Industries > Automotive > Connected Car Market Report 2019-2029

Connected Car Market Report 2019-2029

Forecasts for In-Vehicle (IN-V) Telematics by Type of Connectivity (Embedded, Integrated, Tethered), by Service Provider (OEM, Aftermarket, Connectivity) Plus Analysis of Top Automotive OEMs & Other Technology Companies & Suppliers Providing Solutions for Communication, Safety & Security in the Internet of Things (IoT) Ecosystem

The latest report from business intelligence provider Visiongain offers comprehensive analysis of the global connected car market. Visiongain assesses that the connected car market will reach $42.99bn in 2019.

Now: “Mircon partners BMW to expand in the autonomous and connected vehicle market.” This is an example of the business critical headline that you need to know about – and more importantly, you need to read Visiongain’s objective analysis of how this will impact your company and the industry more broadly. How are you and your company reacting to this news? Are you sufficiently informed?

How this report will benefit you

Read on to discover how you can exploit the future business opportunities emerging in this sector. Visiongain’s new study tells you and tells you NOW.

In this brand new report you find 163 in-depth tables, charts and graphs all unavailable elsewhere.

The 235 page report provides clear detailed insight into the global connected cars market. Discover the key drivers and challenges affecting the market.

By ordering and reading our brand new report today you stay better informed and ready to act.

Report Scope

• Global connected cars market forecasts from 2019-2029 (Market Value $)

• Regional connected cars market forecasts from 2019-2029 (Market Value $)

• North America Forecast 2019-2029

• US Connected Car Forecast 2019-2029

• Canada Connected Car Forecast 2019-2029

• Mexico Connected Car Forecast 2019-2029

• Asia-Pacific Forecast 2019-2029

• China Connected Car Forecast 2019-2029

• Australia Connected Car Forecast 2019-2029

• Indonesia Connected Car Forecast 2019-2029

• India Connected Car Forecast 2019-2029

• Japan Connected Car Forecast 2019-2029

• South Korea Connected Car Forecast 2019-2029

• Others Connected Car Forecast 2019-2029

• Central & South America Forecast 2019-2029

• Brazil Connected Car Forecast 2019-2029

• Argentina Connected Car Forecast 2019-2029

• Others Connected Car Forecast 2019-2029

• Europe Forecast 2019-2029

• UK Connected Car Forecast 2019-2029

• Germany Connected Car Forecast 2019-2029

• France Connected Car Forecast 2019-2029

• Italy Connected Car Forecast 2019-2029

• Spain Connected Car Forecast 2019-2029

• Russia Connected Car Forecast 2019-2029

• Others Connected Car Forecast 2019-2029

• Middle East and North Africa (MENA) Forecast 2019-2029

• Analysis of the key factors driving growth in the global, regional and country level connected cars markets from 2019-2029

• Connected Cars Submarket Forecasts By Type of Connectivity From 2019-2029 (Market Value $ And Unit Shipments)

• Embedded Solutions Forecast 2019-2029

• Integrated Solutions Forecast 2019-2029

• Tethered Solutions Forecast 2019-2029

• Connected Cars Submarket Forecasts By Service Provider From 2019-2029 (Market Value $)

• OEM Hardware Forecast 2019-2029

• Aftermarket Hardware Forecast 2019-2029

• Connectivity Hardware Forecast 2019-2029

Profiles of the leading 31 connected car vendors

• Airbiquity

• Apple Inc.

• AT&T

• Automatic Labs

• BMW AG

• Broadcom

• Fiat Chrysler Automobiles N.V.

• Daimler

• Ford

• General Motors (GM

• Honda Motor Co., Ltd.

• Hyundai Motor

• Intelligent Mechatronic Systems (IMS)

• Octo Telematics

• OnStar

• Qualcomm

• Samsung

• Sierra Wireless Inc.

• Tech Mahindra

• Telefonica

• Tesla Motors

• TomTom

• Toyota

• Verizon Telematics

• Vinli

• Visteon Corporation

• Volkswagen Group (VW)

• Volvo Car Corporation

• WirelessCar

• Zendrive

• Zubie

How will you benefit from this report?

• Keep your knowledge base up to speed. Don’t get left behind

• Reinforce your strategic decision-making with definitive and reliable market data

• Learn how to exploit new technological trends

• Realise your company’s full potential within the market

• Understand the competitive landscape and identify potential new business opportunities & partnerships

Who should read this report?

• Connected car specialists

• Companies with the automotive IoT value chain

• Automotive OEMs

• Telematics providers

• Component suppliers

• Software developers

• Cyber security specialists

• Telecommunications vendors

• Internet of things companies

• Infrastructure developers

• R&D staff

• Technologists

• Senior executives

• Business development managers

• Marketing managers

• Market analysts

• Consultants

• Investors

• Banks

• Government agencies

• Regulators

• Industry associations

Visiongain’s study is intended for anyone requiring commercial analyses for the automotive market and leading companies. You find data, trends and predictions.

Buy our report today Connected Car Market Report 2019-2029. Avoid missing out by staying informed – get our report now.

Visiongain is a trading partner with the US Federal Government

CCR Ref number: KD4R6

1. Report Overview

1.1 Global Connected Car Market Overview

1.2 Why You Should Read This Report

1.3 How this Report Delivers

1.4 Key Questions Answered by This Analytical Report Include:

1.5 Who is This Report For?

1.6 Methodology

1.6.1 Primary Research

1.6.2 Secondary Research

1.6.3 Market Evaluation & Forecasting Methodology

1.7 Frequently Asked Questions (FAQ)

1.8 Associated Visiongain Reports

1.9 About Visiongain

2. Introduction to the Connected Car Market

2.1 Connected Car Market Structure

2.1.1 Connected Car Market Forecast Breakdown

2.2 Connected Car Market Segmentation

2.2.1 Connected Car Market Segmentation Overview-By Type of Connectivity

2.2.1.1 Embedded Solutions Submarket

2.2.1.2 Integrated Solutions Submarket

2.2.1.3 Tethered Solutions Submarket

2.2.2 Connected Car Market Segmentation Overview - By Service Provider

2.2.2.1 Original Equipment Manufacturer (OEM) Hardware Submarket

2.2.2.2 Aftermarket Hardware Submarket

2.2.2.3 Connectivity Hardware Submarket

3. Connected Car Market Overview

3.1 Global Connected Car Market By Technology Type

3.1.1 Introduction

3.1.2 4G/LTE

3.1.3 5G

3.2 Connected Car Technology Applications

3.2.1 Introduction

3.2.2 Navigation

3.2.3 Telematics

3.2.4 Infotainment

3.3 Global Connected Car Market Impactful Factors

3.4 Global Connected Car Market Buyers and Suppliers Positions

3.5 Global Connected Car Market Value Chain Analysis

4. Global & Regional Connected Car Market Forecast 2019-2029

4.1 Global Connected Car Market by Regional Market Share Forecast 2019-2029

4.2 North American Automotive Connected Car Market Forecast 2019-2029

4.2.1 Higher Adoption of New Technology Will Drive the Demand In North American Connected Car Market

4.2.2 North American Connected Car Market Drivers & Restraints

4.3 Central & South America Automotive Connected Car Market Forecast 2019-2029

4.3.1 Government Regulations to Affect Brazilian Market for Connected Cars

4.3.2 Central & South America Connected Car Market Drivers & Restraints

4.4 Asia Pacific Automotive Connected Car Market Forecast 2019-2029

4.4.1 Emerging Markets Will Offer New Opportunities

4.4.2 Asia Pacific Connected Car Market Drivers & Restraints

4.5 Europe Automotive Connected Car Market Forecast 2019-2029

4.5.1 Europe Estimated to Lead the Connected Car Market by 2027

4.5.2 Europe Connected Car Market Drivers & Restraints

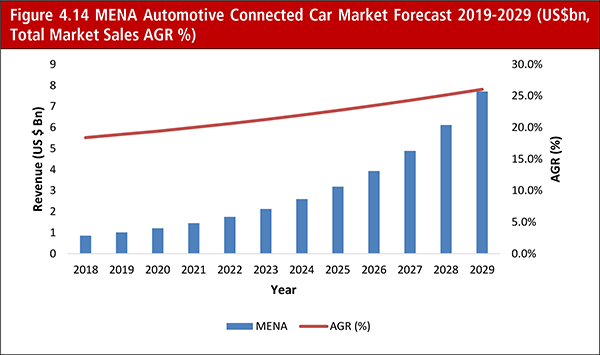

4.6 MENA Automotive Connected Car Market Forecast 2019-2029

4.6.1 Increased Focus on Middle East Market

4.6.2 MENA Connected Car Market Drivers & Restraints

5. Connected Car Submarket Forecast 2019-2029

5.1 Global Connected Car Market Overview

5.1.1 Government Regulations Fuel Growth in the Global Connected Car Market

5.1.2 Discover the Constraints of the Global Connected Car Market

5.2 Global Connected Car Submarket Size Forecast 2019-2029 by Service Provider

5.2.1 OEM Hardware Submarket Forecast 2019-2029

5.2.2 Aftermarket Hardware Submarket Forecast 2019-2029

5.2.3 Connectivity Hardware Submarket Forecast 2019-2029

5.3 Global Connected Car Submarket Size Forecast 2019-2029 by Type of Connectivity

5.3.1 Embedded Solutions Submarket Forecast 2019-2029

5.3.2 Integrated Solutions Submarket Forecast 2019-2029

5.3.3 Tethered Solutions Submarket Forecast 2019-2029

5.4 Global Connected Car Shipments Forecast by Type of Connectivity

6. SWOT Analysis of the Connected Car Market

6.1 SWOT Analysis of the Connected Car By Type of Connectivity

6.1.1 SWOT Analysis of the Embedded Solutions Submarket

6.1.2 SWOT Analysis of the Integrated Solutions Submarket

6.1.3 SWOT Analysis of the Tethered Solutions Submarket

6.2 SWOT Analysis for the Connected Car By Service Provider

6.2.1 SWOT Analysis for the OEM Hardware Submarket

6.2.2 SWOT Analysis for the Aftermarket Hardware Submarket

6.2.3 SWOT Analysis for the Connectivity Hardware Submarket

7. Leading Companies in the Connected Car Market

7.1 Airbiquity Overview

7.1.1 Airbiquity’s Role in the Connected Car Market

7.1.2 Airbiquity’s Key Developments in 2014-2016

7.1.3 Airbiquity’s Future Outlook

7.2 Apple Inc. Overview

7.2.1 Apple Inc. Total Company Sales 2012-2017

7.2.2 Apple CarPlay – A Move Towards the BYOD Connected Car Market

7.2.3 Apple to Take Automotive OS Market Share

7.3 AT&T Overview

7.3.1 AT&T Inc. Total Company Sales 2013-2017

7.3.2 AT&T Inc. Sales by Segment of Business 2017

7.3.3 AT&T Inc. Products / Services

7.3.4 AT&T Inc. Analysis

7.3.5 AT&T Outlook

7.4 Automatic Labs Company Overview

7.4.1 Automatic Labs’ Role in the Connected Car Market

7.4.2 Automatic Labs’ Future Outlook

7.5 BMW AG Overview

7.5.1 BMW AG Total Company Sales 2013-2017

7.5.2 BMW AG Sales by Segment of Business 2017

7.5.3 BMW AG Regional Emphasis / Focus

7.5.4 BMW’s Role in the Connected Car Market

7.5.5 BMW ConnectedDrive & BMW Assist

7.5.6 How Does ConnectedDrive Work?

7.5.7 BMW’s Key Developments

7.5.8 BMW’s Future Outlook

7.5.9 BMW’s Plans for Data Connection and LTE Expansion in its Models

7.6 Broadcom Overview

7.6.1 Broadcom Limited Total Company Sales 2012-2017

7.6.2 Broadcom Limited Sales by Segment of Business 2017

7.6.3 Broadcom Limited Regional Emphasis / Focus

7.6.4 Broadcom’s Role in the Connected Car Market

7.6.5 Broadcom Acquired by Avago Technologies

7.6.6 Broadcom and the OPEN Automotive Ethernet Alliance

7.6.7 Broadcom and the AVnu Alliance

7.7 Fiat Chrysler Automobiles N.V. Overview

7.7.1 FCA NV Total Company Sales 2013-2017

7.7.2 FCA NV Regional Emphasis / Focus

7.7.3 Chrysler’s Role in the Connected Car Market

7.7.4 How Uconnect Access Works

7.7.5 How Uconnect via Mobile Works

7.7.6 Chrysler’s Future Outlook – Chrysler’s Merger with FIAT and NYSE Debut

7.8 Daimler Overview

7.8.1 Daimler AG Total Company Sales 2012-2017

7.8.2 Daimler AG Sales by Segment of Business 2017

7.8.3 Daimler AG Regional Emphasis / Focus

7.8.4 Daimler’s Role in the Connected Car Market

7.8.5 Mercedes-Benz mbrace Overview

7.8.6 Mercedes-Benz’s mbrace mobile app

7.8.7 Daimler’s Future Outlook

7.8.8 Mercedes-Benz and the V2V, V2X Technology

7.9 Ford Overview

7.9.1 Ford Motor Company Total Company Sales 2012-2017

7.9.2 Ford Motor Company Sales by Segment of Business 2017

7.9.3 Ford Motor Company Products / Services

7.9.4 Ford Motor Company Analysis

7.9.5 Ford’s Role in the Connected Car Market

7.9.6 Ford Sync Overview

7.9.7 How Does Ford Sync Work?

7.9.8 Sync AppLink

7.9.9 Ford’s Future Outlook

7.10 General Motors (GM) Overview

7.10.1 General Motors Products / Services

7.10.2 General Motors Analysis

7.10.3 GM’s Role in the Connected Car Market

7.10.4 GM’s Future Outlook

7.11 Honda Overview

7.11.1 Honda Motor Co., Ltd. Total Company Sales 2012-2017

7.11.2 Honda Motor Co., Ltd. Sales by Segment of Business 2017

7.11.3 Honda Motor Co., Ltd. Regional Emphasis / Focus

7.11.4 Honda’s Role in the Connected Car Market

7.11.5 HondaLink Features and Applications

7.11.6 Honda’s Future Outlook

7.12 Hyundai Motor Overview

7.12.1 Hyundai Motor’s Role in the Connected Car Market

7.12.2 Hyundai Motor’s Future Outlook

7.13 Intelligent Mechatronic Systems (IMS) Overview

7.13.1 IMS’ Role in the Connected Car Market

7.13.2 IMS’ Future Outlook

7.14 Octo Telematics Overview

7.14.1 Octo Telematics’ Role in the Connected Car

7.14.2 Octo Telematics’ Future Outlook

7.15 OnStar Overview

7.15.1 OnStar’s Role in the Connected Car Market

7.15.2 OnStar’s Partnership With Insurance Companies

7.15.3 OnStar’s Partnerships with Retailers

7.15.4 OnStar Telematics System Overview

7.15.5 OnStar’s Future Outlook

7.16 Qualcomm Overview

7.16.1 Qualcomm Inc. Total Company Sales 2015-2017

7.16.2 Qualcomm Inc. Sales by Segment of Business 2017

7.16.3 Qualcomm Inc. Regional Emphasis / Focus

7.16.4 Qualcomm Inc. Products / Services

7.16.5 Qualcomm Inc. Analysis

7.16.6 Qualcomm’s Role in the Connected Car Market

7.16.7 Qualcomm Telematics System Overview

7.16.8 Qualcomm’s Automotive Technologies

7.16.9 Qualcomm’s Future Outlook

7.17 Samsung

7.17.1 Samsung Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

7.17.2 Samsung Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

7.17.3 Samsung Connected Car Offerings

7.17.4 Samsung Developments

7.17.5 Samsung Analysis

7.18 Sierra Wireless Overview

7.18.1 Sierra Wireless, Inc. Total Company Sales 2015-2017

7.18.2 Sierra Wireless, Inc. Sales by Segment of Business 2017

7.18.3 Sierra Wireless, Inc. Regional Emphasis / Focus

7.18.4 Sierra Wireless’ Role in the Connected Car Market

7.18.5 Sierra Wireless’ Future Outlook

7.19 Tech Mahindra Overview

7.19.1 Tech Mahindra Limited Regional Emphasis / Focus

7.19.2 Tech Mahindra’s Role in the Connected Car Market

7.19.3 Tech Mahindra’s Future Outlook

7.20 Telefonica Overview

7.20.1 Telefonica Total Company Sales 2015-2017

7.20.2 Telefonica’s Role in the Connected Car Market

7.21 Tesla Motors Overview

7.21.1 Tesla Inc. Total Company Sales 2015-2017

7.21.2 Tesla Inc. Sales by Segment of Business 2017

7.21.3 Tesla Inc. Regional Emphasis / Focus

7.21.4 Tesla Motors’s Role in the Connected Car Market

7.22 TomTom Overview

7.22.1 TomTom NV Total Company Sales 2015-2017

7.22.2 TomTom NV Sales by Segment of Business 2017

7.22.3 TomTom NV Regional Emphasis / Focus

7.22.4 TomTom NV Products / Services

7.22.5 TomTom NV Analysis

7.22.6 TomTom’s Role in the Connected Car Market

7.23 Toyota Overview

7.23.1 Toyota Motor Corporation Total Company Sales 2016-2018

7.23.2 Toyota Motor Corporation Sales by Segment of Business 2018

7.23.3 Toyota Motor Corporation Regional Emphasis / Focus

7.23.4 Toyota’s Role in the Connected Car Market

7.23.5 Toyota Entune

7.23.6 How Does Toyota Entune Work?

7.23.7 Toyota Safety Connect

7.23.8 Toyota’s Future Outlook

7.24 Verizon Telematics Overview

7.24.1 Verizon Telematics’ Role in the Connected Car Market

7.24.2 Verizon’s Manufacturer Services

7.24.3 Verizon Aftermarket Telematics: The In-Drive System

7.24.4 Verizon Hum

7.24.5 Verizon Telematics’ New Service – ‘Vehicle’

7.24.6 Verizon Telematics’ Future Outlook

7.25 Vinli Overview

7.25.1 Vinli’s Role in the Connected Car

7.25.2 Vinli’s Future Outlook

7.26 Visteon Corporation

7.26.1 Visteon Corporation Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

7.26.2 Visteon Corporation Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

7.26.3 Visteon Corporation Recent Developments

7.26.4 Visteon Corporation Analysis

7.27 Volkswagen Group (VW) Overview

7.27.1 Volkswagen AG Total Company Sales 2015-2017

7.27.2 Volkswagen AG Sales by Segment of Business 2017

7.27.3 Volkswagen’s Role in the Connected Car Market

7.27.4 Volkswagen’s role across its Car Brands

7.27.5 Volkswagen’s Future Outlook

7.28 Volvo Car Corporation Overview

7.28.1 Volvo Car Corporation Total Company Sales 2014-2017

7.28.2 Volvo Car Corporation’s role in the Connected Car

7.28.3 Volvo Car Corporation’s Future Outlook

7.29 WirelessCar Overview

7.29.1 WirelessCar’s Role in the Connected Car Market

7.29.2 WirelessCar’s Reference Customers

7.29.3 WirelessCar’s Future Outlook

7.30 Zendrive Company Overview

7.30.1 Zendrive’s Future Outlook

7.31 Zubie Company Overview

7.31.1 Zubie’s Role in the Connected Car

7.31.2 Zubie’s Future Outlook

8. Conclusion & Recommendations

9. Glossary

List of Tables

Table 4.1 Regional Connected Car Market Forecast 2019-2029 (US$bn, Global AGR %, Cumulative)

Table 4.2 Global Connected Car Submarket by Regional Market CAGR Forecast 2019-2024, 2024-2029, 2019-2029 (CAGR %)

Table 4.3 North America Automotive Connected Car Market by National Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 4.4 North American Connected Car Market Drivers & Restraints 2018

Table 4.5 Central & South America Automotive Connected Car Market by National Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 4.6 Central & South American Connected Car Market Drivers & Restraints 2018

Table 4.7 Asia Pacific Automotive Connected Car Market by National Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 4.8 Asia Pacific Connected Car Market Drivers & Restraints 2019

Table 4.9 Europe Automotive Connected Car Market by National Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 4.10 Europe Connected Car Market Drivers & Restraints 2019

Table 4.11 MENA Automotive Connected Car Market by National Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 4.12 MENA Connected Car Market Drivers & Restraints 2019

Table 5.1 Automotive Connected Car Market by Type of Connectivity Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 5.2 OEM Hardware Market Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 5.3 OEM Hardware Submarket Drivers & Restraints

Table 5.4 Aftermarket Hardware Market Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 5.5 Aftermarket Hardware Submarket Drivers & Restraints

Table 5.6 Connectivity Hardware Market Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 5.7 Connectivity Hardware Solutions Submarket Drivers & Restraints

Table 5.8 Automotive Connected Car Market by Type of Connectivity Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 5.9 Embedded Solutions Market Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 5.10 Embedded Solutions Submarket Drivers & Restraints

Table 5.11 Integrated Solutions Market Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 5.12 Integrated Solutions Submarket Drivers & Restraints

Table 5.13 Tethered Solutions Market Forecast 2019-2029 (US$bn, AGR %, CAGR %, Cumulative)

Table 5.14 Tethered Solutions Submarket Drivers & Restraints

Table 5.15 Automotive Connected Car Shipments by Type of Connectivity Forecast 2019-2029 (Million units, AGR %, CAGR %)

Table 6.1 SWOT Analysis of the Embedded Solutions Submarket 2019-2029

Table 6.2 SWOT Analysis of the Integrated Solutions Submarket 2019-2029

Table 6.3 SWOT Analysis of the Tethered Solutions Submarket 2019-2029

Table 6.4 SWOT Analysis of the OEM Hardware Submarket 2019-2029

Table 6.5 SWOT Analysis of the Aftermarket Hardware Submarket 2019-2029

Table 6.6 SWOT Analysis of the Connectivity Hardware Submarket 2019-2029

Table 7.1 Airbiquity Inc. Profile 2018 (CEO, Strongest Business Region, Business Segment in the Market, Submarket Involvement, HQ, Founded, No. of Employees, Website)

Table 7.2 Airbiquity Inc. Last 5 Key Developments

Table 7.3 Apple Overview 2017 (Total Revenue, Telematics System, HQ, Ticker, Website)

Table 7.4 Apple Inc. Total Company Sales 2012-2017 (US$m, AGR %)

Table 7.5 AT&T Inc. Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 7.6 AT&T Inc. Total Company Sales 2013-2017 (US$m, AGR %)

Table 7.7 AT&T Inc. Products / Services (Segment of Business, Product, Sub-Product)

Table 7.8 Automatic Labs Profile 2018 (CEO, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 7.9 BMW AG Profile 2019 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 7.10 BMW AG Total Company Sales 2013-2017 (US$m, AGR %)

Table 7.11 BMW ConnectedDrive Overview 2015 (Launch, Connectivity Category, Subscription fee, Website)

Table 7.12 Broadcom Limited Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, Website)

Table 7.13 Broadcom Limited Total Company Sales 2012-2017 (US$m, AGR %)

Table 7.14 FCA NV Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, Website)

Table 7.15 FCA NV Total Company Sales 2013-2017 (US$m, AGR %)

Table 7.16 Daimler AG Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, Website)

Table 7.17 Daimler AG Total Company Sales 2012-2017 (US$m, AGR %)

Table 7.18 Mercedes-Benz mbrace Overview 2017 (Launch, Connectivity Category, Subscription fee, Website)

Table 7.19 Ford Motor Company Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 7.20 Ford Motor Company Total Company Sales 2012-2017 (US$m, AGR %)

Table 7.21 Ford Motor Company Products / Services (Segment of Business, Product, Sub-Product)

Table 7.22 General Motors Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 7.23 GM’s Financials 2011-2017 (6-Year Revenue, Gross Profit, Operating Income, Net Income, Diluted EPS), (In $Million Apart from EPS)

Table 7.24 General Motors Products / Services (Technology, Services)

Table 7.25 Honda Motor Co., Ltd. Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, Website, Ticker)

Table 7.26 Honda Motor Co., Ltd. Total Company Sales 2012-2017 (US$m, AGR %)

Table 7.27 Hyundai Motor Company Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, Website, Ticker)

Table 7.28 Hyundai Motor Company Total Company Sales 2012-2017 (US$m, AGR %)

Table 7.29 Intelligent Mechatronic Systems Inc. Profile 2018 (CEO, Submarket Involvement, HQ, Founded Year, Website)

Table 7.30 Octo Telematics S.p.A. Profile 2015 (CEO, Total Company Sales US$m, Net Income Profit/Loss US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, Website)

Table 7.31 OnStar Company Overview 2018 (HQ, Ticker, Contact, Website)

Table 7.32 OnStar Telematics System Overview 2017 (Launch year, Company description, Connectivity type, Subscription fee, No. Of Subscribers, Website)

Table 7.33 Qualcomm Inc. Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 7.34 Qualcomm Inc. Products / Services (Segment of Business and Product)

Table 7.35 Qualcomm Telematics System Overview 2017 (Telematics Product, Launch

Table 7.36 Samsung Electronics Co., Ltd. Profile (Established, HQ, Revenues ($m), R&D Spending ($m), Employees, CEO, Ownership, Website)

Table 7.37 Sierra Wireless, Inc. Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, Website, Ticker)

Table 7.38 Tech Mahindra Limited Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, Website, Ticker)

Table 7.39 Telefonica Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, HQ, Founded, Website, Ticker)

Table 7.40 Tesla Inc. Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, Website, Ticker)

Table 7.41 TomTom NV Profile 2017 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 7.42 TomTom NV Products / Services (Segment of Business, Product, Sub-Product)

Table 7.43 Toyota Motor Corporation Profile 2018 (CEO, Total Company Sales US$m, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, Website, Ticker)

Table 7.44 Verizon Telematics, Inc. Profile 2012 (CEO, Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, Website)

Table 7.45 Vinli Inc. Profile (CEO, Strongest Business Region, Submarket Involvement, HQ, Founded, Website)

Table 7.46 Visteon Corporation Profile (Established, HQ, Revenues ($m), R&D Spending ($m), CEO, Ownership, Website)

Table 7.47 Volkswagen AG Profile 2018 (CEO, Total Company Sales US$m, Net Income / Loss (US$m), Strongest Business Region, Submarket Involvement, HQ, Founded, No. of Employees, Website, Ticker)

Table 7.48 Volvo Car Corporation Profile 2017 (CEO, Total Company Sales US$m, Net Income / Loss (US$m), Submarket Involvement, HQ, Founded, No. of Employees, Website, Ticker)

Table 7.49 Volvo Car Corporation Total Company Sales 2014-2017 (US$m, AGR %)

Table 7.50 WirelessCar Company Overview 2018 (Service Provider, HQ, Contact, Website)

Table 7.51 Zendrive Company Overview 2018 (Connectivity Type, HQ, Website)

Table 7.52 Zubie Company Overview 2018 (Connectivity Type, HQ, Website)

List of Figures

Figure 2.1 Connected Car Market Ecosystem

Figure 2.2 Connected Car Market

Figure 2.3 Connected Car Market Forecast Breakdown

Figure 2.4 Global Connected Car Market Structure Overview by Type of Connectivity

Figure 2.5 Global Connected Car Market Structure Overview by Service Provider

Figure 4.1 Global Connected Car Market by Regional Market Forecast 2019-2029 (US$bn, Global AGR %)

Figure 4.2 Global Connected Car Market by Regional Market Share Forecast 2019 (% Share)

Figure 4.3 Global Connected Car Market by Regional Market Share Forecast 2024 (% Share)

Figure 4.4 Global Connected Car Market by Regional Market Share Forecast 2029 (% Share)

Figure 4.5 North America Automotive Connected Car National AGR Forecast 2019-2029 (AGR %)

Figure 4.6 North America Automotive Connected Car Market by National Forecast 2019-2029 (US$bn, Total Market Sales AGR %)

Figure 4.7 Central & South America Automotive Connected Car National AGR Forecast 2019-2029 (AGR %)

Figure 4.8 Central & South America Automotive Connected Car Market by National Forecast 2019-2029 (US$bn, Total Market Sales AGR %)

Figure 4.9 Asia Pacific Automotive Connected Car National AGR Forecast 2019-2029 (AGR %)

Figure 4.10 Asia Pacific Automotive Connected Car Market by National Forecast 2019-2029 (US$bn)

Figure 4.11 Europe Automotive Connected Car National AGR Forecast 2019-2029 (AGR %)

Figure 4.12 Europe Automotive Connected Car Market by National Forecast 2019-2029 (US$bn)

Figure 4.13 MENA Automotive Connected Car Regional AGR Forecast 2019-2029 (AGR %)

Figure 4.14 MENA Automotive Connected Car Market Forecast 2019-2029 (US$bn, Total Market Sales AGR %)

Figure 5.1 Automotive Connected Car Submarket AGR Forecast 2019-2029 (AGR %)

Figure 5.2 Automotive Connected Car Market by Service Provider Forecast 2019-2029 (US$bn, Total Market Sales AGR %)

Figure 5.3 OEM Hardware Market Forecast 2019-2029 (US$bn, Total Market Sales AGR %)

Figure 5.4 Aftermarket Hardware Market Forecast 2019-2029 (US$bn, Total Market Sales AGR %)

Figure 5.5 Connectivity Hardware Market Forecast 2019-2029 (US$bn, Total Market Sales AGR %)

Figure 5.6 Automotive Connected Car Submarket AGR Forecast by Type of Connectivity 2019-2029 (AGR %)

Figure 5.7 Automotive Connected Car Market by Type of Connectivity Forecast 2019-2029 (US$bn, Total Market Sales AGR %)

Figure 5.8 Embedded Solutions Market Forecast 2019-2029 (US$bn, Total Market Sales AGR %)

Figure 5.9 Integrated Solutions Market Forecast 2019-2029 (US$bn, Total Market Sales AGR %)

Figure 5.10 Tethered Solutions Market Forecast 2019-2029 (US$bn, Total Market Sales AGR %)

Figure 5.11 Automotive Connected Car Shipments by Type of Connectivity AGR Forecast 2019-2029 (AGR %)

Figure 5.12 Automotive Connected Car Shipments by Connectivity Forecast 2019-2029 (Million units, Total Market Sales AGR %)

Figure 7.1 Apple Inc. Total Company Sales 2012-2017 (US$m, AGR %)

Figure 7.2 Global Automotive OS Market Share 2017 (%)

Figure 7.3 AT&T Inc. Total Company Sales 2013-2017 (US$m, AGR %)

Figure 7.4 AT&T Inc. Sales by Segment of Business 2017 (% Share)

Figure 7.5 AT&T Inc. Sales AGR by Geographical Location 2017 (% Share)

Figure 7.6 BMW Group Car Sales Overview 2013-2017 (Million Units)

Figure 7.7 BMW AG Total Company Sales 2013-2017 (US$m, AGR %)

Figure 7.8 BMW AG Sales by Segment of Business 2017 (% Share)

Figure 7.9 BMW AG Sales by Geographical Location 2017 (% Share)

Figure 7.10 Broadcom Limited Total Company Sales 2012-2017(US$m, AGR %)

Figure 7.11 Broadcom Limited Sales by Segment of Business 2017 (% Share)

Figure 7.12 Broadcom Limited Sales by Geographical Location 2017 (% Share)

Figure 7.13 FCA NV Total Company Sales 2013-2017 (US$m, AGR %)

Figure 7.14 FCA NV Sales by Geographical Location 2017 (Total Company Sales %)

Figure 7.15 Daimler AG Total Company Sales 2012-2017 (US$m, AGR %)

Figure 7.16 Daimler AG Sales by Segment of Business 2017 (% Share)

Figure 7.17 Mercedes-Benz Car Sales’ Share Distribution in Selected Regions in 2017 (% Share)

Figure 7.18 Ford Motor Company Sales by Segment of Business 2017 (% Share)

Figure 7.19 Honda Motor Co., Ltd. Total Company Sales 2012-2017 (US$m, AGR %)

Figure 7.20 Honda Motor Co., Ltd. Sales by Segment of Business 2017 (% Share)

Figure 7.21 Honda Motor Co., Ltd. Sales by Geographical Location 2017 (% Share)

Figure 7.22 OnStar Services and Applications in the Connected Car Market

Figure 7.23 Qualcomm Inc. Total Company Sales 2015-2017 (US$m)

Figure 7.24 Qualcomm Inc. Sales by Segment of Business 2017 (% Share)

Figure 7.25 Qualcomm Inc. Sales AGR by Geographical Location 2017 (% Share)

Figure 7.26 Samsung Revenue, by Geographic Region, 2017 (% Share) and Revenue & Y-o-Y Growth, 2015-2017 (US$ Bn, Y-o-Y %)

Figure 7.27 Samsung Revenue, by Business Segment, 2017 (% Share) and Research & Development, 2015-2017 (US$ Bn), 2015-2017

Figure 7.28 Sierra Wireless, Inc. Total Company Sales 2015-2017 (US$m)

Figure 7.29 Sierra Wireless, Inc. Sales by Segment of Business 2017 (% Share)

Figure 7.30 Sierra Wireless, Inc. Sales AGR by Geographical Location 2017 (% Share)

Figure 7.31 Tech Mahindra Limited Sales AGR by Geographical Location 2017 (% Share)

Figure 7.32 Telefonica Total Company Sales 2015-2017 (US$m)

Figure 7.33 Tesla Inc. Total Company Sales 2015-2017 (US$m)

Figure 7.34 Tesla Inc. Sales by Segment of Business 2017 (% Share)

Figure 7.35 Tesla Inc. Sales AGR by Geographical Location 2012-2016 (AGR %)

Figure 7.36 TomTom NV Total Company Sales 2015-2017 (US$m)

Figure 7.37 TomTom NV Sales by Segment of Business 2017 (% Share)

Figure 7.38 TomTom NV Sales AGR by Geographical Location 2017 (% Share)

Figure 7.39 Toyota Motor Corporation Total Company Sales 2016-2018 (US$Bn)

Figure 7.40 Toyota Motor Corporation Sales by Segment of Business 2018 (% Share)

Figure 7.41 Toyota Motor Corporation Sales AGR by Geographical Location 2018 (%)

Figure 7.42 Visteon Corporation Revenue, by Geographic Region, 2017 and Revenue & Y-o-Y Growth, 2015-2017

Figure 7.43 Visteon Corporation Revenue, by Business Segment, 2017 and Research & Development, 2015-2017

Figure 7.44 Volkswagen AG Total Company Sales 2015-2017 (US$m)

Figure 7.45 Volkswagen AG Sales by Segment of Business 2017 (% Share)

Figure 7.46 Volkswagen AG Sales by Geographical Location 2017 (%Share)

Figure 7.47 Volvo Car Corporation Total Company Sales 2014-2017 (US$m)

AB Volvo

Accenture

Aha !

Airbiquity Inc.

Amdocs

Apple Inc.

Arity

AT&T

AT&T Mobility

Audi

Audiobooks.com

Autobrain

Automatic Labs Inc.

AutoNavi

Avago Technologies

Baidu

Bell Canada

Best Buy

BlackBerry

BMW Group

Bosch

BP

bright box LLC

Broadcom Limited

Castrol

Castrol innoVentures

Caterpillar Inc.

Changan

China Unicom.

Chrysler

Cirrus Logic

Cisco Systems

Citroen

Comporium

Continental

Cox Automotive

Cruise

CSR

Daimler AG

Deezer

Deloitte

Deutsche Telecom

Didi Chuxing

Diesel Song Cong One Member Limited Liability Company

Dunkin’ Donuts

EE

Ericsson

Etisalat

Facebook

Ferrari

Fiat Chrysler Automobiles (FCA)

Fiat S.p.A.

Ford Motor Company

Ford Vietnam Limited

Freescale Semiconductor

Garmin

Geely

General Motors Company (GM)

General Motors Financial Company, Inc.

Google

Harman International Industries Incorporated

HERE

HiSilicon Technologies

Honda

Huawei

Hyundai Motor Company

Infiniti

Intel

Intelligent Mechatronic Systems (IMS)

Jaguar Land Rover

Jasper Wireless

Kaspersky

KDDI

Kia Motors

KPN

KT

Kymeta

Lio Ho Group (25% partner)

Magna

Magneti Marelli.

Mahindra Group

Mazda

Melody Capital Partners

Mercedes-Benz

Microsoft

Mitsubishi Motors

MobiquiThings

Mojjo

Motorola

MovieTickets.com

Movilodata Internacional

Nash Technologies GmbH

Nissan Motor Company

NJM Insurance Group

Nokia

Nokia Growth Partners (NGP)

NTT Docomo

Numerex

Nvidia

NXP Semiconductors N.V.

Octo Telematics S.p.A

OnStar

OpenAir Equity Partners

OpenTable

Pandora

peiker acustic GmbH & Co. KG

Pivotal

Priceline.com

PSA Peugeot Citroën

Qualcomm Inc

QuickPlay

Realtek Semiconductor

Red Bend

Renault

Renesas Electronics Corporation

Renova Group

Sagemcom

SAIC

Samsung Electronics

Sierra Wireless

SoftBank

Sprint

Slacker Inc.

STMicroelectronics

Synchronoss

Tata Consultancy Services (TCS)

Tech Mahindra

Telefonica

TeliaSonera

Tesla Motors

The Allstate Corporation

T-Mobile

TomTom

Toshiba

Toyota Motor Corporation

Toyota Motor Europe

Toyota Tsusho

Twitter

VC funds

VEBA

Verizon

Verizon Telematics

Vinli

Visteon Corporation

Vodafone

VoiceBox

Volkswagen Group

Volvo Car Corporation

VW

Wavecom

Westly Group

Whoosnapp

WirelessCar AB

Xilinx

Xirgo technologies

Zendrive Inc.

Zubie

Organisations mentioned

AVnu Alliance

California Department of Motor Vehicles (DMV)

European Telecommunications Standards Institute (ETSI)

European Commission

European Committee For Standardisation (CEN)

European Parliament

GENIVI Alliance

GSMA

International Organisation for Standardisation (ISO)

Japan Automotive Software Platform and Architecture (JASPAR)

Michigan Research Institute

OPEN Alliance (One-Pair Ether-Net)

Oregon Department of Transportation

SAE International

U.S Department of Transportation (DOT)

United Nations

US National Highways & Traffic Safety Administration (NHTSA)

Download sample pages

Complete the form below to download your free sample pages for Connected Car Market Report 2019-2029

Related reports

-

Commercial Vehicle Telematics Market Report 2018-2028

The latest report from business intelligence provider company name offers comprehensive analysis of the global Commercial Vehicle Telematics market. Visiongain...

Full DetailsPublished: 28 June 2018 -

Top 20 Connected Car Companies 2019

Visiongain calculates that the connected car market will reach $42.99bn in 2019. ...Full DetailsPublished: 20 November 2018 -

Blockchain Supply Chain Technologies Within the Automotive Market 2019-2029

The latest report from business intelligence provider Visiongain offers comprehensive analysis of blockchain supply chain technologies within the automotive market....Full DetailsPublished: 23 January 2019 -

Automotive Software Market Report 2020-2030

As part of the broader $19.55 billion automotive software market space, there are massive revenue streams within Telematics Systems segment...

Full DetailsPublished: 23 April 2020 -

Top 20 Companies Developing Autonomous Vehicles (AV) Technologies 2018

This report independently evaluates the top 20 players developing autonomous vehicles technologies providing the reader with an objective overview of...Full DetailsPublished: 16 October 2018 -

Automotive Cyber Security Market Report 2018-2028

The Automotive Cyber Security Market Report 2018-2028: evaluates the market drivers and technological solutions essential to the protection of the...

Full DetailsPublished: 18 June 2018 -

Automotive Fuel Cell Market Report 2020-2030

The Passenger Vehicles segment is expected in particular to flourish in the next few years because of growth in the...

Full DetailsPublished: 08 June 2020 -

Autonomous Vehicle (AV) Market Analysis Report 2017-2027

This report presents the realistic outlook for autonomous vehicles (AV) and provides the expected timelines for the implementation of 3...

Full DetailsPublished: 19 May 2017 -

Electronic Toll Collection (ETC) Market Report 2019-2029

Visiongain values the Electronic Toll Collection (ETC) market at $5.3 Billion in 2019.

...Full DetailsPublished: 16 January 2019 -

Automotive Usage-Based Insurance (UBI) Market Report 2018-2028

The rising share of digital distribution of automotive insurance sales and arrival of connected cars, has led Visiongain to publish...

Full DetailsPublished: 11 May 2018

Download sample pages

Complete the form below to download your free sample pages for Connected Car Market Report 2019-2029

Do you have any custom requirements we can help you with?

Any specific country, geo region, market segment or specific company information?

Email us today, we can discuss your needs and see how we can help: jamie.roberts@visiongain.com

Would you like a free report overview of the report of your choice?

If so, please drop an email to Jamie Roberts stating your chosen report title to jamie.roberts@visiongain.com

Visiongain automotive reports are compiled using a broad and rich mixture of both primary and secondary information to produce an overall industry outlook. In order to provide our clients with the best product possible product, we do not rely on any one single source of information. Visiongain analysts reach out to market-leading vendors and automotive industry experts but also review a wealth of financial data and product information from a vast range of sources. To find out more about our reports methodology please email jamie.roberts@visiongain.com

Would you like to get the latest Visiongain automotive reports catalogue?

What are the dynamic growth sectors? where are the regional business opportunities?

Which technologies will prevail and who are the leading companies succeeding in these sectors and why?

If you want definitive answers to business critical questions, discover Visiongain’s full range of business intelligence reports.

If so, please email Jamie Roberts on jamie.roberts@visiongain.com or call her today on +44 207 336 6100

Alliance of Automobile Manufacturers (USA)

Association of Russian Automakers

Audio Video Bridging (AVB)

China Association Of Automoblie Manufacturers

European Association of Automotive Suppliers

European Automobile Manufacturers’ Association

European Council for Automotive Research and Development

Former Society of Automotive Engineers

German Association of the Automotive Industry

International Organization of Motor Vehicle Manufacturers

In-Vehicle Infotainment (IVI)

Italian Association of the Automotive Industry

Japan Automobile Manufacturers Association

One-Pair Ether-Net

Society of Indian Automobile Manufacturers (SIAM)

Society of Motor Manufacturers and Traders

The International Council For Clean Transport

US National Highway Traffic Safety Administration

Don’t Miss Out!

Subscribe to receive the latest Industry news, trending insight and analysis straight to your inbox.Choose your preferences:

Latest Automotive news

Hydrogen Vehicle Market

The global Hydrogen Vehicle market was valued at US$23.34 billion in 2023 and is projected to grow at a CAGR of 22.7% during the forecast period 2024-2034.

17 May 2024

Autonomous Vehicle Market

The global Autonomous Vehicle market was valued at US$35.4 billion in 2023 and is projected to grow at a CAGR of 22.7% during the forecast period 2024-2034.

16 May 2024

Automotive Infotainment Market

The global Automotive Infotainment market is estimated at US$20.2 billion in 2023 and is projected to grow at a CAGR of 6.3% during the forecast period 2024-2034.

14 May 2024

Automotive Cyber Security Market

The global Automotive Cyber Security market was valued at US$2,991.6 million in 2024 and is projected to grow at a CAGR of 19.4% during the forecast period 2024-2034.

13 May 2024