Industries > Aviation > Commercial Aircraft Maintenance, Repair & Overhaul (MRO) Market Report 2018-2028

Commercial Aircraft Maintenance, Repair & Overhaul (MRO) Market Report 2018-2028

Forecasts by Heavy Airframe Maintenance, Aircraft Engine MRO, Component MRO, Line Maintenance, as well as Regional Market Forecasts and Leading Company Profiles

Commercial aircraft MRO continues to play a critical role in the aviation industry Visiongain evaluates this market to be worth $75.5bn in 2018. This report, with a length of 258 pages, features 150+ tables and figures as well as 100+ contracts.

Quantitative Market Analytics

• Global forecasts from 2018-2028

• Regional forecasts from 2018-2028

• Submarket forecasts from 2018-2028

• Regional markets forecast by submarkets 2018-2028

Qualitative Analyses

• SWOT analysis of the market.

• Drivers and restraints for the market

Company profiles of 10 leading companies:

• AAR Corporation

• Air France Industries KLM Engineering & Maintenance

• Airbus SAS

• Boeing Company

• Bombardier Inc

• Delta TechOps

• GE Aviation

• Hong Kong Aircraft Engineering Company Ltd (HAECO)

• Lufthansa Technik AG

• MTU Aero Engines AG

Visiongain’s study is intended for anyone requiring forecasts for the commercial aircraft MRO market. You will find data, trends and predictions, offering insights into this critical sector of the aviation industry.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Commercial Aircraft Maintenance, Repair & Overhaul Market Overview

1.2 Global Commercial Aircraft Maintenance, Repair & Overhaul Market Segmentation

1.3 Why You Should Read This Report

1.4 How This Report Delivers

1.5 Key Questions Answered by This Analytical Report Include:

1.6 Who is This Report For?

1.7 Methodology

1.7.1 Secondary Research

1.7.2 Market Evaluation & Forecasting Methodology

1.8 Frequently Asked Questions (FAQ)

1.9 Associated Visiongain Reports

1.10 About Visiongain

2. Introduction to the Commercial Aircraft Maintenance, Repair & Overhaul Market

2.1 Global Commercial Aircraft MRO Market Structure

2.2 Commercial Aircraft MRO Market Definition

2.3 Commercial Aircraft MRO Submarkets Definitions

2.4 Commercial Aircraft MRO Market Structure

2.4.1 Commercial Aircraft MRO Market Players

2.5 Aircraft Maintenance – Letter Checks

2.6 Maintenance Steering Group

3. Global Commercial Aircraft Maintenance, Repair & Overhaul Market 2018-2028

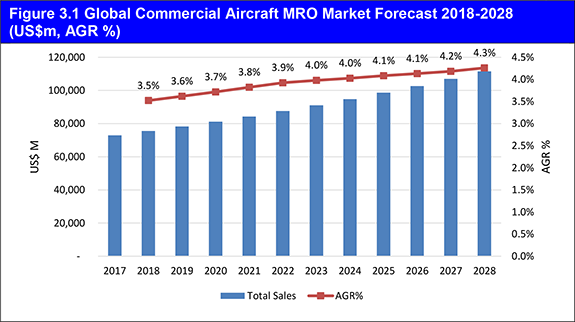

3.1 Global Commercial Aircraft MRO Market Forecast 2018-2028

3.2 Global Commercial Aircraft MRO Market Analysis

3.3 Global Commercial Aircraft MRO Market Drivers & Restraints 2018

4. Global Commercial Aircraft Maintenance, Repair & Overhaul Submarket Forecasts 2018-2028

4.1 Global Commercial Aircraft MRO Heavy Airframe Maintenance Forecast 2018-2028

4.1.1 Global Commercial Aircraft MRO Heavy Airframe Maintenance Submarket Analysis

4.1.2 Global Commercial Aircraft MRO Heavy Airframe Maintenance Submarket Drivers and Restraints

4.2 Global Commercial Aircraft Engine MRO Submarket Forecast 2018-2028

4.2.1 Global Commercial Aircraft Engine MRO Analysis

4.2.2 Global Commercial Aircraft Engine MRO Submarket Drivers and Restraints

4.3 Global Commercial Aircraft Component MRO Forecast 2018-2028

4.3.1 Global Commercial Aircraft Component MRO Analysis

4.3.2 Global Commercial Aircraft Component MRO Submarket Drivers and Restraints

4.4 Global Commercial Aircraft MRO Line Maintenance Forecast 2018-2028

4.4.1 Global Commercial Aircraft MRO Line Maintenance Analysis

4.4.2 Global Commercial Aircraft MRO Line Maintenance Submarket Drivers and Restraints

5. Leading Regional Commercial Aircraft Maintenance, Repair & Overhaul Market Forecasts 2018-2028

5.1 Asia Pacific Commercial Aircraft MRO Market Forecast 2018-2028

5.1.1 Asia Pacific Commercial Aircraft MRO Market Select Contracts & Programmes 2011-2018

5.1.2 Asia Pacific Commercial Aircraft MRO Market Analysis

5.1.3 Minimal Impact from Chinese Economic Slowdown

5.1.4 Becoming the Leading Regional Market in Commercial Aircraft MRO?

5.1.5 International Collaboration and Joint Venture

5.1.6 Engine MRO On the Rise

5.1.7 Regional Market Challenges

5.1.8 Asia Pacific Commercial Aircraft MRO Market Drivers & Restraints

5.2 European Commercial Aircraft MRO Market Forecast 2018-2028

5.2.1 European Commercial Aircraft MRO Market Select Contracts & Programmes 2011-2018

5.2.2 European Commercial Aircraft MRO Market Analysis

5.2.3 Home to Leading Market Players

5.2.4 A Significant Presence of Engine MRO

5.2.5 EU Aircraft Maintenance Probe

5.2.6 European Commercial Aircraft MRO Market Drivers & Restraints

5.3 Latin American Commercial Aircraft MRO Market Forecast 2018-2028

5.3.1 Latin American Commercial Aircraft MRO Market Select Contracts & Programmes 2012-2018

5.3.2 Latin American Commercial Aircraft MRO Market Analysis

5.3.3 Joint Developments for Engine and Component MRO

5.3.4 Latin American Commercial Aircraft MRO Market Drivers & Restraints

5.4 Middle East / Africa Commercial Aircraft MRO Market Forecast 2018-2028

5.4.1 Middle East / Africa Commercial Aircraft MRO Market Select Contracts & Programmes 2011-2018

5.4.2 Middle East / Africa Commercial Aircraft MRO Analysis

5.4.3 Middle East Trend of Joint Ventures

5.4.4 Expanding Engine MRO Capabilities in the Middle East

5.4.5 Capturing the MRO Market in Africa

5.4.6 Middle East / Africa Commercial Aircraft MRO Market Drivers & Restraints

5.5 North American Commercial Aircraft MRO Market Forecast 2018-2028

5.5.1 North American Commercial Aircraft MRO Market Select Contracts & Programmes 2011-2018

5.5.2 North American Commercial Aircraft MRO Market Analysis

5.5.3 Fleet Renewal Is Stabilising the Market

5.5.4 Aircraft Retirements Create an Abundance of Surplus Material

5.5.5 A Changing MRO Landscape

5.5.6 North American Commercial Aircraft MRO Market Drivers & Restraints

5.6 Regional Commercial Aircraft MRO Markets Market Share Forecast 2018

6. SWOT Analysis of the Commercial Aircraft MRO Market 2018-2028

7. Top 10 Commercial Aircraft Maintenance, Repair & Overhaul Companies

7.1 Top 10 Commercial Aircraft MRO Companies 2018

7.2 Safran SA

7.2.1 Safran SA Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2012-2018

7.2.2 Safran SA Key Strategies

7.2.3 Safran SA Parent Company Sales 2014-2017

7.2.4 Safran SA Parent Company Net Income / Loss 2014-2017

7.2.5 Safran SA Commercial Aircraft MRO Products / Services

7.2.6 Safran SA Primary Market Competitors 2017

7.2.7 Safran SA Overview

7.2.8 Safran SA Key Financial Ratio

7.2.9 Safran SA SWOT Analysis

7.3 Air France Industries KLM Engineering & Maintenance

7.3.1 Air France Industries KLM Engineering & Maintenance Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2015-2018

7.3.2 Air France Industries KLM Engineering & Maintenance Key Strategies

7.3.3 Air France Industries KLM Engineering & Maintenance Parent Company Sales 2013-2017

7.3.4 Air France Industries KLM Engineering & Maintenance Net Income 2013-2017

7.3.5 Air France Industries KLM Engineering & Maintenance Regional Emphasis / Focus

7.3.6 Air France Industries KLM Engineering & Maintenance Organisational Structure / Subsidiaries

7.3.7 Air France Industries KLM Engineering & Maintenance Commercial Aircraft MRO Market Products / Services

7.3.8 Air France Industries KLM Engineering & Maintenance Primary Market Competitors 2018 Primary Market Competitors 2018

7.3.9 Air France Industries KLM Engineering & Maintenance Mergers & Acquisitions (M&A) Activity

7.3.10 Air France Industries KLM Engineering & Maintenance Overview

7.3.11 Financial Performance of Air France Industries KLM Engineering & Maintenance

7.3.12 Air France Industries KLM Engineering & Maintenance Key Financial Ratios

7.3.13 Strengthening and Reaffirming Market Positioning

7.3.14 Air France Industries KLM Engineering & Maintenance Future Outlook

7.3.15 Air France Industries KLM Engineering & Maintenance SWOT Analysis

7.4 Airbus Group

7.4.1 Airbus Group Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2012-2018

7.4.2 Airbus Group Key Strategies

7.4.3 Airbus Group Total Company Sales 2013-2017

7.4.4 Airbus Group SE Net Income 2013-2017

7.4.5 Airbus Group Regional Emphasis / Focus

7.4.6 Airbus Group Organisational Structure / Subsidiaries

7.4.7 Airbus Group Commercial Aircraft MRO Products / Services

7.4.8 Airbus Group Primary Market Competitors 2017

7.4.9 Airbus Group Overview

7.4.10 Financial Performance of Airbus Group

7.4.11 Airbus Maintenance & Engineering Services

7.4.12 Airbus Maintenance & Engineering Services

7.4.13 Airbus Group Future Outlook

7.4.14 Airbus Group SWOT Analysis

7.5 Honeywell Aerospace

7.5.1 Honeywell Aerospace Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2014-2017

7.5.2 Honeywell Aerospace Key Strategies

7.5.3 Honeywell Aerospace Total Parent Company Sales 2013-2017

7.5.4 Honeywell Aerospace Parent Company Net Income / Loss 2013-2017

7.5.5 Honeywell Aerospace Commercial Aircraft MRO Products / Services

7.5.6 Honeywell Aerospace Primary Market Competitors 2017

7.5.7 Honeywell Aerospace Overview

7.5.8 Honeywell Aerospace Key Financial Ratio

7.5.9 Honeywell Aerospace SWOT Analysis

7.6 Rolls-Royce plc

7.6.1 Rolls-Royce plc Commercial Aircraft MRO Market Selected Recent Contracts / Projects / Programmes 2013-2017

7.6.2 Rolls-Royce plc Key Strategies

7.6.3 Rolls-Royce plc Total Company Sales 2013-2017

7.6.4 Rolls-Royce plc Sales in the Commercial Aircraft MRO Market 2013-2017

7.6.5 Rolls-Royce plc Net Income 2013-2017

7.6.6 Rolls-Royce plc Commercial Aircraft MRO Products / Services

7.6.7 Rolls-Royce plc Primary Market Competitors 2018

7.6.8 Rolls-Royce plc Overview

7.6.9 Financial Performance of Rolls-Royce plc

7.6.10 Rolls-Royce plc Key Financial Ratio

7.6.11 Integrated Engine Maintenance Services Packages

7.6.12 Rolls-Royce plc Future Outlook

7.6.13 Rolls-Royce plc SWOT Analysis

7.7 General Dynamics Corporation

7.7.1 General Dynamics Corporation Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2015-2018

7.7.2 General Dynamics Corporation Key Strategies

7.7.3 General Dynamics Corporation Total Company Sales 2014-2017

7.7.4 General Dynamics Corporation Net Income / Loss 2014-2017

7.7.5 General Dynamics Corporation Commercial Aircraft MRO Products / Services

7.7.6 General Dynamics Corporation Primary Market Competitors 2017

7.7.7 General Dynamics Corporation Overview

7.7.8 General Dynamics Corporation Key Financial Ratio

7.7.9 General Dynamics Corporation SWOT Analysis

7.8 GE Aviation

7.8.1 GE Aviation Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2013-2018

7.8.2 GE Aviation Key Strategies

7.8.3 GE Aviation Total Parent Company Sales 2013-2017

7.8.4 GE Aviation Parent Company Net Income 2013-2017

7.8.5 GE Aviation Regional Emphasis / Focus

7.8.6 GE Aviation Subsidiaries / Organisational Structure

7.8.7 GE Aviation Commercial Aircraft MRO Products / Services

7.8.8 GE Aviation Primary Market Competitors 2017

7.8.9 GE Aviation Overview

7.8.10 Financial Performance of GE Aviation

7.8.11 GE Aviation Key Financial Ratio

7.8.12 A Key Player in Engine MRO

7.8.13 GE Aviation Future Outlook

7.8.14 GE Aviation SWOT Analysis

7.9 United Technologies Corporation

7.9.1 United Technologies Corporation Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2014-2017

7.9.2 United Technologies Corporation Key Strategies

7.9.3 United Technologies Corporation Total Company Sales 2013-2017

7.9.4 United Technologies Corporation Sales in Aerospace 2013-2017

7.9.5 United Technologies Corporation Net Income 2013-2017

7.9.6 United Technologies Corporation Commercial Aircraft MRO Market Products / Services

7.9.7 United Technologies Corporation Primary Market Competitors 2018

7.9.8 Divestiture Activity of United Technologies Corporation

7.9.9 United Technologies Corporation Overview

7.9.10 Financial Performance of United Technologies Corporation

7.9.11 United Technologies Corporation Key Financial Ratio

7.9.12 Aftermarket Support for Next Generation Airliners

7.9.13 United Technologies Corporation Future Outlook

7.9.14 United Technologies Corporation SWOT Analysis

7.10 Lufthansa Technik AG

7.10.1 Lufthansa Technik AG Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2014-2017

7.10.2 Lufthansa Technik AG Key Strategies

7.10.3 Lufthansa Technik AG Total Company Sales 2013-2017

7.10.4 Lufthansa Technik AG Net Income 2013-2017

7.10.5 Lufthansa Technik AG Regional Emphasis / Focus

7.10.6 Lufthansa Technik AG Subsidiaries / Organisational Structure

7.10.7 Lufthansa Technik AG Commercial Aircraft MRO Products / Services

7.10.8 Lufthansa Technik AG Primary Market Competitors 2016

7.10.9 Lufthansa Technik AG Overview

7.10.10 Financial Performance of Lufthansa Technik AG

7.10.11 Strengthening International Presence

7.10.12 Innovation and Growth in an Increasingly Competitive Market

7.10.13 Lufthansa Technik AG Future Outlook

7.10.14 Lufthansa Technik AG SWOT Analysis

7.11 MTU Aero Engines AG

7.11.1 MTU Aero Engines AG Commercial Aircraft MRO Selected Recent Contracts / Projects / Programmes 2012-2018

7.11.2 MTU Aero Engines AG Key Strategies

7.11.3 MTU Aero Engines AG Total Company Sales 2013-2017

7.11.4 MTU Aero Engines AG Net Income 2013-2017

7.11.5 MTU Aero Engines AG Regional Emphasis / Focus

7.11.6 MTU Aero Engines AG Organisational Structure / Subsidiaries

7.11.7 MTU Aero Engines AG Commercial Aircraft MRO Products / Services

7.11.8 MTU Aero Engines AG Primary Market Competitors 2018

7.11.9 MTU Aero Engines AG Overview

7.11.10 Financial Performance of MTU Aero Engines AG

7.11.11 MTU Aero Engines AG Key Financial Ratio

7.11.12 A Leading Company in Commercial Aircraft Engine MRO

7.11.13 MTU Aero Engines AG Future Outlook

7.11.14 MTU Aero Engines AG SWOT Analysis

7.12 Other Leading Companies in the Value Chain

8. Conclusions

9. Glossary

Associated Visiongain Reports

Visiongain Report Sales Order Form

Appendix A

About Visiongain

Appendix B

Visiongain report evaluation form

List of Tables

Table 1.1 Example Regional Commercial Aircraft Maintenance, Repair & Overhaul Forecast 2018-2028 (US$m, AGR%, CAGR %)

Table 2.1 Commercial Aircraft MRO Submarkets (Submarket, Definition)

Table 2.2 Aircraft Maintenance Checks (Check, Location, Duration, Description)

Table 3.1 Global Commercial Aircraft MRO Market Forecast 2018-2028 (US$m, AGR%, CAGR %)

Table 3.2 Global Commercial Aircraft MRO Market Drivers & Restraints 2018

Table 4.1 Global Commercial Aircraft Maintenance, Repair & Overhaul Submarket Forecast by Type 2018-2028 (US$m, AGR%, CAGR %)

Table 4.2 Global Commercial Aircraft MRO Heavy Airframe Maintenance Forecast by Region 2018-2028 (US$m, AGR%, CAGR %)

Table 4.3 Global Commercial Aircraft MRO Heavy Airframe Maintenance Submarket Drivers & Restraints

Table 4.4 Global Commercial Aircraft Engine MRO Submarket Forecast by Region 2018-2028 (US$m, AGR%, CAGR %)

Table 4.5 Global Commercial Aircraft Engine MRO Submarket Drivers & Restraints

Table 4.6 Global Commercial Aircraft Component MRO Forecast by Region 2018-2028 (US$m, AGR%, CAGR %)

Table 4.7 Global Commercial Aircraft Component MRO Submarket Drivers & Restraints

Table 4.8 Global Commercial Aircraft MRO Line Maintenance Forecast by Region 2018-2028 (US$m, AGR%, CAGR %)

Table 4.9 Global Commercial Aircraft MRO Line Maintenance Submarket Drivers & Restraints

Table 5.1 Regional Commercial Aircraft Maintenance, Repair & Overhaul Submarket Forecast 2018-2028 (US$m, AGR%, CAGR %)

Table 5.2 Asia-Pacific Commercial Aircraft MRO Market Forecast 2018-2028 (US$m, AGR%, CAGR %)

Table 5.3 Asia Pacific Commercial Aircraft MRO Market Select Contracts & Programmes 2011-2018 (Date, Company, Value US$m, Details)

Table 5.4 Asia Pacific Commercial Aircraft MRO Market Drivers & Restraints 2018

Table 5.5 European Commercial Aircraft MRO Market Forecast 2018-2028 (US$m, AGR%, CAGR %)

Table 5.6 European Commercial Aircraft MRO Market Select Contracts & Programmes 2011-2018 (Date, Company, Value US$m, Details)

Table 5.7 European Commercial Aircraft MRO Market Drivers & Restraints 2018

Table 5.8 Latin American Commercial Aircraft MRO Market Forecast 2018-2028 (US$m, AGR%, CAGR %)

Table 5.9 Latin American Commercial Aircraft MRO Market Select Contracts & Programmes 2012-2018 (Date, Company, Value US$m, Details)

Table 5.10 Latin American Commercial Aircraft MRO Market Drivers & Restraints 2018

Table 5.11 Middle East / Africa Commercial Aircraft MRO Market Forecast 2018-2028 (US$m, AGR%, CAGR %)

Table 5.12 Middle East / Africa Commercial Aircraft MRO Market Select Contracts & Programmes 2011-2018 (Date, Company, Value US$m, Details)

Table 5.13 Middle East / Africa Commercial Aircraft MRO Market Drivers & Restraints 2018

Table 5.14 North American Commercial Aircraft MRO Market Forecast 2018-2028 (US$m, AGR%, CAGR %)

Table 5.15 North American Commercial Aircraft MRO Market Select Contracts & Programmes 2011-2018 (Date, Company, Value US$m, Details)

Table 5.16 North American Commercial Aircraft MRO Market Drivers & Restraints 2018

Table 6.1 Global Commercial Aircraft MRO Market SWOT Analysis 2018

Table 7.1 Leading 10 Commercial Aircraft MRO Companies 2018 (Company)

Table 7.2 Safran SA Profile 2017 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, CEO, Parent Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Company Sales from Commercial Aircraft MRO Market %, Parent Company Net Income US$m, Business Segment in the Market, HQ, Founded, Website)

Table 7.3 Selected Recent Safran SA Commercial Aircraft MRO Contracts / Projects / Programmes 2012-2018 (Date, Country / Region, Value US$m, Product, Details)

Table 7.4 Safran SA Key Strategies

Table 7.5 Safran SA Parent Company Sales 2014-2017 (US$m, AGR %)

Table 7.6 Safran SA Parent Company Net Income / Loss 2014-2017 (US$B)

Table 7.7 Safran SA Commercial Aircraft MRO Products / Services (Segment of Business, Product, Specification / Features)

Table 7.8 Safran SA: Key Financial Ratio – 2016

Table 7.9 Safran SA SWOT Analysis 2018

Table 7.10 Air France Industries KLM Engineering & Maintenance Profile 2017 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, Executive Vice President, Parent Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Company Sales from the Commercial Aircraft MRO Market %, Net Income US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website

Table 7.11 Selected Recent Air France Industries KLM Engineering & Maintenance Commercial Aircraft MRO Contracts / Projects / Programmes 2015-2018 (Date, Country / Region, Product, Details)

Table 7.12 Air France Industries KLM Engineering & Maintenance Key Strategies, 2017

Table 7.13 Air France Industries KLM Engineering & Maintenance Parent Company Sales 2013-2017 (US$m, AGR %)

Table 7.14 Air France Industries KLM Engineering & Maintenance Net Income 2013-2017 (US$m, AGR %)

Table 7.15 Air France Industries KLM Engineering & Maintenance Subsidiaries 2017 (Subsidiary, Location)

Table 7.16 Air France Industries KLM Engineering & Maintenance Commercial Aircraft MRO Products / Services (Segment of Business, Product / Service, Specification / Features)

Table 7.17 Air France Industries KLM Engineering & Maintenance: Key Financial Ratios, 2017

Table 7.18 Air France Industries KLM Engineering & Maintenance SWOT Analysis 2017

Table 7.19 Airbus Group Profile 2017 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, CEO, Total Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Company Sales from Commercial Aircraft MRO Market %, Net Income US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.20 Selected Recent Airbus Group Commercial Aircraft MRO Market Contracts / Projects / Programmes 2012-2018 (Date, Country / Region, Product, Details)

Table 7.21 Airbus Group Key Strategies, 2016-2018

Table 7.22 Airbus Group Total Company Sales 2013-2017 (US$m, AGR %)

Table 7.23 Airbus Group SE Net Income 2013-2017 (US$m, AGR %)

Table 7.24 Airbus Group Select Subsidiaries 2017 (Subsidiary, Location)

Table 7.25 Airbus Group Commercial Aircraft MRO Products / Services (Segment of Business, Product / Service, Specification / Features)

Table 7.26 Airbus Group Key Financial Ratios – 2017

Table 7.27 Airbus Group SWOT Analysis 2017

Table 7.28 Honeywell Aerospace Profile 2017 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, CEO, Parent Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Company Sales from the Commercial Aircraft MRO Market %, Net Income, Business Segment in the Market, HQ, Founded, IR Contact, Ticker, Website)

Table 7.29 Selected Recent Honeywell Aerospace Commercial Aircraft MRO Contracts / Projects / Programmes 2014-2017 (Date, Country / Region, Product / Service, Details)

Table 7.30 Honeywell Aerospace Key Strategies

Table 7.31 Honeywell Aerospace Total Parent Company Sales 2013-2017 (US$m, AGR %)

Table 7.32 Honeywell Aerospace Parent Company Net Income / Loss 2013-2017 (US$m)

Table 7.33 Honeywell Aerospace Commercial Aircraft MRO Products / Services (Segment of Business, Product / Service, Specification / Features)

Table 7.34 Honeywell: Key Financial Ratio – 2017

Table 7.35 Honeywell Aerospace SWOT Analysis 2018

Table 7.36 Rolls-Royce plc Profile 2017 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft Market MRO Market Share %, CEO, Total Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Company Sales from the Commercial Aircraft MRO Market %, Net Income US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.37 Selected Recent Rolls-Royce plc Commercial Aircraft MRO Contracts / Projects / Programmes 2013-2017 (Date, Country / Region, Value US$m, Product, Details)

Table 7.38 Rolls-Royce Key Strategies

Table 7.39 Rolls-Royce plc Total Company Sales 2013-2017 (US$m, AGR %)

Table 7.40 Rolls-Royce plc Sales in the Commercial Aircraft MRO Market 2013-2017 (US$m, AGR %)

Table 7.41 Rolls-Royce plc Net Income 2013-2017 (US$m)

Table 7.42 Rolls-Royce plc Commercial Aircraft MRO Products / Services (Segment of Business, Product, Specification / Features)

Table 7.43 Rolls-Royce plc: Key Financial Ratio – 2017

Table 7.44 Rolls-Royce plc SWOT Analysis 2018

Table 7.45 General Dynamics Corporation Profile 2017 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, CEO, Parent Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Company Sales from the Commercial Aircraft MRO Market %, Net Loss US$m, HQ, Founded, Website)

Table 7.46 Selected Recent General Dynamics Corporation Commercial Aircraft MRO Contracts / Projects / Programmes 2015-2018 (Date, Country / Region, Value US$m, Product, Details)

Table 7.47 General Dynamics Corporation Key Strategies

Table 7.48 General Dynamics Corporation Total Company Sales 2014-2017 (US$m, AGR %)

Table 7.49 General Dynamics Corporation Net Income / Loss 2014-2017 (US$B)

Table 7.50 General Dynamics Corporation Commercial Aircraft MRO Products / Services (Segment of Business, Product, Specification / Features)

Table 7.51 General Dynamics Corporation.: Key Financial Ratio – 2017

Table 7.52 General Dynamics Corporation SWOT Analysis 2018

Table 7.53 GE Aviation Profile 2017 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, CEO, Parent Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Company Sales from the Commercial Aircraft MRO Market %, Parent Company Net Income US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.54 Selected Recent GE Aviation Commercial Aircraft MRO Contracts / Projects / Programmes 2013-2018 (Date, Country / Region, Value US$m, Product, Details)

Table 7.55 GE Aviation Key Strategies

Table 7.56 GE Aviation Total Parent Company Sales 2013-2017 (US$m, AGR %)

Table 7.57 GE Aviation Parent Company Net Income 2011-2016 (US$m, AGR %)

Table 7.58 GE Aviation Subsidiaries 2018 (Subsidiary, Location)

Table 7.59 GE Aviation Commercial Aircraft MRO Products / Services (Segment of Business, Product, Specification / Features)

Table 7.60 GE Aviation: Key Financial Ratio – 2017

Table 7.61 GE Aviation SWOT Analysis 2018

Table 7.62 United Technologies Corporation Profile 2017 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, CEO, Total Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Company Sales from the Commercial Aircraft MRO Market %, Net Income US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.63 Selected Recent United Technologies Corporation Commercial Aircraft MRO Contracts / Projects / Programmes 2014-2017 (Date, Country / Region, Value US$m, Product, Details)

Table 7.64 United Technologies Corporation Aircraft Key Strategies

Table 7.65 United Technologies Corporation Total Company Sales 2013-2017 (US$m, AGR %)

Table 7.66 United Technologies Corporation Sales in Aerospace 2013-2017 (US$m, AGR %)

Table 7.67 United Technologies Corporation Net Income 2013-2017 (US$m, AGR %)

Table 7.68 United Technologies Corporation Commercial Aircraft MRO Market Products / Services (Segment of Business, Product / Service, Specification / Features)

Table 7.69 United Technologies Corporation: Key Financial Ratio – 2017

Table 7.70 United Technologies Corporation SWOT Analysis 2018

Table 7.71 Lufthansa Technik AG Profile 2017 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, Chairman, Total Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Company Sales from the Commercial Aircraft MRO Market %, Net Income US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.72 Selected Recent Lufthansa Technik AG Commercial Aircraft MRO Contracts / Projects / Programmes 2014-2017 (Date, Country / Region, Value US$m, Product, Details)

Table 7.73 Lufthansa Technik AG Key Strategies

Table 7.74 Lufthansa Technik AG Total Company Sales 2013-2017 (US$m, AGR %)

Table 7.75 Lufthansa Technik AG Net Income 2013-2017 (US$m, AGR %)

Table 7.76 Lufthansa Technik AG Subsidiaries 2017 (Subsidiary, Location)

Table 7.77 Lufthansa Technik AG Commercial Aircraft MRO Products / Services (Segment of Business, Product / Service, Specification / Features)

Table 7.78 Lufthansa Technik AG SWOT Analysis 2018

Table 7.79 MTU Aero Engines AG Profile 2017 (Commercial Aircraft MRO Market Ranking, Commercial Aircraft MRO Market Share %, CEO, Total Company Sales US$m, Sales in the Commercial Aircraft MRO Market US$m, Share of Company Sales from the Commercial Aircraft MRO Market %, Net Income US$m, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.80 Selected Recent MTU Aero Engine AG Commercial Aircraft MRO Contracts / Projects / Programmes 2012-2018 (Date, Country / Region, Value US$m, Product, Details)

Table 7.81 MTU Aero Engines AG Key Strategies

Table 7.82 MTU Aero Engines AG Total Company Sales 2013-2017 (US$m, AGR %)

Table 7.83 MTU Aero Engines AG Net Income 2013-2017 (US$m, AGR %)

Table 7.84 MTU Aero Engines AG Subsidiaries 2018 (Subsidiary, Location)

Table 7.85 MTU Aero Engines AG Commercial Aircraft MRO Products / Services (Segment of Business, Product / Service, Specification / Features)

Table 7.86 MTU Aero Engines AG: Key Financial Ratio – 2017

Table 7.87 MTU Aero Engines AG SWOT Analysis 2018

Table 7.88 Other Leading Companies in the Commercial Aircraft MRO Market Value 2018 (Company, Revenue, Employee, Location)

List of Figures

Figure 1.1 Commercial Aircraft MRO Market Overview

Figure 1.2 Global Commercial Aircraft MRO Market Segmentation Overview

Figure 2.1 Global Commercial Aircraft MRO Market Segmentation Overview

Figure 2.2 Global Commercial Aircraft MRO Market Structure

Figure 3.1 Global Commercial Aircraft MRO Market Forecast 2018-2028 (US$m, AGR %)

Figure 4.1 Global Commercial Aircraft Maintenance, Repair & Overhaul Submarket Share 2018-2023-2028 (%)

Figure 4.2 Global Commercial Aircraft MRO Heavy Airframe Maintenance Market Share 2018-2023-2028 (%)

Figure 4.3 Global Commercial Aircraft Engine MRO Market Share 2018-2023-2028 (US$m)

Figure 4.4 Global Commercial Aircraft Component MRO Market Share 2018-2023-2028 (US$m)

Figure 4.5 Global Commercial Aircraft MRO Line Maintenance Market Share 2018-2023-2028 (US$m)

Figure 5.1 Regional Commercial Aircraft Maintenance, Repair & Overhaul Submarket Forecast 2018-2028 (US$m, AGR%)

Figure 5.2 Asia-Pacific Commercial Aircraft MRO Market Share Forecast 2018-2023-2028 (US$m)

Figure 5.3 Asia-Pacific Commercial Aircraft MRO Market Forecast 2018-2028 (US$m, AGR%)

Figure 5.4 European Commercial Aircraft MRO Market Share Forecast 2018-2023-2028 (US$m)

Figure 5.5 European Commercial Aircraft MRO Market Forecast 2018-2028 (US$m, AGR%)

Figure 5.6 Latin American Commercial Aircraft MRO Market Share Forecast 2018-2023-2028 (US$m)

Figure 5.7 Latin American Commercial Aircraft MRO Market Forecast 2018-2028 (US$m, AGR%)

Figure 5.8 Middle East / Africa Commercial Aircraft MRO Market Share Forecast 2018-2023-2028 (US$m)

Figure 5.9 Middle East/Africa Commercial Aircraft MRO Market Forecast 2018-2028 (US$m, AGR%)

Figure 5.10 North American Commercial Aircraft MRO Market Share Forecast 2018-2023-2028 (US$m)

Figure 5.11 North American Commercial Aircraft MRO Market Forecast 2018-2028 (US$m, AGR%)

Figure 5.12 Regional Commercial Aircraft MRO Markets Market Share Forecast 2018 (% Share)

Figure 5.13 Regional Commercial Aircraft MRO Markets Market Share Forecast 2023 (% Share)

Figure 5.14 Regional Commercial Aircraft MRO Markets Market Share Forecast 2028 (% Share)

Figure 7.1 Safran SA Parent Company Sales 2014-2017 (US$m, AGR %)

Figure 7.2 Safran SA Net Income / Loss 2014-2017 (US$m)

Figure 7.3 Safran SA Primary Market Competitors 2017

Figure 7.4 Air France Industries KLM Engineering & Maintenance Parent Company Sales 2013-2017 (US$m, AGR %)

Figure 7.5 Air France Industries KLM Engineering & Maintenance Net Income 2013-2017 (US$m, AGR %)

Figure 7.6 Air France Industries KLM Engineering & Maintenance Primary International Operations 2018

Figure 7.7 Air France Industries KLM Engineering & Maintenance Organisational Structure 2016

Figure 7.8 Air France Industries KLM Engineering & Maintenance Primary Market Competitors 2018

Figure 7.9 Airbus Group Total Company Sales 2013-2017 (US$m, AGR %)

Figure 7.10 Airbus Group SE Net Income 2013-2017 (US$m, AGR %)

Figure 7.11 Airbus Group Primary International Operations 2017

Figure 7.12 Airbus Group Organisational Structure 2017

Figure 7.13 Airbus Group Primary Market Competitors 2017

Figure 7.14 Honeywell Aerospace Total Parent Company Sales 2013-2017 (US$m, AGR %)

Figure 7.15 Honeywell Aerospace Parent Company Net Income / Loss 2013-2017 (US$m)

Figure 7.16 Honeywell Aerospace Primary Market Competitors 2017

Figure 7.17 Rolls-Royce plc Total Company Sales 2013-2017 (US$m, AGR %)

Figure 7.18 Rolls-Royce plc Sales in the Commercial Aircraft MRO Market 2013-2017 (US$m, AGR %)

Figure 7.19 Rolls-Royce plc Net Income 2013-2017 (US$m)

Figure 7.20 Rolls-Royce plc Primary Market Competitors 2018

Figure 7.21 General Dynamics Corporation Total Company Sales 2014-2017 (US$m, AGR %)

Figure 7.22 General Dynamics Corporation Net Income / Loss 2014-2017(US$B)

Figure 7.23 General Dynamics Corporation Primary Market Competitors 2017

Figure 7.24 GE Aviation Total Parent Company Sales 2013-2017 (US$m, AGR %)

Figure 7.25 GE Aviation Parent Company Net Income 2013-2017 (US$m, AGR %)

Figure 7.26 GE Aviation Primary International Operations 2018

Figure 7.27 GE Aviation Organisational Structure 2018

Figure 7.28 GE Aviation Primary Market Competitors 2017

Figure 7.29 United Technologies Corporation Total Company Sales 2013-2017 (US$m, AGR %)

Figure 7.30 United Technologies Corporation Sales in Aerospace 2013-2017 (US$m, AGR %)

Figure 7.31 United Technologies Corporation Net Income 2013-2017 (US$m, AGR %)

Figure 7.32 United Technologies Corporation Primary Market Competitors 2018

Figure 7.33 Lufthansa Technik AG Total Company Sales 2013-2017 (US$m, AGR %)

Figure 7.34 Lufthansa Technik AG Net Income 2013-2017 (US$m, AGR %)

Figure 7.35 Lufthansa Technik AG Primary International Operations 2016

Figure 7.36 Lufthansa Technik AG Organisational Structure 2017

Figure 7.37 Lufthansa Technik AG Primary Market Competitors 2017

Figure 7.38 MTU Aero Engines AG Total Company Sales 2013-2017 (US$m, AGR %)

Figure 7.39 MTU Aero Engines AG Net Income 2013-2017 (US$m, AGR %)

Figure 7.40 MTU Aero Engines AG Primary International Operations 2018

Figure 7.41 MTU Aero Engines AG Organisational Structure 2018

Figure 7.42 MTU Aero Engines AG Primary Market Competitors 2018

AAR

Aer Lingus Group Plc

Aero Asahi Corporation

AeroAsia

AeroCentury Corp

Aerolineas Argentinas

Aeroman

Aeromexico

Air Astana

Air Berlin Plc

Air Canada

Air China

Air Dolomiti SpA

Air France

Air India Ltd

Air Lease Corp.

Air New Zealand

Air Transport Services Group (ATSG)

Airbus

Airbus Asia

Alaska Airlines Inc

Alia-The Royal Jordanian Airlines Plc

Ameco Beijing

American Airlines Group, Inc.

American Eurocopter Corporation

ANA HOLDINGS INC.

ANAC

Asiana Airlines

Astronics Corp.

Austrian Airlines Ag

Aviakompaniya Mizhnarodni Avialinii Ukrainy Prat

Aviall, Inc.

Avianca Services

AVIC Aircraft Co. Ltd.

Azul Linhas Aereas Brasileiras

Babcock Mission Critical Services Ltd

Bae Systems Inc.

Barfield

Boeing

Boeing Asia Pacific Aviation Services

Bombardier

Bristow Group, Inc.

Brussels Airlines Sa

Cathay Pacific Airways

Cessna

CFM International Incorporated

China Eastern Airlines

China Southern

China Southern Airlines Co. Ltd.

Citilink

Civil Aviation Administration of China (CAAC)

Cobham Plc

Công ty trách nhiệm hữu hạn một thành viên Hàng không Việt Nam

COOPESA

Copa Airlines

Corporation of China (Comac)

CPI Aerostructures, Inc.

Dassault Aviation SA

Delta TechOps

Doric Nimrod Air Two Ltd.

Dubai Aviation Corporation

EASA

easyJet Plc

Egypt Air Holding Company

Elite Aerospace Inc

Embraer

Emirates Airline

Emirates Engineering

Epi Europrop International Gmbh

Era Helicopters LLC

ERJ aircraft

Esterline Technologies Corp.

Ethiopian Airlines Enterprise

Etihad Engineering

EVA Airways

FAA

Garuda Indonesia

GE Aviation

GE Celma

General Dynamics Corporation

Gulfstream Aerospace

HAECO Ltd.

Hainan Airlines

Honeywell

Hong Kong Aero Engine Services Ltd (HAESL)

Iberia Maintenance

Indamer Aviation

Japan Airlines

Jet Aviation

KLM Engineering

Lufthansa Technik

Malaysia Airlines

MTU Aero Engine AG

Mubadala

Philippine Airlines

PJSC

Pratt & Whitney

Rolls-Royce

Safran

Senior plc

SIA Engineering

SIAEC

Singapore Aero Engine Services Pte Ltd (SAESL)

Singapore Airlines

Snecma America Engine Services

Spirit Aerosystems Inc.

SR Technics

ST Aerospace

TAM MRO

TAP Maintenance

Thai Airways

The European Commission (EC)

Turkish Technic

United Technologies Corporation

VECA Airlines

VietJet Air

Widerøe

Download sample pages

Complete the form below to download your free sample pages for Commercial Aircraft Maintenance, Repair & Overhaul (MRO) Market Report 2018-2028

Related reports

-

The Military Helicopter Market 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Military Helicopter market. Visiongain assesses that...Full DetailsPublished: 29 October 2018 -

Military Aviation Sensors & Switches Market Report 2018-2028

The $167m military aviation sensors and switches market is expected to flourish in the next few years because of increasing...

Full DetailsPublished: 01 June 2018 -

Military Airborne Intelligence, Surveillance & Reconnaissance (ISR) Technologies Market 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Airborne ISR market. Visiongain assesses...Full DetailsPublished: 30 August 2018 -

Civil Helicopter Market Report 2018-2028

The latest report from business intelligence provider company name offers comprehensive analysis of the global civil helicopter market. Visiongain assesses...

Full DetailsPublished: 07 June 2018 -

Commercial Aircraft Cabin Seating & Interiors Market Forecast 2018-2028

Visiongain assessed that the world market for commercial aircraft cabin seating & interiors will reach $16.4 billion in 2018....Full DetailsPublished: 11 September 2018 -

Commercial Aircraft Disassembly, Dismantling & Recycling Market Report 2018-2028

Visiongain assesses that the Commercial Aircraft Disassembly, Dismantling & Recycling market will reach US$6.1bn in 2018. ...Full DetailsPublished: 13 September 2018 -

Chinese Commercial Aviation Market Forecast 2019-2029

Continuing development in China’s economy over the last decade has led to significant impacts on the domestic commercial aviation market....Full DetailsPublished: 11 January 2019 -

Military Radar Systems Market Report 2018-2028

The global Military Radar Systems market consists of worldwide government spending on the procurement, development, and upgrades of radar systems...

Full DetailsPublished: 16 March 2018 -

Military Aircraft Avionics Market Report 2018-2028

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global military aircraft avionics market. Visiongaain assesses...Full DetailsPublished: 31 July 2018 -

Top 20 Commercial Aircraft Maintenance, Repair & Overhaul (MRO) Companies 2018

With an incredible amount of attention devoted to the commercial aircraft MRO market, actually deriving clear market information for the...

Full DetailsPublished: 24 April 2018

Download sample pages

Complete the form below to download your free sample pages for Commercial Aircraft Maintenance, Repair & Overhaul (MRO) Market Report 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Visiongain aviation reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and automotive industry experts but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology please email jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Would you like to get the latest Visiongain aviation reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

Airline Passenger Experience Association (APEX)

Airlines for America

Airport Consultants Council (ACC)

Airports Council International (ACI)

Airports Council International-North America

American Association of Airport Executives

Arab Air Carriers Organization (AACO)

European Aerospace Cluster Partnership

Global Business Travel Association (GBTA)

International Air Transport Association (IATA)

Security Industry Association (SIA)

Security Manufacturers Coalition

Women in Aviation

World Aviation Services

Latest Aviation news

Visiongain Publishes Space-Based Laser Communication Market Report 2024-2034

The global space-based laser communication market was valued at US$1,558.0 million in 2023 and is projected to grow at a CAGR of 13.6% during the forecast period 2024-2034.

13 March 2024

Visiongain Publishes Smart Airport Technologies Market Report 2024-2034

The global Smart Airport Technologies market was valued at US$9.4 billion in 2023 and is projected to grow at a CAGR of 13.8% during the forecast period 2024-2034.

05 February 2024

Visiongain Publishes Air Traffic Control Training Simulator Market Report 2024-2034

The global air traffic control training simulator market was valued at US$966.0 million in 2023 and is projected to grow at a CAGR of 6.5% during the forecast period 2024-2034.

01 February 2024

Visiongain Publishes Commercial Aircraft Maintenance, Repair & Overhaul (MRO) Market Report 2024-2034

The global commercial aircraft maintenance, repair & overhaul (MRO) market was valued at US$78.5 billion in 2023 and is projected to grow at a CAGR of 5.1% during the forecast period 2024-2034.

30 January 2024