Association (GICAT)

German Aerospace Industries Association

Helicopter Association International

Hellenic Aerospace & Defense Industries Group

Homeland Security & Defense Business Council

International Stability Operations Association

Japan Association of Defense Industry

Korea Defense Industry Association

Marine Corps Association & Foundation

National Aeronautic Association

National Association of Ordnance and Explosive Waste Contractors

National Defense Industrial Association

National Defense Transportation Association

National Guard Association of the U.S.

Navy League of the United States

Netherlands Aerospace Group

New Zealand Defence Industry Association

Portuguese Association of Defense Related Industries & New Technologies Companies

Québec Ground Transportation Cluster

Satellite Industry Association

Society of American Military Engineers

South African Aerospace Maritime and Defence Industries Association

Spanish Aerospace and Defence Association Industries

Submarine Industrial Base Council

Swedish Aerospace Industries

Swedish Security and Defence Industry Association

Swiss Aeronautical Industries Group

The Association of Finnish Defence and Aerospace Industries

The Italian Industries Association for Aerospace Systems and Defence

The Netherlands Defence Manufacturers Association

The Society of Japanese Aerospace Companies

UK AeroSpace, Defence & Security Industries

United Kingdom National Defence Association

Latest Defence news

Visiongain Publishes Directed Energy Weapons (DEW) Market Report 2024-2034

The global Directed Energy Weapons (DEW) market was valued at US$6.4 billion in 2023 and is projected to grow at a CAGR of 19.6% during the forecast period 2024-2034.

26 February 2024

Visiongain Publishes Military Embedded Satellite Systems Market Report 2024-2034

The global Military Embedded Satellite Systems market is projected to grow at a CAGR of 8.7% by 2034

21 February 2024

Visiongain Publishes Military Simulation, Modelling and Virtual Training Market Report 2024-2034

The global military simulation, modelling and virtual training market was valued at US$13.2 billion in 2023 and is projected to grow at a CAGR of 8.3% during the forecast period 2024-2034.

15 February 2024

Visiongain Publishes Military Armoured Vehicle Market Report 2024-2034

The global Military Armoured Vehicle market was valued at US$36,123.6 million in 2023 and is projected to grow at a CAGR of 3.6% during the forecast period 2024-2034.

07 February 2024