The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global automotive V2X communications market. Vehicle to everything (V2X) communications incorporates connected car technologies (In-Vehicle) but also vehicle to vehicle (V2V),vehicle to infrastructure (V2I), vehicle to home (V2H) and vehicle to pedestrian (V2P) communications. Visiongain assesses that this market will generate revenues of $54.5bn in 2019.

Now: Keysight Technologies, Nordsys Combine V2X/C-V2X Testing Solutions. This is an example of the business critical headline that you need to know about – and more importantly, you need to read Visiongain’s objective analysis of how this should impact your company and the industry more broadly. How are you and your company reacting to this news? Are you sufficiently informed?

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in the automotive V2X communications sector. Visiongain’s new study tells you and tells you NOW.

In this brand new report you find 113 tables, charts and graphs all unavailable elsewhere.

The 224 page report provides clear detailed insight into the global automotive V2X communications market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand new report today you stay better informed and ready to act.

Report scope

Quantitative Market Analysis

Global Automotive V2X Communications Forecasts From 2019-2029 (Units & $bn)

Regional Automotive V2X Communications Forecasts From 2019-2029 (Units & $bn)

North America V2X Communications Forecast 2019-2029

US V2X Communications Forecast 2019-2029

Latin America V2X Communications Forecast 2019-2029

Brazil V2X Communications Forecast 2019-2029

EMEA V2X Communications Forecast 2019-2029

UK & Ireland V2X Communications Forecast 2019-2029

Germany V2X Communications Forecast 2019-2029

France V2X Communications Forecast 2019-2029

Russia V2X Communications Forecast 2019-2029

Italy V2X Communications Forecast 2019-2029

APAC V2X Communications Forecast 2019-2029

China V2X Communications Forecast 2019-2029

Japan V2X Communications Forecast 2019-2029

India V2X Communications Forecast 2019-2029

Others V2X Communications Forecast 2019-2029

Regional Automotive V2V Communications Forecasts From 2019-2029 (Units)

• North America V2V Communications Forecast 2019-2029

• Latin America V2V Communications Forecast 2019-2029

• EMEA V2V Communications Forecast 2019-2029

• APAC V2V Communications Forecast 2019-2029

Automotive V2X Subsegment Forecasts By Type From 2019-2029 (Units)

• Vehicle to Vehicle (V2V) Forecast 2019-2029 (Units)

• DSRC V2V Modules Revenue Forecast 2019-2029 ($m)

• OEM V2V DSRC Modules Forecast 2019-2029

• Aftermarket V2V DSRC Modules Forecast 2019-2029

Vehicle to Infrastructure (V2I) Forecast 2019-2029 (Units)

Vehicle To Home (V2H) Forecast 2019-2029 (Units)

In Vehicle (IN-V), Forecast 2019-2029 (Units)

In Vehicle (IN-V) Revenue Forecast 2019-2029 ($m)

• Embedded Forecast 2019-2029

• Integrated Forecast 2019-2029

• Tethered Forecast 2019-2029

In Vehicle (IN-V) Revenue Forecast By Service Provider From 2019-2029 ($m)

• OEM Forecast 2019-2029

• Aftermarket Forecast 2019-2029

• Telematics Forecast 2019-2029

• Connectivity Forecast 2019-2029

DSRC Installation Forecast 2019-2029 (Units)

Road Side Units (RSU) Forecast 2019-2029 (Units)

Vehicle to Pedestrian (V2P) / DSRC Equipped Smartphones Forecast 2019-2029 $m)

Smartphone Shipments Forecast 2019-2029 (Units)

Regional Passenger Car Sales Forecast 2019-2029

• EU Forecast 2019-2029

• Russia / Turkey & Other Europe Forecast 2019-2029

• America Forecast 2019-2029

• Asia / Oceania / Middle East Forecast 2019-2029

• Africa Forecast 2019-2029

Qualitative Analysis

• SWOT Analysis Of The Automotive V2X Communications Market.

• Consideration Of Regulation, Policy And Legal Aspects

• Five forces analysis

Competitive Landscape Analysis

Analysis For The 8 Leading Automotive OEMS Involved With V2X Communications Technologies

• BMW AG

• Daimler AG

• General Motors

• Toyota Motor Corporation

• Volkswagen Group

• Renault

• Nissan

• PSA Peugeot Citroen

Profiling For The Leading Automotive V2X Communications Technology Suppliers

• Arada Systems

• Autotalks Ltd.

• Cohda Wireless

• Delphi Automotive PLC

• Denso Corporation

• eTrans Systems

• Kapsch TrafficCom

• Qualcomm Incorporated

• Savari Inc.

• AT&T

• Airbiquity

How will you benefit from this report?

• Keep your knowledge base up to speed. Don’t get left behind

• Reinforce your strategic decision-making with definitive and reliable market data

• Learn how to exploit new technological trends

• Realise your company’s full potential within the market

• Understand the competitive landscape and identify potential new business opportunities & partnerships

Who should read this report?

• Anyone within the automotive industry and IoT value chain.

• Automotive OEMs

• Electronic companies

• Telematics specialists

• Component suppliers

• Software developers

• Telecoms companies

• Technologists

• R&D staff

• Electronics engineers

• Business development managers

• Marketing managers

• Investors

• Banks

• Government agencies

• Regulators

• Industry associations

Visiongain’s study is intended for anyone requiring commercial analyses for the automotive V2X market and leading companies. You find data, trends and predictions.

Buy our report today Automotive Vehicle To Everything (V2X) Communications Market 2019-2029. Avoid missing out by staying informed – get our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1Global V2X Market Overview

1.2 Why You Should Read This Report

1.3 How This Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.6.3 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the V2X Communications Market

2.1 Overview of the Global V2V-V2I Market Status in 2019

2.1.1 Automated Driving Systems (ADS): A Vision for Safety 2.0

2.1.2 The NHTSA Aims to Mandate V2V in All New Cars

2.1.3 The European Commission Announces Europe’s New Connected Car Standards

2.1.4 OEMs & Tier-1s Showcase V2V and V2I Technology

2.2 The Vehicle-to-Everything (V2X) Communications Market

2.3 Learn Which Wireless Communication Technologies Enable V2X

2.3.1 Dedicated Short Range Communication (DSRC) for V2V and V2I

2.3.2 Cellular: LTE-4G for V2V-V2I Communication

2.3.3 Bluetooth for V2V-V2I Communication

2.3.4 WiFi for V2V-V2I Communication

2.3.5 Mobile Networks for V2V-V2I Communication

2.3.6 GPS for V2V-V2I Communication

2.3.7 Short range radio for V2V-V2I Communication

2.3.8 Sensors for V2V-V2I Communication

2.4 Overview of the Vehicle-to-Vehicle Applications

2.4.1 V2V Communications Market Segmentation Overview

2.4.2 Vehicle-to-Infrastructure (V2I) Communication

2.4.3 V2I Segmentation Overview

2.4.4 Vehicle-to-Pedestrians (V2P) Communication

2.4.5 Vehicle-to-Home (V2H) Communication

2.4.6 In-Vehicle (IN-V) Communication

2.5 Market Definition-The V2X & V2V-V2I Markets

2.5.1 V2X, V2V & V2I Market Segmentation Overview

2.6 V2X Interconnected with Connected Car, ITS, and IoT Ecosystems

3. V2X Market Drivers, Challenges, and Trends

3.1 Global V2X Market Drivers 2019

3.2 Global V2X Market Trends 2019

3.3 Market Challenges

4. Global V2X Communications Market & Submarket Forecast 2019-2029

4.1 Global V2V Communication Market Forecast 2019-2029

4.2 Global V2V Market Segmentation Forecast 2019-2029: OEM vs. Aftermarket

4.2.1 Revenues from Aftermarket & OEM DSRC Modules 2019-2029

4.3 Global V2V Communications Market Status in 2019

4.3.1 Learn Why V2V Penetration in New Car Sales is Low in 2018

4.3.2 DSRC for Global V2P Communications 2019-2029

4.4 Global V2I Communications Market Forecast 2019-2029

4.4.1 Global V2I Penetration in New Car Sales Forecast 2019-2029

4.4.2 Learn What Are the Reasons for a Low V2I Penetration in 2018 And The Potential For Growth in US and European Market

4.4.3 Road Side Units (RSU) Installations Forecast 2019-2029

4.5 Global Vehicle-to-Pedestrians (V2P) Market Forecast 2019-2029

4.5.1 Revenues from DSRC-Enabled Smartphones Forecast 2019-2029

4.5.2 Smartphone Shipments Forecast 2019-2029

4.5.3 DSRC Penetration in New Smartphone Sales Forecast 2019-2029

4.5.4 Drivers & Restraints of the V2P Communications Submarket

4.6 Global V2H Communications Submarket Forecast 2019-2029

4.7 Global IN-V Communications Submarket Forecast 2019-2029

4.7.1 Revenues Forecast from Cars with IN-V Modules 2019-2029

4.7.2 IN-V Communications Submarket Segmentation Forecast 2019-2029 - Type of Connectivity

4.7.3 IN-V Submarket Forecast 2019-2029 by Service Provider

4.8 Global V2X Legal Framework Analysis

4.9 Venture Capital investing in the Connected Car industry

5. Regional V2X Market Forecast 2019-2029

5.1 Passenger Car Sales Data: Forecast 2019-29

5.1.1 Regional Passenger Car Sales Forecast 2019-2029

5.1.2 Regional Market Shares Forecast of Passenger Car Sales 2019, 2024, 2029

5.2 Regional V2X Communications Submarket Forecast 2017-2029

5.2.1 North America V2X Communications Forecast 2019- 2029

5.2.2 EMEA V2X Communications Forecast 2019- 2029

5.2.3 APAC V2X Communications Forecast 2019- 2029

5.2.4 Latin America V2X Communications Forecast 2019- 2029

5.3 Regional V2V Communications Submarket Forecast 2019-2029

5.4 Regional V2V Market Share Forecast Summary 2019, 2024, 2029

5.4.1 How Different Motivations Behind V2V Communications Will Lead to Different Regional Penetration of V2V

5.4.2 How Differences in Spectrum Allocation Among Different Regions Affect the Global Standardization of V2V Communications

6. Regulation

6.1 Legal Framework Analysis for US and UK

6.1.1 US V2X Legal Framework and Standards

6.1.2 European V2X Legal Framework and Standards

7. Five Forces Analysis

7.1 Low Bargaining Power of Suppliers

7.2 High Bargaining Power of Buyers

7.3 Moderate threat of Substitution

7.4 Threat of New Entrants

7.5 High Intersegment Rivalry

8. Value Chain

8.1 Component Suppliers “Where to”

8.2 Component Suppliers “How to”

8.2 Component Suppliers “When to”

9. Leading 10 Automotive V2X Companies

9.1 BMW AG

9.1.1 BMW AG Overview

9.1.2 BMW AG Total Company Sales 2013-2017

9.1.3 BMW AG Sales by Segment of Business 2017

9.1.4 BMW AG Regional Emphasis / Focus

9.1.5 BMW’s Role in the V2V and V2I Market

9.1.6 BMW ConnectedDrive & BMW Assist

9.1.7 How Does ConnectedDrive Work?

9.1.8 BMW’s Key Developments

9.1.9 BMW’s Future Outlook

9.2 Daimler AG

9.2.1 Daimler Overview

9.2.2 Daimler AG Total Company Sales 2012-2017

9.2.3 Daimler AG Sales by Segment of Business 2017

9.2.4 Daimler AG Regional Emphasis / Focus

9.2.5 Mercedes-Benz mbrace Overview

9.2.6 Mercedes-Benz’s Mbrace mobile app

9.2.7 Daimler’s Future Outlook

9.2.8 Mercedes-Benz and the V2V, V2X Technology

9.2.9 Daimler’s Car-To-X Communications Technology

9.3 General Motors (GM)

9.3.1 General Motors (GM) Overview

9.3.2 General Motors Products / Services

9.3.3 General Motors Analysis

9.3.4 GM’s Role in the V2V & V2I Market

9.3.5 GM’s Future Outlook

9.4 Toyota Overview

9.4.1 Toyota Motor Corporation Total Company Sales 2016-2018

9.4.2 Toyota Motor Corporation Sales by Segment of Business 2018

9.4.3 Toyota Motor Corporation Regional Emphasis / Focus

9.4.4 Toyota’s Role in the V2X Market

9.4.5 Toyota Entune

9.4. Toyota’s Future Outlook

9.5 Volkswagen Group (VV) Overview

9.5.1 Volkswagen AG Total Company Sales 2015-2017

9.5.2 Volkswagen AG Sales by Segment of Business 2017

9.5.3 Volkswagen’s Role in the V2X Market

9.5.4 Volkswagen’s Future Outlook

10. Leading Suppliers, Tier-1s in the V2V & V2I Market

10.1 Arada Systems

10.1.1 Arada Systems Company Overview

10.1.2 Arada Systems’ Role in the V2V & V2I Market

10.2 Autotalks Ltd.

10.2.1 Autotalks Ltd. Company Overview

10.2.2 Autotalks’s Role in the V2V & V2I Market

10.3 Cohda Wireless

10.3.1 Cohda Wireless Company Overview

10.3.2 Cohda Wireless Role in the V2V & V2I Market

10.4 Delphi Automotive PLC

10.4.1 Delphi Automotive PLC Company Overview

10.4.2 Delphi’s Role in the V2V & V2I Market

10.4.3 Delphi’s Future Outlook

10.5 Denso Corporation

10.5.1 Denso Corporation Company Overview

10.5.2 Denso’s Revenue in the Automotive Market

10.5.3 Denso’s Role in the V2V & V2I Market

10.6 Kapsch TrafficCom

10.6.1 Kapsch Trafficom Company Overview

10.6.2 Kapsch’s Role in the V2V & V2I Market

10.6.3 eTrans Systems’ Role in the V2V & V2I Market

10.7 Qualcomm Inc.

10.7.1 Qualcomm Inc. Total Company Sales 2015-2017

10.7.2 Qualcomm Inc. Sales by Segment of Business 2017

10.7.3 Qualcomm Inc. Regional Emphasis / Focus

10.7.4 Qualcomm Inc. Products / Services

10.7.5 Qualcomm Inc. Analysis

10.7.6 Qualcomm’s Role in the V2V & V2I Market

10.8 Savari Inc.

10.8.1 Savari Inc. Company Overview

10.8.2 Savari’s Role in the V2V & V2X Market

10.9 AT&T Overview

10.9.1 AT&T Inc. Total Company Sales 2013-2017

10.9.2 AT&T Inc. Sales by Segment of Business 2017

10.9.3 AT&T Inc. Products / Services

10.9.4 AT&T Inc. Analysis

10.9.5 AT&T Future Outlook

10.10 Airbiquity Overview

10.10.1 Airbiquity’s Role in the V2X Market

10.10.2 Airbiquity’s Key Developments in 2014-2016

10.10.3 Airbiquity’s Future Outlook

10.11 Renault Company Overview

10.11.1 Renault’s Role in the Automotive V2X Market

10.11.2 Renault J-V Activity

10.12 Nissan Motor Co. Company Overview

10.12.1 Nissan’s Role in the Automotive V2X Communications Market

10.12.2 Nissan J-V Activity

10.13 PSA Peugeot Citroen Company Overview

10.13.1 PSA’s Role in the Automotive V2X Market

10.14 Other Leading Companies in the V2V & V2I Market

11. Conclusions and Recommendations

11.1 What Will Drive Demand in the V2X Market from 2019 to 2029?

11.2 Learn Which Connectivity Technology is Most Suitable to Support V2V and V2I: DSRC, Wi-Fi, LTE, or LIDAR?

12. Glossary

List of Tables

Table 2.1 European Commission’s Action Plan for the Deployment of ITS in Europe

Table 2.2 Dedicated Short Range Communications (DSRC) Service At a Glance

Table 2.3 ADAS Sensors Usage in ADAS End-User Applications

Table 2.4 Vehicle-to-Vehicle (V2V) Communication Applications

Table 4.1 Global Sales of New Passenger Cars Equipped with V2V, V2I, V2H, IN-V Modules Forecast 2019-2029 (Million units, AGR%, CAGR%)

Table 4.2 New Passenger Cars Equipped with V2V Modules Sales Forecast 2019-2029 (million units, AGR%, CAGR%)

Table 4.3 Aftermarket & OEM DSRC Modules Revenue Forecast 2019-2029 ($bn, AGR%, CAGR%)

Table 4.4 Total DSRC Installation Market Forecast 2019-2029 (Million Units, AGR %, CAGR %, Cumulative)

Table 4.5 Passenger Cars Equipped With V2I Modules Sales Forecast 2019-2029 (Millions, AGR%, CAGR%)

Table 4.6 Road Side Units (RSU) Installations Forecast 2019-2029 (Ml, AGR%, CAGR%)

Table 4.7 Revenues Forecast From DSRC-Equipped Smartphones 2019-2029 ($bn, AGR%, CAGR%)

Table 4.8 Smartphone Shipments Forecast 2019-2029 (Billion Units, AGR%, CAGR%)

Table 4.9 Drivers & Restraints of the V2P Communications Submarket

Table 4.10 Passenger Cars Equipped With V2H Modules Forecast 2019-2029 (Ml, AGR%, CAGR%)

Table 4.11 Drivers & Restraints of the V2H Communications Submarket

Table 4.12 Passenger Cars Equipped With IN-V Modules Sales Forecast 2019-2029 (Ml, AGR%, CAGR%)

Table 4.13 Revenue Forecast from Cars With IN-V Modules 2019-2029 ($bn, AGR%, CAGR%)

Table 4.14 Global IN-V Connected Vehicles Submarket Drivers & Restraints

Table 4.15 IN-V Communications Submarket Forecast by Type of Connectivity 2019-2029 ($bn, AGR %)

Table 4.16 IN-V Submarket Forecast by Service Provider 2019-2029 ($bn, AGR %)

Table 5.1 Regional Passenger Car Sales Forecast 2019-2029 (Million units, AGR%)

Table 5.2 Regional V2X Communication Submarket Forecast 2019-2029 ($ Billion, AGR%, CAGR%)

Table 5.3 Regional V2X Communication Submarket Forecast 2019-2029 (Million units, AGR%, CAGR%)

Table 5.4 V2X Communication Submarket Forecast 2019-2029, by Country ($ Billion, AGR%, CAGR%)

Table 5.5 North America V2X Communication Market Forecast 2019-2029 (in Million Units, AGR %, CAGR %, Cumulative)

Table 5.6 EMEA V2X Communication Market Forecast 2019-2029 (in Million Units, AGR %, CAGR %, Cumulative)

Table 5.7 APAC V2X Communication Market Forecast 2019-2029 (in Million Units, AGR %, CAGR %, Cumulative)

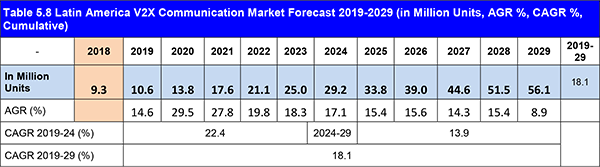

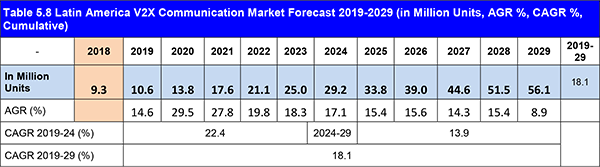

Table 5.8 Latin America V2X Communication Market Forecast 2019-2029 (in Million Units, AGR %, CAGR %, Cumulative)

Table 5.9 Regional V2V Communication Submarket Forecast 2019-2029 (Million Units, AGR%, CAGR%)

Table 6.1 NHTSA Cooperation with the FTC In the Setting of Safety Standards Against hacking for Connected Car and V2V Technology

Table 9.1 Leading Companies in the V2X Market

Table 9.2 BMW AG Profile 2019 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 9.3 BMW AG Total Company Sales 2013-2017 (US$m, AGR %)

Table 9.4 Daimler AG Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, HQ, Founded, No. of Employees, Website)

Table 9.5 Daimler AG Total Company Sales 2012-2017 (US$m, AGR %)

Table 9.6 Mercedes-Benz mbrace Overview 2017 (Launch, Connectivity Category, Subscription fee, Website)

Table 9.7 General Motors Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, HQ, Founded, Website)

Table 9.8 GM’s Financials 2011-2017 (6-Year Revenue, Gross Profit, Operating Income, Net Income, Diluted EPS), (In $Million Apart from EPS)

Table 9.9 General Motors Products / Services (Technology, Services)

Table 9.10 Toyota Motor Corporation Profile 2018 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, Website, Ticker)

Table 9.11 Strategic Alliances with Sumitomo and SPARX

Table 9.12 Volkswagen AG Profile 2017 (CEO, Total Company Sales US$m, Net Income / Loss (US$m), Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, Website, Ticker)

Table 10.1 Arada Systems Overview 2018 (Products, Services, HQ, Website)

Table 10.2 Autotalks Overview 2018 (Products, Services, IR, HQ, Website)

Table 10.3 Cohda Wireless Overview 2017/18 (Revenue, Products, HQ, IR, Employees, Website)

Table 10.4 Delphi Automotive PLC Overview (Company Revenue, HQ, Ticker, Employees, IR Contact, Website)

Table 10.5 Delphi Automotive PLC Financials 2015-2017 (3-year Net Sales, Operating Income, Net Income) 2015-2017

Table 10.6 Denso Overview 2017 (Revenue, Products, Market Cap, Ticker, HQ, Employees, Website)

Table 10.7 Denso’s Financials (5-year Revenue, Gross Profit, Operating Income, Net income, Diluted EPS) 2013 - 2017

Table 10.8 Denso’s 2014, 2015, 2016 and 2017 Sales, by Segment (Billion Yen, %)

Table 10.9 Kapsch 2018 (Revenue, Products, HQ, Employees, Ticker, Website)

Table 10.10 Qualcomm Inc. Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 10.11 Qualcomm Inc. Products / Services (Segment of Business and Product)

Table 10.12 Savari Company 2017 (Revenue, Products, HQ, Contact, Website)

Table 10.13 AT&T Inc. Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 10.14 AT&T Inc. Total Company Sales 2013-2017 (US$m, AGR %)

Table 10.15 AT&T Inc. Products / Services (Segment of Business, Product, Sub-Product)

Table 10.16 Airbiquity Inc. Profile 2018 (CEO, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, Website)

Table 10.17 Airbiquity Inc. Last 5 Key Developments

Table 10.18 Renault Company Overview (Total Revenue, HQ, Ticker, IR Contact, Website)

Table 10.19 Nissan Company Overview (Revenue, HQ, Ticker, IR Contact, Website)

Table 10.20 PSA Company Overview (Revenue, HQ, Ticker, IR Contact, Website)

Table 11.1 Drivers & Restraints of the V2X Communications Market 2019-2029

List of Figures

Figure 2.1 The Vehicle-to-Everything (V2X) & the V2V, V2I, V2P, V2H, IN-V Markets

Figure 2.2 V2V Segmentation Overview: V2M, OEM, Aftermarket

Figure 2.3 V2I Segmentation Overview: ETC, EPP, V2G

Figure 2.4 IN-V Communications’ Segmentation

Figure 2.5 V2X Market Submarket Definition

Figure 2.6 V2V, V2I & V2X Market Segmentation Overview

Figure 2.7 Phases of Evolution of the Connected Car

Figure 3.1 IEEE802.11P v/s Cellular V2X

Figure 4.1 Global Sales of New Passenger Cars Equipped with V2V, V2I, V2H, IN-V Modules Forecast 2019-2029 (Million units, AGR%, CAGR%)

Figure 4.2 V2X Submarkets’ Share Forecast Summary 2019, 2024, 2029 (%)

Figure 4.3 New Passenger Cars Equipped with V2V Modules Sales Forecast 2019-2029 (Ml, AGR%)

Figure 4.4 New Passenger Cars Equipped with V2V Modules Sales Forecast 2019-2029 ($bn, AGR%)

Figure 4.5 Market Share Forecast of OEM & Aftermarket DSRC-Installations Revenues 2019, 2024, 2029 (%)

Figure 4.6 Total DSRC Installation Market Forecast 2019-2029 (Million Units, AGR %)

Figure 4.7 Passenger Cars Equipped With V2I Modules Sales Forecast 2018-2028

(Ml, AGR%)

Figure 4.8 V2I & V2V Penetration in New Vehicles Sales Forecast 2019-2029 (in Million units)

Figure 4.9 Road Side Units (RSU) Installations Forecast 2019-2029 (Millions, AGR%)

Figure 4.10 Revenues Forecast From DSRC-Equipped Smartphones 2019-29 ($bn, AGR%)

Figure 4.11 Smartphone Shipments Forecast 2019-2029 (Billion Units, AGR%)

Figure 4.12 Passenger Cars Equipped With V2H Modules Forecast 2019-2029 (Ml, AGR%)

Figure 4.13 Passenger Cars Equipped With IN-V Modules Sales Forecast 2019-2029 (Ml, AGR%)

Figure 4.14 Revenue Forecast from Cars With IN-V Modules 2019-2029 ($bn, AGR%)

Figure 4.15 IN-V Communications Submarket Share Forecast 2019, 2024, 2029 by Type of Connectivity (%)

Figure 4.16 Global IN-V Submarket Share Forecast 2019, 2024, 2029 by Service Provider (%)

Figure 4.17 Venture Capital Companies in the Automotive Industry

Figure 5.1 Regional Market Share Forecast in Passenger Car Sales 2019, 2024, 2029 (%)

Figure 5.2 Regional V2X Communication Submarket Forecast 2019-2029 (Million units,, AGR%)

Figure 5.3 North America Luxury Car Market 2019-2029, (in Million Units)

Figure 5.4 Regional V2V Communication Submarket Forecast 2019-2029 (Million, AGR%)

Figure 5.5 Regional Market Share Forecast of the V2V Submarket 2019, 2024, 2029 (%)

Figure 9.1 BMW Group Car Sales Overview 2013-2017 (Million Units)

Figure 9.2 BMW AG Total Company Sales 2013-2017 (US$m, AGR %)

Figure 9.3 BMW AG Sales by Segment of Business 2017 (% Share)

Figure 9.4 BMW AG Sales by Geographical Location 2017 (% Share)

Figure 9.4 Daimler AG Total Company Sales 2012-2017 (US$m, AGR %)

Figure 9.5 Daimler AG Sales by Segment of Business 2017 (% Share)

Figure 9.6 Daimler AG Car Sales’ Share Distribution in Selected Regions in 2017 (% Share)

Figure 9.7 Toyota Motor Corporation Total Company Sales 2016-2018 (US$Bn)

Figure 9.8 Toyota Motor Corporation Sales by Segment of Business 2018 (% Share)

Figure 9.9 Toyota Motor Corporation Sales AGR by Geographical Location 2018 (%)

Figure 9.10 Volkswagen AG Total Company Sales 2015-2017 (US$m)

Figure 9.11 Volkswagen AG Sales by Segment of Business 2017 (% Share)

Figure 9.12 Volkswagen AG Sales by Geographical Location 2017 (%Share)

Figure 10.1 Delphi’s 2017 Revenue by Segment (%)

Figure 10.2 Delphi’s 2017 Net Sales by Region (%)

Figure 10.3 Qualcomm Inc. Total Company Sales 2015-2017 (US$m)

Figure 10.4 Qualcomm Inc. Sales by Segment of Business 2017 (% Share)

Figure 10.5 Qualcomm Inc. Sales AGR by Geographical Location 2017 (% Share)

Figure 10.6 AT&T Inc. Total Company Sales 2013-2017 (US$m, AGR %)

Figure 10.7 AT&T Inc. Sales by Segment of Business 2017 (% Share)

Figure 10.8 AT&T Inc. Sales AGR by Geographical Location 2017 (% Share)

Abalta Technologies, Inc.

Adam Opel AG

ADASENS Automotive GmbH

Airbiquity

Alcatel-Lucent

Alibaba

Alpine Electronics of Silicon Valley

Alpine Technology Fund

Amazon

Apple

Aptina LLC

Arada Systems

Arity

Arynga

AT&T

Audi AG

Autosense International

Autotalks Ltd.

Aviva Ventures

Baidu

Belam

BMW AG

BMW China

BMW Group

Bosch Group

Broadcom Limited

CarlQ Technologies

Cetecom GmbH

China Information and Communication Technologies Group Corp (CICT)

China Unicom

Chrysler Group LLC

Cirrus Logic

Cisco

Cisco Internet Business Solutions Group

Citibank Automotive Financing

Clarion

Cohda Wireless Pty

Connected Vehicle to Everything of Tomorrow (ConVeX)

Continental AG

Covisint

Cruise

CSR

Cyberagent ventures

DAF

Daimler AG

Daimler Buses

Daimler Financial Services

Daimler Trucks

Dash labs

Datang Telecom Group

Datax Handelsgmbh

Delphi

Delphi Automotive LLP

Delphi Automotive PLC

Denso Corporation

DENSO International America, Inc.

DGE Inc

Dolby Laboratories, Inc.

dSPACE

Econolite Group

Elliott Management

Enel

Ericsson

escrypt GmbH

eTrans Systems

FCA

Fiat Chrysler

Flex

Fluidtime Data Services GmbH

Ford Motor Company

Freescale Semiconductor

General Motors Company

General Motors Financial Company, Inc.

Glympse

GM

Google Inc

GreenRoad

Harman

HiSilicon Technologies

Hitachi Automotive

Hitachi Ltd

HKT Limited

Honda Motor Company

Honda R&D Americas

Huawei Technologies Co. Limited

Hyundai Motor Company

Hyundai Ventures Investment Corporation

IBM

Infineon Technologies AG

Infinit

InfiniteKey, Inc.

Intel

Kapsch Group

Kapsch TrafficCom

Kathrein Automotive

Kerala State Women's Development Corporation

Kymeta

LeddarTech,

Lesswire AG

LG Electronics (LG)

LOC & ALL

Lyft, Inc

Mahindra Group

MAN Group

Marben

Maruti Suzuki

Mazda

Mercedes-AMG Petronas Motorsport

Mercedes-Benz

Mercedes-Benz R&D North America

Mercedes-Benz Vans

Microsoft

MKI USA, Inc.

Motorola

NEC GmbH

Nissan Motor Company

Nokia Oyj

NTT Docomo, Inc.

NuTonomy

Nuvve

Nvidia

NVIDIA Corporation

NXP Semiconductors

OKI

OnStar

Panasonic Corporation

Panasonic Automotive Systems

PARC (Palo Alto Research Center)

Persistent Venture Fund

Pivotal

Prospect Silicon Valley (ProspectSV)

PSA Peugeot Citroen

QMIC

QNX Software Systems

Qualcomm Atheros

Qualcomm Inc.

Qualcomm Technologies

Realtek Semiconductor

Renault S.A

Renesas Electronics Corporation

Robert Bosch GmbH

Rohde & Schwarz GmbH & Co KG

RoyalTEK

Rsystems International

SAIC Capital

SAIC USA Inc

Samsung Electronics

Savari Inc.

Savari Networks

Security Innovations

Siemens AG

Silver Point Capital

Smart Mobility Consortium

SPARX Group Co., Ltd.

Spirent Communications plc

STMicroelectronics

Suga OAK Holdings

Sumitomo Mitsui Banking Corporation (SMBC)

Swarco Traffic Ltd

SWARCO Traffic Systems

Tass International

TATA Consultancy Services (TCS)

TE Connectivity

Telstra

Tesla

Texas Instruments

The Allstate Corporation

Thunder Software Technology

Toyota InfoTechnology Center USA

Toyota Motor Corporation

Toyota Research Institute

Transportation Technology Ventures

Twitter

UMC Capital

Vector Group

Verizon Communications

Verizon Enterprise Solutions

Verizon Ventures

Vidder Inc

Visteon Corporation

Volkswagen AG

Volkswagen Bank GmbH

Volkswagen Financial Services AG

Volkswagen Financial Services Digital Solutions GmbH

Volvo AB

ZF

Zoomsafer

Organisations mentioned

3rd Generation Partnership Project (3GPP)

5GAA

Car Working Group (CWG

Car-to-Car Consortium (C2C-CC)

Centre for the Protection of National Infrastructure (CPNI)

ETSI

Euro NCAP

European Commission

European Parliament

Federal Highway Administration (FHWA)

Hong Kong Applied Science and Technology Research Institute (ASTRI)

Institute of Electrical and Electronics Engineers' (IEEE)

International Telecommunication Union (ITU)

ITS America

Joint Program Office (ITS JPO)

Michigan Department of Transportation

National Electrical Manufacturers Association (NEMA)

Nederlandse Organisatie voor Toegepast Natuurwetenschappelijk Onderzoek (TNO)

NHTSA

SAE International

Technology & Maintenance Council (TMC) of the American Trucking Association

Tongji University

U.S. Congress

U.S. Department of Transportation

U.S. DOT Research and Innovative Technology Administration (RITA)

U.S. Federal Communications Commission (FCC)

U.S. House of Representatives

U.S. Senate

University of Kaiserslautern

University of Michigan Transportation Research Institute (UMTRI)

Volpe