Visiongain Publishes Directed Energy Weapons (DEW) Market Report 2024-2034

26 February 2024

Visiongain has published a new report entitled Directed Energy Weapons (DEW) Market Report 2024-2034: Forecasts by Type (Lethal Weapons, Non-lethal Weapons), by System (Anti-Satellite (ASAT) DEW, Electromagnetic Railgun Systems, Counter-Drone DEW Systems, Other), by Technology (High-Energy Lasers (HEL), High-Power Microwaves (HPM), Sonic Weapons, Electromagnetic Weapons, Other), by Application (Ground-Based DEW for Military Bases, Airborne DEW for Aircraft Defence, Naval DEW for Ship Defence, Homeland Security, Critical Infrastructure Defence, Other) AND Regional and Leading National Market Analysis PLUS Analysis of Leading Companies AND COVID-19 Impact and Recovery Pattern Analysis.

The global directed energy weapons (DEW) market was valued at US$6.4 billion in 2023 and is projected to grow at a CAGR of 19.6% during the forecast period 2024-2034.

Requirement for Cost-Effective Defense Solutions

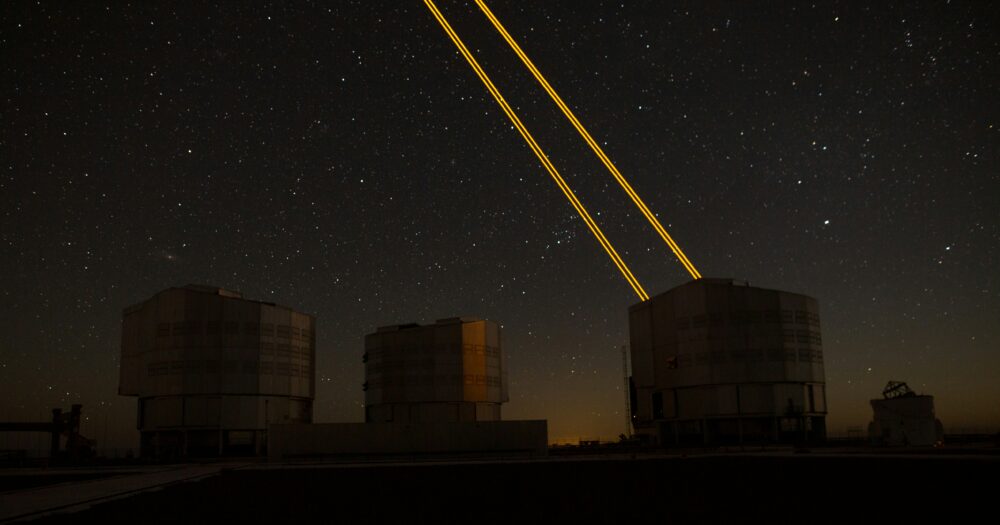

The requirement for cost-effective defense solutions amidst constrained defense budgets is driving the adoption of directed energy weapons by military organizations worldwide. Traditional kinetic weapons and missile defense systems involve high procurement, operation, and maintenance costs, making them economically unsustainable for many defense budgets. Directed energy weapons offer a more cost-effective alternative with reduced ammunition costs, minimal logistical footprint, and lower lifecycle expenses. For example, the deployment of laser-based counter-UAV systems by military forces provides a cost-effective means of defending against small unmanned aerial threats compared to conventional missile-based interceptors.

Increasing Investments in Directed Energy Programs

The increasing investments in directed energy programs by government agencies, defense contractors, and research institutions are driving innovation and growth in the global directed energy weapons market. Countries such as the United States, China, Russia, and European nations are allocating substantial funding to accelerate the development and deployment of directed energy technologies for military applications. These investments support research and development initiatives aimed at enhancing the performance, reliability, and operational capabilities of directed energy weapons across various platforms. For instance, the U.S. Department of Defense's Directed Energy Weapons Directorate (DEWD) oversees a range of directed energy programs focused on advancing laser, microwave, and radiofrequency technologies for military use.

How has COVID-19 had a significant negative impact on the Directed Energy Weapons (DEW) Market?

The COVID-19 pandemic has had a discernible impact on the directed energy weapon (DEW) market, influencing various aspects of its development, production, and deployment. One notable effect has been the disruption of supply chains and manufacturing processes. Lockdowns, restrictions on movement, and workforce limitations imposed to curb the spread of the virus have led to delays in production schedules and the availability of essential components for DEW systems. This has, in turn, affected the overall pace of development and delivery of directed energy weapons.

Financial constraints have emerged as another significant impact of the pandemic on the directed energy weapon market. Many defence budgets faced reallocations and adjustments to address the immediate healthcare and economic challenges posed by the pandemic. Consequently, some defence programs, including those related to advanced technologies like DEWs, experienced budgetary constraints, slowing down investment and procurement processes.

Operational disruptions have affected the testing and validation phases of DEW systems. Social distancing measures and limitations on gatherings have impeded the ability to conduct field trials and exercises. These constraints have slowed down the evaluation and validation of directed energy weapons in real-world scenarios, hindering progress in achieving operational readiness.

How will this Report Benefit you?

Visiongain’s 372-page report provides 113 tables and 198 charts/graphs. Our new study is suitable for anyone requiring commercial, in-depth analyses for the global directed energy weapons (DEW) market, along with detailed segment analysis in the market. Our new study will help you evaluate the overall global and regional market for Directed Energy Weapons (DEW). Get financial analysis of the overall market and different segments including type, system, technology, and application and capture higher market share. We believe that there are strong opportunities in this fast-growing directed energy weapons (DEW) market. See how to use the existing and upcoming opportunities in this market to gain revenue benefits in the near future. Moreover, the report will help you to improve your strategic decision-making, allowing you to frame growth strategies, reinforce the analysis of other market players, and maximise the productivity of the company.

What are the Current Market Drivers?

Need for Precision and Lethality in Modern Warfare

The need for precision and lethality in modern warfare scenarios drives the adoption of directed energy weapons by defense forces worldwide. Traditional kinetic weapons, such as missiles and artillery shells, often result in collateral damage and unintended casualties, limiting their effectiveness in densely populated urban environments and sensitive infrastructure areas. Directed energy weapons offer a more precise and controlled means of engaging targets, minimizing collateral damage and civilian casualties while maximizing lethality against enemy assets. For example, the U.S. Air Force's Tactical High Energy Laser (THEL) system demonstrates the capability of DEWs to engage and destroy incoming artillery shells and rockets with pinpoint accuracy, reducing the risk to friendly forces and civilian populations.

Growing Threat of Ballistic Missile and Hypersonic Weapons

The growing threat posed by ballistic missile proliferation and the development of hypersonic weapons systems is driving the demand for directed energy weapons as a viable defense solution. Ballistic missiles and hypersonic glide vehicles pose significant challenges to existing missile defense systems due to their high speeds, maneuverability, and unpredictable trajectories. Directed energy weapons offer a potential solution for intercepting and neutralizing ballistic missiles and hypersonic threats in the boost, mid-course, and terminal phases of flight. For instance, the concept of using high-energy lasers or particle beams to intercept and destroy incoming missiles in near-real-time is being explored as a cost-effective and reliable defense against advanced missile threats.

Where are the Market Opportunities?

Advancements in Compact and Mobile Directed Energy Platforms

Advancements in compact and mobile directed energy platforms are expanding the operational flexibility and deployment options for directed energy weapons in military environments. Traditional directed energy systems were often large, stationary installations limited to fixed bases or naval vessels, which restricted their mobility and deployment agility. However, recent technological advancements have led to the development of compact, lightweight, and mobile directed energy platforms that can be integrated into various military platforms, including ground vehicles, aircraft, and dismounted soldier systems. For example, the development of man-portable laser weapons, such as the U.S. Army's Mobile Experimental High Energy Laser (MEHEL) system, enables ground troops to engage and neutralize threats with precision and speed in diverse operational environments.

Need for Counter-UAS and Counter-Swarm Capabilities

The proliferation of unmanned aerial systems (UAS) and the emergence of drone swarms as asymmetric threats are driving the demand for directed energy weapons with counter-UAS and counter-swarm capabilities. Unmanned aerial vehicles (UAVs) and drone swarms pose challenges to conventional air defense systems due to their small size, agility, and swarm tactics, making them difficult to detect and intercept using traditional kinetic weapons. Directed energy weapons offer a rapid and effective means of countering UAS threats by providing continuous, 360-degree coverage, rapid engagement, and scalable lethality. For instance, ground-based laser and microwave systems deployed in urban areas or critical infrastructure sites can detect and neutralize hostile drones and swarms with precision, protecting assets and personnel from aerial threats.

Competitive Landscape

The major players operating in the directed energy weapons (DEW) market are BAE Systems PLC, Blue Halo, Elbit Systems Ltd, Honeywell International Inc, L3Harris Technologies, Inc, Leonardo S.p.A, Lockheed Martin Corporation, Moog Inc, Northrop Grumman Corporation, Rafael Advanced Defence Systems Ltd., Raytheon Technologies Corporation, Rheinmetall AG, Textron Inc, Thales Group, The Boeing Company. These major players operating in this market have adopted various strategies comprising M&A, investment in R&D, collaborations, partnerships, regional business expansion, and new product launch.

Recent Developments

- 24 Sept 2023, Raytheon Technologies Corporation has entered into collaboration with Northrop Grumman to develop a prototype High-Power Microwave (HPM) weapon system for maritime applications.

- 04 June 2023, Lockheed Martin and Rafael Advanced Defence Systems partnered to manufacture 100 kW fiber-class laser weapons for the IRON BEAM project, aiming to defend Israel against rockets, mortars, and drones.

Notes for Editors

If you are interested in a more detailed overview of this report, please send an e-mail to contactus@visiongain.com or call +44 (0) 207 336 6100.

About Visiongain

Visiongain is one of the fastest-growing and most innovative independent media companies in Europe. Based in London, UK, Visiongain produces a host of business-to-business reports focusing on the automotive, aviation, chemicals, cyber, defence, energy, food & drink, materials, packaging, pharmaceutical and utilities sectors.

Visiongain publishes reports produced by analysts who are qualified experts in their field. Visiongain has firmly established itself as the first port of call for the business professional who needs independent, high-quality, original material to rely and depend on.

Recent News

Visiongain Publishes Directed Energy Weapons (DEW) Market Report 2024-2034

The global Directed Energy Weapons (DEW) market was valued at US$6.4 billion in 2023 and is projected to grow at a CAGR of 19.6% during the forecast period 2024-2034.

26 February 2024

Read

Visiongain Publishes Military Embedded Satellite Systems Market Report 2024-2034

The global Military Embedded Satellite Systems market is projected to grow at a CAGR of 8.7% by 2034

21 February 2024

Read

Visiongain Publishes Military Simulation, Modelling and Virtual Training Market Report 2024-2034

The global military simulation, modelling and virtual training market was valued at US$13.2 billion in 2023 and is projected to grow at a CAGR of 8.3% during the forecast period 2024-2034.

15 February 2024

Read

Visiongain Publishes Military Armoured Vehicle Market Report 2024-2034

The global Military Armoured Vehicle market was valued at US$36,123.6 million in 2023 and is projected to grow at a CAGR of 3.6% during the forecast period 2024-2034.