Industries > Defence > Leading 20 Chemical, Biological, Radiological & Nuclear (CBRN) Defence Companies 2019

Leading 20 Chemical, Biological, Radiological & Nuclear (CBRN) Defence Companies 2019

Competitive Landscape Analysis of Established Suppliers of Detection, Protection, Decontamination and Simulation & Training Systems

• Do you need Top 20 CBRN Defence Companies market data?

• Succinct Top 20 CBRN Defence Companies market analysis?

• Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive report can transform your own research and save you time.

The global Top 20 CBRN Defence Companies 2019 provides the reader with a thorough overview of the competitive landscape in the

and to identify key growth areas and business opportunities. The report is valuable for anyone who wants to understand the dynamics of CBRN Defence industry and the implementation and adoption of CBRN Defence services. It will be useful for existing players, new entrants and businesses who wish to expand into this sector or explore a new geographical region for market development.

Report highlights

• 258 PAGES! 110 Tables! 93 Figures!

• Analysis of key players in CBRN Defence Companies System

• Thermo Fisher Scientific Inc

• Northrop Grumman

• Leidos Holdings, Inc.

• Rheinmetall Defence

• Scott Safety

• Avon Rubber Plc

• FLIR Systems

• General Dynamics

• Bruker

• Smiths Detection

• Thales Group

• Chemring Group Plc

• Saab

• QinetiQ

• Ecolab Inc ( Parent company of Bioquell Plc.)

• AirBoss of America Corporation

• Environics Oy

• CNIM Group

• Kromtek

• Arktis Radiation Detectors

• Smiths Group

• Textron Inc.

• Thales Group

• Global Top 20 CBRN Defence Companies 2019

• Top 20 Leading companies in the CBRN Defence Companies Market 2019

• Leading companies CBRN Defence business segment analysis

• Leading Companies in the CBRN Defence Companies Market Financial Analysis

• Recent Development in CBRN Defence Companies Market

• Key questions answered

• What does the future hold for the companies in the global CBRN Defence Market?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to success and why?

• What business models should you adopt?

• What industry trends should you be aware of?

• Target audience

• CBRN Defence Solution providers

• Suppliers

• Contractors

• Technologists

• R&D staff

• Consultants

• Analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

• Aerospace and Defense Industry organisation

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1. Report Benefits & Highlights

1.2. CBRN Defence Market Segmentation

1.3. Why You Should Read This Report

1.4. Report Structure

1.5. How This Report Delivers

1.6. Who is This Report for?

1.7. Methodology

1.7.1. Primary Research

1.7.2. Secondary Research

1.7.3. Market Evaluation & Forecasting Methodology

1.8. Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.9. About Visiongain

2. Introduction to the CBRN Defence Market

2.1. CBRN Defence Market Structure

2.2. CBRN Defence Market Definition & Overview

2.3. CBRN Defence Submarkets Definition

2.3.1. CBRN Defence Detection Submarket Definition

2.3.2. CBRN Defence Protection Submarket Definition

2.3.3. CBRN Defence Decontamination Submarket Definition

3. Competitor Positioning in the CBRN Defence Market 2019

3.1. 20 Leading Established Companies in the CBRN Defence Market 2018

3.2. Assessing the CBRN Defence Market Landscape in 2019

4. Leading 20 Established CBRN Defence Companies

4.1. Thermo Fisher Scientific Inc

4.1.1. Thermo Fisher Scientific Inc Analysis

4.1.2. Thermo Fisher Scientific Inc CBRN Defence Selected Recent Contracts & Programmes 2015-2018

4.1.3. Thermo Fisher Scientific Inc Total Company Sales 2014-2018

4.1.4. Thermo Fisher Scientific Inc Sales by Segment of Business Share, 2018

4.1.5. Thermo Fisher Scientific Inc Net Income / Loss 2014-2018

4.1.6. Thermo Fisher Scientific Inc Regional Sales Share, 2018

4.1.7. Thermo Fisher Scientific Inc CBRN Defence Products / Services

4.2. Northrop Grumman Corporation

4.2.1. Northrop Grumman Corporation CBRN Defence Selected Recent Contracts & Programmes 2016-2018

4.2.2. Northrop Grumman Corporation Total Company Sales 2014-2018

4.2.3. Northrop Grumman Corporation Sales by Segment of Business (%), 2018

4.2.4. Northrop Grumman Corporation Regional Emphasis

4.2.5. Northrop Grumman Corporation Organisational Structure / Notable Subsidiaries

4.2.6. Northrop Grumman Corporation Primary Market Competitors 2019

4.2.7. Northrop Grumman Corporation Mergers & Acquisitions (M&A) Activity

4.2.8. Northrop Grumman Corporation Analysis

4.2.9. Northrop Grumman Corporation: Position and Operations in the CBRN Defence Market

4.3. Leidos Holdings, Inc.

4.3.1. Leidos Holdings, Inc. CBRN Defence Selected Recent Contracts & Programmes 2017-2018

4.3.2. Leidos Holdings, Inc. Total Company Sales 2015-2018

4.3.3. Leidos Holdings, Inc. Sales Share by Segment of Business, 2018

4.3.4. Leidos Holdings, Inc. Net Income 2015-2018

4.3.5. Leidos Holdings, Inc. Regional Share, 2018

4.3.6. Leidos Holdings, Inc. CBRN Defence Products / Services

4.3.7. Leidos Holdings, Inc. Analysis

4.4. Rheinmetall AG

4.4.1. Rheinmetall AG CBRN Defence Selected Recent Contracts & Programmes 2015-2018

4.4.2. Rheinmetall AG Total Company Sales 2014-2017

4.4.3. Rheinmetall AG Sales Share by Segment of Business 2017 (%)

4.4.4. Rheinmetall AG Net Income / Loss 2014-2017

4.4.5. Rheinmetall AG Regional Share (%), 2017

4.4.6. Rheinmetall AG CBRN Defence Products / Services

4.4.7. Rheinmetall AG Analysis

4.5. Scott Safety (Subsidiary of 3M)

4.5.1. Scott Safety Global Recent CBRN Related Products and Services

4.5.2. Scott Safety Analysis

4.6. Avon Rubber plc.

4.6.1. Avon Rubber plc. CBRN Defence Selected Recent Contracts & Programmes 2016-2018

4.6.2. Avon Rubber Plc. Total Company Sales 2014-2017

4.6.3. Avon Rubber Plc. Sales by Segment of Business Share, 2018

4.6.4. Avon Rubber Plc. Net Income / Loss 2015-2018

4.6.5. Avon Rubber Plc. Regional Sales Share, 2018

4.6.6. Avon Rubber plc. CBRN Defence Products / Services

4.6.7. Avon Rubber Plc. Analysis

4.7. FLIR Systems Inc.

4.7.1. FLIR Systems Inc. CBRN Defence Selected Recent Contracts & Programmes 2016-2018

4.7.2. FLIR Systems Inc. Total Company Sales & Sales in the Market 2014-2018

4.7.3. FLIR Systems Inc. Sales by Segment of Business Share, 2018 (%)

4.7.4. FLIR Systems Inc. Net Income 2014-2018

4.7.5. FLIR Systems Inc. Regional Emphasis

4.7.6. FLIR Systems Inc. Organisational Structure / Notable Subsidiaries

4.7.7. FLIR Systems Inc. CBRN Defence Products / Services

4.7.8. FLIR Systems Inc Primary Market Competitors 2019

4.7.9. FLIR Systems Inc Mergers & Acquisitions (M&A) Activity

4.7.10. FLIR Systems Inc Analysis

4.7.11. FLIR Systems Inc: Position and Operations in the CBRN Defence Market

4.8. General Dynamics Corporation

4.8.1. General Dynamics Corporation Recent CBRN Defence Related Contracts and Programmes (2017-2018)

4.8.2. General Dynamics Corporation Revenue 2015 - 2018

4.8.3. General Dynamics Corporation Sales Share (%) by Business Segment 2018

4.8.4. General Dynamics Corporation Sales Share by Geography 2018

4.9. Bruker Corporation

4.9.1. Bruker Corporation CBRN Defence Market Selected Recent Contracts / Projects / Programmes 2014-2017

4.9.2. Bruker Corporation Total Company Net Sales 2014-2018

4.9.3. Bruker Corporation Net Income 2014-2018

4.9.4. Bruker Corporation Sales Share by Segment of Business 2018

4.9.5. Bruker Corporation Regional Emphasis / Focus

4.9.6. Bruker Corporation Organisational Structure / Subsidiaries / Number of Employees

4.9.7. Bruker Corporation CBRN Defence Market Products / Services

4.9.8. Bruker Corporation Primary Market Competitors 2019

4.9.9. Bruker Corporation Mergers & Acquisitions (M&A) Activity

4.9.10. Bruker Corporation Overview

4.9.11. Bruker’s Activities in CBRN Defence

4.9.12. A Global Distribution of Facilities

4.9.13. Financial Performance of Bruker Corporation

4.9.14. Bruker Corporation Future Outlook

4.10. Smiths Group Plc

4.10.1. Smiths Group Plc CBRN Defence Selected Recent Contracts & Programmes 2013-2018

4.10.2. Smiths Group Plc Total Company Sales 2014-2018

4.10.3. Smiths Group Plc Sales by Segment of Business, 2018 (%)

4.10.4. Smiths Group Plc Net Income 2014-2018

4.10.5. Smiths Group Plc Regional Emphasis

4.10.6. Smiths Group Plc Organisational Structure / Notable Subsidiaries

4.10.7. Smiths Group Plc CBRN Defence Products / Services

4.10.8. Smiths Group Plc Primary Market Competitors 2019

4.10.9. Smiths Group Plc Mergers & Acquisitions (M&A) Activity

4.10.10. Smiths Group Plc SWOT Analysis 2018

4.10.11. Smiths Group Plc Analysis

4.10.12. Smiths Group: Position and Operations in the CBRN Defence Market

4.11. Thales Group

4.11.1. Thales Group CBRN Defence Selected Recent Contracts & Programmes 2015-2018

4.11.2. Thales Group Total Company Sales 2014-2018

4.11.3. Thales Group Sales by Segment of Business, 2018

4.11.4. Thales Group Net Income / Loss 2014-2018

4.11.5. Thales Group Regional Emphasis

4.11.6. Thales Group Organisational Structure / Notable Subsidiaries

4.11.7. Thales Group CBRN Defence Products / Services

4.11.8. Thales Group Primary Market Competitors 2018

4.11.9. Thales Group Mergers & Acquisitions (M&A) Activity

4.11.10. Thales Group Analysis

4.12. Chemring Group Plc

4.12.1. Chemring Group Plc CBRN Defence Selected Recent Contracts & Programmes 2015-2018

4.12.2. Chemring Group Plc Total Company Sales 2015-2018

4.12.3. Chemring Group Plc Sales Share by Business Segment (%)

4.12.4. Chemring Group Plc Net Income / Loss 2015-2018

4.12.5. Chemring Group Plc Regional Share (%), 2018

4.12.6. Chemring Group Plc CBRN Defence Products / Services

4.12.7. Chemring Group Plc Primary Market Competitors 2019

4.12.8. Chemring Group Plc Mergers & Acquisitions (M&A) Activity

4.12.9. Chemring Group Plc Analysis

4.13. Saab AB

4.13.1. Saab AB CBRN Defence Selected Recent Contracts & Programmes 2012-2018

4.13.2. Saab AB Total Company Sales 2014-2018

4.13.3. Saab AB Sales by Segment of Business, 2018

4.13.4. Saab AB Net Income 2015-2018

4.13.5. Saab AB Regional Emphasis

4.13.6. Saab AB Organisational Structure/Notable Subsidiaries

4.13.7. Saab AB CBRN Defence Products / Services

4.13.8. Saab AB Analysis

4.14. QinetiQ Group Plc

4.14.1. QinetiQ Group Plc Total Company Sales 2014-2018

4.14.2. QinetiQ Group Plc Sales by Segment of Business 2014-2018

4.14.3. QinetiQ Group Plc Net Income 2014-2018

4.14.4. QinetiQ Group Plc Regional Emphasis

4.14.5. QinetiQ Group Plc Organisational Structure / Notable Subsidiaries

4.14.6. QinetiQ Group Plc Primary Market Competitors 2019

4.14.7. QinetiQ Group Plc Mergers & Acquisitions (M&A) Activity

4.14.8. QinetiQ Group Plc Analysis

4.15. Ecolab, Inc. (Parent Company of Bioquell Plc.)

4.15.1. Ecolab, Inc. CBRN Defence Selected Recent Contracts & Programmes 2015-2018

4.15.2. Ecolab, Inc. Total Company Sales 2014-2017

4.15.3. Ecolab, Inc. Sales by Segment of Business Share, 2017

4.15.4. Ecolab, Inc. Net Income / Loss 2014-2017

4.15.5. Ecolab, Inc. Regional Sales Share, 2017

4.15.6. Ecolab, Inc. CBRN Defence Products / Services

4.15.7. Ecolab, Inc. Analysis

4.16. AirBoss of America Corporation

4.16.1. AirBoss of America Corporation CBRN Defence Selected Recent Contracts & Programmes 2010-2018

4.16.2. AirBoss of America Corporation Total Company Sales 2014-2018

4.16.3. AirBoss of America Corporation Sales by Segment of Business Share, 2018

4.16.4. AirBoss of America Corporation Net Income / Loss 2014-2018

4.16.5. AirBoss of America Corporation Regional Sales Share, 2018

4.16.6. AirBoss of America Corporation CBRN Defence Products / Services

4.16.7. AirBoss of America Corporation Analysis

4.17. Environics Oy

4.17.1. Environics Oy Recent CBRN Related Contracts and Programmes (2014-2018)

4.17.2. Environics Oy Global Recent CBRN Related Products and Services

4.17.3. Environics Oy Analysis

4.18. CNIM Group

4.18.1. CNIM Group CBRN Defence Selected Recent Contracts & Programmes 2017-2018

4.18.2. CNIM Group Total Company Sales 2014-2017

4.18.3. CNIM Group Sales by Segment of Business Share, 2017

4.18.4. CNIM Group Net Income / Loss 2014-2017

4.18.5. CNIM Group Regional Sales Share, 2017

4.18.6. CNIM Group CBRN Defence Products / Services

4.18.7. CNIM Group Analysis

4.19. Kromek Group Plc

4.19.1. Kromek Group Plc CBRN Defence Selected Recent Contracts & Programmes 2018-2019

4.19.2. Kromek Group Plc Total Company Sales 2015-2018

4.19.3. Kromek Group Plc Sales by Segment of Business, 2018

4.19.4. Kromek Group Plc Net Income 2015-2018

4.19.5. Kromek Group Plc Regional Share, 2018

4.19.6. Kromek Group Plc CBRN Defence Products / Services

4.19.7. Kromek Group Plc Analysis

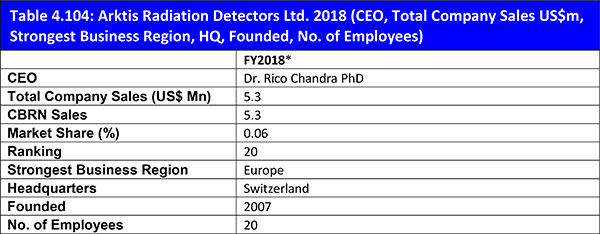

4.20. Arktis Radiation Detectors Ltd.

4.20.1. Arktis Radiation Detectors Ltd. Recent CBRN Related Contracts and Programmes (2015-2018)

4.20.2. Arktis Radiation Detectors Ltd. Global Recent CBRN Related Products and Services

4.20.3. Arktis Radiation Detectors Ltd. Analysis

4.21. Other Notable Companies Involved in the CBRN Defence Market 2019

5. PEST Analysis of the CBRN Defence Market 2019

6. Conclusions and Recommendations

7. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Table

Table 1.1 Sample Company Sales by Geographical Area 2013-2017 (US$m, AGR%)

Table 3.1 Leading 20 CBRN Defence Companies 2018 (Market Ranking, Total Revenue, CBRN Defence Revenue, Market Share %)

Table 4.1 Thermo Fisher Scientific Inc Profile FY2018 (CEO, Total Company Sales US$m, Net Income / Loss US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, Website)

Table 4.2 Selected Recent Thermo Fisher Scientific Inc CBRN Defence Contracts & Programmes 2015-2018 (Date, Country, Value US$m, Product & Details)

Table 4.3 Thermo Fisher Scientific Inc Total Company Sales 2014-2017 (US$m, AGR%)

Table 4.4 Thermo Fisher Scientific Inc Net Income / Loss 2014-2018 (US$m, AGR%)

Table 4.5 Thermo Fisher Scientific Inc CBRN Defence Products / Services (Segment of Business, Product, Specification / Features)

Table 4.6 Northrop Grumman Corporation Profile FY2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.7 Selected Recent Northrop Grumman Corporation CBRN Defence Contracts & Programmes 2016-2018 (Date, Country, Value US$m, Product & Details)

Table 4.8 Northrop Grumman Corporation Total Company Sales 2014-2018 (US$m, AGR%)

Table 4.9 Northrop Grumman Corporation Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.10 Northrop Grumman Corporation Mergers and Acquisitions 2013-2018 (Date, Company Involved, Value US$m, Details)

Table 4.11 Leidos Holdings, Inc. Profile FY2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.12 Selected Recent Leidos Holdings, Inc. CBRN Defence Contracts & Programmes 2017-2018 (Date, Country, Value US$m, Product & Details)

Table 4.13 Leidos Holdings, Inc. Total Company Sales 2015-2018 (US$m, AGR%)

Table 4.14 Leidos Holdings, Inc. Net Income 2015-2018 (US$m, AGR%)

Table 4.15 Leidos Holdings, Inc. CBRN Defence Products / Services (Segment of Business, Product, Specification / Features)

Table 4.16 Rheinmetall AG Profile FY2017 (CEO, Total Company Sales US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Book US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.17 Selected Recent Rheinmetall AG CBRN Defence Contracts & Programmes (Date, Country, Value US$m, Product & Details)

Table 4.18 Rheinmetall AG Total Company Sales 2014-2017 (US$m, AGR%)

Table 4.19 Rheinmetall AG Net Income / Loss 2014-2017 (US$m, AGR%)

Table 4.20 Rheinmetall AG CBRN Defence Products / Services (Segment of Business, Product, Specification / Features)

Table 4.21 Scott Safety 2017 (Total Company Sales US$m, Strongest Business Region, HQ, Founded, No. of Employees 201, Ticker, Website)

Table 4.22:Scott Safety Recent CBRN Defence Related Products and Services

Table 4.23 Avon Rubber plc. Profile FY2018 (CEO, Total Company Sales US$m, Net Income / Loss US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, Website)

Table 4.24 Selected Recent Avon Rubber plc. CBRN Defence Contracts & Programmes 2016-2018 (Date, Country, Value US$m, Product & Details)

Table 4.25 Avon Rubber plc. Total Company Sales 2015-2018 (US$m, AGR%)

Table 4.26 Avon Rubber plc. Net Income / Loss 2015-2018 (US$m, AGR%)

Table 4.27 Avon Rubber plc. CBRN Defence Products / Services (Segment of Business, Product, Specification / Features)

Table 4.28 FLIR Systems Inc. Profile FY2018 (CEO, Total Company Sales US$m, Net Income US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.29 Selected Recent FLIR Systems Inc. CBRN Defence Contracts & Programmes 2009-2018 (Date, Country, Value US$m, Product & Details)

Table 4.30 FLIR Systems Inc. Total Company Sales 2014-2018 (US$m, AGR%)

Table 4.31 FLIR Systems Inc. Net Income 2014-2018 (US$m, AGR%)

Table 4.32 FLIR Systems Inc. Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.33 FLIR Systems Inc. CBRN Defence Products / Services (Segment of Business, Product, Specification / Features)

Table 4.34 FLIR Systems Inc Mergers and Acquisitions, and Partnership 2013-2016 (Date, Company Involved, Value US$m, Details)

Table 4.35: General Dynamics Corporation FY2017 (CEO, Total Company Sales US$m, Strongest Business Region, HQ, Founded, No. of Employees, Ticker, Website)

Table 4.36: General Dynamics Corporation Recent CBRN Defence Related Contracts and Programmes

Table 4.37: Bruker Corporation Profile FY2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.38: Selected Recent Bruker Corporation CBRN Defence Market Contracts / Projects / Programmes 2014-2017 (Date, Country / Region, Product, Details)

Table 4.39 Bruker Corporation Total Company Net Sales 2014-2018 (US$m, AGR %)

Table 4.40 Bruker Corporation Net Income 2014-2018 (US$m, AGR %)

Table 4.41 Bruker Corporation Subsidiaries 2018 (Subsidiary, Location)

Table 4.42: Bruker Corporation CBRN Defence Products / Services (Segment of Business, Product, Specification / Features)

Table 4.43 Bruker Corporation Mergers and Acquisitions 2015 (Date, Company Involved, Value US$m, Details)

Table 4.44 Smiths Group Plc Profile FY2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.45 Selected Recent Smiths Group Plc CBRN Defence Contracts & Programmes 2013-2018 (Date, Country, Value US$m, Product & Details)

Table 4.46 Smiths Group Plc Total Company Sales 2014-2018 (US$m, AGR%)

Table 4.47 Smiths Group Plc Net Income 2014-2018 (US$m, AGR%)

Table 4.48 Smiths Group Plc Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.49 Smiths Group Plc CBRN Defence Products / Services (Segment of Business, Product, Specification / Features)

Table 4.50 Smiths Group Plc Mergers and Acquisitions 2018 (Date, Company Involved, Value US$m, Details)

Table 4.51 Smiths Group Plc Divestitures 2012(Date, Company Involved, Value US$m, Details)

Table 4.52 Smiths Group Plc Strengths, Weaknesses, Opportunities & Threats Analysis 2018

Table 4.53 Thales Group Profile FY2018 (CEO, Total Company Sales US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Book US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.54 Selected Recent Thales Group CBRN Defence Contracts & Programmes 2015-2018 (Date, Country, Value US$m, Product & Details)

Table 4.55 Thales Group Total Company Sales 2014-2018 (US$m, AGR%)

Table 4.56 Thales Group Net Income / Loss 2014-2018 (US$m, AGR%)

Table 4.57 Thales Group Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.58 Thales Group CBRN Defence Products / Services (Segment of Business, Product, Specification / Features)

Table 4.59 Thales Group Mergers and Acquisitions 2012-2014(Date, Company Involved, Value US$m, Details)

Table 4.60 Thales Group Divestitures 2012-2013 (Date, Company Involved, Value US$m, Details)

Table 4.61 Chemring Group Plc Profile FY2018 (CEO, Total Company Sales US$m, Net Income / Loss US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Book US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, Website)

Table 4.62 Selected Recent Chemring Group Plc CBRN Defence Contracts & Programmes 2015-2018 (Date, Country, Value US$m, Product & Details)

Table 4.63 Chemring Group Plc Total Company Sales 2015-2018 (US$m, AGR%)

Table 4.64 Chemring Group Plc Net Income / Loss 2015-2018 (US$m, AGR%)

Table 4.65 Chemring Group Plc CBRN Defence Products / Services (Segment of Business, Product, Specification / Features)

Table 4.66 Chemring Group Plc Mergers and Acquisitions 2012-2014(Date, Company Involved, Value US$m, Details)

Table 4.67 Thales Group Divestitures 2012-2013 (Date, Company Involved, Value US$m, Details)

Table 4.68 Saab AB Profile FY2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.69 Selected Recent Saab AB CBRN Defence Contracts & Programmes 2012-2018 (Activity, Product & Details)

Table 4.70 Saab AB Total Company Sales 2014-2018 (US$m, AGR%)

Table 4.71 Saab AB Net Income 2015-2018 (US$m, AGR%)

Table 4.72 Saab AB Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.73 Saab AB CBRN Defence Products / Services (Segment of Business, Product, Specification / Features)

Table 4.74 QinetiQ Group Plc Profile FY2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Division in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.75 QinetiQ Group Plc Sales by Geographical Location 2017-2018 (US$m, AGR%)

Table 4.76 QinetiQ Group Plc Net Income 2017-2018 (US$m, AGR%)

Table 4.77 QinetiQ Group Plc Sales by Geographical Location 2014-2018 (US$m, AGR%)

Table 4.78 QinetiQ Group Plc Notable Subsidiaries 2018 (Subsidiary, Location)

Table 4.79 QinetiQ Group Plc Mergers and Acquisitions 2014 (Date, Company Involved, Value US$m, Details)

Table 4.80 QinetiQ Group Plc Divestitures 2014-2015 (Date, Company Involved, Value US$m, Details)

Table 4.81 Ecolab, Inc. Profile FY2017 (CEO, Total Company Sales US$m, Net Income / Loss US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, Website)

Table 4.82 Selected Recent Ecolab, Inc. CBRN Defence Contracts & Programmes 2015-2018 (Date, Country, Value US$m, Product & Details)

Table 4.83 Ecolab, Inc. Total Company Sales 2014-2017 (US$m, AGR%)

Table 4.84 Ecolab, Inc. Net Income / Loss 2014-2017 (US$m, AGR%)

Table 4.85 Ecolab, Inc. CBRN Defence Products / Services (Segment of Business, Product, Specification / Features)

Table 4.86 AirBoss of America Corporation Profile FY2018 (CEO, Total Company Sales US$m, Net Income / Loss US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, Website)

Table 4.87 Selected Recent AirBoss of America Corporation CBRN Defence Contracts & Programmes 2010-2018 (Date, Country, Value US$m, Product & Details)

Table 4.88 AirBoss of America Corporation Total Company Sales 2013-2017 (US$m, AGR%)

Table 4.89 AirBoss of America Corporation Net Income / Loss 2015-2018 (US$m, AGR%)

Table 4.90 AirBoss of America Corporation CBRN Defence Products / Services (Segment of Business, Product, Specification / Features)

Table 4.91: Environics Oy Profile FY2017 ( Total Company Sales US$m, Strongest Business Region, HQ, Founded, No. of Employees)

Table 4.92: Environics Oy Recent CBRN Defence Related Contracts and Programmes

Table 4.93: Environics Oy Recent CBRN Defence Related Products and Services

Table 4.94: CNIM Group Profile FY2018 (CEO, Total Company Sales US$m, Net Income / Loss US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, Website)

Table 4.95 Selected Recent CNIM Group CBRN Defence Contracts & Programmes 2017-2018 (Date, Country, Value US$m, Product & Details)

Table 4.96 CNIM Group Total Company Sales 2014-2017 (US$m, AGR%)

Table 4.97: CNIM Group Net Income / Loss 2014-2017 (US$m, AGR%)

Table 4.98 CNIM Group CBRN Defence Products / Services (Segment of Business, Product, Specification / Features)

Table 4.99 Kromek Group Plc Profile FY2018 (CEO, Total Company Sales US$m, Net Income US$m, Net Capital Expenditure US$m, Cost of Research & Development US$m, Order Backlog US$m, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.100 Selected Recent Kromek Group Plc CBRN Defence Contracts & Programmes 2018-2019 (Activity, Product & Details)

Table 4.101 Kromek Group Plc Total Company Sales 2015-2018 (US$m, AGR%)

Table 4.102 Kromek Group Plc Net Income 2015-2018 (US$m, AGR%)

Table 4.103 Kromek Group Plc CBRN Defence Products / Services (Segment of Business, Product, Specification / Features)

Table 4.104: Arktis Radiation Detectors Ltd. 2018 (CEO, Total Company Sales US$m, Strongest Business Region, HQ, Founded, No. of Employees)

Table 4.105: Arktis Radiation Detectors Ltd. Recent CBRN Defence Related Contracts and Programmes

Table 4.106: Arktis Radiation Detectors Ltd. Recent CBRN Defence Related Products and Services

Table 4.107 Other Notable Companies Involved in the CBRN Defence Market 2019

Table 5.1 Global CBRN Defence Market PEST Analysis 2019

List of Figure

Figure 1.1 CBRN Defence Market Segmentation Overview

Figure 1.2 Sample Map of Company Regional Focus 2019

Figure 1.3 Sample Company Sales by Segment of Business 2013-2017 (US$m, AGR%)

Figure 2.1 CBRN Defence Market Segmentation Overview

Figure 2.2 20 Leading Established CBRN Defence Companies 2019

Figure 4.1 Leading CBRN Defence Companies Market Share 2018 (%)

Figure 4.2 Thermo Fisher Scientific Inc Total Company Sales 2014-2018 (US$m, AGR%)

Figure 4.3 Thermo Fisher Scientific Inc Sales by Segment of Business Share, 2018

Figure 4.4 Thermo Fisher Scientific Inc Net Income / Loss 2014-2018 (US$m, AGR%)

Figure 4.5 Thermo Fisher Scientific Inc Regional Sales Share, 2018

Figure 4.6 Northrop Grumman Corporation Total Company Sales 2014-2018 (US$m, AGR%)

Figure 4.7 Northrop Grumman Corporation Sales Share by Segment of Business 2018

Figure 4.8 Northrop Grumman Corporation Primary International Operations 2018

Northrop Grumman Corporation Sales Share by Geographical Location 2018

Figure 4.9 Northrop Grumman Corporation Organisational Structure 2018

Figure 4.10 Northrop Grumman Corporation Primary Market Competitors 2019

Figure 4.11 Leidos Holdings, Inc. Total Company Sales 2015-2018 (US$m, AGR%)

Figure 4.12 Leidos Holdings, Inc. Sales Share by Segment of Business, 2018

Figure 4.13 Leidos Holdings, Inc. Net Income 2015-2018 (US$m, AGR%)

Figure 4.14 Leidos Holdings, Inc. Primary Regional Share, 2018

Figure 4.15 Rheinmetall AG Total Company Sales 2014-2017 (US$m, AGR%)

Figure 4.16 Rheinmetall AG Sales Share by Segment of Business 2017 (%)

Figure 4.17 Rheinmetall AG Net Income / Loss 2014-2017 (US$m, AGR%)

Figure 4.18 Rheinmetall AG Regional Share (%)

Figure 4.19 Avon Rubber plc. Total Company Sales 2014-2017 (US$m, AGR%)

Figure 4.20 Avon Rubber plc. Sales by Segment of Business Share, 2018

Figure 4.21 Avon Rubber plc. Net Income / Loss 2015-2018 (US$m, AGR%)

Figure 4.22 Avon Rubber plc. Regional Sales Share, 2018

Figure 4.23 FLIR Systems Inc. Total Company Sales 2014-2018 (US$m, AGR%)

Figure 4.24 FLIR Systems Inc. Sales by Segment of Business, 2018(%))

Figure 4.25 FLIR Systems Inc. Net Income 2014-2018 (US$m, AGR%)

Figure 4.26 FLIR Systems Inc. Primary International Operations 2018

Figure 4.27 FLIR Systems Inc. Sales by Geographical Location Share (%)

Figure 4.28 FLIR Systems Inc. Organisational Structure 2018

Figure 4.29 FLIR Systems Inc Primary Market Competitors 2019

Figure 4.30 General Dynamics Corporation Revenue (US$ Mn) 2015 - 2018

Figure 4.31 General Dynamics Corporation Revenues Share by Business Segment 2018

Figure 4.32 General Dynamics Corporation Revenue Share by Geography 2018

Figure 4.35 Bruker Corporation Total Company Sales 2014-2018 (US$m, AGR %)

Figure 4.36 Bruker Corporation Net Income 2014-2018 (US$m, AGR %)

Figure 4.37 Bruker Corporation Sales Share by Segment of Business Share 2018 (%)

Figure 4.38 Bruker Corporation Sales by Geographical Location, 2018

Figure 4.39 Bruker Corporation Organisational Structure 2018

Figure 4.40 Bruker Corporation Primary Market Competitors 2019

Figure 4.41 Smiths Group Plc Total Company Sales 2014-2018 (US$m, AGR%)

Figure 4.42 Smiths Group Plc Sales by Segment of Business Share, 2018

Figure 4.43 Smiths Group Plc Net Income 2014-2018 (US$m, AGR%)

Figure 4.44 Smiths Group Plc Primary International Operations 2018

Figure 4.45 Smiths Group Plc Sales by Geographical Location Share, 2018

Figure 4.46 Smiths Group Plc Organisational Structure 2018

Figure 4.47 Smiths Group Plc Primary Market Competitors 2019

Figure 4.48 Thales Group Total Company Sales 2014-2018 (US$m, AGR%)

Figure 4.49 Thales Group Sales by Segment of Business, 2018

Figure 4.50 Thales Group Net Income / Loss 2014-2018 (US$m, AGR%)

Figure 4.51 Thales Group Primary International Operations 2018

Figure 4.52 Thales Group Sales by Geographical Location, 2018 (%)

Figure 4.53 Thales Group Organisational Structure 2018

Figure 4.54 Thales Group Primary Market Competitors 2018

Figure 4.55 Chemring Group Plc Total Company Sales 2015-2018 (US$m, AGR%)

Figure 4.56 Chemring Group Plc Sales Share by Business Segment (%)

Figure 4.57 Chemring Group Plc Net Income / Loss 2015-2018 (US$m, AGR%)

Figure 4.58 Chemring Group Plc Regional Sales Share (%, 2018

Figure 4.59 Chemring Group Plc Primary Market Competitors 2019

Figure 4.60 Saab AB Total Company Sales 2014-2018 (US$m, AGR%)

Figure 4.61 Saab AB Sales by Segment of Business, 2018

Figure 4.62 Saab AB Net Income 2015-2018 (US$m, AGR%)

Figure 4.63 Saab AB Primary International Operations 2018

Figure 4.64 Saab AB Sales by Geographical Location (%), 2018

Figure 4.65 Saab AB Organisational Structure 2018

Figure 4.66 QinetiQ Group Plc Total Company Sales 2014-2018 (US$m, AGR%)

Figure 4.67 QinetiQ Group Plc Sales by Segment of Business 2014-2018 (US$m)

Figure 4.68 QinetiQ Group Plc Net Income 2014-2018 (US$m, AGR%)

Figure 4.69 QinetiQ Group Plc Primary International Operations 2018

Figure 4.70 QinetiQ Group Plc Sales by Geographical Location 2014-2018 (US$m)

Figure 4.71 QinetiQ Group Plc Organisational Structure 2018

Figure 4.72 QinetiQ Group Plc Primary Market Competitors 2019

Figure 4.73 Ecolab, Inc. Total Company Sales 2014-2017 (US$m, AGR%)

Figure 4.74 Ecolab, Inc. Sales by Segment of Business Share, 2017

Figure 4.75 Ecolab, Inc. Net Income / Loss 2014-2017(US$m, AGR%)

Figure 4.76 Ecolab, Inc. Regional Sales Share, 2017

Figure 4.77 AirBoss of America Corporation Total Company Sales 2014-2018 (US$m, AGR%)

Figure 4.78 AirBoss of America Corporation Sales by Segment of Business Share, 2018

Figure 4.79 AirBoss of America Corporation Net Income / Loss 2014-2018 (US$m, AGR%)

Figure 4.80 AirBoss of America Corporation Regional Sales Share, 2018

Figure 4.81 CNIM Group Total Company Sales 2014-2017 (US$m, AGR%)

Figure 4.82 CNIM Group Sales by Segment of Business Share, 2018

Figure 4.83 CNIM Group Net Income / Loss 2014-2017 (US$m, AGR%)

Figure 4.84 CNIM Group Regional Sales Share, 2017

Figure 4.85 Kromek Group Plc Total Company Sales 2015-2018 (US$m, AGR%)

Figure 4.86 Kromek Group Plc Sales by Segment of Business, 2018

Figure 4.87 Kromek Group Plc Net Income 2015-2018 (US$m, AGR%)

Figure 4.88 Kromek Group Plc Primary International Operations Share, 2018

1st Detect Corporation

3d-Radar AS

3M Canada

908 Devices

Achleitner

ADT Corporation

ADT Security Services (Shanghai) Co., Ltd

ADT Security Services do Brasil Ltda

ADT Security Services SA (Argentina)

ADT Security Solutions

Advanced Concept Technologies International

Advanced Scientific (Asi)

Aerius Photonics LLC

Aeryon Labs inc

Affymetrix Inc

Agentase LLC

Agilent Technologies Inc

Ahura Scientific Inc

Air Control Technologies Inc

Air Techniques International Inc

AirBoss Engineered Products Inc

AirBoss Flexible Products Co

AirBoss of America Corporation

AirBoss Rubber Compounding (NC) Inc.

AirBoss-Defense Inc

AirSense Technology Ltd

Alfa Aesar

Allen Vanguard Corporation

Allen Vanguard Counter-Threat Solutions

Alliance Integrated Systems, Inc.

Allied Defense Group, Inc

Alloy Surfaces Company, Inc.

Alluviam, LLC

AMDEX Corporation

AMEC

AMETEK Inc

AMI Software

Analysed Images Ltd

Andair AG

ANP Technologies Inc

Ansell Protective Solutions

Applied Research Associates

AQuate Corporation

Argon Electronics

Arktis

Armourguard Security limited

Artemis Control AG

Asia Enterprises Private Ltd

Astrotech

Asynchrony Solutions Inc

Athena Diagnostics

Atkore International

Atox Bio

Automated Security Limited

Automess GmbH

Avon Engineered Fabrications, Inc

Avon Group Limited UK

Avon Hi-Life, Inc

Avon International Safety Instruments, Inc

Avon Polymer Products Limited

Avon Protection Systems UK Limited

Avon Protection Systems, Inc

Avon Rubber & Plastics, Inc

Avon Rubber Italia S.r.l.

Avon Rubber Overseas Limited

Avon Rubber Plc

Avox Systems Inc

B3 Solutions Inc

Babcock International

Babcock Wanson France

Babcock Wanson Italiana

Babcock Wanson Maroc

Babcock Wanson Russia

Babcock Wanson UK Ltd

Babcock Wanson USA LLC

Bader Sultan & Bros

BAE Systems Plc

Battelle Memorial Institute

BCF Solutions Inc

Beijing Master Systems Engineering

Bentel Security S.r.l.

Bertin Corp (USA)

Bertin Ergonomie

Bertin Expertise and Innovative Processes

Bertin IT

Bertin Pharma SAS

Bertin Services Aerospace

Bertin Systems & Instrumentation

Bertin Technologies SAS

Beth-El Industries

Beth-El Zikhron Yaaqov Industries Ltd

Bharat Electronics Ltd (BEL)

BioFire Defense LLC

Biofire Diagnostics Inc

bioMérieux

Bioquell Asia Pacific Pte Ltd

Bioquell China

Bioquell Defense Inc

Bioquell Holding SAS

Bioquell Hong Kong Ltd

Bioquell Plc

Bioquell Technology (Shenzhen) Ltd

Bioquell UK Ltd

Bioquell, Inc

Block Engineering

Block Mems, LLC

Blücher GmbH

Blücher UK

BMK Consultants

BOIS Filtry Ltd

Booz Allen Hamilton

Bowhead Systems Management LLC

Bruhn NewTech Inc

Bruker Austria GmbH

Bruker AXS GmbH

Bruker Belgium SA/NV

Bruker BioSpin AG

Bruker Biospin GmbH

Bruker BioSpin International AG

Bruker BioSpin Scandinavia AB

Bruker Calid Group

Bruker Corporation

Bruker Daltonics Srl

Bruker Daltonik GmbH

Bruker Elemental GmbH

Bruker Energy & Supercon Technologies Inc

Bruker Italia Srl

Bruker Nano GmbH

Bruker Optik GmbH

Bruker Physik GmbH

Bruker UK

Bruker’s Thermal Analysis,

Building Protection Systems Inc

CACI Technologies Inc

Camber Corporation

Camelbak Products

Camlock Ltd

CAN

Canberra

Carestream Health

CEIA SPA

Celerity Government Solutions LLC

Center for Tribology Inc

CH2M HILL

Charles Stark Draper Laboratory Inc

Chem Image Bio Threat LLC

Chemguard Inc

Chemring Australia Pty ltd

Chemring Countermeasures Ltd

Chemring Defence Germany GmbH

Chemring Defence UK Ltd

Chemring Detection Systems

Chemring Enegertic Devices Inc

Chemring Energetics UK Ltd

Chemring EOD Ltd

Chemring Group Plc

Chemring Marine

Chemring Nobel AS

Chemring Ordnance Inc

Chemring Sensors & Electronic Systems (USA)

Chemring Technology Solutions Ltd (UK)

Chimerix Inc

Cleveland Biolabs Inc

CNIM Azerbaijan Ltd

CNIM Babcock Wanson central Europe

CNIM Bahrain Co WLL

CNIM Canada Inc

CNIM Engineers FZC

CNIM Group

CNIM Hong Kong Ltd

CNIM RUS

CNIM SA

CNIM Saudi

CNIM Singapore

CNIM UK Ltd

Cole-Parmer

Combat Medical Systems LLC

Computer Sciences Corp.

Cortman Textiles Ltd

COSMOS Feuerloeschgeraetebau GmbH

Countervail Corporation

CQC Ltd

Crew Systems Corporation

Cristanini Spa

Cross Match Technologies Inc,

Cryonix, Inc

CSS Dynamac

CTE - CNIM Transport Equipment

Cubic Applications Inc.

CUBRC Inc.

Culmen International LLC

CureVac GmbH

Dass Hitachi

Data Systems Analysts Inc

Davis-Paige Management Systems LLC

Defense Group Inc

Defentect Group Inc

Deloitte LLP

DEW Engineering & Development ULC

DHS Systems LLC

DigitalOptics Corporation’s Micro-Optics

Dionex Corporation

DJI Innovations

Doe & Ingalls

Domain X Technologies LLC

Doosan

Dovel Technologies

Dräger Safety AG & Co KGaA

Drew Marine Germany GmbH

DRS Technologies Inc

D-tect-Systems

DuPont Industrial Biosciences

DVTEL

Dycor Technologies Ltd

Dynamac Corporation

Dynasil Corporation

EADS North America (Airbus Group)

EBCO Systems Ltd

ECA Robotics

ECS Federal Inc

Elite KL Ltd

Ellipse Pharmaceuticals

Elusys Therapeutics Inc

Em.tronic

Emergent BioSolutions Inc

ENESCO Inc

Engility Corporation

Engility Holdings Inc

Environics OY

ERP International LLC

Esterline Corp

European Munitions Businesses

EVERTEC Inc

Evolva SA

Exacq Technologies

EXCET Inc

Extech Instruments Corporation

Federal Resources Supply Company

Field Forensics Inc

FINEP

Finmeccanica) (now Leonardo)

Fire Products GP Holding, LLC

Fire Safety International Ltd

First Line Technology LLC

Fisher BioSciences Japan, KK

Fisher Scientific GmbH

Fisher Scientific International Inc

Flexible Products Co.

Flexible Technologies, Inc

FLIR Advanced Imaging Systems Inc

FLIR Commercial Systems, Inc

FLIR Government Systems Inc

FLIR Systems Aviation LLC

FLIR Systems CV

FLIR Systems Inc.

FLIR Systems Ltd

FLIR Systems Middle East FZE

FNSS Savuma Sistemleri A.S.

Focus Diagnostics Inc

Folded Structures Company LLC

Force 1 Decon

Francisco Partners

Frazer-Nash Consultancy Ltd

FSI Holdings Inc

FSI North America

FWW -Fahrzeugwerk GmbH

GAM Laser Inc

GE Healthcare

General Dynamics

General Dynamics Armament and Technical Products

General Dynamics Corporation

General Dynamics Information Technology

General Dynamics Land Systems

General Dynamics UK

General Electric Company

General Electric Corporation

General Physics Corporation

Genesis Concepts & Consultants LLC

GenPrime Inc

Gentex Corporation

Goldbelt Raven

Griffin Analytical Technologies LLC

Gryphon Scientific

Gumárny Zubrí Inc

Hamilton Associates Inc

Hamilton Sundstrand Corporation (now UTC Aerospace Systems)

Hawaii Biotech Inc

Hazmat Protective Systems

HazmatLINK Ltd

HDT Global

Helmet Integrated Systems Ltd.

Helmut Geissler Glasinstrumente GmbH

Hinduja Group

Hispano Vema

Hotzone Solutions Group

Hotzone Solutions Technologies

Hudstar Systems Inc.

Hypertronics Corporation

ICx Technologies Inc

Idaho Technologies Inc

IIlumina Inc

ILC Dover LP

Immediate Response Technologies LLC

InBios International Inc

Indesys Equipments (I) Pvt. Ltd

Indra Sistemas SA

Industrial Safety Technologies

INFICON

Inovio Pharmaceuticals Inc

IntegenX Inc

Integral Molecular Inc

Intelagard Inc

Intercon Security Ltd

Interconnect Devices, Inc.

InterPuls S.p.A.

Inven

IQuum Inc

iRobot Corporation

ISG/InfraSYS

ITOCHU Corporation

J&S Franklin Ltd

James Fisher Nuclear Limited

JC Production Solutions, Inc.

John Crane Inc

John Crane Italia SpA

John Crane Middle East FZE

John Crane UK Limited

Johnson Matthey

Joint Research and Development Inc

Jordan Valley Semiconductors Ltd

JSC Thermo Electron

Kaketsuken

Kalman and Company Inc

Kärcher Futuretech GmbH

Kendro Laboratory Products (H.K.) Limited

Kentucky Bioprocessing

KeTech Group

KIA Motors

Kilgore Flares Company LLC

Kinetics

Kiple Acquisition Science Technology Logistics Engineering

Komatsu

Krauss Maffei-Wegmann

Kurganmashzavod

LAB GbmH

LAB SA

Labinstruments Oy F

Laboratory Management Systems, Inc.

Lancaster Labs

Leidos Group

Leidos Inc.

Life Technologies Corporation

Limco Airepair Inc

Lion Apparel

Lockheed Martin Corporation

Loew Brant Pte Ltd

Lorex Technology Inc

Luminex Corporation

Lunor

Lutra Associates Limited

MacAulay-Brown Inc

Macron Safety Systems (UK) Limited

Magnox

Mapp Biopharmaceuticals

Markon Solutions

MARSS

Martin GmbH

Mavatech

Mecar SPRL

Mecar USA Inc

Menssana Research Inc

Meridian Medical Technologies Inc

MES Environmental Ltd

Michrom Bioresources Inc,

Micronel AG

Millennium Corporation

Mine Safety Appliances Company

Mirion Technologies

MJL Enterprises LLC

MLT Systems

MMIC EOD Ltd

Morphix Technologies

Morphotek Inc

Mountain Horse LLC

MRIGlobal

NanoGriptech

Nanotherapeutics Inc

NBC Sys

Netzsch Japan K.K

Nexagen, Nobilis

NEXTER Group

Nexter Systems SA

Nomadics Inc

Non-Intrusive Inspection Technology Inc

Nor E First Response Inc

Northrop Grumman Corporation

Northrop Grumman Security Systems LLC

Northrop Grumman Systems Corporation

OMP Engineering

One Lambda Inc

Open Source Robotics Foundation Inc

OptiMetrics Inc

Orono Spectral Solutions Inc.

ORTEC

Otokar

OUTFOX

OUVRY

OWR GmbH

Pall Corporation

Panakeia LLC

Paragon Bioservices Inc

Passport Systems Inc

Patlon Aircraft & Industries Limited

Patricio Enterprises Inc

Paul Boyé Technologies SA

Pentair Ltd

Phadia Group

PharmAthene Inc

Philips Respironics

Physical Sciences Inc

Pimco

Pine Bluff Arsenal

Ploughshare Innovations Ltd

Pose Marré

Positive ID Corporation

Power Distribution, Inc

Power Holdings Inc

Prairie Technologies Inc,

Princeton Security Technologies, Inc

Proengin SA

Proytecsa Security

Quanterion Solutions Inc

Quanterix Corporation

Radiation Decontamination Solutions LLC

Radiation Monitoring Devices Inc

Radiation Shield Technologies

RAE Systems Inc

Rapid Pathogen Screening Inc

Rapiscan

Raymarine Holdings Limited

Raymarine Plc

Raytheon Company

Remel Inc.

Remploy Frontline Ltd

Research International Inc

Respirator ZRT

Respirex International

Rheinmetall AG

Rheinmetall Landsysteme GmbH

Rheinmetall MAN Military Vehicles

Rhenovia Pharma

Rhombus Power Inc

RI Research Instruments GmbH

Rigaku Analytical Devices

Roboti LLC

Roke Manor Research Ltd

Rosatom

Rotem

RSDecon

Saab AB

Safran SA

SAGEM

Saint-Gobain Performance Plastics

Saphymo GmbH

Saphymo Italia

Saphymo SAS

Schafer Corporation

Science And Engineering Services Inc

Science Applications International Corporation (SAIC) (now Leidos)

Scientific Materials Corporation

Scott Health & Safety Limited

Scott Technologies Health & Safety Oy

Scott Technologies, Inc

SecureBio Ltd

Senetek Global

Sensor Technology Engineering Inc

Sensormatic Canada Incorporated

Sensormatic European Distribution Limited

Sensormatic International, Inc.

Sentry Response (Pty) Ltd

Shalon Chemical Industries Ltd

Shanghai Eagle Safety Equipment Ltd

ShopperTrack

Signature Security Group Pty Limited

Simmel

SimplexGrinnel

Simtech

SkyScan N.V.

Smiths Detection – Watford Ltd

Smiths Detection (Asia-Pacific) Pte Ltd

Smiths Detection, Inc

Smiths Group Plc

Smiths Heimann GmbH

Smiths Heimann SAS

Smiths Interconnect

Smiths Medical ASD, Inc

Smiths Medical Deutschland GmbH

Smiths Medical France SA

Smiths Medical International Limited

Smiths Medical Japan Limited

Sogem

Southern Scientific Limited

Spectrum Photonics Inc.

Spi-Bio

SRC, Inc

Staplex

Sterilin

Steris Corporation

Strategic Technology Enterprise Inc

Strategy and Management Services Inc

Supergum Ltd

SwissAnalytic Group AG

Syneren Technologies Corporation

TASC Inc

Tauri Group

Technical Associates

Tecolote Research Inc

Temet Group

Tennessee Apparel Corporation

Tetraphase Pharmaceuticals

Texas A&M

Textron Systems Corporation

Thales Group

Thales Naval

Thales USA Defense and Security

Thermedics Detection de Argentina S.A.

Thermo BioAnalysis LLC

Thermo CRS Holdings Ltd.

Thermo Detection de Mexico, S.A. de C.V.

Thermo Detection Limited

Thermo Electron Australia Pty Limited

Thermo Electron Holdings SAS

Thermo Electron LLS India Private Limited

Thermo Electron Scientific Instruments LLC

Thermo Fisher (Gibraltar) Limited

Thermo Fisher GP LLC

Thermo Fisher Scientific C.V.

Thermo Fisher Scientific Inc

Thermo Fisher Scientific Oy

Titeflex Corporation

TNO Defence and Security

TRaC Global Limited

Tracerco

Traficon International NV

Transtector Systems, Inc.

TREK Diagnostic Systems

TSI Inc

Tunnell Consulting Inc

Turbo Components and Engineering Inc

Tutco, Inc.

Tyco Australia Pty Limited

Tyco Europe SAS

Tyco Fire & Integrated Solutions

Tyco Fire & Security (Beijing) Co., Ltd

Tyco Fire & Security Equipamentos Ltda

Tyco Fire & Security Holding Germany GmbH

Tyco Fire & Security India Private Limited

Tyco Fire & Security Services Korea Co. Ltd

Tyco Fire & Security LLC (UAE)

Tyco Fire Integrated Services Korea Co., Ltd

Tyco Fire, Security & Services Pte. Ltd.

Scott Safety de Mexico, S. de R.L. de C.V.

Scott Safety Plc

Tyco New Zealand Limited

Tyco Safety Products (India) Private Limited

Tyco Safety Products (Shanghai) Co., Ltd.

Tyco Safety Products Canada Ltd.

Tyco Safety Products France SARL

Universal Consulting Services Inc

Universal Detection Technology

Universal Solutions International Inc

UTC Aerospace Systems

Utilis Iberica

Vaxin Inc

Vecsys SA

Veeco Instruments Inc

Vélizy

Verbalys SA

VersoVentures

Veteran Corps of America

Visonic Ltd

Visonic Sicherheitstechnik GmbH

Download sample pages

Complete the form below to download your free sample pages for Leading 20 Chemical, Biological, Radiological & Nuclear (CBRN) Defence Companies 2019

Related reports

-

Border Security Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global border security market. Visiongain assesses that...

Full DetailsPublished: 29 May 2018 -

Critical Infrastructure Protection (CIP) Market Report 2018-2028

Our 304 page report provides 198 tables, charts, and graphs. Read on to discover the most lucrative areas in the...

Full DetailsPublished: 28 June 2018 -

Top 100 Border Security Companies to Watch in 2019

Do you need analysis of the leading 100 border security companies?...Full DetailsPublished: 26 November 2018 -

Chemical, Biological, Radiological & Nuclear (CBRN) Defence Market Report 2019-2029

The CBRN defence market set to grow to $15,193mn by 2029.

...Full DetailsPublished: 19 December 2018 -

Governmental Geospatial Intelligence (GEOINT) Solutions Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Governmental Geospatial Intelligence (GEOINT) Solutions market....

Full DetailsPublished: 31 July 2018

Download sample pages

Complete the form below to download your free sample pages for Leading 20 Chemical, Biological, Radiological & Nuclear (CBRN) Defence Companies 2019

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain defence reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible, Visiongain analysts reach out to market-leading vendors and industry experts and review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology, please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain defence reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

ADS Group

Aerial Refueling Systems Advisory Group

Aerospace and Defence Industries Association of Nova Scotia

Aerospace Industries Association

Aerospace Industries Association of Canada

AHS International – The Vertical Flight Technical Society

Air Force Association

Aircraft Electronics Association

Airlift/Tanker Association

American Astronautical Society

American Gear Manufacturers Association

American Institute of Aeronautics and Astronautics

American Logistics Association

American Society of Naval Engineers

AMSUS – The Society of the Federal Health Agencies

Armed Forces Communications and Electronics Association

Armed Forces Communications and Electronics Association

Army Aviation Association of America

ASD – Aerospace & Defence Association of Europe

Association for Unmanned Vehicle Systems International

Association of Aviation Manufacturers of the Czech Republic

Association of Naval Aviation

Association of Old Crows

Association of Polish Aviation Industry

Association of the Defense Industry of the Czech Republic

Association of the United States Army

Association of the United States Navy

Australia Defence Association

Australian Industry & Defence Network

Australian Industry Group Defence Council

Austrian Aeronautics Industries Group

Aviation Distributors and Manufacturers Association

Aviation Suppliers Association

Belgian Security and Defence Industry

Bulgarian Defence Industry Association

Business Executives for National Security

Canadian Association of Defence and Security Industries

Conference of Defense Associations

Council of Defense and Space Industry Associations

Danish Defence & Security Industries Association

Defence Industry Manufacturers Association

Defense Industry Initiative on Business Ethics and Conduct

Defense Industry Offset Association

Defense Orientation Conference Association

Deutsche Gesellschaft fur Wehrtechnik

Federal Association of the German Security and Defence Industry

Federation of Aerospace Enterprises in Ireland

French Aerospace Industries Association

French Land Defence Manufacturers Association (GICAT)

German Aerospace Industries Association

Helicopter Association International

Hellenic Aerospace & Defense Industries Group

Homeland Security & Defense Business Council

International Stability Operations Association

Japan Association of Defense Industry

Korea Defense Industry Association

Marine Corps Association & Foundation

National Aeronautic Association

National Association of Ordnance and Explosive Waste Contractors

National Defense Industrial Association

National Defense Transportation Association

National Guard Association of the U.S.

Navy League of the United States

Netherlands Aerospace Group

New Zealand Defence Industry Association

Portuguese Association of Defense Related Industries & New Technologies Companies

Québec Ground Transportation Cluster

Satellite Industry Association

Society of American Military Engineers

South African Aerospace Maritime and Defence Industries Association

Spanish Aerospace and Defence Association Industries

Submarine Industrial Base Council

Swedish Aerospace Industries

Swedish Security and Defence Industry Association

Swiss Aeronautical Industries Group

The Association of Finnish Defence and Aerospace Industries

The Italian Industries Association for Aerospace Systems and Defence

The Netherlands Defence Manufacturers Association

The Society of Japanese Aerospace Companies

UK AeroSpace, Defence & Security Industries

United Kingdom National Defence Association

Latest Defence news

Visiongain Publishes Directed Energy Weapons (DEW) Market Report 2024-2034

The global Directed Energy Weapons (DEW) market was valued at US$6.4 billion in 2023 and is projected to grow at a CAGR of 19.6% during the forecast period 2024-2034.

26 February 2024

Visiongain Publishes Military Embedded Satellite Systems Market Report 2024-2034

The global Military Embedded Satellite Systems market is projected to grow at a CAGR of 8.7% by 2034

21 February 2024

Visiongain Publishes Military Simulation, Modelling and Virtual Training Market Report 2024-2034

The global military simulation, modelling and virtual training market was valued at US$13.2 billion in 2023 and is projected to grow at a CAGR of 8.3% during the forecast period 2024-2034.

15 February 2024

Visiongain Publishes Military Armoured Vehicle Market Report 2024-2034

The global Military Armoured Vehicle market was valued at US$36,123.6 million in 2023 and is projected to grow at a CAGR of 3.6% during the forecast period 2024-2034.

07 February 2024