Industries > Defence > Military Unmanned Aerial Vehicle (UAV) Market Report 2018-2028

Military Unmanned Aerial Vehicle (UAV) Market Report 2018-2028

Forecasts & Analysis of Top Companies Leading Development of HALE, MALE, Small, Tactical & UCAV Systems Aisheng, Wing Loong, Falco, Eitan, Taranis, Avenger, TERN, Anka, Barracuda, Reaper, Predator, Orbiter, Aerostar, Scout, Searcher, Heron, Hermes, Nano, Raven, Zephyr, Sentinel, Global Hawk

• Do you need Military Unmanned Aerial Vehicle (UAV) market data?

• Succinct Military Unmanned Aerial Vehicle (UAV) market analysis?

• Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive report can transform your own research and save you time.

The global Military Unmanned Aerial Vehicle (UAV) market consists of worldwide government spending on the procurement and development of Military UAV systems for military purposes. If you want to be part of this growing industry, then read on to discover how you can maximise your investment potential.

Report highlights

• Featuring 174 tables, and 127 figures and charts!

• Analysis of key players in the Global Military UAV Market

• Aeronautics Ltd

• AeroVironment Inc

• BAE Systems plc

• The Boeing Company

• Elbit Systems Ltd

• Leonardo SpA

• General Atomics Aeronautical Systems, Inc. (GA-ASI)

• Israel Aerospace Industries (IAI)

• Lockheed Martin Corporation

• Northrop Grumman Corporation

• Textron Inc

• Thales Group

• Turkish Aerospace Industries Inc

• Xi’an Aisheng (ASN) Technology Group

• Global Military UAV market outlook and analysis from 2018-2028

• Major Military UAV System contracts and projects

• More than 20 detailed tables covering the Military UAV Systems Market, and segmentations by country

• Analysis of major contracts awarded by each country/national market

• Military UAV system type forecasts and analysis from 2018-2028

• This report splits the military unmanned aerial vehicle (UAV) market into five submarkets: High-Altitude Long Endurance (HALE), Medium Altitude Long Endurance (MALE), Small, Tactical, and Unmanned Combat Aerial Vehicle (UCAV).

• Regional Military UAV system market forecasts from 2018-2028

Buy our report today Military Unmanned Aerial Vehicle Market Analysis 2018-2028. Avoid missing out by staying informed – get our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Military Unmanned Aerial Vehicle (UAV) Market Overview

1.2 Global Military Unmanned Aerial Vehicle (UAV) Market Segmentation

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.7.3 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Military Unmanned Aerial Vehicle (UAV) Market

2.1 Military Unmanned Aerial Vehicle (UAV) Market Definition

2.2 Military Unmanned Aerial Vehicle (UAV) Submarkets Definition

2.2.1 Military Unmanned Aerial Vehicle (UAV) HALE Submarket Definition

2.2.2 Military Unmanned Aerial Vehicle (UAV) MALE Submarket Definition

2.2.3 Military Unmanned Aerial Vehicle (UAV) Small Submarket Definition

2.3.4 Military Unmanned Aerial Vehicle (UAV) Tactical Submarket Definition

2.2.5 Military Unmanned Aerial Vehicle (UAV) UCAV Submarket Definition

3. Global Military Unmanned Aerial Vehicle (UAV) Market 2018-2028

3.1 Global Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028

3.2 Global Military Unmanned Aerial Vehicle (UAV) Drivers & Restraints 2018

3.2.1 Global Military Unmanned Aerial Vehicle (UAV) Market Drivers 2018

3.2.2 Global Military Unmanned Aerial Vehicle (UAV) Market Restraints 2018

4. Global Military Unmanned Aerial Vehicle (UAV) Submarket Forecast 2018-2028

4.1 Global Military Unmanned Aerial Vehicle (UAV) HALE Forecast 2018-2028

4.1.1 Global HALE Submarket Analysis

4.2 Global Military Unmanned Aerial Vehicle (UAV) MALE Forecast 2018-2028

4.2.1 Global MALE Submarket Analysis

4.3 Global Military Unmanned Aerial Vehicle (UAV) Small Forecast 2018-2028

4.3.1 Global Small UAV Submarket Analysis

4.4 Global Military Unmanned Aerial Vehicle (UAV) Tactical Forecast 2018-2028

4.4.1 Global Tactical UAV Submarket Analysis

4.5 Global Military Unmanned Aerial Vehicle (UAV) UCAV Forecast 2018-2028

4.5.1 Global UCAV Submarket Analysis

4.6 Global Military Unmanned Aerial Vehicle (UAV) Submarket Cumulative Market Share Forecast 2018-2028

5. Leading National Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028

5.1 Global Military Unmanned Aerial Vehicle (UAV) Market by National Market Share Forecast 2018-2028

5.2 Australia Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028

5.2.1 Australia Military Unmanned Aerial Vehicle (UAV) Market Contracts & Programmes

5.2.2 Australia Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints

5.2.3 Australia Military Unmanned Aerial Vehicle (UAV) Analysis

5.3 France Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028

5.3.1 France Military Unmanned Aerial Vehicle (UAV) Market Contracts & Programmes

5.3.2 France Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints

5.3.3 France Military Unmanned Aerial Vehicle (UAV) Analysis

5.4 Germany Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028

5.4.1 Germany Military Unmanned Aerial Vehicle (UAV) Market Contracts & Programmes

5.4.2 Germany Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints

5.4.3 Germany Military Unmanned Aerial Vehicle (UAV) Analysis

5.5 India Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028

5.5.1 India Military Unmanned Aerial Vehicle (UAV) Market Contracts & Programmes

5.5.2 India Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints

5.5.3 India Military Unmanned Aerial Vehicle (UAV) Analysis

5.6 Japan Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028

5.6.1 Japan Military Unmanned Aerial Vehicle (UAV) Market Contracts & Programmes

5.6.2 Japan Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints

5.6.3 Japan Military Unmanned Aerial Vehicle (UAV) Analysis

5.7 South Korea Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028

5.7.1 South Korea Military Unmanned Aerial Vehicle (UAV) Market Contracts & Programmes

5.7.2 South Korea Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints

5.7.3 South Korea Military Unmanned Aerial Vehicle (UAV) Analysis

5.8 United Kingdom Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028

5.8.1 United Kingdom Military Unmanned Aerial Vehicle (UAV) Market Contracts & Programmes

5.8.2 United Kingdom Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints

5.8.3 United Kingdom Military Unmanned Aerial Vehicle (UAV) Analysis

5.9 United States Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028

5.9.1 United States Military Unmanned Aerial Vehicle (UAV) Market Contracts & Programmes

5.9.2 United States Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints

5.9.3 United States Military Unmanned Aerial Vehicle (UAV) Analysis

5.10 Rest of the World (ROW) Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028

5.10.1 China Military Unmanned Aerial Vehicle (UAV) Market Analysis 2018-2028

5.10.1.1 China Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints

5.10.2 Israel Military Unmanned Aerial Vehicle (UAV) Market Analysis 2018-2028

5.10.2.1 Israel Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints

5.10.2.2 Israel Military Unmanned Aerial Vehicle (UAV) Market Contracts & Programmes

5.10.3 Russia Military Unmanned Aerial Vehicle (UAV) Market Analysis 2018-2028

5.10.3.1 Russia Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints

5.10.3.2 Russia Military Unmanned Aerial Vehicle (UAV) Market Contracts & Programmes

5.10.4 Turkey Military Unmanned Aerial Vehicle (UAV) Market Analysis 2018-2028

5.10.4.1 Turkey Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints

5.10.4.2 Turkey Military Unmanned Aerial Vehicle (UAV) Market Contracts & Programmes

5.10.5 Rest of the World (ROW) Military Unmanned Aerial Vehicle (UAV) Market Contracts & Programmes

6. SWOT Analysis of the Military Unmanned Aerial Vehicle (UAV) Market 2018-2028

7. Emerging Military UAV Sub-Categories

8. Leading 14 Military Unmanned Aerial Vehicle (UAV) Companies

8.1 Leading 14 Military Unmanned Aerial Vehicle (UAV) Company Sales Share Analysis FY2017

8.2 Aeronautics Ltd

8.2.1 Aeronautics Ltd Military Unmanned Aerial Vehicle (UAV) Selected Recent Contracts / Projects / Programmes 2011-2018

8.2.2 Aeronautics Ltd Organisational Structure / Subsidiaries

8.2.3 Aeronautics Ltd Military Unmanned Aerial Vehicle (UAV) Products / Services

8.2.4 Aeronautics Ltd Primary Market Competitors 2017

8.2.5 Aeronautics Ltd Mergers & Acquisitions (M&A) Activity

8.2.6 Aeronautics Ltd Analysis

8.2.7 Aeronautics Ltd Future Outlook

8.3 AeroVironment Inc

8.3.1 AeroVironment Inc Military Unmanned Aerial Vehicle (UAV) Selected Recent Contracts / Projects / Programmes 2012-2018

8.3.2 AeroVironment Inc Total Company Sales 2012-2017

8.3.3 AeroVironment Inc Sales by Segment of Business 2012-2017

8.3.4 AeroVironment Inc Net Income 2012-2017

8.3.5 AeroVironment Inc Order Backlog 2012-2017

8.3.6 AeroVironment Inc Regional Emphasis / Focus

8.3.7 AeroVironment Inc Organisational Structure / Subsidiaries

8.3.8 AeroVironment Inc Military Unmanned Aerial Vehicle (UAV) Products / Services

8.3.9 AeroVironment Inc Primary Market Competitors 2017

8.3.10 AeroVironment Inc Mergers & Acquisitions (M&A) Activity

8.3.11 AeroVironment Inc Analysis

8.3.12 AeroVironment Inc Future Outlook

8.4 BAE Systems plc

8.4.1 BAE Systems plc Military Unmanned Aerial Vehicle (UAV) Selected Recent Contracts / Projects / Programmes 2005-2016

8.4.2 BAE Systems plc Total Company Sales 2012-2017

8.4.3 BAE Systems plc Sales by Segment of Business 2012-2017

8.4.4 BAE Systems plc Net Income 2012-2017

8.4.5 BAE Systems plc Order Backlog 2012-2017

8.4.6 BAE Systems plc Regional Emphasis / Focus

8.4.7 BAE Systems plc Organisational Structure / Subsidiaries

8.4.8 BAE Systems plc Military Unmanned Aerial Vehicle (UAV) Products / Services

8.4.9 BAE Systems plc Primary Market Competitors

8.4.10 BAE Systems plc Mergers & Acquisitions (M&A) Activity

8.4.11 BAE Systems Analysis

8.4.12 BAE Systems Future Outlook

8.5 The Boeing Company

8.5.1 The Boeing Company Military Unmanned Aerial Vehicle (UAV) Selected Recent Contracts / Projects / Programmes 2013-2018

8.5.2 The Boeing Company Total Company Sales 2012-2017

8.5.3 The Boeing Company Sales by Segment of Business 2012-2017

8.5.4 The Boeing Company Net Income 2012-2017

8.5.5 The Boeing Company Order Backlog 2012-2017

8.5.6 The Boeing Company Regional Emphasis / Focus

8.5.7 The Boeing Company Organisational Structure / Subsidiaries

8.5.8 The Boeing Company Military Unmanned Aerial Vehicle (UAV) Products / Services

8.5.9 The Boeing Company Primary Market Competitors

8.5.10 The Boeing Company Mergers & Acquisitions (M&A) Activity

8.5.11 The Boeing Company Analysis

8.5.12 The Boeing Company Future Outlook

8.6 Elbit Systems Ltd

8.6.1 Elbit Systems Ltd Military Unmanned Aerial Vehicle (UAV) Selected Recent Contracts / Projects / Programmes 2010-2018

8.6.2 Elbit Systems Ltd Total Company Sales 2012-2017

8.6.3 Elbit Systems Ltd Sales by Segment of Business 2012-2017

8.6.4 Elbit Systems Ltd Net Income 2012-2017

8.6.5 Elbit Systems Ltd Order Backlog 2012-2017

8.6.6 Elbit Systems Ltd Regional Emphasis / Focus

8.6.7 Elbit Systems Ltd Organisational Structure / Subsidiaries

8.6.8 Elbit Systems Ltd Military Unmanned Aerial Vehicle (UAV) Products / Services

8.6.9 Elbit Systems Ltd Primary Market Competitors 2018

8.6.10 Elbit Systems Ltd Mergers & Acquisitions (M&A) Activity

8.6.11 Elbit Systems Ltd Analysis

8.6.12 Elbit Systems Ltd Future Outlook

8.7 Leonardo SpA

8.7.1 Leonardo SpA Military Unmanned Aerial Vehicle (UAV) Selected Recent Contracts / Projects / Programmes 2013-2018

8.7.2 Leonardo SpA Total Company Sales 2012-2017

8.7.3 Leonardo SpA Sales by Segment of Business 2012-2017

8.7.4 Leonardo SpA Net Income 2012-2017

8.7.5 Leonardo SpA Order Backlog 2012-2017

8.7.6 Leonardo SpA Regional Emphasis / Focus

8.7.7 Leonardo SpA Organisational Structure / Subsidiaries / Number of Employees

8.7.8 Leonardo SpA Military Unmanned Aerial Vehicle (UAV) Products / Services

8.7.9 Leonardo SpA Primary Market Competitors 2018

8.7.10 Leonardo SpA Mergers & Acquisitions (M&A) Activity

8.7.11 Leonardo SpA Analysis

8.7.12 Leonardo SpA Future Outlook

8.8 General Atomics Aeronautical Systems, Inc. (GA-ASI)

8.8.1 General Atomics Aeronautical Systems, Inc. (GA-ASI) Military Unmanned Aerial Vehicle (UAV) Selected Recent Contracts / Projects / Programmes 2014-2018

8.8.2 General Atomics Aeronautical Systems, Inc. (GA-ASI) Organisational Structure

8.8.3 General Atomics Aeronautical Systems, Inc. (GA-ASI) Military Unmanned Aerial Vehicle (UAV) Products / Services

8.8.4 General Atomics Aeronautical Systems, Inc. (GA-ASI) Primary Market Competitors 2017

8.8.5 General Atomics Aeronautical Systems, Inc. (GA-ASI) Mergers & Acquisitions (M&A) Activity

8.8.6 General Atomics Aeronautical Systems, Inc. (GA-ASI) Analysis

8.8.7 General Atomics Aeronautical Systems, Inc. (GA-ASI) Future Outlook

8.9 Israel Aerospace Industries (IAI)

8.9.1 Israel Aerospace Industries (IAI) Military Unmanned Aerial Vehicle (UAV) Selected Recent Contracts / Projects / Programmes 2009-2018

8.9.2 Israel Aerospace Industries (IAI) Total Company Sales 2012-2017

8.9.3 Israel Aerospace Industries (IAI) Sales by Segment of Business 2011-2013

8.9.4 Israel Aerospace Industries (IAI) Net Income 2012-2017

8.9.5 Israel Aerospace Industries (IAI) Regional Emphasis / Focus

8.9.6 Israel Aerospace Industries (IAI) Organisational Structure / Subsidiaries

8.9.7 Israel Aerospace Industries (IAI) Ltd Military Unmanned Aerial Vehicle (UAV) Products / Services

8.9.8 Israel Aerospace Industries (IAI) Primary Market Competitors 2018

8.9.9 Israel Aerospace Industries (IAI) Mergers & Acquisitions (M&A) Activity

8.9.10 Israel Aerospace Industries (IAI) Ltd Analysis

8.9.11 Israel Aerospace Industries (IAI) Ltd Future Outlook

8.10 Lockheed Martin Corporation

8.10.1 Lockheed Martin Corporation Military Unmanned Aerial Vehicle (UAV) Selected Recent Contracts / Projects / Programmes 2017

8.10.2 Lockheed Martin Corporation Total Company Sales 2012-2017

8.10.3 Lockheed Martin Corporation Sales by Segment of Business 2012-2017

8.10.4 Lockheed Martin Corporation Net Income 2012-2017

8.10.5 Lockheed Martin Corporation Order Backlog 2012-2017

8.10.6 Lockheed Martin Corporation Regional Emphasis / Focus

8.10.7 Lockheed Martin Corporation Organisational Structure / Subsidiaries

8.10.8 Lockheed Martin Corporation Military Unmanned Aerial Vehicle (UAV) Products / Services

8.10.9 Lockheed Martin Corporation Primary Market Competitors

8.10.10 Lockheed Martin Corporation Mergers & Acquisitions (M&A) Activity

8.10.11 Lockheed Martin Analysis

8.10.12 Lockheed Martin Corporation Future Outlook

8.11 Northrop Grumman Corporation

8.11.1 Northrop Grumman Corporation Military Unmanned Aerial Vehicle (UAV) Selected Recent Contracts / Projects / Programmes 2009-2018

8.11.2 Northrop Grumman Corporation Total Company Sales 2012-2017

8.11.3 Northrop Grumman Corporation Sales by Business Segment 2012-2017

8.11.4 Northrop Grumman Corporation Net Income 2012-2017

8.11.5 Northrop Grumman Corporation Order Backlog 2012-2017

8.11.6 Northrop Grumman Corporation Regional Emphasis / Focus

8.11.7 Northrop Grumman Corporation Organisational Structure / Subsidiaries

8.11.8 Northrop Grumman Corporation Military Unmanned Aerial Vehicle (UAV) Notable Products / Services

8.11.9 Northrop Grumman Corporation Primary Market Competitors 2018

8.11.10 Northrop Grumman Corporation Mergers & Acquisitions (M&A) Activity

8.11.11 Northrop Grumman Corporation Analysis

8.11.12 Northrop Grumman Corporation Future Outlook

8.12 Textron Inc

8.12.1 Textron Inc Military Unmanned Aerial Vehicle (UAV) Selected Recent Contracts / Projects / Programmes 2010-2016

8.12.2 Textron Inc Total Company Sales 2012-2017

8.12.3 Textron Inc Sales by Segment of Business 2012-2017

8.12.4 Textron Inc Net Income 2012-2017

8.12.5 Textron Inc Order Backlog 2012-2017

8.12.6 Textron Inc Regional Emphasis / Focus 2018

8.12.7 Textron Inc Organisational Structure / Subsidiaries

8.12.8 Textron Inc Military Unmanned Aerial Vehicle (UAV) Products / Services

8.12.9 Textron Inc Primary Market Competitors 2018

8.12.10 Textron Inc Mergers & Acquisitions (M&A) Activity

8.12.11 Textron Inc Analysis

8.12.12 Textron Inc Future Outlook

8.13 Thales Group

8.13.1 Thales Group Military Unmanned Aerial Vehicle (UAV) Selected Recent Contracts / Projects / Programmes 2005-2014

8.13.2 Thales Group Total Company Sales 2012-2017

8.13.3 Thales Group Sales by Segment of Business 2012-2017

8.13.4 Thales Group Net Income 2012-2017

8.13.5 Thales Group Order Book 2012-2017

8.13.6 Thales Group Regional Emphasis / Focus

8.13.7 Thales Group Organisational Structure / Subsidiaries

8.13.8 Thales Group Military Unmanned Aerial Vehicle (UAV) Products / Services

8.13.9 Thales Group Primary Market Competitors 2018

8.13.10 Thales Group Mergers & Acquisitions (M&A) Activity

8.13.11 Thales Group Analysis

8.13.12 Thales Group Future Outlook

8.14 Turkish Aerospace Industries Inc

8.14.1 Turkish Aerospace Industries Inc Military Unmanned Aerial Vehicle (UAV) Selected Recent Contracts / Projects / Programmes 2018

8.14.2 Turkish Aerospace Industries Inc Organisational Structure / Subsidiaries

8.14.3 Turkish Aerospace Industries Inc Military Unmanned Aerial Vehicle (UAV) Products / Services

8.14.4 Turkish Aerospace Industries Inc Primary Market Competitors 2018

8.14.5 Turkish Aerospace Industries Inc Analysis

8.14.6 Turkish Aerospace Industries Inc Future Outlook

8.15 Xi’an Aisheng (ASN) Technology Group

8.15.1 Xi’an Aisheng (ASN) Technology Group Military Unmanned Aerial Vehicle (UAV) Selected Products / Services

8.15.2 Xi’an Aisheng (ASN) Technology Group Primary Market Competitors 2017

8.15.3 Xi’an Aisheng (ASN) Technology Group Analysis

8.15.4 Xi’an Aisheng (ASN) Technology Group Future Outlook

8.16 Other Companies Involved in the Military Unmanned Aerial Vehicle (UAV) Market 2018

9. Conclusions and Recommendations

10. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 1.1 Example of Military Unmanned Aerial Vehicle (UAV) Market by Regional Market Forecast 2018-2028 (US$m, AGR%, Cumulative)

Table 1.2 Example of Leading National Military Unmanned Aerial Vehicle (UAV) Market Forecast by Submarket 2018-2028 (US$m, AGR%, Cumulative)

Table 3.1 Global Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, AGR %, CAGR%, Cumulative)

Table 3.2 Global Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints 2018

Table 4.1 Global Military Unmanned Aerial Vehicle (UAV) Submarket Forecast 2018-2028 (US$m, AGR%, Cumulative)

Table 4.2 Global Military Unmanned Aerial Vehicle (UAV) Submarket by US Vs Non US National Market Forecast 2018-2028 (US$m, Cumulative, Global AGR%)

Table 4.3 Global Military Unmanned Aerial Vehicle (UAV) Submarket CAGR Forecast 2018-2023, 2023-2028, 2018-2028 (CAGR%)

Table 4.4 Global Military Unmanned Aerial Vehicle (UAV) Submarket Percentage Change in Market Share 2018-2023, 2023-2028, 2018-2028 (% Change)

Table 4.5 Global Military Unmanned Aerial Vehicle (UAV) HALE Submarket by US vs. Non-US Market Forecast 2018-2028 (US$m, AGR%, CAGR%, Cumulative)

Table 4.6 Global Military Unmanned Aerial Vehicle (UAV) MALE Submarket by US vs. Non-US Market Forecast 2018-2028 (US$m, AGR%, CAGR%, Cumulative)

Table 4.7 Global Military Unmanned Aerial Vehicle (UAV) Small Submarket by US vs. Non-US Market Forecast 2018-2028 (US$m, AGR%, CAGR%, Cumulative)

Table 4.8 Global Military Unmanned Aerial Vehicle (UAV) Tactical Submarket by US vs. Non-US Market Forecast 2018-2028 (US$m, AGR%, CAGR%, Cumulative)

Table 4.9 Global Military Unmanned Aerial Vehicle (UAV) UCAV Submarket by US vs. Non-US Market Forecast 2018-2028 (US$m, AGR%, CAGR%, Cumulative)

Table 5.1 Leading National Military Unmanned Aerial Vehicle (UAV) Market Forecasts 2018-2028 (US$m, Global AGR%, Cumulative)

Table 5.2 Global Military Unmanned Aerial Vehicle (UAV) by National Market CAGR Forecast 2018-2023, 2023-2028, 2018-2028 (CAGR%)

Table 5.3 Leading National Military Unmanned Aerial Vehicle (UAV) Market Percentage Change in Market Share 2018-2023, 2023-2028, 2018-2028 (% Change)

Table 5.4 Australia Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, AGR %, CAGR%, Cumulative)

Table 5.5 Australia Military Unmanned Aerial Vehicle (UAV) Market Major Contracts & Programmes 2010-2015 (Date, Company, Value US$m, Product, Details)

Table 5.6 Australia Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints 2018

Table 5.7 France Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, AGR %, CAGR%, Cumulative)

Table 5.8 France Military Unmanned Aerial Vehicle (UAV) Market Major Contracts & Programmes 2012-2017 (Date, Company, Value US$m, Product, Details)

Table 5.9 France Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints 2018

Table 5.10 Germany Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, AGR %, CAGR%, Cumulative)

Table 5.11 Germany Military Unmanned Aerial Vehicle (UAV) Market Major Contracts & Programmes 2015-2018 (Date, Company, Value US$m, Product, Details)

Table 5.12 Germany Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints 2018

Table 5.13 India Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, AGR %, CAGR%, Cumulative)

Table 5.14 India Military Unmanned Aerial Vehicle (UAV) Market Major Contracts & Programmes 2009-2018 (Date, Company, Value US$m, Product, Details)

Table 5.15 India Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints 2018

Table 5.16 Japan Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, AGR %, CAGR%, Cumulative)

Table 5.17 Japan Military Unmanned Aerial Vehicle (UAV) Market Major Contracts & Programmes 2012-2015 (Date, Company, Value US$m, Product, Details)

Table 5.18 Japan Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints 2018

Table 5.19 South Korea Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, AGR %, CAGR%, Cumulative)

Table 5.20 South Korea Military Unmanned Aerial Vehicle (UAV) Market Major Contracts & Programmes 2009-2015 (Date, Company, Value US$m, Product, Details)

Table 5.21 South Korea Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints 2018

Table 5.22 United Kingdom Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, AGR %, CAGR%, Cumulative)

Table 5.23 United Kingdom Military Unmanned Aerial Vehicle (UAV) Market Major Contracts & Programmes 2012-2018 (Date, Company, Value US$m, Product, Details)

Table 5.24 United Kingdom Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints 2018

Table 5.25 United States Military Unmanned Aerial Vehicle (UAV) Market by Submarkets Forecast 2018-2028 (US$m, AGR %, CAGR%, Cumulative)

Table 5.26 United States Military Unmanned Aerial Vehicle (UAV) Market Major Contracts & Programmes 2010-2018 (Date, Company, Value US$m, Product, Details)

Table 5.27 United States Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints 2018

Table 5.28 Rest of the World (ROW) Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, AGR %, CAGR%, Cumulative)

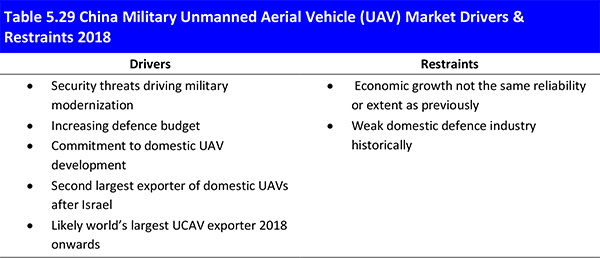

Table 5.29 China Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints 2018

Table 5.30 Israel Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints 2018

Table 5.31 Israel Military Unmanned Aerial Vehicle (UAV) Market Major Contracts & Programmes 2010-2013 (Date, Company, Value US$m, Product, Details)

Table 5.32 Russia Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints 2018

Table 5.33 Russia Military Unmanned Aerial Vehicle (UAV) Market Major Contracts & Programmes 2009-2010 (Date, Company, Value US$m, Product, Details)

Table 5.34 Turkey Military Unmanned Aerial Vehicle (UAV) Market Drivers & Restraints 2018

Table 5.35 Turkey Military Unmanned Aerial Vehicle (UAV) Market Major Contracts & Programmes 2011-2015 (Date, Company, Value US$m, Product, Details)

Table 5.36 Rest of the World (ROW) Military Unmanned Aerial Vehicle (UAV) Market Major Contracts & Programmes 2010-2017 (Date, Country, Company, Value US$m, Product, Details)

Table 6.1 Global Military Unmanned Aerial Vehicle (UAV) Market SWOT Analysis 2018-2028

Table 8.1 Leading 14 Military Unmanned Aerial Vehicle (UAV) Companies Sales Share 2017 (Company, FY2017 Total Company Sales US$m, Primary Submarket Specialisation)

Table 8.2 Aeronautics Ltd Profile 2018 (CEO, Business Segment in the Market, Submarket Involvement, HQ, Founded, IR Contact, Website)

Table 8.3 Selected Recent Aeronautics Ltd Small Unmanned Aerial Vehicle (UAV) Contracts / Projects / Programmes 2011-2018 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 8.4 Aeronautics Ltd Subsidiaries 2018 (Subsidiary, Location)

Table 8.5 Aeronautics Ltd Military Unmanned Aerial Vehicle (UAV) Products / Services (Segment of Business, Product, Specification / Features)

Table 8.6 Aeronautics Ltd Mergers and Acquisitions 2012-2017 (Date, Company Involved, Details)

Table 8.7 AeroVironment Inc Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.8 Selected Recent AeroVironment Inc Military Unmanned Aerial Vehicle (UAV) Contracts / Projects / Programmes 2012-2018 (Date, Country, Value US$m, Product, Details)

Table 8.9 AeroVironment Inc Total Company Sales 2012-2017 (US$m, AGR%)

Table 8.10 AeroVironment Inc Sales by Segment of Business 2012-2017 (US$m, AGR%)

Table 8.11 AeroVironment Inc Net Income 2012-2017 (US$m, AGR%)

Table 8.12 AeroVironment Inc Order Backlog 2012-2017 (US$m, AGR%)

Table 8.13 AeroVironment Inc Subsidiaries 2017 (Subsidiary, Location)

Table 8.14 AeroVironment Inc Military Unmanned Aerial Vehicle (UAV) Products / Services (Segment of Business, Product, Specification / Features)

Table 8.15 AeroVironment Inc Mergers and Acquisitions 2012-2018(Date, Company Involved, Value US$m, Details)

Table 8.16 AeroVironment Inc Divestitures 2013 (Date, Company Involved, Value US$m, Details)

Table 8.17 BAE Systems plc Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.18 Selected Recent BAE Systems plc Military Unmanned Aerial Vehicle (UAV) Contracts / Projects / Programmes 2005-2016 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 8.19 BAE Systems plc Total Company Sales 2012-2017 (US$m, AGR%)

Table 8.20 BAE Systems plc Sales by Business Segment 2012-2017 (US$m, AGR%)

Table 8.21 BAE Systems plc Net Income 2012-2017 (US$m, AGR%)

Table 8.22 BAE Systems plc Order Backlog 2012-2017 (US$m, AGR%)

Table 8.23 BAE Systems plc Sales by Geographical Location 2012-2017 (US$m, AGR%)

Table 8.24 BAE Systems plc Subsidiaries (Subsidiary, Location)

Table 8.25 BAE Systems plc Military Unmanned Aerial Vehicle (UAV) Products / Services (Segment of Business, Product, Specification / Features

Table 8.26 BAE Systems plc Mergers and Acquisitions 2010-2015 (Date, Company Involved, Value US$m, Details)

Table 8.27 BAE Systems plc Divestitures 2011-2015 (Date, Company Involved, Value US$m, Details)

Table 8.28 The Boeing Company Overview 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.29 Selected Recent The Boeing Company Military Unmanned Aerial Vehicle (UAV) Contracts / Projects / Programmes 2013-2018 (Date, Country, Value US$m, Product, Details)

Table 8.30 The Boeing Company Total Company Sales 2012-2017 (US$m, AGR%)

Table 8.31 The Boeing Company Sales by Business Segment 2012-2017 (US$m, AGR%)

Table 8.32 The Boeing Company Net Income 2012-2017 (US$m, AGR%)

Table 8.33 The Boeing Company Order Backlog 2012-2017 (US$m, AGR%)

Table 8.34 The Boeing Company Sales by Geographical Location 2012-2017 (US$m, AGR%)

Table 8.35 The Boeing Company Subsidiaries (Subsidiary, Location)

Table 8.36 The Boeing Company Military Unmanned Aerial Vehicle (UAV) Products / Services (Segment of Business, Product, Specification / Features)

Table 8.37 The Boeing Company Mergers and Acquisitions 2008-2014 (Date, Company Involved, Value US$m, Details)

Table 8.38 The Boeing Company Divestitures 2015 (Date, Company Involved, Value US$m, Details)

Table 8.39 Elbit Systems Ltd Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.40 Selected Recent Elbit Systems Ltd Military Unmanned Aerial Vehicle (UAV) Contracts / Projects / Programmes 2010-2018 (Date, Country, Value US$m, Product, Details)

Table 8.41 Elbit Systems Ltd Total Company Sales 2012-2017 (US$m, AGR%)

Table 8.42 Elbit Systems Ltd Sales by Segment of Business 2012-2017 (US$m, AGR%)

Table 8.43 Elbit Systems Ltd Net Income 2012-2017 (US$m, AGR%)

Table 8.44 Elbit Systems Ltd Order Backlog 2012-2017 (US$m, AGR%)

Table 8.45 Elbit Systems Ltd Sales by Geographical Location 2012-2017 (US$m, AGR%)

Table 8.46 Elbit Systems Ltd Subsidiaries 2018 (Subsidiary, Location)

Table 8.47 Elbit Systems Ltd Military Unmanned Aerial Vehicle (UAV) Products / Services (Segment of Business, Product, Specification / Features)

Table 8.48 Elbit Systems Ltd Mergers and Acquisitions 2011-2013 (Date, Company Involved, Value US$m, Details)

Table 8.49 Elbit Systems Ltd Divestitures 2012-2016 (Date, Company Involved, Details)

Table 8.50 Leonardo SpA Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.51 Selected Recent Leonardo SpA Military Unmanned Aerial Vehicle (UAV) Contracts / Projects / Programmes 2013-2018 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 8.52 Leonardo SpA Total Company Sales 2012-2017 (US$m, AGR%)

Table 8.53 Leonardo SpA Sales by Segment of Business 2012-2017 (US$m, AGR%)

Table 8.54 Leonardo SpA Net Income 2012-2017 (US$m, AGR%)

Table 8.55 Leonardo SpA Order Backlog 2012-2017 (US$m, AGR%)

Table 8.56 Leonardo SpA Sales by Geographical Location 2012-2017 (US$m, AGR%)

Table 8.57 Leonardo SpA Subsidiaries 2017 (Subsidiary, Location)

Table 8.58 Leonardo SpA Military Unmanned Aerial Vehicle (UAV) Products / Services (Segment of Business, Product, Specification / Features)

Table 8.59 Leonardo SpA Mergers and Acquisitions 2011-2014 (Date, Company Involved, Value US$m, Details)

Table 8.60 Leonardo SpA Divestitures 2012 (Date, Company Involved, Value US$m, Details)

Table 8.61 General Atomics Aeronautical Systems, Inc. (GA-ASI) Profile 2018 (CEO, Business Segment in the Market, Submarket Involvement, HQ, Founded, IR Contact, Website)

Table 8.62 Selected Recent General Atomics Aeronautical Systems, Inc. (GA-ASI) Military Unmanned Aerial Vehicle (UAV) Contracts / Projects / Programmes 2014-2018 (Date, Country, Value US$m, Product, Details)

Table 8.63 General Atomics Aeronautical Systems, Inc. (GA-ASI) Military Unmanned Aerial Vehicle (UAV) Products / Services (Segment of Business, Product, Specification / Features)

Table 8.64 General Atomics Aeronautical Systems, Inc. (GA-ASI) Mergers and Acquisitions 2016 (Date, Company Involved, Value US$m, Details)

Table 8.65 Israel Aerospace Industries (IAI) Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, IR Contact, Ticker, Website)

Table 8.66 Selected Recent Israel Aerospace Industries (IAI) Military Unmanned Aerial Vehicle (UAV) Contracts / Projects / Programmes 2009-2018 (Date, Country, Value US$m, Product, Details)

Table 8.67 Israel Aerospace Industries (IAI) Total Company Sales 2012-2017 (US$m, AGR%)

Table 8.68 Israel Aerospace Industries (IAI) Sales by Segment of Business 2011-2013 (US$m, AGR%)

Table 8.69 Israel Aerospace Industries (IAI) Net Income 2012-2017 (US$m, AGR%)

Table 8.70 Israel Aerospace Industries (IAI) Sales by Geographical Location 2011-2013 (US$m, AGR%)

Table 8.71 Israel Aerospace Industries (IAI) Subsidiaries 2018 (Subsidiary, Location)

Table 8.72 Israel Aerospace Industries (IAI) Ltd Military Unmanned Aerial Vehicle (UAV) Products / Services (Segment of Business, Product, Specification / Features)

Table 8.73 Israel Aerospace Industries (IAI) Mergers and Acquisitions 2011-2014 (Date, Company Involved, Details)

Table 8.74 Israel Aerospace Industries (IAI) Divestitures 2011 (Date, Company Involved, Value US$m, Details)

Table 8.75 Lockheed Martin Corporation Profile 2018 (CEO, Total Company Sales US$m, Net Income (US$m), Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.76 Selected Recent Lockheed Martin Corporation Military Unmanned Aerial Vehicle (UAV) Contracts / Projects / Programmes 2018 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 8.77 Lockheed Martin Corporation Total Company Sales 2012-2017 (US$m, AGR%)

Table 8.78 Lockheed Martin Corporation Sales by Business Segment 2012-2017 (US$m, AGR%)

Table 8.79 Lockheed Martin Corporation Net Income 2012-2017 (US$m, AGR%)

Table 8.80 Lockheed Martin Corporation Order Backlog 2012-2017 (US$m, AGR%)

Table 8.81 Lockheed Martin Corporation Sales by Geographical Location 2012-2017 (US$m, AGR%)

Table 8.82 Lockheed Martin Corporation Subsidiaries (Subsidiary, Location)

Table 8.83 Lockheed Martin Corporation Military Unmanned Aerial Vehicle (UAV) Products / Services (Segment of Business, Product, Specification / Features

Table 8.84 Lockheed Martin Corporation Mergers and Acquisitions 2011-2015 (Date, Company Involved, Value US$m, Details)

Table 8.85 Lockheed Martin Corporation Divestitures 2010-2011 (Date, Company Involved, Value US$m, Details)

Table 8.86 Northrop Grumman Corporation Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.87 Selected Recent Northrop Grumman Corporation Military Unmanned Aerial Vehicle (UAV) Contracts / Projects / Programmes 2009-2018 (Date, Country, Co-contractor, Value US$m, Product, Details)

Table 8.88 Northrop Grumman Corporation Total Company Sales 2012-2017 (US$m, AGR%)

Table 8.89 Northrop Grumman Corporation Sales by Business Segment 2012-2017 (US$m, AGR%)

Table 8.90 Northrop Grumman Corporation Net Income 2012-2017 (US$m, AGR%)

Table 8.91 Northrop Grumman Corporation Order Backlog 2012-2017 (US$m, AGR%)

Table 8.92 Northrop Grumman Corporation Sales by Geographical Location 2012-2017 (US$m, AGR%)

Table 8.93 Northrop Grumman Corporation Subsidiaries 2018 (Subsidiary, Location)

Table 8.94 Northrop Grumman Corporation Military Unmanned Aerial Vehicle (UAV) Notable Products / Services 2016 (Segment of Business, Product, Specification / Features)

Table 8.95 Northrop Grumman Corporation Mergers and Acquisitions 2012-2014(Date, Company Involved, Details)

Table 8.96 Northrop Grumman Corporation Divestitures 2008-2011 (Date, Company Involved, Details)

Table 8.97 Textron Inc Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.98 Selected Recent Textron Inc Military Unmanned Aerial Vehicle (UAV) Contracts / Projects / Programmes 2010-2016 (Date, Country, Value US$m, Product, Details)

Table 8.99 Textron Inc Total Company Sales 2012-2017 (US$m, AGR%)

Table 8.100 Textron Inc Sales by Segment of Business 2012-2017 (US$m, AGR%)

Table 8.101 Textron Inc Net Income 2012-2017 (US$m, AGR%)

Table 8.102 Textron Inc Order Backlog 2012-2017 (US$m, AGR%)

Table 8.103 Textron Inc Sales by Geographical Location 2012-2017 (US$m, AGR%)

Table 8.104 Textron Inc Subsidiaries 2018 (Subsidiary, Location)

Table 8.105 Textron Inc Military Unmanned Aerial Vehicle (UAV) Products / Services (Segment of Business, Product, Specification / Features)

Table 8.106 Textron Inc Mergers and Acquisitions 2013-2014 (Date, Company Involved, Value US$m, Details)

Table 8.107 Thales Group Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 8.108 Selected Recent Thales Group Military Unmanned Aerial Vehicle (UAV) Contracts / Projects / Programmes 2005-2014 (Date, Country, Subcontractor, Value US$m, Product, Details)

Table 8.109 Thales Group Total Company Sales 2012-2017 (US$m, AGR%)

Table 8.110 Thales Group Sales by Segment of Business 2012-2017 (US$m, AGR%)

Table 8.111 Thales Group Net Income 2012-2017 (US$m)

Table 8.112 Thales Group Order Book 2012-2017 (US$m, AGR%)

Table 8.113 Thales Group Sales by Geographical Location 2012-2017 (US$m, AGR%)

Table 8.114 Thales Group Subsidiaries 2018 (Subsidiary, Location)

Table 8.115 Thales Group Military Unmanned Aerial Vehicle (UAV) Products / Services (Segment of Business, Product, Specification / Features)

Table 8.116 Thales Group Mergers and Acquisitions 2012-2017 (Date, Company Involved, Value US$m, Details)

Table 8.117 Thales Group Divestitures 2012-2013 (Date, Company Involved, Value US$m, Details)

Table 8.118 Turkish Aerospace Industries Inc Profile 2018 (CEO, Business Segment in the Market, Submarket Involvement, HQ, Founded, IR Contact, Website)

Table 8.119 Selected Recent Turkish Aerospace Industries Inc Military Unmanned Aerial Vehicle (UAV) Contracts / Projects / Programmes 2018 (Date, Country, Product, Details)

Table 8.120 Turkish Aerospace Industries Inc Subsidiaries 2018 (Subsidiary, Location)

Table 8.121 Turkish Aerospace Industries Inc Military Unmanned Aerial Vehicle (UAV) Products / Services (Segment of Business, Product, Specification / Features)

Table 8.122 Xi’an Aisheng (ASN) Technology Group Profile 2018 (Submarket Involvement, HQ, Website)

Table 8.123 Xi’an Aisheng (ASN) Technology Group Military Unmanned Aerial Vehicle (UAV) Selected Products / Services (Product, Specification / Features)

Table 8.124 Other Companies Involved in the Military Unmanned Aerial Vehicle (UAV)Market 2018 (Company)

List of Figures

Figure 1.1 Global Military Unmanned Aerial Vehicle (UAV) Market Segmentation Overview

Figure 1.2 Example of Military Unmanned Aerial Vehicle (UAV) Market by Regional Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 1.3 Example of National vs Global Military Unmanned Aerial Vehicle (UAV) Market CAGR Forecast 2018-2028, 2018-2023, 2023-2028 (CAGR%)

Figure 1.4 Example of National Military Unmanned Aerial Vehicle (UAV) Market by Submarket Forecast 2018-2028 (US$m, AGR %)

Figure 3.1 Global Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, AGR%)

Figure 4.1 Global Military Unmanned Aerial Vehicle (UAV) Submarket AGR Forecast 2018-2028 (AGR%)

Figure 4.2 Global Military Unmanned Aerial Vehicle (UAV) Submarket Forecast 2018-2028 (US$m, Global AGR%)

Figure 4.3 Global Military Unmanned Aerial Vehicle (UAV) Submarket Share Forecast 2018 (% Share)

Figure 4.4 Global Military Unmanned Aerial Vehicle (UAV) Submarket Share Forecast 2023 (% Share)

Figure 4.5 Global Military Unmanned Aerial Vehicle (UAV) Submarket Share Forecast 2028 (% Share)

Figure 4.6 Global Military Unmanned Aerial Vehicle (UAV) Submarket CAGR Forecast 2018-2023 (CAGR%)

Figure 4.7 Global Military Unmanned Aerial Vehicle (UAV) Submarket CAGR Forecast 2023-2028 (CAGR%)

Figure 4.8 Global Military Unmanned Aerial Vehicle (UAV) Submarket CAGR Forecast 2018-2028 (CAGR%)

Figure 4.9 Global Military Unmanned Aerial Vehicle (UAV) Submarket Percentage Change in Market Share 2018-2023 (% Change)

Figure 4.10 Global Military Unmanned Aerial Vehicle (UAV) Submarket Percentage Change in Market Share 2023-2028 (% Change)

Figure 4.11 Global Military Unmanned Aerial Vehicle (UAV) Submarket Percentage Change in Market Share 2018-2028 (% Change)

Figure 4.12 Global Military Unmanned Aerial Vehicle (UAV) HALE Market Forecast by US vs. Non-US Market 2018-2028 (US$m, Global AGR%)

Figure 4.13 Global Military Unmanned Aerial Vehicle (UAV) MALE Market Forecast by US vs. Non-US Market 2018-2028 (US$m, Global AGR%)

Figure 4.14 Global Military Unmanned Aerial Vehicle (UAV) Small Market Forecast by US vs. Non-US Market 2018-2028 (US$m, Global AGR%)

Figure 4.15 Global Military Unmanned Aerial Vehicle (UAV) Tactical Market Forecast by US vs. Non-US Market 2018-2028 (US$m, Global AGR%)

Figure 4.16 Global Military Unmanned Aerial Vehicle (UAV) UCAV Market Forecast by US vs. Non-US Market 2018-2028 (US$m, Global AGR%)

Figure 4.17 Global Military Unmanned Aerial Vehicle (UAV) Submarket Cumulative Market Share Forecast 2018-2023 (% Share)

Figure 4.18 Global Military Unmanned Aerial Vehicle (UAV) Submarket Cumulative Market Share Forecast 2023-2028 (% Share)

Figure 4.19 Global Military Unmanned Aerial Vehicle (UAV) Submarket Cumulative Market Share Forecast 2018-2028 (% Share)

Figure 5.1 Global Military Unmanned Aerial Vehicle (UAV) Market by National Market Forecast 2018-2028 (US$m, Global AGR%)

Figure 5.2 Global Military Unmanned Aerial Vehicle (UAV) Market by National Market AGR Forecast 2018-2028 (AGR%)

Figure 5.3 Leading National Military Unmanned Aerial Vehicle (UAV) Market CAGR Forecast 2018-2023 (CAGR%)

Figure 5.4 Leading National Military Unmanned Aerial Vehicle (UAV) Market CAGR Forecast 2023-2028 (CAGR%)

Figure 5.5 Leading National Military Unmanned Aerial Vehicle (UAV) Market CAGR Forecast 2018-2028 (CAGR%)

Figure 5.6 Global Military Unmanned Aerial Vehicle (UAV) Market by National Market Share Forecast 2018 (% Share)

Figure 5.7 Global Military Unmanned Aerial Vehicle (UAV) Market by National Market Share Forecast 2023 (% Share)

Figure 5.8 Global Military Unmanned Aerial Vehicle (UAV) Market by National Market Share Forecast 2028 (% Share)

Figure 5.9 Australia Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, Australia Total Market Sales AGR %)

Figure 5.10 France Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, France Total Market Sales AGR %)

Figure 5.11 Germany Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, Germany Total Market Sales AGR %)

Figure 5.12 India Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, India Total Market Sales AGR %)

Figure 5.13 Japan Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, Japan Total Market Sales AGR %)

Figure 5.14 South Korea Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, South Korea Total Market Sales AGR %)

Figure 5.15 United Kingdom Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, United Kingdom Total Market Sales AGR %)

Figure 5.16 United States Military Unmanned Aerial Vehicle (UAV) Submarkets AGR Forecast 2018-2028 (AGR %)

Figure 5.17 United States Military Unmanned Aerial Vehicle (UAV) Market by Submarkets Forecast 2018-2028 (US$m, United States Total Market Sales AGR %)

Figure 5.18 Rest of the World (ROW) Military Unmanned Aerial Vehicle (UAV) Market Forecast 2018-2028 (US$m, ROW Total Market Sales AGR %)

Figure 8.1 Aeronautics Ltd Organisational Structure 2018

Figure 8.2 Aeronautics Ltd Primary Market Competitors 2018

Figure 8.3 AeroVironment Inc Total Company Sales 2012-2017 (US$m, AGR%)

Figure 8.4 AeroVironment Inc Sales by Segment of Business 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.5 AeroVironment Inc Net Income 2012-2017 (US$m, AGR%)

Figure 8.6 AeroVironment Inc Order Backlog 2012-2017 (US$m, AGR%)

Figure 8.7 AeroVironment Inc Primary International Operations 2017

Figure 8.8 AeroVironment Inc Organisational Structure 2018

Figure 8.9 AeroVironment Inc Primary Market Competitors 2018

Figure 8.10 BAE Systems plc Total Company Sales 2012-2017 (US$m, AGR%)

Figure 8.11 BAE Systems plc Sales by Business Segment 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.12 BAE Systems plc Net Income 2012-2017 (US$m, AGR%)

Figure 8.13 BAE Systems plc Order Backlog 2012-2017 (US$m, AGR%)

Figure 8.14 BAE Systems plc Primary International Operations 2018

Figure 8.15 BAE Systems plc Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.16 BAE Systems plc Organisational Structure

Figure 8.17 BAE Systems plc Primary Market Competitors 2018

Figure 8.18 The Boeing Company Total Company Sales 2012-2017 (US$m, AGR%)

Figure 8.19 The Boeing Company Sales by Business Segment 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.20 The Boeing Company Net Income 2012-2017 (US$m, AGR%)

Figure 8.21 The Boeing Company Order Backlog 2012-2017 (US$m, AGR%)

Figure 8.22 The Boeing Company Primary International Operations 2018

Figure 8.23 The Boeing Company Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.24 The Boeing Company Organisational Structure 2018

Figure 8.25 The Boeing Company Primary Market Competitors

Figure 8.26 Elbit Systems Ltd Total Company Sales 2012-2017 (US$m, AGR%)

Figure 8.27 Elbit Systems Ltd Sales by Segment of Business 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.28 Elbit Systems Ltd Net Income 2012-2017 (US$m, AGR%)

Figure 8.29 Elbit Systems Ltd Order Backlog 2012-2017 (US$m, AGR%)

Figure 8.30 Elbit Systems Ltd Primary International Operations 2018

Figure 8.31 Elbit Systems Ltd Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.32 Elbit Systems Ltd Organisational Structure 2018

Figure 8.33 Elbit Systems Ltd Primary Market Competitors 2018

Figure 8.34 Leonardo SpA Total Company Sales 2012-2017 (US$m, AGR%)

Figure 8.35 Leonardo SpA Sales by Segment of Business 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.36 Leonardo SpA Net Income 2012-2017 (US$m, AGR%)

Figure 8.37 Leonardo SpA Order Backlog 2012-2017 (US$m, AGR%)

Figure 8.38 Leonardo SpA Primary International Operations 2018

Figure 8.39 Leonardo SpA Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.40 Leonardo SpA Organisational Structure 2018

Figure 8.41 Leonardo SpA Primary Market Competitors 2018

Figure 8.42 General Atomics Aeronautical Systems, Inc. (GA-ASI) Organisational Structure 2018

Figure 8.43 General Atomics Aeronautical Systems, Inc. (GA-ASI) Primary Market Competitors 2018

Figure 8.44 Israel Aerospace Industries (IAI) Total Company Sales 2012-2017 (US$m, AGR%)

Figure 8.45 Israel Aerospace Industries (IAI) Sales by Segment of Business 2011-2013 (US$m, Total Company Sales AGR%)

Figure 8.46 Israel Aerospace Industries (IAI) Net Income 2012-2017 (US$m, AGR%)

Figure 8.47 Israel Aerospace Industries (IAI) Primary International Operations 2018

Figure 8.48 Israel Aerospace Industries (IAI) Sales by Geographical Location 2011-2013 (US$m, Total Company Sales AGR%)

Figure 8.49 Israel Aerospace Industries (IAI) Organisational Structure 2018

Figure 8.50 Israel Aerospace Industries (IAI) Primary Market Competitors 2018

Figure 8.51 Lockheed Martin Corporation Total Company Sales 2012-2017 (US$m, AGR%)

Figure 8.52 Lockheed Martin Corporation Sales by Business Segment 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.53 Lockheed Martin Corporation Net Income 2012-2017 (US$m, AGR%)

Figure 8.54 Lockheed Martin Corporation Order Backlog 2012-2017 (US$m, AGR%)

Figure 8.55 Lockheed Martin Corporation Primary International Operations 2018

Figure 8.56 Lockheed Martin Corporation Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.57 Lockheed Martin Corporation Organisational Structure 2018

Figure 8.58 Lockheed Martin Corporation Primary Market Competitors

Figure 8.59 Northrop Grumman Corporation Total Company Sales 2012-2017 (US$m, AGR%)

Figure 8.60 Northrop Grumman Corporation Sales by Business Segment 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.61 Northrop Grumman Corporation Net Income 2012-2017 (US$m, AGR%)

Figure 8.62 Northrop Grumman Corporation Order Backlog 2012-2017 (US$m, AGR%)

Figure 8.63 Northrop Grumman Corporation Primary International Operations 2018

Figure 8.64 Northrop Grumman Corporation Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.65 Northrop Grumman Corporation Organisational Structure

Figure 8.66 Northrop Grumman Corporation Primary Market Competitors 2018

Figure 8.67 Textron Inc Total Company Sales 2012-2017 (US$m, AGR%)

Figure 8.68 Textron Inc Sales by Segment of Business 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.69 Textron Inc Net Income 2012-2017 (US$m, AGR%)

Figure 8.70 Textron Inc Order Backlog 2012-2017 (US$m, AGR%)

Figure 8.71 Textron Inc Primary International Operations 2018

Figure 8.72 Textron Inc Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.73 Textron Inc Organisational Structure 2018

Figure 8.74 Textron Inc Primary Market Competitors 2018

Figure 8.75 Thales Group Total Company Sales 2012-2017 (US$m, AGR%)

Figure 8.76 Thales Group Sales by Segment of Business 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.77 Thales Group Net Income 2012-2017 (US$m)

Figure 8.78 Thales Group Order Book 2012-2017 (US$m, AGR%)

Figure 8.79 Thales Group Primary International Operations 2018

Figure 8.80 Thales Group Sales by Geographical Location 2012-2017 (US$m, Total Company Sales AGR%)

Figure 8.81 Thales Group Organisational Structure 2018

Figure 8.82 Thales Group Primary Market Competitors 2018

Figure 8.83 Turkish Aerospace Industries Inc Organisational Structure 2018

Figure 8.84 Turkish Aerospace Industries Inc Primary Market Competitors 2018

Figure 8.85 Xi’an Aisheng (ASN) Technology Group Primary Market Competitors 2018

2d3 Sensing

3001 International Inc

3D Robotics

A Level Aerosystems (ZALA Aero)

AAI Corporation

ACELEC

Adaptive Flight

Advanced Aviation Technology A2tech

Advanced Subsonics

Advanced Technologies & Engineering

Advanced UAV Technology

AEL Sistemas S.A

Aerial Insight

Aero Pars

Aerobot

Aerodreams

Aeroland

Aeronautics Ltd

Aeronavics

Aerosonde

Aerospace Long-March International

AeroSpy

Aerostats

Aerotactix

Aerotekniikka UAV Oy

Aero-Terrascan

AeroVironment Inc

AeroVironment International PTE. LTD.

Aeryon Labs

Agusta Holding BV

AgustaWestland Inc

AgustaWestland North America

AgustaWestland NV

AGX TecnologiA

Aibotix

AiDrones

AILC, Inc.

Air Command Systems International SAS (ACSI)

Air Force Institute of Technology

Air Robot GmbH

Airbus

Airbus / EADS & SurveyCopter

Airbus Defence and Space

Airbus Group

Airbus Helicopters

Airbus Military

AirRobot

Airtanker Holdings Ltd

Airway Inc

Alcore Technologies

Alenia Aermacchi

Alliant Techsystems Inc (ATK)

Allied Holdings Inc

Alpha Unmanned Systems

Alpi Aviation

Altavian Inc

Altavian Inc

Altoy Savunma Sanayi ve Havacilik Anonim Sirketi

Amor Group

Amper Programas de Electronica Y Comunicaciones SA

Ansaldo

Arcturus

Ares

Arête Associates

Argon ST, Inc.

Ascending Technologies

ASELSAN

Asr-e-Talaie

Assessment Limited, part of Cohort plc.

Astro Limited

Astrotech

Astrotech Corporation

Astrotech Space Operations

Aurora Flight Sciences

Aurora Integrated Systems

Autocopter

Autonomous Flight Technologies

AV GmbH

AV Massachusetts, LLC

AV Rhode Island, LLC

AV S.r.l. Italy

Avco Corporation

Aveos Fleet Performance

Aviall Services, Inc.

Aviall UK, Inc.

Aviall, Inc.

Aviation Communications & Surveillance Systems

Aviation Industry Corporation of China (AVIC)

Avibras Divisao Aerea

Avibras Divisão Aérea eNaval S.A.

Avic Defense

Avio SpA

Avionics Services

Azad Systems Co

Azimuth

BAE Intelligence and Security

BAE Systems

BAE Systems (Operations) Limited

BAE Systems Controls Inc.

BAE Systems Information and Electronic Systems Integration Inc

BAE Systems Information Solutions Inc

BAE Systems Land & Armaments LP

BAE Systems Oman

BAE Systems plc

BAE Systems Safety Products Inc

BAE Systems Saudi Arabia

BAE Systems Surface Ships Limited

BAE Systems Tensylon High Performance Materials Inc

BAE Systems/Dassault Aviation

Barnard Microsystems Ltd

Baykar Machine

Baykar Makina

BCB/Middlesex University

BCC Cove Corporation

BCC Equipment Leasing Corporation

Beech Holdings LLC

Beechcraft Corporation

Beijing Strong Science & Tech Dev.

Bell Helicopter

Bell Helicopter Textron Inc.

Bell Helicopters

Bertin

Bertin Technologies

Bharat Electronics Limited (BEL)

Bharat Electronics Limited India (BEL)

Bharat Electronics Ltd (BEL) India

BlueBear

BlueBird

BlueBird Aero Systems

Boeing Aerospace Operations, Inc.

Boeing Airborne Surveillance Enterprises, Inc.

Boeing Aircraft Holding Company

Boeing Canada Operations Ltd.

Boeing Capital Corporation

Boeing Capital Loan Corporation

Boeing CAS Holding GmbH

Boeing Commercial Space Company

Boeing Company, The

Boeing Defence UK Limited

Boeing Insitu

Boeing Intellectual Property Licensing Company

Boeing International B.V. & Co. Holding KGaA

Boeing International Logistics Spares, Inc.

Boeing Logistics Spares, Inc.

Boeing North American Space Alliance Company

Boeing Operations International, Inc

Boeing Satellite Systems International, Inc.

Boeing-Insitu

Bonn Hungary

Bosh Technologies

Boston Engineering

BP Plc

Brican Flight Systems

BSK Defense

BSST

Cadillac Gage Textron Inc.

California Microwave Inc

C-Astral Aerospace

CDL Systems Ltd.

Cessna Aircraft Company

Cessna Finance Export Corporation

Challis

Chandler/May, Inc.

Chaos Choppers

Charger Bicycles, LLC

Chengdu Aircraft Industry Corporation (CAC)

Chengdu Aircraft Industry Group

China Aerospace and Science Corporation (COSIC)

China Aerospace Science and Industry Corporation (CASIC)

China Aerospace Science and Technology Corporation (CASC)

China Aerospace Science Industry Corporation (CASIC)

China North Industries Corp.

Citylink Telecommunications Holding Ltd

Cloudwatt

Codarra Advanced Systems

Cohort Plc

Commercial Armored Vehicles LLC

Commtact Ltd

Composite Technology Research

Comptek Research Inc

Controp Precision Technologies

CONTROP Precision Technologies Ltd

Cosworth AG

Cosworth LLC

Cox Construction Co.

Crescent Unmanned Solutions

CropCam

CSIRO

CybAero

CybAero AB

Cyber Technology

CyberFlight

D.T.S. Ltda

Danish Aviation Services

Dassault Aviation S.A.

DCNS

Delft Dynamics

Delta Drone

Deposition Sciences Inc

Diehl Air Cabin GmbH

Diehl BGT Defence

Diehl Group

DJI

Draganfly Innovations

DroneMaker

DRS Technologies

EADS

EADS Cassidian

Eclipse Electronic Systems

Efigenia Aerospace Robotics

EIG

Elbatech Ltd

Elbit Security Systems

Elbit Systems - Kinetic

Elbit Systems Cyclone

Elbit Systems Electro-Optics - Elop Ltd

Elbit Systems EW and SIGINT – Elisra ltd

Elbit Systems Land and C4I Ltd

Elbit Systems Ltd

Elbit Systems of America

Elbit Systems of America LLC

Electronic Systems Logistik GmbH (ESG)

Elettronica SpA

Elimco

Elisra

Elta North America Inc

Elta Systems Ltd

Embention

Embraer

Embraer Defesa e Seguranca

EMT Penzberg

Engaged Capital

Enhanced Protection Systems

Eniks

Entecho

Enterprise Integration Group (EIG)

ESDAS

ESG Elektroniksystem- und Logistik GmbH

ETI

Eurocopter

European Advanced Technology (EAT)

European Advanced Technology S.A.

Fairchild Imaging Inc

Falcon UAV

Farnas

FATA

Federal Data Corporation

Ferra Engineering

Fiberflight Systems

Finmeccanica Group Real Estate

Finmeccanica Group Services SpA

Finmeccanica SpA

Firstec

Flight Solutions

Flying Robots

Flying-Cam

Fly-n-Sense

FlyTronic (WB Electronics (Pl))

FNSS Savuma Sistemleri AS

Forensic Technology WAI Inc

Fraser-Volpe LLC

Fuji Heavy Industries

GE Aviation

General Atomics

General Atomics Aeronautical Systems, Inc. (GA-ASI)

General Dynamics Corporation

GIDS (Global Ind. Def. Solutions)

Global Teknik

Go!Cart Consortium inc Rheinmetall

Greenlee Textron Inc.

Grumman International Inc

Grumman Ohio Corporation

Guided Systems Technologies

Gyrofly Innovations

Hacker

Harbin

Harpia Sistemas SA

Hawkeye UAV

Helipse

HI Aero

High Eye BV

Honeywell

Huntington Ingalls Industries Inc

Huntington Ingalls Industries Inc

I.A.I. ASIA Pte Ltd

IACIT

IAI North America Inc

Idea Forge

IDETEC

ImageSat

ImageSat International N.V. (ISI)

Incubit Technology Ventures Ltd

Industrial Defender, Inc

Infotron

Innocon

Innocon Ltd

Innovative Automation Technologies

Innovative Automation Technologies LLC

Innovative Automation Technologies LLC

Innovator Technologies

Insitu & Airway Inc

Insitu Inc.

Insitu Pacific

Integrated Dynamics

International Aviation Supply

IRAN - Northrop Grumman Programs Service Company

Irkut

Israel Aerospace Industries (IAI)

Israel Military Industries

ITL Optronics

Jeppesen GmbH

Jeppesen Sanderson, Inc.

JetBlue

Jordan Aerospace Industries

Kale

Kale-Baykar

Kaman Aerospace

Kaman Aerospace Corporation

Kautex Inc.

KCPS

Korea Jig and Fixtures

Korean Aeronautical Research Inst.

Korean Aerospace Industries

Korean Air – Aerospace Division (ASD)

Korean Air Aerospace Division (KAL-ASD)

Korean Air Lines

L&T Technology Services

L&T Technology Services

L-1 Identity Solutions Inc

L-3 Communications

L3 Communications Corporation

L-3 Communications Holdings

L-Technologies

L-3 Wescam

La Caisse des Dépôts

LARDOSA

Lardosa Investment B.V.

Larsen & Toubro

LaSalle Capital

Lehmann Aviation

Leonardo SpA

Libyan Italian Advanced Technology Co

Lindsay Goldberg LLC

LiveTV from JetBlue

Lockheed Martin Aerospace Systems Integration Corporation

Lockheed Martin Australia Pty Limited

Lockheed Martin Canada Inc

Lockheed Martin Corporation

Lockheed Martin Desktop Solutions Inc

Lockheed Martin Engine Investments LLC

Lockheed Martin Global Inc

Lockheed Martin Integrated Systems Inc

Lockheed Martin Integrated Technology LLC

Lockheed Martin Investments Inc

Lockheed Martin Logistics Management Inc

Lockheed Martin Operations Support Inc

Lockheed Martin Services Inc

Lockheed Martin Space Alliance Company

Lockheed Martin TAS International Services Inc

Lockheed Martin UK Insys Limited

Lockheed Martin UK Limited

Logicon Commercial Information Services Inc

Logicon Inc

Logicon International Inc

Lola Group

M5 Network Security Pty Ltd

M7

MarcusUAV

Mardan Holdco Pte Ltd

Marlborough Communications Limited

MAVinci UG

Mavionics

MavTech

MBDA

Meggitt

Meggitt Defence Systems

Microairrobot

Microdrones GmbH

MicroPilot

MiG

MikroKopter

Miltec Corporation

Mission Technologies

Mitsubishi Heavy Industries

MKU

MLB

Mocit Inc

Narus Inc

National Aeronautics Lab

Naval Research Laboratory (NRL)

Navmar Applied Sciences Corp.

NGC Denmark ApS

Nitrohawk UAV

Northrop Electro-Optical Systems

Northrop Grumman

Northrop Grumman - Canada

Northrop Grumman Aviation Inc

Northrop Grumman Corporation

Northrop Grumman Electronic Systems International Company

Northrop Grumman Electronic Systems International Company (UK)

Northrop Grumman Electronics Systems Integration International Inc

Northrop Grumman Field Support Services Inc

Northrop Grumman Foreign Sales Corporation

Northrop Grumman Integrated Defence Services Pty Limited

Northrop Grumman International Inc

Northrop Grumman International Services Company Inc

Northrop Grumman ISA International Inc

Northrop Grumman Overseas Holdings Inc

Northrop Grumman Overseas Service Corporation

Northrop Grumman Space Operations LP

Northrop Grumman Systems Corporation Aerospace Systems

Northrop Grumman Tactical Systems LLC

Northrop Grumman Technical Services Corporation

Northrop Grumman Technical Services Inc

Northrop International Aircraft Inc

NORTHWEST UAV PROPULSION SYSTEMS

Nostromo Defensa

Northrop Grumman

Novadem

NRIST

O’Gara Group, The

OASYS Technology LLC

Octatron

Odin Aero

Ohio Univ Avionics

OMG Plc

OpenHydro,

Opgal Optronics

OPK Oboronprom

Optimum Solution

Orange Participations

Orion

Oto Melara, a Finmeccanica Company

Pacific Architects and Engineers Inc

Pakistan Aeronautical Complex

Paramount Group (ATE)

Park Air Electronics Inc

Parrot

Patria Aviation Oy

PCA Electronic Test

Perceptics Corporation

Periscopio

Perimeter Internetworking Corp

Pivotal Power

PrecisionHawk

Prioria Robotics

Procerus Technologies, L.C.

Prox Dynamics

Prox Dynamics AS

PSF Conversion LLP

Pulse Aerospace

PY Automation

PZL Swidnik

Qantas Defence Services (QDS)

Qantas Defence Services Pty Limited

QinetiQ

QinetiQ North America

QTC Holdings Inc

Quest UAV

Rafael Advanced Defense Systems

Raytheon Company

Raytheon, Firstec and KJF

Reference Technologies

Regenerative Fuel Cell Systems, LLC

Remotec Inc

Rheinmetall

Rheinmetall Defence Systems

Robota

Rockwell Collins

Rolls-Royce Holding Plc

Rotomotion

Rotorsim US LLC

RP Flight Systems

RT LTA Systems Ltd

RT Ltd

Ruag Aerospace

Saab

Saab Group

Sabath UAV Services

Safariland, LLC

Safran

Safran Group

Sagem

Santos Labs

Satuma Research

Savi Technology, Inc.

Saymar

SC Elettra

Scale Copter

Schiebel Corporation

Schroth Safety Products GmbH

Selex Communications GmbH

Selex Elsag

Selex ES

Selex ES do Brazil

Selex ES GmbH

Selex ES Inc

Selex Galileo

Selex Sistemi Integrati

SELEX Systems

Selex systems Integration GmbH

Semi Conductor Devices

SenseFly (Parrot Group)

Sensintel

SESA

SGS, LLC

Sharp Aviation K

Sharp Elbit Systems Aerospace Inc.

Sikorsky Aircraft

Silent Falcon UAS

SilverSky

Silverstone & AUVA (US)

SIM Security & Electronic Systems

Sim-Industries

Singapore Technology Aerospace

Sirehna (DCNS) & PY Automation

Sky Intermediate Merger Sub LLC

Sky Intermediate Merger Sub, LLC,

Skycam UAV

SkyTower, Inc.

SkyTower, LLC

Snecma Ltd

Sofradir SAS

Soltam

Solutions Made Simple Inc

Speck Systems

Stark Aerospace Inc

State-funded Agency for Defense Development

Steadicopter

Sterling Software (US) Inc

Sterling Software Weather Inc

stratsec.net

Sukhoi

Survey Copter (Acq. By Cassidian '11)

Swift Engineering (Northrop Grumman)

Swiss-Photonics AG

Sysgo AG

Systems Engineering

Systems Engineering & Assessment Limited

Systems Made Simple

Tactical Airspace Group

Tampa Microwave

Tamuz F.T.K. Solutions Ltd

Tasuma

Tata Advanced Systems (TASL)

TCI Turkish Cabin Interior

TechMent

Tecknisolar Seni

Tekever

Telespazio SpA

Textron

Textron AAI

Textron Acquisition LLC

Textron Acquisition LLC,

Textron Atlantic LLC

Textron Aviation

Textron Aviation Finance Corporation

Textron China Inc.

Textron Communications Inc.

Textron Far East Pte. Ltd.

Textron Fastening Systems Inc.

Textron Financial Corporation

Textron Fluid and Power Inc.

Textron Global Services Inc.

Textron Inc

Textron International Inc.

Textron IPMP Inc.

Textron Management Services Inc.

Textron Realty Corporation

Textron Rhode Island Inc.

Textron Systems Canada Inc.

Textron Systems Unmanned Systems

Thales

Thales Air Defence Ltd

Thales Alenia Space Italia SpA

Thales Alenia Space SAS

Thales Avionics Electrical Systems SAS

Thales Avionics Inc.

Thales Avionics Ltd

Thales Avionics SAS

Thales Canada Inc.

Thales Communications & Security SAS

Thales Components Corporation

Thales Defense & Security, Inc. (ex Communications Inc.)

Thales Electron Devices SAS

Thales Electronic Systems GmbH

Thales Group

Thales Naval Ltd

Thales Optronics Ltd

Thales Optronique SA

Thales Services SAS

Thales Software India Pvt. Ltd

Thales Training & Simulation Ltd

Thales Training & Simulation SA

Thales UK

Thales UK Ltd

Thales Underwater Systems SAS

Thales Underwater Systems SAS Ltd

Thales-Raytheon Systems Company LLC

Thales-Raytheon Systems Company SAS

TopiVision

TOR

Trade Company Ltd

TRAK International, Inc.

Trimble (Gatewing)

Tupolev

Turbine Engine Components Textron (Newington Operations) Inc.

Turkish Aerospace Industries Inc

Turkish Aircraft Industries Corporation (TUSAS)

Tusas Engine Industries (TEI)

UAS Dynamics LLC

UAS Europe

UAV Factory

UAV Services & Systems

UAV Solutions

UAV SOLUTIONS, INC.

UAV Vision

UAVSI

Ucon Systems

Unmanned Systems

Unmanned Systems Group

URS Federal Services Inc.

U-TacS

UTC

Utri

Uvision

Vanguard Defense Industries

Vega GmbH

Veritas Capital

Vestel

Vestel

Vietnam's Academy of Science and Industry and Ministry of Public Security

Viola Group

Vision du Ciel

Vision Systems LLC

Visionix,

Vought Aircraft Industries

V-TOL Aerospace

VTUL a PVO

Wake (with Thales)

weControl

Westminster Insurance Company

Xenint Ltd

Xetron Corporation

Xi’an Aisheng (ASN) Technology Group

Xmobots

Yakovlev

Yamaha

Zanzottera SRL

Zeta Associates, Inc

Organisations Mentioned

Australian Air Force

Australian Army

Australian Defence Force (ADF)

Australian Royal Navy

Azerbaijani Defense Ministry

Beijing University of Aeronautics and Astronautics

Boko Haram

Brazilian Air Force (FAB)

Brazilian Federal Police

British Army

British Army Royal Artillery

Central Intellligence Agency (CIA)

Chinese Ministry of Commerce

Chinese People’s Liberation Army Air Force (PLAAF)

Chinese People's Liberation Air Force (PLAN)

Chinese People's Liberation Army (PLA)

Chinese People's Liberation Navy (PLN)

Chung-Shan Institute of Science and Technology (CSIST)

Daesh/Islamic State

Danish Acquisition and Logistics Organization (DALO)

Department of Homeland Security

European Bank for Reconstruction and Development

European Union (EU)

Federal German Cabinet

Finnish Army

Finnish Ministry of Defence

French Air Force

French Armed Forces

French Army

French Navy

German Air Force

German Alliance 90/Green party

German Armed Forces/Bundeswehr

German Army

German Christian Democratic Union (CDU)

German Christian Social Union of Bavaria (CSU)

German Defense Ministry

German Navy

German Social Democrats (SPD)

Government of Australia

Government of China

Government of France

Government of Germany

Government of India

Government of Israel

Government of Japan

Government of Russia

Government of South Korea

Government of the United Kingdom

Government of the United States of America

Government of Turkey

Hamas

Hezbollah

Indian Air Force

Indian Armed Forces

Indian Army

Indian Directorate General of Infantry

Indian Navy

International Monetary Fund (IMF)

Israel Defence Forces (IDF)

Israeli Air Force

Israeli Navy

Italian Army

Italian Ministry of Defense

Italian Ministry of Defense Directorate of General Aeronautical Armament

Japan Air Self-Defense Force

Japan Ground Self Defence Force

Japan Maritime Self-Defense Force

Japan Self-Defense Forces

Korea Aerospace Research Institute

Mexican Federal Police

Mexican Naval Department

Ministry of Defence of Finland

NATO Support Agency (NSPA)

Nigerian Army

North Atlantic Treaty Organisation (NATO)

Pakistani Navy

Republic of Korea Army

Russian Air Force

Russian Armed Forces

Russian Army

Russian Navy

Russian Special Technological Centre of Saint Petersburg

South Korea Defense Acquisition Program Administration (DAPA)

South Korean Air Force

South Korean Armed Forces

South Korean Defense Acquisition Program Administration (DAPA)

South Korean Navy

Spanish Ministry of Defense

Swedish Defence Materiel Administration (FMV)

Swedish Police Authority

Turkish Aeronautical Association

Turkish Air Force

Turkish Armed Forces

Turkish Armed Forces Foundation

Turkish Army

Turkish Kurdistan Workers Party (PKK)

Turkish Navy

Turkish Peoples' Democratic Party (HDP)

Turkish Undersecretariat for Defence Industries

Ugandan People’s Defence Force (UPDF)

UK Centre for Defence Enterprise (CDE)

UK Conservative and Unionist Party

UK Defence Logistics Organisation (DLO)

UK Defence Procurement Agency

UK Defence Science and Technology Laboratory (DSTL)

UK Department of the Treasury

UK Labour Party

UK Liberal Democrat Party

UK Ministry of Defence (MoD)

UK Royal Air Force

UK Royal Navy

United Nations (UN)

US Air Force

US Air Force Special Operations Command

US Army

US Army Close Combat Weapons Systems Office

US Army Contracting Command

US Army Rapid Equipping Force

US Army Small Business Innovation Research (SBIR) office

US Coast Guard

US Customs and Border Patrol (CBP)

US Defense Advanced Research Projects Agency (DARPA)

US Defense Aquisition Board

US Defense Logistics Agency

US Defense Logistics Agency

US Defense Security Cooperation Agency

US Department of Defense

US Federal Aviation Administration

US Marine Corps

US Missile Defense Agency (MDA)

US Naval Air Warfare Center Aircraft Division (NAWCAD)

US Naval Sea Systems Command (NAVSEA)

US Naval Undersea Warfare Center (NUWC)

US Navy

US Navy Naval Air Systems Command (NAVAIR)

US Office of Naval Research (ONR)

US Special Operations Command

US State Department

Download sample pages

Complete the form below to download your free sample pages for Military Unmanned Aerial Vehicle (UAV) Market Report 2018-2028

Related reports

-

Military Aircraft Avionics Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global military aircraft avionics market. Visiongaain assesses...Full DetailsPublished: 31 July 2018 -

Ground Based Ballistic Missile Defence Systems Market Report 2018-2028

Visiongain’s comprehensive new 395 page report reveals that global expenditure on ground based ballistic missile defence systems will achieve revenues...

Full DetailsPublished: 27 June 2018 -

Military Simulation, Modelling and Virtual Training Market Report 2019-2029

Developments in simulation systems related technology have had a significant impact on the defence military simulation and virtual training market.

...Full DetailsPublished: 06 December 2018 -

Top 100 Border Security Companies to Watch in 2019

Do you need analysis of the leading 100 border security companies?...Full DetailsPublished: 26 November 2018 -

UAV Software Market Forecast 2018-2028

The global UAV Software market consists of worldwide government spending on the procurement, development, and upgrades of UAV software for...

Full DetailsPublished: 25 July 2018 -

Top 20 Border Security Companies 2018

Read on to discover how this definitive report can transform your own research and save you time....Full DetailsPublished: 02 October 2018 -

Military Radar Systems Market Report 2018-2028

The global Military Radar Systems market consists of worldwide government spending on the procurement, development, and upgrades of radar systems...

Full DetailsPublished: 16 March 2018 -

Top 20 Military Embedded Systems Companies 2018

Visiongain assesses that the military embedded system market will generate revenues of $80.96bn in 2018....Full DetailsPublished: 21 September 2018 -

Military Augmented Reality (MAR) Technologies Market Report 2018-2028

The spate of investments in augmented reality technology has led Visiongain to publish this timely report.

...Full DetailsPublished: 05 October 2018 -

Counter-UAV (C-UAV) Market Forecast 2018-2028

Are you looking for a definitive report on the $970m counter-UAV sector? You will receive a highly granular market analysis...