Industries > Defence > Top 100 Border Security Companies to Watch in 2019

Top 100 Border Security Companies to Watch in 2019

Competitive Landscape Analysis of Leading Suppliers of Biometrics, ICT, Manned & Unmanned Vehicles, Physical Infrastructure and Perimeter Surveillance & Detection Systems

• Do you need analysis of the leading 100 border security companies?

• Succinct border security market insight?

• Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive report can transform your own research and save you time.

The global Top 100 Border Security Companies To Watch In 2019 provides the reader with a thorough overview of the competitive landscape within the border security market space and identifies key growth areas and business opportunities. The report will be valuable for anyone who wants to understand the dynamics of border security companie and the implementation and adoption of border security services. It will be useful for existing players, new entrants and businesses who wish to expand into this sector or explore a new geographical region for market development.

Report highlights

• 470 Tables, Charts, And Graphs

• Analysis Of The Leading 100 Players In The Border Security Market Including –

• Airbus Group SE (Border security business acquired by HENSoldt)

• BAE Systems PLC

• Elbit Systems

• Leonardo SpA

• FLIR Systems Inc.

• General Dynamics Corporation

• Harris Corporation

• Israel Aerospace Industries (IAI)

• L-3 Technologies Inc.

• Leidos Holdings Inc

• Lockheed Martin Corporation

• Northrop Grumman Corporation

• QinetiQ Group Plc

• Raytheon Company

• Rockwell Collins Inc

• Saab AB

• Safran SA

• Smiths Group Plc

• Textron Inc

• Thales Group

Plus Analysis Of 80 Other Leading Players In The Border Security Market Space

Profiles include

• Details Of Significant Contracts

• Product / Service Portfolio Analysis

• Financial Information

• Recent Developments In Border Security

• M&A Activity

• Key questions answered

• What Does The Future Hold For Companies In The Global Border Security Market?

• Where Should You Target Your Business Strategy?

• Which Applications Should You Focus Upon?

• Which Disruptive Technologies Should You Invest In?

• Which Companies Should You Form Strategic Alliances With?

• Which Company Is Likely To Success And Why?

• What Business Models Should You Adopt?

• What Industry Trends Should You Be Aware Of?

• Target audience

• Border Security Solution Providers

• Defence Contractors

• Systems Integrators

• Biometrics Specialists

• Hardware Suppliers

• Electronics Companies

• Software Developers

• Surveillance Specialists

• Unmanned Vehicle Manufacturers

• Technologists

• R&D staff

• Product Managers

• Consultants

• Analysts

• CEO’s

• CIO’s

• COO’s

• Business Development Managers

• Marketing Managers

• Investors

• Governments

• Agencies

• Aerospace & Defense Industry Organizations

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1.1. Border Security Market Set to Take-off in 2019

1.2. Aim of the Report

1.3. Structure of the Report

1.4. Why You Should Read This Report

1.5. How This Report Delivers

1.6. Who is This Report For?

1.7. Methodology

1.8. About Visiongain

2. Introduction to the Border Security Market

2.1. Introduction to the Top 100 Border Security Companies

2.2. Assessing the Border Security Market Landscape

2.3. Overview of the Global Border Security Market

2.4. Defining the Global Border Security Market

2.5. Global Border Security Market Segmentation

2.6. Border Security Submarkets Definition

2.6.1. Border Security Perimeter Surveillance and Detection Systems Submarket Definition

2.6.2. Border Security Biometrics and ICT Systems Submarket Definition

2.6.3. Border Security Manned Platforms Submarket Definition

2.6.4. Border Security Unmanned Systems Submarket Definition

2.6.5. Border Security Physical Infrastructure, Support and Other Services Submarket Definition

2.7. Border Security Ground Submarket Definition

2.8. Border Security Aerial Submarket Definition

2.9. Border Security Naval Submarket Definition

2.10. Analysis of Major Trends in the Border Security Market 2019

3. Analysis of Leading Companies in the Global Border Security Ecosystem

4. SWOT Analysis of the Border Security Market 2018

5. Top 100 Companies in the Border Security Market

5.1. Airbus Group SE (Border security business acquired by Hensoldt)

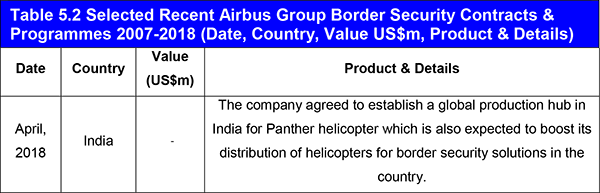

5.1.1. Airbus Group SE Border Security Selected Recent Contracts & Programmes 2007-2018

5.1.2. Airbus Group SE Total Company Sales 2013-2017

5.1.3. Airbus Group SE Sales by Segment of Business 2013-2017

5.1.4. Airbus Group SE Net Income 2013-2017

5.1.5. Airbus Group SE Regional Emphasis

5.1.6. Airbus Group SE Organisational Structure / Notable Subsidiaries

5.1.7. Airbus Group SE Border Security Products / Services

5.1.8. Airbus Group SE Primary Market Competitors 2019

5.1.9. Airbus Group SE Mergers & Acquisitions (M&A) Activity

5.1.10. Airbus Group SE Swot Analysis 2019

5.1.11. Airbus Group Analysis

5.1.12. Airbus Group: Position and Operations in the Border Security Market

5.2. BAE Systems PLC

5.2.1. BAE Systems Border Security Selected Recent Contracts & Programmes 2010-2018

5.2.2. BAE Systems Total Company Sales 2013-2017

5.2.3. BAE Systems Sales by Segment of Business 2013-2017

5.2.4. BAE Systems Net Income 2013-2017

5.2.5. BAE Systems Regional Emphasis

5.2.6. BAE Systems Organisational Structure / Notable Subsidiaries

5.2.7. BAE Systems Border Security Products / Services

5.2.8. BAE Systems Primary Market Competitors 2019

5.2.9. BAE Systems Mergers & Acquisitions (M&A) Activity

5.2.10. BAE Systems Swot Analysis 2019

5.2.11. BAE Systems Analysis

5.2.12. BAE Systems: Position and Operations in the Border Security Market

5.3. Elbit Systems

5.3.1. Elbit Systems Border Security Selected Recent Contracts & Programmes 2013-2018

5.3.2. Elbit Systems Total Company Sales 2013-2017

5.3.3. Elbit Systems Sales by Segment of Business 2013-2017

5.3.4. Elbit Systems Net Income 2013-2017

5.3.5. Elbit Systems Regional Emphasis

5.3.6. Elbit Systems Organisational Subsidiaries

5.3.7. Elbit Systems Border Security Products / Services

5.3.8. Elbit Systems Primary Market Competitors 2019

5.3.9. Elbit Systems Mergers & Acquisitions (M&A) Activity

5.3.10. Elbit Systems SWOT Analysis 2019

5.3.11. Elbit Systems Analysis

5.3.12. Elbit Systems: Position and Operations in the Border Security Market

5.4. Leonardo SpA

5.4.1. Leonardo SpA Border Security Selected Recent Contracts & Programmes 2009-2018

5.4.2. Leonardo SpA Total Company Sales 2013-2017

5.4.3. Leonardo SpA Sales by Segment of Business 2013-2017

5.4.4. Leonardo SpA Net Income / Loss 2013-2017

5.4.5. Leonardo SpA Regional Emphasis

5.4.6. Leonardo SpA Organisational Structure / Notable Subsidiaries

5.4.7. Leonardo SpA Border Security Products / Services

5.4.8. Leonardo SpA Primary Market Competitors 2019

5.4.9. Leonardo SpA Mergers & Acquisitions (M&A) Activity

5.4.10. Leonardo SpA SWOT Analysis 2019

5.4.11. Leonardo SpA Analysis

5.4.12. Leonardo SpA: Position and Operations in the Border Security Market

5.5. FLIR Systems Inc.

5.5.1. FLIR Systems Inc. Border Security Selected Recent Contracts & Programmes 2009-2018

5.5.2. FLIR Systems Inc. Total Company Sales & Sales in the Market 2013-2017

5.5.3. FLIR Systems Inc. Sales by Segment of Business 2013-2017

5.5.4. FLIR Systems Inc. Net Income 2013-2017

5.5.5. FLIR Systems Inc. Regional Emphasis

5.5.6. FLIR Systems Inc. Organisational Structure / Notable Subsidiaries

5.5.7. FLIR Systems Inc. Border Security Products / Services

5.5.8. FLIR Systems Inc Primary Market Competitors 2019

5.5.9. FLIR Systems Inc Mergers & Acquisitions (M&A) Activity

5.5.10. FLIR Systems Inc SWOT Analysis 2019

5.5.11. FLIR Systems Inc Analysis

5.5.12. FLIR Systems Inc: Position and Operations in the Border Security Market

5.6. General Dynamics Corporation

5.6.1. General Dynamics Corporation Border Security Selected Recent Contracts & Programmes 2012-2018

5.6.2. General Dynamics Corporation Total Company Sales 2013-2017

5.6.3. General Dynamics Corporation Sales by Segment of Business 2013-2017

5.6.4. General Dynamics Corporation Net Income 2013-2017

5.6.5. General Dynamics Corporation Regional Emphasis

5.6.6. General Dynamics Corporation Organisational Structure / Notable Subsidiaries

5.6.7. General Dynamics Corporation Border Security Products / Services

5.6.8. General Dynamics Corporation Primary Market Competitors 2019

5.6.9. General Dynamics Corporation Mergers & Acquisitions (M&A) Activity

5.6.10. General Dynamics Corporation SWOT Analysis 2019

5.6.11. General Dynamics Corporation Analysis

5.6.12. General Dynamics Corporation: Position and Operations in the Border Security Market

5.7. Harris Corporation

5.7.1. Harris Corporation Border Security Selected Recent Contracts & Programmes 2013-2018

5.7.2. Harris Corporation Total Company Sales 2013-2017

5.7.3. Harris Corporation Sales by Segment of Business 2016-2017

5.7.4. Harris Corporation Net Income 2013-2017

5.7.5. Harris Corporation Regional Emphasis 2019

5.7.6. Harris Corporation Organisational Structure / Notable Subsidiaries

5.7.7. Harris Corporation Border Security Products / Services

5.7.8. Harris Corporation Primary Market Competitors 2019

5.7.9. Harris Corporation Mergers & Acquisitions (M&A) Activity

5.7.10. Harris Corporation SWOT Analysis 2019

5.7.11. Harris Corporation Analysis

5.7.12. Harris Corporation: Position and Operations in the Border Security Market)

5.8. Israel Aerospace Industries (IAI)

5.8.1. Israel Aerospace Industries (IAI) Border Security Selected Recent Contracts & Programmes 2013-2018

5.8.2. Israel Aerospace Industries (IAI) Total Company Sales 2013-2017

5.8.3. Israel Aerospace Industries (IAI) Regional Emphasis 2019

5.8.4. Israel Aerospace Industries (IAI) Organisational Structure / Notable Subsidiaries

5.8.5. Israel Aerospace Industries (IAI) Border Security Products / Services

5.8.6. Israel Aerospace Industries (IAI) Primary Market Competitors 2019

5.8.7. Israel Aerospace Industries (IAI) Mergers & Acquisitions (M&A) Activity

5.8.8. Israel Aerospace Industries (IAI) SWOT Analysis 2019

5.8.9. Israel Aerospace Industries (IAI) Analysis

5.8.10. Israel Aerospace Industries (IAI): Position and Operations in the Border Security market

5.9. L-3 Technologies Inc.

5.9.1. L-3 Technologies Inc. Border Security Selected Recent Contracts & Programmes 2011-2018

5.9.2. L-3 Technologies Inc. Total Company Sales 2013-2017

5.9.3. L-3 Technologies Inc. Sales by Segment of Business 2013-2017

5.9.4. L-3 Technologies Inc. Net Income 2013-2017

5.9.5. L-3 Technologies Inc. Regional Emphasis

5.9.6. L-3 Technologies Inc. Organisational Structure / Notable Subsidiaries

5.9.7. L-3 Technologies Inc. Border Security Products / Services

5.9.8. L-3 Technologies Inc. Primary Market Competitors 2019

5.9.9. L-3 Technologies Inc. Mergers & Acquisitions (M&A) Activity

5.9.10. L-3 Technologies Inc. SWOT Analysis 2019

5.9.11. L-3 Technologies Inc. Analysis

5.9.12. L-3 Technologies Inc.: Position and Operations in the Border Security Market

5.10. Leidos Holdings Inc

5.10.1.Leidos Holdings Inc Border Security Selected Recent Contracts & Programmes 2013 - 2018

5.10.2. Leidos Holdings Inc Total Company Sales 2013-2017

5.10.3. Leidos Holdings Inc Sales by Segment of Business 2013-2017

5.10.4. Leidos Holdings Inc Net Income / Loss 2013-2017

5.10.5. Leidos Holdings Inc Regional Emphasis

5.10.6. Leidos Holdings Inc Organisational Structure / Notable Subsidiaries

5.10.7. Leidos Holdings Inc Border Security Products / Services

5.10.8. Leidos Holdings Inc Primary Market Competitors 2019

5.10.9. Leidos Holdings Inc Mergers & Acquisitions (M&A) Activity

5.10.10. Leidos Holdings Inc SWOT Analysis 2019

5.10.11. Leidos Holdings Inc Analysis

5.10.12. Leidos Holdings Inc: Position and Operations in the Border Security Market

5.11. Lockheed Martin Corporation

5.11.1. Lockheed Martin Corporation Border Security Selected Recent Contracts & Programmes 2010-2015

5.11.2. Lockheed Martin Corporation Total Company Sales 2013-2017

5.11.3. Lockheed Martin Corporation Sales by Segment of Business 2013-2017

5.11.4. Lockheed Martin Corporation Net Income 2013-2017

5.11.5. Lockheed Martin Corporation Regional Emphasis

5.11.6. Lockheed Martin Corporation Organisational Structure / Notable Subsidiaries

5.11.7. Lockheed Martin Corporation Border Security Products / Services

5.11.8. Lockheed Martin Corporation Primary Market Competitors 2019

5.11.9. Lockheed Martin Corporation Mergers & Acquisitions (M&A) Activity

5.11.10. Lockheed Martin Corporation SWOT Analysis 2019

5.11.11. Lockheed Martin Corporation Analysis

5.11.12. Lockheed Martin Corporation: Position and Operations in the Border Security Market

5.12. Northrop Grumman Corporation

5.12.1. Northrop Grumman Corporation Border Security Selected Recent Contracts & Programmes 2012-2017

5.12.2. Northrop Grumman Corporation Total Company Sales 2013-2017

5.12.3. Northrop Grumman Corporation Sales by Segment of Business 2013-2017

5.12.4. Northrop Grumman Corporation Net Income 2013-2018

Error: the chart below only goes to 2017 ??

5.12.5. Northrop Grumman Corporation Regional Emphasis

5.12.6. Northrop Grumman Corporation Organisational Structure / Notable Subsidiaries

5.12.7. Northrop Grumman Corporation Border Security Products / Services

5.12.8. Northrop Grumman Corporation Primary Market Competitors 2019

5.12.9. Northrop Grumman Corporation Mergers & Acquisitions (M&A) Activity

5.12.10.Northrop Grumman Corporation SWOT Analysis 2019

5.12.11.Northrop Grumman Corporation Analysis

5.12.12.Northrop Grumman Corporation: Position and Operations in the Border Security Market

5.13. QinetiQ Group Plc

5.13.1. QinetiQ Group Plc Border Security Selected Recent Contracts & Programmes 2013-2015

5.13.2. QinetiQ Group Plc Total Company Sales 2013-2018

5.13.3. QinetiQ Group Plc Sales by Geographic Location 2014-2018

5.13.4. QinetiQ Group Plc Net Income 2014-2018

5.13.5. QinetiQ Group Plc Regional Emphasis

5.13.6. QinetiQ Group Plc Organisational Structure / Notable Subsidiaries

5.13.7. QinetiQ Group Plc Border Security Products / Services

5.13.8. QinetiQ Group Plc Primary Market Competitors 2019

5.13.9. QinetiQ Group Plc Mergers & Acquisitions (M&A) Activity

5.13.10.QinetiQ Group Plc SWOT Analysis 2019

5.13.11.QinetiQ Group Plc Analysis

5.13.12 QinetiQ Group Plc: Position and Operations in the Border Security Market

5.14. The Raytheon Company

5.14.1. The Raytheon Company Border Security Selected Recent Contracts & Programmes 2011-2016

5.14.2. The Raytheon Company Total Company Sales 2013-2017

5.14.3. The Raytheon Company Sales by Segment of Business 2013-2017

5.14.4. The Raytheon Company Net Income 2013-2017

5.14.5. The Raytheon Company Regional Emphasis

5.14.6. The Raytheon Company Organisational Structure / Notable Subsidiaries

5.14.7. The Raytheon Company Border Security Products / Services

5.14.8. The Raytheon Company Primary Market Competitors 2019

5.14.9. The Raytheon Company Mergers & Acquisitions (M&A) Activity

5.14.10.The Raytheon Company SWOT Analysis 2019

5.14.11.The Raytheon Company Analysis

5.14.12.The Raytheon Company: Position and Operations in the Border Security Market

5.15. Rockwell Collins Inc

5.15.1. Rockwell Collins Inc Border Security Selected Recent Contracts & Programmes 2017

5.15.2. Rockwell Collins Inc Total Company Sales 2013-2017

5.15.3. Rockwell Collins Inc Sales by Segment of Business 2013-2017

5.15.4. Rockwell Collins Inc Net Income 2013-2017

5.15.5. Rockwell Collins Inc Regional Emphasis

5.15.6. Rockwell Collins Inc Organisational Structure / Notable Subsidiaries

5.15.7. Rockwell Collins Inc Border Security Products / Services

5.15.8. Rockwell Collins Inc Primary Market Competitors 2019

5.15.9. Rockwell Collins Inc Mergers & Acquisitions (M&A) Activity

5.15.10.Rockwell Collins Inc SWOT Analysis 2019

5.15.11.Rockwell Collins Inc Analysis

5.15.12.Rockwell Collins Inc: Position and Operations in the Border Security Market

5.16. Saab AB

5.16.1. Saab AB Border Security Selected Recent Contracts & Programmes 2011-2016

5.16.2. Saab AB Total Company Sales 2013-2017

5.16.3. Saab AB Sales by Segment of Business 2013-2017

5.16.4. Saab AB Net Income 2013-2017

5.16.5. Saab AB Regional Emphasis

5.16.6. Saab AB Organisational Structure/Notable Subsidiaries

5.16.7. Saab AB Border Security Products / Services

5.16.8. Saab AB Primary Market Competitors 2019

5.16.9. Saab AB Mergers & Acquisitions (M&A) Activity

5.16.10.Saab AB SWOT Analysis 2019

5.16.11.Saab AB Analysis

5.16.12.Saab AB: Position and Operations in the Border Security Market

5.17. Safran SA

5.17.1. Safran SA Border Security Selected Recent Contracts & Programmes 2013-2018

5.17.2. Safran SA Total Company Sales 2013-2017

5.17.3. Safran SA Sales by Segment of Business 2013-2017

5.17.4. Safran SA Net Income 2013-2017

5.17.5. Safran SA Regional Emphasis

5.17.6. Safran SA Organisational Structure / Notable Subsidiaries

5.17.7. Safran SA Border Security Products / Services

5.17.8. Safran SA Primary Market Competitors 2019

5.17.9. Safran SA Mergers & Acquisitions (M&A) Activity

5.17.10.Safran SA SWOT Analysis 2019

5.17.11.Safran SA Analysis

5.17.12.Safran SA: Position and Operations in the Border Security Market

5.18. Smiths Group Plc

5.18.1. Smiths Group Plc Border Security Selected Recent Contracts & Programmes 2011-2015

5.18.2. Smiths Group Plc Total Company Sales 2013-2017

5.18.3. Smiths Group Plc Sales by Segment of Business 2013-2017

5.18.4. Smiths Group Plc Net Income 2013-2017

5.18.5. Smiths Group Plc Regional Emphasis

5.18.6. Smiths Group Plc Organisational Structure / Notable Subsidiaries

5.18.7. Smiths Group Plc Border Security Products / Services

5.18.8. Smiths Group Plc Primary Market Competitors 2019

5.18.9. Smiths Group Plc Mergers & Acquisitions (M&A) Activity

5.18.10.Smiths Group Plc SWOT Analysis 2019

5.18.11.Smiths Group Plc Analysis

5.18.12.Smiths Group: Position and Operations in the Border Security Market

5.19. Textron Inc

5.19.1. Textron Inc Border Security Selected Recent Contracts & Programmes 2014-2017

5.19.2. Textron Inc Total Company Sales 2013-2017

5.19.3. Textron Inc Sales by Segment of Business 2013-2017

5.19.4. Textron Inc Net Income 2013-2017

5.19.5. Textron Inc Regional Emphasis

5.19.6. Textron Inc Organisational Structure / Notable Subsidiaries

5.19.7. Textron Inc Border Security Products / Services

5.19.8. Textron Inc Primary Market Competitors 2019

5.19.9. Textron Inc Mergers & Acquisitions (M&A) Activity

5.19.10.Textron Inc SWOT Analysis 2019

5.19.11.Textron Inc Analysis

5.19.12.Textron Inc: Position and Operations in the Border Security Market

5.20. Thales Group

5.20.1. Thales Group Border Security Selected Recent Contracts & Programmes 2010-2018

5.20.2. Thales Group Total Company Sales 2013-2017

5.20.3. Thales Group Sales by Segment of Business 2013-2017

5.20.4. Thales Group Net Income / Loss 2013-2017

5.20.5. Thales Group Regional Emphasis

5.20.6. Thales Group Organisational Structure / Notable Subsidiaries

5.20.7. Thales Group Border Security Products / Services

5.20.8. Thales Group Primary Market Competitors 2019

5.20.9. Thales Group Mergers & Acquisitions (M&A) Activity

5.20.10. Thales Group SWOT Analysis 2019

5.20.11. Thales Group Analysis

5.20.12. Thales Group: Position and Operations in the Border Security Market

5.21. Unisys Corporation

5.21.1. Unisys Corporation Border Security Selected Recent Contracts & Programmes 2007-2018

5.21.2. Unisys Corporation Total Company Sales 2013-2017

5.21.3. Unisys Corporation Sales by Segment of Business 2013-2017

5.21.4. Unisys Corporation Net Income 2013-2017

5.21.5. Unisys Corporation Regional Emphasis

5.21.6. Unisys Corporation Notable Subsidiaries

5.21.7. Unisys Corporation Border Security Products / Services

5.21.8. Unisys Corporation Primary Market Competitors 2019

5.21.9. Unisys Corporation Analysis

5.21.10. Unisys: Position and Operations in the Border Security Market

5.22. G4S Plc

5.22.1. G4S Plc Total Company Sales 2013-2017

5.22.2. G4S Plc Sales by Segment of Business 2013-2017

5.22.3. G4S Plc Net Income 2013-2017

5.22.4. G4S Plc Regional Emphasis

5.22.5. G4S Plc Notable Subsidiaries

5.22.6. G4S Plc Border Security Products / Services

5.22.7. G4S Plc Primary Market Competitors 2019

5.22.8. G4S Plc Analysis

5.22.9. G4S Analysis: Position and Operations in the Border Security Market

5.23. The Boeing Company

5.23.1. The Boeing Company Border Security Selected Recent Contracts & Programmes 2007-2018

5.23.2. The Boeing Company Total Company Sales 2013-2017

5.23.3. The Boeing Company Sales by Segment of Business 2013-2017

5.23.4. The Boeing Company Net Income 2013-2017

5.23.5. The Boeing Company Regional Emphasis

5.23.6. The Boeing Company Notable Subsidiaries

5.23.7. The Boeing Company Border Security Products / Services

5.23.8. The Boeing Company Primary Market Competitors 2019

5.23.9. The Boeing Company Analysis

5.24. Kelvin Hughes Limited

5.24.1. Kelvin Hughes Limited Border Security Selected Recent Contracts & Programmes 2007-2018

5.24.2. Kelvin Hughes Limited Total Company Sales 2013-2017

5.24.3. Kelvin Hughes Limited Net Income 2013-2017

5.24.4. Kelvin Hughes Limited Regional Emphasis

5.24.5. Kelvin Hughes Limited Border Security Products / Services

5.24.6. Kelvin Hughes Limited Primary Market Competitors 2019

5.24.7. Kelvin Hughes Limited Analysis

5.25. General Atomics

5.25.1. Border Security Overview

5.25.2. General Atomics Technologies Recent Developments

5.25.3. General Atomics Technologies Products and Service Offerings

5.25.4. General Atomics Partnerships and Ventures

5.26. Chenega Corporation

5.26.1. Border Security Overview

5.26.2. Chenega Corp. Products & Solutions

5.27. DXC Technology

5.27.1. Border Security Overview

5.27.2. DXC Technology Border Security Products

5.27.3. DXC Technology Recent Developments

5.28. Gemalto N.V

5.28.1. Border Security Overview

5.28.2. Gemalto N.V. Recent Developments

5.28.3. Gemalto N.V. Products and Services

5.28.4. Gemalto N.V. Partnerships and Ventures

5.29. ASELSAN A.Ş.

5.29.1. Border Security Overview

5.29.2. ASELSAN A.Ş. Border Security Products

5.29.3. ASELSAN A.Ş. Latest Developments

5.30. Telstra

5.30.1. Border Security Overview

5.30.2. Telstra Products & Services

5.31. UTI Grup

5.31.1. Border Security Overview

5.31.2. UTI Grup Border Security Products

5.31.3. UTI Grup Latest Developments

5.32. Betafence

5.32.1. Border Security Overview

5.32.2. Betafence Border Security Products

5.32.3. Betafence Latest Developments

5.33. Tata Advanced Systems Limited

5.33.1. Border Security Overview

5.33.2. Tata Advanced Systems Limited Border Security Products

5.33.3. Tata Advanced Systems Limited Latest Developments

5.34. Microsoft

5.34.1. Border Security Overview

5.34.2. Microsoft Border Security Products

5.34.3. Microsoft Latest Developments

5.35. Indra

5.35.1. Border Security Overview

5.35.2. Indra Border Security Products

5.35.3. Indra Latest Developments

5.36. Opgal

5.36.1. Border Security Overview

5.36.2. Opgal Border Security Products

5.36.3. Opgal Latest Developments

5.37. Atos SE

5.37.1. Border Security Overview

5.37.2. Atos SE Border Security Products

5.37.3. Atos SE Latest Developments

5.38. Air Marine Global Border Security Solutions

5.38.1. Border Security Overview

5.39. Tascent Inc.

5.39.1. Border Security Overview

5.39.2. Tascent Inc. Border Security Products

5.39.3. Tascent Inc. Latest Developments

5.40. Magal Security Systems Ltd.

5.40.1. Border Security Overview

5.40.2. Magal Security Systems Ltd. Border Security Products

5.40.3. Magal Security Systems Ltd. Latest Developments

5.41. SITA N.V.

5.41.1. Border Security Overview

5.41.2. SITA N.V. Border Security Products

5.41.3. SITA N.V. Latest Developments

5.42. OSI Systems Inc. / Rapiscan Systems Company

5.42.1. Border Security Overview

5.42.2. OSI Systems Inc. / Rapiscan Systems Company. Border Security Products

5.42.3. OSI Systems Inc. / Rapiscan Systems Company Latest Developments

5.43. Moog, Inc.

5.43.1. Border Security Overview

5.43.2. Moog, Inc. Border Security Products

5.43.3. Moog, Inc. Latest Developments

5.44. Rheinmetall AG

5.44.1. Border Security Overview

5.44.2. Rheinmetall AG Border Security Products

5.44.3. Rheinmetall AG Latest Developments

5.45. Dun & Bradstreet, Inc.

5.45.1. Border Security Overview

5.45.2. Dun & Bradstreet, Inc. Border Security Products

5.45.3. Dun & Bradstreet, Inc. Latest Developments

5.46. Precision Remotes

5.46.1. Border Security Overview

5.46.2. Precision Remotes Border Security Products

5.47. NEC Corporation

5.47.1. Border Security Overview

5.47.2. NEC Corporation Border Security Products

5.47.3. NEC Corporation Latest Developments

5.48. Glosec Group

5.48.1. Border Security Overview

5.48.2. Glosec Group Border Security Products

5.49. Motorola Solutions, Inc.

5.49.1. Border Security Overview

5.49.2. Motorola Solutions, Inc. Border Security Products

5.49.3. Motorola Solutions, Inc. Latest Developments

5.50. BANC3, INC.

5.50.1. Border Security Overview

5.50.2. BANC3, INC. Latest Developments

5.51. Hexagon AB

5.51.1. Border Security Overview

5.51.2. Hexagon AB Border Security Products

5.51.3. Hexagon AB Latest Developments

5.52. CRON Systems Pvt. Ltd.

5.52.1. Border Security Overview

5.52.2. CRON Systems Pvt. Ltd. Border Security Products

5.52.3. CRON Systems Pvt. Ltd. Latest Developments

5.53. Hewlett-Packard Enterprise Co.

5.53.1. Border Security Overview

5.53.2. Hewlett-Packard Enterprise Co. Latest Developments

5.54. Nelco

5.54.1. Border Security Overview

5.54.2. Nelco Border Security Products

5.54.3. Nelco Latest Developments

5.55. DIGNIA SYSTEMS Ltd.

5.55.1. Border Security Overview

5.55.2. DIGNIA SYSTEMS Ltd. Border Security Products

5.56. Reutech Radar Systems

5.56.1. Border Security Overview

5.56.2. Reutech Radar Systems Border Security Products

5.56.3. Reutech Radar Systems Latest Developments

5.57. GEM elettronica

5.57.1. Border Security Overview

5.57.2. GEM elettronica Border Security Products

5.58. RADA Electronic Industries LTD

5.58.1. Border Security Overview

5.58.2. RADA Electronic Industries LTD Border Security Products

5.58.3. RADA Electronic Industries LTD Latest Developments

5.59. Mistral Solutions Pvt. Ltd.

5.59.1. Border Security Overview

5.59.2. Mistral Solutions Pvt. Ltd. Latest Developments

5.60. TCOM, L.P

5.60.1. Border Security Overview

5.60.2. TCOM, L.P Border Security Products

5.60.3. TCOM, L.P Latest Developments

5.61. NSR GROUP

5.61.1. Border Security Overview

5.61.2. NSR GROUP Border Security Products

5.62. Telefonaktiebolaget LM Ericsson

5.62.1. Border Security Overview

5.62.2. Telefonaktiebolaget LM Ericsson Border Security Products

5.63. M2SYS Technology

5.63.1. Border Security Overview

5.63.2. M2SYS Technology Latest Developments

5.64. Strix Systems

5.64.1. Border Security Overview

5.64.2. Strix Systems Border Security Products

5.65. Sensortec Canada Inc

5.65.1. Border Security Overview

5.65.2. Sensortec Canada Inc Border Security Products

5.66. Gatekeeper Intelligent Security

5.66.1. Border Security Overview

5.66.2. Gatekeeper Intelligent Security Border Security Products

5.67. Marshall of Cambridge Aerospace Limited and Marshall Land Systems Limited

5.67.1. Border Security Overview

5.67.2. Marshall of Cambridge Aerospace Limited and Marshall Land Systems Limited Border Security Products

5.68. Lenco Armored Vehicles

5.68.1. Border Security Overview

5.68.2. Lenco Armored Vehicles Border Security Products

5.69. Jurupro Sdn.Bhd

5.69.1. Border Security Overview

5.69.2. Jurupro Sdn.Bhd Border Security Products

5.70. VOTI Detection

5.70.1. Border Security Overview

5.70.2. VOTI Detection Border Security Products

5.70.3. VOTI Detection Latest Developments

5.71. Copenhagen Sensor Technology

5.71.1. Border Security Overview

5.71.2. Copenhagen Sensor Technology Border Security Products

5.71.3. Copenhagen Sensor Technology Latest Developments

5.72. Advanced Technology Systems Company

5.72.1. Border Security Overview

5.72.2. Advanced Technology Systems Company Border Security Products

5.72.3. Advanced Technology Systems Company Border Security Key Development

5.73. Planetek Italia s.r.l.

5.73.1. Border Security Overview

5.73.2. Planetek Italia s.r.l. Border Security Products

5.73.3. Planetek Italia s.r.l. Border Security Key Development

5.74. NOVO DR LTD.

5.74.1. Border Security Overview

5.74.2. NOVO DR LTD. Border Security Products

5.75. ONEX SA

5.75.1. Border Security Overview

5.75.2. ONEX SA Border Security Products

5.75.3. ONEX SA Border Security Key Development

5.76. Scanna

5.76.1. Border Security Overview

5.76.2. Scanna Border Security Products

5.76.3. Scanna Border Security Key Development

5.77. FIMA

5.77.1. Border Security Overview

5.77.2. FIMA Border Security Products

5.77.3. FIMA Border Security Key Development

5.78. Pacific Architects and Engineers

5.78.1. Border Security Overview

5.78.2. Pacific Architects and Engineers Border Security Key Development

5.79. Vision-Box

5.79.1. Border Security Overview

5.79.2. Vision-Box Border Security Key Development

5.80. Silent Sentinel

5.80.1. Border Security Overview

5.80.2. Silent Sentinel Border Security Products

5.80.3. Silent Sentinel Border Security Key Development

5.81. Accipiter Radar Technologies Inc.

5.81.1. Border Security Overview

5.81.2. Accipiter Radar Technologies Inc. Border Security Products

5.81.3. Accipiter Radar Technologies Inc. Border Security Key Development

5.82. ECA GROUP

5.82.1. Border Security Overview

5.82.2. ECA GROUP Border Security Products

5.82.3. ECA GROUP Border Security Key Development

5.83. ROHDE&SCHWARZ

5.83.1. Border Security Overview

5.83.2. ROHDE&SCHWARZ Border Security Products

5.84. Oracle

5.84.1. Border Security Overview

5.84.2. Oracle Border Security Products

5.84.3. Oracle Border Security Key Development

5.85. iProov

5.85.1. Border Security Overview

5.85.2. iProov Border Security Products

5.85.3. iProov Border Security Key Development

5.86. MOBILICOM

5.86.1. Border Security Overview

5.86.2. MOBILICOM Border Security Products

5.86.3. MOBILICOM Border Security Key Development

5.87. SECOM Co., Ltd.

5.87.1. Border Security Overview

5.87.2. SECOM Co., Ltd. Border Security Products

5.88. Veridos

5.88.1. Border Security Overview

5.88.2. Veridos Border Security Products

5.88.3. Veridos Border Security Key Development

5.89. Duos Technologies Inc.

5.89.1. Border Security Overview

5.89.2. Duos Technologies Inc. Border Security Products

5.89.3. Duos Technologies Inc. Border Security Key Development

5.90. Magna BSP

5.90.1. Border Security Overview

5.90.2. Magna BSP Border Security Products

5.91. Sentrillion, Inc.

5.91.1. Border Security Overview

5.91.2. Sentrillion, Inc. Border Security Products

5.91.3. Sentrillion, Inc. Border Security Key Development

5.92. Ayonix Corporation

5.92.1. Border Security Overview

5.92.2. Ayonix Corporation Border Security Products

5.92.3. Ayonix Corporation Border Security Key Development

5.93. BlueBird Aero Systems Ltd.

5.93.1. Border Security Overview

5.93.2. BlueBird Aero Systems Ltd. Border Security Products

5.93.3. BlueBird Aero Systems Ltd. Border Security Key Development

5.94. IBM

5.94.1. Border Security Overview

5.94.2. IBM Border Security Products

5.94.3. IBM Border Security Key Development

5.95. Blighter Surveillance Systems

5.95.1. Border Security Overview

5.95.2. Blighter Surveillance Systems Border Security Products

5.95.3. Blighter Surveillance Systems Border Security Key Development

5.96. CACI International

5.96.1. CACI International Border Security Products

5.96.2. CACI International Border Security Key Development

5.97. Cobham Plc

5.97.1. Border Security Overview

5.97.2. Cobham Plc Border Security Products

5.97.3. Cobham Plc Border Security Key Development

5.98. Accenture Federal Services

5.98.1. Border Security Overview

5.98.2. Accenture Border Security Products

5.98.3. Accenture Border Security Key Development

5.99. Perspecta Inc.

5.99.1. Border Security Overview

5.99.2. Perspecta Inc. Border Security Products

5.99.3. Perspecta Inc. Border Security Key Development

5.100. CONTROP Precision Technologies Limited

5.100.1.Border Security Overview

5.100.2. CONTROP Precision Technologies Limited Border Security Products

5.100.3. CONTROP Precision Technologies Limited Border Security Key Development

6. Conclusion

6.1. Why Will the Border Security Market Continue to Grow?

7. Glossary

List of Tables

Table 2.1 Primary Technologies in the Border Perimeter Surveillance and Detection Systems Submarket

Table 2.2 Primary Technologies in the Biometrics & ICT Systems for Border Control Submarket

Table 2.3 Primary Technologies in the Manned Vehicles, Vessels and Aircraft Platforms Submarket

Table 2.4 Primary Technologies in the Unmanned Air, Ground and Maritime Systems Submarket

Table 2.5 Primary Technologies in the Physical Infrastructure, Support and Other Services Submarket

Table 2.6 Primary Technologies in the Ground Border Security Submarket

Table 2.7 Primary Technologies in the Aerial Border Security Submarket

Table 2.8 Primary Technologies in the Naval Border Security Submarket

Table 2.9 Major Trends, Drivers & Restraints in the Border Security Market 2019 (primary Submarkets Technology, Trends, Drivers & Restraints

Table 4.1 SWOT Analysis of the Global Border Security Market 2019

Table 5.1 Airbus Group SE Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.2 Selected Recent Airbus Group Airbus Group SE 2017 SE Border Security Contracts & Programmes 2007-2018 (Date, Country, Value US$m, Product & Details)

Table 5.3 Airbus Group SE Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.4 Airbus Group SE Net Income 2013-2017 (US$m, AGR%)

Table 5.5 Airbus Group SE Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.6 Airbus Group SE Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.7 Airbus Group SE Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.8 Airbus Group SE Mergers and Acquisitions 2012-2018 (Date, Company Involved, Details)

Table 5.9 Airbus Group Notable Divestitures 2014-2016 (Date, Company Involved, Value US$m, Details)

Table 5.10 Airbus Group SE Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.11 BAE Systems Plc Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.12 Selected Recent BAE Systems Border Security Contracts & Programmes 2010-2018 (Date, Country, Value US$m, Product & Details)

Table 5.13 BAE Systems Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.14 BAE Systems Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.15 BAE Systems Net Income 2013-2017 (US$m, AGR%)

Table 5.16 BAE Systems Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.17 BAE Systems Notable Subsidiaries 2019(Subsidiary, Location)

Table 5.18 BAE Systems Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.19 BAE Systems Notable Mergers and Acquisitions 2013-2017 (Date, Company Involved, Value US$m, Details)

Table 5.20 BAE Systems Notable Divestitures 2011-2017 (Date, Company Involved, Value US$m, Details)

Table 5.21 BAE Systems Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.22 Elbit Systems Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Division in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.23 Selected Recent Elbit Systems Border Security Contracts & Programmes 2013-2018 (Date, Country, Value US$m, Product & Details)

Table 5.24 Elbit Systems Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.25 Elbit Systems Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.26 Elbit Systems Net Income 2013-2017 (US$m, AGR%)

Table 5.27 Elbit Systems Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.28 Elbit Systems Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.29 Elbit Systems Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.30 Elbit Systems Notable Mergers and Acquisitions 2013-2018 (Date, Company Involved, Details)

Table 5.31 Elbit Systems Notable Divestitures 2013-2014 (Date, Company Involved, Details)

Table 5.32 Elbit Systems Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.33 Leonardo Spa Profile 2019 (CEO, Total Company Sales US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.34 Selected Recent Leonardo SpA Border Security Contracts & Programmes 2009-2018 (Date, Country, Value US$m, Product & Details)

Table 5.35 Leonardo SpA Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.36 Leonardo SpA Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.37 Leonardo SpA Net Income / Loss 2013-2017 (US$m, AGR%)

Table 5.38 Leonardo SpA Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.39 Leonardo SpA Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.40 Leonardo SpA Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.41 Leonardo SpA Mergers and Acquisitions 2012-2016 (Date, Company Involved, Details)

Table 5.42 Leonardo SpA Divestitures 2013-2015 (Date, Company Involved, Details)

Table 5.43 Leonardo SpA Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.44 FLIR Systems Inc. Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.45 Selected Recent FLIR Systems Inc. Border Security Contracts & Programmes 2009-2018 (Date, Country, Value US$m, Product & Details)

Table 5.46 FLIR Systems Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.47 FLIR Systems Inc. Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.48 FLIR Systems Inc. Net Income 2013-2017 (US$m, AGR%)

Table 5.49 FLIR Systems Inc. Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.50 FLIR Systems Inc. Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.51 FLIR Systems Inc. Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.52 FLIR Systems Inc Mergers and Acquisitions, and Partnership 2013-2016 (Date, Company Involved, Value US$m, Details)

Table 5.53 FLIR Systems Inc Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.54 General Dynamics Corporation Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.55 Selected Recent General Dynamics Corporation Border Security Contracts & Programmes 2012-2018 (Date, Country, Value US$m, Product & Details)

Table 5.56 General Dynamics Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.57 General Dynamics Corporation Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.58 General Dynamics Corporation Net Income 2013-2017 (US$m, AGR%)

Table 5.59 General Dynamics Corporation Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.60 General Dynamics Corporation Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.61 General Dynamics Corporation Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.62 General Dynamics Notable Mergers and Acquisitions 2011-2018 (Date, Company Involved, Details)

Table 5.63 General Dynamics Divestitures 2011-2015 (Date, Company Involved, Details)

Table 5.64 General Dynamics Corporation Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.65 Harris Corporation Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.66 Selected Recent Harris Corporation Border Security Contracts & Programmes 2013-2018 (Date, Country, Value US$m, Product & Details)

Table 5.67 Harris Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.68 Harris Corporation Sales by Segment of Business 2016-2017 (US$m)

Table 5.69 Harris Corporation Net Income 2013-2017 (US$m, AGR%)

Table 5.70 Harris Corporation Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.71 Harris Corporation Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.72 Harris Corporation Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.73 Harris Corporation Mergers and Acquisitions 2013-2017 (Date, Company Involved, Value US$m, Details)

Table 5.74 Harris Corporation Divestitures 2013-2016(Date, Company Involved, Details)

Table 5.75 Harris Corporation Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.76 Israel Aerospace Industries (IAI) Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.77 Selected Recent Israel Aerospace Industries (IAI) Border Security Contracts & Programmes 2013-2018 (Date, Country, Value US$m, Product & Details)

Table 5.78 Israel Aerospace Industries (IAI) Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.79 Israel Aerospace Industries (IAI) Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.80 Israel Aerospace Industries (IAI) Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.81 Israel Aerospace Industries (IAI) Mergers and Acquisitions 2012-2017 (Date, Company Involved, Value US$m, Details)

Table 5.82 Israel Aerospace Industries (IAI) Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.83 L-3 Technologies Inc. Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.84 Selected Recent L-3 Technologies Inc. Border Security Contracts & Programmes 2011-2018 (Date, Country, Value US$m, Product & Details)

Table 5.85 L-3 Technologies Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.86 L-3 Technologies Inc. Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.87 L-3 Technologies Inc. Net Income 2013-2017 (US$m, AGR%)

Table 5.88 L-3 Technologies Inc. Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.89 L-3 Technologies Inc. Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.90 L-3 Technologies Inc. Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.91 L-3 Technologies Inc. Mergers and Acquisitions 2012-2018 (Date, Company Involved, Value US$m, Details)

Table 5.92 L-3 Technologies Inc. Divestitures 2014-2018 (Date, Company Involved, Details)

Table 5.93 L-3 Technologies Inc. Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.94 Leidos Holdings Inc Profile 2019(CEO, Total Company Sales US$m, Net Income / Loss US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.95 Selected Recent Leidos Holdings Inc Border Security Contracts & Programmes 2013 - 2018 (Date, Country, Value US$m, Product & Details)

Table 5.96 Leidos Holdings Inc Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.97 Leidos Holdings Inc Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.98 Leidos Holdings Inc Net Income / Loss 2013-2017 (US$m, AGR%)

Table 5.99 Leidos Holdings Inc Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.100 Leidos Holdings Inc Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.101 Leidos Holdings Inc Mergers and Acquisitions 2016 (Date, Company Involved, Value US$m, Details)

Table 5.102 Leidos Holdings Inc Divestitures 2013-2015 (Date, Company Involved, Value US$m, Details)

Table 5.103 Leidos Holdings Inc Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.104 Lockheed Martin Corporation Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.105 Selected Recent Lockheed Martin Corporation Border Security Contracts & Programmes 2010-2015 (Date, Country , Value US$m, Product & Details)

Table 5.106 Lockheed Martin Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.107 Lockheed Martin Corporation Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.108 Lockheed Martin Corporation Net Income 2010-2017 (US$m, AGR%)

Table 5.109 Lockheed Martin Corporation Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.110 Lockheed Martin Corporation Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.111 Lockheed Martin Corporation Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.112 Lockheed Martin Corporation Mergers and Acquisitions 2012-2015 (Date, Company Involved, Details)

Table 5.113 Lockheed Martin Corporation Divestitures 2010-2011 (Date, Company Involved, Details)

Table 5.114 Lockheed Martin Corporation Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.115 Northrop Grumman Corporation Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.116 Selected Recent Northrop Grumman Corporation Border Security Contracts & Programmes 2012-2017 (Date, Country, Value US$m, Product & Details)

Table 5.117 Northrop Grumman Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.118 Northrop Grumman Corporation Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.119 Northrop Grumman Corporation Net Income 2013-2018 (US$m, AGR%)

Table 5.120 Northrop Grumman Corporation Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.121 Northrop Grumman Corporation Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.122 Northrop Grumman Corporation Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.123 Northrop Grumman Corporation Mergers and Acquisitions 2013-2018 (Date, Company Involved, Value US$m, Details)

Table 5.124 Northrop Grumman Corporation Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.125 QinetiQ Group Plc Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Division in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.126 Selected Recent QinetiQ Group Plc Border Security Contracts & Programmes 2011-2015 (Date, Country, Value US$m, Product & Details)

Table 5.127: QinetiQ Group Plc 2018 Sales by Geographical Location 2014-2018 (US$m, AGR%)

Table 5.128 QinetiQ Group Plc Sales by Geographical Location 2017-2018 (US$m, AGR%)

Table 5.129 QinetiQ Group Plc Net Income 2017-2018 (US$m, AGR%)

Table 5.130 QinetiQ Group Plc Sales by Geographical Location 2014-2018 (US$m, AGR%)

Table 5.131 QinetiQ Group Plc Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.132 QinetiQ Group Plc Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.133 QinetiQ Group Plc Mergers and Acquisitions 2014 (Date, Company Involved, Value US$m, Details)

Table 5.134 QinetiQ Group Plc Divestitures 2014-2018 (Date, Company Involved, Value US$m, Details)

Table 5.135 QinetiQ Group Plc Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.136 The Raytheon Company Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.137 Selected Recent The Raytheon Company Border Security Contracts & Programmes 2011-2016 (Date, Country, Value US$m, Product & Details)

Table 5.138 The Raytheon Company Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.139 The Raytheon Company Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.140 The Raytheon Company Net Income 2013-2017 (US$m, AGR%)

Table 5.141 The Raytheon Company Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.142 The Raytheon Company Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.143 The Raytheon Company Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.144 The Raytheon Company Mergers and Acquisitions 2013-2015 (Date, Company Involved, Value US$m, Details)

Table 5.145 The Raytheon Company Divestitures 2014 (Date, Details)

Table 5.146 The Raytheon Company Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.147 Rockwell Collins Inc Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.148 Selected Recent Rockwell Collins Inc Border Security Contracts & Programmes 2017 (Date, Country, Value US$m, Product & Details)

Table 5.149 Rockwell Collins Inc Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.150 Rockwell Collins Inc Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.151 Rockwell Collins Inc Net Income 2013-2017 (US$m, AGR%)

Table 5.152 Rockwell Collins Inc Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.153 Rockwell Collins Inc Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.154 Rockwell Collins Inc Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.155 Rockwell Collins Inc Mergers and Acquisitions 2011-2015 (Date, Company Involved, Value US$m)

Table 5.156 Rockwell Collins Inc Divestitures 2013-2015 (Date, Company Involved, Details)

Table 5.157 Rockwell Collins Inc Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.158 Saab AB Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.159 Selected Recent Saab AB Border Security Contracts & Programmes 2011-2016 (Date, Country, Value US$m, Product & Details)

Table 5.160 Saab AB Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.161 Saab AB Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.162 Saab AB Net Income 2013-2017 (US$m, AGR%)

Table 5.163 Saab AB Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.164 Saab AB Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.165 Saab AB Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.166 Saab AB Mergers and Acquisitions 2004-2017 (Date, Company Involved, Details)

Table 5.167 Saab AB Divestitures 2014 (Date, Company Involved, Value US$m, Details)

Table 5.168 Saab AB Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.169 Safran SA Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog U$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.170 Selected Recent Safran SA Border Security Contracts & Programmes 2013-2018 (Date, Country, Value US$m, Product & Details)

Table 5.171 Safran SA Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.172 Safran SA Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.173 Safran SA Net Income 2013-2017 (US$m, AGR%)

Table 5.174 Safran SA Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.175 Safran SA Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.176 Safran SA Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.177 Safran SA Mergers and Acquisitions 2011-2014 (Date, Company Involved, Value US$m, Details)

Table 5.178 Safran SA Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.179 Smiths Group Plc Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.180 Selected Recent Smiths Group Plc Border Security Contracts & Programmes 2011-2015 (Date, Country, Value US$m, Product & Details)

Table 5.181 Smiths Group Plc Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.182 Smiths Group Plc Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.183 Smiths Group Plc Net Income 2013-2017 (US$m, AGR%)

Table 5.184 Smiths Group Plc Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.185 Smiths Group Plc Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.186 Smiths Group Plc Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.187 Smiths Group Plc Mergers and Acquisitions 2018 (Date, Company Involved, Value US$m, Details)

Table 5.188 Smiths Group Plc Divestitures 2012(Date, Company Involved, Value US$m, Details)

Table 5.189 Smiths Group Plc Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.190 Textron Inc Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.191 Selected Recent Textron Inc Border Security Contracts & Programmes 2014-2017 (Date, Country, Value US$m, Product & Details)

Table 5.192 Textron Inc Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.193 Textron Inc Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.194 Textron Inc Net Income 2013-2017 (US$m, AGR%)

Table 5.195 Textron Inc Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.196 Textron Inc Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.197 Textron Inc Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.198 Textron Inc Mergers and Acquisitions 2013-2018 (Date, Company Involved, Details)

Table 5.199 Textron Inc Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.200 Thales Group Profile 2018 (CEO, Total Company Sales US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Book US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.201 Selected Recent Thales Group Border Security Contracts & Programmes 2010-2018 (Date, Country, Value US$m, Product & Details)

Table 5.202 Thales Group Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.203 Thales Group Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 5.204 Thales Group Net Income / Loss 2013-2017 (US$m, AGR%)

Table 5.205 Thales Group Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.206 Thales Group Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.207 Thales Group Border Security Products / Services (Segment of Business, Product, Specification / Features)

Table 5.208 Thales Group Mergers and Acquisitions 2012-2014(Date, Company Involved, Value US$m, Details)

Table 5.209 Thales Group Divestitures 2012-2013 (Date, Company Involved, Value US$m, Details)

Table 5.210 Thales Group Strengths, Weaknesses, Opportunities & Threats Analysis 2019

Table 5.211 Unisys Corporation Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.212 Selected Recent Unisys Corporation Border Security Contracts & Programmes 2007-2018 (Date, Country, Value US$m, Product & Details)

Table 5.213 Unisys Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.214 Unisys Corporation Net Income 2013-2017 (US$m, AGR%)

Table 5.215 Unisys Corporation Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.216 Unisys Corporation Border Security Products / Services (Segment of Business, Product)

Table 5.217 Unisys Corporation Notable Divestitures (Date, Company Involved, Value US$m, Details)

Table 5.218 G4S Plc Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.219 G4S Plc Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.220 G4S Plc Net Income 2013-2017 (US$m, AGR%)

Table 5.221 G4S Plc Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.222 G4S Plc Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.223 G4S Plc Notable Divestitures (Date, Company Involved, Value US$m, Details)

Table 5.224 The Boeing Company Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.225 Selected Recent Boeing Company Border Security Contracts & Programmes 2007-2018 (Date, Country, Value US$m, Product & Details)

Table 5.226 The Boeing Company Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.227 The Boeing Company Net Income 2013-2017 (US$m, AGR%)

Table 5.228 The Boeing Company Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 5.229 The Boeing Company Notable Subsidiaries 2019 (Subsidiary, Location)

Table 5.230 The Boeing Company Border Security Products / Services (Segment of Business, Product)

Table 5.231 The Boeing Company Border Security Products / Services (Segment of Business, Product)

Table 5.232 Kelvin Hughes Limited Profile 2019 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 5.233 Selected Recent Kelvin Hughes Limited Border Security Contracts & Programmes 2007-2018 (Date, Country, Value US$m, Product & Details)

Table 5.234 Kelvin Hughes Limited Total Company Sales 2013-2017 (US$m, AGR%)

Table 5.235 Kelvin Hughes Limited Net Income 2013-2017 (US$m, AGR%)

Table 5.236 Kelvin Hughes Limited Border Security Products / Services (Segment of Business, Product)

Table 5.237 Chenega Corporation Border Security Services

Table 5.238 DXC Technology Border Security Products

Table 5.239 ASELSAN A.Ş. Border Security Products

Table 5.240 Telstra Products & Services

Table 5.241 UTI Grup Border Security Products

Table 5.242 Betafence Border Security Products

Table 5.243 Tata Advanced Systems Limited Border Security Products

Table 5.244 Microsoft Border Security Products

Table 5.245 Indra Border Security Products

Table 5.246 Opgal Border Security Products

Table 5.247 Atos SE Border Security Products

Table 5.248 Tascent Inc. Border Security Products

Table 5.249 Magal Security Systems Ltd. Border Security Products

Table 5.250 SITA N.V. Border Security Products

Table 5.251 ASELSAN A.Ş. Border Security Products

Table 5.252 Moog, Inc. Border Security Products

Table 5.253 Rheinmetall AG Border Security Products

Table 5.254 Dun & Bradstreet, Inc. Border Security Products

Table 5.255 Precision Remotes Border Security Products

Table 5.256 NEC Corporation Border Security Products

Table 5.257 Motorola Solutions, Inc. Border Security Products

Table 5.258 Hexagon AB Border Security Products

Table 5.259 CRON Systems Pvt. Ltd. Border Security Products

Table 5.260 Nelco Border Security Products

Table 5.261 DIGNIA SYSTEMS Ltd. Border Security Products

Table 5.262 Reutech Radar Systems Border Security Products

Table 5.263 GEM elettronica Border Security Products

Table 5.264 RADA Electronic Industries LTD Border Security Products

Table 5.265 TCOM, L.P Border Security Products

Table 5.266 NSR GROUP Border Security Products

Table 5.267 Telefonaktiebolaget LM Ericsson Border Security Products

Table 5.268 Strix Systems Border Security Products

Table 5.269 Sensortec Canada Inc Border Security Products

Table 5.270 Gatekeeper Intelligent Security Border Security Products

Table 5.271 Marshall of Cambridge Aerospace Limited and Marshall Land Systems Limited Border Security Products

Table 5.272 Lenco Armored Vehicles Border Security Products

Table 5.273 Jurupro Sdn.Bhd Border Security Products

Table 5.274 VOTI Detection Border Security Products

Table 5.275 Copenhagen Sensor Technology Border Security Products

Table 5.276 Advanced Technology Systems Border Security Products

Table 5.277 Planetek Italia s.r.l. Border Security Products

Table 5.278 NOVO DR LTD. Border Security Products

Table 5.279 ONEX SA Border Security Products

Table 5.280 Scanna Border Security Products

Table 5.281 FIMA Border Security Products

Table 5.282 Silent Sentinel Border Security Products

Table 5.283 Accipiter Radar Technologies Inc. Border Security Products

Table 5.284 ECA GROUP Border Security Products

Table 5.285 ROHDE&SCHWARZ Border Security Products

Table 5.286 Oracle Border Security Products

Table 5.287 iProov Border Security Products

Table 5.288 MOBILICOM Border Security Products

Table 5.289 SECOM Co., Ltd. Border Security Products

Table 5.290 Veridos Border Security Products

Table 5.291 Duos Technologies Inc. Border Security Products

Table 5.292 Magna BSP Border Security Products

Table 5.293 Sentrillion, Inc. Border Security Products

Table 5.294 Ayonix Corporation Border Security Products

Table 5.295 BlueBird Aero Systems Ltd. Border Security Products

Table 5.296 IBM Border Security Products

Table 5.297 CACI International Border Security Products

Table 5.298 Cobham Plc Border Security Products

Table 5.299 Accenture Border Security Products

Table 5.300 Perspecta Inc. Border Security Products

Table 5.301 CONTROP Precision Technologies Limited Border Security Products

List of Figures

Figure 2.1 Global Border Security Market Segmentation Overview

Figure 5.1 Airbus Group SE Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.2 Airbus Group SE Sales by Segment of Business 2013-2017 (US$m)

Figure 5.3 Airbus Group SE Net Income 2013-2017 (US$m, AGR%)

Figure 5.4 Airbus Group SE Primary International Operations 2018

Figure 5.5 Airbus Group SE Sales by Geographical Location 2013-2017 (US$m)

Figure 5.6 Airbus Group SE Organisational Structure 2018

Figure 5.7 Airbus Group SE Primary Market Competitors 2019

Figure 5.8 BAE Systems Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.9 BAE Systems Sales by Segment of Business 2013-2017 (US$m)

Figure 5.10 BAE Systems Net Income 2013-2017 (US$m, AGR%)

Figure 5.11 BAE Systems Primary International Operations 2019

Figure 5.12 BAE Systems Sales by Geographical Location 2013-2017 (US$m)

Figure 5.13 BAE Systems Organisational Structure 2019

Figure 5.14 BAE Systems Primary Market Competitors 2019

Figure 5.15 Elbit Systems Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.16 Elbit Systems Sales by Segment of Business 2013-2017 (US$m)

Figure 5.17 Elbit Systems Net Income 2013-2017 (US$m, AGR%)

Figure 5.18 Elbit Systems Primary International Operations 2018

Figure 5.19 Elbit Systems Sales by Geographical Location 2013-2017 (US$m)

Figure 5.20 Elbit Systems Organisational Structure 2018

Figure 5.21 Elbit Systems Primary Market Competitors 2019

Figure 5.22 Leonardo SpA Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.23 Leonardo SpA Sales by Segment of Business 2013-2017 (US$m)

Figure 5.24 Leonardo SpA Net Income / Loss 2013-2017 (US$m, AGR%)

Figure 5.25 Leonardo SpA Primary International Operations 2019

Figure 5.26 Leonardo SpA Sales by Geographical Location 2013-2017 (US$m)

Figure 5.27 Leonardo SpA Organisational Structure 2019

Figure 5.28 Leonardo SpA Primary Market Competitors 2019

Figure 5.29 FLIR Systems Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.30 FLIR Systems Inc. Sales by Segment of Business 2013-2017 (US$m)

Figure 5.31 FLIR Systems Inc. Net Income 2013-2017 (US$m, AGR%)

Figure 5.32 FLIR Systems Inc. Primary International Operations 2019

Figure 5.33 FLIR Systems Inc. Sales by Geographical Location 2013-2017 (US$m)

Figure 5.35 FLIR Systems Inc. Organisational Structure 2019

Figure 5.36 FLIR Systems Inc Primary Market Competitors 2019

Figure 5.37 General Dynamics Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.38 General Dynamics Corporation Sales by Segment of Business 2013-2017 (US$m)

Figure 5.39 General Dynamics Corporation Net Income 2013-2017 (US$m, AGR%)

Figure 5.40 General Dynamics Corporation Primary International Operations 2019

Figure 5.41 General Dynamics Corporation Sales by Geographical Location 2013-2017 (US$m)

Figure 5.42 General Dynamics Corporation Organisational Structure 2019

Figure 5.43 General Dynamics Corporation Primary Market Competitors 2019

Figure 5.44 Harris Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.45 Harris Corporation Sales by Segment of Business 2016-2017 (US$m)

Figure 5.46 Harris Corporation Net Income 2013-2017 (US$m, AGR%)

Figure 5.47 Harris Corporation Primary International Operations 2019

Figure 5.48 Harris Corporation Sales by Geographical Location 2013-2017 (US$m)

Figure 5.49 Harris Corporation Organisational Structure 2019

Figure 5.50 Harris Corporation Primary Market Competitors 2019

Figure 5.51 Israel Aerospace Industries (IAI) Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.52 Israel Aerospace Industries (IAI) Primary International Operations 2019

Figure 5.53 Israel Aerospace Industries (IAI) Organisational Structure 2019

Figure 5.54 Israel Aerospace Industries (IAI) Primary Market Competitors 2019

Figure 5.55 L-3 Technologies Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.56 L-3 Technologies Inc. Sales by Segment of Business 2013-2017 (US$m)

Figure 5.57 L-3 Technologies Inc. Net Income 2013-2017 (US$m, AGR%)

Figure 5.58 L-3 Technologies Inc. Primary International Operations 2019

Figure 5.59 L-3 Technologies Inc. Sales by Geographical Location 2013-2017 (US$m)

Figure 5.60 L-3 Technologies Inc. Organisational Structure 2019

Figure 5.61 L-3 Technologies Inc. Primary Market Competitors 2019

Figure 5.62 Leidos Holdings Inc Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.63 Leidos Holdings Inc Sales by Segment of Business 2013-2017 (US$m)

Figure 5.64 Leidos Holdings Inc Primary International Operations 2019

Figure 5.65 Leidos Holdings Inc Organisational Structure 2019

Figure 5.66 Leidos Holdings Inc Primary Market Competitors 2019

Figure 5.67 Lockheed Martin Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.68 Lockheed Martin Corporation Sales by Segment of Business 2013-2017 (US$m)

Figure 5.69 Lockheed Martin Corporation Net Income 2013-2017 (US$m, AGR%)

Figure 5.70 Lockheed Martin Corporation Primary International Operations 2019

Figure 5.71 Lockheed Martin Corporation Sales by Geographical Location 2013-2017 (US$m)

Figure 5.72 Lockheed Martin Corporation Organisational Structure 2019

Figure 5.73 Lockheed Martin Corporation Primary Market Competitors 2019

Figure 5.74 Northrop Grumman Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.75 Northrop Grumman Corporation Sales by Segment of Business 2013-2017 (US$m)

Figure 5.76 Northrop Grumman Corporation Net Income 2013-2017 (US$m, AGR%)

Figure 5.77 Northrop Grumman Corporation Primary International Operations 2019

Figure 5.78 Northrop Grumman Corporation Sales by Geographical Location 2013-2017 (US$m)

Figure 5.79 Northrop Grumman Corporation Organisational Structure 2019

Figure 5.80 Northrop Grumman Corporation Primary Market Competitors 2019

Figure 5.81 QinetiQ Group Plc Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.82 QinetiQ Group Plc Sales by Geographic Location 2014-2017 (US$m)

Figure 5.83 QinetiQ Group Plc Net Income 2014-2018 (US$m, AGR%)

Figure 5.84 QinetiQ Group Plc Primary International Operations 2019

Figure 5.85 QinetiQ Group Plc Sales by Geographical Location 2014-2018 (US$m)

Figure 5.86 QinetiQ Group Plc Organisational Structure 2019

Figure 5.87 QinetiQ Group Plc Primary Market Competitors 2019

Figure 5.88 The Raytheon Company Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.89 The Raytheon Company Sales by Segment of Business 2013-2017 (US$m, Total Company Sales)

Figure 5.90 The Raytheon Company Net Income 2013-2017 (US$m, AGR%)

Figure 5.91 The Raytheon Company Primary International Operations 2019

Figure 5.92 The Raytheon Company Sales by Geographical Location 2013-2017 (US$m)

Figure 5.93 The Raytheon Company Organisational Structure 2019

Figure 5.94 The Raytheon Company Primary Market Competitors 2019

Figure 5.95 Rockwell Collins Inc Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.96 Rockwell Collins Inc Sales by Segment of Business 2013-2017 (US$m)

Figure 5.97 Rockwell Collins Inc Net Income 2013-2017 (US$m, AGR%)

Figure 5.98 Rockwell Collins Inc Primary International Operations 2019

Figure 5.99 Rockwell Collins Inc Sales by Geographical Location 2013-2017 (US$m)

Figure 5.100 Rockwell Collins Inc Organisational Structure 2019

Figure 5.101 Rockwell Collins Inc Primary Market Competitors 2019

Figure 5.102 Saab AB Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.103 Saab AB Sales by Segment of Business 2013-2017 (US$m)

Figure 5.104 Saab AB Net Income 2013-2017 (US$m, AGR%)

Figure 5.105 Saab AB Primary International Operations 2019

Figure 5.106 Saab AB Sales by Geographical Location 2013-2017 (US$m)

Figure 5.107 Saab AB Organisational Structure 2019

Figure 5.108 Saab AB Primary Market Competitors 2019

Figure 5.109 Safran SA Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.110 Safran SA Sales by Segment of Business 2013-2017 (US$m)

Figure 5.111 Safran SA Net Income 2013-2017 (US$m, AGR%)

Figure 5.112 Safran SA Primary International Operations 2019

Figure 5.113 Safran SA Sales by Geographical Location 2013-2017 (US$m)

Figure 5.114 Safran SA Organisational Structure 2019

Figure 5.115 Safran SA Primary Market Competitors 2019

Figure 5.116 Smiths Group Plc Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.117 Smiths Group Plc Sales by Segment of Business 2013-2017 (US$m)

Figure 5.118 Smiths Group Plc Net Income 2013-2017 (US$m, AGR%)

Figure 5.119 Smiths Group Plc Primary International Operations 2019

Figure 5.120 Smiths Group Plc Sales by Geographical Location 2013-2017 (US$m)

Figure 5.121 Smiths Group Plc Organisational Structure 2019

Figure 5.122 Smiths Group Plc Primary Market Competitors 2019

Figure 5.123 Textron Inc Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.124 Textron Inc Sales by Segment of Business 2013-2017 (US$m)

Figure 5.125 Textron Inc Net Income 2013-2017 (US$m, AGR%)

Figure 5.126 Textron Inc Primary International Operations 2019

Figure 5.127 Textron Inc Sales by Geographical Location 2013-2017 (US$m)

Figure 5.128 Textron Inc Organisational Structure 2019

Figure 5.129 Textron Inc Primary Market Competitors 2019

Figure 5.130 Thales Group Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.131 Thales Group Sales by Segment of Business 2013-2017 (US$m)

Figure 5.132 Thales Group Net Income / Loss 2013-2017 (US$m, AGR%)

Figure 5.133 Thales Group Primary International Operations 2019

Figure 5.134 Thales Group Sales by Geographical Location 2013-2017 (US$m)

Figure 5.135 Thales Group Organisational Structure 2019

Figure 5.136 Thales Group Primary Market Competitors 2019

Figure 5.137 Unisys Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Figure 5.138 Unisys Corporation Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 5.139 Unisys Corporation Net Income 2013-2017 (US$m, AGR%)

Figure 5.140 Unisys Corporation Primary International Operations 2019