Industries > Aviation > Top 20 Commercial Aircraft Maintenance, Repair & Overhaul (MRO) Companies 2019

Top 20 Commercial Aircraft Maintenance, Repair & Overhaul (MRO) Companies 2019

MRO Market Share Analysis, Revenues & Contract Details for the Leading Engine, Component, Heavy Airframe & Line Maintenance Providers, Including United Technologies Corporation, Airbus, GE Aviation, Lufthansa Technik & More

With an incredible amount of industry attention devoted to MRO, actually deriving realistic market prospects and opportunities can be difficult. Visiongain has looked beyond the attention-grabbing headlines to create an accurate market research report that will help you arrive at logical, valuable conclusions that are grounded in reality, and not media headlines.

This report independently evaluates the top 20 players active in commercial aircraft maintenance, repair and overhaul, providing the reader with an objective overview of the competitive landscape and analyses the drivers and restraints of the market illustrating the future outlook for commercial aircraft maintenance, repair and overhaul services and business opportunities.

See Profiles Of The 20 Leading Companies In Commercial Aircraft Maintenance, Repair And Overhaul Services, Their MRO Market Share, MRO Revenues, And Their Competitive Positioning, Product Offerings And Outlook

• AAR Corporation

• Air France Industries KLM Engineering & Maintenance

• Airbus SAS

• Boeing Company

• Bombardier Inc.

• Delta TechOps

• Embraer S.A.

• GE Aviation

• General Dynamics Corp.

• Honeywell Aerospace

• Hong Kong Aircraft Engineering Company (HAECO) Ltd

• Lufthansa Technik AG

• MTU Aero Engines AG

• Rolls-Royce plc

• Safran SA

• SIA Engineering Company Ltd.

• Spirit AeroSystems Inc.

• Textron, Inc.

• Turkish Technic

• United Technologies Corporation

For Each Company, The Following Information Is Provided

• MRO market share %

• MRO revenues

• MRO competitive positioning in the top 20

• Contracts tables for each company

• Key strategies followed by major vendors

• Updated financials details and key metrics

567 Commercial Aircraft MRO Contracts Detailed

150 Tables, Charts, And Graphs

Reasons to buy

• Learn where the MRO market is headed

• See where the MRO business opportunities are

• Compare your own evaluations with a second opinion

• Discover the industry dynamics within this market space

• See what the barriers to entry are likely to be

Key players in the MRO market are expected to benefit from growth in overall MRO market spending. With a Visiongain report, you can learn how the development of this market could affect you. This 327 page report will be vital to your industry understanding.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1.1 Global Commercial Aircraft MRO Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Secondary Research

1.6.2 Market Evaluation Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Commercial Aircraft MRO Market

2.1 Global Commercial Aircraft MRO Segments

2.2 Commercial Aircraft MRO Market Definition

2.3 Types of Commercial Aircraft MRO Market Players

2.4 Commercial Aircraft MRO Activities

2.5 Aircraft Maintenance – Letter Checks

2.6 Maintenance Steering Group

2.7 Next Generation Aircraft Could Reduce MRO Demand

2.8 Global Commercial Aircraft MRO Market Drivers & Restraints 2018

3. Competitor Positioning in the Global Commercial Aircraft MRO Market

3.1 Top 20 Commercial Aircraft MRO Company Share Analysis 2018

3.2 Composition of the Commercial Aircraft MRO Market

3.2.1 Commercial Aircraft MRO Market Composition Overview

3.2.2 Positioning of Top 20 Commercial Aircraft MRO Companies

3.2.3 Global Distribution of Top 20 Commercial Aircraft MRO Companies

4. Top 20 Commercial Aircraft MRO Companies 2018

4.1 AAR Corporation

4.1.1 AAR Corporation Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2014-2018

4.1.2 AAR Corporation Key Strategies

4.1.3 AAR Corporation Total Company Sales 2014-2018

4.1.4 AAR Corporation Sales in the Commercial Aircraft MRO Market 2014-2018

4.1.5 AAR Corporation Net Income 2014-2018

4.1.6 AAR Corporation Commercial Aircraft MRO Products / Services

4.1.7 AAR Corporation Primary Market Competitors 2018

4.1.8 AAR Corporation Divestitures Activity

4.1.9 AAR Corporation Overview

4.1.10 Financial Performance of AAR Corporation

4.1.11 AAR Corporation Key Financial Ratio

4.1.12 AAR Corporation Industry Relationship

4.1.13 Providing Extensive MRO Services to Commercial Aviation

4.1.14 AAR Corporation Future Outlook

4.1.15 AAR Corporation SWOT Analysis

4.2 Air France Industries KLM Engineering & Maintenance

4.2.1 Air France Industries KLM Engineering & Maintenance Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2015-2018

4.2.2 Air France Industries KLM Engineering & Maintenance Key Strategies

4.2.3 Air France Industries KLM Engineering & Maintenance Parent Company Sales 2014-2018

4.2.4 Air France Industries KLM Engineering & Maintenance Total Sales 2014-2018

4.2.5 Air France Industries KLM Engineering & Maintenance Net Income 2014-2018

4.2.6 Air France Industries KLM Engineering & Maintenance Commercial Aircraft MRO Market Products / Services

4.2.7 Air France Industries KLM Engineering & Maintenance Primary Market Competitors 2018

4.2.8 Air France Industries KLM Engineering & Maintenance Mergers & Acquisitions (M&A) Activity

4.2.9 Air France Industries KLM Engineering & Maintenance Overview

4.2.10 Air France Industries KLM Engineering & Maintenance Officers and Executives

4.2.11 Financial Performance of Air France Industries KLM Engineering & Maintenance

4.2.12 Air France Industries KLM Engineering & Maintenance Key Financial Ratios

4.2.13 Industry Relationship

4.2.14 Strengthening and Reaffirming Market Positioning

4.2.15 Air France Industries KLM Engineering & Maintenance Future Outlook

4.2.16 Air France Industries KLM Engineering & Maintenance SWOT Analysis

4.3 Airbus Group

4.3.1 Airbus Group Commercial Aircraft MRO Market Selected Recent Contracts / Projects / Programmes 2012-2018

4.3.2 Airbus Group Key Strategies

4.3.3 Airbus Group Total Sales 2014-2018

4.3.4 Airbus Group Net Income 2014-2018

4.3.5 Airbus Group Commercial Aircraft MRO Market Products / Services

4.3.6 Airbus Group Primary Market Competitors 2018

4.3.7 Airbus Group Overview

4.3.8 Financial Performance of Airbus

4.3.9 Airbus Group Key Ratios

4.3.10 Airbus Group Industry Relationship

4.3.11 Airbus Maintenance & Engineering Services

4.3.12 Airbus Group Future Outlook

4.3.13 Airbus Group SWOT Analysis

4.4 Embraer S.A.

4.4.1 Embraer S.A. Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2018-2019

4.4.2 Embraer S.A. Key Strategies

4.4.3 Embraer S.A. Sales 2013-2017

4.4.4 Embraer S.A. Net Income 2013-2017

4.4.5 Embraer S.A. Commercial Aircraft MRO Products / Services

4.4.6 Embraer S.A. Primary Market Competitors 2017

4.4.7 Embraer S.A. Overview

4.4.8 Embraer S.A. Key Financial Ratios

4.4.9 Embraer S.A. SWOT Analysis

4.5 Boeing Company

4.5.1 Boeing Company Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2012-2018

4.5.2 Boeing Company Key Strategies

4.5.3 Boeing Company Total Company Sales 2013-2017

4.5.4 Boeing Company Sales in Commercial Airplanes 2014-2018

4.5.5 Boeing Company Net Income 2014-2018

4.5.6 Boeing Company Commercial Aircraft MRO Products / Services

4.5.7 Boeing Company Primary Market Competitors 2018

4.5.8 Boeing Company Overview

4.5.9 Financial Performance of Boeing Company

4.5.10 Boeing Company Key Financial Ratios

4.5.11 Boeing Company Industry Relationship

4.5.12 A Broad Range of Technical Support and Maintenance Services

4.5.13 Boeing Company Future Outlook

4.5.14 Boeing Company SWOT Analysis

4.6 Bombardier Inc

4.6.1 Bombardier Inc Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2015-2018

4.6.2 Bombardier Inc Key Strategies

4.6.3 Bombardier Inc Total Company Sales 2014-2018

4.6.4 Bombardier Inc. Sales in the Commercial Aircraft MRO Market 2014-2018

4.6.5 Bombardier Inc Net Income / Loss 2014-2018

4.6.6 Bombardier Inc Commercial Aircraft MRO Products / Services

4.6.7 Bombardier Inc Primary Market Competitors 2018

4.6.8 Bombardier Inc. Overview

4.6.9 Financial Performance of Bombardier Inc

4.6.10 Bombardier Inc Key Financial Ratio

4.6.11 Bombardier Inc Industry Relationship

4.6.12 Primary Focus on Component Services

4.6.13 Bombardier Inc Future Outlook

4.6.14 Bombardier Inc. SWOT Analysis

4.7 Honeywell Aerospace

4.7.1 Honeywell Aerospace Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2014-2018

4.7.2 Honeywell Aerospace Key Strategies

4.7.3 Honeywell Aerospace Total Parent Company Sales 2014-2018

4.7.4 Honeywell Aerospace Parent Company Net Income / Loss 2014-2018

4.7.5 Honeywell Aerospace Commercial Aircraft MRO Products / Services

4.7.6 Honeywell Aerospace Primary Market Competitors 2018

4.7.7 Honeywell Aerospace Overview

4.7.8 Honeywell Aerospace Key Financial Ratio

4.7.9 Honeywell Aerospace SWOT Analysis

4.8 Delta TechOps

4.8.1 Delta TechOps Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2011-2018

4.3.2 Delta TechOps Key Strategies

4.8.3 Delta TechOps Parent Company Sales 2014-2018

4.8.4 Delta TechOps Parent Company Net Income 2014-2018

4.8.5 Delta TechOps Commercial Aircraft MRO Products / Services

4.8.6 Delta TechOps Primary Market Competitors 2018

4.8.7 Delta TechOps Overview

4.8.8 Delta TechOps Key Financial Ratios

4.8.9 MRO Capabilities for a Broad Range of Aircraft and Engines

4.8.10 Delta TechOps Future Outlook

4.8.11 Delta TechOps SWOT Analysis

4.9 GE Aviation

4.9.1 GE Aviation Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2013-2018

4.9.2 GE Aviation Key Strategies

4.9.3 GE Aviation Total Parent Company Sales 2014-2018

4.9.4 GE Aviation Parent Company Net Income 2014-2018

4.9.5 GE Aviation Commercial Aircraft MRO Products / Services

4.9.6 GE Aviation Primary Market Competitors 2018

4.9.7 GE Aviation Overview

4.9.8 Financial Performance of GE Aviation

4.9.9 GE Aviation Key Financial Ratio

4.9.10 GE Aviation A Key Player in Engine MRO

4.9.11 GE Aviation Future Outlook

4.9.12 GE Aviation SWOT Analysis

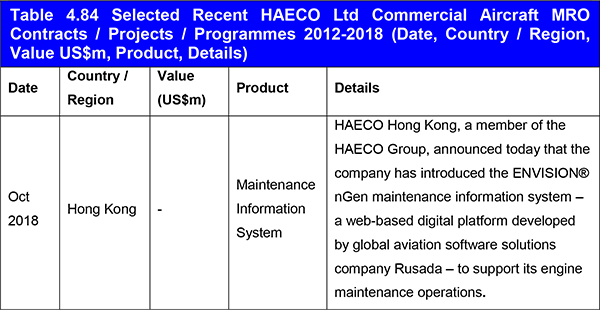

4.10 Hong Kong Aircraft Engineering Company (HAECO) Ltd

4.10.1 HAECO Ltd Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2012-2018

4.10.2 HAECO Key Strategies

4.10.3 HAECO Ltd Total Company Sales 2013-2017

4.10.4 HAECO Ltd Net Income 2013-2017

4.10.5 HAECO Ltd Commercial Aircraft MRO Products / Services

4.10.6 HAECO Ltd Primary Market Competitors 2018

4.10.7 HAECO Ltd Overview

4.10.8 Financial Performance of HAECO Ltd

4.10.9 HAECO Ltd Key Financial Ratio

4.10.10 Comprehensive MRO Services Through an Extensive Group Network

4.10.11 HAECO Ltd Future Outlook

4.10.12 HAECO Ltd SWOT Analysis

4.11. Spirit AeroSystems, Inc.

4.11.1 Spirit AeroSystems, Inc. Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2010-2015

4.11.2 Spirit AeroSystems, Inc. Key Strategies

4.11.3 Spirit AeroSystems, Inc. Parent Company Sales 2014-2018

4.11.4 Spirit AeroSystems, Inc. Parent Company Net Income / Loss 2014-2018

4.11.5 Spirit AeroSystems, Inc. Commercial Aircraft MRO Products / Services

4.11.6 Spirit AeroSystems, Inc. Primary Market Competitors 2017

4.11.7 Spirit AeroSystems, Inc. Overview

4.11.8 Spirit AeroSystems, Inc. Key Financial Ratio

4.11.9 Spirit AeroSystems, Inc. SWOT Analysis

4.12 Lufthansa Technik AG

4.12.1 Lufthansa Technik AG Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2014-2018

4.12.2 Lufthansa Technik AG Key Strategies

4.12.3 Lufthansa Technik AG Total Company Sales 2014-2018

4.12.4 Lufthansa Technik AG Net Income 2014-2018

4.12.5 Lufthansa Technik AG Commercial Aircraft MRO Products / Services

4.12.6 Lufthansa Technik AG Primary Market Competitors 2017

4.12.7 Lufthansa Technik AG Overview

4.12.8 Financial Performance of Lufthansa Technik AG

4.12.9 Strengthening International Presence

4.12.10 Innovation and Growth in an Increasingly Competitive Market

4.12.11 Lufthansa Technik AG Future Outlook

4.12.12 Lufthansa Technik AG SWOT Analysis

4.13 MTU Aero Engines AG

4.13.1 MTU Aero Engine AG Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2012-2018

4.13.2 MTU Aero Engines AG Key Strategies

4.13.3 MTU Aero Engines AG Total Company Sales 2014-2018

4.13.4 MTU Aero Engines AG Net Income 2014-2018

4.13.5 MTU Aero Engines AG Commercial Aircraft MRO Products / Services

4.13.6 MTU Aero Engines AG Primary Market Competitors 2017

4.13.7 MTU Aero Engines AG Overview

4.13.8 Financial Performance of MTU Aero Engines AG

4.13.9 MTU Aero Engines AG Key Financial Ratio

4.13.10 MTU Aero Engines AG Strong MRO Services Portfolio

4.13.11 MTU Aero Engines AG Future Outlook

4.13.12 MTU Aero Engines AG SWOT Analysis

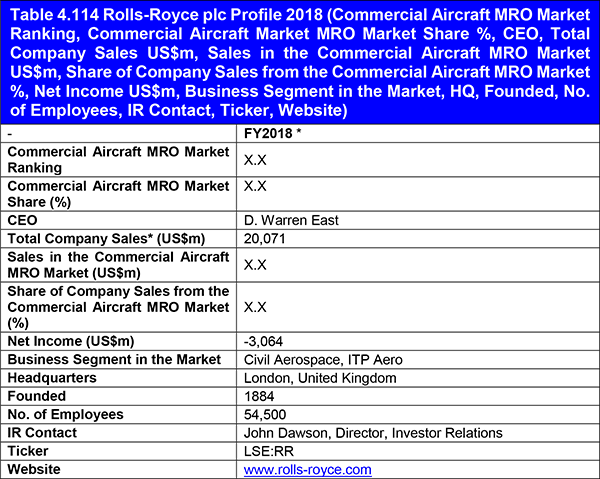

4.14 Rolls-Royce plc

4.14.1 Rolls-Royce plc Commercial Aircraft MRO Market Selected Recent Contracts / Projects / Programmes 2014-2018

4.14.2 Rolls-Royce plc Key Strategies

4.14.3 Rolls-Royce plc Total Company Sales 2014-2018

4.14.4 Rolls-Royce plc Sales in the Commercial Aircraft MRO Market 2014-2018

4.14.5 Rolls-Royce plc Net Income 2014-2018

4.14.6 Rolls-Royce plc Commercial Aircraft MRO Products / Services

4.14.7 Rolls-Royce plc Primary Market Competitors 2018

4.14.8 Rolls-Royce plc Overview

4.14.9 Financial Performance of Rolls-Royce plc

4.14.10 Rolls-Royce plc Key Financial Ratio

4.14.11 Integrated Engine Maintenance Services Packages

4.14.12 Rolls-Royce plc Future Outlook

4.14.13 Rolls-Royce plc SWOT Analysis

4.15 SIA Engineering Company Ltd

4.15.1 SIA Engineering Company Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2011-2017

4.15.2 SIA Engineering Company Ltd. Key Strategies

4.15.3 SIA Engineering Company Ltd Total Company Sales 2014-2018

4.15.4 SIA Engineering Company Ltd Net Income 2014-2018

4.15.5 SIA Engineering Company Ltd Commercial Aircraft MRO Products / Services

4.15.6 SIA Engineering Company Ltd Primary Market Competitors 2017

4.15.7 SIA Engineering Company Ltd Divestitures Activity

4.15.8 SIA Engineering Company Ltd Overview

4.15.9 Financial Performance of SIA Engineering Company Ltd

4.15.10 SIA Engineering Company Ltd Key Financial Ratio

4.15.11 A Major Player in the Asia Pacific

4.15.12 SIA Engineering Company Ltd Future Outlook

4.15.13 SIA Engineering Company Ltd SWOT Analysis

4.16 Safran SA

4.16.1 Safran SA Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2012-2017

4.16.2 Safran SA Key Strategies

4.16.3 Safran SA Parent Company Sales 2014-2017

4.16.4 Safran SA Parent Company Net Income / Loss 2014-2017

4.16.5 Safran SA Commercial Aircraft MRO Products / Services

4.16.6 Safran SA Primary Market Competitors 2017

4.16.7 Safran SA Overview

4.16.8 Safran SA Key Financial Ratio

4.16.9 Safran SA SWOT Analysis

4.17 Turkish Technic

4.17.1 Turkish Technic Selected Recent Contracts / Projects / Programmes 2011-2017

4.17.2 Turkish Technic Total Company Sales 2014-2018

4.17.3 Turkish Technic Net Income / Loss 2014-2018

4.17.4 Turkish Technic Commercial Aircraft MRO Products / Services

4.17.5 Turkish Technic Primary Market Competitors 2017

4.17.6 Turkish Technic Overview

4.17.7 Financial Performance of Turkish Technic

4.17.8 Aspiring to be a Global Leader in Commercial Aircraft MRO

4.17.9 Turkish Technic Future Outlook

4.17.10 Turkish Technic SWOT Analysis

4.18 General Dynamics Corporation

4.18.1 General Dynamics Corporation Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2015-2018

4.18.2 General Dynamics Corporation Key Strategies

4.18.3 General Dynamics Corporation Total Company Sales 2014-2017

4.18.4 General Dynamics Corporation Net Income / Loss 2014-2017

4.18.5 General Dynamics Corporation Commercial Aircraft MRO Products / Services

4.18.6 General Dynamics Corporation Primary Market Competitors 2017

4.18.7 General Dynamics Corporation Overview

4.18.8 General Dynamics Corporation Key Financial Ratio

4.18.9 General Dynamics Corporation SWOT Analysis

4.19 Textron, Inc.

4.19.1 Textron, Inc. Selected Recent Contracts / Projects / Programmes 2014-2018

4.19.2 Textron, Inc. Key Strategies

4.19.3 Textron, Inc. Total Company Sales 2014-2017

4.19.4 Textron, Inc. Net Income / Loss 2014-2017

4.19.5 Textron, Inc. Commercial Aircraft MRO Products / Services

4.19.6 Textron, Inc. Primary Market Competitors 2018

4.19.7 Textron, Inc. Overview

4.19.8 Financial Performance of Textron Inc.

4.19.9 Textron Inc. Key Financial Ratio

4.19.10 Textron, Inc. SWOT Analysis

4.20 United Technologies Corporation

4.20.1 United Technologies Corporation Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2014-2017

4.20.2 United Technologies Corporation Key Strategies

4.20.3 United Technologies Corporation Total Company Sales 2014-2018

4.20.4 United Technologies Corporation Net Income 2014-2018

4.20.5 United Technologies Corporation Commercial Aircraft MRO Market Products / Services

4.20.6 United Technologies Corporation Primary Market Competitors 2019

4.20.7 Divestiture Activity of United Technologies Corporation

4.20.8 United Technologies Corporation Overview

4.20.9 Financial Performance of United Technologies Corporation

4.20.10 United Technologies Corporation Key Financial Ratio

4.20.11 Aftermarket Support for Next Generation Airliners

4.20.12 United Technologies Corporation Future Outlook

4.20.13 United Technologies Corporation SWOT Analysis

5. Other Leading Companies in the Value Chain

6. SWOT Analysis of the Commercial Aircraft MRO Market 2018

7. Conclusions

8. Glossary

List of Tables

Table 2.1 Commercial Aircraft MRO Activities (MRO Activity, Description)

Table 2.2 Aircraft Maintenance Checks (Check, Location, Duration, Description)

Table 2.3 Global Commercial Aircraft MRO Market Drivers & Restraints 2019

Table 3.1 Leading 20 Commercial Aircraft MRO Companies Shares 2018-19 (Ranking, Company, FY2018-19 Total / Parent Company Sales US$m, FY2018-19 Sales in the MRO Market US$m, % Share of MRO Sales from Total Company Sales, Commercial Aircraft MRO Market Share %)

Table 4.1 AAR Corporation Profile 2018 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, CEO, Total Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Sales from Commercial Aircraft MRO Market %, Net Income US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.2 Selected Recent AAR Corporation Aircraft MRO Contracts / Projects / Programmes 2013-2017 (Date, Count

Table 4.3 AAR Corporation Aircraft Key Strategies / Region, Value US$m, Product / Service, Details)

Table 4.4 AAR Corporation Total Company Sales 2014-2018 (US$m, AGR %)

Table 4.5 AAR Corporation Sales in the Commercial Aircraft MRO Market 2014-2018 (US$m, AGR %)

Table 4.6 AAR Corporation Net Income 2014-2018 (US$m, AGR %)

Table 4.7 AAR Corporation Commercial Aircraft MRO Products / Services (Segment of Business, Product, Specification / Features)

Table 4.8 AAR Corporation: Key Financial Ratios, 2018

Table 4.9 AAR Corporation: Industry Relationship

Table 4.10 AAR Corporation SWOT Analysis 2018

Table 4.11 Air France Industries KLM Engineering & Maintenance Profile 2018 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, Executive Vice President, Parent Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Company Sales from the Commercial Aircraft MRO Market %, Net Income US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.12 Selected Recent Air France Industries KLM Engineering & Maintenance Commercial Aircraft MRO Contracts / Projects / Programmes 2015-2018 (Date, Country / Region, Product, Details)

Table 4.13 Air France Industries KLM Engineering & Maintenance Key Strategies, 2018

Table 4.14 Air France Industries KLM Engineering & Maintenance Parent Company Sales 2014-2018 (US$m, AGR %)

Table 4.15 Air France Industries KLM Engineering & Maintenance Sales in the Commercial Aircraft MRO Market 2014-2018 (US$m, AGR %)

Table 4.16 Air France Industries KLM Engineering & Maintenance Net Income 2014-2018 (US$m, AGR %)

Table 4.17 Air France Industries KLM Engineering & Maintenance Commercial Aircraft MRO Products / Services (Segment of Business, Product / Service, Specification / Features)

Table 4.18 Air France Industries KLM Engineering & Maintenance: Officers and Executives

Table 4.19 Air France Industries KLM Engineering & Maintenance: Key Financial Ratios, 2018

Table 4.20 Air France Industries KLM Engineering & Maintenance: Industry Relationship

Table 4.21 Air France Industries KLM Engineering & Maintenance SWOT Analysis 2019

Table 4.22 Airbus Group Profile 2018 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, CEO, Total Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Company Sales from Commercial Aircraft MRO Market %, Net Income US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.23 Selected Recent Airbus Group Commercial Aircraft MRO Market Contracts / Projects / Programmes 2012-2018 (Date, Country / Region, Product, Details)

Table 4.24 Airbus Group Key Strategies, 2016-2018

Table 4.25 Airbus Group Total Sales 2014-2018 (US$m, AGR %)

Table 4.26 Airbus Group Net Income 2014-2018 (US$m, AGR %)

Table 4.27 Airbus Group Commercial Aircraft MRO Products / Services (Segment of Business, Product / Service, Specification / Features)

Table 4.28 Airbus Group Key Financial Ratios – 2018

Table 4.29 Airbus Group Industry Relationship

Table 4.30 Airbus Group SWOT Analysis 2019

Table 4.31 Embraer S.A. Profile 2018 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft Market MRO Share %, Chairman, Parent Company Sales US$m, Total Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Sales from Commercial Aircraft MRO Market %, HQ, Founded, No. of Employees, IR Contact, Website)

Table 4.32 Selected Recent Embraer S.A. Commercial Aircraft MRO Contracts / Projects / Programmes 2011-2018 (Date, Country / Region, Product, Details)

Table 4.33 Embraer Key Strategies

Table 4.34 Embraer S.A. Company Sales 2013-2017 (US$m, AGR %)

Table 4.35 Embraer S.A. Company Net Income 2013-2017 (US$m, AGR %)

Table 4.36 Embraer S.A. Commercial Aircraft MRO Products / Services (Segment of Business, Product, Specification / Features)

Table 4.37 Embraer S.A. Key Financial Ratios – 2017

Table 4.38 Embraer S.A. SWOT Analysis 2019

Table 4.39 Boeing Company Profile 2018 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, CEO, Total Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Sales from the Commercial Aircraft MRO Market %, Net Income US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.40 Selected Recent Boeing Company Commercial Aircraft MRO Contracts / Projects / Programmes 2012-2018 (Date, Country / Region, Product / Service, Details)

Table 4.41 Boeing Company Key Strategies

Table 4.42 Boeing Company Total Company Sales 2014-2018 (US$m, AGR %)

Table 4.43 Boeing Company Sales in Commercial Airplanes 2014-2018 (US$m, AGR %)

Table 4.44 Boeing Company Net Income 2014-2018 (US$m, AGR %)

Table 4.45 Boeing Company Commercial Aircraft MRO Products / Services (Segment of Business, Product / Service, Specification / Features)

Table 4.46 Boeing Company: Key Financial Ratios, 2018

Table 4.47 Boeing Company: Industry Relationship

Table 4.48 Boeing Company SWOT Analysis 2019

Table 4.49 Bombardier Inc Profile 2018 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, CEO, Total Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Sales from the Commercial Aircraft MRO Market %, Net Loss US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 4.50 Selected Recent Bombardier Inc Commercial Aircraft MRO Contracts / Projects / Programmes 2015-2018 (Date, Country / Region, Product / Service, Details

Table 4.51 Bombardier Inc. Key Strategies

Table 4.52 Bombardier Inc Total Company Sales 2014-2018 (US$m, AGR %)

Table 4.53 Bombardier Inc Sales in the Commercial Aircraft MRO Market 2014-2018 (US$m, AGR %)

Table 4.54 Bombardier Inc Net Income / Loss 2014-2018 (US$m)

Table 4.55 Bombardier Inc Commercial Aircraft MRO Products / Services (Segment of Business, Product / Service, Specification / Features)

Table 4.56 Bombardier Inc.: Key Financial Ratio – 2018

Table 4.57 Bombardier Inc.: Industry Relationship

Table 4.58 Bombardier Inc. SWOT Analysis 2019

Table 4.59 Honeywell Aerospace Profile 2018 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, CEO, Parent Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Company Sales from the Commercial Aircraft MRO Market %, Net Income, Business Segment in the Market, HQ, Founded, IR Contact, Ticker, Website)

Table 4.60 Selected Recent Honeywell Aerospace Commercial Aircraft MRO Contracts / Projects / Programmes 2014-2018 (Date, Country / Region, Product / Service, Details)

Table 4.61 Honeywell Aerospace Key Strategies

Table 4.62 Honeywell Aerospace Total Parent Company Sales 2014-2018 (US$m, AGR %)

Table 4.63 Honeywell Aerospace Parent Company Net Income / Loss 2014-2018 (US$m

Table 4.64 Honeywell Aerospace Commercial Aircraft MRO Products / Services (Segment of Business, Product / Service, Specification / Features)

Table 4.65 Honeywell: Key Financial Ratio – 2018

Table 4.66 Honeywell Aerospace SWOT Analysis 2019

Table 4.67 Delta TechOps Profile 2018 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, CEO, Parent Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Company Sales from Commercial Aircraft MRO Market %, Net Income US$m, Business Segment in the Market, HQ, No. of Employees, IR Contact, Ticker, Website)

Table 4.68 Selected Recent Delta TechOps Commercial Aircraft MRO Contracts / Projects / Programmes 2011-2018 (Date, Country / Region, Product / Service, Details)

Table 4.69 Delta TechOps Key Strategies

Table 4.70 Delta TechOps Parent Company Sales 2014-2018 (US$m, AGR %)

Table 4.71 Delta TechOps Parent Company Net Income 2014-2018 (US$m, AGR %)

Table 4.72 Delta TechOps Commercial Aircraft MRO Products / Services (Segment of Business, Product / Service, Specification / Features)

Table 4.73 Delta Airlines Inc.: Key Financial Ratio – 2018

Table 4.74 Delta TechOps SWOT Analysis 2019

List of Figures

Figure 2.1 Global Commercial Aircraft MRO Segments

Figure 2.2 Global Commercial Aircraft Maintenance, Repair & Overhaul Market Players

Figure 3.1 Top 20 Companies in the Commercial Aircraft MRO Market FY2018-19 (Company, Sales US$m)

Figure 3.2 Top 20 Companies in the Commercial Aircraft MRO Market FY2018-19 (% Share)

Figure 3.3 Competitor Positioning Map of Top 20 Commercial Aircraft MRO Companies 2018 (Ranking, Commercial MRO Revenue and Share Index)

Figure 3.4 Market Shares of Top 5 Vs. Remaining 15 Commercial Aircraft MRO Companies 2018 (Company Ranking, Market Share %)

Figure 3.5 Top 20 Commercial Aircraft MRO Companies by Region 2018 (Market Share %)

Figure 4.1 AAR Corporation Total Company Sales 2014-2018 (US$m, AGR %)

Figure 4.2 AAR Corporation Sales in the Commercial Aircraft MRO Market 2014-2018 (US$m, AGR %)

Figure 4.3 AAR Corporation Net Income 2014-2018 (US$m, AGR %)

Figure 4.4 AAR Corporation Primary Market Competitors 2019

Figure 4.5 Air France Industries KLM Engineering & Maintenance Parent Company Sales 2014-2018 (US$m, AGR %)

Figure 4.6 Air France Industries KLM Engineering & Maintenance Sales in the Commercial Aircraft MRO Market 2014-2018 (US$m, AGR %)

Figure 4.7 Air France Industries KLM Engineering & Maintenance Net Income 2014-2018 (US$m, AGR %)

Figure 4.8 Air France Industries KLM Engineering & Maintenance Primary Market Competitors 2019

Figure 4.9 Airbus Group Total Sales 2014-2018 (US$m, AGR %)

Figure 4.10 Airbus Group Net Income 2014-2018 (US$m, AGR %)

Figure 4.11 Airbus Group Primary Market Competitors 2019

Figure 4.12 Embraer S.A. Sales 2013-2017 (US$m, AGR %)

Figure 4.13 Embraer S.A. Net Income 2013-2017 (US$m, AGR %)

Figure 4.14 Embraer S.A. Primary Market Competitors 2019

Figure 4.15 Boeing Company Total Company Sales 2014-2018 (US$m, AGR %)

Figure 4.16 Boeing Company Sales in Commercial Airplanes 2014-2018 (US$m, AGR %)

Figure 4.17 Boeing Company Net Income 2014-2018 (US$m, AGR %)

Figure 4.18 Boeing Company Primary Market Competitors 2019

Figure 4.19 Bombardier Inc Total Company Sales 2014-2018 (US$m, AGR %)

Figure 4.20 Bombardier Inc Sales in the Commercial Aircraft MRO Market 2014-2018 (US$m, AGR %)

Figure 4.21 Bombardier Inc Net Income / Loss 2014-2018 (US$m)

Figure 4.22 Bombardier Inc Primary Market Competitors 2019

Figure 4.23 Honeywell Aerospace Total Parent Company Sales 2014-2018 (US$m, AGR %)

Figure 4.24 Honeywell Aerospace Parent Company Net Income / Loss 2014-2018 (US$m)

Figure 4.25 Honeywell Aerospace Primary Market Competitors 2019

Figure 4.26 Delta TechOps Parent Company Sales 2014-2018 (US$m, AGR %)

Figure 4.27 Delta TechOps Parent Company Net Income 2014-2018 (US$m, AGR %)

Figure 4.28 Delta TechOps Primary Market Competitors 2019

Figure 4.29 GE Aviation Total Parent Company Sales 2014-2018 (US$m, AGR %)

Figure 4.30 GE Aviation Parent Company Net Income 2014-2018 (US$m, AGR %)

Figure 4.31 GE Aviation Primary Market Competitors 2019

Figure 4.32 HAECO Ltd Total Company Sales 2013-2017 (US$m, AGR %)

Figure 4.33 HAECO Ltd Net Income 2013-2017 (US$m, AGR %)

Figure 4.34 HAECO Ltd Primary Market Competitors 2019

Figure 4.35 Spirit AeroSystems, Inc. Parent Company Sales 2014-2018 (US$m, AGR %)

Figure 4.36 Spirit AeroSystems, Inc. Parent Company Net Income / Loss 2014-2018 (US$m, AGR %)

Figure 4.37 Spirit AeroSystems, Inc. Primary Market Competitors 2017

Figure 4.38 Lufthansa Technik AG Total Company Sales 2014-2018 (US$m, AGR %)

Figure 4.39 Lufthansa Technik AG Net Income 2014-2018 (US$m, AGR %)

Figure 4.40 Lufthansa Technik AG Primary Market Competitors 2019

Figure 4.41 MTU Aero Engines AG Total Company Sales 2014-2018 (US$m, AGR %)

Figure 4.42 MTU Aero Engines AG Net Income 2014-2018 (US$m, AGR %)

Figure 4.43 MTU Aero Engines AG Primary Market Competitors 2019

Figure 4.44 Rolls-Royce plc Total Company Sales 2014-2018 (US$m, AGR %)

Figure 4.45 Rolls-Royce plc Sales in the Commercial Aircraft MRO Market 2014-2018 (US$m, AGR %)

Figure 4.46 Rolls-Royce plc Net Income 2014-2018 (US$m)

Figure 4.47 Rolls-Royce plc Primary Market Competitors 2019

Figure 4.48 SIA Engineering Company Ltd Total Company Sales 2014-2018 (US$m, AGR %)

Figure 4.49 SIA Engineering Company Ltd Net Income 2014-2018 (US$m, AGR %)

Figure 4.50 SIA Engineering Company Ltd Primary Market Competitors 2019

Figure 4.51 Safran SA Parent Company Sales 2014-2017 (US$m, AGR %)

Figure 4.52 Safran SA Net Income / Loss 2014-2017 (US$m)

Figure 4.53 Safran SA Primary Market Competitors 2019

Figure 4.54 Turkish Technic Total Company Sales 2014-2018 (US$m, AGR %)

Figure 4.55 Turkish Technic Net Income / Loss 2014-2018 (US$m)

Figure 4.56 Turkish Technic Primary Market Competitors 2019

Figure 4.57 General Dynamics Corporation Total Company Sales 2014-2018 (US$m, AGR %)

Figure 4.58 General Dynamics Corporation Net Income / Loss 2015-2018 (US$B)

Figure 4.59 General Dynamics Corporation Primary Market Competitors 2019

Figure 4.60 Textron, Inc. Total Company Sales 2015-2018 (US$m, AGR %)

Figure 4.61 Textron, Inc. Net Income / Loss 2015-2018 (US$m)

Figure 4.62 Textron, Inc. Primary Market Competitors 2019

Figure 4.63 United Technologies Corporation Total Company Sales 2014-2018 (US$m, AGR %)

Figure 4.64 United Technologies Corporation Net Income 2014-2018 (US$m, AGR %)

Figure 4.65 United Technologies Corporation Primary Market Competitors 2019

AAR Corporation

AAR Landing Gear LLC

AAR Parts Trading Inc.

Able Aerospace Services

Able Engineering & Component Services

ABX Air, Air Transport International

ACI JET

AECO ITM Limited

Aegean Airlines

AerCap

AerData Group BV

Aerion Corporation

Aero Asahi Corporation

Aero Maintenance Group

Aero Technologies

AeroCentury Corp.

Aeroflot

Aerolineas Argentinas SA

AeroLogic

Aeroman

Aeromexico

Aerotron

AFI KLM E&M

AFPT Maintenance Training

Air Astana

Air Berlin Plc

Air Canada

Air Canada Jazz

Air China Cargo

Air China Ltd.

Air Contractors Ltd.

Air Europa

Air Evac Lifeteam

Air France Industries KLM Engineering & Maintenance (AFI KLM E&M)

Air Inc.

Air Independence

Air India Limited

Air Lease Corp.

Air Madagascar

Air Malta

Air Mauritius

Air New Zealand Ltd.

Air Nostrum

Air Philippines Corp.

Air Serbia

Air Transat

Air Transport Services Group, Inc

Air Vanuatu

Air Wisconsin

AirAsia

AirAsia X

Airbus

Airbus Asia Training Centre

Airbus Corporate Jet Centre

Airbus SAS

Aircastle Ltd

Aircraft Industries

Airinmar

Alaska Airlines.

Aleris Corp

Alessi

Alia-The Royal Jordanian Airlines Plc

Alitalia

All Nippon Airways Co., Ltd. (ANA)

Allegiant Air

Ameco Beijing

American Airlines Group, Inc.

American Eurocopter Corporation

Ameriflight, LLC

Amex

Ana Holdings Inc.

ANSYS

Arkefly

Aruba Airlines

ASCO

Asiana Airlines

Astra Airlines

Astronics Corp.

Atlas Air

AtlasGlobal Airlines

Atlasjet

ATR

ATSG

Austral Líneas Aéreas

Austrian Airlines AG

Aviall

Avianca

Aviaso.

AVIC Aircraft Co. Ltd.

Azul

Azul Airline

Azul Linhas Aereas Brasileiras

AZUR Air

BA CityFlyer

Babcock Mission Critical Services Ltd

BAE Systems Inc.

Bamboo Airways

Barfield Inc.

Batam Aero Technik

Beijing Capital Airlines

Bell Helicopter

Berkshire Hathaway

BH Air

Bluebird Cargo

BMI Regional

Boeing Asia Pacific Aviation Services Pte Ltd.

Boeing Company

Bombardier Business Aircraft

Bombardier Inc

Bombardier Services Corporation

Borajet Airlines

Bristow Group, Inc.

British Airways

Brussels Airlines SA

Canjet

Cargo Air (Bulgaria)

Cargo Aircraft Management

Cathay Pacific Airways Ltd.

Cebu Pacific Air

CemAir (PTY) Ltd.

Cessna

CFM International

China Airlines Ltd.

China Cargo Airlines

China Eastern Airlines Corp. Ltd.

China Express Airlines

China Southern Airlines Co. Ltd.

China United Airline

Chorus Aviation

Citilink

CityJet

Cobalt

Cobham Plc

Colorful Guizhou Airlines

Comair Ltd.

Comlux

Compass Airlines

Congo Airways

Congo Airways

CONVIASA

Copa Airlines

Corsair

Cox Machine

Dassault Aviation SA

Dassault Systemes

Delta Air Lines

Delta TechOps

Deutsche Lufthansa AG

DHL

Dragonair

easyJet Plc

Eaton

Egyptair

El Al Israel Airlines

Embraer SA

Emirates

Emirates Engineering

Endeavor Air

Enter Air

EPCOR

Erickson Inc.

Ethiopian Airlines

Etihad Airways

Etihad Airways Engineering

Eurowings

EVA Air

Evergreen Aviation Technologies

ExpressJet

FACC

FedEx

Finnair

flyadeal

Flybe

Flydubai

Fokker

ForeFlight

Frontier Airlines

GA Telesis LLC

Garuda Indonesia

GE Aviation

GE Aviation Turkey

General Dynamics Corporation

GKN Aerospace

GMF AeroAsia

GMR Aero Technic Ltd.

GoAir

GOL

GOL Linhas Aereas

Goodrich Aerostructures Service China Ltd,

Goshawk Aviation Limited

Grupo Aeromexico

Guizhou Airlines

Gulf Air

Gulfstream Aerospace

HAECO Americas

HAECO Component Overhaul (Xiamen) Ltd

HAECO Group

HAECO Hong Kong

HAECO ITM Ltd

Haeco Spirit AeroSystems

HAESL.

Hainan Airlines

Hamilton Sundstrand

Hawaii Island Air, Inc.

Hawaiian Airlines

Hawker Pacific Aerospace.

Heavy Maintenance Singapore Services Pte Ltd (HMS Services)

HNA Group

Honeywell Aerospace

Honeywell Aerospace Trading (HAT)

Honeywell International

Hong Kong Aircraft Engineering Company (HAECO) Ltd

IAE

Iberia

IBEX Airlines

IBM Corp

Icelandair

Indamer Aviation

IndiGo

Innova Aerospace

International Airlines Group (IAG)

Intersky

Japan Airlines

Japanese Aero Engines Corporation

Jazeera Airways

Jazz Aviation

Jeju Air

Jet Aviation

Jet Aviation Basel

Jet Aviation Singapore

Jet2

Jetairfly

JetBlue Airways

Jetstar

Jetstar Pacific

Kenyan Airways

KLM UK Engineering,

Korea Aerospace Industries (KAI)

Korean Air

Kuwait Airways

LATAM Airlines Group (LATAM)

Liebherr Aerospace

LM UK Engineering & Alliance Airlines Pty Ltd

LMI Aerospace, Inc.

Lockheed Martin Corporation

Lockheed Martin Commercial Engine Solutions

LOT Polish Airlines

Lufthansa Airlines

Lufthansa Technik

Lufthansa Technik Aero Alzey GmbH (LTAA)

Lufthansa Technik AG

Lufthansa Technik Budapest

Lufthansa Technik Maintenance International

Lufthansa Technik Philippines

Lufthansa Technik Puerto Rico

Lufthansa Technik Training

Luxaviation Group

Luxembourg carrier

Magellan Aerospace Limited

Malaysia Airlines

Malaysia Airlines Berhad

Maldivian

Mango Airlines

MB Aerospace,

MBDA

Meggitt PLC

Meridianafly

Mesa Air

Mesa Airlines Inc.

Messier-Bugatti-Dowty

Metis Design Corporation

Microsoft Corp

Mid-Continent Aircraft Corporation

Middle East Airlines

Middle River Aircraft Systems Inc,

Mitsubishi Aircraft Corporation

Mitsubishi Regional Jet

MNG Airlines

Monarch Airlines

Moog Inc.

MTU Aero Engines AG

MTU Maintenance

MTU Maintenance Canada

MTU Maintenance Hannover

MTU Maintenance Zhuhai

Mubadala Aerospace

Myanmar National Airlines

National Airlines

Neos

NetJets, Inc.

Nextnine

Nordic Aviation

Nordic Aviation Capital

Nordic Regional Airlines

Nordwind Airlines

Northrop Grumman Corporation

Norwegian

Norwegian Air Shuttle

Olympic Air

Oman Air

Omni Air International

OneAero MRO

OneWeb

Onur Air’

Orbest Airlines

Otis

Pakistan International Airlines

Pegasus Airlines

Philippine Airlines (PAL)

Pratt & Whitney

Pratt & Whitney AeroPower

Pratt & Whitney Canada

Pratt & Whitney Christchurch Engine Centre

Premier Engineering & Manufacturing Inc.

Privilege Style

PSA Airlines

PT Garuda Maintenance Facility Aero Asia Tbk

Qantas Group

Qatar Airways

Ramco Systems

Raytheon

Republic Airline Inc.

Republic Airways

Revima Group

Rockwell Collins

Rolls-Royce Holdings plc

Rolls-Royce Overseas Holdings Limited

Rolls-Royce plc

Royal Air Maroc

Royal Jordanian Airlines

Rusada

RwandAir

S7 Engineering

Sabena Technics

Safi Airways

Safran

Safran Aircraft Engines

Safran Electrical & Power

Safran Electronics Asia Pte Ltd.

Safran SA

Sagem Defense Securite

SAMCO Aircraft Maintenance BV

Satair

SATAIR Group

SATENA

Saudi Arabian Airlines

Saudia Aerospace Engineering Industries (SAEI)

SC Cruises

Scandinavian Airlines System (SAS)

Scoot

Seletar Aerospace Park

Senior plc

Sepang Aircraft Engineering,

Serene Air

Shanghai Airlines)

SIA Engineering Company Ltd (SIAEC)

Sichuan Airlines

Sichuan Services Aero Engine Maintenance Company (SSAMC)

Siemens AG

Sikorsky Aircraft

Silk Way West Airlines

SilkAir

Singapore Airlines

Singapore Airlines Cargo

Singapore Component Solutions

SkyTeam Alliance

Skywest Airlines

SkyWest, Inc.

Smartlynx Airlines

Solaseed Airlines

South African Airways

South African Airways Technical (SAAT) Ltd.

Souther Field Aviation Inc

Southwest Airlines

Spairliners

Spare Solution Support India

SpiceJet

SpiceJet Limited

Spirit

Spirit AeroSystems Inc.

Spirit Airlines

SPP Canada Aircraft Inc.

SriLankan Airlines

ST Aerospace

ST Engineering Ltd

StandardAero

Stratasys Ltd

Sumitomo Corporation

Sun Country Airlines

Sunwing Airlines

Surinam Airways

Swiss International Air Lines

Taikoo (Xiamen) Aircraft Engineering Company Ltd (TAECO)

Taikoo (Xiamen) Landing Gear Services Co Ltd,

Taikoo Engine Services (Xiamen) Co Ltd

Taikoo Spirit AeroSystems Composite Co Ltd.

TAM MRO

TAM SA

TAROM

Telair Cargo Group

Textron Aviation Canada Ltd.

Textron Aviation, Inc.

Textron, Inc.

Thai Airline

Thai Airways International

Thai Smile

Thomas Cook Group

Thomas Cook Group Airlines

Thomson Airways

Tianjin Airlines

Tigerair Australia

Tigerair Singapore

Tigerair Taiwan

TIMCO Aviation Services

TNT Airways

Tradewinds Engine Services

Transaero Airlines

Transavia

TransDigm

Triumph Group Inc

TUI Airlines

TUI Travel plc

TUIFly Nordic

Tunisair Group

Tunisair Technics

Turkish Airlines

Turkish Technic

Ukraine International Airlines (UIA)

Umbra Cuscinetti S.p.A.

United Airlines

United Technologies Corporation

UPS

Utair Aviation

UTC Aerospace Systems

UTC Building and Industrial Systems

UTC Climate, Control & Security

VECA Airlines

ViaSat

VietJet Air

Vietnam Airlines

Virgin America

Virgin Atlantic

Virgin Australia

Vistara

VivaAerobus

Wamos Air

Westjet

Widerøe

Wizz Air

Xiamen Airlines

XL Airways France

Yakutia Airlines

Zhejiang Loong Airlines

Zodiac Aerospace Inc.

Airports mentioned

Amsterdam Schiphol Airport

Bangkok Suvarnabhumi Airport

Brussels Airport

Charles de Gaulle Airport

Chennault International Airport

Chicago Rockford International Airport

Dubai World Central (DWC) Airport

Duluth International Airport

El Salvador International Airport.

Gaoqi International Airport

Greater Rockford Airport Authority

Guarulhos International Airport

Heathrow Airport

Hong Kong International Airport

Indianapolis International Airport

Macau International Airport

O.R. Tambo International Airport

Paris Charles de Gaulle Airport

Paris Le Bourget Airport

Paris Orly Airport

Queretaro Intercontinental Airport

San Francisco International Airport

Seattle-Tacoma International Airport

Singapore Changi Airport

Ted Stevens Anchorage International Airport

Tokyo-Narita International Airport

Toulouse Airport

U-Tapao International Airport

Organisations mentioned

Brazilian National Civil Aviation Agency (ANAC).

Civil Aviation Administration of China (CAAC)

Civil Aviation Safety Authority of Australia (CASA)

Czech Technical University (CTU)

Directorate General of Civil Aviation (DGCA) of India

European Aviation Safety Agency (EASA)

Federal Aviation Authority (FAA)

Federal Office of Bundeswehr Equipment, Information Technology and In-Service Support

International Air Transportation Association (IATA)

Internal Narcotics & Law Enforcement (US)

Japanese Civil Aviation Bureau (JCAB)

Ministry of Defence (UK)

Russian State Centre of Aviation Flight Safety

Singapore Economic Development Board

University of Strathclyde's Advanced Forming Research Centre (AFRC)

US Air Force (USAF)

US Navy

Wichita State University

Download sample pages

Complete the form below to download your free sample pages for Top 20 Commercial Aircraft Maintenance, Repair & Overhaul (MRO) Companies 2019

Related reports

-

Commercial Aircraft Cabin Seating & Interiors Market Forecast 2018-2028

Visiongain assessed that the world market for commercial aircraft cabin seating & interiors will reach $16.4 billion in 2018....Full DetailsPublished: 11 September 2018 -

MRO Software in Aviation Market Forecast Report 2019-2029

Airlines are increasingly connecting to artificial intelligence to their MRO strategies....Full DetailsPublished: 14 November 2019 -

Commercial Aircraft Modernization, Upgrade and Retrofit Market Report 2018-2028

This brand new report on the commercial aircraft Modernisation upgrade and retrofit market features market sizing, forecasts and detailed contract...

Full DetailsPublished: 12 April 2018 -

Drone Analytics Market Report 2019-2029

This latest report by business intelligence provider Visiongain assesses that the global Drone Analytics market is expected to grow at...

Full DetailsPublished: 01 January 1970 -

Flight Data Monitoring Systems Market Report 2019-2029

The global Flight Data Monitoring Systems market is expected to grow at a lucrative rate during the forecast period.

...Full DetailsPublished: 01 January 1970 -

Military Aircraft Maintenance, Repair & Overhaul (MRO) Market Report 2021-2031

Big spenders on defence devote approximately or more than 2 percent of their GDP to defence, a substantial amount. It...Full DetailsPublished: 30 October 2020 -

Commercial Aircraft Health Monitoring Systems (AHMS) Market Report 2018-2028

INDUSTRY PROFESSIONALS: cut through media hype and exaggeration by reading an objective dispassionate Visiongain report on the $721m commercial aircraft...

Full DetailsPublished: 27 March 2018 -

Commercial Aircraft Maintenance, Repair & Overhaul (MRO) Market Report 2018-2028

Commercial aircraft MRO continues to play a critical role in the aviation industry Visiongain evaluates this market to be worth...

Full DetailsPublished: 16 May 2018 -

Europe Maintenance, Repair and Overhaul (MRO) Market Report 2019-2029

This latest report by business intelligence provider Visiongain assesses that Europe Maintenance, Repair and Overhaul (MRO) Market spending will reach...

Full DetailsPublished: 01 January 1970 -

Aerospace Used Serviceable Material Market Report 2020-2030

The global aerospace used serviceable material market is competitive in nature as large number of well-established manufacturers are operating in...

Full DetailsPublished: 22 May 2020

Download sample pages

Complete the form below to download your free sample pages for Top 20 Commercial Aircraft Maintenance, Repair & Overhaul (MRO) Companies 2019

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Visiongain aviation reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and automotive industry experts but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology please email jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Would you like to get the latest Visiongain aviation reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

Airline Passenger Experience Association (APEX)

Airlines for America

Airport Consultants Council (ACC)

Airports Council International (ACI)

Airports Council International-North America

American Association of Airport Executives

Arab Air Carriers Organization (AACO)

European Aerospace Cluster Partnership

Global Business Travel Association (GBTA)

International Air Transport Association (IATA)

Security Industry Association (SIA)

Security Manufacturers Coalition

Women in Aviation

World Aviation Services

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Aviation news

Aircraft Computers Market

The global Aircraft Computers market is projected to grow at a CAGR of 5.7% by 2034

24 June 2024

Space Mining Market

The global Space Mining market is projected to grow at a CAGR of 20.7% by 2034

07 June 2024

Connected Aircraft Market

The global Connected Aircraft market is projected to grow at a CAGR of 17.2% by 2034

05 June 2024

Satellite Ground Station Market

The global Satellite Ground Station market was valued at US$65.69 billion in 2023 and is projected to grow at a CAGR of 13.3% during the forecast period 2024-2034.

21 May 2024