Industries > Automotive > Automotive Advanced Driver Assistance Systems (ADAS) Market Report 2018-2028

Automotive Advanced Driver Assistance Systems (ADAS) Market Report 2018-2028

Forecasts by Application (ACC, AEB, AFL, BSM, DMS, FCW, HUD, ISA, LDW, NVS, PDS, PA, RSR, SVC), by Sensor (Radar (SRR-MRR, LRR), Camera, IR, Lidar, Ultrasonic) Plus Analysis of Top Companies & The Evolution Towards Autonomous Vehicles (AV), Self-Driving & Driverless Cars

The penetration rate of Advanced Driver Assistance Systems (ADAS) is expected to grow strongly over the next decade, driven mainly by government regulations and increasing consumer awareness. Europe and US NCAP mandates that all new cars must be equipped with Autonomous Emergency Breaking (AEB) and Forward Collision Warning (FCW) systems.

However, over the longer term horizon, ADAS systems are part of the technological ‘roadmap’ and stepping stone towards the eventual end goal of semi-autonomous and fully autonomous vehicle. This is a major focus of automotive industry R&D at the moment for both OEMs and tech companies that have recently penetrated the automotive sector.

Many semiconductor companies, which have previously not participated in the automotive industry, now develop or have started offering ADAS applications or sensors. Like with any new technology, a considerable amount of market uncertainty remains, especially how end-users will respond to the advanced computer controls/assistance with steering and reaction to critical situations.

Nonetheless, ADAS applications have entered the growth phase in 2018, OEM’s and their suppliers understand that ADAS features can also become the main differentiating factor among automotive companies.

The world market for Automotive Advanced Driver Assistance Systems (ADAS) will record revenues of $38.4bn in 2018.

• Do you need automotive ADAS market data?

• Succinct automotive ADAS market analysis?

• ADAS Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive automotive ADAS report can transform your own research and save you time.

If you want to be part of the growing Automotive ADAS industry, then read on to discover how you can maximise your investment potential.

Report highlights

• 254 Tables, Charts, And Graphs

• Analysis Of Key Players In Automotive ADAS

Automotive OEMs

• BMW AG

• Daimler AG

• Fiat Chrysler Automobiles (FCA) Group

• Ford Motor Company

• General Motors (GM)

• Honda Motor Company

• Hyundai Motor Group

• Nissan Motor Company

• PSA Peugeot Citroen

• Renault Company

• Suzuki Motor Corporation

• Toyota Motor Company

• Volkswagen Group AG

• Volvo Group

Automotive ADAS suppliers

• Aisin Seiki Co Company Overview

• Autoliv AB

• Bosch Company Overview

• Continental AG

• Delphi Automotive

• Denso Corporation

• NXP Semiconductors

• Gentex Corporation

• Harman International

• Hella KGaA Hueck & Co

• Hyundai Mobis

• Magna International

• Panasonic Corporation

• Takata Corporation

• Texas Instruments

• ZF Group

• Valeo S.A

• Tech Mahindra

• Global Automotive ADAS Market Outlook And Analysis From 2018-2028 (Market Value $m)

• Automotive ADAS Forecasts By Application 2018 – 2028 (Market Value $m)

• Adaptive Cruise Control (ACC) Forecast 2018-2028

• Adaptive Front Lights (AFL) Forecast 2018-2028

• Autonomous Emergency Braking (AEB) Forecast 2018-2028

• Blind-Spot Monitoring (BSM) Forecast 2018-2028

• Driver Monitoring System (DMS) Forecast 2018-2028

• Forward Collision Warning (FCW) Forecast 2018-2028

• Head-Up Display (HUD) Forecast 2018-2028

• Intelligent Speed Adaptation (ISA) Forecast 2018-2028

• Lane Departure Warning (LDW) Forecast 2018-2028

• Night Vision System (NVS) Forecast 2018-2028

• Park Assist (PA) Forecast 2018-2028

• Pedestrian Detection System (PDS) Forecast 2018-2028

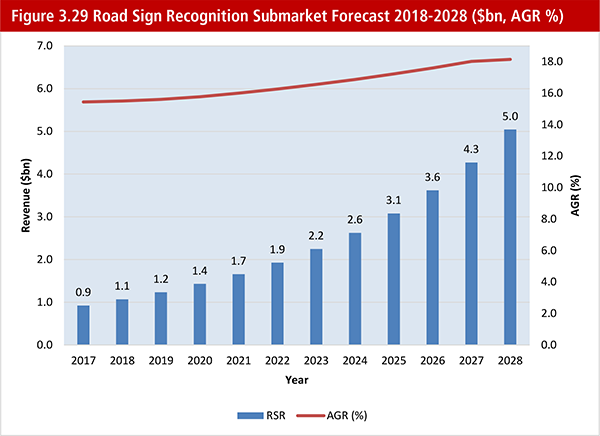

• Road Sign Recognition (RSR) Forecast 2018-2028

• Surround-View Cameras (SVC) Forecast 2018-2028

• Automotive ADAS Sales Forecasts By Sensor in 2018 (Unit Volume)

• Radar (SRR-MRR, LRR) 2018

• Camera Forecast 2018

• Infrared (IR) Forecast 2018

• Lidar Forecast 2018

• Ultrasonic Forecast 2018

• Automotive ADAS Sensors in 2018 (Market Value $m, Average Sensor Pricing ($))

• Regional & Leading National Automotive ADAS Market Forecasts 2018-2028

America Automotive ADAS Market Forecast 2018-2028

• United States Automotive ADAS Market Forecast 2018-2028

• Canadian Automotive ADAS Market Forecast 2018-2028

• Brazilian Automotive ADAS Market Forecast 2018-2028

• Rest of South America Automotive ADAS Market Forecast 2018-2028

Europe Automotive ADAS Market Forecast 2018-2028

• German Automotive ADAS Market Forecast 2018-2028

• United Kingdom Automotive ADAS Market Forecast 2018-2028

• French Automotive ADAS Market Forecast 2018-2028

• Italian Automotive ADAS Market Forecast 2018-2028

• Spanish Automotive ADAS Market Forecast 2017-2027

• Dutch Automotive ADAS Market Forecast 2018-2028

• Russian Automotive ADAS Market Forecast 2018-2028

• Rest Of Europe (ROE) Automotive ADAS Market Forecast 2018-2028

Asia/Oceania/ME Automotive ADAS Market Forecast 2018-2028

• Chinese Automotive ADAS Market Forecast 2018-2028

• Japanese Automotive ADAS Market Forecast 2017-2027

• Indian Automotive ADAS Market Forecast 2018-2028

• South Korean Automotive ADAS Market Forecast 2018-2028

• Rest of Asia/Oceania/ME Automotive ADAS Market Forecast 2018-2028

Rest of the World (ROW) Automotive ADAS Market Forecast 2018-2028

• Key Questions Answered

• What does the future hold for the Automotive ADAS market?

• Where should you target your business strategy?

• Which ADAS applications should you focus upon?

• Which disruptive ADAS technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to success and why?

• What business models should you adopt?

• What industry trends should you be aware of?

• Target Audience

• Automotive OEMs

• Component suppliers

• Sensor companies

• Electronics companies

• Software developers

• App developers

• ICT specialists

• Semiconductor companies

• Technologists

• R&D staff

• Consultants

• Market analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Automotive ADAS Market 2018-2028 Overview

1.2 Leading Companies in the ADAS Market Profiled in Our Report

1.3 Global Automotive ADAS Market Segmentation

1.4 Why You Should Read This Report

1.5 How This Report Delivers

1.6 Key Questions Answered by This Analytical Report Include:

1.7 Who is This Report For?

1.8 Methodology

1.9 Frequently Asked Questions (FAQ)

1.10 Associated Visiongain Reports

1.11 About Visiongain

2. Introduction to the Automotive ADAS Market

2.1 Learn About the Status of the ADAS Market in 2018

2.1.1 ADAS Penetration is Higher in the Premium Car Segment

2.1.1.1 What Restrains the Average Penetration of ADAS?

2.1.2. ADAS Applications are Expanding to the Mid & Small Car Segment

2.1.3 Learn How Government Mandates Will Drive ADAS Penetration

2.2 Why ADAS Is the Next Step Towards Autonomous Driving

2.3 Read Why ADAS Suppliers Are Instrumental For Autonomous Driving

2.4 Automotive ADAS Market Definition

2.4.1 ADAS vs. Active Safety Definition

2.5 Global Automotive ADAS Market Segmentation

2.5.1 Automotive ADAS Market By End-User Application

2.5.1.1 Adaptive Cruise Control (ACC) Submarket

2.5.1.2 Autonomous Emergency Braking (AEB)

2.5.1.3 Adaptive Front Lights (AFL) Submarket

2.5.1.4 Blind Spot Monitoring (BSM) Submarket

2.5.1.5 Driver Monitoring Systems (DMS) Submarket

2.5.1.6 Forward Collision Warning (FCW) Submarket

2.5.1.7 Heads-Up Display (HUD) Submarket

2.5.1.8 Intelligent Speed Adaptation (ISA) Submarket

2.5.1.9 Lane Departure Warning (LDW) Submarket

2.5.1.10 Night Vision System (NVS) Submarket

2.5.1.11 Parking Assistance (PA) Submarket

2.5.1.12 Pedestrian Detection System (PDS) Submarket

2.5.1.13 Road Sign Recognition (RSR) Submarket

2.5.1.14 Surround View Cameras (SVC) Submarket

2.5.2 Automotive ADAS Sensors

2.5.2.1 Overview of the Sensors Used in ADAS End-User Applications

2.6 ADAS Sensors: Radar (LRR, MRR, SRR), Camera (Stereo, Mono, Rear-View, Surround-View), LIDAR, Infrared (IR), Ultrasonic

2.6.1 Sales Volume of ADAS Sensors by Category in 2017 and 2018

2.6.2 Market Value of ADAS Sensors in 2018

3. Global Automotive ADAS Market & Submarkets

3.1 Global Automotive ADAS Market 2018-2028 Overview

3.2 Learn How Government Mandates Will Drive ADAS Penetration between 2018 and 2028

3.3 Restraints in the Global Automotive ADAS Market

3.3.1 Discover the Drivers & Restraints of the Automotive ADAS Market

3.4 Global Automotive ADAS Sensors Submarket Forecast 2018-2028

3.5 Global Automotive ADAS Submarkets Forecasts 2018-2028

3.6 Global Automotive ADAS Submarkets Share Forecast 2018, 2023, 2028

3.7 Adaptive Cruise Control (ACC) Submarket Forecast 2018-2028

3.7.1 Drivers & Restraints of the Adaptive Cruise Control Submarket 2018-2028

3.7.2 Overview of the Adaptive Cruise Control Submarket 2018-2028

3.7.3 How Adaptive Cruise Control Benefits from Combining Safety and Comfort

3.18 Adaptive Front Lights (AFL) Submarket Forecast 2018-2028

3.18.1 Drivers & Restraints of the Adaptive Front Lights Submarket 2018-2028

3.8.2 Overview of the Adaptive Front Lights Submarket 2018-2028

3.9 Blind-Spot Monitoring (BSM) Submarket Forecast 2018-2028

3.9.1 Drivers & Restraints of the Blind Spot Monitoring Submarket 2018-2028

3.9.2 Overview of the Blind Spot Monitoring Submarket 2018-2028

3.9.3 What Role Will Driver Annoyance Play in the Growth of BSM?

3.10 Driver Monitoring System (DMS) Submarket Forecast 2018-2028

3.10.1 Drivers & Restraints of the Driver Monitoring System Submarket 2018-2028

3.10.2 Overview of the Driver Monitoring System Submarket 2018-2028

3.10.3 How Driver Monitoring will Become the 2nd Fastest Growing Active Safety Systems Submarket

3.11 Forward Collision Warning (FCW) Submarket Forecast 2018-2028

3.11.1 Drivers & Restraints of the Forward Collision Warning Submarket 2018-2028

3.11.2 Overview of the Forward Collision Warning Submarket 2017-2027

3.12 Heads-Up Display (HUD) Submarket Forecast 2018-2028

3.12.1 Overview of the Heads-Up Display Submarket 2018-2028

3.12.2 Drivers & Restraints of the Heads-Up Display Submarket 2018-2028

3.13 Intelligent Speed Adaptation (ISA) Submarket Forecast 2018-2028

3.13.1 Overview of the Intelligent Speed Adaptation Submarket 2018-2028

3.13.2 Drivers & Restraints of the Intelligent Speed Adaptation Submarket 2018-2028

3.14 Lane Departure Warning (LDW) Submarket Forecast 2018-2028

3.14.1 Overview of the Lane Departure Warning Submarket 2017-2027

3.14.2 Drivers & Restraints of the Lane Departure Warning Submarket 2018-2028

3.14.3 Why Lane Departure Warning Systems Will Need to Improve for the Market to Grow

3.15 Night Vision System (NVS) Submarket Forecast 2018-2028

3.15.1 Drivers & Restraints of the Night Vision System Submarket 2018-2028

3.15.2 Overview of the Night Vision System Submarket 2018-2028

3.15.3 Find Out About The Opportunities And Limitations of Different Types of Night Vision Systems

3.`6 Park Assistance (PA) Submarket Forecast 2018-2028

3.16.1 Overview of the Park Assistance Submarket 2018-2028

3.16.2 Drivers & Restraints of the Park Assistance Submarket 2018-2028

3.17 Pedestrian Detection System (PDS) Submarket Forecast 2017-2027

3.17.1 Overview of the Pedestrian Detection System Submarket 2018-2028

3.17.2 Drivers & Restraints of the Pedestrian Detection System Submarket 2018-2028

3.18 Road Sign Recognition (RSR) Submarket Forecast 2018-2028

3.18.1 Overview of the Road Sign Recognition Submarket 2018-2028

3.18.2 Drivers & Restraints of the Road Sign Recognition Submarket 2018-2028

3.19 Surround-View Cameras (SVC) Submarket Forecast 2018-2028

3.19.1 Overview of the Surround-View Cameras Submarket 2018-2028

3.19.2 Drivers & Restraints of the Surround-View Cameras Submarket 2018-2028

3.20 Autonomous Emergency Braking (AEB) Submarket Forecast 2018-2028

3.20.1 Overview of the Autonomous Emergency Braking Submarket 2018-2028

3.20.2 Drivers & Restraints of the Autonomous Emergency Braking Submarket 2018-2028

4. Regional & Leading National Automotive ADAS Market Forecast 2018-2028

4.1 Leading National Automotive ADAS Markets Forecast 2018-2028

4.2 Rankings of the Leading National ADAS Markets 2018, 2023, 2028

4.3 Leading National Automotive ADAS Markets Share Forecasts 2018, 2023, 2028

4.4 Regional Automotive ADAS Market Forecast 2018-2028

4.4.1 Regional Automotive ADAS Market Share Forecast 2018, 2023, 2028

4.5 America Automotive ADAS Market Forecast 2018-2028

4.5.1 United States Automotive ADAS Market Forecast 2018-2028

4.5.1.1 Drivers & Restraints of the US Automotive ADAS Market 2018-2028

4.5.1.2 Overview of the US Automotive ADAS Market 2018-2028

4.5.1.3 Find out How Legislation and Consumer Behaviour Affect the US Automotive ADAS Market

4.5.2 Canadian Automotive ADAS Market Forecast 2018-2028

4.5.2.1 Drivers & Restraints of the Canadian Automotive ADAS Market 2018-2028

4.5.2.2 Overview of the Canadian Automotive ADAS Market 2018-2028

4.5.2.3 Why Canada’s Automotive ADAS Market has Reached Above Average Penetration Rates

4.5.3 Brazilian Automotive ADAS Market Forecast 2018-2028

4.5.3.1 Drivers & Restraints of the Brazilian Automotive ADAS Market 2018-2028

4.5.3.2 Overview of the Brazilian Automotive ADAS Market 2018-2028

4.5.3.3 How the Low Quality of Brazil’s Road Network as Well as Government Involvement Will Drive the ADAS Market

4.5.4 Rest of South America Automotive ADAS Market Forecast 2018-2028

4.5.4.1 Overview of the Rest of South America Automotive ADAS Market 2018-2028

4.6 Europe Automotive ADAS Market Forecast 2018-2028

4.6.1 German Automotive ADAS Market Forecast 2018-2028

4.6.1.1 Drivers & Restraints of the German Automotive ADAS Market 2018-2028

4.6.1.2 Overview of the German Automotive ADAS Market 2018-2028

4.6.1.3 How the German Luxury Car Segment Drives Innovation and Sales of the ADAS Market

4.6.2 United Kingdom Automotive ADAS Market Forecast 2018-2028

4.6.2.1 Drivers & Restraints of the UK Automotive ADAS Market 2018-2028

4.6.2.2 Overview of the UK Automotive ADAS Market 2018-2028

4.6.2.3 How Consumer Awareness is Affecting Fitment Rates in the UK Automotive ADAS Market

4.6.3 French Automotive ADAS Market Forecast 2018-2028

4.6.3.1 Drivers & Restraints of the French Automotive ADAS Market 2018-2028

4.6.3.2 Overview of the French Automotive ADAS Market 2018-2028

4.6.3.3 Find out About the Characteristics of the French Car Market and Their Effects on its Automotive ADAS Market

4.6.4 Italian Automotive ADAS Market Forecast 2018-2028

4.6.4.1 Overview of the Italian Automotive ADAS Market 2018-2028

4.6.4.2 Drivers & Restraints of the Italian Automotive ADAS Market 2018-2028

4.6.4.3 Find out About the Role of Insurance Companies in the Italian Automotive ADAS Market

4.6.5 Spanish Automotive ADAS Market Forecast 2017-2027

4.6.5.1 Drivers & Restraints of the Spanish Automotive ADAS Market 2018-2028

4.6.5.2 Overview of the Spanish Automotive ADAS Market 2018-2028

4.6.5.3 Find out How the Spanish Automotive ADAS Market Will Recover from its Downturn

4.6.6 Dutch Automotive ADAS Market Forecast 2018-2028

4.6.6.1 Overview of the Dutch Automotive ADAS Market 2018-2028

4.6.7 Russian Automotive ADAS Market Forecast 2018-2028

4.6.7.1 Drivers & Restraints of the Russian Automotive ADAS Market 2018-2028

4.6.7.2 Overview of the Russian Automotive ADAS Market 2018-2028

4.6.7.3 How Russia’s Automotive ADAS Market Will Eventually Catch Up With Other Countries

4.6.8 Rest Of Europe (ROE) Automotive ADAS Market Forecast 2018-2028

4.6.8.1 Drivers & Restraints of the Rest of Europe ADAS Market 2018-2028

4.6.8.2 Overview of the Rest of Europe Automotive ADAS Market 2018-2028

4.6.8.3 Find out Which Countries in the Rest of Europe Will Have Large Automotive ADAS Markets

4.7 Asia/Oceania/ME Automotive ADAS Market Forecast 2018-2028

4.7.1 Chinese Automotive ADAS Market Forecast 2018-2028

4.7.1.1 Drivers & Restraints of the Chinese Automotive ADAS Market 2018-2028

4.7.1.2 Overview of the Chinese Automotive ADAS Market 2018-2028

4.7.1.3 Why the Unsafe Image of Chinese Cars can have a Dichotomous Effect on the Country’s ADAS Market

4.7.2 Japanese Automotive ADAS Market Forecast 2017-2027

4.7.2.1 Drivers & Restraints of the Japanese Automotive ADAS Market 2018-2028

4.7.2.2 Overview of the Japanese Automotive ADAS Market 2018-2028

4.7.2.3 Find out About the Role ADAS can Play in the Implementation of Japan’s Intelligent Transport System

4.7.3 Indian Automotive ADAS Market Forecast 2018-2028

4.7.3.1 Drivers & Restraints of the Indian Automotive ADAS Market 2018-2028

4.7.3.2 Overview of the Indian Automotive ADAS Market 2018-2028

4.7.3.3 Will India be One of the Fastest Growing Asian Automotive ADAS Markets?

4.7.4 South Korean Automotive ADAS Market Forecast 2018-2028

4.7.4.1 Drivers & Restraints of the South Korean Automotive ADAS Market 2018-2028

4.7.4.2 Overview of the South Korean Automotive ADAS Market 2018-2028

4.7.4.3 How South Korea’s Domestic Car Industry and its Intelligent Transport System Will Drive the Automotive ADAS Market

4.7.5 Rest of Asia/Oceania/ME Automotive ADAS Market Forecast 2018-2028

4.7.5.1 Overview of the Rest of Asia/Oceania/ME Automotive ADAS Market 2018-2028

4.8 Rest of the World (ROW) Automotive ADAS Market Forecast 2018-2028

4.8.1 Drivers & Restraints of the Rest of World Automotive ADAS Market 2018-2028

4.8.2 Overview of the Rest of World Automotive ADAS Market 2018-2028

4.8.3 Important Developments in the RoW Automotive ADAS Market

5. SWOT Analysis of the Automotive ADAS Market

5.1 Advantages and Disadvantages of Automotive ADAS Sensors

6. Leading Companies in the Automotive ADAS Market

6.1 BMW AG Company Overview

6.1.1 BMW’s Role in the Automotive ADAS Market

6.1.2 BMW’s Automotive ADAS Portfolio

6.1.3 BMW J-V Activity

6.2 Daimler AG Company Overview

6.2.1 Daimler’s Role in the Automotive ADAS Market

6.2.2 Daimler’s Automotive ADAS Portfolio

6.2.3 Daimler’s Joint-Venture Activity

6.2.4 Mercedes-Benz and the V2V, V2X Technology

6.3 Fiat Chrysler Automobiles (FCA) Group Overview

6.3.1 FCA’s Role in the Automotive ADAS Market

6.3.2 FCA’s J-V Activity

6.4 Ford Motor Company Overview

6.4.1 Ford’s Role in the Automotive ADAS Market

6.4.2 Ford J-V Activity

6.5 General Motors (GM) Company Overview

6.5.1 GM’s Role in the Automotive ADAS Market

6.5.2 GM J-V Activity

6.6 Honda Motor Company Overview

6.6.1 Honda’s Role in the Automotive ADAS Market

6.7 Hyundai Motor Group Company Overview

6.7.1 Hyundai-Kia’s Role in the Automotive ADAS Market

6.8 Nissan Motor Co. Company Overview

6.8.1 Nissan’s Role in the Automotive ADAS Market

6.8.2 Nissan J-V Activity

6.9 PSA Peugeot Citroen Company Overview

6.9.1 PSA’s Role in the Automotive ADAS Market

6.10 Renault Company Overview

6.10.1 Renault’s Role in the Automotive ADAS Market

6.10.2 Renault J-V Activity

6.11 Suzuki Motor Corporation Company Overview

6.11.1 Suzuki’s Role in the Automotive ADAS Market

6.11.2 Suzuki J-V Activity

6.12 Toyota Motor Company Overview

6.12.1 Toyota’s Role in the Automotive ADAS Market

6.12.2 Toyota & V2I Communications Technology

6.12.3 Toyota J-V Activity

6.13 Volkswagen Group AG Company Overview

6.13.1 VW’s Role in the Automotive ADAS Market

6.14 Volvo Group Company Overview

6.14.1 Volvo’s Role in the Automotive ADAS Market

6.14.2 Volvo J-V Activity

6.15 Aisin Seiki Co Company Overview

6.15.1 Aisin Seiki’s Role in the Automotive ADAS Market 2018

6.15.2 Aisin Seiki’s Automotive ADAS Portfolio

6.15.3 Aisin Seiki’s Future Outlook

6.16 Autoliv AB Company Overview

6.16.1 Autoliv’s Role in the Automotive ADAS Market

6.16.2 Autoliv’s Automotive ADAS Portfolio

6.16.3 Autoliv’s Future Outlook

6.17 Bosch Company Overview

6.17.1 Bosch’s Role in the Automotive ADAS Systems Market

6.17.2 Bosch’s Automotive ADAS Portfolio

6.17.3 Bosch’s Future Outlook

6.18 Continental AG Company Overview

6.18.1 Continental’s Role in the Automotive ADAS Market

6.18.2 Continental’s Automotive ADAS Portfolio

6.18.3 Continental’s Future Outlook

6.19 Delphi Automotive Company Overview

6.19.1 Delphi’s Role in the Automotive ADAS Market

6.19.2 Delphi’s Automotive ADAS Portfolio

6.19.3 Delphi’s Future Outlook

6.20 Denso Corporation Company Overview

6.20.1 Denso’s Role in the Automotive ADAS Market

6.20.2 Denso’s Automotive ADAS Portfolio

6.20.3 Denso’s Future Outlook

6.21 NXP Semiconductors (Freescale Semiconductors) Company Overview

6.21.1 NXP’s Role in the Automotive ADAS Market

6.21.2 NXP’s Automotive ADAS Portfolio

6.21.3 NXP’s Future Outlook

6.22 Gentex Corporation Company Overview

6.22.1 Gentex’s Role in the Automotive ADAS Market

6.22.2 Gentex’s Automotive ADAS Portfolio

6.22.3 Gentex’s Future Outlook

6.23 Harman International Company Overview

6.23.1 Harman’s Role in the Automotive ADAS Market

6.23.2 Harman’s Automotive ADAS Portfolio

6.23.3 Harman’s Future Outlook

6.24 Hella KGaA Hueck & Co Company Overview

6.24.1 Hella’s Role in the Automotive ADAS Market

6.24.2 Hella’s Automotive ADAS Portfolio

6.24.3 Hella’s Future Outlook

6.25 Hyundai Mobis Company Overview

6.25.1 Hyundai Mobis’s Role in the Automotive ADAS Market

6.25.2 Hyundai Mobis’s Automotive ADAS Portfolio

6.25.3 Hyundai Mobis’s Future Outlook

6.26 Magna International Company Overview

6.26.1 Magna’s Role in the Automotive ADAS Market

6.26.2 Magna’s Automotive ADAS Portfolio

6.26.3 Magna’s Future Outlook

6.27 Panasonic Corporation Company Overview

6.27.1 Panasonic’s Role in the Automotive ADAS Market

6.27.2 Panasonic’s Automotive ADAS Portfolio

6.27.3 Panasonic’s Future Outlook

6.28 Takata Corporation Company Overview

6.28.1 Takata’s Role in the Automotive ADAS Market

6.28.2 Takata’s Automotive ADAS Portfolio

6.28.3 Takata’s Future Outlook

6.29 Texas Instruments Company Overview

6.29.1 Texas Instruments’ Role in the Automotive ADAS Market

6.29.2 Texas Instruments’ Automotive ADAS Portfolio

6.30 ZF Group Company Overview

6.30.1 ZF’s Role in the Automotive ADAS Market

6.30.2 ZF’s Automotive ADAS Portfolio

6.30.3 ZF’s Future Outlook

6.31 Valeo S.A Company Overview

6.31.1 Valeo’s Role in the Automotive ADAS Market

6.31.2 Valeo’s Automotive ADAS Portfolio

6.31.3 Valeo’s Future Outlook

6.32 Tech Mahindra Company Profile

6.32.1 Tech Mahindra’s Role in the Automotive ADAS Market

6.32.2 Tech Mahindra’s Automotive ADAS Portfolio

6.32.3 Tech Mahindra’s Future Outlook

6.33 Other Leading Companies in the Automotive ADAS Market

7.Conclusions

7.1 Global Automotive ADAS Market Forecast Summary 2017, 2022, 2027

7.2 Discover the Drivers & Restraints of the Automotive ADAS Market

7.3 Overview of the Car Manufacturers’ ADAS Portfolio in 2018

7.4 Overview of the ADAS Suppliers’ Portfolio in 2018

7.5 Global Automotive ADAS Submarket Forecast Summary 2018, 2023, 2028

7.6 Global Automotive ADAS Submarket Share Forecast 2018, 2023, 2028

7.7 Global Automotive ADAS Submarkets Comparisons

7.7.1 Global Automotive ADAS Submarkets Rankings 2018, 2023, 2028

7.7.2 Learn Which Automotive ADAS Submarket Grows Fastest From 2018-2028

7.8 Leading National Automotive ADAS Markets Rankings 2018, 2023, 2028

7.9 Leading National Automotive ADAS Markets Share Forecasts 2018, 2023, 2028

7.10 Recommendations

7.10.1 How to Embrace the Market for OEMs

7.10.2.1 Component Suppliers “Where” to

7.10.2.2 Component Suppliers “How” to

7.10.2.3 Component Suppliers “When”to

7.11 Recap

8. Glossary

List of Tables

Table 1.1 Overview of the Leading Companies in the ADAS Market Profiled in Our Report

Table 2.1 Overview of the ADAS End-User Application Offerings from Premium Carmakers as Part of the Standard or Optional Equipment (Audi, BMW, Cadillac,

Table 2.2 Overview of the ADAS End-User Application Offerings from Volume Carmakers as Part of the Standard or Optional Equipment

Table 2.3 Future US and Euro NCAP Developments

Table 2.4 Overview of the ADAS Sensors: Radar, Camera, Infrared, Ultrasonic, LIDAR

Table 2.5 Overview of the Sensors Used in ADAS End-User Applications

Table 2.6 Market Value of ADAS Sensors in 2018 ($ Million)

Table 3.1 Global Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR%, Cumulative)

Table 3.2 Japan ADAS Developments (2014-2018)

Table 3.3 European Regulations (2013-2018)

Table 3.4 Vehicle Safety Features (2011-2015)

Table 3.5 Global Automotive ADAS Market Drivers & Restraints

Table 3.6 Automotive ADAS Sensors Submarket Forecasts 2018-2028 (mn units)

Table 3.7 Global Automotive ADAS Submarket Forecasts 2018-2028 ($bn, AGR %)

Table 3.8 Adaptive Cruise Control Submarket Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 3.9 Drivers & Restraints of the Adaptive Cruise Control Submarket 2018-2028

Table 3.10 Adaptive Front Lights Submarket Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 3.11 Drivers & Restraints of the Adaptive Front Lights Submarket 2018-2028

Table 3.12 Blind Spot Monitoring Submarket Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 3.13 Drivers & Restraints of the Blind Spot Monitoring Submarket 2018-2028

Table 3.14 Driver Monitoring System Submarket Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 3.15 Drivers & Restraints of the Driver Monitoring Submarket 2018-2028

Table 3.16 Forward Collision Warning Submarket Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 3.17 Drivers & Restraints of the Forward Collision Warning Submarket 2018-2028

Table 3.18 Heads Up Display Submarket Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 3.19 Drivers & Restraints of the Heads-Up Display Submarket 2018-2028

Table 3.20 Intelligent Speed Adaptation Submarket Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 3.21 Drivers & Restraints of the Intelligent Speed Adaptation Submarket

Table 3.22 Lane Departure Warning Submarket Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 3.23 Drivers & Restraints of the Lane Departure Warning Submarket 2018-2028

Table 3.24 Night Vision System Submarket Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 3.25 Drivers & Restraints of the Night Vision System Submarket 2018-2028

Table 3.26 Park Assistance Submarket Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 3.27 Drivers & Restraints of the Park Assistance Submarket 2018-2028

Table 3.28 Pedestrian Detection System Submarket Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 3.29 Drivers & Restraints of the PDS Submarket 2018-2028

Table 3.30 Road Sign Recognition Submarket Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 3.31 Drivers & Restraints of the Road Sign Recognition Submarket 2018-2028

Table 3.32 Surround-View Cameras Submarket Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 3.33 Drivers & Restraints of the Surround View Camera Submarket 2018-2028

Table 3.34 Autonomous Emergency Braking (AEB) Submarket Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 3.35 Drivers & Restraints of the AEB Submarket 2018-2028

Table 4.1 Leading National Automotive ADAS Markets Forecast 2018-2028 ($bn, AGR %)

Table 4.2 Rankings of the Leading National ADAS Market 2018, 2023, 2028 by Revenue ($bn)

Table 4.3 Regional Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Table 4.4 US Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.5 Drivers & Restraints of the US Automotive ADAS Market 2018-2028

Table 4.6 Canadian Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.7 Drivers & Restraints of the Canadian Automotive ADAS Market 2018-2028

Table 4.8 Brazilian Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.9 Drivers & Restraints of the Brazilian Automotive ADAS Market 2018-2028

Table 4.10 Rest of South America Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.11 German Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.12 Drivers & Restraints of the German Automotive ADAS Market 2018-2028

Table 4.13 UK Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.14 Drivers & Restraints of the UK Automotive ADAS Market 2018-2028

Table 4.15 French Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.16 Drivers & Restraints of the French Automotive ADAS Market 2018-2028

Table 4.17 Italian Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.18 Drivers & Restraints of the Italian Automotive ADAS Market 2018-2028

Table 4.19 Spanish Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.20 Drivers & Restraints of the Spanish Automotive ADAS Market 2018-2028

Table 4.21 Dutch Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.22 Russian Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.23 Drivers & Restraints of the Russian Automotive ADAS Market 2018-2028

Table 4.24 ROE Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.25 Drivers & Restraints of the Rest of Europe ADAS Market 2018-2028

Table 4.26 Chinese Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.27 Drivers & Restraints of the Chinese Automotive ADAS Market 2018-2028

Table 4.28 Japanese Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.29 Drivers & Restraints of the Japanese Automotive ADAS Market 2018-2028

Table 4.30 Indian Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.31 Drivers & Restraints of the Indian Automotive ADAS Market 2018-2028

Table 4.32 South Korean Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.33 Drivers & Restraints of the South Korean Automotive ADAS Market 2018-2028

Table 4.34 Rest of Asia/Oceania/ME Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.35 ROW Automotive ADAS Market Forecast 2018-2028 ($bn, AGR%, CAGR %)

Table 4.36 Drivers & Restraints of the Rest of World Automotive ADAS Market 2018-2028

Table 5.1 SWOT Analysis of the Automotive ADAS Market 2018-2028

Table 5.2 Advantages & Disadvantages of Automotive ADAS Sensors (Radar, Camera, Lidar, Ultrasonic, Infrared Camera)

Table 6.1 BMW AG Overview (Revenue, No. of Employees, ADAS Portfolio, HQ, Ticker, Contact, Website)

Table 6.2 BMW’s Automotive ADAS Portfolio

Table 6.3 Daimler AG Overview (Revenue, HQ, ADAS Portfolio, Ticker, IR, Website)

Table 6.4 Daimler’s Automotive ADAS Portfolio

Table 6.5 FCA Group Company Overview (Revenue, ADAS Portfolio Overview, HQ, Ticker, Website)

Table 6.6 FCA’s Financials 2014-2017 (3-Year Revenue, Diluted EPS), (In $Million Apart from EPS)

Table 6.7 Ford Overview (Revenue, ADAS Portfolio, Cars Sold, HQ, Market Share in Car Sales, No of Employees, Ticker, Contact, Website)

Table 6.8 General Motors Company Overview (Revenue, ADAS Portfolio, HQ, Ticker, Contact, Website)

Table 6.9 GM’s Financials 2011-2017 (6-Year Revenue, Gross Profit, Operating Income, Net Income, Diluted EPS), (In $Million Apart from EPS)

Table 6.10 Honda Motor Company Overview (Revenue, ADAS Portfolio, HQ, Ticker, Website)

Table 6.11 Hyundai-Kia Company Overview (Revenue, ADAS Portfolio, HQ, Ticker, IR, Website)

Table 6.12 Nissan Company Overview (Revenue, ADAS Portfolio, HQ, Ticker, IR Contact, Website)

Table 6.13 PSA Company Overview (Revenue, ADAS Portfolio, HQ, Ticker, IR Contact, Website)

Table 6.14 Renault Company Overview (Total Revenue, HQ, Ticker, IR Contact, Website)

Table 6.15 Suzuki Company Overview 2012 (Total Revenue, HQ, Ticker, IR Contact, Website)

Table 6.16 Toyota Overview (Revenue, ADAS Portfolio, HQ, Market Cap, Ticker, No. of Employees, IR, Contact, Website)

Table 6.17 Volkswagen Company Overview (Revenue, ADAS Portfolio, HQ, Global Car Sales Market Share, Ticker, Website)

Table 6.18 Volvo Group Company Overview (Revenue, ADAS Portfolio, HQ, IR Contact, Website)

Table 6.19 Aisin Seiki Company Overview 2018 (Company Revenue, Revenue in the ADAS Market, ADAS Segment, ADAS Portfolio, HQ, Ticker, Employees, Website)

Table 6.20 Aisin Financials 2013-2017 (5-year Revenue, Gross Profit, Oper. Income, Net income, Diluted EPS), (In $Million Apart from EPS)

Table 6.21 Aisin’s Automotive ADAS Portfolio

Table 6.22 Autoliv AB Overview 2018 (Company Revenue, Revenue, Revenue in the ADAS Market, ADAS Segment, ADAS Portfolio, HQ, Ticker, Contact, Employees, Website)

Table 6.23 Autoliv’s Automotive ADAS Portfolio

Table 6.24 Bosch Company Overview (Company Revenue, Revenue in the ADAS Market, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 6.25 Bosch’s Automotive ADAS Portfolio

Table 6.26 Continental Overview (Company Revenue, Revenue in the ADAS Market ADAS Segment, ADAS Portfolio, HQ, Ticker, Employees, Website)

Table 6.27 Continental’s Financials (5-year Revenue, Gross Profit, Operating Income, Net income, Diluted EPS) 2013 - 2017

Table 6.28 Continental’s 2016 and 2017 Sales, Employees and Shares by Segment (Billion EUR, %)

Table 6.29 Continental’s Automotive ADAS Portfolio

Table 6.30 Delphi Overview (Company Revenue, Revenue in the ADAS Market, ADAS Segment, ADAS Portfolio, HQ, Ticker, Employees, Website)

Table 6.31 Delphi’s Automotive ADAS Portfolio

Table 6.32 Denso Company Overview (Company Revenue, Revenue in the ADAS Market, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 6.33 Denso’s Financials (5-year Revenue, Gross Profit, Operating Income, Net income, Diluted EPS) 2013 - 2017

Table 6.34 Denso’s 2014, 2015, 2016 and 2017 Sales, by Segment (Billion Yen, %)

Table 6.35 Denso’s Automotive ADAS Portfolio

Table 6.36 NXP Semiconductors Company Overview (Company Revenue, Revenue in the ADAS Market, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 6.37 NXP’s Automotive ADAS Portfolio

Table 6.38 Gentex Company Overview (Company Revenue, Revenue in the ADAS Market, ADAS Segment, ADAS Portfolio, HQ, Ticker, Website)

Table 6.39 Gentex’s Financials 2012-2017 (5-year Revenue, Gross Profit, Op. Income, Net income, Diluted EPS), (In $Million Apart from EPS)

Table 6.40 Gentex’s Automotive ADAS Portfolio

Table 6.41 Harman Company Overview (Company Revenue, Revenue in the ADAS Market, ADAS Segment, ADAS Portfolio, HQ, Ticker, Employees, Website)

Table 6.42 Harman’s Financials 2013-2017 (5-year Revenue, Gross Profit, Op. Income, Net income, Diluted EPS), (In $Million Apart from EPS)

Table 6.43 Harman’s Automotive ADAS Portfolio

Table 6.44 Hella Company Overview (Company Revenue, Revenue in the Automotive ADAS Market, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 6.45 Hella’s Automotive ADAS Portfolio

Table 6.46 Hyundai Mobis Company Overview (Company Revenue, Revenue in the ADAS Market, ADAS Segment, ADAS Portfolio, HQ, Ticker, Website)

Table 6.47 Hyundai Mobis’s Automotive ADAS Portfolio

Table 6.48 Magna International Company Overview (Company Revenue, Revenue in the Automotive ADAS Market, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 6.49 Magna’s Financials 2012-2017 (5-year Revenue, Gross Profit, Op. Income, Net income, Diluted EPS), (In $Million Apart from EPS)

Table 6.50 Magna’s Automotive ADAS Portfolio

Table 6.51 Panasonic Company Overview (Company Revenue, Revenue in the Automotive ADAS Market, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 6.52 Panasonic’s Financials (5-year Revenue, Gross Profit, Op. Income, Net income, Diluted EPS), 2013 - 2017

Table 6.53 Panasonic’s Automotive ADAS Portfolio

Table 6.54 Takata Company Overview (Company Revenue, Revenue in the Automotive ADAS Market, ADAS Segment, ADAS Portfolio, HQ, Ticker, Website)

Table 6.55 Takata’s Automotive ADAS Portfolio

Table 6.56 Texas Instruments Company Overview (Company Revenue, Revenue in the Automotive ADAS Market , ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 6.57 T.I’s Financials (5-year Revenue, Gross Profit, Op. Income, Net income, Diluted EPS) 2013- 2017

Table 6.58 Texas Instruments Automotive ADAS Portfolio

Table 6.59 ZF Overview (Company Revenue, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 6.60 ZF’s Financials 2013-2017 (5-year Revenue)

Table 6.61 ZF Group’s ADAS Portfolio

Table 6.62 Valeo Company Overview (Company Revenue, Revenue in the Automotive ADAS Market, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 6.63 Valeo’s Automotive ADAS Portfolio

Table 6.64 Tech Mahindra Company Overview (Company Revenue, ADAS Segment, ADAS Portfolio, HQ, Employees, Website)

Table 6.65 Tech Mahindra’s Automotive ADAS Portfolio

Table 6.66 Other Leading Companies in the Automotive ADAS Market (Company, HQ)

Table 7.1 Global Automotive ADAS Market Forecast Summary 2018, 2023, 2028 ($bn, CAGR %)

Table 7.2 Global Automotive ADAS Market Drivers & Restraints

Table 7.3 Overview of the ADAS Portfolio of the Leading 14 Car Manufacturers in 2018 (ADAS End-User Applications)

Table 7.4 Overview of the ADAS Portfolio of the Top 20 Leading ADAS Suppliers in 2018 (ADAS End-User Applications, ADAS Sensors)

Table 7.5 Global Automotive ADAS Submarkets Forecast Summary 2018, 2023, 2028 ($bn, CAGR %)

Table 7.6 Global Automotive ADAS Submarkets Rankings 2018, 2023, 2028 (Ranking, Market Share %)

Table 7.7 Leading National Automotive ADAS Markets Rankings 2018, 2023, 2028 (Ranking, Revenues $bn)

List of Figures

Figure 1.1 Segmentation of the Automotive ADAS Market

Figure 2.1 From ADAS towards Driverless Cars

Figure 2.2 ADAS & the Timeline for Autonomous Driving

Figure 2.3 Segmentation of the Automotive ADAS Market

Figure 2.4 Overview of the Automotive ADAS Market by End-User Application

Figure 2.5 Schematic of in-vehicle system Adaptive Cruise Control. Red car automatically' follows blue car

Figure 2.6 Adaptive Headlight assembly on Toyota Avalon

Figure 2.7 Blind Spot Monitor on a Volvo S80

Figure 2.8 A Driver Monitoring System display in a Lexus vehicle

Figure 2.9 Forward Collision Warning on Lincoln MKS

Figure 2.10 Heads-Up Display of a BMW E60 model

Figure 2.11 Lane Assist in VW Golf

Figure 2.12 Night Vision Assistant in an Audi A8

Figure 2.13 Parking sensor in a Audi A4 model

Figure 2.14 Sales Volume of ADAS Sensors by Category in 2016, 2017 and 2018 (Million Units)

Figure 2.15 Average Pricing of ADAS Sensors in 2018 ($)

Figure 3.1 Global Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 3.2 Global Automotive ADAS Sensors Submarket Share Forecast 2018, 2023, 2028 (%)

Figure 3.3 Global Automotive ADAS Submarket Forecasts 2018-2028 ($bn)

Figure 3.4 Global Automotive ADAS Submarket Share Forecast 2018 (%)

Figure 3.5 Global Automotive ADAS Submarket Share Forecast 2023 (%)

Figure 3.6 Global Automotive ADAS Submarket Share Forecast 2028 (%)

Figure 3.7 Adaptive Cruise Control Submarket Forecast 2018-2028 ($bn, AGR %)

Figure 3.8 Adaptive Cruise Control Regional Share Forecast 2018, 2023, 2028 (%)

Figure 3.9 Adaptive Front Lights Submarket Forecast 2018-2028 ($bn, AGR %)

Figure 3.10 Adaptive Front Lights Regional Share Forecast 2018, 2023, 2028(%)

Figure 3.11 Blind Spot Monitoring Submarket Forecast 2018-2028 ($bn, AGR %)

Figure 3.12 Blind Spot Monitoring Regional Share Forecast 2018, 2023, 2028 (%)

Figure 3.13 Driver Monitoring System Submarket Forecast 2018-2028 ($bn, AGR %)

Figure 3.14 Driver Monitoring System Regional Share Forecast 2018, 2023, 2028 (%)

Figure 3.15 Forward Collision Warning Submarket Forecast 2018-2028 ($bn, AGR %)

Figure 3.16 Forward Collision Warning Regional Share Forecast 2018, 2023, 2028 (%)

Figure 3.17 Heads Up Display Submarket Forecast 2018-2028 ($bn, AGR %)

Figure 3.18 Heads Up Display Regional Share Forecast 2018, 2023, 2028 (%)

Figure 3.19 Intelligent Speed Adaptation Submarket Forecast 2018-2028 ($bn, AGR %)

Figure 3.20 Intelligent Speed Adaptation Regional Share Forecast 2018, 2023, 2028 (%)

Figure 3.21 Lane Departure Warning Submarket Forecast 2018-2028 ($bn, AGR %)

Figure 3.22 Lane Departure Warning Regional Share Forecast 2018, 2023, 2028 (%)

Figure 3.23 Night Vision System Submarket Forecast 2018-2028 ($bn, AGR %)

Figure 3.24 Night Vision System Regional Share Forecast 2018, 2023, 2028 (%)

Figure 3.25 Park Assistance Submarket Forecast 2018-2028 ($bn, AGR %)

Figure 3.26 Park Assistance Regional Share Forecast 2018, 2023, 2028 (%)

Figure 3.27 Pedestrian Detection System Submarket Forecast 2018-2028 ($bn, AGR %)

Figure 3.28 Pedestrian Detection System Regional Share Forecast 2018, 2023, 2028 (%)

Figure 3.29 Road Sign Recognition Submarket Forecast 2018-2028 ($bn, AGR %)

Figure 3.30 Road Sign Recognition Regional Share Forecast 2018, 2023, 2028 (%)

Figure 3.31 Surround-View Cameras Submarket Forecast 2018-2028 ($bn, AGR %)

Figure 3.32 Surround-View Cameras Regional Share Forecast 2018, 2023, 2028 (%)

Figure 3.33 Autonomous Emergency Braking Submarket Forecast 2018-2028 ($bn, AGR %)

Figure 3.34 Autonomous Emergency Braking Regional Share Forecast 2018, 2023, 2028 (%)

Figure 4.1 Leading National Automotive ADAS Markets Forecasts 2018-2028 ($bn)

Figure 4.2 Leading National Automotive ADAS Market Share Forecast 2018 (%)

Figure 4.3 Leading National Automotive ADAS Market Share Forecast 2023 (%)

Figure 4.4 Leading National Automotive ADAS Market Share Forecast 2028 (%)

Figure 4.5 Regional Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.6 Regional Automotive ADAS Market Share Forecast Summary 2018, 2023, 2028 (%)

Figure 4.7 US Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.8 Canadian Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.9 Brazilian Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.10 Rest of South America Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.11 German Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.12 UK Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.13 French Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.14 Italian Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.15 Spanish Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.16 Dutch Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.17 Russian Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.18 ROE Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.19 Chinese Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.20 Japanese Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.21 Indian Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.22 South Korean Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.23 Rest of Asia/Oceania/ME Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 4.24 ROW Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 6.1 BMW Group Car Sales Overview 2013-2017 (Million Units)

Figure 6.2 Market Share in 2016 BMW Group’s Sales in Selected Regions (%)

Figure 6.3 Mercedes-Benz Car Sales’ Share Distribution in Selected Regions in 2017 (%)

Figure 6.4 Aisin’s Sales Brake-down by Product Category 2017 (%)

Figure 6.5 Aisin’s Sales Brake-down by Region 2017 (%)

Figure 6.6 Autoliv’s 2017 Sales by Segment (%)

Figure 6.7 Autoliv’s 2017 Sales by Region (%)

Figure 6.8 Bosch Group’s 2017 Sales by Region (%)

Figure 6.9 Bosch Group’s 2017 Sales by Business Segment (%)

Figure 6.10 Delphi’s 2017 Revenue by Segment (%)

Figure 6.11 Delphi’s 2017 Net Sales by Region (%)

Figure 6.12 NXP’s Net Sales by Region in 2017 (%)

Figure 6.13 NXP’s Net Sales by Product Category in 2017 (%)

Figure 6.14 Magna 2017 Sales Breakdown by Segment (%)

Figure 6.15 Takata’s 2017 Sales by Product Category (%)

Figure 6.16 Takata’s 2017 Sales by Region (%)

Figure 6.17 ZF’s Sales by Business Segment 2017 (%)

Figure 6.18 Valeo’s 2017 Revenue by Segment (%)

Figure 6.19 Tech Mahindra’s 2017 Revenue by Region (%)

Figure 7.1 Global Automotive ADAS Market Forecast 2018-2028 ($bn, AGR %)

Figure 7.2 Global Automotive ADAS Submarket Share Forecast 2018 (%)

Figure 7.3 Global Automotive ADAS Submarket Share Forecast 2023 (%)

Figure 7.4 Global Automotive ADAS Submarket Share Forecast 2028 (%)

Figure 7.5 Automotive ADAS Submarkets CAGR Rankings 2018-2028 (CAGR %)

Figure 7.6 Leading National Automotive ADAS Market Share Forecast 2018 (%)

Figure 7.7 Leading National Automotive ADAS Market Share Forecast 2023 (%)

Figure 7.8 Leading National Automotive ADAS Market Share Forecast 2028 (%)

Aisin Group

Aisin Seiki

Audi

Autoliv Inc.

Avtovaz

Axel Springer Media Entrepreneurs

BAIC Automotive Group

Becker

Beijing Automotive

BMW

Borgwarner Inc

Bosch

Brilliance

British ASL Vision

BYD Auto Co Ltd.

Changan Automobile

Chery

Clarion

CloudAtlas Electronic Equipment System Co. Ltd

Continental AG

Daimler AG

Dana Holding

Delphi

Delphi Automotive

Delphi Hyundai

Denso Corporation

Denza Shenzhen BYD Daimler New Technology Co. Ltd. (BDNT)

Diesel Song Cong One Member Limited Liability Company

Dongfeng Motor Corporation

Faurecia

FAW Group

Fiat Chrysler Automobiles (FCA)

Fiat Group Automobiles S.p.A.

Ficosa International S.A.

Ford Motor Company

Ford Vietnam Limited

Freescale

Fuji

Fujitsu Ten

GAC Group

Geely Automobile Holdings Limited

General Motors Company (GM)

Gentex Corporation

Gestamp Automoción

GKN

Gongcheng DENSO (Chongqing) Co., Ltd.

Google Inc.

Great Wall

Hafei Motor

Harman International

Hawtai

Hella Corporate Center USA, Inc

Hella KGaA Hueck & Co

Honda

Hyundai

Hyundai Mobis

IBM

Infineon Semiconductors AG

Infineon Technologies AG

International Rectifier Corp.

Isuzu

Iteris Inc

JAC Motors

Lear

Lio Ho Group

Luxoft

Magna Electronics

Magna International Inc.

Magna Steyr

Mahindra Group

Maruti Suzuki

Mazda

Mercedes-Benz

Meritor Inc.

Mitsubishi

Mobileye N.V.

Neonode Inc

Nissan Motor Company

Nissin Kogyo

NXP Semiconductors

Omron

Panasonic Corporation

Peiker

Philips & Lite-On Digital Solutions (PLDS)

Porsche

Protruly Night Vision

PSA Peugeot Citroën

Qualcomm

Renault

Renault-Nissan Alliance

Ricardo plc

Robert Bosch GmbH (Bosch)

Safran

SAIC Motor Corporation

Schrader international

Seeing Machines

Sensata

Shanghai Automotive

Shanghai General Motors Company Ltd

Smarteye AB

Sogefi Group

Ssangyong.

Subaru

ST Microelectronics

Suzuki Motor Corporation

Takata (Tianjin) Automotive Components Co. Ltd.

Takata Corporation

Takata Vehicle Safety Systems Technical Center Co. Ltd.

Tass International

Tata Motors

Tech Mahindra

Texas instruments

ThyssenKrupp AG

Tognum AG

Tokai Rika

TomTom

Toyota Motor Corporation

TRW Automotive

Valeo S.A.

Velodyne Inc.

Veyance Technologies Inc.

Volkswagen Commercial Vehicles

Volkswagen Financial Services

Volkswagen Group

Volvo Group

Voxx Electronics

VW Group

WABCO Vehicle Control Systems

Wuyang-Honda Motors (Guangzhou) Co., Ltd.

ZF Friedrichshafen

ZF Group

Zhejiang Geely Holding Group

Organisations mentioned

China NCAP

Euro NCAP

European Commission

Japan NCAP

National Highway Transportation Safety Administration (NHTSA)

Organisation Internationale des Constructeurs d'Automobiles (OICA)

RWTH Aachen University

Technology and Innovation Management Institute of RWTH Aachen University

U.S. NCAP

Download sample pages

Complete the form below to download your free sample pages for Automotive Advanced Driver Assistance Systems (ADAS) Market Report 2018-2028

Related reports

-

Commercial Aircraft NextGen Avionics Market Report 2018-2028

Are you interested or involved in the $5.6bn Commercial Aircraft NextGen Avionics market? Visiongain has produced an in depth market...

Full DetailsPublished: 06 August 2018 -

Autonomous Commercial Vessel Market Report 2019-2029

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global Autonomous commercial vessels market. Visiongain assesses...Full DetailsPublished: 29 November 2018 -

Unmanned Combat Aerial Vehicle (UCAV) Market Report 2018-2028

The global Unmanned Combat Aerial Vehicle Systems market consists of worldwide government spending on the procurement, development, and upgrades of...

Full DetailsPublished: 29 March 2018 -

Top 20 Automotive Sensor Companies 2018

Automotive Sensors, ADAS, Magnetic Automotive sensors, non-magnetic automotive sensors, Micro-electro-mechanical system (MEMS), Fuel Injector Pressure Sensor, Tire Pressure Sensor, Airbag...Full DetailsPublished: 19 October 2018 -

Military Embedded Systems Market Forecast 2018-2028

Developments in military embedded systems have had a significant impact on the embedded systems market. This market is estimated by...

Full DetailsPublished: 26 April 2018 -

Land-Based Radar System Market 2018-2028

The increasing need for surveillance to provide enhanced public safety, growing military expenditure, and technological advancements have led Visiongain to...Full DetailsPublished: 31 October 2018 -

Industrial Internet of Things (IIoT) Market Report 2018-2028

Visiongain has produced an in-Depth market research report studying the Industrial Internet of Things, analysing the rapid growth of this...

Full DetailsPublished: 01 May 2018 -

Automotive Head-Up Display (HUD) Market Analysis Report 2017-2027

The BMW launch of a new windshield head-up display has led Visiongain to publish this timey report. The $598m automotive...Full DetailsPublished: 03 May 2017 -

Top 20 Autonomous Truck Companies 2018

The growth of the autonomous truck sector is largely dependent on demonstrating the potential benefits whilst mitigating the associated costs....Full DetailsPublished: 10 October 2018 -

Biometric Vehicle Access Technologies Market Report 2019-2029

The $574.3m Biometric Vehicle Access Technologies market is expected to flourish in the next few years because of growing security...

Full DetailsPublished: 19 February 2019

Download sample pages

Complete the form below to download your free sample pages for Automotive Advanced Driver Assistance Systems (ADAS) Market Report 2018-2028

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain automotive reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and automotive industry experts but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain automotive reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

Alliance of Automobile Manufacturers (USA)

Association of Russian Automakers

Audio Video Bridging (AVB)

China Association Of Automoblie Manufacturers

European Association of Automotive Suppliers

European Automobile Manufacturers’ Association

European Council for Automotive Research and Development

Former Society of Automotive Engineers

German Association of the Automotive Industry

International Organization of Motor Vehicle Manufacturers

In-Vehicle Infotainment (IVI)

Italian Association of the Automotive Industry

Japan Automobile Manufacturers Association

One-Pair Ether-Net

Society of Indian Automobile Manufacturers (SIAM)

Society of Motor Manufacturers and Traders

The International Council For Clean Transport

US National Highway Traffic Safety Administration

Latest Automotive news

Visiongain Publishes Connected Vehicle Market Report 2024-2034

The global Connected Vehicle market was valued at US$82.67 billion in 2023 and is projected to grow at a CAGR of 14.7% during the forecast period 2024-2034.

24 April 2024

Visiongain Publishes Automotive Electronics Market Report 2024-2034

The global Automotive Electronics market was valued at US$270.7 million in 2023 and is projected to grow at a CAGR of 8.7% during the forecast period 2024-2034.

15 April 2024

Visiongain Publishes Automobile AI and Generative Design Market Report 2024-2034

The global Automobile AI and Generative Design market was valued at US$630.7 million in 2023 and is projected to grow at a CAGR of 19% during the forecast period 2024-2034.

02 April 2024

Visiongain Publishes Vehicle to Grid (V2G) Market Report 2024-2034

The global Vehicle to Grid (V2G) market was valued at US$3,391 million in 2023 and is projected to grow at a CAGR of 27.6% during the forecast period 2024-2034.

08 March 2024