Industries > Defence > Leading 20 Electronic Warfare Companies 2018

Leading 20 Electronic Warfare Companies 2018

Competitive Landscape Analysis of Established Suppliers: BAE, Boeing, Cobham Plc, Cohort Plc, Northrop Grumman, Elbit Systems, Leonardo SpA, Harris Corporation, L-3 Technologies, Lockheed Martin, Raytheon,Textron, Hensoldt, General Dynamics, Rockwell Collins, Thales, Saab, Teledyne, IAI, Leidos

Read on to discover how this definitive report can transform your own research and save you time.

The top 20 electronic warfare companies report consists of in-depth analysis of top companies involved in the electronic warfare spectrum. If you want to be part of this growing industry, then read on to discover how you can maximise your investment potential.

Report highlights

• More than 398 tables, charts, and graphs

• Analysis of key players in the Global Electronic Warfare Market

• Boeing Company

• Northrop Grumman

• Raytheon

• Lockheed Martin

• Rockwell Collins

• BAE Systems AE

• Saab AB

• Thales Group

• Harris Corporation

• Israel Aerospace Industries Ltd.

• Leidos

• IAI

• Teledyne

• General Dynamics

• Textron

• L-3 Technologies

• Leonardo SpA

• Elbit

• Cohort

• Cobham

• Top 20 Electronic Warfare companies outlook and analysis 2018

• The leading companies by market share in Electronic warfare in table and chart form

• Key questions answered

• What does the future hold for the Electronic Warfare Market?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to success and why?

• What business models should you adopt?

• What industry trends should you be aware of?

• Target audience

• Electronic warfare system companies

• Defense contractors

• Avionics manufacturers

• Defense software providers

• Sub-component manufacturers

• Electronics companies

• R&D staff

• Consultants

• Analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

• Systems Integrators

Buy our report today Leading 20 Electronic Warfare Companies 2018. Avoid missing out by staying informed – get our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1.1 Report Benefits & Highlights

1.2 Electronic Warfare Market Segmentation

1.3 Why You Should Read This Report

1.4 Report Structure

1.5 How This Report Delivers

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.7.3 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Electronic Warfare Market

2.1 Electronic Warfare Market Structure

2.2 Electronic Warfare Market Definition & Overview

2.3 Electronic Warfare Submarkets Definition

2.4 Analysis of Major Trends in the Electronic Warfare Market 2018

3. Competitor Positioning in the Electronic Warfare Market 2018

3.1 20 Leading Established Companies in the Electronic Warfare Market 2018

3.2 Assessing the Electronic Warfare Market Landscape in 2018

4. Leading 20 Established Electronic Warfare Companies

4.1 BAE Systems plc

4.1.1 BAE Systems plc Electronic Warfare Selected Recent Contracts / Projects / Programmes 2010-2018

4.1.2 BAE Systems plc Total Company Sales 2013-2017

4.1.3 BAE Systems, plc. Sales by Segment of Business 2013-2017

4.1.4 BAE Systems, plc. Net Income / Loss 2013-2017

4.1.5BAE Systems Order Backlog 2013-2017

4.1.6 BAE Systems, plc. Sales by Regional Segment of Business 2012-2016

4.1.7 BAE Systems Organizational Structure / Notable Subsidiaries

4.1.8 BAE Systems plc Electronic Warfare Products / Services

4.1.9 BAE Systems plc Primary Market Competitors 2018

4.1.10 BAE Systems plc Mergers & Acquisitions (M&A) Activity

4.1.11 BAE Systems SWOT Analysis 2018

4.1.12 BAE Systems plc Future Outlook

4.2 The Boeing Company

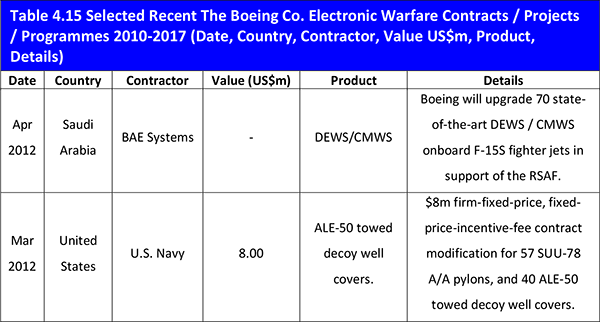

4.2.1 The Boeing Co. Electronic Warfare Selected Recent Contracts / Projects / Programmes 2010-2017

4.2.2 The Boeing Co. Total Company Sales 2013-2017

4.2.3 The Boeing Co. Net Income 2013-2017

4.2.4 The Boeing Company Order Backlog 2013-2017

4.2.5 The Boeing Company, plc. Sales by Regional Segment of Business 2013-2017

4.2.6 The Boeing Co. Sales by Segment of Business 2013-2017

4.2.7 The Boeing Company Organizational Structure / Notable Subsidiaries

4.2.8 The Boeing Co. Electronic Warfare Products / Services

4.2.9 The Boeing Co. Primary Market Competitors 2018

4.2.10 The Boeing Co. Mergers & Acquisitions (M&A) Activity

4.2.11The Boeing Company SWOT Analysis 2018

4.2.12 The Boeing Co. Analysis

4.3 Cobham plc

4.3.1 Cobham plc Electronic Warfare Selected Recent Contracts / Projects / Programmes 2010-2017

4.3.2 Cobham plc Total Company Sales 2013-2017

4.3.3 Cobham plc Sales by Segment of Business 2012-2016

4.3.4 Cobham plc Net Income / Loss 2013-2017

4.3.5 Cobham plc Order Backlog 2013-2017

4.3.6 Cobham plc Sales by Regional Segment of Business 2012-2016

4.3.7 Cobham plc Organizational Structure / Notable Subsidiaries

4.3.8 Cobham plc Electronic Warfare Products / Services

4.3.10 Cobham Plc SWOT Analysis 2018

4.3.11 Cobham plc Analysis

4.4 Cohort plc

4.4.1 Cohort plc Electronic Warfare Selected Recent Contracts / Projects / Programmes 2011-2017

4.4.2 Cohort plc Total Company Sales 2013-2017

4.4.3 Cohort plc Sales by Segment of Business 2013-2016

4.4.4 Cohort plc Net Income / Loss 2013-2017

4.4.5 Cohort plc Order Backlog 2013-2017

4.4.6 Cohort plc Sales by Regional Segment of Business 2013-2016

4.4.7 Cohort plc Organizational Structure / Notable Subsidiaries

4.4.8 Cohort plc Electronic Warfare Products / Services

4.4.9 Cohort plc Primary Market Competitors 2018

4.4.10 Cohort plc Mergers & Acquisitions (M&A) Activity

4.4.11 Cohort plc SWOT Analysis 2018

4.4.12 Cohort plc Analysis

4.5 Northrop Grumman Corporation

4.5.1 Northrop Grumman Electronic Warfare Selected Recent Contracts / Projects / Programmes 2010-2018

4.5.2 Northrop Grumman Total Company Sales 2013-2017

4.5.3 Northrop Grumman Sales by Segment of Business 2014-2017

4.5.4 Northrop Grumman Company Net Income / Loss 2013-2017

4.5.5 Northrop Grumman Order Backlog 2013-2017

4.5.6 Northrop Grumman Sales by Regional Segment of Business 2013-2017

4.5.7 Northrop Grumman Corporation Organizational Structure / Notable Subsidiaries

4.5.8 Northrop Grumman Electronic Warfare Products / Services

4.5.9 Northrop Grumman Primary Market Competitors 2018

4.5.10 Northrop Grumman Mergers & Acquisitions (M&A) Activity

4.5.11 Northrop Grumman Corporation SWOT Analysis 2018

4.5.12 Northrop Grumman Analysis

4.6 Elbit Systems Ltd

4.6.1 Elbit Systems Ltd Selected Recent Contracts / Projects / Programmes 2012-2018

4.6.2 Elbit Systems Ltd Total Company Sales 2013-2017

4.6.3 Elbit Systems Ltd Net Income 2013-2017

4.6.4 Elbit Systems Ltd. Order Backlog 2013-2017

4.6.5 Elbit Systems Ltd Sales by Segment of Business 2012-2016

4.6.6 Elbit Systems Ltd Sales by Regional Segment of Business 2012-2016

4.6.7 Elbit Systems Organizational Structure / Notable Subsidiaries

4.6.8 Elbit Systems Ltd Electronic Warfare Products / Services

4.6.9 Elbit Systems Ltd Primary Market Competitors 2018

4.6.10 Elbit Systems Ltd Mergers & Acquisitions (M&A) Activity

4.6.11Elbit Systems SWOT Analysis 2018

4.6.12 Elbit Systems Ltd Analysis

4.7 Leonardo S.p.A.

4.7.1 Leonardo S.p.A. Selected Recent Contracts / Projects / Programmes 2010-2018

4.7.2 Leonardo S.p.A. Total Company Sales 2013-2017

4.7.3 Leonardo S.p.A. Net Income 2013-2017

4.7.4 Leonardo S.p.A Order Backlog 2013-2017

4.7.5 Leonardo S.p.A. Sales by Segment of Business 2013-2017

4.7.6 Leonardo SPA Sales by Regional Segment of Business 2013-2017

4.7.7 Leonardo S.p.A. Organizational Structure / Notable Subsidiaries

4.7.8 Leonardo S.p.A. Electronic Warfare Products / Services

4.7.9 Leonardo S.p.A. Primary Market Competitors 2018

4.7.10 Leonardo S.p.A. Mergers & Acquisitions (M&A) Activity

4.7.11 Leonardo S.p.A. SWOT Analysis 2018

4.7.12 Leonardo S.p.A. Analysis

4.8 Harris Corporation

4.8.1 Harris Corporation Electronic Warfare Selected Recent Contracts / Projects / Programmes 2010-2018

4.8.2 Harris Corporation Total Company Sales 2013-2017

4.8.3 Harris Corporation Net Income 2013-2017

4.8.4Harris Corporation Order Backlog 2013-2016

4.8.5 Harris Corporation Sales by Segment of Business 2015-2016

4.8.6 Harris Corporation Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

4.8.7 Harris Corporation Organizational Structure / Notable Subsidiaries

4.8.8 Harris Corporation Electronic Warfare Products / Services

4.8.9 Harris Corporation Primary Market Competitors 2018

4.8.10 Harris CorporationMergers & Acquisitions (M&A) Activity

4.8.11Harris Corporation SWOT Analysis 2018

4.8.12 Harris Corporation Analysis

4.9 L3 Technologies, Inc.

4.9.1 L3 Technologies, Inc. Selected Recent Contracts / Projects /Programmes 2010-2015

4.9.2 L3 Technologies, Inc. Total Company Sales 2013-2017

4.9.3 L3 Technologies, Inc. Net Income 2013-2017

4.9.4 L3 Technologies, Inc. Order Backlog 2013-2017

4.9.5 L3 Technologies, Inc. Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

4.9.6 L-3 Technologies Organizational Structure / Notable Subsidiaries

4.9.7 L3 Technologies, Inc. Electronic Warfare Products / Services

4.9.8 L3 Technologies, Inc. Primary Market Competitors 2018

4.9.9 L3 Technologies, Inc. Mergers & Acquisitions (M&A) Activity

4.9.10 L3 Technologies, Inc. SWOT Analysis 2018

4.9.11 L3 Technologies, Inc. Analysis

4.10 Lockheed Martin Corporation

4.10.1 Lockheed Martin Electronic Warfare Selected Recent Contracts / Projects / Programmes 2010-2018

4.10.2 Lockheed Martin Total Company Sales 2013-2017

4.10.3 Lockheed Martin Net Income 2013-2017

4.10.4 Lockheed Martin Corporation Order Backlog 2013-2017

4.10.5 Lockheed Martin Sales by Segment of Business 2013-2017

4.10.6 Lockheed Martin Sales by Regional Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

4.10.7 Lockheed Martin Corporation Organizational Structure / Notable Subsidiaries

4.10.8 Lockheed Martin Electronic Warfare Products / Services

4.10.9 Lockheed Martin Primary Market Competitors 2018

4.10.10 Lockheed Martin Mergers & Acquisitions (M&A) Activity

4.10.11 Lockheed Martin Corporation SWOT Analysis 2018

4.10.12 Lockheed Martin Analysis

4.11 Raytheon Co.

4.11.1 Raytheon Company Electronic Warfare Selected Recent Contracts / Projects / Programmes 2012-2018

4.11.2 Raytheon Total Company Sales 2013-2017

4.11.3 Raytheon Net Income 2013-2017

4.11.4 The Raytheon Company Order Backlog 2013-2017

4.11.5 Raytheon Sales by Segment of Business 2013-2017

4.11.6 Raytheon Regional Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

4.11.7 The Raytheon Company Organizational Structure / Notable Subsidiaries

4.11.8 Raytheon Electronic Warfare Products / Services

4.11.9 Raytheon Primary Market Competitors 2018

4.11.10 Raytheon Mergers& Acquisitions (M&A) Activity

4.11.11Raytheon Company SWOT Analysis 2018

4.11.12 Raytheon Analysis

4.12 Textron Inc.

4.12.1 Textron Inc. Selected Recent Contracts / Projects / Programmes 2012-2017

4.12.2 Textron Inc. Total Company Sales 2013-2017

4.12.3 Textron Inc. Net Income 2013-2017

4.12.4 Textron Inc. Order Backlog 2013-2017

4.12.5 Textron Inc. Sales by Segment of Business 2013-2017

4.12.6 Textron Inc. Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

4.12.7 Textron Inc. Organizational Structure / Notable Subsidiaries

4.12.8 Textron Inc. Electronic Warfare Products / Services

4.12.9 Textron Inc. Primary Market Competitors 2018

4.12.10 Textron Inc. Mergers & Acquisitions (M&A) Activity

4.12.11 Textron Inc. SWOT Analysis 2018

4.12.12 Textron Inc. Analysis

4.13 Hensoldt

4.13.1 Hensoldt Electronic Warfare Selected Recent Contracts / Projects / Programmes 2016-2017

4.13.2 Hensoldt Organizational Structure / Notable Subsidiaries

4.13.3 HensoldtElectronic Warfare Products / Services

4.13.4 HensoldtAcquisition Activity

4.13.5 Hensoldt SWOT Analysis 2018

4.13.6 Hensoldt Analysis

4.14 General Dynamics Corporation

4.14.1 General Dynamics Corporation Electronic Warfare Selected Recent Contracts / Projects / Programmes 2016

4.14.2 General Dynamics Corporation Total Company Sales 2013-2017

4.14.3 General Dynamics Corporation Sales by Segment of Business 2013-2017

4.14.4 General Dynamics Corporation Company Net Income / Loss 2013-2017

4.14.5 General Dynamics Corporation Order Backlog 2013-2017

4.14.6 General Dynamics Corporation Sales by Regional Segment of Business 2013-2017

4.14.7 General Dynamics Corporation Organizational Structure / Notable Subsidiaries

4.14.8 General Dynamics Corporation Electronic Warfare Products / Services

4.14.9 General Dynamics Corporation Primary Market Competitors 2018

4.14.10 General Dynamics Corporation Mergers & Acquisitions (M&A) Activity

4.14.11 General Dynamics Corporation SWOT Analysis 2018

4.14.12 General Dynamics Corporation Analysis

4.15 Rockwell Collins, Inc.

4.15.1 Rockwell Collins, Inc. Electronic Warfare Selected Recent Contracts / Projects / Programmes 2010-2016

4.15.2 Rockwell Collins, Inc. Total Company Sales 2013-2017

4.15.3 Rockwell Collins, Inc.Sales by Segment of Business 2013-2017

4.15.4 Rockwell Collins, Inc. Company Net Income / Loss 2013-2017

4.15.5 Rockwell Collins, Inc. Order Backlog 2013-2017

4.15.6 Rockwell Collins, Inc. Sales by Regional Segment of Business 2013-2017

4.15.7 Rockwell Collins, Inc. Organizational Structure / Notable Subsidiaries

4.15.8 Rockwell Collins, Inc. Electronic Warfare Products / Services

4.15.9 Rockwell Collins, Inc. Primary Market Competitors 2018

4.15.10 Rockwell Collins, Inc. Mergers & Acquisitions (M&A) Activity

4.15.11 Rockwell Collins Inc SWOT Analysis 2018

4.15.12 Rockwell Collins, Inc. Analysis

4.16 Thales Group

4.16.1 Thales Group Electronic Warfare Selected Recent Contracts / Projects / Programmes 2015-2018

4.16.2 Thales Group Total Company Sales 2013-2017

4.16.3 Thales GroupSales by Segment of Business 2013-2017

4.16.4 Thales Group Company Net Income / Loss 2013-2017

4.16.5 Thales Group Order Backlog 2013-2017

4.16.6 Thales Group Sales by Regional Segment of Business 2013-2017

4.16.7 Thales Group Organizational Structure / Notable Subsidiaries

4.16.8 Thales Group Electronic Warfare Products / Services

4.16.9 Thales Group Primary Market Competitors 2018

4.16.10 Thales Group Mergers & Acquisitions (M&A) Activity

4.16.11 Thales Group SWOT Analysis 2018

4.16.12 Thales Group Analysis

4.17 SAAB AB

4.17.1 SAAB AB Electronic Warfare Selected Recent Contracts / Projects / Programmes 2011-2017

4.17.2 SAAB AB Total Company Sales 2013-2017

4.17.3 SAAB ABSales by Segment of Business 2013-2017

4.17.4 SAAB AB Company Net Income / Loss 2013-2017

4.17.5 SAAB AB Order Backlog 2013-2017

4.17.6 SAAB AB Sales by Regional Segment of Business 2013-2017

4.17.7 SAAB AB Organizational Structure / Notable Subsidiaries

4.17.8 SAAB AB Electronic Warfare Products / Services

4.17.9 SAAB AB Primary Market Competitors 2018

4.17.10 SAAB AB Mergers & Acquisitions (M&A) Activity

4.17.11Saab AB SWOT Analysis 2018

4.17.12 SAAB AB Analysis

4.18 Teledyne Technologies, Inc.

4.18.1 Teledyne Technologies, Inc. Total Company Sales 2013-2017

4.18.2 Teledyne Technologies, Inc.Sales by Segment of Business 2013-2017

4.18.3 Teledyne Technologies, Inc. Company Net Income / Loss 2013-2017

4.18.4 Teledyne Technologies, Inc.Order Backlog 2013-2017

4.18.5 Teledyne Technologies, Inc. Sales by Regional Segment of Business 2013-2017

4.18.6 Teledyne Technologies, Inc. Organizational Structure / Notable Subsidiaries

4.18.7 Teledyne Technologies, Inc. Electronic Warfare Products / Services

4.18.8 Teledyne Technologies, Inc. Primary Market Competitors 2018

4.18.9 Teledyne Technologies, Inc. Mergers & Acquisitions (M&A) Activity

4.18.10 Teledyne Technologies, Inc. SWOT Analysis 2018

4.18.11 Teledyne Technologies, Inc. Analysis

4.19 Israel Aerospace Industries (IAI) Ltd.

4.19.1 Israel Aerospace Industries Ltd. Electronic Warfare Selected Recent Contracts / Projects / Programmes 2013-2017

4.19.2 Israel Aerospace Industries Ltd. Total Company Sales 2013-2017

4.19.3 Israel Aerospace Industries Ltd.Sales by Segment of Business 2013-2017

4.19.4 Israel Aerospace Industries Ltd. Company Net Income / Loss 2013-2017

4.19.5 Israel Aerospace Industries Ltd. Order Backlog 2013-2017

4.19.6 Israel Aerospace Industries Ltd. Sales by Regional Segment of Business 2013-2017

4.19.7 Israel Aerospace Industries Ltd. Organizational Structure / Notable Subsidiaries

4.19.8 Israel Aerospace Industries Ltd. Electronic Warfare Products / Services

4.19.9 Israel Aerospace Industries Ltd. Primary Market Competitors 2018

4.19.10 Israel Aerospace Industries Ltd. Mergers & Acquisitions (M&A) Activity

4.19.11 Israel Aerospace Industries Ltd. SWOT Analysis 2018

4.19.12 Israel Aerospace Industries Ltd. Analysis

4.20 Leidos Holdings, Inc.

4.20.1 Leidos Holdings, Inc. Electronic Warfare Selected Recent Contracts / Projects / Programmes 2014-2017

4.20.2 Leidos Holdings, Inc. Total Company Sales 2013-2017

4.20.3 Leidos Holdings, Inc.Sales by Segment of Business 2013-2017

4.20.4 Leidos Holdings, Inc. Company Net Income / Loss 2013-2017

4.20.5 Leidos Holdings, Inc. Order Backlog 2013-2017

4.20.6 Leidos Holdings, Inc. Sales by Regional Segment of Business 2013-2017

4.20.7 Leidos Holdings Inc Organizational Structure / Notable Subsidiaries

4.20.8 Leidos Holdings, Inc. Electronic Warfare Products / Services

4.20.9 Leidos Holdings, Inc. Primary Market Competitors 2018

4.20.10 Leidos Holdings, Inc. Mergers & Acquisitions (M&A) Activity

4.20.11 Leidos Holdings Inc SWOT Analysis 2018

4.20.12 Leidos Holdings, Inc. Analysis

4.21 Other Notable Companies Involved in the Electronic Warfare Market 2018

5. PEST Analysis of the Electronic Warfare Market 2018

6. Conclusions and Recommendations

7. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Figures

Figure 1.1 Electronic Warfare Market Segmentation Overview

Figure 2.1 Electronic Warfare Market Segmentation Overview

Figure 2.2 20 Leading Established Electronic Warfare Companies 2018

Figure 4.1 Leading 20 Electronic Warfare Companies 2017 (Market Ranking, Electronic Warfare Revenue, Market Share %)

Figure 4.2 BAE Systems plc Total Company Sales 2013-2017 (US$m, AGR %)

Figure 4.3 BAE Systems, plc. Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 4.4 BAE Systems, plc. Sales AGR by Segment of Business 2014-2017 (AGR %)

Figure 4.5 BAE Systems, plc. Net Income / Loss 2013-2017 (US$m, AGR %)

Figure 4.6 BAE Systems Order Backlog 2013-2017 (US$m, AGR%)

Figure 4.7 BAE Systems, plc. Sales by Regional Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.8 BAE Systems, plc. Sales AGR by Regional Segment of Business 2013-2016 (AGR %)

Figure 4.9 BAE Systems Organizational Structure 2018

Figure 4.10 BAE Systems plc Primary Market Competitors 2018

Figure 4.11 The Boeing Co. Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.12 The Boeing Co. Net Income 2013-2017 (US$m, AGR%)

Figure 4.13 The Boeing Company Order Backlog 2013-2017 (US$b, AGR%)

Figure 4.14 The Boeing Company Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 4.15 The Boeing Company Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 4.16 The Boeing Co. Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 4.17 The Boeing Co. Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 4.18 The Boeing Company Organizational Structure 2018

Figure 4.19 The Boeing Co. Primary Market Competitors 2018

Figure 4.20 Cobham plc Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.21 Cobham plc Sales by Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.22 Cobham plc Sales AGR by Segment of Business 2013-2016 (AGR %)

Figure 4.23 Cobham plc Net Income / Loss 2013-2017 (US$m, AGR %)

Figure 4.24 Cobham plcOrder Backlog 2013-2017 (US$m, AGR%)

Figure 4.25 Cobham plc Sales by Regional Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.26 Cobham plc Sales AGR by Regional Segment of Business 2012-2016 (AGR %)

Figure 4.27 Cobham plc Organizational Structure 2018

Figure 4.28 Cobham plc Primary Market Competitors 2018

Figure 4.29 Cohort plc Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.30 Cohort plc Sales by Segment of Business 2013-2016 (US$m, Total Company Sales AGR %)

Figure 4.31 Cohort plc Sales AGR by Segment of Business 2014-2016 (AGR %)

Figure 4.32 Cohort plc Net Income / Loss 2013-2017 (US$m, AGR %)

Figure 4.33 Cohort plcOrder Backlog 2013-2017 (US$m, AGR%)

Figure 4.34 Cohort plc Sales by Regional Segment of Business 2013-2016 (US$m, Total Company Sales AGR %)

Figure 4.35 Cohort plc Organizational Structure 2018

Figure 4.36 Cohort plc Primary Market Competitors 2018

Figure 4.37 Northrop Grumman Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.38 Northrop Grumman Sales by Segment of Business 2014-2017 (US$m, Total Company Sales AGR%)

Figure 4.39 Northrop Grumman Sales AGR by Segment of Business 2015-2017 (AGR%)

Figure 4.40 Northrop Grumman Net Income / Loss 2013-2017 (US$m)

Figure 4.41 Northrop Grumman Order Backlog 2013-2017 (US$m, AGR%)

Figure 4.42 Northrop Grumman Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR )

Figure 4.43 Northrop Grumman Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 4.44 Northrop Grumman Corporation Organizational Structure 2018

Figure 4.45 Northrop Grumman Primary Market Competitors 2018

Figure 4.46 Elbit Systems Ltd Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.47 Elbit Systems Ltd Net Income 2013-2017 (US$m, AGR%)

Figure 4.48 Elbit Systems Ltd.Order Backlog 2013-2017 (US$m, AGR%)

Figure 4.49 Elbit Systems Ltd Sales by Segment of Business 2012-2016 (US$m, Total Company Sales AGR%)

Figure 4.50 Elbit Systems LtdSales AGR by Segment of Business 2013-2016 (AGR%)

Figure 4.51 Elbit Systems Ltd Sales by Regional Segment of Business 2012-2016 (US$m, Total Company Sales AGR %)

Figure 4.52 Elbit Systems Ltd Sales AGR by Regional Segment of Business 2013-2016 (AGR %)

Figure 4.53 Elbit Systems Organizational Structure 2018

Figure 4.54 Elbit Systems Ltd Primary Market Competitors 2018

Figure 4.55 Leonardo S.p.A. Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.56 Leonardo S.p.A. Net Income / Loss 2013-2017 (US$m)

Figure 4.57Leonardo S.p.AOrder Backlog 2013-2017 (US$m, AGR%)

Figure 4.58 Leonardo S.p.A. Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 4.59 Leonardo S.p.A. Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 4.60 Leonardo SPA Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 4.61 Leonardo SPA, Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 4.62Leonardo S.p.A.Organizational Structure 2018

Figure 4.63 Leonardo S.p.A. Primary Market Competitors 2018

Figure 4.64 Harris Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.65 Harris Corporation Net Income 2013-2017 (US$m, AGR%)

Figure 4.66 Harris CorporationOrder Backlog 2013-2016 (US$m, AGR%)

Figure 4.67 Harris Corporation Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 4.68 Harris Corporation Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 4.69 Harris Corporation Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 4.70 Harris Corporation Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 4.71 Harris Corporation Organizational Structure 2018

Figure 4.72 Harris Corporation Primary Market Competitors 2018

Figure 4.73 L3 Technologies, Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.74 L3 Technologies, Inc. Net Income 2013-2017 (US$m, AGR%)

Figure 4.75L3 Technologies, Inc.Order Backlog 2013-2017 (US$m, AGR%)

Figure 4.76 L3 Technologies, Inc. Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 4.77 L3 Technologies, Inc. AGR by Regional Segment of Business 2013-2017 (Sales AGR %)

Figure 4.78 L3 Technologies, Inc. Organizational Structure 2018

Figure 4.79 L3 Technologies, Inc. Primary Market Competitors 2018

Figure 4.80 Lockheed Martin Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.81 Lockheed Martin Net Income 2014-2017 (US$m, AGR%)

Figure 4.82 Lockheed Martin Corporation Order Backlog 2013-2017 (US$m, AGR%)

Figure 4.83 Lockheed Martin Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 4.84 Lockheed Martin Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 4.85 Lockheed Martin Sales AGR by Geographical Location 2014-2017 (AGR%)

Figure 4.86 Lockheed Martin Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR%)

Figure 4.87 Lockheed Martin Corporation Organizational Structure 2018

Figure 4.88 Lockheed Martin Primary Market Competitors 2018

Figure 4.89 Raytheon Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.90 Raytheon Net Income 2013-2017 (US$m, AGR%)

Figure 4.91 The Raytheon Company Order Backlog 2013-2017 (US$m, AGR%)

Figure 4.92 Raytheon Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 4.93 Raytheon Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 4.94 Raytheon Sales AGR by Geographical Location 2014-2017 (AGR%)

Figure 4.95 Raytheon Sales by Geographical Location 2013-2017 (US$m, Total Company Sales AGR%)

Figure 4.96 The Raytheon Company Organizational Structure 2018

Figure 4.97 Raytheon Primary Market Competitors 2018

Figure 4.98 Textron Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.99 Textron Inc. Net Earnings 2013-2017 (US$m, AGR%)

Figure 4.100 Textron Inc. Order Backlog 2013-2017 (US$m, AGR%)

Figure 4.101 Textron Inc. Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 4.102 Textron Inc. Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 4.103 Textron Inc. Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR %)

Figure 4.104 Textron Inc. Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 4.105 Textron Inc. Organizational Structure 2018

Figure 4.106 Textron Inc. Primary Market Competitors 2018

Figure 4.107 Hensoldt Organizational Structure 2018

Figure 4.108 General Dynamics Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.109 General Dynamics Corporation Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 4.110 General Dynamics Corporation Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 4.101 General Dynamics Corporation Net Income / Loss 2013-2017 (US$m)

Figure 4.102 General Dynamics Corporation Order Backlog 2013-2017 (US$m, AGR%)

Figure 4.103 General Dynamics Corporation Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR )

Figure 4.104 General Dynamics Corporation Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 4.105 General Dynamics Corporation Organizational Structure 2018

Figure 4.106 General Dynamics Corporation Primary Market Competitors 2018

Figure 4.107 Rockwell Collins, Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.108 Rockwell Collins, Inc. Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 4.109 Rockwell Collins, Inc. Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 4.110 Rockwell Collins, Inc. Net Income / Loss 2013-2017 (US$m)

Figure 4.111 Rockwell Collins, Inc.Order Backlog 2013-2017 (US$m, AGR%)

Figure 4.112 Rockwell Collins, Inc. Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR )

Figure 4.113 Rockwell Collins, Inc. Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 4.114 Rockwell Collins, Inc. Organizational Structure 2018

Figure 4.115 Rockwell Collins, Inc.Primary Market Competitors 2018

Figure 4.116 Thales Group Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.117 Thales Group Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 4.118 Thales Group Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 4.119 Thales Group Net Income / Loss 2013-2017 (US$m)

Figure 4.120 Thales Group Order Backlog 2013-2017 (US$m, AGR%)

Figure 4.121 Thales Group Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR )

Figure 4.122 Thales Group Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 4.123 Thales Group Organizational Structure 2018

Figure 4.124 Thales Group Primary Market Competitors 2018

Figure 4.125 SAAB AB Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.126 SAAB AB Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 4.127 SAAB AB Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 4.128 SAAB AB Net Income / Loss 2013-2017 (US$m)

Figure 4.129 SAAB AB Order Backlog 2013-2017 (US$m, AGR%)

Figure 4.130 SAAB AB Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR)

Figure 4.131 SAAB AB Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 4.132 SAAB AB Organizational Structure 2018

Figure 4.133 SAAB AB Primary Market Competitors 2018

Figure 4.134 Teledyne Technologies, Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.135 Teledyne Technologies, Inc.Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 4.136 Teledyne Technologies, Inc. Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 4.137 Teledyne Technologies, Inc. Net Income / Loss 2013-2017 (US$m)

Figure 4.138 Teledyne Technologies, Inc.Order Backlog 2013-2017 (US$m, AGR%)

Figure 4.139 Teledyne Technologies Order Backlog 2013-2017 (US$m, AGR%)

Figure 4.140 Teledyne Technologies, Inc. Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR )

Figure 4.141 Teledyne Technologies, Inc. Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 4.142 Teledyne Technologies, Inc.Organizational Structure 2018

Figure 4.143 Teledyne Technologies, Inc. Primary Market Competitors 2018

Figure 4.144 Israel Aerospace Industries Ltd. Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.145 Israel Aerospace Industries Ltd. Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 4.146 Israel Aerospace Industries Ltd. Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 4.147 Israel Aerospace Industries Ltd. Net Income / Loss 2013-2017 (US$m)

Figure 4.148 Israel Aerospace Industries Ltd.Order Backlog 2013-2017 (US$m, AGR%)

Figure 4.149 Israel Aerospace Industries Ltd. Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR )

Figure 4.150 Israel Aerospace Industries Ltd. Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 4.151 Israel Aerospace Industries Ltd. Organizational Structure 2018

Figure 4.152 Israel Aerospace Industries Ltd. Primary Market Competitors 2018

Figure 4.153 Leidos Holdings, Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Figure 4.154 Leidos Holdings, Inc. Sales by Segment of Business 2013-2017 (US$m, Total Company Sales AGR%)

Figure 4.155 Leidos Holdings, Inc. Sales AGR by Segment of Business 2014-2017 (AGR%)

Figure 4.156 Leidos Holdings, Inc. Net Income / Loss 2013-2017 (US$m)

Figure 4.157 Leidos Holdings, Inc. Order Backlog 2013-2017 (US$m, AGR%)

Figure 4.158 Leidos Holdings, Inc. Sales by Regional Segment of Business 2013-2017 (US$m, Total Company Sales AGR )

Figure 4.159 Leidos Holdings, Inc. Sales AGR by Regional Segment of Business 2014-2017 (AGR %)

Figure 4.160 Leidos Holdings Inc Organizational Structure 2018

Figure 4.161 Leidos Holdings, Inc. Primary Market Competitors 201

List of Tables

Table 2.1 Major Trends, Drivers & Restraints in the Electronic Warfare Market 2018 (primary Submarkets Technology, Trends, Drivers & Restraints

Table 3.1 Leading 20 Electronic Warfare Companies Sales Share 2018 (Company, FY2017 Total Company Sales US$m, Submarket Specialization)

Table 4.1 Leading 20 Electronic Warfare Companies 2018 (Market Ranking, Total Revenue, Electronic Warfare Revenue, Market Share %)

Table 4.2 BAE Systems plc Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.3 Selected Recent BAE Systems plc Electronic Warfare Contracts / Projects / Programmes 2010-2018 (Date, Country, Contractor, Value US$m, Product, Details)

Table 4.4 BAE Systems plc Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.5 BAE Systems, plc. Sales by Segment of Business 2013-2017 (US$m, AGR %)

Table 4.6 BAE Systems, plc. Net Income / Loss 2013-2017 (US$m, AGR %)

Table 4.7 BAE Systems, plc. Order Backlog 2013-2017 (US$m, AGR %)

Table 4.8 BAE Systems, plc. Sales by Regional Segment of Business 2012-2016 (US$m, AGR %)

Table 4.9 BAE Systems Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.10 BAE Systems plc Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.11 BAE Systems plc Mergers and Acquisitions 2008-2015 (Date, Company Involved, Value US$m, Details)

Table 4.12 BAE Systems plc Divestitures 2011-2015 (Date, Company Involved, Value US$m, Details)

Table 4.13 BAE Systems Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.14 The Boeing Co. Profile 2018 (CEO, Total Company Sales US$m, Sales in the Market US$m, Net Income US$m, US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.15 Selected Recent The Boeing Co. Electronic Warfare Contracts / Projects / Programmes 2010-2017 (Date, Country, Contractor, Value US$m, Product, Details)

Table 4.16 Boeing Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.17 The Boeing Co. Net Income 2013-2017 (US$m, AGR%)

Table 4.18 The Boeing Company Order Backlog 2013-2017 (US$b, AGR %)

Table 4.19 The Boeing Company, Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 4.20 The Boeing Co. Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 4.21 The Boeing Company Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.22 The Boeing Co. Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.23 The Boeing Co. Mergers and Acquisitions 2008-2018 (Date, Company Involved, Value US$m, Details)

Table 4.24 The Boeing Co. Divestitures 2014 (Date, Company Involved, Details)

Table 4.25 The Boeing CompanyStrengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.26 Cobham plc Profile 2018 (CEO, Total Company Sales US$m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.27 Selected Recent Cobham plc Electronic Warfare Contracts / Projects / Programmes 2010-2017 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 4.28 Cobham plc Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.29 Cobham plc Sales by Segment of Business 2012-2016 (US$m, AGR %)

Table 4.30 Cobham plc Net Income / Loss 2013-2017 (US$m, AGR%)

Table 4.31 Cobham plcOrder Backlog 2013-2017 (US$m, AGR%)

Table 4.32 Cobham plc Sales by Regional Segment of Business 2012-2016 (US$m, AGR %)

Table 4.33 Cobham plc Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.34 Cobham plc Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.35 Cobham plc Mergers & Acquisitions (M&A) Activity 2010-2014 (Date, Company Involved, Value US$m, Details)

Table 4.36 Cobham plc Divestitures 2010-2011 (Date, Company Involved, Value US$m, Details)

Table 4.37 Cobham Plc Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.38 Cohort plc Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.39 Selected Recent Cohort plc Electronic Warfare Contracts / Projects / Programmes 2011-2017 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 4.40 Cohort plc Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.41 Cohort plc Sales by Segment of Business 2013-2016 (US$m, AGR %)

Table 4.42 Cohort plc Net Income / Loss 2013-2017 (US$m, AGR%)

Table 4.43 Cohort plc Order Backlog 2013-2017 (US$m, AGR %)

Table 4.44 Cohort plc Sales by Regional Segment of Business 2013-2016 (US$m, AGR %)

Table 4.45 Cohort plc Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.46 Cohort plc Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.47 Cohort plc Mergers and Acquisitions 2013-2015 (Date, Company Involved, Value US$m, Details)

Table 4.48 Cohort plc Divestitures 2014 (Date, Company Involved, Value US$m, Details)

Table 4.49 Airbus Group SE Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.50 Northrop Grumman Profile 2018 (CEO, Total Company Sales US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.51 Selected Recent Northrop Grumman Electronic Warfare Contracts / Projects / Programmes 2010-2018 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 4.52 Northrop Grumman Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.53 Northrop Grumman Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 4.54 Northrop Grumman Net Income / Loss 2013-2017 (US$m)

Table 4.55 Northrop Grumman Order Backlog 2013-2017 (US$m, AGR %)

Table 4.56 Northrop Grumman Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 4.57 Northrop Grumman Corporation Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.58 Northrop Grumman Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.59 Northrop Grumman Mergers and Acquisitions 2012-2018 (Date, Company Involved, Value US$m, Details)

Table 4.60 Northrop Grumman Divestitures 2000 (Date, Company Involved, Value US$m, Details)

Table 4.61 Northrop Grumman Corporation Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.62 Elbit Systems Ltd Group Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.63 Elbit Systems Selected Recent Elbit Systems Electronic Warfare Contracts / Projects / Programmes 2010-2018 (Date, Country, Contractor, Value US$m, Product, Details)

Table 4.64 Elbit Systems Ltd Total Company Sales 2011-2015 (US$m, AGR%)

Table 4.65 Elbit Systems Ltd Net Income 2013-2017 (US$m, AGR%)

Table 4.66 Elbit Systems Ltd.Order Backlog 2013-2017 (US$m, AGR %)

Table 4.67 Elbit Systems Ltd Sales by Segment of Business 2012-2016 (US$m, AGR%)

Table 4.68 Elbit Systems Ltd Sales by Regional Segment of Business 2012-2016 (US$m, AGR %)

Table 4.69 Elbit Systems Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.70 Elbit Systems Ltd Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.71 Elbit Systems Ltd Mergers and Acquisitions 2010-2018 (Date, Company Involved, Value US$m, Details)

Table 4.72 Elbit Systems Ltd Divestitures 2012-2014 (Date, Company Involved, Details)

Table 4.73 Elbit Systems Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.74 Leonardo S.p.A. Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, HQ, Founded, No. of Employees, Ticker, Website)

Table 4.75 Leonardo S.p.A. Selected Recent Leonardo S.p.A. Electronic Warfare Contracts / Projects / Programmes 2010-2018 (Date, Country, Contractor, Value US$m, Product, Details)

Table 4.76 Leonardo S.p.A. Total Company Sales 2012-2016 (US$m, AGR%)

Table 4.77 Leonardo S.p.A. Net Income / Loss 2013-2017 (US$m, AGR%)

Table 4.78 Leonardo S.p.A Order Backlog 2013-2017 (US$m, AGR %)

Table 4.79 Leonardo S.p.A. Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 4.80 Leonardo SPA, Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 4.81 Leonardo S.p.A. Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.82 Leonardo S.p.A. Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.83 Leonardo S.p.A. Mergers and Acquisitions 2008-2017 (Date, Company Involved, Value US$m, Details)

Table 4.84 Leonardo S.p.A. Divestitures 2013-2015 (Date, Company Involved, Value US$m, Details)

Table 4.85 Leonardo S.p.A.Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.86 Harris Corporation Profile 2018 (CEO, Total Company Sales US$m, Sales in the Market US$m, Share of Company Sales from Electronic Warfare Market %, Net Income US$m,, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.87 Selected Recent Harris Corporation Electronic Warfare Contracts / Projects / Programmes 2010-2018 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 4.88 Harris Corporation Total Company Sales 2012-2016 (US$m, AGR%)

Table 4.89 Harris CorporationNet Income 2013-2017 (US$m, AGR%)

Table 4.90 Harris Corporation Order Backlog 2013-2017 (US$m, AGR %)

Table 4.91 Harris Corporation Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 4.92 Harris Corporation, Sales by Regional Segment of Business 2012-2016 (US$m, AGR %)

Table 4.93 Harris Corporation Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.94 Harris Corporation Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.95 Harris Corporation Mergers and Acquisitions 2010-2015 (Date, Company Involved, Value US$m, Details)

Table 4.96 Harris Corporation Divestitures 2012-2013 (Date, Company Involved, Value US$m, Details)

Table 4.97 Harris Corporation Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.98 L3 Technologies, Inc. Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.99 L3 Technologies, Inc. Selected Recent Elbit Systems Electronic Warfare Contracts / Projects / Programmes 2010-2015 (Date, Country, Contractor, Value US$m, Product, Details)

Table 4.100 L3 Technologies, Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.101 L3 Technologies, Inc. Net Income 2013-2017 (US$m, AGR%)

Table 4.102 L3 Technologies, Inc. Order Backlog 2013-2017 (US$m, AGR %)

Table 4.103 L3 Technologies, Inc., Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 4.104 L3 Technologies, Inc. Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.105 L3 Technologies, Inc. Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.106 L3 Technologies, Inc. Mergers and Acquisitions 2012-2017 (Date, Company Involved, Value US$m, Details)

Table 4.107 L3 Technologies, Inc. Divestitures 2014 (Date, Company Involved, Details)

Table 4.108 L3 Technologies, Inc.Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.109 Lockheed Martin Profile 2018 (CEO, Total Company Sales US$m, Sales in the Market US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.110 Selected Recent Lockheed Martin Electronic Warfare Contracts / Projects / Programmes 2010-2018 (Date, Country, Contractor, Value US$m, Product, Details)

Table 4.111 Lockheed Martin Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.112 Lockheed Martin Net Income 2013-2017 (US$m, AGR%)

Table 4.113 Lockheed Martin CorporationOrder Backlog 2013-2017 (US$m, AGR %)

Table 4.114 Lockheed Martin Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 4.115 Lockheed Martin Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 4.116 Lockheed Martin Corporation Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.117 Lockheed Martin Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.118 Lockheed Martin Mergers and Acquisitions 2008-2015 (Date, Company Involved, Value US$m, Details)

Table 4.119 Lockheed Martin Divestitures 2010-2011 (Date, Company Involved, Value US$m, Details)

Table 4.120 Lockheed Martin Corporation Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.121 Raytheon Co. Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.122 Selected Recent Raytheon Electronic Warfare Contracts / Projects / Programmes 2012-2018 (Date, Country, Contractor, Value US$m, Product, Details)

Table 4.123 Raytheon Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.124 Raytheon Net Income 2013-2017 (US$m, AGR%)

Table 4.125 The Raytheon CompanyOrder Backlog 2013-2017 (US$m, AGR %)

Table 4.126 Raytheon Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 4.127 Raytheon Sales by Geographical Location 2013-2017 (US$m, AGR%)

Table 4.128 The Raytheon Company Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.129 Raytheon Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.130 Raytheon Mergers and Acquisitions 2011-2014 (Date, Company Involved, Value US$m, Details)

Table 4.131 Raytheon Divestitures 2014 (Date, Company Involved, Details)

Table 4.132 The Raytheon Company Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.133 Textron Inc. Group Profile 2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.134 Textron Inc. Selected Recent Electronic Warfare Contracts / Projects / Programmes 2010-2017 (Date, Country, Contractor, Value US$m, Product, Details)

Table 4.135 Textron Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.136 Textron Inc. Net Earnings 2013-2017 (US$m, AGR%)

Table 4.137 The Raytheon Company Order Backlog 2013-2017 (US$m, AGR %)

Table 4.138 Textron Inc. Sales by Segment of Business 2013-2017 ($m)

Table 4.139 Textron Inc., Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 4.140 Textron Inc. Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.141 Textron Inc. Electronic Warfare Products / Services (Segment of Business, Product, Specification)

Table 4.142 Textron Inc. Mergers and Acquisitions 2007-2014 (Date, Company Involved, Value US$m, Details)

Table 4.143 Textron Inc. Divestitures 2008 (Date, Company Involved, Details)

Table 4.144 Textron Inc. Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.145 Hensoldt Profile 2018 (CEO, Total Company Sales US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.146 Selected Recent Hensoldt Electronic Warfare Contracts / Projects / Programmes (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 4.147 Hensoldt Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.148 Hensoldt Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.149 Hensoldt Acquisition 2018 (Date, Company Involved, Value US$m, Details)

Table 4.150 Textron Inc. Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.151 General Dynamics Corporation Profile 2018 (CEO, Total Company Sales US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.152 Selected Recent General Dynamics Corporation Electronic Warfare Contracts / Projects / Programmes 2016 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 4.153 General Dynamics Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.154 General Dynamics Corporation Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 4.155 General Dynamics Corporation Net Income / Loss 2013-2017 (US$m)

Table 4.156 General Dynamics CorporationOrder Backlog 2013-2017 (US$m, AGR %)

Table 4.157 General Dynamics Corporation Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 4.158 General Dynamics Corporation Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.159 General Dynamics Corporation Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.160 General Dynamics Corporation Mergers and Acquisitions 2012-2018 (Date, Company Involved, Value US$m, Details)

Table 4.161 General Dynamics Divestitures 2011-2015 (Date, Company Involved, Details)

Table 4.162 General Dynamics Corporation Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.163 Rockwell Collins, Inc. Profile 2018 (CEO, Total Company Sales US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.164 Selected Recent Rockwell Collins, Inc. Electronic Warfare Contracts / Projects / Programmes 2010-2016 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 4.165 Rockwell Collins, Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.166 Rockwell Collins, Inc. Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 4.167 Rockwell Collins, Inc. Net Income / Loss 2013-2017 (US$m)

Table 4.168 Rockwell Collins, Inc.Order Backlog 2013-2017 (US$m, AGR %)

Table 4.169 Rockwell Collins, Inc. Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 4.170 Rockwell Collins, Inc. Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.171 Rockwell Collins, Inc. Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.172 Rockwell Collins, Inc. Mergers and Acquisitions 2012-2016 (Date, Company Involved, Value US$m, Details)

Table 4.173 Rockwell Collins, Inc. Divestitures 2013-2015 (Date, Company Involved, Details)

Table 4.174 Rockwell Collins, Inc. Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.175 Thales Group Profile 2018 (CEO, Total Company Sales US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.176 Selected Recent Thales Group Electronic Warfare Contracts / Projects / Programmes 2015-2018 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 4.177 Thales Group Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.178 Thales Group Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 4.179 Thales Group Net Income / Loss 2013-2017 (US$m)

Table 4.180 Thales Group Order Backlog 2013-2017 (US$m, AGR %)

Table 4.181 Thales Group Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 4.182 Thales Group Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.183 Thales Group Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.184 Thales Group Mergers and Acquisitions 2012-2014(Date, Company Involved, Value US$m, Details)

Table 4.185 Thales Group Divestitures 2012-2013 (Date, Company Involved, Value US$m, Details)

Table 4.186 Thales Group Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.187 SAAB AB Profile 2018 (CEO, Total Company Sales US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.188 Selected Recent SAAB AB Electronic Warfare Contracts / Projects / Programmes 2011-2017 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 4.189 SAAB AB Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.190 SAAB AB Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 4.191 SAAB AB Net Income / Loss 2013-2017 (US$m)

Table 4.192 SAAB ABOrder Backlog 2013-2017 (US$m, AGR %)

Table 4.193 SAAB AB Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 4.194 SAAB AB Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.195 SAAB AB Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.196 SAAB AB Mergers and Acquisitions 2004-2015 (Date, Company Involved, Details)

Table 4.197 SAAB AB Divestitures 2014 (Date, Company Involved, Value US$m, Details)

Table 4.198 Saab AB Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.199 Teledyne Technologies, Inc. Profile 2018 (CEO, Total Company Sales US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.200 Teledyne Technologies, Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.201 Teledyne Technologies, Inc. Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 4.202 Teledyne Technologies, Inc. Net Income / Loss 2013-2017 (US$m)

Table 4.203 Teledyne Technologies, Inc.Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 4.204 Teledyne Technologies, Inc. Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.205 Teledyne Technologies, Inc. Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.206 Teledyne Technologies, Inc. Mergers and Acquisitions 2012-2017 (Date, Company Involved, Value US$m, Details)

Table 4.207 Teledyne Technologies, Inc.Divestitures 2016 (Date, Company Involved, Details)

Table 4.208 Teledyne Technologies, Inc. Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.209 Israel Aerospace Industries Ltd. Profile 2018 (CEO, Total Company Sales US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.210 Selected Recent Israel Aerospace Industries Ltd. Electronic Warfare Contracts / Projects / Programmes 2013-2017 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 4.211 Israel Aerospace Industries Ltd. Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.212 Israel Aerospace Industries Ltd. Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 4.213 Israel Aerospace Industries Ltd. Net Income / Loss 2013-2017 (US$m)

Table 4.214 Israel Aerospace Industries Ltd.Order Backlog 2013-2017 (US$m, AGR %)

Table 4.215 Israel Aerospace Industries Ltd. Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 4.216 Israel Aerospace Industries Ltd. Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.217 Israel Aerospace Industries Ltd. Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.218 Israel Aerospace Industries Ltd. Mergers and Acquisitions 2012-2016 (Date, Company Involved, Value US$m, Details)

Table 4.219 Israel Aerospace IndustriesLtd. Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.220 Leidos Holdings, Inc. Profile 2018 (CEO, Total Company Sales US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.221 Selected Recent Leidos Holdings, Inc. Electronic Warfare Contracts / Projects / Programmes 2014-2017 (Date, Country / Region, Contractor, Value US$m, Product, Details)

Table 4.222 Leidos Holdings, Inc. Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.223 Leidos Holdings, Inc. Sales by Segment of Business 2013-2017 (US$m, AGR%)

Table 4.224 Leidos Holdings, Inc. Net Income / Loss 2013-2017 (US$m)

Table 4.225 Leidos Holdings, Inc.Order Backlog 2013-2017 (US$m, AGR %)

Table 4.226 Leidos Holdings, Inc.Sales by Regional Segment of Business 2013-2017 (US$m, AGR %)

Table 4.227 Leidos Holdings Inc Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.228 Leidos Holdings, Inc. Electronic Warfare Products / Services (Segment of Business, Product, Specification / Features)

Table 4.229 Leidos Holdings, Inc. Mergers and Acquisitions 2016 (Date, Company Involved, Value US$m, Details)

Table 4.230 Leidos Holdings Inc Divestitures 2013-2015 (Date, Company Involved, Value US$m, Details)

Table 4.231 Leidos Holdings Inc Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.232 Other Notable Companies Involved in the Electronic Warfare Market 2018 (Company, Submarket Involvement)

Table 5.1 Global Electronic Warfare Market PEST Analysis 2018

Boeing Company

Cobham plc

Cohort plc

Elbit Systems Ltd

General Dynamics

Harris Corporation

Hensoldt

IAI

L3 Technologies

Leidos Holdings, Inc.

Leonardo S.P.A

Lockheed Martin

Northrop Grumman

Raytheon

Rockwell Collins

SAAB AB

Teledyne Technologies

Textron Inc.

Thales

Download sample pages

Complete the form below to download your free sample pages for Leading 20 Electronic Warfare Companies 2018

Related reports

-

Military Communications Market Report 2019-2029

The need for a highly interconnected military over air, land and sea for nations to react and take action in...

Full DetailsPublished: 25 March 2019 -

Military Electro-Optical and Infrared (EO/IR) Systems Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Military Electro-Optical Infrared System market. Visiongain...Full DetailsPublished: 22 January 2018 -

Military Simulation, Modelling and Virtual Military Training Market Report 2017-2027

Developments in simulation systems related technology have had a significant impact on the defence military simulation and virtual training market....

Full DetailsPublished: 11 May 2017 -

Military Smart Weapons Market Report 2019-2029

Visiongain expects nations to continue procuring Military Smart Weapons for their arsenals.

...Full DetailsPublished: 19 December 2018 -

Military Embedded Systems Market Forecast 2018-2028

Developments in military embedded systems have had a significant impact on the embedded systems market. This market is estimated by...

Full DetailsPublished: 26 April 2018 -

Military Unmanned Aerial Vehicle (UAV) Market Report 2018-2028

The global Military Unmanned Aerial Vehicle (UAV) market consists of worldwide government spending on the procurement and development of Military...

Full DetailsPublished: 31 August 2018 -

Military Airborne Intelligence, Surveillance & Reconnaissance (ISR) Technologies Market 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Airborne ISR market. Visiongain assesses...Full DetailsPublished: 30 August 2018 -

Military Sensor Fusion Market Forecast 2020-2030

The $263.8 million military sensor fusion is expected to flourish in the next few years because of rising adoption of...

Full DetailsPublished: 14 April 2020 -

Military Sensor Fusion Market Forecast 2019-2029

The $ 204 million military sensor fusion market is expected to flourish in the next few years because of rising...Full DetailsPublished: 26 November 2018 -

Electronic Warfare (EW) Market Report 2019-2029

The recent developments in electronic warfare systems in defence platforms and systems, has led Visiongain to publish this timey report....

Full DetailsPublished: 26 March 2019

Download sample pages

Complete the form below to download your free sample pages for Leading 20 Electronic Warfare Companies 2018

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain defence reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible, Visiongain analysts reach out to market-leading vendors and industry experts and review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain defence reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

ADS Group

Aerial Refueling Systems Advisory Group

Aerospace and Defence Industries Association of Nova Scotia

Aerospace Industries Association

Aerospace Industries Association of Canada

AHS International – The Vertical Flight Technical Society

Air Force Association

Aircraft Electronics Association

Airlift/Tanker Association

American Astronautical Society

American Gear Manufacturers Association

American Institute of Aeronautics and Astronautics

American Logistics Association

American Society of Naval Engineers

AMSUS – The Society of the Federal Health Agencies

Armed Forces Communications and Electronics Association

Armed Forces Communications and Electronics Association

Army Aviation Association of America

ASD – Aerospace & Defence Association of Europe

Association for Unmanned Vehicle Systems International

Association of Aviation Manufacturers of the Czech Republic

Association of Naval Aviation

Association of Old Crows

Association of Polish Aviation Industry

Association of the Defense Industry of the Czech Republic

Association of the United States Army

Association of the United States Navy

Australia Defence Association

Australian Industry & Defence Network

Australian Industry Group Defence Council

Austrian Aeronautics Industries Group

Aviation Distributors and Manufacturers Association

Aviation Suppliers Association

Belgian Security and Defence Industry

Bulgarian Defence Industry Association

Business Executives for National Security

Canadian Association of Defence and Security Industries

Conference of Defense Associations

Council of Defense and Space Industry Associations

Danish Defence & Security Industries Association

Defence Industry Manufacturers Association

Defense Industry Initiative on Business Ethics and Conduct

Defense Industry Offset Association

Defense Orientation Conference Association

Deutsche Gesellschaft fur Wehrtechnik

Federal Association of the German Security and Defence Industry

Federation of Aerospace Enterprises in Ireland

French Aerospace Industries Association

French Land Defence Manufacturers Association (GICAT)

German Aerospace Industries Association

Helicopter Association International

Hellenic Aerospace & Defense Industries Group

Homeland Security & Defense Business Council

International Stability Operations Association

Japan Association of Defense Industry

Korea Defense Industry Association

Marine Corps Association & Foundation

National Aeronautic Association

National Association of Ordnance and Explosive Waste Contractors

National Defense Industrial Association

National Defense Transportation Association

National Guard Association of the U.S.

Navy League of the United States

Netherlands Aerospace Group

New Zealand Defence Industry Association

Portuguese Association of Defense Related Industries & New Technologies Companies

Québec Ground Transportation Cluster

Satellite Industry Association

Society of American Military Engineers

South African Aerospace Maritime and Defence Industries Association

Spanish Aerospace and Defence Association Industries

Submarine Industrial Base Council

Swedish Aerospace Industries

Swedish Security and Defence Industry Association

Swiss Aeronautical Industries Group

The Association of Finnish Defence and Aerospace Industries

The Italian Industries Association for Aerospace Systems and Defence

The Netherlands Defence Manufacturers Association

The Society of Japanese Aerospace Companies

UK AeroSpace, Defence & Security Industries

United Kingdom National Defence Association

Latest Defence news

Visiongain Publishes Directed Energy Weapons (DEW) Market Report 2024-2034

The global Directed Energy Weapons (DEW) market was valued at US$6.4 billion in 2023 and is projected to grow at a CAGR of 19.6% during the forecast period 2024-2034.

26 February 2024

Visiongain Publishes Military Embedded Satellite Systems Market Report 2024-2034

The global Military Embedded Satellite Systems market is projected to grow at a CAGR of 8.7% by 2034

21 February 2024

Visiongain Publishes Military Simulation, Modelling and Virtual Training Market Report 2024-2034

The global military simulation, modelling and virtual training market was valued at US$13.2 billion in 2023 and is projected to grow at a CAGR of 8.3% during the forecast period 2024-2034.

15 February 2024

Visiongain Publishes Military Armoured Vehicle Market Report 2024-2034

The global Military Armoured Vehicle market was valued at US$36,123.6 million in 2023 and is projected to grow at a CAGR of 3.6% during the forecast period 2024-2034.

07 February 2024