• Do you need definitive automotive sensor market data?

• Succinct automotive sensor market analysis?

• Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive automotive sensor report can transform your own research and save you time.

The emergence of advanced driver assistance systems (ADAS) and the roadmap towards semi-autonomous and fully vehicles autonomous has driven increasing R&D spending on the development of sensors, which has led Visiongain to publish this timely report. The automotive sensor market is expected to flourish in the next few years because of increasing consumer demand and acceptance of advanced technology equipped vehicles and this is expected to feed through in the latter part of the decade driving growth to new heights.

Visiongain calculates that the automotive sensor market will reach $19.3bn in 2019.

If you want to be part of this growing industry, then read on to discover how you can maximise your investment potential.

Report highlights

117 tables, charts, and graphs

Analysis of key players in automotive sensor technologies

• Allegro Microsystems

• Bosch

• Continental

• Delphi Automotive

• Denso Company

• Elmos Instruments

• Gentex

• Hella

• Hyundai Mobis

• Infinion Technologies

• Magna International

• Freescale Semiconductors / NXP Semiconductors

• Panasonic Corporation

• Renesas Electronics

• Sensata Technologies

• Sony Semiconductor Solutions Corporation

• STMicroelectronics

• Texas Instruments

• TRW Automotive

• Valeo

Global Automotive Sensor Market outlook and analysis 2019-2029 ($m & Unit Volume)

Automotive Sensor Type Forecasts 2019-2029 ($m & Unit Volume)

• Pressure Sensor Forecast 2019-2029

• Temperature Sensor Forecast 2019-2029

• Position Sensor Forecast 2019-2029

• Motion Sensor Forecast 2019-2029

• Optical Sensor Forecast 2019-2029

• Torque Sensor Forecast 2019-2029

• Gas Sensor Forecast 2019-2029

• Level Sensor Forecast 2019-2029

• Other Sensor Forecast 2019-2029

Automotive Sensor Forecast By Vehicle Type 2019-2029 ($m & Unit Volume)

• Passenger Vehicle Forecast 2019-2029

• Conventional Forecast 2019-2029

• Electric Cars Forecast 2019-2029

• Commercial Vehicle Forecast 2019-2029

• Conventional Forecast 2019-2029

• Electric Cars Forecast 2019-2029

Automotive Sensor Forecasts By Region 2019-2029 ($m & Unit Volume)

America Automotive Sensors Market Forecast 2019-2029

• U.S. Automotive Sensor Market Forecast 2019-2029

• Mexico Automotive Sensor Market Forecast 2019-2029

• Rest of North America Automotive Sensor Market Forecast 2019-2029

Europe Automotive Sensors Market Forecast 2019-2029

• Germany Automotive Sensor Market Forecast 2019-2029

• U.K. Automotive Sensor Market Forecast 2019-2029

• France Automotive Sensor Market Forecast 2019-2029

• Rest of Europe Automotive Sensor Market Forecast 2019-2029

Asia Pacific (APAC) Automotive Sensors Market Forecast 2019-2029

• Japan Automotive Sensor Market Forecast 2019-2029

• China Automotive Sensor Market Forecast 2019-2029

• India Automotive Sensor Market Forecast 2019-2029

• Rest of Asia Pacific Automotive Sensor Market Forecast 2019-2029

Key questions answered

• What does the future hold for the automotive sensor industry?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to success and why?

• What business models should you adopt?

• What industry trends should you be aware of?

Target audience

• Leading Automotive companies

• Automotive OEMs

• Component suppliers

• Sensor specialists

• Electronics companies

• Autonomous vehicle developers

• Connected car companies

• Telematics companies

• Software companies

• Technologists

• R&D staff

• Consultants

• Analysts

• Senior executives

• Business development managers

• Investors

• Governments

• Agencies

• Industry organizations

• Banks

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1. Global Automotive Sensor Market Overview

1.1.1. Automotive Sensor Market: By Technology

1.1.2. Automotive Sensor Market: By Vehicle Type

1.1.3. Automotive Sensor Market: By Type

1.1.4. Automotive Sensor Market: By Region

1.2. Why You Should Read This Report

1.3. How This Report Delivers

1.4. Key Questions Answered by This Analytical Report Include:

1.5. Who is This Report For?

1.6. Research Methodology

1.6.1. Primary Research

1.6.2. Secondary Research

1.6.3. Market Evaluation & Forecasting Methodology

1.7. Frequently Asked Questions (FAQ)

1.8. Associated Visiongain Reports

1.9. About Visiongain

2. Market Analysis

2.1. Market Dynamics

2.1.1. Global Automotive Sensor Market Drivers

2.1.1.1. Strict Government Regulations

2.1.1.2. Development Of Global Auto Manufacturers Into New Emerging Market

2.1.1.3. Growing Demand For High And Medium End Vehicles

2.1.1.4. Rising Consumer Preference For Safety, Security, Comfort And Efficiency

2.1.1.5. Growing Content Of Sensor In An Automobile As Per Moore’s Law

2.1.2. Global Automotive Sensor Market Restraints

2.1.2.1. Underdeveloped Aftermarket Services

2.1.2.2. Growing Pressure Of Prices

2.1.3. Global Automotive Sensor Market Opportunities

2.1.3.1. Anticipated Future Demand For Autonomous Cars And Connected Vehicles

2.1.3.2. Upcoming Technologies Such As Combo Sensors

2.1.3.3. Growing Demand For Electro mobility

2.2. Porter’s Five Forces Analysis

2.2.1. Threat of New Entrants

2.2.2. Bargaining Power of Buyers

2.2.3. Bargaining Power of Suppliers

2.2.4. Threat of Substitutes

2.2.5. Intensity of Competitive Rivalry

3. Global Automotive Sensor Analysis By Technology

3.1. Introduction

3.2. Micro-Electro-Mechanical Systems (MEMS)

3.2.1. Fuel Injector Pressure Sensor

3.2.2. Tire Pressure Sensor

3.2.3. Airbag Sensor

3.2.4. Roll Over Detection Sensor

3.2.5. Vehicle Dynamic Control (VDC) Sensor

3.2.6. Throttle Position Sensor

3.2.7. MEMS Based Sensors and Automotive Applications

3.2.8. Emerging Automotive Applications for MEMS based sensors

3.2.8.1. Vehicle Security Systems

3.2.8.2. Black Box for Vehicles

3.2.8.3. Vehicle Tracking and Telematics

3.2.8.4. Market Trends and Developments

3.3. Non-Electro-Mechanical Systems (Non-MEMS)

3.3.1. Non-MEMS Based Technology, Sensors and Automotive Applications

3.3.2. Magnetic Hall-Effect Technology

3.3.3. Emission Control Technology

3.3.4. Battery Sensor Technology in Start/Stop Vehicle

3.3.5. Optical Sensor Technology

3.3.6. Others

3.3.7. Market Trends and Developments

3.4. Nano-Electro-Mechanical Systems (NEMS)

3.4.1. Market Trends

4. Global Automotive Sensor Market Analysis, by Vehicle Type, 2019 - 2029

4.1. Introduction

4.2. Global Automotive Sensor Market Value Forecast, By Vehicle Type, 2019 - 2029 (US$ Mn & Mn Units)

4.3. Conventional Fuel Cars

4.3.1. Sensors in Chassis

4.3.2. Sensors in Power Trains

4.3.3. Sensors in Body Systems

4.4. Alternative Fuel Car

4.4.1. Sensors in Chassis

4.4.2. Sensors in Power Trains

4.4.3. Sensors in Body Systems

4.5. Heavy Vehicles

4.5.1. Sensor In Trucks

4.5.2. Sensors in Off-Road vehicle

5. Global Automotive Sensor Market Analysis, By Sensor Type, 2019 - 2029

5.1. Introduction

5.1.1. Global Automotive Sensor Market Forecast By Sensor Type 2019 - 2029 (US$ Mn & Mn Units)

5.2. Pressure Sensor Market Analysis, 2018

5.2.1. Key Trends For Pressure Sensors

5.2.2. Key Challenges For Pressure Sensors

5.2.3. Pressure Sensor Types – Chassis

5.2.4. Pressure Sensor Types - Power Train

5.2.5. Pressure Sensor Types- Body Systems

5.2.6. Key Market Players In Pressure Sensors

5.3. Temperature Sensor Market Analysis 2018

5.3.1. Temperature Sensor in Chassis

5.3.2. Temperature Sensor in Power Trains

5.3.3. Temperature Sensor in Body Systems

5.3.4. Key Market Players In Temperature Sensors

5.4. Position Sensor Market Analysis 2018

5.4.1. Position Sensors in Chassis

5.4.2. Position Sensors in Power Trains

5.4.3. Position Sensors in Body Systems

5.4.4. Key Trends In Position Sensors

5.4.5. Key Market Players In Position Sensors

5.5. Motion Sensors Market Analysis 2018

5.5.1. Motion Sensors in Chassis

5.5.2. Motion Sensors in Power Trains

5.5.3. Motion Sensors in Body Systems

5.5.4. Key Trends In Motion Sensors

5.5.5. Key Challenges In Motion Sensors

5.5.6. Key Market Players In Motion Sensors

5.6. Optical Sensor Market Analysis 2018

5.6.1. Optical Sensors in Chassis

5.6.2. Optical Sensors in Power Trains

5.6.3. Optical Sensors in Body Systems

5.6.4. Key Trends In Optical Sensors

5.6.5. Key Challenges For Optical Sensors

5.6.6. Key Market Players In Optical Sensors

5.7. Torque Sensor Market Analysis 2018

5.7.1. Torque Sensor Types - Chassis

5.7.2. Torque Sensor Types - Power Trains

5.7.3. Key Trends In Torque Sensors

5.7.4. Key Market Players In Torque Sensors

5.8. Gas Sensor Market Analysis 2018

5.8.1. Gas Sensors In Power Trains

5.8.2. Key Trends In Gas Sensors

5.8.3. Key Market Players In Gas Sensors

5.9. Level Sensor Market Analysis 2018

5.9.1. Level Sensor Types – Power Trains

6. Global Automotive Sensors Market Analysis, By Region 2019-2029

6.1. Introduction

6.2. Global Automotive Sensor Market Forecast, By Region 2019 – 2029 (US$ Mn)

7. America Automotive Sensors Market Analysis, 2019-2029

7.1. Introduction

7.2. America Automotive Sensor Market Forecast, By Vehicle Type,2019 - 2029 (US$ Mn & Mn Units)

7.3. America Automotive Sensor Market Forecast, By Sensor Type, 2019 - 2029 (Million Units)

7.4. America Automotive Sensor Market Forecast, By Country 2019 - 2029 (US$ Mn & Mn Units)

7.5. U.S. Automotive Sensor Market Analysis 2019-2029

7.6. Mexico Automotive Sensor Market Analysis 2019-2029

7.7. Others

7.8. Key Market Players In the America Automotive Sensor Market

8. Europe Automotive Sensors Market Analysis, 2019-2029

8.1. Introduction

8.2. Europe Automotive Sensor Market Forecast, By Vehicle Type, 2019 - 2029 (US$ Mn & Mn Units)

8.3. Europe Automotive Sensor Market Forecast, By Sensor Type, 2019 - 2029 (US$ Mn & Mn Units)

8.4. Europe Automotive Sensor Market Forecast, By Country 2019 - 2029 (US$ Mn)

8.5. Germany Automotive Sensor Market Analysis 2019-2029

8.6. U.K. Automotive Sensor Market Analysis 2019-2029

8.7. France Automotive Sensor Market Analysis 2019 - 2029

8.8. Key Market Players In the Europe Automotive Sensor Market

9. Asia Pacific (APAC) Automotive Sensors Market Analysis, 2019-2029

9.1. Introduction

9.2. Asia Pacific (APAC) Automotive Sensor Market Forecast, By Vehicle Type,2019 - 2029 (US$ Mn and Million Units)

9.3. Asia Pacific (APAC) Automotive Sensor Market Forecast, By Sensor Type, 2019 - 2029 (US$ Mn & Mn Units)

9.4. Asia Pacific (APAC) Automotive Sensor Market Forecast, By Country 2019 - 2029 (US$ Mn & Mn Units)

9.5. Japan Automotive Sensor Market 2019 - 2029

9.6. China Automotive Sensor Market 2019 - 2029

9.7. India Automotive Sensor Market 2019 - 2029

9.8. Others Asia Pacific Automotive Sensor Market 2019 - 2029

9.9. Key Market Players In the Asia Pacific (APAC) Automotive Sensor Market 2018

10. Rest of the World Automotive Sensor Market 2019 – 2029

11. Competitive Analysis Automotive Sensor Market 2019

11.1.Bosch Company

11.1.1 Overview

11.1.2. Bosch’s Automotive Sensor Portfolio

11.1.3. Bosch’s Future Outlook

11.2. Continental AG Company

11.2.1.Overview

11.2.2. Continental Automotive Sensor Portfolio

11.2.3. Continental’s Future Outlook

11.3. Delphi Automotive (Aptiv PLC)

11.3.1.Company Overview

11.3.2. Delphi Automotive Sensor Portfolio

11.3.3. Delphi’s Future Outlook

11.4. STMicroelectronics Company

11.4.1. Overview

11.4.2. STMicroelectronics Automotive Sensor Portfolio

11.4.3. STMicroelectronics’s Future Outlook

11.5 Freescale Semiconductors/NXP Semiconductors

11.5.1. Company Overview

11.5.2. Freescale Automotive Sensor Portfolio

11.5.3. Freescale Future Scope

11.6. Denso

11.6.1. Company Overview

11.6.2. Denso Automotive Sensor Portfolio

11.6.3. Denso Future Outlook

11.7. Sony (Sony Semiconductor Solutions Corporation)

11.7.1. Company Overview

11.7.2. Sony’s Automotive Sensor Portfolio

11.7.3. Sony Future Outlook

11.8. Gentex

11.8.1. Company Overview

11.8.2. Gentex Automotive Sensor Portfolio

11.8.3. Gentex Future Outlook

11.9. Hella

11.9.1. Company Overview

11.9.2. Hella Automotive Sensor Portfolio

11.9.3. Hella Future Outlook

11.10. Hyundai Mobis

11.10.1. Company Overview

11 10.2. Hyundai Automotive Sensor Portfolio

11.10.3. Hyundai Future Outlook

11.11. Magna International

11.11.1. Company Overview

11.11.2. Magna International Automotive Portfolio

11.11.3. Magna International Future Outlook

11.12. Panasonic Corporation

11.12.1. Company Overview

11.12.2. Panasonic Automotive Sensor Portfolio

11.12.3. Panasonic’s Future Outlook

11.13. Renesas Electronics Corporation

11.13.1. Company Overview

11.13.2. Renesas Automotive Sensor Portfolio

11.13.3. Renesas’s Future Outlook

11.14. Texas Instruments

11.14.1. Company Overview

11.14.2. Texas Instruments Automotive Sensor Portfolio

11.14.3. Texas Instruments’ Future Outlook

11.15. Elmos Instruments

11.15.1. Company Overview

11.15.2. Elmos Automotive Sensor Portfolio

11.16. Valeo S.A

11.16.1. Company Overview

11.16.2. Valeo Automotive Sensor Portfolio

11.16.3. Valeo Future Outlook

11.17. Allegro Microsystems

11.17.1. Company Overview

11.17.2. Allegro Microsystems Automotive Sensor Portfolio

11.17.3. Allegro Microsystems Future Outlook

11.18. TRW Automotive

11.18.1. Company Overview

11.18.2. TRW’s Automotive Sensor Portfolio

11.18.3. TRW’s Future Outlook

11.19. Infineon Technologies

11.19.1. Company Overview

11.19.2. Infineon Technologies Automotive Sensor Portfolio

11.19.3. Infineon Technologies Future Outlook

11.20. Sensata Technologies

11.20.1. Company Overview

11.20.2. Sensata Automotive Sensor Portfolio

11.20.3. Sensata Future Outlook

12. Glossary

List of Tables

Table 3.1 Key Developments in Automotive MEMS Sensor Market

Table 3.2 Key Developments in Automotive non-MEMS Sensor Market

Table 4.1 Global Automotive Sensor Market Value Forecast, By Vehicle Type, 2019 - 2029 US$ Mn, AGR %, CAGR %)

Table 4.2 Global Automotive Sensor Market Volume Forecast, By Vehicle Type, 2019 - 2029 (Million Units, AGR %, CAGR %)

Table 5.1 Global Automotive Sensor Market Value Forecast, By Sensor Type, 2019 - 2029 US$ Mn, AGR %, CAGR %)

Table 5.2 Global Automotive Sensor Market Volume Forecast, By Sensor Type, 2019 - 2029 (Million Units, AGR %, CAGR %

Table 5.3 Key Trends Of Pressure Sensor Body System

Table 5.4 Key Trends of Body System Position Sensors

Table 5.5 Key Trends Of Motion Sensor In Body Systems

Table 5.6 Key Trends Of Optical Sensor Market

Table 5.7 Key Trends In Torque Sensor Market

Table 5.8 Key Trends In Power Train Gas Sensors

Table 6.1 Geographical Analysis Breakdown For The Global Automotive Sensor Market

Table 6.2 Global Automotive Sensor Market Forecast, By Region 2019 - 2029 (US$ Mn, AGR%, CAGR%)

Table 6.3 Global Automotive Sensor Volume Forecast, By Region 2019 - 2029 (Mn Units, AGR%, CAGR%)

Table 7.1 America Automotive Sensor Market Value Forecast, By Vehicle Type, 2019 - 2029 US$ Mn, AGR %, CAGR %)

Table 7.2 America Automotive Sensor Volume Forecast, By Vehicle Type, 2019 - 2029 (Million Units, AGR %, CAGR %)

Table 7.3 America Automotive Sensor Market Value Forecast, By Sensor Type, 2019 - 2029 US$ Mn, AGR %, CAGR %)

Table 7.4 America Automotive Sensor Volume Forecast, By Sensor Type, 2019 - 2029 (Million Units, AGR %, CAGR %

Table 7.5 America Automotive Sensor Market Forecast, By Country 2019 - 2029 (US$ Mn, AGR%, CAGR%)

Table 7.6 America Automotive Sensor Volume Forecast, By Country 2019 - 2029 (Million Units, AGR%, CAGR%)

Table 8.1 Europe Automotive Sensor Market Value Forecast, By Vehicle Type, 2019 - 2029 US$ Mn, AGR %, CAGR %)

Table 8.2 Europe Automotive Sensor Volume Forecast, By Vehicle Type, 2019 - 2029 (Million Units, AGR %, CAGR %)

Table 8.3 Europe Automotive Sensor Market Value Forecast, By Sensor Type, 2019 - 2029 US$ Mn, AGR %, CAGR %)

Table 8.4 Europe Automotive Sensor Volume Forecast, By Sensor Type, 2019 - 2029 (Million Units, AGR %, CAGR %

Table 8.5 Europe Automotive Sensor Market Forecast, By Country 2019 - 2029 (US$ Mn, AGR%, CAGR%)

Table 8.6 Europe Automotive Sensor Volume Forecast, By Country 2019 - 2029 (Million Units, AGR%, CAGR%)

Table 9.1 Asia Pacific (APAC) Automotive Sensor Market Value Forecast, By Vehicle Type, 2019 - 2029 US$ Mn, AGR %, CAGR %)

Table 9.2 Asia Pacific (APAC) Automotive Sensor Volume Forecast, By Vehicle Type, 2019 - 2029 (Million Units, AGR %, CAGR %)

Table 9.3 Asia Pacific (APAC) Automotive Sensor Market Value Forecast, By Sensor Type, 2019 - 2029 US$ Mn, AGR %, CAGR %)

Table 9.4 Asia Pacific (APAC) Automotive Sensor Volume Forecast, By Sensor Type, 2019 - 2029 (Million Units, AGR %, CAGR %

Table 9.5 Asia Pacific (APAC) Automotive Sensor Market Forecast, By Country 2019 - 2029 (US$ Mn, AGR%, CAGR%)

Table 9.6 Asia Pacific (APAC) Automotive Sensor Volume Forecast, By Country 2019 - 2029 (Million Units, AGR%, CAGR%)

Table 11.1 Bosch Company Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Employees, Website

Table 11.2 Bosch’s Automotive SENSOR Portfolio

Table 11.3 Continental AG Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Ticker, Employees, Website)

Table 11.4 Continental Automotive Sensor Portfolio

Table 11.5 Delphi Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Ticker, Employees, Website)

Table 11.6 Delphi’s Automotive Sensor Portfolio

Table 11.7 STMicroelectronics Overview (Company Revenue, Automotive Sensors Segment, Automotive Sensors Portfolio, HQ, Ticker, Employees, Website)

Table 11.8 STMicroelectronics Automotive SENSOR Portfolio

Table 11.9 Freescale Company Overview (Company Revenue, Automotive Sensors Segment, Automotive Sensors Portfolio, HQ, Employees, Website)

Table 11.10 Freescale Automotive SENSOR Portfolio

Table 11.11 Denso Company Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table 11.12 Denso Automotive Sensor Portfolio

Table 11.13 Sony Company Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table 11.14 Sony Corporation SENSOR Portfolio

Table 11.15 Gentex Company Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ,Ticker, Website)

Table 11.16 Gentex’s Automotive Sensors Portfolio

Table 11.17 Hella Company Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table 11.18 Hella’s Automotive Sensor Portfolio

Table 11.19 Hyundai Mobis Company Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Ticker, Website)

Table 11.20 Hyundai Automotive Sensor Portfolio

Table 11.21 Magna Company Overview( Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table 11.22 Magna’s Automotive Sensor Portfolio

Table 11.23 Panasonic Company Overview (Company Revenue, sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table 11.24 Panasonic Automotive Sensor Portfolio

Table 11.25 Renesas Company Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table 11.26 Renesas Automotive Sensor Portfolio

Table 11.27 Texas Instruments Company Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table 11.28 Texas’s Automotive Sensor Portfolio

Table 11.29 Elmos Instruments Company Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table 11.30 Elmos Automotive Sensor Portfolio

Table 11.31 Valeo Company Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table 11.32 Valeo’s Automotive Sensors Portfolio

Table 11.33 Allegro Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Ticker, Contact, Employees, Website)

Table 11.34 Allegro’s Automotive SENSOR Portfolio

Table 11.35 TRW Automotive Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table 11.36 TRW Sensor Portfolio

Table 11.37 Infineon Technologies Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table 11.38 Infineon’s Automotive SENSOR Portfolio

Table 11.39 Sensata Technologies Overview (Company Revenue, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table 11.40 Sensata’s Automotive SENSOR Portfolio

List of Figures

Figure 2.1 Automotive Sensor Market Porter’s Five Forces Analysis, 2019

Figure 3.1 Automotive Sensor by Technology

Figure 4.1 Automotive Sensor Market By Vehicle Type

Figure 4.2 Chassis Of An Electric Vehicle

Figure 5.1 Pressure Sensor and Automotive Applications

Figure 5.2 Types of Chassis Pressure Sensors

Figure 5.3 Types of Power Train Pressure Sensors

Figure 5.4 Types of Power Train Pressure Sensors for Body Systems

Figure 5.5 Pressure Sensor Percentage Break Up: By Functional Application, 2018

Figure 5.6 Key Applications of Automotive Temperature Sensors

Figure 5.7 Power Train Temperature Sensor

Figure 5.8 Body System Temperature Sensor end Application Point

Figure 5.9 Temperature sensor Percentage Break Up: By Functional Application, 2018 (%)

Figure 5.10 Key Applications of Automotive Position Sensors

Figure 5.11 Chassis Position Sensor End Application Point

Figure 5.12 Key Applications Of Automotive Position Sensors

Figure 5.13 Body System Position Sensor End Application Point

Figure 5.14 Position Sensor Percentage Break Up: By Functional Application, 2018 (%)

Figure 5.15 Chassis Motion Sensors End Application Point

Figure 5.16 Power Train Motion Sensor End Application Point

Figure 5.17 Challenges For Motion Sensor Based Automation Systems

Figure 5.18 Motion Sensor Percentage Break Up: By Functional Application, 2018 (%)

Figure 5.19 Key Applications of Automotive Optical Sensors

Figure 5.20 Types of Chassis Optical Sensors

Figure 5.21 Types of Body System Optical Sensors

Figure 5.22 Optical Sensors In A Modern Vehicles

Figure 5.23 Optical Sensors In A Modern Vehicle

Figure 5.24 Optical Sensor Percentage Break Up : By Functional Application 2018 (%)

Figure 5.25 Types of Chassis Torque Sensor

Figure 5.26 Types of Power Train Torque Sensor

Figure 5.27 Torque Sensor Percentage Break Up: By Functional Application 2018 (%)

Figure 5.28 Types of Power Train Gas Sensor

Figure 6.1 Geographical Analysis Breakdown For The Global Automotive Sensor Market

Figure 6.2 Global Automotive Sensor Market Forecast, By Region, 2019 - 2029 (US$ Million, AGR %)

Figure 6.3 Global Automotive Sensor Volume Forecast, By Region, 2019 - 2029 (Million Units, AGR %)

Figure 7.1 Geographical Analysis Breakdown For The Global Automotive Sensor Market

Figure 7.2 America Automotive Sensor Market Forecast, By Country, 2019 - 2029 (US$ Million, AGR %, CAGR %)

Figure 7.3 America Automotive Sensor Volume Forecast, By Country, 2019 - 2029 (US$ Million, AGR %)

Figure 8.1 Geographical Analysis Breakdown For The Europe Automotive Sensor Market

Figure 8.2 Europe Automotive Sensor Market Forecast, By Country, 2019 - 2029 (US$ Million, AGR %)

Figure 8.3 Europe Automotive Sensor Volume Forecast By Country, 2019 - 2029 (Million Units, AGR %)

Figure 9.1 Geographical Analysis Breakdown For The Asia Pacific Automotive Sensor Market

Figure 9.2 Asia Pacific Automotive Sensor Market Forecast, By Country, 2019 - 2029 (US$ Million, AGR %)

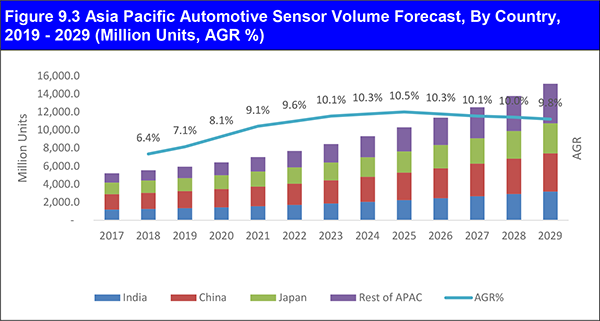

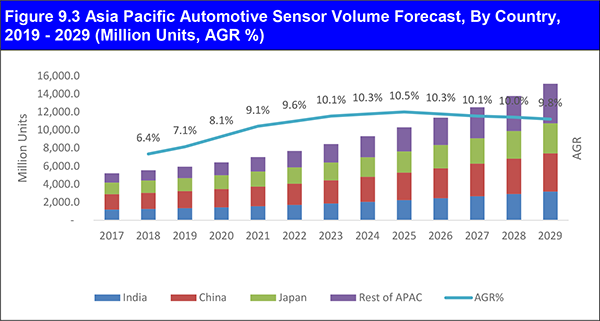

Figure 9.3 Asia Pacific Automotive Sensor Volume Forecast, By Country, 2019 - 2029 (Million Units, AGR %)

AB SKF, Automotive & Aerospace

Akebono Brake Industry Co.

Aleph Automotive Sensors

Alibaba Group

Allegro Microsystems

Alpine Electronics Inc.

Althen

American Axle & Mfg. Holdings Inc.

American Sensor Technologies

Amphenol Corporation

Analog Devices Inc. (ADI)

Anfield Sensors Inc.

API Technologies Corporation

Apple

Aptiv PLC

Asahi Glass Co.

ASC

Audi

Autoneum

Avago Technologies

BASF SE

BEI Sensors

Beijing Hella BHAP Automotive Lightning Co. Ltd

Bendix Commercial Vehicles Systems LLC (Knorr Bremse Group)

Bentley

BMW Group

BorgWarner Inc.

Bosch

Bosch Sensortec

Boston Piezo-Optics Inc.

Bourns, Inc.

Bridgewater Interiors

Brose Fahrzeugteile GmbH

CalsonicKansei Corp.

Ceramtec

Chrysler

CIE Automotive SA

CITIC Dicastal Co.

Conekt

Continental AG

Cooper-Standard Automotive

CTS Corporation

Cummins Inc.

Dana Holding Corporation

Delphi

Delphi

Delphi Automotive LLP

Delphi Automotive PLC

Denso Corporation

DigiKey Electronics

DIS

Dow Automotive

Draexlmaier Group

DunAnMicrostaq Inc.

DuPont

Dura Automotive Systems

Eberspaecher Gruppe GmbH

Elmos instruments

EXA Thermometrics

Faurecia

Federal-Mogul Corporation

Flex

Flex-N-Gate Corporation

FLIR

Ford

Freescale Semiconductors Inc.

F-Tech Inc.

Futek

GE

Geely Automobile Holdings Ltd.

General Electric Company

General Motors

Gentex Corporation

Gestamp

Gill Sensors

GKN

Goodyear Tire & Rubber Co.

Google

Grupo Antolin

GSS (Gas sensing solutions)

Hamamatsu Photonics K.K

Hella India Automotive Pvt. Ltd.

Hella KGaA Hueck & Co.

Hitachi

Hitachi Automotive Systems

Honda

Honeywell

Hyundai

Hyundai Dymos Inc.

Hyundai Kia Automotive Group

Hyundai Mobis

Hyundai Powertech Co.

Hyundai-Kia

Hyundai-WIA Corp.

IAC Group

Ibeo

Infineon Technologies AG

Innoviz

Intel

Interface

Inteva Products

Jaguar

JATCO

Jenoptic

Johnson Controls Inc.

JTEKT Corp.

Kandi Technologies Group Inc.,

Kautex Textron GmbH

Keihin Corp.

Key Safety Systems Inc.

KGaA Hueck & Co.

Kia Motors Corporation

Kistler

Koito Manufacturing

Kona Samsung

KSPG AG

Lear Corporation

Leoni AG

Leopold Kostal GmbH und Co.

LG Innotek

Linamar Corporation

Magna International

Mahle GmbH

Mando Corporation

Martinrea International Inc.

Mazda

Mazda Motor

Measurement Specialties

Meder electronics

Melexis

Mercedes-Benz

Metaldyne Performance Group Inc.

Methode Electronics

MGCANICA, INC,

Michelin Group

Micro-Epsilon

Micronas

Mitsuba Corporation

Mitsubishi Electric Corporation

Mitsubishi Motors Corporation

Mobileye

Mouser Electronics

Murata Electronics

Murata Manufacturing Co. Ltd.

MVD Auto

Nemak

Nexteer Automotive

NGK Spark Plug Company Limited

NHK Spring Company

Nihon Dempa Kogyo Co., Ltd.,

Nila Tech Private Limited

Nissan Motor Corporation

Nissin Kogyo Co.

Nokia Network

Novelis Inc.

NSK

NTN Corporation

NTT Docomo

Nvidia

NXP Semiconductors N.V.

Optrand

Oxford YASA Motor

Paile International co. Ltd.

Panasonic Corporation

PCB

Phonon Corporation

Piher Sensors And Controls

Pioneer Corporation

Plastic Omnium Company

Rakon

Renesas Electronics Corporation

Robert Bosch GmbH

Robert Bosch LLC

Ryobi

Salutica Allied Solutions Sdn. Bhd

Samvardhana Motherson Group

Santech Enterprises

Schaeffler AG

Schot

Schott

Schrader

Seiko Epson Corporation (Epson)

Sensata Technologies

Sensata Technologies Holding N.V.

Sensirion AG

Sensor Technology Limited

Sensors India

Sensors Unlimited

Showa Corporation

SKF Group

Sony Corporation

Sony Semiconductor Solutions Corporation

ST Microelectronics

Stoneridge

Subaru

Sumitomo Electric Industries

Sumitomo Riko Company

Takata Corporation

TDK Corporation

Techmor

Technoton sensors TTD

Tenneco Inc.

Tesla

Texas Instruments

Thyssenkrupp AG

Toshiba

Tower International

Toyoda Gosei Company

Toyota Boshoku Corporation

Tridon

TRW Automotive

TRW Automotive Body Control Systems (TRW BCS)

TS Tech Co.

TT Electronics plc

United Technologies Company

U-Shin

Valeo S.A.

Vibracoustic GmbH

Vishay

Visteon Corporation

Volkswagen

VTI Technologies

Webasto SE

Wells Vehicle Electronics

Yanfeng Automotive Trim Systems Company

Yazaki Corporation

YURA TechCo., Ltd

Zettler

ZF Aftermarket

ZTE

Zukunft Ventures GmbH

Organisations mentioned

California Air Resources Board (CARB)

Centre for Nano Science and Engineering (CeNSE) of the Indian Institute of Science (IISc)

China Association of Automobile Manufacturers

EnoCenter for Transportation

Euro NCAP

European Automobile Manufacturers Association (ACEA)

European Bank for Reconstruction and Development (EBRD)

European Commission

Eurostat

German Aerospace Centre

German Federal Ministry of Economic Affairs and Energy

German Federal Ministry of Education and Research

German Federal Ministry of Transport and Digital Infrastructure

Japan Automobile Manufacturers Association (JAMA)

Japanese Ministry of Land, Infrastructures, Transport and Tourism (MLIT)

Open Automotive Alliance

Organization for Economic Co- Operation and Development (OECD)

Oxford University Energy & Power Group (EPG)

Round Table Automated Driving

U.S. Central Intelligence Agency (CIA)

U.S. Environmental Protection Agency (EPA)

World Bank