The latest report from business intelligence provider visiongain assesses that the global Next Generation Cyber Security market is expected to generate revenues of $20.2 billion in 2018. See comprehensive analysis of the lucrative business prospects within this flourishing new sector.

Now: Cyber security has become one of the most important segments of national security in recent years, in lieu of the proliferation of advanced attack software, and the way in which more and more essential systems are coming to rely upon digitalisation. This is especially true in the critical infrastructure sector, where modern industrial control systems (ICS) and SCADA systems have proven particularly vulnerable. This is an example of the business-critical news that you need to know about – and more importantly, you need to read Visiongain’s objective analysis of how this will impact your company and the industry more broadly. How are you and your company reacting to this news? Are you sufficiently informed?

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector. Visiongain’s new study tells you and tells you NOW.

In this updated report, you will receive 143 in-depth tables, charts and graphs–unavailable elsewhere.

The 164 page report provides clear detailed insight into the global Next Generation Cyber Security market. It reveals the key drivers and challenges affecting the market.

By ordering and reading our brand new report today you will be better informed and ready to act.

Discover Commercial Potentials of Next Generation Cyber Security Benefiting Your Authority

The period 2018-2028 will see a meteoric rise in the market size of Next Generation Cyber Security. Are you prepared for this? You should be.

During this period, Next Generation Cyber Security will be one of the fastest growing segments of the Cyber sector. Global revenues are expected to reach $20.2 billion in 2018 and will increase in size significantly from 2018 and 2028. This updated report Next Generation Cyber Security Market Forecast 2018-2028: Forecasts by solution (Software, Service), By Deployment Type (On-Premise, Cloud), By User Type (SMEs, Large Enterprises), By Industry (Government & Defence, Healthcare, IT & Telecom, BFSI, Retail, Energy & Utility, Manufacturing, Others) and by Geography (North America, Europe, Asia-Pacific, Middle East & Africa) Plus Leading Companies analyses trends in the market both quantitatively and qualitatively. In recent years, this global Next Generation Cyber Security market has undergone a technological revolution with the rising sophistication of cyber-attacks. Next Generation Cyber Security is of increasing importance currently as both developed and developing nations becomes underlined by threats from hackers.

The Key Growth Driver

The key growth driver for the Next Generation Cyber Security is the increasing number of cyber-attacks on sensitive data of high profile organizations and governments. This situation will encourage greater use of Next Generation Cyber Security by companies, governments and militaries alike. The Next Generation Cyber Security industry is responding with innovative products, making full use of technological advances in cyber space. This market has great developmental potential, both strategically and commercially. The market is expected to be worth $20.2 billion during 2018 worldwide. Are you capturing as large a part of this market as you should be? This report will ensure you do.

What does the future hold for Next Generation Cyber Security providers? Visiongain’s new study tells you and tells you NOW.

In this updated report you will receive 143 in-depth tables and unique charts – unavailable elsewhere.

By ordering and reading this report today, you will receive

• Global Next Generation Cyber Security market forecasts from 2018-2028

• Regional Next Generation Cyber Security market forecasts from 2018-2028 covering Asia-Pacific, South America, North America, Europe, Middle East and Africa

• Country Next Generation Cyber Security forecasts from 2018-2028 covering USA, Canada, Mexico, UK, Germany, France, Spain, China, India, Japan, Australia

• Next Generation Cyber Security submarket forecasts from 2018-2028 covering

– By Solution (Software, Service)

– Development type (On-Premise, Cloud)

– End User Type (SMEs, Large Enterprise)

– Industry (Government, Healthcare, IT, BFSI, retail, energy, manufacturing, Others)

• Analysis of the key factors driving growth in the global and regional/country- level Next Generation Cyber Security markets from 2018-2028

• Profiles of the leading players and analysis of their prospects over the forecast period

– Cisco Systems

– IBM Corporation

– Symantec Corporation

– McAfee LLC

– Trend Micro

– Juniper Network

– Kaspersky Lab

– Fortient Inc

– Palo Alto Network

– Nextgen Software

– Trinary IT Services

– Happiest Minds

• Analysis of game changing technological trends being employed by the leading players and how these will shape the cyber security industry.

• Market conclusions & recommendations.

Who should read this report?

• Anyone within the cyber security value chain.

• Cyber security companies

• Cyber security risk insurance companies

• IT Companies

• Internet of Things (IoT) companies

• Software developers

• Infrastructure security companies

• Chief information officers (CIO)

• Chief executive officers (CEO)

• Chief operating officers (COO

• Commercial directors

• Business development managers

• Marketing managers

• Technologists

• Suppliers

• Investors

• Banks

• Government agencies

• Contractors

This unique report is available today. Only by ordering and reading this report will you stay up-to-date and fully informed of how your industry is changing and how you can be at the forefront of those changes. I look forward to receiving your order.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Next Generation Cyber Security Market

1.2 Why You Should Read This Report

1.3 Key Questions Answered by This Analystical Report

1.4 Who is This Report For?

1.5 Methodology

1.6 Frequently Asked Questions (FAQ)

1.7 Associated Visiongain Reports

1.8 About Visiongain

2. Introduction to the Next Generation Cyber Security

2.1 What is Next Generation Cyber Security

2.2 Classification of Next Generation Cyber Security Market

3. Next Generation Cyber Security: Global Market by Solution, 2018-2028

3.1 Software Component of Next Gneration Cyber Security Market Forecast & Analysis 2018-2028

3.2 Next Generation Cyber Security Software Market by Regional Market Forecast

3.3 Services Component of Next Generation Cyber Security Market Forecast & Analysis 2018-2028

3.4 Next Generation Cyber Security Market by Regional Market Forecast 2018-2028

4. Next Generation Cyber Security: Global Market by Development Type 2018-2028

4.1 On-Premise Deployment in Next Generation Cyber Security Market Forecast & Analysis 2018-2028

4.2 Next Generation Cyber Security Market for On-Premise by regional Market Forecast 2018-2028

4.3 Cloud Deployment in Next Generation Cyber Security Market Forecast & Analysis 2018-2028

4.4 Next Generation Cyber Security Market for Cloud by Regional Market Forecast 2018-2028

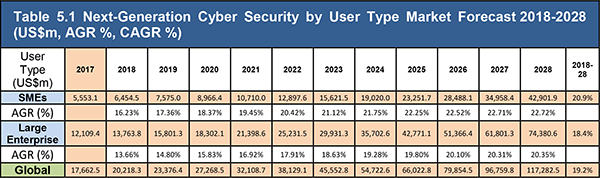

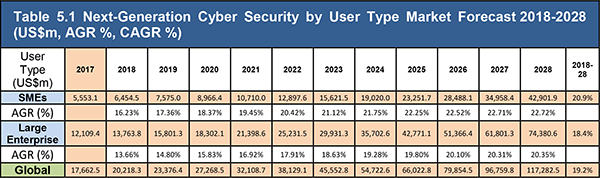

5. Next Generation Cyber Security: Global Market by User Type, 2018-2028

5.1 SMEs Segment in Next Generation Cyber Security Market Forecast & Analysis 2018-2028

5.2 Next Generation Cyber Security Market for SMEs by regional Market Forecast 2018-2028

5.3 Large Enterprises in Next Generation Cyber Security Market Forecast & Analysis 2018-2028

5.4 Next Generation Cyber Security Market for Large Enterprises by regional Market Forecast 2018-2028

6. Next Generation Cyber Security: Global Market by Industry Vertical, 2018-2028

6.1 Next Generation Cyber Security Market for Government & Defense Forecast & Analysis 2018-2028

6.2 Next-Generation Cyber Security Market for Government & Defense by Regional Market Forecast 2018-2028

6.3 Next Generation Cyber Security Market for Healthcare Forecast & Analysis 2018-2028

6.4 Next Generation Cyber Security Market for Healthcare by Regional Market Forecast 2018-2028

6.5 Next Generation Cyber Security Market for IT & Telecom Forecast & Analysis 2018-2028

6.6 Next Generation Cyber Security Market for IT & Telecom by Regional Market Forecast 2018-2028

6.7 Next Generation Cyber Security Market for Banking, Financial Services, and Insurance (BFSI) Forecast & Analysis 2018-2028

6.8 Next Generation Cyber Security Market for BFSI by Regional Market Forecast 2018-2028

6.9 Next Generation Cyber Security Market for Retail Forecast & Analysis 2018-2028

6.10 Next Generation Cyber Security Market for Retail by Regional Market Forecast 2018-2028

6.11 Next Generation Cyber Security Market for Energy & Utilities Forecast & Analysis 2018-2028

6.12 Next Generation Cyber Security Market for Energy & Utilities by Regional Market Forecast 2018-2028

6.13 Next Generation Cyber Security Market for Manufacturing Forecast & Analysis 2018-2028

6.14 Next Generation Cyber Security Market for Manufacturing by Regional Market Forecast 2018-2028

6.15 Next Generation Cyber Security Market for Others Forecast & Analysis 2018-2028

6.16 Next Generation Cyber Security Market for Others by Regional Market Forecast 2018-2028

7. Next-Generation Cyber Security: Global Market by Geography, 2018-2028

7.1 North America Next-Generation Cyber Security Market Forecasts 2018-2028

7.1.1 U.S. Next-Generation Cyber Security Market Forecast 2018-2028

7.1.2 Canada Next-Generation Cyber Security Market Forecast 2018-2028

7.1.3 Mexico Next-Generation Cyber Security Market Forecast 2018-2028

7.2 Europe Next-Generation Cyber Security Market Forecast 2018-2028

7.2.1 Germany Next-Generation Cyber Security Market Forecast 2018-2028

7.2.2 UK Next-Generation Cyber Security Market Forecast 2018-2028

7.2.3 France Next-Generation Cyber Security Market Forecast 2018-2028

7.2.4 Spain Next-Generation Cyber Security Market Forecast 2018-2028

7.2.5 Rest of Europe Next-Generation Cyber Security Market Forecast 2018-2028

7.3 Asia-Pacific Next-Generation Cyber Security Market Forecast 2018-2028

7.3.1 China Next-Generation Cyber Security Market Forecast 2018-2028

7.3.2 India Next-Generation Cyber Security Market Forecast 2018-2028

7.3.3 Japan Next-Generation Cyber Security Market Forecast 2018-2028

7.3.4 Australia Next-Generation Cyber Security Market Forecast 2018-2028

7.3.5 Rest of Asia Pacific Next-Generation Cyber Security Market Forecast 2018-2028

7.4 South America Next-Generation Cyber Security Market Forecast 2018-2028

7.5 Middle East & Africa Next-Generation Cyber Security Market Forecast 2018-2028

8. Critical Analysis: Next Generation Cyber Security

8.1 Drivers

8.1.1 Increasing Use of Internet-enabled Devices

8.1.2 Rise in the Adoption of Cloud Computing Applications

8.1.3 Rise in Cyber Terrorism

8.2 Restraints

8.2.1 Limited Security Budgets

8.2.2 Lack of Competent Security Experts

8.3 Opportunities

8.3.1 Increasing Acceptance of BYOD Policies Within Enterprises

8.3.2 Need for Advanced Security Solutions

9. Porter’s Five Forces Analysis for the Next Generation Cyber Security Market

9.1 Moderate to Low Bargaining Power of Suppliers

9.2 Moderate to High Bargaining Power of Buyers

9.3 Low Threat of Substitutes

9.4 High Threat of New Entrants

9.5 High Intensity of Competitive Rivalry

10. Leading Companies in Next Generation Cyber Security Market

10.1 Cisco Systems Inc.

10.1.1 Cisco Systems Inc. Company Overview

10.1.2 Cisco Systems Inc. Company Snapshot

10.1.3 Cisco Systems Inc. Business Performance

10.1.4 Cisco Systems Inc. Segment Information

10.1.5 Cisco Systems Inc. Geographic Analysis

10.1.6 Cisco Systems Inc. Key Insights

10.1.7 Cisco Systems Inc. Key Strategic Moves & Developments

10.2 IBM Corporation

10.2.1 IBM Corporation Company Overview

10.2.2 IBM Corporation Company Snapshot

10.2.3 IBM Corporation Business Performance

10.2.4 IBM Corporation Segment Information

10.2.5 IBM Corporation Geographic Analysis

10.2.6 IBM Corporation Key Insights

10.2.7 IBM Corporation Key Strategic Moves & Developments

10.3 Symantec Corporation

10.3.1 Symantec Corporation Company Overview

10.3.2 Symantec Corporation Company Snapshot

10.3.3 Symantec Corporation Business Performance

10.3.4 Symantec Corporation Segment Information

10.3.5 Symantec Corporation Geographic Analysis

10.3.6 Symantec Corporation Key Insights

10.3.7 Symantec Corporation Key Strategic Moves & Developments

10.4 McAfee, LLC

10.4.1 McAfee, LLC Company Overview

10.4.2 McAfee, LLC Company Snapshot

10.4.3 McAfee, LLC Business Performance

10.4.4 McAfee, LLC Key Insights

10.4.5 McAfee, LLC Key Strategic Moves & Developments

10.5 Trend Micro Incorporated

10.5.1 Trend Micro Company Overview

10.5.2 Trend Micro Company Snapshot

10.5.3 Trend Micro Business Performance

10.5.4 Trend Micro Geographic Analysis

10.5.5 Trend Micro Key Insights

10.5.6 Trend Micro Key Strategic Moves & Developments

10.6 Juniper Networks, Inc.

10.6.1 Juniper Networks, Inc. Company Overview

10.6.2 Juniper Networks, Inc. Company Snapshot

10.6.3 Juniper Networks, Inc. Business Performance

10.6.4 Juniper Networks, Inc. Segment Information

10.6.5 Juniper Networks, Inc. Geographic Analysis

10.6.6 Juniper Networks, Inc. Key Insights

10.6.7 Juniper Networks, Inc. Key Strategic Moves & Developments

10.7 Kaspersky Lab

10.7.1 Kaspersky Lab Company Overview

10.7.2 Kaspersky Lab Company Snapshot

10.7.3 Kaspersky Lab Business Performance

10.7.4 Kaspersky Lab Key Insights

10.7.5 Kaspersky Lab Key Strategic Moves & Developments

10.8 Fortinet Inc.

10.8.1 Fortinet Inc. Company Overview

10.8.2 Fortinet Inc. Company Snapshot

10.8.3 Fortinet Inc. Business Performance

10.8.4 Fortinet Inc. Segment Information

10.8.5 Fortinet Inc. Geographic Analysis

10.8.6 Fortinet Inc. Key Insights

10.8.7 Fortinet Inc. Key Strategic Moves & Developments

10.9 Palo Alto Networks, Inc.

10.9.1 Palo Alto Networks, Inc. Company Overview

10.9.2 Palo Alto Networks, Inc. Company Snapshot

10.9.3 Palo Alto Networks, Inc. Business Performance

10.9.4 Palo Alto Networks, Inc. Segment Information

10.9.5 Palo Alto Networks, Inc. Geographic Analysis

10.9.6 Palo Alto Networks, Inc. Key Insights

10.9.7 Palo Alto Networks, Inc. Key Strategic Moves & Developments

10.10 Nextgen Software

10.10.1 Nextgen Software Company Overview

10.10.2 Nextgen Software Company Snapshot

10.10.3 Nextgen Software Business Performance

10.10.4 Nextgen Software Key Insights

10.10.5 Nextgen Software Key Strategic Moves & Developments

10.11 Trinary IT Services

10.11.1 Trinary IT Services Company Overview

10.11.2 Trinary IT Services Company Snapshot

10.11.3 Trinary IT Services Business Performance

10.11.4 Trinary IT Services Key Insights

10.11.5 Trinary IT Services Key Strategic Moves & Developments

10.12 Happiest Minds

10.12.1 Happiest Minds Company Overview

10.12.2 Happiest Minds Company Snapshot

10.12.3 Happiest Minds Business Performance

10.12.4 Happiest Minds Key Insights

10.12.5 Happiest Minds Key Strategic Moves & Developments

11. Other Companies In the Next Generation Cyber Security Market

12. Conclusion

13. Glossary

List of Tables

Table 3.1 Next-Generation Cyber security Market by Solution Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 3.2 Next-Generation Cyber security Market for Software by Regional Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 3.3 Next-Generation Cyber security Market for Services by Regional Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 4.1 Next-Generation Cyber Security Market by Deployment Model Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 4.2 Next-Generation Cyber security Market for On-premise Segment by Regional Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 4.3 Next-Generation Cyber Security Market for Cloud Segment by Regional Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 5.1 Next-Generation Cyber Security by User Type Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 5.2 Next-Generation Cyber Security Market for SMEs by Regional Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 5.3 Next-Generation Cyber security Market for Large Enterprises by Regional Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 6.1 Next-Generation Cyber Security Market by Industry Vertical Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 6.2 Next-Generation Cyber Security Market for Government & Defense by Regional Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 6.3 Next-Generation Cyber Security Market for Healthcare by Regional Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 6.4 Next-Generation Cyber Security Market for IT & Telecom by Regional Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 6.5 Next-Generation Cyber Security Market for BFSI by Regional Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 6.6 Next-Generation Cyber Security Market for Retail by Regional Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 6.7 Next-Generation Cyber Security Market for Energy & Utilities by Regional Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 6.8 Next-Generation Cyber Security Market for Manufacturing by Regional Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 6.9 Next-Generation Cyber Security Market for Others by Regional Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.1 Next-Generation Cyber Security Market Forecast by Region & Country, 2018-2028 (US$m, Global AGR %, CAGR %)

Table 7.2 North America Next-Generation Cyber Security Market by Country Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.3 North America Next-Generation Cyber Security Market by Solution Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.4 North America Next-Generation Cyber Security Market by Deployment Model Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.5 North America Next-Generation Cyber Security Market by User Type Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.6 North America Next-Generation Cyber Security Market by Industry Vertical Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.7 Europe Next-Generation Cyber Security Market by Country Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.8 Europe Next-Generation Cyber Security Market by Solution Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.9 Europe Next-Generation Cyber Security Market by Deployment Model Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.10 Europe Next-Generation Cyber Security Market by User Type Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.11 Europe Next-Generation Cyber Security Market by Industry Vertical Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.12 Asia-Pacific Next-Generation Cyber Security Market by Country Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.13 Asia-Pacific Next-Generation Cyber Security Market by Solution Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.14 Asia-Pacific Next-Generation Cyber Security Market by Deployment Model Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.15 Asia-Pacific Next-Generation Cyber Security Market by User Type Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.16 Asia-Pacific Next-Generation Cyber Security Market by Industry Vertical Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.17 South America Next-Generation Cyber Security Market by Country Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.18 South America Next-Generation Cyber Security Market by Solution Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.19 South America Next-Generation Cyber Security Market by Deployment Model Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.20 South America Next-Generation Cyber Security Market by User Type Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.21 South America Next-Generation Cyber Security Market by Industry Vertical Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.22 MEA Next-Generation Cyber Security Market by Region Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.23 MEA Next-Generation Cyber Security Market by Solution Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.24 MEA Next-Generation Cyber Security Market by Deployment Model Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.25 MEA Next-Generation Cyber Security Market by User Type Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 7.26 MEA Next-Generation Cyber Security Market by Industry Vertical Market Forecast 2018-2028 (US$m, AGR %, CAGR %)

Table 10.1 Cisco Systems Inc. Snapshot (Year of Inception, Key Executives, Primary Business, Geographic Presence, Product Portfolio, Key Strategic Move, Revenue 2015-2017)

Table 10.2 Cisco Systems Inc. Key Strategic Moves 2017-2018

Table 10.3 IBM Corporation Snapshot (Year of Inception, Key Executives, Primary Business, Geographic Presence, Product Portfolio, Key Strategic Move, Revenue 2015-2017)

Table 10.4 IBM Corporation Key Strategic Developments 2017

Table 10.5 Symantec Corporation Snapshot (Year of Inception, Key Executives, Primary Business, Geographic Presence, Product Portfolio, Key Strategic Move, Revenue 2015-2017)

Table 10.6 Symantec Key Developments 2017

Table 10.7 McAfee Snapshot (Year of Inception, Key Executives, Primary Business, Geographic Presence, Product Portfolio, Key Strategic Move, Revenue 2015-2017)

Table 10.8 McAfee Key Developments 2018

Table 10.9 Trend Micro Snapshot (Year of Inception, Key Executives, Primary Business, Geographic Presence, Product Portfolio, Key Strategic Move, Revenue 2015-2017)

Table 10.10 Trend Micro Key Developments 2018

Table 10.11 Juniper Networks Snapshot (Year of Inception, Key Executives, Primary Business, Geographic Presence, Product Portfolio, Key Strategic Move, Revenue 2015-2017)

Table 10.12 Juniper Networks Inc Key Developments 2017

Table 10.13 Kaspersky Lab Snapshot (Year of Inception, Key Executives, Primary Business, Geographic Presence, Product Portfolio, Key Strategic Move, Revenue 2015-2017)

Table 10.14 Kaspersky Lab Key Developments 2017-2018

Table 10.15 Fortinet Snapshot (Year of Inception, Key Executives, Primary Business, Geographic Presence, Product Portfolio, Key Strategic Move, Revenue 2015-2017)

Table 10.16 Fortinet Inc Key Developments 2017-2018

Table 10.17 Palo Alto Networks Snapshot (Year of Inception, Key Executives, Primary Business, Geographic Presence, Product Portfolio, Key Strategic Move, Revenue 2015-2017)

Table 10.18 Palo Alto Networks Inc. Key Developments

Table 10.19 Nextgen Software Snapshot (Year of Inception, Key Executives, Primary Business, Geographic Presence, Product Portfolio, Key Strategic Move, Revenue 2015-2017)

Table 10.20 Nextgen Software Key Developments 2018

Table 10.21 Trinary IT Services Snapshot (Year of Inception, Key Executives, Primary Business, Geographic Presence, Product Portfolio, Key Strategic Move, Revenue 2015-2017)

Table 10.22 Trinary IT Services Key Developments

Table 10.23 Happiest Minds Snapshot (Year of Inception, Key Executives, Primary Business, Geographic Presence, Product Portfolio, Key Strategic Move, Revenue 2015-2017)

Table 10.24 Happiest Minds Key Developments

Table 11.1 Other Companies in the Next-Generation Cyber Security Market 2017

List of Figures

Figure 2.1 Global Next-Generation Cyber Security Market Segmentation Overview, 2018

Figure 3.1 Global Next-Generation Cyber Security Market by Solution, Market Share 2017, (% Share)

Figure 3.2 Next-Generation Cyber security Market by Solution Forecast 2018-2028 (US$m)

Figure 3.3 Next-Generation Cyber security Market by Solution AGR Forecast 2018-2028 (AGR %)

Figure 3.4 Next-Generation Cyber Security Market for Software Segment Forecast ($Mn, CAGR %) 2018-2028

Figure 3.5 Next-Generation Cyber Security Market for Service Segment Forecast ($Mn, CAGR %) 2018-2028

Figure 4.1 Global Next-Generation Cyber Security Market by Deployment Model, Market Share 2017, (% Share)

Figure 4.2 Next-Generation Cyber Security Market by Deployment Model Market Forecast 2018-2028 (US$m)

Figure 4.3 Next-Generation Cyber Security Market by Deployment Model AGR Forecast 2018-2028 (AGR %)

Figure 4.4 Next-Generation Cyber Security Market for On-premise Segment Forecast ($Mn, CAGR %) 2018-2028

Figure 4.5 Next-Generation Cyber Security Market for Cloud Segment Forecast ($Mn, CAGR %) 2018-2028

Figure 5.1 Next-Generation Cyber security Market by User Type, 2017, (% Share)

Figure 5.2 Next-Generation Cyber Security Market by User Type Market Forecast 2018-2028 (US$m)

Figure 5.3 Next-Generation Cyber Security Market by User Type AGR Forecast 2018-2028 (AGR %)

Figure 5.4 Next-Generation Cyber Security Market for SMEs Forecast ($Mn, CAGR %) 2018-2028

Figure 5.5 Next-Generation Cyber Security Market for Large Enterprises Forecast ($Mn, CAGR %) 2018-2028

Figure 6.1. Global Next-Generation Cyber Security Market by Industry Vertical, 2017, (% Share)

Figure 6.2 Next-Generation Cyber Security Market by Industry Vertical Market Forecast 2018-2028 (US$m)

Figure 6.3 Next-Generation Cyber Security Market by Industry Vertical AGR Forecast 2018-2028 (AGR %)

Figure 6.4 Next-Generation Cyber Security Market by Government & Defense, Forecast ($Mn, CAGR %) 2018-2028

Figure 6.5 Next-Generation Cyber Security Market for Healthcare Forecast ($Mn, CAGR %) 2018-2028

Figure 6.6 Next-Generation Cyber Security Market for IT & Telecom, Forecast ($Mn, CAGR %) 2018-2028

Figure 6.7 Next-Generation Cyber Security Market for BFSI, Forecast ($Mn, CAGR %) 2018-2028

Figure 6.8 Next-Generation Cyber Security Market for Retail Forecast ($Mn, CAGR %) 2018-2028

Figure 6.9 Next-Generation Cyber Security Market for Energy & Utilities Forecast ($Mn, CAGR %) 2018-2028

Figure 6.10 Next-Generation Cyber Security Market for Manufacturing Forecast ($Mn, CAGR %) 2018-2028

Figure 6.11 Next-Generation Cyber Security Market for Others Forecast ($Mn, CAGR %) 2018-2028

Figure 7.1 Global Next-Generation Cyber Security Market, By Geography, 2017, (% Share)

Figure 7.2 North America Next-Generation Cyber Security Market, By Country, 2017, (% Share)

Figure 7.3 North America Next-Generation Cyber Security Market by Country Market Forecast 2018-2028 (US$m)

Figure 7.4 North America Next-Generation Cyber Security Market by Country AGR Forecast 2018-2028 (AGR %)

Figure 7.5 U.S. Next-Generation Cyber Security Market Forecast ($Mn, CAGR %) 2018-2028

Figure 7.6 Canada Next-Generation Cyber Security Market Forecast ($Mn, CAGR %) 2018-2028

Figure 7.7 Mexico Next-Generation Cyber Security Market Forecast ($Mn, CAGR %) 2018-2028

Figure 7.8 Europe Next-Generation Cyber Security Market, By Country, 2017, (% Share)

Figure 7.9 Europe Next-Generation Cyber Security Market by Country Market Forecast 2018-2028 (US$m)

Figure 7.10 Europe Next-Generation Cyber Security Market by Country AGR Forecast 2018-2028 (AGR %)

Figure 7.11 Germany Next-Generation Cyber Security Market Forecast ($Mn, CAGR %) 2018-2028

Figure 7.12 UK Next-Generation Cyber Security Market Forecast ($Mn, CAGR %) 2018-2028

Figure 7.13 France Next-Generation Cyber Security Market Forecast ($Mn, CAGR %) 2018-2028

Figure 7.14 Spain Next-Generation Cyber Security Market Forecast ($Mn, CAGR %) 2018-2028

Figure 7.15 Rest of Europe Next-Generation Cyber Security Market Forecast ($Mn, CAGR %) 2018-2028

Figure 7.16 Asia-Pacific Next-Generation Cyber Security Market, By Country, 2017, (% Share)

Figure 7.17 Asia-Pacific Next-Generation Cyber Security Market by Country Market Forecast 2018-2028 (US$m)

Figure 7.18 Asia-Pacific Next-Generation Cyber Security Market by Country AGR Forecast 2018-2028 (AGR %)

Figure 7.19 China Next-Generation Cyber Security Market Forecast ($Mn, CAGR %) 2018-2028

Figure 7.20 India Next-Generation Cyber Security Market Forecast ($Mn, CAGR %) 2018-2028

Figure 7.21 Japan Next-Generation Cyber Security Market Forecast ($Mn, CAGR %) 2018-2028

Figure 7.22 Australia Next-Generation Cyber Security Market Forecast ($Mn, CAGR %) 2018-2028

Figure 7.23 Rest of Asia-Pacific Next-Generation Cyber Security Market Forecast ($Mn, CAGR %) 2018-2028

Figure 7.24 South America Next-Generation Cyber Security Market by Country Market Forecast 2018-2028 (US$m)

Figure 7.25 South America Next-Generation Cyber Security Market by Country AGR Forecast 2018-2028 (AGR %)

Figure 7.26 MEA Next-Generation Cyber Security Market by Country Market Forecast 2018-2028 (US$m)

Figure 7.27 MEA Next-Generation Cyber Security Market by Country AGR Forecast 2018-2028 (AGR %)

Figure 9.1 Porter’s Five Forces Analysis for Next-Generation Cyber Security Market, 2018-2028

Figure 10.1 Cisco Systems Inc. Revenue 2015-2017 ($Million)

Figure 10.2 Cisco Systems Inc. Segment Performance 2017 (% Share of Revenue)

Figure 10.3 Cisco Systems Inc. Geographic Analysis 2017 (% Share of Revenue)

Figure 10.4 IBM Corporation Revenue 2015-2017 ($Million)

Figure 10.5 IBM Corporation Segment Performance 2017 (% Share of Revenue)

Figure 10.6 IBM Corporation Geographic Analysis 2017 (% Share of Revenue)

Figure 10.7 Symantec Corporation Revenue 2015-2017 ($Million)

Figure 10.8 Symantec Corporation Segment Performance 2017 (% Share of Revenue)

Figure 10.9 Symantec Corporation Geographic Analysis 2017 (% Share of Revenue)

Figure 10.10 Trend Micro Revenue 2015-2017 ($Million)

Figure 10.11 Trend Micro Geographic Analysis 2017 (% Share of Revenue)

Figure 10.12 Juniper Networks Revenue 2015-2017 ($Million)

Figure 10.13 Juniper Networks Segment Performance 2017 (% Share of Revenue)

Figure 10.14 Juniper Networks Geographic Analysis 2017 (% Share of Revenue)

Figure 10.15 Fortinet Revenue 2015-2017 ($Million)

Figure 10.16 Fortinet Segment Performance 2017 (% Share of Revenue)

Figure 10.17 Fortinet Geographic Analysis 2017 (% Share of Revenue)

Figure 10.18 Palo Alto Networks Revenue 2015-2017 ($Million)

Figure 10.19 Palo Alto Networks Segment Performance 2017 (% Share of Revenue)

Figure 10.20 Palo Alto Networks Geographic Analysis 2017 (% Share of Revenue)