• Do you need definitive automotive sensor market data?

• Succinct automotive sensor market analysis?

• Technological insight?

• Clear competitor analysis?

• Actionable business recommendations?

Read on to discover how this definitive report can transform your own research and save you time.

The emergence of autonomous and semi-autonomous vehicles and increasing research and development spending on the development of fully automated vehicles, has led Visiongain to publish this timely report. The automotive sensor market is expected to flourish in the next few years because of increasing consumer demand and acceptance of advanced technology equipped vehicles which are expected to feed through in the latter part of the decade driving growth to new heights. If you want to be part of this growing industry, then read on to discover how you can maximise your investment potential.

Report highlights

• 59 quantitative tables, charts, and graphs

• Market share analysis, revenues and competitive positioning of key players in automotive sensor technologies

• Allegro Microsystems

• Bosch

• Continental

• Delphi Automotive

• Denso Company

• Elmos Instruments

• Gentex

• Hella

• Hyundai Mobis

• Infineon Technologies

• Magna International

• NXP Semiconductors

• Panasonic Corporation

• Renesas Electronics

• Sensata

• Sony Semiconductor Solutions Corporation

• STMicroelectronics

• Texas Instruments

• TRW Automotive

• Valeo

• Global Automotive Sensor Market Outlook And Analysis 2018-2028 ($bn)

• Global Automotive Sensor Submarket Sizing 2018 (Unit volume)

• Motion Sensor

• Position Sensor

• Pressure Sensor

• Temperature Sensor

• Level Sensor

• Gas Sensor

• Torque Sensor

• Optimal Sensor

• Other Sensor

• Key questions answered

• What does the future hold for the automotive sensor industry?

• Where should you target your business strategy?

• Which applications should you focus upon?

• Which disruptive technologies should you invest in?

• Which companies should you form strategic alliances with?

• Which company is likely to success and why?

• What business models should you adopt?

• What industry trends should you be aware of?

• Target audience

• Automotive sensor specialists

• Automotive OEMs

• Component suppliers

• Electronics companies

• Software providers

• AI developers

• Technologists

• R&D staff

• Consultants

• Analysts

• CEO’s

• CIO’s

• COO’s

• Business development managers

• Investors

• Governments

• Agencies

• Industry organizations

• Banks

Visiongain is a trading partner with the US Federal Government CCR

Ref number: KD4R6

1. Report Overview

1.1. Global Automotive Sensor Market Overview

1.1.1. Automotive Sensor Market: By Technology

1.1.2. Automotive Sensor Market: By Vehicle Type

1.1.3. Automotive Sensor Market: By Type

1.1.4. Automotive Sensor Market: By Region

1.2. Why You Should Read This Report

1.3. How This Report Delivers

1.4. Key Questions Answered by This Analytical Report Include:

1.5. Who is This Report For?

1.6. Methodology

1.6.1. Primary Research 1.6.2. Secondary Research

1.6.3. Market Evaluation & Forecasting Methodology

1.7. Frequently Asked Questions (FAQ)

1.8. Associated Visiongain Reports

1.9. About Visiongain

2. Global Automotive Sensor Analysis By Technology

2.1. Introduction

3. Micro-Electro-Mechanical Systems (MEMS) Analysis

3.1. Fuel Injector Pressure Sensor

3.2. Tire Pressure Sensor

3.3. Airbag Sensor

3.4. Roll Over Detection Sensor

3.5. Vehicle Dynamic Control (VDC) Sensor

3.6. Throttle Position Sensor

4. Non-Electro-Mechanical Systems (Non-MEMS) Analysis

4.1. Non-MEMS Based Technology, Sensors and Automotive Applications

4.1.1. Magnetic Hall-Effect Technology

4.1.2. Emission Control Technology

4.1.3. Battery Sensor Technology in Start/Stop Vehicle

4.1.4. Optical Sensor Technology

4.1.5.Others

5. Automotive Sensor Market by Vehicle Type Analysis

5.1. Introduction

5.2. Conventional Fuel Cars

5.2.1. Sensors in Chassis

5.2.2. Sensors in Power Trains

5.2.3. Sensors in Body Systems

5.3. Alternative Fuel Car

5.3.1. Sensors in Chassis

5.3.2. Sensors in Power Trains

5.3.3. Sensors in Body Systems

5.4. Heavy Vehicles

5.4.1. Sensor In Trucks

5.4.2. Sensors in Off-Road vehicle

6. Global Automotive Sensor Market, By Type Analysis

6.1. Introduction

6.2. Pressure Sensor Market Analysis, 2018

6.3. Pressure Sensor Types – Chassis

6.3.1. Pressure Sensor Types - Power Train

6.3.2. Pressure Sensor Types- Body Systems

6.4. Temperature Sensor Market Analysis, 2018

6.4.1. Temperature Sensor in Chassis

6.4.2. Temperature Sensor in Power Trains

6.4.3. Temperature Sensor in Body Systems

7. Global Automotive Sensors Market & Submarket 2018

7.1. Introduction

7.1.1. Global Automotive Sensor Market 2018

7.1.1.1. Sales Volume of Automotive Sensors by Technology, 2018

8. Market Dynamics

8.1. Global Automotive Sensor Market Drivers

8.1.1. Strict Government Regulations

8.1.2. Development Of Global Auto Manufacturers Into New Emerging Market

8.1.3. Growing Demand For High And Medium End Vehicles

8.1.4. Rising Consumer Preference For Safety, Security, Comfort And Efficiency

8.1.5. Growing Content Of Sensor In An Automobile As Per Moore’s Law

8.2. Global Automotive Sensor Market Restraints

8.2.1. Underdeveloped Aftermarket Services

8.2.2. Growing Pressure Of Prices

8.3. Global Automotive Sensor Market Opportunities

8.3.1. Anticipated Future Demand For Autonomous Cars And Connected Vehicles

8.3.2. Upcoming Technologies Such As Combo Sensors

8.3.3. Growing Demand For Electro mobility

9. Top-20 Companies Positioning in the Automotive Sensor Market 2018

9.1. Ranking of the Leading 20 Companies by Revenues in the Automotive Sensor Market in 2018

9.2. What is the Level of Revenue Concentration in the Automotive Sensors Marketplace in 2017?

9.3. Bosch Company Overview

9.3.1. Bosch’s Automotive Sensor Portfolio

9.3.2. Bosch’s Future Outlook

9.4. Continental AG Company Overview

9.4.1. Continental Automotive Sensor Portfolio

9.4.2. Continental’s Future Outlook

9.5. Delphi Automotive (Aptiv PLC) Company Overview

9.5.1. Delphi Automotive Sensor Portfolio

9.5.2. Delphi’s Future Outlook

9.6. STMicroelectronics Company Overview

9.6.1. STMicroelectronics Automotive Sensor Portfolio

9.6.2. STMicroelectronics’s Future Outlook

9.7. Freescale Semiconductors/NXP Semiconductors Company Overview

9.7.1. Freescale Automotive Sensor Portfolio

9.7.2. Freescale Future Scope

9.8. Denso Company Overview

9.8.1. Denso Automotive Sensor Portfolio

9.8.2. Denso Future Outlook

9.9. Sony (Sony Semiconductor Solutions Corporation) Company Overview

9.9.1. Sony’s Automotive Sensor Portfolio

9.9.2. Sony Future Outlook

9.10. Gentex Company Overview

9.10.1. Gentex Automotive Sensor Portfolio

9.10.2. Gentex Future Outlook

9.11. Hella Company Overview

9.11.1. Hella Automotive Sensor Portfolio

9.11.2. Hella Future Outlook

9.12. Hyundai Mobis Company Overview

9.12.1. Hyundai Automotive Sensor Portfolio

9.12.2. Hyundai Future Outlook 77

9.13. Magna International Company Overview

9.13.1. Magna International Automotive Portfolio

9.13.2. Magna International Future Outlook

9.14. Panasonic Corporation Company Overview

9.14.1. Panasonic Automotive Sensor Portfolio

9.14.2. Panasonic’s Future Outlook

9.15. Renesas Electronics Corporation Company Overview

9.15.1. Renesas Automotive Sensor Portfolio

9.15.2. Renesas’s Future Outlook

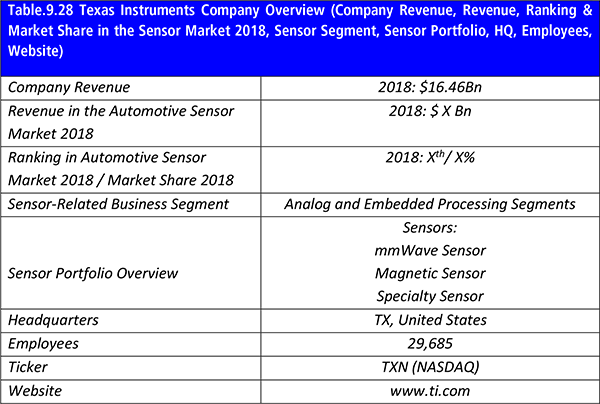

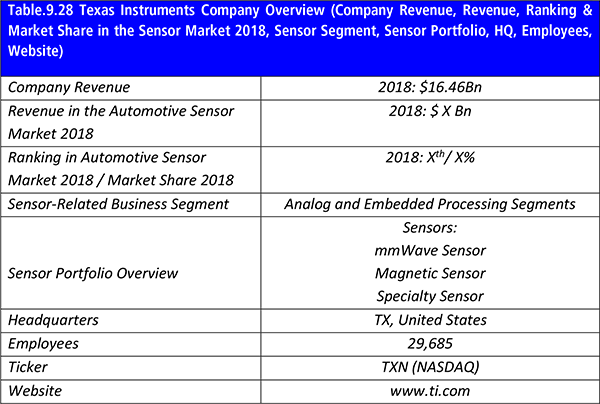

9.16. Texas Instruments Company Overview

9.16.1. Texas Instruments Automotive Sensor Portfolio

9.16.2. Texas Instruments’ Future Outlook

9.17. Elmos Instruments Company Overview

9.17.1. Elmos Automotive Sensor Portfolio

9.18. Valeo S.A Company Overview

9.18.1. Valeo Automotive Sensor Portfolio

9.18.2. Valeo Future Outlook

9.19. Allegro Microsystems Company Overview

9.19.1. Allegro Microsystems Automotive Sensor Portfolio

9.19.2. Allegro Microsystems Future Outlook

9.20. TRW Automotive Company Overview

9.20.1. TRW’s Automotive Sensor Portfolio

9.20.2. TRW’s Future Outlook

9.21. Infineon Technologies Company Overview

9.21.1. Infineon Technologies Automotive Sensor Portfolio

9.21.2. Infineon Technologies Future Outlook

9.22. Sensata Technologies Company Overview

9.22.1. Sensata Automotive Sensor Portfolio

9.22.2. Sensata Future Outlook

10. Glossary

List of Tables

Table 1.1 Overview of the 20 Automotive Sensors Suppliers Analysed

Table 7.1 Market Value of the Top 20 Automotive Sensor Companies - Global Automotive Sensors Market 2018 ($bn, AGR%, CAGR%)

Table 9.1 20 Leading Suppliers Revenues in the Automotive Sensor Market in 2018, Market Share (%)($, bn)

Table .9.2 Bosch Company Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table 9.3 Bosch’s Automotive SENSOR Portfolio

Table.9.4 Continental AG Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Ticker, Employees, Website)

Table 9.5 Continental Automotive SENSOR Portfolio

Table.9.6 Delphi Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Ticker, Employees, Website)

Table.9.7 Delphi’s Automotive Sensor Portfolio

Table.9.8 STMicroelectronics Overview (Company Revenue, Revenue, Ranking & Market Share in the Automotive Sensors Market 2018, Automotive Sensors Segment, Automotive Sensors Portfolio, HQ, Ticker, Employees, Website)

Table.9.9 STMicroelectronics Automotive SENSOR Portfolio

Table.9.10 Freescale Company Overview (Company Revenue, Revenue, Ranking & Market Share in the Automotive Sensors Market 2018, Automotive Sensors Segment, Automotive Sensors Portfolio, HQ, Employees, Website)

Table.9.11 Freescale Automotive SENSOR Portfolio

Table.9.12 Denso Company Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table.9.13 Denso Automotive Sensor Portfolio

Table.9.14 Sony Company Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table.9.15 Sony Corporation SENSOR Portfolio

Table.9.16 Gentex Company Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ,Ticker, Website)

Table 9.17 Gentex’s Automotive Sensors Portfolio

Table.9.18 Hella Company Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table.9.19 Hella’s Automotive Sensor Portfolio

Table.9.20 Hyundai Mobis Company Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Ticker, Website)

Table.9.21 Hyundai Automotive Sensor Portfolio

Table.9.22 Magna Company Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table.9.23 Magna’s Automotive Sensor Portfolio

Table.9.24 Panasonic Company Overview (Company Revenue, Revenue, Ranking & Market Share in the Automotive Sensors Market 2018, sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table.9.25 Panasonic Automotive Sensor Portfolio

Table.9.26 Renesas Company Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table.9.27 Renesas Automotive Sensor Portfolio

Table.9.28 Texas Instruments Company Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table.9.29 Texas’s Automotive Sensor Portfolio

Table.9.30 Elmos Instruments Company Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table.9.31 Elmos Automotive Sensor Portfolio

Table.9.32 Valeo Company Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table.9.33 Valeo’s Automotive Sensors Portfolio

Table.9.34 Allegro Overview 2017 (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Ticker, Contact, Employees, Website)

Table.9.35 Allegro’s Automotive SENSOR Portfolio

Table.9.36 TRW Automotive Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table.9.37 TRW Automotive’s Sensor Portfolio

Table.9.38 Infineon Technologies Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table.9.39 Infineon’s Automotive SENSOR Portfolio

Table.9.40 Sensata Technologies Overview (Company Revenue, Revenue, Ranking & Market Share in the Sensor Market 2018, Sensor Segment, Sensor Portfolio, HQ, Employees, Website)

Table.9.41 Sensata’s Automotive SENSOR Portfolio

List of Figures

Figure 2.1 Automotive Sensor by Technology

Figure 5.1 Automotive Vehicle Type

Figure 5.2 Chassis Of An Electric Vehicle

Figure 6.1 Pressure Sensor and Automotive Applications

Figure 6.2 Types of Chassis Pressure sensors

Figure 6.3 Types of Power Train Pressure Sensors

Figure 6.4 Types of Power Train Pressure Sensors for Body Systems

Figure 6.5 Pressure Sensor Percentage Break Up: By Functional Application

Figure 6.6 Key Applications of Automotive Temperature Sensors

Figure 6.7 Power Train Temperature Sensor

Figure 6.8 Body System Temperature Sensor end Application point

Figure 7.1 Market Value of the Top 20 Automotive Sensor Companies - Global Automotive Sensors Market 2018 ($bn)

Figure 7.2 Sales Volume of Automotive Sensors by Category in 2018 (Billion Units)

Figure 9.1: Market Share of the 20 Leading Suppliers by Revenues in the Automotive Sensor Market in 2018 ($bn)

Figure 9.2 Ranking of the 20 Leading Suppliers by Revenues in the Automotive Sensor Market in 2018 ($bn)

Figure 9.3 Allocation of Market Shares in the Top-20 ADAS Ranking (%, Top 5, Top 6-10, Top 11-15, Top 16-20, Other)

AB SKF, Automotive & Aerospace

Akebono Brake Industry Co. .

Alibaba Group

Allegro Microsystems

Alpine Electronics Inc.

American Axle & Mfg. Holdings Inc.

American Sensor Technologies

Analog Devices

Anfield Sensors Inc.

Apple

Asahi Glass Co.

Autoneum

BASF SE

BEI Sensors

BMW

BorgWarner Inc.

Bosch Company

Bosch Sensortec

Bourns Inc.

Bridgewater Interiors

Brose Fahrzeugteile GmbH

CalsonicKansei Corp.

Chrysler

CIE Automotive SA

CITIC Dicastal Co.

Continental AG

Continental Automotive

Continental Corporation

Cooper-Standard Automotive

CTS Corporation

Cummins Inc. .

Dana Holding Corp.

Delphi

Delphi Automotive

Denso Corporation

Dow Automotive

Draexlmaier Group

DuPont

Dura Automotive Systems

Eberspaecher Gruppe GmbH

Elmos

Epson Corporation

Faurecia

Federal-Mogul Corp.

Flex

Flex-N-Gate Corp.

Ford

Freescale Semiconductors

F-Tech Inc.

GE

Gentex Corporation

Gestamp

Gill Sensors

GKN

GM

Goodyear Tire & Rubber Co.

Google

Grupo Antolin

HELLA KGaA Hueck & Co.

Hitachi Automotive Systems

Honeywell

Hyundai

Hyundai Dymos Inc.

Hyundai Mobis

Hyundai Powertech Co.

Hyundai-WIA Corp.

IAC Group

Ibeo

Infineon Technologies AG

Innoviz

Intel

Inteva Products

JATCO

Johnson Controls Inc.

JTEKT Corp.

Kautex Textron GmbH

Keihin Corp.

Key Safety Systems Inc.

Koito Manufacturing

Kona Samsung

KSPG AG

Lear Corp.

Leoni AG

Leopold Kostal GmbH und Co.

Linamar Corp.

Magna International Inc

Mahle GmbH

Mando Corporation

Martinrea International Inc.

Measurement Specialties

Meder Electronics

Melexis Semiconductors

Mercedes-Benz

Metaldyne Performance Group Inc.

Michelin Group

Micronas

Mitsuba Corporation

Mitsubishi Electric Corporation

Mobileye

Murata

MW

Nemak

Nexteer Automotive

NGK Spark Plug Ltd.

NHK Spring Co.

Nissan

Nissin Kogyo Co.

Nokia Network

Novelis Inc.

NSK

NTN Corporation

NTT Docomo

NXP

Oxford YASA Motors

Panasonic Corporation

Piher Sensors & Controls S.A.

Pioneer Corporation

Plastic Omnium Co.

Renesas Electronics

Robert Bosch GmbH

Ryobi

Salutica Allied Solutions Sdn. Bhd

Samvardhana Motherson Group

Schaeffler AG

Schott

Schrader International Inc. (US)

Sensata Technologies Holding N.V

Sensirion

Sensor Technology Limited

Showa Corporation

Sony Corporation

Sony Semiconductor Solutions Corporation

ST Microelectronics

Sumitomo Electric Industries

Sumitomo Riko Co.

Takata Corporation

TDK Corporation

Tenneco Inc.

Tesla

Texas Instruments

Thyssenkrupp AG

Tower International

Toyoda Gosei Co.

Toyota

Toyota Boshoku Corporation

TRW Automotive

TS Tech Co.

U-Shin

Valeo SA

Vibracoustic GmbH

Visteon Corporation

Volkswagen

Webasto SE

Yanfeng Automotive Trim Systems Co.

Yazaki Corp.

YURA TechCo., Ltd

ZF

ZTE

Zukunft Ventures GmbH

Organisations mentioned

California Air Resources Board (CARB)

Euro NCAP

European Bank for Reconstruction and Development (EBRD)

European Commission

Eurostat

Organization for Economic Co- Operation and Development (OECD)

Oxford University's Energy and Power Group

U.S. Central Intelligence Agency (CIA)

U.S. Environment Protection Agency (EPA)

World Bank