Numerous technological developments and innovations in the automotive sector have led Visiongain to publish this unique connected car report, which may be crucial to your company’s improved success. I thought it would be of interest to you.

Visiongain calculates that the connected car market will reach $42.99bn in 2019.

Do you know?

• Who are the leading automotive OEM and non-OEM companies in the connected car market?

• What are the different types of products and services offered by the various companies in the connected car market?

• What percentage of the market is being taken by each of the leading companies?

• Who are the leading companies dominating the connected car market?

• What are the strategies being used by the companies to sustain their competitive position within the connected car market?

• What are the recent developments of the leading companies in the connected car market?

Reasons To Buy

Global Connected Car Market Forecast 2019-2029

SWOT Analysis Of The Connected Car Market

Value Chain Analysis Of The Connected Car Market

The report provides market share %, revenue and ranking of the 20 leading companies operating within the connected car market space

• Apple Inc.

• AT&T Inc.

• BMW AG

• Broadcom Corporation

• Daimler AG

• Fiat Chrysler Automobiles

• Ford Motor Company

• General Motors Co.

• Google Inc.

• Honda Motor Co.

• Qualcomm Inc.

• Samsung

• Sierra Wireless

• Tech Mahindra Ltd.

• Tesla

• Toyota Motor Corporation

• Verizon Communications

• Visteon Corporation

• Volkswagen Group

• Volvo

Reasons why you must order and read this report today:

• This report will help you in understanding the connected car ecosystem.

• This report will help you in understanding the market strategies used by the top 20 connected car companies.

• This report will help you in understanding where should you target your business strategy

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to succeed and why?

• What business models should you adopt?

• What industry trends should you be aware of?

This independent, 180 page report guarantees you will remain better informed than your competition. With over 70 tables and figures examining the top 20 connected car companies, the report gives you a visual, one-stop breakdown of your market., as well as analysis, from 2019-2029 keeping your knowledge that one step ahead allowing you to succeed.

This report is essential reading for you or anyone in the automotive, telematics, electronics or telecommunications sectors with an interest in connected cars. Purchasing this report today will help you to recognise those important market opportunities and understand the possibilities there.

Target audience

• Automotive OEMs

• Electronics companies

• Telecommunications companies

• Telematics specialists

• Software developers

• Automobile organizations

• Technology investors

• Automobile investors

• Market analysts

• Consultants

• Investors

• National and international automobile authorities

• Business, marketing or competitive intelligence manager

• Business intelligence consultant

• Marketing manager

• Business development manager

• Product development manager

• Chief executive officer (CEO)

• Commercial director

• Sales manager

• R&D manager

• Banks

• Regulators

• Associations

• Automobile industry bodies

• Automobile regulators and other policy makers

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1 Report Overview

1.1 Global Connected Car Market Overview

1.2 Why you should read this report

1.3 Benefits of this report

1.4 Report Structure

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Secondary Research

1.7 Frequently Asked Questions (FAQs)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2 Introduction to the Connected Car Market

2.1 Connected Car Definition

2.2 Connected Car Market Definition

2.3 Connected Car Market Size and Forecast 2019-2029

2.4 Connected Car Market Segmentation- By Connectivity

2.4.1 Embedded Solutions Submarket

2.4.1.1 Embedded Solutions Analysis

2.4.1.2 Benefits of Embedded Solutions for OEMs

2.4.1.3 Why the Level of Penetration of Embedded Solutions is Low

2.4.2 Integrated Solutions Submarket

2.4.2.1 Integrated Solutions Analysis

2.4.3 Tethered Solutions Submarket

2.4.3.1 Tethered Solutions Analysis

2.4.3.2 Why tethered solutions will decrease in the future

3 Connected Car Market Segmentation Overview-By Application

3.1.1 Infotainment Systems

3.1.1.1 Infotainment Systems Analysis

3.1.1.2 Connected Car Market, by Application

3.1.1.3 Navigation Systems Analysis

3.1.1.4 Telematics Systems

3.1.1.5 Telematics System Analysis

4 Overview of Connected Car Services and Applications

4.1 Safety and Security Services

5 Connected Car Devices

5.1 OEM Connected Car Solutions-Applications Overview

5.2 Global Connected Car Market 2019

6 Drivers, Restraints and Challenges for the Global Connected Car Market

6.1.1 Drivers

6.1.2 Restraints and Challenges

7 Global Connected Car Market Trends 2017

7.1 Shared Data Plans To Reduce The Number Of Data Subscriptions Per User

7.2 Growing Popularity Of LTE Data Connections In Cars Will Pave The Way For Ethernet Adoption

7.3 Increase In Popularity Of Predictive Driving Through Contextual Help Function

7.4 Big Data Platform Provided By Connected Cars To Push Further Developments

7.5 Adoption Of Android OS In The Automotive Infotainment Market

8 Five Force Analysis of the Connected Car Market 2019

8.1 Opportunities for Service Providers

9 Value Chain For The Connected Car Market

10 Leading 20 Connected Car Companies

10.1 Leading 20 Companies Ranking in the Connected Car Market

10.2 Composition of the Connected Car Market in 2017

10.3 Leading 10 OEM Ranking in the Connected Car Market 2018

10.4 Leading 10 Non-OEM Ranking in the Connected Car Market 2018

11 Top 20 Connected Car Company Profiles

11.1 Samsung

11.1.1 Samsung Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

11.1.2 Samsung Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

11.1.3 Samsung Connected Car Offerings

11.1.4 Samsung Developments

11.1.5 Samsung Analysis

11.2 Apple

11.2.1 Apple Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

11.2.2 Apple Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

11.2.3 Apple Developments

11.2.4 Apple Analysis

11.3 AT&T

11.3.1 AT&T revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

11.3.2 AT&T Revenue, by Business Segment, 2017

11.3.3 AT&T Offering & Recent Development

11.3.4 AT&T Analysis

11.4 BMW AG

11.4.1 BMW AG Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

11.4.2 BMW AG Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

11.4.3 BMW AG Developments

11.4.4 BMW AG Analysis

11.5 Broadcom Limited

11.5.1 Broadcom Limited Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

11.5.2 Broadcom Limited Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

11.5.3 Broadcom Limited Analysis

11.6 Daimler

11.6.1 Daimler Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

11.6.2 Daimler Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

11.6.3 Daimler Developments-

11.6.4 Daimler Analysis

11.7 Fiat Chrysler Automobiles Group

11.7.1 Fiat Chrysler Automobiles Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

11.7.2 Fiat Chrysler Automobiles Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

11.7.3 Fiat Chrysler Automobiles Recent Developments

11.7.4 Fiat Chrysler Automobiles group Analysis

11.8 Ford Motor Company

11.8.1 Ford Motor Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

11.8.2 Ford Motor Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

11.8.3 Ford Motor Recent Developments

11.8.4 Ford Motor Company Analysis

11.9 General Motors

11.9.1 General Motors Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

11.9.2 General Motors Research & Development, 2015-2017

11.9.3 General Motors Recent Developments

11.9.4 General Motors Analysis

11.10 Honda Motor

11.10.1 Honda Motors Revenue, by Geographic Region, and Revenue & Y-o-Y Growth, 2015-20172017and Revenue & Y-o-Y Growth, 2015-2017

11.10.2 Honda Motors Revenue, by Business Segment, 2017and Research & Development, 2015-2017

11.10.3 Honda Motors Recent Developments

11.10.4 Honda Motors Analysis

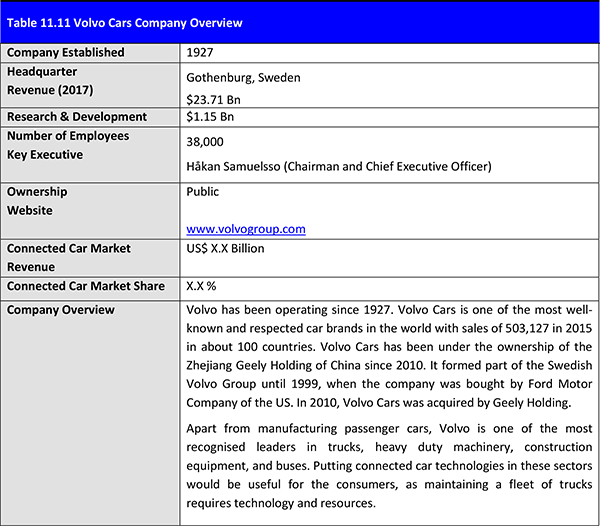

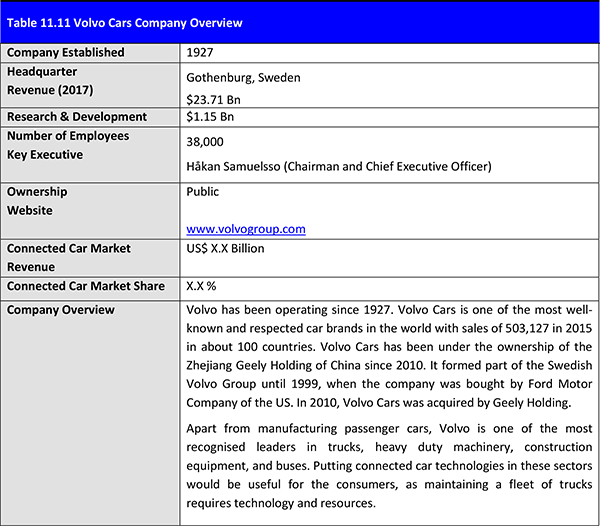

11.11 Volvo Cars

11.11.1 Volvo Cars Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

11.11.2 Volvo Cars Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

11.11.3 Volvo Cars Recent Developments

11.11.4 Volvo Cars Corporation Analysis

11.12 Tech Mahindra.

11.12.1 Tech Mahindra. Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

11.12.2 Tech Mahindra Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

11.12.3 Tech Mahindra Recent Developments

11.12.4 Tech Mahindra Analysis

11.13 Tesla Motors.

11.13.1 Tesla Motors Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2015-2017

11.13.2 Tesla Motor Revenue, by segment, 2018 and Research & Development, 2015-2017

11.13.3 Tesla Motors Recent Developments

11.13.4 Tesla Motors Analysis

11.14 Qualcomm Incorporated

11.14.1 Qualcomm Inc. Revenue, by Geographic Region, 2017, and Revenue & Y-o-Y Growth, 2015-2017

11.14.2 Qualcomm Inc. Revenue, by Business Segment 2017, and Research & Development, 2015-2017

11.14.3 Qualcomm Inc. Recent Developments

11.14.4 Qualcomm Analysis

11.15 Sierra Wireless

11.15.1 Sierra Wireless Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

11.15.2 Sierra Wireless Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

11.15.3 Sierra Wireless Recent Developments

11.15.4 Sierra Wireless Analysis

11.16 Toyota

11.16.1 Toyota Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

11.16.2 Toyota Revenue, by End Application, 2017 and Research & Development, 2015-2017

11.16.3 Toyota Recent Developments

11.16.4 Toyota Analysis

11.17 Verizon Communications

11.17.1 Verizon Communications Revenue & Y-o-Y Growth, 2015-2017

11.17.2 Verizon Communications Revenue, by Business Segment, 2017

11.17.3 Verizon Communications Recent Developments

11.17.4 Verizon Communications Analysis

11.18 Visteon Corporation

11.18.1 Visteon Corporation Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

11.18.2 Visteon Corporation Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

11.18.3 Visteon Corporation Recent Developments

11.18.4 Visteon Corporation Analysis

11.19 Volkswagen

11.19.1 Volkswagen Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

11.19.2 Volkswagen Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

11.19.3 Volkswagen Recent Developments

11.19.4 Volkswagen Analysis

11.20 Google

11.20.1 Google Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

11.20.2 Google Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

11.20.3 Google Recent Developments

12 SWOT Analysis of the Connected Car Market- By Type of Connectivity

12.1 SWOT Analysis of the Embedded Solutions Submarket 2019

12.2 SWOT Analysis of the Integrated Solutions Submarket 2019

12.3 SWOT Analysis of the Tethered Solutions Submarket 2019

13 Conclusion

13.1 Global Connected Car Market 2018

13.2 Opportunities in the Connected Car Market 2018

13.3 Leading 10 Non-OEM Ranking in the Connected Car Market 2017

14 Glossary

Appendix A

Appendix B

List of Tables

Table 1.1 Companies Profiled in this Report and Country HQ

Table 2.1 Connected Car Market Size Overview 2019-2029 (US$ Bn)

Table 2.2 Embedded Solutions Submarket Drivers & Restraints

Table 2.3 Integrated Solutions Submarket Drivers & Restraints

Table 2.4 Tethered Solutions Submarket Drivers & Restraints

Table 4.1 Connected Car Services and Applications Overview 2019

Table 5.1 Connected Car Devices Overview 2019

Table 5.2 OEM Connected Car Telematics Solutions by Application (Feature, OnStar, mbrace2, BMW Assist, Lexus Enform, Toyota Entune, Ford Sync3, Infinity Connection)

Table 6.1 Global Connected Car Market Drivers, Restraints and Challenges

Table 6.2 Global Connected Car – BRIC Countries Connectivity Solutions Brief

Table 6.3 Global Connected Car – Automotive Infotainment Software Platforms

Table 8.1 Five Forces Analysis of the Connected Car Market 2019

Table 9.1 Value chain For The Connected Car Market

Table 10.1 Ranking of the Leading 20 Connected Car Companies 2018 ($bn, %)

Table 10.2 Ranking of the Leading 10 Connected Car OEMs 2018 ($bn, %)

Table 10.3 Ranking of the Leading 10 Connected Car Non-OEMs 2018 ($bn, %)

Table 11.1 Samsung Electronics Co., Ltd. Overview

Table 11.2 Apple Inc. Overview2015-2017

Table 11.3 AT&T Overview11.6 AT&T Revenue, by Business Segment, 2017 (%

Table 11.4 BMW AG Overview, 2015-2017 (US$ Bn), 2015-2017

Table 11.5 Broadcom Limited Overview& Development, 2015-2017 (US$ Mn), 2015-

Table 11.6 Daimler Overview, 2015-2017 (US$ Bn), 2015-2017

Table 11.7 Fiat Chrysler Automobiles Overview, 2015-2017

Table 11.8 Ford Motor Company Overview, 2015-2017

Table 11.9 General Motors Company Overview (US$ Bn), 2015-2017

Table 11.10 Honda Motor Company Overview, 2015-2017

Table 11.11 Volvo Cars Company Overview

Table 11.12 Tech Mahindra Company Overview, 2015-2017

Table 11.13 Tesla Motors Company Overview

Table 11.14 Qualcomm Inc. Overview, 2015-2017

Table 11.15 Sierra Wireless Overview, 2015-2017

Table 11.16 Toyota Overview11.32 Revenue, by End Application, 2017 and

Table 11.17 Verizon Communication Overview, 2015-2017

Table 11.18 Visteon Corporation Overview, 2015-2017

Table 11.19 Volkswagen Overview, 2015-2017

Table 11.20 Google Company Overview201

Table 12.1 SWOT Analysis of the Embedded Solutions Submarket 2019

Table 12.2 SWOT Analysis of the Integrated Solutions Submarket 2019

Table 12.3 SWOT Analysis of the Tethered Solutions Submarket 2019

Table 13.1 Global Connected Car Market Challenges

Table 13.2 Ranking of the Leading 10 Connected Car Non-OEMs 2018 ($bn, %)

List of Figures

Figure 2.1 Connected Car Definition and Applications

Figure 2.2 Connected Car Ecosystem

Figure 2.3 Connected Car Market Breakdown

Figure 2.4 Connected Car Market Structure by Type of Connectivity

Figure 3.1 Connected Car Market Structure by Application

Figure 5.1 Global Passenger Car Shipped with Connectivity 2019-2029 (Millions of Units)

Figure 10.1 Market Share Ranking of the Leading 20 Connected Car Companies 2018 (%)

Figure 11.1 Samsung Revenue, by Geographic Region, 2017 (% Share) and Revenue & Y-o-Y Growth, 2015-2017 (US$ Bn, Y-o-Y %)

Figure 11.2 Samsung Revenue, by Business Segment, 2017 (% Share) and Research & Development, 2015-2017 (US$ Bn), 2015-2017

Figure 11.3 Apple Revenue, by Geographic Region, 2017 (% Share) and Revenue & Y-o-Y Growth, 2015-2017 (US$ Bn, Y-o-Y %)

Figure 11.4 Apple, by Business Segment, 2017 (% Share) and Research & Development, 2015-2017 (US$ Mn), 2015-2017

Figure 11.5 AT&T Revenue, by Geographic Region, 2017 (% Share) and Revenue & Y-o-Y Growth, 2015-2017 (US$ Bn, Y-o-Y %)

Figure 11.6 AT&T Revenue, by Business Segment, 2017 (% Share)

Figure 11.7 BMW AG, by Geographic Region, 2017 (% Share) and Revenue & Y-o-Y Growth, 2015-2017 (US$ Bn, Y-o-Y %)

Figure 11.8 BMW AG Revenue, by Business Segment, 2017 (% Share) and Research & Development, 2015-2017 (US$ Bn), 2015-2017

Figure 11.9 Broadcom Limited Revenue, by Geographic Region, 2017 (% Share) and Revenue & Y-o-Y Growth, 2015-2017 (US$ Bn, Y-o-Y %)

Figure 11.10 Broadcom Limited Revenue, by Business Segment, 2017 (% Share) and Research & Development, 2015-2017 (US$ Mn), 2015-2017

Figure 11.11 Daimler Revenue, by Geographic Region, 2017 (% Share) and Revenue & Y-o-Y Growth, 2015-2017 (US$ Bn, Y-o-Y %)

Figure 11.12 Daimler Revenue, by Business Segment, 2017 (% Share) and Research & Development, 2015-2017 (US$ Bn), 2015-2017

Figure 11.13 Fiat Chrysler Automobiles Revenue, by Geographic Region, 2017 (% Share) and Revenue & Y-o-Y Growth, 2015-2017 (US$ Bn, Y-o-Y %)

Figure 11.14 Fiat Chrysler Automobiles Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

Figure 11.15 Ford Motor Revenue, by Geographic Region, 2017 (% Share) and Revenue & Y-o-Y Growth, 2015-2017 (US$ Bn, Y-o-Y %)

Figure 11.16 Ford Motor Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

Figure 11.17 General Motors Revenue, by Geographic Region, 2017 (% Share) and Revenue & Y-o-Y Growth, 2015-2017 (US$ Bn, Y-o-Y %)

Figure 11.18 General Motors Revenue, by Business Segment, 2017 (% Share) and Research & Development, 2017 (US$ Bn), 2015-2017

Figure 11.19 Honda Motors Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

Figure 11.20 Honda Motors Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

Figure 11.21 Volvo Cars Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

Figure 11.22 Volvo Cars Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

Figure 11.23 Tech Mahindra. Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

Figure 11.24 Tech Mahindra Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

Figure 11.25 Tesla Motors Revenue, by Geographic Region, 2018 and Revenue & Y-o-Y Growth, 2015-2017

Figure 11.26 Tesla Motor Revenue, by product, 2018 and Research & Development, 2015-2017

Figure 11.27 Qualcomm Inc. Revenue, by Geographic Region, 2017, and Revenue & Y-o-Y Growth, 2015-2017

Figure 11.28 Qualcomm Inc. Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

Figure 11.29 Sierra Wireless Revenue, by Geographic Region 2017, and Revenue & Y-o-Y Growth, 2015-2017

Figure 11.30 Sierra Wireless Revenue, by Business Segment 2017, and Research & Development, 2015-2017

Figure 11.31 Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

Figure 11.32 Revenue, by End Application, 2017 and Research & Development, 2015-2017

Figure 11.33 Verizon Communications Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

Figure 11.34 Verizon Communications Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

Figure 11.35 Visteon Corporation Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

Figure 11.36 Visteon Corporation Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

Figure 11.37 Volkswagen Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

Figure 11.38 Volkswagen Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

Figure 11.39 Google Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

Figure 11.40 Google Revenue, by Segment, 2017 and Research and development expenditure, 2015-2017

Accenture

Alibaba A.I. Labs

Aioi Nissay Dowa Insurance Co., Ltd.

Alphabet

Alpine Electronics

Amazon

American Honda Motor, Co. Inc.

Apple Inc.

AT&T Inc.

Audi AG

Autoliv Development AB.

Autonomic

Avis Budget Group

Baidu

Bertrandt

Blackberry

BMW AG

Bosch

BRAIQ

Broadcom Corporation

Brocade Communications Systems Inc

Calico

CapitalG

car2go

CarForce

Carvoyant:

Complex IT

Continental

Cruise

CSC

Daimler AG

Daimler Financial Services AG

Daimler Mobility Services

Daimler Trucks & Buses

Daimler Trucks North America (DTNA)

Datang Telecom Group

DeepMap

Delphi

Delphi Automotive

Denso

DidiChuxing

Dominos

DriveNow

DynaOptics

EBS

Ericsson

EXO Technologies

ExxonMobil

Facebook

Fiat Chrysler Automobiles (FCA)

Ford Motor Company

Ford Smart Mobility LLC

Freescale Semiconductor

Fuse

Garmin

Geely Auto

Geely Holding

General Motors Co.(GM)

Geotab

Google Fiber

Google Inc.

Grab Holdings Inc.

GV

Harman International

Honda Motor Company

Honda R&D Co., Ltd

Honeywell

Hughes Telematics (HTI)

Hyundai

IBM

INE Corporation

In-Motion Technology

INRIX

Intel

Jaguar Land Rover (JLR)

JapanTaxi Co., Ltd.

KDDI Corporation

KIA

Land Rover

LeddarTech

LG

LG Display

Lightbridge Communications Corporation

Lyft, Inc.

Mahindra & Mahindra Ltd (M&M Ltd)

Mahindra Group

MapAnyhting Inc.

Matterne

Maven

Mazda

Mercedes-Benz

Mercedes-Benz Cars & Vans

Mercedes-Benz Connectivity Services GmbH

Mercedes-Benz Vans

Microsoft Corporation

Mitsubishi Corporation

Mitsubishi Electric

Mobileye

MOG

moovel

MS&AD Insurance Group

mytaxi

NETGEAR

Nippon Telegraph and Telephone Corporation (NTT)

Nissan

Nokia

NVidia

NXP Semiconductor

OnStar

OYO Corporation

Panasonic

Panasonic Corporation of North America

Pandora

Parkmobile LLC

Parkopedia

Peugeot Scooters

Pioneer Electronics

Porsche

Postmates

PSA Peugeot -Citroen

QNX Software Systems

Qualcomm Inc.

Qualcomm Technologies

Qualcomm Wireless Communication Technologies (China) Limited

Renault

Renesas Electronics

Resser

Sagecom

Salesforce Ventures Portfolio

Samsung Electronics Co., Ltd.

Servco Pacific (Servco)

Sidecar

Sierra Wireless

Siroop

SOFGEN Holdings

SoftBank

Spotify

Subaru

Suzuki Motor Corporation

Tactual Labs

Tech Mahindra Ltd.

Tesla Grohmann Automation GmbH

Tesla Motors

TomTom

Toyota Connected (TC)

Toyota Connected Europe (TCEU)

Toyota Connected North America Inc. (TCNA)

Toyota Motor Corporation

Toyota Motor Europe

Toyota Research Institute (TRI)

Twitter

Uber Technologies Inc.

Vauxhall

Verily

Verizon Communications

Verizon Telematics

Verizon Wireless

Via

ViaVan

Visteon Corporation

Volkswagen AG

Volkswagen Group

Volvo Car Corporation

VW

Wavecom

Waymo

WayRay

X

Yelp

Zenuity AB

Zipcar

Zotye

Zubie

Organisations mentioned

American Center for Mobility

Bridge Alliance

China Academy of Telecommunications Technology (CATT)

Colorado Department of Transportation (CDOT)

Connected Car Consortium

Department of Motor Vehicles, CA

European Commission

Frankfurt Airport

Hamburg Airport

Intelligent Transportation Society of America

Michigan Department of Transportation

National Highway Traffic Safety Administration (NHTSA)

Open Automotive Alliance

Shanghai Municipal Commission of Economy and Informatization

Shanghai Municipal Public Security Bureau

Shanghai Municipal Transportation Commission

SmartDeviceLink Consortium

U.S. Department of Transportation (DOT)