Industries > Aviation > Commercial Aircraft Disassembly, Dismantling & Recycling Market Report 2018-2028

Commercial Aircraft Disassembly, Dismantling & Recycling Market Report 2018-2028

Forecasts & Analysis by Segment (Aircraft Storage, Aircraft Disassembly & Dismantling, Engine Teardown, Component Management), Regional Forecasts, Analysis of Regional Airline Fleets, DDR Contract Tables Plus Analysis of Leading Companies

Recently awarded high value contracts related to aircraft recycling, dismantling and disassembly have led Visiongain to publish this unique report, which may be crucial to your company’s improved success.

Visiongain assesses that the Commercial Aircraft Disassembly, Dismantling & Recycling market will reach US$6.1bn in 2018. This is primarily driven by increase in airline spending across various countries. Further, companies are increasing their product and services line ups for airlines. It is therefore critical that you have your timescales correct and your forecasting plans ready. This report will ensure that you do.

Reasons why you must order and read this report today:

122 Tables And Figures Illustrating The Outlook Within The Commercial Aircraft Disassembly, Dismantling & Recycling Market Space

Detailed Profiles Of Key Companies Operating Within The Commercial Aircraft Disassembly, Dismantling & Recycling Market:

• AAR Corporation

• AerSale Inc

• Air Salvage International

• Bombardier Inc.

• Aircraft End-of-Life Solutions (AELS) BV

• AJW Group

• Apollo Aviation Group

• Magellan Aviation Group

• GA Telesis LLC

• Marana Aerospace Solutions

• Tarmac Aerosave

• Universal Asset Management Inc.

Highlights Of Key Business Segments In Order To Assist Key Players Across The Value Chain To Optimise Their Business Strategies

• Aircraft Storage Forecast 2018-2028

• Aircraft Disassembly & Dismantling Forecast 2018-2028

• Engine Teardown Forecast 2018-2028

• Components Management Forecast 2018-2028

In-Depth Regional Market Trends And Outlook Coupled With The Macroeconomic Factors Driving The Market

• North America Disassembly, Dismantling & Recycling Forecast 2018-2028

• Europe Disassembly, Dismantling & Recycling Forecast 2018-2028

• Asia-Pacific Disassembly, Dismantling & Recycling Forecast 2018-2028

• Rest of the World (RoW) Disassembly, Dismantling & Recycling Forecast 2018-2028

200+ Recent Contracts Relating To Commercial Aircraft Disassembly, Dismantling & Recycling Will Help Inform And Identify Key Revenue Generating Areas

SWOT Analysis Of The Factors Influencing The Market Dynamics.

Analysis Of Key Findings And Recommendations Highlight Crucial Market Trends In The Commercial Aircraft Disassembly, Dismantling & Recycling Market, Thereby Assisting Players To Form Evidence Based Decision Making.

This independent, 260+ page report guarantees you will remain better informed than your competition. With more than 122 tables and figures examining the Commercial Aircraft Disassembly, Dismantling & Recycling market space, the report gives you a visual, one-stop breakdown of your market. as well as analysis, from 2018-2028 keeping your knowledge that one step ahead allowing you to succeed.

This report is essential reading for you or anyone in the aerospace and defence sector with an interest in Commercial Aircraft Disassembly, Dismantling & Recycling. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1.1 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market Overview

1.1.1 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market Segmentation

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.6.3 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Commercial Aircraft Disassembly, Dismantling & Recycling Market

2.1 Commercial Aircraft Disassembly, Dismantling & Recycling Market Structure Overview

2.2 Commercial Aircraft Disassembly, Dismantling & Recycling Market Introduction

2.3 Commercial Aircraft Disassembly, Dismantling & Recycling Definition

2.3.1 Supply Chains for Commercial Aircraft Disassembly, Dismantling & Recycling

2.3.2 Aims of the Commercial Aircraft Recycling Industry Visiongain Has Defined

2.3.3 Economic Incentives of Recycling Aircraft Visiongain Has Defined

2.3.4 Environmental Incentives of Aircraft Recycling Visiongain Has Defined

2.3.5 Projected Aircraft Fleet Statistics Over The Period 2018-2028

2.4 Types of Commercial Aircraft Disassembly, Dismantling & Recycling Technology & Systems

2.4.1 The Increasing Usage Of Composite Materials In Next Generation Commercial Aircraft

2.4.2 Usability Of Carbon Fibre Parts & Recycled Composites In Commercial Aviation

2.4.3 Material Separation Process

2.4.4 Extending Commercial Aircraft Operating Life

2.4.5 The Market For Second Hand Parts

2.5 Global Data For Stored, Scrapped & Active Aircraft Currently Operated By Leading Airlines In Their Respective Regions

2.5.1 North America Analysis

2.5.2 Asia Pacific Analysis

2.5.3 Middle East Analysis

2.5.4 South America Analysis

2.5.5 Europe Analysis

2.5.6 Africa Analysis

3. Global Commercial Aircraft Disassembly, Dismantling & Recycling Market 2018-2028

3.1 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market Forecast 2018-2028

3.2 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market Drivers & Restraints 2018

3.2.1 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market Drivers 2018

3.2.2 Aircraft Retirement Factors

3.2.3 Impact of Earlier Aircraft Retirement On The Disassembly, Dismantling & Recycling Process

3.2.4 Aircraft Dismantling Versus Resale

4. Global Commercial Aircraft Disassembly, Dismantling & Recycling Submarket Forecast 2018-2028

4.1 Global Commercial Aircraft Storage Forecast 2018-2028

4.1.1 Commercial Aircraft Storage Submarket Analysis

4.1.2 Multiple Factors Influencing Commercial Aircraft Storage Patterns

4.1.3 Fleet Specific Retirement Phases

4.1.4 Commercial Aircraft Storage is Concentrated in Specific Geographical Regions

4.2 Global Commercial Aircraft Disassembly & Dismantling Submarket Forecast 2018-2028

4.2.1 Commercial Aircraft Disassembly & Dismantling Submarket Analysis

4.2.2 Dismantling Can be Conducted In Most Locations

4.2.3 Improving The Commercial Aircraft Dismantling Process

4.3 The Commercial Aircraft Engine Teardown Submarket 2018-2028

4.3.1 Engine Teardown Submarket Analysis

4.3.2 Engines Account for the Highest Proportion of Commercial Aircraft Value

4.3.3 Multiple Supply Chains for Engine Teardown Activities

4.3.4 Healthy Prospects for Engine Teardown Demand

4.4 The Commercial Aircraft Disassembly, Dismantling & Recycling Component Management Submarket 2018-2028

4.4.1 Component Management Submarket Analysis

4.4.2 Why is Component Management and Logistics a Critical Aspect for Commercial Aircraft Operators?

4.4.3 The Outlook for Second Hand Parts

5. Leading Regional Commercial Aircraft Disassembly, Dismantling & Recycling Market Forecasts 2018-2028

5.1 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market by Regional Market Share Forecast 2018-2028

5.2 The North American Commercial Aircraft Disassembly, Dismantling & Recycling Market Forecast 2018-2028

5.2.1 The North American Commercial Aircraft Disassembly, Dismantling & Recycling Submarkets

5.2.2 The North American Commercial Aircraft Disassembly, Dismantling & Recycling Market Drivers & Restraints

5.2.3 The North American Commercial Aircraft Disassembly, Dismantling & Recycling Market Contracts & Programmes

5.3 The European Commercial Aircraft Disassembly, Dismantling & Recycling Market Forecast 2018-2028

5.3.1 The European Commercial Aircraft Disassembly, Dismantling & Recycling Submarkets

5.3.2 Commercial Aircraft Storage Is Less of a Long Term Affair in Europe

5.3.3 Optimistic Outlook in the MRO and Aftermarket Sectors

5.3.4 The European Commercial Aircraft Disassembly, Dismantling & Recycling Market Drivers & Restraints

5.3.5 The European Commercial Aircraft Disassembly, Dismantling & Recycling Market Contracts & Programmes

5.4 The Asia-Pacific Commercial Aircraft Disassembly, Dismantling & Recycling Market Forecast 2018-2028

5.4.1 The Asia-Pacific Commercial Aircraft Disassembly, Dismantling & Recycling Submarkets

5.4.2 A Small Share in Commercial Aircraft Storage

5.4.3 Regional Commercial Aircraft Dismantling Activities are in the Pipeline

5.4.4 A Developing MRO and Aftermarket Industry is a Catalyst for Second Hand Component Demand

5.4.5 The Asia Pacific Commercial Aircraft Disassembly, Dismantling & Recycling Market Drivers & Restraints

5.4.6 The Asia Pacific Commercial Aircraft Disassembly, Dismantling & Recycling Market Contracts & Programmes

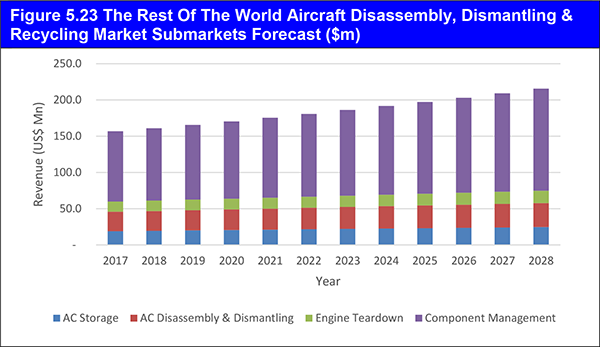

5.5 The Rest of the World Commercial Aircraft Disassembly, Dismantling & Recycling Market Forecast 2018-2028

5.5.1 The Rest of the World Commercial Aircraft Disassembly, Dismantling & Recycling Submarkets

5.5.2 Commercial Aircraft Storage and Dismantling is Unlikely to Change Significantly

5.5.3 Mixed Demand for Second Hand Components

5.5.4 The Rest of the World Commercial Aircraft Disassembly, Dismantling & Recycling Market Drivers & Restraints

5.5.5 The Rest of the World Commercial Aircraft Disassembly, Dismantling & Recycling Market Contracts & Programmes

6. SWOT Analysis of the Regional Commercial Aircraft Disassembly, Dismantling & Recycling Market 2018-2028

7. Top 12 Leading Companies in the Commercial Aircraft Disassembly, Dismantling & Recycling Market

7.1 Top 12 Leading Commercial Aircraft Disassembly, Dismantling & Recycling Companies 2018

7.2 AAR Corporation

7.2.1 AAR Corporation Commercial Aircraft Disassembly, Dismantling & Recycling Selected Recent Contracts / Projects / Programmes

7.2.2 AAR Corporation Total Company Sales 2013-2017

7.2.3 AAR Corporation Regional Emphasis / Focus

7.2.4 AAR Corporation Primary Market Competitors 2018

7.2.5 AAR Corporation Organisational Structure

7.2.6 M&A Activity of AAR Corporation

7.2.7 AAR Corporation Future Outlook

7.3 AerSale Inc

7.3.1 AerSale Inc Commercial Aircraft Disassembly, Dismantling & Recycling Selected Recent Contracts / Projects / Programmes 2010-2015

7.3.2 AerSale Inc Regional Emphasis / Focus

7.3.3 AerSale Inc Organisational Structure / Certifications

7.3.4 AerSale Inc Primary Market Competitors 2018

7.3.5 AerSale Inc Overview

7.3.6 Maintaining Extensive Inventories

7.3.7 Ideally Located Storage Facility

7.3.8 Robust Logistics and Distribution Network

7.3.9 Competitors of AerSale Inc

7.3.10 M&A Activity of AerSale Inc

7.3.11 Future Outlook of AerSale Inc

7.4 Air Salvage International

7.4.1 Air Salvage Commercial Aircraft Disassembly, Dismantling & Recycling Selected Recent Contracts / Projects / Programmes 2012-2017

7.4.2 Air Salvage International Organisational Structure / Certification

7.4.3 Air Salvage International Regional Emphasis / Focus

7.4.4 Air Salvage International Primary Market Competitors 2018

7.4.5 Leading Facility in the UK for Commercial Aircraft Storage, Disassembly and Dismantling Solutions

7.4.6 Airframe Components and Engine Parts Inventories and Distribution

7.4.7 Complying with Stringent Regulations

7.5 Bombardier Inc.

7.5.1 Bombardier Inc. Commercial Aircraft Disassembly, Dismantling & Recycling Selected Recent Contracts / Projects / Programmes 2013-2018

7.5.2 Bombardier Inc. Organisational Structure / Certifications

7.5.3 Bombardier Inc. Primary Market Competitors 2018

7.5.4 Company Overview

7.5.5 Primary drivers of the market

7.5.6 Future Outlook of Bombardier Inc.

7.6 Aircraft End-of-Life Solutions (AELS) BV

7.6.1 Aircraft End-of-Life Solutions (AELS) BV Commercial Aircraft Disassembly, Dismantling & Recycling Selected Recent Contracts / Projects / Programmes 2010-2018

7.6.2 Aircraft End-of-Life Solutions (AELS) BV Regional Emphasis / Focus

7.6.3 Aircraft End-of-Life Solutions (AELS) BV Primary Market Competitors 2018

7.6.4 Aircraft End-of-Life Solutions (AELS) BV Organisational Structure

7.6.5 Complete Commercial Aircraft End of Life Support

7.6.6 Maximising Value as an End Product of Services

7.6.7 Regional Emphasis / Focus of Aircraft End of Life Solutions

7.6.8 Future Outlook of Aircraft End of Life Solutions

7.7 AJW Group

7.7.1 AJW Group Commercial Aircraft Disassembly, Dismantling & Recycling Selected Recent Contracts / Projects / Programmes 2013-2018

7.7.2 AJW Group Regional Emphasis / Focus

7.7.3 AJW Group Organisational Structure / Certifications

7.7.4 AJW Group Primary Market Competitors 2018

7.7.5 AJW Group Overview

7.7.6 Procuring Aircraft for Obtaining Valuable Component Parts

7.7.7 Future Outlook of the AJW Group

7.8 Apollo Aviation Group

7.8.1 Apollo Aviation Group Commercial Aircraft Disassembly, Dismantling & Recycling Selected Recent Contracts / Projects / Programmes 2011-2018

7.8.2 Apollo Aviation Regional Emphasis / Focus

7.8.3 Apollo Aviation Organisational Structure

7.8.4 Apollo Aviation Primary Market Competitors 2018

7.8.5 Apollo Aviation Group Overview

7.8.6 Strategies Designed to Maximise Rates of Return

7.8.7 Diverse Portfolio of Aircraft and Engine Types

7.8.8 Regional Emphasis / Focus of Apollo Aviation Group

7.9 Magellan Aviation Group

7.9.1 Magellan Aviation Group Commercial Aircraft Disassembly, Dismantling & Recycling Selected Recent Contracts / Projects / Programmes 2014-2017

7.9.2 Magellan Aviation Group Organisational Structure / Certifications

7.9.3 Magellan Aviation Group Regional Emphasis / Focus

7.9.4 Magellan Aviation Group Primary Market Competitors 2018

7.9.5 Magellan Aviation Group Overview

7.10 GA Telesis LLC

7.10.1 GA Telesis LLC Commercial Aircraft Disassembly, Dismantling & Recycling Selected Recent Contracts / Projects / Programmes 2011-2018

7.10.2 GA Telesis LLC Regional Emphasis / Focus

7.10.3 GA Telesis LLC Organisational Structure

7.10.4 GA Telesis LLC Primary Market Competitors 2018

7.10.5 GA Telesis LLC Overview

7.10.6 Acquiring Aircraft for Disassembly Purposes

7.10.7 Tapping into the Chinese Market

7.10.8 Future Outlook of GA Telesis LLC

7.11 Marana Aerospace Solutions

7.11.1 Marana Aerospace Solutions Overview

7.11.2 What is the Appeal of Arizona?

7.11.3 Full Service End of Life Solutions

7.11.4 Competitors of Marana Aerospace Solutions

7.11.5 Regional Emphasis / Focus of Marana Aerospace Solutions

7.11.6 Future Outlook of Marana Aerospace Solutions

7.12 Tarmac Aerosave

7.12.1 Europe’s Biggest Aircraft Storage and Recycling Facility

7.12.2 Comprehensive Aircraft End of Life Support

7.12.3 Can Tarmac Aerosave’s Spanish Facility be a Viable Alternative to North America?

7.12.4 Regional Emphasis / Focus of Tarmac Aerosave

7.12.5 Future Outlook of Tarmac Aerosave

7.13 Universal Asset Management Inc ( Acquired by Aircraft Recycling International Ltd.)

7.13.1 An Expanding Company

7.13.2 Providing a Broad Range of Services for Aircraft Disassembly and Asset Management

7.13.3 Green Solutions and Sustainability

7.13.4 Regional Emphasis / Focus of Universal Asset Management Inc.

7.13.5 Future Outlook of Universal Asset Management Inc.

7.14 Other Companies Involved in the Commercial Aircraft Disassembly, Dismantling & Recycling Market 2018

8. Conclusions and Recommendations

8.1 The Future Demands And Issues With Aircraft Scrapping & Recycling

8.2 Storage Vs Scrapping

8.3 Aircraft Disassembly & Dismantling Factors

8.4 Drivers & Restraints for the Global Commercial Aircraft Disassembly, Dismantling & Recycling Market 2018-2028

9. Glossary

List of Tables

Table 2.1 Average Fleet Data Per Region In Terms Of Stored, Scrapped & Active Fleet Based On 49 Major Airline Carriers (Number Of Aircraft), 2017

Table 2.2 Leading Airlines In North America, 2017 (Airliner, Stored, Scrapped & Active)

Table 2.3 Leading Airlines In Asia Pacific, 2017 (Airlines, Stored, Scrapped & Active)

Table 2.4 Leading Airlines In Middle East, 2017 (Airlines, Stored, Scrapped & Active)

Table 2.5 Leading Airlines In South America, 2017 (Airlines, Stored, Scrapped & Active)

Table 2.6 Leading Airlines In Europe, 2017 (Airlines Stored, Scrapped & Active)

Table 2.7 Leading Airlines In Africa, 2017 (Airlines, Stored, Scrapped & Active )

Table 3.1 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market Forecast 2018-2028 ($m, AGR %, CAGR %, Cumulative)

Table 3.2 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market Drivers & Restraints 2018

Table 4.1 Global Commercial Aircraft Disassembly, Dismantling & Recycling Submarket Forecast 2018-2028 ($m, AGR %, Cumulative)

Table 4.2 Global Commercial Aircraft Disassembly, Dismantling & Recycling Submarket CAGR Forecast 2018-2023, 2013-2028, 2018-2028 (CAGR %)

Table 4.3 The Commercial Aircraft Storage Submarket Forecast by Regional Market 2018-2028 (Sales $m, AGR %, Cumulative $m)

Table 4.4 Commercial Aircraft Disassembly & Dismantling Submarket Forecast by Regional Market 2018-2028 (Sales $m, AGR %, Cumulative $m)

Table 4.5 Component Management Submarket Forecast by Regional Market 2018-2028 (Sales $m, AGR %, Cumulative $m)

Table 5.1 Leading Regional Commercial Aircraft Disassembly, Dismantling & Recycling Submarket Forecast 2018-2028 ($m, Global AGR %, Cumulative)

Table 5.2 The North American Commercial Aircraft Disassembly, Dismantling & Recycling Market Submarkets Forecast 2018-2028 ($m, AGR %, CAGR %, Cumulative)

Table 5.3 The North American Commercial Aircraft Disassembly, Dismantling & Recycling Market Drivers & Restraints 2018

Table 5.4 The North American Commercial Aircraft Disassembly, Dismantling & Recycling Market Contracts & Programmes (Date, Company, Value $m, Details)

Table 5.5 The European Commercial Aircraft Disassembly, Dismantling & Recycling Market Submarkets Forecast 2018-2028 ($m, AGR %, CAGR %, Cumulative)

Table 5.6 The European Commercial Aircraft Disassembly, Dismantling & Recycling Market Drivers & Restraints

Table 5.7 The European Commercial Aircraft Disassembly, Dismantling & Recycling Market Contracts & Programmes (Date, Company/Country , Details)

Table 5.8 The Asia-Pacific Commercial Aircraft Disassembly, Dismantling & Recycling Market Submarkets Forecast 2018-2028 ($m, AGR %, CAGR %, Cumulative)

Table 5.9 The Asia Pacific Commercial Aircraft Disassembly, Dismantling & Recycling Market Drivers & Restraints

Table 5.10 The Asia Pacific Commercial Aircraft Disassembly, Dismantling & Recycling Market Major Contracts & Programmes (Date, Company, Details)

Table 5.11 The Rest Of The World Commercial Aircraft Disassembly, Dismantling & Recycling Market Submarkets Forecast 2018-2028 ($m, AGR %, CAGR %, Cumulative)

Table 5.12 The Rest Of The World Commercial Aircraft Disassembly, Dismantling & Recycling Market Drivers & Restraints

Table 5.13 The Rest Of The World Commercial Aircraft Disassembly, Dismantling & Recycling Market Major Contracts & Programmes (Date, Company, Details)

Table 6.1 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market SWOT Analysis 2018-2028

Table 7.1 Top 12 Leading Commercial Aircraft Disassembly, Dismantling & Recycling Companies 2018 (Primary Submarket Specialization)

Table 7.2 Other Companies in the Commercial Aircraft Disassembly, Dismantling & Recycling Market (Company, Product / Service)

Table 7.3 AAR Corporation Profile 2017 (CEO, Total Company Sales $m, Sales in the Market $m, Strongest Business Region, Business Segment in the Market, HQ, Founded, No. of Employees, IR Contact, Ticker, Website)

Table 7.4 AAR Corporation Commercial Aircraft Disassembly, Dismantling & Recycling Contracts / Programmes (Date, Country, Value $m, Details)

Table 7.5 AAR Corporation Commercial Aircraft Disassembly, Dismantling & Recycling Products / Services (Company Division, Product, Specification)

Table 7.6 AAR Corporation Total Company Sales 2013-2017 ($m, AGR %)

Table 7.7 AerSale Inc Profile 2017 (CEO, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 7.8 Selected Recent AerSale Inc Commercial Aircraft Disassembly, Dismantling & Recycling Contracts / Projects / Programmes 2010-2015 (Date, Country / Region, Details)

Table 7.9 AerSale Inc Commercial Aircraft Disassembly, Dismantling & Recycling Products / Services (Products, Specifications)

Table 7.10 AerSale Inc Certifications (Issuing Agency, Certificate, Associated Activity)

Table 7.11 Air Salvage International Profile 2017 (CEO, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 7.12 Selected Recent Air Salvage International Commercial Aircraft Disassembly, Dismantling & Recycling Contracts / Projects / Programmes 2012-2017 (Date, Country, Details)

Table 7.13 Air Salvage International Commercial Aircraft Disassembly, Dismantling & Recycling Products / Services (Company Division, Product / Service, Specification)

Table 7.14 Air Salvage International Certifications (Issuing Agency, Certificate, Associated Activity)

Table 7.15 Bombardier Inc. Profile 2017 (CEO, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 7.16 Selected Recent Bombardier Inc. Commercial Aircraft Disassembly, Dismantling & Recycling Contracts / Projects / Programmes 2013-2018 (Date, Country, Details)

Table 7.17 Bombardier Inc. Commercial Aircraft Disassembly, Dismantling & Recycling Products / Services (Service, Specification)

Table 7.18 Aircraft End-of-Life Solutions (AELS) BV Profile 2017 (CEO, Strongest Business Region, Submarket Involvement, HQ, Founded, Number of Employees, IR Contact, Website)

Table 7.19 Selected Recent Aircraft End-of-Life Solutions (AELS) BV Commercial Aircraft Disassembly, Dismantling & Recycling Contracts / Projects / Programmes 2010-2018 (Date, Country, Product, Details)

Table 7.20 Aircraft End-of-Life Solutions (AELS) BV Commercial Aircraft Disassembly, Dismantling & Recycling Products / Services (Product / Service, Specification)

Table 7.21 Aircraft End-of-Life Solutions (AELS) BV Certifications (Issuing Agency, Certificate, Associated Activity)

Table 7.22 AJW Group Profile 2017 (CEO, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 7.23 AJW Group Commercial Aircraft Disassembly, Dismantling & Recycling Contracts / Programmes 2013-2018 (Date, Country, Details)

Table 7.24 AJW Group Commercial Aircraft Disassembly, Dismantling & Recycling Products / Services (Company Division, Product / Service, Specification)

Table 7.25 AJW Group Certifications (Issuing Agency, Certificate, Associated Activity)

Table 7.25 AJW Group Certifications (Issuing Agency, Certificate, Associated Activity)

Table 7.26 Apollo Aviation Group 2017 (CEO, Total Company assets $m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Website)

Table 7.27 Selected Apollo Aviation Group Commercial Aircraft Disassembly, Dismantling & Recycling Contracts / Projects / Programmes 2011-2018 (Date, Country , Value $m, Details)

Table 7.28 Apollo Aviation Group Commercial Aircraft Disassembly, Dismantling & Recycling Company Products / Services (Company Division, Product, Specification)

Table 7.29 Magellan Aviation Group 2017 (CEO, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 7.30 Selected Recent Magellan Aviation Group Commercial Aircraft Disassembly, Dismantling & Recycling Contracts / Projects / Programmes 2012-2017 (Date, Country, Details)

Table 7.31 Magellan Aviation Group Commercial Aircraft Disassembly, Dismantling & Recycling Products / Services (Product / Service, Specification)

Table 7.32 GA Telesis LLC Profile 2017 (Total Company Managing Assets $m, Strongest Business Regions, Submarket Involvement, HQ, Founded, No. of Employees, IR Contact, Website)

Table 7.33 Selected Recent GA Telesis LLC Commercial Aircraft Disassembly, Dismantling & Recycling Contracts / Projects / Programmes 2011-2018 (Date, Country / Region, Details)

Table 7.34 GA Telesis LLC Commercial Aircraft Disassembly, Dismantling & Recycling Products / Services (Company Division, Product / Service, Specification)

Table 7.35 Marana Aerospace Solutions Company Overview 2017 (Year Founded, HQ, CEO, Website, Related Submarket Activity)

Table 7.36 Marana Aerospace Solutions Commercial Aircraft Disassembly, Dismantling & Recycling Company Products / Services (Product / Service, Specification)

Table 7.37 Marana Aerospace Solutions Certifications (Issuing Agency, Certificate, Associated Activity)

Table 7.38 Tarmac Aerosave Company Overview 2017 (Year Founded, HQ, CEO, Website, Related Submarket Activity)

Table 7.39 Tarmac Aerosave Commercial Aircraft Disassembly, Dismantling & Recycling Products / Services (Product / Service, Specification)

Table 7.40 Tarmac Aerosave Solutions Certifications (Issuing Agency, Certificate)

Table 7.41 Universal Asset Management Inc. Company Overview 2017 (Year Founded, HQ, CEO, Number of Employees, Website, Related Submarket Activity)

Table 7.42 Universal Asset Management Inc Commercial Aircraft Disassembly, Dismantling & Recycling Contracts / Programmes (Date, Country, Details)

Table 7.43 Universal Asset Management Inc Commercial Aircraft Disassembly, Dismantling & Recycling Products / Services (Company Division, Product / Service, Specification)

Table 7.44 Ascent Aviation Services Corporation Certifications (Issuing Agency, Certificate, Associated Activity)

Table 7.45 Other Companies Involved in the Commercial Aircraft Disassembly, Dismantling & Recycling Market 2018 (Company, Location)

Table 7.46 Other Companies in the Commercial Aircraft Disassembly, Dismantling & Recycling Market (Company, Product / Service)

Table 8.1 Drivers & Restraints for the Global Commercial Aircraft Disassembly, Dismantling & Recycling Market

List of Figures

Figure 1.1 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market Segmentation Overview

Figure 2.1 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market Structure Overview

Figure 2.2 Commercial Aircraft Disassembly, Dismantling & Recycling Process

Figure 2.3 Parties Involved in the Commercial Aircraft Disassembly, Dismantling & Recycling Process

Figure 2.4 Commercial Aircraft End-of-Life Options

Figure: 2.5 Global Next Generation Fleet Outlook 2018-2028 (Number Of Aircraft, Replacement & Change)

Figure 2.6 Usage Of Composites In Commercial Aircraft Timeline 1968 – 2018 (Cost Of Carbon Fiber Per Pound (US$Lb), % Aircraft Composite)

Figure 2.7 Advantages & Disadvantages of Used Carbon Fibre Products For Commercial Application

Figure 2.8 Conversion Modifications from Passenger-To-Freight Conversion (PFC) Operations

Figure 2.9 Valued Components On A Scrapped Boeing 747-400 Commercial Aircraft

Figure 2.10 Average Stored Aircraft Per Airline By Region, 2017 (Number Of Aircraft)

Figure 2.11 Average Scrapped Aircraft Per Airline By Region, 2017 (Number Of Aircraft)

Figure 2.12 Average Active Aircraft Per Airline By Region, 2017 (Number Of Aircraft)

Figure 2.13 Major Carriers In North America Fleet Detail, 2017 (Number Of Aircraft (Stored/ Scrapped)

Figure 2.14 Major Carriers In Asia Pacific Fleet Detail, 2017 (Number Of Aircraft (Stored/ Scrapped), Active Fleet)

Figure 2.15 Major Carriers In Middle East Fleet Detail, 2017 (Number Of Aircraft (Stored/ Scrapped), Active Fleet)

Figure 2.16 Major Carriers In South America Fleet Detail, 2017 (Number Of Aircraft (Stored / Scrapped), Active Fleet)

Figure 2.17 Major Carriers In Europe Fleet Detail, 2017 (Number Of Aircraft (Stored/ Scrapped), Active Fleet)

Figure 2.18 Major Carriers In Africa Fleet Detail, 2017 (Number Of Aircraft (Stored/ Scrapped), Active Fleet)

Figure 3.1 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market Forecast 2018-2028 ($m, AGR %)

Figure 3.2 Aircraft End Of Life Extension Options

Figure 4.1 Global Commercial Aircraft Disassembly, Dismantling & Recycling Submarket AGR Forecast 2018-2028 (AGR %)

Figure 4.2 Global Commercial Aircraft Disassembly, Dismantling & Recycling Submarket Forecast 2018-2028 (Sales $m, Global AGR %)

Figure 4.3 Global Commercial Aircraft Disassembly, Dismantling & Recycling Submarket Share Forecast 2018 (% Share)

Figure 4.4 Global Commercial Aircraft Disassembly, Dismantling & Recycling Submarket Share Forecast 2023 (% Share)

Figure 4.5 Global Commercial Aircraft Disassembly, Dismantling & Recycling Submarket Share Forecast 2028 (% Share)

Figure 4.6 Global Commercial Aircraft Disassembly, Dismantling & Recycling Submarkets Cumulative Market Share Forecast 2018-2028 (% Share)

Figure 4.7 Global Commercial Aircraft Storage Submarket by Regional Market AGR Forecast 2018-2028 (AGR %)

Figure 4.8 Aircraft Storage Market Forecast by Regional Market 2018-2028 ($m, Global AGR %)

Figure 4.9 Aircraft Storage Market Share by Regional Market Forecast 2018, 2023, 2028 (% Share)

Figure 4.10 Aircraft Disassembly & Dismantling Submarket by Regional Market AGR Forecast 2018-2028 (AGR %)

Figure 4.11 Aircraft Disassembly & Dismantling Market Forecast by Regional Market 2018-2028 ($m, Global AGR %)

Figure 4.12 Aircraft Disassembly & Dismantling Market Share by Regional Market Forecast 2018, 2023, 2028 (% Share)

Figure 4.13 The Commercial Aircraft Disassembly & Dismantling Process

Figure 4.14 Engine Teardown Submarket by Regional Market AGR Forecast 2018-2028 (AGR %)

Figure 4.15 Engine Teardown Market Forecast by Regional Market 2018-2028 ($m, Global AGR %)

Figure 4.16 Engine Teardown Market Share by Regional Market Forecast 2018, 2023, 2028 (% Share)

Figure 4.17 Component Management Submarket by Regional Market AGR Forecast 2018-2028 (AGR %)

Figure 4.18 Component Management Market Forecast by Regional Market 2018-2028 ($m, Global AGR %)

Figure 4.19 Component Management Market Share by Regional Market Forecast 2018, 2023, 2028 (% Share)

Figure 5.1 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market by Regional Market Forecast 2018-2028 ($m)

Figure 5.2 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market by Regional Market AGR Forecast 2018-2028 (AGR %)

Figure 5.3 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market by Regional Market Share Forecast 2018 (% Share)

Figure 5.4 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market by Regional Market Share Forecast 2023 (% Share)

Figure 5.5 Global Commercial Aircraft Disassembly, Dismantling & Recycling Market by Regional Market Share Forecast 2028 (% Share)

Figure 5.5 North American Commercial Aircraft Disassembly, Dismantling & Recycling Market & Submarket Forecast ($m, Regional Sales AGR %)

Figure 5.6 The North American Commercial Aircraft Disassembly, Dismantling & Recycling Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.7 North American Aircraft Storage Sales ($m, Sales AGR %)

Figure 5.8 North American Aircraft Disassembly & Dismantling ($m, Sales AGR %)

Figure 5.9 North American Aircraft Engine Teardown ($m, Sales AGR %)

Figure 5.10 North American Aircraft Component Management ($m, Sales AGR %)

Figure 5.11 European Aircraft Disassembly, Dismantling & Recycling Market & Submarket Forecast ($m, Regional AGR %)

Figure 5.12 The European Commercial Aircraft Disassembly, Dismantling & Recycling Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.13 The European Commercial Aircraft Storage Submarket Forecast 2018-2028 (Sales $m, AGR %)

Figure 5.14 The European Commercial Aircraft Disassembly & Dismantling Submarket Forecast 2018-2028 (Sales $m, Regional AGR %)

Figure 5.15 The European Commercial Aircraft Engine Teardown Submarket Forecast 2018-2028 (Sales $m, AGR %)

Figure 5.16 The European Commercial Aircraft Component Management Submarket Forecast 2018-2028 (Sales $m, AGR %)

Figure 5.17 Asia-Pacific Aircraft Disassembly, Dismantling & Recycling Market & Submarket Forecast ($m)

Figure 5.18 The Asia-Pacific Commercial Aircraft Disassembly, Dismantling & Recycling Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.19 The Asia-Pacific Aircraft Storage Submarket Forecast 2018-2028 (Sales $m, AGR %)

Figure 5.20 The Asia-Pacific Commercial Aircraft Disassembly & Dismantling Submarket Forecast 2018-2028 (Sales $m, AGR %)

Figure 5.21 The Asia-Pacific Commercial Aircraft Engine Teardown Submarket Forecast 2018-2028 (Sales $m AGR %)

Figure 5.22 The Asia-Pacific Aircraft Component Management Submarket Forecast 2018-2028 (Sales $m, AGR %)

Figure 5.23 The Rest Of The World Aircraft Disassembly, Dismantling & Recycling Market Submarkets Forecast ($m)

Figure 5.24 The Rest Of The World Commercial Aircraft Disassembly, Dismantling & Recycling Market Share Forecast 2018, 2023, 2028 (% Share)

Figure 5.25 The Rest Of The World Aircraft Storage Submarket Forecast 2018-2028 (Sales $m, AGR %)

Figure 5.26 The Rest Of The World Commercial Aircraft Disassembly & Dismantling Submarket Forecast 2018-2028 (Sales $m, AGR %)

Figure 5.27 The Rest Of The World Commercial Aircraft Engine Teardown Submarket Forecast 2018-2028 (Sales $m, AGR %)

Figure 5.28 The Rest Of The World Component Management Submarket Forecast 2018-2028 (Sales $m, AGR %)

Figure 7.1 AAR Corporation Total Company Sales 2013-2017 ($m, AGR %)

Figure 7.2 AAR Corporation Primary International Operations 2018

Figure 7.3 AAR Corporation Primary Market Competitors 2018

Figure 7.4 AAR Corporation Organizational Structure 2018

Figure 7.5 AerSale Inc Primary International Operations 2018

Figure 7.6 AerSale Inc Organizational Structure 2018

Figure 7.7 AerSale Inc Primary Market Competitors 2018

Figure 7.8 Air Salvage International Organisational Structure 2018

Figure 7.9 Air Salvage International Primary International Operations 2018

Figure 7.10 Air Salvage International Primary Market Competitors 2018

Figure 7.11 Bombardier Inc. Organisational Structure 2018

Figure 7.12 Bombardier Inc. Primary Market Competitors 2018

Figure 7.13 Aircraft End-of-Life Solutions (AELS) BV Primary International Operations 2018

Figure 7.14 Aircraft End-of-Life Solutions (AELS) BV Primary Market Competitors 2018

Figure 7.15 Aircraft End-of-Life Solutions (AELS) BV Organisational Structure 2018

Figure 7.16 AJW Group Primary International Operations 2018

Figure 7.17 AJW Group Organisational Structure 2018

Figure 7.18 AJW Group Primary Market Competitors 2018

Figure 7.19 Apollo Aviation International Operations 2018

Figure 7.20 Apollo Aviation Organizational Structure 2018

Figure 7.21 Apollo Aviation Primary Market Competitors 2018

Figure 7.22 Magellan Aviation Group Organisational Structure 2018

Figure 7.23 Magellan Aviation Group Primary International Operations 2018

Figure 7.24 Magellan Aviation Group Market Competitors 2018

Figure 7.25 GA Telesis LLC International Operations 2018

Figure 7.26 GA Telesis LLC Organisational Structure 2018

Figure 7.27 GA Telesis LLC Primary Market Competitors 2018

Figure 7.28 Marana Aerospace Solutions Organizational Structure

Figure 7.29 Marana Aerospace Solutions Customer Locations

Figure 7.30 Tarmac Aerosave Organisational Structure

Figure 7.31 Locations of Tarmac Aerosave’s Facilities

Figure 7.32 Universal Asset Management Organisational Structure

AAR Corporation

AAR’s Aviation Supply Chain Group

AELS

AerCap

AerFin Ltd

Aero Controls

Aero Mechanical Industries, Inc.

Aeroflot

Aerolease

Aerolíneas

AeroMechanical Industries Inc

Aeromexico

Aeronautical Engineers

AerSale Inc

Afriqiyah Airways

Air Algérie

Air Arabia

Air Atlanta Icelandic

Air Canada

Air China

Air Contractors Ltd.

Air Corsica

Air France

Air France Industries KLM Engineering & Maintenance (AFI KLM E&M)

Air France-KLM SA

Air Incheon

Air Namibia

Air New Zealand

Air Salvage International (ASI)

Air Transat

Airbus Group

Aircraft Demolition LLC

Aircraft Maintenance and Engineering Corporation (AMECO)

Aircraft Recycling International Ltd.

AirSale

AJ Walter Aviation Singapore Pte Ltd

AJW Aviation

AJW Group

AJW Group (AELS)

Alaska Airlines

Alenia Aeronautica

Alitalia

All Nippon Airways (ANA)

Allegiant Air

Ameco Beijing

American Airlines

American Eagle

AMETEK

APAS

Apollo Aviation Group LLC

Apollo Aviation Management Limited

Apollo Aviation Management Singapore Pte Ltd

Apple Aviation

ARC Aerospace Industries

Armavir

Ascent Aviation Services Corporation

ASCO

Asia Pacific Aircraft Storage (APAS)

Asiana Airlines

Atlas Air

ATR

Austrian Airlines

Aviall

Avianca

Aviation Capital Group (ACG)

Aviation Technical Services (ATS)

Bangladesh Airlines

Bank of America Merrill Lynch

BBAM

Beijing Capital International Airport Co. Ltd

Boeing Company

Boeing Tianjin Composites Co., Ltd,

Bombardier

Bombardier Aerospace Netherlands BV

Bonus Aerospace

Bonus Tech Inc

British Airways (BA)

Business Park Avellaneda

Cargo-B

Cargolux

Cathay Pacific Airways

CAVU Aerospace

Cebu Pacific

Century Tokyo Leasing Company

CFM International

Chateuroux Air Center

China Aircraft Leasing Group

China Aircraft Leasing Group Holdings Ltd (CALC)

China Aircraft Services Limited (CASL)

China Airlines

China Eastern Airlines

COMAC’s Shanghai Aircraft Design and Research Institute

Comair Limited

ComAV Technical Services

Continental Airlines

Contrail Aviation Support

Cool Containers LLC

Croatian Airlines

Delta Airlines

eCube Solutions

Egyptair

Embraer

Emirates

Engine Lease Finance Corporation (ELFC)

Ethiopian Airlines

Etihad

Etihad Airways Engineering

EVA Air

Evergreen Aviation

Fedex Express

Finnair Airlines

FL Technics

Flight Director

fly Dubai

Fokker Services

GA Innovation China (GAIC)

GA Telesis Aircraft Systems Group

GA Telesis Component Solutions Group (CSG)

GA Telesis Composite Repair Group

GA Telesis Engine Services Ltd (GATES)

GA Telesis LLC

GA Telesis MRO Services

GA Telesis Turbine Engine Group.

GA Telesis, UK

GA Telesis’ Composite Repair Group (CRG)

GE Capital Aviation Services (GECAS)

General Electric (GE)

German Operating Aircraft Leasing (GOAL) GmbH & Co. KG.

GMF AeroAsia

GOL

Gulf Air

Haitec

Heavy Maintenance Singapore Services Pte Ltd

Honeywell

Hong Kong Aircraft Engineering Co., Ltd. (HAECO)

Husqvarna

HVF West LLC

Iberia

IBEX Airlines

Indamer Aviation

IndiGo

Interjet

International Aero Engines (IAE)

Intertrade

Island Air

Israel Aircraft Industries (IAI)

ITS Infinity Trading

Japan Airlines

Jet Airways

Jet Yard LLC

JMV Aviation

JT Power

Kellstrom Industries

Kenya AAR Corp.

Kenya Airways

KLM

KLM Engineering

KLM UK Engineering

Kulula.com

Kuwait Airways

Latam (Brazil)

Lockheed Martin

LOT Polish Airlines

Lufthansa

Lufthansa Technik AERO Alzey

Lufthansa Technik AG

Maeve Airlines

Malaysia Airlines

Malaysia Aviation Group Berhad

Male Hungarian Airlines

Mandala Airlines

Marana Aerospace Solutions (MAS)

Maxair Ventures Inc

McDonnel Douglas

MD Turbines

Mesa Airlines Inc

Mitsubishi Aircraft Corporation

Mitsubishi Regional Jet

MTU Aero Engines AG

Norwegian Air Shuttle

Olympic Airways

Oman Air

Orange Aero

Orix Aviation

Pacific Aerospace Resources and Technologies

Pinal Airpark

Pratt & Whitney

Pratt & Whitney Canada

Primera

Qantas

Qatar

Qwest Air Parts

Raytheon

Republic Airline

Rockwell Collins Inc

Rolls-Royce

Rolls-Royce Holdings Plc

Roswell Industrial Air Centre

Royal Air Maroc

Ryanair

Saab

Sabena Technics

Sabena Technics Brussels

Safair

Safran Group

Saudi Arabian Airlines

Scandinavian Airlines

Scoot Airlines

SEMR Aerospace

SIA Engineering Company (SIAEC)

Singapore Airlines

SITA France

Sky Airlines

Skyline Aero

SMBC Aviation Capital Netherlands B.V.

Snecma

South African Airways (SAA)

Southern California Logistics

Southwest Airlines

Spectrum Aerospace

Spirit Aerosystems

Spirit Airlines

SR Technics

SR Technics’ Single Component Services (SCS).

ST Aerospace

StandardAero

Stewart Industries International LLC

Stifel Aircraft Credit and Finance

Sumitomo Precision Products

Suez Environnement

Swiftair

Swissport UK

Sycamore Aviation

Tarmac Aerosave

Telair Cargo Group

Telesis Component Repair Group Southeast

Thai Airlines

The Boeing Company

Tianjin HAITE High Tech Co., LTD.

Tokyo Century Corporation

TransAsia Airways

Transavia

Tunisair

Tunisair Technics

Turkish Airlines

UAM Holdings Inc

Unical Aviation

United Airlines

United Technologies Corporation

Universal Air Repair LLC.

Universal Asset Management (UAM) Inc.

US Airways

Utair Aviation

UTC Aerospace Systems,

Valliere Aviation Group

Van Dalen Recycling and Trading

VAS Aero Services

Viasat

Vietnam Airlines

VIM Airlines

Virgin Atlantic

Vivaerobus

Volaris

Volotea

Vueling

WCP Inc.

Western Global Airlines

Xiamen Airlines

Airports mentioned

Alice Springs Airport

Beijing Capital Airport

Brussels Airport

Cap Haitian International Airport

Cotswold Airport

Domodedovo Airport

Dubai World Central Airport

East Midlands Airport

Frankfurt-Hahn Airport

Goodyear (Phoenix) Litchfield Municipal Airport

Hazard International Airport

Indianapolis International Airport

Kolkata Airport

Leeuwenborgh Mechanic School

London Heathrow Airport

Lourdes Tarbes Airport

Luxembourg Airport

Maastricht Airport

Madrid Barajas Airport

Malaysia Airlines

Mojave Air & Space Port

Ostend-Bruges International Airport

Paris-Charles de Gaulle Airport

San Francisco International Airport

Singapore Change Airport

SMBC Aviation Capital Netherlands B.V.

Southern California Logistics Airport

Stuttgart Municipal Airport

Teruel Airport

Tucson International Airport

Tupelo Regional Airport (TUP)

Twente Airport

Walnut Ridge Airport

Woensdrecht Airport

Organisations mentioned

Aircraft Fleet Recycling Association (AFRA)

Aviation Suppliers Association (ASA )

Bermuda Department of Civil Aviation

Brazil ANAC

CAAC

Civil Aviation Authority of the Cayman Islands

Defense Logistics Agency

EASA

European Commission

FAA

Hong Kong Institute of Vocational Education,

ISO

Leeuwenborgh Mechanic School

Mexico DGAC

NASA

Northland Community and Technical College

Pima Air & Space Museum

States of Guernsey Office of the Director of Civil Aviation

UK Environment Agency

UK Ministry of Defense

University of Nottingham

US Department of Defense

US State Department

US’ Federal Air Marshal Service

Vervoerders, Inzamelaars, Handelaren en Bemiddelars (VIHB)

Download sample pages

Complete the form below to download your free sample pages for Commercial Aircraft Disassembly, Dismantling & Recycling Market Report 2018-2028

Related reports

-

Top 20 Commercial Airline Low Cost Carrier (LCC) Companies 2019

The growing prevalence of low cost carriers (LCC) has led Visiongain to publish this unique report, which may be crucial...Full DetailsPublished: 06 February 2019 -

Van Market Outlook Report 2019-2029

The $40bn van market is expected to flourish in the next few years because of Increasing demand for vans especially...

Full DetailsPublished: 13 November 2018 -

Commercial Aircraft Modernization, Upgrade and Retrofit Market Report 2018-2028

This brand new report on the commercial aircraft Modernisation upgrade and retrofit market features market sizing, forecasts and detailed contract...

Full DetailsPublished: 12 April 2018 -

Commercial Aircraft Cabin Seating & Interiors Market Forecast 2018-2028

Visiongain assessed that the world market for commercial aircraft cabin seating & interiors will reach $16.4 billion in 2018....Full DetailsPublished: 11 September 2018 -

Commercial Aircraft Health Monitoring Systems (AHMS) Market Report 2018-2028

INDUSTRY PROFESSIONALS: cut through media hype and exaggeration by reading an objective dispassionate Visiongain report on the $721m commercial aircraft...

Full DetailsPublished: 27 March 2018 -

Aerospace Composites Market Report 2018-2028

Aerospace composites represent a key part of the aerospace sector. This is due to the integral role they are currently...

Full DetailsPublished: 08 June 2018 -

Top 20 Commercial Aircraft Maintenance, Repair & Overhaul (MRO) Companies 2019

With an incredible amount of industry attention devoted to MRO, actually deriving realistic market prospects and opportunities can be difficult....Full DetailsPublished: 24 April 2019 -

Oil Refineries Market Report 2018-2028

With the recent upswing in oil prices these margins are again rising and Visiongain expects the value of the refinery...Full DetailsPublished: 24 July 2018 -

Electric Vehicle Supply Equipment (EVSE) Market Report 2019-2029

Read on to discover how this definitive report can transform your own research and save you time.

...Full DetailsPublished: 31 December 2018 -

Waste to Energy (WtE) Yearbook 2018

Visiongain assesses that CAPEX on Waste-to-Energy will reach $15.4bn in 2018.

...Full DetailsPublished: 28 September 2018

Download sample pages

Complete the form below to download your free sample pages for Commercial Aircraft Disassembly, Dismantling & Recycling Market Report 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Visiongain aviation reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and automotive industry experts but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology please email jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Would you like to get the latest Visiongain aviation reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

Airline Passenger Experience Association (APEX)

Airlines for America

Airport Consultants Council (ACC)

Airports Council International (ACI)

Airports Council International-North America

American Association of Airport Executives

Arab Air Carriers Organization (AACO)

European Aerospace Cluster Partnership

Global Business Travel Association (GBTA)

International Air Transport Association (IATA)

Security Industry Association (SIA)

Security Manufacturers Coalition

Women in Aviation

World Aviation Services

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Aviation news

Aircraft Computers Market

The global Aircraft Computers market is projected to grow at a CAGR of 5.7% by 2034

24 June 2024

Space Mining Market

The global Space Mining market is projected to grow at a CAGR of 20.7% by 2034

07 June 2024

Connected Aircraft Market

The global Connected Aircraft market is projected to grow at a CAGR of 17.2% by 2034

05 June 2024

Satellite Ground Station Market

The global Satellite Ground Station market was valued at US$65.69 billion in 2023 and is projected to grow at a CAGR of 13.3% during the forecast period 2024-2034.

21 May 2024