Industries > Defence > Military Aircraft Maintenance, Repair & Overhaul (MRO) Market Report 2019-2029

Military Aircraft Maintenance, Repair & Overhaul (MRO) Market Report 2019-2029

Forecasts by Segments (Operational & Field Maintenance, Heavy Engine Maintenance, Heavy Airframe Maintenance, Components). Forecasts by Country with Details of Fleet Structure (Combat, Tanker, Special Mission, Transport, Training) Plus Analysis of Top Companies

Maintenance, Repair and Overhaul capabilities are a key part of the defence sector and play an especially crucial role for military aircraft. This is due to the constant need for a capable and operational military aircraft, part of any robust military force. As a result, the market outlook for this area of the defence sector is positive. Visiongain assesses the market to be valued at $35.7bn in 2019 and with continued advancement and sustained market demand, Visiongain predicts growth for the global military MRO market.

5 Reasons why you must order and read this report today:

1) The report provides detailed profiles of 20 leading companies operating within the military aircraft MRO market

– Airbus Group

– Leonardo

– AMMROC

– BAE Systems PLC

– Boeing Defense, Space and Security

– Dassault Aviation

– DynCorp International

– Embraer S.A

– GE Aviation

– Hindustan Aeronautics Limited (HAL)

– Honeywell Aerospace

– L-3 Communications

– Lockheed Martin Corporation

– Northrop Grumman Corporation

– Pratt & Whitney

– Rolls Royce Defence Aerospace

– RUAG Aviation

– Safran SA

– ST Aerospace

– United Aircraft Corporation

2) Global Military Aircraft MRO Market Forecast 2019-2029

3) The 20 Leading national military aircraft MRO markets are forecast and analysed in full detail for the forecast period, including

North America

– US Military Aircraft MRO Market Forecast 2019-2029

– Canada Military Aircraft MRO Market Forecast 2019-2029

Asia Pacific

– China Military Aircraft MRO Market Forecast 2019-2029

– India Military Aircraft MRO Market Forecast 2019-2029

– Japan Military Aircraft MRO Market Forecast 2019-2029

– Pakistan Military Aircraft MRO Market Forecast 2019-2029

– South Korea Military Aircraft MRO Market Forecast 2019-2029

– Taiwan Military Aircraft MRO Market Forecast 2019-2029

– Singapore Military Aircraft MRO Market Forecast 2019-2029

– Australia Military Aircraft MRO Market Forecast 2019-2029

Europe

– UK Military Aircraft MRO Market Forecast 2019-2029

– France Military Aircraft MRO Market Forecast 2019-2029

– Italy Military Aircraft MRO Market Forecast 2019-2029

– Germany Military Aircraft MRO Market Forecast 2019-2029

– Spain Military Aircraft MRO Market Forecast 2019-2029

– Russia Military Aircraft MRO Market Forecast 2019-2029

Middle East & Africa

– Saudi Arabia Military Aircraft MRO Market Forecast 2019-2029

– UAE Military Aircraft MRO Market Forecast 2019-2029

– Israel Military Aircraft MRO Market Forecast 2019-2029

– Turkey Military Aircraft MRO Market Forecast 2019-2029

Rest of the World

– Rest of the World Military Aircraft MRO Market Forecast 2019-2029

4) Our study also shows which submarkets will grow at the fastest rates over the period 2019-2029

– Operational And Field Maintenance Market Forecast 2019-2029

– Heavy Airframe Maintenance Market Forecast 2019-2029

– Heavy Engine Maintenance Market Forecast 2019-2029

– Components Maintenance Market Forecast 2019-2029

5) Details of over 480 military aircraft MRO contracts

Target readership

• Defence and aerospace OEMs

• Prime defence contractors

• Component suppliers

• Avionics manufacturers

• Aircraft maintenance companies

• Defence industry research organisations

• Defence and aerospace marketing teams

• Business analysis departments

• Venture capitalists

• Investment analysts

• Consultancies

• Defence and aerospace industry investors

• Technology investors/hedge funds

• Defence industry regulators and other policy deciders

• Government agencies

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1.1 Global Military Aircraft Maintenance, Repair & Overhaul (MRO) Market Overview

1.2 Global Military Aircraft Maintenance, Repair & Overhaul (MRO) Market Segmentation

1.3 Why You Should Read This Report

1.4 How This Report Deliver

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Primary Research

1.7.2 Secondary Research

1.7.3 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Military Aircraft Maintenance, Repair & Overhaul (MRO) Market

2.1 Military Aircraft Maintenance, Repair & Overhaul (MRO) Market Structure

2.1.1 Military Aircraft Maintenance, Repair & Overhaul (MRO) Definition

2.2 Introduction to the Military Aircraft Maintenance, Repair & Overhaul (MRO) Market

2.2.1 Overview of the Global Military Maintenance, Repair and Overhaul (MRO) Market

2.3 Issues and Developments in the Military Aircraft MRO Market

2.3.1 Funding Commitments

2.3.2 Evolving Forms of Performance-based MRO Contracts

2.3.3 Oil and Fuel Price Rises

2.3.4 New Procedures and Technologies for Generating Extra Efficiencies in MRO Processes

2.3.5 Capacity

3. Global Military Aircraft Maintenance, Repair & Overhaul (MRO) Market 2019-2029

3.1 Global Military Aircraft MRO Market Forecast 2019-2029

3.2 Fastest Growing Military Aircraft MRO National Markets 2019-2029

3.3 Global Military Aircraft Maintenance, Repair & Overhaul Market Drivers & Restraints 2019

3.3.1 Global Military Aircraft Maintenance, Repair & Overhaul (MRO) Market 2019-2029 Analysis

4. Military Aircraft Maintenance, Repair & Overhaul Submarkets Forecast 2019-2029

4.1 Maintenance, Repair & Overhaul (MRO) Submarkets 2019-2029

4.1.1 Maintenance, Repair & Overhaul (MRO) Submarkets 2019-2029

4.1.2 Maintenance, Repair & Overhaul (MRO) Submarket Drivers 2019-2029

4.1.3 Fastest Growing Global Military Aircraft Maintenance, Repair & Overhaul (MRO) Submarkets 2019-2029

4.1.4 Fastest Growing Global Military Aircraft Maintenance, Repair & Overhaul (MRO) Submarkets 2019-2024

4.1.5 Fastest Growing Global Military Aircraft Maintenance, Repair & Overhaul (MRO) Submarkets 2024-29

4.1.6 Global Military Aircraft Maintenance, Repair and Overhaul (MRO) Submarkets Cumulative Sales

4.2 Global Military Aircraft MRO Market Operational and Field Maintenance Submarket Forecast 2019-2029

4.2.1 Operational and Field Maintenance Submarket Forecast 2019-2029

4.2.2 Operational and Field Maintenance Submarket Drivers and Restraints

4.2.3 How Will the Operational and Field Maintenance Submarket Analysis

4.3 Global Military Aircraft MRO Market Heavy Airframe Maintenance Submarket

4.3.1 Heavy Airframe Maintenance Submarket Forecast 2019-2029

4.3.2 Heavy Airframe Maintenance Submarket Drivers and Restraints

4.3.3 Heavy Airframe Maintenance Submarket Analysis

4.4 Global Military Aircraft MRO Market Heavy Engine Submarket

4.4.1 Heavy Engine Maintenance Submarket Forecast 2019-2029

4.4.2 Heavy Airframe Maintenance Submarket Drivers and Restraints

4.4.3 Heavy Engine Maintenance, Repair And Overhaul Submarket Analysis

4.5 Global Military Aircraft MRO Market Internal Components Submarket

4.5.1 Components Submarket Forecast 2019-2029

4.5.2 Internal Components Maintenance Submarket Drivers and Restraints

4.5.3 Military Aircraft Component Submarket Analysis

5. Leading National Military Aircraft Maintenance, Repair & Overhaul (MRO) Market Forecasts 2019-2029

5.1 Leading 15 National Military Aircraft Maintenance, Repair and Overhaul (MRO) Markets Share Forecast 2019-2029

5.2 Barriers to Entry Analysis of the 2019 Military Aircraft Maintenance, Repair & Overhaul (MRO) Market

5.3 Analysis of the Leading National Military Aircraft Maintenance Repair & Overhaul (MRO) Market Forecasts

5.4 Fastest Growing Leading National Military Aircraft Maintenance, Repair & Overhaul (MRO) Markets 2019-2029

5.5 Fastest Growing Leading National Military Aircraft Maintenance, Repair & Overhaul (MRO) Markets 2019-2024

5.6 Fastest Growing Leading National Military Aircraft Maintenance, Repair & Overhaul (MRO) Markets 2024-29

5.7 Leading National Military Aircraft Maintenance, Repair & Overhaul (MRO) Markets Cumulative Sales 2019-2029

5.8 United States Military Aircraft Maintenance, Repair & Overhaul (MRO) Market 2019-2029

5.8.1 US Military Aircraft Fleet Structure 2019

5.8.2 US Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.8.3 US Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Contracts & Programmes

5.8.4 US Military Aircraft MRO Market Analysis

5.9 Russian Military Aircraft Maintenance, Repair & Overhaul (MRO) Market 2019-2029

5.9.1 Russian Military Aircraft Fleet Structure 2019

5.9.2 Russian Military Aircraft Maintenance, Repair and Overhaul Market Drivers and Restraints

5.9.3 Russian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Contracts & Programmes

5.9.4 Russian Military Aircraft MRO Market Analysis

5.10 Chinese Military Aircraft Maintenance, Repair & Overhaul (MRO) Market 2019-2029

5.10.1 Chinese Military Aircraft Fleet Structure 2019

5.10.2 Chinese Military Maintenance, Repair and Overhaul Market Drivers & Restraints

5.10.3 Chinese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Contracts & Programmes

5.10.4 China’s Military Aircraft MRO Market Analysis

5.11 Indian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

5.11.1 Indian Military Aircraft Fleet Structure 2019

5.11.2 Indian Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.11.3 Indian Military Aircraft Maintenance, Repair and Overhaul (MRO)Market Contracts & Programmes

5.11.4 India’s Military Aircraft MRO Market Analysis

5.12 Japanese Military Aircraft Maintenance, Repair & Overhaul (MRO) Market 2019-2029

5.12.1 Japanese Military Aircraft Fleet Structure 2019

5.12.2 Japanese Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.12.3 Japanese Military Aircraft Maintenance, Repair & Overhaul (MRO) Contracts & Programmes

5.12.4 Japanese Military Aircraft MRO Market Analysis

5.13 UK Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

5.13.1 UK Military Aircraft Fleet Structure 2019

5.13.2 UK Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.13.3 UK Military Aircraft Maintenance, Repair & Overhaul (MRO) Contracts & Programmes

5.13.4 UK Military Aircraft MRO Market Analysis

5.14 Israeli Military Aircraft Maintenance, Repair & Overhaul (MRO) Market 2019-2029

5.14.1 Israeli Military Aircraft Fleet Structure 2019

5.14.2 Israeli Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.14.3 Israeli Military Aircraft Maintenance, Repair and Overhaul (MRO) Contracts & Programmes

5.14.4 Israeli Military Aircraft MRO Market Analysis

5.15 French Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

5.15.1 French Military Aircraft Fleet Structure 2019

5.15.2 French Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.15.3 French Military Aircraft Maintenance, Repair & Overhaul (MRO) Contracts & Programmes

5.15.4 France’s Military Aircraft MRO Market Analysis

5.16 Saudi Arabian Military Aircraft Maintenance, Repair & Overhaul (MRO) Market 2019-2029

5.16.1 Saudi Arabian Military Aircraft Fleet Structure 2019

5.16.2 Saudi Arabian Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.16.3 Saudi Arabian Military Aircraft Maintenance, Repair and Overhaul (MRO) Contracts & Programmes

5.16.4 Saudi Arabian Military Aircraft MRO Market Analysis

5.17 Pakistani Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

5.17.1 Pakistani Military Aircraft Fleet Structure 2019

5.17.2 Pakistani Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.17.3 Pakistani Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Contracts & Programmes

5.17.4 Pakistani Military Aircraft MRO Market Analysis

5.18 South Korean Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

5.18.1 South Korean Military Aircraft Fleet Structure 2019

5.18.2 South Korean Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.18.3 South Korean Military Aircraft Maintenance, Repair and Overhaul (MRO) Contracts & Programmes

5.18.4 South Korean Military Aircraft MRO Market Analysis

5.19 Turkish Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

5.19.1 Turkish Military Aircraft Fleet Structure 2019

5.19.2 Turkish Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.19.3 Turkish Military Aircraft Maintenance, Repair and Overhaul (MRO) Contracts & Programmes

5.19.4 Turkish Military Aircraft MRO Market Analysis

5.20 Italian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

5.20.1 Italian Military Aircraft Fleet Structure 2019

5.20.2 Italian Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.20.3 Italian Military Aircraft Maintenance, Repair and Overhaul (MRO) Contracts & Programmes

5.20.4 Italy’s Military Aircraft MRO Market Analysis

5.21 German Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

5.21.1 German Military Aircraft Fleet Structure 2019

5.21.2 German Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.21.3 German Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Contracts & Programmes

5.21.4 German Military Aircraft MRO Market Analysis

5.22 Spanish Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

5.22.1 Spanish Military Aircraft Fleet Structure 2019

5.22.2 Spanish Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.22.3 Spanish Military Aircraft Maintenance, Repair and Overhaul Market Contracts & Programmes

5.22.4 Spanish Military Aircraft MRO Market Analysis

5.23 Taiwanese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

5.23.1 Taiwanese Military Aircraft Fleet Structure 2019

5.23.2 Taiwanese Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.23.3 Taiwanese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Contracts & Programmes

5.23.4 Taiwanese Military Aircraft MRO Market Analysis

5.24 Canadian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

5.24.1 Canadian Military Aircraft Fleet Structure 2019

5.24.2 Canadian Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.24.3 Canadian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Contracts & Programmes

5.24.4 Canadian Military Aircraft MRO Market Analysis

5.25 Australian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

5.25.1 Australian Military Aircraft Fleet Structure 2019

5.25.2 Australian Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

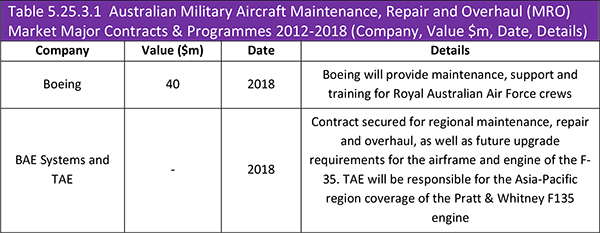

5.25.3 Australian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Contracts & Programmes

5.25.4 Australia’s Military Aircraft MRO Analysis

5.26 UAE Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

5.26.1 UAE Military Aircraft Fleet Structure 2019

5.26.2 UAE Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.26.3 UAE Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Contracts & Programmes

5.26.4 UAE Military Aircraft MRO Market Analysis

5.27 Singaporean Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

5.27.1 Singaporean Military Aircraft Fleet Structure 2019

5.27.2 Singaporean Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.27.3 Singaporean Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Contracts & Programmes

5.27.4 Singapore Military Aircraft MRO Analysis

5.28 Rest of the World Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

5.28.1 Rest of the World Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints

5.28.2 Rest of the World Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Contracts & Programmes

5.28.3 The Military Aircraft MRO Market for the Rest of the World MRO Market 2019-2029

6. PEST Analysis of the Military Aircraft MRO Market 2019-2029

7. Leading 20 Companies in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.1 Airbus Group

7.1.1 Airbus Group Military Aircraft Maintenance, Repair and Overhaul (MRO) Contracts / Projects / Programmes

7.1.2 Airbus Group Total Company Revenue 2013-2017

7.1.3 Airbus Group Notable Products / Services

7.1.4 Airbus Group Analysis

7.1.5 Airbus Group Regional Emphasis / Focus

7.2 Leonardo

7.2.1 Leonardo SpA (Parent Company) Total Company Revenue 2013-2017

7.2.2 Leonardo Products / Services

7.2.3 Leonardo Analysis

7.2.4 Leonardo SpA (Parent Company) Company Regional Emphasis / Focus

7.3 AMMROC

7.3.1 AMMROC Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.3.2 AMMROC Analysis

7.3.3 AMMROC Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.4 BAE Systems PLC

7.4.1 BAE Systems Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.4.2 BAE Systems Total Company Revenue 2013-2017

7.4.3 BAE Systems Analysis

7.4.4 BAE Systems Company Regional Emphasis / Focus

7.5 Boeing Defense, Space and Security

7.5.1 Boeing Defense, Space and Security Contracts / Projects / Programmes

7.5.2 Boeing Defence, Space and Security Total Company Revenue 2013-2017

7.5.3 Boeing Defense, Space and Security Products / Services

7.5.4 Boeing Defense, Space and Security Analysis

7.5.5 The Boeing Company (Parent Company) Regional Emphasis / Focus

7.6 Dassault Aviation

7.6.1 Dassault Aviation Total Company Revenue 2013-2017

7.6.2 Dassault Aviation MRO Contracts / Projects / Programmes

7.6.3 Dassault Aviation Major Products / Services

7.6.4 Dassault Aviation Analysis

7.6.5 Dassault Aviation Regional Emphasis / Focus

7.7 DynCorp International

7.7.1 DynCorp International MRO Contracts

7.7.2 DynCorp International Total Company Revenue 2013-2017

7.7.3 DynCorp International Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.7.4 DynCorp International Analysis

7.8 Embraer S.A

7.8.1 Embraer S.A Contracts / Projects / Programmes

7.8.2 Embraer S.A Total Company Revenue 2013-2017

7.8.3 Embraer Defense and Security Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.8.4 Embraer Defense and Security Analysis

7.9 GE Aviation

7.9.1 GE Aviation Contracts / Projects / Programmes

7.9.2 GE Company Total (Parent Company) Company Revenue 2013-2017

7.9.3 GE Aviation Products / Services / Major Subsidiaries

7.9.4 GE Aviation Analysis

7.10 Hindustan Aeronautics Limited (HAL)

7.10.1 Hindustan Aeronautics Limited (HAL) Contracts / Projects / Programmes

7.10.2 Hindustan Aeronautics Limited (HAL) Total Company Revenue 2013-2017

7.10.3 Hindustan Aeronautics Limited (HAL) Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.10.4 Hindustan Aeronautics Limited (HAL) Analysis

7.10.5 Hindustan Aeronautics Limited Regional Emphasis / Focus

7.11 Honeywell Aerospace

7.11.1 Honeywell Aerospace Contracts / Projects / in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.11.2 Honeywell International Inc (Parent Company) Total Company Revenue 2013-2017

7.11.3 Honeywell Aerospace Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.11.4 Honeywell Aerospace Analysis

7.12 L-3 Communications

7.12.1 L-3 Communications Contracts / Projects / Programmes

7.12.2 L-3 Communications Total Company Revenue 2013-2017

7.12.3 L-3 Communications Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.12.4 L-3 Communications Analysis

7.12.5 L-3 Communications Company Regional Emphasis / Focus

7.13 Lockheed Martin Corporation

7.13.1 Lockheed Martin Corporation Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.13.2 Lockheed Martin Corporation Total Company Revenue 2013-2017

7.13.3 Lockheed Martin Corporation Military Aircraft Maintenance, Repair and Overhaul (MRO) Products / Services

7.13.4 Lockheed Martin Corporation Analysis

7.13.5 Lockheed Martin Corporation Primary Market Competitors

7.13.6 Lockheed Martin Corporation Regional Emphasis / Focus

7.14 Northrop Grumman Corporation

7.14.1 Northrop Grumman Corporation Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.14.2 Northrop Grumman Corporation Total Company Revenue 2013-2017

7.14.3 Northrop Grumman Corporation Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.14.4 Northrop Grumman Corporation’s Analysis

7.14.5 Northrop Grumman Corporation Primary Market Competitors

7.14.6 Northrop Grumman Corporation Regional Emphasis / Focus

7.14.7 Northrop Grumman Corporation Recent M&A Activity

7.15 Pratt & Whitney

7.15.1 Pratt & Whitney Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.15.2 United Technologies Corporation (Parent Company) Total Company Revenue 2013-2017

8.15.3 Pratt & Whitney Products / Services

7.15.4 Pratt & Whitney Analysis

7.15.5 Pratt & Whitney Regional Emphasis / Focus

7.16 Rolls Royce Defence Aerospace

7.16.1 Rolls Royce (Defence Aerospace) Contracts / Projects / Programmes

7.16.2 Rolls Royce PLC (Parent Company) Total Company Revenue 2013-2017

7.16.3 Rolls Royce (Defence Aerospace) Products / Services

7.16.4 Rolls Royce (Defence Aerospace) Analysis

7.17 RUAG Aviation

7.17.1 RUAG Aviation Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.17.2 RUAG (Parent Company) Total Company Revenue 2013-2017

7.17.3 RUAG Aviation Analysis

7.18 Safran SA

7.18.1 Safran Group Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.18.2 Safran Group Total Company Revenue 2013-2017

7.18.3 Safran SA Analysis

7.19 ST Aerospace

7.19.1 ST Aerospace Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.19.2 ST Aerospace Products / Services

7.19.3 ST Engineering (Parent Company) Total Company Revenue 2013-2017

7.19.4 ST Aerospace Analysis

7.20 United Aircraft Corporation

7.20.1 United Aircraft Corporation Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.20.2 United Aircraft Corporation Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market

7.20.3 United Aircraft Corporation Analysis

7.21 Other Notable Companies in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019

8. Conclusions & Recommendations

8.1 Summary and Market Outlook 2019-2029

8.2 Key Findings

8.3 Recommendations

9. Glossary

List of Tables

Table 1.4.1 Leading National Military Aircraft MRO Market Forecast 2019-2029 ($m, AGR %)

Table 2.1.1.1 Military Aircraft Maintenance, Repair & Overhaul (MRO) Submarkets (Submarket, Characteristics)

Table 2.3.2.1 Visiongain’s Anticipated Mean Yearly WTI Oil Price ($/Barrel)

Table 3.1.1 Global Military Aircraft MRO Market Forecast 2019-2029 ($m, AGR%, CAGR%, Cumulative)

Table 3.2.1 National MRO Markets 2019-2029 by Baseline Market Growth (AGR %)

Table 3.2.2 National Military Aircraft MRO Markets 2019-2029 (CAGR %)

Table 3.2.3 Top 20 Leading Nations Military Active Aircraft Fleet Structure (Combat Aircraft, Special Mission Aircraft, Tanker Aircraft, Transport Aircraft, Training Aircraft, Total Fleet)

Table 3.4.1 Drivers and Restraints in the Military Aircraft Maintenance, Repair & Overhaul (MRO) Market

Table 4.1.1 Military Aircraft MRO Submarket Forecast 2019-2029 ($m, AGR%)

Table 4.1.2.1 Fastest Growing Global Military Aircraft Maintenance, Repair and Overhaul (MRO) Submarkets CAGR Forecast 2019-2029 (Submarket, CAGR%)

Table 4.1.3.1 Fastest Growing Global Military Aircraft Maintenance, Repair and Overhaul (MRO) Submarkets CAGR Forecast 2019-2029 (Submarket, CAGR %)

Table 4.1.4.1 Fastest Growing Global Military Aircraft Maintenance, Repair and Overhaul (MRO) Submarkets CAGR Forecast 2029-2029 (CAGR %)

Table 4.2.1.1 Operational and Field Maintenance Submarket Forecast 2019-2029 ($m, AGR %, Cumulative CAGR %)

Table 4.2.2.1 Operational and Field Maintenance Submarket Drivers and Restraints

Table 4.3.1.1 Heavy Airframe Maintenance Submarket Forecast 2019-2029 ($m, AGR %, Cumulative, CAGR %)

Table 4.3.2.1 Operational and Field Maintenance Submarket Drivers and Restraints

Table 4.4.1.1 Heavy Engine Maintenance Submarket Forecast 2019-2029 ($m, AGR %, Cumulative, CAGR %)

Table 4.4.2.1 Heavy Engine Maintenance Submarket Drivers & Restraints

Table 4.5.1.1 Internal Components Submarket Forecast 2019-2029 ($m, AGR %, Cumulative, CAGR %)

Table 5.1 Leading 20 National Military Aircraft Maintenance, Repair and Overhaul (MRO) Markets Forecast 2019-2029 ($m, AGR %)

Table 5.4.1 Fastest Growing 6 Leading National Military Aircraft Maintenance, Repair and Overhaul (MRO) Markets Forecast 2019-2029 CAGR (%)

Table 5.5.1 Fastest Growing Leading National Military Aircraft Maintenance, Repair and Overhaul (MRO) Markets CAGR Forecast 2019-2024 CAGR (%)

Table 5.6.1 Fastest Growing Leading National Military Aircraft Maintenance, Repair and Overhaul (MRO) Markets Forecast 2024-2029 CAGR (%)

Table 5.8.1 United States Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.8.2.1 United States Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Drivers & Restraints 2019

Table 5.8.3.1 US Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2013-2028 (Company, Value $m, Date, Details)

Table 5.9.1 Russian Military Aircraft MRO Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.9.2.1 Russian Military Aircraft MRO Drivers & Restraints 2019

Table 5.9.3.1 Russian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2013-2028 (Company, Value $m, Date, Details)

Table 5.10.1 Chinese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.10.2.1 Chinese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Drivers & Restraints 2019

Table 5.10.3.1 Chinese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes (Company, Date, Details)

Table 5.11.1 Indian Military Aircraft Maintenance, Repair and Overhaul MMRO Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.11.2.1 Indian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Drivers & Restraints 2019

Table 5.11.3.1 Indian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2013-2028 (Company, Value $m, Date, Details)

Table 5.12.1 Japanese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.12.2.1 Japanese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Drivers & Restraints 2019

Table 5.12.3.1 Japanese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes (Project, Details)

Table 5.13.1 UK Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.13.2.1 UK Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Drivers & Restraints 2019

Table 5.13.3.1 UK Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2014-2028 (Company, Value $m, Date, Details)

Table 5.14.1 Israel Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.14.2.1 Israeli Military Aircraft Maintenance, Repair and Overhaul (MRO) Drivers & Restraints 2019

Table 5.14.3.1 Israeli Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2012-2018 (Company, Value $m, Date, Details)

Table 5.15.1 French Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.15.2.1 Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Drivers & Restraints 2019

Table 5.15.3.1 French Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2011-2018 (Company, Value $m, Date, Details)

Table 5.16.1 Saudi Arabian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.16.2.1 Saudi Arabian Military Aircraft Maintenance, Repair and Overhaul (MRO) Drivers & Restraints 2019

Table 5.16.3.1 Saudi Arabian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2013-2028 (Company, Value $m, Date, Details)

Table 5.17.1 Pakistani Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.17.2.1 Pakistani Military Aircraft Maintenance, Repair and Overhaul (MRO) Drivers & Restraints 2019

Table 5.17.3.1 Pakistani Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2013-2018 (Company, Value, Date, Details)

Table 5.18.1 South Korean Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.18.2.1 South Korean Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Drivers & Restraints 2019

Table 5.18.3.1 South Korean Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes (Company, Details)

Table 5.19.1 Turkish Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.19.2.1 Turkish Military Aircraft Maintenance, Repair and Overhaul (MRO) Drivers & Restraints 2019

Table 5.19.3.1 Turkish Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2018 (Company, Date, Details)

Table 5.20.1 Italian Military Aircraft Maintenance, Repair and Overhaul (MRO) 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.20.2.1 Italian Military Aircraft Maintenance, Repair and Overhaul (MRO) Drivers & Restraints 2019

Table 5.20.3.1 Italian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2012-2018 (Company, Value $m, Date, Details)

Table 5.21.1 German Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.21.2.1 German Military Aircraft Maintenance, Repair and Overhaul (MRO) Drivers & Restraints 2019

Table 5.21.3.1 German Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2012-2018 (Company, Value, Date, Details)

Table 5.22.1 Spanish Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.22.2.1 Spanish Military Aircraft Maintenance, Repair and Overhaul (MRO)s Market Drivers & Restraints 2019

Table 5.22.3.1 Spanish Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2012-2015 (Company, Value $m, Date, Details)

Table 5.23.1 Taiwanese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.23.2.1 Taiwanese Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints 2019

Table 5.23.3.1 Taiwanese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2014-2015 (Company, Value $m, Date, Details)

Table 5.24.1 Canadian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.24.2.1 Canadian Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints 2019

Table 5.24.3.1 Canadian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2014-2018 (Company, Value $m, Date, Details)

Table 5.25.1 Australian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.25.2.1 Australian Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints 2019

Table 5.25.3.1 Australian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2012-2018 (Company, Value $m, Date, Details)

Table 5.26.1 UAE Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.26.2.1 UAE Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Drivers & Restraints 2019

Table 5.26.3.1 UAE Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2013-2018 (Company, Value, Date $m, Details)

Table 5.27.1 Singaporean Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.27.2.1 Singaporean Military Aircraft Maintenance, Repair and Overhaul Market Drivers & Restraints 2019

Table 5.27.3.1 Singaporean Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes (Company, Value, Date, Details)

Table 5.28.1 Rest of the World Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %, CAGR %, Cumulative)

Table 5.28.1.1 Rest of the World Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Drivers & Restraints 2019

Table 5.28.2.1 Rest of the World Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Major Contracts & Programmes 2013-2018 (Company, Value $m, Date, Details)

Table 6.1 PEST Analysis of the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019-2029

Table 7.1.1 Airbus Group (CEO, Total Company Revenue $m, Net Property, Plant & Equipment $m, Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website, Submarket Involvement)

Table 7.1.1.1 Airbus Group Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Value $m, Details)

Table 7.1.2.1 Airbus Group Company Revenue 2013-2017 ($m, AGR %)

Table 7.1.7.1 Airbus Group Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.2.1 Alenia Aermacchi 2019 (Parent Company of Alenia Aermacchi, Parent Company’s CEO, Parent Company’s Total Company Revenue $m, Parent Company’s Net Property, Plant & Equipment $m, Parent Company’s Strongest Business Region, HQ, Founded, Parent Company’s No. of Employees, Parent Company’s IR Contact, Parent Company’s Ticker, Website, Submarket Involvement)

Table 7.2.1.1 Leonardo SpA (Parent Company) Total Company Revenue 2013-2017 ($m, AGR %)

Table 7.2.4.1 Alenia Aermacchi SpA Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.3.1 AMMROC (CEO, Strongest Business Region, HQ, Founded, Website, Submarket Involvement)

Table 7.3.1.1 AMMROC Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Value $m, Details)

Table 7.3.4.1 AMMROC Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.4.1 BAE Systems PLC (CEO, Total Company Revenue $m, Net Property, Plant & Equipment $m, Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website, Submarket Involvement)

Table 7.4.1.1 BAE Systems Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Value $m, Details)

Table 7.4.2.2 BAE Systems Total Company Revenue 2013-2017 ($m, AGR %)

Table 7.5.1 Boeing Defense, Space and Security 2019 (Parent Company of Boeing Defense, Space and Security, Parent Company’s CEO, Parent Company’s Total Company Revenue $m, Parent Company’s Net Property, Plant & Equipment $m, Parent Company’s Strongest Business Region, HQ, Founded, Parent Company’s No. of Employees, Parent Company’s IR Contact, Parent Company’s Ticker, Parent Company’s Website, Submarket Involvement)

Table 7.5.1.1 Boeing Defense, Space and Security Major Company Contracts / Projects in the US Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Value $m, Details)

Table 7.5.2.1 Boeing Defence, Space and Security Total Company Revenue 2013-2017 ($m, AGR %)

Table 7.5.3.1 Boeing Defense, Space and Security Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.6.1 Dassault Aviation (CEO, Total Company Revenue $m, Net Property, Plant & Equipment $m, Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website, Submarket Involvement)

Table 7.6.1.1 Dassault Aviation Total Company Revenue 2013-2017 ($m, AGR %)

Table 8.6.2.1 Dassault Aviation Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Value $m, Details)

Table 8.6.7.1 Dassault Aviation Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.7.1 DynCorp International (CEO, Total Company Revenue $m, Net Property, Plant & Equipment $m, Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website, Submarket Involvement)

Table 7.7.1.1DynCorp International Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Value $m, Details)

Table 7.7.2.1 DynCorp International Total Company Revenue 2014-2017 ($m, AGR %)

Table 7.7.3.1 DynCorp International Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.8.1 Embraer S.A (CEO, Total Company Revenue $m, Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website, Submarket Involvement)

Table 7.8.1.1 Embraer S.A Defense and Security Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Value $m, Details)

Table 7.8.2.1 Embraer S.A Total Company Revenue 2013-2017 ($m, AGR %)

Table 8.8.4.1 Embraer Defense and Security Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.9.1 GE Aviation (Parent Company of GE Aviation, CEO, Total Company Revenue $m, Parent Company’s Net Property, Plant & Equipment $m, Strongest Business Region, HQ, Parent Company Founded, Parent Company’s No. of Employees, Parent Company’s IR Contact, Parent Company’s Ticker, Website, Submarket Involvement)

Table 7.9.1.1 GE Aviation Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Value $m, Details)

Table 7.9.2.1 GE Company (Parent Company) Total Company Revenue 2013-2017 ($m, AGR %)

Table 7.9.3.1 GE Aviation Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.10.1 Hindustan Aeronautics Limited (CEO, Total Company Revenue $m, Strongest Business Region, , HQ, Founded, No. of Employees, IR Contact, Ticker, Website, Submarket Involvement)

Table 7.10.1.1 Hindustan Aeronautics Ltd Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Value $m, Details)

Table 7.10.2.1 Hindustan Aeronautics Limited (HAL) Total Company Revenue 2013-2017 ($m, AGR %)

Table 8.10.4.1 Hindustan Aeronautics Ltd Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.11.1 Honeywell Aerospace (Parent Company of Honeywell Aerospace, CEO, Parent Company’s Total Company Revenue $m, Parent Company’s Net Property, Plant & Equipment $m, Strongest Business Region, HQ, Parent Company Founded, Parent Company’s No. of Employees, IR Contact, Ticker, Website, Submarket Involvement)

Table 7.11.1.1 Honeywell Aerospace Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Value $m, Details)

Table 7.11.2.1 Honeywell International Inc (Parent Company) Total Company Revenue 2013-2017 ($m, AGR %)

Table 7.11.3.1 Honeywell Aerospace Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.12.1 L-3 Communications (CEO, Total Company Revenue $m, Net Property, Plant & Equipment $m, Strongest Business Region, HQ, Founded, No. of Employees, Ticker, Website, Submarket Involvement)

Table 7.12.1.1 L-3 Communications Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Value $m, Details)

Table 7.12.2.1 L-3 Communications Total Company Revenue 2013-2017 ($m, AGR %)

Table 7.12.3.1 L-3 Communications Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.13.1 Lockheed Martin Corporation (CEO, Total Company Revenue $m, Net Property, Plant & Equipment $m, Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website, Submarket Involvement)

Table 7.13.1.1 Lockheed Martin Corporation Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Value $m, Details)

Table 7.13.2.1 Lockheed Martin Corporation Total Revenue 2013-2017 ($m, AGR %)

Table 7.13.3.1 Lockheed Martin Corporation Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.14.1 Northrop Grumman Corporation (CEO, Total Company Revenue $m, Net Property, Plant & Equipment $m, Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website, Submarket Involvement)

Table 7.14.1.1 Northrop Grumman Corporation Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Value $m, Details)

Table 7.14.2.1 Northrop Grumman Corporation Total Company Revenue 2013-2017 ($m, AGR %)

Table 7.14.3.1 Northrop Grumman Corporation Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.14.7.1 Northrop Grumman Corporation Mergers & Acquisitions (Date, Company Involved, Details)

Table 7.14.7.1 Northrop Grumman Corporation Divestitures (Date, Company Involved, Details)

Table 7.15.1 Pratt & Whitney Corporation (Parent Company of Pratt & Whitney, CEO, Parent Company’s Total Company Revenue $m, Strongest Business Region, HQ, Parent Company Founded, Parent Company’s No. of Employees, Parent Company’s IR Contact, Website)

Table 7.15.1.1 Pratt & Whitney Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Value $m, Details)

Table 7.15.2.1 United Technologies Corporation (Parent Company) Total Company Revenue 2013-2017 ($m, AGR %)

Table 7.15.3.1 Pratt & Whitney Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.16.1 Rolls Royce PLC (Defence Aerospace) (Parent Company of Rolls Royce Defence Aerospace, President, Parent Company’s Total Company Revenue $m, Parent Company’s Net Property, Plant & Equipment $m, Strongest Business Region, HQ, Founded, Total Company No. of Employees, Rolls Royce Defence Aerospace No. of Employees, Parent Company’s IR Contact, Parent Company’s Ticker, Parent Company’s Website, Submarket Involvement)

Table 7.16.1.1 Rolls Royce (Defence Aerospace) Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Value $m, Details)

Table 7.16.2.1 Rolls Royce Defence Aerospace Total Company Revenue 2013-2017 ($m, AGR %)

Table 7.16.3.1 Rolls Royce (Defence Aerospace) Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.17.1 RUAG Aviation 2019 (Parent Company of RUAG Aviation, CEO, Total Company Revenue $m, Net Income $m, Net Property, Plant & Equipment $m, Strongest Business Region, , HQ, Founded, Parent Company’s No. of Employees, Website, Submarket Involvement)

Table 7.17.1.1 RUAG Aviation Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.17.2.1 RUAG (Parent Company) Total Company Revenue 2013-2017 ($m, AGR %)

Table 7.18.1 Safran SA (Parent Company of Safran SA, CEO, Parent Company’s Total Company Revenue $m, Parent Company’s Net Property, Plant & Equipment $m, Strongest Business Region, HQ, Founded, Parent Company’s No. of Employees, Parent Company’s IR Contact, Parent Company’s Ticker, Website, Submarket Involvement)

Table 7.18.1 Safran SA Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Details)

Table 7.18.1.1 Safran S.A Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.19.1 ST Aerospace (Parent Company of ST Aerospace, CEO, Parent Company’s Total Company Revenue $m, Parent Company’s Net Property, Plant & Equipment $m, Strongest Business Region, HQ, Parent Company Founded, No. of Employees, Parent Company’s IR Contact, Parent Company’s Ticker, Website, Submarket Involvement)

Table 7.19.1.1 ST Aerospace Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Value $m, Details)

Table 7.19.2.1 ST Aerospace Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.19.3.1 ST Engineering (Parent Company) Total Company Revenue 2013-2017 ($m, AGR %)

Table 7.20.1 United Aircraft Corporation (CEO, Total Company Revenue $m, Strongest Business Region, HQ, Founded, No. of Employees, IR Contact, Ticker, Website, Submarket Involvement)

Table 7.20.1.1 United Aircraft Corporation Major Company Contracts / Projects in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Date, Country, Details)

Table 7.20.2.1 United Aircraft Corporation Products & Services in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market (Product, Specification)

Table 7.21.1 Notable Companies in the Military Aircraft Maintenance, Repair and Overhaul (MRO) Market 2019 (Company, Location, Product /service)

Table 9.1.1 Global Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast Summary 2019, 2024, 2029 ($m, CAGR %)

Table 8.2.1 Leading National Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecasts Summary 2019, 2024, 2029 ($m, CAGR %)

Table 8.2.2 Global Military Aircraft Maintenance, Repair and Overhaul (MRO) Submarket Forecasts Summary 2019, 2024, 2029 ($m, CAGR %)

Table 9.1.1 Global Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast Summary 2019, 2024, 2029 ($m, CAGR %)

List of Figures

Figure 1.1.1 Global Military Fixed-Wing Aircraft Fleet Mix (Aircraft Type, % share)

Figure 1.2.1 Global Military Aircraft MRO Market Segmentation Overview

Figure 1.4.1 Leading National Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 1.4.2 Leading National Military Aircraft Maintenance, Repair and Overhaul (MRO) Markets Compound Annual Growth Rates Forecast 2019-2029 (CAGR%)

Figure 1.4.3 Leading 20 National Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecasts 2019-2029 ($m, AGR %)

Figure 2.1.1 Global MRO Market Segmentation Overview

Figure 2.3.2.1 Visiongain’s Anticipated WTI Oil Price, High Oil Price Scenario and Low Price Scenario ($/Barrel)

Figure 3.1 Leading National Military Aircraft MRO Market Forecast 2019-2029 ($m, AGR%)

Figure 3.2.1 Top Five Fastest Growing MRO National Markets 2019-2029 (CAGR %)

Figure 3.2.3 Cumulative National Military Aircraft MRO Market Share 2019-2029 (% Share)

Figure 4.1.1 MRO Submarket Forecast 2019-2029 ($m, AGR %)

Figure 4.1.2 MRO Submarkets Share Forecast 2019 (% Share)

Figure 4.1.3 MRO Submarkets Share Forecast 2024 (% Share)

Figure 4.1.4 MRO Submarkets Share Forecast 2029 (% Share)

Figure 4.1.2.1 Fastest Growing Global Military Aircraft Maintenance, Repair and Overhaul (MRO) Submarkets CAGR Forecast 2019-2029 (CAGR %)

Figure 4.1.3.1 Fastest Growing Global Military Aircraft Maintenance, Repair and Overhaul (MRO) Submarkets CAGR Forecast 2019-2024 (CAGR %)

Figure 4.1.4.1 Fastest Growing Global Military Aircraft Maintenance, Repair and Overhaul (MRO) Submarkets CAGR Forecast 2024-2029 (CAGR %)

Figure 4.1.5.1 Global Military Aircraft Maintenance, Repair and Overhaul (MRO) Submarkets Cumulative Sales Forecast 2019-2029 ($m)

Figure 4.1.5.1 Global Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Submarkets Cumulative Spending Share Forecast 2019-2029 ($ million)

Figure 4.2.1.1 Operational and Field Maintenance Submarket Forecast 2019-2029 ($m, AGR %)

Figure 4.2.1.2 Operational and Field Maintenance Submarket Share Forecast 2019, 2024, 2029 (% Share)

Figure 4.3.1.1 Heavy Airframe Maintenance Submarket Forecast 2019-2029 ($m, AGR%)

Figure 4.3.1.2 Heavy Airframe Maintenance Submarket Share Forecast 2019, 2024, 2029 (% Share)

Figure 4.4.1.1 Heavy Engine Maintenance Submarket Forecast 2019-2029 ($m, AGR%)

Figure 4.4.1.2 Heavy Engine Maintenance Submarket Share Forecast by Regional Market 2019, 2024, 2029 (% Share)

Figure 4.5.1.1 Internal Components Submarket Forecast 2019-2029 ($m, AGR%)

Figure 4.5.1.2 Internal Components Submarket Share Forecast 2019, 2024, 2029 (% Share)

Table 4.5.2.1 Internal Components Submarket Drivers & Restraints

Figure 5.1 Leading 20 National Military Aircraft Maintenance, Repair and Overhaul (MRO) Markets Forecasts 2019-2029 ($m, Global AGR %)

Figure 5.1.1 Leading National Military Aircraft Maintenance, Repair and Overhaul (MRO) Markets Share Forecast 2019 (% Share)

Figure 5.1.2 Leading National Military Aircraft Maintenance, Repair and Overhaul (MRO) Markets Share Forecast 2024 (% Share)

Figure 5.1.3 Leading National Military Aircraft Maintenance, Repair and Overhaul (MRO) Markets Share Forecast 2029 (% Share)

Figure 5.2.1 Barriers to Entry vs. National Market Size vs. AGR% 2019 (AGR %)

Figure 5.4.1 Fastest Growing Leading National Military Aircraft Maintenance, Repair and Overhaul (MRO) Markets CAGR Forecast 2019-2029 (CAGR %)

Figure 5.5.2 Fastest Growing Leading National Military Aircraft Maintenance, Repair and Overhaul (MRO) Markets CAGR Forecast 2019-2024 (CAGR%)

Figure 5.6.1 Fastest Growing 19 Leading National Military Aircraft Maintenance, Repair and Overhaul (MRO) Markets CAGR Forecast 2024-2029 (CAGR %)

Figure 5.7.1 Leading National Military Aircraft Maintenance, Repair and Overhaul (MRO) Markets Cumulative Sales Forecast 2019-2029 ($m)

Figure 5.7.2 Leading National Military Aircraft Maintenance, Repair and Overhaul (MRO) Markets Cumulative Sales Forecast 2019-2029 (% Share)

Figure 5.8.1 United States Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.8.2 United States Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.8.1.1 US Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total US Fleet)

Figure 5.9.1 Russian Military Aircraft MRO Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.9.2 Russian Military Aircraft MRO Market Forecast 2019-2029 ($m, AGR %)

Figure 5.9.1.1 Russian Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total Russian Fleet)

Figure 5.10.1 Chinese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.10.2 Chinese Military Aircraft MRO Market Forecast 2019-2029 ($m, AGR %)

Figure 5.10.1.1 Chinese Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total Chinese Fleet)

Figure 5.11.1 Indian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.11.2 Indian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.11.1.1 Indian Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total Indian Fleet)

Figure 5.12.1 Japanese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.12.2 Japanese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.12.1.1 Japanese Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total Japanese Fleet)

Figure 5.13.1 UK Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.13.2 UK Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.13.1.1 UK Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total US Fleet)

Figure 5.14.1 Israeli Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.14.2 Israeli Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.14.1.1 Israeli Military Aircraft Fleet Structure (Aircraft Type, % Share of Total Israeli Fleet)

Figure 5.15.1 French Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.15.2 French Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.15.1.1 French Military Aircraft Fleet Structure (Aircraft Type, % Share of Total French Fleet)

Figure 5.16.1 Saudi Arabian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.16.2 Saudi Arabian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.16.1 Saudi Arabian Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total Saudi Arabian Fleet)

Figure 5.17.1 Pakistani Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.17.2 Pakistani Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.17.1.1 Pakistani Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total Pakistani Fleet)

Figure 5.18.1 South Korean Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.18.2 South Korean Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.18.1.1 South Korean Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total South Korean Fleet)

Figure 5.19.1 Turkish Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.19.2 Turkish Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.19.1.1 Turkish Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total Turkish Fleet)

Figure 5.20.1 Italian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.20.2 Italian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.20.1.1 Italian Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total Italian Fleet)

Figure 5.21.1 German Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.21.2 German Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.21.1.1 German Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total German Fleet)

Figure 5.22.1 Spanish Military Aircraft Maintenance, Repair and Overhaul MRO Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.22.2 Spanish Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.22.1.1 Spanish Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total Spanish Fleet)

Figure 5.23.1 Taiwanese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.23.2 Taiwanese Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.23.1.1 Taiwanese Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total Taiwanese Fleet)

Figure 5.24.1 Canadian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.24.2 Canadian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.24.1.1 Canadian Military Aircraft Fleet Structure (Aircraft Type, % Share of Total Canadian Fleet)

Figure 5.25.1 Australian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.25.2 Australian Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.25.1.1 Australian Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total Australian Fleet)

Figure 5.26.1 UAE Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.26.2 UAE Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 5.26.1.1 UAE Military Aircraft Fleet Structure (Aircraft Type, % Share of Total UAE Fleet)

Figure 5.27.1 Singaporean Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.27.2 Singaporean Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($bn, AGR %)

Figure 5.27.1.1 Singaporean Military Aircraft Fleet Structure 2019 (Aircraft Type, % Share of Total US Fleet)

Figure 5.28.1 Rest of the World Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Global Market Share Forecast 2019, 2024, 2029 (% Share)

Figure 5.28.2 Rest of the World Military Aircraft Maintenance, Repair and Overhaul (MRO) Market Forecast 2019-2029 ($m, AGR %)

Figure 7.1.2.1 Airbus Group Total Company Revenue 2013-2017 ($m, AGR %)

Figure 7.1.9.1 Airbus Group Primary International Operations 2019

Figure 7.2.1.1 Leonardo SpA (Parent Company) Total Company Revenue 2013-2017 ($m, AGR %)

Figure 7.2.6.3 Alenia Aermacchi Primary International Operations 2019

Figure 7.4.2.1 BAE Systems Total Company Revenue 2013-2017 ($m, AGR %)

Figure 7.4.7.1 BAE Systems Primary International Operations 2019

Figure 7.5.2.1 Boeing Defence, Space and Security Total Company Revenue 2013-2017 ($m, AGR %)

Figure 7.5.9.1 The Boeing Company (Parent Company) Primary International Operations 2019

Figure 7.6.1.1 Dassault Aviation Total Company Revenue 2013-2017 ($m, AGR %)

Figure 7.6.9.1 Dassault Aviation Primary International Operations 2019

Figure 7.7.2.1 DynCorp International Total Company Revenue 2014-2017 ($m, AGR %)

Figure 7.8.2.1 Embraer S.A Total Company Revenue 2013-2017 ($m, AGR %)

Figure 7.8.4.1 Embraer S.A Primary International Operations 2019

Figure 7.9.2.1 GE Company Total Company Revenue 2013-2017 ($m, AGR %)

Figure 7.9.3.1 GE Aviation Major Subsidiaries 2017

Figure 7.10.2.1 Hindustan Aeronautics Limited (HAL) Total Company Revenue 2013-2017 ($m, AGR %)

Figure 7.10.5.1 Hindustan Aeronautics Limited Primary International Operations 2019

Figure 7.11.2.1 Honeywell International Inc (Parent Company) Total Company Revenue 2013-2017 ($m, AGR %)

Figure 7.12.2.1 L-3 Communications Ltd Total Company Revenue 2013-2017 ($m, AGR %)

Figure 7.12.5.1 L-3 Communications International Operations 2019

Figure 7.13.2.1 Lockheed Martin Corporation Total Company Revenue 2013-2017 ($m, AGR %)

Figure 7.13.5.1 Lockheed Martin Corporation Primary Market Competitors 2019

Figure 7.14.2.1 Northrop Grumman Corporation Total Company Revenue 2013-2017 ($m, AGR %)

Figure 7.14.5.1 Northrop Grumman Corporation Primary Market Competitors 2019

Figure 7.14.6.1 Northrop Grumman Corporation Primary International Operations 2019

Figure 7.15.2.1 United Technologies Corporation Total Company Revenue 2013-2017 ($m, AGR%)

Figure 7.15.5.1 Pratt & Whitney Primary International Operations 2019

Figure 7.16.2.1 Rolls Royce PLC (Parent Company) Total Company Revenue 2013-2017 ($m, AGR %)

Figure 7.17.1.1 RUAG Aviation Organisational Structure

Figure 7.17.2.1 RUAG (Parent Company) Total Company Revenue 2013-2017 ($m, AGR%)

Figure 7.17.3.1 RUAG Aviation Primary International Operations 2019

Figure 7.18.1 Safran Group Organisational Structure

Figure 7.18.3.1 Safran Group Primary International Operations 2019

Figure 7.19.3.1 ST Engineering (Parent Company) Total Company Revenue 2013-2017 ($m, AGR %)

Figure 7.19.4.1 ST Aerospace Primary International Operations 2019

3Di Technologies

AAR Airlift Group Inc.

Advanced Engineering Consultants

Advanced Laser Systems Technology, Inc.

AECOM

AeroKool Corporation

Aeromet

AeroPrecision

AFI KLM E & M

Airborne Technologies, Inc.

Airbus

Airbus / Turkish Aerospace Industries

Airbus Communication, Intelligence & Security Systems

Airbus Defense and Space Inc.

Airbus Equipment

Airbus Group

Airbus Helicopters

Airbus Military

Airbus Military Aircraft

Airbus Space Systems

Aircelle

Airtec, Inc.

Al Raha Group for Technical Services

Alenia Aermacchi

Alliant Techsystems Inc.

Allied Holdings, Inc

Alsalam Aircraft Company

AMI

AMI Industries, Inc.

AMMROC

Applied Technologies

APSS

Army Fleet Support

ASA

Atkins and Gama Aviation

ATR

Aviation Communication & Surveillance Systems

Avic International Holding Corporation

Avio Aero

Avio Group

B/E Aerospace, Inc.

BAe Dynamics

BAE India

BAE Saudi Arabia

BAE Systems AB

BAE Systems Advanced Technologies

BAE Systems Aerospace

BAE Systems Air and Information

BAE Systems Applied Intelligence (formally Detica)

BAE Systems Australia

BAE Systems Avionics

BAE Systems Detica

BAE Systems Inc

BAE Systems India

BAE Systems Information and Electronic Systems Integration Inc.

BAE Systems Integrated Systems Technology

BAE Systems Land and Armaments

BAE Systems Marine

BAE Systems Maritime- Naval Ships

BAE Systems Maritime- Submarines

BAE Systems Military Air & Information

BAE Systems PLC

BAE Systems Surface Fleet Solutions

Battlespace Flight Services LCC

Beechcraft Defense Co.

Bell Boeing Joint Program Office

Bell Helicopter Textron Inc.

Berry Aviation Inc.

Boeing Capital Corporation

Boeing Company

Boeing Commercial Airplanes

Boeing Defence Australia Limited

Boeing Defense, Space and Security

Boeing Global Support and Services (GS&S)

Bombardier

Calian Technologies Ltd

California Microwave, Inc

Calzoni

Carrier

Cascade Aerospace

Cassidian

Cessna Aircraft Co.

CFM International

Chengdu

Chengdu Aircraft Industry Corporation

Chesapeake Sciences Corporation

China Electronics Technology Group Corporation

Chromalloy

Cincinnati Electronics

Coleman Aerospace

ComCept

Comptek Research, Inc

Corda

CPI Aero

Crestview Aerospace

CSC Applied Technologies

Cutter Enterprises, LLC

CyTerra, Inc.

D.P. Associates Inc.

Dassault

Dassault Aviation

Datron Advanced Technologies

De Havilland Canada

Defense Support Services LLC

DIV Capital Corporation

Doss Aviation, Inc.

DRS C3 & Aviation Co.

DRS Technologies

DTS Aviation Services LLC

DutchAeroServices

Dyn Al Rushaid Services JV

Dyn Marine Services LLC

DynCorp (Aust.) Pty. Limited

DynCorp Aerospace Operations (UK) Ltd

DynCorp Aerospace Operations LLC

DynCorp International Aero Services Inc

DynCorp International FZ-LLC

Dyncorp International LLC

DynCorp International of Nigeria LLC

DynCorp International Private Limited

DynCorp International Services GmbH

DynCorp International Services LLC

DynCorp-Hiberna Limited JV

DynEgypt L.L.C.

DynMarine Services of Virginia LLC

DynPurertoRico Corporation

DynSG LLC

EADS North America

EDO Corporation

ELAC Nautik GmbH

Elbit Systems

Electrodynamics Inc.

Electron Technologies, Inc.

Embraer

Engine Alliance

ESSCO

EUROATLAS

Eurojet

Evergreen Helicopters

Federal Data Corporation

Finmeccanica SpA

First Support Services Inc.

Flight International

Flybe

Fokker Services

FUNA

G.A. International

GCS

GE Aviation Systems

GE Honda

GE Honda Aero Engines

GE International

General Atomics – Aeronautical Systems Inc.

General Atomics - Systems Integration

General Dynamics Advanced Information Systems (GDAIS)

General Dynamics Armament and Technical Products

General Dynamics UK

General Electric Aircraft Engines

General Electric Aviation

General Electric Co.

General PAE Applied Technologies

Goodrich Corporation

Graybar Electric Company Inc.

Greenwich Aerogroup

Grumman Ohio Corporation

Gulfstream Aerospace Corp.

Hamilton Sundstrand

Hawker Beechcraft Corporation

Hawker Beechcraft Defense Company

HEICO Aerospace

Henschel

Herakles

Hindustan Aeronautical Limited (HAL)

Hindustan Aeronautics Limited Accessories Complex

Hindustan Aeronautics Limited Bangalore Complex

Hindustan Aeronautics Limited Helicopter Complex

Hindustan Aeronautics Limited MiG Complex

Hispano-Suiza

Honeywell Aerospace and Defense Ballistic Protection Materials

Honeywell Airports

Honeywell Aviation and Air Transport

Honeywell Defense

Honeywell International Aerospace

Honeywell International Inc.

Honeywell Space

Honeywell Space and Defense

Huntington Ingalls Industries Inc

IFS

Indra

Integrated Optical Systems

Interconnect Wiring

Interstate Electronics Corporation (IEC)

IRAN - Northrop Grumman Programs Service Company

Irkut Corporation

Israeli Aerospace Industries (IAI)

ITT Corp

IV Capital Corporation

JOVYATLAS

Kawasaki

Kay and Associates Inc.

Kelly Aviation Center

KEO

King Aerospace Inc.

Klein Associates, Inc

Klimov

Korea Aerospace Industries (KAI)

Korean Air Lines Co.

L-3 Australia Operations

L-3 Aviation Recorders

L-3 Avionics Systems

L-3 Combat Propulsion Systems

L-3 Communications Aerospace LLC

L-3 Communications AM&M

L-3 Communications Army Fleet Support

L-3 Communications Comcept

L-3 Communications Corp

L-3 Communications Crestview Aerospace

L-3 Communications Electronic Systems

L-3 Communications Integrated Optical Systems

L-3 Communications Integrated Systems

L-3 Communications KEO

L-3 Communications Link Simulation and Training

L-3 Communications MAS

L-3 Communications National Security Solutions

L-3 Communications Platform integration

L-3 Communications Systems Field Support

L-3 Communications TCS

L-3 Dynamic Positions & Control Systems

L-3 Electron Technologies, Inc

L-3 Electronic System Services

L-3 Flight International

L-3 Fuzing & Ordinance Systems

L-3 G.A. International

L-3 GCS

L-3 Henschel

L-3 Integrated Optical Systems

L-3 Interstate Electronics Corporation (IEC)

L-3 Link Simulation & Training

L-3 Linkabit

L-3 London Operations

L-3 Marine Systems Korea

L-3 Marine Systems UK

L-3 Maritime Systems

L-3 MAS Canada

L-3 Middle East Operations

L-3 Mission Integration

L-3 National Security Solutions

L-3 Ocean Systems

L-3 Oceania

L-3 Photonics

L-3 Platform Integration

L-3 Security & Detection Systems

L-3 Southern California Microwave

L-3 Space & Navigation

L-3 Tarqa Systems

L-3 Telemetry-East

L-3 Telemetry-West

L-3 Unmanned Systems

L-3 Vertex Aerospace

L-3 Warrior Systems

L-3 Washington Operations

Labinal

Link Simulation & Training

Link UK

Lockheed Martin Aeronautics Co.

Lockheed Martin Aerospace Systems Integration Corporation

Lockheed Martin Australia Pty Limited

Lockheed Martin Canada Inc

Lockheed Martin Desktop Solutions Inc

Lockheed Martin Engine Investments LLC

Lockheed Martin Global Inc

Lockheed Martin Global LLC

Lockheed Martin Information Systems & Global Solutions

Lockheed Martin Integrated Systems

Lockheed Martin Integrated Technology LLC

Lockheed Martin Investments Inc

Lockheed Martin Logistics Management Inc

Lockheed Martin Missiles and Fire Control

Lockheed Martin Mission Systems and Sensors

Lockheed Martin Mission Systems and Training

Lockheed Martin Operations Support Inc

Lockheed Martin Serves Inc

Lockheed Martin Space Alliance Company

Lockheed Martin Space Systems

Lockheed Martin TAS International Services Inc

Lockheed Martin UK Insys Limited

Lockheed Martin UK Limited (United Kingdom)

Lockheed Martin, BAE Systems, Northrop Grumman

Logicon Commercial Information Services Inc

Logicon International, Inc

LTM Inc.

Lufthansa

Lyngso Marine

M1 Support Services

M5 Network Security Pty Ltd

M7 Aerospace LLC

Magellan Aerospace

Magnet-Motor GmbH

MAPPS Inc

Marine Systems Korea

Marine Systems UK

MariPro, Inc

Marshall Aerospace

Martin Baker Aircraft Co.

MAS

MAVCO

MBDA

Mecanex USA Inc

Meggit Aircraft Braking Systems

Messier-Bugatti-Dowty

Mirage Rebuild Factory

Mitsubishi Heavy Industries

Mobile-Vision, Inc

Mocit, Inc

Moog Inc.

Morpho

Mubadala Aerospace

Mustang Technology

Narda Microwave-East

Narda Microwave-West

Narda Safety Test Solutions GmbH

Narda Satellite Networks

NASCO Aircraft Brake Inc.

National Security Solutions

NGC Denmark ApS

Nordam Group, Inc.

Northrop Electro-Optical Systems

Northrop Grumman - Canada

Northrop Grumman Aviation, Inc

Northrop Grumman Corp Technical Services DI.

Northrop Grumman Corporation

Northrop Grumman Corporation ISR & Targeting Systems

Northrop Grumman Corporation Land & Self Protection Systems

Northrop Grumman Corporation Navigation & Maritime Systems

Northrop Grumman Corporation Aerospace Systems

Northrop Grumman Corporation Applied Intelligence Commercial

Northrop Grumman Corporation Applied Intelligence Government

Northrop Grumman Corporation Cyber Solutions

Northrop Grumman Corporation Defense and Government Services

Northrop Grumman Corporation Defense Systems

Northrop Grumman Corporation Electronic Systems

Northrop Grumman Corporation Federal & Defense Technologies

Northrop Grumman Corporation Information Systems

Northrop Grumman Corporation Integrated Logistics & Modernization

Northrop Grumman Corporation Intelligence Systems

Northrop Grumman Corporation IT Solutions

Northrop Grumman Corporation Military Aircraft Systems

Northrop Grumman Corporation Space Systems

Northrop Grumman Corporation Strategic Programs & Technology

Northrop Grumman Corporation Training Solutions

Northrop Grumman Corporation Unmanned Systems

Northrop Grumman Electronic Systems International Company (UK)

Northrop Grumman Electronics Systems Integration International, Inc

Northrop Grumman Field Support Services, Inc

Northrop Grumman Foreign Sales Corporation

Northrop Grumman International Services Company, Inc

Northrop Grumman International, Inc

Northrop Grumman ISA International, Inc

Northrop Grumman Overseas Holdings, Inc

Northrop Grumman Overseas Service Corporation

Northrop Grumman Space & Mission Systems Corp.

Northrop Grumman Space Operations, L.P.

Northrop Grumman Systems Corp.

Northrop Grumman Tactical Systems, LLC

Northrop Grumman Technical Services Corporation

Northrop International Aircraft, Inc

Oceania

OGMA

Orbital Alliant Techsystems Inc.

Otis

PacOrd, Inc

PAE Government Services Inc.

Pakistan Aeronautical Complex (PAC)

Park Air Electronics, Inc

Parker Hannifin Corp.

Parker Hannifin Customer Support Military Division

Perceptics Corporation

Photonics

PKL Services Inc.

Power Paragon, Inc

PowerJet

PPA Group

Pratt & Whitney

Pratt & Whitney Aftermarket Services Inc.

Pratt & Whitney Military Engines

Precision Aerospace Corporation

Qantas Defence Services (QDS)

QTC Holdings Inc

Randtron Antenna Systems

Raytheon Co.

Raytheon Technical Services Co.

Remotec, Inc

Robertson Fuel Systems

Rockwell Collins Inc.

Rolls Royce Defense Services Inc.

Rolls-Royce Engine Services

Rolls-Royce Engine Services-Oakland Inc.

Rolls-Royce PLC

Rosoboronexport

RUAG Ammotec

RUAG Australia (Formally Rosebank Engineering Australia)

RUAG Aviation

RUAG Defence

RUAG Space

RUAG Technology

Russian Aircraft Corporation MiG (RAC MiG)

S&K Aerospace

Saab AB

Sabena Technics

Salut

SAM Electronics, GmbH

Sandia Corporation

Scandia Technologies

Science Applications International Corp (SAIC)

Security & Detection Systems (L-3)

Services International Limited LLC

Sierra Nevada Corp

Sikorsky Aerospace Maintenance

Sikorsky Aircraft Corp.

Sikorsky Support Services, Inc.

SMA Engines

Snap-On

Snecma

Sonoma EO, Inc

Southeast Aerospace Inc.

Southern California Microwave

SPED Electrical Systems

SRI International

ST Aerospace

ST Electronics

ST Kinetics

ST MarinePowerJet

StandardAero

StandardAero Inc

Sterling Software (US) Inc

Sterling Software Weather, Inc

Sukhoi

SuperJet International